Attached files

| file | filename |

|---|---|

| EX-99.6 - EXHIBIT 99.6 - Bally's Corp | tm2112603d1_ex99-6.htm |

| EX-99.5 - EXHIBIT 99.5 - Bally's Corp | tm2112603d1_ex99-5.htm |

| EX-99.4 - EXHIBIT 99.4 - Bally's Corp | tm2112603d1_ex99-4.htm |

| EX-99.3 - EXHIBIT 99.3 - Bally's Corp | tm2112603d1_ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - Bally's Corp | tm2112603d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Bally's Corp | tm2112603d1_ex99-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Bally's Corp | tm2112603d1_ex23-1.htm |

| EX-10.2 - EXHIBIT 10.2 - Bally's Corp | tm2112603d1_ex10-2.htm |

| EX-2.1 - EXHIBIT 2.1 - Bally's Corp | tm2112603d1_ex2-1.htm |

| 8-K - FORM 8-K - Bally's Corp | tm2112603d1_8k.htm |

Exhibit 10.1

EXECUTION VERSION

| 13 APRIL 2021 |

|

PREMIER ENTERTAINMENT PARENT, LLC (as Parent)

PREMIER ENTERTAINMENT SUB, LLC (as Borrower)

arranged by DEUTSCHE BANK AG, LONDON BRANCH GOLDMAN SACHS BANK USA and BARCLAYS BANK PLC (as Arrangers)

with DEUTSCHE BANK AG, LONDON BRANCH (as Interim Facility Agent) and DEUTSCHE BANK AG, LONDON BRANCH (as Interim Security Agent)

|

|

INTERIM FACILITIES AGREEMENT

|

|

99 Bishopsgate www.lw.com

|

CONTENTS

| Clause | Page | |

| 1. | INTERPRETATION | 1 |

| 2. | THE INTERIM FACILITies - AVAILABILITY | 1 |

| 3. | THE MAKING OF THE INTERIM LOANS | 2 |

| 4. | NATURE OF AN INTERIM FINANCE PARTY’S RIGHTS AND OBLIGATIONS | 4 |

| 5. | UTILISATION | 4 |

| 6. | REPAYMENT AND PREPAYMENT | 5 |

| 7. | INTEREST | 7 |

| 8. | TAXES | 12 |

| 9. | INCREASED COSTS | 20 |

| 10. | PAYMENTS | 23 |

| 11. | FEES AND EXPENSES | 26 |

| 12. | INDEMNITIES | 28 |

| 13. | SECURITY | 31 |

| 14. | AGENTS AND ARRANGERS | 34 |

| 15. | PRO RATA PAYMENTS | 41 |

| 16. | SET-OFF | 42 |

| 17. | NOTICES | 42 |

| 18. | CONFIDENTIALITY | 44 |

| 19. | KNOW YOUR CUSTOMER REQUIREMENTS | 45 |

| 20. | REPRESENTATIONS, UNDERTAKINGS AND EVENTS OF DEFAULT | 46 |

| 21. | CHANGES TO PARTIES | 49 |

| 22. | IMPAIRMENT AND REPLACEMENT OF INTERIM FINANCE PARTIES | 56 |

| 23. | CONDUCT OF BUSINESS BY THE INTERIM FINANCE PARTIES | 56 |

| 24. | AMENDMENTS AND WAIVERS | 57 |

| 25. | MISCELLANEOUS | 58 |

| 26. | GOVERNING LAW | 59 |

| 27. | JURISDICTION | 59 |

| 28. | ACKNOWLEDGEMENT REGARDING ANY SUPPORTED QFCS | 61 |

| Schedule 1 | 63 | |

| Definitions and Interpretation | ||

| Schedule 2 | 92 | |

| Form of Drawdown Request | ||

| Schedule 3 | 93 | |

| Conditions Precedent | ||

| Schedule 4 | 96 | |

| Major Representations, Undertakings and Events of Default | ||

| Major Undertakings | ||

| Major Events of Default | ||

| Schedule 5 | 107 | |

| Impairment and Replacement of Interim Finance Parties | ||

| Defaulting Lender | ||

| Schedule 6 | 119 | |

| Form of Transfer Certificate | ||

| Schedule 7 | 122 | |

| Form of Assignment Agreement | ||

| Schedule 8 | 125 | |

| The Original Interim Lenders | ||

| Schedule 9 | 126 | |

| GUARANTEE | ||

| Schedule 10 | 130 | |

| form of extension request | ||

| Schedule 11 | 131 | |

| CONDITIONS PRECEDENT REQUIRED TO BE DELIVERED BY AN ADDITIONAL GUARANTOR | ||

| Schedule 12 | 133 | |

| Form of Accession Deed | ||

| Schedule 13 | 135 | |

| Form of us tax compliance certificates | ||

| Schedule 14 | 139 | |

| REFERENCE RATE TERMS | ||

| Schedule 15 | 142 | |

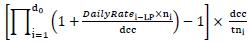

| DAILY NON-CUMULATIVE COMPOUNDED RFR RATE | ||

| Schedule 16 | 144 | |

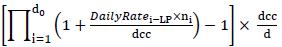

| CUMULATIVE COMPOUNDED RFR RATE | ||

THIS AGREEMENT is made on 13 April 2021:

| (1) | PREMIER ENTERTAINMENT PARENT, LLC, a company incorporated with limited liability under the laws of the State of Delaware (the “Parent”); |

| (2) | PREMIER ENTERTAINMENT SUB, LLC, a company incorporated with limited liability under the laws of the State of Delaware (the “Borrower”); |

| (3) | DEUTSCHE BANK AG, LONDON BRANCH, GOLDMAN SACHS BANK USA and BARCLAYS BANK PLC as arrangers (the “Arrangers”); |

| (4) | THE FINANCIAL INSTITUTIONS listed in Schedule 8 (The Original Interim Lenders) as lenders (the “Original Interim Lenders”); |

| (5) | DEUTSCHE BANK AG, LONDON BRANCH as agent of the other Interim Finance Parties (the “Interim Facility Agent”); and |

| (6) | DEUTSCHE BANK AG, LONDON BRANCH as security agent for the Interim Finance Parties (the “Interim Security Agent”). |

| 1. | INTERPRETATION |

Terms defined in Schedule 1 (Definitions and Interpretation) to this Agreement have the same meanings when used in this Agreement. Each Schedule to this Agreement forms part of the terms of this Agreement.

| 2. | THE INTERIM FACILITies - AVAILABILITY |

| 2.1 | The Interim Facilities |

Subject to the terms of this Agreement, the Original Interim Lenders make available to the Borrower:

| (a) | an interim term loan facility in an aggregate amount equal to the Total Interim Facility (GBP) Commitments available to be utilised in Sterling (“Interim Facility (GBP)”); and |

| (b) | an interim term loan facility in an aggregate amount equal to the Total Interim Facility (EUR) Commitments available to be utilised in euro (“Interim Facility (EUR)”). |

| 2.2 | Availability Periods |

The undrawn Interim Commitments of each Interim Lender under each Interim Facility will be automatically cancelled at 11:59 p.m. (London time) on the last day of the Certain Funds Period.

| 2.3 | Voluntary Cancellation |

The Parent may, by two (2) Business Days’ prior written notice to the Interim Facility Agent, at any time cancel any undrawn amount of any Interim Facility. Any cancellation shall reduce the Commitments of the Interim Lenders rateably under the relevant Interim Facility.

