Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CBL & ASSOCIATES PROPERTIES INC | cbl-ex991_42.htm |

| 8-K - 8-K - CBL & ASSOCIATES PROPERTIES INC | cbl-8k_20210415.htm |

Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

|

In re: |

|

§ |

|

Chapter 11 |

|

|

|

§ |

|

|

|

CBL & ASSOCIATES |

|

§ |

|

|

|

PROPERTIES, INC., et al., |

|

§ |

|

Case No. 20-35226 (DRJ) |

|

|

|

§ |

|

|

|

Debtors.1 |

|

§ |

|

(Jointly Administered) |

|

|

|

§ |

|

|

|

|

1 |

A complete list of the Debtors in these Chapter 11 Cases may be obtained on the website of the Debtors’ proposed claims and noticing agent at https://dm.epiq11.com/CBLProperties. The Debtors’ service address for the purposes of these Chapter 11 Cases is 2030 Hamilton Place Blvd., Suite 500, Chattanooga, Tennessee 37421. |

DISCLOSURE STATEMENT FOR AMENDED JOINT CHAPTER 11 PLAN

OF CBL & ASSOCIATES PROPERTIES, INC. AND ITS AFFILIATED DebtorS

|

WEIL, GOTSHAL & MANGES LLP Alfredo R. Pérez (15776275) 700 Louisiana Street, Suite 1700 Houston, Texas 77002 Telephone: (713) 546-5000 Facsimile: (713) 224-9511

|

WEIL, GOTSHAL & MANGES LLP Ray C. Schrock, P.C. (admitted pro hac vice) Garrett A. Fail (admitted pro hac vice) Moshe A. Fink (admitted pro hac vice) New York, New York 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 |

|

Counsel for Debtors and Debtors in Possession

|

|

|

|

|

|

Dated: April 15, 2021 |

|

|

|

DISCLOSURE STATEMENT, DATED APRIL 15, 2021

Solicitation of Votes on the Amended Joint Plan of

CBL & ASSOCIATES PROPERTIES, INC., ET AL.

|

THIS SOLICITATION OF VOTES (THE “SOLICITATION”) IS BEING CONDUCTED TO OBTAIN SUFFICIENT VOTES TO ACCEPT THE AMENDED JOINT CHAPTER 11 PLAN OF CBL & ASSOCIATES PROPERTIES, INC. AND ITS AFFILIATED DEBTORS IN THE ABOVE-CAPTIONED CHAPTER 11 CASES (COLLECTIVELY, THE “DEBTORS”), ATTACHED HERETO AS EXHIBIT A (THE “PLAN”). |

|

|

|

THE VOTING DEADLINE TO ACCEPT OR REJECT THE PLAN IS 4:00 P.M. (PREVAILING CENTRAL TIME) ON [●], 2021 UNLESS EXTENDED BY THE DEBTORS IN WRITING. |

|

|

|

THE RECORD DATE FOR DETERMINING WHICH HOLDERS OF CLAIMS OR INTERESTS MAY VOTE ON THE PLAN IS [●], 2021 (THE “RECORD DATE”). |

|

RECOMMENDATION BY THE DEBTORS |

|

|

|

The board of directors of CBL & Associates Properties, Inc. has unanimously approved the transactions contemplated by the Solicitation and the Plan. The Debtors believe the Plan is in the best interests of all stakeholders and recommend that all creditors whose votes are being solicited submit ballots to accept the Plan. |

|

|

|

Subject to the terms and conditions of the Restructuring Support Agreement (as defined below), the Consenting Creditors (as defined below) have already agreed to vote in favor of, or otherwise support, the Plan. |

HOLDERS OF CLAIMS OR INTERESTS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND SHOULD CONSULT WITH THEIR OWN ADVISORS BEFORE CASTING A VOTE WITH RESPECT TO THE PLAN.

THE ISSUANCE OF THE NEW SENIOR SECURED NOTES, NEW CONVERTIBLE NOTES (AND THE NEW COMMON STOCK ISSUABLE UPON CONVERSION THEREOF), NEW COMMON STOCK, AND NEW LP UNITS UNDER THE PLAN SHALL BE EXEMPT UNDER THE SECURITIES ACT OF 1933 (AS AMENDED, THE “SECURITIES ACT”), ALL RULES AND REGULATIONS PROMULGATED THEREUNDER, AND ANY OTHER APPLICABLE FEDERAL SECURITIES LAWS PURSUANT TO SECTION 1145 OF THE BANKRUPTCY CODE AND TO THE FULLEST EXTENT PERMITTED BY SECTION 1145 OF THE BANKRUPTCY CODE, WITHOUT FURTHER ACT OR ACTIONS BY ANY PERSON.

THE SECURITIES ISSUED PURSUANT TO THE PLAN HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING STATEMENTS INCORPORATED BY REFERENCE, PROJECTED FINANCIAL INFORMATION, AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED HEREIN.

FURTHERMORE, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN, INCLUDING ANY PROJECTIONS, ARE SUBJECT TO A NUMBER OF ASSUMPTIONS, RISKS, AND UNCERTAINTIES, MANY OF WHICH ARE BEYOND THE CONTROL OF THE DEBTORS, INCLUDING THE IMPLEMENTATION OF THE PLAN. IMPORTANT ASSUMPTIONS AND OTHER IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY INCLUDE, BUT ARE NOT LIMITED TO, THOSE FACTORS, RISKS AND UNCERTAINTIES DESCRIBED IN MORE DETAIL UNDER THE HEADING “CERTAIN RISK FACTORS TO BE CONSIDERED” BELOW, AS WELL AS CERTAIN OTHER RISKS INHERENT IN THE DEBTORS’ BUSINESSES AND OTHER FACTORS LISTED IN THE DEBTORS’ SEC FILINGS. PARTIES ARE CAUTIONED THAT THE FORWARD-LOOKING STATEMENTS SPEAK AS OF THE DATE MADE, ARE BASED ON THE DEBTORS’ CURRENT BELIEFS, INTENTIONS AND EXPECTATIONS, AND ARE NOT GUARANTEES OF FUTURE PERFORMANCE. ACTUAL RESULTS OR DEVELOPMENTS MAY DIFFER MATERIALLY FROM THE EXPECTATIONS EXPRESSED OR IMPLIED IN THE FORWARD-LOOKING STATEMENTS, AND THE DEBTORS UNDERTAKE NO OBLIGATION TO UPDATE OR OTHERWISE REVISE ANY FORWARD-LOOKING STATEMENTS, INCLUDING ANY PROJECTIONS CONTAINED HEREIN, TO REFLECT EVENTS OR CIRCUMSTANCES EXISTING OR ARISING AFTER THE DATE HEREOF OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

NO INDEPENDENT AUDITOR OR ACCOUNTANT HAS REVIEWED OR APPROVED THE FINANCIAL PROJECTIONS OR THE LIQUIDATION ANALYSIS HEREIN.

THE DEBTORS HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR ADVICE, OR TO MAKE ANY REPRESENTATION, IN CONNECTION WITH THE PLAN OR THIS DISCLOSURE STATEMENT.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY WITH THE SUMMARIES IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE.

ALL EXHIBITS TO THIS DISCLOSURE STATEMENT ARE INCORPORATED INTO, AND ARE A PART OF, THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL HEREIN.

THE PLAN PROVIDES THAT THE FOLLOWING PARTIES, EACH IN THEIR RESPECTIVE CAPACITIES AS SUCH, ARE DEEMED TO GRANT THE RELEASES PROVIDED FOR IN THE PLAN: (i) holders of all Claims AND INTERESTS THAT vote to accept thE Plan, (ii) holders of ALL CLAIMS AND INTERESTS WHOSE VOTE TO ACCEPT OR REJECT THE PLAN IS SOLICITED BUT THAT DO NOT VOTE EITHER TO ACCEPT OR TO REJECT THE PLAN, (iii) holders of Claims AND INTERESTS THAT VOTE, OR ARE DEEMED, TO REJECT THE PLAN BUT DO NOT OPT OUT OF GRANTING THE RELEASES SET FORTH IN THE PLAN, (iv) holders of Claims and Interests THAT WERE GIVEN NOTICE OF THE OPPORTUNITY TO OPT OUT OF GRANTING THE RELEASES SET FORTH IN THE PLAN BUT DID NOT OPT OUT, AND (v) THE RELEASED PARTIES (AS DEFINED IN THE PLAN).

HOLDERS OF CLAIMS IN VOTING CLASSES (CLASSES 3, 4, 5, 7, 10, 11, 12, AND 14) HAVE RECEIVED A RELEASE OPT-OUT FORM ATTACHED TO THEIR BALLOT. HOLDERS OF CLAIMS IN NON-VOTING CLASSES (CLASSES 1, 2, 6, 8, 9, AND 13) HAVE RECEIVED A RELEASE OPT-OUT FORM ATTACHED TO THEIR NOTICE OF NON-VOTING STATUS AND NOTICE OF RIGHT TO OPT OUT OF CERTAIN RELEASES. SEE SECTION 10.7 OF THE PLAN FOR A DESCRIPTION OF THE RELEASES AND RELATED PROVISIONS.

