Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KIMCO REALTY CORP | nt10023151x1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - KIMCO REALTY CORP | nt10023151x1_ex2-1.htm |

| 8-K - FORM 8-K - KIMCO REALTY CORP | nt10023151x1_8k.htm |

Exhibit 99.2

Investor Presentation KIMCO AND WEINGARTENSTRATEGIC MERGER APRIL 2021 Creates Premier Open-Air

Shopping Center & Mixed-Use Real Estate Company 1

SAFE HARBOR This communication contains certain

“forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. Neither Kimco Realty Corporation (“KIM”) nor Weingarten Realty Investors (“WRI”)

intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with the

safe harbor provisions. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,” “projects,” “could,” “estimates” or variations of such words and other similar expressions are intended

to identify such forward-looking statements, which generally are not historical in nature, but not all forward-looking statements include such identifying words. Forward-looking statements regarding KIM and WRI, include, but are not limited to,

statements related to the anticipated acquisition of WRI and the anticipated timing and benefits thereof; KIM’s expected financing for the transaction; KIM’s ability to deleverage and its projected target net leverage; and other statements that

are not historical facts. These forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties. Actual results and the

timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with: KIM’s and WRI’s ability

to complete the acquisition on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary shareholder approvals and satisfaction of other closing conditions to consummate the

acquisition; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction; risks related to diverting the attention of WRI and KIM

management from ongoing business operations; failure to realize the expected benefits of the acquisition; significant transaction costs and/or unknown or inestimable liabilities; the risk of shareholder litigation in connection with the proposed

transaction, including resulting expense or delay; the risk that WRI’s business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; KIM’s ability to obtain the expected

financing to consummate the acquisition; risks related to future opportunities and plans for the combined company, including the uncertainty of expected future financial performance and results of the combined company following completion of the

acquisition; effects relating to the announcement of the acquisition or any further announcements or the consummation of the acquisition on the market price of KIM’s common stock or WRI’s common shares; the possibility that, if KIM does not

achieve the perceived benefits of the acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of KIM’s common stock could decline; general adverse economic and local real estate conditions; the

inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business; local real estate conditions; increases in interest rates; foreign currency exchange rates; increases in

operating costs and real estate taxes; changes in the dividend policy for KIM’s common stock or preferred stock or KIM’s ability to pay dividends; impairment charges; unanticipated changes in the company’s intention or ability to prepay certain

debt prior to maturity and/or hold certain securities until maturity; pandemics or other health crises, such as coronavirus disease 2019 (COVID-19); and other risks and uncertainties affecting KIM and WRI, including those described from time to

time under the caption “Risk Factors” and elsewhere in KIM’s and WRI’s Securities and Exchange Commission (“SEC”) filings and reports, including KIM’s Annual Report on Form 10-K for the year ended December 31, 2020, WRI’s Annual Report on Form

10-K for the year ended December 31, 2020, and future filings and reports by either company. Moreover, other risks and uncertainties of which KIM or WRI are not currently aware may also affect each of the companies’ forward-looking statements and

may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking

statements, even if they are subsequently made available by KIM or WRI on their respective websites or otherwise. Neither KIM nor WRI undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.Important Additional Information and Where to Find ItIn connection with the proposed

merger, KIM will file with the SEC a registration statement on Form S-4 to register the shares of KIM common stock to be issued in connection with the merger. The registration statement will include a joint proxy statement/prospectus which will

be sent to the common stockholders of KIM and the shareholders of WRI seeking their approval of their respective transaction-related proposals. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE

RELATED JOINT PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT KIM, WRI AND THE PROPOSED TRANSACTION.Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from KIM at its website,

www.kimcorealty.com, or from WRI at its website, www.weingarten.com. Documents filed with the SEC by KIM will be available free of charge by accessing KIM’s website at www.kimcorealty.com under the heading Investors or, alternatively, by

directing a request to KIM at IR@kimcorealty.com or 500 North Broadway Suite 201, Jericho, New York 11753, telephone: (866) 831- 4297, and documents filed with the SEC by WRI will be available free of charge by accessing WRI’s website at

www.weingarten.com under the heading Investors or, alternatively, by directing a request to WRI at ir@weingarten.com or 2600 Citadel Plaza Drive, Houston, TX 77008, telephone: (800) 298-9974.Participants in the SolicitationKIM and WRI and certain

of their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the common stockholders of KIM and the shareholders of WRI in respect of

theproposed transaction under the rules of the SEC. Information about KIM’s directors and executive officers is available in KIM’s proxy statement dated March 17, 2021 for its 2021 Annual Meeting of Stockholders. Information about WRI’s directors

and executive officers is available in WRI’s proxy statement dated March 15, 2021 for its 2021 Annual Meeting of Shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the joint proxy

statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from KIM or WRI using the sources indicated above.No Offer or SolicitationThis communication

shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. 2

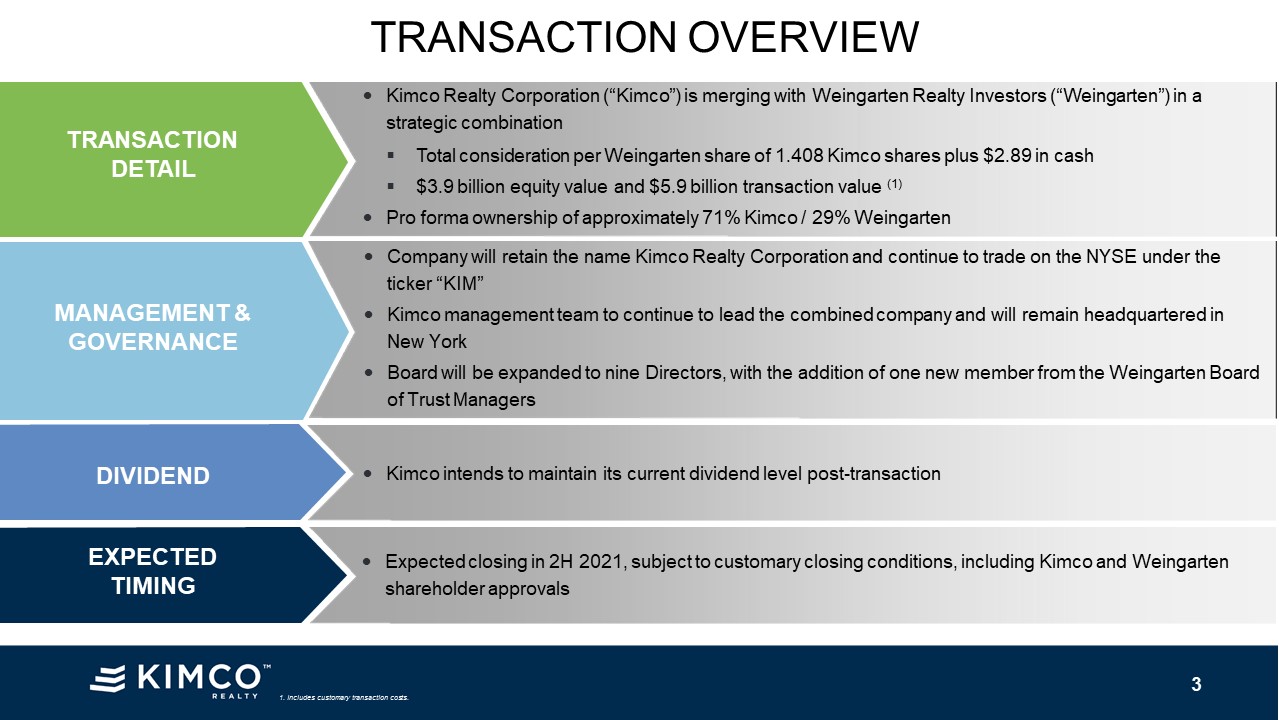

TRANSACTION OVERVIEW 1. Includes customary transaction costs. TRANSACTION DETAIL Kimco Realty

