Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - AGILITI, INC. \DE | d59213dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 21, 2021

No. 333-253947

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Agiliti, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7350 | 83-1608463 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6625 West 78th Street, Suite 300

Minneapolis, MN 55439

Telephone: (952) 893-3200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Thomas J. Leonard

Chief Executive Officer

6625 West 78th Street, Suite 300

Minneapolis, MN 55439

Telephone: (952) 893-3200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Robert M. Hayward, P.C. Alexander M. Schwartz Kirkland & Ellis LLP 300 North LaSalle Chicago, IL 60654 (312) 862-2000 |

Alexander D. Lynch Barbra J. Broudy Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, NY 10153 (212) 310-8000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated Filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller Reporting Company | ☐ | |||

| Emerging Growth Company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.0001 per share |

30,263,157 | $20.00 | $605,263,140 | $66,034.21 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes the aggregate offering price of shares of common stock subject to the underwriters’ option to purchase additional shares. |

| (2) | Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | The registrant has previously paid the registration fee. |

The registrant hereby amends this Registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. The preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

Subject to Completion.

Preliminary Prospectus dated April 21, 2021

26,315,789 Shares

PROSPECTUS

Common Stock

This is an initial public offering of shares of common stock of Agiliti, Inc.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $18.00 and $20.00. We have been approved to list our common stock on the New York Stock Exchange (“NYSE”) under the symbol “AGTI.”

See “Risk Factors” beginning on page 24 to read about factors you should consider before buying shares of our common stock.

Immediately after this offering, assuming an offering size as set forth above, funds controlled by our principal stockholder, Thomas H. Lee Partners, L.P., will own approximately 78.4% of our outstanding common stock (or 76.0% of our outstanding common stock if the underwriters’ option to purchase additional shares is exercised in full). As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the NYSE. See “Management—Corporate Governance—Controlled Company Status.”

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount (1) |

$ | $ | ||||||

| Proceeds, before expenses, to Agiliti, Inc. |

$ | $ | ||||||

| (1) | See “Underwriting (Conflicts of Interest)” for a description of compensation payable to the underwriters. |

To the extent that the underwriters sell more than 26,315,789 shares of common stock, the underwriters have the option to purchase up to an additional 3,947,368 shares of our common stock at the initial public offering price less the underwriting discount.

| BofA Securities | Goldman Sachs & Co. LLC | Morgan Stanley | BMO Capital Markets |

| Citigroup | Jefferies | UBS Investment Bank |

| KeyBanc Capital Markets |

Raymond James |

MUFG |

SMBC Nikko |

| Mischler Financial Group, Inc. |

Siebert Williams Shank |

Prospectus dated , 2021

Table of Contents

| 1 | ||||

| 18 | ||||

| 24 | ||||

| 46 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 53 | ||||

| 56 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

58 | |||

| 72 | ||||

| 90 | ||||

| 98 | ||||

| 123 | ||||

| 125 | ||||

| 128 | ||||

| 132 | ||||

| 141 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

143 | |||

| 148 | ||||

| 154 | ||||

| 154 | ||||

| 154 | ||||

| F-1 | ||||

Neither we nor any of the underwriters have authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission (the “SEC”). We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations, and prospects may have changed since such date.

For investors outside of the United States, neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

Table of Contents

BASIS OF PRESENTATION

Unless we state otherwise or the context otherwise requires, the terms “Agiliti,” the “Company,” “our company,” “we,” “us,” and “our” in this prospectus refer to Agiliti, Inc. and, where appropriate, its consolidated subsidiaries. The term “THL” refers to Thomas H. Lee Partners, L.P., our principal stockholder, and the term “THL Stockholder” refers to THL Agiliti LLC, an affiliate of Thomas H. Lee Partners, L.P.

Agiliti Health, Inc. is the predecessor of Agiliti, Inc. for financial reporting purposes. The financial data presented in this prospectus for the year ended December 31, 2020 (Successor), the period from January 1 through January 3, 2019 (Predecessor) and for the period from January 4 through December 31, 2019 (Successor) is derived from the audited consolidated financial statements of Agiliti, Inc. and the related notes thereto included elsewhere in this prospectus. The financial data for the year ended 2018 is derived from the audited consolidated financial statements of Agiliti Health, Inc. and the related notes thereto included elsewhere in this prospectus.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from independent industry analysts and publications, as well as our own estimates and research. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the information presented in this prospectus is generally reliable, forecasts, assumptions, expectations, beliefs, estimates and projects involve risk and uncertainties and are subject to change based on various factors, including those described under “Forward-Looking Statements” and “Risk Factors”.

Certain information in the text of this prospectus relating to the size of the U.S. medical equipment services market is contained in independent industry publications produced by Frost & Sullivan, Prescient & Strategic Intelligence, Zion Market Research and iData Research.

This prospectus includes references to our Net Promoter Score. A Net Promoter Score is a metric used for measuring customer satisfaction and loyalty. We calculate our Net Promoter Score by asking customers the following question: “How likely are you to recommend Agiliti to another organization?” Customers are then given a scale from 0 (labeled as “Not at all likely”) to 10 (labeled as “Extremely Likely”). Customers rating us 6 or below are considered “Detractors”, 7 or 8 are considered “Passives”, and 9 or 10 are considered “Promoters”. To calculate our Net Promoter Score, we subtract the total percentage of Detractors from the total percentage of Promoters. For example, if 50% of overall respondents were Promoters and 10% were Detractors, our Net Promoter Score would be 40. The Net Promoter Score gives no weight to customers who decline to answer the survey question. This method is substantially consistent with how businesses across our industry and in other industries typically calculate their Net Promoter Score. Our most recent Net Promoter Score as of December 31, 2020 was 55. We use our Net Promoter Score results to anticipate and provide more attention to customers who may be in the Detractor category and, for those in the Promoter category, as a predictive indicator of a customer’s desire to remain a customer for the long-term.

TRADEMARKS AND TRADENAMES

This prospectus includes our trademarks and service marks such as “Agiliti®” and the Agiliti logo, “Asset360®,” “BioMed360®,” “Universal Hospital Services, Inc.,” “UHS®” and the UHS logo, “OnCare,” “Harmony” and “Quartet” which are protected under applicable intellectual property laws and are the property of us or our subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of

ii

Table of Contents

other companies which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names.

iii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. For a more complete understanding of us and this offering, you should read and carefully consider the entire prospectus, including the more detailed information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes. Some of the statements in this prospectus are forward-looking statements. See “Forward-Looking Statements.”

Unless the context otherwise requires, the terms “Agiliti,” the “Company,” “our company,” “we,” “us” and “our” in this prospectus refer to Agiliti, Inc. and, where appropriate, its consolidated subsidiaries. The term “THL” refers to Thomas H. Lee Partners, L.P., our principal stockholder, and the term “THL Stockholder” refers to THL Agiliti LLC, an affiliate of Thomas H. Lee Partners, L.P.

Our Mission

Agiliti is an essential service provider to the U.S. healthcare industry with solutions that help support a more efficient, safe and sustainable healthcare delivery system. We ensure healthcare providers have the critical medical equipment they need to care for patients—wherever and whenever it’s needed—with a service model that helps lower costs, reduce waste and maintain the highest quality standard of medical device management in the industry. We are motivated by a belief that every interaction has the power to change a life, which forms the cornerstone of how we approach our work and frames the lens through which we view our responsibility to make a difference for the customers, patients and communities we serve.

