Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CPI AEROSTRUCTURES INC | cvu-8k_041621.htm |

Exhibit 99.1

1 C onfidential | © 2021 CPI Aerostructures, Inc. Expertise in Aerospace Technologies 2020 Q4 Results Presentation Speakers: Douglas McCrosson, President & Chief Executive Officer Tom Powers, Acting Chief Financial Officer

2 C onfidential | © 2021 CPI Aerostructures, Inc. Disclosure Statements This presentation contains forward - looking statements that are based on current expectations of management and certain assumptions that are subject to risks and uncertainties . There can be no assurance that such risks and uncertainties will not affect the accuracy of the forward - looking statements or that actual results will not differ materially from the results anticipated in the forward - looking statements . Included in these risks are : risks related to the restatement of the Company’s prior period consolidated financial statements and the material weaknesses in the Company’s internal controls, any adverse developments in existing legal proceedings or the initiation of new legal proceedings, the Company’s continued compliance with NYSE American listing rules, the effect of economic conditions in the industries and markets where the Company operates, including financial market conditions, the impact of the COVID - 19 pandemic (including its impact on global supply, demand, and distribution capabilities as the outbreak continues), the financial condition of the Company’s customers and suppliers, the cyclicality of the aerospace market, the level of US government defense spending (including changes or shifts in defense spending due to budgetary constraints, spending cuts resulting from sequestration, the allocation of funds to governmental responses to COVID - 19 , or changing political conditions, and uncertain funding of programs), the ability of the government and the Company’s other customers to terminate contracts at any time, production rates for commercial and military aircraft programs, competitive pricing pressures, startup costs for new programs, technology and product development risks and uncertainties, product performance and costs resulting from changes to and compliance with applicable regulatory requirements, level of indebtedness, and cash flow from operations . Additional information concerning these and other risk factors can be found in the company’s filings with the Securities and Exchange Commission . Because the risks, assumptions, and uncertainties referred to above could cause actual results or outcomes to differ materially from those expressed in any forward - looking statements, investors are cautioned not to place undue reliance on any such forward - looking statements, each of which speaks only as of the date made . The Company has no obligation to update any forward - looking statement to reflect events or circumstances after the date hereof . The information contained in this presentation is qualified in its entirety by cautionary statements and risk factors disclosed in the Company's Securities and Exchange Commission filings, including CPI Aero’s Form 10 - K for the 12 - month periods ending December 31 , 2020 and December 31 , 2019 available at http : //www . sec . gov . CPI AERO is a registered trademark of CPI Aerostructures, Inc . All other trademarks referenced herein are the property of their respective owners .

3 C onfidential | © 2021 CPI Aerostructures, Inc. Recent Highlights Douglas McCrosso n P resident & Chief Executive Officer

4 C onfidential | © 2021 CPI Aerostructures, Inc. Highlights Revenue of $25.4 million vs. $22.7 million for 4Q 2019, 11.9% higher Revenue from military programs grew 12.9% vs. 4Q 2019 on effective execution of funded military backlog Gross profit of $4.6 million nearly doubled vs. 4Q 2019 Gross profit margin of 18.2%, expanded 730 bps vs. 4Q 2019 Net income of $1.30 million, $2.7 million improvement vs. net loss of $1.4 million for 4Q 2019 Schedule compression and improved MRP process that is quicker to respond to changing demand signals Limits growth of inventory and contract assets Under POC revenue recognition, deferring cost to a future period lowers revenue and associated profit in current period 2020 cash used in operations of $1.6 million vs. $0.4 million use of cash for 2019 Customer overpayment during 2019 and CPI Aero’s repayment in 2020 masks cash flow improvement – Without this overpayment, we would have reported a $3.6 million use of cash flow for 2019 versus $1.6 million positive cash flow from operations for 2020 – a $5.2 million improvement on essentially the same revenue 1. Strong Finish to the Year 2. Continued Focus on Working Capital Management and Cash Flow Generation

