Attached files

| file | filename |

|---|---|

| EX-23.1 - Save Foods Inc. | ex23-1.htm |

| EX-5.1 - Save Foods Inc. | ex5-1.htm |

As filed with the Securities and Exchange Commission on April 6, 2021

Registration Statement No. 333-254327

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SAVE FOODS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2870 | 26-468460 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Save Foods, Inc.

Kibbutz Alonim, Israel, 3657700

Tel: (347) 468 9583

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David Palach

Chief Executive Officer

Save Foods, Inc.

Kibbutz Alonim, Israel, 3657700

Tel: (347) 468 9583

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Oded Har-Even, Esq. David A. Huberman, Esq. Ron Ben-Bassat, Esq. Sullivan & Worcester LLP 1633 Broadway New York, NY 10019 (212) 660-3060 |

Leslie

Marlow, Esq. Patrick J. Egan, Esq. Gracin & Marlow, LLP The Chrysler Building 405 Lexington Avenue, 26th Floor New York, NY 10174 (212) 907- 6457 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] |

Accelerated filer [ ] |

Non-accelerated filer [X] |

Smaller reporting company [X] |

Emerging Growth Company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Securities Being Registered | Proposed Maximum Aggregate

Offering |

Amount

of Registration Fee(3) |

||||||

| Common Stock, par value $0.0001 per share | $ | 13,800,000 | $ | 1,505.58 | ||||

| Underwriter’s warrants to purchase Common Stock (4) | — | — | ||||||

| Common Stock issuable upon exercise of the Underwriter’s warrants (5) | 750,000 | 81.83 | ||||||

| Total Registration Fee | $ | 14,550,000 | $ | 1,587.41 | (6) | |||

| (1) | Estimated solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). Includes the offering price of shares of Common Stock that the Underwriter have the option to purchase to cover over-allotments, if any. |

(2)

|

Pursuant to Rule 416 under the Securities Act, the shares registered hereby also include an indeterminate number of additional shares of Common Stock as may from time to time become issuable by reason of stock splits, distributions, recapitalizations or other similar transactions. |

| (3) | Calculated pursuant to Rule 457(o) under the Securities Act based on an estimate of the proposed maximum aggregate offering price. |

| (4) | No fee required pursuant to Rule 457(g). |

| (5) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The underwriter’s warrants are exercisable at a per share exercise price equal to 125% of the public offering price. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the underwriter’s warrants is equal to 125% of $600,000 (which is 5% of $12,000,000). |

| (6) | Previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement related to these securities filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell or a solicitation of an offer to buy these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED APRIL 6, 2021 |

1,090,909 Shares

Common Stock

Save Foods, Inc.

We are offering up to 1,090,909 shares of our Common Stock par value $0.0001 per share (“Common Stock”). We anticipate that the initial public offering price will be between $10.00 and $12.00. We have applied to list our Common Stock on the Nasdaq Capital Market under the symbol “SVFD.” No assurance can be given that our application will be approved or that a trading market will develop.

Our Common Stock is currently traded on the OTC Markets, Pink Open Market, under the symbol “SAFO.” On March 31, 2021, the last reported sale price of our Common Stock was $15 per share.

Investing in our securities involves risks. See “Risk Factors” beginning on page 14 of this prospectus for a discussion of the risks that you should consider in connection with an investment in our securities. Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the initial public offering price payable to the underwriter. We have agreed to reimburse the underwriters for certain expenses and the underwriters will receive compensation in addition to underwriting discounts and commissions. We have also agreed to issue warrants to the representative of the underwriters as a portion of the underwriting compensation payable to the underwriters in connection with this offering. See the section titled “Underwriting” beginning on page 92 of this prospectus for additional disclosure regarding underwriter compensation and offering expenses. |

We have granted the underwriters an option for a period of 45 days to purchase up to 163,636 additional shares of our Common Stock.

We estimate the expenses of this offering, excluding underwriting discounts and commissions, will be approximately $325,000.

The underwriters expect to deliver the Company’s securities to the purchasers on or about April , 2021.

ThinkEquity

a division of Fordham Financial Management, Inc.

The date of this prospectus is April , 2021.

| 1 |

| 2 |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any free writing prospectus that we have authorized for use in connection with this offering. Neither we nor the underwriters have authorized anyone to provide you with information that is different. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find Additional Information” in the prospectus. In addition, this prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed or will be filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

For investors outside the United States: Neither we nor any of the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable. We are ultimately responsible for all disclosure included in this prospectus.

Except where the context requires otherwise, in this prospectus the “Company,” “Save Foods,” “we,” “us” and “our” refer to Save Foods, Inc., a Delaware corporation and, where appropriate, its subsidiary, Save Foods Ltd.

In June 2019, we implemented a one-for-fifteen reverse stock split of our common stock pursuant to which holders of our Common Stock received one share of our Common Stock for every fifteen shares of Common Stock held.

On February 23, 2021, we implemented a one-for-seven reverse stock split of our common stock pursuant to which holders of our Common Stock received one share of our Common Stock for every seven shares of Common Stock held. Unless the context expressly dictates otherwise, all references to share and per share amounts referred to herein reflect the reverse stock split.

| 3 |

Cautionary NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, including statements regarding the progress and timing of our product development, the goals of our development activities, estimates of the potential markets for our products, estimates of the capacity of manufacturing and other facilities to support our products, our expected future revenues, operations and expenditures and projected cash needs. The forward-looking statements are contained principally in the sections of this prospectus entitled “Prospectus Summary” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” These statements relate to future events of our financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. Those risks and uncertainties include, among others:

| ● | our expectations regarding our short and long-term capital requirements; | |

| ● | our ability to raise additional capital to meet our liquidity needs; | |

| ● | our ability to meet the initial listing requirements of the Nasdaq Capital Market and to comply with the continued listing standards of the Nasdaq Capital Market; | |

| ● | our ability to generate sufficient proceeds from this offering to affect our business plan; | |

| ● | our expected use of proceeds from this offering; | |

| ● | sales of our products; | |

| ● | the size and growth of our product market; | |

| ● | our marketing plans; | |

| ● | our activity in the civilian market; | |

| ● | our ability to obtain market acceptance of our technology and products; | |

| ● | our ability to satisfy U.S. (including the U.S. Food and Drug Administration, the United States Environmental Protection Agency and the California Department of Pesticide Regulation), and international regulatory requirements and obtain required approvals for sales or exports of our products; | |

| ● | our ability to compete in our respective markets; | |

| ● | our plans to continue to invest in research and development; | |

| ● | our ability to gain acceptance of packing house community and other industries for use of our products; | |

| ● | our ability to establish and maintain strategic partnerships with third parties, including for the distribution of products; | |

| ● | our ability to attract and retain sufficient, qualified personnel; | |

| ● | our ability to obtain or maintain patents or other appropriate protection for the intellectual property; | |

| ● | our ability to grow both domestically and internationally; | |

| ● | our ability to adequately support future growth; | |

| ● | potential product liability or intellectual property infringement claims; | |

| ● | the effect of COVID-19 on our business; and | |

| ● | information with respect to any other plans and strategies for our business. |

Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential,” or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this prospectus and, except as required by law, we undertake no obligation to update or review publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this prospectus. You should read this prospectus, the documents incorporated by reference in this prospectus, the documents referenced in this prospectus and the documents filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

| 4 |

This summary highlights information about us, this offering and selected information contained elsewhere in and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus and the documents incorporated by reference herein, including our financial statements and the related notes and the information set forth under the sections titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” Unless otherwise indicated, all share amounts and per share amounts in this prospectus have been presented on a retrospective and pro forma basis to reflect the reverse stock split of our outstanding shares of common stock at a ratio of 1-for-7 which we effected on February 23, 2021.

Our Company

We develop eco-friendly “green” solutions for the food industry. Our solutions are developed to improve the food safety and shelf life of fresh produce. We do this by controlling human and plant pathogens, thereby reducing spoilage, and in turn, reducing food loss.

Our products are based on a proprietary blend of food acids which have a synergistic effect when combined with certain types of oxidizing agent-based sanitizers and fungicides at low concentrations. Our “green” products are capable of cleaning, sanitizing and controlling pathogens on fresh produce with the goal of making them safer for human consumption and extending their shelf life by reducing their decay. One of the main advantages of our products is that our active ingredients do not leave any toxicological residues on the fresh produce we treat. In contrary, by forming a temporary protective shield around the fresh produce we treat, our products make it difficult for pathogens to develop and potentially provide protection which also reduces cross-contamination.

The U.S. Food and Drug Administration (the “FDA”) Food Safety Modernization Act (the “FSMA”) is transforming the United States’ food safety system by shifting the focus from responding to foodborne illness to preventing it. According to the recent data from the Centers for Disease Control and Prevention, approximately 48 million people in the United States get sick each year from foodborne diseases. We believe this is a significant public health burden that is largely preventable. Since 2011, the FDA has had a legislative mandate to require comprehensive, science-based preventive controls across the food supply. In the context of fresh produce at packing houses, the FDA’s final produce safety rule (with an initial compliance date of January 26, 2018) provides for the use of sanitizers to ensure produce is cleaned from human pathogens.

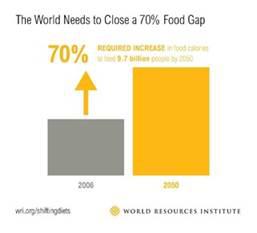

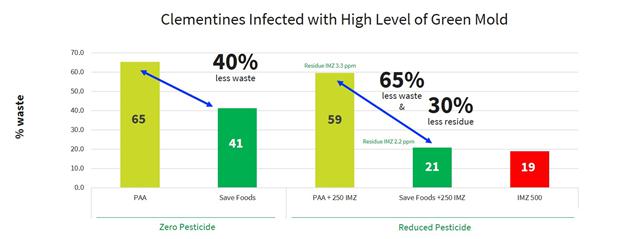

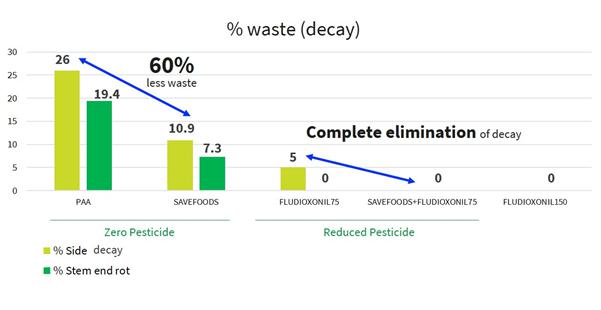

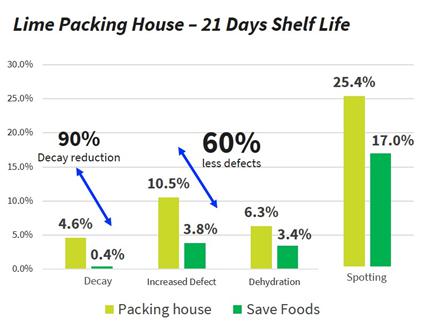

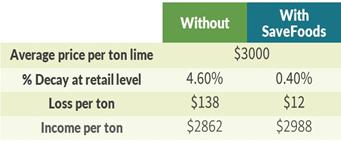

In addition, most conventional chemical pesticides (fungicides), which are currently used to protect fresh produce from microbial spoilage and reduce food waste, are toxic, they remain on fruit peel and present health concerns, while also polluting the environment. Therefore, the use of these products is strictly regulated and their residue on food and on the environment are carefully monitored. Today’s trends led by both consumers and regulatory bodies are to significantly reduce the use of fungicides and switch to greener solutions. In a series of studies conducted in collaboration with a large post-harvest service company during the second quarter of 2020, our products have shown to extend the shelf life of fresh produce in “organic” (where no fungicides are used at the post-harvest stage) and conventional (where fungicides are being used at the post-harvest stage) settings. On average, our products may reduce the rotten fruits at the retail level by 50%.

We have a unique opportunity to make a positive difference throughout the food value chain from field to fork and address two of the major’s challenges in the food industry today — safety and waste. We target major markets that use conventional chemical pesticides and sanitizers, including the pre- and post-harvest market, the greenhouse market and the fresh-cut market, where our “green” products are used as alternatives for, or mixed with, conventional products in order to reduce (i) health and environmental concerns, and/or (ii) microbial resistance that has reduced the efficacy of conventional chemical pesticides.

Our Core Products

Our innovative products address two of the most significant challenges in the food industry: increase food safety and reduce food loss. Our main product lines consist of a proprietary blend of organic food acids applied in post-harvest applications designed to ensure food safety and increase fruit and vegetable’ shelf life by reducing microbial spoilage.

