Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Evil Empire Designs, Inc. | evil_ex321.htm |

| EX-31.2 - CERTIFICATION - Evil Empire Designs, Inc. | evil_ex312.htm |

| EX-31.1 - CERTIFICATION - Evil Empire Designs, Inc. | evil_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

Commission File No. 000-56212

| EVIL EMPIRE DESIGNS, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 45-5530035 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

441 Eastgate Rd.

Henderson, Nevada 89011

(Address of principal executive offices, zip code)

(725) 666-3700

(Registrant’s telephone number, including area code)

____________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

|

|

|

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT:

Common Stock, $.001 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At June 30, 2020, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $0.00.

As of April 9, 2021, there were 8,057,750 shares of the Registrant’s common stock, par value $0.001 per share, outstanding.

EVIL EMPIRE DESIGNS, INC.

| 2 |

| Table of Contents |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of Evil Empire Designs, Inc., a Nevada corporation (the “Company”), contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: (i) commercialization of our products, (ii) development and protection of our intellectual property, (iii) the Company’s need for and ability to obtain additional financing, (iv) industry competition, (v) the exercise of the control over us by Sheila Cunningham, the Company’s sole director and officer, and majority shareholder, (vi) other factors over which we have little or no control; and (vii) other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Our management has included projections and estimates in this Form 10-K, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

| 3 |

| Table of Contents |

DESCRIPTION OF BUSINESS

Our Corporate History and Background

Evil Empire Designs, Inc. was incorporated on December 23, 2009, under the laws of the State of Nevada, under the name “US Tera Energy Corp.” On August 6, 2015, we changed our name to “JayCor Resources Inc.” On September 12, 2016, we changed our name to Evil Empire Designs, Inc. Sheila Cunningham has our served our sole director since March 11, 2016, and as our President, Chief Executive Officer, Secretary, Treasurer since March 16, 2016. Our business offices are currently located at 441 Eastgate Rd., Suite A, Henderson, Nevada 89011.

At December 31, 2020, our total current assets were $6,954 and our total current liabilities were $472,910. Our net loss for the twelve months ended December 31, 2020 was $31,589. Our accumulated deficit at December 31, 2020 was $(522,755).

Our principal administrative offices are located 441 Eastgate Rd., Henderson, Nevada 89011, and our telephone number is (725) 666-3700. Our website is www.evilempiredesigns.com.

Summary Financial Information

The tables and information below are derived from our audited financial statements as of December 31, 2020.

|

|

| December 31, 2020 |

| |

| Financial Summary |

|

|

| |

| Cash and Cash Equivalents |

| $ | 5,265 |

|

| Total Assets |

|

| 180,970 |

|

| Total Liabilities |

|

| 472,910 |

|

| Total Stockholders’ Equity (Deficit) |

| $ | (291,940 | ) |

| 4 |

| Table of Contents |

Business Overview

At Evil Empire our mission is to design and produce the highest quality aftermarket parts that appeal to middle and upper class female motorcycle enthusiasts to enhance the look of their American V-Twin or metric1 motorcycle allowing them to express their individuality.

Evil Empire designs is committed to providing our customers with products and services that meet, conform to and exceed their individual motorcycle needs, ensuring their design, values and investment expectations are being met.

Our target market is middle and upper income female motorcycle enthusiasts. Evil Empire is a professional company that is dedicated to customizing motorcycles with a cutting edge style. Evil Empire designs aftermarket parts and accessories for female motorcyclist who want to express themselves with an original style of their own.

Company Goals And Objectives

Our goal is to be the number one provider of motorcycle customization parts, as defined by sales revenue, specifically targeted towards women within 5 years. Our objective is to engineer, prototype and manufacture new designs on a consistent schedule to not only stay current, but become a leader in the motorcycle aftermarket industry, while maintaining healthy profit margins. We intend to launch a minimum of two new products per year.

Products - Generally

Evil Empire offers a line of custom parts and accessories for Harley Davidson or metric motorcycles. Our quality parts are made in the USA and Evil Empire is dedicated to providing the highest standard of customer service.

We will engineer, prototype and manufacture new designs on a consistent schedule to stay current in the motorcycle aftermarket industry.

Industry

Motorcycle customization is a growth industry. And most of that growth is increasingly attributed to new female riders. As women take to riding in larger numbers, they tend to accessorize their bikes in order to display their individuality. We intent to assist these women by providing unique designs and high quality products to make their bikes their own.

Core Competencies

Evil Empire’s core competency is in understanding the “biker culture,” and the customization market. Our CEO, Sheila Cunningham, an avid motorcycle rider, has been featured in several magazines for her customization work. Her designs have struck a nerve among female riders who seek her out in customizing their own motorcycles.

Because we are a growth company requiring additional capital, we’ve chosen to incorporate with a view to listing the company so that our investors may achieve liquidity should that be required.

