Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MIDDLEBY CORP | tm2113649d1_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - MIDDLEBY CORP | tm2113649d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - MIDDLEBY CORP | tm2113649d1_ex2-1.htm |

| 8-K - FORM 8-K - MIDDLEBY CORP | tm2113649d1_8k.htm |

Exhibit 99.2

1 Middleby Acquisition of Welbilt April 21, 2021

2 Disclaimer Forward - Looking Statements This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amende d (the “Securities Act”), and Section 21E of the Exchange Act. Some of these forward - looking statements can be identified by the use of forward - looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks, ” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. Such forward - looking statements, including those regarding the timing a nd consummation of the transactions described herein, involve risks and uncertainties. Middleby’s and Welbilt’s experience and results may differ materially from the experience and results anticipated in such statements. Th e a ccuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but are not limited to, the following factors: the risk that the conditions to the closing of the transaction are not satisfied, inc luding the risk that required approvals of the transaction from the stockholders of Middleby or Welbilt or from regulators are not obtained; litigation relating to the transaction; uncertainties as to the timing of the consummation of th e t ransaction and the ability of each party to consummate the transaction; risks that the proposed transaction disrupts the current plans or operations of Middleby or Welbilt; the ability of Middleby and Welbilt to retain and hire key p ers onnel; competitive responses to the proposed transaction; unexpected costs, charges or expenses resulting from the transaction; potential adverse reactions or changes to relationships with customers, suppliers, distributo rs and other business partners resulting from the announcement or completion of the transaction; the combined company’s ability to achieve the synergies expected from the transaction, as well as delays, challenges and expenses as sociated with integrating the combined company’s existing businesses; the impact of COVID - 19 or other public health crises and any related company or government policies and actions to protect the health and safety of ind ivi duals or government policies or actions to maintain the functioning of national or global economies and markets; and legislative, regulatory and economic developments. Other factors that might cause such a difference include thos e d iscussed in Middleby’s and Welbilt’s filings with the SEC, which include their Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, and in the joint proxy statement/prospectus on Form S - 4 to be filed in connection with the proposed transactions. For more information, see the section entitled “Risk Factors” and the forward looking statements disclosure contained in Middleby’s and Welbilt’s Annual Reports on Fo rm 10 - K and in other filings. The forward - looking statements included in this presentation are made only as of the date hereof and, except as required by federal securities laws and rules and regulations of the SEC, Middleby and Welbilt undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Participants in the Solicitation Middleby, Welbilt and certain of their respective directors and executive officers may be deemed to be participants in the so lic itation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Middleby is set forth in Middleby’s proxy statement for its 2021 annual meeting of stockholders, which was filed wit h the SEC on March 31, 2021, and Middleby’s Annual Report on Form 10 - K for the fiscal year ended January 2, 2021, which was filed with the SEC on March 3, 2021. Information about the directors and executive officers of Wel bil t is set forth in its proxy statement for its 2021 annual meeting of shareholders, which was filed with the SEC on March 15, 2021, and Welbilt’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2020, which was filed wit h the SEC on February 26, 2021. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus careful ly when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Middleby or Welbilt using the sources indicated above.

