Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SMARTFINANCIAL INC. | tm2112884d1_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - SMARTFINANCIAL INC. | tm2112884d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - SMARTFINANCIAL INC. | tm2112884d1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - SMARTFINANCIAL INC. | tm2112884d1_ex2-1.htm |

Exhibit 99.3

1 Acquisition of: April 14, 2021, 10:00am ET Webcast: www.smartbank.com (Investor Relations) Audio Only: 888 - 317 - 6003 Confirmation #: 3063532 Miller Welborn Chairman of the Board Billy Carroll President & CEO SCB S EVIER C OUNTY B ANK

2 Forward - Looking Statements Certain statements in this communication may constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended with respect to the beliefs, plans, goals, expectations, and estimates of SmartFinancial , Inc . (“SMBK”, “ SmartFinancial ” or the “Company”) . Forward - looking statements are not a representation of historical information but instead pertain to future operations, strategies, financial results or other developments . These forward - looking statements may be identified by their reference to a future period or periods or by the use of forward - looking terminology such as “anticipate,” “believe,” “could,” “continue,” “seek,” “intend,” “estimate,” “expect,” “foresee,” “hope,” “intend,” “may,” “might,” “plan,” “should,” “predict,” “project,” “goal,” “outlook,” “potential,” “will,” “will result,” “will likely result,” or “would” or future or conditional verb tenses and variations or negatives of such terms . These forward - looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction . SmartFinancial cautions readers not to place undue reliance on the forward - looking statements contained in this communication, in that actual results could differ materially from those indicated in such forward - looking statements as a result of a variety of factors, many of which are beyond the control of SmartFinancial . The factors that could cause actual results to differ materially include the following : the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between SmartFinancial and Sevier County Bancshares, Inc . (“SVRH“ or “Sevier County”) ; the outcome of any legal proceedings that may be instituted against SmartFinancial or SVRH ; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated ; the ability of SmartFinancial and SVRH to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction ; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction ; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where SmartFinancial and SVRH do business; certain restrictions during the pendency of the proposed transaction that may impact the SVRH’s ability to pursue certain business opportunities ; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate SVRH’s operations and those of SmartFinancial and its subsidiaries ; such integration may be more difficult, time consuming or costly than expected ; revenues following the proposed transaction may be lower than expected ; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; SmartFinancial’s and SVRH’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing ; the dilution caused by SmartFinancial’s issuance of additional shares of its capital stock in connection with the proposed transaction ; and other factors that may affect future results of SmartFinancial and SVRH ; and the other factors discussed in “Risk Factors” in SmartFinancial’s Annual Report on Form 10 - K for the year ended December 31 , 2020 and SmartFinancial’s other filings with the U . S . Securities and Exchange Commission (the “SEC”), which are available at https : //www . sec . gov and in the “Investor Relations” section of SmartFinancial’s website, https : //smartbank . com, under the heading “About Us . ” SmartFinancial assumes no obligation to update the information in this communication, except as otherwise required by law . Non - GAAP Financial Measures Statements included in this presentation include Non - GAAP financial measures and should be read along with the accompanying tables, which provide a reconciliation of Non - GAAP financial measures to GAAP financial measures . SmartFinancial management uses several Non - GAAP financial measures and ratios derived therefrom, including : ( i ) tangible common equity, (ii) tangible assets, and (iii) tangible book value per share, and (iv) net income contribution . Tangible common equity excludes goodwill and other intangible assets from shareholders’ equity . Tangible assets excludes goodwill and other intangible assets from total assets . Tangible book value per share divides tangible common equity by total shares outstanding . Net income contribution excludes certain tax benefits and expenses and includes estimated cost synergies . Management believes that Non - GAAP financial measures provide additional useful information that allows investors to evaluate the ongoing performance of the company and provide meaningful comparisons to its peers . Management believes these non - GAAP financial measures also enhance investors' ability to compare period - to - period financial results and allow investors and company management to view our operating results excluding the impact of items that are not reflective of the underlying operating performance . Non - GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider SmartFinancial's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company . Non - GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP . Legal Disclaimer

3 Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the Proposed Transaction . No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer or solicitation would be unlawful . In connection with the Proposed Transaction the Company will file with the SEC a registration statement on Form S - 4 (the "Registration Statement") that will include a proxy statement of SVRH and a prospectus of the Company (the "Proxy Statement - Prospectus"), and the Company may file with the SEC other relevant documents concerning the Proposed Transaction . The definitive Proxy Statement - Prospectus will be mailed to the shareholders of SVRH . SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT - PROSPECTUS REGARDING THE PROPOSED TRANSACTION CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY THE COMPANY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION . Free copies of the Proxy Statement - Prospectus, as well as other filings containing information about the Company, may be obtained at the SEC's Internet site (http : //www . sec . gov), when they are filed by the Company . You will also be able to obtain these documents, when they are filed, free of charge, from the Company at www . smartfinancialinc . com . Copies of the Proxy Statement - Prospectus can also be obtained, when it becomes available, free of charge, by directing a request to SmartFinancial , Inc . , 5401 Kingston Pike, Suite 600 , Knoxville, TN 37919 , Attention : Ron Gorczynski, Chief Financial Officer, Telephone : ( 865 ) 437 - 5724 or to Sevier County Bank, 111 East Main Street, Sevierville, Tennessee 37862 Attention : John Presley, Executive Chairman, Telephone : ( 865 ) 453 - 6101 . Participants in the Solicitation The Company, SVRH and certain of their directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of SVRH in connection with the Proposed Transaction . Information about the Company's directors and executive officers is available in its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 17 , 2020 . Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement - Prospectus pertaining to the Proposed Transaction and other relevant materials to be filed with the SEC when they become available . Free copies of these documents may be obtained as described in the preceding paragraph . Compliance Disclosure