Products and Services

Aftermarket Body Parts

Evil Empire will concentrate on the research, design and development of the finest quality of aftermarket parts, including, but not limited to custom fiberglass saddlebags, side panels, and fenders, gas tanks, and seats. Our custom bags have already been featured in several motorcycle magazines.

| 5 |

| Table of Contents |

Billet Aluminum Parts and Accessories

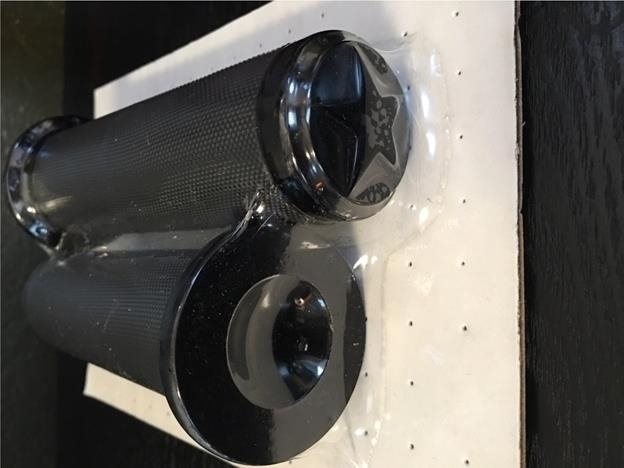

Evil Empire will continue to design and manufacture billet floorboards and passenger floorboards, foot pegs, shifter pegs, shift linkages, exhaust tips, handlebar grips, mirrors, license place frames, and various types of billet accessories. Our first two products in this category - custom floorboards and handlebar grips - have already been featured in several magazines. Examples of some of our accessories are s follows:

Fat Bob Fender

| 6 |

| Table of Contents |

Mid-Controls

Exhaust Muffler

| 7 |

| Table of Contents |

Faring

Hardbags and Lids

| 8 |

| Table of Contents |

Mid-Controls

Packaged Powder Coated Handgrips

| 9 |

| Table of Contents |

Aftermarket Handlebars

Evil Empire will offer 3 different design handlebars varying is size and dimensions to accommodate the female rider. Offering them in Chrome Plating, Powdercoat and Raw form.

Apparel

We also offer t-shirts, hooded sweatshirts and hats that will display the Evil Empire name and Logo.

We are committed to providing our customers with products and services that meet, conform to and exceed their individual motorcycle needs.

Custom Design

In year two, after our launch and media blitz, we plan on offering a custom design service specifically for women. Ms. Cunningham will lead the effort as she already has a following of female riders and has customized several motorcycles.

Competitive Advantage

Our competitive advantage lies in the uniqueness of our designs and the quality of our merchandise. Our floorboards are manufactured in the United States, are designed correctly and are machined rather than stamped. These factors put us at the top end of the retail price range, but since our target market purchases top end motorcycles, it doesn’t make sense to expect them to customize an expensive motorcycle with cheap parts.

Pricing

We standardize our pricing on our website and throughout our dealer network. Discounting will not be allowed in order to keep the quality image of the product from being tarnished. Sale prices are to be expected at seasonal times and will be permitted, but the sale of the product through discount channels will not.

| 10 |

| Table of Contents |

Marketing Plan

The Company has conducted both primary and secondary research resulting in key insights to implement our strategic plan.

Industry Analysis and Industry Trends

Based on information we have obtained from the Whiteboard Research Summary on Motorcycle Industry (the “Whiteboard Research Summary”), we believe that the demand for custom aftermarket motorcycle parts and accessories is highly dependent on the number of Harley-Davidson and metric motorcycles sold. We also believe the motorcycle industry itself is highly dependent on disposable income, confidence in the future of the economy, and leisure time. Prior to the recession of 2009, the largest market segment for the previous five years was composed of middle-aged males. As these consumers aged and as the recession hit, motorcycle manufacturers saw sales decline. In the USA, Harley-Davidson, the industry’s largest manufacturer reported a sales decline of 23.4%. In response, industry looked for new segments to exploit: expanding overseas, targeting younger/new riders, and targeting women.

The Whiteboard Research Summary gave us a snapshot of the overall market. In 2014, consumers in the United States purchased some 484,000 motorcycles; this figure reflects a 3.8 percent increase in total U.S. motorcycle sales over the previous year. The consensus for years going forward calls for a 3% annual growth. Wisconsin based Harley-Davidson had a total market share of 46.5%, up from 36% in 2013.

In 2013, Harley-Davidson’s 601+cc segment reached a market share of about 55% indicating a heavier weighting on this segment of sales. This segment is also our key target market since these bikes are higher end bikes and their riders are less sensitive to economic fluctuations. The Whiteboard Research Summary concluded that higher incomes, higher consumer confidence in the economy and higher gas prices all contribute to the growth of this market.

As part of our primary research, we surveyed riders at motorcycle shows across the USA and Canada. The results for the most part were as expected. Almost all the people we surveyed liked the designs of our handlebars and floorboards. They especially liked the sturdiness of the floorboards. The saddlebags were enthusiastically endorsed as well. One key insight we achieved from this research is that in colder weather (the Canadian motorcycle show), there was concern as to how cold the handlebars would get since they’re not insulated. Although this is mitigated by the fact that the majority of our target market is geographically located in California (according to 2013 data, the majority of motorcycle fans reside in California, where almost 800,000 motorcycles are registered.), we have begun designing a handlebar to withstand the Canadian weather.

As of 2013, roughly 12% of the riders in the USA were women – an increase of about 30% over the last decade according the Motorcycle Industry Council. Whether it is because they’ve been targeted, or because they realize the benefits of riding, Harley Davidson, the top-selling motorcycle brand among women in the U.S., sold more new on-road motorcycles to women in the U.S. in 2013.

According to a study conducted by Kelton and commissioned by Harley-Davidson recently commissioned Kelton to conduct a study surveying women riders. According to the results:

“Women riders are more than twice as likely to always feel happy (37% of riders vs. 16% of non-riders) and more than a third (34%) reported that they felt less stressed after starting to ride. Further, nearly twice as many always feel confident (35% of riders vs. 18% of non-riders).