Overview

We believe we are one of the leading experts in the management, maintenance and mobilization of mission-critical, regulated, reusable medical devices. We offer a comprehensive suite of medical equipment management and service solutions that help providers reduce capital and operating expenses, optimize medical equipment utilization, reduce waste, enhance staff productivity and bolster patient safety.

We commenced operations in 1939, originally incorporated in Minnesota in 1954 and reincorporated in Delaware in 2001. Since January 2019, we have been controlled by the THL Stockholder.

In our more than 80 years serving healthcare providers, we’ve built an at-scale, strong nationwide operating footprint allowing us to reach customers across the entire healthcare continuum—from individual facilities to the largest and most complex healthcare systems. Our ability to rapidly mobilize, track, repair and redeploy equipment during times of peak need or emergent events has made us a service provider of choice for city, state and federal governments to manage emergency equipment stockpiles.

1

Table of Contents

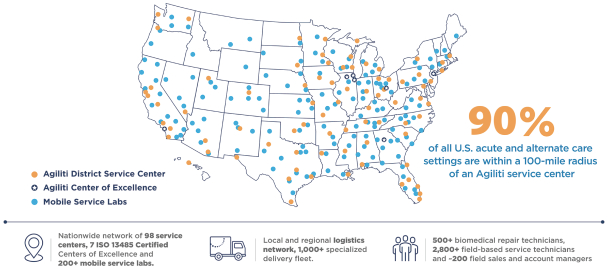

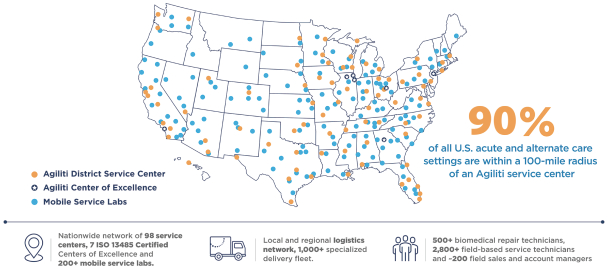

Agiliti at-a-glance: Powered by an at-scale, nationwide logistics and service infrastructure

Our diverse customer base includes approximately 7,000 active national, regional and local acute care hospitals, health system integrated delivery networks and alternate site providers (such as surgery centers, specialty hospitals, home care providers, long-term acute care hospitals and skilled nursing facilities). We serve the federal government as well as a number of city and state governments providing management and maintenance of emergency equipment stockpiles, and we are an outsourced service provider to medical device manufacturers supporting critical device remediation and repair services. We deliver our solutions through our nationwide network of 98 service centers and seven Centers of Excellence, employing a team of more than 500 specialized biomed repair technicians, more than 2,800 field-based service operators who work onsite within customer facilities or in our local service centers, and approximately 200 field sales and account managers. Our fees are paid directly by our customers rather than by direct reimbursement from third-party payors, such as private insurers, Medicare or Medicaid.

Industry Challenges

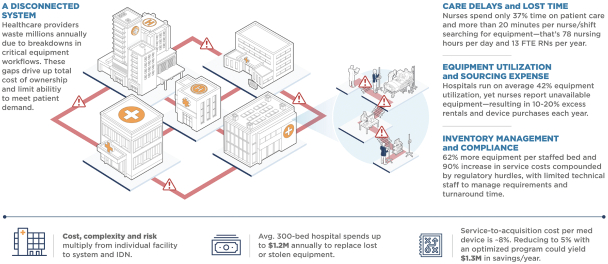

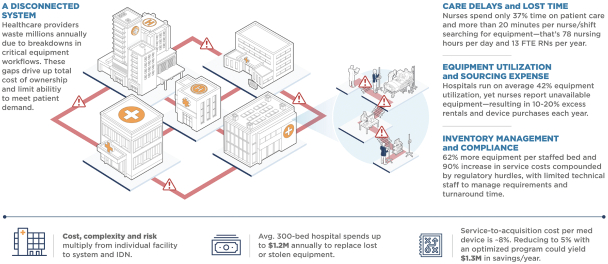

Across the healthcare system, providers face compounding financial and operational challenges, including cost pressure from payors, nursing and clinical staff shortages, increasing regulatory oversight, and advances in medical technology that generally result in higher prices for newer equipment and a higher cost of managing that equipment over its lifecycle. In our experience, one area that most hospitals and health systems identify for operational and cost improvement is the management and maintenance of medical equipment.

Healthcare facilities have been shown to own large quantities of reusable capital equipment ranging from multi-million dollar highly technical devices (e.g. MRIs) to lower cost, high volume devices (e.g. infusion pumps) required for patient care, treatment and diagnosis. In our experience, providers often face challenges effectively managing their medical equipment inventory. Hospitals typically utilize roughly 42% of their owned medical equipment inventory at any given time, yet caregivers report that they routinely lack access to readily available patient-ready equipment. Nurses report spending an average of 20 minutes per shift searching for equipment, and no more than 37% of their time on direct patient care. Operational silos that naturally occur among hospital departments create inadvertent breakdowns within equipment management workflows, from the administrators who order equipment, to the support staff who clean/reprocess and deliver the equipment, to the nurses and doctors who use the equipment.

2

Table of Contents

The repair and maintenance of this highly technical equipment continues to increase in complexity and cost. Over 15 years there has been a 62% increase in the number of medical devices per hospital bed and a 90% increase in costs related to maintaining this equipment (between 1995 and 2010). Most healthcare facilities struggle to maintain in-house capabilities to ensure timely maintenance, repair and turnaround of their medical inventory which may impact time-to-therapy and patient safety, while driving up capital replacement costs on equipment that could have otherwise been kept operational with proper maintenance.

Finally, the healthcare system experiences seasonality in patient volumes, resulting in peak-need demand for specialized medical equipment (e.g. ventilators, specialty beds, infusion pumps). Given the common breakdowns in managing and maintaining their inventory during times of normal operation, hospitals face additional burden on equipment availability during times of peak need and will procure supplemental equipment through additional acquisition channels to fill this gap.

Critical gaps and costly challenges for providers at the intersection of care and technology

These challenges drive up significant costs and time delays within individual hospital facilities, but when multiplied across several hospitals and alternate site facilities within an IDN, the losses increase significantly. An average 2,500 bed IDN has been shown to waste more than $11 million annually on inefficient equipment maintenance and unnecessary capital purchases, while clinicians lose valuable patient time and productivity hours managing equipment needs.

These dynamics, supported by the following trends, further support the essential nature of our work:

Focus on reducing costs and increasing operational efficiency. Hospitals and other healthcare facilities face substantial pressure to conserve capital, reduce costs and become more efficient. Our solutions offer customers a way to realize costs savings while enhancing operational improvements for medical equipment access and availability, improving organizational efficiency and financial viability.

Demand for better patient safety and outcomes. Hospitals turn to Agiliti to assist in effectively managing equipment to help minimize incidents of hospital-acquired conditions (e.g. infections, patient falls and pressure injuries), and to ensure equipment is available when and where it is needed for patient care, helping improve time to therapy and support optimal patient outcomes.