3 Disclaimer Additional Information about the Merger and Where to Find It In connection with the proposed transaction, Middleby intends to file with the SEC a registration statement on Form S - 4 that wil l include a joint proxy statement of Middleby and Welbilt that also constitutes a prospectus of Middleby. Each of Middleby and Welbilt also plan to file other relevant documents with the SEC regarding the proposed transaction. No offeri ng of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Any definitive joint proxy statement/prospectus (if and when available) will be mailed to sh areholders of Middleby and Welbilt. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRET Y I F AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain free copies of these documents (if and when available), and other documents containing important information about Middleby and Welbilt, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies o f t he documents filed with the SEC by Middleby will be available free of charge on Middleby’s website at www.middleby.com or by contacting Middleby’s Investor Relations Department by email at dbretz@middleby.com or by phone at (847) 429 - 7756. Copies of the documents filed with the SEC by Welbilt will be available free of charge on Welbilt’s website at www.welbilt.com or by contacting Welbilt’s Investor Relations Department by email at richard.sheffer@wel bil t.com or by phone at (727) 853 - 3079. No Offer or Solicitation This presentation is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the sec uri ties laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Non - GAAP Measures Adjusted EBITDA and Adjusted Earnings Per Share (EPS) (the “Non - GAAP Measures”) are performance measures that provide supplement al information that Middleby and Welbilt believe is useful to analysts and investors to evaluate ongoing results of operations, when considered alongside other GAAP measures such as net income, operating income and gross p rof it. These Non - GAAP Measures exclude the financial impact of items management does not consider in assessing the ongoing operating performance of Middleby, Welbilt or the combined company and thereby facilitate r evi ew of its operating performance on a period - to - period basis. Please refer to the reconciliations of certain GAAP reported to non - GAAP adjusted information included in the annex to this presentation for additional information. O ther companies may have different capital structures and comparability to the results of operations of Middleby, Welbilt or the combined company, which may be impacted by the effects of acquisition accounting on its depreciation an d amortization. As a result of the effects of these factors and factors specific to other companies, Middleby and Welbilt believe these Non - GAAP Measures provide helpful information to analysts and investors to facilitate a compa rison of their operating performance to that of other companies. The presentation of Non - GAAP Measures in this presentation should not be construed as an inference that future results will be unaffected by unusual or non - recurring items. This presentation also contains certain forward - looking Non - GAAP Measures. Due to the forward - looking nature of such Non - GAAP Me asures, management of Middleby and Welbilt cannot reliably or reasonably predict certain necessary components of the most directly comparable forward - looking GAAP measures. Accordingly, Middleby and Welbilt are not able to pres ent a quantitative reconciliation of such forward - looking Non - GAAP Measures to their most directly comparable forward - looking GAAP financial measures. Amounts excluded from these Non - GAAP Measures in the future could be signifi cant.

4 Today’s Presenters Timothy FitzGerald Chief Executive Officer Bryan Mittelman Chief Financial Officer William Johnson Chief Executive Officer

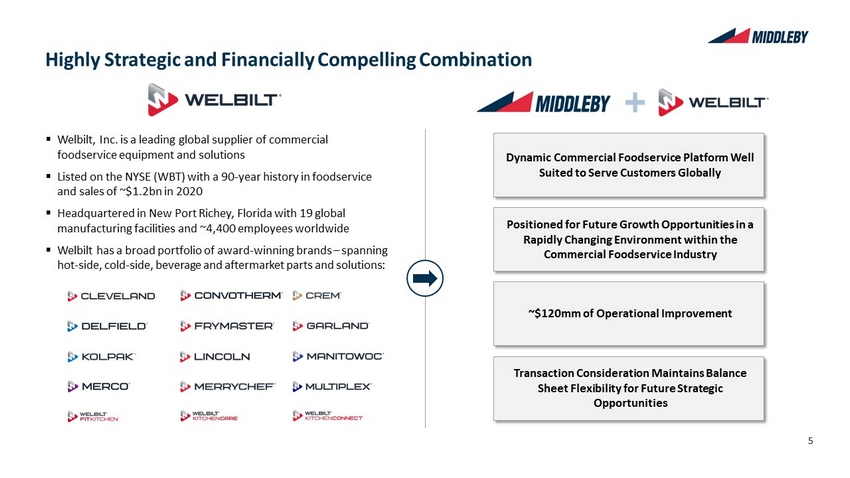

5 Highly Strategic and Financially Compelling Combination . Dynamic Commercial Foodservice Platform Well Suited to Serve Customers Globally ~$120mm of Operational Improvement Positioned for Future Growth Opportunities in a Rapidly Changing Environment within the Commercial Foodservice Industry Transaction Consideration Maintains Balance Sheet Flexibility for Future Strategic Opportunities ▪ Welbilt, Inc. is a leading global supplier of commercial foodservice equipment and solutions ▪ Listed on the NYSE (WBT) with a 90 - year history in foodservice and sales of ~$1.2bn in 2020 ▪ Headquartered in New Port Richey, Florida with 19 global manufacturing facilities and ~4,400 employees worldwide ▪ Welbilt has a broad portfolio of award - winning brands – spanning hot - side, cold - side, beverage and aftermarket parts and solutions:

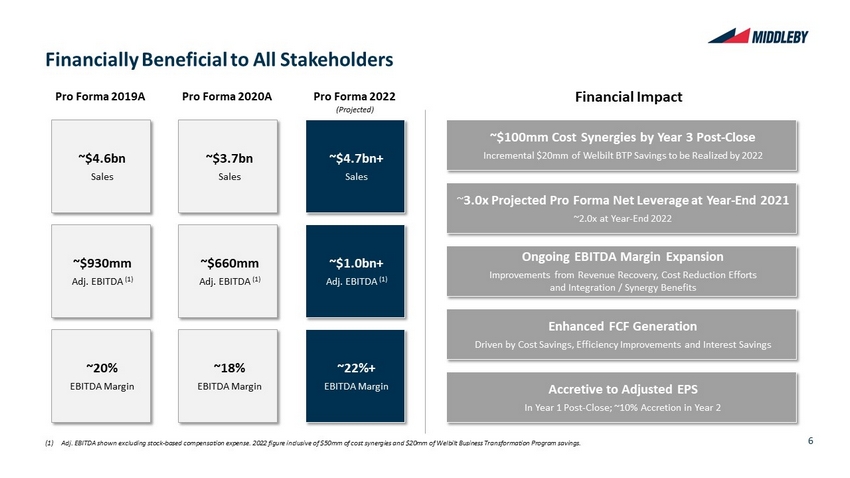

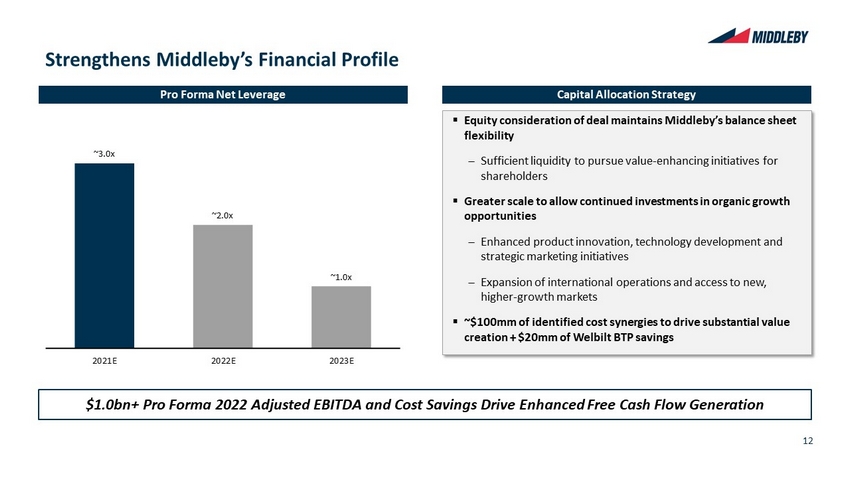

6 Ongoing EBITDA Margin Expansion Improvements from Revenue Recovery, Cost Reduction Efforts and Integration / Synergy Benefits Financially Beneficial to All Stakeholders ~ 3.0x Projected Pro Forma Net Leverage at Year - End 2021 ~2.0x at Year - End 2022 Accretive to Adjusted EPS In Year 1 Post - Close; ~10% Accretion in Year 2 ~$100mm Cost Synergies by Year 3 Post - Close Incremental $20mm of Welbilt BTP Savings to be Realized by 2022 Enhanced FCF Generation Driven by Cost Savings, Efficiency Improvements and Interest Savings Pro Forma 2019A Pro Forma 2020A Pro Forma 2022 (Projected) Financial Impact ~$4.6bn Sales ~$3.7bn Sales ~$4.7bn+ Sales ~$930mm Adj. EBITDA (1) ~$660mm Adj. EBITDA (1) ~$1.0bn+ Adj. EBITDA (1) ~20% EBITDA Margin ~18% EBITDA Margin ~22%+ EBITDA Margin (1) Adj. EBITDA shown excluding stock - based compensation expense. 2022 figure inclusive of $50mm of cost synergies and $20mm of Welb ilt Business Transformation Program savings.

