Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BERKSHIRE HILLS BANCORP INC | tm2113048d1_8k.htm |

Exhibit 99.1

| SM 2020 SUMMARY ANNUAL REPORT TRANSFORMATION |

| Dear Shareholders, Customers, Employees, and Community Stakeholders: I am honored to be chosen to lead Berkshire Bank’s transformation to high performance in pursuit of enhancing value for all stakeholders. I appre- ciate our Board of Directors’ support and encouragement as I work with Berkshire’s leadership team to make strategic choices and implement corresponding initiatives to significantly improve our purpose-driven organization’s financial performance. Berkshire has a 175-year history of serving businesses and con- sumers from all walks of life. That heritage has helped Berkshire overcome many challenging moments. Moments that helped Berkshire adapt, move forward, and become a stronger company. This is one of those moments, and I firmly be- lieve that the organization’s collective focus on fulfilling our mission in our competitively differentiated way will strengthen us further to the benefit of all stake- holders. We are committed to making Berkshire better and stronger, faster. Berkshire is charting its path forward in a highly com- petitive, rapidly evolving banking environment in which the coronavirus pandemic has accelerated digital channel Nitin J. Mhatre Chief Executive Officer BETTER, STRONGER, FASTER TRANSFORMATION 1 2020 SUMMARY ANNUAL REPORT We are moving forward with collective passion, resolve, and confidence to prove that Berkshire’s purpose-driven, community-dedicated banking will enhance returns for all our stakeholders. |