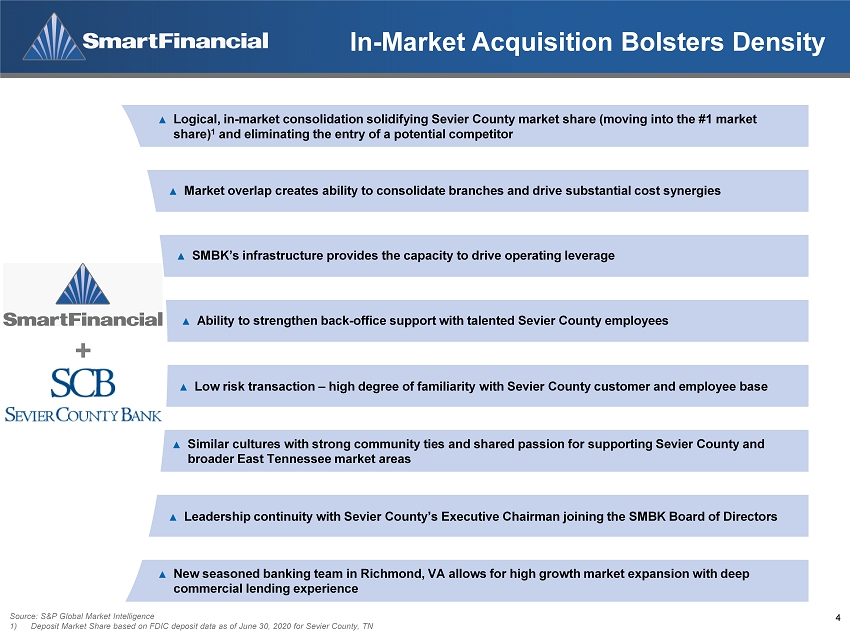

4 ▲ Logical, in - market consolidation solidifying Sevier County market share (moving into the #1 market share) 1 and eliminating the entry of a potential competitor ▲ Market overlap creates ability to consolidate branches and drive substantial cost synergies ▲ SMBK’s infrastructure provides the capacity to drive operating leverage ▲ New seasoned banking team in Richmond, VA allows for high growth market expansion with deep commercial lending experience ▲ Ability to strengthen back - office support with talented Sevier County employees ▲ Low risk transaction – high degree of familiarity with Sevier County customer and employee base ▲ Similar cultures with strong community ties and shared passion for supporting Sevier County and broader East Tennessee market areas ▲ Leadership continuity with Sevier County’s Executive Chairman joining the SMBK Board of Directors In - Market Acquisition Bolsters Density Source: S&P Global Market Intelligence 1) Deposit Market Share based on FDIC deposit data as of June 30, 2020 for Sevier County, TN +

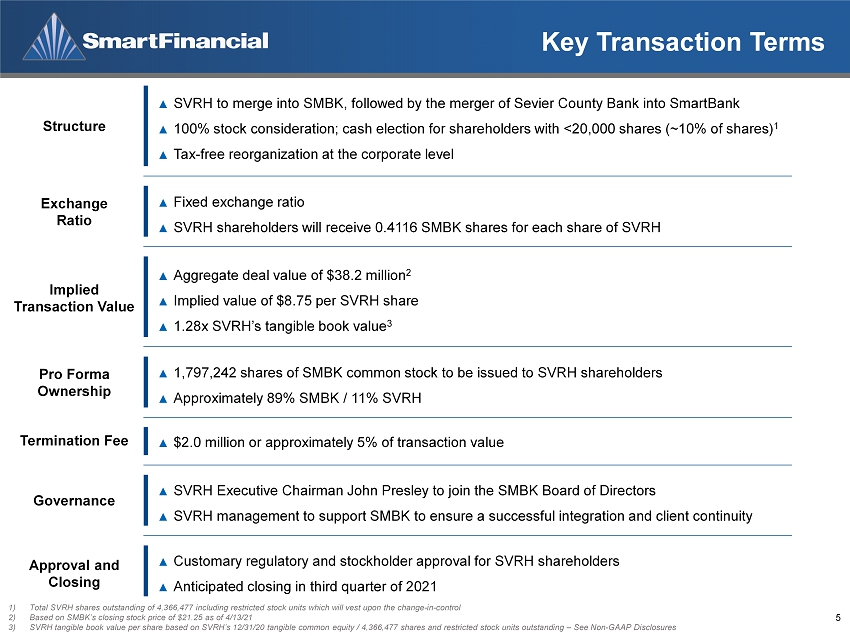

5 1) Total SVRH shares outstanding of 4,366,477 including restricted stock units which will vest upon the change - in - control 2) Based on SMBK’s closing stock price of $21.25 as of 4/13/21 3) SVRH tangible book value per share based on SVRH’s 12/31/20 tangible common equity / 4,366,477 shares and restricted stock un its outstanding – See Non - GAAP Disclosures ▲ SVRH to merge into SMBK, followed by the merger of Sevier County Bank into SmartBank ▲ 100% stock consideration; cash election for shareholders with <20,000 shares (~10% of shares) 1 ▲ Tax - free reorganization at the corporate level Structure ▲ Fixed exchange ratio ▲ SVRH shareholders will receive 0.4116 SMBK shares for each share of SVRH Exchange Ratio ▲ Aggregate deal value of $38.2 million 2 ▲ Implied value of $8.75 per SVRH share ▲ 1.28x SVRH’s tangible book value 3 Implied Transaction Value ▲ 1,797,242 shares of SMBK common stock to be issued to SVRH shareholders ▲ Approximately 89% SMBK / 11% SVRH Pro Forma Ownership Governance ▲ SVRH Executive Chairman John Presley to join the SMBK Board of Directors ▲ SVRH management to support SMBK to ensure a successful integration and client continuity Approval and Closing ▲ Customary regulatory and stockholder approval for SVRH shareholders ▲ Anticipated closing in third quarter of 2021 Termination Fee ▲ $2.0 million or approximately 5% of transaction value Key Transaction Terms

