Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ATHENA GOLD CORP | athena_8k.htm |

| EX-99.2 - FACT SHEET - ATHENA GOLD CORP | athena_ex9902.htm |

Exhibit 99.1

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 1 The Resurgence of the Walker Lane Trend APRIL 2021 : AHNR

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 2 DISCLAIMER This presentation of Athena Gold Corporation (the "Company") is for information only and shall not constitute an invitation or o ffer to buy, sell, issue or subscribe for, or the solicitation of an offer to buy, sell or issue, or subscribe for any securities. It has been provided solely to assist the recipient in evaluating the Company. This presentation is not, nor is it to be construed under any circumstances as a prospectus, a public offering of securities, or an offering memorandum as defined under any applicable securities legislation. This presentation does not contain all of the information that would no rmally appear in an offering document registered under applicable securities laws. This presentation should not be construed as legal, financial or tax advice to any person, as each person's circumstances are di fferent. Readers should consult with their own professional advisors regarding their particular circumstances. In making an investment decision, investors must rely on their own examination of the Company, including the merits and risks in volved. The Company's securities have not been approved or disapproved by the U.S. Securities and Exchange Commission (the "SEC") or by any state securities commission or regulatory authority, nor have any of the foregoing authorities or any Canadian provincial securities regulator passed on the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. FORWARD LOOKING STATEMENTS This presentation contains forward - looking statements and forward - looking information (collectively, "forward - looking statements ") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995 concerning the business, operations and financial performance and condition of the Company. All statements, other than state me nts of historical fact, included herein including, without limitation, statements regarding future capital expenditures and financings (including the amount and nature thereof), anticipated conten t, commencement, and cost of exploration programs in respect of the Company's projects and mineral properties, anticipated exploration program results from exploration activities, the discovery and delineation of mineral deposits, resou rce s and/or reserves on the Company's projects and mineral properties, and the anticipated business plans and timing of future activities of the Company, are forward - looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "will", "expects", "may", "should", "bud get ", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, m igh t or will occur or be taken or achieved. Forward - looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward - looking information. Such risks and other factors include, among others, the a bility of the Company to obtain sufficient financing to fund its business activities and plans, operating and technical difficulties in connection with mineral exploration and development and mine development activities for the Company 's projects generally, including the geological mapping, prospecting and sampling programs for the Company's projects, actual results of exploration activities, including the estimation or realization of mineral reserves and mineral r eso urces, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements fo r additional capital, future prices of precious metals, tantalum and lithium, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore g rad e or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental and regulatory approvals (including of any applicable stock exchange), permits or financing or in the completion of development or construction activities, risks relating to epidemics or pandemics such as COVID - 19, including the impact of COVID - 19 on the Company's busines s, financial condition and results of operations, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timi ng and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Fac tors" in the Company's most recent continuous disclosure filing available on the EDGAR filing system at www.sec.gov . Readers are cautioned not to place undue reliance on forward - looking statements. The Company undertakes no obligation to update any of the forward - looking information in this presentation or incorporated by reference herein, except as otherwise required by law.