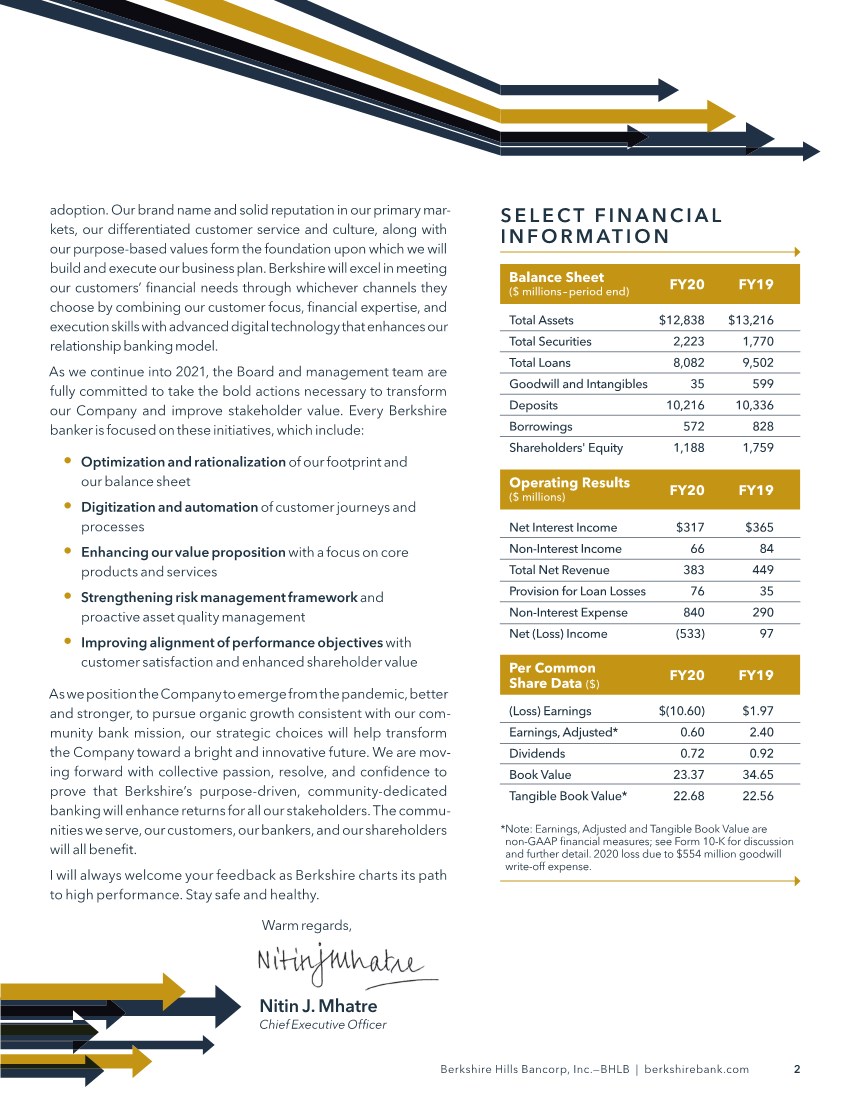

| adoption. Our brand name and solid reputation in our primary mar- kets, our differentiated customer service and culture, along with our purpose-based values form the foundation upon which we will build and execute our business plan. Berkshire will excel in meeting our customers’ financial needs through whichever channels they choose by combining our customer focus, financial expertise, and execution skills with advanced digital technology that enhances our relationship banking model. As we continue into 2021, the Board and management team are fully committed to take the bold actions necessary to transform our Company and improve stakeholder value. Every Berkshire banker is focused on these initiatives, which include: • Optimization and rationalization of our footprint and our balance sheet • Digitization and automation of customer journeys and processes • Enhancing our value proposition with a focus on core products and services • Strengthening risk management framework and proactive asset quality management • Improving alignment of performance objectives with customer satisfaction and enhanced shareholder value As we position the Company to emerge from the pandemic, better and stronger, to pursue organic growth consistent with our com- munity bank mission, our strategic choices will help transform the Company toward a bright and innovative future. We are mov- ing forward with collective passion, resolve, and confidence to prove that Berkshire’s purpose-driven, community-dedicated banking will enhance returns for all our stakeholders. The commu- nities we serve, our customers, our bankers, and our shareholders will all benefit. I will always welcome your feedback as Berkshire charts its path to high performance. Stay safe and healthy. Warm regards, Nitin J. Mhatre Chief Executive Of ficer * Note: Earnings, Adjusted and Tangible Book Value are non-GAAP financial measures; see Form 10-K for discussion and further detail. 2020 loss due to $554 million goodwill write-off expense. SELECT FINANCIAL INFORMATION $(10.60) 0.60 0.72 23.37 22.68 $1.97 2.40 0.92 34.65 22.56 (Loss) Earnings Earnings, Adjusted* Dividends Book Value Tangible Book Value* FY20 FY19 Per Common Share Data ($) $317 66 383 76 840 (533) $365 84 449 35 290 97 Net Interest Income Non-Interest Income Total Net Revenue Provision for Loan Losses Non-Interest Expense Net (Loss) Income Operating Results ($ millions) FY20 FY19 Total Assets Total Securities Total Loans Goodwill and Intangibles Deposits Borrowings Shareholders' Equity $12,838 2,223 8,082 35 10,216 572 1,188 $13,216 1,770 9,502 599 10,336 828 1,759 Balance Sheet ($ millions – period end) FY20 FY19 2 Berkshire Hills Bancorp, Inc.—BHLB | berkshirebank.com |

| BERKSHIRE BANK’S MISSION to provide relationship-based community banking is as relevant today as when we were founded in 1846. Our core service markets became national disease hotspots ear- ly in the pandemic, with mandatory shuttering of most societal and economic activity in March 2020. Conditions improved in the third quarter, but another wave of COVID-19 cases slowed improve- ment, and economic conditions remained stressed through 2020. Changes in the Company’s financial situation and re- sults were primarily due to the pandemic and the changes in financial market conditions and economic expectations. During this time, Berkshire prioritized our employees, customers, and communities’ health, safety, and eco- nomic resilience as we answered the call for help. We assisted employees by launching the You FIRST employee assistance fund, providing additional paid sick time, premium pay for on-site staff, and flexible work schedules for remote employees. Additionally, Berkshire provided communities we serve with $1 million in COVID-19 relief grants through our Foundation, including $500 thousand directed to- ward small business assistance. Further, Berkshire adjusted its business model to man- age pandemic-related impacts to operations, customers, and operating profitability. We modified branch hours and proactively provided options for payment deferrals. Our participation in government-backed relief programs, including the Paycheck Protection Program (PPP), origi- nated $708 million in round one. We continue to closely manage COVID-19-sensitive commercial borrowers with a primary focus on our hospitality and Firestone Financial customers. As conditions gradually normalize in 2021, Berkshire will pursue organic growth consistent with its community bank mission. 175 YEARS O F ANSWERING THE CALL SUMMIT MARKETING EFFECTIVENESS AWARDS PLATINUM All Wallets Welcome Campaign SILVER Online Banking Campaign AWARDS For a complete list, scan below to learn more: 3 2020 SUMMARY ANNUAL REPORT |