Corporation (“Kimco”) is merging with Weingarten Realty Investors (“Weingarten”) in a strategic combination Total consideration per Weingarten share of 1.408 Kimco shares plus $2.89 in cash$3.9 billion equity value and $5.9 billion transaction

value (1) Pro forma ownership of approximately 71% Kimco / 29% Weingarten MANAGEMENT & GOVERNANCE Company will retain the name Kimco Realty Corporation and continue to trade on the NYSE under the ticker “KIM”Kimco management team to

continue to lead the combined company and will remain headquartered in New YorkBoard will be expanded to nine Directors, with the addition of one new member from the Weingarten Board of Trust Managers DIVIDEND Kimco intends to maintain its

current dividend level post-transaction EXPECTEDTIMING Expected closing in 2H 2021, subject to customary closing conditions, including Kimco and Weingarten shareholder approvals 3

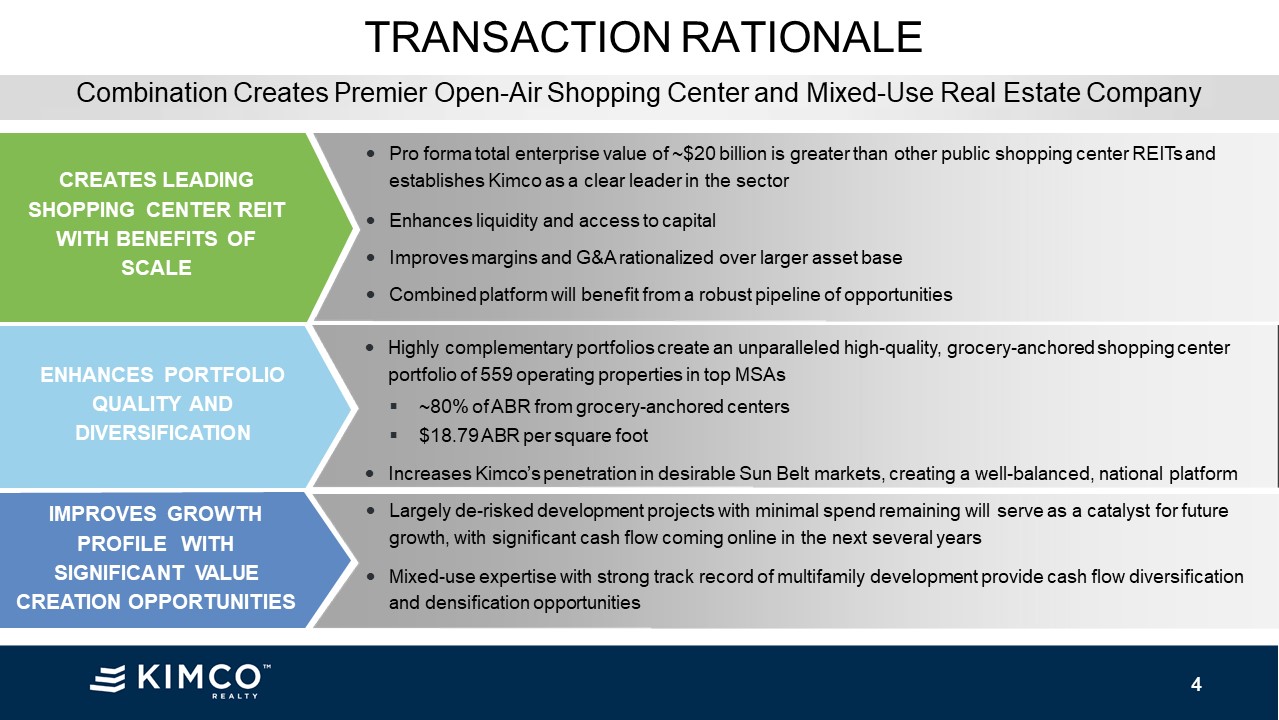

Combination Creates Premier Open-Air Shopping Center and Mixed-Use Real Estate Company TRANSACTION

RATIONALE ENHANCES PORTFOLIO QUALITY AND DIVERSIFICATION Highly complementary portfolios create an unparalleled high-quality, grocery-anchored shopping center portfolio of 559 operating properties in top MSAs ~80% of ABR from

grocery-anchored centers$18.79 ABR per square foot Increases Kimco’s penetration in desirable Sun Belt markets, creating a well-balanced, national platform CREATES LEADING SHOPPING CENTER REIT WITH BENEFITS OF SCALE Pro forma total enterprise

value of ~$20 billion is greater than other public shopping center REITs and establishes Kimco as a clear leader in the sector Enhances liquidity and access to capitalImproves margins and G&A rationalized over larger asset baseCombined

platform will benefit from a robust pipeline of opportunities IMPROVES GROWTH PROFILE WITH SIGNIFICANT VALUE CREATION OPPORTUNITIES Largely de-risked development projects with minimal spend remaining will serve as a catalyst for future growth,

with significant cash flow coming online in the next several yearsMixed-use expertise with strong track record of multifamily development provide cash flow diversificationand densification opportunities 4

