Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PNC FINANCIAL SERVICES GROUP, INC. | q12021financialsupplement.htm |

| 8-K - 8-K - PNC FINANCIAL SERVICES GROUP, INC. | pnc-20210416.htm |

The PNC Financial Services Group First Quarter 2021 Earnings Conference Call April 16, 2021 Exhibit 99.2

Cautionary Statement Regarding Forward-Looking and Non-GAAP Financial Information Our earnings conference call presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on our corporate website. The presentation contains forward-looking statements regarding our outlook for earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these as well as other factors in our 2020 Form 10-K and our other subsequent SEC filings. Our forward-looking statements may also be subject to risks and uncertainties including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. We include non-GAAP financial information in this presentation. Non-GAAP financial information includes financial metrics such as fee income, tangible book value, pretax, pre-provision earnings, net interest margin and return on tangible common equity. Reconciliations for such financial information may be found in our presentation, in these slides, including the Appendix, in other materials on our corporate website, and in our SEC filings. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 1

First Quarter 2021 Highlights 2 Solid financial performance: – Generated linked quarter positive operating leverage – Large provision recapture due to improving economic outlook – Robust deposit growth; loans remained challenged – Maintained strong capital and liquidity position Continued solid progress toward closing and integration of BBVA USA transaction Launched Low Cash ModeSM solution to help Virtual Wallet® customers avoid overdraft fees Net Income $1.8 billion Diluted Earnings Per Share $4.10 Loan to Deposit Ratio 63% Linked Quarter Operating Leverage 5.2% CET1 Ratio 12.6% – Basel III common equity Tier 1 (CET1) capital ratio – March 31, 2021 ratio is estimated. Details of the calculation are presented in the capital table in the financial highlights.

Balance Sheet: Well-Positioned with Record Capital and Liquidity 3 Total Average Assets Grew LQ 1% Spot Investment Securities Grew LQ 11% Deposit Costs Declined LQ -2 bps Return on Average Assets 1.58% 1Q21 vs. 4Q20 1Q21 vs. 1Q20 Average balances, $ billions 1Q21 $ Chg. % Chg. $ Chg. % Chg. Commercial $164.9 ($5.4) (3%) $0.8 1% Consumer $73.2 ($2.3) (3%) ($6.3) (8%) Total loans $238.1 ($7.7) (3%) ($5.5) (2%) Investment securities $86.4 $0.7 1% $2.0 2% Federal Reserve Bank balances $85.2 $9.1 12% $67.9 392% Deposits $365.4 $6.0 2% $75.7 26% Borrowed funds $35.2 ($3.0) (8%) ($22.0) (38%) Common shareholders’ equity $49.8 $0.3 1% $4.8 11% 1Q21 4Q20 Chg. 1Q20 Chg. Basel III common equity Tier 1 capital ratio 12.6% 12.2% 0.4% 9.4% 3.2% Tangible book value per common share $96.57 $97.43 (1%) $84.93 14% – Basel III common equity Tier 1 capital ratio – March 31, 2021 ratio is estimated. Details of the calculation are presented in the capital table in the financial highlights. – Tangible book value per common share (Non-GAAP) – See reconciliation in appendix. – LQ – Linked Quarter, which is 1Q21 vs. 4Q20 for average comparisons and 3/31/21 vs. 12/31/20 for spot comparisons. 1Q21 Highlights