The main steps in post-harvest applications are cleaning, sanitization, and coating (wax). Our products address the cleaning and sanitization application points which are the critical first steps for preserving the quality of fresh produce by controlling microbial contamination related to food safety (e.g., Listeria, Salmonella, E. coli) and food loss due to microbial spoilage (e.g., fungi, mold and yeast).

| 5 |

One of the main advantages of our food acid blend is its non-toxic and safe residues that are providing protection to the treated produce. All the blend ingredients are recognized by the FDA as Generally Recognized as Safe (the “GRAS”) when used as intended in fruit and vegetable wash applications. Moreover, they significantly reduce or eliminate the need for additional post-harvest applications with conventional fungicide by at least 50%, and in some cases entirely, and can reduce food waste due to spoilage by up to 50% (see results below on easy peelers and mango).

Our main products are:

| ● | Processing Aids – SavePROTECT or PeroStar: post-harvest treatment added to fruit and vegetable wash water as a processing aid to increase the efficiency of the oxidizing agent present in the water tank against plant pathogens to reduce produce loss; and | |

| ● | Sanitizers - SF3HS and SF3H: post-harvest cleaning and sanitizing solution to control both plant and foodborne pathogens to ensure both food safety as well as increase produce’s shelf life. |

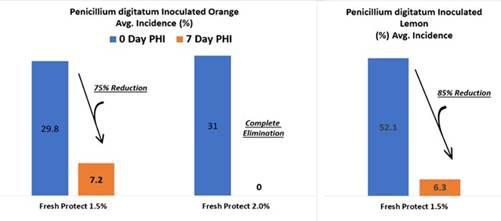

Our product portfolio also includes our SpuDefender, which targets and is designed to control the post-harvest potato sprout, and our FreshProtect, which targets and is designed to control spoilage-creating microorganisms on post-harvest citrus fruit and has a potential to reduce the bacterial load entering the packing house in pre-harvest applications.

Our Strengths

We believe that our main strengths include:

| ● | Strong Management Team with Commitment to Green Products. Led by a team with over 30 years of experience in developing sanitization products and solutions for the agriculture industry, we plan on becoming a significant player in providing consumers with healthy and green fresh produce from farm to fork while endeavoring to ensure food safety and reducing food waste. We believe that our proprietary blend of food acids provides protection to the treated produce and works in synergy with well-known fungicides and sanitizers. This synergy allows us to significantly reduce the concentration of the fungicides that are heavily regulated in several countries and, in certain countries, outright banned and meet the food trends of sustainable and green produce. | |

| ● | Multi-Purpose Products that Simplify Crop Treatment Routine and Save Money. While most chemicals marketed in the industry address either food safety or food waste, our multi-purpose products are intended to provide a solution for both problems, while simplifying crop treatment and achieving cost saving. Our products are capable of cleaning and controlling pathogens that would otherwise render fresh produce as unsafe for human consumption. Our proprietary blend of food acids combined with well-known sanitizers are very efficient against foodborne pathogens like E. coli, Salmonella and Listeria as well as plant pathogens in short contact time (99.999% reduction within 30 seconds of contact). In addition, with multipurpose products, there is no need to order, ship or dispose of bottles of product, resulting in less energy consumed, less CO2, less fuel, and less waste. Our focus on natural product chemistries allows us to continually drive lower costs, higher product gross margins and efficacy through longer shelf life and reduction of food waste. | |

| ● | Strong Intellectual Property Portfolio. We believe that we have built a strong intellectual property position throughout the food chain (from field to fork) as our patents claim compositions and methods that can be used to protect food and agricultural products from decay. We rely on a combination of important intellectual property assets, to protect our innovation. Our employees, consultants, customers, and vendors are subject to confidentiality agreements that protect our proprietary manufacturing processes. Our patent portfolio includes granted patents in the United States, Europe, and Israel, as well as several priority applications, across several patent families, including composition-of-matter claims, methods of use claims, including for treating edible matter, for improving the appearance of edible plant matter, and sterilization methods, as well as for articles for implementing these methods. These patents directly protect a proprietary method for extending life shelf and reducing edible matter from microbial decay. |

| 6 |

| ● | Commercially Available Products and Seamless Implementation. One of the oxidizers being used with our products is peracetic acid (“PAA”), a well-known and widely used sanitizer. Following the enforcement of the FSMA in connection with the use of sanitizers, more and more packers have been choosing this healthy and eco-friendly sanitizer over chlorine, and this choice facilitates implementation of our products. In addition, the application of our products does not require special equipment as they are used in combination with or replace existing products applied on the packing line or in the mix tank in the field. This allows a relatively cheap, seamless and fast implementation. | |

| ● | Significant Reduction of Hazardous Chemicals Food Residue. All the ingredients in our blend of food acids are recognized by the FDA as GRAS when used as intended in fruit and vegetable wash applications, while oxidizers we use, such as hydrogen peroxide, rapidly decompose into water and oxygen. The absence of toxicological residues not only improves food quality but also promotes occupational safety for the employees of packing houses, contributing to a friendlier and safer working environment. |

Our Strategy

In September 2018, the Company changed its organizational structure and management team. After reviewing the Company’s then existing strategy and results of operation, as well as examining the market opportunities, the new management team decided to update the Company’s strategy, reduce the marketing and sales of its existing products, and focus the Company’s efforts and financial resources in developing its next generation products. During the years 2019 and 2020, we developed, validated and tested the efficacy of our next generation product – a blend of food acids – on a variety of crops in small and large scale commercial pilots.

Our strategy is to develop and commercialize our products through strategic partnerships with global post-harvest service companies and with large food distributors and retailers with the intent of: (i) extending the shelf life of fresh produce while reducing (and even eliminating) the use of harmful chemicals (fungicides); (ii) ensuring food safety and shelf life by controlling foodborne pathogens and allow our customers to meet FSMA regulatory requirements; (iii) reducing food loss and the associated carbon “footprint.”

In order to achieve our goals, we intend to:

| ● | Advance our Breakthrough Technologies and Commercialization Efforts. During the first half of 2021, we plan to run a series of additional pilot studies in various commercial collaborations with post-harvest service vendors packing houses and food retailers. | |

| ● | Develop a Strong Marketing Message Around Promoting Safe Food While Avoiding Food Waste. We plan to brand our fresh produce with a “chemical residues free” or “naturally protected” seal of approval, and we believe that like-minded fruit packers around the globe will seek to differentiate themselves from their competitors by obtaining this seal. | |

| ● | Acquire or License Complementary Products and Technologies. We actively search for products and technologies that can enhance our portfolio and grow our business to address all the post-harvest treatments such as fruit coating products or technologies. | |

| ● | Expand to Additional Produce and Geographies. Our plan is to focus first on key countries and regions with the largest markets for our crops, including Mexico, Spain, Italy, Israel and key markets in the United States such as California, Florida and Texas. We also plan to increase the variety of crops that can be treated with our products, to include produce such as apples, bell peppers, tomatoes and papayas. | |

| ● | Leverage Our Products Through Collaborations. Our focus and expertise in the development of green products for the agritech industry and in post-harvest treatments allow us to be a partner of choice for other businesses looking for development partners and for larger companies wanting to leverage their product such as PAA into new combination products. For example, companies selling or owning fungicides, the maximum residue level (“MRL”) of which is being reduced, and that are working in synergy with our products are good partners. This type of collaboration could allow them to continue selling their product. |

| 7 |

Our selling and marketing strategy is twofold:

| ● | establish collaborations with food retailers; and | |

| ● | partner with service vendors to fruit and vegetable packing houses. |

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects that you should consider before making a decision to invest in our Common Stock. These risks are discussed more fully in the section titled “Risk Factors” beginning on page 14 of this prospectus, and include the following:

|

● |

we have a history of operating losses and expect to incur additional losses in the future; | |