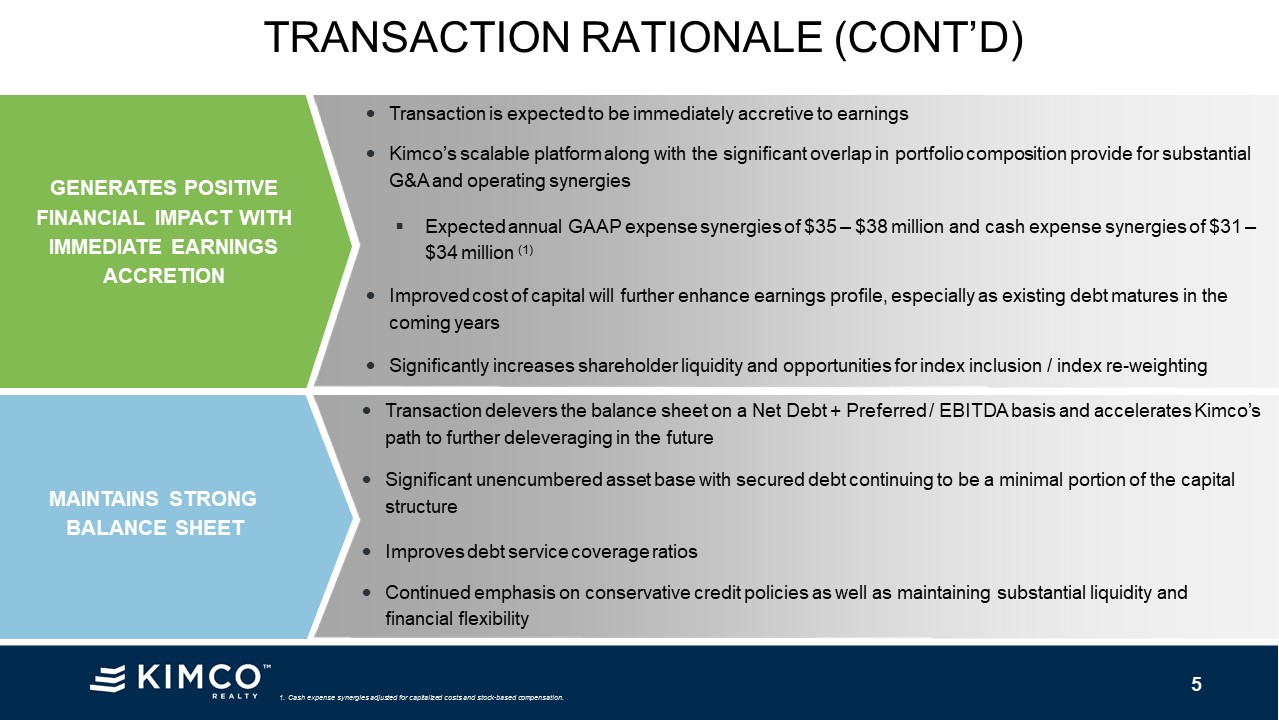

TRANSACTION RATIONALE (CONT’D) 1. Cash expense synergies adjusted for capitalized costs and

stock-based compensation. GENERATES POSITIVE FINANCIAL IMPACT WITH IMMEDIATE EARNINGS ACCRETION Transaction is expected to be immediately accretive to earnings Kimco’s scalable platform along with the significant overlap in portfolio

composition provide for substantial G&A and operating synergiesExpected annual GAAP expense synergies of $35 – $38 million and cash expense synergies of $31 –$34 million (1) Improved cost of capital will further enhance earnings profile,

especially as existing debt matures in thecoming years MAINTAINS STRONG BALANCE SHEET Significantly increases shareholder liquidity and opportunities for index inclusion / index re-weightingTransaction delevers the balance sheet on a Net Debt +

Preferred / EBITDA basis and accelerates Kimco’s path to further deleveraging in the future Significant unencumbered asset base with secured debt continuing to be a minimal portion of the capital structure Improves debt service coverage

ratiosContinued emphasis on conservative credit policies as well as maintaining substantial liquidity and financial flexibility 5

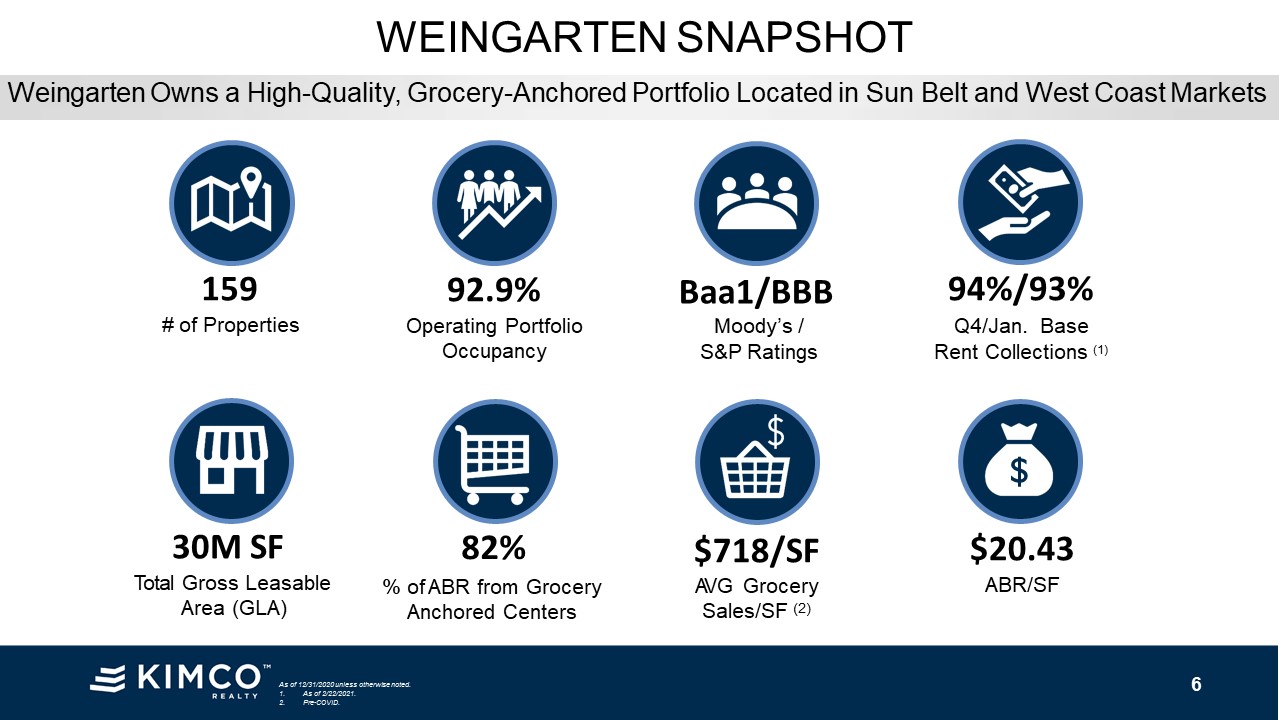

WEINGARTEN SNAPSHOT As of 12/31/2020 unless otherwise noted. 1.2. As of 2/22/2021.

Pre-COVID. 159# of Properties 30M SFTotal Gross Leasable Area (GLA) $718/SFAVG Grocery Sales/SF (2) 82%% of ABR from Grocery Anchored Centers 92.9%Operating Portfolio Occupancy $20.43ABR/SF Baa1/BBBMoody’s /

S&P Ratings 94%/93%Q4/Jan. Base Rent Collections (1) $ Weingarten Owns a High-Quality, Grocery-Anchored Portfolio Located in Sun Belt and West Coast Markets 6