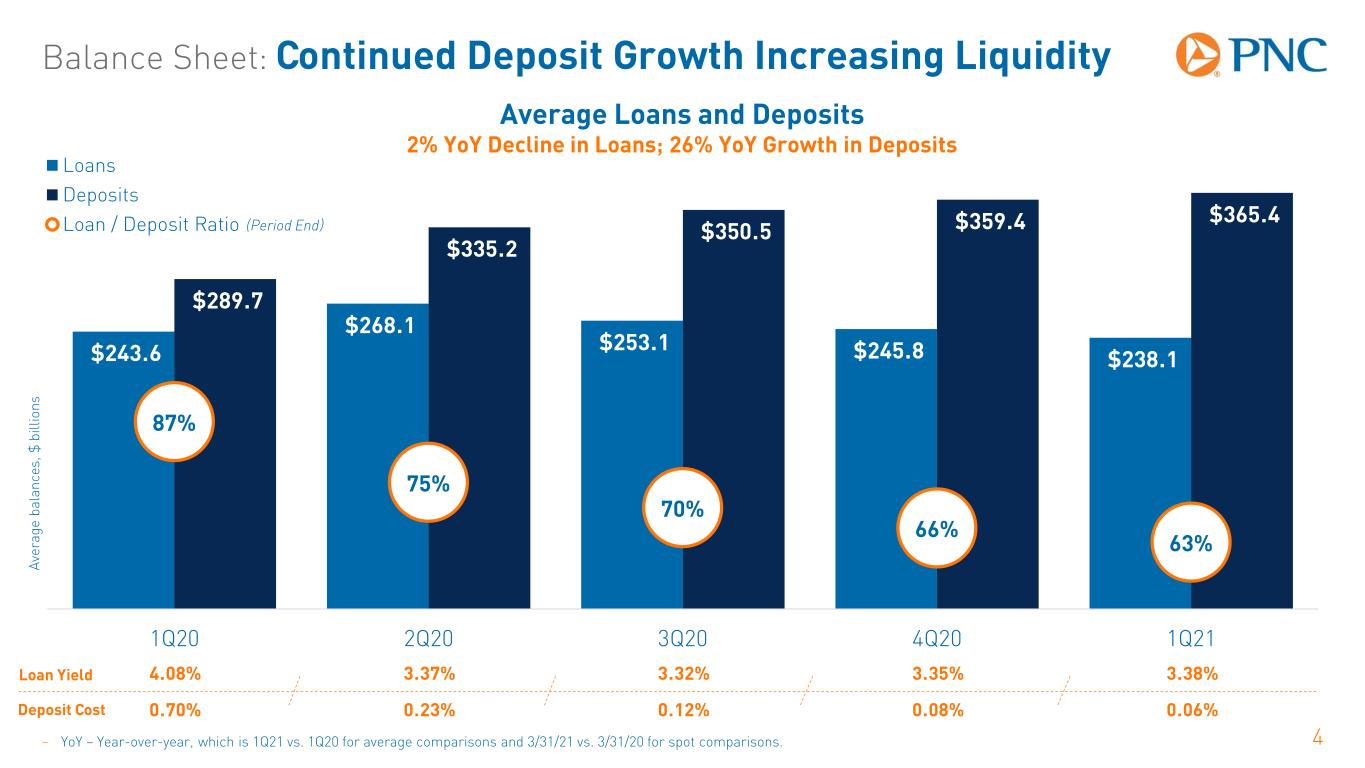

Balance Sheet: Continued Deposit Growth Increasing Liquidity 4 Loan Yield Deposit Cost 4.08% 3.37% 3.32% 3.35% 3.38% 0.70% 0.23% 0.12% 0.08% 0.06% A ve ra ge b al an ce s, $ b ill io n s $243.6 $268.1 $253.1 $245.8 $238.1 $289.7 $335.2 $350.5 $359.4 $365.4 87% 75% 70% 66% 63% 50% 60% 70% 80% 90% 100% 110% 120% 130% 140% $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 1Q20 2Q20 3Q20 4Q20 1Q21 Loans Deposits Loan / Deposit Ratio (Period End) Average Loans and Deposits 2% YoY Decline in Loans; 26% YoY Growth in Deposits – YoY – Year-over-year, which is 1Q21 vs. 1Q20 for average comparisons and 3/31/21 vs. 3/31/20 for spot comparisons.

Balance Sheet: Substantial Liquidity Presents Upside 5 Securities Yield Avg. IOR 2.78% 2.41% 2.18% 2.08% 1.97% 1.25% 0.10% 0.10% 0.10% 0.10% A ve ra ge b al an ce s, $ b ill io n s – Avg. IOR – Period average of the daily rate for Interest on Reserves (IOR) on balances held at the Federal Reserve. $17.3 $34.2 $60.0 $76.1 $85.2 $84.4 $88.4 $90.5 $85.7 $86.4 1.37% 0.69% 0.65% 0.86% 1.34% 0.30% 0.80% 1.30% 1.80% 2.30% $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 1Q20 2Q20 3Q20 4Q20 1Q21 FRB Balances Securities Average 10-Yr Treasury Yield Average Securities and Federal Reserve Bank (FRB) Balances FRB Balances Nearly 5x YoY Levels; 2% YoY Growth in Securities 3/31/21 Period End Balance Securities: $98.3 bn, +11% LQ FRB Balances: $85.8 bn, +1% LQ

Income Statement: Solid Results in the Current Environment 6 – Pretax, pre-provision earnings (Non-GAAP) – See the reconciliation in the appendix. – Net interest margin is calculated using taxable-equivalent net interest income, a Non-GAAP measure, a reconciliation of which is provided in the appendix. 1Q21 vs. 4Q20 1Q21 vs. 1Q20 $ millions 1Q21 $ Chg. % Chg. $ Chg. % Chg. Revenue $4,220 $12 0% ($116) (3%) Noninterest expense $2,574 ($134) (5%) $31 1% Pretax, pre-provision earnings $1,646 $146 10% ($147) (8%) Provision for (recapture of) credit losses ($551) ($297) 117% ($1,465) (160%) Net income from continuing operations $1,826 $370 25% $1,067 141% 1Q21 4Q20 Chg. 1Q20 Chg. Efficiency ratio 61% 64% (3%) 59% 2% Net interest margin 2.27% 2.32% (5 bps) 2.84% (57 bps) Diluted EPS from continuing operations $4.10 $3.26 26% $1.59 158% Net Income from Continuing Ops. Grew LQ 25% Pretax, Pre-Provision Earnings Grew LQ 10% Noninterest Income to Revenue 44% Return on Average Common Equity 14.31% 1Q21 Highlights

