Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Cadence Bancorporation | nt10023011x1_ex99-1.htm |

| 8-K - FORM 8-K - Cadence Bancorporation | nc10023011x1_8k.htm |

Exhibit 99.2

Transformational Merger: BancorpSouth Bank and Cadence Bancorporation Creating a Premier Regional Banking Franchise Across Texas and the Southeast April 12, 2021

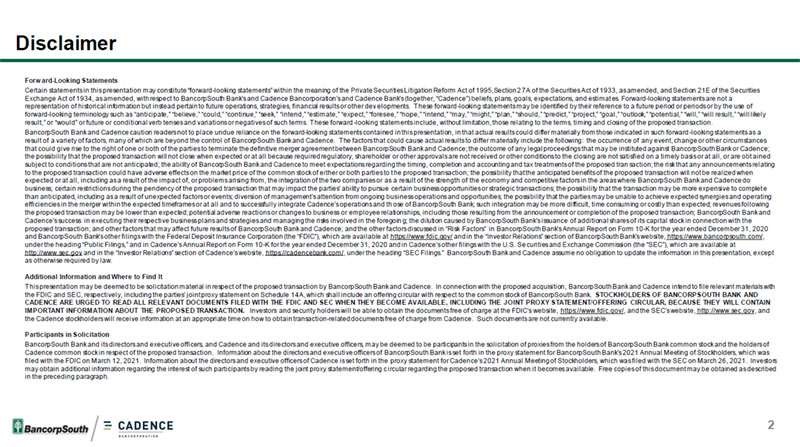

Disclaimer Forward-Looking Statements Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,Section 2 7A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to BancorpSouth Bank’s and Cadence Bancorporation’s and Cadence Bank’s (together, “Cadence”) beliefs, plans, goals, expectations, and estimat es. Forward-looking statements are not a representation of historical information but instead pertain to future operations, strategies, financial results or other dev elopments. These forward-looking statements may be identified by their reference to a future period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,” “could,” “continue,” “seek,” “intend,” “estimate,” “expect,” “foresee,” “hope,” “intend,” “may,” “might,” “plan,” “should,” “predict,” “project,” “goal,” “outlook,” “potential,” “will,” “will result,” “will likely result,” or “would” or future or conditional verb tenses and variations or negatives of such terms. These forward -looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. BancorpSouth Bank and Cadence caution readers not to place undue reliance on the forward-looking statements contained in this presentation, in that actual results could differ materially from those indicated in such forward -looking statements as a result of a variety of factors, many of which are beyond the control of BancorpSouth Bank and Cadence. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BancorpSouth Bank and Cadence; the outcome of any legal proceedings that may be instituted against BancorpSouth Bank or Cadence; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obt ained subject to conditions that are not anticipated; the ability of BancorpSouth Bank and Cadence to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed tran saction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to t he proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BancorpSouth Bank and Cadence do business certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complet e than anticipated, including as a result of unexpected factors or events diversion of management’s attention from ongoing business operations and opportunities the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate Cadence’s operations and th ose of BancorpSouth Bank; such integration may be more difficult, time consuming or costly than expected; revenues following the proposed transaction may be lower than expected; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction BancorpSouth Bank and Cadence’s success in executing their respective business plans and strategies and managing the risks involved in the foregoin g; the dilution caused by BancorpSouth Bank’s issuance of additional shares of its capital stock in connection with the proposed transaction; and other factors that may affect future results of BancorpSouth Bank and Cadence and the other factors discussed in “Risk Factors” in BancorpSouth Bank’s Annual Report on Form 10-K for the year ended December 31, 2020 and BancorpSouth Bank’s other filings with the Federal Deposit Insurance Corporation (the “FDIC”), which are available at https://www.fdic.gov/ and in the “Investor Relations” section of BancorpSouth Bank’s website, https://www.bancorpsouth.com/, under the heading “Public Filings,”and in Cadence’s Annual Report on Form 10-K for the year ended December 31, 2020 and in Cadence’s other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at http://www.sec.gov and in the “Investor Relations” section of Cadence’s website, https://cadencebank.com/, under the heading “SEC Filings.” BancorpSouth Bank and Cadence assume no obligation to update the information in this presentation, except as otherwise required by law. Additional Information and Where to Find It This presentation may be deemed to be solicitation material in respect of the proposed transaction by BancorpSouth Bank and Cadence. In connection with the proposed acquisition, BancorpSouth Bank and Cadence intend to file relevant materials with the FDIC and SEC, respectively, including the parties’ joint proxy statement on Schedule 14A, which shall include an offering ci rcular with respect to the common stock of BancorpSouth Bank. STOCKHOLDERS OF BANCORPSOUTH BANK AND CADENCE ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE FDIC AND SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE JOINT PROXY STATEMENT/OFFERING CIRCULAR, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents free of charge at the FDIC’s website, https://www.fdic.gov/, and the SEC’s website, http://www.sec.gov, and the Cadence stockholders will receive information at an appropriate time on how to obtain transaction-related documents free of charge from Cadence. Such documents are not currently available. Participants in Solicitation BancorpSouth Bank and its directors and executive officers, and Cadence and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of BancorpSouth Bank common stock and the holders of Cadence common stock in respect of the proposed transaction. Information about the directors and executive officers of BancorpSouth Bank is set forth in the proxy statement for BancorpSouth Bank’s 2021 Annual Meeting of Stockholders, which was filed with the FDIC on March 12, 2021. Information about the directors and executive officers of Cadence is set forth in the proxy statement for Cadence’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2021. Investors may obtain additional information regarding the interest of such participants by reading the joint proxy statement/offering c ircular regarding the proposed transaction when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 2