TABLE OF CONTENTS

Page

|

I. |

INTRODUCTION |

|

8 |

|

|

|

A. |

Background and Overview of the Plan and Restructuring |

|

8 |

|

|

B. |

Summary of Plan Classification and Treatment of Claims |

|

11 |

|

|

C. |

Inquiries |

|

17 |

|

II. |

THE DEBTORS’ BUSINESS |

|

18 |

|

|

|

A. |

History and Business |

|

18 |

|

|

B. |

Properties and Business Operations |

|

18 |

|

|

C. |

Tenant Composition and Diversification |

|

20 |

|

|

D. |

Centralized Management and Operations |

|

21 |

|

|

E. |

Recent Financial Performance |

|

23 |

|

III. |

DEBTORS’ CORPORATE AND CAPITAL STRUCTURE |

|

23 |

|

|

|

A. |

Corporate Structure |

|

23 |

|

|

B. |

Corporate Governance and Management |

|

24 |

|

|

C. |

Prepetition Capital Structure |

|

25 |

|

IV. |

SIGNIFICANT EVENTS LEADING TO THE CHAPTER 11 FILINGS |

|

30 |

|

|

|

A. |

Trends and Uncertainties in Retail Market |

|

30 |

|

|

B. |

Tenant Struggles and Rent Abatement |

|

31 |

|

|

C. |

Impact of COVID-19 Pandemic |

|

32 |

|

|

D. |

Prepetition Operational Initiatives |

|

32 |

|

|

E. |

Debt Restructuring Effort and Original Restructuring Support Agreement |

|

33 |

|

|

F. |

Prepetition Bank Lender Actions |

|

36 |

|

|

G. |

Prepetition Employee Retention Programs |

|

37 |

|

|

H. |

Appointment of New Independent Director and Formation of a Special Committee |

|

37 |

|

|

I. |

Independent Investigation |

|

38 |

|

V. |

OVERVIEW OF CHAPTER 11 CASES |

|

38 |

|

|

|

A. |

Commencement of Chapter 11 Cases |

|

38 |

|

|

B. |

De Minimis Asset Sales, Claims, and Causes of Action Procedures |

|

40 |

|

|

C. |

Appointment of Creditors’ Committee |

|

41 |

|

|

D. |

Wells Fargo Adversary Proceeding |

|

41 |

|

|

E. |

Court-Ordered Mediation |

|

42 |

|

|

F. |

Exclusivity |

|

42 |

|

|

G. |

Statements and Schedules, and Claims Bar Dates |

|

42 |

|

|

H. |

Motion to Extend Time to Assume or Reject Unexpired Leases |

|

43 |

5

|

VI. |

SUMMARY OF PLAN |

|

43 |

|

|

|

A. |

General |

|

43 |

|

|

B. |

Administrative Expense Claims, Fee Claims, and Priority Tax Claims. |

|

44 |

|

|

C. |

Classification of Claims and Interests |

|

46 |

|

|

D. |

Treatment of Claims and Interests |

|

49 |

|

|

E. |

Means for Implementation |

|

55 |

|

|

F. |

Distributions |

|

65 |

|

|

G. |

Procedures for Resolving Claims |

|

72 |

|

|

H. |

Executory Contracts and Unexpired Leases |

|

74 |

|

|

I. |

Conditions Precedent to the Occurrence of the Effective Date |

|

80 |

|

|

J. |

Effect of Confirmation |

|

83 |

|

|

K. |

Retention of Jurisdiction |

|

89 |

|

|

L. |

Miscellaneous Provisions |

|

91 |

|

VII. |

TRANSFER RESTRICTIONS AND CONSEQUENCES UNDER FEDERAL SECURITIES LAWS |

|

93 |

|

|

VIII. |

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES OF PLAN |

|

95 |

|

|

|

A. |

Consequences to the Debtors and Certain Unitholders |

|

96 |

|

|

B. |

Consequences to U.S. Holders of Certain Claims |

|

102 |

|

|

C. |

Consequences to U.S. Holders of Existing REIT Common Stock or Existing REIT Preferred Stock |

|

111 |

|

|

D. |

Consequences to Non-U.S. Holders of Certain Claims and Interests |

|

112 |

|

|

E. |

Consequences of the Ownership and Disposition of the New LP Units |

|

114 |

|

|

F. |

Consequences of the Ownership and Disposition of New Common Stock |

|

117 |

|

|

G. |

Information Reporting and Backup Withholding |

|

125 |

|

IX. |

CERTAIN RISK FACTORS TO BE CONSIDERED |

|

125 |

|

|

|

A. |

Certain Bankruptcy Law Considerations |

|

126 |

|

|

B. |

Risks Relating to the New Common Stock and New LP Units Issued Under the Plan |

|

128 |

|

|

C. |

Risks Relating to the New Senior Secured Notes and the New Convertible Notes |

|

129 |

|

|

D. |

Additional Risks Relating to the New Convertible Notes |

|

133 |

|

|

E. |

Risks Relating to the Exit Credit Facility |

|

133 |

|

|

F. |

Additional Risk Factors To Be Considered |

|

135 |

6

|

X. |

VOTING PROCEDURES AND REQUIREMENTS |

|

141 |

|

|

|

A. |

Voting Deadline |

|

141 |

|

|

B. |

Voting Procedures |

|

142 |

|

|

C. |

Parties Entitled to Vote |

|

143 |

|

|

D. |

Convertible Notes Election |

|

145 |

|

|

E. |

Further Information, Copies of Materials |

|

146 |

|

XI. |

CONFIRMATION OF PLAN |

|

146 |

|

|

|

A. |

Confirmation Hearing |

|

146 |

|

|

B. |

Objections to Confirmation |

|

146 |

|

|

C. |

Requirements for Confirmation of Plan |

|

149 |

|

XII. |

ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF PLAN |

|

153 |

|

|

|

A. |

Alternative Plan of Reorganization |

|

154 |

|

|

B. |

Sale Under Section 363 of the Bankruptcy Code |

|

154 |

|

|

C. |

Liquidation under Chapter 7 of Bankruptcy Code |

|

154 |

|

XIII. |

CONCLUSION AND RECOMMENDATION |

|

155 |

|

EXHIBITS

|

EXHIBIT A |

Plan |

|

EXHIBIT B |

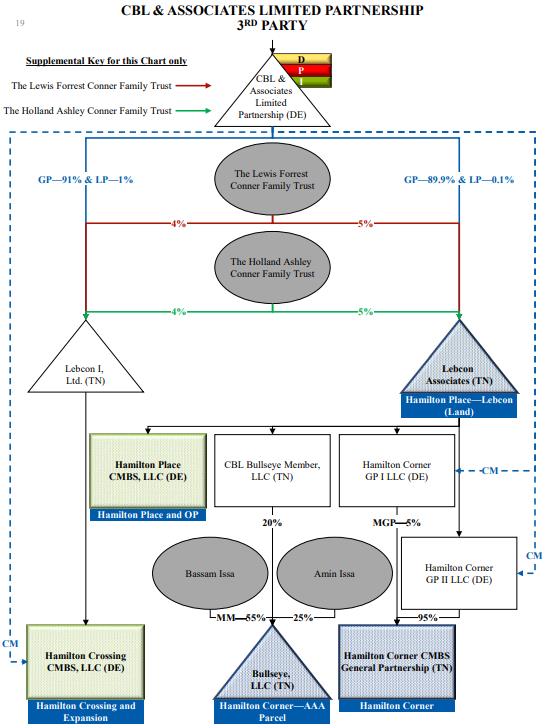

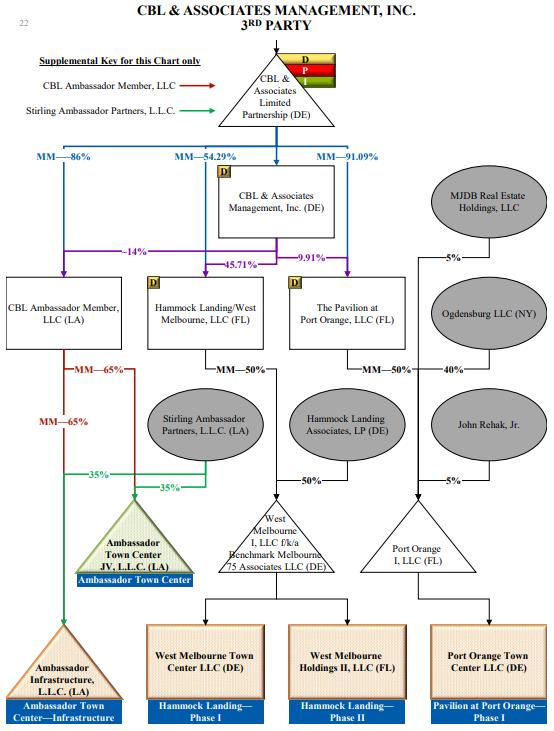

Organizational Chart |

|

EXHIBIT C |

RSA |

|

EXHIBIT D |

Liquidation Analysis |

|

EXHIBIT E |

Financial Projections |

|

EXHIBIT F |

Valuation Analysis |

7

CBL & Associates Properties, Inc. (the “REIT”) and its direct and indirect subsidiaries that are debtors and debtors in possession in the above-captioned chapter 11 cases (collectively, the “Debtors” and, together with the REIT’s non-Debtor direct or indirect subsidiaries, “CBL” or the “Company”), submit this disclosure statement (as may be amended from time to time, the “Disclosure Statement”) in connection with the solicitation of votes (the “Solicitation”) on the Amended Joint Chapter 11 Plan of CBL & Associates Properties, Inc. and Its Affiliated Debtors, dated April 15, 2021 (the “Plan”),2 attached hereto as Exhibit A.

The purpose of this Disclosure Statement is to provide information of a kind, and in sufficient detail, to enable creditors of, and holders of interests in, the Debtors that are entitled to vote on the Plan to make an informed decision on whether to vote to accept or reject the Plan. This Disclosure Statement contains summaries of the Plan, certain statutory provisions, events contemplated in the chapter 11 cases (the “Chapter 11 Cases”) that commenced beginning on November 1, 2020 (the “Petition Date”), and certain documents related to the Plan.

As described in more detail below, the Debtors faced certain financial and other challenges prior to the Petition Date, including the ongoing COVID-19 pandemic. Recognizing that a comprehensive balance sheet deleveraging and restructuring was necessary, the Company, Weil, Gotshal & Manges LLP (“Weil”) and Moelis & Company LLC (“Moelis” and, together with Weil, the “Advisors”) engaged in extensive arms’ length, good faith negotiations with an ad hoc group of the beneficial owners and/or investment advisors or managers of discretionary funds, accounts or other entities for the holders or beneficial owners of approximately 66% of the Company’s Senior Unsecured Notes (collectively, with other holders of the Senior Unsecured Notes that subsequently executed the Original Restructuring Support Agreement (as defined herein), the “Consenting Noteholders” or the “Ad Hoc Bondholder Group”), which culminated in the execution of that certain Restructuring Support Agreement dated August 18, 2020 (the “Original Restructuring Support Agreement”) pursuant to which the Consenting Noteholders agreed to, among other things, support a plan. After the Petition Date, the Debtors and the Required Consenting Noteholders negotiated certain modifications to the terms of the restructuring, which are reflected in the original plan (Docket No. 370) (the “Original Plan”).