| THE COMPANY RECORDED a noncash loss in 2020 due to the pandemic including a charge to goodwill from past bank mergers. Net cash provided by operating activities increased and regulatory capital measures continued to improve. Net interest income, our primary source of income, decreased. In response, management and our fully engaged Board of Directors took bold actions to transform our Company and improve stakeholder value. That review and strategy emphasizes improving core operating performance with a relationship banking model that serves our communities and clients. Our brand name and solid reputation in our primary markets, differentiated customer service and culture, and purpose-based values form the foundation upon which Berkshire will build and execute its business plan to improve the organization’s financial performance. Concluding the review process, the Board sought to hire a new CEO with a proven track record in banking to support the bank’s refinement and execution of its strategic choices. Following an extensive national search process, Berkshire’s Board chose Nitin J. Mhatre to lead the Company based on his decades of experience driving growth and profitability in community and global banks; proven leadership qualities in a range of roles building customer-centric cultures; commitment to technology-driven innovation and digital transformation; and his vision, passion, and integrity. Berkshire is confident about these initiatives and positioning as the Company emerges from the pandemic. The Board of Directors and Management team are focused on the return it is earning on capital and the best allocation of that capital. The first focus is on using capital wisely to support the franchise. We expect to resume organic growth as we deepen our relationships in our core footprint, and we will prioritize capital for that purpose. Returning capital to shareholders will remain an essential consideration of our strategy—including maintaining a competitive dividend and evaluating stock buybacks based on our assessment of the environment and market and regulatory factors. FOCUS ON OUR STRATEGIC CHOICES The emergence of the COVID-19 pandemic highlighted community banking’s vital role answering the call for all our stakeholders. 4 Berkshire Hills Bancorp, Inc.—BHLB | berkshirebank.com |

| BERKSHIRE IS CHARTING its path forward in a highly competitive, rapidly evolving bank- ing environment in which the coronavirus pandemic has accelerated digital channel adoption. Our digitization and automation roadmap is a key component of our strategic focus. In 2020, Berkshire Bank upgrad- ed the technology we rely on to serve our customers and support our operations. We launched a best-in-industry mobile deposit account open- ing platform, upgraded call center technology, rolled out e-signature platforms, and completed enterprise deployment of Salesforce CRM to help operations teams efficiently track data for customer needs. Our customers adapted to the new environment by in- creasing mobile and online banking adoption and leveraging our Interactive Teller Machines. We completed the wind-down of our national mortgage banking operation, exited our indirect automobile lending business, and further reduced non-strategic portfolios acquired in the past, such as our private aircraft lending portfolio. These shifts allow us to focus on core products and services to enhance relationships and customer expe- rience. The MyBanker program, which provides personalized banking services to everyone, regardless of income, at no cost, is a crucial part of our omnichannel approach to community banking. To further optimize our banking footprint and respond to changes in cus- tomer behavior, we announced the planned sale of our eight New Jersey and Pennsylvania offices and are on track to complete this transaction by mid-year 2021. We also announced plans to consolidate 16 branch- es in our New England and New York markets to strengthen the franchise further. We are targeting strong deposit retention due to our branch footprint, flexible MyBanker team, and long history of successfully executing consolidations. In addition to reshaping our branch network, the Company is pursuing possibilities for identifying and releasing surplus corporate real estate and making other operational adjustments to its business model to formalize cost-saving op- portunities arising from the remote work environment. Our continued focus on our New England and New York markets allows us to deepen our engagement in our communities. We appointed two additional Regional Presidents to join the existing team of regional leaders. They will help drive collaboration across busi- ness lines to deepen relationships and improve profitability. In 2020, we established Regional Advisory Councils in each market to bring together local leaders and their collective insights on the local economies. These steps will allow Berkshire to excel in meeting our customers’ financial needs through whichever chan- nels they choose by combining our customer focus, financial expertise, and execution skills with advanced digital technology that enhances our rela- tionship banking model. TRANSFORMING T H E COMMUNITY BANK MODEL TO STRENGTHEN THE FRANCHISE 5 2020 SUMMARY ANNUAL REPORT |