● |

we have not generated significant revenue from the sale of our products and do not believe that our current cash on hand will be sufficient to fund our growth plans or our projected operating requirements. This raises substantial doubt about our ability to continue as a going concern. In addition, the report of our independent registered public accounting firm contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern; | |

● |

even if this offering is successful, we expect that we will need to raise significant additional capital, which we may be unable to obtain; | |

● |

because of our limited operating history, we may not be able to successfully operate our business or execute our business plan; | |

| ● | our products and technology require additional trials; | |

● |

the commercial success of our new generation products, as well as any future products, depends upon the degree of market acceptance by the packing house community as well as by other prospect markets and industries; | |

| ● | the COVID-19 pandemic, or any other pandemic, epidemic or outbreak of an infectious disease, may materially and adversely affect our business and operations; | |

| ● | we may face significant competition from other companies looking to develop or acquire new alternative environmentally friendly solutions for the treatment of fruits and vegetables, and other edible matter; | |

| ● | our success is dependent upon the acceptance of our environmentally friendly solutions for fruits and vegetable; | |

| ● | we may be unable to respond effectively to technological changes in our industry, which could reduce the demand for our products; |

| 8 |

| ● | we currently rely on a limited number of suppliers to produce certain key components of our products. | |

● |

if we are unable to establish sales, marketing and distribution capabilities or enter into successful relationships with third parties to perform these services, we may not be successful in commercializing our products; | |

| ● | we rely on rapidly establishing global distributorship network in order to effectively market our products; | |

● |

the results of our early tests may not be indicative of results in future tests and we cannot assure you that any planned or future tests will lead to results sufficient for the necessary regulatory approvals; | |

● |

our products are highly regulated by governmental agencies in the countries where we conduct business and into which we plan to expand. Our failure to obtain regulatory approvals and registration, to comply with registration and regulatory requirements or to maintain regulatory approvals would have an adverse impact on our ability to market and sell our products; | |

● |

our success is dependent upon our ability to achieve regulatory approvals and registration in the United States and abroad (Mexico, Israel, Spain and Italy), which might take longer periods than expected; | |

● |

the inherent dangers in production and transportation of hydrogen peroxide and highly concentrated organic acids could cause disruptions and could expose us to potentially significant losses, costs or other liabilities; | |

● |

our business and operations may be affected by climate change conditions, which could materially harm our financial results; | |

● |

conditions in the global economy may adversely affect our business, financial condition and results of operation; | |

● |

our relationship with our employees could deteriorate, and certain key employees could leave, which could adversely affect our business and results of operations; | |

| ● | we are subject to risks relating to portfolio concentration; | |

● |

our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations; | |

● |

international expansion of our business exposes us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States, Mexico or Israel; | |

| ● | our business depends to some extent on international transactions; | |

● |

if we are unable to secure and maintain patent or other intellectual property protection for the intellectual property used in our products, our ability to compete will be harmed; | |

● |

if we are unable to prevent unauthorized use or disclosure of our proprietary trade secrets and unprotected know-how, our ability to compete will be harmed; | |

● |

we could become subject to patent and other intellectual property litigation that could be costly, result in the diversion of management’s attention, require us to pay damages and force us to discontinue selling our products; | |

● |

we may be subject to claims challenging the inventorship or ownership of our patents and other intellectual property; | |

● |

we may experience claims that our products infringe the intellectual property rights of others, which may cause us to incur unexpected costs or prevent us from selling our products or services; | |

● |

if we or our contractors or service providers fail to comply with laws and regulations, we or they could be subject to regulatory actions, which could affect our ability to develop, market and sell our products or future products that we may develop and may harm our reputation in our industry; | |

| ● | regulatory reforms may adversely affect our ability to sell our products profitably; | |

| ● | conditions in Israel may limit our ability to manage and market our products, which would lead to a decrease in revenues; | |

● |

we may not be able to enforce covenants not-to-compete under current Israeli law that might result in added competition for our products; | |

● |

it may be difficult to acquire jurisdiction and enforce liabilities against our officers and directors who are based in Israel; and | |

● |

even if we meet the initial listing requirements of the Nasdaq Capital Market, there can be no assurance that we will be able to comply with the continued listing standards of the Nasdaq Capital Market. Our failure to meet the continued listing requirements of the Nasdaq Capital Market could result in a de-listing of our Common Stock. |

| 9 |

Corporate Information

We were incorporated in the State of Delaware on April 1, 2009. Our principal executive offices are located at Kibbutz Alonim, Israel, 3657700 and our telephone number is (347) 468 9583. Our website address is www.savefoods.co. The information contained on, or that can be accessed through, our websites is not incorporated by reference into this prospectus and is intended for informational purposes only.

The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our filings with the SEC are also available to the public through the SEC’s website at http://www.sec.gov.