Thereafter, the Debtors, the Bank Lenders (as defined below), and the Ad Hoc Bondholder Group re-engaged in negotiations, including a Court-ordered mediation (the “Mediation”) between the Debtors, Ad Hoc Bondholder Group, Bank Lenders, and the Creditors’ Committee (collectively, the “Mediation Parties”). After several weeks of extensive good faith negotiations, the Debtors, Consenting Noteholders, and Consenting Bank Lenders agreed upon terms of a consensual restructuring and entered into an amended restructuring support agreement (the “Restructuring Support Agreement” or “RSA”) dated March 21, 2021 (the “RSA Effective Date”). The Debtors

|

|

2 |

Capitalized terms used in this Disclosure Statement, but not defined herein, have the meanings ascribed to them in the Plan or the RSA, as applicable. To the extent any inconsistencies exist between this Disclosure Statement and the Plan, the Plan shall govern. |

8

have filed a motion with the Court seeking authority to perform their obligations under the RSA (Docket No. 1019) (the “RSA Approval Motion”). The terms of the comprehensive, tripartite settlement embodied in the RSA resolve the contentious and complicated issues at the heart of these Chapter 11 Cases, including (i) the treatment of the Bank Lenders’, Consenting Crossholders’, and Consenting Noteholders’ claims in these Chapter 11 Cases, and (ii) claims asserted by the Debtors and the Bank Lenders in the Wells Fargo Adversary Proceeding (as defined below).

In accordance with the RSA, including the Plan Term Sheet (as defined below) attached thereto, the Plan provides for a comprehensive restructuring of the Company’s balance sheet. Specifically, the proposed restructuring embodied in the Plan (the “Restructuring”) contemplates, among other things:

|

|

• |

The following treatment of holders of Claims and Interests: |

|

|

o |

Each holder of an Allowed First Lien Credit Facility Claim will receive its pro rata share of (i) the Exit Credit Facility Distribution and (ii) $100,000,000 in Cash, payable, first, from Cash deposited in the segregated account maintained by the Debtors pursuant to paragraph 11(a)(ii) of the Final Cash Collateral Order and, second, from other Cash on hand. |

|

|

o |

Each holder of an Allowed Consenting Crossholder Claim will receive its pro rata share of (based on the ratio of such holder’s Consenting Crossholder Claims to the aggregate amount of Consenting Crossholder Claims held by all Consenting Crossholders) the Consenting Crossholder Claims Recovery Pool; provided, that each Consenting Crossholder entitled to receive New Senior Secured Notes on account of its Crossholder Claim shall be entitled to make the Convertible Notes Election. |

|

|

o |

Each holder of an Allowed Ongoing Trade Claim will receive the following treatment: (i) if a holder of an Ongoing Trade Claim executes a trade agreement (a “Trade Agreement”) with the Debtors (the form and terms of such Trade Agreement to be determined by the Debtors in consultation with the (A) Required Consenting Noteholders and the Creditors’ Committee and, (B) solely with respect to the Exit Credit Facility Subsidiaries, the Required Consenting Bank Lenders), four (4) equal cash installments, payable on a quarterly basis, which payments shall result in full payment in the Allowed amount of such Ongoing Trade Claim; or (ii) if a holder of an Ongoing Trade Claim does not execute a Trade Agreement, such holder’s Pro Rata share of the Unsecured Claims Recovery Pool in accordance with section 4.7 of the Plan. |

|

|

o |

Each Allowed Property-Level Guarantee Settlement Claim will either (i) be Reinstated; (ii) remain Unimpaired; or (iii) receive such treatment as agreed upon between the Debtors and the holder of such Property-Level Guarantee Claim (with the consent of the Required Consenting Noteholders, such consent not to be unreasonably withheld). |

9

|

|

o |

Each holder of an Allowed Unsecured Claim will receive its pro rata share of the Unsecured Claims Recovery Pool; provided, that each Consenting Noteholder (and, for the avoidance of doubt, only a Consenting Noteholder) entitled to receive New Senior Secured Notes on account of its Senior Unsecured Notes Claim shall be able to make the Convertible Notes Election. |

|

|

o |

If Class 10 is an Accepting Class, each holder of an Existing LP Common Unit will either (i) receive its Pro Rata share of the New LP Units or (ii) be deemed to have converted or redeemed, as applicable, such holder’s Existing LP Common Unit(s), effective the day prior to the Distribution Record Date, in exchange for Existing REIT Common Stock on terms consistent with the applicable prepetition agreements for the Existing LP Common Units, thereby receiving such treatment as if such holder owned Existing REIT Common Stock on the Distribution Record Date. |

|

|

o |

If Class 11 is an Accepting Class, each holder of Allowed Existing REIT Preferred Stock will receive its Pro Rata share of 5.5% of the New Common Stock issued in accordance with the Restructuring Transactions, subject to dilution by the Management Incentive Plan and subsequent issuances of common equity (including securities or instruments convertible into common equity) by the REIT from time to time after the Effective Date, as set forth in the Plan. |

|

|

o |

If Class 12 is an Accepting Class, each holder of Allowed Existing REIT Common Stock will receive its Pro Rata share of 5.5% of the New Common Stock issued in accordance with the Restructuring Transactions, subject to dilution by the Management Incentive Plan and subsequent issuances of common equity (including securities or instruments convertible into common equity) by the REIT from time to time after the Effective Date, as set forth in the Plan. |

|

|

• |

On the Effective Date, (i) the First Lien Credit Agreement will be replaced by a new credit facility in an aggregate principal amount of $883.7 million (the “Exit Credit Facility”) pursuant to the terms set forth in that certain exit credit facility term sheet (the “Exit Credit Facility Term Sheet”), a copy of which is attached to the Plan as Exhibit B; and (ii) the Senior Unsecured Notes will be replaced by new senior secured notes in an aggregate principal amount of up to $555 million (the “New Senior Secured Notes”) pursuant to the terms set forth in that certain new notes term sheet (the “New Notes Term Sheet”), a copy of which is attached to the Plan as Exhibit C; provided, the Debtors may distribute up to $100 million of New Convertible Notes (exchangeable with the New Notes Issuer for New Common Stock) in lieu of the New Senior Secured Notes on a dollar-for-dollar basis pursuant to the terms set forth in that certain term sheet (the “New Convertible Notes Term Sheet”), a copy of which is attached to the Plan as Exhibit D. |

10

|

|

• |

The Debtors will receive Commitment Letters from the Commitment Parties where such parties agree to purchase, in the aggregate, $50 million of New Convertible Notes on the Effective Date. |

|

|

• |

The Restructuring will leave the Debtors’ operations and business intact without impairing the Property Level Debt (as defined herein). |

The Debtors believe that the Restructuring contemplated by the Plan and RSA provides the Company with a viable path forward and a framework to successfully exit chapter 11 in a timely fashion with the support of the Consenting Creditors. As described more fully herein, the restructuring will reduce the Company’s funded indebtedness by approximately $1 billion and annual interest expenses by approximately $20 million while eliminating the Debtors’ outstanding preferred stock. This deleveraging will enhance the Debtors’ long-term growth prospects and competitive position and will provide the Debtors with excess capital to invest in and grow their business. Thus, the Restructuring will allow the Debtors to emerge from the Chapter 11 Cases as a stronger company, better positioned to withstand the challenges and volatility of the real estate industry and retail market. Importantly, the Company is not currently seeking to modify or impair the Property Level Debt (as defined herein) or to make operational changes to the business, and that debt is not currently the subject of these Chapter 11 Cases. The Consenting Creditors have played a critically important role in formulating the Restructuring and actively participated in the development and negotiation of the Plan.

The effect of the Restructuring on the Operating Partnership’s (as defined below) funded indebtedness is summarized as follows (in millions):

|

Pre-Restructuring Capital Structure (Approx.) |

Pro Forma Post-Restructuring Capital Structure (Approx.) |

||

|

First Lien Credit Facility |

$1,115.7 |

Exit Credit Facility |

$883.7 |

|

Senior Unsecured Notes |

$1,375.0 |

Senior Secured Notes / New Convertible Notes |

$555.0 |

|

|

|

New Money Convertible Notes |

$50.0 |

|

Total Funded Debt |

$2,490.0 |

Total Funded Debt |

$1,488.7 |

The Debtors believe that upon consummation of the Plan and the transactions contemplated thereby, the post-emergence enterprise will have the ability to continue to succeed as a REIT and develop, redevelop, acquire, lease, manage, and operate regional shopping malls, open-air and mixed-use centers, outlet centers, associated centers, community centers, office buildings, and other properties.

Pursuant to the Bankruptcy Code, only holders of claims or interests in “impaired” Classes are entitled to vote on the Plan (unless, for reasons discussed in more detail below, such holders are deemed to reject the Plan pursuant to section 1126(g) of the Bankruptcy Code). Under section 1124 of the Bankruptcy Code, a class of claims or interests is deemed to be “impaired” unless (i) the Plan leaves unaltered the legal, equitable, and contractual rights to which such claim or interest

11

entitles the holder thereof or (ii) notwithstanding any legal right to an accelerated payment of such claim or interest, the Plan cures all existing defaults (other than defaults resulting from the occurrence of events of bankruptcy) and reinstates the maturity of such claim or interest as it existed before the default.

