Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Evofem Biosciences, Inc. | evfm_x472021xpresentations.htm |

1© 2021 Evofem Biosciences, Inc. For investor discussions only.For investor discussions only. Saundra Pelletier, CEO Revolutionizing Women’s Sexual and Reproductive Health NASDAQ: EVFM April 2021

2© 2021 Evofem Biosciences, Inc. For investor discussions only.For investor discussions only. Forward-Looking Statements This presentation contains forward looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 and other federal securities laws. In some cases, you can identify forward looking statements by terms such as “may,” ”will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “strategy,” “objective,” “designed,” “suggest,” “currently,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. Each of these forward-looking statements involves risks and uncertainties. Actual results may differ materially from those, express or implied, in these forward-looking statements. Factors that may cause differences between current expectations and actual results include, but are not limited to, the following: o The rate and degree of market acceptance of Phexxi ® (lactic acid, citric acid and potassium bitartrate) vaginal gel o Evofem’s ability to successfully commercialize Phexxi ® and its ability to develop sales and marketing capabilities o Evofem’s ability to maintain and protect its intellectual property o Evofem’s ability to rely on existing cash reserves to fund its current development plans and operations and to raise additional capital when needed o Evofem’s reliance on third-party providers, such as third-party manufacturers and clinical research organizations o The presence or absence of any adverse events or side effects relating to the use of Phexxi ® and EVO100 o the outcome or success of Evofem’s clinical trials including EVOGUARD o Evofem’s ability to retain members of its management and other key personnel o General risks to the economy represented by spread of the COVID-19 virus o Evofem’s ability to obtain the necessary regulatory approvals for its product candidates and the timing of such approvals, and, o Any other risk factors detailed in Evofem’s filings from time to time with the US Securities and Exchange Commission including, without limitation, the 10-K filed on March 12, 2020, 8-K filed on June 2, 2020 and subsequent filings. The forward looking statements in this presentation represent Evofem’s views only as of the date of this presentation, April 6, 2021, and Evofem expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Evofem’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based for any reason, except as required by law, even as new information becomes available or other events occur in the future. All forward-looking statements in this presentation are qualified in their entirety by this cautionary statement.

3© 2021 Evofem Biosciences, Inc. For investor discussions only. Evofem Biosciences 101 Commercial-stage biopharmaceutical company First commercial product launched September 2020 o FDA-approved hormone-free, on-demand prescription contraceptive vaginal gel Phase 3 investigational candidate EVO100 for prevention of chlamydia and prevention of gonorrhea in women

4© 2021 Evofem Biosciences, Inc. For investor discussions only. 1. Daniels K, Abma JC. Current contraceptive status among women aged 15-49: United States, 2015-2017. NCHS Data Brief. 2018; 327: 1-14. 2. Example market penetration in segment 3. Gross value of Phexxi user = $267.50 WAC x 7 annual refills = $1,872.50 (does not reflect net pricing to Evofem) * Non-Rx Contraceptives: 6.3M barrier methods; 2.8M withdrawal; 1.0M periodic abstinence; 0.1M other Large Market Opportunity Other Non- Targets - 12.3MM Surgical Sterilization - 17.7MM Non-Rx Contraceptive Users - 10.3MM No Contraceptive - 13.1MM Rx Contraceptive Users - 18.8MM Secondary Targets 1.0% – 2.0%(2) Primary Targets 3.5% – 4.5% (2) Primary Targets 2.0% – 3.5% (2) 190k – 380k users 360k – 460k users 260k – 460k users $350M - $710M (3) $670M – $860M (3) $490M – $860M (3) + + US Contraceptive Market: 72.2M Women1 EVEN MODEST MARKET PENETRATION WOULD RESULT IN SIGNIFICANT GROSS REVENUES

5© 2021 Evofem Biosciences, Inc. For investor discussions only. The Time is Right for Phexxi In the U.S., there are 23 million women at risk for pregnancy who are NOT using hormonal contraception1 5 1. Daniels K, Abma JC. Current contraceptive status among women aged 15-49: United States, 2015-2017. NCHS Data Brief. 2018; 327: 1-14.