| A PART OF OUR VALUE PROPOSITION as a community bank is our commitment to purpose, values, and social responsibility. Our Be FIRST culture is integrated throughout our business. We strive to cultivate a culture of authenticity and actively build a community composed of members who bring diversity in their background, culture, and life experiences. We embrace equity, inclusion, and social justice as pillars of excellence critical to community well-being and organizational growth. To bring those beliefs to life, we enhanced our diversity, equity, and inclusion training for employees, completed a gap analysis to improve the impact of existing programs, named a Chief Human Resources and Culture Officer, and enhanced our commitment to gender equity. Half of those holding the title of Regional President and nearly 50% of our executive management positions at Berkshire are held by women. We strengthened our commitment to our employees by launching the You FIRST Employee Assistance Fund to help those impacted by financial hardships, developing a new Employee Mentoring Program, and completing a pay equity analysis that ensures equitable compensation. The pandemic highlighted the need for increased protection to those experiencing gender-based violence so we enhanced our existing Domestic Violence Policy, providing 15 days paid leave to employees. In communities, we provided philanthropic investments of $4 million, and our XTEAM employee volunteer program stepped up to answer the call to help many in our neighborhoods. As a result of our collective efforts, the Human Rights Campaign Corporate Equality Index awarded Berkshire a perfect score in 2020. Additionally, we were recognized for our impact with the Inspiring Workplaces Award for Diversity & Inclusion, Communitas Award for Leadership in Corporate Social Responsibility, and were listed in the Bloomberg Gender-Equality Index for the second consecutive year. We invite you to learn more about all the ways we are a socially responsible and values-driven community bank in this year’s corporate responsibility report: Meaningful Moments: Answering the Call available online at berkshirebank.com/csr PURPOSE AND VALUES GUIDED Berkshire employees answer the call to assist our communities through our award-winning XTEAM Employee Volunteer Program. BELONGING fosters an environment where all relationships matter FOCUSING on a positive attitude and everything else will follow INCLUSION invites openness and builds belonging RESPECT cultivates an unyielding commitment to integrity and responsibility SERVICE quality should be delivered regardless of income or wealth TEAMWORK empowers collaboration and cooperation 6 Berkshire Hills Bancorp, Inc.—BHLB | berkshirebank.com |

| ANSWERING THE CALL 8 6, 411 68% WOMEN IN MANAGEMENT $708MM HELPED WITH FINANCIAL EDUCATION PROGRAMMING IN PPP LOANS TO HELP OVER 5,000 CUSTOMERS 80% We’re proud to support a culture of equity and inclusion in our workplace and communities. $12.8 Billion in Assets • Boston headquartered regional community bank with $12.8 billion in assets • Branch locations primarily in New England and New York • Retail banking, commercial banking, insurance, and wealth management CORPORATE PROFILE 7 2020 SUMMARY ANNUAL REPORT • New transformational leadership focused on performance improvement • Differentiated purpose-based Be FIRST culture with prominent ESG focus • Optimizing branch footprint and positioning in desirable New England and upstate New York markets • Increasing digitization and automation using leading technology and personal MyBankers • Maintaining solid risk management and strong capital footings INVESTMENT CONSIDERATIONS |