Holders of Claims and Interests in the following Classes (the “Voting Classes”, and each a “Voting Class”) are being solicited under, and are entitled to vote on, the Plan:

|

|

• |

Class 3 — First Lien Credit Facility Claims; |

|

|

• |

Class 4 — Consenting Crossholder Claims; |

|

|

• |

Class 5 — Ongoing Trade Claims; |

|

|

• |

Class 7 — Unsecured Claims; |

|

|

• |

Class 9 — Existing LP Preferred Units; |

|

|

• |

Class 10 — Existing LP Common Units; |

|

|

• |

Class 11 — Existing REIT Preferred Stock; |

|

|

• |

Class 12 — Existing REIT Common Stock; and |

|

|

• |

Class 14 — Section 510(b) Claims. |

The following table summarizes: (1) the treatment of Claims and Interests under the Plan; (2) which Classes are impaired by the Plan; (3) which Classes are entitled to vote on the Plan; and (4) the estimated recoveries for holders of Claims and Interests.3 The table is qualified in its entirety by reference to the full text of the Plan.4 For a more detailed summary of the terms and provisions of the Plan, see Section VI — Summary of the Plan below. A detailed discussion of the analysis underlying the estimated recoveries, including the assumptions underlying such analysis, is set forth in the valuation analysis in Exhibit F hereto.

|

|

3 |

Any Claim or Interest in a Class that is considered vacant under section 3.6 of the Plan will be deemed eliminated from the Plan for purposes of voting to accept or reject the Plan, and disregarded for purposes of determining whether the Plan satisfies section 1129(a)(8) of the Bankruptcy Code with respect to such Class. |

|

4 |

The summary of the Plan provided herein is qualified in its entirety by reference to the Plan. |

12

|

Class and |

Treatment under the Plan |

Impairment and |

Approx. |

|

Class 1: Other Priority Claims |

The legal, equitable, and contractual rights of the holders of Allowed Other Priority Claims are unaltered by the Plan. Except to the extent that a holder of an Allowed Other Priority Claim agrees to different treatment, on the later of the Effective Date and the date that is twenty (20) days after the date such Other Priority Claim becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Priority Claim shall receive, on account of such Allowed Claim, at the option of the Reorganized Debtors (i) Cash in an amount equal to the Allowed amount of such Claim or (ii) other treatment consistent with the provisions of section 1129 of the Bankruptcy Code. |

Unimpaired |

100% |

|

Class 2: Other Secured Claims |

The legal, equitable, and contractual rights of the holders of Allowed Other Secured Claims are unaltered by the Plan. Except to the extent that a holder of an Allowed Other Secured Claim agrees to different treatment, on the later of the Effective Date and the date that is twenty (20) days after the date such Other Secured Claim becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Secured Claim shall receive, on account of such Allowed Claim, at the option of the Reorganized Debtors (i) Cash in an amount equal to the Allowed amount of such Claim, (ii) Reinstatement or such other treatment sufficient to render such holder’s Allowed Other Secured Claim Unimpaired pursuant to section 1124 of the Bankruptcy Code, or (iii) such other recovery necessary to satisfy section 1129 of the Bankruptcy Code. |

Unimpaired |

100% |

|

Class 3: First Lien Credit Facility Claims

|

Each holder of an Allowed First Lien Credit Facility Claim shall receive, in full and final satisfaction of such Claim its Pro Rata share of (i) the Exit Credit Facility Distribution and (ii) $100,000,000 in Cash payable, first, from Cash deposited in the segregated account maintained by the Debtors pursuant to paragraph 11(a)(ii) of the Final Cash Collateral Order and, second, from other Cash on hand. |

Impaired |

[●]% |

|

|

5 |

The values set forth under Approximate Percentage Recovery are based on the midpoint of the range of reorganized equity value of the Debtors as described in the Valuation Analysis attached hereto. |

13

|

Class 4: Consenting Crossholder Claims |

Pursuant to Bankruptcy Rule 9019, in full and complete satisfaction of Consenting Crossholder Claims, each Consenting Crossholder shall agree to receive, and receive, as less favorable treatment than the First Lien Credit Facility Claims in respect of its Consenting Crossholder Claims, its Pro Rata share (based on the ratio of such holder’s Consenting Crossholder Claims to the aggregate amount of Consenting Crossholder Claims held by all Consenting Crossholders) of the Consenting Crossholder Claims Recovery Pool; provided that each Consenting Crossholder entitled to receive New Senior Secured Notes on account of its Crossholder Claim shall be entitled to make the Convertible Notes Election. |

Impaired |

[●]% |

|

Class 5: Ongoing Trade Claims |

Except to the extent that a holder of an Allowed Ongoing Trade Claim agrees to different treatment, on and after the Effective Date, or as soon as reasonably practicable thereafter, each holder of an Allowed Ongoing Trade Claim shall receive: (i) if a holder of an Ongoing Trade Claim executes a Trade Agreement with the Debtors (the form and terms of such Trade Agreement to be determined by the Debtors in consultation with the (A) Required Consenting Noteholders and the Creditors’ Committee and, (B) solely with respect to the Exit Credit Facility Subsidiaries, the Required Consenting Bank Lenders), four (4) equal Cash installments, payable on a quarterly basis, which payments shall result in full payment in the Allowed amount of such Ongoing Trade Claim; or (ii) if a holder of an Ongoing Trade Claim does not execute a Trade Agreement, such holder’s Pro Rata share of the Unsecured Claims Recovery Pool in accordance with section 4.7 of the Plan. |

Impaired |

[●]% |

|

Class 6: Property-Level Guarantee Settlement Claims |

Pursuant to Bankruptcy Rule 9019, on and after the Effective Date, or as soon as reasonably practicable thereafter, each Allowed Property-Level Guarantee Settlement Claim shall, in accordance with the applicable settlement agreement between the Debtors and such holder of a Property-Level Guarantee Claim, either (i) be Reinstated; (ii) remain Unimpaired; or (iii) receive such treatment as agreed upon between the Debtors and the holder of such Property-Level Guarantee Claim (with the consent of the Required Consenting Noteholders, such consent not to be unreasonably withheld). |

Unimpaired |

100% |

14

|

Class 7: Unsecured Claims

|

Except to the extent that a holder of an Allowed Unsecured Claim agrees to different treatment, on and after the Effective Date, or as soon as reasonably practicable thereafter, each holder of an Allowed Unsecured Claim shall receive, in full and final satisfaction of such Claim, such holder’s Pro Rata share of the Unsecured Claims Recovery Pool; provided that each Consenting Noteholder (and, for the avoidance of doubt, only a Consenting Noteholder) entitled to receive New Senior Secured Notes on account of its Notes Claim shall be able to make the Convertible Notes Election. |

Impaired |

[●]% |

|

Class 8: Intercompany Claims |

On or after the Effective Date, all Intercompany Claims shall be paid, adjusted, continued, settled, reinstated, discharged, or eliminated, in each case to the extent determined to be appropriate by the Debtors (with the consent of the Required Consenting Noteholders, such consent not to be unreasonably withheld) or Reorganized Debtors, as applicable; provided, that any Intercompany Claims that shall remain as liabilities of the Exit Credit Facility Borrower or any Exit Credit Facility Subsidiary shall be subject to approval by the Required Consenting Bank Lenders (and absent consent from the Required Consenting Bank Lenders, such remaining liabilities shall be reduced to zero). |

Unimpaired |

100% |

|

Class 9:

|

On the Effective Date, the Existing LP Preferred Units shall be cancelled (or otherwise eliminated) and shall receive no distribution under the Plan. |

Impaired (Not entitled to |

0% |

|

Class 10: Existing LP Common Units |

On the Effective Date, the Existing LP Common Units shall be cancelled (or otherwise eliminated).

If Class 10 is an Accepting Class, on the Effective Date, each holder of an Existing LP Common Unit shall, at such holder’s election, either (i) receive its Pro Rata share of the New LP Units or (ii) be deemed to have converted or redeemed, as applicable, such holder’s Existing LP Common Unit(s), effective the day prior to the Distribution Record Date, in exchange for Existing REIT Common Stock on terms consistent with the applicable prepetition agreements for the Existing LP Common Units, thereby receiving such treatment as if such holder owned Existing REIT Common Stock on the Distribution Record Date.

If Class 10 is not an Accepting Class, each holder of an Allowed Existing LP Common Unit shall not receive or retain any distribution on account of such Interest. |

Impaired |

[●]% |

15

|

Class 11: Existing REIT Preferred Stock |

On the Effective Date, the Existing REIT Preferred Stock shall be cancelled (or otherwise eliminated).

If Class 11 is an Accepting Class, on the Effective Date, or as soon as reasonably practicable thereafter, each holder of Allowed Existing REIT Preferred Stock shall receive, in full and final satisfaction of such Interest, such holder’s Pro Rata share of 5.5% of the New Common Stock issued in accordance with the Restructuring Transactions, subject to dilution by the Management Incentive Plan and subsequent issuances of common equity (including securities or instruments convertible into common equity) by the REIT from time to time after the Effective Date, as set forth in the Plan.

If Class 11 is not an Accepting Class, each holder of Allowed Existing REIT Preferred Stock shall not receive or retain any distribution on account of such Interest. |

Impaired |

[●]% |

|

Class 12: |

On the Effective Date, the Existing REIT Common Stock shall be cancelled (or otherwise eliminated).

If Class 12 is an Accepting Class, each holder of Allowed Existing REIT Common Stock shall receive, on the Effective Date, or as soon as reasonably practicable thereafter, in full and final satisfaction of such Interest, such holder’s Pro Rata share of 5.5% of the New Common Stock issued in accordance with the Restructuring Transactions, subject to dilution by the Management Incentive Plan and subsequent issuances of common equity (including securities or instruments convertible into common equity) by the REIT from time to time after the Effective Date, as set forth in the Plan.

If Class 12 is not an Accepting Class, each holder of Allowed Existing REIT Common Stock shall not receive or retain any distribution on account of such Interest. |

Impaired |

[●]% |

|

Class 13: Intercompany Interests

|

On the Effective Date, all Intercompany Interests shall be treated as set forth in section 5.10 of the Plan. |

Unimpaired |

100% |

16

|

Class 14: Section 510(b) Claims

|

Section 510(b) Claims shall be cancelled, released, discharged, and extinguished as of the Effective Date and shall be of no further force or effect, and holders of Section 510(b) Claims shall receive New Common Stock issued in accordance with the Restructuring Transactions (from New Common Stock, if any, allocated to be issued to holders of Existing REIT Preferred Stock and Existing REIT Common Stock) in an amount sufficient to provide such holder a percentage recovery equal to the percentage recovery provided to holders of Existing REIT Common Stock pursuant to the Plan, if any. |

Impaired |

[●]% |

If you have any questions regarding the packet of materials you have received, please contact Epiq Corporate Restructuring, LLC (“Epiq”), the Debtors’ voting agent (the “Voting Agent”) at (i) (855) 914-4668 (US & Canada toll-free), (ii) 1 (503) 520-4416 (international), or (iii) CBLProperties@epiqglobal.com. Additional copies of this Disclosure Statement, which includes the Plan and the Plan Supplement (when filed), are also available on the Voting Agent’s website, https://dm.epiq11.com/cblproperties. PLEASE DO NOT DIRECT INQUIRIES TO THE BANKRUPTCY COURT.