This prospectus contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

| 10 |

The Offering

| Common

Stock offered by us |

1,090,909 shares | |

| Common Stock issued and outstanding | 1,606,760 shares (as of April 1, 2021) | |

Total shares of Common Stock to be outstanding after this offering |

2,743,801 shares (or 2,907,437 shares if the underwriters exercise in full their option to purchase additional 163,636 shares to cover over-allotments, if any) | |

| Over-allotment option | We have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to an additional 163,636 shares of Common Stock at the public offering price, less the underwriting discount. | |

| Use of proceeds |

We estimate that we will receive gross proceeds of approximately $12,000,000, assuming a public offering price of $11.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus before deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We currently expect to use the net proceeds from this offering for the following purposes: |

| ● | approximately $2.6 million for product research and development (which may include acquisition of technology to complement our product portfolio) and purchase of lab equipment; | |

| ● | approximately $1.2 million for gaining regulatory approvals and commercialization; | |

| ● | approximately $2.7 million for selling and marketing; and | |

| ● | the remainder for working capital and general corporate purposes. |

| See “Use of Proceeds” for additional information. |

| Risk factors | See “Risk Factors” beginning on page 14 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Common Stock. | |

| Proposed Nasdaq Capital Market symbol | We have applied to list the Common Stock to be issued in this offering on the Nasdaq Capital Market under the symbol “SVFD.” |

| 11 |

The number of Common Stock that will be outstanding after this offering as shown above is based on 1,606,760 shares of Common Stock issued and outstanding as of the date of this prospectus, and the issuance and sale of 1,090,909 shares of our Common Stock in this offering at a public offering price of $11.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus, and the issuance of 46,132 shares of Common Stock upon the automatic conversion of convertible promissory notes, assuming a public offering price of $11.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus. This number excludes:

| ● | 129,984 shares of Common Stock issuable upon the exercise of warrants outstanding as of the date of this prospectus, with an exercise price of $8.40 per share; |

| ● | 206,862 shares of Common Stock issuable upon the exercise of options to directors, employees and consultants under our 2018 equity incentive plan (the “Equity Incentive Plan”) at a weighted average exercise price of $3.37, of which 119,042 vested as of the date of this prospectus; and |

| ● | 76,730 shares of Common Stock reserved for future issuance under our Equity Incentive Plan. |

Unless otherwise indicated, all information in this prospectus assumes and gives effect to:

| ● | no exercise of the underwriter’s over-allotment option; |

| ● | no exercise of the representative’s warrants; |

| ● | automatic conversion of convertible promissory notes issued in a series of convertible loan agreements into an aggregate of 46,132 shares of Common Stock, assuming an offering price of $11.00, which is the midpoint of the price range set forth on the cover page of this prospectus, which will occur immediately prior to the closing of this offering; | |

| ● | an initial public offering price of $11.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus; and |

| ● | a one-for-seven reverse stock split effected on February 23, 2021. |

| 12 |

Summary Consolidated Financial Data

The following table summarizes our consolidated financial data as of, and for the periods ended on, the dates indicated. We have derived the following consolidated statements of operations data for the years ended December 31, 2020 and 2019 from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future. The following summary consolidated financial data should be read in conjunction with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this prospectus. Our consolidated financial statements are prepared and presented in accordance with U.S. generally accepted accounting principles (“GAAP”).

| Year ended | ||||||||

| U.S. dollars, except share and per share data | December 31 | |||||||

| 2020 | 2019 | |||||||

| Revenues from sales of products | 232,274 | 175,823 | ||||||

| Cost of sales | (43,405 | ) | (144,548 | ) | ||||

| Gross profit | 188,869 | 31,275 | ||||||

| Research and development expenses | (417,000 | ) | (615,623 | ) | ||||

| Selling and marketing expenses | (51,105 | ) | (342,058 | ) | ||||

| General and administrative expenses | (1,070,109 | ) | (1,004,899 | ) | ||||

| Operating loss | (1,349,345 | ) | (1,931,305 | ) | ||||

| Financing expenses, net | (270,393 | ) | (43,408 | ) | ||||

| Other expenses, net | (2,532 | ) | - | |||||

| Share in losses of affiliated company | - | (15,690 | ) | |||||

| Gain on disposal of affiliated company | 15,690 | - | ||||||

| Net loss | (1,606,580 | ) | (1,990,403 | ) | ||||

| Less: Net loss attributable to non-controlling interests | 13,441 | 18,986 | ||||||

| Net loss attributable to the Company | (1,593,139 | ) | (1,971,417 | ) | ||||

| Loss per share (basic and diluted) | (1.05 | ) | (1.38 | ) | ||||

| Basic and diluted weighted average number of shares of Common Stock outstanding | 1,519,122 | 1,424,045 | ||||||

| As of December 31, 2020 | ||||||||||||

| U.S. dollars | Actual | Pro Forma (1) | Pro

Forma As Adjusted (2) | |||||||||

| Consolidated Balance Sheet Data: | ||||||||||||

| Cash and cash equivalents | 242,900 | 516,900 | 11,231,900 | |||||||||

| Restricted cash | 22,395 | 22,395 | 22,395 | |||||||||

| Total assets | 687,649 | 961,649 | 11,676,649 | |||||||||

| Additional paid-in capital | 11,867,585 | 12,366,580 | 23,081,471 | |||||||||

| Accumulated deficit | (12,277,647 | ) | (12,244,498 | ) | (12,244,498 | ) | ||||||

| Total stockholders’ equity (deficit) | (465,453 | ) | 66,696 | 10,781,696 | ||||||||

| (1) | The pro forma data gives effect to (a) our receipt during January 2021 of aggregate of proceeds of $274,000 upon the issuance of convertible promissory notes in the aggregate principal amount of $274,000 issued in a series of convertible loan agreements; and (b) the automatic conversion of convertible promissory notes in the aggregate principal amount of $499,000, issued in a series of convertible loan agreements into an aggregate of 46,132 shares of Common Stock, assuming an offering price of $11.00, which is the midpoint of the price range set forth on the cover page of this prospectus, which will occur immediately prior to the closing of this offering. |

| (2) | The pro forma as adjusted balance sheet data give additional effect to the pro forma adjustments and the sale of 1,090,909 shares of Common Stock in this offering at the assumed initial public offering price of $11.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| 13 |

Investing in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our financial statements and related notes, before deciding whether to purchase shares of our securities. If any of the following risks is realized, our business, operating results, financial condition and prospects could be materially and adversely affected. In that event, the price of our Common Stock could decline, and you could lose part or all of your investment.

Risks Related to Our Financial Condition and Capital Requirements

We have a history of operating losses and expect to incur additional losses in the future.

We have sustained losses in recent years, which as of December 31, 2020, accumulated to $12.3 million, including an operating net loss of $1.3 million and $1.9 million for the years ended December 31, 2020 and 2019, respectively. We are likely to continue to incur significant net losses for at least the next several years as we continue to pursue our strategy, which is currently focused on research and development. Our losses have had, and will continue to have, an adverse effect on our stockholders’ equity and working capital. Any failure to achieve and maintain profitability would continue to have an adverse effect on our stockholders’ equity and working capital and could result in a decline in our share price or cause us to cease operations.

We have not generated significant revenue from the sale of our products and do not believe that our current cash on hand will be sufficient to fund our growth plans or our projected operating requirements. This raises substantial doubt about our ability to continue as a going concern. In addition, the report of our independent registered public accounting firm contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern.

