Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - AMERICAN EDUCATION CENTER, INC. | tm2037997d1_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - AMERICAN EDUCATION CENTER, INC. | tm2037997d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - AMERICAN EDUCATION CENTER, INC. | tm2037997d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERICAN EDUCATION CENTER, INC. | tm2037997d1_ex31-2.htm |

| EX-21.1 - EXHIBIT 21.1 - AMERICAN EDUCATION CENTER, INC. | tm2037997d1_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 333-201029

| AMERICAN EDUCATION CENTER INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 38-3941544 | |

| (State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

1 Rockefeller Plaza, 10th floor New York, NY |

10020 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (646) 722-2931

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standard provided pursuant to Section 13(a) of the Exchanger Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant as of December 31, 2020 (the last business day of the Registrant’s most recently completed fiscal year) was $5,127,000.

As of April 15, 2021, the registrant had 56,497,113 shares of common stock issued and outstanding.

TABLE OF CONTENTS

EXPLANATORY NOTE

Throughout this Annual Report on Form 10-K, the “Company”, “we,” “us,” and “our,” refer to (i) American Education Center, Inc., a Nevada corporation (“AEC Nevada”); (ii) American Education Center, Inc., a New York corporation (“AEC New York”) and its subsidiary; (iii) AEC Southern Management Co., Ltd, a company formed pursuant to the laws of England and Wales (“AEC Southern UK”), before it ceased to be an indirect wholly owned subsidiary of AEC Nevada on May 1, 2019 pursuant to a sale; and (iv) AEC Management Ltd., a British Virgin Islands company (“AEC BVI”) and the subsidiaries of BVI, unless otherwise indicated or the context otherwise requires.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements (as such term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). The statements herein which are not historical reflect our current expectations and projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our management and our interpretation of what we believe to be significant factors affecting our business, including many assumptions about future events. Such forward-looking statements include statements regarding, among other things:

| · | our ability to deliver, market and generate sales of our advisory services; | |

| · | our ability to develop and/or introduce new advisory services; | |

| · | our projected revenues, profitability and other financial metrics; | |

| · | our future financing plans; | |

| · | our anticipated needs for working capital; | |

| · | the anticipated trends in our industry; | |

| · | our ability to expand our sales and marketing capability; | |

| · | acquisitions of other companies or assets that we might undertake in the future; | |

| · | competition existing today or that will likely arise in the future; | |

| · | global or national health concerns, including the outbreak of epidemic or contagious diseases such as the COVID-19 epidemic; and | |

| · | other factors discussed elsewhere herein. |

Forward-looking statements, which involve assumptions and describe our plans, strategies, and expectations, are generally identifiable by use of the words “may,” “should,” “will,” “plan,” “could,” “target,” “contemplate,” “predict,” “potential,” “continue,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these or similar words. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements because of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue the Company’s operations. These statements may be found under Part II, Item 7- “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as elsewhere in this Annual Report on Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, matters described in this Annual Report on Form 10-K.

In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report on Form 10-K will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. Such statements are presented only as some guide about future possibilities and do not represent assured events, and we anticipate that subsequent events and developments will cause our views to change. You should, therefore, not rely on these forward-looking statements as representing our views as of any date after the date of this Annual Report on Form 10-K.

This Annual Report on Form 10-K also contains estimates and other statistical data prepared by independent parties and by us relating to market size and growth and other data about our industry. These estimates and data involve a number of assumptions and limitations, and potential investors are cautioned not to give undue weight to these estimates and data. We have not independently verified the statistical and other industry data generated by independent parties and contained in this Annual Report on Form 10-K. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk.

Potential investors should not make an investment decision based solely on our projections, estimates or expectations.

Overview

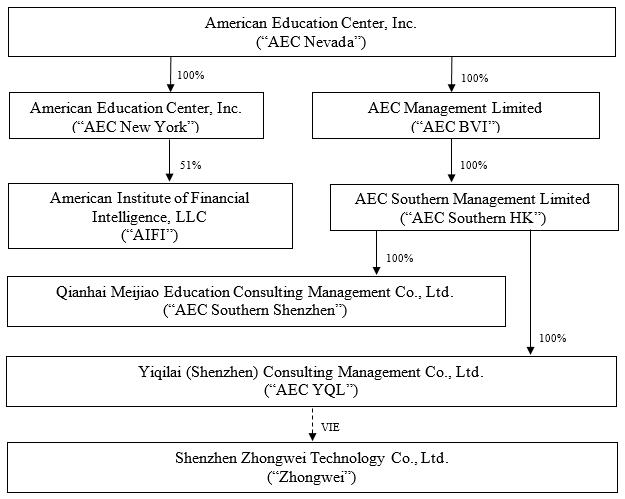

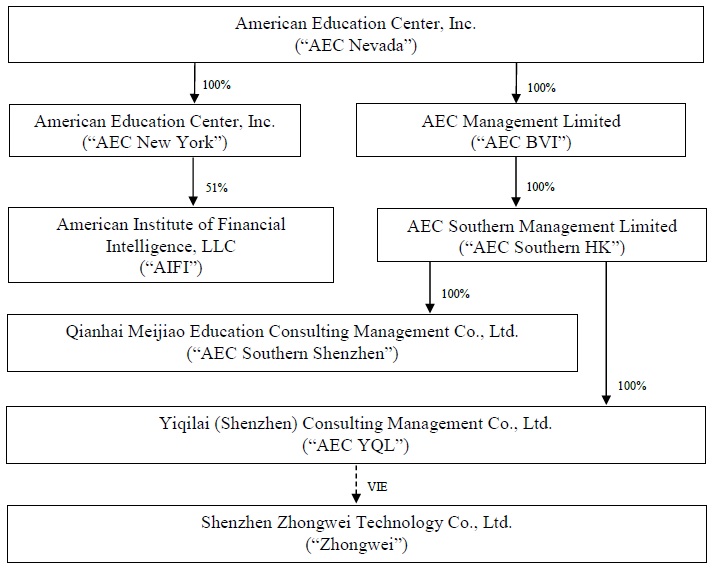

American Education Center Inc. (“AEC Nevada”) was incorporated in Nevada in May 2014 as a holding company. AEC Nevada operates through its wholly owned subsidiaries, American Education Center, Inc., incorporated in the State of New York in 1999 (“AEC New York”), and AEC Management Ltd., incorporated in the British Virgin Islands on October 23, 2018 (“AEC BVI”), and the subsidiaries of AEC BVI.

AEC New York was approved and licensed by the Department of the State of New York in 1999 to engage in education consulting service between the U.S. and the People’s Republic of China (the “PRC”). For more than 20 years, AEC New York has devoted itself to international education exchange between China and the U.S., by providing education and career enrichment opportunities for students, teachers, and educational institutions from both countries.

AEC Nevada acquired AEC Southern UK and its subsidiaries in 2016 pursuant to the Share Exchange Agreement (as defined below). AEC Southern UK holds 100% of the equity interests in AEC Southern Management Limited, a Hong Kong company (“AEC Southern HK”) incorporated on December 29, 2015, with a registered capital of HK$10,000. AEC Southern UK owns 100% of the equity interests in Qianhai Meijiao Education Consulting Management Co., Ltd. (“AEC Southern Shenzhen”), a foreign wholly owned subsidiary incorporated pursuant to PRC law on March 29, 2016, with a registered capital of RMB5,000,000.