3

Table of Contents

Caregiver retention and satisfaction. As healthcare organizations experience ongoing pressures around nursing retention and clinician job satisfaction, we expect providers will increasingly turn to our programs to outsource clinical equipment management processes to allow nurses more time to spend on patient care.

Increased capital and operating expense pressures and regulatory compliance. Hospitals continue to experience restricted capital and operating budgets, while the cost and complexity of medical equipment and associated recordkeeping and regulatory scrutiny increases. We expect providers will increasingly look to us to support the management and maintenance of their equipment inventory to achieve capital and operating expense savings, operating efficiencies and regulatory compliance.

Our Value Proposition

As a critical outsource partner to more than 7,000 U.S. healthcare customers, including most leading providers nationwide, we’ve tailored our solution offering and service model to address the unique challenges and opportunities we witness among our customers related to the effective management of medical equipment.

By partnering with Agiliti, providers have the benefits of:

| ➣ | Cost savings and lower total costs of equipment ownership |

| • | Increased utilization of both customer-owned and supplemental equipment |

| • | Lower overall total cost of equipment ownership by combining our solutions to solve challenges across the end-to-end equipment management process |

| • | Optimized management and logistics of provider-owned equipment through tracking, monitoring, reprocessing, maintaining, and ensuring equipment is safety-tested and redeployed for use |

| • | Reduced maintenance and repair costs through the use of our proprietary technology, flexible staffing models, parts pool, equipment capabilities, diverse skill mix of knowledgeable equipment technicians and our commitment to quality |

| • | Benefits of specialized technician labor to augment clinical biomed staff, having been shown to help reduce service costs and provide required technical proficiency to address more complex equipment types |

| • | Access to our extensive data and expertise on the cost, performance, features and functions of all major items of medical equipment |

| • | Assistance with capital planning, vendor management and regulatory compliance |

| ➣ | More time to spend with patients and confidence in the availability of patient-ready medical equipment |

| • | Increased productivity and satisfaction among nursing staff achieved by eliminating certain non-clinical work tasks and saving an average 300-bed hospital over 28,000 caregiver hours annually |

| • | Improved time-to-therapy for patients at risk for falls, skin breakdown and bariatric safety by expediting delivery of therapeutic equipment direct to the patient room |

| • | Access to supplemental moveable medical equipment, surgical equipment and next generation technology without the expense of acquisition on a pay-per-procedure basis |

| ➣ | Improved regulatory compliance, risk management and extended use life |

| • | Optimal maintenance intervals and parts replacement to extend equipment use life, reduce waste and lower obsolescence risk |

4

Table of Contents

| • | Compliance with regulatory and recordkeeping requirements and adherence to manufacturers’ specifications on the reprocessing and maintenance of medical equipment |

| • | Equipment quality assurance through the use of our comprehensive QMS based on the quality standards recognized worldwide for medical devices |

| • | Risk mitigation and lower costs associated with product recalls or device modifications |

| ➣ | Technical expertise and supplemental staffing to sustain optimal equipment workflow |

| • | Reduced administrative and time burdens on clinical staff related to managing and locating available equipment and coordinating among multiple vendors |

| • | Specialized technical and clinical specialists that directly interact with and work alongside customers to optimize equipment outsourcing solutions |

Our Market Opportunities

We participate in a $14 billion U.S. medical equipment services market comprised of the services we offer through our onsite managed services, clinical engineering services and equipment solutions service lines. We believe that this market will grow at mid-single digits annually.

There is a fundamental shift in the needs of health systems, hospitals and alternate site providers to move from supplemental and peak need sourcing of medical equipment toward more comprehensive onsite inventory management and maintenance solutions. As healthcare facilities look to balance the challenge of providing better care at lower costs, they are more open to third party partnerships that outsource critical but non-core support functions. The move toward full outsourcing is not unlike trends in similar services at hospitals including food service, laundry, professional staffing and technology.

We believe there are several key macro trends that will drive increased demand for our products and services:

Favorable demographic trends. According to the U.S. Census Bureau, individuals aged 65 and older in the United States comprise the fastest growing segment of the population and are expected to grow to approximately 81 million individuals by 2040. The aging population and increasing life expectancy are driving demand for healthcare services.

Increase in chronic disease and obesity. According to the Centers for Disease Control and Prevention (“CDC”), six in ten Americans live with at least one chronic disease and 42% of the U.S. population is obese. These populations demand greater access to specialty equipment to support care and minimize the incidence of injury during a hospital stay.

Increased mergers & acquisitions. We have seen that hospitals and healthcare systems continue to expand their covered network and acquire alternate care delivery settings in order to care for patient populations in the most cost-effective way. In our experience, providers are increasingly seeking partners that provide comprehensive services. Working with one vendor that can operate at a nationwide and system-wide scale has shown to be attractive to cities, states, and integrated delivery networks (“IDNs”) who maintain equipment inventories across multiple locations.

Centralizing shared services across the IDN. Health systems with duplicate services across multiple facilities in close proximity have an increased risk of unnecessary variation, higher costs, and suboptimal outcomes. In our experience, because most health systems do not currently have the storage, technical or transportation resources for managing a shared equipment management function, they will seek third party support to optimize equipment utilization, redeploy equipment where needed and reduce overall equipment costs.

5

Table of Contents

Increase in infection control risks. Infection control remains an essential priority for hospitals and health systems and has further escalated as a top priority due to the COVID-19 pandemic. We expect increased demand for onsite equipment management programs to address proper reprocessing of devices in order to help lower infection risks and allow clinicians more time at the patient bedside and less time cleaning equipment.

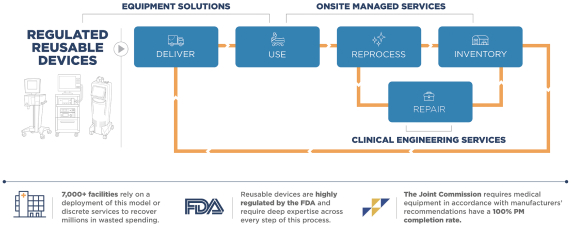

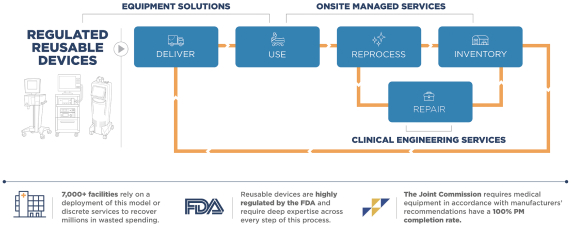

Our Solutions

We provide comprehensive medical device management solutions based on a proven framework to help providers reduce the cost and complexity of acquiring, managing and maintaining critical medical equipment inventories. The integrated nature of our service offerings within this end-to-end framework ensures we maximize value to customers as we address more aspects of the equipment lifecycle continuum.

