Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LiveXLive Media, Inc. | ea139058-8k_livexlivemedia.htm |

Exhibit 99.1

Investor Presentation April 2021 1

SAFE HARBOR 2 The information in this presentation is provided to you by LiveXLive Media, Inc . (the “Company”) solely for informational purposes and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument of the Company, or to participate in any investment activity or trading strategy, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment in the United States or anywhere else . By viewing or participating in this presentation, you acknowledge and agree that (i) the information contained in this presentation is intended for the recipient of this information only and shall not be disclosed, reproduced or distributed in any way to anyone else, (ii) no part of this presentation or any other materials provided in connection herewith may be copied, retained, taken away, reproduced or redistributed following this presentation, and (iii) all participants must return all materials provided in connection herewith to the Company at the completion of the presentation . By viewing, accessing or participating in this presentation, you agree to be bound by the foregoing limitations . No representations, warranties or undertakings, express or implied, are made and no reliance should be placed on the accuracy, fairness or completeness of the information, sources or opinions presented or contained in this presentation, or in the case of projections contained herein, as to their attainability or the accuracy and completeness of the assumptions from which they are derived, and it is expected that each prospective investors will pursue his, her or its own independent investigation . The statistical and industry data included herein was obtained from various sources, including certain third parties, and has not been independently verified . By viewing or accessing the information contained in this presentation, the recipient hereby acknowledges and agrees that neither the Company nor any representatives of the Company accepts any responsibility for or makes any representation or warranty, express or implied, with respect to the truth, accuracy, fairness, completeness or reasonableness of the information contained in, and omissions from, these materials and that neither the Company nor any of its affiliates, employees, officers, directors, advisers, placement agents or representatives accepts any liability whatsoever for any loss howsoever arising from any information presented or contained in these materials . This presentation contains forward - looking statements, including descriptions about the intent, belief or current expectations of the Company and its management about future performance and results . Such forward - looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those expressed or implied by such forward - looking statements . These factors include risks and uncertainties as to the Company identifying, acquiring, securing and developing content ; the Company’s reliance on one key customer for a substantial percentage of its revenue ; the Company’s ability consummate any proposed financing, acquisition or transaction, the timing of the closing of such proposed event, including the risks that a condition to closing would not be satisfied within the expected timeframe or at all or that the closing of any proposed financing, acquisition or transaction will not occur or whether any such event will enhance shareholder value ; ability to attract, maintain and increase the number of the Company’s users and paid subscribers, the Company's intent to repurchase shares of its common stock from time to time under its announced stock repurchase program and the timing, price, and quantity of repurchases, if any, under the program ; successfully implementing the Company’s growth strategy, including relating to its technology platform and applications, management’s relationships with industry stakeholders, the effects of the global Covid - 19 pandemic, changes in economic conditions, competition and other risks including, but not limited to, those described in the Company’s Annual Report on Form 10 - K, filed with the Securities and Exchange Commission (the “SEC”) on June 26 , 2020 , Quarterly Report on Form 10 - Q, filed with the SEC on or about February 16 , 2021 , and other filings and submissions with the SEC . These forward - looking statements speak only as of the date set forth below and the Company disclaims any obligations to update these statements except as may be required by law . Neither the Company nor any of its affiliates, advisors, placement agents or representatives has any obligation to, nor do any of them undertake to, revise or update the forward - looking statements contained in this presentation to reflect future events or circumstances . This presentation speaks as of April 4 , 2021 . The information presented or contained in this presentation is subject to change without notice and its accuracy is not guaranteed . Neither the delivery of this presentation nor any further discussion of the Company or any of its affiliates, shareholders, officers, directors, employees, agents or advisors with any of the recipients shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since that date .