1

| 3. | THE MAKING OF THE INTERIM LOANS |

| 3.1 | Conditions Precedent |

| (a) | The obligations of each Interim Lender to participate in each Interim Loan are subject only to the conditions precedent that on the date on which that Interim Loan is to be made: |

| (i) | the Interim Facility Agent has received (or acting at the direction of the Majority Interim Lenders waived the requirement to receive) all of the documents and evidence referred to in Schedule 3 (Conditions Precedent), where required, in form and substance satisfactory to it (acting reasonably or on the instructions of the Majority Interim Lenders (each acting reasonably)); |

| (ii) | no Major Event of Default is continuing or would result from the making of the relevant Interim Loan; and |

| (iii) | it is not unlawful in any applicable jurisdiction for such Interim Lender to make, or to allow to have outstanding, that Interim Loan. |

| (b) |

| (i) | The Interim Facility Agent shall notify the Parent and the Interim Lenders promptly upon being satisfied that the conditions described in paragraph (a)(i) above have been received by it or waived and the Interim Facility Agent shall, if requested by the Parent, promptly provide the Parent with a letter confirming the same. The Interim Lenders authorise the Interim Facility Agent to give any such notifications and/or provide any such letter. |

| (ii) | The Interim Facility Agent shall not be liable for any damages, costs or losses whatsoever as a result of giving any notification and/or letter referred to in paragraph (b)(i) above (unless they result from the fraud, default or negligence of the Interim Facility Agent). |

| 3.2 | Certain Funds Period |

Notwithstanding any other provision of any Interim Finance Document, during the Certain Funds Period none of the Interim Finance Parties shall:

| (a) | refuse to participate in or make available any Interim Loan, provided that the condition in paragraph (a)(i) of Clause 3.1 (Conditions Precedent) above has been satisfied; |

| (b) | be entitled to take any action to rescind, terminate or cancel this Agreement (or any provision hereof or obligation hereunder) or any Interim Loan or Interim Commitment; |

| (c) | exercise any right of set-off, indemnification or counterclaim in respect of any Interim Loan or Interim Commitment; |

| (d) | accelerate any Interim Loan or otherwise demand or require repayment or prepayment of any sum from any Obligor; or |

2

| (e) | enforce (or instruct the Interim Security Agent to enforce) any Security Interest under any Interim Finance Document, | |

| unless at any time any of the conditions in paragraphs (a)(ii) to (a)(iii) (inclusive) of Clause 3.1 (Conditions Precedent) above are not satisfied (which, in respect of paragraph (a)(iii) of Clause 3.1 (Conditions Precedent) above, shall allow the relevant Interim Lender to take such action in respect of itself only and shall not permit any other Interim Finance Parties to take such action), provided that, immediately upon the expiry of the Certain Funds Period, all such rights, remedies and entitlements shall be available to the Interim Finance Parties, notwithstanding that they may not have been used or been available for use during the Certain Funds Period. | ||

| 3.3 | Purpose |

The proceeds of each Interim Loan are to be applied in or towards (directly or indirectly):

| (a) | financing the cash consideration paid or payable for the Acquisition (including in respect of the acquisition of shares in Target pursuant to a Scheme or an Offer, any proposals to be made under Rule 15 of the City Code and, if applicable a Squeeze-Out or any other acquisition of shares in Target by the Borrower or other payments in connection with, related to or in lieu of such acquisition); |

| (b) | refinancing or otherwise discharging indebtedness of the Target Group under the Senior Facilities Agreement (as defined in the Commitment Letter) (the “Existing Facilities”) and paying any breakage costs, redemption premium, make-whole costs and other fees, costs and expenses payable in connection with such refinancing and/or discharge of the Existing Facilities (the “Refinancing”); |

| (c) | financing or refinancing other related amounts, including fees, premiums, expenses and other transaction costs incurred in connection with the Transactions (including but not limited to the Acquisition and/or the Refinancing) and/or the Transaction Documents; and/or |

| (d) | any other purpose contemplated by the Funds Flow Statement or the Tax Structure Memorandum. |

| 3.4 | Override |

Notwithstanding any other term of this Agreement or any other Interim Finance Document, none of:

| (a) | the actions, steps or events set out in, or reorganisations specified in or expressly contemplated by, or expressly referred to in the Tax Structure Memorandum or the Transaction Documents (or, in each case, the actions or intermediate steps necessary to implement any of those steps, actions or events); and |

| (b) | the actions permitted under the Existing Facilities (prior to discharge) as they relate to the Target Group, |

|

| in any case, shall constitute, or result in, a breach of any representation, warranty, undertaking or other term of the Interim Finance Documents or a Default or a Major Event of Default, actual or potential, and each such event shall be expressly permitted under the terms of the Interim Finance Documents, including the use of the proceeds of any Interim Loan for any purpose set out in the Tax Structure Memorandum or the Funds Flow Statement. | ||

3

| 4. | NATURE OF AN INTERIM FINANCE PARTY’S RIGHTS AND OBLIGATIONS |

| 4.1 | No Interim Finance Party is bound to monitor or verify any Interim Loan nor be responsible for the consequences of such Interim Loan. |

| 4.2 | The obligations of each Interim Finance Party under the Interim Finance Documents are several. |

| 4.3 | Failure by an Interim Finance Party to perform its obligations does not affect the obligations of any other Party under the Interim Finance Documents. |

| 4.4 | No Interim Finance Party is responsible for the obligations of any other Interim Finance Party under the Interim Finance Documents. |

| 4.5 | The rights of each Interim Finance Party under the Interim Finance Documents are separate and independent rights. |

| 4.6 | An Interim Finance Party may, except as otherwise stated in the Interim Finance Documents, separately enforce its rights under the Interim Finance Documents. |

| 4.7 | A debt arising under the Interim Finance Documents to an Interim Finance Party is a separate and independent debt. |

| 4.8 | Each Interim Lender will promptly notify the Parent if it becomes aware of any matter or circumstance which would entitle it not to advance or participate in any Interim Loan. |

| 5. | UTILISATION |

| 5.1 | Giving of Drawdown Requests |

| (a) | The Borrower may borrow an Interim Loan by giving to the Interim Facility Agent a duly completed Drawdown Request. A Drawdown Request is, once given, irrevocable. |

| (b) | The latest time for receipt by the Interim Facility Agent of a duly completed Drawdown Request: |

| (i) | for an Interim Loan in Sterling is 09.30 a.m. (London time) on the date falling one (1) Business Day before the proposed Drawdown Date; and |

| (ii) | for an Interim Loan in euro is 09.30 a.m. (London time) on the date falling one (1) Business Day before the proposed Drawdown Date, |

in each case, or such later time and/or date as agreed by the Interim Facility Agent.

| (c) | The Interim Facility (GBP) and Interim Facility (EUR) may be drawn during the Certain Funds Period. |

| (d) | The Borrower may only draw fifteen (15) Interim Loans under the Interim Facility (GBP). |

| (e) | The Borrower may only draw two (2) Interim Loans under the Interim Facility (EUR). |

4

| 5.2 | Completion of Drawdown Requests |

A Drawdown Request for an Interim Loan will not be regarded as having been duly completed unless:

| (a) | the Drawdown Date is a Business Day within the Certain Funds Period; |

| (b) | the amount of the Interim Loan does not exceed the Total Interim Commitments in respect of the applicable Interim Facility; and |

| (c) | the currency of the Interim Loan complies with paragraph (d) of Clause 5.3 (Advance of Interim Loans) and the proposed Interest Period complies with paragraph (b) of Clause 7.2 (Payment of interest). |

| 5.3 | Advance of Interim Loans |

| (a) | The Interim Facility Agent must promptly notify each Interim Lender of the details of the requested Interim Loan and the amount of its share in that Interim Loan. |

| (b) | Each Interim Lender will participate in each Interim Loan in the proportion which its Interim Commitment under the applicable Interim Facility bears to the Total Interim Commitments under that Interim Facility, immediately before the making of that Interim Loan. |

| (c) | No Interim Lender is obliged to participate in any Interim Loan if as a result the amount of its share in the applicable Interim Facility would exceed its Interim Commitments under that Interim Facility. |

| (d) | Each Interim Loan may only be denominated in the currency or currencies in which the applicable Interim Facility is stated to be available under Clause 2.1 (The Interim Facilities) above, unless otherwise agreed in writing by all the Interim Lenders under the applicable Interim Facility. |

| (e) | If the applicable conditions set out in this Agreement have been met, each Interim Lender shall make its participation in each Interim Loan available to the Interim Facility Agent for the account of the Borrower by the Drawdown Date through its Facility Office. |

| 6. | REPAYMENT AND PREPAYMENT |

| 6.1 | Repayment |

| (a) | The Borrower must repay all outstanding Interim Loans (together with all outstanding interest thereon) on the Final Repayment Date or, if earlier: |

| (i) | in full on the date of receipt by an Obligor of a written demand (the “Acceleration Notice”) from the Interim Facility Agent (acting on the instructions of the Majority Interim Lenders) following the occurrence of a Major Event of Default which is continuing requiring immediate prepayment and cancellation in full of the Interim Facilities; or |

| (ii) | the date of receipt by any Obligor or any Group Company of the proceeds from the first utilisation made under any Long-term Financing (free of any escrow or similar arrangements), to the extent of such proceeds. |

