Attached files

| file | filename |

|---|---|

| 8-K - 8-K IP - CAMBRIDGE BANCORP | catc-8k_20210421.htm |

NASDAQ: CATC Parent of Cambridge Trust Company Investor Presentation April 21, 2021 EX: 99.1

03 Company Profile 07 Financial Highlights 20 Strategic Focus 24 Appendix Contents This presentation includes non-GAAP measures and should be reviewed with our Q1 2021 Earnings Release and the Company’s SEC filings

Company Profile Banking subsidiary: Cambridge Trust Company (1890) Private Bank & Wealth Management Firm Headquarters: Harvard Square, Cambridge, MA Client Wealth Assets: $4.3 billion Banking Assets: $4.3 billion Gross Loans: $3.2 billion Total Deposits: $3.7 billion Noninterest income: 26% of revenue NASDAQ: CATC Market Cap: $587 million* 3 As of March 31, 2021 *Market Cap is as of March 31, 2021

Why Cambridge Bancorp? 4 Market of operations offer significant long term growth prospects Private Banking business model with diversified fee revenue through wealth management focus Strong financial performance with excellent asset quality track record Low cost core deposit base Financially and strategically attractive acquisitions Client

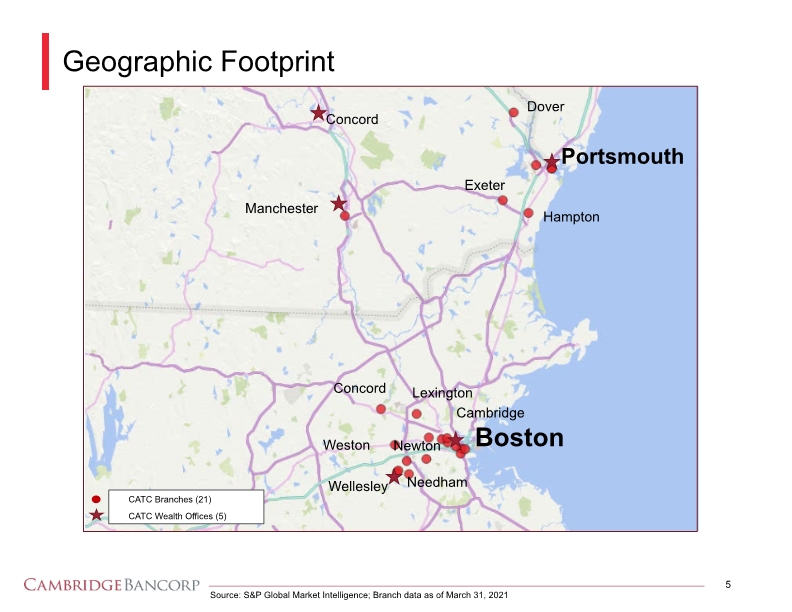

Geographic Footprint 5 Source: S&P Global Market Intelligence; Branch data as of March 31, 2021 Boston Cambridge Lexington Concord Weston Wellesley Needham Newton Portsmouth Dover Concord Manchester Hampton Exeter Portsmouth Concord Manchester Dover Exeter Hampton Concord Lexington Cambridge Boston Weston Wellesley Needham Newton

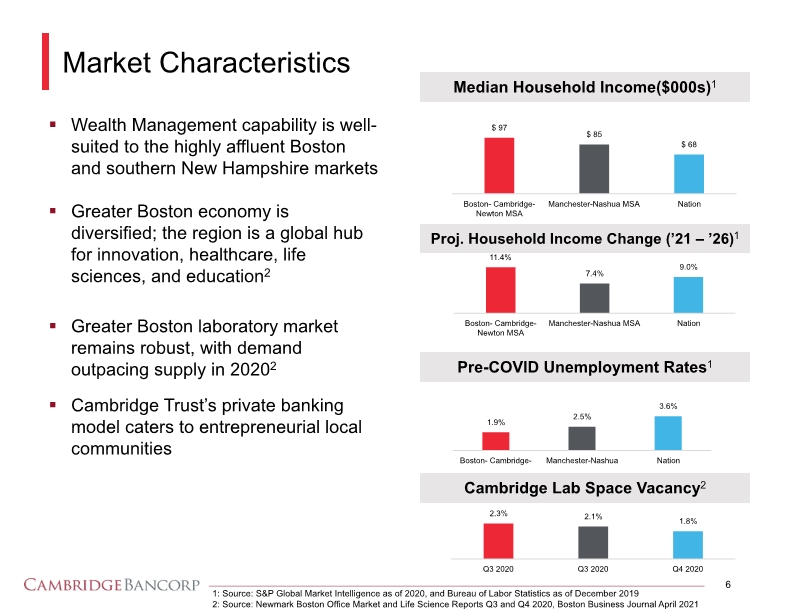

Market Characteristics 6 1: Source: S&P Global Market Intelligence as of 2020, and Bureau of Labor Statistics as of December 2019 2: Source: Newmark Boston Office Market and Life Science Reports Q3 and Q4 2020, Boston Business Journal April 2021 Pre-COVID Unemployment Rates1 Median Household Income($000s)1 Proj. Household Income Change (’21 – ’26)1 Wealth Management capability is well-suited to the highly affluent Boston and southern New Hampshire markets Greater Boston economy is diversified; the region is a global hub for innovation, healthcare, life sciences, and education2 Greater Boston laboratory market remains robust, with demand outpacing supply in 20202 Cambridge Trust’s private banking model caters to entrepreneurial local communities Cambridge Lab Space Vacancy2 Bar chart