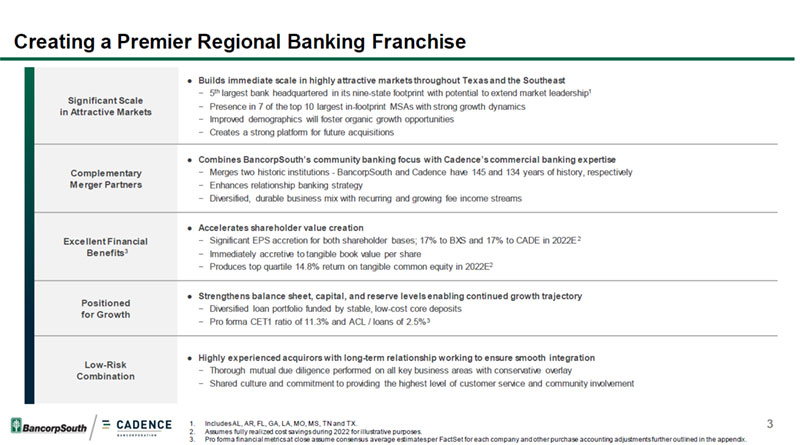

Creating a Premier Regional Banking Franchise ● Builds immediate scale in highly attractive markets throughout Texas and the Southeast 5th largest bank headquartered in its nine-state footprint with potential to extend market leadership1 Significant Scale Presence in 7 of the top 10 largest in-footprint MSAs with strong growth dynamics in Attractive Markets Improved demographics will foster organic growth opportunities Creates a strong platform for future acquisitions ● Combines BancorpSouth’s communitybanking focus with Cadence’s commercial banking expertise Complementary Merges two historic institutions - BancorpSouth and Cadence have 145 and 134 years of history, respectively Merger Partners Enhances relationship banking strategy Diversified, durable business mix with recurring and growing fee income streams ● Accelerates shareholder value creation Excellent Financial Significant EPS accretion for both shareholder bases; 17% to BXS and 17% to CADE in 2022E2 Benefits3 Immediately accretive to tangible book value per share Produces top quartile 14.8% return on tangible common equity in 2022E2 ● Strengthens balance sheet, capital, and reserve levels enabling continued growth trajectory Positioned Diversified loan portfolio funded by stable, low-cost core deposits for Growth Pro forma CET1 ratio of 11.3% and ACL / loans of 2.5%3 ● Highly experienced acquirors with long-term relationship working to ensure smooth integration Low-Risk Thorough mutual due diligence performed on all key business areas with conservative overlay Combination Shared culture and commitment to providing the highest level of customer service and community involvement 1. Includes AL, AR, FL, GA, LA, MO, MS, TN and TX. 3 2. Assumes fully realized cost savings during 2022 for illustrative purposes. 3. Pro forma financial metrics at close assume consensus average estimates per FactSet for each company and other purchase accounting adjustments further outlined in the appendix.

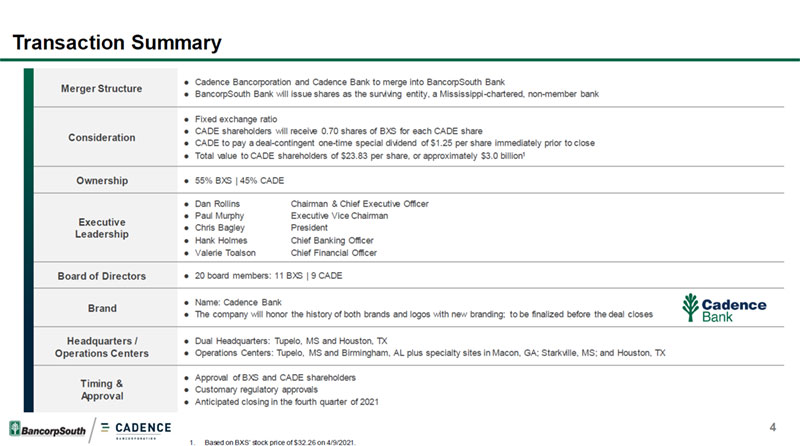

Transaction Summary ● Cadence Bancorporation and Cadence Bank to merge into BancorpSouth Bank Merger Structure ● BancorpSouth Bank will issue shares as the surviving entity, a Mississippi-chartered, non-member bank ● Fixed exchange ratio ● CADE shareholders will receive 0.70 shares of BXS for each CADE share Consideration ● CADE to pay a deal-contingent one-time special dividend of $1.25 per share immediately prior to close ● Total value to CADE shareholders of $23.83 per share, or approximately $3.0 billion1 Ownership ● 55% BXS | 45% CADE ● Dan Rollins Chairman & Chief Executive Officer ● Paul Murphy Executive Vice Chairman Executive ● Chris Bagley President Leadership ● Hank Holmes Chief Banking Officer ● Valerie Toalson Chief Financial Officer Board of Directors ● 20 board members: 11 BXS | 9 CADE ● Name: Cadence Bank Brand ● The company will honor the history of both brands and logos with new branding; to be finalized before the deal closes Headquarters / ● Dual Headquarters: Tupelo, MS and Houston, TX Operations Centers ● Operations Centers: Tupelo, MS and Birmingham, AL plus specialty sites in Macon, GA; Starkville, MS; and Houston, TX ● Approval of BXS and CADE shareholders Timing & ● Customary regulatory approvals Approval ● Anticipated closing in the fourth quarter of 2021 4 1. Based on BXS’ stock price of $32.26 on 4/9/2021.