Our ability to become profitable depends upon our ability to generate revenue. We have not yet generated any material revenues and we do not know when, or if, we will generate any such revenue. We currently have no sources of recurring revenue and are therefore dependent upon external sources for financing our operations. There can be no assurance that we will succeed in obtaining the necessary financing to continue our operations.

This raises substantial doubt about our ability to continue as a going concern. In addition, the report of our independent registered public accounting firm contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our audited financial statements do not include any adjustments that might result from the outcome of the uncertainty regarding our ability to continue as a going concern. This going concern opinion could materially limit our ability to raise additional funds through the issuance of equity or debt securities or otherwise. Further reports on our financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. If we cannot continue as a going concern, our investors may lose their entire investment in our Common Stock.

Even if this offering is successful, we expect that we will need to raise significant additional capital, which we may be unable to obtain.

Our capital requirements in connection with our research and development activities and transition to commercial operations have been, and will continue to be significant. We will require additional funds to continue research, development and testing of our technologies and products, to obtain intellectual property protection relating to our technologies when appropriate, and to market our products. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. In either of the aforementioned situations, we may not be able to fully implement its growth plans.

Additional financings that we may require in the future will dilute the percentage ownership interests of our stockholders and may adversely affect our earnings and net book value per share. In addition, we may not be able to secure any such additional financing on terms acceptable to us, if at all. Moreover, if we are unable to obtain such additional capital as discussed above, we will be required to stop our operations, and will resume our activities, only after capital is raised.

| 14 |

Risks Related to Our Business, Industry and Business Operations

Because of our limited operating history, we may not be able to successfully operate our business or execute our business plan.

In September 2018, the Company changed its organizational structure and management team. After reviewing the Company’s then existing strategy and results of operation, as well as examining the market opportunities, the new management team decided to update the Company’s strategy, reduce the marketing and sales of its existing products, and focus the Company’s efforts and financial resources in developing its next generation products. During the years 2019 and 2020, we developed, validated and tested the efficacy of our next generation product – a blend of food acids – on a variety of crops in small and large scale commercial pilots.

Given our limited operating history, it is hard to evaluate our proposed business and prospects. Our proposed business operations will be subject to numerous risks, uncertainties, expenses and difficulties associated with early-stage enterprises. Such risks include, but are not limited to, the following:

| ● | the absence of a lengthy operating history; | |

| ● | insufficient capital to fully realize our operating plan; | |

| ● | expected continual losses for the foreseeable future; | |

| ● | operating in multiple currencies; | |

| ● | our ability to anticipate and adapt to a developing market(s); | |

| ● | acceptance of our products by the pre- and post-harvest industry players and consumers; | |

| ● | limited marketing experience; | |

| ● | a competitive environment characterized by well-established and well-capitalized competitors; | |

| ● | the ability to identify, attract and retain qualified personnel; and | |

| ● | operating in an environment that is highly regulated by a number of agencies. |

Because we are subject to these risks, evaluating our business may be difficult, our business strategy may be unsuccessful and we may be unable to address such risks in a cost-effective manner, if at all. If we are unable to successfully address these risks our business could be harmed.

Our products and technology require additional trials.

The efficacy of our products has only been shown in the limited number of pathogens tested on certain produce and aforementioned climates, and therefore our products have yet to be proven against certain additional and relevant pathogens, produce and market climates to validate the efficacy and benefits of our products. However, due to COVID-19, and the current restrictions on travels, we may delay or postpone certain of our planned trials.

The commercial success of our new generation products, as well as any future products, depends upon the degree of market acceptance by the packing house community as well as by other prospect markets and industries.

In order to achieve high volume sales and attain a leading market share and become the new standard of treatment, our products must not only be approved by the regulators, but also endorsed by the major packing houses and service providers, retailers of fruits and vegetables as well as environmental organizations. Our success depends on our ability to create significant value to the growers, the packing houses and the food retailers. We are aware of this key factor and are focusing on conducting large scale trials with major fruits and vegetables packers and retail suppliers of fresh consumed goods in several countries, in order to show the efficacy of the products and our technology, and to receive the recognition of packers and retailers. However, there can be no assurances that we will succeed in such an endeavor, nor is it clear how long it will take until we receive market recognition.

| 15 |

There can be no assurance that any product that we bring to the market will gain market acceptance by prospective customers. The commercial success of our new generation products and any future product depends in part on the packing house community as well as other industries for various use cases, depending on the acceptance by such industries of our technology as a useful and cost-effective solution compared to current solutions. If our new generation products or any future product does not achieve an adequate level of acceptance, we may not generate significant product revenue and may not become profitable. The degree of market acceptance of our products will depend on a number of factors, including:

| ● | the results of our large-scale trials; | |

| ● | the cost, safety, efficacy, and convenience of our new generation products; | |

| ● | the acceptance of our products as a superior solution in the fresh produce industry; | |

| ● | the ability of third parties to enter into relationships with us without violating their existing agreements; | |

| ● | the effectiveness of our selling and marketing efforts; | |

| ● | the strength of marketing and distribution support for, and timing of market introduction of, competing products; and | |

| ● | publicity concerning our products or competing products. |

Our efforts to penetrate the packing house industry and educate the marketplace on the benefits of our products may require significant resources and may never be successful.

The COVID-19 pandemic, or any other pandemic, epidemic or outbreak of an infectious disease, may materially and adversely affect our business and operations.

The outbreak of COVID-19, which originated in Wuhan, China, in late 2019, has since spread across the globe, including the United States, Israel and many European countries in which we operate. On March 11, 2020, the World Health Organization declared the outbreak a pandemic. While COVID-19 is still spreading and the final implications of the pandemic are difficult to estimate at this stage, it is clear that it has affected the lives of a large portion of the global population. At this time, the pandemic has caused states of emergency to be declared in various countries, travel restrictions imposed globally, quarantines established in certain jurisdictions and various institutions and companies being closed. We are actively monitoring the pandemic and we are taking all necessary measures to respond to the situation in cooperation with the various stakeholders.

A COVID-19 infection outbreak among our workforce could result in a temporary or long-term disruption in our business activities, including manufacturing and other functions.

Based on guidelines provided by the Israeli Government, employers (including us) are required to prepare and increase as much as possible the capacity and arrangement for employees to work remotely. In that regard, and in compliance with all applicable Israeli rules and guidelines, our offices have remained closed since the middle of March 2020, and all of our employees currently work remotely. In addition, some of our employees, including our Chief Technology Officer, are currently on a temporary leave without pay (furlough) and we have postpend some of our planned field tests due to the current restriction on international travels.

| 16 |

We may face significant competition from other companies looking to develop or acquire new alternative environmentally friendly solutions for the treatment of fruits and vegetables, and other edible matter.

