Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Coronado Global Resources Inc. | tm2113285d1_8k.htm |

Exhibit 99.1

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO U.S. PERSONS

QUARTERLY REPORT

Coronado Global Resources Inc. ARBN: 628 199 468 Registered Office Level 33, Central Plaza One 345 Queen Street Brisbane QLD 4000 Australia T +61 7 3031 7777 F +61 7 3229 7402 E investors@coronadoglobal.com.au www.coronadoglobal.com.au About Coronado Coronado Global Resources Inc. is a leading international producer of high-quality metallurgical coal, an essential element in the production of steel. Our coals, transformed in the steelmaking process, support the manufacture of everyday steel-based products that enrich lives around the world. Coronado has a portfolio of operating mines and development projects in Queensland, Australia, and Pennsylvania, Virginia and West Virginia in the United States. Coronado is one of the largest metallurgical coal producers globally by export volume. The management team has over 100 years of combined experience in all aspects of the coal value chain and has a successful track record of building and operating coal mining operations in Australia, the United States and globally. This operational experience is supplemented with a strong knowledge base of domestic and international coal markets and their key drivers. Coronado was listed on the ASX on 23 October 2018. All $ values are US dollars unless otherwise stated. All production and sales tonnages are in metric tonnes unless otherwise stated. All information contained within this release is unaudited.

March 2021

Highlights

OPERATIONS

| ROM production for the March quarter was 6.8 Mt, up 0.9% on the December quarter. |

| Saleable production for the March quarter was 4.6 Mt, up 0.1 Mt or 2.5% on the December quarter. |

| COVID-19 vaccination roll-out at our U.S. Operations has seen a significant portion of the workforce vaccinated. Coronado’s COVID-19 Steering Committee continues to drive preventative measures and hygiene protocols to ensure safety of our employees and minimise impacts on production. |

COAL SALES

| March quarter sales of 4.4 Mt were down 10.5% compared to the previous quarter, primarily due to the seasonal impact of Lunar new year. |

| Metallurgical coal sales tonnes as a proportion of total sales was 82.6% for the March quarter, up 1.6% over the December quarter due to improved product mix. |

| Export sales for Q1 2021 of 77% were in line with the previous quarter. |

| Export sales to China from Buchanan started to achieve significantly higher pricing than U.S. domestic sales. |

| Group realised metallurgical coal price of $94.3 per tonne for the March quarter (mix of FOR and FOB pricing) was up 12.5% compared to the prior quarter, as a result of higher average benchmark prices. |

FINANCIAL AND CORPORATE

March quarter revenue was $376 million, up 1% on the previous quarter.

| Q1 2021 mining cost per tonne sold increased to $62.2 per tonne (unaudited) due to FX, weather impacts and production constraints, however full year costs are expected to be within the market guidance range ($57 - $59 per tonne). |

| Net debt of $290 million as at 31 March 2021, compared to $282 million at 31 December 2020. |

| Q1 2021 capital expenditure of $22.6 million was down 45% on Q1 2020 ($41.4 million). |

Coronado will release its Form 10-Q quarterly results on 11 May 2021.

Message from the CEO

Gerry Spindler, Chief Executive Officer

The Coronado team continues to respond admirably to the many challenges presented by the significant imbalances in global coal markets and the enduring effects of the COVID-19 pandemic.

Our COVID-19 Steering Committee has successfully established a roll-

out of vaccinations at our US operations to ensure the continued health and safety of our workforce and mitigate future impacts to U.S. production from the pandemic. To date, 392 employees have received the first shot with 222 of those employees being fully vaccinated.

As a global supplier of metallurgical coal, our geographic diversification has helped us withstand the negative impact on benchmark pricing stemming from Chinese import restrictions on Australian coal. Our U.S. Operations have successfully taken advantage of the policy shift by increasing sales volumes directly into the country during the quarter.

Safety and COVID-19 Response

In Australia, the TRIFR at the end of March was 8.92, down from 9.40 at December 2020 and 9.88 at September 2020. The U.S. Operations recorded a TRIR of 1.35 and continue to outperform national industry averages.

Safety continues to be at the forefront of everything we do. In Australia and the U.S., the implementation of incident reduction initiatives including enhanced hazard recognition and risk assessments, continue to have a positive effect.

In the US, the Lower War Eagle Underground Mine at the Logan Complex achieved 500+ days without a Lost Time incident and the Buchanan mine preparation plant has exceeded eight years without a reportable incident, both are exceptional achievements.

