Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOK FINANCIAL CORP | bokf-20210421.htm |

BOK Financial Corporation First Quarter 2021 Earnings Conference Call April 21, 2021

Forward-Looking Statements: This presentation contains forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, the economy generally and the expected or potential impact of the novel coronavirus (COVID-19) pandemic, and the related responses of the government, consumers, and others, on our business, financial condition and results of operations. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. Management judgments relating to and discussion of the provision and allowance for credit losses, allowance for uncertain tax positions, accruals for loss contingencies and valuation of mortgage servicing rights involve judgments as to expected events and are inherently forward-looking statements. Assessments that acquisitions and growth endeavors will be profitable are necessary statements of belief as to the outcome of future events based in part on information provided by others which BOK Financial has not independently verified. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expected, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to changes in government, consumer or business responses to, and ability to treat or prevent further outbreak of, the COVID-19 pandemic, changes in commodity prices, interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and nontraditional competitors, changes in banking regulations, tax laws, prices, levies and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the Securities and Exchange Commission which can be accessed at www.BOKF.com. All data is presented as of March 31, 2021 unless otherwise noted. Legal Disclaimers 2

Steven G. Bradshaw Chief Executive Officer 3

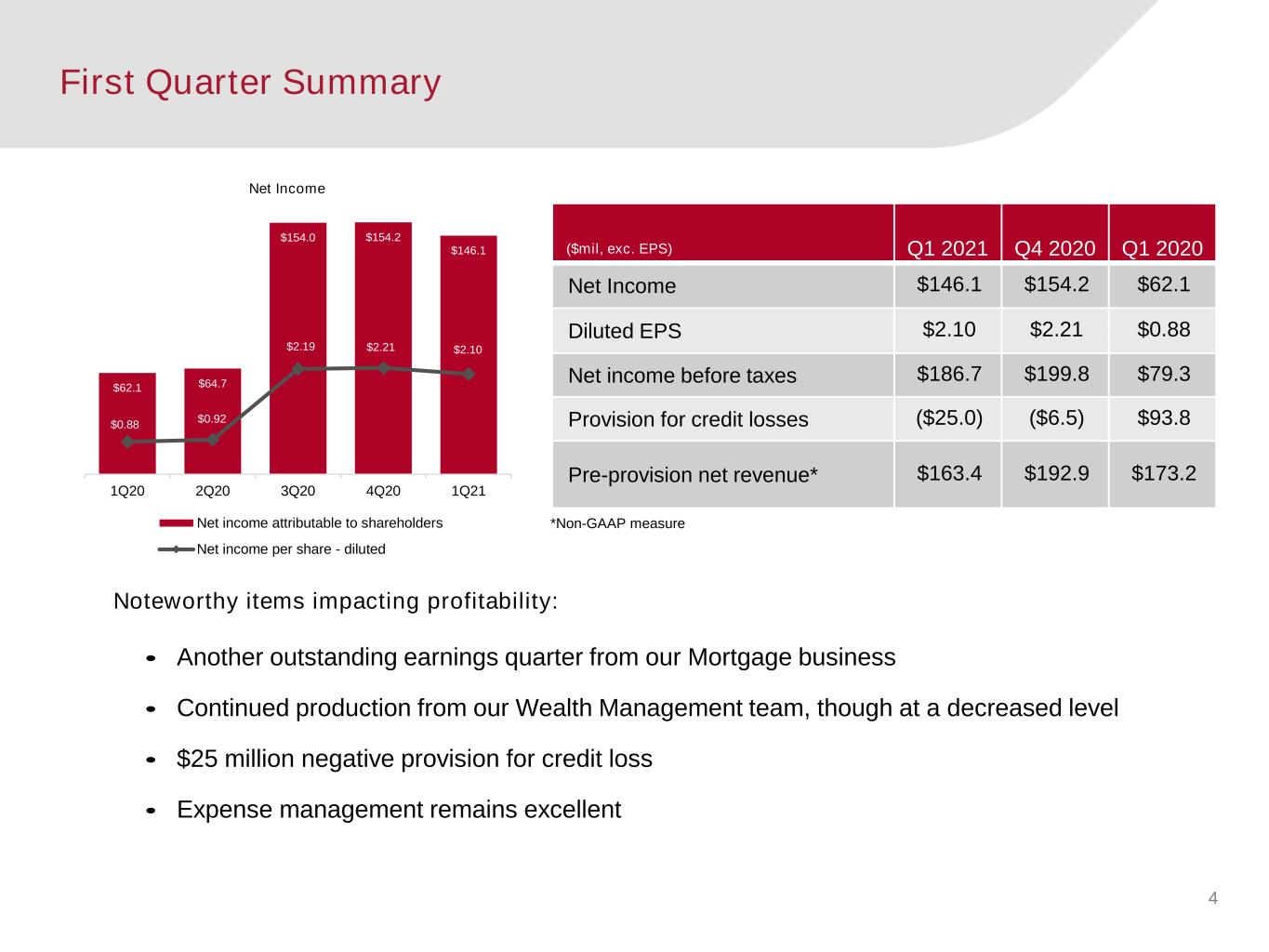

Noteworthy items impacting profitability: • Another outstanding earnings quarter from our Mortgage business • Continued production from our Wealth Management team, though at a decreased level • $25 million negative provision for credit loss • Expense management remains excellent First Quarter Summary ($mil, exc. EPS) Q1 2021 Q4 2020 Q1 2020 Net Income $146.1 $154.2 $62.1 Diluted EPS $2.10 $2.21 $0.88 Net income before taxes $186.7 $199.8 $79.3 Provision for credit losses ($25.0) ($6.5) $93.8 Pre-provision net revenue* $163.4 $192.9 $173.2 $62.1 $64.7 $154.0 $154.2 $146.1 $0.88 $0.92 $2.19 $2.21 $2.10 1Q20 2Q20 3Q20 4Q20 1Q21 Net Income Net income attributable to shareholders Net income per share - diluted *Non-GAAP measure 4

