Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Federal Home Loan Bank of Chicago | april122021xmembermeeting.htm |

1 R YA N H AY H U R S T M a n a g i n g D i r e c t o r a n d M a n a g e r o f F i n a n c i a l S t r a t e g i e s G r o u p , T h e B a k e r G r o u p L P 2 0 2 0 F I N A N C I A L R E S U LT S Roger Lundstrom EVP and CFO, Group Head, Financial Accounting and Markets, FHLBank Chicago Exhibit 99.1

DISCLAIMER 2 Certain information included in this presentation speaks only as of a particular date or dates included in this presentation. The information in the presentation may have become out of date. The Federal Home Loan Bank of Chicago (FHLBank Chicago) does not undertake an obligation, and disclaims any duty, to update any of the information in this presentation. FHLBank Chicago makes no representations or warranties about the accuracy, currency, completeness, or suitability of any information in this presentation, and no representation of non-infringement. This presentation is not intended to constitute legal, accounting, investment or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. This presentation may contain forward-looking statements which are based upon FHLBank Chicago’s current expectations and speak only as of the date hereof. All statements other than statements of historical fact are “forward-looking statements,” including any projections or guidance of dividends or other financial items and any statements of belief. These statements may use forward-looking terms, such as “expects,” “could,” “plans,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. FHLBank Chicago cautions that, by their nature, forward-looking statements involve risks or uncertainties, that actual results could differ materially from those expressed or implied in these forward-looking statements. These forward-looking statements involve risks and uncertainties including, but not limited to, the impact of the COVID-19 pandemic on the global and national economies and on FHLBank Chicago and its members’ businesses, maintaining compliance with regulatory and statutory requirements (including relating to FHLBank Chicago’s dividend payments and retained earnings), a decrease in FHLBank Chicago’s levels of business which may negatively impact its results of operations or financial condition, the reliability of FHLBank Chicago’s projections, assumptions, and models on future financial performance and condition, and the risk factors set forth in FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on FHLBank Chicago’s website at fhlbc.com. “MPF®”, “MPF Xtra®”, “DPP®”, and “Community First®” are registered trademarks of FHLBank Chicago.