Income Statement: Broad Based Business Mix 7 Total Revenue Stable Linked Quarter Revenue Details of Total Revenue Linked Quarter Noninterest Income Up 5% but NII Down 3% 1Q21 vs. 4Q20 1Q21 vs. 1Q20 $ millions 1Q21 $ Chg. % Chg. $ Chg. % Chg. Net interest income $2,348 ($76) (3%) ($163) (6%) Asset management $226 $5 2% $25 12% Consumer services $384 ($3) (1%) $7 2% Corporate services $555 ($95) (15%) $29 6% Residential mortgage $105 $6 6% ($105) (50%) Service charges on deposits $119 ($15) (11%) ($49) (29%) Fee Income $1,389 ($102) (7%) ($93) (6%) Other noninterest income $483 $190 65% $140 41% Noninterest income $1,872 $88 5% $47 3% Total Revenue $4,220 $12 0% ($116) (3%) $ m ill io n s $1,825 $1,549 $1,797 $1,784 $1,872 $2,511 $2,527 $2,484 $2,424 $2,348 $4,336 $4,076 $4,281 $4,208 $4,220 2.84% 2.52% 2.39% 2.32% 2.27% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 0 500 1000 1500 2000 2500 3000 3500 4000 4500 1Q20 2Q20 3Q20 4Q20 1Q21 Noninterest Income NII NIM − NII – Net interest income. − NIM – Net interest margin.