Proven framework for end-to-end management of FDA-regulated, reusable medical devices

While customers may initially engage with us across one aspect of our service lines within this framework, we employ a variety of land-and-expand tactics to grow our relationships and customer share-of-wallet over time. These tactics include:

| • | Gateway solutions offer an entry point to the economic buyer and include peak needs equipment, surgical lasers and equipment, specialty beds and surfaces and supplemental clinical engineering services; |

| • | Vertical solutions provide a deeper level of service with clinical offerings tailored to specific patient needs (e.g. bariatrics, wound management) and clinical engineering programs for broad equipment categories (general biomedical devices, diagnostic imaging equipment, surgical instruments); |

| • | Comprehensive, connected solutions through onsite managed services and outsourced clinical engineering services that connect previously fragmented customer workflow processes to drive operational efficiencies, realize improved clinician and equipment productivity, lower total cost of ownership, ensure regulatory compliance, reduce waste, improve time to therapy and allow customers to effectively lower costs; and |

| • | Comprehensive logistics, management and clinical engineering solutions that allow IDNs to manage equipment inventories across multiple locations, and supports city, state and federal government agencies in managing and maintaining equipment stockpiles. |

We deploy our solution offering across three primary service lines:

Onsite Managed Services: Comprehensive programs that assume full responsibility for the management, reprocessing and logistics of medical equipment at individual facilities and IDNs. Our more than 1,700 onsite

6

Table of Contents

employees work 24/7 in customer facilities, augmenting clinical support by integrating proven equipment management processes, utilizing our proprietary management software and conducting daily rounds and unit-based training to ensure equipment is used and managed properly, overall helping to optimize day-to-day operations, adjust for fluctuations in patient census and acuity and support better care outcomes. We have over 225 onsite managed service customers. Revenue attributable to such customers for the years ended December 31, 2020 and 2019 represented 28% and 28% of our total revenue, respectively.

Clinical Engineering Services: Maintenance, repair and remediation solutions for all types of medical equipment, including general biomedical equipment and diagnostic imaging technology, through supplemental and fully outsourced offerings. Our supplemental offering helps customers manage their equipment repair and maintenance backlog, assist with remediation and regulatory reporting and temporarily fill open biotechnical positions. Our more than 500 technical repair staff flex in and out of customer facilities on an as-needed basis. We contract our Clinical Engineering Services with acute care and alternate site facilities across the U.S., as well as with the federal government and any medical device manufacturers that require a broad logistical footprint to support their large-scale service needs. We have over 6,000 clinical engineering service customers. Revenue attributable to such customers for the years ended December 31, 2020 and 2019 represented 33% and 31% of our total revenue, respectively.

Equipment Solutions: Supplemental, peak need and per-case rental of general biomedical, specialty, and surgical equipment, contracted directly with customers at approximately 7,000 U.S. acute care hospitals and alternate site facilities. We consistently achieve high customer satisfaction ratings, as evidenced by our Net Promoter Score (“NPS”) of 55 for the year ended December 31, 2020, by delivering patient-ready equipment within our contracted equipment delivery times and in response to our technical support and educational in-servicing for equipment within clinical departments, including the emergency room, operating room, intensive care, rehabilitation and general patient care areas. We are committed to providing the highest quality of equipment to our customers, supported by our comprehensive QMS which is based on the quality standards recognized worldwide for medical devices: 21 CFR 820 and ISO 13485:2016. We have over 5,000 equipment solution customers. Revenue attributable to such customers for the years ended December 31, 2020 and 2019 represented 38% and 41% of our total revenue, respectively.

Many of our customers have multiple contracts and have revenue reported in multiple service lines. Our contracts vary based upon service offering, including with respect to term (with most being multi-year contracts), pricing (daily, monthly and fixed fee arrangements) and termination (termination for convenience to termination for cause only). Many of our contracts contain customer commitment guarantees and annual price increases tied to the consumer price index. Standard contract terms include payment terms, limitation of liability, force majeure provisions and choice of law/venue.

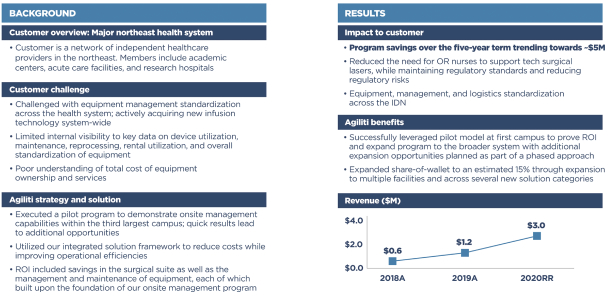

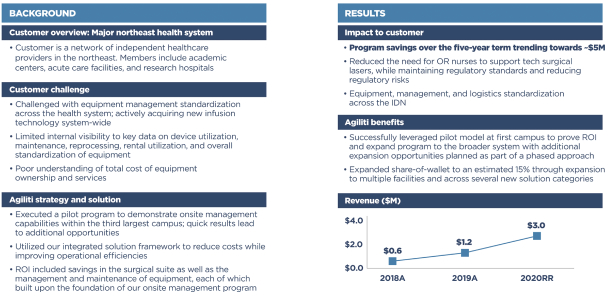

Because we work closely with customers to provide a long-term, value-based solution vs. a product-based, transactional approach, they are motivated to expand their relationships with us over time. We have approximately 82% white space within our current customer base. As indicated by the Customer Case Study presented below, we have demonstrated an ability to grow revenue up to 5-6x with an existing customer. We believe that this case study demonstrates the potential of our “land and expand” strategy of efficiently increasing revenue from our existing customers as they move toward our full suite of highly complementary services. From the year ended December 31, 2015 to the year ended December 31, 2020, our top 50 customers that experienced the largest growth in revenue over the same period increased in revenue from an aggregate of approximately $21.3 million to approximately $117.3 million (with increases at each customer ranging from $1.0 million to $8.8 million and an average increase of $1.9 million, and with consistent growth across our three primary service lines), primarily driven by our efforts to expand our share of wallet within our existing customer base. During the same period, our average existing customer growth rate was approximately 4.3%.

7

Table of Contents

Further, the infrastructure and capabilities required to provide connected, responsive equipment lifecycle management is typically cost-prohibitive, even for large IDNs. Our nationwide network of clinical engineers, storage and repair facilities, vehicles and analytics tools gives us scale to provide cost-effective services for individual facilities, systems, regional IDNs, governments and device manufacturers.

Customer Case Study:

Competitive Strengths

Strong value proposition. Comprehensive, end-to-end medical equipment management and service solutions, and ability to respond quickly to customer needs with reliable, high quality service expertise helps us to:

| • | lower total cost of device ownership by reducing capital and operating costs related to owning and managing medical equipment; |

| • | enhance operational productivity and staff satisfaction by ensuring equipment is available when and where needed; and |

| • | maintain high standards of quality and regulatory compliance related to medical equipment use, maintenance and end-of-life disposal. |

Large, nationwide infrastructure. Our extensive network of 98 service centers and seven Centers of Excellence with round-the-clock service capabilities enables us to compete effectively for large, national contracts as well as drive growth regionally and locally. Our more than 500 biomedical repair technicians, more than 2,800 field-based service operators, and approximately 200 field sales and account managers engage directly with our customers to drive improved cost, efficiency and clinical outcomes. Our specialized teams, large equipment fleet, and quality assurance programs have been built over 80 years and provide the scale to serve the most complex acute care hospitals that demand access to current and preferred technologies to meet the complex needs of their patients.

8

Table of Contents

Proprietary software and asset management tools. Our software technology and management tools enable us to meet unique customer demands and support sophisticated onsite managed services which drive cost efficiencies and equipment productivity for caregivers.