WHERE TO FIND ADDITIONAL INFORMATION: The Company currently files quarterly and annual reports with, and furnishes other information to, the SEC. Copies of any document filed with the SEC may be obtained by visiting the SEC website at http://www.sec.gov and performing a search under the “Company Filings” link. Each of the following filings is incorporated as if fully set forth herein and is a part of this Disclosure Statement. Reports filed with the SEC (but not furnished) on or after the date of this Disclosure Statement are also incorporated by reference herein.

|

|

• |

Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on April 8, 2021 (the “10-K”); and |

|

|

• |

Current Reports on Form 8-K filed with the SEC on March 22, 2021 (with respect to Item 1.01) and April 9, 2021 (with respect to Item 2.02). |

17

CBL was founded in 1978 by Charles B. Lebovitz and five business associates. In 1979, the Company constructed its first mall in Del Rio, Texas. In 1987, the Company built its flagship mall, Hamilton Place, in Chattanooga, Tennessee, where the Company’s corporate headquarters is currently located. When it opened in 1987, Hamilton Place was the largest shopping mall in Tennessee and among the largest in the nation.

In 1993, CBL & Associates Properties Inc. was formed as a REIT and became a public company through an initial public offering.

Since going public in 1993, under the leadership of Charles Lebovitz and his son Stephen Lebovitz, the Company’s current chief executive officer, CBL experienced tremendous growth measured by both portfolio size and cash flow increases. In 2005, the Debtors expanded their reach to the west coast, opening their first mall in California, Imperial Valley Mall in El Centro. Between 2007 and 2017, the Debtors steadily grew their portfolio through joint ventures and large-scale acquisitions, including a record year in 2007 with approximately $1.6 billion in acquisitions. The Company has also expanded existing operations into new spaces, including entry into the outlet center space in 2011 with the development of the Outlet Shoppes at Oklahoma City in a joint venture with a third party. Over the years, CBL continually strengthened its portfolio with a strategy that included, among other things, active management, aggressive leasing, and profitable reinvestment in its properties with the ultimate goal of increasing shareholder value.

By 2018, the Debtors had over 100 Properties (as defined below) in their portfolio, positioning them as one of the largest owners and managers of shopping centers in the southeast region of the United States and among the largest mall REITs in the country.

As of December 31, 2020, the Company’s owned and managed portfolio consisted of interests in 104 properties (the “Properties”), which total approximately 67 million square feet. The Properties are located across 24 states primarily in the southeastern and midwestern United States. The Company wholly owns 65 properties, owns joint venture interests in 33 properties, and manages six (6) properties for third parties. The Company’s portfolio is comprised of various types of Properties, each of which is discussed below.

|

|

i. |

Shopping Malls and Outlet Centers: |

As of the Petition Date, the Company owns a controlling interest in 51 shopping malls and a non-controlling interest in 10 shopping malls (collectively, the “Malls”). The Malls are primarily located in middle markets and generally have strong competitive positions because they are the only, or the dominant, regional mall in their respective trade areas. The Company also owns, together with joint venture partners, five (5) outlet centers, each featuring an array of outlet shops.

18

The Malls are generally anchored by two or more “Anchors,” a department store, other large format retail stores, non-retail space, or theaters greater than 50,000 square feet, or “Junior Anchors,” a retail store, non-retail space, or a theater comprising more than 20,000 square feet but less than 50,000 square feet. Traditional retail Anchors and non-retail and theater Anchors offer an experience, service, or merchandise, as applicable, that appeals to a broad range of customers and plays a significant role in generating customer traffic and creating a desirable location for the tenants at a particular Mall. In addition to the Anchors and Junior Anchors, the Malls contain well diversified groups of smaller retailers, offering a wide variety of products and services. The Company has over 5,000 stores across all of the Malls.

|

|

ii. |

Associated Centers: |

The Company owns, or has an interest in, twenty-three (23) “Associated Centers,” which are retail properties that are adjacent to a Mall. Associated Centers generally include one or more Anchors, or “big box” retailers, along with some smaller tenants. The Associated Centers are typically managed by the staff at the adjacent Mall.

|

|

iii. |

Community Centers: |

The Company owns, or has an interest in, six (6) “Community Centers.” Community Centers are properties designed to attract local and regional area customers and are typically anchored by a combination of supermarkets, or value-priced stores, which attract shoppers to a Community Center’s smaller retail shops. The tenants at the Community Centers typically offer necessities, value-oriented merchandise, and convenience merchandise.

|

|

iv. |

Office Buildings and Self-Storage Facilities: |

The Company owns, or has an interest in, four (4) office buildings, including the buildings that house the Company’s corporate headquarters in Chattanooga, Tennessee, and the Company has an interest in four (4) self-storage facilities.

|

|

v. |

Outparcels: |

The Company owns, either in whole or in part, various “Outparcels,” which is land, generally located on the periphery of another Property, used for freestanding developments, such as retail stores, banks, and restaurants.

|

|

vi. |

Encumbered vs. Unencumbered Properties: |

The Properties also can be generally classified into three broad groups based upon the debt (if any) that encumbers a particular Property. As of December 31, 2020, approximately forty-two (42) of the Properties (the “Property Level Loan Properties”) are mortgaged to secure Property Level Debt (as defined below). Approximately sixteen (16) Property Level Loan Properties are wholly owned by certain of the Company’s non-debtor affiliates or subsidiaries (the “Non-Debtor Affiliates”) and approximately twenty-six (26) Property Level Loan Properties are partially owned by Non-Debtor Affiliates. Further, approximately twenty (20) of the Properties (the “Credit Facility Properties”) are mortgaged and the equity in certain of the entities directly and indirectly owning such Bank Facility Properties are pledged to secure the First Lien Credit Facility (as

19

defined below). The remainder of the Properties are currently unencumbered by any debt (collectively, the “Unencumbered Properties”).

The Company’s tenant base is well diversified from both a geographic and revenue perspective. The top five markets for CBL, based on percentage of total revenues, were as follows for the year ended December 31, 2020:

|

Market |

Percentage of Total Revenues |

|

Chattanooga, TN |

7.0% |

|

St. Louis, MO |

6.1% |

|

Lexington, KY |

5.1% |

|

Laredo, TX |

5.0% |

|

Madison, WI |

3.8% |

20

With respect to tenant mix, national and regional retail chains (excluding local franchises), including among others, Victoria’s Secret, Footlocker, and American Eagle, leased approximately 68.7% of the occupied mall store gross leasable area as of December 31, 2020. CBL’s top 10 tenants, based on percentage of total revenues, were as follows as of December 31, 2020:

|

# |

Tenant |

# Stores |

Percentage of Total Revenues |

|

1 |

L Brands, Inc. (e.g., Bath & Body Works, PINK, Victoria’s Secret, White Barn Candle) |

117 |

3.96% |

|

2 |

Foot Locker, Inc. |

106 |

3.55% |

|

3 |

Signet Jewelers Limited (e.g., Kay Jewelers, Jared Jewelers) |

135 |

3.01% |

|

4 |

American Eagle Outfitters, Inc. |

68 |

2.57% |

|

5 |

Dick’s Sporting Goods, Inc. (e.g., Dick’s Sporting Goods, Golf Galaxy, Field & Stream) |

26 |

2.13% |

|

6 |

Genesco, Inc. (e.g., Journey’s, Hat Shack, Johnston & Murphy) |

98 |

1.78% |

|

7 |

H&M Hennes & Mauritz AB |

43 |

1.71% |

|

8 |

Luxottica Group S.P.A. (e.g., Lenscrafters, Pearle Vision, Sunglass Hut) |

96 |

1.49% |

|

9 |

Finish Line, Inc. |

40 |

1.44% |

|

10 |

The Gap, Inc. |

49 |

1.42% |

|

|

|

778 |

23.06% |

CBL primarily derives revenue from two sources: (i) rental revenue from retail and non-retail tenants and (ii) income from property management, leasing, and development activities. Rental revenues are primarily derived from leases with retail and non-retail tenants and generally include fixed minimum rents, percentage rents based on tenants’ sales volumes, and reimbursements from tenants for expenditures related to real estate taxes, insurance, common area maintenance, and other recoverable operating expenses, as well as certain capital expenditures. CBL also generates revenues from management, leasing and development fees, sponsorships, sales of peripheral land at the Properties, and from sales of operating real estate assets when it is determined that CBL can realize an appropriate value for a particular asset. The Company’s general near-to-midterm operational objectives are to achieve stabilization in same center net operating income (“NOI”)

21

and reduce overall cost of debt and equity by maximizing earnings before income, taxes, depreciation, and amortization (“EBITDA”) and cash flows.

To achieve operating efficiencies and revenue enhancement at the Properties, CBL employs a centralized management approach through CBL & Associates Limited Partnership (the “Operating Partnership”) and CBL & Associates Management, Inc. (the “Management Company”), a wholly-owned subsidiary of the Operating Partnership.6

CBL conducts its management and development activities through the Management Company. Specifically, the Management Company manages all but fourteen (14) of the Properties (the “Non-Managed Properties”).7 The Management Company is also responsible for the Company’s leasing activities. Additionally, the Management Company employs the Company’s workforce, which, as of December 31, 2020, consisted of approximately 418 full-time employees and approximately fifty-six (56) part-time employees.

The Management Company also provides and centrally administers accounting, collections, business development, construction, contracting, design, finance, forecasting, human resources and employee benefits, insurance and risk management, property services, marketing, leasing, legal, tax, treasury, and other services for all properties under CBL’s ownership and management.

CBL’s integrated, national business model benefits the Company in numerous ways. The centralized leasing programs enable the Company to develop relationships with department stores and national and regional retailers and to meet retailer needs at multiple properties and locations across the Company’s portfolio. It also facilitates a single point of contact for tenants at shopping centers across the country for both leasing and tenant-service issues. Centralized management also enables the Company to obtain national contracts for property services (such as security, janitorial, and trash collection) in order to reduce costs and ensure uniformity and quality in services.