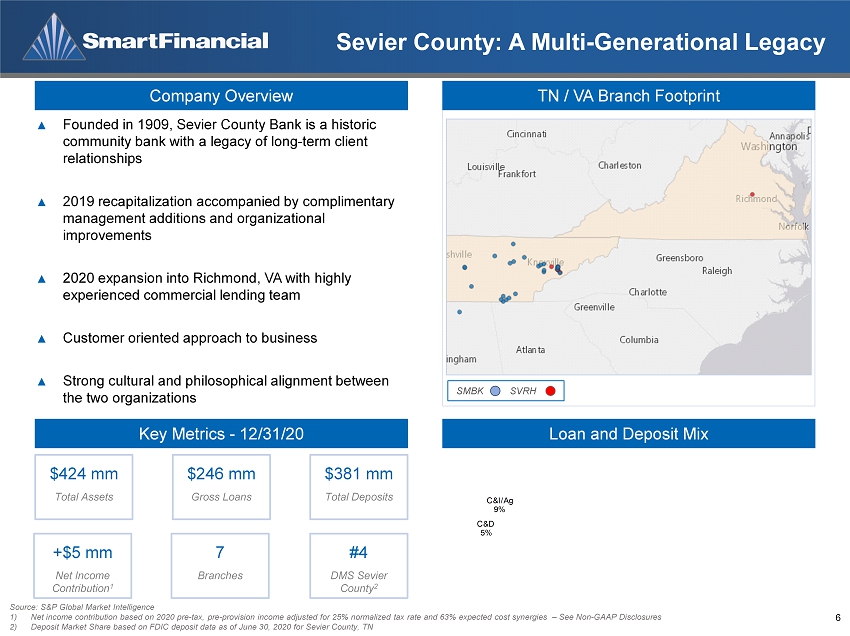

6 CRE 55% Cons. RE 20% C&D 5% C&I/Ag 9% Cons./ Other 11% NIB 13% IB Non - Time 51% Time 36% ▲ Founded in 1909, Sevier County Bank is a historic community bank with a legacy of long - term client relationships ▲ 2019 recapitalization accompanied by complimentary management additions and organizational improvements ▲ 2020 expansion into Richmond, VA with highly experienced commercial lending team ▲ Customer oriented approach to business ▲ Strong cultural and philosophical alignment between the two organizations Source: S&P Global Market Intelligence 1) Net income contribution based on 2020 pre - tax, pre - provision income adjusted for 25% normalized tax rate and 63% expected cost s ynergies – See Non - GAAP Disclosures 2) Deposit Market Share based on FDIC deposit data as of June 30, 2020 for Sevier County, TN TN / VA Branch Footprint Company Overview Key Metrics - 12/31/20 SMBK SVRH Loan and Deposit Mix $424 mm Total Assets $246 mm Gross Loans $381 mm Total Deposits +$5 mm Net Income Contribution 1 7 Branches #4 DMS Sevier County 2 Sevier County: A Multi - Generational Legacy