6© 2021 Evofem Biosciences, Inc. For investor discussions only. Driving the Phexxi Uptake Curve: Direct-To-Consumer (DTC) Marketing 2021 Phexxi consumer marketing initiatives designed to reach women in a purposeful and targeted manner • High impact campaign across television, streaming and digital channels • Robust influencer activations and partnerships • Consumer focused, dynamic, and designed to drive demand for Phexxi “Get Phexxi” DTC campaign launched February 14th

7© 2021 Evofem Biosciences, Inc. For investor discussions only.For investor discussions only. TELEVISION YOUTUBE SOCIAL MEDIA PHEXXI.COM DIGITAL MEDIA PRINT MATERIALS GET PHEXXI – ROLLOUT

8© 2021 Evofem Biosciences, Inc. For investor discussions only. FROM PDF, PLEASE ACCESS THE “GET PHEXXI” AD VIA HTTPS://WWW.YOUTUBE.COM/WATCH?V=6QSF5EGNKRW

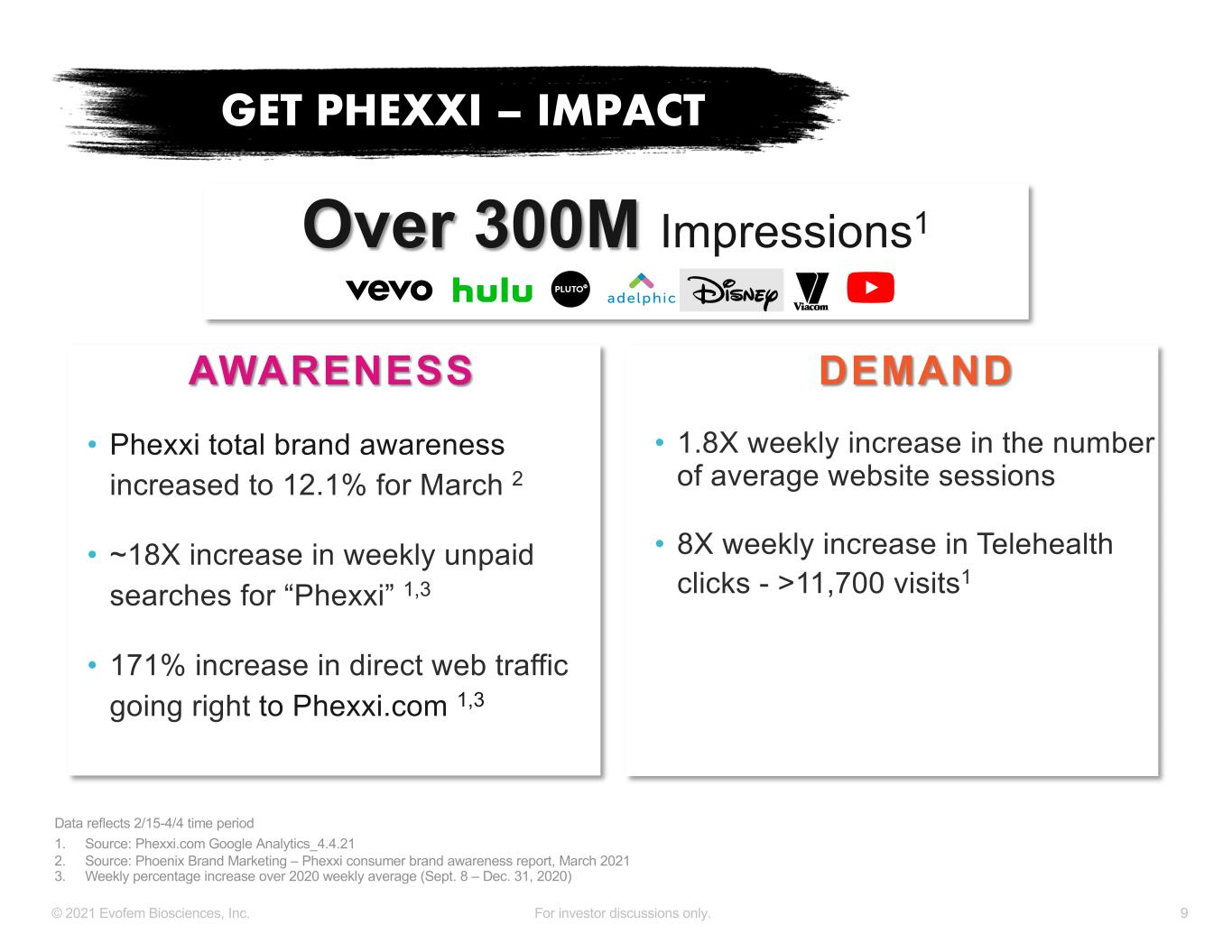

9© 2021 Evofem Biosciences, Inc. For investor discussions only. AWARENESS • Phexxi total brand awareness increased to 12.1% for March 2 • ~18X increase in weekly unpaid searches for “Phexxi” 1,3 • 171% increase in direct web traffic going right to Phexxi.com 1,3 DEMAND • 1.8X weekly increase in the number of average website sessions • 8X weekly increase in Telehealth clicks - >11,700 visits1 GET PHEXXI – IMPACT 1. Source: Phexxi.com Google Analytics_4.4.21 2. Source: Phoenix Brand Marketing – Phexxi consumer brand awareness report, March 2021 3. Weekly percentage increase over 2020 weekly average (Sept. 8 – Dec. 31, 2020) Data reflects 2/15-4/4 time period Over 300M Impressions1

10© 2021 Evofem Biosciences, Inc. For investor discussions only. Phexxi Brand Awareness Growth Post-DTC TV Online Social PHEXXI AWARENESS Awareness data based on surveys with patients conducted by Phoenix Brand Marketing Phexxi Total Brand Awareness: composite metric including Unaided Brand, Unaided Ad, Aided Brand and Aided Ad awareness Total Ad Awareness: composite metric of Unaided and Aided Ad Awareness, asked prior to ad exposure 2.45% 3.53% 4.64% 3.81% 5.66% 4.43% 4.07% 8.35% 12.10% 1.54% 1.87% 2.27% 2.49% 3.55% 2.26% 2.18% 4.80% 9.70% 0% 2% 4% 6% 8% 10% 12% 14% 16% Jul '20 (n=1,039) Aug '20 (n=1,067) Sep '20 (n=1,055) Oct '20 (n=1,206) Nov '20 (n=1,042) Dec '20 (n=1,062) Jan '21 (n=1,056) Feb '21 (n=1,042) Mar'21 (n=1041) Total Brand Awareness Total Ad Awareness