5

| (b) | If an Interim Loan is, or is declared to be, due and payable in accordance with the terms of this Agreement, all interest and all other amounts accrued or outstanding in respect of that Interim Loan shall be immediately due and payable. |

| (c) | If an Interim Loan is, or is declared to be, due and payable, in accordance with the terms of this Agreement, on demand, all interest and all other amounts accrued or outstanding in respect of that Interim Loan shall be immediately due and payable on demand by the Interim Facility Agent on the instructions of the Majority Interim Lenders. |

| (d) | If an Interim Loan is, or is declared to be, due and payable in accordance with the terms of this Agreement, the Interim Facility Agent may, and shall if so directed by the Majority Interim Lenders, by notice to the Parent, exercise or direct the Interim Security Agent to exercise any or all of its rights, remedies, powers or discretions under the Interim Finance Documents. |

| (e) | Amounts repaid under an Interim Facility cannot be redrawn. |

| 6.2 | Prepayment |

| (a) | The Borrower may prepay the whole or any part of any outstanding Interim Loan (including, for the avoidance of doubt, the whole or any part of any outstanding Interim Loan owed to a particular Interim Lender to the extent provided for by the terms of this Agreement), together with accrued but unpaid interest, at any time: |

| (i) | in the case of an Interim Facility (GBP) Loan, on giving one (1) Business Day prior notice in writing to the Interim Facility Agent; or |

| (ii) | in the case of an Interim Facility (EUR) Loan, on giving one (1) Business Day prior notice in writing to the Interim Facility Agent. |

| (b) | Amounts prepaid under an Interim Facility cannot be redrawn. |

| (c) | On the occurrence of a prepayment under this Clause 6.2, a corresponding amount of the Interim Commitments shall be cancelled. |

| 6.3 | Cancellation of Interim Commitments |

| (a) | On the occurrence of any event referred to in paragraph (a) of Clause 6.1 (Repayment), the Interim Commitments, which, at that time, are unutilised shall be cancelled in full. |

| (b) | Upon the payment of funds (the “Relevant Proceeds”) into the Escrow Account, the Borrower (or the Parent on its behalf) shall provide a notice to the Interim Lenders as to the amount of Interim Commitments to be cancelled (the “Commitment Reduction”). The Commitment Reduction shall equal the aggregate sterling converted amount of the Relevant Proceeds as agreed by the Borrower and the Financial Adviser. Promptly upon receipt of notice of the Commitment Reduction, the applicable Interim Commitments shall be irrevocably cancelled in the amount of the Commitment Reduction. |

| 6.4 | Extension Option |

| (a) | The Parent may, by delivering an Extension Request to the Interim Facility Agent no earlier than twenty (20) days and not later than ten (10) days before the Original Final Repayment Date, request that the Final Repayment Date be extended to the Extended Final Repayment Date. |

6

| (b) | The Interim Facility Agent shall promptly notify the Interim Lenders that an Extension Request has been served following receipt of the Extension Request. |

| (c) | Provided that no Major Event of Default is continuing on the date of the Extension Request, the Final Repayment Date shall be automatically extended to the Extended Final Repayment Date upon receipt by the Interim Facility Agent of the Extension Request (the “Extension Effective Date”). |

| (d) | An Extension Request shall be irrevocable. |

| 7. | INTEREST |

| 7.1 | Calculation of interest – Interim Facility (GBP) Loans |

| (a) | The rate of interest on each Interim Facility (GBP) Loan for any day during an Interest Period is the percentage rate per annum which is the aggregate of the applicable: |

| (i) | Margin; and |

| (ii) | Compounded Reference Rate for that day. |

| (b) | If any day during an Interest Period for an Interim Facility (GBP) Loan is not an RFR Banking Day, the rate of interest on that Interim Facility (GBP) Loan for that day will be the rate applicable to the immediately preceding RFR Banking Day. |

| 7.2 | Calculation of interest – Interim Facility (EUR) Loans |

The rate of interest on each Interim Facility (EUR) Loan for its Interest Period is the percentage rate per annum which is the aggregate of the applicable:

| (a) | the Margin; and |

| (b) | EURIBOR in relation to any Interim Facility (EUR) Loan for that Interest Period. |

| 7.3 | Payment of interest |

| (a) | The period for which each Interim Loan is outstanding shall be divided into successive interest periods (each, an “Interest Period”), each of which will start on the expiry of the previous Interest Period or, in the case of the first Interest Period for an Interim Loan, on the relevant Drawdown Date. |

| (b) | The Borrower of each Interim Facility (GBP) Loan (or the Parent on its behalf) shall select an Interest Period as specified in the applicable Reference Rate Terms. |

| (c) | Prior to the Extension Effective Date, the Borrower of each Interim Facility (EUR) Loan (or the Parent on its behalf) shall select an Interest Period of one (1), two (2) or three (3) weeks, one (1) or two (2) months or ninety (90) days (or any other period agreed with the Interim Facility Agent) in each Drawdown Request and (in relation to subsequent Interest Periods for the Interim Facility (EUR) Loans) thereafter no later than 09.30 a.m. (London time) one (1) Business Day prior to the end of the existing Interest Period for the outstanding Interim Facility (EUR) Loans. |

7

| (d) | Upon and following the Extension Effective Date, the Borrower of each Interim Facility (EUR) Loan (or the Parent on its behalf) shall select an Interest Period of one (1), two (2) or three (3) months (or any other period agreed with the Interim Facility Agent) in each Drawdown Request and (in relation to subsequent Interest Periods for the Interim Facility (EUR) Loans) thereafter no later than 09.30 a.m. (London time) one (1) Business Day prior to the end of the existing Interest Period for the outstanding Interim Facility (EUR) Loans. |

| (e) | If the Borrower (or the Parent on its behalf) does not select an Interest Period for an Interim Facility (GBP) Loan, the default Interest Period shall (subject to paragraph (h) below) be as specified in the applicable Reference Rate Terms. |

| (f) | If the Borrower (or the Parent on its behalf) does not select an Interest Period for an Interim Facility (EUR) Loan, the default Interest Period shall (subject to paragraph (h) below) be one (1) month prior to the Extension Effective Date and three (3) months upon and following the Extension Effective Date (or, if earlier, a period ending on the Final Repayment Date). |

| (g) | The Borrower must pay accrued interest on each Interim Loan made to it on the last day of each Interest Period in respect of that Interim Loan and on any date on which that Interim Loan is repaid or prepaid. |

| (h) | Notwithstanding paragraphs (a), (b), (e) and (f) above, no Interest Period will extend beyond the Final Repayment Date. |

| (i) | Subject to paragraph (j) below, if an Interest Period would otherwise end on a day which is not a Business Day, that Interest Period will instead end on the next Business Day in that calendar month (if there is one) or the preceding Business Day (if there is not), provided that no Interest Period will extend beyond the Final Repayment Date. |

| (j) | If the Interim Loan is an Interim Facility (GBP) Loan, any rules specified as “Business Day Conventions” in the Reference Rate Terms shall apply to each Interest Period. |

| (k) | If there is a repayment, prepayment or recovery of all or any part of an Interim Loan other than on the last day of its Interest Period, the Borrower will pay the Interim Finance Parties promptly following demand their break costs (if any). The break costs (the “Break Costs”) will be the amount by which: |

| (i) | in respect of any Interim Facility (GBP) Loan, any amount specified as such in the Reference Rate Terms; or |

| (ii) | in respect of any Interim Facility (EUR) Loan, the amount (if any) by which: |

| (A) | EURIBOR (disregarding for this purpose any interest rate floor) which would have been payable at the end of the relevant Interest Period on the amount of the Interim Facility (EUR) Loan repaid, prepaid or recovered; exceeds |

| (B) | if positive, the amount of interest the Interim Lenders would have received by placing a deposit equal to the relevant amount with leading banks in the Relevant Interbank Market for a period starting on the Business Day following receipt and ending on the last day of the relevant Interest Period. |

8

| 7.4 | Interest on overdue amounts |

| (a) | If an Obligor fails to pay when due any amount payable by it under the Interim Finance Documents, it must immediately on demand by the Interim Facility Agent pay interest on the overdue amount from its due date up to the date of actual payment, both before, on and after judgment. |

| (b) | Interest on an overdue amount is payable at a rate determined by the Interim Facility Agent to be one (1) per cent. per annum above the rate which would have been payable if the overdue amount had, during the period of non-payment, constituted part of that Interim Loan. |

| (c) | Interest (if unpaid) on an overdue amount will be compounded with that overdue amount on the last day of each Interest Period (or such duration as selected by the Interim Facility Agent acting reasonably) to the extent permitted under any applicable law and regulation. |

| 7.5 | Interest calculation |

| (a) | Interest shall be paid in the currency of the relevant Interim Loan and shall accrue from day to day and be calculated on the basis of the actual number of days elapsed and a 365 day year, or in any case where the practice in the Relevant Interbank Market differs, in accordance with that market practice. |

| (b) | The aggregate amount of any accrued interest in respect of the Interest Period for an Interim Facility (GBP) Loan shall be rounded to 2 decimal places. |

| (c) | The Interim Facility Agent shall promptly upon an Interest Payment being determined in respect of an Interim Facility (GBP) Loan notify: |

| (i) | the Borrower of that Interest Payment; |

| (ii) | each relevant Interim Lender of the proportion of that Interest Payment which relates to that Interim Lender’s participation in the relevant Interim Facility (GBP) Loan; and |

| (iii) | the relevant Interim Lenders and the Borrower of: |

| (A) | each applicable rate of interest relating to the determination of that Interest Payment; and |

| (B) | to the extent it is then determinable, the Market Disruption Rate (if any) relating to the relevant Interim Facility (GBP) Loan. |