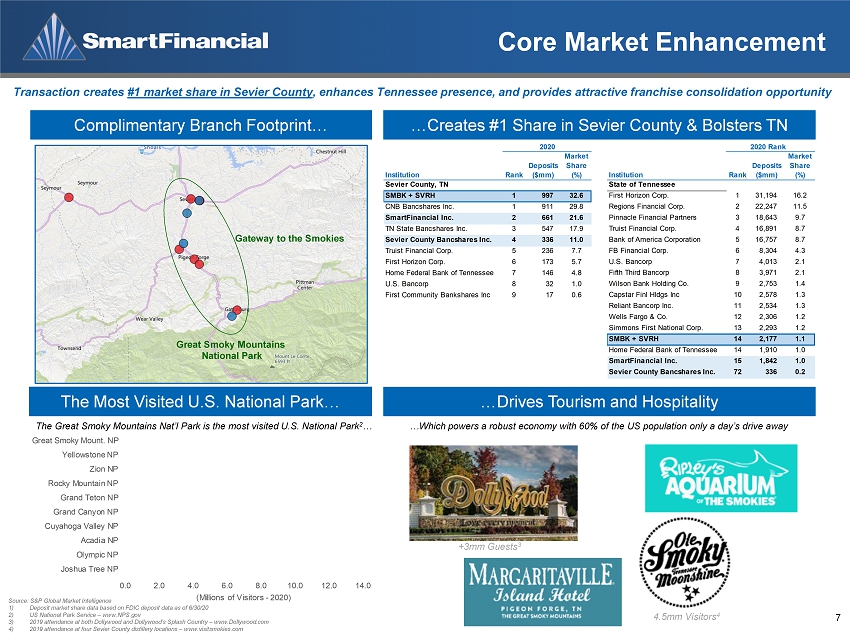

7 Core Market Enhancement Source: S&P Global Market Intelligence 1) Deposit market share data based on FDIC deposit data as of 6/30/20 2) US National Park Service – www.NPS.gov 3) 2019 attendance at both Dollywood and Dollywood’s Splash Country – www.Dollywood.com 4) 2019 attendance at four Sevier County distillery locations – www.visitsmokies.com …Creates #1 Share in Sevier County & Bolsters TN Transaction creates #1 market share in Sevier County , enhances Tennessee presence, and provides attractive franchise consolidation opportunity Complimentary Branch Footprint… Institution Rank Deposits ($mm) Market Share (%) Sevier County, TN SMBK + SVRH 1 997 32.6 CNB Bancshares Inc. 1 911 29.8 SmartFinancial Inc. 2 661 21.6 TN State Bancshares Inc. 3 547 17.9 Sevier County Bancshares Inc. 4 336 11.0 Truist Financial Corp. 5 236 7.7 First Horizon Corp. 6 173 5.7 Home Federal Bank of Tennessee 7 146 4.8 U.S. Bancorp 8 32 1.0 First Community Bankshares Inc 9 17 0.6 2020 Institution Rank Deposits ($mm) Market Share (%) State of Tennessee First Horizon Corp. 1 31,194 16.2 Regions Financial Corp. 2 22,247 11.5 Pinnacle Financial Partners 3 18,643 9.7 Truist Financial Corp. 4 16,891 8.7 Bank of America Corporation 5 16,757 8.7 FB Financial Corp. 6 8,304 4.3 U.S. Bancorp 7 4,013 2.1 Fifth Third Bancorp 8 3,971 2.1 Wilson Bank Holding Co. 9 2,753 1.4 Capstar Finl Hldgs Inc 10 2,578 1.3 Reliant Bancorp Inc. 11 2,534 1.3 Wells Fargo & Co. 12 2,306 1.2 Simmons First National Corp. 13 2,293 1.2 SMBK + SVRH 14 2,177 1.1 Home Federal Bank of Tennessee 14 1,910 1.0 SmartFinancial Inc. 15 1,842 1.0 Sevier County Bancshares Inc. 72 336 0.2 2020 ;Rank The Most Visited U.S. National Park… The Great Smoky Mountains Nat’l Park is the most visited U.S. National Park 2 … Great Smoky Mountains National Park Gateway to the Smokies 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 Joshua Tree NP Olympic NP Acadia NP Cuyahoga Valley NP Grand Canyon NP Grand Teton NP Rocky Mountain NP Zion NP Yellowstone NP Great Smoky Mount. NP (Millions of Visitors - 2020) …Drives Tourism and Hospitality …Which powers a robust economy with 60% of the US population only a day’s drive away +3mm Guests 3 4.5mm Visitors 4

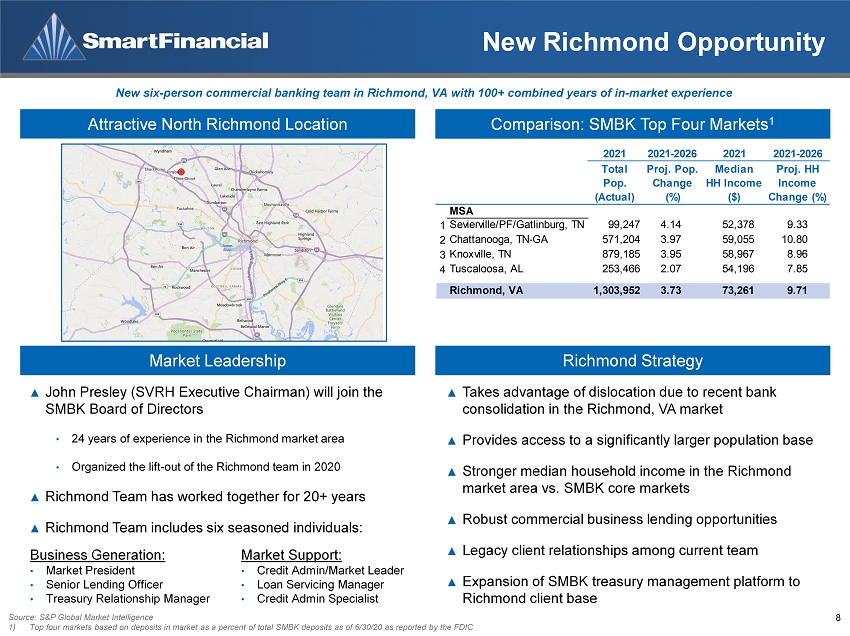

8 New Richmond Opportunity Source: S&P Global Market Intelligence 1) Top four markets based on deposits in market as a percent of total SMBK deposits as of 6/30/20 as reported by the FDIC Comparison: SMBK Top Four Markets 1 New six - person commercial banking team in Richmond, VA with 100+ combined years of in - market experience Attractive North Richmond Location Market Leadership Richmond Strategy ▲ Takes advantage of dislocation due to recent bank consolidation in the Richmond, VA market ▲ Provides access to a significantly larger population base ▲ Stronger median household income in the Richmond market area vs. SMBK core markets ▲ Robust commercial business lending opportunities ▲ Legacy client relationships among current team ▲ Expansion of SMBK treasury management platform to Richmond client base Business Generation: • Market President • Senior Lending Officer • Treasury Relationship Manager Market Support: • Credit Admin/Market Leader • Loan Servicing Manager • Credit Admin Specialist ▲ John Presley (SVRH Executive Chairman) will join the SMBK Board of Directors • 24 years of experience in the Richmond market area • Organized the lift - out of the Richmond team in 2020 ▲ Richmond Team has worked together for 20+ years ▲ Richmond Team includes six seasoned individuals: 2021 2021-2026 2021 2021-2026 Total Pop. (Actual) Proj. Pop. Change (%) Median HH Income ($) Proj. HH Income Change (%) MSA 1 Sevierville/PF/Gatlinburg, TN 99,247 4.14 52,378 9.33 2 Chattanooga, TN-GA 571,204 3.97 59,055 10.80 3 Knoxville, TN 879,185 3.95 58,967 8.96 4 Tuscaloosa, AL 253,466 2.07 54,196 7.85 Richmond, VA 1,303,952 3.73 73,261 9.71