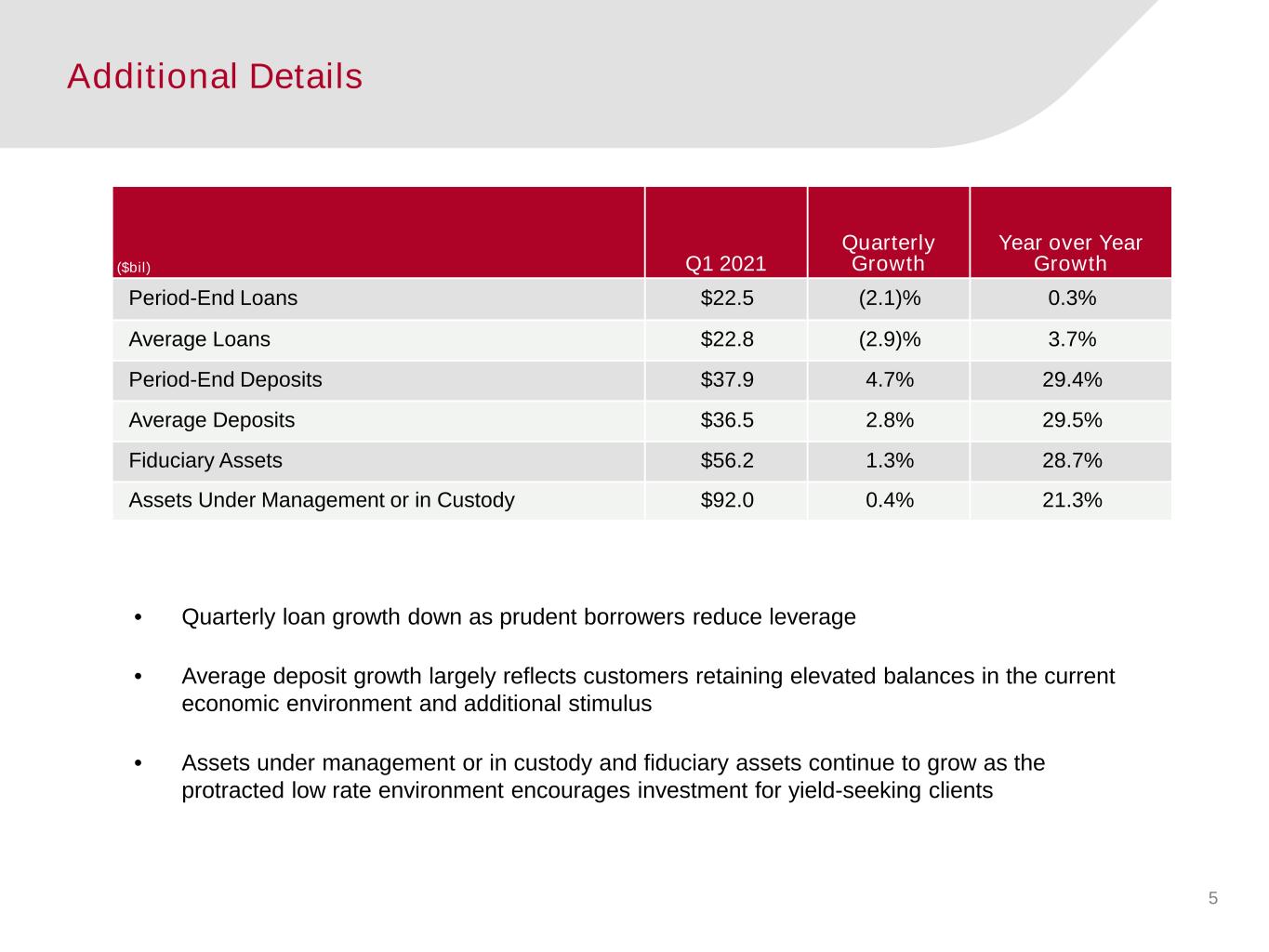

($bil) Q1 2021 Quarterly Growth Year over Year Growth Period-End Loans $22.5 (2.1)% 0.3% Average Loans $22.8 (2.9)% 3.7% Period-End Deposits $37.9 4.7% 29.4% Average Deposits $36.5 2.8% 29.5% Fiduciary Assets $56.2 1.3% 28.7% Assets Under Management or in Custody $92.0 0.4% 21.3% • Quarterly loan growth down as prudent borrowers reduce leverage • Average deposit growth largely reflects customers retaining elevated balances in the current economic environment and additional stimulus • Assets under management or in custody and fiduciary assets continue to grow as the protracted low rate environment encourages investment for yield-seeking clients Additional Details 5

Stacy Kymes Chief Operating Officer 6

Loan Portfolio ($mil) Mar 31, 2021 Dec 31, 2020 Mar 31, 2020 Seq. Loan Growth YOY Loan Growth Energy $3,202.5 $3,469.2 $4,111.7 (7.7)% (22.1)% Services 3,421.9 3,508.6 3,955.7 (2.5)% (13.5)% Healthcare 3,290.8 3,306.0 3,165.1 (0.5)% 4.0% General business 2,742.6 2,793.8 3,563.5 (1.8)% (23.0)% Total C&I $12,657.8 $13,077.5 $14,796.0 (3.2)% (14.5)% Commercial Real Estate 4,503.3 4,698.5 4,450.1 (4.2)% 1.2% Loans to Individuals 3,524.2 3,549.1 3,217.9 (0.7)% 9.5% Core Loans $20,685.3 $21,325.2 $22,464.0 (3.0)% (7.9)% Paycheck Protection Program 1,848.6 