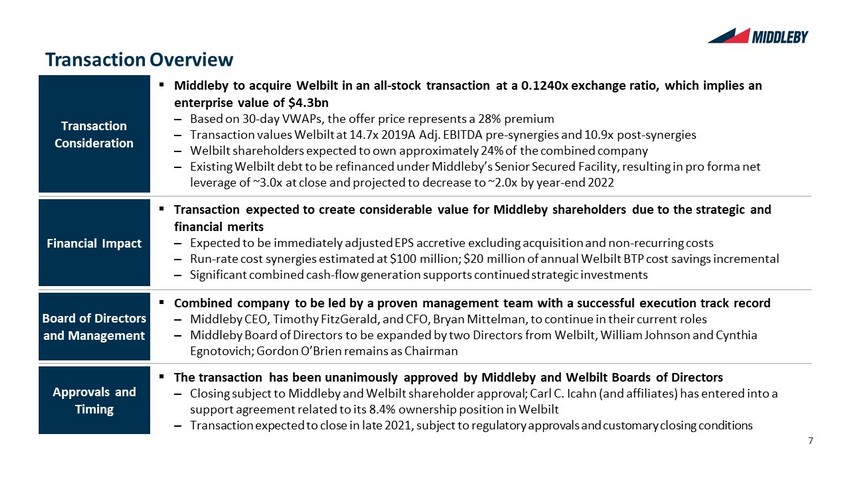

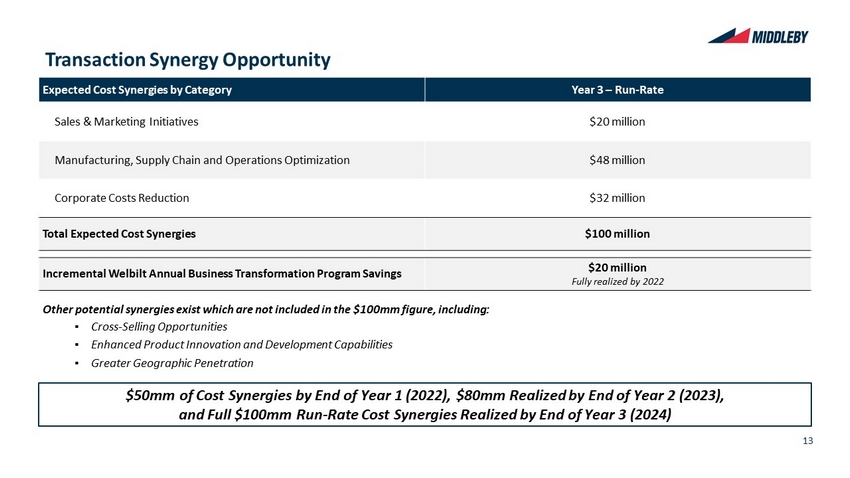

7 Transaction Overview Transaction Consideration Financial Impact Approvals and Timing ▪ Middleby to acquire Welbilt in an all - stock transaction at a 0.1240x exchange ratio, which implies an enterprise value of $4.3bn ‒ Based on 30 - day VWAPs, the offer price represents a 28% premium ‒ Transaction values Welbilt at 14.7x 2019A Adj. EBITDA pre - synergies and 10.9x post - synergies ‒ Welbilt shareholders expected to own approximately 24% of the combined company ‒ Existing Welbilt debt to be refinanced under Middleby’s Senior Secured Facility, resulting in pro forma net leverage of ~3.0x at close and projected to decrease to ~2.0x by year - end 2022 ▪ The transaction has been unanimously approved by Middleby and Welbilt Boards of Directors ‒ Closing subject to Middleby and Welbilt shareholder approval; Icahn Associates has entered into a support agreement related to its 8.4% ownership position in Welbilt ‒ Transaction expected to close in late 2021, subject to regulatory approvals and customary closing conditions ▪ Transaction expected to create considerable value for Middleby shareholders due to the strategic and financial merits ‒ Expected to be immediately adjusted EPS accretive excluding acquisition and non - recurring costs ‒ Run - rate cost synergies estimated at $100 million; $20 million of annual Welbilt BTP cost savings incremental ‒ Significant combined cash - flow generation supports continued strategic investments Board of Directors and Management ▪ Combined company to be led by a proven management team with a successful execution track record ‒ Middleby CEO, Timothy FitzGerald, and CFO, Bryan Mittelman, to continue in their current roles ‒ Middleby Board of Directors to be expanded by two Directors from Welbilt, William Johnson and Cynthia Egnotovich ; Gordon O’Brien remains as Chairman