Coronado’s COVID-19 Steering Committee continues to monitor the effect of the pandemic across our operations in Australia and the U.S. to ensure the safety and well-being of all employees and contractors. We aim to have the majority of our U.S. workforce vaccinated as soon as possible and our Australian workforce will be vaccinated according to the Federal government’s vaccination program.

First Quarter Operating Performance

Australian Operations in Q1 were impacted by a breakdown of the bucket wheel reclaimer limiting Curragh’s ability to stockpile and rail coal for three weeks. Seasonal wet weather also had an impact on mining operations. In January, we

deployed additional fleets at Curragh Main to accelerate overburden removal to increase coal availability in subsequent quarters. Estimated one-time production loss from these factors was about 10%.

U.S. Operations continued to ramp up production to align with domestic and international demand and higher export pricing due to the CFR arbitrage. The Buchanan mine is operating at full capacity and Logan continues to expand production levels. North American and Atlantic basin steel producers have increased production and demand from China has increased due to China’s import restrictions on Australian coal, resulting in improved pricing and higher pricing from the U.S. into China.

Balance Sheet and Liquidity

At the end of March Coronado’s net debt position was $290 million, an increase of $8m in the quarter. We are working on initiatives that will generate further liquidity over the next quarters.

Market Outlook

The FOB Australia Premium Low Vol metallurgical coal price increased 17.5% quarter on quarter to $127/tonne for the period January to March 2021. During the same period, the US Low Vol HCC metallurgical coal price increased by 26% to $151/tonne

Global steel demand remains bullish as crude steel production approaches pre-pandemic levels and the global economic recovery continues. This is underpinned by increased activity in the construction and automotive sectors supported in part by government stimulus.

China’s ban on Australian imports continues to distort the global metallurgical coal market with higher CFR China prices drawing in additional spot supply from USA, Canada, Russia and Mongolia replacing Australian imports. The timing of any change to the Australia coal ban remains uncertain, with Australian exports continuing to rebalance into more distant Atlantic basin markets.

The impact on Coronado from a volume perspective is minimal. Our Australian Operations do not have term volume contracts with Chinese counterparts and only sell into this market sporadically. The restrictions do not apply to our U.S. operations which has seen Buchanan cargoes to China increase during the quarter. Towards the end of the quarter we started to see materially improved pricing for Buchanan.

Guidance for saleable production, mining cost per tonne sold, and capex for FY21 remains unchanged.

Production and Sales

Quarterly Production and Sales Performance

| Summary Information (unaudited) |

Mar Q21 |

Dec Q20 |

Change |

Mar 2021 YTD |

Mar 2020 YTD |

Change | |

| ROM Production | Mt | 6.8 | 6.8 | 0.9% | 6.8 | 6.9 | (0.4%) |

| Australia | Mt | 3.6 | 3.7 | (2.5%) | 3.6 | 3.0 | 19.6% |

| USA | Mt | 3.2 | 3.1 | 5.1% | 3.2 | 3.9 | (15.9%) |

| Saleable Production | Mt | 4.6 | 4.5 | 2.5% | 4.6 | 4.5 | 1.5% |

| Australia | Mt | 3.0 | 3.0 | 0.7% | 3.0 | 2.6 | 16.3% |

| USA | Mt | 1.6 | 1.5 | 6.2% | 1.6 | 1.9 | (18.4%) |

| % Met Coal | % | 82.8% | 81.0% | 1.8% | 82.8% | 82.0% | 0.8% |

| Sales Volumes | Mt | 4.4 | 4.9 | (10.5%) | 4.4 | 4.5 | (2.1%) |

| Australia | Mt | 2.9 | 3.2 | (7.3%) | 2.9 | 2.6 | 14.0% |

| USA | Mt | 1.5 | 1.8 | (16.4%) | 1.5 | 1.9 | (23.6%) |

| Sales Mix | |||||||

| Met Coal | % | 82.6% | 81.0% | 1.6% | 82.6% | 81.1% | 1.5% |

| Thermal Coal | % | 17.4% | 19.0% | (1.6%) | 17.4% | 18.9% | (1.5%) |

| Export Sales | % | 77.0% | 77.0% | 0.0% | 77.0% | 75.0% | 2.0% |

| Domestic Sales | % | 23.0% | 23.0% | 0.0% | 23.0% | 25.0% | (2.0%) |

| AU- Realised Met Price (FOB) | US$/t | 94.2 | 85.5 | 10.2% | 94.2 | 120.3 | (21.7%) |