According to the Harley-Davidson Women Riders Survey, the benefits of riding continue:

|

| • | More riders than non-riders (40% vs. 18%) feel extremely satisfied with their careers. |

|

|

|

|

|

| • | More than twice as many riders as non-riders (32% vs. 15%) agree that they feel beautiful daily. |

|

|

|

|

|

| • | Women who ride are more content with their significant other (60 percent of riders vs. 38 percent of non-riders) and intimacy (51 percent riders; 35 percent non-riders). |

|

|

|

|

|

| •

| More riders than non-riders (75% vs. 64%) usually feel content instead of worried, and almost a quarter (23%) of riders report that they rarely feel anxious.” (http://www.motorcyclecruiser.com/news/women-flock-to-motorcycling-record-numbers) |

| 11 |

| Table of Contents |

Customers

Evil Empire’s ideal customer is an upper-middle to upper income female, between the ages of thirty-four and sixty-five. Younger riders may not have the discretionary income to afford our product, and the number of women riding after the age of sixty-five diminishes quickly due to the physical exertion and risk of motorcycle riding. She enjoys riding at least part of the time. She is individualistic and has a personal sense of style. She is confident in herself and her decisions. In short, a powerful, self-fulfilled woman.

We intend to appeal to her sense of individuality by offering products that will make her motorcycle stand out from the crowd. Evil Empire products will be easily available to our customer from our website and through motorcycle dealerships. At this time, to keep the final cost to the customer at a minimum, we do not intend to sell through wholesalers or jobbers. Initially we will target dealerships in California, Nevada and Arizona where seasonality in motorcycle riding and customization are not issues. Our research also indicates California has the highest number of motorcycle riders in the country.

Competition

Competition in the industry is fragmented with no clear market leader. Many of our competitors are well established. Many offer higher end aftermarket motorcycle parts and accessories. Some also offer customization and motorcycle sales. On a stand-alone basis our product offering is comparable to all, and superior to some.

Our niche: middle to high-income women who ride at least occasionally, with a sense of self and individuality is unexploited. We intend to fill the void and quickly become the go-to solution for these women.

Our competitive advantage is that we are actively targeting a new group of riders the motorcycle manufacturers are starting to exploit before our male-centric competition. In order to capitalize on this we intend to move quickly.

Obstacles we’ll have to overcome include the established competition and the motorcycle manufacturers themselves who often times offer similar products in their dealerships (although their offerings don’t match the quality of our offerings).

Strategy

Our strategy is based on targeting middle to high-income women who ride at least occasionally, with a sense of self.

Positioning

Evil Empire will position the Company and its products as a lifestyle brand, made in America for independent women. The intent is to form a “cult” of customers, in much the same way Harley-Davidson has created a cult of customers.

Promotion

Our CEO, Sheila Cunningham will conduct interviews with several motorcycle magazines in which she and her products have been featured. Evil Empire will also advertise in these magazines.

Our designs and logos are formulated to appeal to women who enjoy the cutting edge in style, and lifestyle. The conversation around these is designed to spark a following using social media, leading to word of mouth proliferation.

Evil Empire also intends to inundate trade shows, bike rallies, and other competitions. Our CEO is an accomplished rider and an avid motorcycle racer. We intend to exploit her image as something worthy of aspiration.

Each of our products are sold with a quality warranty card. Once filled, Evil Empire will begin building a database of customers to whom we can repeatedly market (the “Evil Empire Club”). These customers will get promotions on new products and minimally once a year be invited to a Evil Empire Club ride. The ride will consist of women in the club descending on an unsuspecting SPA town where they will be pampered for a weekend. The publicity generated from this event will be invaluable.

The cost of these promotions is minimal. Trade shows and magazine articles are the bigger expenses and have been accounted for in our financial projections.

| 12 |

| Table of Contents |

Pricing

Evil Empire has priced its products in line with our competitors. The products are priced to reflect the quality of products and also to ensure a good profit for the Company. Evil Empire will compete on brand image, quality of product, and lifestyle.

Distribution Channels

Evil Empire products will be available on our website and through dealer-retailers. We will not be using wholesalers or jobbers to keep the final retail price in line with our competitors, and to ensure the quality lifestyle image we’re trying to create and maintain remains untarnished.

Competition and Competitive Strategy

We expect that we will compete for members with traditional aftermarket motorcycle parts businesses. We believe that we will face extensive challenges in attempting to compete because we do not have the ability to verify who is purchasing parts that compete with ours, at what cost, and the terms and conditions under which our competitors are offering the same or similar parts as ours. We believe that the market for our products is constantly changing in terms of how consumers purchase aftermarket motorcycle parts and what those consumers’ particular tastes may be.

Patents, Trademarks, Licenses, Franchise Restrictions and Contractual Obligations & Concessions

We rely on a combination of trademark laws, trade secrets, confidentiality provisions and other contractual provisions to protect our proprietary rights, which are primarily our brand names, product designs and marks. We hold one U.S. Design Patent, titled, Side Hardbag for a Motorcycle, which was granted Patent No. D830,056 (the “Patent”). The Patent covers claims relating to the ornamental design for a side hardbag for a motorcycle. Barring any unforeseen circumstances, the Company believes the Patent should be valid until November 2036, given that the Patent filing occurred in November 2016.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the construction and operation of any facility in any jurisdiction which we would conduct activities. We do not believe that government regulation will have a material impact on the way we conduct our business, however, any government regulation imposing greater fees for Internet use or restricting information exchange over the Internet could result in a decline in the use of the Internet and the viability of Internet-based services, which could harm our business and operating results.