Commitment to quality. Though not required by the FDA, we’ve committed to doing the right thing for our customers and their patients by staffing a dedicated Quality team and implementing a Quality Management System (QMS) based on the standards recognized worldwide for medical devices: 21 CFR 820 and ISO 13485:2016. We believe our robust QMS policies set us apart in our industry from those who may use less stringent quality practices on the equipment they own or maintain.

Superior customer service. We believe we have a long-standing reputation among our customers for outstanding service and quality, and we strive to seamlessly integrate our employees and solutions into the operations of our customers. We believe that our aggressive focus on the overall customer experience has helped us achieve high customer satisfaction ratings, as evidenced by our NPS of 55 for the year ended December 31, 2020.

No direct third-party payor reimbursement risk. Our fees are paid directly by our customers, rather than by third-party payors. Accordingly, our exposure to uncollectible receivables or reimbursement changes is reduced, as evidenced by our bad debt expense of approximately 0.3%, 0.2% and 0.4% of total revenue for the years ended December 31, 2020, 2019 and 2018, respectively.

Values driven culture centered on doing the right thing for our many stakeholders. Our team operates on a set of shared aspirations that underpin our culture, strategy and service model to help contribute to a safer and more sustainable healthcare system:

WE ARE BUILDING THE PREMIER CLINICAL EQUIPMENT SERVICES COMPANY. We ensure clinicians have the equipment they need, when they need it, with the confidence it is maintained to the highest industry standards.

WE ARE ESSENTIAL TO CUSTOMERS. We deliver a unique and valuable offering that helps customers improve their business and prioritize patient care.

WE ARE EMPOWERED AND ENGAGED. We lead by example, inspiring one another to be at our best, to be accountable, and to develop with purpose. We value our diversity, knowing different perspectives lead to better outcomes.

WE ARE OPERATIONALLY EXCELLENT. We demonstrate a tireless commitment to quality, reliability, and continuous improvement.

WE ARE CREATING A CATEGORY OF ONE. Together, we are building a highly differentiated, leading service company that is the vendor of choice for customers and an employer of choice nationwide.

Highly engaged team. We believe a strong and sustainable company begins with an engaged and empowered team. We are committed to investing in our team’s development and to fostering a culture of diversity, inclusion, trust and transparency. In 2020, we achieved a 77 employee engagement score rating, which places us nearing the extraordinary company benchmark according to third-party engagement indices.

Proven management team. Our diverse and industry leading management team brings decades of executive-level healthcare expertise from across the sector and has successfully supervised the development of our competitive strategy and furthered our reputation as an industry leader in our category.

Key Elements of our Growth Strategy

Retain and expand existing customer relationships. While our overall market opportunity is large, there is also significant expansion opportunity within our existing customers. We believe there is approximately

9

Table of Contents

$1.7 billion of white space among our current contracted customer base. Capturing more of our customer share-of-wallet is core to our growth strategy.

Grow our customer base among customers that outsource. We believe there is a significant opportunity to further grow our business by winning new customer contracts within the $5.85 billion that is contracted annually for medical equipment management services in the U.S. This is less than half of the total addressable market, and with increasing pressures on providers, we expect outsourcing to significantly accelerate.

Grow our serviceable market by contracting with those that insource today. Currently, we estimate that $14 billion is spent annually in the U.S. for medical equipment services and functionality, but less than half of the total market is currently outsourced to an equipment management service, while the rest is done in-house in facilities. We believe that as we reach additional potential customers with demonstrated value both in improved patient care and reduced costs, we can grow our total addressable market by contracting with new clients that were not previously outsourcing device management services.

Invest in complementary offerings that enhance customer relationships. As the medical device field becomes increasingly complex, we are constantly evaluating additional services and methods of approaching service delivery that may increase value for our clients. As an example, we recently expanded our work with federal, state, and local governments to help maintain and mobilize strategic stockpiles of ventilators and other critical medical equipment.

Opportunistically pursue accretive M&A. We believe that pursuing opportunistic M&A will drive increasing returns through embedded customer relationships. From 2015-2020, we successfully integrated seven acquisitions and will continue to opportunistically pursue additional inorganic growth.

COVID-19 Update

As COVID-19 drove demand for emergent acute care around the country and illuminated the importance of resilient supply chains and service networks, the importance of our services were also magnified. We are proud to have rapidly developed and deployed a response plan to ensure the safety of our team, while continuing to meet our customers’ evolving needs for patient-ready medical equipment when and where it was needed; notably, doing so without service interruptions.

We believe our value proposition now resonates with an even broader audience of customers as providers, IDNs and governments prepare for potential future surges in demand for acute care and the required equipment necessary to care for patients.

Specifically, during the COVID-19 pandemic, we have:

| • | fully and rapidly deployed our fleet of medical devices and accessories across the U.S. to ensure they are reaching the maximum number of patients; |

| • | leveraged our logistics, inventory management, and maintenance/repair infrastructure to work with medical device brokers and manufacturers to make thousands of additional critical medical devices available to healthcare facilities; |

| • | deployed our local biomedical repair teams to augment teams at hospitals around the country to ensure their owned medical equipment remains fully operational and available for patient needs; |

| • | redeployed teams from our 98 local service centers to support surge medical capacity in parks, gymnasiums, and hotel rooms across the country; |

10

Table of Contents

| • | been awarded a new contract to manage the maintenance and field repair of the national strategic ventilator stockpile; we are likewise working with various state and municipal governments to manage and mobilize their centralized and local medical device stockpiles; and |

| • | prioritized the care and safety of our employees who are essential to helping our customers meet patient care needs. We committed to avoid COVID-19 related layoffs or furloughs and bridge the income of our team members with variable net pay for the duration of the pandemic. We provided 100% coverage for COVID-19 testing and telemedicine, extended short-term medical leave and disability coverage related to COVID-19, and granted additional time-off benefits for COVID-19 related needs, so that our teams were able to safely focus on our customers and their patients as we served alongside them in front-line response efforts. |

Recent Developments

Recent Operating Results (Preliminary and Unaudited)

We are in the process of finalizing our results for the three months ended March 31, 2021. We have presented below certain preliminary results representing our estimates for the three months ended March 31, 2021, which are based only on currently available information and do not present all necessary information for an understanding of our financial condition as of March 31, 2021 or our results of operations for the three months ended March 31, 2021. We have provided ranges, rather than specific amounts, for the preliminary estimates for the unaudited financial data described below primarily because our financial closing procedures for the three months ended March 31, 2021 are not yet complete and, as a result, our final results upon completion of our closing procedures may vary from the preliminary estimates. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to this preliminary financial data or the accounting treatment thereof and does not express an opinion or any other form of assurance with respect thereto. We expect to complete our interim financial statements for the three months ended March 31, 2021 subsequent to the completion of this offering. While we are currently unaware of any items that would require us to make adjustments to the financial information set forth below, it is possible that we or our independent registered public accounting firm may identify such items as we complete our interim financial statements. Accordingly, undue reliance should not be placed on these preliminary estimates. These preliminary estimates are not necessarily indicative of any future period and should be read together with “Risk Factors”, “Forward-Looking Statements”, and our consolidated financial statements and related notes included in this Registration Statement. Adjusted EBITDA is a supplemental measure that is not calculated and presented in accordance with GAAP. See “Prospectus Summary—Summary Consolidated Financial Data—Adjusted EBITDA.”