AEC BVI acquired AEC Southern HK and its subsidiary, AEC Southern Shenzhen, on April 22, 2019 pursuant to a share transfer agreement by and among the related parties, AEC BVI and AEC Southern UK, for a nominal consideration (the “AEC Southern HK Transfer”). Pursuant to a certain share exchange agreement dated May 1, 2019, AEC Nevada sold 100% of the equity interest in AEC Southern UK, on May 1, 2019, to three individuals, Ye Tian, Rongxia Wang and Weishou Li (the “AEC Southern UK Sale”). Thereafter, AEC Southern UK ceased to be a subsidiary of AEC Nevada. AEC Southern HK formed Yiqilai (Shenzhen) Consulting Management Co., Ltd. (“AEC YQL”) in Shenzhen, China on May 22, 2020 pursuant to PRC laws. AEC YQL is a wholly owned subsidiary of AEC Southern HK, and as of the date of this annual report, it does not have significant business activities.

AEC YQL gained control over Shenzhen Zhongwei Technology Co., Ltd. (“Zhongwei”), a PRC company from Ding Xiang (Shenzhen) Investment Co., Ltd., a PRC company, through VIE Agreements (defined hereinafter) on August 18, 2020. Zhongwei is involved in, among other things, e-commerce, and our company plans to leverage Zhongwei’s current e-commerce platform, and to engage in business such as online education e-commerce. In consideration for entering into the transactions contemplated by the VIE Agreements, on August 18, 2020, the Company entered into a Share Issuance Agreement (the “Share Issuance Agreement”) with the shareholders of Ding Xiang (Shenzhen) Investment Co., Ltd. (“Zhongwei Ultimate Shareholders”), whereby the Company agreed to issue to the Ding Xiang Shareholders an aggregate of 2,640,690 shares of the Company’s common stock, par value $0.001. The transactions underlying the Share Issuance Agreement closed in August 2020.

AEC BVI, via its operating entity in the PRC, AEC Southern Shenzhen, serves as a local platform for expanding the Company’s business in mainland China. Our PRC operations are based in the city of Shenzhen, Guangdong province, a city designated by the PRC as a Special Economic Zone (“SEZ”). SEZs are granted a more free-market oriented economic and regulatory environment, with business and tax policies designed to attract foreign investment and technology.

Our mission is to become a leading provider of international education services, and to provide total solutions for technology in education field.

Currently, we provide four types of consulting services:

| · | Placement Advisory Services; | |

| · | Career Advisory Services; | |

| · | Student & Family Advisory Services; and | |

| · | Other Advisory Services. |

Services to our clients are provided through the Company’s principal executive office in New York, NY and AEC Southern Shenzhen’s office in Shenzhen, which is shared with Zhongwei, China.

Leveraging our knowledge of and access to the education system and environment in the U.S., our understanding of China’s market demand for overseas education services and the evolving economy in China, we specialize in the delivery of customized high school and college placement advisory services as well as career advisory services to Chinese students wishing to study and gain post-graduate work experience in the U.S. Our advisory services are specifically designed to address the educational needs of the rising middle-class families in China. The demand for our advisory services is primarily the result of China’s decades-long one-child policy, society’s focus and emphasis on children’s education, and families’ desire to gain access to U.S. colleges and universities as well as work experience in the U.S.

Our total revenues for the fiscal years ended December 31, 2020 and 2019 were $ 342,499 and $5,308,412, respectively. For the fiscal year ended December 31, 2019, a vast majority of the revenue was from student advisory services in the U.S., delivered by AEC New York, which accounted for approximately 97.7% of our total revenue. Similarly, for the fiscal year ended December 31, 2020, revenue from student advisory services in the U.S., delivered by AEC New York, accounted for approximately 69.2% of our total revenue. Our strategy is to continue to strengthen localized services provision for students in the U.S. and continue to expand the U.S. market. We have already formulated and are in the process of implementing this multi-stage growth plan by marketing on various media platforms. Based in Shenzhen, we are also promoting localized services for Chinese students through various social media. For the U.S. market, besides the previous plans, we are continually monitoring the development of the COVID-19 epidemic as well as the impact on our operations and financial performance and actively adjusting our operational and marketing strategies. For the China market, we have been expanding our services in China through the platform of Zhongwei ever since we gained control power over Zhongwei through variable interest entity arrangement. As of the date of this report, the Zhongwei platform is still in trial operation stage. For detailed information on marketing strategies and growth plans targeting to grow our advisory services in the U.S., please refer to the section entitled “Item 1. Business—Our Marketing Strategies” and “Item 1. Business—Our Growth Strategy.”

1

Share Exchange with AEC Southern Management Co. Ltd

On November 8, 2016, AEC Nevada, AEC Southern UK, Ye Tian (“Tian”), Rongxia Wang (“Wang”) (Tian and Wang, owners of record of 100% equity interests of AEC Southern UK, collectively, the “Former AEC Southern UK Shareholders”), and Yangying Zou (“Zou”) entered into a share exchange agreement (the “Share Exchange Agreement”) whereby AEC Nevada acquired AEC Southern UK as a 100% subsidiary, for a consideration of 1,500,000 shares of its common stock, par value $0.001 per share (“Common Stock”). Additionally, AEC Nevada also agreed to appoint Zou to serve as the CEO of AEC Southern UK and agreed to issue to Zou an aggregate of 1,500,000 shares of Common Stock at the closing (the “Share Exchange Closing Date”) of the Share Exchange Agreement. The transactions underlying the Share Exchange Agreement are referred hereinafter as the “Share Exchange Transaction.” On March 27, 2017, the parties to the Share Exchange Agreement agreed to amend the Share Exchange Agreement so that the Share Exchange Agreement would take effect on October 31, 2016, and amend the Share Exchange Closing Date to be on October 31, 2016. Pursuant to the Share Exchange Agreement, AEC Southern Shenzhen became an operating entity of the Company in China.

Share Purchase Agreement with China Cultural Finance Holdings Company Limited

On October 30, 2017, the Company entered into a Share Purchase Agreement (the “Share Purchase Agreement”) with China Cultural Finance Holdings Company Limited, a British Virgin Islands corporation (“CCFH”) pursuant to which the Company issued 500,000 shares (the “Shares”) of the Company’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”), at price of $4 per Share to CCFH, with the rights, privileges, and preferences set forth in the Certificate of Designation of Series A Convertible Preferred Stock, for the aggregate price of $2,000,000 (the “Purchase Price”). The transactions underlying the Share Purchase Agreement closed on the same day (the “Share Purchase Closing Date”).

Pursuant to the Share Purchase Agreement, the Company agreed to use its commercially reasonable efforts to apply to list on the NASDAQ Capital Market or such other national securities exchange as is reasonably acceptable to CCFH (the “National Exchanges”), so that the Common Stock will commence trading on one of the National Exchanges (the “Uplisting”) within 365 days after the Share Purchase Closing Date (the “Uplisting Deadline”). Pursuant to the Share Purchase Agreement, if the Company did not complete Uplisting on or before the Uplisting Deadline, CCFH had, within 30 days following the Uplisting Deadline, the right to request the Company to buy back any number of the Shares (the “Buy Back Shares”), for a payment of the Buy Back Shares times the Purchase Price Per Share and such interest payment at a rate of 5% per annum accruing from the Share Purchase Closing Date, subject to the terms and conditions of the Shares Purchase Agreement. CCFH did not exercise such right to buy back.