Research and Development Activities and Costs

We have not incurred any research and development costs for the fiscal years ended December 31, 2020.

Employees

As of the date hereof, we have 1 non-employee officer, Sheila Cunningham, who operates our company. The Company also uses approximately 19 independent contractor consultants and advisors in connection with its operations.

Description of Properties

Our executive offices are located at 441 Eastgate Rd., Henderson, Nevada 89011, and our telephone number is (725) 666-3700. We do not own any real estate or other physical properties.

Bankruptcy or Similar Proceedings

We have never been subject to bankruptcy, receivership or any similar proceeding.

| 13 |

| Table of Contents |

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We currently do not own any physical property or real property. Our executive offices are located 441 Eastgate Rd., Henderson, Nevada 89011. We believe that this space is adequate for our present operations.

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company.

ITEM 4. MINE SAFETY DISCLOSURES

None.

| 14 |

| Table of Contents |

Our common stock is not listed or quoted on any market or exchange. We intend to have our common stock be quoted on the OTC Markets.

To qualify for quotation on the OTC Markets, an equity security must have one registered broker-dealer, known as the market maker, willing to list bid or sale quotations and to sponsor the company listing. We do not yet have an agreement with a registered broker-dealer, as the market maker, willing to list bid or sale quotations and to sponsor the Company listing. If the Company meets the qualifications for trading securities on the OTC Markets our securities will trade on the OTC Markets until a future time, if at all, that we apply and qualify for admission to quotation on the NASDAQ Capital Market. We may not now and it may never qualify for quotation on the OTC Markets or be accepted for listing of our securities on the NASDAQ Capital Market.

Holders

As of April 9, 2021, there were 8,057,750 shares of common stock issued and outstanding held by approximately 58 holders of record.

Dividends

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future. There are no restrictions in our Articles of Incorporation or Bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

|

| • | we would not be able to pay our debts as they become due in the usual course of business; or |

|

| • | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution, unless otherwise permitted under our Articles of Incorporation. |

| 15 |

| Table of Contents |

Recent Sales of Unregistered Securities

There are no unreported sales of equity securities at December 31, 2020.

Securities Authorized for Issuance Under Equity Compensation Plans

The Company does not have any equity compensation plans.

Penny Stock Regulations

The SEC has adopted regulations that generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual incomes exceeding $0.20 million individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during the year ended December 31, 2020.

ITEM 6. SELECTED FINANCIAL DATA

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

The Company was incorporated in the State of Nevada on December 23, 2009, and established a fiscal year end of December 31.

Going Concern

To date the Company has little operations or revenues and consequently has incurred recurring losses from operations. No revenues are anticipated until we complete the financing we endeavor to obtain, as described in the Form 10-K, and implement our initial business plan. The ability of the Company to continue as a going concern is dependent on raising capital to fund our business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern.

Our activities have been financed from related-party loans and the proceeds of share subscriptions.

The Company plans to raise additional funds through debt or equity offerings. There is no guarantee that the Company will be able to raise any capital through this or any other offerings.

| 16 |

| Table of Contents |

PLAN OF OPERATION

We are an early stage corporation and have generated revenues of $12,797 from our business during the year ended December 31, 2020. During the 12 months following the date of filing of this Annual Report on Form 10-K, will be focused on attempting to raise $750,000 of funds to expand our business. We have no assurance that future financing will materialize. If that financing is not available, we may be unable to continue. Management believes that if we are successful in raising $750,000, we will be able to generate sales revenue within the following twelve months thereof. However, if such public financing is not available, we could fail to satisfy our future cash requirements. We have no assurance that future financing will materialize. If that financing is not available we may be unable to continue. Management believes that if subsequent private placements are successful, we will be able to generate sales revenue within the following twelve months thereof. However, additional equity financing may not be available to us on acceptable terms or at all, and thus we could fail to satisfy our future cash requirements.

If we are unsuccessful in raising the additional proceeds through a private placement offering we will then have to seek additional funds through debt financing, which would be highly difficult for an early-stage company to secure. Therefore, the Company is highly dependent upon the success of the anticipated private placement offering and failure thereof would result in the Company having to seek capital from other sources such as debt financing, which may not even be available to the Company. However, if such financing were available, because we are an early stage company, it would likely have to pay additional costs associated with high risk loans and be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such debt financing and determine whether the business could sustain operations and growth and manage the debt load. If we cannot raise additional proceeds via a private placement of its common stock or secure debt financing it would be required to cease business operations. As a result, investors in our common stock would lose all of their investment.

With new investors joining, the Company will increase its current efforts on marketing and selling its already created variety of products.

RESULTS OF OPERATIONS

Comparison of the Years ended December 31, 2020 and 2019

As of December 31, 2020, we suffered from a working capital deficit of $465,956. As a result, our continuation as a going concern is dependent upon improving our profitability and the continuing financial support from our stockholders or other capital sources. Management believes that the continuing financial support from the existing shareholders and external financing will provide the additional cash to meet our obligations as they become due. Our financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities that may result in the Company not being able to continue as a going concern.