| Three months ended March 31, 2021 |

Three months ended March 31, 2020 |

|||||||||||

| Low (estimated) |

High (estimated) |

|||||||||||

| (in thousands) | ||||||||||||

| Consolidated Statements of Operations Data (unaudited): |

||||||||||||

| Total Revenue |

$ | 230,000 | $ | 235,000 | $ | 179,240 | ||||||

| Operating income (1) |

$ | 32,000 | $ | 37,000 | $ | 1,241 | ||||||

| Non-GAAP Financials Data (unaudited): |

||||||||||||

| Adjusted EBITDA (2) |

$ | 81,000 | $ | 86,000 | $ | 48,716 | ||||||

| (1) | Excludes the remeasurement of the tax receivable agreement for 2021 and 2020. |

11

Table of Contents

| (2) | We define Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization, excluding non-cash share-based compensation expense, management fees and non-recurring gains, expenses or losses, transaction expenses and tax receivable agreement remeasurement. However, we cannot reconcile our estimated range of Adjusted EBITDA to net income (loss), the most directly comparable GAAP measure, without unreasonable efforts because we are unable to estimate our income tax (expense) benefit for the period, as we are in the process of evaluating our tax attributes. In addition, we are in the process of remeasuring the fair value of our tax receivable agreement and finalizing the purchase accounting related to the Northfield acquisition. See “Prospectus Summary—Summary Consolidated Financial Data—Adjusted EBITDA” for a discussion of Adjusted EBITDA, why we believe this measure is important and certain limitations regarding this measure. |

For the three months ended March 31, 2020, interest expense, depreciation and amortization, non-cash share-based compensation expense, management fees and other expense, and transaction costs was $17.8 million, $40.2 million, $2.4 million, $4.1 million and $0.8 million, respectively. For the three months ended March 31, 2021, interest expense, depreciation and amortization, non-cash share-based compensation expense, management fees and other expense, and transaction costs are estimated to have been $18 million $43 million, $2 million, $1 million, and $3 million, respectively. The depreciation and amortization estimate does not include an estimate for the purchase accounting impacts of the Northfield acquisition as we are in the process of finalizing the fair value opening balance sheet for fixed assets and intangibles.

We expect total revenue to increase 28% to 31% for the three months ended March 31, 2021 compared to the three months ended March 31, 2020 primarily driven by new contracts signed over the past year including the new contract signed in 2020 for the comprehensive maintenance and management services of medical ventilator equipment with the U.S. Department of Health and Human Services, increased demand for equipment needed in connection with the COVID-19 pandemic as further described in “Prospectus Summary—COVID-19 Update” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Impact of COVID-19 on our Business” and increased revenue from our acquisitions on January 31, 2020 and March 19, 2021 of surgical equipment repair and maintenance service providers. For more information on the acquisition on January 31, 2020, see Note 4 to our audited consolidated financial statements for the year ended December 31, 2020 included elsewhere in this prospectus. For more information on the acquisition on March 19, 2021, see “—Northfield Acquisition.”

We expect cost of revenue and selling, general and administrative expenses to increase 9% to 13% for the

three months ended March 31, 2021 compared to the three months ended March 31, 2020, primarily driven by the increase in revenue. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Consolidated Results of Operations for the year ended December 31, 2020 compared to the period from January 4 through December 31, 2019” for a discussion of the trends driving increases in costs and expenses for the year ended December 31, 2020, which we expect to remain the drivers for increases in costs and expenses through March 31, 2021.

We expect income from operations of $32 million to $37 million for the three months ended March 31, 2021 compared to income from operations of $1.2 million for the three months ended March 31, 2020, as we continue to see positive leverage from our revenue volume growth related to the new contracts signed and the higher utilization of our equipment placed at customer locations needed to fight the COVID-19 pandemic.

We expect Adjusted EBITDA of $81 million to $86 million for the three months ended March 31, 2021 as compared to Adjusted EBITDA of $48.7 million for the three months ended March 31, 2020.

Northfield Acquisition

On October 28, 2020, Agiliti Health, Inc., an indirect subsidiary of the Company, entered into a Stock Purchase Agreement (the “Northfield SPA”) with Northfield Medical Holdings LLC (the “Northfield Seller”) and Northfield

12

Table of Contents

Medical, Inc. (“Northfield Medical”), a nationwide provider of surgical equipment repair services, to purchase 100% of the issued and outstanding capital stock of Northfield Medical from the Northfield Seller for $475.0 million, subject to adjustments (the “Northfield Acquisition”). Northfield Medical provides service and repair of medical devices, specializing in the repair of endoscopes, surgical instruments and other operating room equipment. We believe the acquisition of Northfield will enable the Company to: (i) offer a broader array of clinical engineering repair and maintenance services, extending its end-to-end service offering to customers; (ii) expand the Company’s reach and breadth within the operating room and procedural care space; and (iii) serve more customers by overlaying Northfield’s operations within the Company’s nationwide geographic footprint.

The acquisition closed on March 19, 2021. A portion of the financing for the acquisition was in the form of a $200 million first lien incremental term loan facility under the existing First Lien Term Loan Facility. Additionally, in connection with the entry by the parties into the Northfield SPA, certain members of the Northfield Medical management team delivered commitment letters to reinvest a portion of the transaction proceeds to be received by such executives in connection with the Northfield Acquisition to acquire our common stock on the closing date of the Northfield Acquisition. The aggregate commitment amount is expected to result in the issuance of 752,328 shares of common stock. In connection with this offering, the Company also intends to issue restricted stock units, performance restricted stock units and options to acquire shares of our common stock to certain members of the Northfield Medical management team in an aggregate amount of approximately 71,269 shares of our common stock under the 2018 Omnibus Incentive Plan. The restricted stock unit and stock option awards will vest ratably over a three-year period and the performance restricted stock unit awards vest based on the achievement of performance metrics over a three-year period, subject to the recipient’s continued employment through each vesting date. The acquisition is considered “significant” under Regulation S-X and requires the filing within 75 days of the closing date of audited financial statements of Northfield Medical for the year ended December 31, 2020.

For the year ended December 31, 2020, Northfield Medical generated approximately $111.1 million of revenue, and operating earnings were a nominal amount for 2020.

Summary of Risks Associated with Our Business, Our Indebtedness, this Offering and Our Common Stock

There are a number of risks related to our business, our indebtedness, this offering and our common stock that you should consider before you decide to participate in this offering. You should carefully consider all the information presented in the section entitled “Risk Factors” in this prospectus. Some of the principal risks related to our business include the following:

| • | Political and policy changes could materially limit our growth opportunities. Geopolitical issues, the availability and cost of credit and government stimulus programs in the United States and other countries have contributed to increased volatility and uncertain expectations for the global economy. Additionally, healthcare costs have risen significantly over the past decade, and there continue to be proposals by legislators, regulators and third-party payors to keep these costs down. We cannot predict which healthcare initiatives, if any, will be implemented at the federal or state level, or the effect that any future regulation or legislation would have on us. However, an expansion of the government’s role in the U.S. healthcare industry may lower industry reimbursements for our products, reduce medical procedure volumes and may thereby materially adversely affect our business and our ability to execute our growth strategy. |

| • | The COVID-19 pandemic could materially and adversely affect our business, operating results, financial condition and prospects. We source equipment from different parts of the world that have been affected by COVID-19, which could have an adverse impact on our supply chain operations and the ability of manufacturers to obtain materials needed to assemble the products that we offer. Government shutdown orders or a change to our business classification as an “essential business” may result in a closure of operations for an uncertain duration, impacting our business results. In addition, in |

