Attached files

| file | filename |

|---|---|

| EX-21 - LIST OF SUBSIDIARIES - RENAVOTIO, INC. | riii_ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

July 15, 2020

Date of Report (Date of earliest event reported)

333-188401

Commission File Number

| RENAVOTIO, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| 99-0385424 |

| (State or other jurisdiction of incorporation or organization) |

| (IRS Employer Identification No.) |

|

|

|

|

| 601 South Boulder Ave., Suite 600, Tulsa, OK |

| 74119 |

| (Address of principal executive offices) |

| (Zip Code) |

(888) 928-1312

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Unless the context otherwise requires, “we,” “us,” “our,” and the “Company” refer to Renevatio, Inc. and its consolidated subsidiaries.

| Introductory Note |

This Current Report on Form 8-K/A amends and supplements our Current Report on Form 8-K filed with the Securities and Exchange Commission on July 17, 2020 disclosing, among other things, our acquisition of Renavotio Infratech, Inc. on July 15, 2020.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

ON ACCOUNTING AND FINANCIAL DISCLOSURE

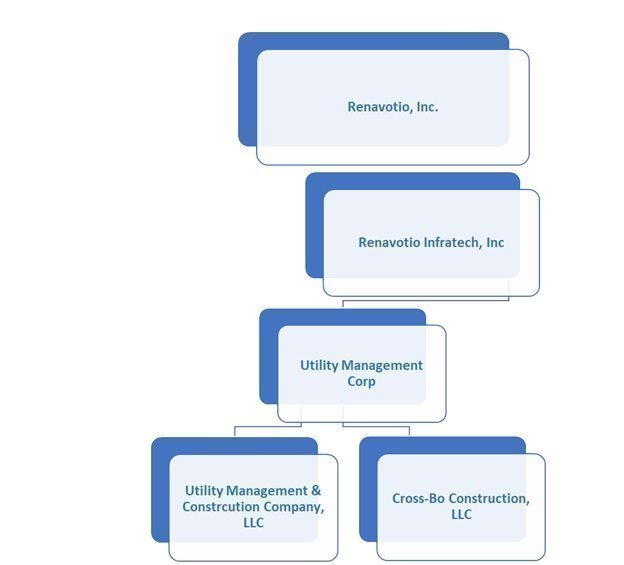

In conjunction with the agreements detailed below under Item 1.01 and our reorganization, on August 29, 2020, the closing date of our acquiring Renavotio Infratech, our wholly owned subsidiaries became:

|

| · | Renavotio Infratech, Inc., a Delaware corporation. |

|

| · | Utility Management Corp, a Delaware corporation. |

|

| · | Utility Management & Construction, LLC and Cross-Bo Construction, LLC, both Oklahoma Limited Liability Companies. |

As a result of our contemplated reorganization, on June 25, 2020, we filed an Amendment to our Articles of Incorporation in Nevada changing our corporate name to “Renavotio, Inc.” In connection with the name change, on September 25, 2020, the Financial Institute Regulatory Authority (FINRA) approved our name change to Renavotio, Inc., and our OTCQB ticker symbol change to “RIII.”

Item 1.01. Entry into a Material Definitive Agreement

April 3, 2020 Securities Exchange Agreement with Renavotio Infratech and its Shareholders

(Acquisition of Renavotio Infratech)

On April 3, 2020, we executed a Securities Exchange Agreement (the “Exchange Agreement”) with Renavotio Infratech, Inc., a Delaware corporation (“Renavotio Infratech”) and its Shareholders (the “Renavotio Infratech Shareholders”) to acquire 100% of the equity interests of Renavotio Infratech or 20,000,000 common stock shares of Renavotio Infratech, in exchange for our payment of the following consideration: (a) 20,000 of our Series A Preferred Stock issued pro rata to the Renavotio Infratech Shareholders; (b) cancellation of 30,000,000 of our Common Stock Shares owned by Success Holding Group, USA (“Success Holding”), a company controlled by our then controlling shareholders Steve Chen and Brian Kistler; (c) our future issuance to a party designated by our then CEO, Chi Jui Hong, of 6,000,000 our Common Stock Shares, which designee, Wei-Der Lee, was authorized by our Board of Directors. ; and (d) cancellation of receivables in related party transactions between us and Success Holding.

July 15, 2020 Agreement between Renavotio Infratech, Inc. and Utility Management Corp

(Acquisition of Utility Management Corp by, Renavotio Infratech, Inc.)

On July 15, 2020, Renavotio Infratech, Inc. completed a Stock Purchase Agreement with Utility Management Corp. (“Utility Management”), a Delaware corporation, and its stockholders, whereby Utility Management sold to Renavotio Infratech all of Utility Management’s issued and outstanding shares and the limited liability interests of Utility Management’s wholly owned subsidiaries, Cross-Bo Construction, LLC and Utility Management & Construction, LLC, both of which are Oklahoma limited liability companies, at which time Utility Management became Renavotio Infratech’s wholly owned subsidiary.

In connection with Renavotio Infratech’s acquiring Utility Management, we provided the following consideration to Utility Management: (i) we assumed Utility Management’s existing debt; and (ii) we issued such number of shares of our common stock equal to (x) One Million Three Hundred Thousand Dollars ($1,300,000) divided by (y) the greater of (1) $.07 or (2) the average closing price of share of our Common Stock for the ten (10) trading days immediately prior to the Closing Date.

The foregoing agreement summaries do not purport to be complete and qualified in their s entirety as to the actual provisions of those agreements, which are filed as Exhibits 10.5, 10.9 and 10.10, and are incorporated herein by reference.

| 2 |

August 29, 2020 Agreement with Renavotio, Inc. and Success Holding

On August 29, 2020, the closing date of our acquiring Renavotio Infratech, we entered into an agreement with Success Holding consistent with the closing conditions in the April 3, 2020 Securities Exchange Agreement, and: (a) issued the 6,000,000 million shares to designee, Wei-Der Lee; and (b) transferred all of the ownership and assets and all liabilities of the Success Holding’s subsidiaries to Success Holding. Upon proof of the ownership being transferred, the transaction will be closed.

Item 2.01. Completion of Disposition of Assets

The information contained in Item 1.01 and the financial statements included herein, the above and the financial statements included herein are hereby incorporated by reference.

Item 3.02 Unregistered Sales of Equity Securities

The disclosures set forth in Items 1.01 and 2.01 are incorporated into this Item 3.02 by reference.

Item 5.01 Changes in Control of Registrant

Item 5.02 Departure and Directors or Certain Officers/Appointment of Certain Officers

On April 3, 2020, our Board of Directors accepted the resignations of Brian Kistler as President, Secretary, Treasurer; Steve Andrew Chen, as Chairman; Chi Jui (Chris) Hong, Chief Executive Officer (CEO), Director; and Frank Tseng, Chief Financial Officer. Upon acceptance of these resignations, our Board simultaneously elected William Robinson as our Chairman/CEO/President/Secretary/Treasurer. Steve Andrew Chen and Brian Kistler remained as our Board members.