LiveXLive at a Glance We give fans, brands, and bands the best seat in the house Lis t en • The only all - in - one global streaming platform dedicated to streaming of live music, entertainment, podcasts, audio and video content • Delivers live entertainment to millions of fans in 220+ countries • Offers premium live streams from the world’s top festivals and concerts, expertly curated streaming radio stations , podcasts , vodcasts, and original video and audio content connecting artists to their fans 24/7 Complementary Portfolio of Assets and Brands W atch A t t e nd Enga g e T ransact 3

1M+ 1 Paid Subscribers (03/31/21) Premium Content with Global Reach 3.2B+ Audio Listens since 01 / 0 1 / 2 0 158 Livestreamed Music Events since 01/01/20 1,780+ Artists Streamed since 01/01/20 220+ Countries Reached by Live Music Streaming 300M+ people reached via 24 - hour OTT streaming channel 1,120+ Hours of Live Music since 01/01/20 Platforms TikTok Twitter Dail y m otion STIRR O&O Fa cebo o k YouTube Twitch Podcasting over 235 shows and produces over 400 podcast episodes per week 1 See the Company's 10 - Q for QE 12/31/20 4

Investment Highlights Multiple monetization paths and levers to drive sustainable growth Growing library of original content and exclusive content partnerships LiveXLive’s model addresses five large market verticals Global network of distribution and channel partners 3 4 5 6 Distinguished Board of Directors and advisors with industry experience 8 A leading all - in - one streaming artist platform 1 Successful M&A strategy drives diversified revenue base 2 World - class management team 7 5

• Leading premium music & live streaming platform featuring 158 events & 1,780+ artists • Pay - per - view platform allows artists to perform digital concerts with innovative features • 24 - hour linear OTT streaming channel reaches 300M+ households • Nearly all new Tesla EVs sold in the U.S. comes with a paid 1 - year subscription to Slacker • StudioOne to produce original content slate both live and taped; short, medium and long formats • Subscription and advertiser - supported podcast network • 400+ episodes created per week and 235+ shows on air currently • Total social media reach exceeds 240M • New Vodcast Network features video podcasts from creators produced by StudioOne • eCommerce - focused merchandise personalization company • Thousands of exclusive personalized items • Deep partnerships with artists to create exclusive merchandise • Further diversifies business model into merchandising business • Full - service club, concert, and festival promotion company • Produces 300+ club and theater events annually • Features world - class festivals, e.g. Spring Awakening , Mamby on the Beach • Fully integrated into network of talent booking and marketing content 1 A Leading All - in - One Streaming Artist Platform 6

Attract, produce and create differentiated and exclusive content 1 Host live concerts and pay - per - view events to expand audience reach 2 Utilize actionable audience data and insights to improve experience 3 All - in - one content platform enhances user engagement & retention 5 Multiple monetization channels drive growth and strong artist value proposition 7 Cultivate meaningful connections between artists and their fans, 24/7 6 At t ract E n g a ge R e tain Mo n etize 1 Flywheel Strategy Creates Superior Value Proposition Differentiated experience drives user conversion 4 7

8 Sources: Company filings, Company websites Audio streaming Live music streaming M usic e v e nts 1 Unrivaled Capabilities Across Audio, Video, and Live Events Audio streaming Ad - s u p p o rted x x x x x x x x x Subscription x x x x x x x x x x Podcasts x x x x x x x x Video streaming Originals x x Live video streaming x x x x T i c k et e d show x x x x x Linear / OTT channels x Live events x x x x x Merchandise x x x x

Multifaceted revenue streams anchored by recurring subscription revenue 2 Successful M&A Strategy Drives Diversified Revenue Base Revenue composition as of 12/31/19 Revenue composition as of 12/31/20 94% 6% Subscription Advertising Merchandising Ticket / Event 44% 40% 11% 1% Sponsorship & Licensing 4% 1 9 1 Represents only eight days of revenue