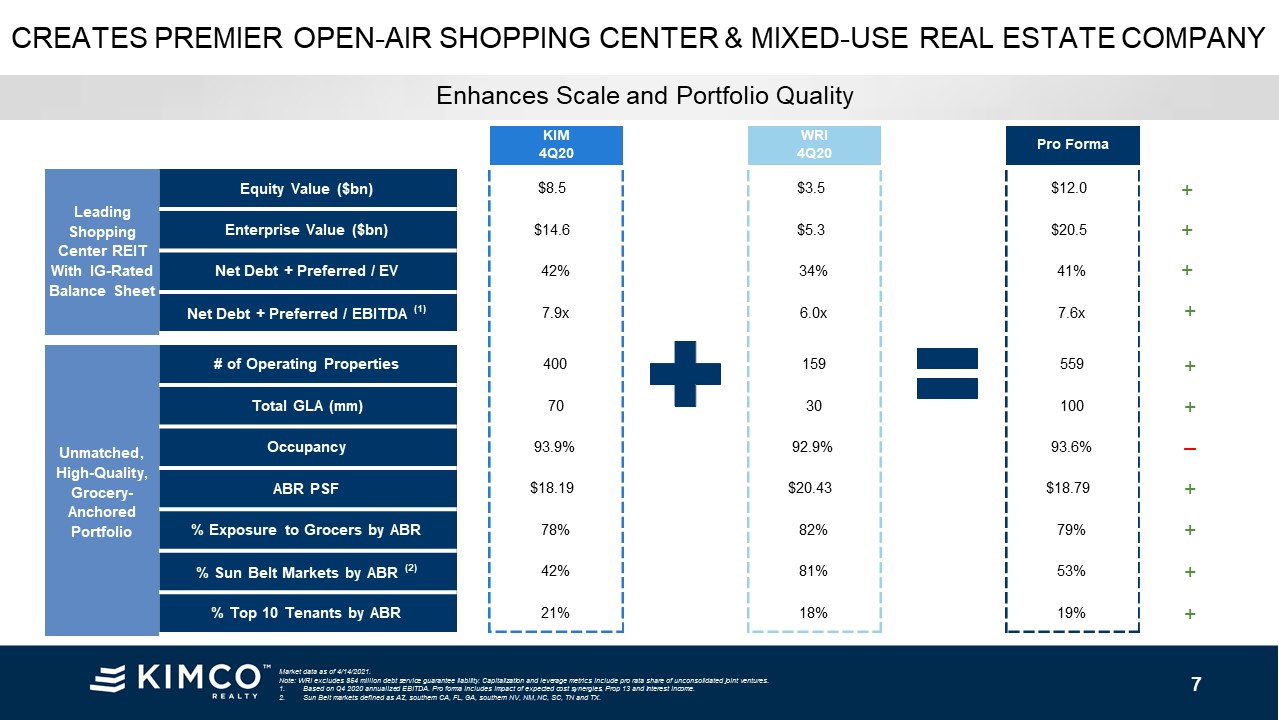

KIM4Q20 WRI4Q20 Pro

Forma $8.5 $3.5 $12.0 $14.6 $5.3 $20.5 42% 34% 41% 7.9x 6.0x 7.6x 400 159 559 70 30 100 93.9% 92.9% 93.6% $18.19 $20.43 $18.79 78% 82% 79% 42% 81% 53% Equity Value ($bn) Enterprise Value ($bn) Net Debt

+ Preferred / EV Net Debt + Preferred / EBITDA (1) # of Operating Properties Total GLA (mm) Occupancy ABR PSF % Exposure to Grocers by ABR % Sun Belt Markets by ABR (2) % Top 10 Tenants by ABR 21% 18% 19% Unmatched, High-Quality,

Grocery- Anchored Portfolio Leading Shopping Center REIT With IG-Rated Balance Sheet Enhances Scale and Portfolio Quality Market data as of 4/14/2021.Note: WRI excludes $54 million debt service guarantee liability. Capitalization and leverage

metrics include pro rata share of unconsolidated joint ventures. 1.2. Based on Q4 2020 annualized EBITDA. Pro forma includes impact of expected cost synergies, Prop 13 and interest income. Sun Belt markets defined as AZ, southern CA, FL, GA,

southern NV, NM, NC, SC, TN and TX. CREATES PREMIER OPEN-AIR SHOPPING CENTER & MIXED-USE REAL ESTATE COMPANY ++++ – ++ ++++ 7

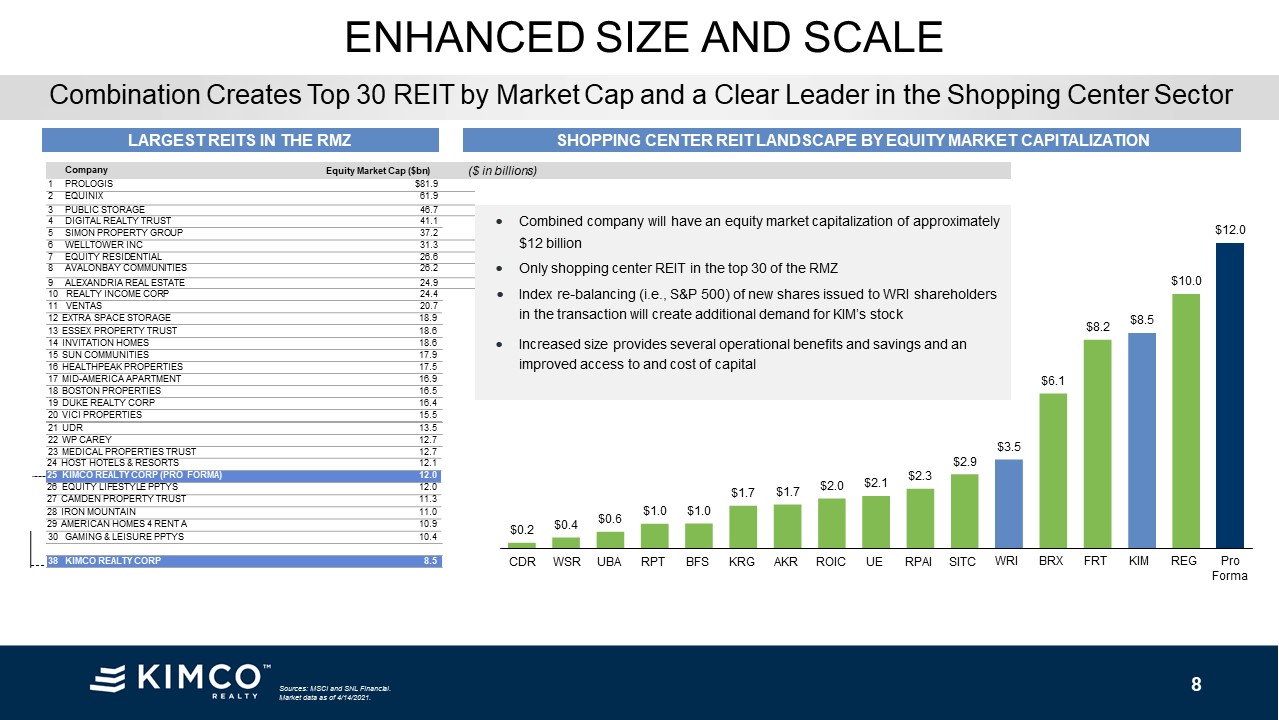

Combination Creates Top 30 REIT by Market Cap and a Clear Leader in the Shopping Center Sector Sources:

MSCI and SNL Financial. Market data as of 4/14/2021. ENHANCED SIZE AND SCALE LARGEST REITS IN THE RMZ SHOPPING CENTER REIT LANDSCAPE BY EQUITY MARKET CAPITALIZATION 12 EXTRA SPACE STORAGE 18.9 13 ESSEX PROPERTY TRUST 18.6 14

INVITATION HOMES 18.6 15 SUN COMMUNITIES 17.9 16 HEALTHPEAK PROPERTIES 17.5 17 MID-AMERICA APARTMENT 16.9 18 BOSTON PROPERTIES 16.5 19 DUKE REALTY CORP 16.4 20 VICI PROPERTIES 15.5 21 UDR 13.5 22 WP CAREY 12.7 23 MEDICAL

PROPERTIES TRUST 12.7 24 HOST HOTELS & RESORTS 12.1 25 KIMCO REALTY CORP (PRO FORMA) 12.0 26 EQUITY LIFESTYLE PPTYS 12.0 27 CAMDEN PROPERTY TRUST 11.3 28 IRON