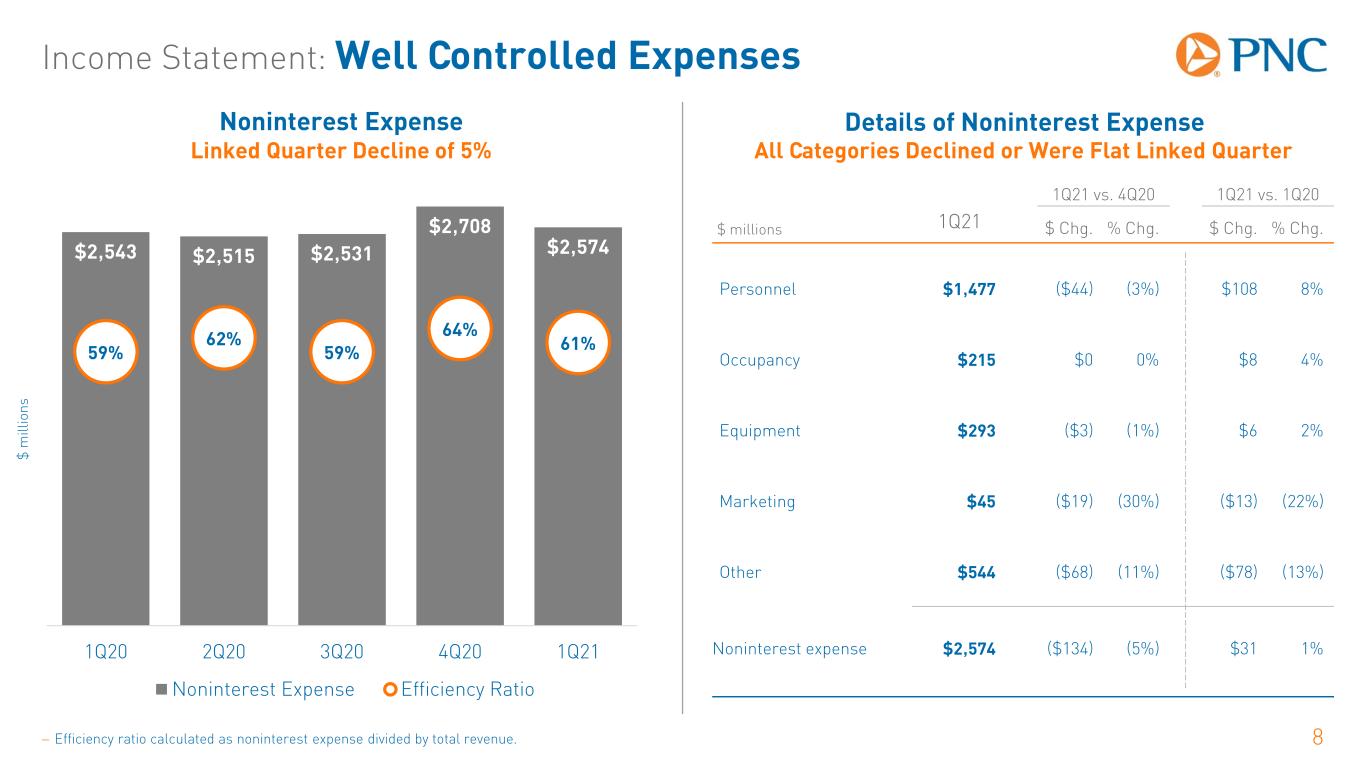

Income Statement: Well Controlled Expenses 8 Noninterest Expense Linked Quarter Decline of 5% Details of Noninterest Expense All Categories Declined or Were Flat Linked Quarter 1Q21 vs. 4Q20 1Q21 vs. 1Q20 $ millions 1Q21 $ Chg. % Chg. $ Chg. % Chg. Personnel $1,477 ($44) (3%) $108 8% Occupancy $215 $0 0% $8 4% Equipment $293 ($3) (1%) $6 2% Marketing $45 ($19) (30%) ($13) (22%) Other $544 ($68) (11%) ($78) (13%) Noninterest expense $2,574 ($134) (5%) $31 1% $2,543 $2,515 $2,531 $2,708 $2,574 59% 62% 59% 64% 61% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 500 1000 1500 2000 2500 3000 1Q20 2Q20 3Q20 4Q20 1Q21 Noninterest Expense Efficiency Ratio $ m ill io n s − Efficiency ratio calculated as noninterest expense divided by total revenue.