On July 15, 2020 we appointed Robert Mackey as our Chief Operating Officer/Director.

On August 26, 2020, Steve Andrew Chen, our Interim Chief Financial Officer, resigned as our Interim Chief Financial Officer. Steven Chen’s resignation as our Interim Chief Financial Officer was not in connection with any disagreement with our management regarding us, or our operations, policies or practices.

On December 16, 2020, we appointed William Robinson as our Chief Executive Officer/Chief Financial Officer/Principal Accounting Officer/Treasurer/Director.

Forward-Looking Statements

This Current Report on Form 8-K, or some of the information incorporated herein by reference, contains statements that are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding the financial position, business strategy and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Current Report on Form 8-K, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. When we discuss our s strategies or plans, we are making projections, forecasts or forward-looking statements. Such statements are based on the beliefs of, as well as assumptions made by and information currently available to our management.

The forward-looking statements contained in this Current Report on Form 8-K and in any document incorporated by reference are based on current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we anticipate. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in our Risk Factor Section beginning on page 16. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

| 3 |

DESCRIPTION OF BUSINESS

Reorganization of Corporate Structure

As a result of our acquiring Renavotio Infratech, Inc. via a Securities Exchange Agreement, we adopted a new business plan provided by our now subsidiary, Renavotio Infratech, Inc. and its subsidiary, Utility Management Corp. and our Subsidiaries Utility Management & Construction, LLC and Cross-Bo Construction, LLC, consisting of the following businesses:

|

| · | Renavotio Infratech, Inc. (RI) provides Medical Infrastructure, including Personal Protection Equipment, Gowns, Mask, Gloves and Disinfectant sales, marketing and Production. |

|

| · | RI’s subsidiary Utility Management Corp’s (UMC) operating subsidiary Utility Management & Construction, LLC provides Water, Sewer and Environmental monitoring. |

|

| · | UMS’s second operating subsidiary Cross-Bo Construction, LLC provides Underground Infrastructure installation including Fiber optic, 5G, Water and Sewer installations and construction. |

As a result of our reorganization, our wholly owned subsidiaries became:

|

| · | Renavotio Infratech, Inc., a Delaware corporation, incorporated on March 19, 2020, which operated as a private company from its date of incorporation until we acquired it. |

|

| · | Utility Management Corp, a Delaware corporation, incorporated on March 22, 2020, which operated as a private company from its date of incorporation until we acquired it. |

|

| · | Utility Management & Construction, LLC and Cross-Bo Construction, LLC, both Oklahoma Limited Liability Companies, incorporated as Limited Liability Companies in Oklahoma on January 1, 1962 and December 22, 2004, respectively, private companies from their date of incorporation until we acquired it. |

| 4 |

Corporate History

We were incorporated in the State of Nevada on January 30, 2013 under the name Altimo Group Corp, which had as its initial business plan o placing and operating frozen yogurt making machines.

Effective July 14, 2014, we had a change in control. In accordance with the terms and provisions of a stock purchase agreement dated May 5, 2014 (the “Stock Purchase Agreement”) by and among Marek Tomaszewski, the seller of an aggregate of 8,000,000 shares of our common stock (the “Control Block Seller”), and Success Holding Group Corp. USA, a Nevada corporation (the “Control Block Purchaser”), the Control Block Purchaser purchased from the Control Block Shareholders, all of the 8,000,000 shares of common stock held of record. In accordance with the terms and provisions of the Stock Purchase Agreement, we accepted the resignations of its sole officer and director, Marek Tomaszewski as President, Chief Executive Officer, Secretary, Treasurer and Chief Financial Officer effective July 14, 2014. Simultaneously, the Board of Directors appointed the following individuals: Steve Chen as a member of the Board of Directors and the Chief Executive Officer; and (ii) Brian Kistler as a member of the Board of Directors and the President, Secretary, Treasurer and Chief Financial Officer. Effective July 14, 2014, our Board of Directors, and majority shareholders approved an amendment to our articles of incorporation to change our name to “Success Entertainment Group International Inc.” (the “Name Change Amendment”). The Name Change Amendment was approved by our Board of Directors to better reflect the new nature of our business operations. The Name Change Amendment was filed with the Secretary of State of Nevada on August 22, 2014 changing our name to “Success Entertainment Group International Inc.” effective as of the Closing Date.

| 5 |

On July 15, 2014, the Board of Directors of Altimo Group Corp authorized and approved the execution of that certain general release and waiver of debt agreement (the “Release Agreement”) with Marek Tomaszekwsi, our prior President, Chief Executive Officer, Secretary, Treasurer and Chief Financial Officer (the “Creditor”), pursuant to which the Creditor agreed to waive and release the debt due and owing to it in the aggregate amount of $5,100 (the “Released Debt”). In accordance with the terms and provisions of the Release Agreement, the Creditor agreed to release, acquit, covenant not to sue and specifically release and waive any claims or rights it may have under common law and statutory law relating to the Released Debt. Effective July 15, 2014, pursuant to the change in ownership described above, the focus our direction to becoming a producer/developer of Internet movies and business training films.

On December 1, 2014, our Board of Directors authorized an amendment to its Bylaws to change our fiscal year end From March 31 to December 31.

On December 2, 2014, our Board of Directors accepted the resignation of Steve Chen as the Chief Executive Officer and appointed Chris (Chi Jui) Hong as the Chief Executive Officer and a member of the Board of Directors. Following this appointment, our Board of Directors consists of three members: (i) Steve Andrew Chen; (ii) Brian Kistler; and (iii) Chris (Chi Jui) Hong.

On November 19, 2015, we acquired 100% shares of Double Growth Investment Ltd. On December 9, 2015, we acquired 100% shares of Coronet Limited, Fortunate Yields Limited, Solution Elite Limited, Ultimate Concept Limited, Viva Leader Limited. All these subsidiaries were registered in Republic of Seychelles. We made these acquisitions for future investment purpose. In 2016, we discontinued Coronet Limited, Fortunate Yields Limited, Solution Elite Limited, Ultimate Concept Limited, Viva Leader Limited by non-payment of the annual renewal fee.

On December 14, 2017, we acquired 100% shares of Success Events (Hong Kong) Limited, a company registered in Hong Kong Special Administrative Region. Success Events (Hong Kong) Limited holds 60% shares of Shenzhen Internet Media Co., Ltd. and 100% shares of Distribution Network Inc. Shenzhen Internet Media Co., Ltd was registered in China. Distribution Network Inc. was registered in Seychelles and its main business are holding seminar in Great China Area.

On February 28, 2018, Success Events (Hong Kong) Limited transferred 60% shares of Shenzhen Internet Media Co., Ltd. to a company in China. Shenzhen Internet Media Co., Ltd., and is no longer our subsidiary.

On May 30, 2018, Success Events (Hong Kong) Limited acquired 100% shares of Success Win (Shanghai) Co., Ltd.

In 2020, we entered into the acquisition agreements detailed above.