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 3 QUALIFIED PERSON Ken Brook, RPG , is a Qualified Person as defined by National Instrument 43 - 101 Standards of Disclosure for Mineral Projects ("NI 43 - 101"), has approved the scientific and technical information concerning the Company discussed in this presentation. Mr. Brook is independent of the Company. CAUTIONARY NOTE TO UNITED STATES INVESTORS The Company has prepared the disclosure in this investor presentation, and the technical report titled " Technical Report On The Excelsior Springs Property Esmeralda County, Nevada, USA " and authored by Doyle Kenneth Brook Jr. (the "Technical Report") has been prepared, in accordance with National Instrument 43 - 101 Standards of Disclosure for Mineral Projects ("NI 43 - 101") of the Canadian Securities Administrators and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amend ed (the "CIM Standards") . NI 43 - 101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral pr oje cts. The terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in accordance with NI 43 - 101 and the CIM Standards. These definitions differ materially from the definitions i n the SEC Industry Guide 7 ("SEC Industry Guide 7") under the United States Securities Act of 1933 , as amended (the "U.S. Securities Act"). Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to rep ort mineral reserves, the three - year historical average price is used in any mineral reserve or cash flow analysis to designate mineral reserves and the primary environmental analysis or report must be filed with the appropriate governmental a uth ority. The terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by NI 43 - 101 and the CIM Standards; however, these terms are not d efined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. The Company may use certain terms, such as "Measured Mineral Resources", "Indicated Mineral R eso urces", "Inferred Mineral Resources" and "Probable Mineral Reserves" which differ materially from the definitions in SEC Industry Guide 7 under the U.S. Securities Act. U.S. Investors are cautioned not to assume that all or an y p art of mineral deposits in these categories will ever be converted into Mineral Reserves. In addition, "reserves" reported by the Company in the future under Canadian standards may not qualify as reserves under SEC standards. Under SEC st and ards, mineralization may not be classified as a "reserve" unless the mineralization can be economically and legally extracted or produced at the time the "reserve" determination is made. Inferred mineral resources have a great amoun t o f uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance. The historical production referenced in the Technical Report and referred to herein is unconfirmed, and the Company believes that it provide s a n indication of the potential of the property and is relevant to ongoing exploration. The SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules under subpart 1300 of Regul ation S - K of the U.S. Securities Act (the "SEC Modernization Rules"). The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Moderni zat ion Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mi ner al reserves" to be substantially similar to international standards. The SEC Modernization Rules will become mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. CONFIDENTIAL INFORMATION This presentation is confidential and is being provided to you solely for your information and may not be reproduced, in whol e o r in part, in any form or forwarded or further distributed to any other person. Any forwarding, distribution or reproduction of this document in whole or in part is unauthorized. By accepting and reviewing this presentation, you acknowl edg e and agree ( i ) to maintain the confidentiality of this document and the information contained herein, (ii) to protect such information in the same manner you protect your own confidential information, which shall be at least a reasonab le standard of care, and (iii) to not utilize any of the information contained herein except to assist with your evaluation of the Company.

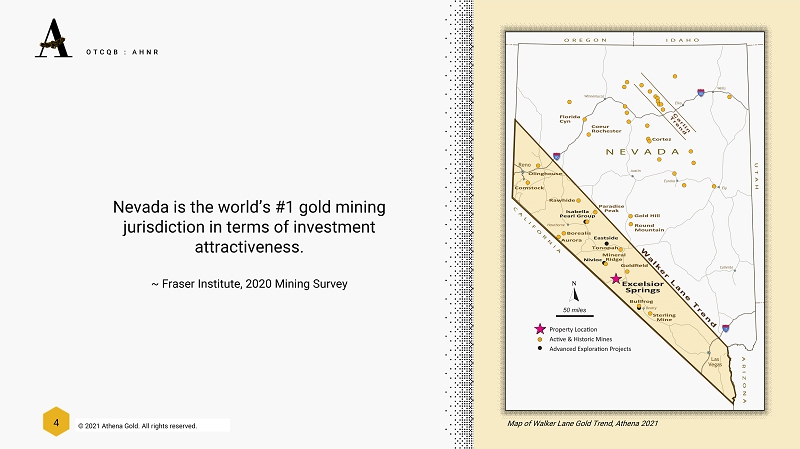

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 4 Nevada is the world’s #1 gold mining jurisdiction in terms of investment attractiveness. ~ Fraser Institute, 2020 Mining Survey OTCQB : AHNR Map of Walker Lane Gold Trend, Athena 2021

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 5 A JUNIOR GOLD EXPLORER CURRENTLY ADVANCING THE EXCELSIOR SPRINGS PROJECT IN THE HEART OF NEVADA’S WALKER LANE GOLD DISTRICT ABOUT US Top Tier Exploration & Mining Jurisdiction Comprehensive Exploration Strategy Committed & Experienced Team Significant Mineralization De - Risked Project with Blue Sky Potential Near Term Results Expected • Goldfield - 5M oz Au • Bullfrog - 2M oz Au • Tonopah - 2Moz Au • Mineral Ridge - 1.5Moz Au • Drill program to start in 3Q 2021 • Goal of expanding mineralization and developing mineable resources 61% of the historic drill results show gold mineralization above the typical Nevada, open - pit - mine cut off grade of 0.25g Au/T • Q2: Geophysics • Q3: Oriented Core Drilling • Q4: RC Drilling John Power, President of Athena Silver (now Athena Gold) since 2010. History of providing high returns to investors Opportunity to define a commercial resource by leveraging the latest exploration technologies utilizing the extensive, historical project database