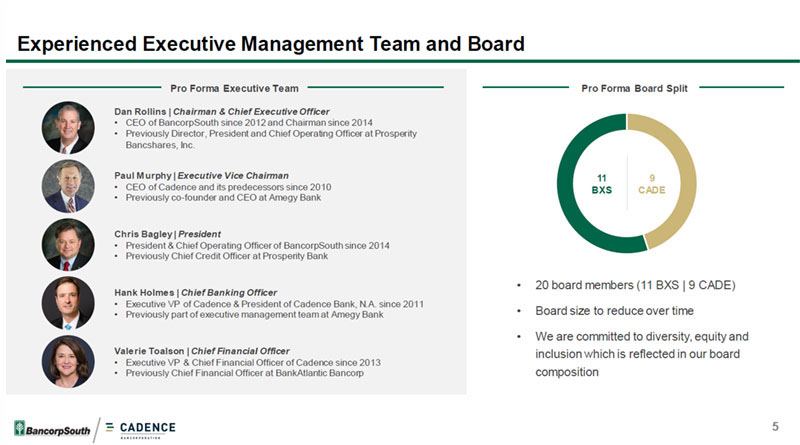

Experienced Executive Management Team and Board Pro Forma Executive Team Pro Forma Board Split Dan Rollins | Chairman & Chief Executive Officer CEO of BancorpSouth since 2012 and Chairman since 2014 Previously Director, President and Chief Operating Officer at Prosperity Bancshares, Inc. Paul Murphy | Executive Vice Chairman 11 9 CEO of Cadence and its predecessors since 2010 BXS CADE Previously co-founder and CEO at Amegy Bank Chris Bagley | President President & Chief Operating Officer of BancorpSouth since 2014 Previously Chief Credit Officer at Prosperity Bank 20 board members (11 BXS | 9 CADE) Hank Holmes | Chief Banking Officer Executive VP of Cadence & President of Cadence Bank, N.A. since 2011 Previously part of executive management team at Amegy Bank Board size to reduce over time We are committed to diversity, equity and Valerie Toalson | Chief Financial Officer inclusion which is reflected in our board Executive VP & Chief Financial Officer of Cadence since 2013 Previously Chief Financial Officer at BankAtlantic Bancorp composition 5

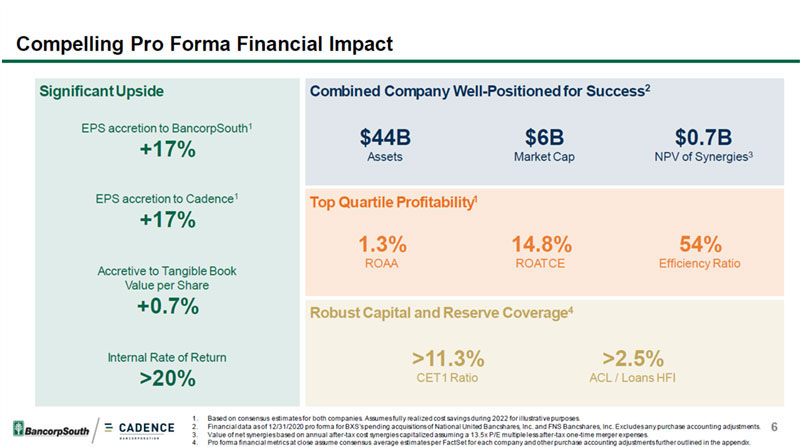

Compelling Pro Forma Financial Impact Significant Upside Combined Company Well-Positioned for Success2 EPS accretion to BancorpSouth1 $44B $6B $0.7B +17% Assets Market Cap NPV of Synergies3 EPS accretion to Cadence1 Top Quartile Profitability1 +17% 1.3% 14.8% 54% ROAA ROATCE Efficiency Ratio Accretive to Tangible Book Value per Share +0.7% Robust Capital and Reserve Coverage4 Internal Rate of Return >11.3% >2.5% >20% CET1 Ratio ACL / Loans HFI 1. Based on consensus estimates for both companies. Assumes fully realized cost savings during 2022 for illustrative purposes. 2. Financial data as of 12/31/2020 pro forma for BXS’s pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. Excludes any purchase accounting adjustments. 6 3. Value of net synergies based on annual after-tax cost synergies capitalized assuming a 13.5x P/E multiple less after-tax one-time merger expenses. 4. Pro forma financial metrics at close assume consensus average estimates per FactSet for each company and other purchase accounting adjustments further outlined in the appendix.

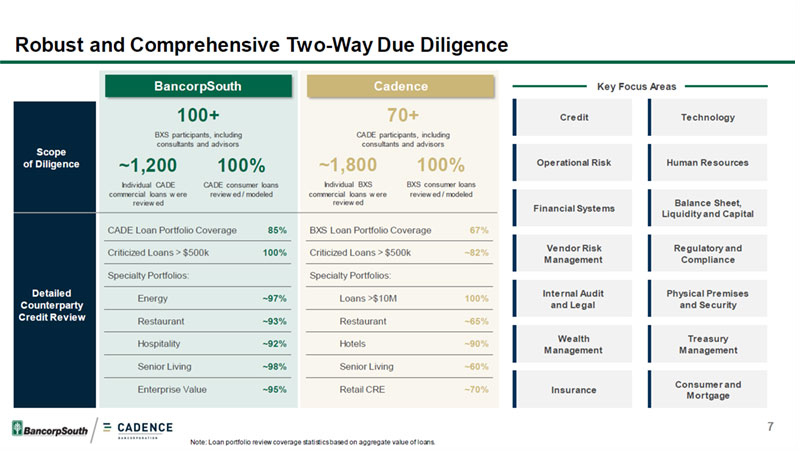

Robust and Comprehensive Two-Way Due Diligence BancorpSouth Cadence Key Focus Areas 100+ 70+ Credit Technology BXS participants, including CADE participants, including consultants and advisors consultants and advisors Scope of Diligence ~1,200 100% ~1,800 100% Operational Risk Human Resources Individual CADE CADE consumer loans Individual BXS BXS consumer loans commercial loans w ere review ed / modeled commercial loans w ere review ed / modeled review ed review ed Balance Sheet, Financial Systems Liquidity and Capital CADE Loan Portfolio Coverage 85% BXS Loan Portfolio Coverage 67% Vendor Risk Regulatory and Criticized Loans > $500k 100% Criticized Loans > $500k ~82% Management Compliance Specialty Portfolios: Specialty Portfolios: Detailed Internal Audit Physical Premises Energy ~97% Loans >$10M 100% Counterparty and Legal and Security Credit Review Restaurant ~93% Restaurant ~65% Wealth Treasury Hospitality ~92% Hotels ~90% Management Management Senior Living ~98% Senior Living ~60% Consumer and Enterprise Value ~95% Retail CRE ~70% Insurance Mortgage 7 Note: Loan portfolio review coverage statistics based on aggregate value of loans.