Business Purchase Agreement with FIFPAC, Inc.

On July 10, 2018, the Company entered into a Business Purchase Agreement (the “Business Purchase Agreement”) with FIFPAC Inc. (“FIFPAC”), a New Jersey corporation, the 100% owner of American Institute of Financial Intelligence LLC, a New Jersey limited liability company (“AIFI”).

Pursuant to the Business Purchase Agreement, the Company issued 100,000 shares of Common Stock to FIFPAC on July 10, 2018, in exchange for a 51% equity ownership in AIFI.

Certificate of Amendment to Increase Authorized Stock

On November 6, 2018, the board of directors of the Company, with the written consent of the holders of a majority of the shares of the Company’s Common Stock issued and outstanding and the Company’s preferred stock issued and outstanding, voting together as a single class, authorized the Company to (i) increase the number of authorized shares of Common Stock from 180,000,000 to 450,000,000 and the number of authorized shares of preferred stock from 20,000,000 to 50,000,000 (the “Authorized Stock Increase”), and (ii) file a Certificate of Amendment with the Secretary of State of the State of Nevada to effect the Authorized Stock Increase.

On November 8, 2018, the Company filed a Certificate of Amendment with the Secretary of State of the State of Nevada to effect the Authorized Stock Increase, which became effective upon filing.

2

Designation of Series B Convertible Preferred Stock

On November 13, 2018, the Company filed with the Secretary of State of the State of Nevada the Certificate of Designation of Series B Convertible Preferred Stock (the “Certificate of Designation”), which became effective upon filing. The Certificate of Designation established and designated the Series B Convertible Preferred Stock (“Series B Preferred Stock”) and the rights, preferences, privileges, and limitations thereof, summarized in the following:

The Company designated 25,000,000 shares as Series B Preferred Stock out of the 50,000,000 unissued shares of preferred stock of the Company, par value $0.001 per share, with an original issue price of $0.1 per share. Series B Preferred Stock is senior in rights of payment, including dividend rights and liquidation preference, to the Company’s common stock but junior to Series A Preferred Stock with respect to liquidation preference.

Holders of shares of Series B Preferred Stock are entitled to vote with shareholders of the Company’s common stock, voting together as a single class, except on matters that require a separate vote of the holders of Series B Preferred Stock. In any such vote, each share of Series B Preferred Stock is entitled to 20 votes per share.

Each share of Series B Preferred Stock shall, upon the approval of the board of directors of the Company and without the payment of additional consideration by such holder thereof, be convertible into one fully paid and non-assessable share of the Company’s common stock at a conversion price of $1 per share.

Share Issuance Agreement and Exchange Agreement with China Cultural Finance Holdings Company Limited

On November 26, 2018, the Company entered into a Share Issuance Agreement (the “Share Issuance Agreement”) with CCFH, whereby the Company agreed to issue a certain number of shares Common Stock to CCFH in exchange for an RMB5,000,000 investment in the Company’s subsidiary, AEC Southern Shenzhen, a foreign wholly owned subsidiary incorporated pursuant to PRC laws. The transactions underlying the Share Issuance Agreement closed on the same day and 7,199,113 shares of Common Stock were issued to CCFH.

On November 26, 2018, the Company entered into an Exchange Agreement (the “CCFH Exchange Agreement”) with CCFH, whereby the Company agreed to issue 12,500,000 shares of Series B Preferred Stock, and 7,500,000 shares of Common Stock to CCFH in exchange for the 500,000 shares of Series A Preferred Stock already held by CCFH. The transactions underlying the CCFH Exchange Agreement closed on the same day and 12,500,000 shares of Series B Preferred Stock and 7,500,000 shares of Common Stock were issued to CCFH.

As a result of the Share Issuance Agreement and the CCFH Exchange Agreement, no shares of Series A Preferred were issued and outstanding as of November 26, 2018.

Manager Share Issuance Agreement with Max P. Chen

On November 26, 2018, the Company entered into a Manager Share Issuance Agreement (the “Manager Share Issuance Agreement”) with Mr. Max P. Chen, the Chief Executive Officer, President, and Chairman of the Board of the Company, whereby the Company agreed to reward Mr. Chen for his dedicated services to the Company by issuing 12,500,000 shares of Series B Preferred Stock to him. The 12,500,000 shares of Series B Preferred Stock were issued to Mr. Chen on November 26, 2018.

Corporate Reorganization

On April 22, 2019, AEC BVI acquired AEC Southern HK and its subsidiary, AEC Southern Shenzhen, pursuant to a share transfer agreement by and between AEC BVI and AEC Southern UK, for a nominal consideration. On May 1, 2019, AEC Nevada transferred 100% of the equity interest in AEC Southern UK, to three individuals, including Former AEC Southern UK Shareholders, Ye Tian and Rongxia Wang, and Weishou Li pursuant to a share exchange agreement. Upon completion of the above transactions, AEC Southern UK is no longer one of our subsidiaries. We operate and control both AEC Southern HK and AEC Southern Shenzhen via AEC BVI.

On May 22, 2020, AEC Southern HK formed Yiqilai (Shenzhen) Consulting Management Co., Ltd. (“AEC YQL”) in Shenzhen, China pursuant to PRC laws. AEC YQL is a wholly owned subsidiary of AEC Southern HK, and as of the date of this Report, does not have significant business activities.

On August 18, 2020, AEC YQL entered into a series of contractual arrangements, including an Equity Pledge Agreement, Exclusive Management Consulting Agreement, Exclusive Option Agreement, and Irrevocable Power of Attorney (collectively, the “VIE Agreements”), with Shenzhen Zhongwei Technology Co., Ltd. (“Zhongwei”), a PRC company, and Ding Xiang (Shenzhen) Investment Co., Ltd., a PRC company (“Pledgor”), the sole shareholder of Zhongwei controlled by Dewei Li and Bin Liu (the “Zhongwei Ultimate Shareholders”). Pursuant to the VIE Agreements, AEC YQL gained control over Zhongwei. Zhongwei is involved in, among other things, e-commerce, and the Company plans to leverage Zhongwei’s current e-commerce platform, and to engage in business such as online education e-commerce. In consideration for entering into the transactions contemplated by the VIE Agreements, on August 18, 2020, the Company entered into a Share Issuance Agreement (the “Share Issuance Agreement”) with the Zhongwei Ultimate Shareholders, whereby the Company agreed to issue to the Zhongwei Ultimate Shareholders an aggregate of 2,640,690 shares of the Company’s common stock, par value $0.001. The transactions underlying the Share Issuance Agreement closed in August 2020.

3

Corporate Structure

The corporate structure of the Company as of the date of this quarterly report is illustrated as follows:

The address of our principal executive offices and corporate offices is 1 Rockefeller Plaza, 10th floor, New York, NY 10020. Our telephone number is (646) 722-2931. Our website is www.aec100.com.