This paragraph (c) shall not apply to any Interest Payment determined pursuant to Clause 7.9 (Proposed Disrupted Loans).

| (d) | The Interim Facility Agent shall promptly notify the relevant Interim Lenders and the Borrower of the determination of a rate of interest relating to an Interim Facility (GBP) Loan to which Clause 7.9 (Proposed Disrupted Loans) applies. |

9

| (e) | The Interim Facility Agent shall promptly notify each relevant Party of the determination of a rate of interest relating to an Interim Facility (EUR) Loan under this Agreement. |

| (f) | This Clause shall not require the Interim Facility Agent to make any notification to any Party on a day which is not a Business Day. |

| 7.6 | Replacement of Screen Rate |

| (a) | Subject to paragraphs (b) and (c) below, any amendment or waiver which relates to providing for an additional or alternative benchmark rate, base rate or reference rate to apply in relation to that currency in place of that Screen Rate or Compounded Reference Rate for an applicable Interim Facility (including any amendment, replacement or waiver to the definition of, “EURIBOR”, “Compounded Reference Rate” (or any component definition thereof) or “Screen Rate”, including an alternative or additional page, service or method for the determination thereof) (or which relates to aligning any provision of an Interim Finance Document to the use of that other benchmark rate, base rate or reference rate, including making appropriate adjustments to this Agreement for basis, duration, time and periodicity for determination of that other benchmark rate, base rate or reference rate for any Interest Period and making other consequential and/or incidental changes) (a “Benchmark Rate Change”) may be made with the consent of the Majority Interim Lenders and the Parent. |

| (b) | If either the Parent or the Interim Facility Agent (acting on the instructions of the Majority Interim Lenders) requests the making of a Benchmark Rate Change, the Parent shall notify the Interim Facility Agent (or, as the case may be, the Interim Facility Agent shall notify the Parent) thereof and if such Benchmark Rate Change cannot be agreed upon by the date which is five (5) Business Days before the end of the current Interest Period (or in the case of a new Interim Loan, the date which is five (5) Business Days before the date upon which the Drawdown Request will be served, as notified by the Parent to the Interim Facility Agent), the Screen Rate applicable to any Interim Lender’s share of an applicable Interim Loan shall be replaced by the rate certified to the Interim Facility Agent by that Interim Lender as soon as practicable (and in any event by the date falling two (2) Business Days before the date on which interest is due to be paid in respect of the relevant Interest Period) to be that which expresses as a percentage rate per annum of the cost to the relevant Interim Lender of funding its participation in that applicable Interim Loan in the Relevant Interbank Market. |

| (c) | Notwithstanding the definitions of “EURIBOR”, “Compounded Reference Rate” (or any component definition thereof) or “Screen Rate” in Schedule 1 (Definitions and Interpretation) or any other term of any Interim Finance Document, the Interim Facility Agent may from time to time (with the prior written consent of the Parent) specify a Benchmark Rate Change for any currency for the purposes of the Interim Finance Documents, and each Interim Lender authorises the Interim Facility Agent to make such specification. |

| 7.7 | Absence of quotations |

| (a) | If: |

| (i) | there is no applicable RFR or Central Bank Rate for the purposes of calculating the Daily Non-Cumulative Compounded RFR Rate for an RFR Banking Day during an Interest Period for an Interim Facility (GBP) Loan; and |

10

| (ii) | “Cost of funds will apply as a fallback” is specified in the Reference Rate Terms, |

Clause 7.9 (Proposed Disrupted Loans) shall apply to that Interim Facility (GBP) Loan for that Interest Period.

| (b) | If EURIBOR is to be determined by reference to the Reference Banks but a Reference Bank does not supply a quotation by 12.00 noon (Brussels time) on the Rate Fixing Day then EURIBOR shall be determined on the basis of the quotations of the remaining Reference Banks, subject to Clause 7.8 (Market Disruption Notice). |

| 7.8 | Market Disruption Notice |

If, in relation to any actual or proposed Interim Loan (a “Disrupted Loan”):

| (a) | in the case of an Interim Facility (GBP) Loan, if: |

| (i) | a Market Disruption Rate is specified in the Reference Rate Terms; and |

| (ii) | before the Reporting Time the Interim Facility Agent receives notifications from an Interim Lender or Interim Lenders (whose participations in an Interim Facility (GBP) Loan equal or exceed forty (40) per cent. of that Interim Facility (GBP) Loan) that its cost of funds relating to its participation in that Interim Facility (GBP) Loan would be in excess of that Market Disruption Rate, |

then Clause 7.9 (Proposed Disrupted Loans) shall apply to that Interim Facility (GBP) Loan for the relevant Interest Period; and

| (b) | in the case of an Interim Facility (EUR) Loan: |

| (i) | EURIBOR is to be determined by reference to rates supplied by Reference Banks and none or only one of the Reference Banks supplies a rate by 12.00 noon (Brussels time) on the Rate Fixing Day; or |

| (ii) | before close of business in London on the Rate Fixing Day for the relevant Interest Period, one or more Interim Lenders whose participations in that Interim Facility (EUR) Loan equal or exceed in aggregate forty (40) per cent. of the amount of that Interim Facility (EUR) Loan notify the Interim Facility Agent that by reason of circumstances affecting the Relevant Interbank Market generally the cost to those Interim Lenders of obtaining matching deposits in the Relevant Interbank Market would be in excess of EURIBOR, |

in each case, the Interim Facility Agent will promptly give notice of such event to the Parent and the Interim Lenders (a “Market Disruption Notice”).

11

| 7.9 | Proposed Disrupted Loans |

If a Market Disruption Notice is given in respect of a proposed Disrupted Loan and this Clause 7.9 applies to an Disrupted Loan for an Interest Period, Clause 7.1 (Calculation of interest) shall not apply to that Disrupted Loan for that Interest Period and the interest rate applicable on each Interim Lender’s participation in that Disrupted Loan will be the applicable Margin plus:

| (a) | in relation to a Disrupted Loan under Interim Facility (GBP), the rate certified by that Interim Lender to the Interim Facility Agent by the Reporting Time; or |

| (b) | in relation to a Disrupted Loan under Interim Facility (EUR), the rate certified by that Interim Lender to the Interim Facility Agent no later than five (5) Business Days after the Rate Fixing Day, in each case, to be its cost of funds (from any source which it may reasonably select). |

| 8. | TAXES |

| 8.1 | Gross-up |

| (a) | Each Obligor must make all payments under the Interim Finance Documents without any Tax Deduction, unless a Tax Deduction is required by law. |

| (b) | If the Parent or an Interim Lender becomes aware that an Obligor must make a Tax Deduction (or that there is any change in the rate or the basis of a Tax Deduction), it shall promptly notify the Interim Facility Agent. Failure to give such notice shall not affect the obligations of any Obligor under the Interim Finance Documents. If the Interim Facility Agent receives such notification from an Interim Lender it shall notify the Parent. |

| (c) | If any Tax Deduction is required by law to be made by an Obligor (or by the Interim Facility Agent on behalf of an Obligor): |

| (i) | except as provided in Clause 8.2 (Exceptions from gross-up), the amount of the payment due from such Obligor will be increased to an amount which (after taking into account any Tax Deduction including a Tax Deduction imposed on or with respect to the increased amount pursuant to this paragraph (c)(i)) leaves an amount equal to the amount which would have been due if no Tax Deduction had been required; and |

| (ii) | the Parent will: |

| (A) | ensure that the Tax Deduction and any payment required in connection with it does not exceed the minimum amount required by law; |

| (B) | make the Tax Deduction and any payment required in connection with such Tax Deduction within the time allowed by law; and |

| (C) | within thirty (30) days of making any Tax Deduction or any payment to the relevant Tax authorities required in connection with it, deliver to the Interim Facility Agent (for the Interim Finance Party entitled to the payment) evidence satisfactory to that Interim Finance Party (acting reasonably) that such Tax Deduction has been made or (as applicable) such payment paid to the appropriate authority. |