Name Change and Symbol Change

On September 25, 2020, with a Market Effective Date of September 28, 2020, FINRA approved our name change from Success Entertainment Group International, Inc. to Renavotio, Inc., and our OTCQB ticker symbol change to “RIII.” We changed our corporate name with the State of Nevada to Renavotio, meaning “reborn or renew” in Latin, to better illustrate our current business operations, most significantly our infrastructure services as our tag line is renew and revitalize our infrastructure.

Our Business

We operate the following infrastructure and medical platforms through e-commerce, platform sharing; and database-membership:

|

| · | Fiber optics and 5G installation |

|

| · | Utility Management |

|

| · | Medical technology |

|

| · | PPE infrastructure products |

|

| · | Underground utility construction |

| 6 |

Our operations are conducted through:

|

| · | Renavotio Infratech, Inc. (“RII”), a Delaware Corporation and its subsidiaries: |

|

| · | Utility Management Corp (“Utility Management”) and its 2 Subsidiaries, Utility Management & Construction, LLC (“Utility Management, LLC”) and Cross-Bo Construction, LLC (“Cross-Bo, LLC”) |

Industry Data

According to the 2021 American Infrastructure Report Card, issued by the American Society of Civil Engineers, all categories of American infrastructure require modernization and improvement. According to the report, nationwide infrastructure funding for the ten years to 2029 is projected to reach $3.3 trillion. Nevertheless, the same report concludes that, at this level of funding, the nation will still face an unmet infrastructure investment gap through 2031 of $2.6 trillion. By 2039, a continued underinvestment in the nation’s infrastructure at current rates will cost $10 trillion in GDP, as well as more than 3 million jobs and $2.4 trillion in exports by 2039. By 2039, America’s overdue infrastructure bill will cost the average American household $3,300 a year, or $63 a week.

| 7 |

Renavotio Infratech, Inc., (“RII”)

RII’s sells personal protective equipment (medical gloves, face masks, face shields, medical gowns). RII has purchased these products from overseas manufacturers; however, due to price gouging and speculation pertaining to the Pandemic related market, over the next 24 months RII seeks to develop direct factory relationships and agreements with manufacturers in the US to provide fixed price agreements to hospitals, medical distributors, and government agencies, for which there are no assurances that RII will be successful in securing such agreements.

Utility Management Corp., (“RII Subsidiary”)

RII’s wholly owned subsidiary, Utility Management, offers the following through its subsidiaries, Utility Management & Construction LLC and Cross-Bo Construction LLC:

|

| · | Management and operation of water utility systems |

|

| · | Water and waste management technology |

|

| · | Internet of things (“IoT”) |

|

| · | Underground infrastructure, construction, and installation |

|

| · | 5G technology solutions |

Our acquisition of Utility Management Corp. positions us to pursue opportunities in the utility management and underground utility space. In December 2020 Utility Management completed its initial expansion of its turn-key managed utility and constructions services by adding two additional municipalities to its portfolio of customers. Utility Management continues to reach out to other cities to add municipal clients in early 2021.

Utility Management & Construction LLC (Utility Management Subsidiary) (“UMCCO”)

UMCCO, an Oklahoma limited liability company, is an engineering and smart utility management company that provides a one-stop solution for rural communities to reduce the consumption of electricity, natural gas, and water utilities for commercial, industrial, and municipal end users. UMCCO’s unique approach creates immediate bottom-line savings for clients, by providing the engineering, planning, permitting, and installation through their second wholly owned subsidiary, Cross-Bo Construction (“Cross-Bo”), an Oklahoma limited liability company that specializes in water, sewer, Telcom, and 5G design and installation, establishing a long-term value proposition while also achieving respective sustainability goals

UMCCO also provides consulting and operational services to small towns or county CO-OPS that operate their own water and sewer systems to provide long-term savings, utilizing smart-utility monitoring and dedicated engineering and service personnel. These utility related platforms capture utility data from handheld GPS devices or in-place sensors, with planned use of drones to identify waste contamination, leak detection, and topographic underground utility installation planning. As a community-based management company based in Oklahoma, it specializes in the management and operation of small utility systems (Rural Waters Systems or Public Trusts or Authority), including record keeping, reporting, budgeting, customer correspondence, billing, and engineering. provides water-systems management. Utility Management provides services to over 1200 customers in the Northeast Oklahoma and Southeast Kansas area and intends to expand into other areas of the Midwest.

UMCCO provides geographic information system (“GIS”) solutions, infrastructure management and “smart city” infrastructure technology to construction, environmental consulting, utility, and government clients in the United States. (A “smart city” is an urban area that uses different types of electronic IoT sensors to collect data and them to manage assets and resources efficiently.)

|

| · | The Utility platforms enables local and distributed teams to do field data collection using mobile devices (iOS and Android) and manage all geospatial data using a web interface; and |

|

| · | The Utility Platforms are a collection of components and application program interfaces (APIs) that make it easy to create a full, custom mapping solution very quickly. These components enable extensive and intensive data analysis, routing, and dissemination of geospatial information |

| 8 |

UMCCO has licensed products that use of georeferenced imagery and vector datasets to obtain insights about that data. They can be used for field asset management, cadaster mapping, urban planning, the analysis of aerial and satellite imagery and other typical GIS use cases. These solutions are currently used across a variety of sectors, including utilities, intelligence, materials (mining), industrial (transportation), government (local, state, national and international) and others. In addition, UMCCO has been using this software user for more than three years, these solutions to help map and visualize the locations of subsurface as-built conditions. Going forward, Bravo expects to expand its use of these solutions to locate and map underground telecoms infrastructure. We intend to invest in research and development to increase the functionality this technology, including incorporating active IoT sensor monitoring and network-connected sensor products that can help create a comprehensive “smart infrastructure” solution for clients. Over the next 24 months, we intend to pursue commercialization of these solutions through investment in product, sales, and business development, and to integrate these platforms into our Infrastructure Services business, of which there are no assurances.

UMCCO’s solutions leverage cloud technology and a mobile-first approach to data acquisition and geo-analytics. The solutions are a set of cloud-based tools to collect, visualize and analyze geographic information. With the UMCCO solutions, a field crew can collect and update data using iOS and Android smartphones and tablets working online or offline. The web interface enables its users to display, analyze and share data easily. Incorporating these solutions allows organizations to streamline mapping workflows and reduce repetitive mapping workflows. On occasions where the customer has a pre-existing GIS or computer-aided design (CAD) system, APIs and plug-ins enable easy integration with them.

Cross-Bo Construction, LLC (Utility Management Subsidiary) (“Cross Bo”)

Cross-Bo operates in Oklahoma, Kansas, and Missouri and provides services on infrastructure projects, specializing in Utility System installation and maintenance, which includes providing the hard assets and expertise to install pipelines for water, wastewater, storm water and gas systems up to thirty-six (“36”) inches in diameter. Cross Bo’s Hydrovac excavators, drilling, and heavy excavating equipment enables it to compete in the municipal utility bidding market for installation of water, wastewater, storm water, and gas system construction and installation. Cross-Bo has expertise in the installation of HDPE, PVC, and Ductile Piping Systems.