Our Business

Headquartered in New York with operations in China, the Company, during fiscal year ended December 31, 2020 operated, and currently operates, in two market segments:

| (1) | AEC New York capitalizes on the rising demand from the middle-class families in China for quality education in the U.S. It delivers customized high school and college placement and career advisory services to Chinese students wishing to study in the U.S. Its advisory services include language training, college admission advisory, on-campus advisory, internship and start-up advisory as well as student and family services. |

| (2) | AEC BVI, through AEC Southern Shenzhen and Zhongwei, delivers customized high school and college placement and career advisory services to Chinese students intending to study in the U.S., through business referred by AEC New York. During the fiscal year ended December 31, 2020 and presently, the revenue of AEC BVI is generated by the operation of AEC Southern Shenzhen and Zhongwei. |

4

Our Key Revenue Drivers

We have expanded our service platform to include advisory services for our student customers wishing to study and gain post-graduate work experiences in the U.S. Currently, our main advisory services include:

| · | Placement Advisory Services; | |

| · | Career Advisory Services; | |

| · | Student & Family Advisory Services; and | |

| · | Other Advisory Services. |

All advisory services above are provided by our subsidiaries, AEC New York, AEC Southern Shenzhen and Zhongwei.

Placement Advisory Services

Our Placement Advisory Services include Language Training, Placement Advisory and Elite College Advisory services.

Since 1999, we have been delivering customized Language Training & Placement Advisory services to Chinese students. Our one-stop advisory service encompasses ESL training and assistance throughout the high school, college application, and admission process.

Our Language Training service is based on the existing ESL training platform which provides language training for standard test preparation and is designed to help improve student’s English listening, speaking, reading, and writing skills. We expect student Student customers will be able to take these training courses online when our ESL online training platform goes live in third quarter of 2021.

Targeting the needs of Chinese families in obtaining admission to Ivy League and other prestigious universities in the U.S., our Elite College Advisory service is designed to assist qualified Chinese students in applying to prestigious colleges and universities in the U.S. Specifically, we arrange campus tours, assist our student customers with their university applications, provide tailored language training, offer guidance on interview and communication techniques, and follow up on their applications.

Once our student customers are admitted into their target universities, our Placement Advisory services further extend to academic and cultural related experiences including, among other things, providing assistance with applying for a second major or minor, transferring to a different university, housing accommodations, and applying for accelerated degrees. To help students optimize their on-campus experience and train their leadership and social skills, we also organize seminars and social events with our partner scholars and universities, non-profit and for-profit business organizations. Additionally, to help enrich their cultural experiences, we organize extracurricular and artistic activities including dance, music, painting, photography, and other performance events.

For college application, we have designed the Key School Admissions Program, giving student customers closely guided application consulting services to gain admission to top U.S. universities.

For on-campus academic counseling, we offer the Elite100 program that focuses on leadership and communication skills development for our student customers.

We provide placement services through AEC New York, AEC Southern Shenzhen and Zhongwei. AEC New York refers businesses to AEC Southern Shenzhen when clients in China need local support.

Career Advisory Services

Our Career Advisory Services include our Internship Advisory program and our Start-up Advisory program.

Our Internship Advisory program focuses on student’s career development by helping them identify and secure suitable internship and part-time or full-time work opportunities that are appropriate for their educational background and experience level. Through this program, we strive to help students map and navigate their career path and counsel them on matters including academic improvement to career assistance. Through this program, our student customers are given opportunities to communicate with professionals in their field of study and to participate in real-world case studies.

Our Start-up Advisory program provides advisory services to individual students and/or their families who want to start or make an investment in a business in the U.S. Collaborating with our strategic partners, our services include (i) recommending alternative business development opportunities; (ii) assistance with business plan development; (iii) assistance with accounting and financial management, marketing, product and project design; and (iv) assistance in project financing.

5

Student & Family Advisory Services

Our Student & Family Advisory Services are designed to assist our students and/or their families in the process of settling down in the U.S., such that they can effectively focus on their studies. We provide thorough services tailored to the unique needs of each student family encountered in the U.S.

Through our business partners, we assist the students’ families with purchasing real estate properties, organizing their personal financial management and investment needs, getting insurance and starting businesses. Our American Dream Program helps students’ families find investment projects in the U.S. We also advise corporate clients whose executives are moving to the U.S. for work. The scope of our services includes assistance with business consulting, relocation and other aspects of family support services.

Other Advisory Services

Through our Foreign Student Recruitment services, we assist universities in China to recruit students from the U.S. We customize this service based on our strategic relationship with college and universities in the U.S. and the specific recruitment goals of these universities in China. The demand for our recruitment services is driven mainly by the lack of an established channel to attract students from the U.S. and the needs by the Chinese universities to expand and diversify their student body.

Our Foreign Educator Placement services are designed to meet the increasing demand for experienced educators and teachers from the U.S. to teach in China. Such demand covers the need to recruit qualified US educators from Pre K-12 to teach in China.

Recent Development

The COVID-19 pandemic has severely affected China and the rest of the world. In an effort to contain the spread of the COVID-19 pandemic, China and many other countries have taken precautionary measures, such as imposing travel restrictions, quarantining individuals infected with or suspected of being infected with COVID-19, encouraging or requiring people to work remotely, and canceling public activities, among others. The pandemic has resulted in quarantines, travel restrictions, and temporary closure of stores and facilities in China and other countries including the United States. These ongoing measures adversely affected our operations and financial performance in 2020.

Consequently, we expect the COVID-19 outbreak will continue to have material and adverse impacts on the Company’s business operations and its financial condition, including but not limited to material negative impact to the Company’s total revenues. Since late March 2020, due to restrictions on domestic and international travels and uncertainty of the pandemic, the company’s revenue substantially decreased approximately 90%. Because of the significant uncertainties surrounding the COVID-19 outbreak, the extent of the business disruption and the related financial impact cannot be reasonably estimated at this time. In response to COVID-19, we have taken some measures, such as reducing our office rent.

On May 22, 2020, AEC Southern HK formed Yiqilai (Shenzhen) Consulting Management Co., Ltd. (“WOFE”) in the PRC. We intend to use WOFE as the primary entity to carry out our plan to identify and acquire an operating company in the PRC for online education e-commerce platform business. This new subsidiary is expected to expand and add to our current business and is expected to better serve our student customers.

6

Our Competitive Advantage

Our strength comes mainly from our understanding of the Chinese education and education-related service markets and our ability in not only anticipating areas with great market demand but also delivering quality, customized services on a consistent basis. We have a scalable business platform that is conducive to growth in earnings and profitability; and have a business model that we believe adapts well to changing market conditions. We believe that the following competitive strengths enhance our position in the markets that we are currently competing in:

| · | Experienced Management. Our management team is comprised of industry experts with extensive experience in the education service industry, knowledge of the education system in the U.S. and a deep understanding of the Chinese market as well as finance executives who specializes in mergers and acquisitions, business reorganization, internal controls and risk management. We have established a corporate culture that is based on integrity, built compliance into risk management, integrated structure and discipline into our operating management and financial reporting processes, and made it a priority to deliver quality, customized services without compromising our ability to generate sustainable operating profits. |

| · | Proven Business Model. Our business model is to target those service areas that are driven by significant market demand and have potential for sustainable growth in the long run. As a total solutions education advisory services provider, we have been successful in meeting the market demand for quality education and career development in the U.S. |

| · | Scalable Business Platform. As an emerging business in the education service business, we believe we have the structure and discipline to control our operating expenses and overhead as we grow our business and strive to improve our operating profits. By keeping a relatively low headcount and optimizing the use of outsourced industry experts, we believe we have been effective in delivering quality services while maintaining healthy operating margins. |

| · | Customized Service Approach. Our success is built on our reputation in delivering consistent, reliable, quality, and customized advisory services. Our approach is result oriented and we customize our service based on the specific needs of our student and corporate customers. Without compromising our objective of delivering consistent growth in earnings and profitability, we take pride in the delivery of tailored advisory services to our student customers. |