12

| 8.2 | Exceptions from gross-up |

An Obligor is not required to make any increased payment to an Interim Finance Party under Clause 8.1 (Gross-up) by reason of a Tax Deduction if:

| (a) | the Tax Deduction is the result of the Taxes described in paragraph (b)(i) (Tax indemnity); or |

| (b) | the Tax Deduction is on account of Tax imposed with respect to payments made by or with respect to a US Tax Obligor, if such Tax is a US Excluded Tax. |

| 8.3 | Tax indemnity |

| (a) | The Parent shall (or shall procure that another Group Company will) (within five (5) Business Days of demand by the Interim Facility Agent) pay to an Interim Finance Party an amount equal to the loss, liability or cost which that Interim Finance Party determines (acting reasonably and in good faith) will be or has been (directly or indirectly) suffered for or on account of Tax by that Interim Finance Party in relation to a payment received or receivable from an Obligor under an Interim Finance Document. |

| (b) | Paragraph (a) above shall not apply: |

| (i) | to any Tax assessed on an Interim Finance Party under the law of the jurisdiction (or any political subdivision thereof) in which: |

| (A) | that Interim Finance Party is incorporated or, if different, in which that Interim Finance Party is treated as resident for tax purposes; or |

| (B) | that Interim Finance Party’s Facility Office or other permanent establishment is located in respect of amounts received or receivable in that jurisdiction (or any political subdivision thereof) or in respect of amounts attributed to the permanent establishment on the basis that personnel of the Interim Finance Party are undertaking relevant functions in the jurisdiction (or any political subdivision thereof) where that permanent establishment is located; or |

| (C) | that Interim Finance Party has a present or former connection (other than any connection arising solely under the Interim Facilities or any transactions contemplated thereby) in respect of amounts received or receivable under the Interim Finance Documents in that jurisdiction, |

if that Tax is imposed on or calculated by reference to the net income received or receivable (but not any sum deemed to be received or receivable) by that Interim Finance Party or if that Tax is a franchise Tax, branch profits Tax or similar Tax; or

| (ii) | to the extent a loss or liability: |

| (A) | is compensated for by payment of an amount under Clause 8.1 (Gross-up); |

| (B) | would have been compensated for by payment of an increased amount under Clause 8.1 (Gross-up) but was not so compensated solely because one of the exclusions in Clause 8.2 (Exceptions from gross-up) applied; |

| (C) | is compensated for by payment of an amount under Clause 8.5 (Stamp Taxes) or Clause 8.6 (Value added taxes) or would have been compensated for by payment of an increased amount under such Clauses but was not so compensated solely because one of the exclusions in the applicable Clause applied; |

13

| (D) | (for the avoidance of doubt) is suffered or incurred in respect of any Bank Levy (or any payment attributable to, or liability arising as a consequence of, a Bank Levy); or |

| (E) | relates to a FATCA Deduction required to be made by a party. |

| (c) | An Interim Finance Party making, or intending to make a claim under paragraph (a) above shall promptly notify the Parent and the Interim Facility Agent of the event which has given, or will give, rise to the claim. |

| 8.4 | Tax Credit |

If an Obligor or a Group Company pays an additional amount under Clause 8.1 (Gross-up) or Clause 8.3 (Tax indemnity) and an Interim Finance Party determines (in its absolute discretion acting in good faith) that it (or one of its Affiliates) has obtained and utilised a Tax Credit attributable to that additional amount or the Tax Deduction in consequence of which the additional amount was required, then, subject to the penultimate sentence of this Clause 8.4, that Interim Finance Party shall pay to the Obligor or that Group Company (as the case may be) an amount equal to such Tax Credit (but only to the extent of the additional amounts paid under Clause 8.1 (Gross-up) or Clause 8.3 (Tax indemnity) with respect to the Taxes giving rise to such Tax Credit and subject to that penultimate sentence), net of all out-of-pocket expenses (including Taxes) of such Interim Finance Party and its Affiliates (as applicable) and without interest (other than any interest paid by the relevant governmental or tax authority with respect to such Tax Credit); provided that, the Obligor, upon the request of such Interim Finance Party, shall repay to such Interim Finance Party the amount paid over pursuant to this Clause 8.4 in the event that such Interim Finance Party (or any of its Affiliates) is required to repay such Tax Credit to the relevant governmental or tax authority or it otherwise transpires that the Interim Finance Party is unable to obtain and utilize the Tax Credit. Notwithstanding anything to the contrary in this Clause 8.4, in no event will the Interim Finance Party be required to pay any amount to the Obligor pursuant to this Clause 8.4 the payment of which would place the Interim Finance Party and its Affiliates in a less favourable net after-Tax position than the Interim Finance Party and its Affiliates would have been in if the Tax subject to indemnification and giving rise to such Tax Credit had not been deducted, withheld or otherwise imposed and the indemnification payments or additional amounts with respect to such Tax had never been paid. This Clause 8.4 shall not be construed to require any Interim Finance Party to make available its Tax returns (or the Tax returns of any Affiliate) (or any other information relating to its or any of its Affiliate’s Taxes that it deems confidential) to the Borrower or any other person.

| 8.5 | Stamp Taxes |

The Parent shall pay (or shall procure that another Group Company pays) within five (5) Business Days of demand and indemnify each Interim Finance Party against all losses, costs and liabilities which that Interim Finance Party (directly or indirectly) suffers or incurs in relation to any stamp duty, stamp duty reserve tax, transfer tax, registration or other similar Tax payable in respect of any Interim Finance Document except for:

| (a) | any such Tax payable in respect of any transfer, assignment, sub-participation or other disposal of an Interim Finance Party’s rights or obligations under an Interim Finance Document, unless such transfer, assignment, sub-participation or other disposal is (i) pursuant to Clause 9.2 (Mitigation) or (ii) at the request of the Parent under Part 3 (Replacement of an Interim Lender/Increase) of Schedule 5 (Impairment and Replacement of Interim Finance Parties) other than such a request in respect of a Defaulting Lender; or |

14

| (b) | any such Tax to the extent it becomes payable upon a voluntary registration made by any Interim Finance Party if such registration is not necessary to evidence, prove, maintain, enforce, compel or otherwise assert the rights of such Interim Finance Party under an Interim Finance Document. |

| 8.6 | Value added taxes |

| (a) | All amounts expressed to be payable under an Interim Finance Document by any party to an Interim Finance Party which (in whole or in part) constitute the consideration for a supply or supplies for VAT purposes shall be deemed to be exclusive of any VAT which is chargeable on such supply or supplies and accordingly, subject to paragraph (b) below, if VAT is or becomes chargeable on any supply or supplies made by any Interim Finance Party to any party in connection with an Interim Finance Document, and such Interim Finance Party is required to account to the relevant tax authority for the VAT, that party shall pay to the Interim Finance Party (in addition to and at the same time as paying the consideration for that supply or supplies) an amount equal to the amount of the VAT (upon such Interim Finance Party providing an appropriate VAT invoice to such party). |

| (b) | If VAT is or becomes chargeable on any supply made by any Interim Finance Party (the “Supplier”) to any other Interim Finance Party (the “Recipient”) under an Interim Finance Document, and any party other than the Recipient (the “Relevant Party”) is required by the terms of any Interim Finance Document to pay an amount equal to the consideration for that supply to the Supplier (rather than being required to reimburse or indemnify the Recipient in respect of that consideration): |

| (i) | (where the Supplier is the person required to account to the relevant tax authority for the VAT) the Relevant Party must also pay to the Supplier (at the same time as paying that amount) an additional amount equal to the amount of the VAT. The Recipient must (where this paragraph (i) applies) promptly pay to the Relevant Party an amount equal to any credit or repayment the Recipient receives from the relevant tax authority which the Recipient reasonably determines relates to the VAT chargeable on that supply; and |

| (ii) | (where the Recipient is the person required to account to the relevant tax authority for the VAT) the Relevant Party must promptly, following demand from the Recipient, pay to the Recipient an amount equal to the VAT chargeable on that supply but only to the extent that the Recipient reasonably determines that it is not entitled to credit or repayment from the relevant tax authority in respect of that VAT. |

| (c) | Where an Interim Finance Document requires any party to reimburse or indemnify an Interim Finance Party for any costs or expenses, that party shall reimburse or indemnify (as the case may be) the Interim Finance Party against any VAT incurred by the Interim Finance Party in respect of the costs or expenses, to the extent that the Interim Finance Party reasonably determines that neither it nor any group of which it is a member for VAT purposes is entitled to credit or receive repayment in respect of the VAT from the relevant tax authority. |