13

Table of Contents

| response to the COVID-19 pandemic, the federal government and certain state and local governments have purchased significant amounts of medical equipment of the type that we offer in our rental fleet. These purchases of medical equipment that previously would have been rented may reduce the demand for our rental equipment and may thereby materially adversely affect our ability to grow our customer base and retain and expand our existing customer relationships. |

| • | We may be unable to maintain existing contracts or contract terms or enter into new contracts with our customers. Our ability to retain and expand existing customer relationships depends on continuing contracts with customers, including through group purchasing organizations (“GPOs”) and IDNs. If we are unable to maintain our contracts, or if the GPOs or IDNs seek additional discounts or more beneficial terms on behalf of their members, we may lose a portion or all of our existing business with, or revenues from, customers that are members of such GPOs and IDNs. In addition, certain of our customers account for large portions of our revenue, including the U.S. government, and to the extent that contracts with significant customers are terminated or are not renewed, our revenue and operating results would be significantly impacted. |

| • | A substantial portion of our revenues come from customers with which we do not have long-term commitments, and cancellations by or disputes with customers could decrease the amount of revenue we generate, thereby reducing our ability to operate and expand our business. Our customers are generally not obligated to outsource our equipment under long-term commitments. The short-term services we provide could be terminated by the customer without notice or payment of any termination fee. A large number of such terminations may adversely affect our ability to generate revenue growth and sufficient cash flows to support our growth strategies. |

| • | If we fail to maintain our reputation, including by adequately protecting our intellectual property, our sales and operating results may decline. We believe that our ability to execute our growth strategies depends on our ability to maintain and grow the value of our brand. Challenges or reactions to action or inaction by us on certain issues could harm our reputation, as could any failure to maintain the high-quality customer support that underpins our reputation for having outstanding service and quality. Our ability to protect our brand also depends on our ability to protect our confidential information, including with respect to our proprietary software and asset management tools, and if we fail to do so we may be subject to payment of monetary damages, the loss of valuable intellectual property rights or the loss of personnel. If we are unable to maintain our reputation, our ability to grow our serviceable market, grow our customer base and opportunistically pursue acquisitions will be materially adversely impacted. |

| • | If our customers’ patient census or services decrease, the revenue generated by our business could decrease. Our operating results are dependent in part on the amount and types of equipment necessary to service our customers’ needs, which are heavily influenced by patient census and the services those patients receive. At times of lower patient census, such as during severe economic downturns, our customers have a decreased need for our services on a supplemental or peak needs basis, causing our revenue to decrease. |

| • | Our competitors may engage in significant competitive practices, which could cause us to lose market share, reduce prices or increase expenditures. For example, competitors may sell significant amounts of surplus equipment or sell capital equipment at a lower gross margin to obtain the future repeat sales of disposables for a higher gross margin, thereby decreasing the demand for our equipment solutions. Any actions we may be required to take as a result of increased competitive pressure, including decreasing our prices, renegotiating contracts with customers on more favorable terms or increasing our sales and marketing expenses, could have a material adverse effect on our results of operations, curtail our ability to invest in complementary offerings that enhance our customer relationships and limit our opportunities to pursue accretive M&A. |

14

Table of Contents

| • | Consolidation in the healthcare industry may lead to a reduction in the prices we charge, thereby decreasing our revenue. Numerous initiatives and reforms initiated to combat rising healthcare costs, in addition to other economic factors, have contributed to a consolidation trend in the healthcare industry. Consolidation has resulted in increased competition to provide products and services to industry participants, and this competition is likely to grow increasingly intense. Competitive bidding also emphasizes the importance of relationships with both payors and others in the industry that impact reimbursement of our clients and customers. Further consolidation may reduce competition among our existing and prospective customers and exert further downward pressure on the prices of our products, potentially decreasing our revenue, which would limit our ability to pursue our growth strategies. |

| • | We have substantial indebtedness. As of December 31, 2020, we had approximately $922.2 million and $240.0 million in borrowings outstanding under our First Lien Term Loan Facility (as defined herein) and Second Lien Term Loan Facility (as defined herein), respectively, and $6.3 million of letters of credit outstanding under our Revolving Credit Facility. The proceeds from the borrowings under the Second Lien Term Loan Facility were used to pay a dividend in an amount equal to approximately $240.0 million (including transaction costs) to our equityholders as a means of providing our equityholders with a return on their investment. Our substantial amount of indebtedness may require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes, and increase our vulnerability to general adverse economic, industry and competitive conditions. |

| • | If we are unable to fund our significant cash needs, including capital expenditures, we may be unable to expand our business as planned or to service our debt. We currently estimate that over the next 12 months, we will make net investments of approximately $60 million to $70 million in new and pre-owned medical equipment, leasehold improvements and other capital expenditures. In addition, a substantial portion of our cash flow from operations must be dedicated to servicing our debt. To the extent that we cannot fund our cash needs from our operating cash flow, we will be unable to pursue our growth strategies. |

| • | THL controls us, and its interests may conflict with yours or ours in the future. Immediately after this offering, assuming an offering size as set forth herein, the THL Stockholder will beneficially own approximately 78.4% of our outstanding common stock (or 76.0% of our outstanding common stock if the underwriters’ option to purchase additional shares is exercised in full). For as long as the THL Stockholder continues to own a significant portion of our stock, THL will be able to significantly influence the composition of our board of directors, including the approval of actions requiring shareholder approval. Accordingly, for such period of time, THL will have significant influence with respect to our management, business plans and policies, including the appointment and removal of our officers, decisions on whether to raise future capital and amending our charter and bylaws, which govern the rights attached to our common stock, and their interest in such matters may conflict with yours or ours. |

| • | We may fail to realize all of the anticipated benefits of the Northfield Acquisition or those benefits may take longer to realize than expected. We may also encounter significant difficulties in integrating the business of Northfield Medical. The failure to meet the challenges involved in the integration process and realize the anticipated benefits of the Northfield Acquisition could cause an interruption of, or a loss of momentum in, our operations and could have a material adverse effect on our business, financial condition and results of operations. |

| • | We are not providing audited historical financial information for Northfield Medical or pro forma financial statements reflecting the impact of the Northfield Acquisition on our historical operating results. We will not file a Current Report on Form 8-K until after the closing of this offering |

15

Table of Contents

| with the required financial information and, we are not currently in a position to include this information in this prospectus. As a result, investors in this offering will be required to determine whether to participate in this offering without the benefit of this historical and pro forma financial information. |

| • | An active, liquid trading market for our common stock may not develop, which may limit your ability to sell your shares. The initial public offering price will be determined by negotiations between us and the underwriters and may not be indicative of market prices of our common stock that will prevail in the open market after the offering. The failure of an active and liquid trading market to develop and continue would likely have a material adverse effect on the value of our common stock, which may impair our ability to raise capital to pursue our growth strategies, to continue to fund operations and to pursue acquisitions using our shares as consideration. |

These and other risks are more fully described in the section entitled “Risk Factors” in this prospectus. If any of these risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, you could lose all or part of your investment in our common stock.