| Index Price | US$/t | 127.1 | 108.2 | 17.5% | 127.1 | 155.1 | (18.1%) |

| % of Index | % | 74.1% | 79.0% | (4.9%) | 74.1% | 77.6% | (3.5%) |

| US - Realised Met Price (FOR) | US$/t | 94.5 | 81.3 | 16.2% | 94.5 | 84.7 | 11.6% |

| % of Index | % | 74.4% | 75.1% | (0.7%) | 74.4% | 54.6% | 19.8% |

| Group - Realised Met Price | US$/t | 94.3 | 83.8 | 12.5% | 94.3 | 102.0 | (7.5%) |

| % of Index | % | 74.2% | 77.4% | (3.2%) | 74.2% | 65.8% | 8.4% |

Note: Coronado reports its production and financial information on a geographical segment basis. Please refer to the Appendix for operation specific production and sales data. Some numerical figures in the above table have been subject to rounding adjustments. Accordingly, numerical figures shown as totals may not equal the sum of the figures that follow them.

March quarter Group ROM coal production was 6.8 Mt, 0.9% higher compared to the December quarter. ROM production from Australian Operations (Curragh) was 3.6 Mt, 2.5% lower compared to the previous quarter while ROM production from U.S. Operations (Buchanan and Logan) was 3.2 Mt, 5.1% higher compared to the previous quarter.

Saleable production for the Group of 4.6 Mt for the March quarter was up 2.5% compared to the December quarter. Saleable production from Australia Operations was 3.0 Mt, up 0.7% compared to December quarter. U.S. Operations’ saleable production of 1.6 Mt for the March quarter was 6.2% higher than the previous quarter as production continues to ramp up back to pre-COVID levels to meet increasing demand. Year on year saleable production at U.S. Operations for the March quarter was 0.3Mt, or 18.4% lower primarily due to the Greenbrier mine being idled and held for sale, labour shortages and adverse geological conditions incurred at certain operations in the first quarter of 2021.

Sales volumes for the Group of 4.4 Mt for the March quarter were 10.5% lower compared to December quarter. Sales volume from Australia Operations of 2.9 Mt for the March quarter were 7.3% lower compared to December quarter due to a large inventory drawdown in the December quarter and production impacts due to lower than expected overburden movement negatively impacting coal mining and CHPP equipment failures. Sales volumes from the U.S. declined 0.3 Mt or 16.4% from previous quarter and 0.4 Mt or 23.6% from same quarter year on year. The December quarter benefited from rationalization of high inventory levels and the previous year’s March quarter benefited from higher production and strong metallurgical seaborne demand pre-COVID. In addition, March 2021 quarter’s sales volumes in the U.S. were adversely impacted by poor rail service which delayed timing of certain shipments.

The realised metallurgical coal price for Australia (Curragh) was $94.2 per tonne (FOB) for the March quarter, an increase of 10.2% compared to the previous quarter. The realised metallurgical coal price for the U.S. operations of $94.5 per tonne (FOR) was 16.2% higher than the December quarter and 21.6% better than the previous year’s March quarter. The increase in realised metallurgical coal price was largely driven by strong demand and higher average prices in the seaborne export markets particularly in the Asian market for the March quarter compared to previous quarter and the previous year’s March quarter.

Coronado’s proportion of metallurgical coal sales volume in the March quarter was 82.6% of the total sales mix. Export sales volume as a percentage of total sales for the March quarter was 77.0%, consistent with previous quarter.

Q1 FY21 Sales Volume Mix Q1 FY21 Export Volume Mix

Metallurgical Coal Thermal Coal

Export sales Domestic Sales

Financial and Corporate

March quarter revenue was $376 million (unaudited), up 1.0% compared to the December quarter.

Q1 2021 mining cost per tonne sold of $62.2 per tonne (unaudited). Despite higher mining costs per tonne attributable to foreign currency, weather impacts and production constraints in the quarter, the Company expects full year costs to be within market guidance of $57.0 - $59.0 per tonne.

Q1 2021 capital expenditure of $22.6 million, down 45% on Q1 2020 ($41.4 million) due to savings and deferrals.