1,682.3 -- 9.9% --% Total Loans $22,533.8 $23,007.5 $22,464.0 (2.1)% 0.3% • New energy deals sufficient to offset paydowns remain difficult in current environment, as borrowers continue to pay down debt • Quarterly growth in senior housing loans offset by a decrease to hospital system loans • Forgiveness of PPP slowed as latest round of PPP was opened during the quarter 7

• Net charge-offs decreased to 25 basis points, or 28 basis points excluding PPP loans, remaining below historical averages • Last four quarter average net charge-offs at 28 basis points (31 basis points excluding PPP loans) continues to be at or below historic range of 30 to 40 basis points • Appropriately reserved with an ALLL excluding PPP loans of 1.70% and combined allowance of 1.86% including unfunded commitments excluding PPP loans • Total non-accrual loans down $18.7 million • A decrease of $23.3 million in Energy non-accruals • Potential problem loans (substandard, accruing) totaled $422 million at 3/31, compared to $478 million at 12/31 $163.2 $255.4 $221.2 $234.7 $216.0 1Q20 2Q20 3Q20 4Q20 1Q21 Non-accruals (mil) Energy Healthcare CRE Residential and Other 0.31% 0.23% 0.37% 0.28% 0.25% 0.00% 0.20% 0.40% 0.60% 1Q20 2Q20 3Q20 4Q20 1Q21 Net charge-offs (annualized) to average loans Key Credit Quality Metrics 8