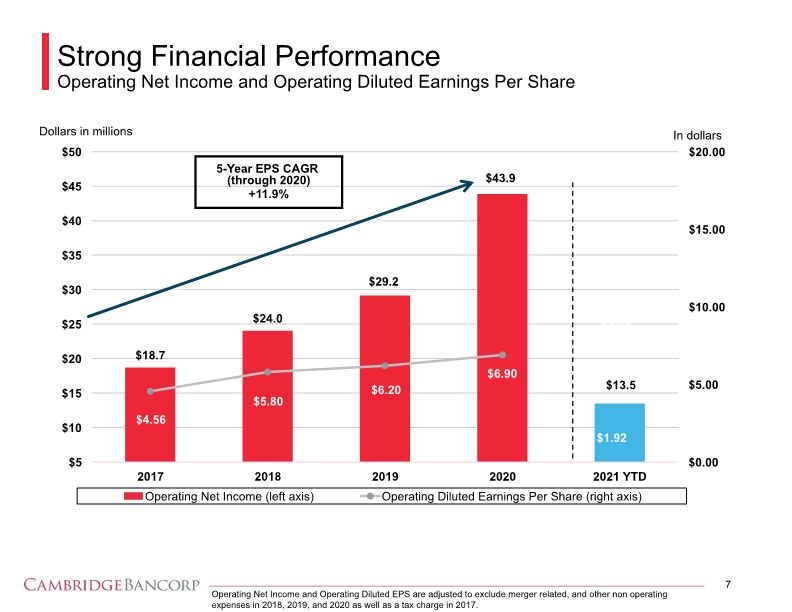

Strong Financial Performance Operating Net Income and Operating Diluted Earnings Per Share 5-Year EPS CAGR (through 2020) +11.9% In dollars Operating Net Income and Operating Diluted EPS are adjusted to exclude merger related, and other non operating expenses in 2018, 2019, and 2020 as well as a tax charge in 2017. Dollars in millions 7 Bar chart

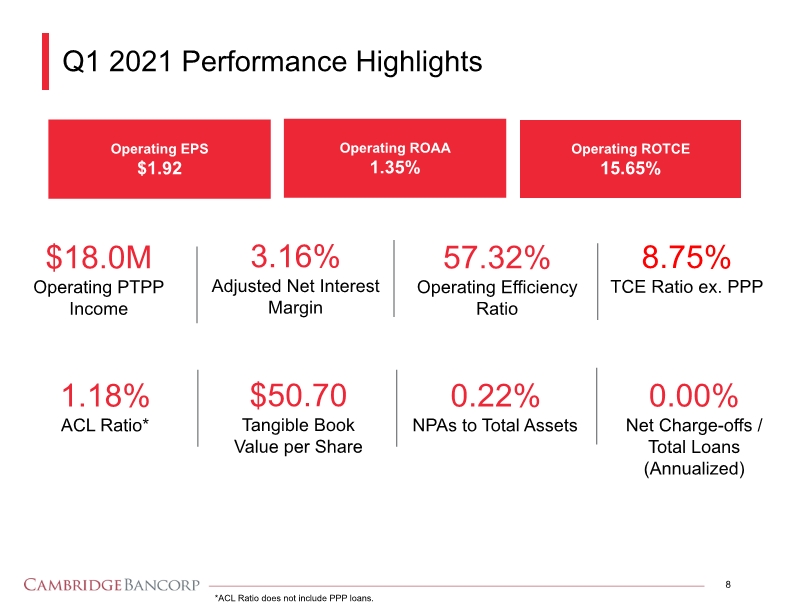

Q1 2021 Performance Highlights 8 *ACL Ratio does not include PPP loans. Operating EPS $1.92 Operating ROAA 1.35% Operating ROTCE 15.65% $18.0M Operating PTPP Income 3.16% Adjusted Net Interest Margin 57.32% Operating Efficiency Ratio 8.75% TCE Ratio ex. PPP 0.22% NPAs to Total Assets 1.18% ACL Ratio* 0.00% Net Charge-offs / Total Loans (Annualized) $50.70 Tangible Book Value per Share

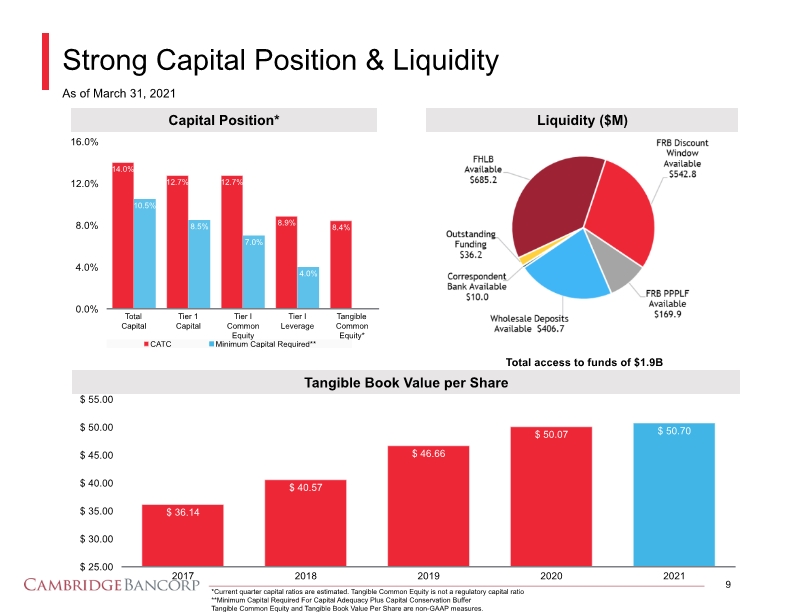

Strong Capital Position & Liquidity 9 Capital Position* Tangible Book Value per Share Total access to funds of $1.9B *Current quarter capital ratios are estimated. Tangible Common Equity is not a regulatory capital ratio **Minimum Capital Required For Capital Adequacy Plus Capital Conservation Buffer Tangible Common Equity and Tangible Book Value Per Share are non-GAAP measures. As of March 31, 2021 Liquidity ($M) Bar & Pie chart