15

| (d) | Any reference in Clause 8.6 to any party shall, at any time when such party is treated as a member of a group for VAT purposes, include (where appropriate and unless the context otherwise requires) a reference to the person who is treated as making the supply or (as appropriate) receiving the supply under the grouping rules (as provided for in section 43 of the Value Added Tax Act 1994 or in Article 11 of the Council Directive 2006/112/EC (or as implemented by the relevant member state of the European Union or any other similar provision in any jurisdiction which is not a member state of the European Union)) so that a reference to a party shall be construed as a reference to that party or the relevant group or unity (or fiscal unity) of which that party is a member for VAT purposes at the relevant time or the relevant member (or head) of that group or unity (or fiscal unity) at the relevant time (as the case may be). |

| (e) | In relation to any supply made by an Interim Finance Party to any party under an Interim Finance Document, if reasonably requested by such Interim Finance Party, that party must promptly provide such Interim Finance Party with details of that party’s VAT registration and such other information as is reasonably requested in connection with such Interim Finance Party’s VAT reporting requirements in relation to such supply. |

| 8.7 | US Tax Forms |

| (a) | Any Interim Lender that is entitled to an exemption from or reduction of withholding Tax with respect to payments made under any Interim Finance Document by or in respect of an obligation of any Borrower that is a US Person (each, a “US Borrower”) shall deliver to such US Borrower (with a copy to the Interim Facility Agent), at the time or times reasonably requested by any US Borrower or the Interim Facility Agent and at the time or times prescribed by applicable law, such properly completed and executed documentation reasonably requested by such US Borrower or the Interim Facility Agent or prescribed by applicable law, as will permit such payments to be made without withholding or at a reduced rate of withholding. In addition, any Interim Lender, if reasonably requested by any US Borrower or the Interim Facility Agent, shall deliver such other documentation prescribed by applicable law or reasonably requested by such US Borrower or the Interim Facility Agent as will enable such US Borrower or the Interim Facility Agent to determine whether or not such Interim Lender is subject to backup withholding or information reporting requirements. Notwithstanding anything to the contrary in the preceding two sentences, the completion, execution and submission of such documentation (other than such documentation set forth in paragraphs (b)(i) and (b)(ii) of this Clause 8.7) shall not be required if in the Interim Lender’s reasonable judgment such completion, execution or submission would subject such Interim Lender to any material unreimbursed cost or expense or would materially prejudice the legal or commercial position of such Interim Lender. |

| (b) | Without limiting the generality of the foregoing, |

| (i) | any Interim Lender that is a US Person shall deliver to the US Borrower and the Interim Facility Agent on or about the date on which such Interim Lender becomes an Interim Lender under this Agreement (and from time to time thereafter upon the reasonable request of the US Borrower or the Interim Facility Agent), executed copies of IRS Form W-9 certifying that such Interim Lender is exempt from U.S. federal backup withholding tax; |

| (ii) | any Interim Lender that is not a US Person (each, a “Non-US Lender”) shall, to the extent it is legally entitled to do so, deliver to the US Borrower and the Interim Facility Agent (in such number of copies as shall be requested by the recipient) on or about the date on which such Non-US Lender becomes an Interim Lender under this Agreement (and from time to time thereafter upon the reasonable request of the US Borrower or the Interim Facility Agent), whichever of the following is applicable: |

16

| (A) | in the case of a Non-US Lender claiming the benefits of an income tax treaty to which the United States is a party (x) with respect to payments of interest under any Interim Finance Document, executed copies of IRS Form W-8BEN or IRS Form W-8BEN-E establishing an exemption from, or reduction of, U.S. federal withholding Tax pursuant to the “interest” article of such tax treaty and (y) with respect to any other applicable payments under any Interim Finance Document, IRS Form W-8BEN or IRS Form W-8BEN-E establishing an exemption from, or reduction of, U.S. federal withholding Tax pursuant to the “business profits” or “other income” article of such tax treaty; |

| (B) | executed copies of IRS Form W-8ECI; |

| (C) | in the case of a Non-US Lender claiming the benefits of the exemption for portfolio interest under Section 881(c) of the US Code, (x) a certificate substantially in the form of the applicable portion of Schedule 13 (Forms of US Tax Compliance Certificates) to the effect that such Non-US Lender is not a “bank” within the meaning of Section 881(c)(3)(A) of the US Code, a “10 percent shareholder” of the US Borrower within the meaning of Section 871(h)(3)(B) of the US Code, or a “controlled foreign corporation” related to the US Borrower as described in Section 881(c)(3)(C) of the US Code (a “US Tax Compliance Certificate”) and (y) executed copies of IRS Form W-8BEN or IRS Form W 8BEN-E; or |

| (D) | to the extent a Non-US Lender is not the beneficial owner, executed copies of IRS Form W-8IMY, accompanied by IRS Form W-8ECI, IRS Form W-8BEN, IRS Form W 8BEN-E, a US Tax Compliance Certificate substantially in the form of the applicable portion of Schedule 13 (Forms of US Tax Compliance Certificates), IRS Form W-9, and/or other certification documents from each beneficial owner, as applicable; provided that if the Non-US Lender is a partnership and one or more direct or indirect partners of such Non-US Lender are claiming the portfolio interest exemption, such Non-US Lender may provide a US Tax Compliance Certificate substantially in the form of the applicable portion of Schedule 13 (Forms of US Tax Compliance Certificates) on behalf of each such direct and indirect partner; and |

| (iii) | any Non-US Lender shall, to the extent it is legally entitled to do so, deliver to the US Borrower and the Interim Facility Agent (in such number of copies as shall be requested by the recipient) on or about the date on which such Non-US Lender becomes an Interim Lender under this Agreement (and from time to time thereafter upon the reasonable request of the US Borrower or the Interim Facility Agent), executed copies of any other form prescribed by applicable law as a basis for claiming exemption from or a reduction in U.S. federal withholding Tax, duly completed, together with such supplementary documentation as may be prescribed by applicable law to permit the US Borrower or the Interim Facility Agent to determine the withholding or deduction required to be made. |

17

| (c) | Each Interim Lender agrees that if any form or certification it previously delivered expires or becomes obsolete or inaccurate in any respect, it shall update such form or certification or promptly notify the US Borrower and the Interim Facility Agent in writing of its legal inability to do so. |

| (d) | In the event that any Borrower is a US Borrower, on or prior to the date that the Interim Facility Agent (and any successor thereto) becomes a party to this Agreement, and from time to time as reasonably requested by the US Borrower, (x) if the Interim Facility Agent is a US Person, it shall provide the US Borrower executed copies of IRS Form W-9, or (y) if the Interim Facility Agent is not a US Person, it shall provide the US Borrower executed copies of IRS Form W-8IMY certifying that the Interim Facility Agent is acting as a “nonqualified intermediary” and accompanied by any required attachments (including certification documents from each beneficial owner). In addition, with respect to any U.S.-source fees, interest or other payments received on its behalf, the Interim Facility Agent shall provide the US Borrower executed copies of IRS Form W-8BEN-E claiming an exemption under an applicable tax treaty that would allow the US Borrower to make payments to it without deduction or withholding of any U.S. federal withholding Taxes. |

| 8.8 | FATCA information |

| (a) | Subject to paragraph (c) below, each Party shall, within ten (10) Business Days of a reasonable request by another Party: |

| (i) | confirm to that other Party whether it is: |

| (A) | a FATCA Exempt Party; or |

| (B) | not a FATCA Exempt Party; |

| (ii) | supply to that other Party such forms, documentation and other information relating to its status under FATCA as that other Party reasonably requests for the purposes of that other Party’s compliance with FATCA; and |

| (iii) | supply to that other Party such forms, documentation and other information relating to its status as that other Party reasonably requests for the purposes of that other Party’s compliance with any other law, regulation or exchange of information regime. |

| (b) | If a Party confirms to another Party pursuant to paragraph (a)(i) above that it is a FATCA Exempt Party and it subsequently becomes aware that it is not, or has ceased to be a FATCA Exempt Party, that Party shall notify that other Party reasonably promptly. |

| (c) | Paragraph (a) above shall not oblige any Interim Finance Party to do anything, and paragraph (a)(iii) above shall not oblige any other Party to do anything, which would or might in its reasonable opinion constitute a breach of: |

| (i) | any law or regulation; |

| (ii) | any fiduciary duty; or |

18

| (iii) | any duty of confidentiality. |

| (d) | If a Party fails to confirm whether or not it is a FATCA Exempt Party or to supply forms, documentation or other information requested in accordance with paragraphs (a)(i) or (a)(ii) above (including, for the avoidance of doubt, where paragraph (c) above applies), then such Party shall be treated for the purposes of the Interim Finance Documents (and payments under them) as if it is not a FATCA Exempt Party until such time as the Party in question provides the requested confirmation, forms, documentation or other information. |