We expect to face significant competition in every aspect of our business, and particularly from other companies that seek to enter our focal market. As regulators continue to move away from current residue chemical solutions, such as chlorpropham or CIPC, existing suppliers of these solutions are continually looking to develop or acquire new alternative environment-friendly solutions that can sustain their market share and revenue streams, or to enable the continuance of CIPC at current levels in new ways of treatment. Additionally, as market opportunity becomes eminent, competitors and new players will most likely attempt to develop similar or comparable solutions. It is possible that superior or more cost-effective alternative technology will emerge that will achieve greater market acceptance and render our products less competitive. Furthermore, existing vendors can cooperate to combat new players by reducing market prices and margins or other competitive initiatives. Our future success will therefore depend, to a large extent, upon our ability to achieve market acceptance of our innovative solutions as well as develop and introduce new products and enhancements to existing products. No assurance can be given that we will be able to compete in such a marketplace.

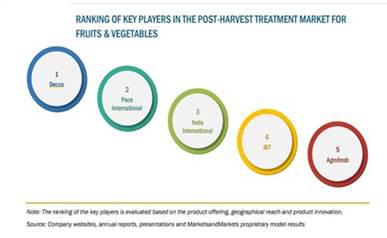

The market for post-harvest solutions is fragmented with various regional suppliers. The market of post-harvest treatments for fruits and vegetables is dominated by five large players with wide reach across the globe. We believe that the principal factors of competition in our industry include reputation, product quality, customer service and customer intimacy, product innovation, technical service and value creation.

Our success is dependent upon the acceptance of our environmentally friendly solutions for fruits and vegetables.

Our future success is dependent upon the acceptance of our environmentally friendly, non-toxicresidual treatment solutions for fruits and vegetables. While the market is signaling that such a direction is likely, certain trends as well as the future size of this market, and other potential markets for our products, rely upon a number of factors, many of which are beyond our control. For example, both the failure to convince retailers to bear additional costs for “green” fruit and vegetables as well as the failure to persuade consumers to purchase “green” fruits and vegetables for higher prices may adversely affect our business, financial condition, operating results and cash flow going forward.

We may be unable to respond effectively to technological changes in our industry, which could reduce the demand for our products.

Our future business success will depend upon our ability to maintain and enhance our technological capabilities and develop and market products, services and applications that meet changing customer needs and market conditions in a cost-effective and timely manner. Maintaining and enhancing technological capabilities and developing new products may also require significant investments in research and development. We may not be successful in developing new products, services and technology that successfully compete or be able to anticipate changing customer needs and preferences, and our customers may not accept one or more of our new products or services. If we fail to keep pace with evolving technological innovations or fail to modify our products and services in response to customers’ needs or preferences, then our business, financial condition and results of operations could be adversely affected.

We currently rely on a limited number of suppliers to produce certain key components of our products.

We rely on unaffiliated contract manufacturers to produce certain key components of our products. In Israel, we are working with a well-known producer of chemicals, SasaTech, who is responsible for the production of our products. SasaTech is well known for its knowledge and handling of hydrogen peroxide. In the United States, we have worked for the past few years with Seeler Industries, a national leader in the marketing and handling of hydrogen peroxide. There is limited available manufacturing capacity that meets our quality standards and regulatory requirements, especially for the manufacturing of the SF3H and SF3HS with one of their active ingredient – hydrogen peroxide – as well as for FreshProtect with one of its active ingredient – PO3. If we are unable to arrange for sufficient production capacity among our contract manufacturers or if our contract manufacturers encounter production, quality, financial, or other difficulties, including labor or geopolitical disturbances, we may encounter difficulty in meeting customer demands as we seek alternative sources of supply, or we may have to make financial accommodations to such contract manufacturers or otherwise take steps to mitigate supply disruption. We may be unable to locate an additional or alternate contract manufacturer that meets our quality controls and standards and regulatory requirements in a timely manner or on commercially reasonable terms. Any such difficulties could have an adverse effect on our business, financial condition and results of operations, which could be material.

| 17 |

If we are unable to establish sales, marketing and distribution capabilities or enter into successful relationships with third parties to perform these services, we may not be successful in commercializing our products.

We have a limited selling and marketing infrastructure and have limited experience in the sale, marketing or distribution of products. To achieve commercial success for any product for which we have obtained marketing approval, we will need to enter into collaborations with third parties like post-harvest service companies and establish a selling and marketing infrastructure or to out-license our products.

In the future, we may consider building a focused selling and marketing infrastructure to market our products in the United States or elsewhere in the world. There are risks involved with establishing our own sales, marketing and distribution capabilities. For example, recruiting and training a sales force could be expensive and time consuming and could delay any product launch. This may be costly, and our investment would be lost if we cannot retain or reposition our selling and marketing personnel.

Factors that may inhibit our efforts to commercialize our products on our own include:

| ● | our inability to recruit, train and retain adequate numbers of effective selling and marketing personnel; | |

| ● | the inability of sales personnel to obtain access to potential customers; | |

| ● | the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage relative to companies with more extensive product lines; and | |

| ● | unforeseen costs and expenses associated with creating an independent selling and marketing organization. |

If we are unable to establish our own sales, marketing and distribution capabilities or enter into successful arrangements with third parties to perform these services, our revenues and our profitability may be materially adversely affected.

In addition, we may not be successful in entering into arrangements with third parties to sell, market and distribute our products in our target markets, including first the United States, Mexico, Spain, Italy and Israel, or may be unable to do so on terms that are favorable to us. We likely will have little control over such third parties, and any of them may fail to devote the necessary resources and attention to sell and market our products effectively. If we do not establish sales, marketing and distribution capabilities successfully, either on our own or in collaboration with third parties, we will not be successful in commercializing our product candidates.

We rely on rapidly establishing global distributorship network in order to effectively market our products.

We have developed initial partnerships with local partners. In order to expand selling and marketing globally, and capture leading market share before any potential reaction from the competitors, we will need to rapidly expand geographically and establish a global distribution network. This is likely to put pressure on our management, financial and operational resources. In order to mitigate this factor, once we establish a significant presence in the market, we will proceed to establish strategic partnerships with some of the leading players in the market; however, there are no assurances that we will succeed in establishing such partnerships, which may harm the marketing of our products and the development of our business.

| 18 |

The results of our early tests may not be indicative of results in future tests and we cannot assure you that any planned or future tests will lead to results sufficient for the necessary regulatory approvals.