MOUNTAIN 11.0 29 AMERICAN HOMES 4 RENT A 10.9 30 GAMING & LEISURE PPTYS 10.4 38 KIMCO REALTY CORP 8.5 $0.2 $0.4 $0.6 $1.0 $1.0 $1.7 $1.7 $2.0 $2.1 $2.3 $2.9 $3.5 $6.1 $8.2 $8.5 $10.0 $12.0 CDR

WSR UBA RPT BFS KRG AKR ROIC UE RPAI SITC WRI BRX FRT KIM REG ProForma Company Equity Market Cap ($bn) ($ in billions) 1 PROLOGIS $81.9 2 EQUINIX 61.9 3 PUBLIC STORAGE 46.7 4 DIGITAL REALTY TRUST 41.1 Combined company will

have an equity market capitalization of approximately 5 SIMON PROPERTY GROUP 37.2 6 WELLTOWER INC 31.3 $12 billion 7 EQUITY RESIDENTIAL 26.6 8 AVALONBAY COMMUNITIES 26.2 Only shopping center REIT in the top 30 of the RMZ 9

ALEXANDRIA REAL ESTATE 24.9 10 REALTY INCOME CORP 24.4 11 VENTAS 20.7 Index re-balancing (i.e., S&P 500) of new shares issued to WRI shareholders in the transaction will create additional demand for KIM’s stockIncreased size

provides several operational benefits and savings and animproved access to and cost of capital 8

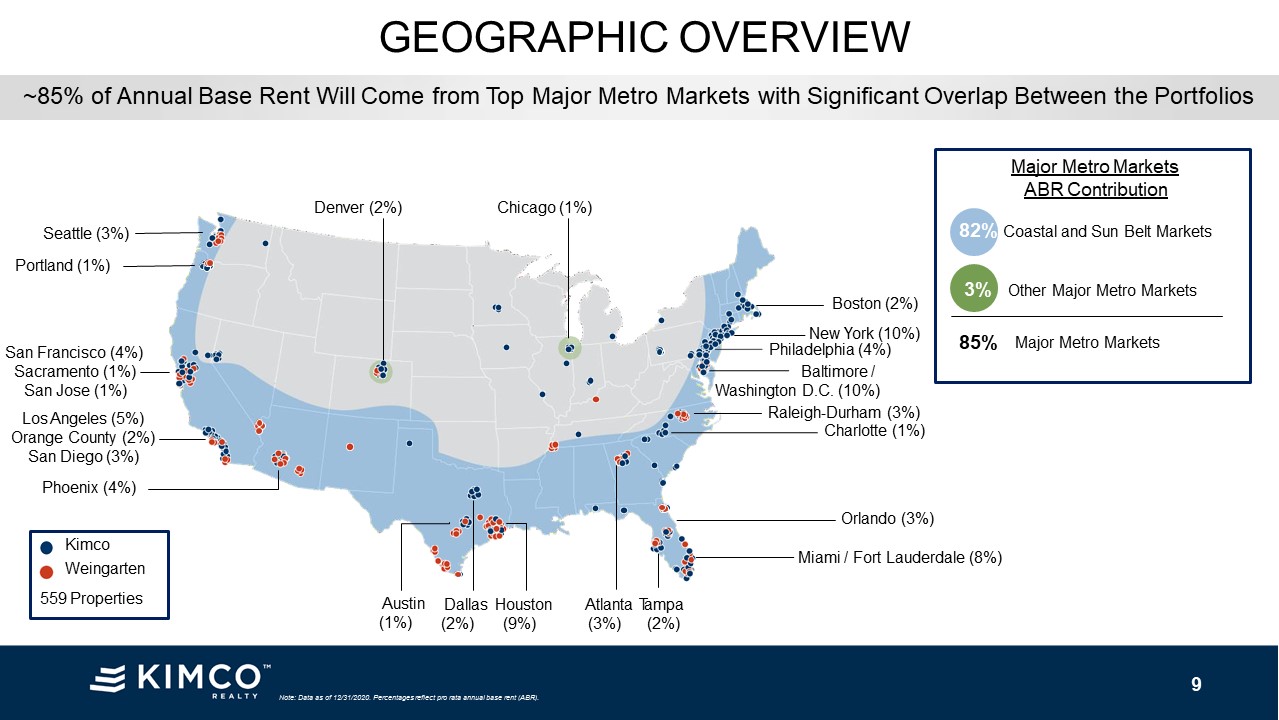

~85% of Annual Base Rent Will Come from Top Major Metro Markets with Significant Overlap Between the

Portfolios Note: Data as of 12/31/2020. Percentages reflect pro rata annual base rent (ABR). GEOGRAPHIC OVERVIEW San Francisco (4%) Sacramento (1%)San Jose (1%) Seattle (3%) Portland (1%) Los Angeles (5%)Orange County (2%)San Diego

(3%) Phoenix (4%) Denver (2%) Chicago (1%) Austin(1%) Dallas Houston Atlanta Tampa (2%) (9%) (3%) (2%) Miami / Fort Lauderdale (8%) Orlando (3%) Charlotte (1%) Boston (2%) New York (10%) Philadelphia (4%) Raleigh-Durham

(3%) Major Metro Markets ABR Contribution82% Coastal and Sun Belt Markets3% Other Major Metro Markets85% Major Metro Markets Baltimore / Washington D.C.