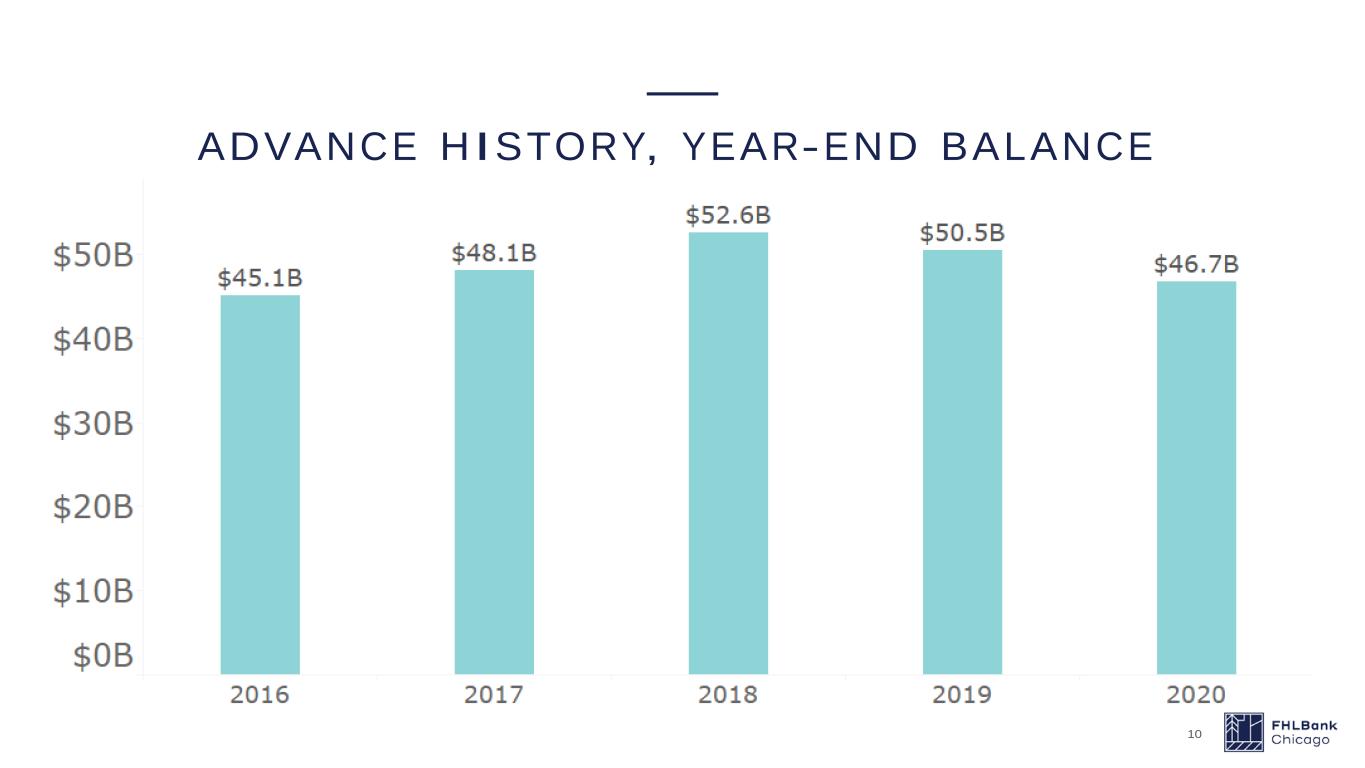

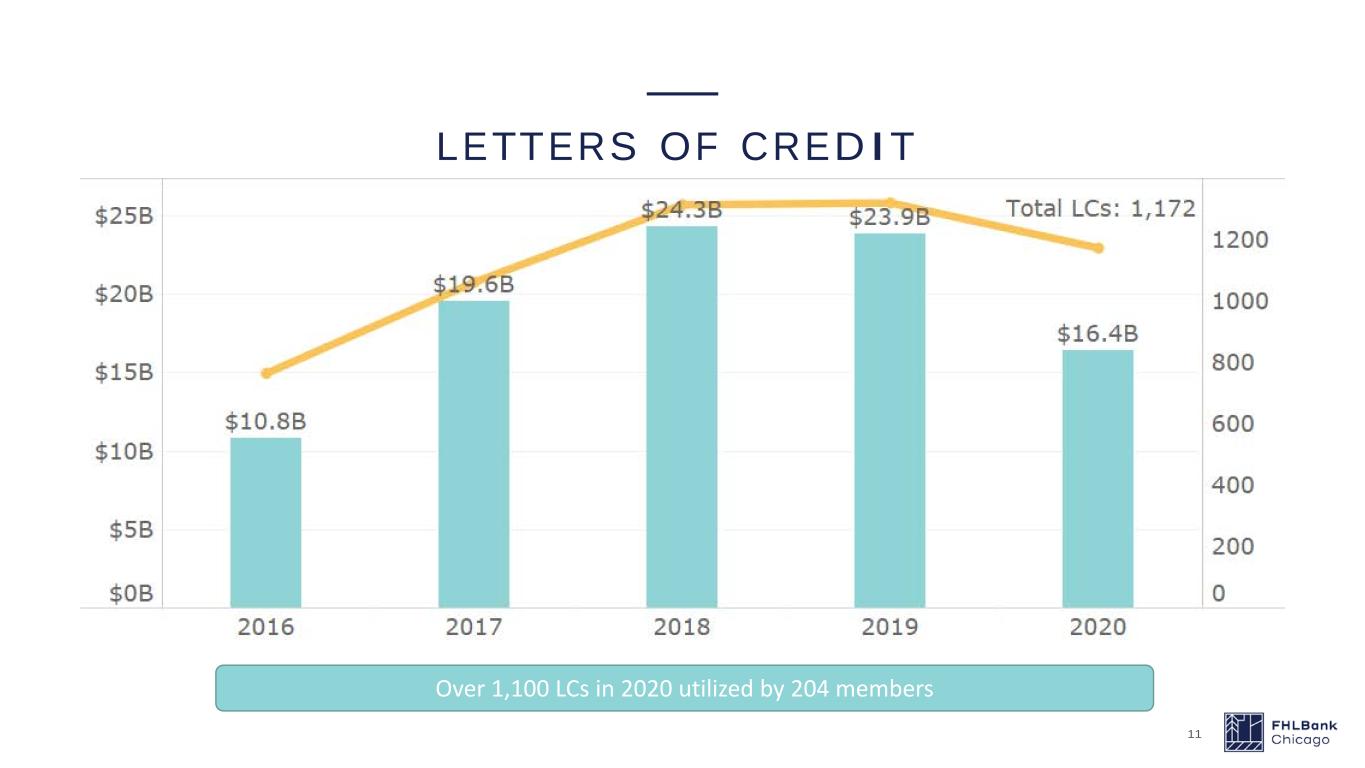

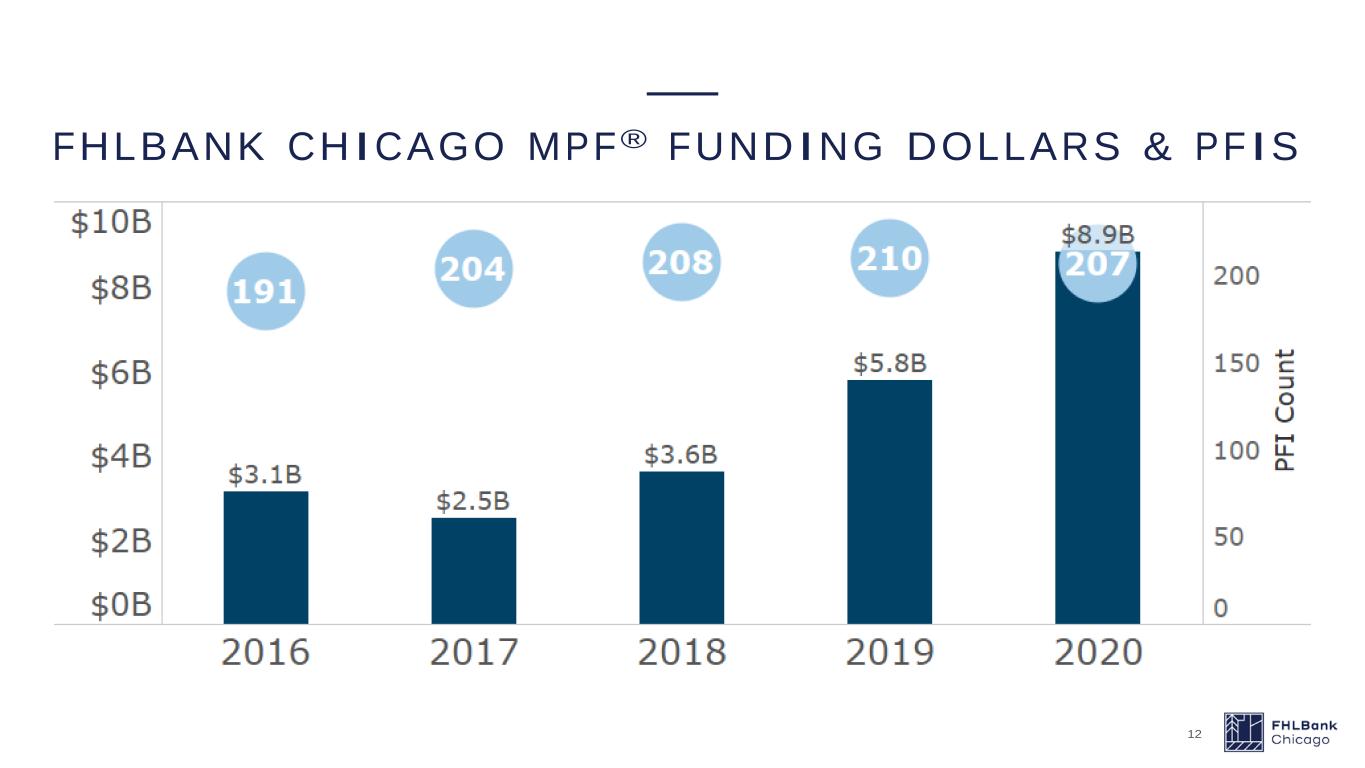

KEY 2020 ACCOMPLISHMENTS M E M B E R S F U N D I N G S O L U T I O N S S E C O N D A R Y M A R K E T S • Maintained 5% activity dividend through unprecedented times • Q4 2020 Dividend B1 Activity 5.00% B2 Membership 2.00% • Continued dividend guidance throughout 2020 • Advances at $46.7 billion, down 8% from 2019 • Advances hit record high during 2020 • Introduction of the COVID 19- Relief 0% advance • Letters of Credit at $16.4 billion • MPF® new volumes at $8.9 billion, highest level since 2003 • MPF Xtra® product primary reason for increase • 152 PFIs funded into on balance sheet products • $9.0 million in credit enhancement fee income paid to PFIs 3