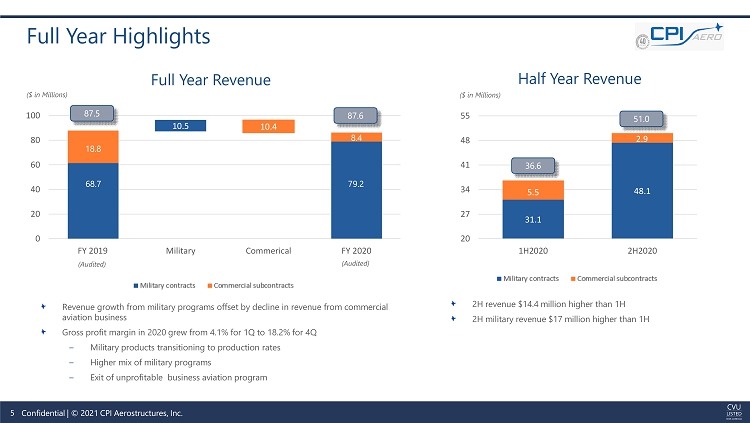

5 C onfidential | © 2021 CPI Aerostructures, Inc. 10.5 10.4 0 20 40 60 80 100 FY 2019 Military Commerical FY 2020 Full Year Highlights Revenue growth from military programs offset by decline in revenue from commercial aviation business Gross profit margin in 2020 grew from 4.1% for 1Q to 18.2% for 4Q – Military products transitioning to production rates – Higher mix of military programs – Exit of unprofitable business aviation program ($ in Millions) 31.1 48.1 5.5 2.9 20 27 34 41 48 55 1H2020 2H2020 2H revenue $14.4 million higher than 1H 2H military revenue $17 million higher than 1H 36.6 51.0 Full Year Revenue Half Year Revenue ($ in Millions) 87.6 87.5 8.4 79.2 18.8 68.7 (Audited) (Audited)

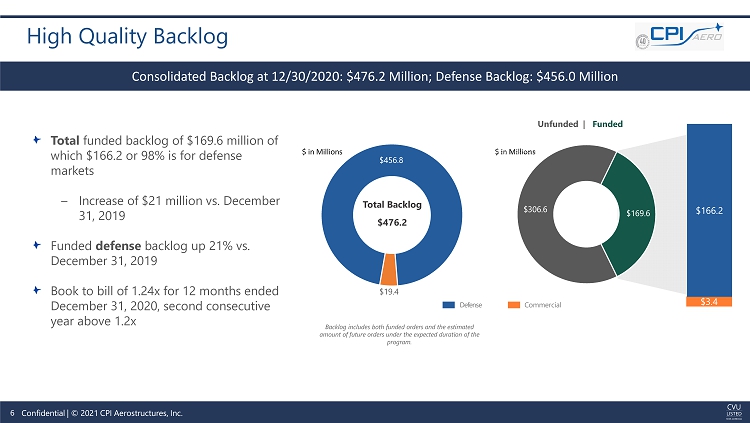

6 C onfidential | © 2021 CPI Aerostructures, Inc. High Quality Backlog Consolidated Backlog at 12/30/2020: $476.2 Million; Defense Backlog: $456.0 Million $456.8 $19.4 Total Backlog $476.2 Backlog includes both funded orders and the estimated amount of future orders under the expected duration of the program. $169.6 $ 306.6 Unfunded | Funded $3.4 $166.2 Defense Commercial Total funded backlog of $169.6 million of which $166.2 or 98% is for defense markets – Increase of $21 million vs. December 31, 2019 Funded defense backlog up 21% vs. December 31, 2019 Book to bill of 1.24x for 12 months ended December 31, 2020, second consecutive year above 1.2x $ in Millions

7 C onfidential | © 2021 CPI Aerostructures, Inc. Business Development Pipeline EW/ ISR Pods Space Hypersonics Unmanned Aerial Systems

8 C onfidential | © 2021 CPI Aerostructures, Inc. Financial Highlights Tom Powers Acting Chief Financial Officer

9 C onfidential | © 2021 CPI Aerostructures, Inc. 4Q 2020 / FY 2020 Highlights Fourth Quarter 2020 vs. Fourth Quarter 2019 Full Year 2020 vs. Full Year 2019 Revenue of $25.4 million compared to $22.7 million Gross profit of $4.6 million compared to $2.5 million Gross profit margin of 18.2% compared to 10.9% Net income of $1.3 million compared to net loss of $(1.4) million Earnings per diluted share of $0.11 compared to loss per diluted share of $(0.12) Cash flow from operations of $1.7 million compared to $3.7 million Revenue of $87.6 million compared to $87.5 million Gross profit of $12.1 million compared to $9.1 million Gross margin of 13.8% compared to 10.4% Net loss of $(1.3) million compared to a net loss of $(4.5) million Loss per share of $(0.11) compared to a loss per share of $(0.38) Cash flow used by operations of $(1.6) million compared to a use of $(0.4) million