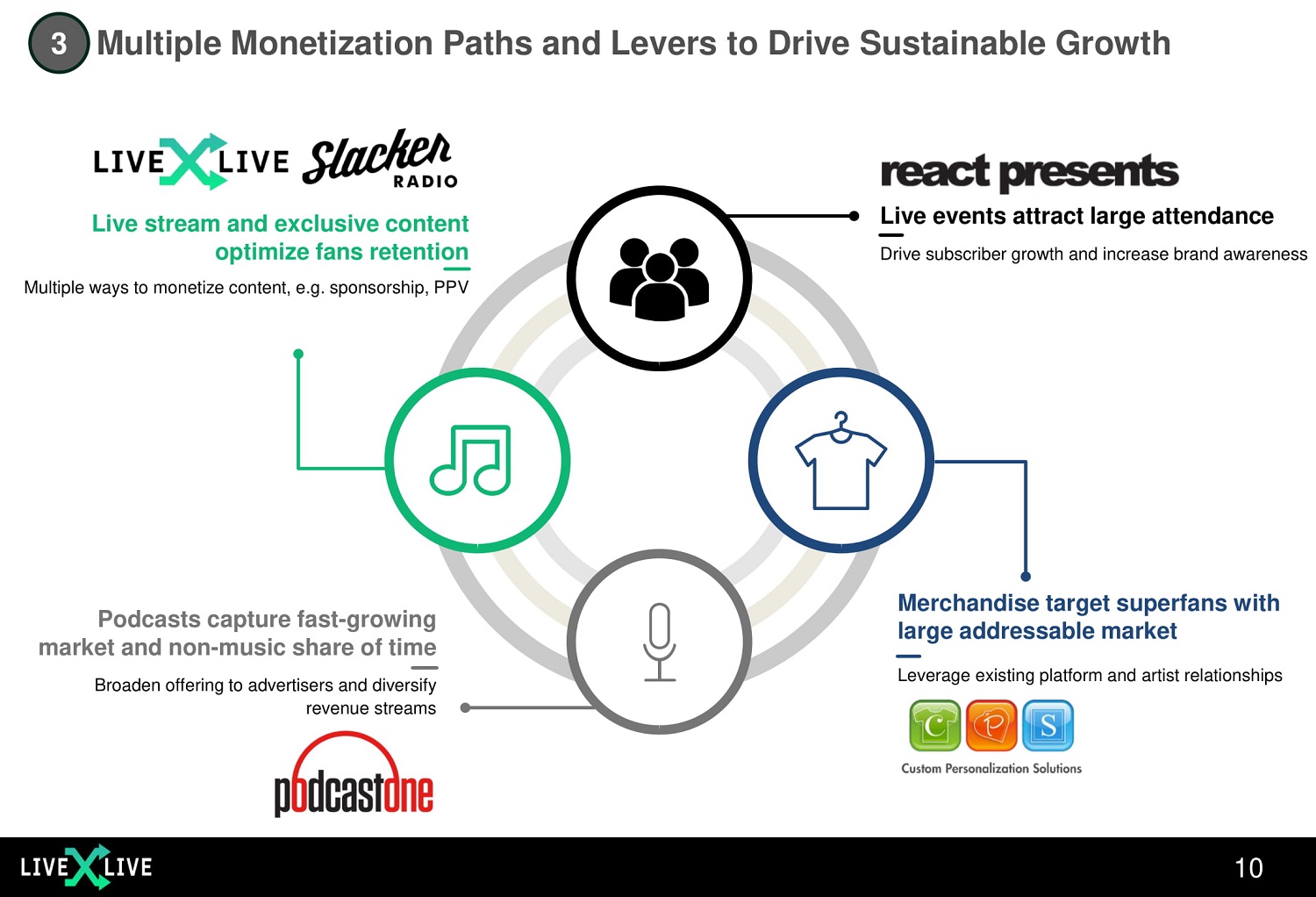

3 Multiple Monetization Paths and Levers to Drive Sustainable Growth Merchandise target superfans with large addressable market Leverage existing platform and artist relationships Podcasts capture fast - growing market and non - music share of time Broaden offering to advertisers and diversify revenue streams Live events attract large attendance Drive subscriber growth and increase brand awareness Live stream and exclusive content optimize fans retention Multiple ways to monetize content, e.g. sponsorship, PPV 10