11© 2021 Evofem Biosciences, Inc. For investor discussions only. - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 852 Sales Units (wholesale to pharmacy) Dispensed Units (IQVIA) Accelerating Retail Demand “Get Phexxi” DTC Campaign Launch PHEXXI MONTHLY UNITS Data Sources: ValueCentric (852 sales units), IQVIA (dispensed units)

12© 2021 Evofem Biosciences, Inc. For investor discussions only. Monthly Prescription Growth 375 967 1,100 1,378 1,542 2,147 4 46 133 231 236 292 0 500 1,000 1,500 2,000 2,500 3,000 Sept. 2020 Oct. 2020 Nov. 2020 Dec. 2020 Jan. 2021 Feb. 2021 PHEXXI PRESCRIPTIONS NRx Refills 1,233 379 1,013 1,609 Source: IQVIA (including Knipper) monthly data Note: Some Phexxi prescriptions are for more than one unit 1,778 2,439 37% m/m increase

13© 2021 Evofem Biosciences, Inc. For investor discussions only. 2 229 478 532 595 555 709 1 87 226 393 505 658 2 230 565 758 988 1,060 1,367 0 250 500 750 1,000 1,250 1,500 1,750 Aug. '20 Sep. '20 Oct. '20 Nov. '20 Dec. '20 Jan. '21 Feb. '21 HCPS PRESCRIBING PHEXXI New Prescribers Returning Over 3,300 HCPs Have Prescribed Phexxi Since Launch1 * 29% m/m increase Source: IQVIA data HCPs: health care providers

14© 2021 Evofem Biosciences, Inc. For investor discussions only. Reaching HCPs with “Best in Class” Sales Team 70 Women’s Health sales reps and regional managers • Targeting ~3,500 accounts and the top 12K are the highest prescribing HCPs • Leveraging HCP segmentation tool to quickly refine target accounts based on customer response and business opportunities Internal Sales Team (tele-reps) • Engaging ~4,400 accounts, or ~8K HCPs, to sell Phexxi via telesales model to drive additional Phexxi Rxs • Partner = Archer Healthcare Resourced to be scalable, adaptable, flexible; efficiently designed to support our strategy