Consistent with its centralized and integrated business model, the Company has a strong infrastructure in place for cash management and treasury functions. Each Property’s cash (receipts and disbursements) is controlled and safely transmitted through the centralized treasury platform. The Property-owning Debtors and Non-Debtor Affiliates’ personnel at the Properties are not allowed to manage cash for security purposes. Consequently, all cash management functions are performed through the treasury platform via a centralized cash management system (the “Cash Management System”).8

The centralized Cash Management System reduces costs associated with cash management, including bank accounts, personnel, bookkeeping, treasury, and related expenses. The Cash Management System also serves to provide security and prevent fraud. The Cash Management System provides management the ability to monitor and allocate liquidity to the Properties.

|

|

6 |

The Company also utilizes this approach so as to comply with certain requirements of the Internal Revenue Code of 1986 with respect to real estate investment trusts. |

|

7 |

The Non-Managed Properties are all owned by joint ventures and are managed by a property manager that is affiliated with the third-party partner, which receives a fee for its services. The third-party partner of each of these Properties controls the cash flow distributions, although CBL’s approval is required for certain major decisions. |

|

8 |

The Cash Management System is described in greater detail in the Emergency Motion of Debtors for Entry of Interim and Final Orders (I) Authorizing Debtors to Continue (A) Using Existing Cash Management System, Bank Accounts, and Business Forms and (B) Funding Intercompany Transactions, (II) Providing Administrative Expense Priority for Postpetition Intercompany Claims, and (III) Granting Related Relief (Docket No. 15). |

22

After years of steady growth, CBL’s financial performance has been declining given the recent and ongoing struggles of the retail sector generally. CBL had a net loss attributable to common shareholders of $332.5 million for the year ending December 31, 2020, as compared to a net loss attributable to common shareholders of $153.7 million in the prior-year period. For the reasons discussed below, the Company’s financial performance in 2020—as exacerbated by the COVID-19 pandemic—declined.

As of December 31, 2020, on a historical GAAP basis, CBL reported approximately $4.44 billion in total assets and approximately $3.91 billion in total liabilities. For the year ending December 31, 2020, CBL reported total revenue of approximately $575.9 million.

Funds from operations (“FFO”) allocable to Operating Partnership common unitholders, as adjusted, decreased 48.2% to $140.8 million for the year ended December 31, 2020 compared to $271.5 million for the prior year. FFO allocable to common shareholders, as adjusted, for the year ending December 31, 2020, was $132.9 million, or $0.70 per diluted share, compared with $235.2 million, or $1.36 per diluted share, for the year ending December 31, 2020.

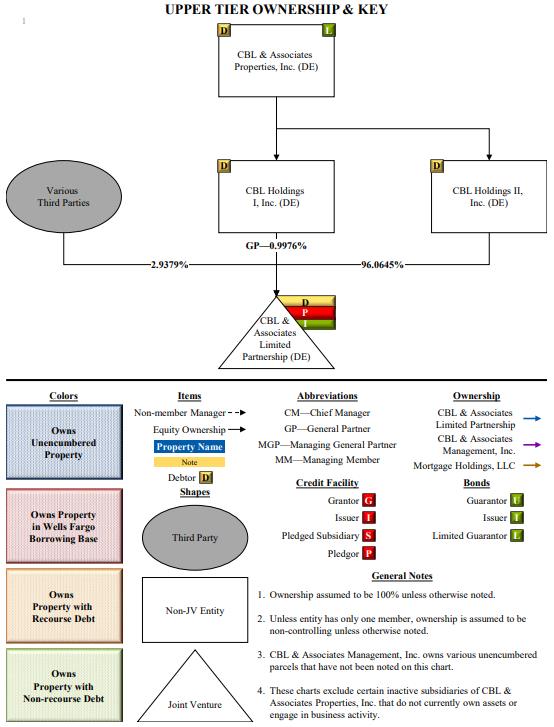

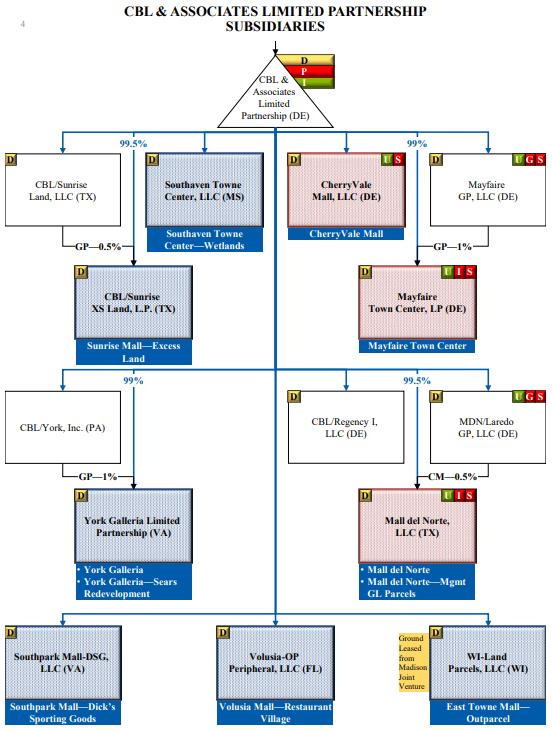

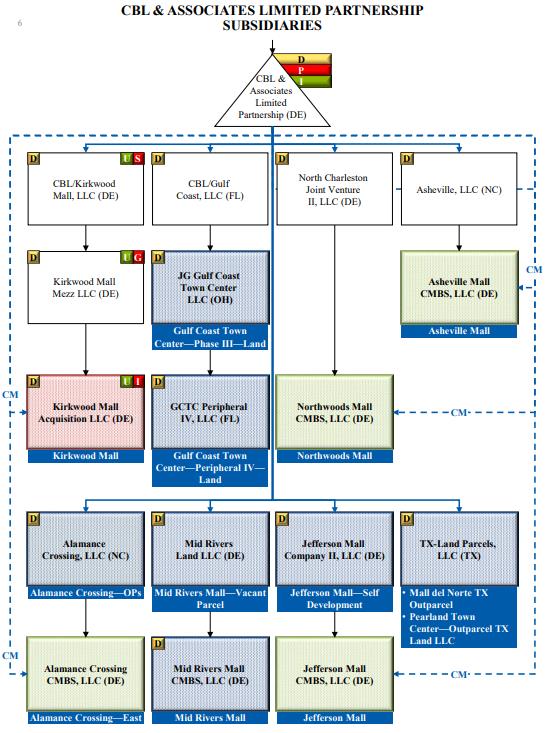

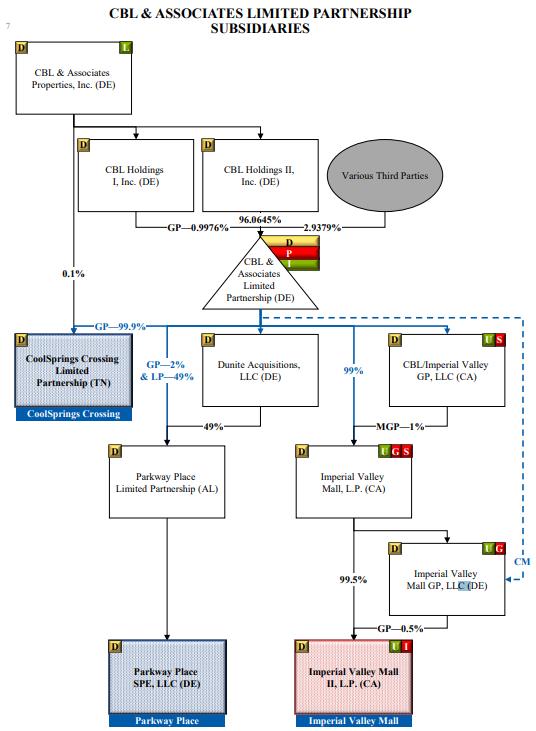

III. DEBTORS’ CORPORATE AND CAPITAL STRUCTURE

The Company is a self-administered and self-managed real estate investment trust. The REIT is the 100% owner of two qualified real estate investment trust subsidiaries, CBL Holdings I, Inc. (“Holdings I”) and CBL Holdings II, Inc. (“Holdings II”).

As of December 31, 2020, Holdings I and Holdings II own approximately 1.0% and 96.5%, respectively, of the outstanding common units of the Operating Partnership. Holdings I is the sole general partner of the Operating Partnership. Third parties own approximately 2.5% of the outstanding LP Common Units.

The Company conducts substantially all of its business through the Operating Partnership

23

. The Operating Partnership owns 100% of the equity interests of the Management Company. Except for the REIT, Holdings I, Holdings II, and as set forth in the following sentence, the Operating Partnership owns, either directly or indirectly, 100% of the outstanding equity interests in the Debtors. The REIT owns directly (i) 0.1% of the equity interests in CoolSprings Crossing Limited Partnership and (ii) less than 0.05% of the equity interests in Henderson Square Limited Partnership.