A H P D P P ® C O M M U N I T Y A D V A N C E S V O L U N TA R Y P R O G R A M S COMMUNITY INVESTMENT • 83 applications by 39 members and 48 sponsors • 46 awards for 22 members and 24 sponsors • $25.9 million awarded for 2,228 units • Community First® Awards: $40K to 4 beneficiaries • Capacity-Building Grants: $949K to 21 beneficiaries • COVID-19 Relief Programs: 59% of members participated in all three programs • 23 members originating 83 advances for $1.2 billion • Housing: 9 members originating 44 advances for $837 million • Development: 5 members originating 15 advances for $396 million • Small Business: 13 members originating 24 advances for $16.4 million • 253 members enrolled • $17.0 million disbursed to 2,999 homebuyers 4

CORE MISSION ASSETS 2 0 2 0 Y T D A v e r a g e s The Bank has continued to maintain a mission-focused balance sheet. Core mission asset level drives how we support members. 5 $53.6B Advances $10.3B MPF $64B Mission Assets

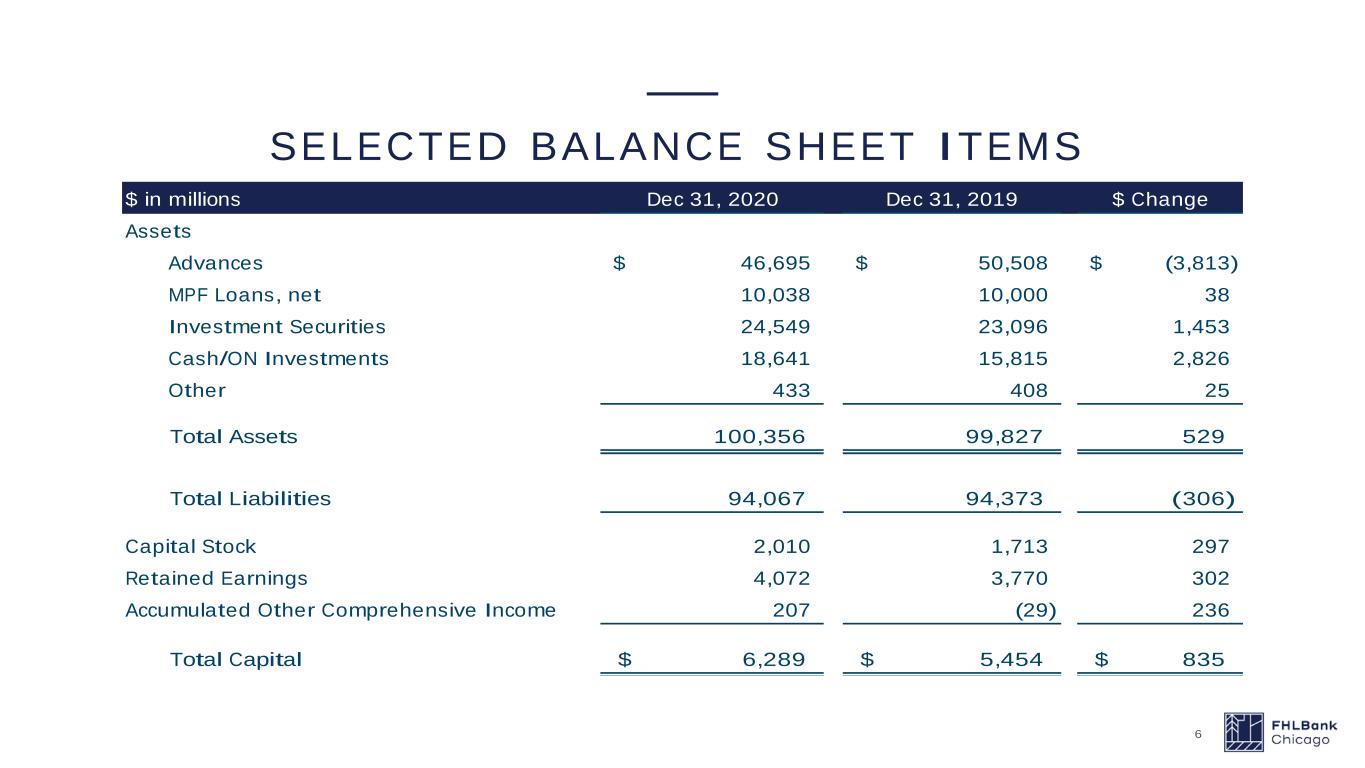

SELECTED BALANCE SHEET ITEMS 6 $ in millions Dec 31, 2020 Dec 31, 2019 $ Change Assets Advances 46,695$ 50,508$ (3,813)$ MPF Loans, net 10,038 10,000 38 Investment Securities 24,549 23,096 1,453 Cash/ON Investments 18,641 15,815 2,826 Other 433 408 25 Total Assets 100,356 99,827 529 Total Liabilities 94,067 94,373 (306) Capital Stock 2,010 1,713 297 Retained Earnings 4,072 3,770 302 Accumulated Other Comprehensive Income 207 (29) 236 Total Capital 6,289$ 5,454$ 835$