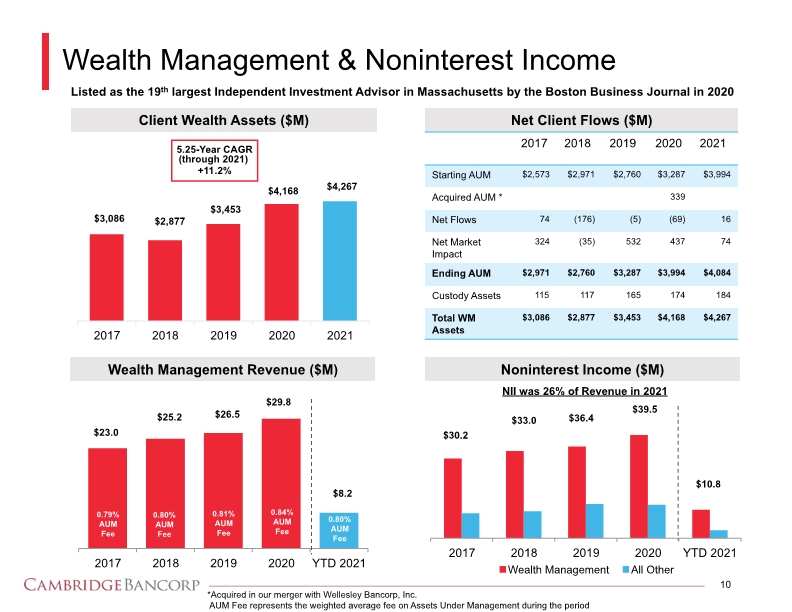

Wealth Management & Noninterest Income 10 Client Wealth Assets ($M) Wealth Management Revenue ($M) Net Client Flows ($M) 5.25-Year CAGR (through 2021) +11.2% Noninterest Income ($M) *Acquired in our merger with Wellesley Bancorp, Inc. AUM Fee represents the weighted average fee on Assets Under Management during the period Listed as the 19th largest Independent Investment Advisor in Massachusetts by the Boston Business Journal in 2020 NII was 26% of Revenue in 2021 Bar chart 2017 2018 2019 2020 2021 Starting AUM Acquired AUM *Net FlowsNet Market ImpactEnding AUM Custody Assets Total WM Assets74 $2,573 324 115 $2,971$3,086$2,877 $3,453$4,168$4,267 117 165 174 184$2,760$3,287$3,994$4,084 (35) 532 437 74 (176) (5) (69) 16 339$2,760$3,287$3,994

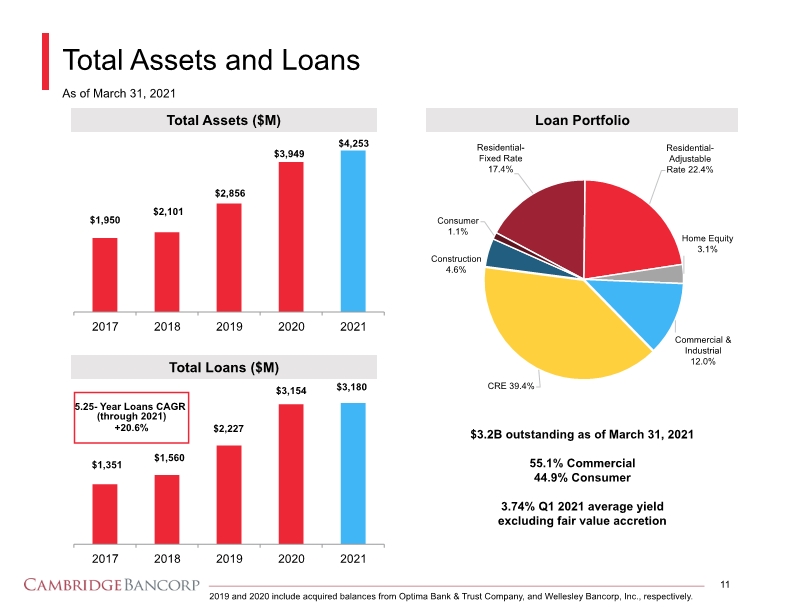

Total Assets and Loans 11 Total Assets ($M) Total Loans ($M) Loan Portfolio 5.25- Year Loans CAGR (through 2021) +20.6% 2019 and 2020 include acquired balances from Optima Bank & Trust Company, and Wellesley Bancorp, Inc., respectively. $3.2B outstanding as of March 31, 2021 55.1% Commercial 44.9% Consumer 3.74% Q1 2021 average yield excluding fair value accretion As of March 31, 2021 Bar & Pie chart