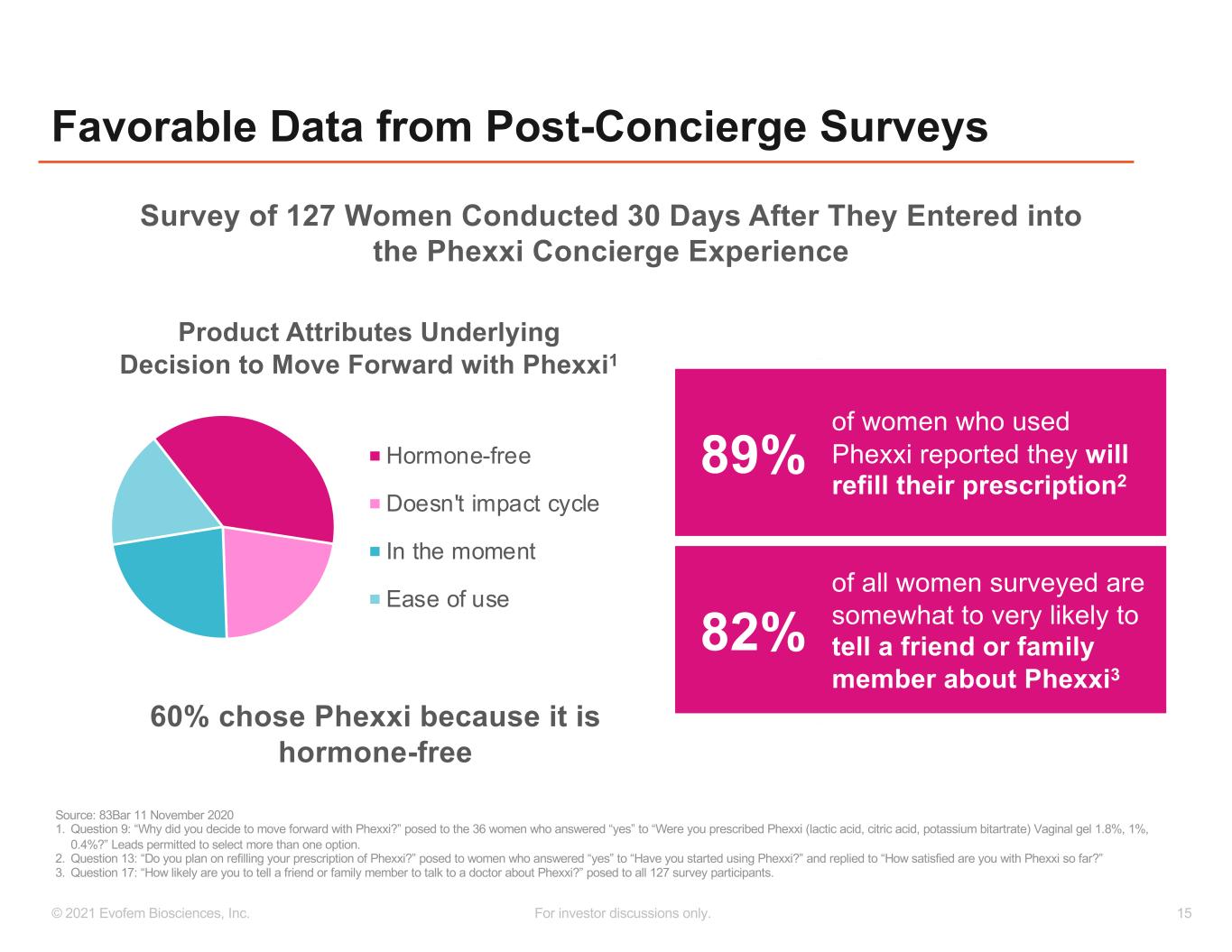

15© 2021 Evofem Biosciences, Inc. For investor discussions only. Favorable Data from Post-Concierge Surveys Hormone-free Doesn't impact cycle In the moment Ease of use Product Attributes Underlying Decision to Move Forward with Phexxi1 Source: 83Bar 11 November 2020 1. Question 9: “Why did you decide to move forward with Phexxi?” posed to the 36 women who answered “yes” to “Were you prescribed Phexxi (lactic acid, citric acid, potassium bitartrate) Vaginal gel 1.8%, 1%, 0.4%?” Leads permitted to select more than one option. 2. Question 13: “Do you plan on refilling your prescription of Phexxi?” posed to women who answered “yes” to “Have you started using Phexxi?” and replied to “How satisfied are you with Phexxi so far?” 3. Question 17: “How likely are you to tell a friend or family member to talk to a doctor about Phexxi?” posed to all 127 survey participants. 89% of women who used Phexxi reported they will refill their prescription2 82% of all women surveyed are somewhat to very likely to tell a friend or family member about Phexxi3 Survey of 127 Women Conducted 30 Days After They Entered into the Phexxi Concierge Experience 60% chose Phexxi because it is hormone-free

16© 2021 Evofem Biosciences, Inc. For investor discussions only. Market Access Channel % of Lives Covered (3/31/21) Commercial 55.1% Medicaid 100.0% Notes: • Covered means patient has access to Phexxi, whether unrestricted or restricted access (i.e. prior authorizations or step therapy (trial of another product before Phexxi would be approved)) • Commercial lives includes Health Exchange Lives and VA/Tricare/DoD • Medicaid - Per our agreement with CMS as of 1/1/21 Phexxi must be generally covered (cannot be excluded). Source: Managed Markets Insight and Technology

17© 2021 Evofem Biosciences, Inc. For investor discussions only. Phexxi for Cancer Patients: NCODA Collaboration • ~800,000 new cases of cancer reported annually among women1 • Many women with cancer are contraindicated to hormones • Collaboration to develop and share resources and educational information for medically-integrated oncology pharmacy teams involved in the care of