Fees and Commissions Revenue ($mil) Growth: Q1 2021 Quarterly, Sequential Quarterly, Year over Year Trailing 12 Months Brokerage and Trading $20.8 (47.4)% (59.1)% (13.5)% Transaction Card 22.4 2.4% 2.5% 0.6% Fiduciary and Asset Management 41.3 (1.1)% (7.1)% (1.9)% Deposit Service Charges and Fees 24.2 (0.6)% (7.4)% (2.0)% Mortgage Banking 37.1 (5.6)% (0.1)% —% Other Revenue 16.3 14.7% 32.4% 7.7% Total Fees and Commissions $162.2 (10.4)% (15.9)% (3.8)% • Brokerage and Trading revenue decreased linked-quarter due to normalizing volumes and margins • Mortgage Banking off from record levels due to margin compression, though volumes remain solid • Other Revenue up due to higher revenue from repossessed oil and gas properties 9

Steven Nell Chief Financial Officer 10

Net Interest Revenue and Margin ($mil) Q1 2021 Q4 2020 Q3 2020 Q2 2020 Q1 2020 Net interest revenue $280.4 $297.2 $271.8 $278.1 $261.4 Net interest margin 2.62% 2.72% 2.81% 2.83% 2.80% Yield on available for sale securities 1.84% 1.98% 2.11% 2.29% 2.48% Yield on loans 3.55% 3.68% 3.60% 3.63% 4.50% Cost of int-bearing deposits 0.17% 0.19% 0.26% 0.34% 0.98% Cost of wholesale borrowings 0.50% 0.54% 0.51% 0.44% 1.57% 11 • Net interest revenue impacted by the timing of loan fees, including a $2 million decline in PPP fees linked quarter. • Net interest margin pressured due to lower average outstanding loan balances and the available for sale securities portfolio yield declining 14 basis points. Reduction in interest bearing deposit cost at a decreased pace from previous quarters.