The following table sets forth certain operational data for the years ended December 31, 2020 and 2019:

|

|

| Years Ended December 31, |

| |||||

|

|

| 2020 |

|

| 2019 |

| ||

| Revenues |

| $ | 12,797 |

|

| $ | 3,054 |

|

| Cost of revenue |

|

| 878 |

|

|

| 206 |

|

| Gross margin |

|

| 11,919 |

|

|

| 2,848 |

|

| Total operating expenses |

|

| 160,542 |

|

|

| 130,953 |

|

| Other income (expense) |

|

| (25,257 | ) |

|

| (17,613 | ) |

| Loss before Income Taxes |

|

| (173,880 | ) |

|

| (145,718 | ) |

| Income tax expense |

|

| - |

|

|

| - |

|

| Net loss |

|

| (173,880 | ) |

|

| (145,718 | ) |

Revenue. We generated revenues of $12,979 and $3,054 for the years ended December 31, 2020 and 2019.

Cost of Revenue. Cost of revenue for the years ended December 31, 2020 and 2019, was $878 and $206, respectively. Cost of revenue increased primarily as a result of the increase in our business volume.

Gross Profit. We achieved a gross profit of $11,919 and $2,848 for the years ended December 31, 2020 and 2019, respectively. The increase in gross profit is primarily attributable to the increase in our business volume.

General and Administrative Expenses (“G&A”). We incurred G&A expenses of $150,817 and $120,531 for the years ended December 31, 2020 and 2019, respectively. The increase in G&A is primarily attributable to the stock-based compensation.

Income Tax Expense. Our income tax expenses for the years ended December 31, 2020 and 2019were $0.

Net Loss. During the year ended December 31, 2020, we incurred a net loss of $173,880, as compared to $145,718 for the same period ended December 31, 2019.

| 17 |

| Table of Contents |

Liquidity and Capital Resources

As of December 31, 2020, we had cash and cash equivalents of $5,265, accounts receivable and accrued expenses of $104,581, convertible notes payable of $323,329, and notes payable of $45,000.

We believe that our current cash and other sources of liquidity discussed below are adequate to support general operations for at least the next 12 months.

|

|

| Years Ended December 31, |

| |||||

|

|

| 2020 |

|

| 2019 |

| ||

| Net cash provided used in operating activities |

| $ | (129,350 | ) |

| $ | (124,625 | ) |

| Net cash provided by investing activities |

|

| (127,092 | ) |

|

| (4,006 | ) |

| Net cash provided by financing activities |

|

| 242,610 |

|

|

| 137,554 |

|

Net Cash Used In Operating Activities.

For the year ended December 31, 2020, net cash used in operating activities was $129,350, which consisted primarily of a net loss of $173,880 offset by depreciation and amortization of $9,757, changes in operating assets of $73, inventory of $9,416, and an increase in accrued expenses and other payables of $25,284.

For the year ended December 31, 2019, net cash used in operating activities was $124,625, which consisted primarily of a net loss of $145,718, offset by depreciation and amortization of $10,422, changes in operating assets of $(73), inventory of $(8,481), and accrued expenses and other payables of $19,615.

We expect to continue to rely on cash generated through financing from our existing shareholders and private placements of our securities, however, to finance our operations and future acquisitions.

Net Cash Provided By Investing Activities.

For the year ended December 31, 2020, there is no net cash provided by investing activities.

For the year ended December 31, 2019, there is no net cash provided by investing activities.

Net Cash Provided By Financing Activities.

For the year ended December 31, 2020, net cash provided by financing activities was $242,610 consisting of $141,660 of proceeds from the sale of convertible promissory notes, $45,000 of proceeds from the sale of notes, and $55,950 of proceeds from the sale of common stock.

For the year ended December 31, 2019, net cash provided by financing activities was $137,554 consisting of $39,064 of proceeds from the sale of notes, and $98,490 from the sale of common stock.

Off-Balance Sheet Arrangements

We have not entered into any financial guarantees or other commitments to guarantee the payment obligations of any third parties. In addition, we have not entered into any derivative contracts that are indexed to our own shares and classified as shareholders’ equity, or that are not reflected in our financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. Moreover, we do not have any variable interest in an unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

COVID-19

We continue to evaluate the impact of the COVID-19 pandemic on the industry and our Company and have concluded that while it is reasonably possible that the virus could have a negative effect on our financial position and results of our operations, the specific impact is not readily determinable as of the date of this filing. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| 18 |

| Table of Contents |

Critical Accounting Policies and Estimates

1. Basis of presentation

These accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

2. Use of estimates and assumptions

In preparing these consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the years reported. Actual results may differ from these estimates.

3. Basis of consolidation

The consolidated financial statements include the financial statements of the Company and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

4. Cash and cash equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

5. Accounts receivable

Accounts receivable are recorded at the invoiced amount and do not bear interest, which are due within contractual payment terms, generally 30 to 90 days from completion of service. Credit is extended based on evaluation of a customer’s financial condition, the customer credit-worthiness and their payment history. Accounts receivable outstanding longer than the contractual payment terms are considered past due. Past due balances over 90 days and over a specified amount are reviewed individually for collectibility. At the end of fiscal year, the Company specifically evaluates individual customer’s financial condition, credit history, and the current economic conditions to monitor the progress of the collection of accounts receivables. The Company will consider the allowance for doubtful accounts for any estimated losses resulting from the inability of its customers to make required payments. For the receivables that are past due or not being paid according to payment terms, the appropriate actions are taken to exhaust all means of collection, including seeking legal resolution in a court of law. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers. As of December 31, 2020 and 2019, there was no allowance for doubtful accounts.