female oncology patients who may be prescribed Phexxi for pregnancy prevention oPositive Quality Intervention (PQI) in connection with Phexxi oWhite papers oVirtual education platforms oNational meetings and initiatives Source: 1. U.S. Cancer Statistics: Highlights from 2017 Incidence. U.S. Cancer Statistics Data Briefs, No. 17, June 2020. https://www.cdc.gov/cancer/uscs/about/data-briefs/no17-USCS- highlights-2017-incidence.htm

18© 2021 Evofem Biosciences, Inc. For investor discussions only. PIPELINE: EVO100 for Prevention of Chlamydia and Gonorrhea in Women EVO100 is investigational and safety and efficacy have not been established.

19© 2021 Evofem Biosciences, Inc. For investor discussions only. STI Prevention Market Opportunity • 78M sexually active women potentially at risk for STIs (US)4 • Chlamydia and Gonorrhea infections are on the rise oUS chlamydia and gonorrhea infection rates increased for 5th consecutive year despite availability of condoms for STI prevention1,2 oGlobal incidence likely to reach ~95M by 20255 • CDC updated its Treatment Guidelines for gonorrhea infections in December 2020 due to resistance to azithromycin6 Sources: 1. US. 2018. Centers for Disease Control and Prevention (2019): CDC detailed fact sheet on gonorrhea 2. US. 2018. Centers for Disease Control and Prevention (2019): CDC detailed fact sheet on chlamydia 3. CDC Division of STD Prevention communique 25 Jan 2021. 4. Based on US Census Projections, CDC Data Brief 327, primary market research data collected Q2 2020 5. Chlamydia, gonorrhea, trichomonas and syphilis: global prevalence and incidence estimates. June 6, 2019. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6653813/ 6. Centers for Disease Control and Prevention: Update to CDC's Treatment Guidelines for Gonococcal Infection, 2020 December 18, 2020. EVO100 is investigational and safety and efficacy have not been established. “Any sexually active person can be infected with chlamydia2" U.S. Centers for Disease Control “Anyone who is sexually active can get gonorrhea1" U.S. Centers for Disease Control “1 in 5 people in the U.S. have an STI… nearly 68M infections3” U.S. Centers for Disease Control