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 6 EACH OPERATOR HAS ADVANCED THE PROJECT AND DRILLED EXTENSIONS OF THE KNOWN GOLD MINERALIZATION. Unverified, historic production, reported to be 19,200 oz Au (18,000 tons containing 1.2 oz Au/ton (37.3g Au/T) Efforts to re - timber the shafts and attempts at small scale mining Great Pacific Resources (11 RC holes) Lucky Hardrock JV (12 RC holes) Walker Lane Gold (22 RC holes) Evolving Gold (8 RC holes) Global Geoscience and partner Osisko Mining (31 RC holes & Geophysics) Late 1800s 1960s & 1970s 1986 1988 2005 - 2007 2008 2011 - 2014 HISTORY Athena Gold 2020 - Reno Gazette - Journal (Reno, Nevada), 13 Nov 1908

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 7 • Advanced exploration stage • Prestigious Walker Lane • 2 Patented lode claims & 140 BLM lode claims (2,884 acres / 1,167 hct ) • Good location in mining friendly Esmeralda County • Significant prior exploration creates solid foundation • Intrusion gold targets EXCELSIOR SPRINGS - FLAGSHIP PROJECT

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 8 BUILDING ON A HISTORY OF SUCCESS THE WALKER LANE DISTRICT IS KNOWN FOR SEVERAL GOLD PROJECTS THAT PRODUCED MORE THAN 1 MILLION OUNCES. BASED ON PREVIOUS DRILL RESULTS, IT IS BELIEVED THAT EXCELSIOR SPRINGS HAS POTENTIAL TO JOIN THIS PRESTIGIOUS GROUP OF WALKER LANE PROJECTS. Total holes drilled Holes containing at least 20ft (6.1m) @1g/t Au Holes containing at least 20ft (6.1m) @0.5g/t Au Holes containing at least 20ft (6.1m) @0.1 - 0.25 g/t Au Holes containing at least 20ft (6.1m) @0.01 g/t Au # of holes 84 24 40 51 65 % of total holes 100% 29% 48% 61% 77% Source: An NI 43-101 Technical Report dated December 16, 2020 entitled “Technical Report for the Excelsior Springs Property E sme ralda County, Nevada, U.S.A.” prepared by Ken Brook, RPG, QP

9 OTCQB : AHNR OTCQB : AHNR © 2021 Athena Gold. All rights reserved. 9 SIGNIFICANT MINERALIZATION HISTORIC DRILL HOLES WITH SIGNIFICANT GOLD GRADES AND THICKNESSES: Hole No. Interval Meters Gold G/T Depth From Meters To TA - 03 16.8 1.47 1.5 18.3 TA - 11 15.2 1.68 0.0 15.2 88 - 06 27.4 2.74 0.0 27.4 88 - 08 38.1 1.25 0.0 38.1 EX - 02 33.6 2.87 70.1 103.7 EX - 15 48.8 0.80 19.8 68.6 EX - 30 22.9 2.21 71.6 94.5 GE - 08 22.9 1.85 93.0 115.6 GE - 14 19.8 1.10 7.6 27.4 Drill hole intercepts in the main Buster Zone, Geo Vector Consultants, 2020

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 10 FUNDAMENTAL GROWTH & VALUE STRATEGY BUILD VALUE BY DELIVERING ON 3 KEY EXPLORATION PROGRAMS Oriented Core Drill Program Q3 - 2021 RC Drill Program Q4 - 2021 Geophysics Program Q2 - 2021 1 2 3

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 11 • Results of the prior IP survey in 2011 indicated shallow, high - chargeability anomaly. • As outlined in our 43 - 101, the new IP survey will provide a greater depth penetration and better definition of the southwestern anomaly. • Favorable results from the new survey could define a new high priority drill target. 1. GEOPHYSICS PROGRAM Zonge Geosciences, Inc. 2011 Southwestern anomaly