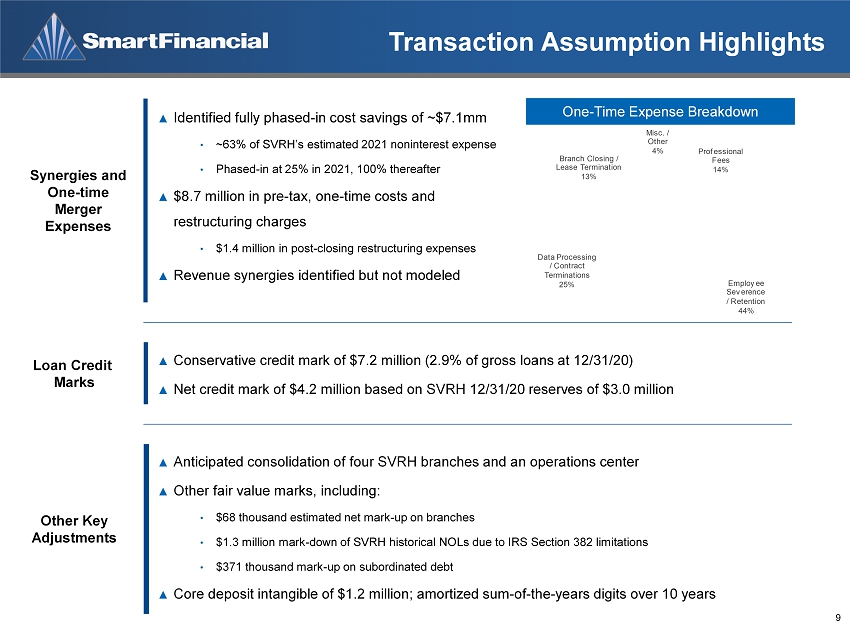

9 Transaction Assumption Highlights ▲ Identified fully phased - in cost savings of ~$7.1mm • ~63% of SVRH’s estimated 2021 noninterest expense • Phased - in at 25% in 2021, 100% thereafter ▲ $8.7 million in pre - tax, one - time costs and restructuring charges • $1.4 million in post - closing restructuring expenses ▲ Revenue synergies identified but not modeled Synergies and One - time Merger Expenses ▲ Conservative credit mark of $7.2 million (2.9% of gross loans at 12/31/20) ▲ Net credit mark of $4.2 million based on SVRH 12/31/20 reserves of $3.0 million Loan Credit Marks ▲ Anticipated consolidation of four SVRH branches and an operations center ▲ Other fair value marks, including: • $68 thousand estimated net mark - up on branches • $1.3 million mark - down of SVRH historical NOLs due to IRS Section 382 limitations • $371 thousand mark - up on subordinated debt ▲ Core deposit intangible of $1.2 million; amortized sum - of - the - years digits over 10 years Other Key Adjustments One - Time Expense Breakdown Professional Fees 14% Employee Severence / Retention 44% Data Processing / Contract Terminations 25% Branch Closing / Lease Termination 13% Misc. / Other 4%

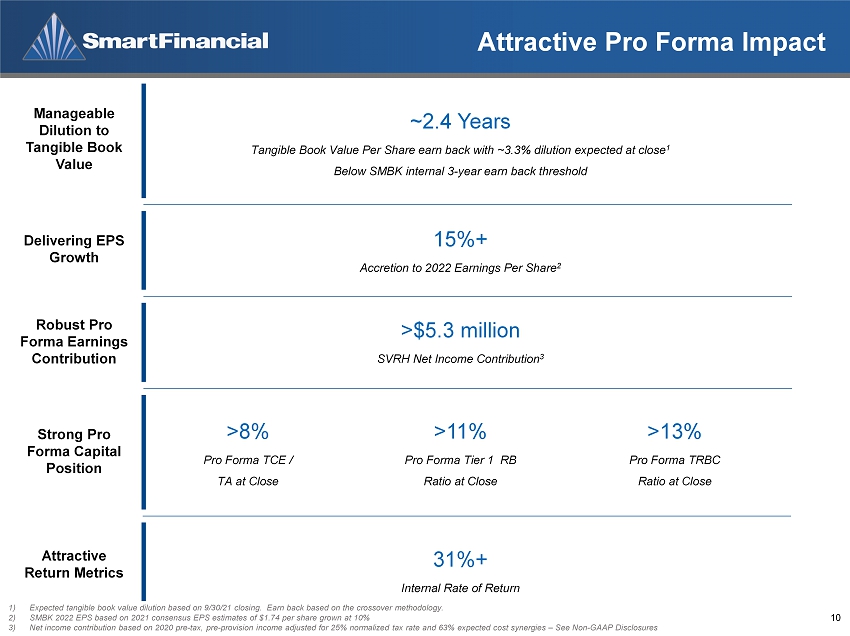

10 Attractive Pro Forma Impact 15%+ Accretion to 2022 Earnings Per Share 2 31%+ Internal Rate of Return 1) Expected tangible book value dilution based on 9/30/21 closing. Earn back based on the crossover methodology. 2) SMBK 2022 EPS based on 2021 consensus EPS estimates of $1.74 per share grown at 10% 3) Net income contribution based on 2020 pre - tax, pre - provision income adjusted for 25% normalized tax rate and 63% expected cost s ynergies – See Non - GAAP Disclosures ~2.4 Years Tangible Book Value Per Share earn back with ~3.3% dilution expected at close 1 Below SMBK internal 3 - year earn back threshold Manageable Dilution to Tangible Book Value Delivering EPS Growth Attractive Return Metrics Strong Pro Forma Capital Position Robust Pro Forma Earnings Contribution >8% Pro Forma TCE / TA at Close >13% Pro Forma TRBC Ratio at Close >$5.3 million SVRH Net Income Contribution 3 >11% Pro Forma Tier 1 RB Ratio at Close