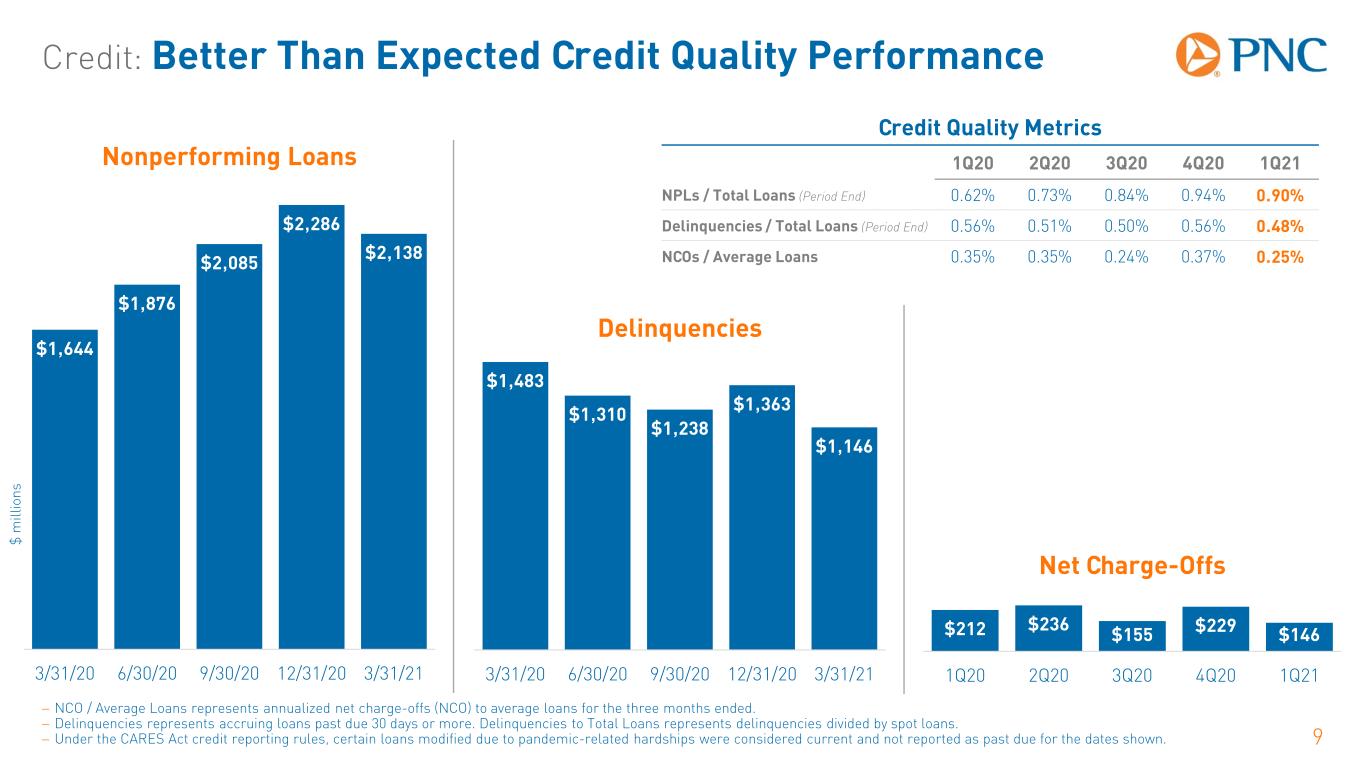

Credit: Better Than Expected Credit Quality Performance 9 − NCO / Average Loans represents annualized net charge-offs (NCO) to average loans for the three months ended. − Delinquencies represents accruing loans past due 30 days or more. Delinquencies to Total Loans represents delinquencies divided by spot loans. − Under the CARES Act credit reporting rules, certain loans modified due to pandemic-related hardships were considered current and not reported as past due for the dates shown. $1,483 $1,310 $1,238 $1,363 $1,146 0 500 1000 1500 2000 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $1,644 $1,876 $2,085 $2,286 $2,138 0 500 1000 1500 2000 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $212 $236 $155 $229 $146 0 500 1000 1500 2000 1Q20 2Q20 3Q20 4Q20 1Q21 $ m ill io n s Nonperforming Loans Delinquencies Net Charge-Offs Credit Quality Metrics 1Q20 2Q20 3Q20 4Q20 1Q21 NPLs / Total Loans (Period End) 0.62% 0.73% 0.84% 0.94% 0.90% Delinquencies / Total Loans (Period End) 0.56% 0.51% 0.50% 0.56% 0.48% NCOs / Average Loans 0.35% 0.35% 0.24% 0.37% 0.25%

Credit: Well Reserved for the Current Environment 10 − ACL is Allowance for Loan and Lease Losses plus Allowance for Unfunded Lending Related Commitments, and excludes Allowances for Investment Securities and Other Financial Assets. − Portfolio Changes primarily represent the impact of increases / decreases in loan balances, age and mix due to new originations / purchases, as well as credit quality and net charge-off activity. Economic / Qualitative Factors primarily represent our evaluation and determination of an economic forecast applied to our loan portfolio, as well as updates to qualitative factor adjustments. − ACL at 1/1/20 is Allowance for Credit Losses inclusive of $642 million, Day 1 CECL Impact, divided by 12/31/19 total loans. Allowance for Credit Losses (ACL) ACL 1/1/20 ACL 12/31/20 ACL 9/30/20 ACL 6/30/20 ACL 3/31/20 ACL 3/31/21 $3,702 $4,394 $6,590 $6,440 $5,945 $5,221 $251 $473 1.54% 1.66% 2.55% 2.58% 2.46% 2.20% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 0 1000 2000 3000 4000 5000 6000 7000 1/1/2020 3/31/2020 6/30/2020 9/30/2020 12/31/2020 Port Chgs . E / Q Factors 3/31/2021 ACL to Total Loans ACL to Total Loans ACL to Total Loans $ m ill io n s ACL to Total Loans ACL to Total Loans ACL to Total Loans Portfolio Changes Economic / Qualitative Factors

Update on BBVA USA Acquisition 11 Progress to Date Next Steps Conduct mock application and technology conversions to ensure system readiness Finalize alignment strategy for businesses and functional areas Prepare for implementation of PNC Regional President model across BBVA USA markets Plan for system and bank conversion in 4Q21 Expect to close transaction by mid-2021 On Track to Build Coast-to-Coast National Franchise Filed all key regulatory applications Finalized integration strategy and key milestones through conversion Established direct connections between PNC and BBVA USA data centers, and initiated test data transmissions and mapping Conducted numerous listening sessions with community organizations across combined footprint Re-affirmed plan to migrate core systems to PNC applications, significantly reducing complexity

Outlook: Second Quarter 2021 Compared to First Quarter 2021 12 − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies and merger integration costs. − Average loans, net interest income, fee income, and noninterest expense outlook represents estimated percentage change for second quarter 2021 compared to first quarter 2021. − The range for Other noninterest income excludes net securities gains and activities related to Visa Class B common shares. Balance Sheet Income Statement Net interest income Up approximately 2% Fee income Up approximately 3 - 5% Other noninterest income $300 - $350 million Noninterest expense Stable Net charge-offs $150 - $200 million Average loans Stable

Outlook: PNC Standalone FY 2021 Compared to FY 2020 13 − FY – Full year. − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies and merger integration costs. BBVA USA projected PPNR benefit to PNC standalone results does not include integrations costs and assumes a mid-year close. − Average loans, revenue, and noninterest expense outlook represents estimated percentage change for PNC standalone full year 2021 compared to full year 2020. − PPNR – Pre-provision net revenue. Balance Sheet Average loans Down approximately 3 - 4% Revenue Stable Noninterest expense Stable Effective tax rate 17% Income Statement BBVA USA Projected to Add $700 million in PPNR to PNC 2021 Standalone Results