Highly - rated Originals • Weekly music and celebrity news show • Traveling studio that originates from live music events and festivals • Highlight events by showcasing exotic locales, unique venues, and artist backstories • 72 - hour live streamed music festival (Mar 26 – 28, 2021) • Featured 130 artists and generated nearly 28 million views during 3 - day festival • Inaugural festival in 2020 generated 5 billion views on TikTok for hashtag #musiclives Podcasts Partnerships StudioOne to develop and distribute new originals and tentpole events across the platform 4 Growing Library of Original Content and Exclusive Content Partnerships 11

LIVE EVENTS Source: IFPI, BBC, Billboard, eMarketer, Facebook Live, Forbes, The Verge, Statista, Nielsen, Broker research LIV E S T R E A M MERCHANDISE MUSIC SUBSCRIPTIONS Over 3.8 billion smartphone users projected globally by this year 1.6 Billion 3.8 Billion 2014 2021 5 LiveXLive’s Model Addresses Five Large Market Verticals • Over 300 million paid music subscribers globally today – estimated to grow to 1.2 billion by 2030 • 74% of concert fans said they will continue to watch livestreaming events even after physical events resume • 37% (104 million) listen to podcasts at least every month Global video streaming market expected to be $80B by 2025 Users watch live video 3x longer and comment 10x more than recorded footage 30M+ People attend at least one music festival in the US annually 52% of US attended a live music event in 2018 Global live music market expected to be $30B in 2021 Global licensed me r chandise ma r ket expected to reach $400B by 2023 2021, spendi n g w il l jump nearly 45% to $1.13 billion. As podcast listenership has soared in recent years, ad dollars will continue to follow suit. PODCAST 12

6 Global Network of Distribution and Channel Partners Desktop Mo b ile O T T 13 Over 220 countries reached by Live Music Streaming

Robert Ellin Chairman & CEO Over 30 years of investment and turnaround experience, deep relationships in media and entertainment, prior public company experience as Executive Chairman of Mandalay Digital Dermot McCormack President Renowned music industry executive, with expertise from content development to technology, growth strategies and monetization M ichael Qua r tie r i EVP, CFO Former CFO at Scientific Games (Nasdaq: SGMS) and SVP, CAO at Las Vegas Sands (NYSE: LVS). Recognized in 2020 by Institutional Investor as the #1 Chief Financial Officer in Gaming and Lodging Norman Pattiz Ex e c ut i v e Chai r m an PodcastOne Over 50 years deep experience in radio, original programming and podcasts, and former founder of Westwood One, the largest radio network in the U.S. M ike Bebel Senior EVP Music industry veteran & digital music service entrepreneur with more than 20 years of global operating experience J a c k ie S tone CMO Top 50 Marketer with over 27 years of global expertise across brand building, growth, acquisition and loyalty David Schulhof Pre s iden t, Li v eXLi v e M u s i c Publishing Executive with more than 20 years of experience in the music, digital media & private equity sectors Garrett English Chief Creative Officer Deep experience in music content, news and live production and programming, including producing the VMAs and launching MTV internationally in Japan, Africa and Russia Jason Miller Global Head Of Sales National brand advertising developer who has integrated solutions across audio, video, digital, social, mobile, & event platforms Roe Williams Global Head of Talent And Artist Partnerships Previously orchestrated deals with Adidas, Grey Goose, Tosy, Office Max, Unilever, and General Mills 7 World - Class Management Team 14