11 Due Diligence Process Diligence Focus Areas Consumer / Commercial Credit Treasury Management Legal / Compliance Accounting Policy and Tax Human Resources Technology & Operations Retail Operations x Comprehensive due diligence coordinated and led by executives of both SMBK and SVRH x Engagement of external counsel, consultants and internal M&A team x SMBK has extensive prior diligence and integration experience – six acquisitions in the past nine years Process Complete Credit Review ▲ Reviewed a large sample from various industry types with a particular focus on pandemic - impacted sectors 1 ▲ Reviewed 350+ loans, including: • 100% of the top 25 relationships • 100% of the 90+ days past due and nonaccruals, watchlist and special mention or worse • 100% of the loans with a relationship balance over $500 thousand • 73% of the construction and development portfolio • 90% of the Commercial Real Estate (CRE) portfolio • 70% of the C&I and Owner - Occupied CRE portfolio ▲ Reviewed 73% of the portfolio ▲ Multiple senior management diligence meetings with coordinated cooperation on both sides ▲ Fully engaged SMBK senior leadership performing business and operational reviews of functional areas: • Chairman & CEO: Corporate Structure / Organizational Continuity • CFO & EVP Planning: Accounting / Finance • CLO & CCO: Credit Diligence / Lending Operations • CIO: Technology / Cybersecurity / Third Party Risk Management • CPO: Human Resources / Human Capital / Key Talent • Head of Retail & SVP Operations: Treasury Management / Deposit Operations / Retail Operations • VP General Counsel: Compliance / Internal Audit / Legal ▲ Support from legal counsel, accounting and other outside professionals 1) Office, retail and hospitality

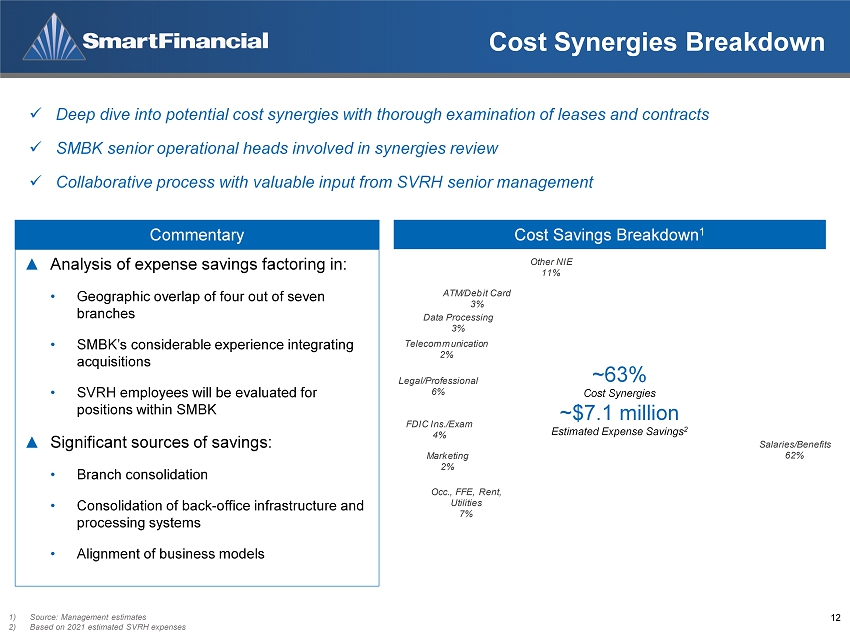

12 Salaries/Benefits 62% Occ., FFE, Rent, Utilities 7% Marketing 2% FDIC Ins./Exam 4% Legal/Professional 6% Telecommunication 2% Data Processing 3% ATM/Debit Card 3% Other NIE 11% Cost Synergies Breakdown 1) Source: Management estimates 2) Based on 2021 estimated SVRH expenses ▲ Analysis of expense savings factoring in: • Geographic overlap of four out of seven branches • SMBK’s considerable experience integrating acquisitions • SVRH employees will be evaluated for positions within SMBK ▲ Significant sources of savings: • Branch consolidation • Consolidation of back - office infrastructure and processing systems • Alignment of business models ~63% Cost Synergies ~$7.1 million Estimated Expense Savings 2 x Deep dive into potential cost synergies with thorough examination of leases and contracts x SMBK senior operational heads involved in synergies review x Collaborative process with valuable input from SVRH senior management Cost Savings Breakdown 1 Commentary