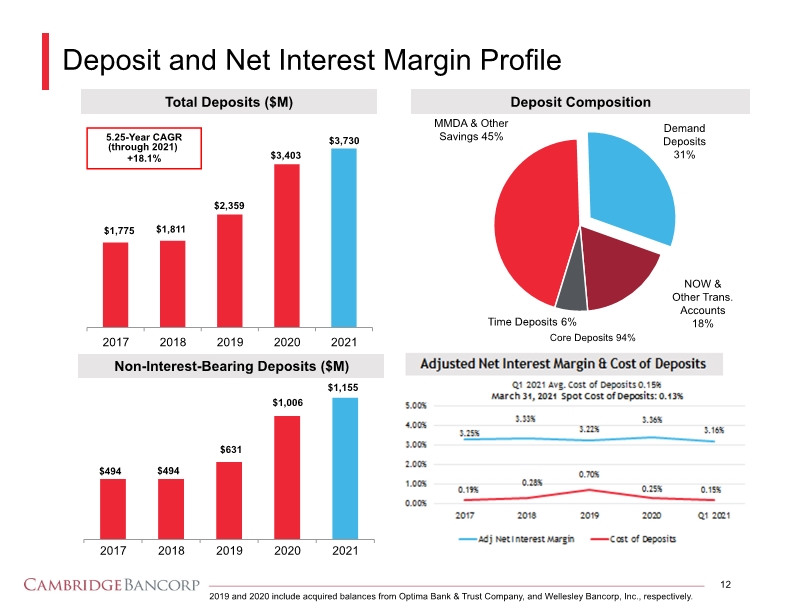

Deposit and Net Interest Margin Profile 12 Total Deposits ($M) Non-Interest-Bearing Deposits ($M) Deposit Composition 5.25-Year CAGR (through 2021) +18.1% Core Deposits 94% 2019 and 2020 include acquired balances from Optima Bank & Trust Company, and Wellesley Bancorp, Inc., respectively. Bar & pie chart line Chart

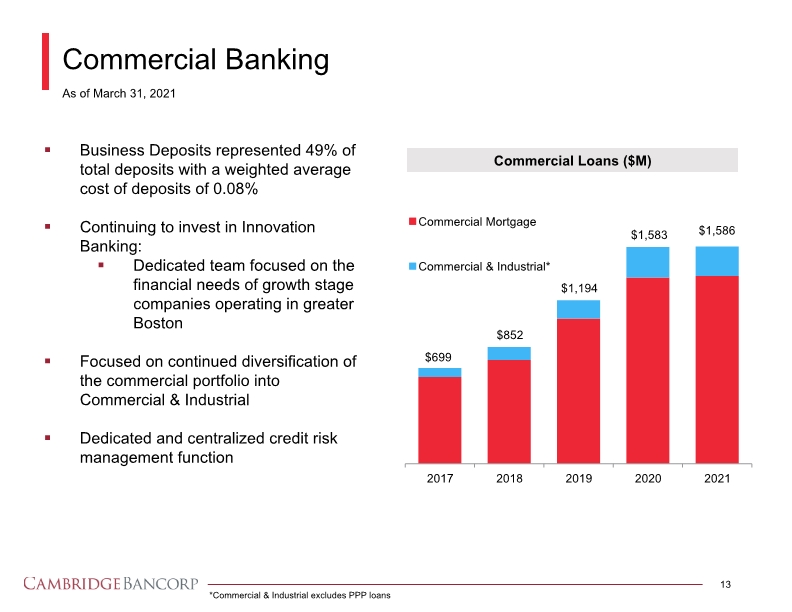

Commercial Banking 13 *Commercial & Industrial excludes PPP loans Business Deposits represented 49% of total deposits with a weighted average cost of deposits of 0.08% Continuing to invest in Innovation Banking: Dedicated team focused on the financial needs of growth stage companies operating in greater Boston Focused on continued diversification of the commercial portfolio into Commercial & Industrial Dedicated and centralized credit risk management function As of March 31, 2021 Commercial Loans ($M) Bar chart

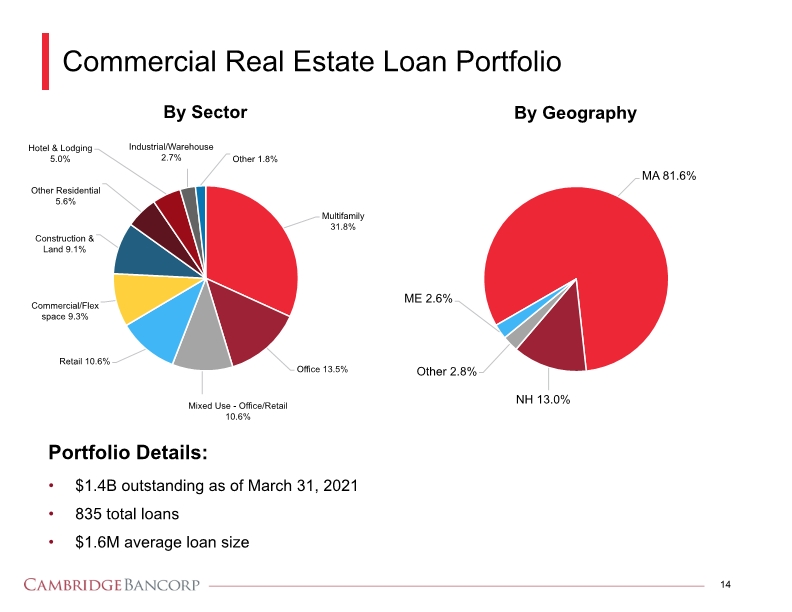

By Sector Commercial Real Estate Loan Portfolio 14 By Geography Portfolio Details: $1.4B outstanding as of March 31, 2021 835 total loans $1.6M average loan size Pie Chart