Strategic Rationale 8

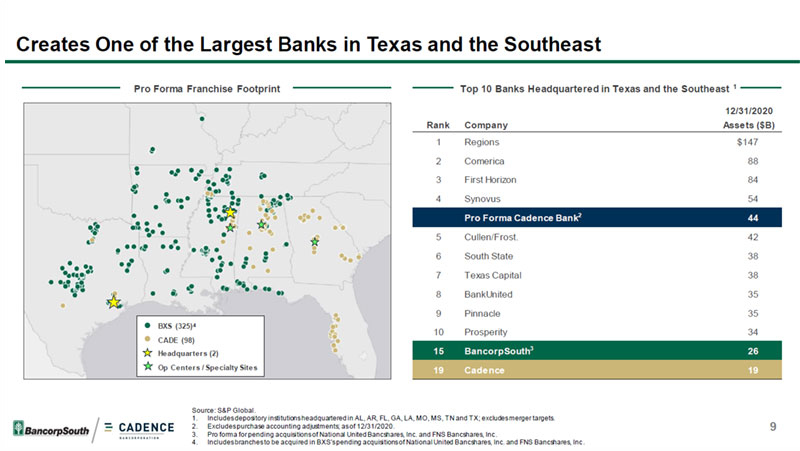

Creates One of the Largest Banks in Texas and the Southeast Pro Forma Franchise Footprint Top 10 Banks Headquartered in Texas and the Southeast 1 12/31/2020 Rank Company Assets ($B) 1 Regions $147 2 Comerica 88 3 First Horizon 84 4 Synovus 54 Pro Forma Cadence Bank2 44 5 Cullen/Frost. 42 6 South State 38 7 Texas Capital 38 8 BankUnited 35 9 Pinnacle 35 BXS (325)4 10 Prosperity 34 CADE (98) Headquarters (2) 15 BancorpSouth3 26 Op Centers / Specialty Sites 19 Cadence 19 Source: S&P Global. 1. Includes depository institutions headquartered in AL, AR, FL, GA, LA, MO, MS, TN and TX; excludes merger targets. 2. Excludes purchase accounting adjustments; as of 12/31/2020. 9 3. Pro forma for pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. 4. Includes branches to be acquired in BXS’s pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc.

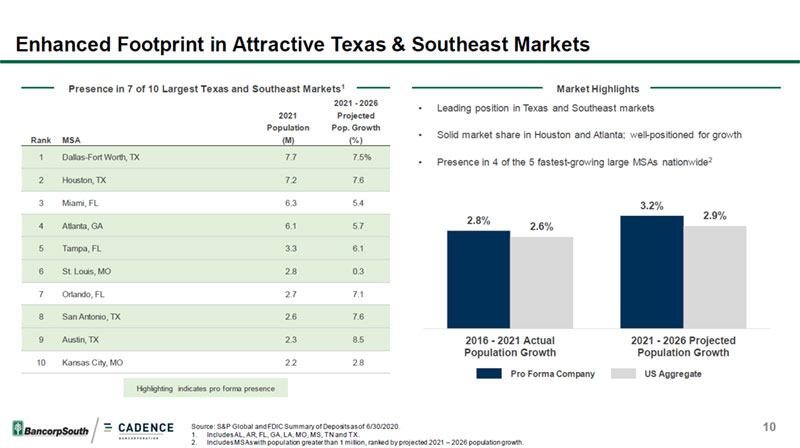

Enhanced Footprint in Attractive Texas & Southeast Markets Presence in 7 of 10 Largest Texas and Southeast Markets Presence in High Growth Markets1 1 Market Highlights 2021 - 2026 Leading position in Texas and Southeast markets 2021 Projected Population Pop. Growth Solid market share in Houston and Atlanta; well-positioned for growth Rank MSA (M) (%) 1 Dallas-Fort Worth, TX 7.7 7.5% Presence in 4 of the 5 fastest-growing large MSAs nationwide2 2 Houston, TX 7.2 7.6 3 Miami, FL 6.3 5.4 3.2% 2.9% 2.8% 4 Atlanta, GA 6.1 5.7 2.6% 5 Tampa, FL 3.3 6.1 6 St. Louis, MO 2.8 0.3 7 Orlando, FL 2.7 7.1 8 San Antonio, TX 2.6 7.6 9 Austin, TX 2.3 8.5 2016 - 2021 Actual 2021 - 2026 Projected Population Growth Population Growth 10 Kansas City, MO 2.2 2.8 Pro Forma Company US Aggregate Highlighting indicates pro forma presence Source: S&P Global and FDIC Summary of Deposits as of 6/30/2020. 10 1. Includes AL, AR, FL, GA, LA, MO, MS, TN and TX. 2. Includes MSAs with population greater than 1 million, ranked by projected 2021 2026 population growth.