Our Growth Strategy

Our goal is to become a leading total solutions educational services provider for Chinese students wishing to study and gain work experiences in the U.S. Our business development plan includes, among other things, the following strategic initiatives:

| · | Expand organically within existing markets and into new markets. To carry out our vision of strengthening our market position in the U.S., we are implementing a combination of on- and off-line marketing approaches to expand our student-customer base in markets we currently serve. Such approaches include the recently launched Membership Program that is designed to maximize the power of personal and commission-based referral of our services to other potential customers; and the AEC Help mobile application, a social network platform that is intended to bring students together under one roof, offering them alternative solutions to issues frequently encountered by foreign students in the U.S. |

| · | Our Membership Program allows third-party agents and education service providers, either individuals or entities, to sign up as members. Benefits to becoming our members include access to all programs pursuant to our student advisory services currently provided by AEC New York. Our members typically have access to clients with needs that can be met by programs provided by AEC New York. After paying a one-time, non-refundable fee of $50,000 to become a member, members can seamlessly integrate our services with their service offerings by outsourcing the specific services to us. We believe the Membership Program will allow us to broaden the reach of our brand and services without establishing additional offices in China and in the U.S. |

| · | Our AEC Help mobile application was developed in-house and is operated by AEC New York. It is an iOS app that users can download for free from the Apple AppStore. Users are international students who are in the U.S. or seek to study in the U.S. The app provides various academic and non-academic resources compiled by us to assist users for studying and living in the U.S. Resources available through the AEC Help app include academic resources where users can filter and search for universities based on the user’s own test scores and preferences, and non-academic resources such as unit conversions, maps, real-time exchange rates, student events, etc. Where the online resources cannot provide sufficient assistance to our users, they are able to reach a member of our staff who will connect the user with a third-party service provide directly. We believe this social media network, AEC Help, will allow us to broaden our reach to potential student customers. |

| · | To grow organically, we plan to expand our service offerings to existing student customers, as well as deepening our strategic relationships with top universities, top companies, and top recruitment agencies, to aggregate our resources to collectively deliver customized career advisory services. Previously, we intended to launch the Other Recruitment & Placement Services, which include our Foreign Student Recruitment services and Foreign Educator Placement services in 2019. However, due to the outbreak of COVID-19, this plan has been postponed to 2021. As of the date of this annual report, we already started implementing this plan. For detailed information on the impact of the outbreak of COVID-19, refer to “Item 1. Business—Outbreak of COVID-19.” |

7

| · | Through our Foreign Student Recruitment services, we will assist universities in China to recruit foreign students from the U.S. and other countries. We customize this service based on our relationship with universities in China and their specific recruitment goals. We believe the demand for our recruitment services is driven mainly by the lack of an established channel to attract students from the U.S. and the needs to expand and diversify the university’s student body. |

| · | Our Foreign Educator Placement services are designed to meet the increasing demand for experienced educators from the U.S. to teach in China. Based on our understanding of the market demand, we believe there is a significant service opportunity for us to recruit qualified U.S. educators from Pre-K-12 to college to teach in China. |

| · | Technology Platforms. We believe that our future success also depends, in part, on our ability to vertically integrate training courses and content delivery, specifically, complementing and integrating off-line, in person delivery with off-the-shelf, online delivery of training modules, which will increase the scalability of our operation. We are in the process of completing the development of an online ESL/language training platform for our student customers as well as an online training platform for our customer’s corporate clients in China which, when completed and launched, will allow participants to access our training courses on demand and on a 24/7 basis. Leveraging these two newly developed online training platforms, we believe we could realize significant growth in our revenues from language training as well as corporate training. Since we gained control power of Zhongwei through VIE Agreements on August 18, 2020, we have been expanding our local online services in China through the platform of Zhongwei with the legitimate certificate. Through this platform, we are attracting local small educational institutions to register in our system and sharing resources to meet local customers’ needs. As of the date of this report, this platform is still in trial operation stage. |

| · | Mergers and Acquisitions. We plan to grow our training and advisory business through acquisitions and intend to replicate our success by identifying potential merger and acquisition targets, especially training institutions that are successful in their respective fields or industries, to efficiently and rapidly broaden our service offering. In addition, we are performing market research to identify suitable new markets and suitable targets in the education and training industry that are potentially profitable such as trade skills training, and personal development. |

| · | As part of our growth strategy, we acquired AIFI in 2018. We intend to provide, through AIFI, financial education and services through its training and certification programs with the goal in building a financial education information ecosystem to cultivate people’s sound financial judgement and decision-making abilities. The AIFI programs are intended to provide extensive and important financial literacy knowledge and relevant services to the financial services industry, non-profit organizations and schools. Specific target audiences include but are not limited to industry professionals, financial literacy educators, lending industry customers, college students, and K-12 students. In the fiscal year ended December 31, 2020 and 2019, we did not generate any revenue from AIFI. |

Our Management Team

We believe we have a strong and experienced management team including our founder, chief executive officer, interim chief financial officer, and chairman, Mr. Max P. Chen, a pioneer and leader in the education service industry; Ms. Congying Fang, the director, president, and the chief executive officer of AEC BVI; and Ms. Weihua Zhu, the chief operating officer of AEC New York with over a decade of experience in education advisory services. Our team as a whole has many years of public and private company experience, industry and professional experience and a significant network of business contacts in the industry, and extensive experience in SEC reporting, compliance and risk management, business reorganization, and mergers and acquisitions.

Our Industry and Market Opportunities

The demand for global education is growing rapidly in China, and the U.S. remains the top choice for Chinese students wishing to study abroad. According to one article published by the PRC’s Ministry of Education in March 2018, approximately 5.19 million Chinese students had studied in foreign countries in the past 40 years since 1978.

8

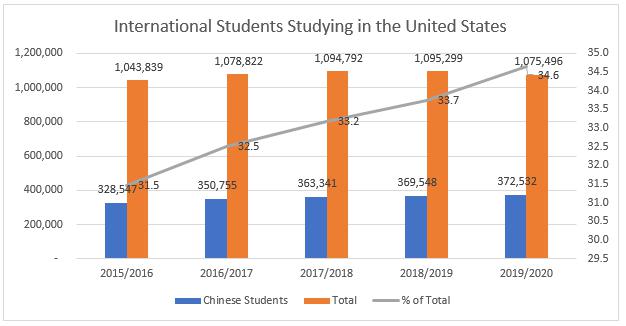

Source: Open Doors, IIE. Leading Places of Origin: Previous Years. Retrieved from https://opendoorsdata.org/data/international-students/all-places-of-origin/

The number of Chinese students entering the U.S. to study grew sharply in 2006, when Congress loosened restrictions on student visas from China for the first time since 2001. Accordingly, there is a large and growing number of Chinese students in the U.S. seeking a broad range of acclimation support and services, including education consulting services. We strive to become a bridge for these students with our service offerings.