Additionally, Cross-Bo operates as a subsurface utility engineering (referred to in the industry as “SUE”) location, inspection and maintenance company, and has developed methodologies, combined with the use of its equipment, to generate detailed records of subsurface “as-built conditions”, such as the location of water, electrical, gas, fiber optic and other critical underground utility infrastructure assets. These services enable construction and maintenance activities to be conducted on a given physical site with the precision needed to limit damage to underground utility infrastructure and to avoid utility outages.

| In December, 2020, UMCCO completed 1,500 smart meter installations across the state of Oklahoma. Along with its subsidiary, Cross-Bo Construction, LLC, both companies have completed over 50,000 feet of water line installations and are now bidding on multiple proposals with Municipalities reopening the bidding process, giving Utility management and Cross-Bo potential increased revenue opportunities in 2021. |

Our Future Plans

Over the next 24 months, we will attempt to expand our business and service offerings, as follows:

|

| · | Expand our Infrastructure Services, developing relationships with municipalities, utilities, and construction companies. |

|

| · | Through Cross-Bo, should it be successful in is planned rollout of 5G mobile telecommunications services, develop and market those 5G services through an expanded geographic area, initially into Kansas and Missouri. |

|

| · | Capitalize on infrastructure expansion project in Tulsa, Oklahoma. Capitalize on ATT’s 5G expansion in the Midwest to provide support Infrastructure Services. |

|

| · | Acquire private companies in the Infrastructure Services area. |

|

| · | Seek strategic partnerships and/or revenue sharing opportunities in the niche infrastructure technology solutions area. |

| 9 |

With all of our acquisitions, we intend to focus on post-transaction integration and business improvements, including through cross-selling opportunities and the leveraging of operational efficiencies through a central platform of finance, legal and human resources capabilities.

These solutions will provide our Infrastructure Services business with a potential competitive advantage and will enable us to develop and commercialize new services and products. We intend to continue to invest in the development of additional platform capabilities, including capabilities relating to smart IoT sensors and to help create niche “smart infrastructure” solutions for clients.

There are no assurances that we will be successful in any of the above expansion plans.

Technology-Enabled Infrastructure Solutions

We believe that the infrastructure and infrastructure services industries are starting to adopt new technology solutions to deliver cost savings and compliance adherence. As a result, we believe that smart utility products will provide our Infrastructure Services business with a significant competitive advantage. Similarly, we believe that our Infrastructure Services business will provide our Technology Solutions business with insights from a broad range of infrastructure clients, helping to guide the development of our technology products. We believe our technology platform coupled with our infrastructure client relationships and insights will enable us to develop and commercialize new services and products faster than if we were either an infrastructure services-only, or a technology solutions-only, business. We also expect that sustained operational and business development activities across our businesses will accelerate the commercial penetration of our technology solutions into the infrastructure markets we already serve.

Business Strategies

Our goal is to provide innovative, market-leading solutions for the public and private infrastructure services industry, in particular where new technologies can enhance conventional service and product offerings, for revenue generating opportunities, economies of scale and potential improved operating result, which we plan to achieve our goal through the implementation of the following strategies:

|

| · | Acquire Complementary Companies. We plan to selectively acquire companies that expand our existing operations, can leverage their businesses using our existing platform and are accretive to long-term stockholder value. |

|

| · | Potential Increased Revenue from Existing Clients. We intend to expand our relationships with our existing clients and increase their business with us by cross selling our technology solutions and infrastructure services, including in multiple markets in the U.S. and globally. |

|

| · | Attract New Clients. We intend to invest in sales and business development efforts, including to expand the geographies in which we sell our infrastructure services and technology solutions. For example, Cross-Bo is licensed in Oklahoma, Kansas, and Missouri, and is currently targeting specific projects relating to the 5G telecommunications rollout, a new opportunity in the Midwest and throughout the United States. Additionally, UMMC is utilizing multiple infrastructure management software tools for use in its rural utility management program. |

|

| · | Continuously Improve Operations. We intend to continually improve our operations, including reducing costs and increasing productivity, initially through the centralization of shared management services in our parent company. Selectively Invest in Technology and New Services and Products. We intend to invest in our technology and infrastructure platforms to serve the evolving needs of our clients. |

Significant Developments

We developed our sales and logistics in connection with the procurement and delivery process of our PPE products.

On October 28, 2020, we and an overseas supplier of 3M N95 1860 Face Masks (the “Face Masks’) completed an agreement for the supply from the overseas supplier for 10 Million Face Masks. Upon completion of our first purchase of 500,000 Face Masks, we are required to purchase the remaining 9.5 Million Face Masks within 2 months after the 500,000 Face Masks purchase. In December 2020, we mutually cancelled the P.O. for the remaining 9,500,000 N95 mask, on the P.O. for 10,000,000 N95 mask order due to issues related to product reliability and potential counterfeit masks being substituted for original issue mask.

| 10 |

In November 2020, we closed the sale of the first tranche of 500,000 N95 masks to a medical supply company representing a state agency buyer.

In December 2020, we received an order of 1,900,000 N95 masks. In December 2020, we cancelled the balance of the remaining 1,400,000 N95 mask, on the P.O. for 1,900,000 N95 mask order due to issues related to product reliability and potential counterfeit masks being substituted for original issue mask.

In December 2020, we expanded our marketing plans with Kevin Harrington.

In December 2020, we secured production of PPE to supply third parties with masks, gloves and gowns. This reduced the chance of counterfeit products being substituted for original manufactured products.

On January 29, 2021, we, as the Seller, entered into a Securities Purchase Agreement with Tysadco Partners, LLC, a Delaware Limited Liability Company (the “Purchaser), whereby we sold 4,000,000 of our Common Stock Shares to the Purchaser for the Purchase Price of $220,000 or five and one-half cents per share.

On February 1, 2021, we entered into a Corporate Development Advisory Agreement with ClearThink Capital and its affiliate, Tysadco Partners, LLC (“Consultant”), for the Consultant to provide various consulting services to us to increase awareness and visibility of the investment community, including developing and implementing an ongoing stock market support system, drafting and distributing our press release, social media engagement, corporate profiles, and providing public market oversight. We shall compensate the Consultant with a monthly fee of $7,500 consisting of: (a) $2,500 cash; and (b) $5,000 of our restricted common stock shares to be issued on a quarterly basis in the name of Tysadco Partners LLC based on the closing price on the last day of the preceding period. We did not grant the Consultant registration rights and the shares may be sold pursuant to Rule 144. At our option, any portion of the stock compensation may be payable in cash to us. Should we uplist to NASDAQ or the NYSI, the monthly fee payable to the Consultant will increase to $10,000 per month, with the cash component increasing to $5,000 per month. We have the option to pay the entire monthly fee in all cash.