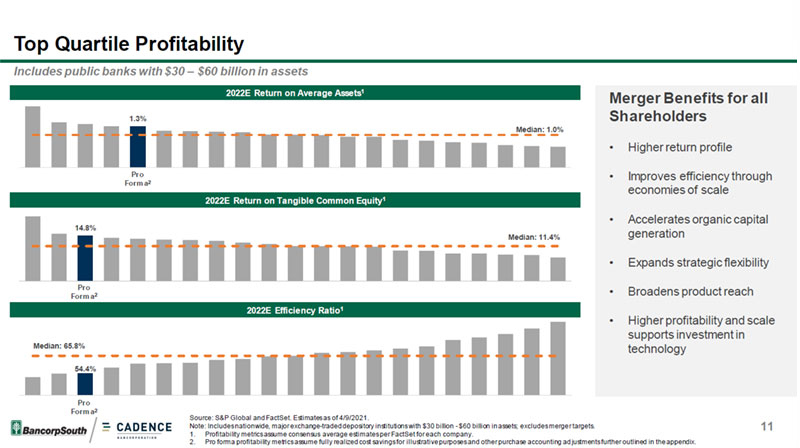

Top Quartile Profitability Includes public banks with $30 $60 billion in assets 2022E Return on Average Assets1 Merger Benefits for all 1.3% Shareholders Median: 1.0% Higher return profile Pro Improves efficiency through Forma2 economies of scale 2022E Return on Tangible Common Equity1 Accelerates organic capital 14.8% generation Median: 11.4% Expands strategic flexibility Pro Broadens product reach Forma2 2022E Efficiency Ratio1 Higher profitability and scale supports investment in Median: 65.8% technology 54.4% Pro Forma2 Source: S&P Global and FactSet. Estimates as of 4/9/2021. Note: Includes nationwide, major exchange-traded depository institutions with $30 billion - $60 billion in assets; excludes merger targets. 11 1. Profitability metrics assume consensus average estimates per FactSet for each company. 2. Pro forma profitability metrics assume fully realized cost savings for illustrative purposes and other purchase accounting ad justments further outlined in the appendix.

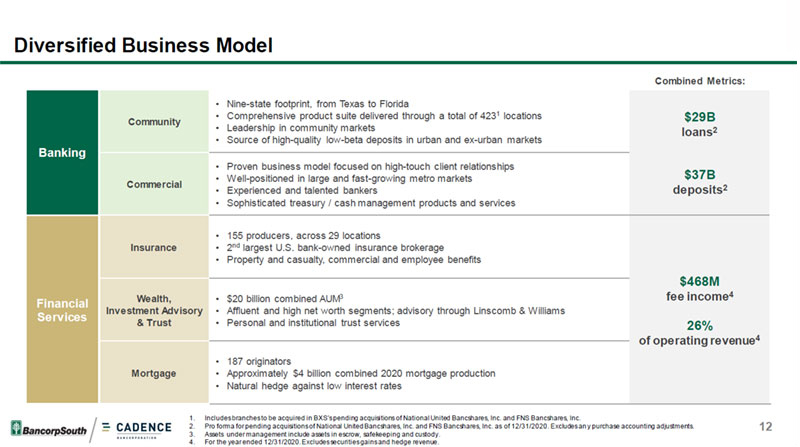

Diversified Business Model Combined Metrics: Nine-state footprint, from Texas to Florida Comprehensive product suite delivered through a total of 4231 locations $29B Community Leadership in community markets loans2 Source of high-quality low-beta deposits in urban and ex-urban markets Banking Proven business model focused on high-touch client relationships Well-positioned in large and fast-growing metro markets $37B Commercial deposits2 Experienced and talented bankers Sophisticated treasury / cash management products and services 155 producers, across 29 locations Insurance 2nd largest U.S. bank-owned insurance brokerage Property and casualty, commercial and employee benefits $468M Wealth, $20 billion combined AUM3 fee income4 Financial Investment Advisory Affluent and high net worth segments; advisory through Linscomb & Williams Services & Trust Personal and institutional trust services 26% of operating revenue4 187 originators Mortgage Approximately $4 billion combined 2020 mortgage production Natural hedge against low interest rates 1. Includes branches to be acquired in BXS’s pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. 2. Pro forma for pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. as of 12/31/2020. Excludes an y purchase accounting adjustments. 12 3. Assets under management include assets in escrow, safekeeping and custody. 4. For the year ended 12/31/2020. Excludes securities gains and hedge revenue.

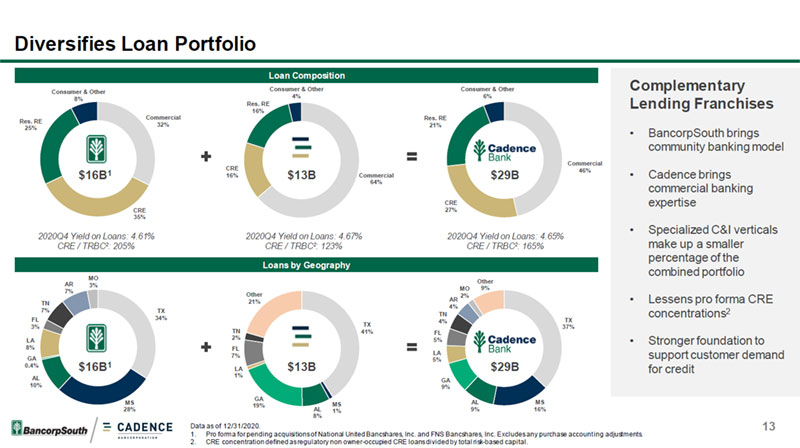

Diversifies Loan Portfolio Loan Composition Consumer & Other Consumer & Other Complementary Consumer & Other 4% 6% 8% Res. RE Lending Franchises 16% Commercial Res. RE Res. RE 32% 21% 25% BancorpSouth brings community banking model Commercial CRE 46% $16B1 16% $13B Commercial $29B Cadence brings 64% commercial banking CRE expertise CRE 27% 35% Specialized C&I verticals 2020Q4 Yield on Loans: 4.61% 2020Q4 Yield on Loans: 4.67% 2020Q4 Yield on Loans: 4.65% CRE / TRBC2: 205% CRE / TRBC2: 123% CRE / TRBC2: 165% make up a smaller percentage of the Loans by Geography combined portfolio MO Other AR 3% MO 9% 7% Other 2% 21% AR Lessens pro forma CRE TN 4% 7% TX TN concentrations2 FL 34% TX 4% 3% TX 37% TN 41% FL LA 2% 5% Stronger foundation to 8% FL LA 7% support customer demand GA 5% 0.4% $16B1 LA $13B $29B for credit 1% AL GA 10% 9% GA MS MS AL MS 19% 28% AL 1% 9% 16% 8% Data as of 12/31/2020. 13 1. Pro forma for pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. Excludes any purchase account ing adjustments. 2. CRE concentration defined as regulatory non owner-occupied CRE loans divided by total risk-based capital.