(10%) Kimco Weingarten559 Properties 9

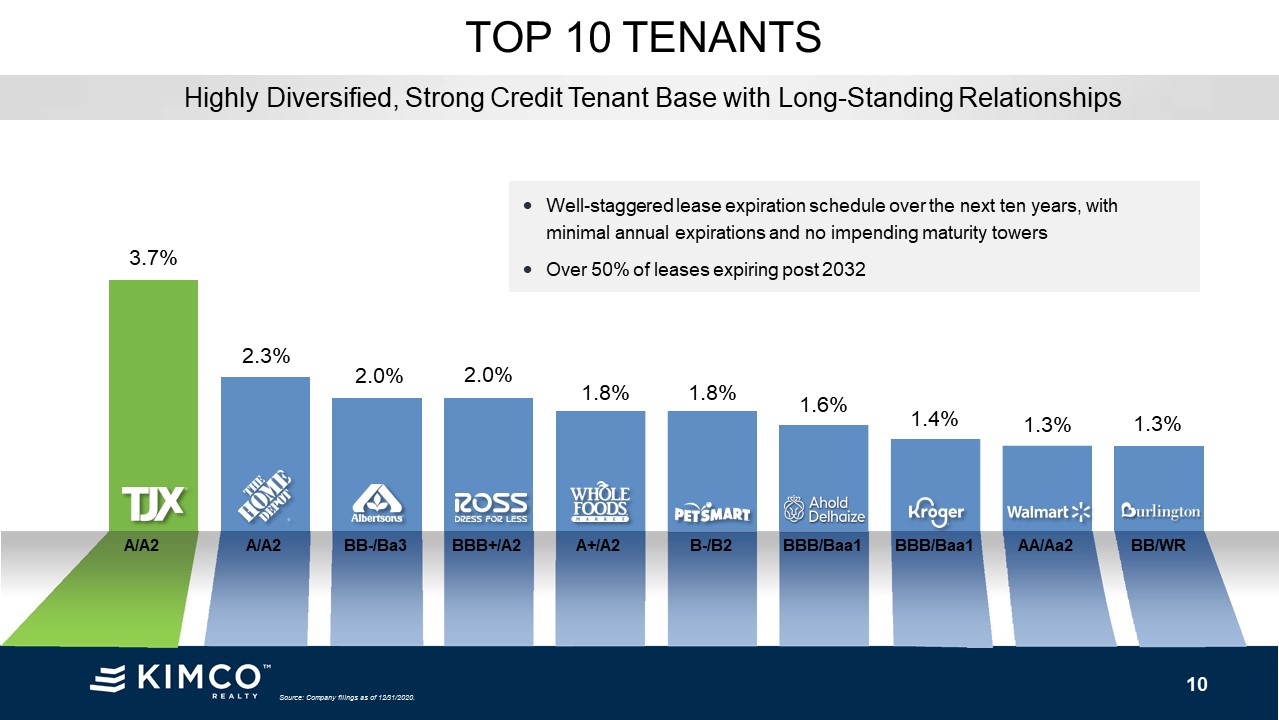

Highly Diversified, Strong Credit Tenant Base with Long-Standing Relationships Source: Company filings as

of 12/31/2020. TOP 10 TENANTS 3.7% 2.3% 2.0% 2.0% 1.8% 1.8% 1.6% 1.4% 1.3% 1.3% A/A2 A/A2 BB-/Ba3 BBB+/A2 A+/A2 B-/B2 BBB/Baa1 BBB/Baa1 AA/Aa2 BB/WR Well-staggered lease expiration schedule over the next ten

years, with minimal annual expirations and no impending maturity towersOver 50% of leases expiring post 2032 10

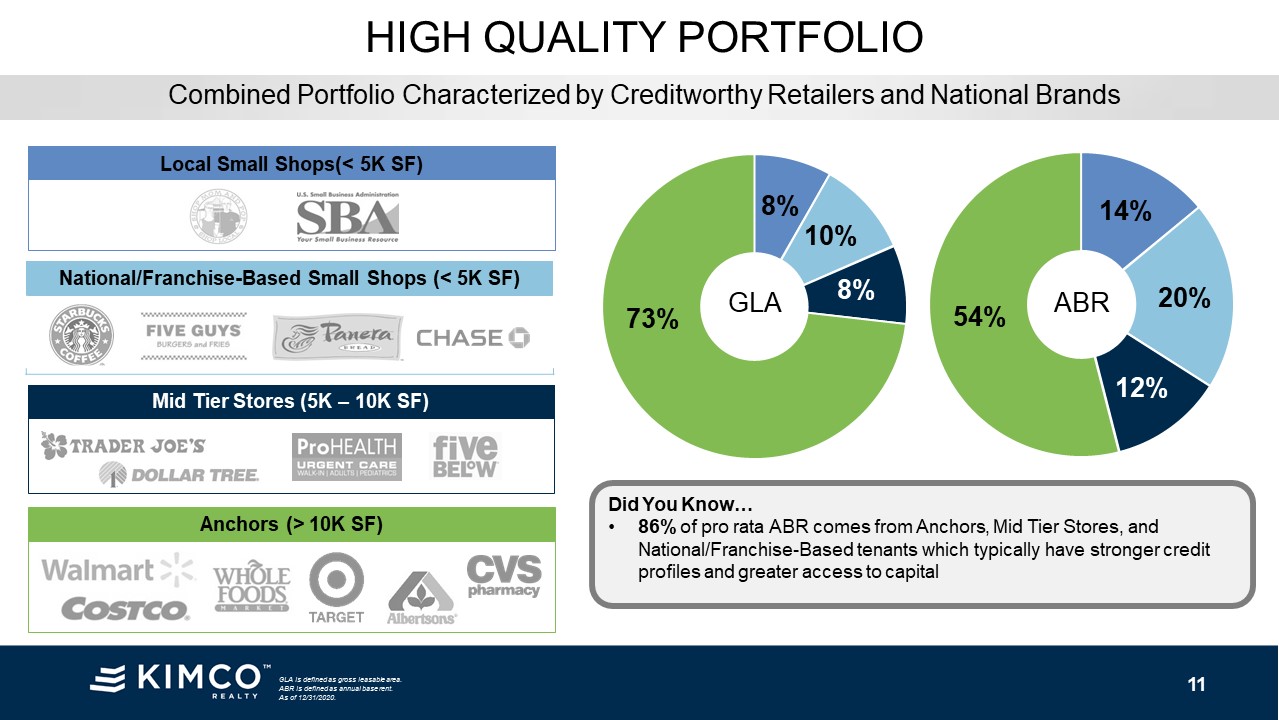

GLA is defined as gross leasable area. ABR is defined as annual base rent.As of 12/31/2020. HIGH QUALITY

PORTFOLIO Did You Know… 86% of pro rata ABR comes from Anchors, Mid Tier Stores, and National/Franchise-Based tenants which typically have stronger credit profiles and greater access to

capital 14% 20% 12% 54% Anchors (> 10K SF) Mid Tier Stores (5K – 10K SF) National/Franchise-Based Small Shops (< 5K SF) Combined Portfolio Characterized by Creditworthy Retailers and National

BrandsLocal Small Shops(< 5K SF) ABR GLA 8%10%8% 73% 11

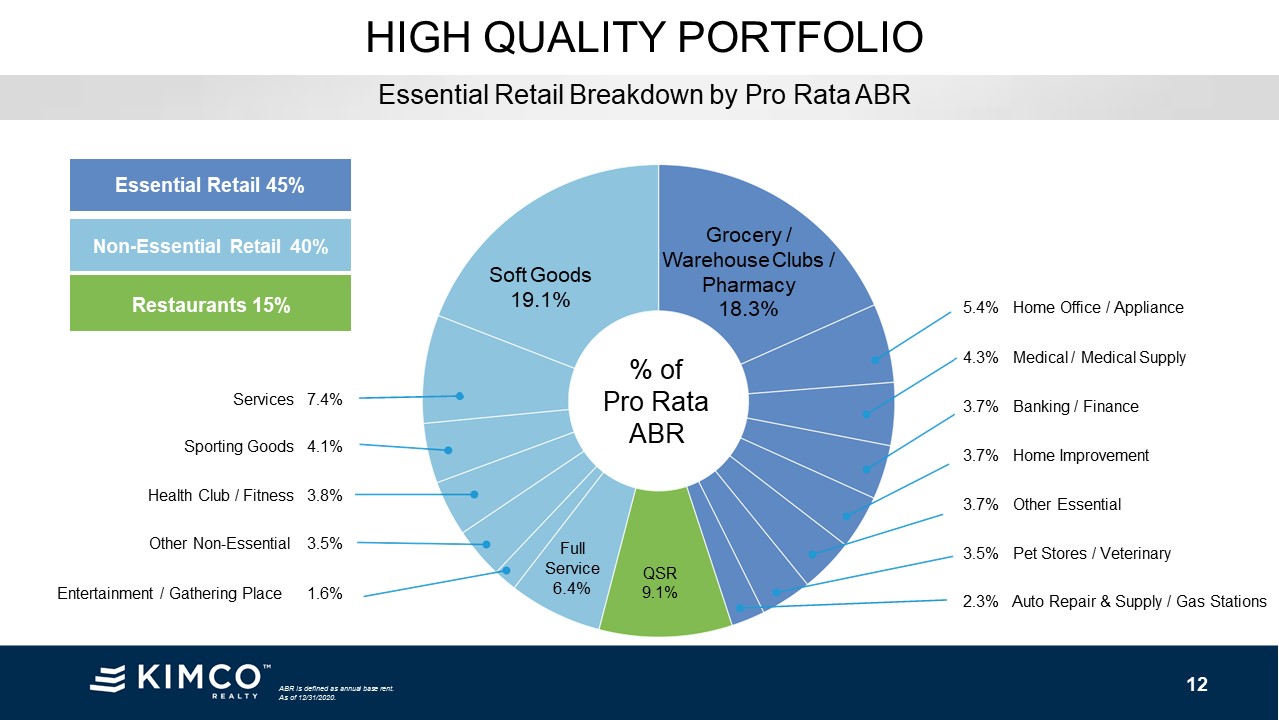

QSR 9.1% Full Service 6.4% Essential Retail Breakdown by Pro Rata ABR ABR is defined as annual base