Ramin Arani Independent Dire c to r Former lead manager of Fidelity’s Puritan Fund and current Board member of Vice Media, Ellen Digital and Opportunity Network Patrick Wachsberger Independent Director Founder and CEO of Picture Perfect Entertainment and former Chairman of Lionsgate Films Steven Bornstein Former CEO of ESPN and NFL Network Jason Flom CEO of Lava Records Distinguished & Experienced Board of Directors Strong Suite of Formal Advisors Kenneth Solomon Independent Dire c to r Chairman and CEO of The Tennis Channel, partner at Arcadia Investment Partners and Chairman of Ovation TV Craig Foster Independent Dire c to r Former Chief Financial Officer and Chief Accounting Officer of Amobee, Inc. Chris McGurk Former CEO of MGM and Universal Pictures Roger Werner Former CEO and President of ESPN and Speedvision Jay Krigsman Independent Dire c to r Executive Vice President and Asset Manager of The Krausz Companies Bridget Baker Independent Dire c to r Former President of Content and TV Network Distribution of Comcast and NBCUniversal Jules Haimovitz Former President of Viacom and founder of Showtime Maria Garrido Independent Dire c to r Sr. Vice President Brand Management at Vivendi Group 8 Distinguished Board of Directors and Advisors with Industry Experience 15

Financial and Operating Highlights $7 $34 $39 2018 2019 2020 2021 2022 Strong Revenue and Subscribers Growth Diversifying Revenue Streams CAGR: 95% • Ability to monetize content via multiple channels as business scales • Recent accretive transactions accelerate path to profitability • Expects to generate annual cost savings of approximately $3.4M from recent integration of PodcastOne, CPS, and React Presents • Operating profits expected to be $1.5M - $3.0M in 2022 Note: Fiscal year ended Mar 31. Numbers in millions. Historical financials not pro forma for acquisitions 1 See the Company's 10 - Q for QE 12/31/20; 2 Midpoint of guidance (assumes no live event revenue due to COVID - 19); 3 Represents only eight days of revenue NM NM 15% 68% 62% Paid subs 657k 820k 1M 2 $65 $105 2 As of 12/31/19 As of 12/31/20 Subscription services Sponsorship & Licensing Merchandising Ticket / Event Advertising 94% 6% 44% 16 40% 11% 4% 1% 1 3 Y/Y growth %

($M) FY21 FY22 Revenue $64.5 – $65.5 $100 – $110 1 Adjusted Operating (Loss) / Income ($5.0) – ($2.5) $1.5 – $3.0 1 Capital Expenditure $3 – $5 – Livestream Events Expected to livestream 135+ music festivals and events – 17 Financial Outlook 1 Assumes no revenue from live events

App e ndix

• Pay - per - view (PPV) platform allows artists to perform digital PPV concert(s) with innovative digital features, such as virtual meet & greets, behind the scenes access, and real - time unique and collectible merchandise offerings • Multiple monetization avenues including subscription, advertising, sponsorship, merchandise sales, licensing, and ticketing • Ability to produce premium live events for approx. $20K/hr., compared to current industry comps at approx. $500K/hr • Integrated business model allows for the same content to be monetized many different times and in many different ways • Nearly all new Tesla EVs sold in the U.S. come with a paid one - year subscription to LiveXLive and Slacker Radio streaming app LiveXLive’s 24 - hour linear OTT streaming channel reaches 300 million+ households LiveXLive creates a valuable connection between bands, fans and brands by building long - term franchises in audio, video, podcasting, pay - per - view (PPV), livestreaming, and specialty merchandise Overview Selected franchise titles • A leading premium streaming platform delivering premium livestreams from the world’s top artists, festivals and concerts, and original artists’ video and audio content Selected metrics (72 - hour non - stop livestreamed music festival) (Weekly music and celebrity news show) (Weekly Friday night livestream concert) (Weekly hip - hop music performance show) (Mini - docu series on various music artists) 158 Live s t r e a me d Mu s i c Even t s s in c e 01 / 01 / 2 0 1,780+ A rt i s ts S tre a m ed s in c e 01 / 01 / 2 0 122M+ Content views over time 1 See the Company's 10 - Q for QE 12/31/20 $ 1M+ 1 Paid subscribers (03/31/21) 19