At 31 March 2021 the Company’s net debt position was $290 million (consisting of $34 million in cash and $324 million in drawn debt), up from $282 million at 31 December 2020.

On 6 January 2021 the Company successfully raised proceeds of $23.5 million (A$30.2 million) post completion of the sale and leaseback of Heavy Mining Equipment (HME) assets from the Curragh mine. Funds were applied against debt and under the terms of the second waiver agreement with SFA lenders agreed in August 2020.

At 31 March 2020 the outstanding receivables position with XCoal was $57.8 million. The Company expects to receive all remaining outstanding trade receivables amounts from Xcoal by 30 September 2021.

Coronado will hold a virtual Annual General Meeting (AGM) of security holders at 10.00am on 27 May 2021 (AEST). Subsequent to the end of Q1 2021, Mr Ernie Thrasher advised that he will not seek re-election as a Director of the Company and that his term as a Director will cease at the conclusion of the 2021 AGM.

Operational Overview and Outlook

Safety

In Australia, the 12-month rolling average Total Reportable Injury Frequency Rate (TRIFR) at 31 March was 8.92, which compares favourably to 9.40 at the end of December and

9.88 at the end of September.

In the U.S., the 12-month rolling average Total Reportable Incident Rate (TRIR) at 31 March was 1.35, compared to

1.34 at the end of December.

Reportable rates in the U.S. are below the relevant industry benchmarks. Australian rates have improved over the previous two quarters. In Australia and the U.S., several actions have been implemented to continue to reduce the respective rates which include enhanced hazard recognition and risk assessments, and increased inspections and audits to ensure compliance with safety and health standards by both employees and contractors.

Coronado’s COVID-19 Steering Committee continues to monitor the effect of the pandemic across our operations in Australia and the U.S. and have implemented proactive preventative measures to ensure the safety and well-being of employees and contractors.

The COVID-19 Steering Committee has partnered with local vaccine providers in West Virginia and Virginia to inoculate those employees who have requested the vaccination. To date, 392 employees have received the first shot with 222 of those employees being fully vaccinated. The partnerships with vaccine providers allowed most of our employees to be vaccinated on site. The supply of the three vaccinations (Pfizer, Moderna, and Johnson & Johnson) remain plentiful, and as additional employees request the vaccination, they will be directed to the providers in their area who can distribute the vaccine usually within 24-hours of the request.

Australia (Curragh)

ROM production for the March quarter was 3.6Mt, a decrease of 2.5%. Saleable production was 3.0Mt, a 0.7% increase from the previous quarter.

First quarter saleable production was negatively impacted by lower than expected overburden movement which resulted in lower ROM coal mined reducing plant feed, as well as unforeseen equipment breakdowns in the CHPP, including a three week breakdown of the bucket wheel reclaimer. Overburden movement was impacted by seasonal wet

weather throughout the quarter which affected mine sequencing operations. Where applicable, performance improvement plans are being implemented to regain lost production.

Sales volumes of 2.9Mt were 7.3% lower than the prior quarter.

The realised average metallurgical coal price for Australia was $94.2 per tonne (FOB) for the March quarter which was 10.2% higher than the previous quarter. This compares to a 17.5% increase in benchmark pricing quarter on quarter. The realised price reflects the sale of some carryover tonnes from the previous quarter pricing period.

United States (Buchanan, Logan and Greenbrier)

During the March quarter, U.S. operations continued to ramp up production in line with the recovery in steel and metallurgical coal markets as economies come to terms with the impact of the pandemic. Buchanan returned to full production as market conditions continued to improve in seaborne markets, particularly in Asia. Logan also increased production in line with market demand in North America, but still short of full capacity primarily due to local labour shortages. Greenbrier remained idled during the quarter as market prices for high quality mid-vol coal did not support a return to production.

ROM production for the March quarter was 3.2Mt (5.1% higher), saleable production was 1.6Mt (6.2% higher), and sales volumes was 1.5Mt (16.4% lower) compared to the December quarter. The increase in production is primarily from the Buchanan mine in response to higher Asian seaborne demand however sales volume lagged the previous month primarily due to poor rail service delaying the timing of certain shipments. North American and Atlantic basin steel producers have also been increasing production in line with improving steel demand as the economy begins to recover.

U.S. segment stockpiles have returned to normal inventory levels. Coronado’s Logan operations continues to scale up production to meet improving demand and the segment is well positioned to further increase production quickly as the market continues to recover to pre-COVID-19 demand levels.