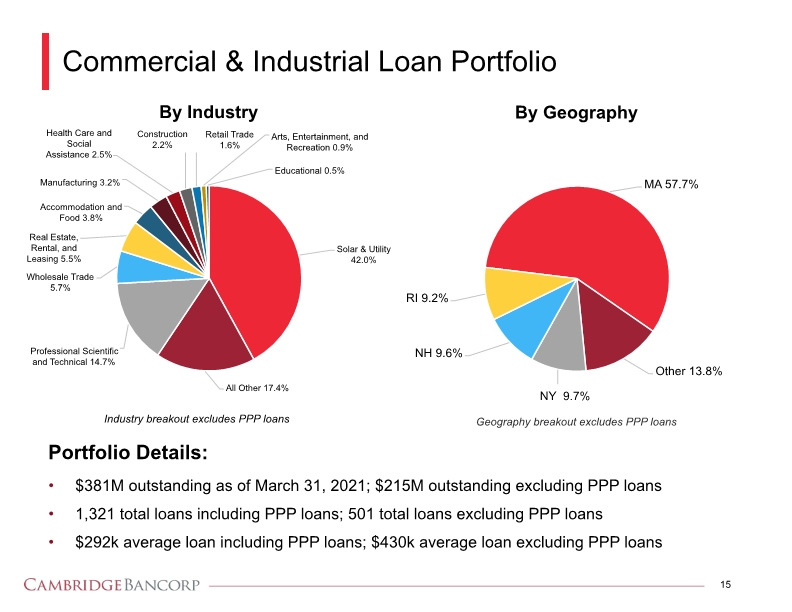

By Industry Industry breakout excludes PPP loans Commercial & Industrial Loan Portfolio 15 By Geography Portfolio Details: $381M outstanding as of March 31, 2021; $215M outstanding excluding PPP loans 1,321 total loans including PPP loans; 501 total loans excluding PPP loans $292k average loan including PPP loans; $430k average loan excluding PPP loans Pie chart

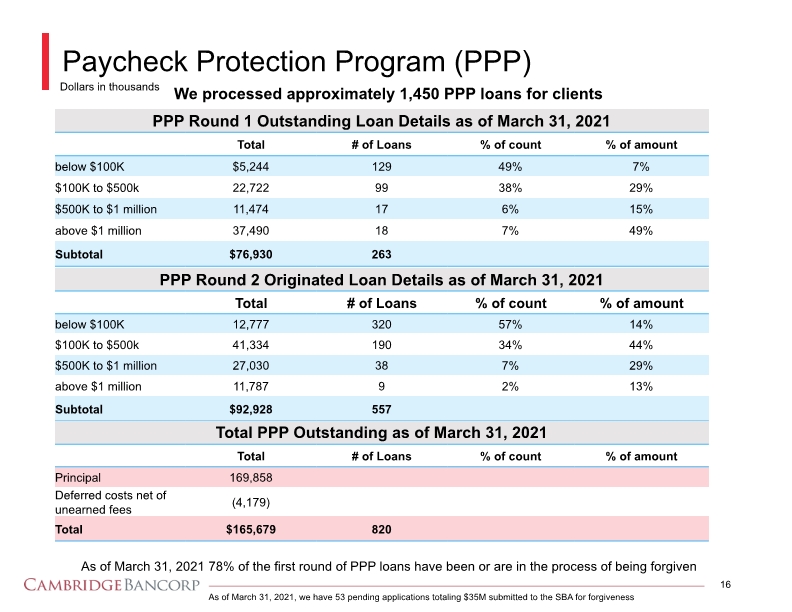

Paycheck Protection Program (PPP) 16 PPP Round 1 Outstanding Loan Details as of March 31, 2021 Dollars in thousands We processed approximately 1,450 PPP loans for clients As of March 31, 2021 78% of the first round of PPP loans have been or are in the process of being forgiven PPP Round 2 Originated Loan Details as of March 31, 2021 Total PPP Outstanding as of March 31, 2021 As of March 31, 2021, we have 53 pending applications totaling $35M submitted to the SBA for forgiveness Total# of Loans% of count% of amountbelow $100K$100K to $500k$500K to $1 millionabove $1 millionSubtotal$5,24422,72211,47437,490$76,930 129 99 17 18 263 49% 38% 6% 7% 7% 29% 15% 49% 12,77741,33427,03011,787$92,928320 PrincipalDeferred costs net of unearned fees Total169,858(4,179)$165,679 820 190 38 9 557 57% 34% 7% 2% 14% 44% 29% 13%