According to Project Atlas, a collaborative global research initiative led by the Institute of International Education, in the academic year 2019/2020, the total number international students studying in the U.S. (in both public and private institutions) was 1,075,496, of which 372,532, or 34.6%, were Chinese nationals. For the academic year 2018/2019, the total number international students studying in the U.S. (in both public and private institutions) was 1,095,299, of which 369,548, or 33.7%, were Chinese nationals. This growth trend has been in place for several years. However, with the current political environment in Washington, DC regarding visas, as well as the effect of Covid-19 which may discourage Chinese students from pursuing study-abroad in the year of 2021, it is not known whether it will continue in the future.

9

Our Competition

The education service and consulting industry targeting both PRC citizens abroad and PRC residents is rapidly evolving, highly fragmented and competitive. We expect competition in this industry to persist and intensify. For services provided by AEC New York, we primarily serve Chinese student customers and their families in the U.S. For services provided by AEC BVI, our prospective student clients are primarily located in China.

Our advisory services for student customers face significant competition from New Oriental Education & Technology Group Inc., a leader in the market of advisory services for student customers that we operate in.

Our Marketing Strategies

We believe prospective student customers are attracted to our advisory services due to our excellent brand name, personalized service model, and the quality of our services. Historically, as a small business, we rely extensively on our strategic partners and word-of-mouth referrals in growing our student customers, and employ the following marketing and recruiting methods to attract new student customers:

Commission-based referrals. To enhance the effectiveness of the referral process, we pay a commission that ranges from 10% to 20% for successful referrals. Our placement advisory and career advisory services have benefited from, and are expected to continue to benefit from, commission-based referrals by our current and former student customers.

Marketing materials. We plan to publish a “Chinese Visitors Guide Book.” It is planned to be a travel book with plug-in advertisements for the Company, which will assist Chinese visitors to the U.S. and simultaneously promote our services. We will also advertise in e-magazines, prepare and distribute brochures and present at exhibitions as part of our marketing strategy.

Social media marketing. We maintain our own WeChat official account that offers information on education and life abroad. In addition, we work with other WeChat official accounts with significant followings to publish information on AEC services. After every offline event, our employees will create chat groups with all event attendants to facilitate direct communication and follow up.

We have launched our in-house developed mobile application—AEC Help. It is an iOS app that users can download for free from the Apple AppStore. Users are international students who are in the U.S. or seek to study in the U.S. The app provides various academic and non-academic resources compiled by us to assist users for studying and living in the U.S. Resources available through AEC Help Application include academic resources where users can filter and search for universities based on the user’s own test scores and preferences, and non-academic resources such as unit conversions, maps, real-time exchange rates, student events, etc. Where the online resources cannot provide sufficient assistance to our users, they are able to reach a member of our staff who will connect the user with a third-party service provide directly. We believe this social media network, AEC Help, will allow us to broaden our reach to potential student customers.

Our Customers

We currently provide services to Chinese students wishing to study and/or gain work experience in the U.S. Some of these Chinese students are our direct customers, and the others are ultimate users of our services through corporate customers we serve.

Our target corporate customers include staffing agencies and student placement agencies. Our target student customers include high school students who want to apply for U.S. colleges, college students who need academic counseling and future career consulting, and graduates who need professional development, as well as students’ families. The cost of studying abroad is high, therefore international students usually come from middle class or high-net-worth families.

For the year ended December 31, 2020, our largest customer, Oxbridge International Group Inc. accounted for 54.8% of our revenues.

Our Regulatory Environment

Regulation of the Education Industry in the U.S.

Government authorities in the U.S., at the Federal, state and local level, extensively regulate education and exchange student programs. Such regulations include, among other things, the regulations, and policies of the United States Department of Education. Unlike the systems of most other countries, however, the education system in the U.S. is highly decentralized, and the Federal government and Department of Education are not heavily involved in determining curricula or educational standards. The establishment and grading of such standards have been left to state and local school districts.

The Education Department of the State of New York in 1999 consented for AEC New York to incorporate pursuant to §216 of New York Education Law Relating to Education Corporations, and Section 104 of the New York Business Corporation Law, and consented in 2003 for AEC New York to amend its certificate of incorporation to include education consulting service as its business purpose, pursuant to §216 of New York Education Law Relating to Education Corporations, and Section 104(e) of the New York Business Corporation Law.

10

A more formalized regulation is the requirement that a citizen of a foreign country who wishes to enter the U.S. must first obtain a visa, either a nonimmigrant visa for temporary stay, or an immigrant visa for permanent residence. Foreign students must have a student visa to study in the U.S. Visas generally require an application and an interview.

In addition to the regulatory approval requirements described above, we are or will be, directly or indirectly, subject to extensive regulation of the educational industry by the Federal and state governments and the governments’ of foreign countries in which our services are provided.

Regulation of the Education Industry in China

The principal laws and regulations governing private education in China consist of the Education Law of the PRC, the Law for Promoting Private Education (2003), the Implementation Rules for the Law for Promoting Private Education (2004), and Law for Promoting Private Education (2016).

Under these regulations, “private schools” are defined as schools established by non-governmental organizations or individuals using non-government funds. Private schools providing academic qualifications education, kindergarten education, education for self-study examination, and other education shall be subject to approval by the education authorities at or above the county level, while private schools engaging in occupational qualification training and occupational skill training shall be subject to approvals from the authorities in charge of labor and social welfare at or above the county level.

Since our operations in the PRC are either delivered through our AEC New York office for education consulting services, placement services, and family support services, and through our AEC BVI and its subsidiaries, we believe we are not involved in providing services relating to the fundamental education systems of the PRC, which include a school system of pre-school education, primary education, secondary education, and higher education, a system of nine-year compulsory education and a system of education certificates. Therefore, we believe our operations in the PRC are not subject to the PRC Private Education Laws. If our operations are found to be subject to, and/or in violation of any of these laws, regulations, rules, or policies or any other law or governmental regulation to which we or our customers are or will be subject, or if interpretations of the foregoing changes, we and our PRC subsidiaries may be subject to civil and criminal penalties, damages, fines, and the curtailment or restructuring of our operations. Similarly, if our customers are found non-compliant with applicable laws, they may be subject to sanctions.

Foreign Investment in Educational Service Industry

The Ministry of Commerce of the PRC, or MOFCOM, and the National Development and Reform Commission, or NDRC, promulgated the Catalogue of Industries for Guiding Foreign Investment, or the “Catalogue,” as amended on March 10, 2015, which came into effect on April 10, 2015, and as further amended on June 28, 2017, and came into effect on July 28, 2017 (the “2017 Catalogue”). On June 28, 2018, the MOFCOM and NDRC promulgated the Special Measures for Foreign Investment Access (2018 version), or the “2018 Negative List,” terminating the 2017 Catalogue. According to the 2018 Negative List, any foreign investment in preschool education, senior high school education, and higher education has to take the form of a cooperative joint venture. Foreign investment is banned from compulsory education, which means grades one to nine. Foreign investment is allowed in after-school tutoring services and training services that do not grant certificates or diplomas. We do not believe we are subject to the aforementioned bans on foreign investment in educational service industries.

Employment Laws

We are subject to laws and regulations governing our relationship with our employees, including wage and hour requirements, working and safety conditions, social insurance, housing funds, and other welfare. These include local labor laws and regulations, which may require substantial resources for compliance.