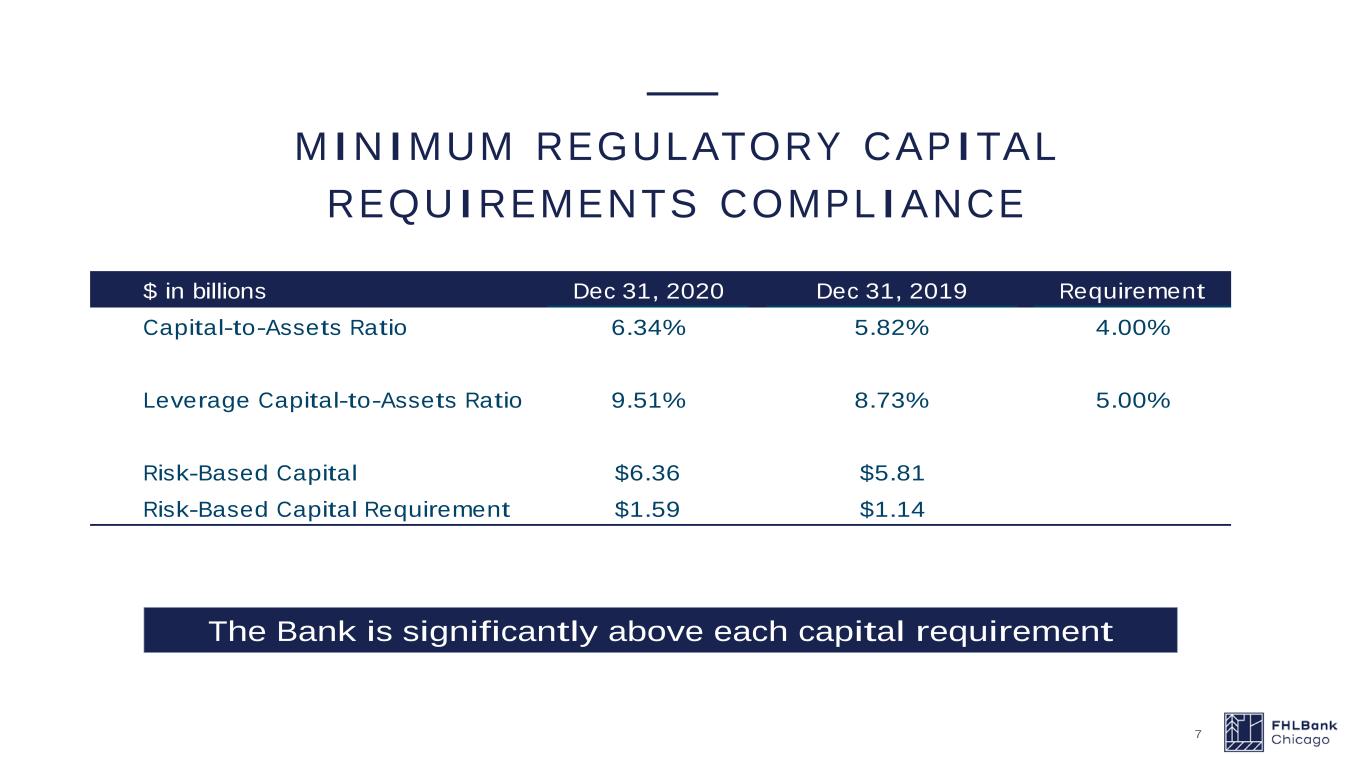

MINIMUM REGULATORY CAPITAL REQUIREMENTS COMPLIANCE 7 $ in billions Dec 31, 2020 Dec 31, 2019 Requirement Capital-to-Assets Ratio 6.34% 5.82% 4.00% Leverage Capital-to-Assets Ratio 9.51% 8.73% 5.00% Risk-Based Capital $6.36 $5.81 Risk-Based Capital Requirement $1.59 $1.14 The Bank is significantly above each capital requirement