rent. As of 12/31/2020. HIGH QUALITY PORTFOLIO Essential Retail 44% Non-Essential Retail42% Restaurants 14% 5.4% Home Office / Appliance 4.3% Medical / Medical Supply 3.7% Banking / Finance 3.7% Home Improvement 3.7% Other

Essential 3.5% Pet Stores / Veterinary 2.3% Auto Repair & Supply / Gas Stations Grocery / Warehouse Clubs / Pharmacy18.3% Entertainment / Gathering Place 1.6% Soft Goods19.1% Essential Retail 45%Non-Essential Retail

40% Restaurants 15% Services 7.4% Sporting Goods 4.1% Health Club / Fitness 3.8% Other Non-Essential 3.5% % of Pro RataABR 12

Weingarten’s Largely De-Risked, Mixed-Use Development Projects Will Drive Earnings Growth and Value

Creation MEANINGFUL NAV CREATION OPPORTUNITY Source: Company filings as of 12/31/2020. Project West Alex Centro Arlington The Driscoll at River Oaks Location Alexandria, VA Arlington, VA Houston,

TX Cost Incurred to Date $193M $129M $122M Estimated Final Cost $200M $135M $150M Anchor Tenants Harris Teeter (Kroger) Harris Teeter (Kroger) Kroger Retail 127,000 SF 72,000 SF (65,000

SF WRI Share) 11,000 SF Multifamily 278 Units 366 Units 318 Units Leasing 2020 Status Update Retail 82% signed with Harris Teeter expected to open in 2021 98% signed with Harris Teeter & some

shop space open Leasing activity has commenced Multifamily 46% signed as of 2/15/2021 89% signed as of 2/15/2021 47% signed as of 2/15/2021 13

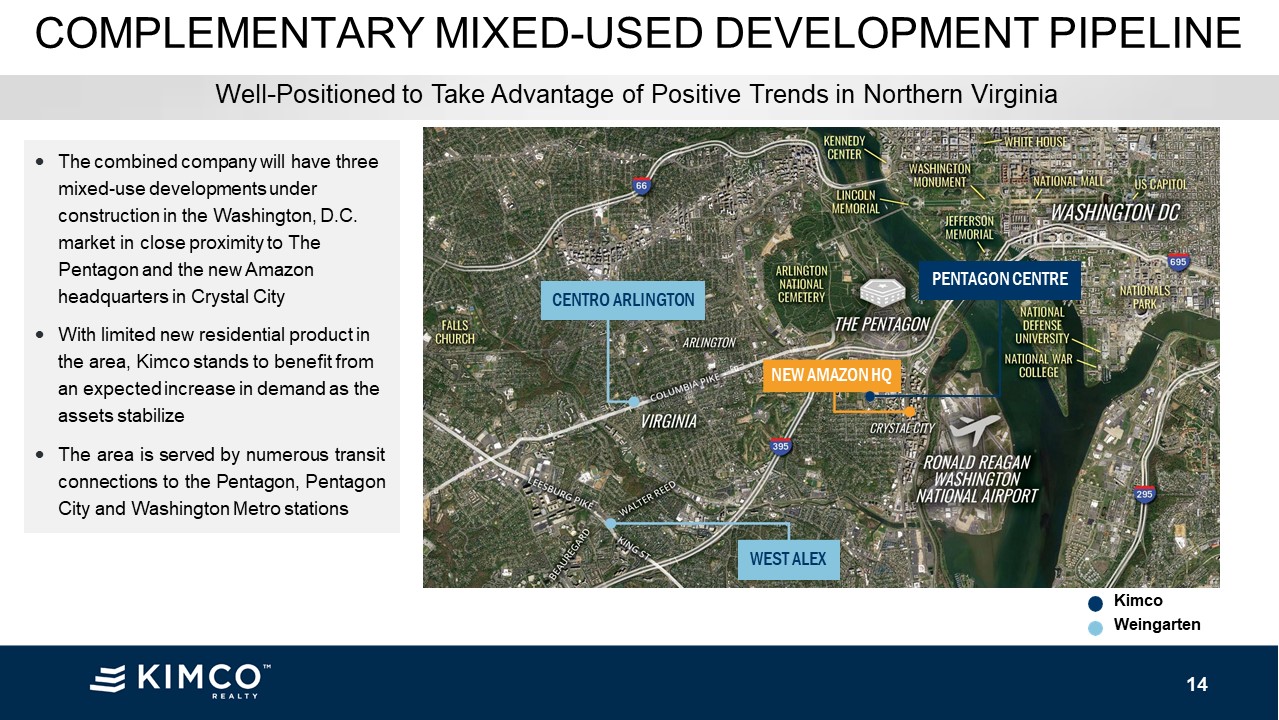

COMPLEMENTARY MIXED-USED DEVELOPMENT PIPELINE PENTAGON CENTRE Kimco Weingarten The combined company

will have three mixed-use developments under construction in the Washington, D.C. market in close proximity to The Pentagon and the new Amazon headquarters in Crystal CityWith limited new residential product in the area, Kimco stands to benefit

from an expected increase in demand as the assets stabilizeThe area is served by numerous transit connections to the Pentagon, Pentagon City and Washington Metro stations Well-Positioned to Take Advantage of Positive Trends in Northern