8 Strategic Rationale Expands Portfolio of Highly - Respected Foodservice Industry Brands Welbilt brands are recognized globally for quality and innovation Middleby adds 12 complementary hot - side, cold - side and beverage brands 1 Broadens Customer Offerings with Complementary Products and Solutions Expands Middleby’s beverage platform, addressing one of our key strategic priorities Extends cooking and warming technologies and products offerings, and provides innovative cold - side and refrigeration expertise Positioned to better serve customers with a wider set of product and service solutions 2 Combined Sales and Service Capabilities to Best Serve Evolving Industry Needs Premier sales and service organization supporting customers globally Supports investments in transformational customer - facing digital initiatives 5 Expands International Manufacturing Footprint and Global Infrastructure Significantly enhances manufacturing in Asia and Europe Broadly expands sales capabilities in higher - growth Asian region 4 Provides for Accelerated Innovation and Transformational Technology Investments Sharing engineering amongst brands to allow for accelerated product innovation across entire portfolio Shared investments, efforts and development in strategic controls, IoT and forward - looking automation initiatives 3 Value Creation Through Synergy Potential of Combined Organization Cost efficiencies through supply chain, manufacturing, operating expenses and best practices Ability to scale investments and leverage combined operating infrastructure Sales and service synergies supporting long - term revenue growth 6

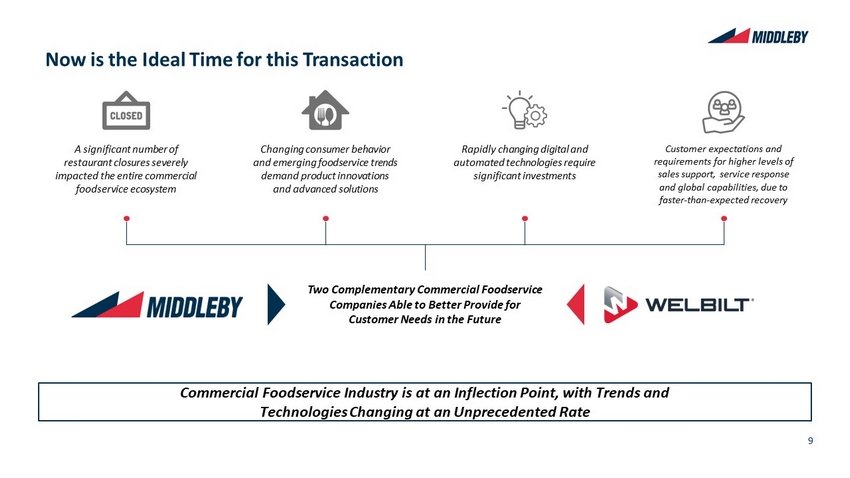

9 A significant number of restaurant closures severely impacted the entire commercial foodservice ecosystem Now is the Ideal Time for this Transaction Commercial Foodservice Industry is at an Inflection Point, with Trends and Technologies Changing at an Unprecedented Rate Changing consumer behavior and emerging foodservice trends demand product innovations and advanced solutions Rapidly changing digital and automated technologies require significant investments Customer expectations and requirements for higher levels of sales support, service response and global capabilities, due to faster - than - expected recovery Two Complementary Commercial Foodservice Companies Able to Better Provide for Customer Needs in the Future

10 Manufacturing Capabilities Broad - Based Technology Investments Improved Capabilities to Provide World - Class Solutions to our Customers Sales Combined enterprise able to leverage global infrastructure to better support large chain customers with localized operations and selling initiatives worldwide Service Customer service, parts fulfillment and technical service will be strengthened to meet needs of global customer base Integrated Solutions Cross - pollination of innovation, technology and IP between organizations to drive new product and service development Greater breadth of manufacturing capabilities, including localized manufacturing capacity Combined organization is better suited to handle rapidly changing customer initiatives, some of which they are no longer staffed to handle independently Enhanced on - going service and technical support capabilities for combined installed base of products Aftermarket Support