On February 1, 2021, we entered into a Marketing and Distribution Agreement (the “Marketing Agreement“) with VerifyMe, Inc. (Nasdaq: VRME) (“VerifyMe”), a company that provides anti-counterfeiting and brand protection solutions. The Marketing Agreement provides that: (a) VerifyMe appoints us as non-exclusive global preferred sales representative to promote, market, distribute and sell VerifyMe products as an enhancement to our personal protection equipment products (“PPE”), including face masks, gloves, gowns, goggles, and face shields, to ensure the authenticity and origin of our PPE; (b) we will not enter into similar agreements or arrangements with any competitor of VerifyMe without its written consent; (c) VerifyMe will grant us preferential pricing of its products for incorporation into our PPE; (d) if we make a sale of PPE incorporating VerifyMe products, we will make prompt payment to VerifyMe for such products; and (e) if we facilitate a direct sale by VerifyMe of PPE incorporating VerifyMe products, VerifyMe will pay us a commission of 15% of revenue that it receives from such sale. The Marketing Agreement may be terminated on 30 days’ notice by either party.

On February 8, 2021 Renavotio, Inc. entered into Master Distribution Agreement with Resgreen Group (RGGI), a leading mobile robotics company, to market and handle all of the logistical functions such as order processing, shipping, billing and collections for the Wanda SD/SA, disinfecting robot.

On February 22, 2021 Renavotio, Inc. announce it has secured a $2,150,000 initial purchase order from a PPE supplier for boxes of surgical gloves, which order is subject to the buyer's product inspection and final 60% payment.

At our Annual of Stockholders (the “Annual Meeting”) held on February 22, 2021, the Company’s stockholders approved each of the proposals set forth below by the final voting results set forth below.

| 11 |

Proposal 1

To elect the following individuals as directors of the Company, each to serve a term of one year or until his or her successor is duly elected or appointed:

|

|

| Number of Shares |

| |||||

|

|

| Votes For |

|

| Votes Withhold |

| ||

| William Robinson |

|

| 188,710,842 |

|

|

| 588,681 |

|

| Dr. Robert Mackey |

|

| 188,653,001 |

|

|

| 646,522 |

|

| Steven Chen |

|

| 188,653,001 |

|

|

| 646,522 |

|

| Brian Kistler |

|

| 185,453,158 |

|

|

| 3,846,365 |

|

Proposal 2

To ratify the appointment of Yichien Yeh, CPA, as the Company’s independent registered public accounting firm:

| Number of Shares | ||||||||||

| Votes For |

|

| Votes Against |

|

| Abstain |

| |||

|

| 189,399,273 |

|

|

| 57,500 |

|

|

| 500 |

|

Proposal 3

| To ratify the name change from Success Entertainment Group International Inc. to Renavotio, Inc.: |

| Number of Shares | ||||||||||

| Votes For |

|

| Votes Against |

|

| Abstain |

| |||

|

| 189,309,757 |

|

|

| 147,516 |

|

|

| 0 |

|

Proposal 4

To approve by an advisory vote regarding executive compensation:

| Number of Shares | ||||||||||

| Votes For |

|

| Votes Against |

|

| Abstain |

| |||

|

| 188,008,118 |

|

|

| 1,055,007 |

|

|

| 236,398 |

|

Proposal 5

| To approve by an advisory vote the frequency of future executive compensation advisory votes: |

| Number of Shares | ||||||||||||||

| One Year |

|

| Two Years |

|

| Three Years |

|

| Abstain |

| ||||

|

| 38,474,913 |

|

|

| 1,697,613 |

|

|

| 148,616,086 |

|

|

| 510,913 |

|

Proposal 6

To ratify the Company’s 2019 Non-Qualified Stock Incentive Plan and the 2020 Equity Incentive Plan:

| Number of Shares | ||||||||||

| Votes For |

|

| Votes Against |

|

| Abstain |

| |||

|

| 188,079,258 |

|

|

| 944,192 |

|

|

| 276,073 |

|

| 12 |

Proposal 7

To increase the authorized preferred stock from an aggregate of 32,442,857 shares of preferred stock to 50,000,000 shares of preferred stock, $0.00001 par value:

| Number of Shares | ||||||||||

| Votes For |

|

| Votes Against |

|

| Abstain |

| |||

|

| 184,544,374 |

|

|

| 4,382,335 |

|

|

| 372,814 |

|

Following the Annual Meeting, our Board of Directors approved the reappointment of the following executive officers:

|

| · | William Robinson as Chairman of the Board, CEO, President, Secretary/Treasurer, Interim CFO |

|

| · | Dr. Robert Mackey as Chief Operating Officer |

On March 4, 2021, we entered into an Amended Corporate Development Advisory Agreement (“Amended Agreement”), which canceled the February 1, 2021 Agreement, and replaced the compensation terms, as follows: (a) we pay the Consultant a $8,333.33 Monthly Fee for a period of 24 months, which amount will be paid via our restricted common stock shares to be issued in the name of Tysadco; and (b) the number of restricted common stock shares earned is 4,000,000 based on our stock value at the March 2, 2020 closing price.

March 24, 2021, we announce we had secured an additional $1.8 Million purchase order from a PPE medical distributor for surgical gloves, the order is subject to the buyer's product inspection and final payment.

Competition

There are many competitors in the sales of personal protection equipment and infrastructure services that have greater assets, revenues, operational resources and financial resources then we do.

We believe there is a significant market opportunity to build a leading infrastructure-focused business that facilitates industry consolidation and delivers cost-effective infrastructure services and technology solutions.

|

|

| Large and Growing Client Market |

|

| Essential Nature of Infrastructure Services Multiple opportunities in the rural footprint we currently operate in One stop service company offering utility management and installation |

Infrastructure services are often essential expenditures for municipal governments and others. We believe that the essential nature of infrastructure services for many clients and potential clients will result in long-term growth opportunities and also help generate stable revenue streams over the economic cycle.

Highly Fragmented Provider Market

The U.S. has a large number of small and medium-sized companies providing infrastructure services to public and private customers on a local or regional basis. We believe that many of these companies are closely held or family-owned and -run, whose owners may have few exit opportunities. In addition, we believe that many of these companies need and want to align with larger and better capitalized platforms, potentially resulting in opportunities for our focused acquisition strategy.

Increasing Adoption of New Technologies

Many municipalities, utilities and other market participants are in the early stages of adopting new technologies to monitor and support their infrastructure, such as geospatial mapping and remote sensor technology. These new technology solutions have the potential to increase productivity in, and reduce costs associated with, construction, maintenance, and related activities.

Website

Our website is located at www.renavotio.com. No information from this website is included in this Prospectus

| 13 |

Research and Development

We did not incur any research or development expenditures over the last two (2) fiscal years or since our inception.

Intellectual Property

We do currently have any patents, trademarks, or other intellectual property.

Revenue

We generate revenue from the following:

|

| · | Sale of Medical Personal Protection Equipment |

|

| · | PPE Production Logistics |

|

| · | Infrastructure Services |

|

| · | Utility Management |

|

| · | Engineering and Service Fees |

|

| · | Reoccurring long term operational contracts |

|

| · | Installation of Smart utility monitoring of Water, Sewer, Cable and Gas |

|

| · | Installation of Water, Sewer, Cable and Gas |

|

| · | Planned Fiber Optic and 5G installation |

Target Markets

Our target markets include:

|

| · | Hospitals, medical facilities, medical distributors |

|

| · | Municipalities, State and Federal and other government bodies |

|

| · | Utility companies, Commercial Development projects and Rural Telcom |

Intellectual Property

We have no registered patents, trademarks, or other intellectual property.