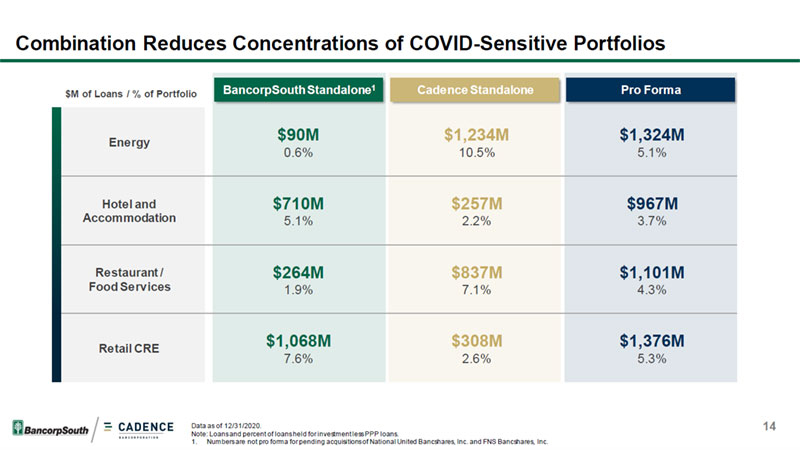

Combination Reduces Concentrations of COVID-Sensitive Portfolios $M of Loans / % of Portfolio BancorpSouthStandalone1 Cadence Standalone Pro Forma $90M $1,234M $1,324M Energy 0.6% 10.5% 5.1% Hotel and $710M $257M $967M Accommodation 5.1% 2.2% 3.7% Restaurant / $264M $837M $1,101M Food Services 1.9% 7.1% 4.3% $1,068M $308M $1,376M Retail CRE 7.6% 2.6% 5.3% Data as of 12/31/2020. 14 Note: Loans and percent of loans held for investment less PPP loans. 1. Numbers are not pro forma for pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc.

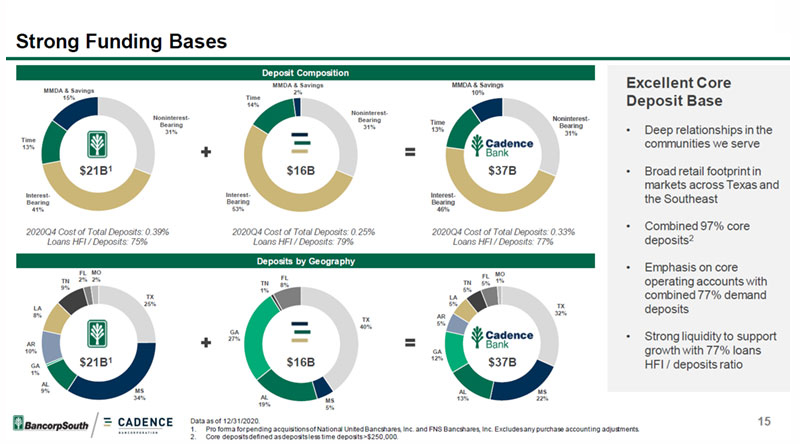

Strong Funding Bases Deposit Composition MMDA & Savings MMDA & Savings Excellent Core MMDA & Savings 2% 10% 15% Time Deposit Base 14% Noninterest- Noninterest- Bearing Noninterest-Bearing Time 31% Bearing 31% 13% Deep relationships in the 31% Time communities we serve 13% $21B1 $16B $37B Broad retail footprint in markets across Texas and Interest- Interest- Interest- the Southeast Bearing Bearing Bearing 41% 53% 46% Combined 97% core 2020Q4 Cost of Total Deposits: 0.39% 2020Q4 Cost of Total Deposits: 0.25% 2020Q4 Cost of Total Deposits: 0.33% Loans HFI / Deposits: 75% Loans HFI / Deposits: 79% Loans HFI / Deposits: 77% deposits2 Deposits by Geography Emphasis on core FL MO MO FL FL TN 2% 2% 1% TN 8% TN 5% operating accounts with 9% 1% 5% TX LA combined 77% demand 25% 5% TX LA deposits 8% 32% AR TX 5% 40% GA Strong liquidity to support 27% AR 10% GA growth with 77% loans $21B1 $16B 12% $37B GA HFI / deposits ratio 1% AL 9% MS AL MS 34% AL 13% 22% MS 19% 5% Data as of 12/31/2020. 15 1. Pro forma for pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. Excludes any purchase account ing adjustments. 2. Core deposits defined as deposits less time deposits >$250,000.