Our products have been tested in multiple commercial and small-scale pilots on certain types of produce and during specific time of the year. We are currently in the development and optimization phases of these products. Results from our later-stage commercial tests may show lower efficacy than our early-tests conducted previously and we cannot guarantee that when commercialized, our products will be effective and stable and product improvements as well as possible changes in the application and usage protocol may be required. These factors may significantly delay receipts of regulatory approvals, and the introduction of our products into the market. Likewise, we cannot be sure these products will be commercially viable, and have no assurances that we will be able to expand upon our current product offerings or that any such expansion will generate revenue.

Our products are highly regulated by governmental agencies in the countries where we conduct business and into which we plan to expand. Our failure to obtain regulatory approvals and registration, to comply with registration and regulatory requirements or to maintain regulatory approvals would have an adverse impact on our ability to market and sell our products.

Some of our products are subject to technical review and approval by government authorities in each country where we currently conduct our business and where we intend to sell our products.

The regulatory requirements to which we are subject are complex and vary from country to country. To obtain new registrations, it is necessary to have a local registrant, and to understand the country’s regulatory requirements, both at the time an application for registration is submitted and when the registration decision is made, which may be several years later. A significant investment in registration data is required (covering all aspects from manufacturing specifications through storage and transport, use, and, finally, disposal of unwanted product and used containers) to ensure that product performance (e.g. bio efficacy), intrinsic hazards and use patterns are fully characterized. Risk assessments are conducted by government regulatory authorities who make the final decision on whether the documented risk associated with a product and active ingredient is acceptable prior to granting approval for sale. This process may be prolonged due to requirements for additional data or internal administrative processes. There is a risk that registration of a new product may not be obtained or that a product label may be severely reduced, restricting the use of the product. If these circumstances arise, there is a risk that the substantial investments made in product development will generate the projected sales that justified the investment, and our business, financial condition and results of operations may be adversely affected by failure to obtain new registrations.

Products that are already approved may be subject to periodic review by regulatory authorities in many countries. Such reviews frequently require the provision of new data and more complex risk assessments. The outcome of such reviews of existing registrations cannot be guaranteed and registrations may be modified or canceled. Since all government regulatory authorities have the right to review existing registrations at any time, the sustainability of the existing portfolio cannot be guaranteed. Existing registrations may be lost at any time, resulting in an immediate impact on sales. Furthermore, prior to expiration, it is necessary to renew registrations. The renewal period and processes vary by country and may require additional studies to support the renewal process. Failure to comply could result in cancellation of the registration, resulting in an impact on sales.

In addition, new laws and regulations may be introduced, or existing laws and regulations may be changed or may become subject to new interpretations, which could result in additional compliance costs, seizures, confiscations, recalls, monetary fines or delays that could affect us or our customers.

In the United States, to complete the registration process of our sanitizers, we will need to submit a number of studies in the form of a registration application or dossier, which has not yet been submitted to the United States Environmental Protection Agency (the “EPA”). In addition, applicable rules and regulations in California require registration of processing aids with the California Department of Pesticide Regulation (the “CDPR”). On July 31, 2020 we submitted an “Application for Registration of Adjuvant” for our SavePROTECT processing aid to the CDPR. We anticipate registration of our SavePROTECT during the second half of 2021, however, there can be no assurance that we will successfully complete any required studies or that we will obtain such registration.

Our success is dependent upon our ability to achieve regulatory approvals and registration in the United States and abroad (Mexico, Israel, Spain and Italy), which might take longer periods than expected.

We are subject to extensive national, state and local government regulation. A critical key to our success and ability to expand our business is our ability to obtain regulatory approvals and registration in the United States and in other countries for the use of our products. The regulatory approvals of some of our products are dependent on trials to show the efficacy and the non-toxicity of our products, and are time and cost consuming. We do not anticipate any significant problems in obtaining future required licenses, permits or approvals that are necessary to expand our business, however such registration filling might take longer period than expected due to various factors including the recent disruptions in regular services as a result of COVID-19, and it might delay obtaining such regulatory approvals, or might cause delays in starting operations on a large scale in these countries and other jurisdictions.

| 19 |

The inherent dangers in production and transportation of hydrogen peroxide and highly concentrated organic acids could cause disruptions and could expose us to potentially significant losses, costs or other liabilities.

Our operations are subject to significant hazards and risks inherent to the transportation of the active ingredient of one of our products – hydrogen peroxide. In high concentrations, our blend of acids has a very low pH which may lead to skin burn and hydrogen peroxide is an aggressive oxidizer and both can corrode many materials. We are working with limited low concentration of the material, however in high concentrations of H2O2 it will react violently. Hydrogen peroxide should be stored in a cool, dry, well-ventilated area and away from any flammable or combustible substances. It should be transported in special tanks and vehicles and should be stored in a container composed of non-reactive materials. These hazards and risks include, but are not limited to fires, explosions, third-party interference (including terrorism) and mechanical failure of equipment at our or third-party facilities. The occurrence of any of these events could result in production and distribution difficulties and disruptions, personal injury or wrongful death claims and other damage to properties.

Our business and operations may be affected by climate change conditions, which could materially harm our financial results.

Our business may be affected from changes in climate conditions as such events would affect the crops and their storability in those cases where there is unusually warm, dry, humid or cold weather before cropping.

In such instances, we may suffer a decrease in revenues as a result of a smaller storage volume of rooms or shorter storage period. We anticipate that once we increase our operations, and enter certain markets which experience or will experience significant climate change, such as above-common rain fall, heat waves, dry air conditions, and unusually cold or prolonged cold weather conditions, such events may materially impact our financial results.

Conditions in the global economy may adversely affect our business, financial condition and results of operation.

Although demand for fresh horticultural products is considered inelastic in developed economies, the fresh produce and citrus industries that we sell to may be affected by material changes in supply, market prices, exchange rates and general economic conditions. Delays or reductions in our customers’ purchasing or shifts to lower-cost alternatives that result from tighter economic market conditions would reduce demand for our products and services and could, consequently, have a material adverse effect on our business, financial condition and results of operations.

Our relationship with our employees could deteriorate, and certain key employees could leave, which could adversely affect our business and results of operations.

Our business involves complex operations and demands a management team to determine and implement our strategy and workforce that is knowledgeable and has expertise in many areas necessary for our operations. As a company focused on research and development in the highly-specialized horticultural post-harvest field, we rely on our ability to attract and retain skilled employees, consultants and contractors, including our specialized research and development. As of April 1, 2021, we employed two full-time employees and four part-time employees, including the employees employed by our subsidiary, Save Foods Ltd. The departure of highly skilled employees, consultants or contractors or one or more employees who hold key regional management positions could have an adverse impact on our operations, including customers choosing to follow a such regional manager to one of our competitors.