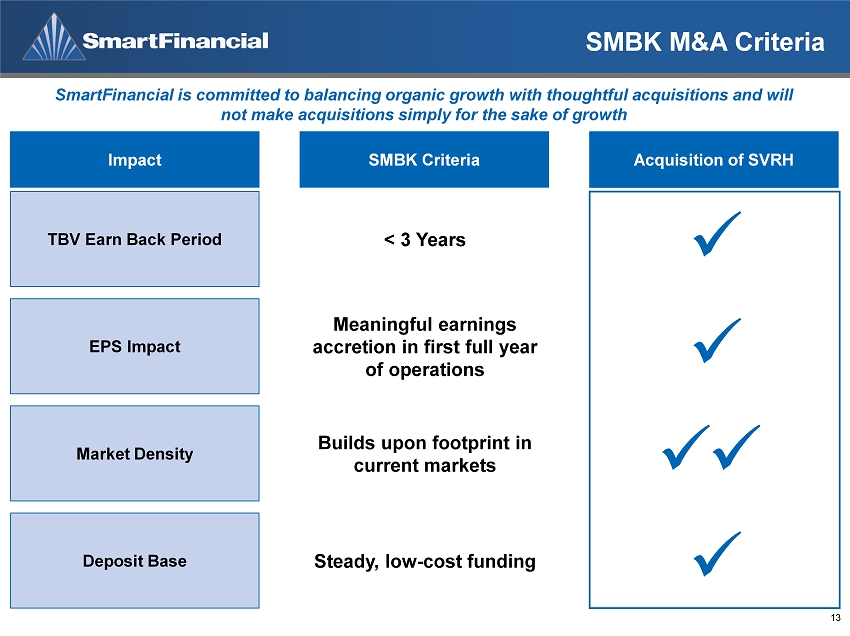

13 SMBK M&A Criteria Impact SMBK Criteria Acquisition of SVRH TBV Earn Back Period EPS Impact Market Density Deposit Base < 3 Years Meaningful earnings accretion in first full year of operations Builds upon footprint in current markets Steady, low - cost funding x 1 x 1 x 1 x 1 SmartFinancial is committed to balancing organic growth with thoughtful acquisitions and will not make acquisitions simply for the sake of growth x 1

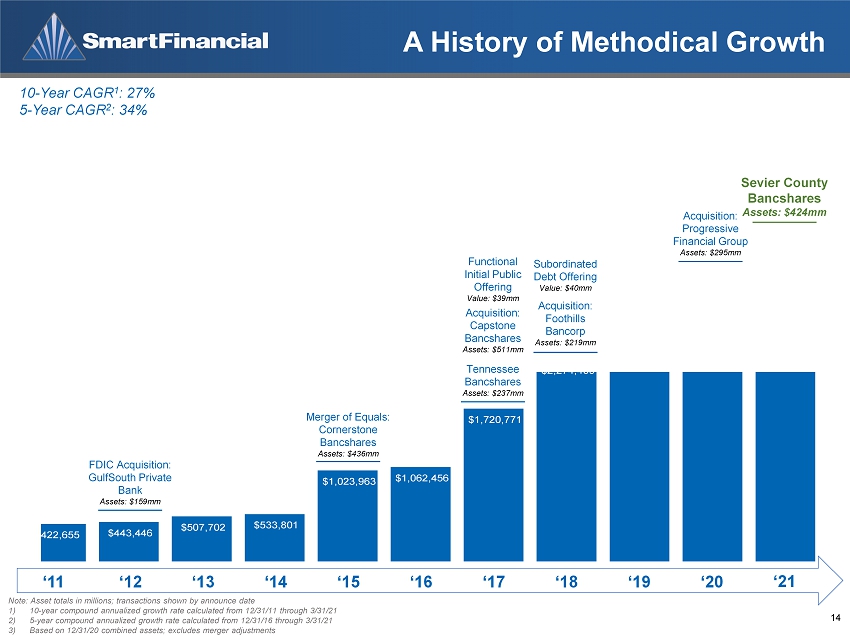

14 $422,655 $443,446 $507,702 $533,801 $1,023,963 $1,062,456 $1,720,771 $2,274,409 $2,449,123 $3,304,949 3,728,980 A History of Methodical Growth ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘14 ‘12 ‘13 ‘11 Merger of Equals: Cornerstone Bancshares Assets: $436mm FDIC Acquisition: GulfSouth Private Bank Assets: $159mm Functional Initial Public Offering Value: $39mm Acquisition: Capstone Bancshares Assets: $511mm Tennessee Bancshares Assets: $237mm Acquisition: Progressive Financial Group Assets: $295mm Acquisition: Foothills Bancorp Assets: $219mm Subordinated Debt Offering Value: $40mm 10 - Year CAGR 1 : 27% 5 - Year CAGR 2 : 34% ‘21 Note: Asset totals in millions; transactions shown by announce date 1) 10 - year compound annualized growth rate calculated from 12/31/11 through 3/31/21 2) 5 - year compound annualized growth rate calculated from 12/31/16 through 3/31/21 3) Based on 12/31/20 combined assets; excludes merger adjustments Sevier County Bancshares Assets: $424mm 3