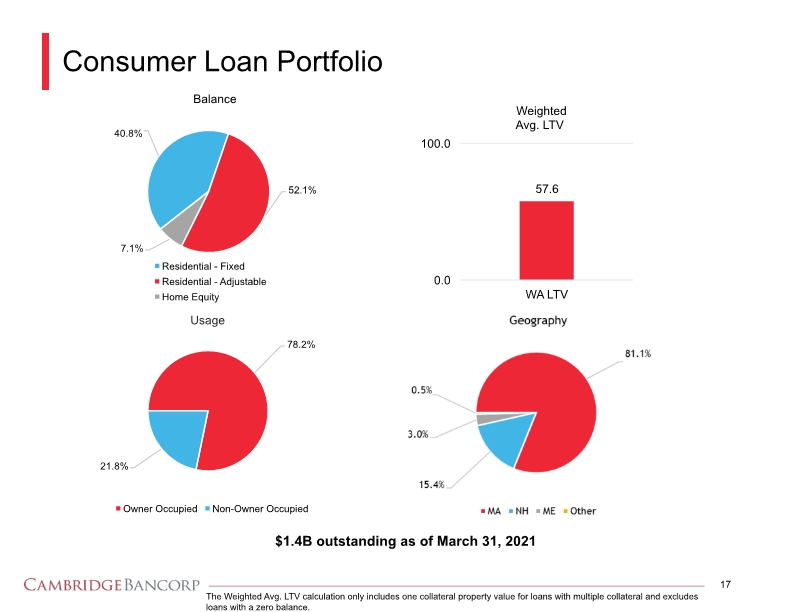

Consumer Loan Portfolio $1.4B outstanding as of March 31, 2021 17 The Weighted Avg. LTV calculation only includes one collateral property value for loans with multiple collateral and excludes loans with a zero balance. Pie & bar chart

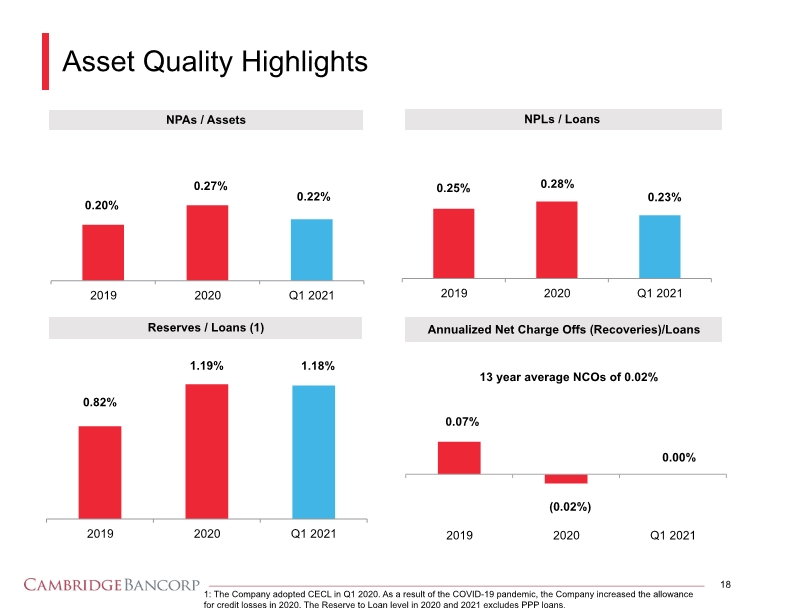

Asset Quality Highlights NPLs / Loans Reserves / Loans (1) Annualized Net Charge Offs (Recoveries)/Loans NPAs / Assets 13 year average NCOs of 0.02% 1: The Company adopted CECL in Q1 2020. As a result of the COVID-19 pandemic, the Company increased the allowance for credit losses in 2020. The Reserve to Loan level in 2020 and 2021 excludes PPP loans. 18 Bar chart

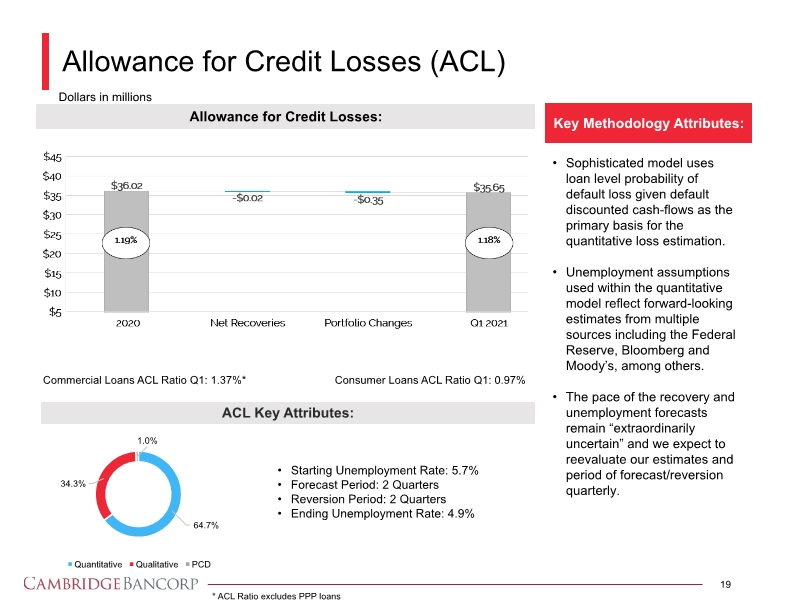

Allowance for Credit Losses (ACL) 19 Allowance for Credit Losses: Dollars in millions ACL Key Attributes: Key Methodology Attributes: Starting Unemployment Rate: 5.7% Forecast Period: 2 Quarters Reversion Period: 2 Quarters Ending Unemployment Rate: 4.9% Sophisticated model uses loan level probability of default loss given default discounted cash-flows as the primary basis for the quantitative loss estimation. Unemployment assumptions used within the quantitative model reflect forward-looking estimates from multiple sources including the Federal Reserve, Bloomberg and Moody’s, among others. The pace of the recovery and unemployment forecasts remain “extraordinarily uncertain” and we expect to reevaluate our estimates and period of forecast/reversion quarterly. Commercial Loans ACL Ratio Q1: 1.37%* Consumer Loans ACL Ratio Q1: 0.97% * ACL Ratio excludes PPP loans Bar & Pie Chart