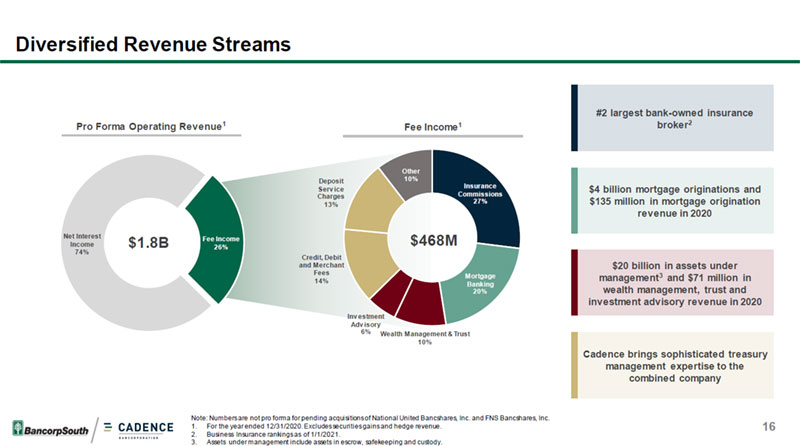

Diversified Revenue Streams #2 largest bank-owned insurance Pro Forma Operating Revenue1 Fee Income1 broker2 Other Deposit 10% Insurance Serv ice $4 billion mortgage originations and Charges Commissions 27% $135 million in mortgage origination 13% revenue in 2020 Net Interest Fee Income $468M Income $1.8B 26% 74% Credit, Debit and Merchant $20 billion in assets under Fees Mortgage management3 and $71 million in 14% Banking 20% wealth management, trust and investment advisory revenue in 2020 Inv estment Adv isory 6% Wealth Management & Trust 10% Cadence brings sophisticated treasury management expertise to the combined company Note: Numbers are not pro forma for pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. 1. For the year ended 12/31/2020. Excludes securities gains and hedge revenue. 16 2. Business Insurance rankings as of 1/1/2021. 3. Assets under management include assets in escrow, safekeeping and custody.

Combination Will be Beneficial to All Stakeholders Customers Communities Employees & Culture Shareholders ● Expands breadth of ● Committed to the ● Provenand experienced ● Double-digit earnings products available to communities that we serve leadership accretion customers ● Over 24,000 employee ● Complementary cultures ● Immediate accretion to ● Ability to serve a larger volunteer service hours in with disciplined approach to tangible book value at close number of clients 2020 across both companies risk management ● Strong growth trajectory ● Company will be able to ● Dedicated to serving low-to- ● Operation centers moderate income and mass maintained in key ● Accelerates efficiencies make more investments in customized technology market clients through geographies across footprint ● Competitive positioning as solutions financial education and the partner of choice for targeted products ● Expands core competencies future strategic acquisitions across organizations 17

Appendix 18

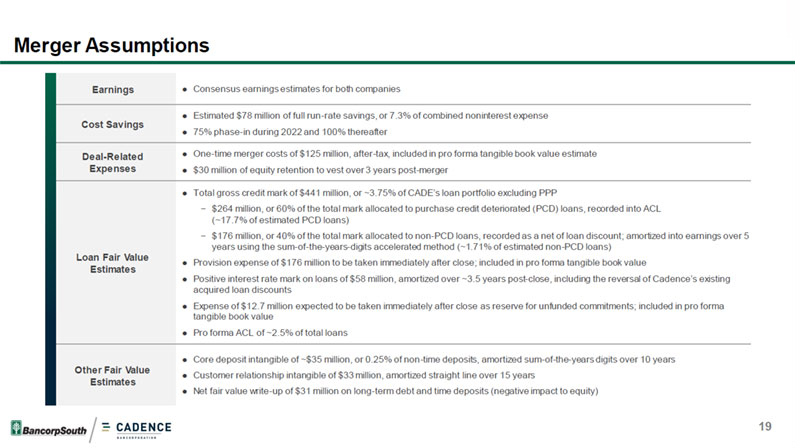

Merger Assumptions Earnings ● Consensus earnings estimates for both companies ● Estimated $78 million of full run-rate savings, or 7.3% of combined noninterest expense Cost Savings ● 75% phase-in during 2022 and 100% thereafter Deal-Related ● One-time merger costs of $125 million, after-tax, included in pro forma tangible book value estimate Expenses ● $30 million of equity retention to vest over 3 years post-merger ● Total gross credit mark of $441 million, or ~3.75% of CADE’s loan portfolio excluding PPP $264 million, or 60% of the total mark allocated to purchase credit deteriorated (PCD) loans, recorded into ACL (~17.7% of estimated PCD loans) $176 million, or 40% of the total mark allocated to non-PCD loans, recorded as a net of loan discount; amortized into earnings over 5 years using the sum-of-the-years-digits accelerated method (~1.71% of estimated non-PCD loans) Loan Fair Value ● Provision expense of $176 million to be taken immediately after close; included in pro forma tangible book value Estimates ● Positive interest rate mark on loans of $58 million, amortized over ~3.5 years post-close, including the reversal of Cadence’s existing acquired loan discounts ● Expense of $12.7 million expected to be taken immediately after close as reserve for unfunded commitments; included in pro forma tangible book value ● Pro forma ACL of ~2.5% of total loans ● Core deposit intangible of ~$35 million, or 0.25% of non-time deposits, amortized sum-of-the-years digits over 10 years Other Fair Value ● Customer relationship intangible of $33 million, amortized straight line over 15 years Estimates ● Net fair value write-up of $31 million on long-term debt and time deposits (negative impact to equity) 19