6. Revenue recognition

The Company adopted Accounting Standards Codification (“ASC”) 606 – Revenue from Contracts with Customers” (“ASC 606”) as of January 1, 2019 using the modified retrospective method. This method allows the Company to apply ASC 606 to new contracts entered into after January 1, 2019, and to its existing contracts for which revenue earned through December 31, 2018 has been recognized under the guidance in effect prior to the effective date of ASC 606. The revenue recognition processes the Company applied prior to adoption of ASC 606 align with the recognition and measurement guidance of the new standard, therefore adoption of ASC 606 did not require a cumulative adjustment to opening equity.

Under ASC 606, a performance obligation is a promise within a contract to transfer a distinct good or service, or a series of distinct goods and services, to a customer. Revenue is recognized when performance obligations are satisfied and the customer obtains control of promised goods or services. The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for goods or services. Under the standard, a contract’s transaction price is allocated to each distinct performance obligation. To determine revenue recognition for arrangements that the Company determines are within the scope of ASC 606, the Company performs the following five steps:

|

| • | identify the contract with a customer; |

|

| • | identify the performance obligations in the contract; |

|

| • | determine the transaction price; |

|

| • | allocate the transaction price to performance obligations in the contract; and |

|

| • | recognize revenue as the performance obligation is satisfied. |

The Company records its revenue from booking income upon the ticket booking service is rendered to travelers. The Company also records its revenue from the sale of air tickets upon the confirmation and issuance of tickets to the travelers.

| 19 |

| Table of Contents |

7. Income taxes

The Company adopted the ASC 740 Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

8. Comprehensive income

ASC Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying consolidated statements of changes in shareholders’ equity, consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

9. Share-based compensation

The Company follows ASC 718, Compensation—Stock Compensation (“ASC 718”), which requires the measurement and recognition of compensation expense for all share-based payment awards, including restricted stock units, based on estimated grant date fair values. Restricted stock units are valued using the market price of the Company’s common shares on the date of grant. The Company records compensation expense, net of estimated forfeitures, over the requisite service period.

10. Related parties

The Company follows the ASC 850-10, Related Party for the identification of related parties and disclosure of related party transactions.

Pursuant to section 850-10-20 the related parties include a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and Income-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved; b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d) amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

| 20 |

| Table of Contents |

11. Commitments and contingencies

The Company follows the ASC 450-20, Commitments to report accounting for contingencies. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, financial position, and results of operations or cash flows.

12. Fair value of financial instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and has adopted paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by paragraph 820-10-35-37 of the FASB Accounting Standards Codification are described below:

| Level 1 |

| Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

|

|

|

|

| Level 2 |

| Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

|

|

|

|

| Level 3 |

| Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amounts of the Company’s financial assets and liabilities, such as cash and cash equivalents, accounts receivable, deposits, prepayment and other receivables, amount due from a director and operating lease right-of-use assets, approximate their fair values because of the short maturity of these instruments.

| 21 |

| Table of Contents |

13. Recent accounting pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standard Board (“FASB”) or other standard setting bodies and adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the impact of recently issued standards that are not yet effective will not have a material impact on its financial position or results of operations upon adoption.

Recently Adopted Accounting Standards

In June 2016, the FASB issued guidance that affects loans, trade receivables and any other financial assets that have the contractual right to receive cash. Under the new guidance, an entity is required to recognize expected credit losses rather than incurred losses for financial assets. The new guidance is effective for fiscal years beginning after December 15, 2019 and interim periods within those fiscal years. The Company adopted the new guidance effective January 1, 2020, with no material impact to the Company’s consolidated financial position, results of operations or cash flows.

In August 2018, the FASB issued guidance which modifies certain disclosure requirements over fair value measurements. The guidance is effective for fiscal years beginning after December 15, 2019, including all interim periods within that fiscal year. The Company adopted the new guidance effective January 1, 2020. The Company does not currently classify any of its derivative contracts or restoration plan assets as Level 3 assets or liabilities, nor did the Company have any transfers amongst fair value levels during the year ended December 31, 2020. As a result, the guidance did not have an impact on Company’s the fair value measurement disclosures upon adoption.

In January 2017, the FASB issued guidance which eliminates the second step from the traditional two-step goodwill impairment test. Under current guidance, an entity performed the first step of the goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount; if an impairment loss was indicated, the entity computed the implied fair value of goodwill to determine whether an impairment loss existed, and if so, the amount to recognize. Under the new guidance, an impairment loss is recognized for the amount by which the carrying amount exceeds the reporting unit’s fair value (the Step 1 test), with no further testing required. Any impairment loss recognized is limited to the amount of goodwill allocated to the reporting unit. The new guidance is effective for public companies that are Securities and Exchange Commission (“SEC”) registrants for fiscal years beginning after December 15, 2019. The Company adopted the new guidance on January 1, 2020, and applied the guidance prospectively to its goodwill impairment tests.

Accounting Standards Not Yet Adopted as of December 31, 2020

In December 2019, the FASB issued new guidance to simplify the accounting for income taxes by removing certain exceptions to the general principles and also simplification of areas such as franchise taxes, step-up in tax basis goodwill, separate entity financial statements and interim recognition of enactment of tax laws or rate changes. The new guidance is effective for fiscal years beginning after December 15, 2020 and interim periods within those fiscal years, with early adoption permitted. The Company is currently evaluating the impact of this new guidance on its consolidated financial statements.