Coal Market Outlook

| A$ Australian dollar currency ASX Australian Securities Exchange Capital Expenditure Expenditure included as a component of Investing Activities within the Coronado Consolidated Statement of Cash Flows CHPP Coal Handling Preparation Plant EBITDA Earnings before interest, tax, depreciation and amortization FOB Free Onboard Board in the vessel at the port FOR Free Onboard Rail in the railcar at the mine HCC Hard coking coal HVA High Vol A HVB High Vol B Index Platts Premium Low Volatile HCC, US$/t FOB East Coast Australia Kt Thousand tonnes, metric Met Coal Metallurgical quality coal Mining costs per tonne sold Costs of coal revenues / sales volumes Mt Million tonnes, metric PCI Pulverised Coal Injection Net Debt Defined as borrowings less cash Realised price Weighted average revenue per tonne sold ROM Run of Mine, coal mined Saleable production Coal available to sell, either washed or bypassed Sales volumes Sales to third parties Strip Ratio Ratio of overburden removed to coal mined (ROM) TRIFR Total Reportable Injury Frequency Rate TRIR Total Reportable Incident Rate US$ United States dollar currency |

Global steel demand continues to remain strong with crude steel production approaching pre-pandemic levels. Global hot rolled coil (HRC) prices are reaching historical highs as demand continues to rise faster than supply growth.

Steel demand for the balance of 2021 is widely forecast to remain very strong, underpinned by the ongoing global economic recovery and resultant demand in construction and automotive sectors resulting in continued sustained global demand for metallurgical coals.

China’s ban on Australian coal imports, in place since October 2020, continues to distort the global metallurgical coal market with higher CFR China prices drawing in additional spot supply from USA, Canada, Russia and Mongolia replacing the traditional Australian imports. The timing of any change to the Australia coal ban remains uncertain, with this situation continuing to provide U.S. East Coast coal producers a current price arbitrage of

~US$24tonne.

Exploration & Development

During the quarter at the Curragh Complex, exploration works were undertaken in respect of a potential future underground mining area. 14 drill holes and 2D seismic campaign were completed, and these results are being evaluated.

Additional core hole drilling and subsurface geotechnical exploration at Mon Valley (PSF), Pennsylvania USA, has been put on hold in the first half of 2021.

Glossary

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO U.S. PERSONS

APPENDIX

Quarterly Production and Sales Performance by Mine

| Summary Information (unaudited) |

Mar Q21 |

Dec Q20 |

Change |

Mar 2021 YTD |

Mar 2020 YTD |

Change | |

| ROM Production | Mt | 6.8 | 6.8 | 0.9% | 6.8 | 6.9 | (0.4%) |

| Curragh | Mt | 3.6 | 3.7 | (2.5%) | 3.6 | 3.0 | 19.6% |

| Buchanan | Mt | 1.8 | 1.9 | (2.7%) | 1.8 | 1.9 | (7.3%) |

| Logan | Mt | 1.4 | 1.2 | 18.6% | 1.4 | 1.7 | (14.4%) |

| Greenbrier | Mt | 0.0 | 0.0 | 0.0% | 0.0 | 0.2 | (100.0%) |

| Saleable Production | Mt | 4.6 | 4.5 | 2.5% | 4.6 | 4.5 | 1.5% |

| Curragh | Mt | 3.0 | 3.0 | 0.7% | 3.0 | 2.6 | 16.3% |

| Buchanan | Mt | 1.1 | 1.1 | 4.4% | 1.1 | 1.2 | (8.0%) |

| Logan | Mt | 0.5 | 0.4 | 12.6% | 0.5 | 0.6 | (23.4%) |

| Greenbrier | Mt | 0.0 | 0.0 | 0.0% | 0.0 | 0.1 | (100.0%) |

| Sales Volumes | Mt | 4.4 | 4.9 | (10.5%) | 4.4 | 4.5 | (2.1%) |

| Curragh | Mt | 2.9 | 3.2 | (7.3%) | 2.9 | 2.6 | 14.0% |

| Buchanan | Mt | 1.1 | 1.3 | (14.2%) | 1.1 | 1.3 | (16.5%) |

| Logan | Mt | 0.4 | 0.5 | (21.9%) | 0.4 | 0.5 | (21.8%) |

| Greenbrier | Mt | 0.0 | 0.0 | 0.0% | 0.0 | 0.1 | (99.9%) |

Some numerical figures in the above table have been subject to rounding adjustments. Accordingly, numerical figures shown as totals may not equal the sum of the figures that follow them.