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract. The National Labor Contract Law has enhanced rights for the nation’s workers, including permitting open-ended labor contracts and severance payments. The legislation requires employers to provide written contracts to their workers, restricts the use of temporary labor, and makes it harder for employers to lay off employees. It also requires that employees with fixed-term contracts be entitled to an indefinite-term contract after a fixed-term contract is renewed once or the employee has worked for the employer for a consecutive 10-year period.

As required under the Regulation of Insurance for Labor Injury implemented on January 1, 2004, and amended in 2010, the Provisional Measures for Maternity Insurance of Employees of Corporations implemented on January 1, 1995, the Decisions on the Establishment of a Unified Program for Old-Aged Pension Insurance of the State Council issued on July 16, 1997, the Decisions on the Establishment of the Medical Insurance Program for Urban Workers of the State Council promulgated on December 14, 1998, the Unemployment Insurance Measures promulgated on January 22, 1999, and the Social Insurance Law of the PRC implemented on July 1, 2011, employers are required to provide their employees in the PRC with welfare benefits covering pension insurance, unemployment insurance, maternity insurance, labor injury insurance and medical insurance. In accordance with the Regulations on the Management of Housing Fund which was promulgated by the State Council in 1999 and amended in 2002, employers must register at the designated administrative centers and open bank accounts for depositing employees’ housing funds. Employer and employee are also required to pay and deposit housing funds, with an amount no less than 5% of the monthly average salary of the employee in the preceding year in full and on time. Except for housing funds, we are in compliance with payment of all other employment related insurance on behalf of our employees.

11

Taxation in the U.S.

We are subject to income taxes in the U.S., and our domestic tax liabilities will be subject to the allocation of expenses in differing jurisdictions. Our future effective tax rates could be subject to volatility or adversely affected by a number of factors, including:

· changes in the valuation of our deferred tax assets and liabilities;

· expected timing and amount of the release of any tax valuation allowances;

· tax effects of stock-based compensation;

· costs related to intercompany restructurings;

· changes in tax laws, regulations or interpretations thereof; and

· lower than anticipated future earnings in jurisdictions where we have lower statutory tax rates and higher than anticipated future earnings in jurisdictions where we have higher statutory tax rates.

In addition, we may be subject to audits of our income and sales and other transaction taxes by U.S. federal and state authorities.

Taxation in the PRC

Pursuant to the Provisional Regulations on Value-Added Tax (“VAT”) of the PRC, or the “VAT Regulations,” which were promulgated by the State Council on December 13, 1993, and took effect on January 1, 1994, and were amended on November 10, 2008, February 6, 2016, and November 19, 2017, respectively, and the Rules for the Implementation of the Provisional Regulations on Value Added Tax of the PRC, which were promulgated by the Ministry of Finance of the PRC, on December 25, 1993, and were amended on December 15, 2008, and October 28, 2011, respectively, entities and individuals that sell goods or labor services of processing, repair or replacement, sell services, intangible assets, or immovables, or import goods within the territory of the PRC are taxpayers of value-added tax. The VAT rate is 16% for taxpayers selling goods, labor services, or tangible movable property leasing services or importing goods, except otherwise specified; 10% for taxpayers selling goods, labor services, or tangible movable property leasing services or importing goods, except otherwise specified; 6% for taxpayers selling services or intangible assets.

Regulations on Dividend Distribution in the U.S.

Our Board of Directors’ ability to declare a dividend is subject to restrictions imposed by Nevada corporate law. Nevada corporate law provides that no distribution (including dividends on, or redemption or repurchases of, shares of capital stock) may be made if, after giving effect to such distribution, (i) the corporation would not be able to pay its debts as they become due in the usual course of business, or, (ii) except as otherwise specifically permitted by the articles of incorporation, the corporation’s total assets would be less than the sum of its total liabilities plus the amount that would be needed at the time of a dissolution to satisfy the preferential rights of preferred stockholders. Directors may consider financial statements prepared on the basis of accounting practices that are reasonable in the circumstances, a fair valuation, including but not limited to unrealized appreciation and depreciation, and any other method that is reasonable in the circumstances.

Regulations on Dividend Distribution in the PRC

The principal regulations governing dividend distributions by wholly foreign owned enterprises and Sino-foreign equity joint ventures include:

| · | The Wholly Foreign Owned Enterprise Law (1986), as amended; |

| · | The Wholly Foreign Owned Enterprise Law Implementing Rules (1990), as amended; |

| · | the Sino-foreign Equity Joint Venture Enterprise Law (1979), as amended; and |

| · | the Sino-foreign Equity Joint Venture Enterprise Law Implementing Rules (1983), as amended. |

12

Under these regulations, wholly foreign owned enterprises and Sino-foreign equity joint ventures in China may pay dividends only out of their retained earnings, if any, determined in accordance with PRC accounting standards and regulations. Additionally, a wholly foreign-owned enterprise is required, as other enterprises subject to PRC laws, to set aside at least 10% of its after-tax profits each year, if any, to fund statutory reserve funds until the cumulative amount of such funds reaches 50% of its registered capital. For our PRC subsidiary that has achieved profit under the PRC accounting standards, it has set aside at least 10% of its after-tax profits to meet the statutory reserve requirements. A wholly foreign-owned enterprise may, at its discretion, allocate a portion of its after-tax profits calculated based on the PRC accounting standards to staff welfare and bonus funds. Our subsidiary has not set aside its after-tax profits, if any, to fund these discretionary staff welfare and bonus funds. We have not implemented any policy or plan for our PRC subsidiaries to maintain discretionary staff welfare and bonus funds. These reserve funds and staff welfare and bonus funds are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. These requirements apply to AEC Southern Shenzhen.

M&A Rules and Overseas Listings

On August 8, 2006, six PRC regulatory agencies, namely, the MOFCOM, the State Assets Supervision and Administration Commission, the State Administration of Taxation, State Administration for Industry & Commerce, or SAIC, China Securities Regulatory Commission, or CSRC, and the State Administration of Foreign Exchange, jointly adopted the Provisions Regarding Mergers and Acquisitions of Domestic Projects by Foreign Investors, or the M&A Rules, which became effective on September 8, 2006. This M&A Rules purport to require, among other things, offshore special purpose vehicles formed for the purpose of acquiring PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. While the application of the M&A Rules remains unclear, we believe, based on the advice of our PRC counsel, that CSRC approval was not required in the context of our initial public offering as we are not a special purpose vehicle formed for the purpose of acquiring domestic companies that are controlled by our PRC individual shareholders, as we acquired contractual control rather than equity interests in our domestic affiliated entities. However, we cannot assure you that the relevant PRC government agency, including the CSRC, would reach the same conclusion as our PRC counsel. If the CSRC or other PRC regulatory agency subsequently determines that we needed to obtain the CSRC’s approval for our initial public offering or if CSRC, we may face sanctions by the CSRC or other PRC regulatory agencies. In such event, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of the proceeds from our initial public offering into the PRC, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, and prospects, as well as the trading price of our Common Stock.

Properties/Facilities

Our principal executive office is located at 1 Rockefeller Plaza, 10th floor, New York, NY 10020(the “Headquarters”). We entered into a lease agreement for the Headquarters with an unrelated third-party landlord, pursuant to which the Company pays a monthly rent of $273. The lease will expire on August 31, 2022.

We terminated the lease located at 2 Wall Street in August 2020 due to the pandemic. Our office is currently located at 1 Rockefeller Plaza, 10th, New York 10020.