Strategic Progress and Focus Generated record operating earnings in 2020 Completed merger with Wellesley Bancorp on June 1, 2020 Expanded the Company’s presence in Greater Boston with the addition of 6 banking offices in Norfolk, Middlesex and Suffolk Counties Supported clients & communities during the pandemic which included $194M in PPP Lending Completed merger with Optima Bank & Trust on April 17, 2019 Addition of 6 banking office locations in New Hampshire to complement over $1 billion of Wealth Management assets in this important market Named the 19th Largest Independent Investment Advisor in Massachusetts (according to Boston Business Journal) Named as one of the region’s top corporate charitable contributors (according to Boston Business Journal) Increased resources to support expansion of business development initiatives Near Term Priorities: COVID-19 - Focused on our team, clients, community support and risk management Merger Integration Continuing Priorities: Leverage private banking model in highly attractive markets Increase brand awareness Expand Wealth Management assets under management Grow and diversify Commercial Banking opportunities & relationships Expand client base & deepen existing relationships to grow deposit base 20 Recent Progress Strategic Focus

Sustainability at Cambridge Trust We embrace inclusiveness across all areas of our organization We have more female Board members than any other company listed on Nasdaq* We are among the Top 15 Greater Boston Companies with Most Diverse Corporate Boards 21 Community Impact Cambridge Trust is helping to build a better tomorrow for our clients, employees, communities, and society. -Denis Sheahan, President and CEO We engage in renewable energy lending and we do not lend to companies that produce fossil fuels We are making investments in technology to reduce the use of paper and carbon emissions We offer sustainable investing options for clients through internally developed Socially Responsible Investing strategies We provide affordable mortgage programs and access to financial subsidies for first-time homebuyers We provide a range of financial solutions for nonprofit organizations and minority-owned, women-owned and veteran-owned businesses We give back not only through our charitable donations and grants but also our team’s volunteer support for a variety of local organizations. Employee Engagement We are committed to recruiting, developing and promoting a diverse workforce We foster a culture that encourages employees to contribute their professional best Diversity & Inclusion The Environment ~1,450 PPP Loans Benefited an Estimated 24,000 Local Jobs 91% Increase in charitable giving in 2020 $425,000 Directly for Pandemic Relief & Racial Equity / Social Justice Additional information can be found within the sustainability section of our website *S&P Global Market Intelligence © 2021 as of December 10, 2020

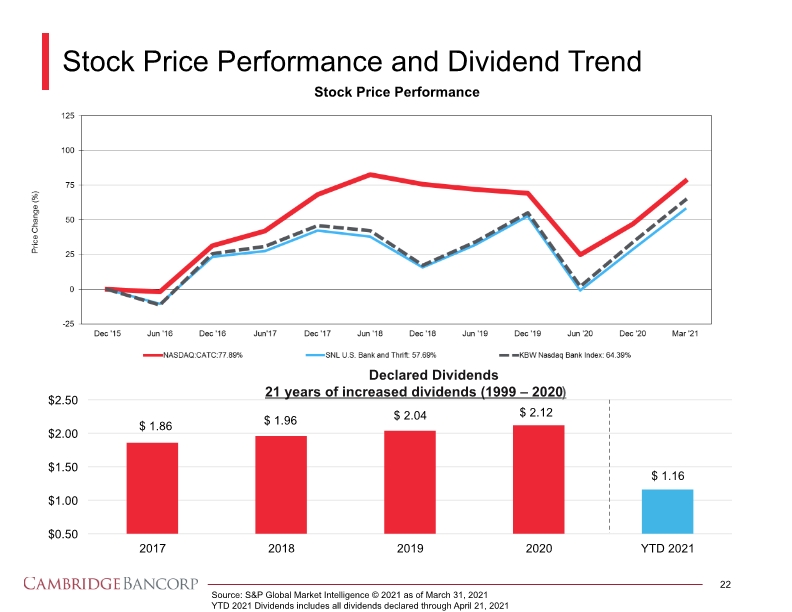

Stock Price Performance and Dividend Trend 22 Source: S&P Global Market Intelligence © 2021 as of March 31, 2021 YTD 2021 Dividends includes all dividends declared through April 21, 2021 Declared Dividends 21 years of increased dividends (1999 – 2020) Stock Price Performance Line & Bar chart

Why Cambridge Bancorp? 23 Focused private banking business model Attractive geographic markets Affluent client base Expanding commercial services Investing for future growth Consistently profitable Strong returns Core deposit funded Well-capitalized Strong asset quality Sound underwriting acumen and risk management practices Client-centric service culture Loyal client base Experienced, conservative leadership Commitment to our community Business Model Performance Credit Culture