| (e) | If a Borrower is a US Tax Obligor, or the Interim Facility Agent reasonably believes that its obligations under FATCA or any other applicable law or regulation require it, each Interim Lender shall, within 10 Business Days of: |

| (i) | where the Borrower is a US Tax Obligor and the relevant Interim Lender is an Original Interim Lender, the date of this Agreement; |

| (ii) | where a Borrower is a US Tax Obligor on a Transfer Date or a date on which an increase in the Interim Commitments takes effect pursuant to paragraph 2 (Increase) of Part 3 (Replacement of an Interim Lender / Increase) of Schedule 5 (Impairment and Replacement of Interim Finance Parties) and the relevant Interim Lender is a New Interim Lender or an Increase Lender, the relevant Transfer Date or a date on which an increase in the Interim Commitments takes effect; |

| (iii) | the date a new US Tax Obligor accedes as a Borrower; or |

| (iv) | where no Borrower is a US Tax Obligor, the date of the request from the Interim Facility Agent, |

supply to the Interim Facility Agent:

| (A) | a withholding certificate on Form W-8, Form W-9 or any other relevant form; or |

| (B) | any withholding statement or other document, authorisation or waiver as the Interim Facility Agent may require to certify or establish the status of such Interim Lender under FATCA or that other law or regulation. |

The Interim Facility Agent shall provide any withholding certificate, withholding statement, document, authorisation or waiver it receives from an Interim Lender pursuant to this paragraph (e) above to the relevant Obligor.

| (f) | If any withholding certificate, withholding statement, document, authorisation or waiver provided to the Interim Facility Agent by an Interim Lender pursuant to paragraph 8.9(e) above is or becomes materially inaccurate or incomplete, that Interim Lender shall promptly update it and provide such updated withholding certificate, withholding statement, document, authorisation or waiver to the Interim Facility Agent unless it is unlawful for the Interim Lender to do so (in which case the Interim Lender shall promptly notify the Interim Facility Agent in writing of its legal inability to do so). The Interim Facility Agent shall provide any such updated withholding certificate, withholding statement, document, authorisation or waiver to the relevant Obligor. |

19

| 8.9 | FATCA Deduction |

| (a) | Each Party may make any FATCA Deduction it is required to make by FATCA, and any payment required in connection with that FATCA Deduction, and no Party shall be required to increase any payment in respect of which it makes such a FATCA Deduction or otherwise compensate the recipient of the payment for that FATCA Deduction. |

| (b) | Each Party shall promptly, upon becoming aware that it must make a FATCA Deduction (or that there is any change in the rate or the basis of such FATCA Deduction), notify the Party to whom it is making the payment and, in addition, shall notify the Parent and the Interim Facility Agent, and the Interim Facility Agent shall notify the other Interim Finance Parties. |

| 9. | INCREASED COSTS |

| 9.1 | Increased Costs |

| (a) | If (i) the introduction of, or a change in, or a change in the interpretation, administration or application of, any law, regulation or treaty occurring after the date on which it becomes party to this Agreement, or (ii) compliance with any law, regulation or treaty made after the date on which it becomes party to this Agreement or (iii) the implementation or application of or compliance with Basel III and/or CRD IV or any other law or regulation which implements Basel III and/or CRD IV, results in any Interim Finance Party (a “Claiming Party”) or any Affiliate of it incurring any Increased Cost (as defined in paragraph (c) below): |

| (i) | the Claiming Party will notify the Parent and the Interim Facility Agent of the circumstances giving rise to that Increased Cost as soon as reasonably practicable after becoming aware of it and will as soon as reasonably practicable provide a certificate confirming the amount of that Increased Cost with (to the extent available) appropriate supporting evidence; and |

| (ii) | within five (5) Business Days of demand by the Claiming Party, the Parent will (or shall procure that another Group Company will) pay to the Claiming Party the amount of any Increased Cost incurred by it (or any Affiliate of it). |

| (b) | No Group Company will be obliged to compensate any Claiming Party under paragraph (a) above in relation to any Increased Cost: |

| (i) | to the extent already compensated for by a payment under Clause 8 (Taxes) (or would have been so compensated but for an exclusion in Clauses 8.2 (Exceptions from gross-up), 8.3 (Tax indemnity), 8.5 (Stamp Taxes) or 8.6 (Value added taxes)); |

| (ii) | attributable to the breach by the Claiming Party of any law, regulation or treaty or any Interim Finance Document; |

| (iii) | attributable to a Tax Deduction required by law to be made by an Obligor; |

| (iv) | attributable to any penalty having been imposed by the relevant central bank or monetary or fiscal authority upon the Claiming Party (or any Affiliate of it) by virtue of its having exceeded any country or sector borrowing limits or breached any directives imposed upon it; |

20

| (v) | attributable to the implementation or application of or compliance with the “International Convergence of Capital Measurement and Capital Standards, a Revised Framework” published by the Basel Committee on Banking Supervision in June 2004 in the form existing on the date of this Agreement (but excluding any amendment to Basel II arising out of Basel III (as defined in paragraph (c)(ii) below)) (“Basel II”) or any other law or regulation which implements Basel II (whether such implementation, application or compliance is by a government, regulator, Interim Finance Party or any of its Affiliates) but excluding any Increased Cost attributable to Basel III or any other law or regulation which implements Basel III (in each case, unless an Interim Finance Party was or reasonably should have been aware of that Increased Cost on the date on which it became an Interim Finance Party under this Agreement); |

| (vi) | attributable to any Bank Levy (or any payment attributable to, or liability arising as a consequence of, a Bank Levy); |

| (vii) | attributable to a FATCA Deduction required to be made by a Party; |

| (viii) | attributable to the implementation or application of, or compliance with, Basel III or CRD IV or any other law or regulation which implements or applies Basel III or CRD IV, in each case, to the extent the relevant Interim Finance Party was aware of (or could reasonably be expected to have been aware of) the relevant Increased Cost at the date of this Agreement or, if later, the date it became an Interim Finance Party; or |

| (ix) | not notified to the Parent in accordance with paragraph (a)(i) above. |

| (c) | In this Agreement: |

| (i) | “Increased Cost” means: |

| (A) | an additional or increased cost; |

| (B) | a reduction in any amount due, paid or payable to the Claiming Party under any Interim Finance Document; or |

| (C) | a reduction in the rate of return from an Interim Facility or on the Claiming Party’s (or its Affiliates’) overall capital, |

suffered or incurred by a Claiming Party (or any Affiliate of it) as a result of it having entered into or performing its obligations under any Interim Finance Document or making or maintaining its participation in any Interim Loan; and

| (ii) | “Basel III” means: |

| (A) | the agreements on capital requirements, a leverage ratio and liquidity standards contained in “Basel III: A global regulatory framework for more resilient banks and banking systems”, “Basel III: International framework for liquidity risk measurement, standards and monitoring” and “Guidance for national authorities operating the countercyclical capital buffer” published by the Basel Committee on Banking Supervision in December 2010, each as amended, supplemented or restated; |

21

| (B) | the rules for global systemically important banks contained in “Global systemically important banks: assessment methodology and the additional loss absorbency requirement Rules text” published by the Basel Committee on Banking Supervision in November 2011, as amended, supplemented or restated; and |

| (C) | any further guidance or standards published by the Basel Committee on Banking Supervision relating to Basel (III); and |

| (iii) | “CRD IV” means EU CRD IV and UK CRD IV. |

| (iv) | “EU CRD IV” means: |

| (A) | Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms; and |

| (B) | Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC. |

| (v) | “UK CRD IV” means: |

| (A) | Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the “Withdrawal Act”); |

| (B) | the law of the United Kingdom or any part of it, which immediately before IP completion day (as defined in the European Union (Withdrawal Agreement) Act 2020) implemented Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC and its implementing measures; and |

| (C) | direct EU legislation (as defined in the Withdrawal Act), which immediately before IP completion day (as defined in the European Union (Withdrawal Agreement) Act 2020) implemented EU CRD IV as it forms part of domestic law of the United Kingdom by virtue of the Withdrawal Act. |

| 9.2 | Mitigation |

| (a) | If circumstances arise which entitle an Interim Finance Party: |

| (i) | to receive payment of an additional amount under Clause 8 (Taxes); |

22

| (ii) | to demand payment of any amount under Clause 9.1 (Increased Costs); or |

| (iii) | to require cancellation or prepayment to it of any amount under Clause 9.3 (Illegality), |

then that Interim Finance Party will, in consultation with the Parent, take all reasonable steps to mitigate the effect of those circumstances (including by transferring its rights and obligations under the Interim Finance Documents to an Affiliate or changing its Facility Office or transferring its Interim Commitments and participation in each Interim Loan for cash at par plus all accrued but unpaid interest thereon to another bank, financial institution or other person nominated for such purpose by the Parent).