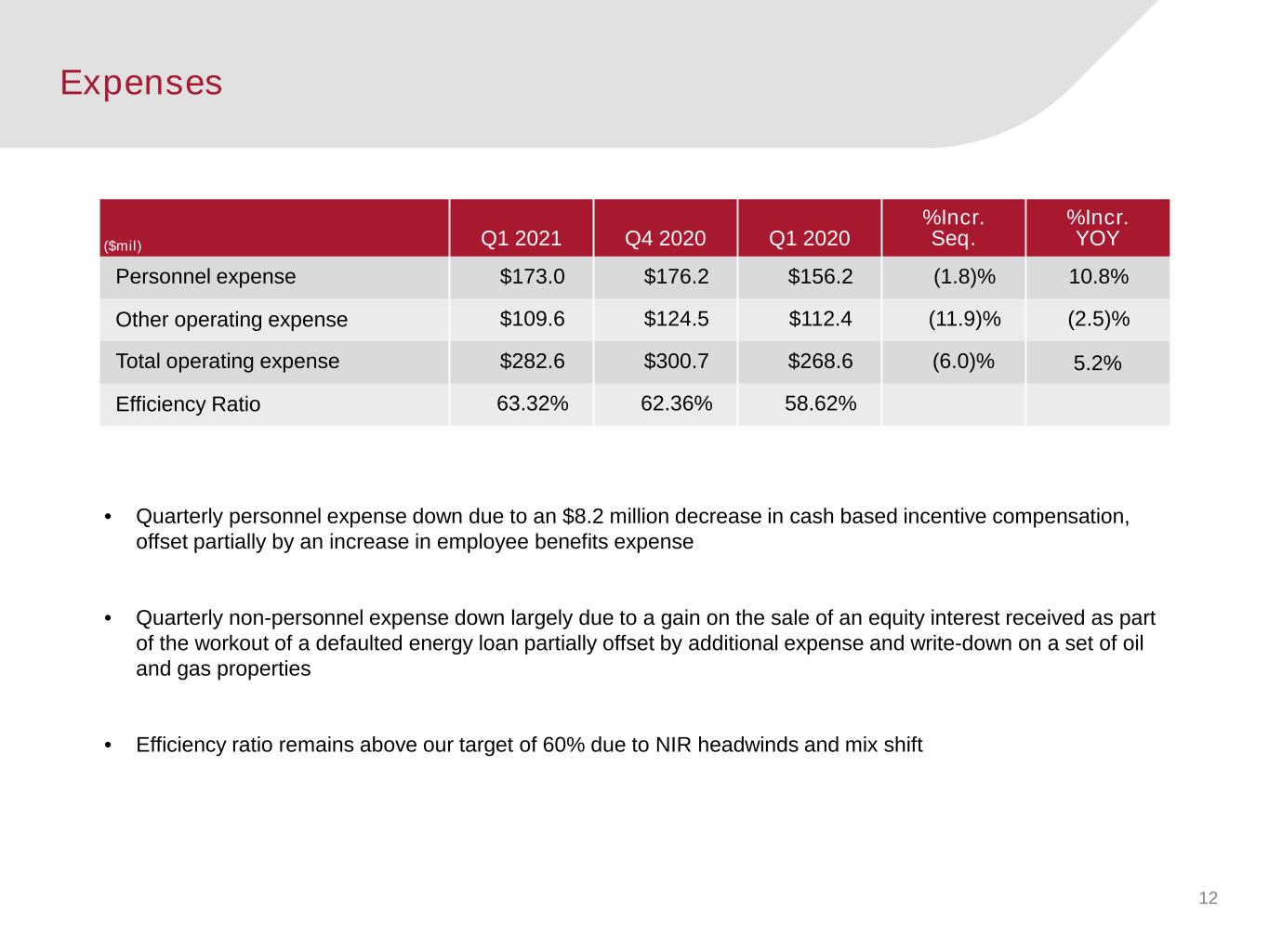

Expenses ($mil) Q1 2021 Q4 2020 Q1 2020 %Incr. Seq. %Incr. YOY Personnel expense $173.0 $176.2 $156.2 (1.8)% 10.8% Other operating expense $109.6 $124.5 $112.4 (11.9)% (2.5)% Total operating expense $282.6 $300.7 $268.6 (6.0)% 5.2% Efficiency Ratio 63.32% 62.36% 58.62% • Quarterly personnel expense down due to an $8.2 million decrease in cash based incentive compensation, offset partially by an increase in employee benefits expense • Quarterly non-personnel expense down largely due to a gain on the sale of an equity interest received as part of the workout of a defaulted energy loan partially offset by additional expense and write-down on a set of oil and gas properties • Efficiency ratio remains above our target of 60% due to NIR headwinds and mix shift 12

Q1 2021 Q4 2020 Q1 2020 Loan to Deposit Ratio 59.5% 63.7% 76.8% Period End Deposits $37.9 billion $36.1 billion $29.2 billion Available secured wholesale borrowing capacity $12.8 billion $12.8 billion $12.8 billion Common Equity Tier 1 12.1% 12.0% 11.0% Total Capital Ratio 14.0% 13.8% 12.7% Tangible Common Equity Ratio 8.8% 9.0% 8.4% • Deposit growth continues to be strong • Nearly $13 billion of secured borrowing capacity • CET1 and Total Capital are 500bp and 350bp above well-capitalized, respectively • Repurchased 260,000 shares at an average price of $77.20 per share in the open market Liquidity & Capital 13

• Loan growth will slowly accelerate in tandem with the broader economic recovery this year, excluding the impact of PPP • Available-for-sale security portfolio yield expected to decrease as prepayments force reinvestment at lower rates • Interest-bearing deposit costs nearing a bottom • The combination of securities reinvestment at lower rates and minimal room to further lower deposit costs will impact net interest margin • Fee revenue categories expected to grow modestly with the exception of brokerage and trading and mortgage • Operating expenses budgeted to grow at a low single digit pace • Additional loan loss reserve release possible with an improving economic outlook • Opportunistic share repurchase activity to continue • Intend to bring all employees back to the office by end of Q2 Forecast and Assumptions 14

Steven G. Bradshaw Chief Executive Officer 15

Question and Answer Session 16