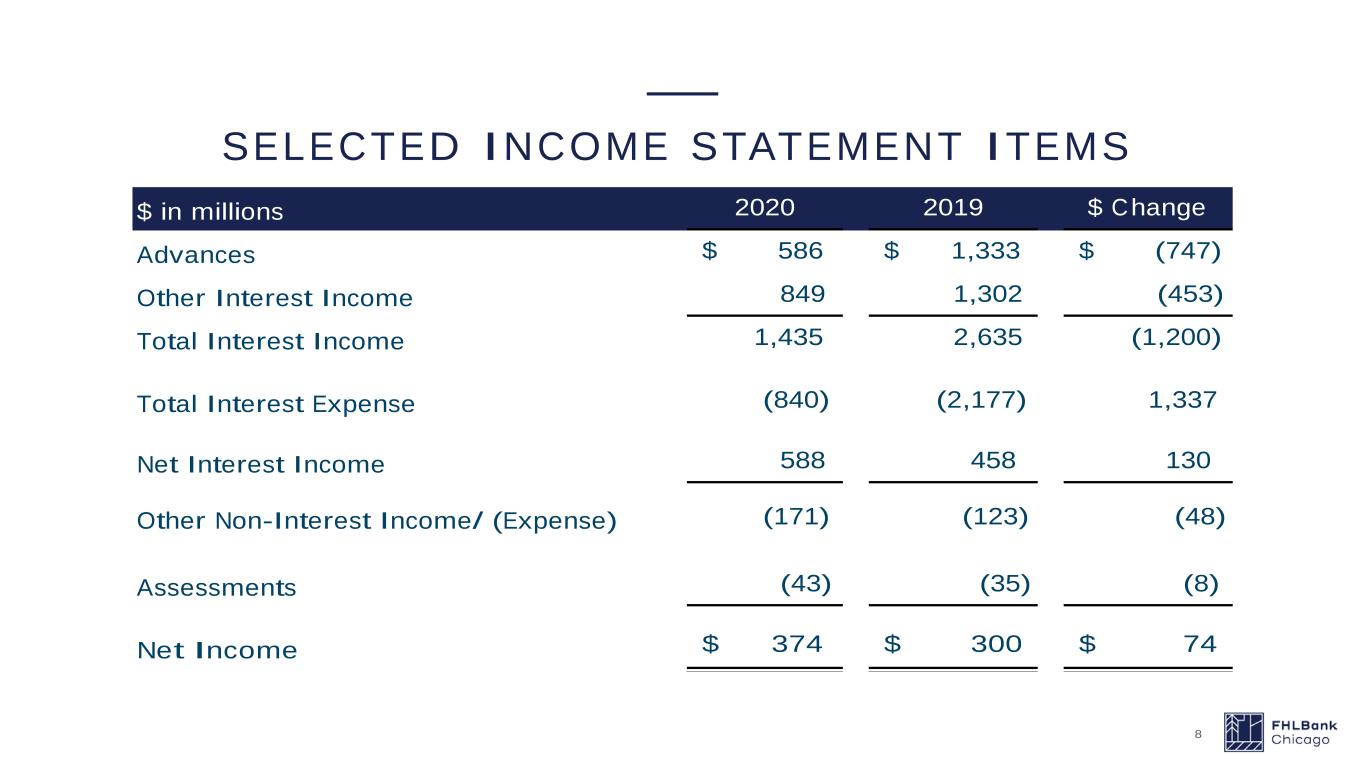

SELECTED INCOME STATEMENT ITEMS 8 $ in millions 2020 2019 $ Change Advances $ 586 $ 1,333 $ (747) Other Interest Income 849 1,302 (453) Total Interest Income 1,435 2,635 (1,200) Total Interest Expense (840) (2,177) 1,337 Net Interest Income 588 458 130 Other Non-Interest Income/ (Expense) (171) (123) (48) Assessments (43) (35) (8) Net Income $ 374 $ 300 $ 74