| (b) | No Interim Finance Party will be obliged to take any such steps or action if to do so is likely in its opinion (acting in good faith) to be unlawful or to have an adverse effect on its business, operations or financial condition or breach its banking policies or require it to disclose any confidential information. |

| (c) | The Parent shall (or shall procure that another Group Company will), within five (5) Business Days of demand by the relevant Interim Finance Party, indemnify such Interim Finance Party for any costs or expenses reasonably incurred by it as a result of taking any steps or action under this Clause 9.2. |

| (d) | This Clause 9.2 does not in any way limit, reduce or qualify the obligations of the Parent under the Interim Finance Documents. |

| 9.3 | Illegality |

If after the date of this Agreement (or if later, the date the relevant Interim Lender became a Party) it becomes unlawful in any applicable jurisdiction for an Interim Finance Party to participate in the Interim Facilities, maintain its Interim Commitments or participation in any Interim Loan or perform any of its obligations under any Interim Finance Documents, then:

| (a) | that Interim Finance Party shall promptly so notify the Interim Facility Agent and the Parent upon becoming aware of that event; and |

| (b) | the Parent shall (or shall procure that a Group Company will) prepay that Interim Finance Party’s participation in all outstandings under the Interim Facilities (together with any related accrued interest) and pay (or procure payment of) all other amounts due to that Interim Finance Party under the Interim Finance Documents and that Interim Finance Party’s Interim Commitment will be cancelled, in each case, to the extent necessary to cure the relevant illegality and, on the date specified by that Interim Finance Party in such notice (being the last Business Day immediately prior to the illegality taking effect or the latest date otherwise allowed by the relevant law (taking into account any applicable grace period)) unless an earlier date is otherwise agreed or required by the Parent, provided that on or prior to such date the Parent shall have the right to require that Interim Lender to transfer its Interim Commitments and participation in each Interim Loan to another bank, financial institution or other person nominated for such purpose by the Parent which has agreed to purchase such rights and obligations at par plus accrued interest. |

23

| 10. | PAYMENTS |

| 10.1 | Place |

| (a) | Unless otherwise specified in an Interim Finance Document, on each date on which payment is to be made by any Party (other than the Interim Facility Agent) under an Interim Finance Document, such Party shall pay, in the required currency, the amount required to the Interim Facility Agent, for value on the due date at such time and in such funds as the Interim Facility Agent may specify to the Party concerned as being customary at that time for settlement of transactions in the relevant currency in the place of payment. All such payments shall be made to the account specified by the Interim Facility Agent for that purpose in the principal financial centre of the country of the relevant currency (or in relation to euro, US Dollars and Sterling, London). |

| (b) | Unless otherwise specified in an Interim Finance Document (including any Drawdown Request), each payment received by the Interim Facility Agent under the Interim Finance Documents for another Party shall, subject to paragraphs (c) and (d) below and to Clause 10.3 (Assumed receipt), be made available by the Interim Facility Agent as soon as practicable after receipt to the Party entitled to receive payment in accordance with this Agreement (in the case of an Interim Lender, for the account of its Facility Office), to such account as that Party may notify to the Interim Facility Agent by not less than five (5) Business Days’ notice with a bank in the principal financial centre of the country of that currency (or in relation to euro, US Dollars and Sterling, London). |

| (c) | The Interim Facility Agent may with the consent of the Parent (or in accordance with Clause 16 (Set-Off)) apply any amount received by it for an Obligor in or towards payment (as soon as practicable after receipt) of any amount then due and payable by an Obligor under the Interim Finance Documents or in or towards purchase of any amount of any currency to be so applied. |

| (d) | Each Agent may deduct from any amount received by it for another Party any amount due to such Agent from that other Party but unpaid and apply the amount deducted in payment of the unpaid debt owed to it. |

| 10.2 | Currency of payment |

| (a) | Subject to paragraphs (b) to (e) (inclusive) below, Sterling is the currency of account and payment of any sum due from any Obligor under any Interim Finance Documents shall be made in Sterling. |

| (b) | Each payment in respect of costs, expenses or Taxes shall be made in the currency in which the costs, expenses or Taxes were incurred. |

| (c) | Each repayment of an Interim Loan or overdue amount or payment of interest thereon shall be made in the currency of the Interim Loan or overdue amount. |

| (d) | Each payment under Clauses 8.1 (Gross-up), 8.3 (Tax indemnity) or 9.1 (Increased Costs) shall be made in the currency specified by the Interim Finance Party making the claim (being the currency in which the Tax or losses were incurred). |

| (e) | Any amount expressed in the Interim Finance Documents to be payable in a particular currency shall be paid in that currency. |

24

| 10.3 | Assumed receipt |

| (a) | Where an amount is or is required to be paid to the Interim Facility Agent under any Interim Finance Document for the account of another person (the “Payee”), the Interim Facility Agent is not obliged to pay that amount to the Payee until the Interim Facility Agent is satisfied that it has actually received that amount. |

| (b) | If the Interim Facility Agent nonetheless pays that amount to the Payee (which it may do at its discretion) and the Interim Facility Agent had not in fact received that amount, then the Payee will on demand refund that amount to the Interim Facility Agent (together with interest on that amount at the rate determined by the Interim Facility Agent to be equal to the cost to the Interim Facility Agent of funding that amount for the period from payment by the Interim Facility Agent until refund to the Interim Facility Agent of that amount), provided that the Obligors will have no obligation to refund any such amount received from the Interim Facility Agent and paid by it (or on its behalf) to any third party for a purpose set out in Clause 3.3 (Purpose). |

| 10.4 | No set-off or counterclaim |

All payments made or to be made by an Obligor under the Interim Finance Documents must be paid in full without (and free and clear of any deduction for) set-off or counterclaim.

| 10.5 | Business Days |

| (a) | If any payment would otherwise be due under any Interim Finance Document on a day which is not a Business Day, that payment shall be due on the next Business Day in the same calendar month (if there is one) or the preceding Business Day (if there is not). |

| (b) | During any such extension of the due date for payment of any principal or overdue amount, or any extension of an Interest Period, interest shall accrue and be payable at the rate payable on the original due date. |

| 10.6 | Change in currency |

| (a) | Unless otherwise prohibited by law, if more than one currency or currency unit are at the same time recognised by the central bank of any country as the lawful currency of that country: |

| (i) | any reference in any Interim Finance Document to, and any obligations arising under any Interim Finance Document in, the currency of that country shall be translated into, and paid in, the currency or currency unit designated by the Interim Facility Agent (after consultation with the Parent); and |

| (ii) | any translation from one currency or currency unit to another shall be at the official rate of exchange recognised by the central bank of that country for the conversion of that currency or currency unit into the other, rounded up or down by the Interim Facility Agent (acting reasonably). |

| (b) | If a change in any currency of a country occurs, the Interim Finance Documents will, to the extent the Interim Facility Agent specifies is necessary (acting reasonably and after consultation with the Parent), be amended to comply with any generally accepted conventions and market practice in any Relevant Interbank Market and otherwise to reflect the change in currency. The Interim Facility Agent will notify the other Parties to the relevant Interim Finance Documents of any such amendment, which shall be binding on all the Parties. |

25

| 10.7 | Application of proceeds |

| (a) | If the Interim Facility Agent receives a payment that is insufficient to discharge all amounts then due and payable by an Obligor under any Interim Finance Document, the Interim Facility Agent shall apply that payment towards the obligations of the Obligors under the Interim Finance Documents in the following order: |

| (i) | first, in payment pro rata of any fees, costs and expenses of the Agents and the Arrangers due but unpaid under the Interim Finance Documents; |

| (ii) | second, in payment pro rata of any fees, costs and expenses of the Interim Lenders, due but unpaid under the Interim Finance Documents; |

| (iii) | third, in payment pro rata of any accrued interest in respect of each Interim Facility, due but unpaid under the Interim Finance Documents; |

| (iv) | fourth in payment pro rata of any principal due but unpaid under each Interim Facility; and |

| (v) | fifth in payment pro rata of any other amounts due but unpaid under the Interim Finance Documents; and |

| (vi) | the balance, if any, in payment to the Borrower. |

| (b) | The Interim Facility Agent shall, if directed by all the Interim Lenders, vary the order set out in sub-paragraphs (a)(ii) to (a)(v). |

| (c) | Any such application by the Interim Facility Agent will override any appropriation made by any Obligor. |