Appendix: Cautionary Statement Regarding Forward-Looking Information 14 This presentation includes “snapshot” information about PNC used by way of illustration and is not intended as a full business or financial review. It should not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings. We also make statements in this presentation, and we may from time to time make other statements, regarding our outlook for earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. Our forward-looking statements are subject to the following principal risks and uncertainties. Our businesses, financial results and balance sheet values are affected by business and economic conditions, including the following: − Changes in interest rates and valuations in debt, equity and other financial markets, − Disruptions in the U.S. and global financial markets, − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply and market interest rates, − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives, − Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness, − Impacts of tariffs and other trade policies of the U.S. and its global trading partners, − The length and extent of the economic impact of the COVID-19 pandemic, − The impact of the results of the recent U.S. elections on the regulatory landscape, capital markets, and the response to and management of the COVID-19 pandemic, including the effectiveness of already-enacted fiscal stimulus from the federal government and a potential infrastructure bill, and − Commodity price volatility.

Appendix: Cautionary Statement Regarding Forward-Looking Information 15 Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our view that: − The U.S. economy is in an economic recovery, following a very severe but very short economic contraction in the first half of 2020 due to the COVID-19 pandemic and public health measures to contain it. − Despite the improvement in the economy in recent months, economic activity remains below its pre-pandemic level and unemployment remains elevated. − Growth will pick up in the spring of 2021 as vaccine distribution continues and the federal government provides aid to households, small and medium-sized businesses, and state and local governments. PNC expects real GDP to return to its pre-pandemic level in the third quarter of 2021, and employment in the second half of 2022. − PNC expects the Federal Open Market Committee to keep the fed funds rate in its current range of 0.00 to 0.25 percent until late 2023. PNC's ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding a stress capital buffer established by the Federal Reserve Board in connection with the Federal Reserve Board's Comprehensive Capital Analysis and Review (CCAR) process. The Federal Reserve also has imposed additional limitations on capital distributions through the second quarter of 2021 by CCAR-participating bank holding companies. PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC’s balance sheet. In addition, PNC’s ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models. Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain management. These developments could include: − Changes to laws and regulations, including changes affecting oversight of the financial services industry, consumer protection, bank capital and liquidity standards, pension, bankruptcy and other industry aspects, and changes in accounting policies and principles. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries. These matters may result in monetary judgments or settlements or other remedies, including fines, penalties, restitution or alterations in our business practices, and in additional expenses and collateral costs, and may cause reputational harm to PNC. − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Impact on business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general.

Appendix: Cautionary Statement Regarding Forward-Looking Information 16 Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. Our planned acquisition of BBVA USA Bancshares, Inc. presents us with risks and uncertainties related both to the acquisition transaction itself and to the integration of the acquired business into PNC after closing: − The business of BBVA USA Bancshares, Inc., including its U.S. banking subsidiary, BBVA USA, going forward may not perform as we currently project or in a manner consistent with historical performance. As a result, the anticipated benefits, including estimated cost savings, of the transaction may be significantly harder or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events, including those that are outside of our control. − The combination of BBVA USA Bancshares, Inc., including its U.S. banking subsidiary, BBVA USA, with that of PNC and PNC Bank may be more difficult to achieve than anticipated or have unanticipated adverse results relating to BBVA USA Bancshares, Inc., including its U.S. banking subsidiary, BBVA USA, or our existing businesses. − Completion of the transaction is dependent on the satisfaction of customary closing conditions, which cannot be assured. The timing of completion of the transaction is dependent on various factors that cannot be predicted with precision at this point. In addition to the planned BBVA USA Bancshares, Inc. transaction, we grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, and the integration of the acquired businesses into PNC after closing. Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. Business and operating results can also be affected by widespread natural and other disasters, pandemics, dislocations, terrorist activities, system failures, security breaches, cyberattacks or international hostilities through impacts on the economy and financial markets generally or on us or our counterparties specifically. We provide greater detail regarding these as well as other factors in our 2020 Form 10-K, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this presentation or in our SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document.

Appendix: Consumer and Retail Small Business Modifications 17 − Govt. guaranteed / investor owned includes govt. insured or guaranteed loans and investor owned mortgages; $2.6 billion and 55,000 accounts remain in assistance. − Exited Assistance includes loans that were paid-off or charged-off, representing $161 million or approximately 41,000 accounts. − Balances are as of 3/31/21 and include auto, credit card, personal, home equity, resi-mortgage, private education and small business loans, and exclude loans serviced by others. Consumer and Retail Small Business Customer Balances in Hardship Assistance 1 2 3 4 Received Assistance As of 3/31/21 Govt Guaranteed / Investor Owned Exited Assistance Still In Assistance with Credit Risk As of 3/31/21 $7.8bn 167,000 Accounts $14.2bn 376,000 Accounts $5.6bn 187,000 Accounts $0.8bn 22,000 Accounts 94% Accounts current or less than 30 days past due $0.3 billion Scheduled to exit assistance in the next 6 weeks 67% Of accounts made a payment in last payment cycle 1% Of Consumer and Retail Small Business Loans 68% Of balances are secured with collateral