20© 2021 Evofem Biosciences, Inc. For investor discussions only. EVOGUARD Phase 3 Trial Underway • Phase 3, double-blind, placebo-controlled study to evaluate the efficacy of EVO100 in the prevention of urogenital Chlamydia trachomatis (CT) and Neisseria gonorrhea (GC) infection o16-week treatment phase, 4-week follow up • Enrolling 1,730 healthy women at 90 sites in the US oEnrollment underway since October 2020 o71 study sites activated • All 90 planned sites identified oStudy remains on track to complete enrollment by the end of 2021 • Builds on statistically significant results of Phase 2B/3 ‘AMPREVENCE’ trial published March 2021 in prestigious peer-reviewed American Journal of Obstetrics and Gynecology1 1. Chappell T et al. EVO100 Prevents Chlamydia and Gonorrhea in Women at High-Risk for Infection. Am. J. Obstet Gynecol, 2021. https://doi.org/10.1016/j.ajog.2021.03.005

21© 2021 Evofem Biosciences, Inc. For investor discussions only. EVO100: Expected Timeline to Approval 2021 2022 2023 Potential US Approval & Commercial Launch NDA submission2 Top-Line Results1 Initiate Pivotal Phase 3 Trial • FDA Fast Track designation for prevention of chlamydia in women • FDA QIDP designation for prevention of gonorrhea in women o Potential 5-year regulatory exclusivity extension Complete enrollment1 1. Assumes timely enrollment 2. Assumes favorable outcomes of the Phase 3 clinical trial

22© 2021 Evofem Biosciences, Inc. For investor discussions only. Financial Overview • Balance sheet at December 31, 2020 o$48.9M in unrestricted cash and equivalents o$22.2M in restricted cash from Adjuvant Capital • Raised $30M in March 2021 through underwritten equity offering • $4.5M in April from full exercise of the underwriters’ overallotment option • Shares outstanding: 102.8M1 • Warrants outstanding: 10.4M2 oWeighted average exercise price $4.54 1. As of April 6, 2021 2. As of 28 February 2021

23© 2021 Evofem Biosciences, Inc. For investor discussions only. Gross-to-Net (GTN) Strategy • Implementing strategies beginning April 2021 to improve margins oAdjusting components of existing co-pay assistance program oEstablishing traditional Phexxi sample program oEnhancing prior authorization assistance program • Potential GTN improvement expected beginning Q2 2021 oGoal to achieve ~50% or better GTN by YE 2021

24© 2021 Evofem Biosciences, Inc. For investor discussions only. IP Covering Phexxi Through 2033/2034 Evofem owns issued patents covering Phexxi through the following patent expiry dates: • March 15, 2033: U.S., Mexico, Australia, New Zealand, Singapore, India, Israel, Japan, Korea, Vietnam, Ukraine, South Africa • December 19, 2034: Europe plus Australia, New Zealand, India, Russia and South Africa Additional international patent applications pending covering Phexxi with expected terms through December 19, 2034 Exclusively licensed U.S. patent covering Phexxi (U.S. Patent No. 6,706,276) • Exclusive license from Rush University • Expected five-year term extension to March 6, 2026 (pending evaluation of five-year PTE application); received an interim extension to March 6, 2022 Both patents covering Phexxi in U.S. are Orange Book listed1 1. https://www.accessdata.fda.gov/scripts/cder/ob/patent_info.cfm?Product_No=001&Appl_No=208352&Appl_type=N

25© 2021 Evofem Biosciences, Inc. For investor discussions only. Anticipated Milestones üPublication of pivotal AMPREVENCE manuscript Q1 in American Journal of Obstetrics & Gynecology • Execute GTN improvement strategies Q2 • Announce Phexxi Celebrity Spokesperson Q3 • DTC campaign phase 2 launch Q3 • Improve and expand manufacturing lines to meet Q3 expected demand • Complete EVOGUARD enrollment Q4 • Ongoing progress to gain new vaginal pH modulator category for Phexxi with FDA

26© 2021 Evofem Biosciences, Inc. For investor discussions only. Our Time is Now • Paradigm shifting away from daily hormone dependency • Phexxi is the first and only hormone-free prescription contraception women control and use only when needed oSubstantial U.S. sales opportunity with even modest market penetration oDTC campaign underway to propel the Phexxi uptake curve • Phase 3 candidate for prevention of two STIs oLarge unmet medical need, with 78M women at risk • Deeply-committed, highly experienced leadership team

27© 2021 Evofem Biosciences, Inc. For investor discussions only. © 2021 Evofem Biosciences, Inc.