Virginia CENTRO ARLINGTON WEST ALEX NEW AMAZON HQ 14

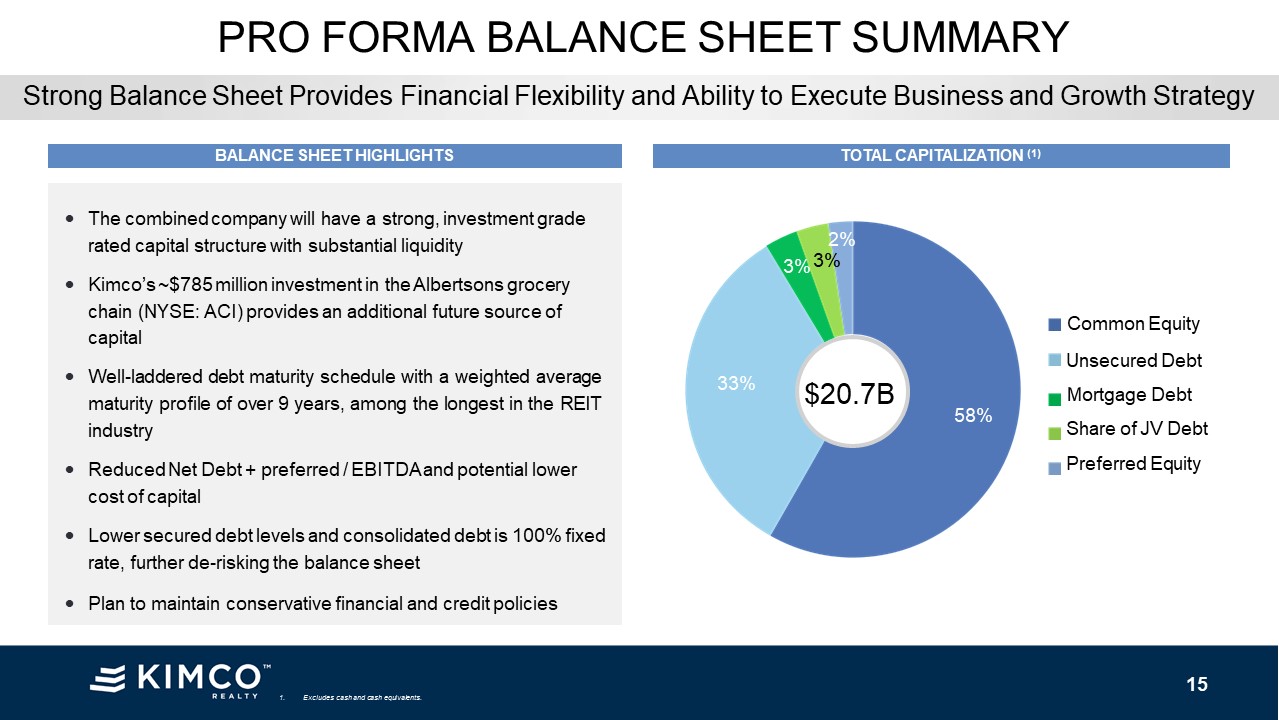

58% 33% 2%3% 3% Strong Balance Sheet Provides Financial Flexibility and Ability to Execute Business and

Growth Strategy PRO FORMA BALANCE SHEET SUMMARY $20.7B Common EquityUnsecured Debt Mortgage Debt Share of JV Debt Preferred Equity The combined company will have a strong, investment grade rated capital structure with substantial

liquidityKimco’s ~$785 million investment in the Albertsons grocery chain (NYSE: ACI) provides an additional future source of capitalWell-laddered debt maturity schedule with a weighted average maturity profile of over 9 years, among the longest

in the REIT industryReduced Net Debt + preferred / EBITDA and potential lower cost of capitalLower secured debt levels and consolidated debt is 100% fixed rate, further de-risking the balance sheetPlan to maintain conservative financial and

credit policies 1. Excludes cash and cash equivalents. BALANCE SHEET HIGHLIGHTS TOTAL CAPITALIZATION (1) 15

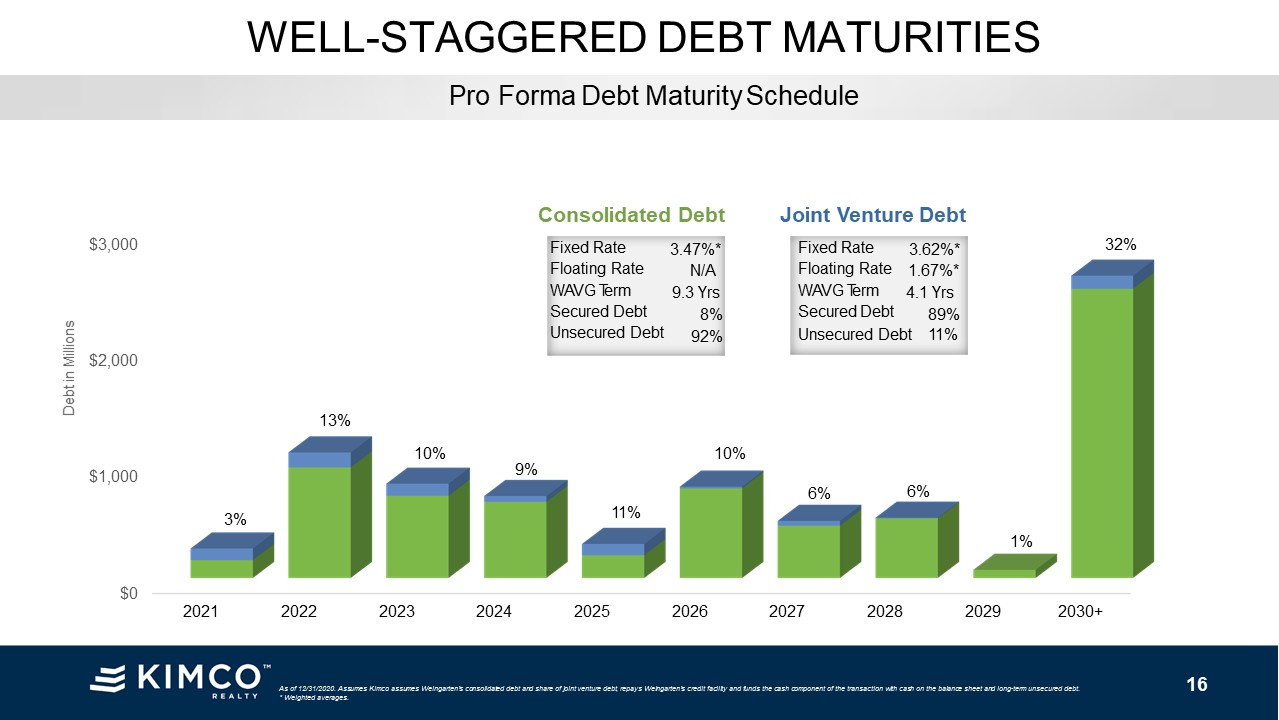

WELL-STAGGERED DEBT MATURITIES Pro Forma Debt Maturity

Schedule $0 $1,000 $2,000 $3,000 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030+ 3% 13% 10% 9% 11% 10% 6% 6% 1% Debt in Millions Consolidated Debt Joint Venture Debt Fixed Rate Floating Rate WAVG Term Secured

Debt 3.62%*1.67%*4.1 Yrs89% Unsecured Debt 11% Fixed Rate Floating Rate WAVG Term Secured Debt Unsecured Debt 3.47%*N/A9.3 Yrs8%92% 32% As of 12/31/2020. Assumes Kimco assumes Weingarten’s consolidated debt and share of joint venture debt,

repays Weingarten’s credit facility and funds the cash component of the transaction with cash on the balance sheet and long-term unsecured debt.* Weighted averages. 16

TRANSACTION HIGHLIGHTS NAV CREATIONIncrease net asset value (NAV) through combined mixed-use

development platform and sector- leading retailer relationships BENEFITS OF SCALE$20 billion pro forma enterprise value will facilitate access to capital and create economies of scale FINANCIAL STRENGTHImmediate earnings accretion with

substantial synergies while maintaining strong balance sheet PREMIER OPEN AIR SHOPPING CENTER & MIXED- USE REITThe transaction will create an unparalleled, grocery-anchored shopping center portfolio 17