Dependence on One or a Few Major Customers

We are not dependent upon any major customers

| 14 |

Employees

We have 3 employees consisting of our Chairman/Chief Executive and Chief Financial Officer, Billy Robinson, Brian Kistler, Corporate Compliance Officer and our Chief Operating Officer, Dr. Robert Mackey.

Utility Management & Construction LLC has the following employees:

|

| ☐ | President, who is also our Chief Operating Officer |

|

| ☐ | Controller |

|

| ☐ | Operations Manager |

|

| ☐ | 3 Administrative personnel |

|

| ☐ | 2 Supervisors |

|

| ☐ | 1 Meter Reader |

|

| ☐ | 13 Technicians |

Cross-Bo Construction LLC has the following employees:

|

| ☐ | President, who is also our Chief Operating Officer |

|

| ☐ | General Manager |

|

| ☐ | Contracts Specialist |

|

| ☐ | 1 Foreman |

|

| ☐ | 6 Operators |

|

| ☐ | Dump truck operator |

|

| ☐ | Shop Maintenance Laborer |

|

| ☐ | Shop Maintenance |

Seasonality of Business

Seasonality does not materially affect our business.

Sources and Availability of Products

We purchase, inventory, and deliver medical protection equipment from our leased fulfillment center in Chattanooga Tennessee. We import medical protective equipment from China, Vietnam, Korea, and Malaysia.

We purchase and inventory waterline, sewer line, meters, and fiber optic cable for our water related infrastructure services through various US located sources.

Raw Materials

We do not use raw materials in our business.

Government Regulations

We are subject to government regulation by the Environmental Protection Agency with respect to our infrastructure services. We are subject to regulation of the following agencies with respect to our sales of medical protection equipment.

|

| · | Department of Commerce |

|

| · | US Treasury |

|

| · | US Customs |

|

| · | EFA |

Termination of the Tritanium Labs, Inc. Acquisition

On October 21, 2020, we (as a Nevada corporation) and our wholly owned subsidiary, Renavotio Infratech, Inc., a Delaware corporation (the "Buyer"), completed a Share Purchase Agreement with Tritanium Labs, Inc. (“Tritanium”) and its stockholders (the "Seller"), whereby we agreed to purchase all of Tritanium’s outstanding capital stock and its subsidiaries with a closing date of November 30, 2020.We provided an extension document to Tritanium, which they did not respond to; accordingly, the Agreement has been terminated for failure to meet the closing date of November 30, 2020.

DESCRIPTION OF PROPERTY

Our executive, administrative and operating offices are located at 601 South Boulder Ave, Suite 600 Tulsa, OK 74119. We pay $300 per month for shared use of the space on a month-to-month basis. We believe that our facilities are adequate for our needs and that additional suitable space is available on acceptable terms as required.

We also own a four-acre 5,500 square foot office complex and a 5,000 square foot warehouse in Ochelata, Oklahoma from which our corporate operations, including Utility Management Corp, Utility Management & Construction, LLC and Cross-Bo Construction, LLC, operate from We purchased the office complex and warehouse, which is subject to an SBA loan of $905,163 and requires a monthly payment of $10,125.

| 15 |

We have PPE fulfillment operation in Chattanooga, Tennessee where we operate in a 230,000 square foot facility. We have a monthly minimum operations cost of $750 monthly on a month-to-month lease basis. All fulfillment operations are on a contract basis and vary month to month.

RISK FACTORS

An investment in our securities involves a high degree of risk. You should not invest in our securities if you cannot afford to lose your entire investment. In deciding whether you should invest in our securities, you should carefully consider the following information together with all of the other information contained in this Current Report. Any of the following risk factors can cause our business, prospects, financial condition or results of operations to suffer and you to lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

If we are unable to manage our acquisitions and growth effectively, our business could be adversely affected.

A significant expansion of our operations with the addition of our operating subsidiaries, and new personnel will be required in all areas of our operations in order to implement our recent acquisitions in the business of infrastructure services and sales of personal protection equipment. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. For us to continue to manage such growth, we must put in place legal and accounting systems, and implement human resource management and other tools. There is no assurance that we will be able to successfully manage this anticipated rapid growth. A failure to manage our growth effectively could materially and adversely affect our results of operations.

We have a limited operating history and are subject to the risks encountered by early-stage companies.

Because our new business has a limited operating history within our operations, you should consider and evaluate our operating prospects in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets.

We have had negative cash flows from operations since inception; we will require significant additional financing, the availability of which cannot be assured, and if our company is unable to obtain such financing, our business may fail.

To date, we have had negative cash flows from operations and have depended on sales of our equity securities and debt financing to meet our cash requirements. We may continue to have negative cash flows. We have estimated that we will require approximately $2,000,000 to fully carry out our business plan for the next twelve months. There is no assurance that actual cash requirements will not exceed our estimates. We will require additional financing to finance working capital and pay for operating expenses and capital requirements until we achieve a positive cash flow.

Our ability to generate positive cash flow will be dependent upon our ability to generate sufficient revenues from our new business plan and raise significant additional financing. If we are unable to obtain such financing, we will not be able to fully develop our business. Specifically, we will need to raise additional funds to:

|

| · | support our planned growth and carry out our business plan |

|

| · | hire top quality personnel for all areas of our business; and |

|

| · | address competing technological and market developments |

We be unable to obtain additional equity or debt financing on acceptable terms as required. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements. Any additional equity financing may involve substantial dilution to our then existing shareholders. If we require, but are unable to obtain, additional financing in the future, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions, withstand adverse operating results and compete effectively. More importantly, if we are unable to raise further financing when required, we may be forced to scale down our operations and our ability to generate revenues may be negatively affected.

| 16 |

We expect to incur substantial expenses to meet our reporting obligations as a public company.

We estimate that it will cost approximately $250,000 annually to maintain the proper legal, management and financial controls for our filings required as a public reporting company, funds that would otherwise be spent for our business operations. Our public reporting costs may increase over time, which will increase our expenses and may decrease our potential profitability.

We will need substantial additional funding to continue our operations, which could result in dilution to our stockholders; we may be unable to raise capital when needed, if at all, which could cause us to have insufficient funds to pursue our operations, or to delay, reduce or eliminate our development of new programs or commercialization efforts.