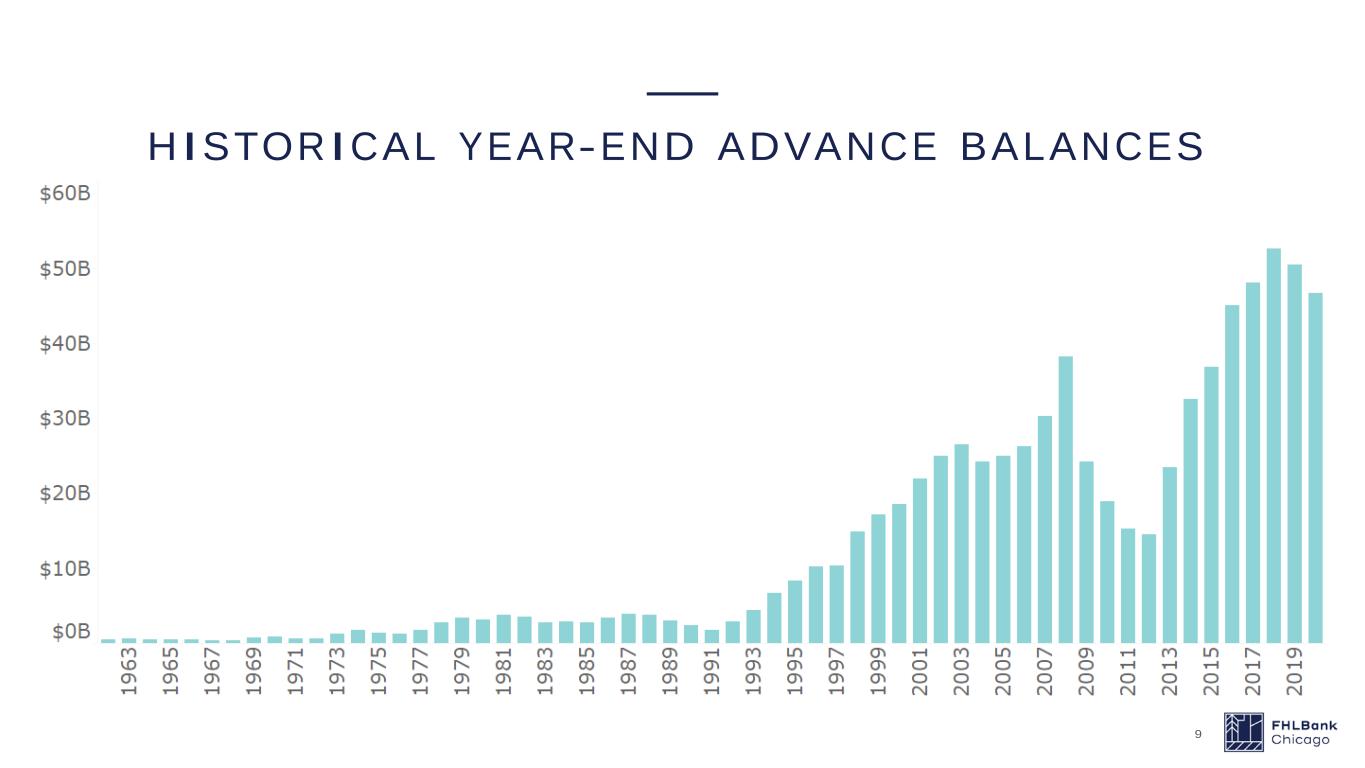

HISTORICAL YEAR-END ADVANCE BALANCES 9

ADVANCE HISTORY, YEAR-END BALANCE 10

LETTERS OF CREDIT 11 Over 1,100 LCs in 2020 utilized by 204 members

12 FHLBANK CHICAGO MPF® FUNDING DOLLARS & PFIS

2020 Summary 13 We continue to support member utilization of our products and the communities in which members operate MPF Program saw large growth in 2020 The Bank remains financially strong