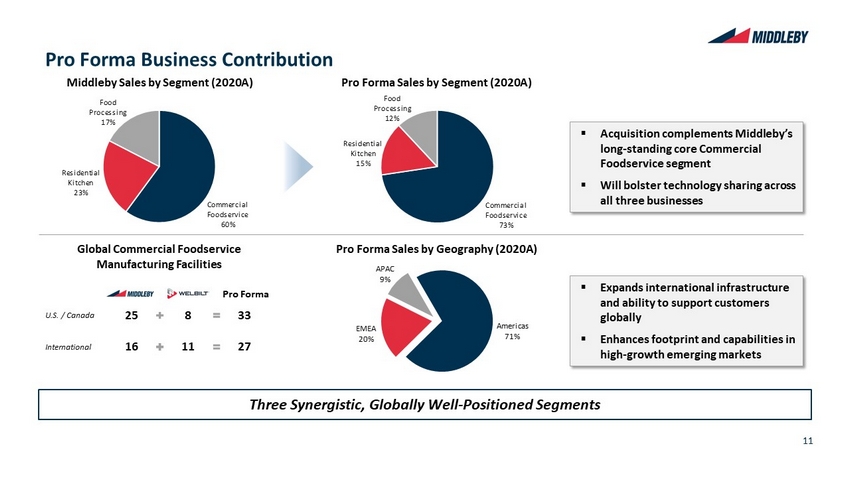

11 Commercial Foodservice 73% Residential Kitchen 15% Food Processing 12% Commercial Foodservice 60% Residential Kitchen 23% Food Processing 17% Pro Forma Business Contribution ▪ Acquisition complements Middleby’s long - standing core Commercial Foodservice segment ▪ Will bolster technology sharing across all three businesses Middleby Sales by Segment (2020A) Pro Forma Sales by Segment (2020A) ▪ Expands international infrastructure and ability to support customers globally ▪ Enhances footprint and capabilities in high - growth emerging markets Pro Forma Sales by Geography (2020A) Americas 71% EMEA 20% APAC 9% Three Synergistic, Globally Well - Positioned Segments Global Commercial Foodservice Manufacturing Facilities U.S. / Canada International Pro Forma 25 8 33 16 11 27

12 Strengthens Middleby’s Financial Profile Capital Allocation Strategy ▪ Equity consideration of deal maintains Middleby’s balance sheet flexibility Sufficient liquidity to pursue value - enhancing initiatives for shareholders ▪ Greater scale to allow continued investments in organic growth opportunities Enhanced product innovation, technology development and strategic marketing initiatives Expansion of international operations and access to new, higher - growth markets ▪ ~$100mm of identified cost synergies to drive substantial value creation + $20mm of Welbilt BTP savings Pro Forma Net Leverage ~3.0x ~2.0x ~1.0x 2021E 2022E 2023E $1.0bn + Pro Forma 2022 Adjusted EBITDA and Cost Savings Drive Enhanced Free Cash Flow Generation

13 Transaction Synergy Opportunity $50mm of Cost Synergies by End of Year 1 (2022), $80mm Realized by End of Year 2 (2023), and Full $100mm Run - Rate Cost Synergies Realized by End of Year 3 (2024) Expected Cost Synergies by Category Year 3 – Run - Rate Sales & Marketing Initiatives $20 million Manufacturing, Supply Chain and Operations Optimization $48 million Corporate Costs Reduction $32 million Total Expected Cost Synergies $100 million Incremental Welbilt Annual Business Transformation Program Savings $20 million Fully realized by 2022 Other potential synergies exist which are not included in the $100mm figure, including: ▪ Cross - Selling Opportunities ▪ Enhanced Product Innovation and Development Capabilities ▪ Greater Geographic Penetration