We expect to incur additional costs associated with operating as a public company and to require substantial additional funding to continue to pursue our business and our expansion plans. We may also encounter unforeseen expenses, difficulties, complications, delays, and other unknown factors that may increase our capital needs and/or cause us to spend our cash resources faster than we expect. Accordingly, we expect that we will need to obtain substantial additional funding in order to continue our operations. To date, we have financed our operations entirely through equity investments by related parties and other investors and the incurrence of debt. We expect to continue to do so in the foreseeable future. Additional funding from those or other sources may not be available when or in the amounts needed, on acceptable terms, or at all. If we raise capital through the sale of equity, or securities convertible into equity, it will result in dilution to our existing stockholders, which could be significant depending on the price at which we may be able to sell our securities. If we raise additional capital through the incurrence of additional indebtedness, we will likely become subject to further covenants restricting our business activities, and holders of debt instruments may have rights and privileges senior to those of our equity investors. In addition, servicing the interest and principal repayment obligations under debt facilities could divert funds that would otherwise be available to support development of new programs and marketing to current and potential new clients. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce, or eliminate development of new programs or future marketing efforts. Any of these events could significantly harm our business, financial condition, and prospects.

Our officers and director may be subject to conflicts of interest

Some of our officers and directors provide their services on a non-exclusive, part-time basis, and may therefore become subject to conflicts of interest resulting from their other activities.

Billy Robinson, our Chief Executive Officer/Chief Financial Officer, devotes his working time also to other business endeavors, which include serving as Chairman of UAV Corp, an Aerospace communications, Airship, and drone business. Potential conflicts may arise between our CEO’s responsibilities to us and those to UAV Corp, including how much time he devotes to our affairs, as well as what business opportunities may be presented to him, which may arise in a conflict of interest between his interests in UAV Corp and our interests. Billy Robinson controls 50.11% of our outstanding voting shares through his ownership of 19,650,000 Preferred Class A Shares.

Dr. Robert Mackey, our Chief Operating Officer/Director is also the President of Utility Management and Construction, LLC and Cross Bo Construction, LLC, which companies are our wholly owned subsidiaries. Dr. Robert Mackey owns 6.81% of our fully diluted outstanding shares. Accordingly, there are potential and actual conflicts of interests between and among our Chief Operating Officer’s interests and our interests.

Currently, we have no policy in place to address such conflicts of interest. As a result, our business and results of operations could be materially adversely affected if our officers favor the interests of their interests in other corporations they control over our interests.

A terrorism attack, other geopolitical crisis, or widespread outbreak of an illness or other health issue, such as the current Coronavirus outbreak, could negatively impact our operations.

Our operations are susceptible to global events, including acts or threats of war or terrorism, international conflicts, political instability, and natural disasters. The occurrence of any of these events could have an adverse effect on our business results and financial condition.

We are susceptible to a widespread outbreak of an illness or other health issue, such as the recent Coronavirus (also referred to herein as “COVID-19 19”) outbreak first reported in Wuhan, Hubei Province, China in December 2019, resulting in millions of confirmed cases identified around the world and in countries in which we conduct business, including the United States. The outbreak has caused governments to implement quarantines, implement significant restrictions on travel, closed schools, and workplaces, and implement work restrictions, all of which can impair normal business operations. Globally air travel has been significantly interrupted as has air freight, ocean freight, and even truck deliveries.

| 17 |

As a result of pandemic outbreaks, businesses have been and can be shut down, supply chains can be interrupted, slowed, or rendered inoperable, and individuals can become ill, quarantined, or otherwise unable to work and/or travel due to health reasons or governmental restrictions. Governmental mandates may require forced shutdowns of our facilities for extended or indefinite periods. In addition, these widespread outbreaks of illness could adversely affect our workforce resulting in serious health issues and absenteeism. Pandemic outbreaks could also interfere with general commercial activity related to our supply chain and customer base, which could have an adverse effect on our financial condition and operational results. See additional risk factors regarding COVID-19 below.

Our operations are substantially dependent upon key personnel.

Our performance is substantially dependent on the continued services and performance of William (“Billy”) Robinson, our CEO, Corporate Compliance Officer, Brian Kistler and our Chief Operating Officer, Dr. Robert Mackey. The loss of services of any of our executive officers or other key employees could have a material adverse effect on our business, financial condition, and results of operations. In addition, any future expansion of our business will depend on our ability to identify, attract, hire, train, retain and motivate other highly skilled managerial, marketing, customer service and manufacturing personnel, and our inability to do so could have a material adverse effect on our business, financial condition and results of operations.

Cybersecurity incidents could disrupt business operations, result in the loss of critical and confidential information, and adversely impact our reputation and results of operations.

Global cybersecurity threats can range from uncoordinated individual attempts to gain unauthorized access to our information technology (“IT”) systems to sophisticated and targeted measures known as advanced persistent threats. While we employ comprehensive measures to prevent, detect, address and mitigate these threats (including access controls, data encryption, vulnerability assessments, management training, continuous monitoring of our IT networks and systems and maintenance of backup and protective systems), cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption or unavailability of critical data and confidential or proprietary information (our own or that of third parties) and the disruption of business operations. While no cybersecurity attack to date has had a material impact on our financial condition, results of operations or liquidity, the threat remains and the potential consequences of a material cybersecurity incident include reputational damage, litigation with third parties, diminution in the value of our investment in research, development and engineering, and increased cybersecurity protection and remediation costs, which in turn could adversely affect our competitiveness and results of operations.

We have made and expect to continue to make acquisitions as a primary component of our new business plan and growth strategy; we may be unable to identify suitable acquisition candidates or consummate acquisitions on acceptable terms, or we may be unable to successfully integrate acquisitions, which could disrupt our operations and adversely impact our business and operating results.

A primary component of our growth strategy has been to acquire complementary businesses to develop our new business plan of infrastructure services. We intend to continue to pursue acquisitions of complementary technologies, products, and businesses as a primary component of our growth strategy to enhance our infrastructure services and expand our customer base and provide access to new markets and increase benefits of scale. Acquisitions involve certain known and unknown risks that could cause our actual growth or operating results to differ from our expectations. For example:

|

| · | we may be unable to identify suitable acquisition candidates or to consummate acquisitions on acceptable terms |

|

| · | we may pursue international acquisitions, which inherently pose more risks than domestic acquisitions |

|

| · | we compete with others to acquire complementary products, technologies, and businesses, which may result in decreased availability of, or increased price for, suitable acquisition candidates |

|

| · | we may be unable to obtain the necessary financing, on favorable terms or at all, to finance any or all of our potential acquisitions |

|

| · | we may ultimately fail to consummate an acquisition; and |

|

| · | acquired technologies, products or businesses may not perform as we expect, and we may fail to realize anticipated revenue and profits. |

| 18 |

In addition, our acquisition strategy may divert management’s attention away from our existing business, resulting in the loss of key customers or employees, and expose us to unanticipated problems or legal liabilities, including responsibility as a successor for undisclosed or contingent liabilities of acquired businesses or assets.