| 2020 FOUNDATION HIGHLIGHTS 40% increase in philanthropic funding from the prior year 40% Foundation donated a record $4 million to more than 500 organizations in 2020 $4 million Over the past 10 years, Berkshire’s Foundation provided approximately $21 million to organizations and communities $21 million 8 Berkshire Hills Bancorp, Inc.—BHLB | berkshirebank.com |

| LEADERSHIP TEAM Nitin J. Mhatre Chief Executive Officer Sean A. Gray President and Chief Operating Officer Subhadeep Basu SEVP, Chief Financial Officer George F. Bacigalupo SEVP, Head of Commercial Banking Jennifer Carmichael EVP, Chief Internal Audit Officer Jacqueline Courtwright EVP, Chief Human Resources and Culture Officer Tami M. Gunsch SEVP, Head of Consumer Banking Gregory D. Lindenmuth SEVP, Chief Risk Officer Georgia Melas EVP, Chief Credit Officer Wm. Gordon Prescott EVP, General Counsel and Corporate Secretary Deborah A. Stephenson SEVP, Compliance and Regulatory Jason T. White EVP, Chief Information Officer 9 2020 SUMMARY ANNUAL REPORT |

| BOARD OF DIRECTORS J. Williar Dunlaevy Chairperson of the Board, Former Chairman and CEO of Legacy Bancorp, Inc. and Legacy Banks David M. Brunelle Vice Chairperson of the Board, Managing Director of North Point Wealth Management Baye Adofo-Wilson, Esq. CEO BAW Development, LLC Rheo A. Brouillard Former President and Chief Executive Officer of SI Financial Group, Inc and Savings Institute Bank & Trust Robert M. Curley Berkshire Bank New York Chairman, Former Chairman and President for Citizens Bank in New York John B. Davies Former Executive Vice President of Massachusetts Mutual Life Insurance Company William H. Hughes III Founder and President of Open4 Learning Cornelius D. Mahoney Former Chairman, President and CEO of Woronoco Bancorp, Inc. and Woronoco Savings Bank Dr. Sylvia Maxfield Dean of the Providence College School of Business Nitin J. Mhatre Chief Executive Officer of Berkshire Hills Bancorp, Inc. Laurie Norton Moffatt Director and CEO of the Norman Rockwell Museum Jonathan I. Shulman Former EVP and Treasurer Keycorp D. Jeffrey Templeton Owner and President of The Mosher Company, Inc. For more information, see our Corporate Responsibility Report berkshirebank.com/csr SM MEANINGFUL MOMENTS ANSWERING THE CALL 2020 CORPORATE RESPONSIBILITY REPORT 10 Berkshire Hills Bancorp, Inc.—BHLB | berkshirebank.com |

| This document contains forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995). There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire’s most recently filed reports on Forms 10-K and 10-Q, which are available on the SEC’s website at www.sec.gov. Berkshire does not undertake any obligation to update forward-looking statements. Banking products are provided by Berkshire Bank: Member FDIC. Equal Housing Lender. Berkshire Bank is a Massachusetts chartered bank. Insurance and investment products as well as investment securities and obligations of Berkshire Hills Bancorp, Inc. are NOT FDIC-INSURED, are NOT A BANK DEPOSIT, NOT GUARANTEED BY THE BANK, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY and MAY LOSE VALUE. CORPORATE OFFICES Berkshire Hills Bancorp, Inc. 60 State Street Boston, MA 02109 800.773.5601 berkshirebank.com STOCK LISTING Berkshire Hills Bancorp, Inc., is listed on the New York Stock Exchange under the symbol “BHLB.” INVESTOR INFORMATION Investor Relations Attn: Kevin Conn Berkshire Hills Bancorp, Inc. 617.641.9206 investorrelations@berkshirebank.com ir.berkshirebank.com TRANSFER AGENT AND REGISTRAR Shareholders who wish to change the name, address, or ownership of stock, report lost stock certificates, inquire about the Dividend Reinvestment Plan, or consolidate stock accounts should contact: Broadridge Corporate Issuer Solutions, Inc. P.O. Box 1342 Brentwood, NY 11717 844.458.9357 shareholder@broadridge.com shareholder.broadridge.com/bhlb |