LiveXLive’s Slacker Radio is a subscription music streaming service offering songs and access to expertly crafted stations, podcasts from PodcastOne, livestreamed video and on - demand programming, and livestreamed festivals, concerts and pay - per - view (PPV) events • Ranked as the best quality music app and “Editor’s Choice” by PC Magazine, outpacing better known brands such as Spotify and SiriusXM • Blends a team of forward - thinking music curators and content programmers with cutting edge analytics which provide a seamless music discovery • Estimated music subscription global TAM currently at over 300 million paid music subscribers - estimated to grow to 1.2 billion by 2030 1 • Targeted 10 million paid subscribers (0.0008% of 2030 estimated TAM) 28M+ Songs in catalogue 600+ Expertly crafted stations, podcasts, concerts, PPV events 3.2B+ A u di o Li s te n s s i n ce 01 / 01 / 2 0 63B+ Audio listens since inception 77+ Automobiles partnerships for in - built music streaming $ 1M+ 2 Paid subscribers (03/31/21) 1 Broker research 2 See the Company's 10 - Q for QE 12/31/20 20

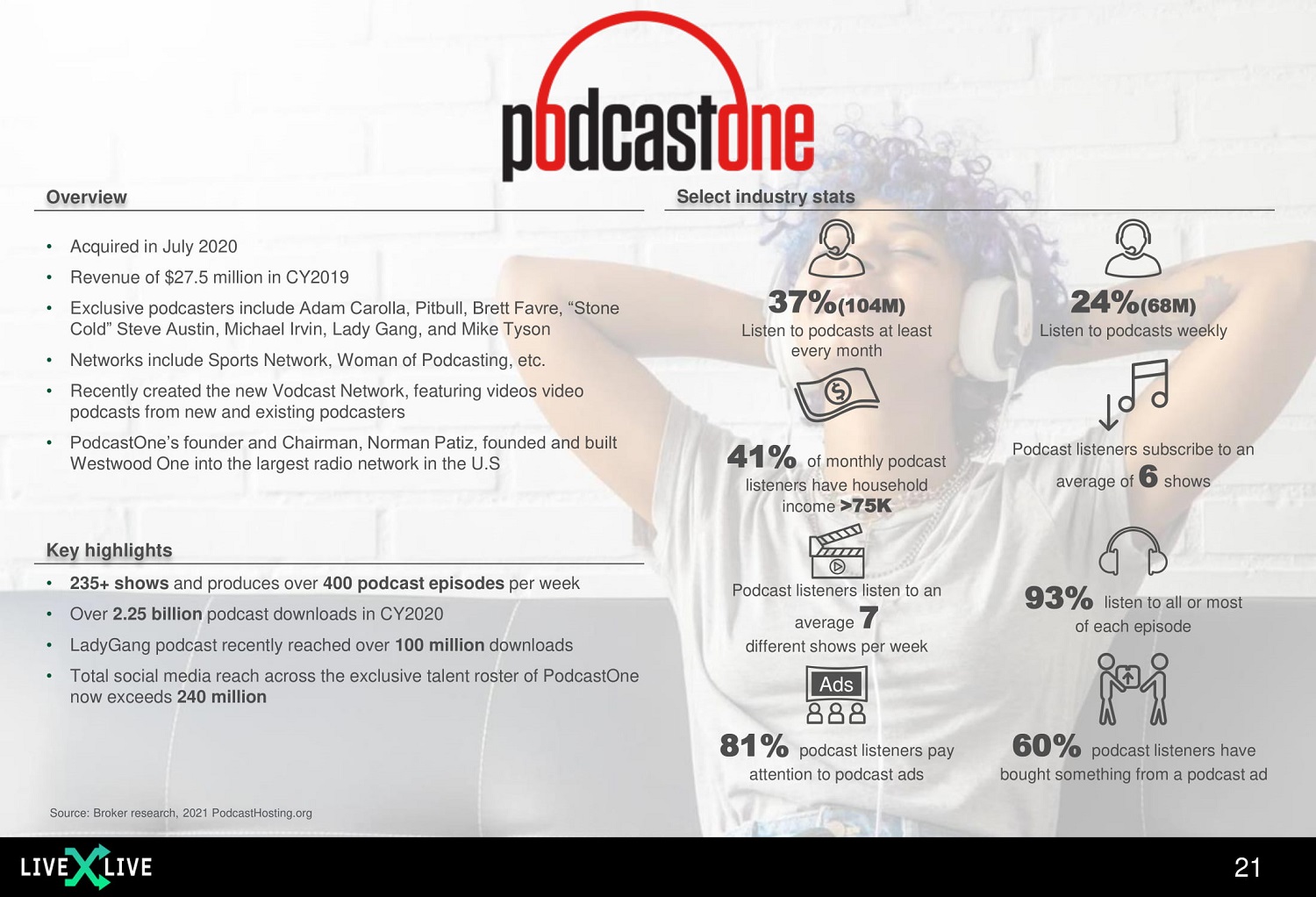

• Acquired in July 2020 • Revenue of $27.5 million in CY2019 • Exclusive podcasters include Adam Carolla, Pitbull, Brett Favre, “Stone Cold” Steve Austin, Michael Irvin, Lady Gang, and Mike Tyson • Networks include Sports Network, Woman of Podcasting, etc. • Recently created the new Vodcast Network, featuring videos video podcasts from new and existing podcasters • PodcastOne’s founder and Chairman, Norman Patiz, founded and built Westwood One into the largest radio network in the U.S Source: Broker research, 2021 PodcastHosting.org Select industry stats 37% (104M) Listen to podcasts at least every month 24% (68M) Listen to podcasts weekly 41% of monthly podcast listeners have household income >75K Podcast listeners subscribe to an a v erage of 6 s h o w s Podcast listeners listen to an average 7 