15 Appendix

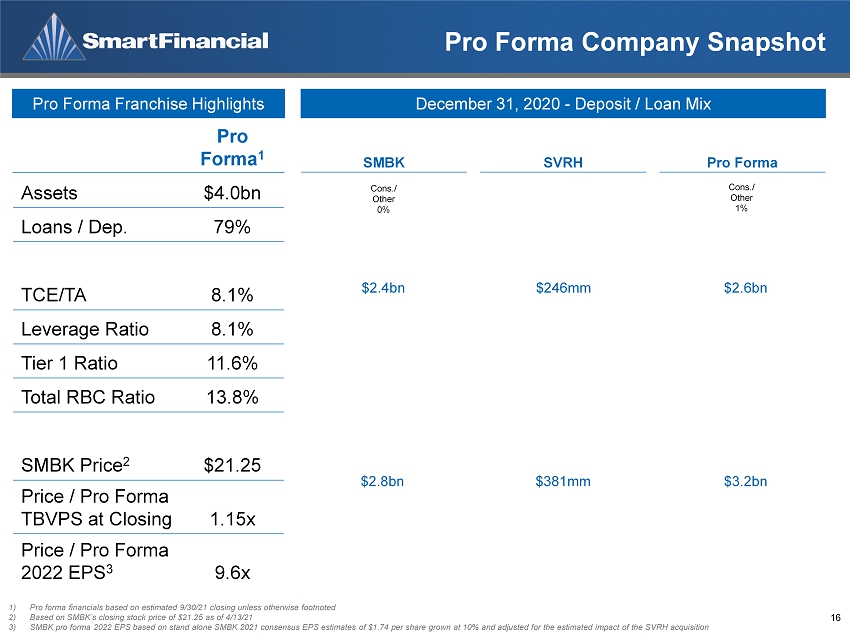

16 Pro Forma Company Snapshot December 31, 2020 - Deposit / Loan Mix SMBK SVRH Pro Forma $2.4bn $246mm $2.6bn $2.8bn $381mm $3.2bn Pro Forma 1 Assets $4.0bn Loans / Dep. 79% TCE/TA 8.1% Leverage Ratio 8.1% Tier 1 Ratio 11.6% Total RBC Ratio 13.8% SMBK Price 2 $21.25 Price / Pro Forma TBVPS at Closing 1.15x Price / Pro Forma 2022 EPS 3 9.6x Pro Forma Franchise Highlights 1) Pro forma financials based on estimated 9/30/21 closing unless otherwise footnoted 2) Based on SMBK’s closing stock price of $21.25 as of 4/13/21 3) SMBK pro forma 2022 EPS based on stand alone SMBK 2021 consensus EPS estimates of $1.74 per share grown at 10% and adjusted f or the estimated impact of the SVRH acquisition Cons./ Other 0% Cons./ Other 1% NIB 24% IB Non - Time 56% Time 20% NIB 13% IB Non - Time 51% Time 36% NIB 23% IB Non - Time 55% Time 22% CRE 42% Cons. RE 19% C&D 12% C&I/Ag 27% CRE 55% Cons. RE 20% C&D 5% C&I/Ag 9% Cons./ Other 11% CRE 44% Cons. RE 19% C&D 11% C&I/Ag 25%

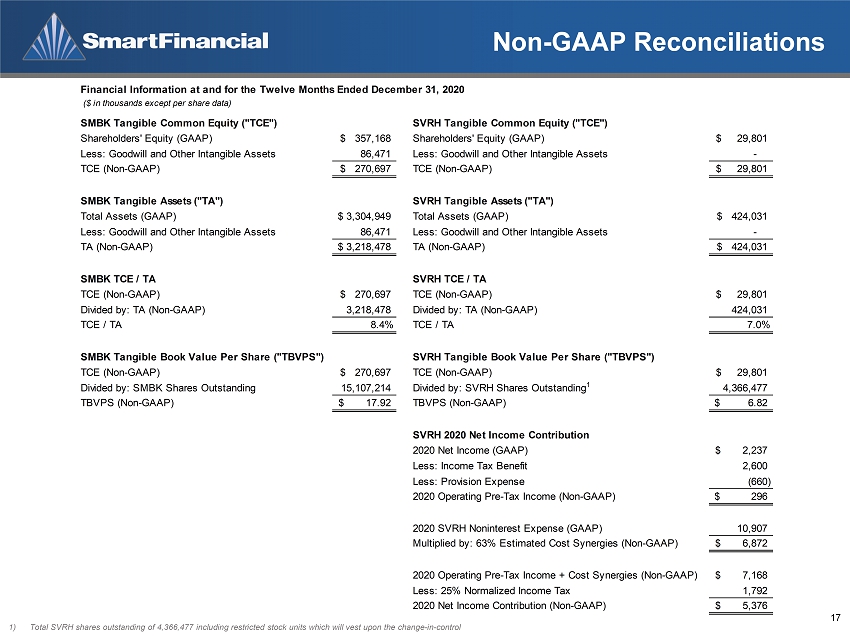

17 Non - GAAP Reconciliations 1) Total SVRH shares outstanding of 4,366,477 including restricted stock units which will vest upon the change - in - control Financial Information at and for the Twelve Months Ended December 31, 2020 ($ in thousands except per share data) SMBK Tangible Common Equity ("TCE") SVRH Tangible Common Equity ("TCE") Shareholders' Equity (GAAP) 357,168$ Shareholders' Equity (GAAP) 29,801$ Less: Goodwill and Other Intangible Assets 86,471 Less: Goodwill and Other Intangible Assets - TCE (Non-GAAP) 270,697$ TCE (Non-GAAP) 29,801$ SMBK Tangible Assets ("TA") SVRH Tangible Assets ("TA") Total Assets (GAAP) 3,304,949$ Total Assets (GAAP) 424,031$ Less: Goodwill and Other Intangible Assets 86,471 Less: Goodwill and Other Intangible Assets - TA (Non-GAAP) 3,218,478$ TA (Non-GAAP) 424,031$ SMBK TCE / TA SVRH TCE / TA TCE (Non-GAAP) 270,697$ TCE (Non-GAAP) 29,801$ Divided by: TA (Non-GAAP) 3,218,478 Divided by: TA (Non-GAAP) 424,031 TCE / TA 8.4% TCE / TA 7.0% SMBK Tangible Book Value Per Share ("TBVPS") SVRH Tangible Book Value Per Share ("TBVPS") TCE (Non-GAAP) 270,697$ TCE (Non-GAAP) 29,801$ Divided by: SMBK Shares Outstanding 15,107,214 Divided by: SVRH Shares Outstanding 1 4,366,477 TBVPS (Non-GAAP) 17.92$ TBVPS (Non-GAAP) 6.82$ SVRH 2020 Net Income Contribution 2020 Net Income (GAAP) 2,237$ Less: Income Tax Benefit 2,600 Less: Provision Expense (660) 2020 Operating Pre-Tax Income (Non-GAAP) 296$ 2020 SVRH Noninterest Expense (GAAP) 10,907 Multiplied by: 63% Estimated Cost Synergies (Non-GAAP) 6,872$ 2020 Operating Pre-Tax Income + Cost Synergies (Non-GAAP) 7,168$ Less: 25% Normalized Income Tax 1,792 2020 Net Income Contribution (Non-GAAP) 5,376$

18 Billy Carroll President & CEO 865.868.0613 billy.carroll@smartbank.com Miller Welborn Chairman 423.385.3067 miller.welborn@smartbank.com 5401 Kingston Pike, Suite 600 Knoxville, TN 37919 Investor Contact

19