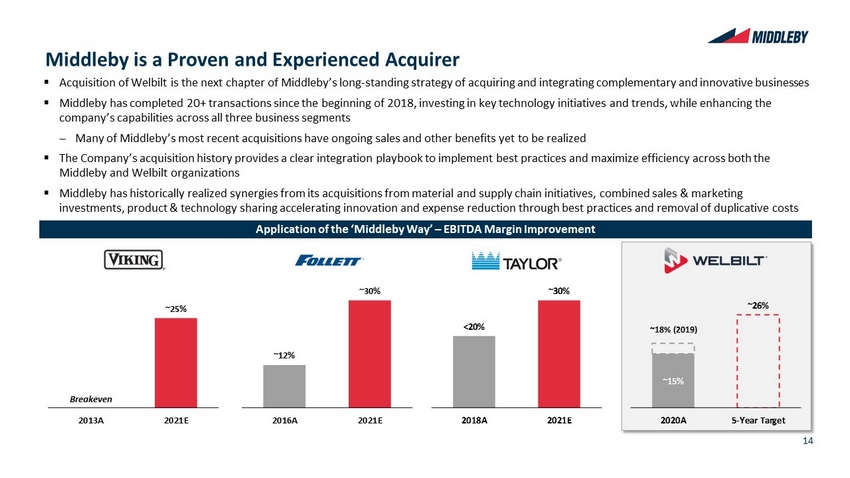

14 Middleby is a Proven and Experienced Acquirer ▪ Acquisition of Welbilt is the next chapter of Middleby’s long - standing strategy of acquiring and integrating complementary and innovative businesses ▪ Middleby has completed 20+ transactions since the beginning of 2018, investing in key technology initiatives and trends, whil e e nhancing the company’s capabilities across all three business segments Many of Middleby’s most recent acquisitions have ongoing sales and other benefits yet to be realized ▪ The Company’s acquisition history provides a clear integration playbook to implement best practices and maximize efficiency a cro ss both the Middleby and Welbilt organizations ▪ Middleby has historically realized synergies from its acquisitions from material and supply chain initiatives, combined sales & marketing investments, product & technology sharing accelerating innovation and expense reduction through best practices and removal of du plicative costs Application of the ‘ Middleby Way’ – EBITDA Margin Improvement Breakeven ~25% 2013A 2021E ~12% ~30% 2016A 2021E ~15% ~26% ~18% (2019) 2020A 5-Year Target <20% ~30% 2018A 2021E

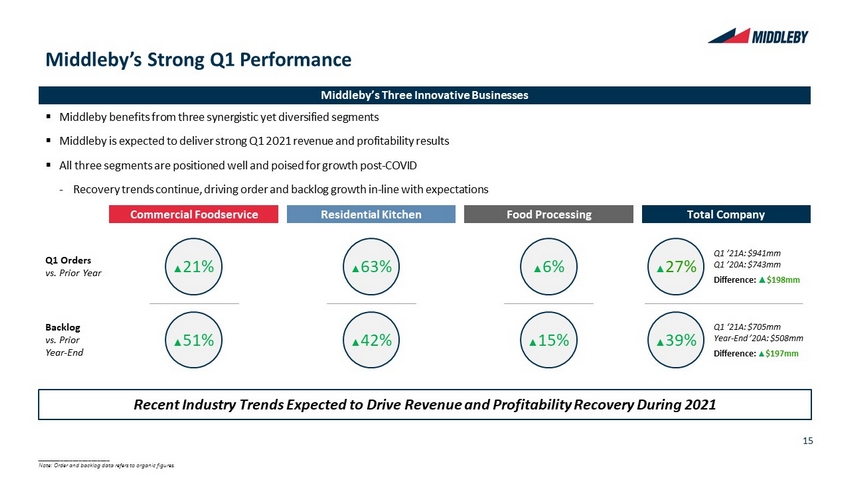

15 Middleby’s Strong Q1 Performance Food Processing Commercial Foodservice Residential Kitchen Middleby’s Three Innovative Businesses ________________________ Note: Order and backlog data refers to organic figures. ▲ 51 % ▲ 42 % ▲ 63 % Q1 Orders vs. Prior Year Backlog vs. Prior Year - End ▪ Middleby benefits from three synergistic yet diversified segments ▪ Middleby is expected to deliver strong Q1 2021 revenue and profitability results ▪ All three segments are positioned well and poised for growth post - COVID - Recovery trends continue, driving order and backlog growth in - line with expectations Total Company ▲ 27 % ▲ 39 % Q1 ’21A: $941mm Q1 ’20A: $743mm Difference: ▲ $198mm Q1 ‘21A: $705mm Year - End ’20A: $508mm Difference: ▲ $197mm ▲ 21 % ▲ 15 % ▲ 6 % Recent Industry Trends Expected to Drive Revenue and Profitability Recovery During 2021