different shows per week 93% listen to all or most of each episode 81% podcast listeners pay attention to podcast ads 60% podcast listeners have bought something from a podcast ad A ds Overview • 235+ shows and produces over 400 podcast episodes per week • Over 2.25 billion podcast downloads in CY2020 • LadyGang podcast recently reached over 100 million downloads • Total social media reach across the exclusive talent roster of PodcastOne now exceeds 240 million Key highlights 21

• Acquired in December 2020 • Direct - to - consumer commerce platform • Create, manufacture and distribute unique and limited - edition personalized clothing, jewelry, toys as well as virtual goods • Intends to partner with artists and stars from the music, podcast and entertainment industry with massive social media and marketing reach • Provides monetization opportunities for both LiveXLive and artists 22 $20M CY 202 0 R e v enu e $1M CY 202 0 EB I T D A $400B E x pec t e d g l oba l li cens e d m e r chand i s e m a r k e t b y 202 3

• Full - service club, concert, and festival promotion company • Produces 300+ club and theater events annually across the Midwest • Feature world - class festivals such as Spring Awakening Music Festival & Mamby on the Beach • React Presents team is fully integrated into the LiveXLive ecosystem including talent booking & marketing of LiveXLive content • Launched React curated playlists on LiveXLive in 2020 • “Spring Awakening Excursions” series “Cancun Awakening” originally scheduled to take place April 28 – May 2, 2021, a boutique destination vacation package with world class artists in an intimate setting • React Presents recorded revenue of approximately $15 million in 2019 • 79% of fans expect to return to live music within 4 months of COVID - 19 restrictions lifting • 85% of all Ticketmaster tickets were held for postponed events rather than asking for refunds 23

NASDAQ: LIVX | IR@LIVEXLIVE.COM