Appendix: COVID-19 High Impact Industries 18 − PPP Lending within the Commercial Real Estate and Related Loans category is not material. − Balances as of 3/31/21; excludes securitizations. − Commercial & Industrial loans exclude PNC Real Estate business loans. Commercial real estate and related loans include commercial loans in the PNC Real Estate business. $7.2 billion Commercial Real Estate and Related Loans Non-Essential Retail & Restaurants: Malls, lifestyle centers, outlets, restaurants Hotel: Full service, limited service, extended stay Seniors Housing: Assisted living, independent living $2.6 billion / 62% Utilization $2.9 billion / 89% Utilization $1.7 billion / 67% Utilization $17.1 billion Outstanding Loan Balances ($14.5 billion excluding PPP Loans) $9.9 billion Commercial & Industrial Loans ($7.3 billion excluding PPP Loans) Leisure Recreation: Restaurants, casinos, hotels, convention centers Healthcare Facilities: Elective, private practices Other Impacted Areas: Shipping, senior living, specialty education Consumer Services: Religious organizations, childcare $1.9 billion / 84% Utilization Includes $0.5 billion in PPP Loans $0.8 billion / 45% Utilization Includes $0.2 billion in PPP Loans $1.0 billion / 79% Utilization Includes $0.5 billion in PPP Loans Leisure Travel: Cruise, airlines, other travel / transportation $0.6 billion / 58% Utilization Includes $0.1 billion in PPP Loans Retail (non-essential): Retail excluding auto, gas, staples $1.0 billion / 23% Utilization Includes $0.2 billion in PPP Loans $4.6 billion / 63% Utilization Includes $1.1 billion in PPP Loans