Our Principal Stockholder

THL is a premier private equity firm that invests in middle market growth companies, headquartered primarily in North America, exclusively in three sectors: Financial Services, Healthcare and Technology & Business Solutions. The firm couples its deep sector expertise with dedicated internal operating resources to transform and build great companies of lasting value in partnership with company management. Since 1974, THL has raised more than $25 billion of equity capital, invested in over 150 companies and completed more than 400 add-on acquisitions representing an aggregate enterprise value at acquisition of over $200 billion.

General Corporate Information

We commenced operations in 1939, originally incorporated in Minnesota in 1954 and reincorporated in Delaware in 2001. Since the Business Combination (as defined below), we have been controlled by THL Stockholder, an affiliate of THL.

Agiliti, Inc. was formed on August 1, 2018 in order to consummate a merger with Federal Street Acquisition Corp., a special purpose acquisition company affiliated with THL (“FSAC”) pursuant to the Amended and Restated Agreement and Plan of Merger, dated as of December 19, 2018 (the “A&R Merger Agreement”), by and among Agiliti, FSAC, Umpire SPAC Merger Sub, Inc., Umpire Cash Merger Sub, Inc., Agiliti Holdco, Inc. (“Agiliti Holdco”), solely in their capacities as Majority Stockholders, IPC/UHS, L.P. and IPC/UHS Co-Investment Partners, L.P., solely in its capacity as the Stockholders’ Representative (as defined in the A&R Merger Agreement), IPC/UHS and, solely for the purposes stated therein, Umpire Equity Merger Sub, Inc. Pursuant to the A&R Merger Agreement, (i) FSAC became a wholly owned subsidiary of Agiliti and the holders of Class A common stock, par value $0.0001 per share, of FSAC (the “FSAC Class A Common Stock”) received shares of common stock, par value $0.0001 per share, of Agiliti (our “common stock”); and (ii) Agiliti Holdco became a wholly owned subsidiary of FSAC and the equityholders of Agiliti Holdco received cash and/or shares of our common stock and/or fully-vested options to purchase shares of our common stock as merger consideration (the transactions contemplated by the A&R Merger Agreement are referred to herein as the “Business Combination”).

16

Table of Contents

Our principal executive offices are located at 6625 West 78th Street, Suite 300, Minneapolis, Minnesota 55439-2604. Our telephone number is (952) 893-3200. Our website address is www.agilitihealth.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock. We are a holding company and all of our business operations are conducted through our subsidiaries.

17

Table of Contents

| Common stock offered |

26,315,789 shares. |

| Option to purchase additional shares |

3,947,368 shares. |

| Common stock to be outstanding after this |

125,299,085 shares (or 129,246,453 shares if the underwriters’ option to purchase additional shares is exercised in full). |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $460.3 million, or approximately $530.9 million if the underwriters’ option to purchase additional shares is exercised in full, assuming an initial public offering price of $19.00 per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting the underwriting discount and estimated offering expenses payable by us. |

| The principal purposes of this offering are to increase our capitalization and financial flexibility, create a public market for our common stock and enable access to the public equity markets for us and our shareholders. We expect to use approximately $450.0 million of net proceeds of this offering (or $520.0 million of the net proceeds of this offering if the underwriters exercise their option to purchase additional shares in full) to repay outstanding borrowings and related fees and expenses, under our Credit Facilities (as defined herein). See “Use of Proceeds” for additional information. |

| Conflicts of interest |

Certain affiliates of Goldman Sachs & Co. LLC currently hold 100% of our Second Lien Term Loan Facility and, as such, will receive 5% or more of the net proceeds of this offering due to the repayment of outstanding borrowings and related fees and expenses, under our Credit Facilities. Therefore, Goldman Sachs & Co. LLC is deemed to have a conflict of interest within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“Rule 5121”). Accordingly, this offering is being conducted in accordance with Rule 5121, which requires, among other things, that a “qualified independent underwriter” as described in Rule 5121 participate in the preparation of, and exercise the usual standards of “due diligence” with respect to, the registration statement and this prospectus. BofA Securities, Inc., one of the managing underwriters of this offering, has agreed to act as a qualified independent underwriter for this offering and to undertake the legal responsibilities and liabilities of an underwriter under the Securities Act of 1933, as amended (the “Securities Act”), specifically including those inherent in Section 11 thereof. BofA Securities, Inc. will not receive any additional fees for serving as a qualified independent underwriter in connection with this offering. We have agreed to indemnify BofA Securities, Inc. against liabilities incurred in connection with acting as a qualified |

18

Table of Contents

| independent underwriter, including liabilities under the Securities Act. For more information, see “Underwriting (Conflicts of Interest)—Conflicts of Interest.” |

| Controlled company |

After this offering, assuming an offering size as set forth in this section, the THL Stockholder will own approximately 78.4% of our common stock (or 76.0% of our common stock if the underwriters’ option to purchase additional shares is exercised in full). As a result, we expect to be a controlled company within the meaning of the corporate governance standards of the NYSE. See “Management—Corporate Governance—Controlled Company Status.” |

| Directed share program |

At our request, the underwriters have reserved up to 1,315,789 shares of our common stock, or 5% of the shares of our common stock to be offered by this prospectus for sale, at the initial public offering price, to certain individuals through a directed share program, including certain employees and certain other individuals identified by management. Shares purchased through the directed share program will not be subject to a lock-up restriction, except in the case of shares purchased by any of our officers and certain of our employees and existing equityholders. The number of shares of our common stock available for sale to the general public will be reduced to the extent these individuals or entities purchase such reserved shares. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered by this prospectus. See “Certain Relationships and Related Party Transactions” and “Underwriting (Conflicts of Interest)”. |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed trading symbol |

“AGTI.” |

The number of shares of common stock to be outstanding following this offering is based on 98,983,296 shares of common stock outstanding as of March 1, 2021, and excludes:

| • | 6,690,308 shares of common stock issuable upon the exercise of options outstanding as of March 1, 2021, with a weighted average exercise price of $4.86 per share; |

| • | 2,537,619 shares of common stock issuable upon vesting and settlement of restricted stock units, or performance restricted stock units, as of March 1, 2021 (assuming vesting at 150% for performance restricted stock units vesting as of March 6, 2021 and assuming 100% vesting for the performance restricted stock units thereafter); |

| • | 752,328 shares of common stock issued in connection with the Northfield Acquisition; |

| • | 190,226 shares of common stock issuable upon the exercise of warrants outstanding as of March 1, 2021, with a weighted average exercise price of $9.27 per share; |

| • | 14,474 shares of common stock issuable upon the exercise of options expected to be issued in conjunction with this offering to members of the Northfield management team at an assumed exercise |

19

Table of Contents

| price of $19.00 (which is the midpoint of the estimated price range set forth on the cover page of this prospectus); |

| • | 56,795 shares of common stock issuable upon vesting and settlement of restricted stock units, or performance restricted stock units expected to be issued in conjunction with this offering to members of Northfield management team (assuming performance-based units vest at 100%, and assuming an initial public offering price of $19.00 per share, which is the midpoint of the estimated range set forth on the cover of this prospectus); |

| • | 497,868 shares of common stock issuable upon the exercise of options expected to be issued in conjunction with this offering to employees of Agiliti at an assumed exercise price of $19.00, which is the midpoint of the estimated price range set forth on the cover page of this prospectus; |