AEC Southern Shenzhen entered into a new lease in the fiscal year ended December 31, 2019, pursuant to which it leases office space from an unrelated third party on a month to month basis with a monthly rental cost of RMB52,456 (approximately US$8,497). The lease will expire on April 30, 2024. Zhongwei currently shares the same office as AEC Southern Shenzhen.

We believe our facilities are sufficient for our business operations.

Employees

As of the filing date hereof, the Company has 21 full and part-time employees inclusive of outsourced consultants. None of our employees are represented by a labor union. We have not experienced any work stoppages, and we consider our relations with our employees to be good.

Off-Balance Sheet Arrangements

We did not have, during the periods presented, and we are currently not a party to, any off-balance sheet arrangements.

Seasonality

AEC New York typically experiences seasonal fluctuations in its revenues and results of operations, primarily due to quarterly changes in student enrollments related to the admission seasons. AEC BVI does not experience substantial seasonality in its revenues and results of operations.

13

Intellectual Property

We regard our trademarks, domain names, know-how, proprietary technologies and similar intellectual property as critical to our success, and we rely on trademark and trade secret law and confidentiality and invention assignment with our employees and others to protect our proprietary rights. Our intellectual property includes two domain names, https://americaneducationcenter.org/and https://aec100.com.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our technology. Monitoring unauthorized use of our technology is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriation of our technology. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

In addition, third parties may initiate litigation against us alleging infringement of their proprietary rights or declaring their non-infringement of our intellectual property rights. In the event of a successful claim of infringement and our failure or inability to develop non-infringing technology or license the infringed or similar technology on a timely basis, our business could be harmed. Moreover, even if we are able to license the infringed or similar technology, license fees could be substantial and may adversely affect our results of operations.

Risks Related to Our Business

If we are not able to continue to attract students to enroll in our courses without a significant decrease in course fees, our revenues may decline, and we may not be able to maintain profitability.

The success of our business depends primarily on the number of students enrolled in our courses and the amount of course fees that our students are willing to pay. Therefore, our ability to continue to attract students to enroll in our courses without a significant decrease in course fees is critical to the continued success and growth of our business. This in turn will depend on several factors, including our ability to develop new programs and enhance existing programs to respond to changes in market trends and student demand, expand our geographic reach, manage our growth while maintaining the consistency of our service quality, effectively market our programs to a broader base of prospective students, develop and license additional high-quality educational content and respond to competitive pressures, as well as the ability of our partner colleges and institutions to maintain their faculties’ teaching quality. If we are unable to continue to attract students to enroll in our courses without a significant decrease in course fees, our revenues may decline and we may not be able to operate profitability.

Our business depends on our brand name “American Education Center.” Because we do not currently have any copyright or trademark protection for our company name or brand name, there is no guarantee that someone else will not encroach upon our intellectual property rights, which could negatively affect our business and results of operations.

We believe that market recognition of our name “American Education Center” has contributed significantly to the success of our business. We also believe that maintaining and enhancing the “American Education Center” brand is critical to maintaining our competitive advantage. We offer a diverse set of programs, services, and products to primary and middle school students, college students, and other adults throughout many provinces and cities in China. As we continue to grow in size, expand our programs, services, and product offerings, and extend our geographic reach, our ability to maintain and improve the quality and consistency of our services, products, and offerings may be more difficult to achieve. We currently have no copyright or trademark for our company name or brand name. We may seek such protection in the future; however, we currently have no plans to do so. Since we have no copyright protection, unauthorized persons may attempt to copy aspects of our business, including our web site design or functionality, products, or marketing materials. Any encroachment upon our corporate information, including the unauthorized use of our brand name, the use of a similar name by a competing company or a lawsuit initiated against us for infringement upon another company's proprietary information or improper use of their copyright, may affect our ability to create brand name recognition, cause customer confusion and/or have a detrimental effect on our business. Litigation or proceedings may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets and domain name and/or to determine the validity and scope of the proprietary rights of others. Any such infringement, litigation or adverse proceeding could result in substantial costs and diversion of resources and could harm our business and results of operations.

14

A severe or prolonged slowdown in the global or Chinese economy could materially and adversely affect our business and our financial condition.

The rapid growth of the Chinese economy has slowed down since 2012 and such slowdown may continue. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies, including the United States and China. There have been concerns over unrest and terrorist threats in the Middle East, Europe and Africa, which have resulted in volatility in oil and other markets. There have also been concerns on the relationship among China and other Asian countries, which may result in or intensify potential conflicts in relation to territorial disputes. Economic conditions in China are sensitive to global economic conditions, as well as changes in domestic economic and political policies and the expected or perceived overall economic growth rate in China. Any severe or prolonged slowdown in the global or Chinese economy may materially and adversely affect our business, results of operations and financial condition. In addition, continued turbulence in the international markets may adversely affect our ability to access capital markets to meet liquidity needs.

If we fail to successfully execute our growth strategies, our business and prospects may be materially and adversely affected.

Our growth strategies include but are not limited to expanding our service offerings to satisfy the needs of our student customers. Our ability in executing our growth strategies depends largely on our capability in developing and delivering quality, customized services on a consistent basis and in a cost-effective and timely manner, as well as maintaining and continuing to establish strategic relationships with other businesses and education institutions. If we fail to successfully execute our growth strategies, we may be unable to maintain and grow our business operation, and our profitability may be materially and adversely affected.

We face competition in the student advisory services markets, and if we fail to compete effectively, our profitability may be adversely affected.

The markets for language training, college placement, and career advisory are rather fragmented. With relatively low entry barriers, we face competition that focuses generally on price. The number of our student customers may decrease due to price competition. Some of our competitors have greater resources than we do. These competitors may be able to devote greater resources than us to the development, promotion, and marketing of their programs and services, and respond more quickly to changes in student needs, admissions standards, or new technologies. We cannot assure you that we will be able to compete successfully against current or future competitors. If we are unable to maintain our competitive position or otherwise respond to evolving competition effectively, our profitability may be adversely affected.

We may need additional capital for growth purposes. The availability of capital and the terms on which it will be available are uncertain.

We may need to raise funds to take advantage of growth or acquisition opportunities in the future. We currently have no arrangements or commitments for additional financings. If we cannot expand our operation or make acquisitions that we believe are necessary to maintain our competitive position, we may not be able to maintain a reasonable growth rate. If we raise additional capital by selling equity or equity-linked securities, these securities would dilute the ownership percentage of our existing stockholders. Also, these securities could also have rights, preferences, or privileges senior to those of our Common Stock. Similarly, if we raise additional capital by issuing debt securities, those securities may contain covenants that restrict us in terms of how we operate our business, which could also affect the value of our Common Stock. We may not be able to raise capital on reasonable terms or at all.

Our strategic relationships are usually non-exclusive arrangements and our strategic partners may provide the same or similar services to our competitors, which could significantly dilute any competitive advantage we get from these relationships.

We rely on our strategic partners to provide us with access to potential student customers and corporate customers with clients that need compliance training and advisory services. Our strategic partners may enter identical or similar relationships with our competitors, which could diminish the value of our service offerings. Our strategic partners could terminate their relationship with us at any time. We may not be able to maintain our existing relationships or enter new strategic relationships.

Because we rely on a limited number of customers for a large portion of our revenue, the loss of one or more of these customers could materially harm our business.