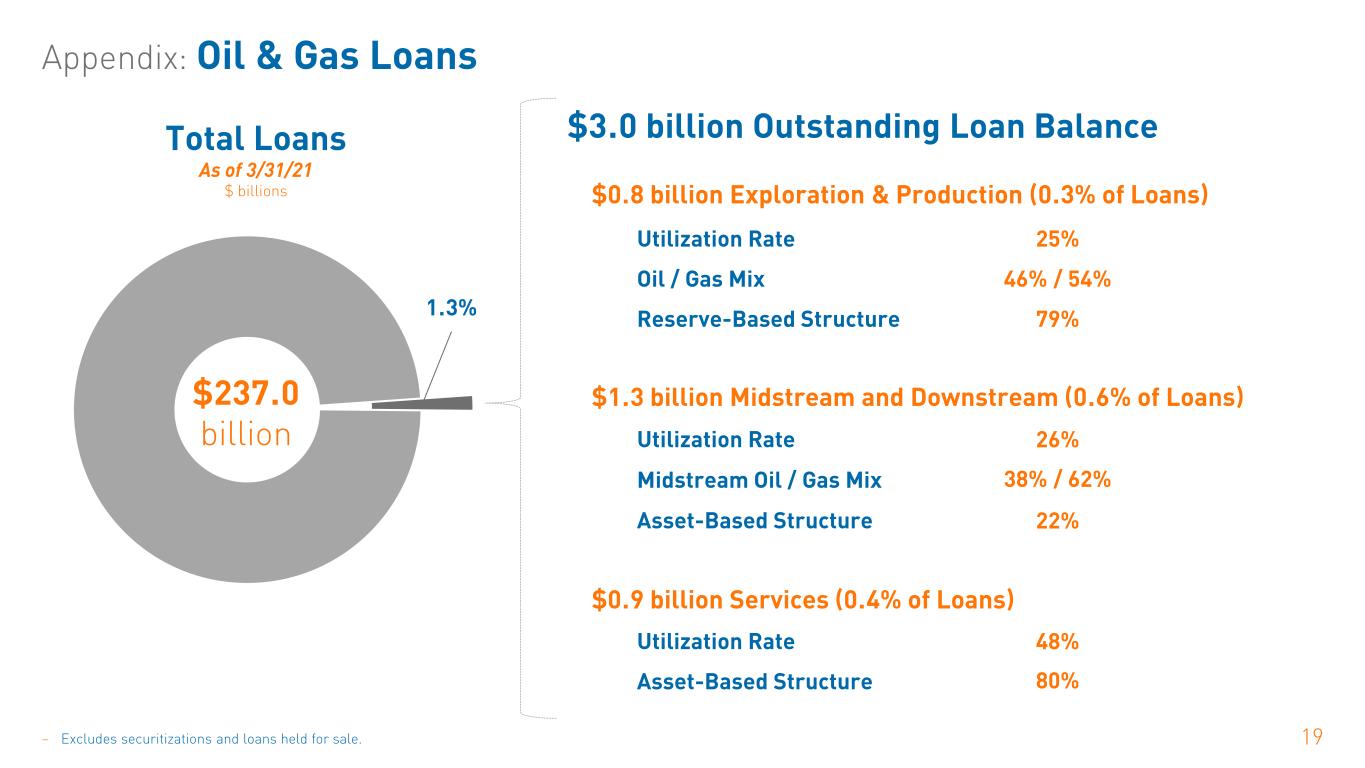

Appendix: Oil & Gas Loans 19– Excludes securitizations and loans held for sale. $0.8 billion Exploration & Production (0.3% of Loans) Utilization Rate 25% $3.0 billion Outstanding Loan Balance Oil / Gas Mix 46% / 54% Reserve-Based Structure 79% $1.3 billion Midstream and Downstream (0.6% of Loans) $0.9 billion Services (0.4% of Loans) Utilization Rate 48% Asset-Based Structure 80% Utilization Rate 26% Midstream Oil / Gas Mix 38% / 62% Asset-Based Structure 22% 1.3% Total Loans As of 3/31/21 $ billions $237.0 billion

Appendix: Non-GAAP to GAAP Reconciliation 20 Return On Tangible Common Equity (Non-GAAP) For the three months ended $ millions Mar. 31, 2021 Dec. 31, 2020 Mar. 31, 2020 Return on average common shareholders’ equity 14.31% 11.16% 7.51% Average common shareholders’ equity $49,842 $49,525 $45,058 Average Goodwill and Other intangible assets (9,448) (9,387) (9,432) Average deferred tax liabilities on Goodwill and Other intangible assets 189 188 189 Average tangible common equity $40,583 $40,326 $35,815 Net income attributable to common shareholders $1,758 $1,393 $844 Net income attributable to common shareholders, if annualized $7,130 $5,526 $3,385 Return on average tangible common equity (Non-GAAP) 17.57% 13.70% 9.45% Return on average tangible common equity is a non-GAAP financial measure and is calculated based on annualized net income attributable to common shareholders divided by tangible common equity. We believe that return on average tangible common equity is useful as a tool to help measure and assess a company's use of common equity.

Appendix: Non-GAAP to GAAP Reconciliation 21 Tangible Book Value per Common Share (Non-GAAP) For the three months ended $ millions, except per share data Mar. 31, 2021 Dec. 31, 2020 Mar. 31, 2020 Book value per common share $118.47 $119.11 $106.70 Tangible book value per common share Common shareholders’ equity $50,331 $50,493 $45,269 Goodwill and Other intangible assets (9,489) (9,381) (9,425) Deferred tax liabilities on Goodwill and Other intangible assets 189 188 189 Tangible common shareholders' equity $41,031 $41,300 $36,033 Period-end common shares outstanding (in millions) 425 424 424 Tangible book value per common share (Non-GAAP) $96.57 $97.43 $84.93 Tangible book value per common share is a non-GAAP measure and is calculated based on tangible common shareholders’ equity divided by period-end common shares outstanding. We believe this non-GAAP measure serves as a useful tool to help evaluate the strength and discipline of a company's capital management strategies and as an additional, conservative measure of total company value.

Appendix: Non-GAAP to GAAP Reconciliation 22 Pretax, Pre-Provision Earnings (Non-GAAP) For the three months ended $ millions Mar. 31, 2021 Dec. 31, 2020 Mar. 31, 2020 Net interest income $2,348 $2,424 $2,511 Noninterest income 1,872 1,784 1,825 Total Revenue $4,220 $4,208 $4,336 Noninterest expense 2,574 2,708 2,543 Pretax, pre-provision earnings (Non-GAAP) $1,646 $1,500 $1,793 Provision for (recapture of) credit losses (551) (254) 914 Income taxes (benefit) from continuing operations 371 298 120 Net income from continuing operations $1,826 $1,456 $759 We believe that pretax, pre-provision earnings is a useful tool to help evaluate the ability to provide for credit costs through operations and provides an additional basis to compare results between periods by isolating the impact of provision for (recapture of) credit losses, which can vary significantly between periods.

Appendix: Non-GAAP to GAAP Reconciliation 23 Taxable-Equivalent Net Interest Income (Non-GAAP) For the three months ended $ millions Mar. 31, 2021 Dec. 31, 2020 Mar. 31, 2020 Net interest income (GAAP) $2,348 $2,424 $2,511 Taxable-equivalent adjustments 15 17 22 Net interest income (Fully Taxable-Equivalent - FTE) $2,363 $2,441 $2,533 The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest income, we use interest income on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP. Taxable equivalent net interest income is only used for calculating net interest margin and net interest income shown elsewhere in this presentation is GAAP net interest income.