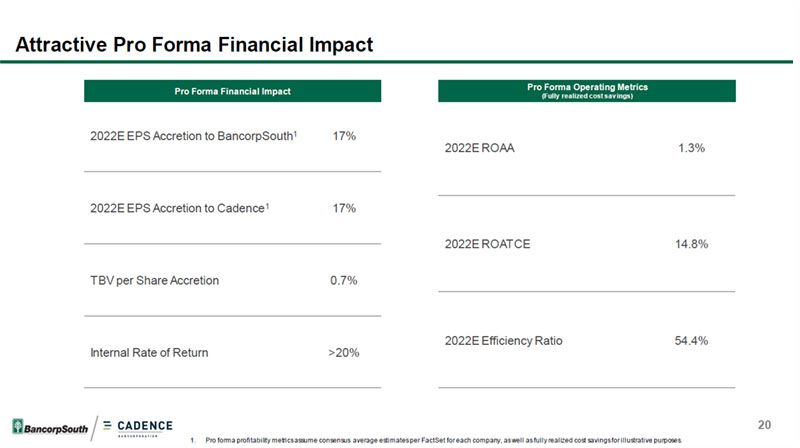

Attractive Pro Forma Financial Impact Pro Forma Operating Metrics Pro Forma Financial Impact (Fully realized cost sav ings) 2022E EPS Accretion to BancorpSouth1 17% 2022E ROAA 1.3% 2022E EPS Accretion to Cadence1 17% 2022E ROATCE 14.8% TBV per Share Accretion 0.7% 2022E Efficiency Ratio 54.4% Internal Rate of Return >20% 20 1. Pro forma profitability metrics assume consensus average estimates per FactSet for each company, as well as fully realized cost savings for illustrative purposes.

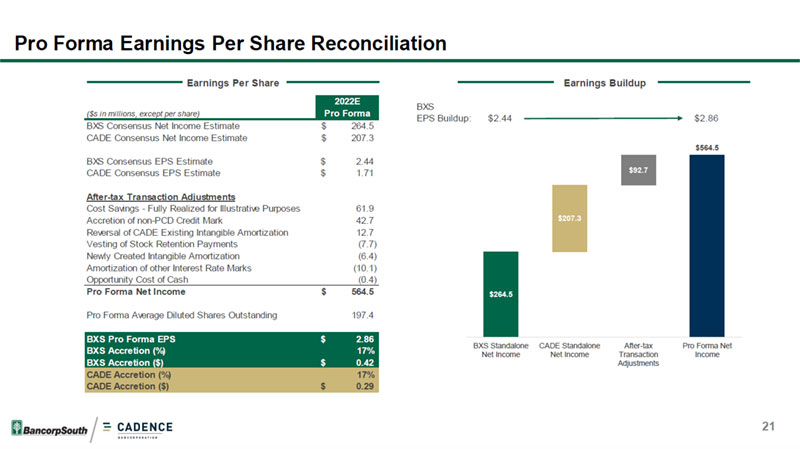

Pro Forma Earnings Per Share Reconciliation Earnings Per Share Earnings Buildup 2022E BXS ($s in millions, except per share) Pro Forma EPS Buildup: $2.44 $2.86 BXS Consensus Net Income Estimate $ 264.5 CADE Consensus Net Income Estimate $ 207.3 $564.5 BXS Consensus EPS Estimate $ 2.44 CADE Consensus EPS Estimate $ 1.71 $92.7 After-tax Transaction Adjustments Cost Savings - Fully Realized for Illustrative Purposes 61.9 Accretion of non-PCD Credit Mark 42.7 $207.3 Reversal of CADE Existing Intangible Amortization 12.7 Vesting of Stock Retention Payments (7.7) Newly Created Intangible Amortization (6.4) Amortization of other Interest Rate Marks (10.1) Opportunity Cost of Cash (0.4) Pro Forma Net Income $ 564.5 $264.5 Pro Forma Average Diluted Shares Outstanding 197.4 BXS Pro Forma EPS $ 2.86 BXS Standalone CADE Standalone After-tax Pro Forma Net BXS Accretion (%) 17% Net Income Net Income Transaction Income BXS Accretion ($) $ 0.42 Adjustments CADE Accretion (%) 17% CADE Accretion ($) $ 0.29 21

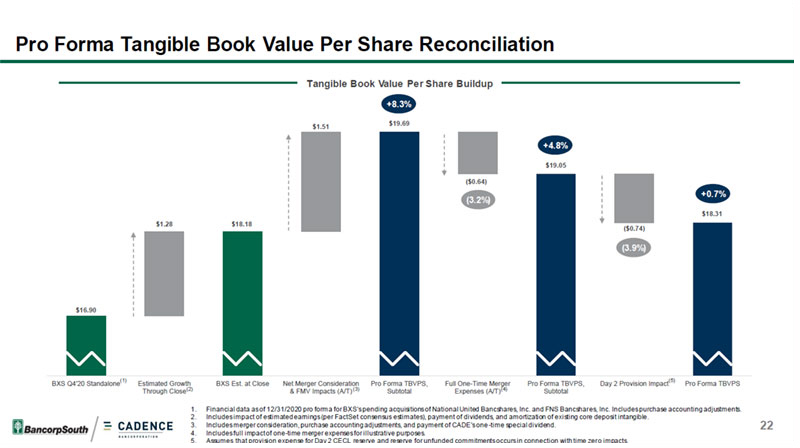

Pro Forma Tangible Book Value Per Share Reconciliation Tangible Book Value Per Share Buildup +8.3% $19.69 $1.51 +4.8% $19.05 ($0.64) +0.7% (3.2%) $18.31 $1.28 $18.18 ($0.74) (3.9%) $16.90 (1) (5) BXS Q4'20 Standalone Estimated Growth BXS Est. at Close Net Merger Consideration Pro Forma TBVPS, Full One-Time Merger Pro Forma TBVPS, Day 2 Provision Impact Pro Forma TBVPS Through Close(2) & FMV Impacts (A/T)(3) Subtotal Expenses (A/T)(4) Subtotal 1. Financial data as of 12/31/2020 pro forma for BXS’s pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. Includes purchase accounting adjustments. 2. Includes impact of estimated earnings (per FactSet consensus estimates), payment of dividends, and amortization of existing core deposit intangible. 3. Includes merger consideration, purchase accounting adjustments, and payment of CADE’s one -time special dividend. 22 4. Includes full impact of one-time merger expenses for illustrative purposes. 5. Assumes that provision expense for Day 2 CECL reserve and reserve for unfunded commitments occurs in connection with time zero impacts.