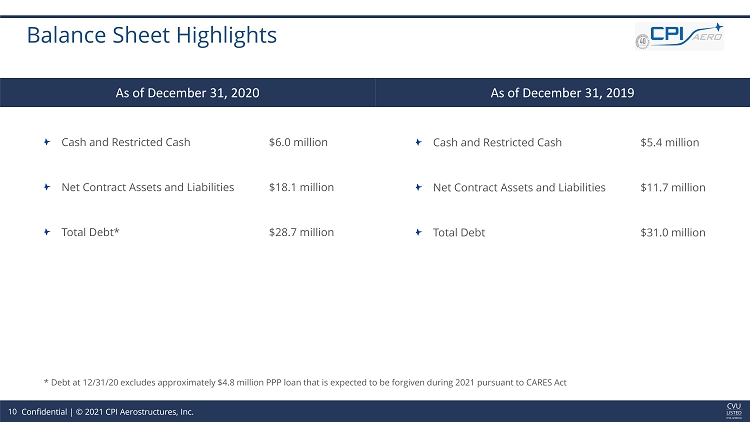

10 C onfidential | © 2021 CPI Aerostructures, Inc. Balance Sheet Highlights * Debt at 12/31/20 excludes approximately $4.8 million PPP loan that is expected to be forgiven during 2021 pursuant to CARES Ac t As of December 31, 2020 As of December 31, 2019 Cash and Restricted Cash $6.0 million Net Contract Assets and Liabilities $18.1 million Total Debt* $28.7 million Cash and Restricted Cash $5.4 million Net Contract Assets and Liabilities $11.7 million Total Debt $31.0 million

11 C onfidential | © 2021 CPI Aerostructures, Inc. Looking Ahead Douglas McCrosso n P resident & Chief Executive Officer

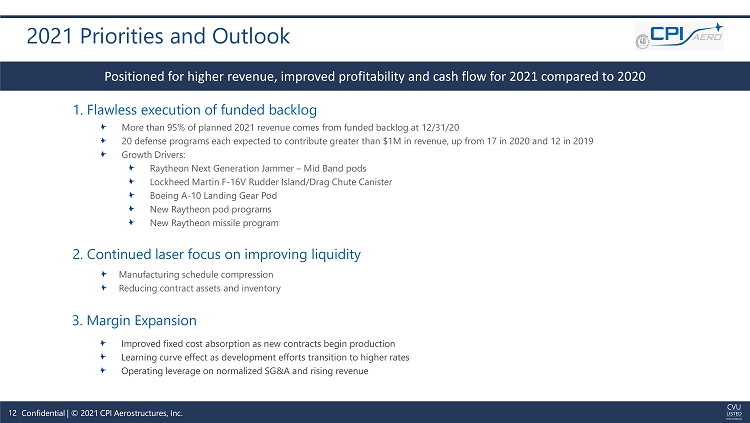

12 C onfidential | © 2021 CPI Aerostructures, Inc. 2021 Priorities and Outlook More than 95% of planned 2021 revenue comes from funded backlog at 12/31/20 20 defense programs each expected to contribute greater than $1M in revenue, up from 17 in 2020 and 12 in 2019 Growth Drivers: Raytheon Next Generation Jammer – Mid Band pods Lockheed Martin F - 16V Rudder Island/Drag Chute Canister Boeing A - 10 Landing Gear Pod New Raytheon pod programs New Raytheon missile program Improved fixed cost absorption as new contracts begin production Learning curve effect as development efforts transition to higher rates Operating leverage on normalized SG&A and rising revenue Manufacturing schedule compression Reducing contract assets and inventory 1. Flawless execution of funded backlog 2. Continued laser focus on improving liquidity 3. Margin Expansion Positioned for higher revenue, improved profitability and cash flow for 2021 compared to 2020

13 C onfidential | © 2021 CPI Aerostructures, Inc. Q&A Session Douglas McCrosso n P resident & Chief Executive Officer

14 C onfidential | © 2021 CPI Aerostructures, Inc. Investor Relations Counsel Jody Burfening, LHA Investor Relations (212) 838 - 3777 cpiaero@lhai.com LHA Investor Relations | 800 3 rd Avenue, New York, NY 10022 | (212) 838 - 3777 https://www. https://www.facebook.com/CPIAero @CPIAero https:// https://twitter.com/CPIAero @CPIAero https://www.linkedin.com/company/cpi - aerostructures @ CPI Aerostructures