24 Appendix

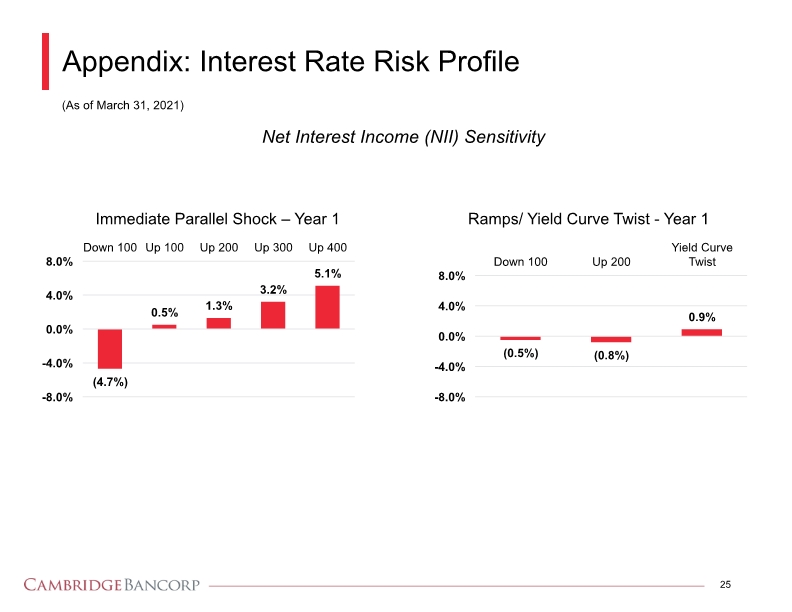

25 Net Interest Income (NII) Sensitivity (As of March 31, 2021) Appendix: Interest Rate Risk Profile Ramps/ Yield Curve Twist - Year 1 Immediate Parallel Shock – Year 1 Bar chart

Forward Looking Statements and Non-GAAP Measures Certain statements herein may constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about the Company and its industry involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding the Company’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, the impact of any laws or regulations applicable to the Company, and measures being taken in response to the COVID-19 pandemic and the impact of the COVID-19 pandemic on the Company’s business are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Such factors include, but are not limited to, the following: the current global economic uncertainty and economic conditions being less favorable than expected, disruptions to the credit and financial markets, changes in the Company’s accounting policies or in accounting standards, weakness in the real estate market, legislative, regulatory or accounting changes that adversely affect the Company’s business and/or competitive position, the Dodd-Frank Act’s consumer protection regulations, the duration and scope of the COVID-19 pandemic and its impact on levels of consumer confidence, actions governments, businesses and individuals take in response to the COVID-19 pandemic, the impact of the COVID-19 pandemic and actions taken in response to the pandemic on global and regional economies and economic activity, the pace of recovery when the COVID-19 pandemic subsides, challenges from the integration of the Company and Optima Bank & Trust Company and Wellesley Bancorp Inc. (“Wellesley”)resulting in the combined business not operating as effectively as expected, disruptions in the Company’s ability to access the capital markets, the cost savings of the merger with Wellesley may not be fully realized or may take longer to realize than expected, operating costs, customer loss and business disruption following the merger with Wellesley, including adverse effects on relationships with employees, may be greater than expected, and other factors that are described in the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year end December 31, 2020, which the Company filed on March 15, 2021. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). This information includes operating net income and operating diluted earnings per share, tangible book value per share and the tangible common equity ratio, return on average assets, return on tangible common equity, efficiency ratio on an operating basis, operating pre-tax pre-provision income, and operating return on average assets. Operating net income and operating diluted earnings per share exclude items that management believes are unrelated to its core banking business such as merger, acquisition, and capital raise expenses, gain (loss) on disposition of investment securities, and other items. The Company’s management uses operating net income and operating diluted earnings per share to measure the strength of the Company’s core banking business and to identify trends that may to some extent be obscured by such excluded gains or losses. Management also supplements its evaluation of financial performance with analysis of tangible book value per share (which is computed by dividing shareholders’ equity less goodwill and acquisition related intangible assets, or “tangible common equity,” by common shares outstanding), the tangible common equity ratio (which is computed by dividing tangible common equity by tangible assets, defined as total assets less goodwill and acquisition related intangibles), analysis of return on average assets and return on tangible common equity on an operating basis, the operating efficiency ratio (which is computed by dividing noninterest expense adjusted for nonoperating expenses and total revenue adjusted for gain/(loss) on disposition of investment securities), analysis of operating pre-tax pre-provision income over average assets (which is computed by dividing income before taxes adjusted by provision for (release) for credit losses, non-operating expenses, and gain/(loss) on disposition of investment securities over average assets). The Company has included information on tangible book value per share, the tangible common equity ratio, and return on average assets and return on tangible common equity on an operating basis because management believes that investors may find it useful to have access to the same analytical tool used by management. As a result of merger and acquisition activity, the Company has recognized goodwill and other intangible assets in conjunction with business combination accounting principles. Excluding the impact of goodwill and other intangibles in measuring asset and capital values for the ratios provided, along with other bank standard capital ratios, provides a framework to compare the capital adequacy of the Company to other companies in the financial services industry. These non-GAAP measures should not be viewed as a substitute for operating results and other financial measures determined in accordance with GAAP. An item which management deems to be nonoperating and excludes when computing these non-GAAP measures can be of substantial importance to the Company’s results for any particular quarter or year. The Company’s non-GAAP performance measures, including operating net income, operating diluted earnings per share, tangible book value per share, the tangible common equity ratio, and return on average assets, return on average equity, and efficiency ratio on an operating basis are not necessarily comparable to non-GAAP performance measures which may be presented by other companies. . Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented under “GAAP to Non-GAAP Reconciliations.” Reconciliations are included in the most recent Earnings Release, which can be located on our website here: http://ir.cambridgetrust.com/News/ 26

27 Cambridge Bancorp Parent of Cambridge Trust Company Denis K. Sheahan Chairman, President and Chief Executive Officer 617-520-5520Michael F. Carotenuto Senior Vice President and Chief Financial Officer 617-520-5520