Cautionary Notice Regarding Forward-Looking Statements

This report contains forward-looking statements concerning our business, operations, financial performance and condition, the coal, steel and other industries, as well as our plans, objectives and expectations for our business, operations, financial performance and condition. Forward-looking statements may be identified by words such as "may," "could," "believes," "estimates," "expects," "intends," "considers", “forecasts”, “targets” and other similar words. Forward-looking statements provide management's current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, income, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volume, or other financial items, descriptions of management’s plans or objectives for future operations, or descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect the company's good faith beliefs, assumptions and expectations, but they are not a guarantee of future performance or events. Furthermore, the company disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond the Company's control, that are described in our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the ASX and SEC on 24 February 20, as well as additional factors we may describe from time to time in other filings with the ASX and SEC. You may get such filings for free at our website at www.coronadoglobal.com.au. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties

Reconciliation of Non-GAAP financial measures

This report includes a discussion of results of operations and references to and analysis of certain non-GAAP measures (as described below) which are financial measures not recognised in accordance with U.S. GAAP. Non-GAAP financial measures are used by the Company and investors to measure operating performance.

Non-GAAP financial measures used in this report include (i) sales volumes and average realised price per Mt or metallurgical coal sold, which we define as metallurgical coal revenues divided by metallurgical sales volume; and (ii) average mining costs per Mt sold, which we define as mining costs divided by sales volumes.

We evaluate our mining cost on a cost per metric tonne basis. Mining costs is based on reported cost of coal revenues, which is shown on our statement of operations and comprehensive income exclusive of freight expense, Stanwell rebate, other royalties, depreciation, depletion and amortization and selling, general and administrative expenses, adjusted for other items that do not relate directly to the costs incurred to produce coal at the mine.

Reconciliations of certain forward-looking non-GAAP financial measures, including market guidance, to the most directly comparable GAAP financial measures are not provided because the Company is unable to provide such reconciliations without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of items impacting comparability and the periods in which such items may be recognised. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

A reconciliation of consolidated costs and expenses, consolidated operating costs, and consolidated mining costs are shown below:

For the three months ended March 31, 2021 | |

| (In US$000, except for volume data, unaudited) | Total Consolidated |

| Total costs and expenses | 421,866 |

| Less: Selling, general and administrative expense | (5,775) |

| Less: Depreciation, depletion and amortization | (53,081) |

| Total operating costs | 363,010 |

| Less: Other royalties | (20,947) |

| Less: Stanwell rebate | (15,819) |

| Less: Freight expenses | (52,141) |

| Less: Other non-mining costs | (5,921) |

| Total mining costs | 268,182 |

| Sales Volume excluding non-produced coal (MMt) | 4.3 |

| Average mining costs per tonne sold | $62.2/t |

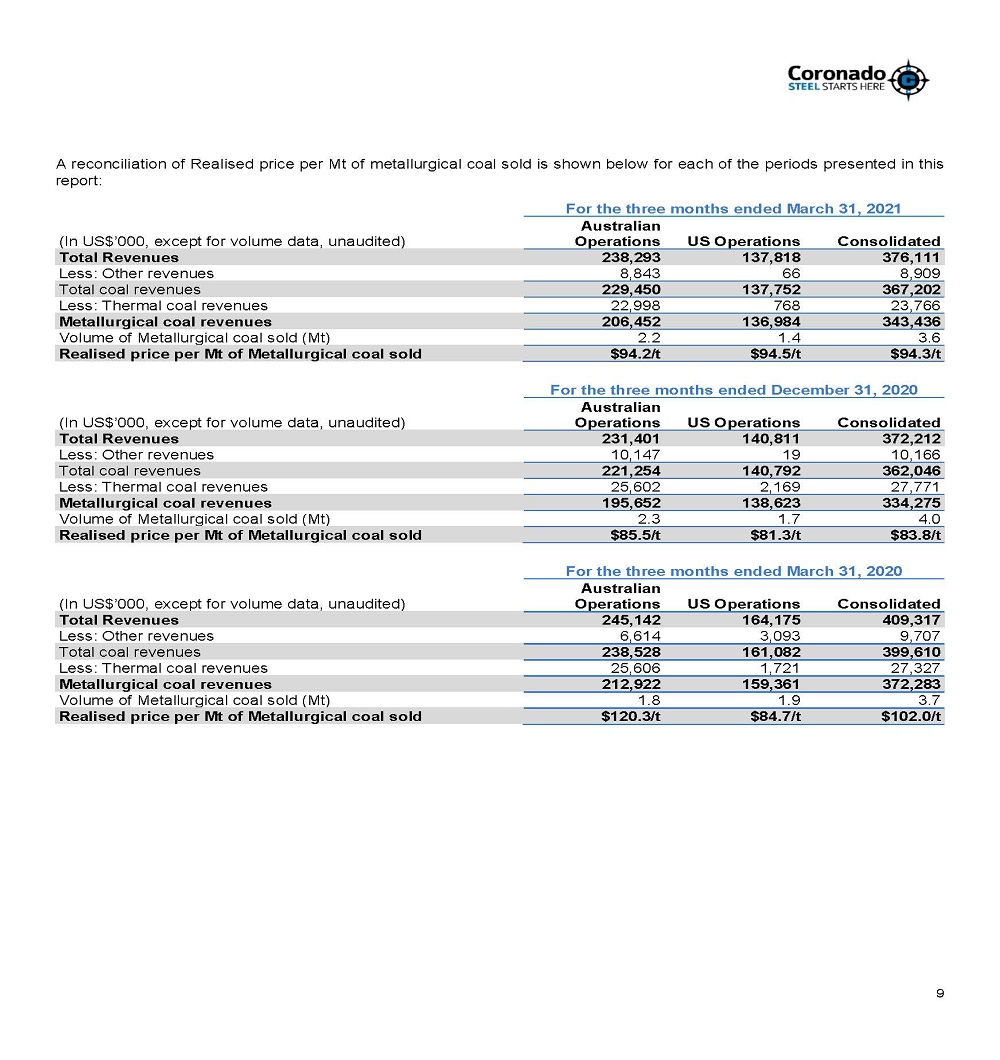

A reconciliation of Realised price per Mt of metallurgical coal sold is shown below for each of the periods presented in this report:

| For the three months ended March 31, 2021 | |||

(In US$’000, except for volume data, unaudited) |

Australian Operations |

US Operations |

Consolidated |

| Total Revenues | 238,293 | 137,818 | 376,111 |

| Less: Other revenues | 8,843 | 66 | 8,909 |

| Total coal revenues | 229,450 | 137,752 | 367,202 |

| Less: Thermal coal revenues | 22,998 | 768 | 23,766 |

| Metallurgical coal revenues | 206,452 | 136,984 | 343,436 |

| Volume of Metallurgical coal sold (Mt) | 2.2 | 1.4 | 3.6 |

| Realised price per Mt of Metallurgical coal sold | $94.2/t | $94.5/t | $94.3/t |

| For the three months ended December 31, 2020 | |||

(In US$’000, except for volume data, unaudited) |

Australian Operations |

US Operations |

Consolidated |

| Total Revenues | 231,401 | 140,811 | 372,212 |

| Less: Other revenues | 10,147 | 19 | 10,166 |

| Total coal revenues | 221,254 | 140,792 | 362,046 |

| Less: Thermal coal revenues | 25,602 | 2,169 | 27,771 |

| Metallurgical coal revenues | 195,652 | 138,623 | 334,275 |

| Volume of Metallurgical coal sold (Mt) | 2.3 | 1.7 | 4.0 |

| Realised price per Mt of Metallurgical coal sold | $85.5/t | $81.3/t | $83.8/t |

| For the three months ended March 31, 2020 | |||

(In US$’000, except for volume data, unaudited) |

Australian Operations |

US Operations |

Consolidated |

| Total Revenues | 245,142 | 164,175 | 409,317 |

| Less: Other revenues | 6,614 | 3,093 | 9,707 |

| Total coal revenues | 238,528 | 161,082 | 399,610 |

| Less: Thermal coal revenues | 25,606 | 1,721 | 27,327 |

| Metallurgical coal revenues | 212,922 | 159,361 | 372,283 |

| Volume of Metallurgical coal sold (Mt) | 1.8 | 1.9 | 3.7 |

| Realised price per Mt of Metallurgical coal sold | $120.3/t | $84.7/t | $102.0/t |