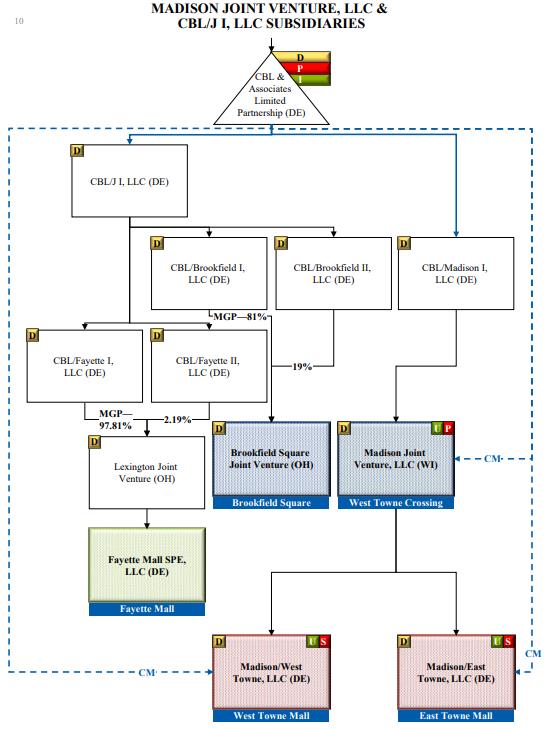

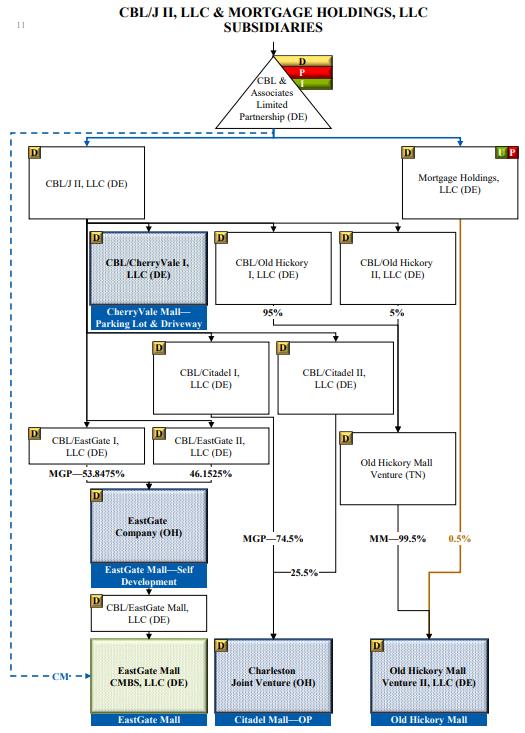

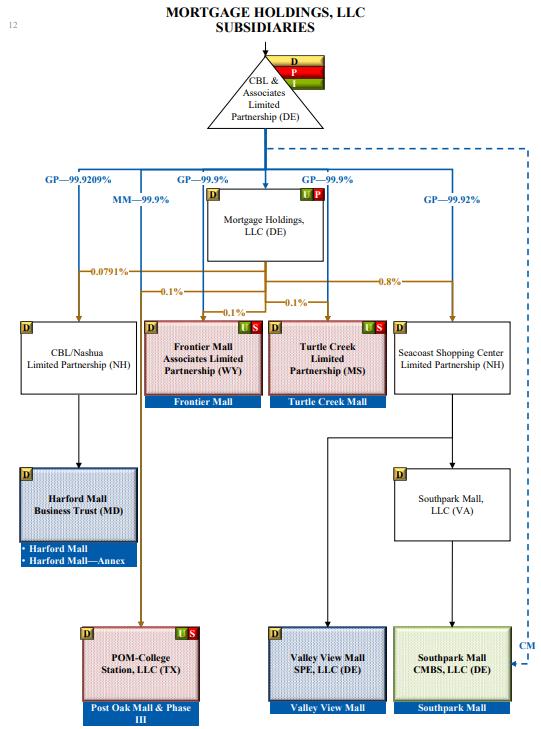

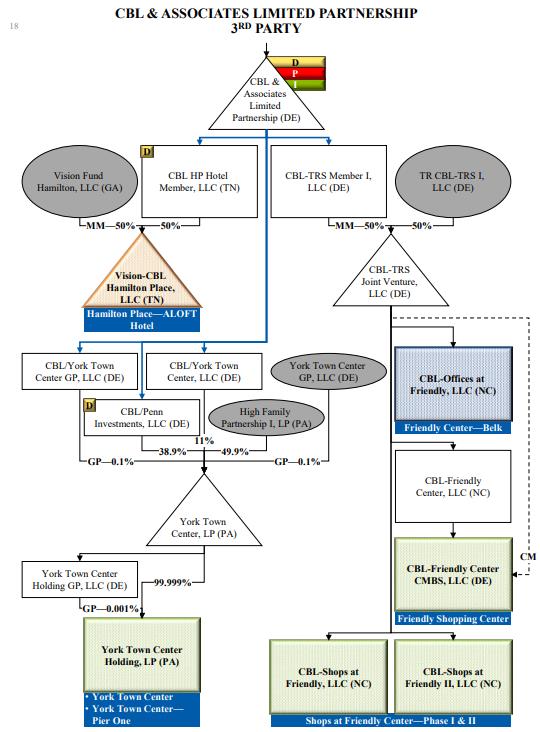

A chart depicting the Company’s organizational structure as of the Petition Date, is attached hereto as Exhibit B. The following chart depicts the Company’s simplified corporate structure:

The board of directors of the REIT (the “Board”) consists of nine (9) directors. Charles Lebovitz serves as the Chairman of the Board.

In addition to Charles Lebovitz, the Company’s executive officer team consists of the following individuals:

|

Name |

Position |

|

Stephen D. Lebovitz |

Chief Executive Officer |

|

Michael I. Lebovitz |

President |

|

Farzana Khaleel |

Executive Vice President – Chief Financial Officer |

|

Jeffery V. Curry |

Chief Legal Officer and Secretary |

|

Katie A. Reinsmidt |

Executive Vice President – Chief Investment Officer |

|

Michael C. Harrison, Jr. |

Executive Vice President – Operations |

|

Alan L. Lebovitz |

Executive Vice President – Management |

24

The following description of the Company’s capital structure is for informational purposes only and is qualified in its entirety by reference to the documents setting forth the specific terms of such obligations and their respective related agreements.

|

|

i. |

First Lien Credit Facility. |

On January 30, 2019, certain of the Debtors entered into that certain Credit Agreement (as may be amended, restated, amended and restated, supplemented or otherwise modified from time to time, and including all related credit documents, the “First Lien Credit Agreement”), by and among the Operating Partnership, as borrower, Well Fargo Bank, National Association, as administrative agent (together with any successor administrative agent, the “Administrative Agent” or “Wells Fargo”), the lenders party thereto (the “Bank Lenders”) and certain other parties specified therein. The First Lien Credit Agreement provides for a term loan facility (the “Term Loan”) in the original aggregate principal amount of $500 million and a revolving loan facility (the “Revolver” and, together with the Term Loan, the “First Lien Credit Facility”) in the aggregate maximum committed principal amount of $685 million (including any letters-of-credit issued thereunder). The First Lien Credit Agreement matures in July 2023 and bears interest at a variable rate of LIBOR plus 2.25%.

As of the Petition Date, the aggregate principal amount outstanding under the Term Loan was believed by the Debtors to be approximately $439 million.9 As of the Petition Date, the Revolver had approximately $676 million in aggregate principal amount outstanding thereunder, and no further draws are permitted. Additionally, as of the Petition Date, there were no letters of credit outstanding.

The obligations under the First Lien Credit Agreement are secured, pursuant to, among other documents, (i) that certain Collateral Agreement, dated as of January 30, 2019, by and among certain subsidiaries of the Operating Partnership, and Wells Fargo Bank, National Association, as collateral agent (the “Collateral Agent”), (ii) that certain Pledge Agreement, dated as of January 30, 2019, by and among the Operating Partnership, the direct and indirect subsidiaries of the Operating Partnership party thereto, and the Collateral Agent, and (iii) certain mortgages granted to the Collateral Agent in respect of the Credit Facility Properties, principally by the Credit Facility Properties and by pledges of the equity interests of the entities owning such Credit Facility Properties.

|

|

9 |

The Administrative Agent asserts that the aggregate principal amount outstanding under the Term Loan was approximately $447 million as of the Petition Date. |

25

The REIT is a limited guarantor of the First Lien Credit Facility, solely with respect to the payment obligations of Holdings I as the general partner of the Operating Partnership, under the First Lien Credit Facility.

|

|

ii. |

Senior Unsecured Notes. |

The Operating Partnership, as issuer, the REIT, as limited Guarantor, and Delaware Trust Company (as successor to U.S. Bank National Association), as trustee, are parties to that certain indenture, dated as of November 23, 2013 (as amended, restated, or supplemented from time to time, the “Indenture”) governing the following three tranches of senior unsecured notes (collectively, the “Senior Unsecured Notes”):

|

Notes |

Principal Amount Outstanding |

Rate |

Maturity |

|

2023 Notes |

$450 million |

5.250% |

December 1, 2023 |

|

2024 Notes |

$300 million |

4.600% |

October 15, 2024 |

|

2026 Notes |

$625 million |

5.950% |

December 15, 2026 |

The REIT is a limited guarantor of the Senior Unsecured Notes, solely with respect to losses suffered solely by reason of fraud or willful misrepresentation by the Operating Partnership or its affiliates.

|

|

iii. |

Property-Level Debt. |

The Company has incurred, in the aggregate, approximately $1.9 billion of property-level debt, which amount includes the Company’s share of Property Level Debt incurred together with its joint venture partners, secured by the Property Level Debt Properties, including non-recourse mortgage loans (the “Non-Recourse Loans”) and certain other loans with recourse to the general credit of the Operating Partnership, and/or the REIT, or subsidiaries thereof, including construction loans (the “Recourse Loans” and, together with the Non-Recourse Loans, the “Property Level Debt”). The borrowers on the Property Level Debt instruments are generally non-Debtor affiliates. There are thirteen (13) loans that are recourse to a subsidiary of the Operating Partnership.

Much of the Property Level Debt has been securitized and sold into the commercial mortgage-backed securities (“CMBS”) markets and is currently being administered by primary servicers. With the exception of two (2) Non-Recourse Loans, the Operating Partnership and/or the REIT, or a subsidiary thereof, is a non-recourse carveout guarantor and environmental guarantor on each of the Non-Recourse Loans and a guarantor under each of the Recourse Loans.

As of December 31, 2020, the Company was current with respect to its obligations under the Property Level Debt, with the exception of the Property Level Debt on the following Properties, which were in default and not subject to a forbearance or waiver agreement with the applicable lender: (i) Greenbrier Mall; (ii) EastGate Mall; (iii) Park Plaza (currently in receivership); and (iv) Asheville Mall (currently in receivership). The commencement of the Chapter 11 Cases constituted an event of default or termination event, and caused the automatic and immediate

26

acceleration of all debt outstanding under or in respect of, thirty-eight (38) of the Property Level Debt instruments. Such Property Level Debt instruments provide that, as a result of the Chapter 11 Cases, the principal and interest due thereunder shall be immediately due and payable without notice from the lenders thereunder.

|

|

iv. |

REIT Preferred Stock and Operating Partnership Preferred Units. |

The REIT issued depositary shares representing a 1/10th fractional share of the 7.375% Series D Cumulative Redeemable Preferred Stock outstanding (such depositary shares, the “Series D Preferred Stock”) and depositary shares representing a 1/10th fractional share of the 6.625% Series E Cumulative Redeemable Preferred Stock outstanding (such depositary shares, the “Series E Preferred Stock” and, together with the Series D Preferred Stock, the “REIT Preferred Stock”). As of December 31, 2020, the REIT had approximately 18,150,000 shares of Series D Preferred Stock outstanding and approximately 6,900,000 shares of Series E Preferred Stock outstanding. The Operating Partnership issues an equivalent number of preferred units (the “LP Preferred Units”) to Holdings II on behalf of the REIT in exchange for the contribution of proceeds from the REIT to the Operating Partnership when the REIT issues REIT Preferred Stock. The LP Preferred Units generally have the same terms and economic characteristics as the corresponding REIT Preferred Stock.

|

|

v. |

REIT Common Stock. |

As of December 31, 2020, the REIT had approximately 196,569,917 shares of common stock outstanding (the “REIT Common Stock”). As of the Petition Date, the REIT Common Stock was listed on the New York Stock Exchange (the “NYSE”) under the symbol “CBL.”