In March 2020, the FASB issued guidance to address certain accounting consequences from the anticipated transition from the use of the London Interbank Offered Rate (“LIBOR”) and other interbank offered rates to alternative reference rates. The new guidance contains practical expedients for reference rate reform related activities that impact debt, leases, derivatives and other contracts. The guidance is optional and may be elected over time as reference rate reform activities occur. During the year ended December 31, 2020, the Company elected to apply the hedge accounting expedients related to probability and the assessments of effectiveness for future LIBOR-indexed cash flows to assume that the index upon which future hedged transactions will be based on matches the index of the corresponding derivatives. Application of these expedients preserves the presentation of derivatives consistent with past presentation. The Company continues to evaluate the impact of the guidance and may apply other elections as applicable as additional changes in the market occur.

The Company believes that other recent accounting pronouncement will not have a material effect on the Company’s consolidated financial position, results of operations and cash flows.

Subsequent Events

None through date of this filing.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

| 22 |

| Table of Contents |

Evil Empire Designs, Inc.

| F-1 |

| Table of Contents |

Boyle CPA, LLC

Certified Public Accountants & Consultants

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and

Board of Directors of Evil Empire Designs, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Evil Empire Designs, Inc. (the “Company”) as of December 31, 2020 and 2019, the related consolidated statements of operations, stockholders’ deficit, and cash flows for each of the two years in the period ended December 31, 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2020 and 2019, and the results of its operations and its cash flows for each of the two years in the period ended December 31, 2020, in conformity with accounting principles generally accepted in the United States of America.

Substantial Doubt About the Company’s Ability to Continue as a Going Concern

As discussed in Note 3 to the financial statements, the Company’s accumulated deficit and nominal source of revenues sufficient to cover operating costs raise substantial doubt about its ability to continue as a going concern for one year from the issuance of these financial statements. Management’s plans are also described in Note 3. The financial statements do not include adjustments that might result from the outcome of this uncertainty.

Basis of Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ Boyle CPA, LLC

We have served as the Company’s auditor since 2018

Bayville, NJ

April 14, 2021

| 361 Hopedale Drive SE |

| P (732) 822-4427 |

| Bayville, NJ 08721 |

| F (732) 510-0665 |

| F-2 |

| Table of Contents |

BALANCE SHEETS AS OF:

|

|

| December 31, |

| |||||

|

|

| 2020 |

|

| 2019 |

| ||

|

|

|

|

|

|

|

| ||

| ASSETS |

|

|

|

|

|

| ||

| Current assets: |

|

|

|

|

|

| ||

| Cash and cash equivalents |

| $ | 5,265 |

|

| $ | 19,097 |

|

| Inventory |

|

| 1,689 |

|

|

| 11,105 |

|

| Other Current assets |

|

| -- |

|

|

| 73 |

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

| 6,954 |

|

|

| 30,275 |

|

|

|

|

|

|

|

|

|

|

|

| Fixed assets |

|

|

|

|

|

|

|

|

| Fixed assets, net of depreciation of $29,196 and $21,608 |

|

| 19,016 |

|

|

| 14,514 |

|

| Other assets, net of amortization of $2,167 and $11,462 |

|

| -- |

|

|

| 2,167 |

|

| Other assets- investment |

|

| 155,000 |

|

|

| -- |

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

| $ | 180,970 |

|

| $ | 46,956 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

| $ | 104,581 |

|

| $ | 79,297 |

|

| Convertible notes payable |

|

| 323,329 |

|

|

| 181,669 |

|

| Notes payable |

|

| 45,000 |

|

|

| -- |

|

| Total current liabilities |

|

| 472,910 |

|

|

| 260,996 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ deficit: |

|

|

|

|

|

|

|

|

| Preferred stock, $0.001 par value 25,000,000 authorized none are issued or outstanding |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par value 100,000,000 authorized 8,057,750 and 7,767,500, issued and outstanding, respectively: |

|

| 8,058 |

|

|

| 7,768 |

|

| Additional paid in capital |

|

| 222,757 |

|

|

| 127,097 |

|

| Accumulated deficit |

|

| (522,755 | ) |

|

| (348,875 | ) |

| Total stockholders’ deficit |

|

| (291,940 | ) |

|

| (214,010 | ) |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ deficit |

| $ | 180,970 |

|

| $ | 46,956 |

|

The accompanying notes are an integral part of these financial statements.

| F-3 |

| Table of Contents |

STATEMENTS OF OPERATIONS

|

|

| Years Ended December 31, |

| |||||

|

|

| 2020 |

|

| 2019 |

| ||

|

|

|

|

|

|

|

| ||

| Revenue |

| $ | 12,797 |

|

| $ | 3,054 |

|

| Cost of goods |

|

| 878 |

|

|

| 206 |

|

| Gross Margin |

|

| 11,919 |

|

|

| 2,848 |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Amortization and depreciation |

|

| 9,725 |

|

|

| 10,422 |

|

| General and administrative expenses |

|

| 150,817 |

|

|

| 120,531 |

|

| Total operating expenses |

|

| 160,542 |

|

|

| 130,953 |

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

| (148,623 | ) |

|

| (128,105 |

|

|

|

|

|

|

|

|

|

|

|

| Other income(expense) |

|

|

|

|

|

|

|

|

| Other expense |

|

| - |

|

|

| (697 | ) |

| Interest expense |

|

| (25,257 | ) |

|

| (16,916 | ) |

| Total other income (expense) |

|

| (25,257 | ) |

|

| (17,613 | ) |

|

|

|

|

|

|

|

|

|

|

| Net loss |

| $ | (173,880 | ) |

| $ | (145,718 | ) |

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and diluted |

| $ | (0.02 | ) |

| $ | (0.02 | ) |

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding |

|

| 7,945,694 |

|

|

| 7,304,966 |

|

The accompanying notes are an integral part of these financial statements.