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 12 • Tremendous opportunity to better understand the structural geology. • No historic core drilling. • Structure is poorly understood. • Oriented Core drilling is necessary to understand the structural controls of mineralization on the project by providing accurate strikes and dips of the mineralized veins. • Athena will utilize Oriented Targeting Solutions to conduct an oriented core drill program. This company has vast experience in the Walker Lane District and has worked with majors including Agnico Eagle Mines, South32 and Barrick. Image provided for illustrative purposes and is not meant to represent the Athena Project Case study of oriented core drill program Oriented Targeting Solutions 2. ORIENTED CORE DRILL PROGRAM

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 13 The objective of the RC program is to confirm the attitude of the mineralized structures and to significantly expand the number of mineralized intercepts by utilizing proper orientation of the RC drill holes. Eighty five percent of the mapped structures dip north, northeast, or northwest yet only 5% of the drill holes had a southern azimuth that is required to test these structures. Generate sufficient data to estimate initial resource. RC Programs to be designed with our senior technical advisor, David Beling, P.E. Dave is the former President of Bullfrog Gold Corp. and has successful track records in the Walker Lane and other mining districts in Nevada. Phase 3a Phase 3b 3. RC DRILL PROGRAM

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 14 A RISK - MANAGED APPROACH TO RESOURCE DEFINITION LEVERAGING THE LATEST EXPLORATION TECHNOLOGIES TO ADVANCE EXCELSIOR SPRINGS PROJECT. Target date Q2 - 2021 • IP Survey to better define the Southwestern Anomaly to a depth of 900 ft (274m). • Estimated Cost $122,235 Target date Q3 - 2021 • Oriented Core 2,000ft (610m) oriented core drilling • Estimated Cost $311,050 Target date Q4 - 2021 • 10,000ft (3048m) RC drilling • Estimated Cost $430,050 Phase 1 Phase 2 Phase 3

© 2021 Athena Gold. All rights reserved. OTCQB : AHNR 15 • Past President of Redwood Microcap Fund, Inc.(1985 - 2005). Increased shareholder value by 6X under his stewardship. • Lead investor of Airsoft, Inc. Returned 20X to investment group • President of Athena Silver since 2010 - managed Langtry Silver project and developed NI 43 - 101 compliant resource of over 60 million oz Ag • 20+ years in private and offshore banking heading up international desks in London, Zurich and Johannesburg. • Founding partner of several private companies in domains such as financial services, property development and private equity funds bringing them to profitability. • Markus holds a MCom from the University of Fribourg in Switzerland and is currently a director and the chair of the Audit Committee of Nubian Resources Ltd. • A seasoned mining professional and director with over 50 years experience . • Served on the board of 14 listed companies . Currently a director of NioCorp Developments Ltd . • Past CEO of Bullfrog Gold Corp ( 2011 - 2020 ) where he led the acquisition of Barrick Gold’s lands and developed 500 , 000 + ounces of gold resources in the Bullfrog Mining District . John Power CHIEF EXECUTIVE OFFICER Markus Janser DIRECTOR David Beling , P.E STRATEGIC TECHNICAL ADVISOR DEDICATED & EXPERIENCED TEAM

16 OTCQB : AHNR OTCQB : AHNR © 2021 Athena Gold. All rights reserved. 16 CAPITAL STRUCTURE 15 February 2021 Millions Issued Shares 60.2 Float 17.7 Option/Warrants None Nubian Resources (Future Issuance) 45 Fully Diluted Common Shares 108.7 Market Capitalization US$7m Current Price US$0.11 52 - Week Range (US$0.01 - $0.23) Management Ownership 33,566,624 shares Nubian Resources 5,000,000 shares : AHNR TARGET LISTING ON THE CSE: 2Q - 2021

© 2021 Athena Gold. All rights reserved. 17 17

Athena Gold Corporation 2010 - A Harbison Dr., PMB #312, Vacaville, CA USA 95687 For more information: John Power Athena CEO T: +1 (707) 291 6198 E: johncaseypower@gmail.com OTCQB : AHNR