If we fail to conduct due diligence on our potential targets effectively, we may, for example, not identify problems at target companies or fail to recognize incompatibilities or other obstacles to successful integration. Our inability to successfully integrate future acquisitions could impede us from realizing all of the benefits of those acquisitions and could severely weaken our business operations. The integration process may disrupt our business and, if new technologies, products, or businesses are not implemented effectively, may preclude the realization of the full benefits expected by us and could harm our results of operations. In addition, the overall integration of new technologies, products or businesses may result in unanticipated problems, expenses, liabilities, and competitive responses. The difficulties integrating an acquisition include, among other things:

|

| · | issues in integrating the target company’s technologies, products, or businesses with ours |

|

| · | incompatibility of marketing and administration methods |

|

| · | maintaining employee morale and retaining key employees |

|

| · | integrating the cultures of both companies |

|

| · | preserving important strategic customer relationships |

|

| · | consolidating corporate and administrative infrastructures and eliminating duplicative operations; and |

|

| · | coordinating and integrating geographically separate organizations |

In addition, even if the operations of an acquisition are integrated successfully, we may not realize the full benefits of the acquisition, including the synergies, cost savings or growth opportunities that we expect. These benefits may not be achieved within the anticipated time frame, or at all.

Further, acquisitions may cause us to:

|

| · | issue common stock that would dilute our current stockholders’ ownership percentage |

|

| · | use a substantial portion of our cash resources |

|

| · | increase our interest expense, leverage, and debt service requirements if we incur additional debt to pay for an acquisition |

|

| · | assume liabilities for which we do not have indemnification from the former owners; further, indemnification obligations may be subject to dispute or concerns regarding the creditworthiness of the former owners |

|

| · | record goodwill and non-amortizable intangible assets that are subject to impairment testing and potential impairment charges |

|

| · | experience volatility in earnings due to changes in contingent consideration related to acquisition earn-out liability estimates |

|

| · | incur amortization expenses related to certain intangible assets |

|

| · | lose existing or potential contracts as a result of conflict-of-interest issues |

|

| · | become subject to adverse tax consequences or deferred compensation charges |

|

| · | incur large and immediate write-offs; or |

|

| · | become subject to litigation |

Our by-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our by-laws contain provisions with respect to the indemnification of our officers and directors against all expenses, liability and loss (including attorneys’ fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by him or her in connection with any action, suit or proceeding to which they were made parties by reason of his or her being or having been one of our directors or officers. In the event that any of our officers or directors incurs any expenses, liability or loss resulting from any such action, suit or proceeding, we will be responsible for such expenses, liabilities, or losses, which could have a material adverse effect on our business and financial condition. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers or controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission this indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

| 19 |

Our financial statements may not be comparable to those of other companies.

Pursuant to Section 107(b) of the JOBS Act, we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company effective dates, and our stockholders and potential investors may have difficulty in analyzing our operating results if comparing us to such companies.

Our Chief Executive Officer has the ability to control corporate and stockholder matters, providing him with the ability to control or influence stockholder decisions.

Our Chief Executive Officer, William Robinson, owns 19,650,000 Preferred A Shares, which shares may be on a fully diluted basis converted into 136,480,212 Common Shares, which would represent 50.11 % of our Voting Common Stock Shares outstanding. Our Chief Executive Officer’s ability to convert his Preferred A Shares into a majority of our Common Stock Shares outstanding gives him the control over a majority of our outstanding voting power, enabling him to control corporate and stockholder matters, including funding employee equity incentive programs, electing directors, and determining the outcome of all matters submitted to a vote of our stockholders.

Preferred C Shares issued pursuant to Advisory Agreements, if converted into Common Shares, will cause material dilution to Common Stock held by our shareholders.

We have Advisory Agreements with Kevin Harrington and Joe Abrams, which provide for the issuance of an aggregate of 11,442,857 Preferred C Shares. The 11,442,857 Preferred C Shares are convertible at any time at the holder’s option into Common Stock Shares at a valuation of $0.07 per share. Should the 11,442,857 or any material amount thereof be converted into Common Stock Shares, there will be material dilution to the shareholder interests of our shareholders.

We do not have an independent board of directors which could create a conflict of interests and pose a risk from a corporate governance perspective.

Our Board of Directors consists mostly of current executive officers and consultants, which means that we do not have any outside or independent directors. The lack of independent directors:

|

| · | May prevent the Board from being independent from management in its judgments and decisions and its ability to pursue the Board responsibilities without undue influence. |

|

| · | May present us from providing a check on management, which can limit management taking unnecessary risks. |

|

| · | Create potential for conflicts between management and the diligent independent decision-making process of the Board. |

|

| · | Present the risk that our executive officers on the Board may have influence over their personal compensation and benefits levels that may not be commensurate with our financial performance. |

|

| · | Deprive us of the benefits of various viewpoints and experience when confronting challenges that we face. |

Because officers serve on our Board of Directors, it will be difficult for the Board to fulfill its traditional role as overseeing management.

Because we do not have a nominating or compensation committee, shareholders will have to rely on the entire board of directors, no members of which are independent, to perform these functions.

We do not have a nominating or compensation committee, or any such committee comprised of independent directors. The board of directors performs these functions. No members of the board of directors are independent directors. Thus, there is a potential conflict in that board members who are also part of management will participate in discussions concerning management compensation and audit issues that may affect management decisions.

| 20 |

Our election not to opt out of the JOBS Act extended accounting transition period may not make our financial statements easily comparable to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company we can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised, and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the application date for private companies. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards. As of present, there are no new or revised accounting standards that have been issued by the PCAOB or the SEC applicable to us for which we have adopted the application date for private companies.

The JOBS Act will also allow us to postpone the date by which we must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC. The recently enacted JOBS Act is intended to reduce the regulatory burden on emerging growth companies. The Registrant meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

|

| · | be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting; |

|

| · | be exempt from the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act and certain disclosure requirements of the Dodd-Frank Act relating to compensation of its chief executive officer; |

|

| · | be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934 and instead provide a reduced level of disclosure concerning executive compensation; and |

|

| · | be exempt from any rules that may be adopted by the Public Registrant Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements. |

We intend to take advantage of some or all the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. We have elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act. Among other things, this means that the Registrant’s independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of our internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, we may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Registrant. As a result, investor confidence and the market price of our common stock may be adversely affected.

We may have difficulty obtaining officer and director coverage or obtaining such coverage on favorable terms or financially be unable to obtain any such coverage, which may make it difficult for our attracting and retaining qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

We also expect that being a public company and these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage or financially be unable to obtain such coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

We are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act of 2002 and if we fail to comply in a timely manner, our business could be harmed, and our stock price could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require an annual assessment of internal controls over financial reporting, and for certain issuers an attestation of this assessment by the issuer’s independent registered public accounting firm. The standards that must be met for management to assess the internal controls over financial reporting as effective are evolving and complex, and require significant documentation, testing, and possible remediation to meet the detailed standards.

| 21 |

We expect to incur expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In addition, although attestation requirements by our independent registered public accounting firm are not presently applicable to us, we could become subject to these requirements in the future and we may encounter problems or delays in completing the implementation of any resulting changes to internal controls over financial reporting. In the event that our Chief Executive Officer or Chief Financial Officer determine that our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how the market prices of our shares will be affected; however, we believe that there is a risk that investor confidence and share value may be negatively affected.