| F-4 |

| Table of Contents |

STATEMENTS OF STOCKHOLDERS’ DEFICIT

|

|

|

|

| Additional |

|

|

|

| Total |

| ||||||||||

|

|

| Common Stock |

|

| Paid-In |

|

| Accumulated |

|

| Stockholders’ |

| ||||||||

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Deficit |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Balance at December 31, 2018 |

|

| 7,275,000 |

|

|

| 7,275 |

|

|

| 29,100 |

|

|

| (203,157 | ) |

|

| (166,782 | ) |

| Common stock issued for cash |

|

| 492,500 |

|

|

| 493 |

|

|

| 97,997 |

|

|

|

|

|

|

| 98,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

| -- |

|

|

| -- |

|

|

| -- |

|

|

| (145,718 | ) |

|

| (145,718 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2019 |

|

| 7,767,500 |

|

| $ | 7,768 |

|

| $ | 127,097 |

|

| $ | (348,875 | ) |

| $ | (214,010 | ) |

| Common stock issued for cash |

|

| 290,250 |

|

|

| 290 |

|

|

| 55,660 |

|

|

| -- |

|

|

| 55,950 |

|

| Contribution of investment |

|

| --- |

|

|

| -- |

|

|

| 40,000 |

|

|

| - |

|

|

| 40,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

| -- |

|

|

| -- |

|

|

| -- |

|

|

| (173,880 | ) |

|

| (173,880 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2020 |

|

| 8,057,750 |

|

|

| 8,058 |

|

|

| 222,757 |

|

|

| (522,755 | ) |

|

| (291,940 | ) |

The accompanying notes are an integral part of these financial statements.

| F-5 |

| Table of Contents |

STATEMENTS OF CASH FLOWS

|

|

| Years Ended December 31. |

| |||||

|

|

| 2020 |

|

| 2019 |

| ||

|

|

|

|

|

|

|

| ||

| Cash flows from operating activities: |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||

| Net loss |

| $ | (173,880 | ) |

| $ | (145,718 | ) |

| Adjustments to reconcile net loss from operations to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

| 9,757 |

|

|

| 10,422 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Other current assets |

|

| 73 |

|

|

| (73 | ) |

| Inventory |

|

| 9,416 |

|

|

| (8,481 | ) |

| Accounts payable and accrued expenses |

|

| 25,284 |

|

|

| 19,615 |

|

| Net cash used in operating activities |

|

| (129,350 | ) |

|

| (124,625 | ) |

|

|

|

|

|

|

|

|

|

|

| Cash flows used in investing activities |

|

|

|

|

|

|

|

|

| Investments |

|

| (115,000 | ) |

|

|

|

|

| Acquisition of fixed assets |

|

| (12,092 | ) |

|

| (4,006 | ) |

| Net cash used in investing activities |

|

| (127,092 | ) |

|

| (4,006 | ) |

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Sale of common stock |

|

| 55,950 |

|

|

| 98,490 |

|

| Proceeds from notes payable |

|

| 45,000 |

|

|

| -- |

|

| Proceeds from convertible note payable |

|

| 141,660 |

|

|

| 39,064 |

|

| Net cash provided by financing activities |

|

| 242,610 |

|

|

| 137,554 |

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash |

|

| (13,832 | ) |

|

| 9,313 |

|

| Cash – beginning of period |

|

| 19,097 |

|

|

| 9,784 |

|

| Cash – end of period |

| $ | 5,265 |

|

| $ | 19,097 |

|

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENT DISCLOSURES: |

|

|

|

|

|

|

|

|

| Interest paid |

| $ | -- |

|

| $ | -- |

|

| Income taxes paid |

| $ | -- |

|

| $ | -- |

|

|

|

|

|

|

|

|

|

|

|

| NON-MONETORY TRANSATIONS |

|

|

|

|

|

|

|

|

| Contribution of investment |

| $ | 40,000 |

|

| $ |

|

|

The accompanying notes are an integral part of these audited financial statements.

| F-6 |

| Table of Contents |

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF BUSINESS

Evil Empire Designs, Inc., (formerly Jaycor Resources Inc.) (Jaycor) was organized on December 23, 2009 under the name US Terra Energy Corp in the State of Nevada. The Company was organized to explore investment opportunities in the energy business. In June 2016 the Company changed its business model to making and selling accessories to the motorcycle market.

The Company authorized 125,000,000 shares consisting of 100,000,000 of common stock with a par value of $0.001 per share and 25,000,000 shares of preferred stock with a par value of $0.001 per share.

On April 24, 2012, the Company filed a Certificate of Amendment amending the Articles of Incorporation changing the name of the Corporation to Jaycor Resources, Inc.

On September 21, 2016, the Company filed a Certificate of Amendment amending the Articles of Incorporation changing the name of the Corporation to Evil Empire Designs, Inc.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for financial information and reflect all adjustments which, in the opinion of management, are necessary for a fair presentation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the balance sheet. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. As of December 31, 2020 and 2019, the Company did not have any cash equivalents.

Inventory

Inventories are stated at the lower or cost of market using the first-in; first-out (FIFO) cost method of accounting. The inventory consists of raw materials used to make various products for sale.

Revenue recognition

Revenue is recognized when control of the promised goods or services is transferred to the Company’s customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services.

| F-7 |

| Table of Contents |

Property and Equipment