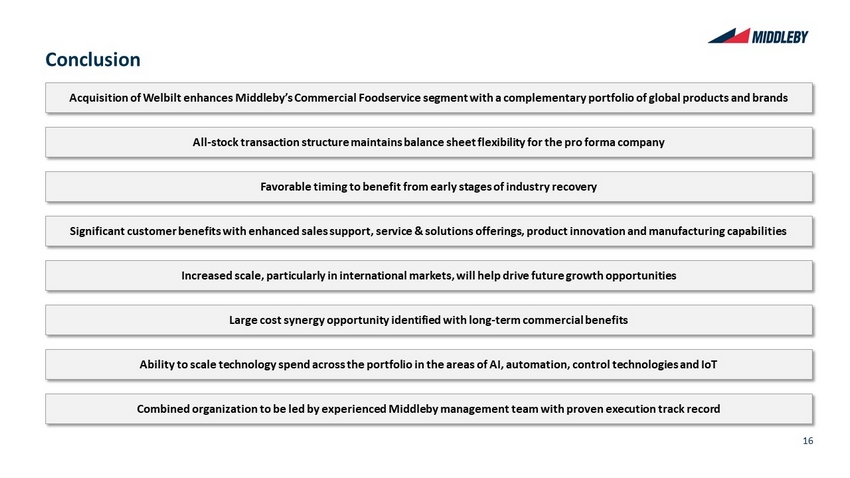

16 Acquisition of Welbilt enhances Middleby’s Commercial Foodservice segment with a complementary portfolio of global products a nd brands Large cost synergy opportunity identified with long - term commercial benefits Increased scale, particularly in international markets, will help drive future growth opportunities Favorable timing to benefit from early stages of industry recovery Combined organization to be led by experienced Middleby management team with proven execution track record All - stock transaction structure maintains balance sheet flexibility for the pro forma company Ability to scale technology spend across the portfolio in the areas of AI, automation, control technologies and IoT Significant customer benefits with enhanced sales support, service & solutions offerings, product innovation and manufacturin g c apabilities Conclusion

17 Thank You – Q&A

18 18 Appendix

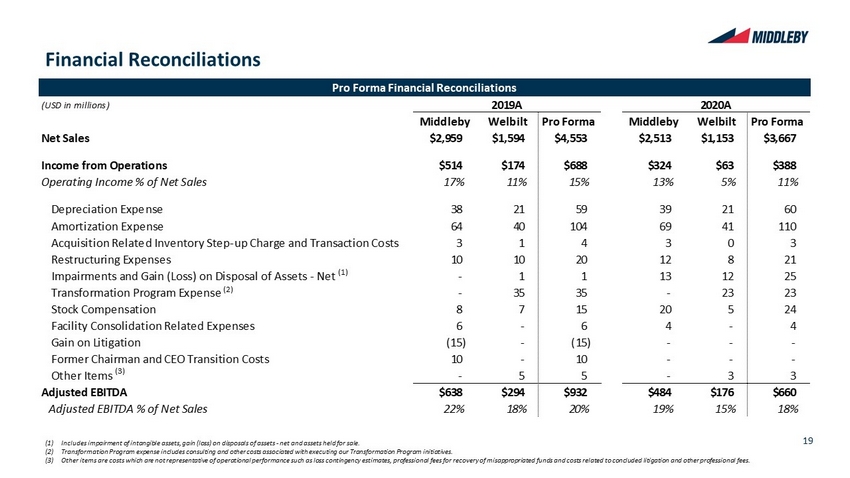

19 Financial Reconciliations (USD in millions) Middleby Welbilt Pro Forma Middleby Welbilt Pro Forma Net Sales $2,959 $1,594 $4,553 $2,513 $1,153 $3,667 Income from Operations $514 $174 $688 $324 $63 $388 Operating Income % of Net Sales 17% 11% 15% 13% 5% 11% Depreciation Expense 38 21 59 39 21 60 Amortization Expense 64 40 104 69 41 110 Acquisition Related Inventory Step-up Charge and Transaction Costs 3 1 4 3 0 3 Restructuring Expenses 10 10 20 12 8 21 Impairments and Gain (Loss) on Disposal of Assets - Net - 1 1 13 12 25 Transformation Program Expense - 35 35 - 23 23 Stock Compensation 8 7 15 20 5 24 Facility Consolidation Related Expenses 6 - 6 4 - 4 Gain on Litigation (15) - (15) - - - Former Chairman and CEO Transition Costs 10 - 10 - - - Other Items - 5 5 - 3 3 Adjusted EBITDA $638 $294 $932 $484 $176 $660 Adjusted EBITDA % of Net Sales 22% 18% 20% 19% 15% 18% 2019A 2020A (1) Includes impairment of intangible assets, gain (loss) on disposals of assets - net and assets held for sale. (2) Transformation Program expense includes consulting and other costs associated with executing our Transformation Program initi ati ves. (3) Other items are costs which are not representative of operational performance such as loss contingency estimates, professiona l f ees for recovery of misappropriated funds and costs related to concluded litigation and other professional fees. Pro Forma Financial Reconciliations (1) (2) (3)