However, on November 2, 2020, the NYSE announced that (i) it had suspended trading in the REIT Common Stock and (ii) it had determined to commence proceedings to delist the REIT Common Stock, as well as the depositary shares representing a 1/10th fractional share of the Series D Preferred Stock and the depositary shares representing a 1/10th fractional share of the Series E Preferred Stock due to “abnormally low” trading price levels. As a result, immediately thereafter, the REIT Common Stock and the depositary shares representing fractional interests in its Series D Preferred Stock and Series E Preferred Stock commenced trading on the OTC Markets, operated by the OTC Markets Group, Inc., under the symbols “CBLAQ”, “CBLDQ” and “CBLEQ”, respectively. On November 17, 2020, CBL submitted to the NYSE regulation staff a formal request for review of the NYSE’s decision to delist the common stock and to make an oral presentation to the committee of the board of directors of NYSE regulation staff in support of its appeal. By communication dated February 1, 2021, the NYSE scheduled a formal review of its decision for July 15, 2021.

|

|

vi. |

Operating Partnership Common Units. |

Partners in the Operating Partnership hold their ownership through LP Preferred Units and common and special common units of limited partnership interests in the Operating Partnership (the “LP Common Units”). As of December 31, 2020, the Operating Partnership had approximately 201,687,773 LP Common Units outstanding. The LP Common Units and the REIT Common Stock have essentially the same economic characteristics, as they effectively participate

27

equally in the net income and distributions of the Operating Partnership. For each share of REIT Common Stock, the Operating Partnership has issued a corresponding number of LP Common Units to Holdings I and Holdings II in exchange for the proceeds from the REIT Common Stock issuance. Subject to certain limitations, each limited partner in the Operating Partnership has the right to exchange all or a portion of its LP Common Units for REIT Common Stock, or at the Company’s election, their cash equivalent. When an exchange for REIT Common Stock occurs, the REIT assumes the LP Common Units.

As of December 31, 2020, the Operating Partnership had three series of special common units outstanding:

|

|

• |

Series S Special Common Units: Among other rights under the Operating Partnership’s limited partnership agreement, the holders of Series S special common units (“S-SCUs”) have the right, subject to certain conditions, to a minimum annual distribution of $2.92875 per S-SCU. Approximately 1,560,942 S-SCUs were outstanding as of December 31, 2020. |

|

|

• |

Series L Special Common Units: Among other rights under the Operating Partnership’s limited partnership agreement, the holders of Series L special common units (“L-SCUs”) are entitled to the same distribution rights as the holders of the common units of the Operating Partnership. Approximately 571,700 L-SCUs were outstanding as of December 31, 2020. |

|

|

• |

Series K Special Common Units: Among other rights under the Operating Partnership’s limited partnership agreement, the holders of Series K special common units (“K-SCUs”) have the right, subject to certain conditions, to an annual dividend at a rate of 6.25%, or $2.96875 per K-SCU. Approximately 868,821 K-SCUs were outstanding as of December 31, 2020. |

During 2019, subject to further quarterly review, the Board suspended all future dividends with respect to the REIT Preferred Stock and REIT Common Stock. The Board also suspended all distributions with respect to the LP Common Units and LP Preferred Units (the “Dividend Suspension”). CBL has not paid any dividends since the Dividend Suspension.

|

|

vii. |

Prepetition Legal Proceedings |

|

|

(a) |

Prepetition Litigation. |

Certain Debtors are named as defendants from time to time in routine litigation proceedings, including, but not limited to, personal injury and breach of contract disputes. The Debtors, however, cannot predict with certainty the outcome or effect of the resolution of Claims arising from pending or threatened litigation or legal proceedings, and the eventual outcome could materially differ from their current estimates.

|

|

(b) |

Salon Adrian Litigation |

On March 16, 2016, a class action lawsuit was brought against the Company in the United States District Court for the Middle District of Florida (the “Florida Court”) by Wave Lengths Hair

28

Salons of Florida, Inc. d/b/a Salon Adrian, alleging, among other things that certain of the Company entities overcharged tenants for electricity at certain bulk-metered malls (the “Salon Adrian Litigation”). In April 2019, the Company entered into a settlement agreement and release with respect to the class action (the “Salon Adrian Settlement”) whereby the Company set aside a common fund with monetary and non-monetary value of $90 million to be disbursed to class members in accordance with an agreed-upon formula that is based upon aggregate damages of $60 million. In August 2019, the Florida Court approved the Salon Adrian Settlement.

In the third quarter of 2019, the Company received document requests, in the form of subpoenas, from the SEC and the Department of Justice regarding the Salon Adrian Litigation and other related matters. The Company is continuing to cooperate in these matters.

|

|

(c) |

Securities Litigation. |

The Company and its current and former officers and directors are parties to the following securities litigations.

|

|

• |

The Securities Class Action: A consolidated securities class action lawsuit (the “Securities Class Action”) is pending against the Company and certain of its officers and directors (the “D&Os”) in the United States District Court for the Eastern District of Tennessee (the “Tennessee District Court”). The matter is stayed as against the Company pursuant to the automatic stay under section 362 of the Bankruptcy Code. The Securities Class Action, which was brought by persons who purchased or otherwise acquired the Company’s securities during a specified period of time, alleged, among other things, that (i) the Company failed to timely disclose the potential material liability that CBL faced as a result of the Salon Adrian Litigation and (ii) the Company knowingly engaged in an illegal scheme to overcharge its tenants and made false statements to its investors regarding its revenues and prospects, which were materially overstated due to the alleged underlying scheme. While the outcome of the Securities Class Action is unknown, the plaintiffs are seeking, among other things, compensatory damages and attorneys’ fees and costs. A mediation on the Securities Class Action occurred on December 10, 2020, but it did not result in a settlement. |

On December 4, 2020, the Debtors filed a motion with the Bankruptcy Court seeking, among other things, an order authorizing: (i) certain insurers under the Debtors’ directors and officers insurance policies (the “D&O Policies”) to advance defense costs on behalf of certain of the D&Os in accordance with the D&O Policies and (ii) the potential use of D&O proceeds for settlement purposes in connection with the Securities Class Action mediation (Docket No. 298) (the “D&O Proceeds Motion”). By order dated December 21, 2020, the Bankruptcy Court granted the D&O Proceeds Motion (Docket No. 345).

On December 23, 2020, the plaintiffs in the Securities Class Action filed additional pleadings in the Tennessee District Court requesting that they be allowed to proceed with their claims against the D&Os. Consequently, on January 7, 2021, the Debtors filed a motion with the Bankruptcy Court seeking an order extending the automatic stay to the D&Os (Docket No. 763) (the “D&O Stay Motion”). By order dated January

29

16, 2021, the Bankruptcy Court extended the automatic stay to the D&Os through and including April 16, 2021 (the “D&O Deadline”), without prejudice to the Debtors to seek further extensions (Docket No. 819).

On March 25, 2021, the Debtors filed a motion seeking to further extend the D&O Deadline through and including the 30th day following the Bankruptcy Court’s entry of the Confirmation Order (Docket No. 992) (the “D&O Extension Motion”). By order dated April 12, 2021, the Bankruptcy Court extended the automatic stay to the D&Os to the earlier of (i) May 27, 2021, and (ii) the date on which the Bankruptcy Court enters a separate order on the D&O Extension Motion, without prejudice to the Debtors to seek further extensions (Docket No. 1042).

|

|

• |

The Derivative Litigation: Certain of the Company’s current and former directors and officers have been named as defendants in nine (9) shareholder derivative lawsuits (the “Derivative Litigations” and, together with the Securities Class Action, the “Securities Litigation”). The complaints allege, among other things, breaches of fiduciary duties, unjust enrichment, waste of corporate assets and violation of federal securities laws. The factual allegations upon which the Derivative Litigations are based are similar to the factual allegations made in the Securities Class Action. While the outcome of the Derivative Litigations is unknown, the plaintiffs are seeking, among other things, unspecified damages and restitution for the Company from the individual defendants, the payment of costs and attorneys’ fees, and that the Company be directed to reform certain governance and internal procedures. On the Petition Date, the Derivative Litigations became property of the Debtors’ Estates. Additional information concerning the Securities Litigation can be found in the 10-K. |

IV.

SIGNIFICANT EVENTS LEADING

TO THE CHAPTER 11 FILINGS

CBL, as a national retail landlord, is susceptible to changes in the retail real estate markets. Over the past several years, the retail industry has been shifting, with the closing of brick-and-mortal retail stores becoming more common as shoppers have increasingly moved towards e-commerce. The Company anticipates that the number of traditional department stores, such as those acting as Anchors or Junior Anchors in the Malls, will continue to decline over time. Beyond the decline in number, the market share of traditional department stores is also declining, as is their ability to drive traffic.

As new technologies emerge, the relationships between customers, retailers, and shopping centers are evolving on a rapid basis. Commercial landlords like CBL must diversify its sources of income and types of tenants to enhance the mall experience, which demands additional capital. Additionally, an increasing number of retailers are utilizing their stores as showrooms or as part of an omni-channel strategy (allowing customers to shop seamlessly through various sales channels, where customers’ sales occur outside the Malls). As a result, customers may make purchases through other sales channels during or immediately after visiting the Malls, with such

30

sales not being captured currently in the Company’s sales figures or monetized in minimum or overage rents.