Attached files

| file | filename |

|---|---|

| EX-23.3 - EX-23.3 - Bowman Consulting Group Ltd. | d18075dex233.htm |

| EX-23.1 - EX-23.1 - Bowman Consulting Group Ltd. | d18075dex231.htm |

| EX-21.1 - EX-21.1 - Bowman Consulting Group Ltd. | d18075dex211.htm |

| EX-10.14 - EX-10.14 - Bowman Consulting Group Ltd. | d18075dex1014.htm |

| EX-10.13 - EX-10.13 - Bowman Consulting Group Ltd. | d18075dex1013.htm |

| EX-10.12 - EX-10.12 - Bowman Consulting Group Ltd. | d18075dex1012.htm |

| EX-10.11 - EX-10.11 - Bowman Consulting Group Ltd. | d18075dex1011.htm |

| EX-10.10 - EX-10.10 - Bowman Consulting Group Ltd. | d18075dex1010.htm |

| EX-10.8 - EX-10.8 - Bowman Consulting Group Ltd. | d18075dex108.htm |

| EX-10.7 - EX-10.7 - Bowman Consulting Group Ltd. | d18075dex107.htm |

| EX-10.6 - EX-10.6 - Bowman Consulting Group Ltd. | d18075dex106.htm |

| EX-10.5 - EX-10.5 - Bowman Consulting Group Ltd. | d18075dex105.htm |

| EX-3.2 - EX-3.2 - Bowman Consulting Group Ltd. | d18075dex32.htm |

| EX-3.1 - EX-3.1 - Bowman Consulting Group Ltd. | d18075dex31.htm |

| S-1 - S-1 - Bowman Consulting Group Ltd. | d18075ds1.htm |

Exhibit 10.9

FOURTH AMENDMENT TO CREDIT AGREEMENT

THIS FOURTH AMENDMENT TO CREDIT AGREEMENT (this “Amendment) dated as of August 30, 2019, is by and between BANK OF AMERICA, N.A. {the “Bank”), and BOWMAN CONSULTING GROUP, LTD., a Virginia corporation (the “Borrower”).

The Borrower and the Bank are parties to a Credit Agreement dated as of August 24, 2017 (the “Credit Agreement”), and they now desire to (i) add a new non-revolving line of credit as more fully described herein and {ii) amend certain provisions of the Credit Agreement as provided herein.

Accordingly, for and in consideration of the premises and the mutual covenants contained herein, the receipt and sufficiency of which consideration are hereby mutually acknowledged, the Borrower and the Bank hereby agree as follows:

1. Capitalized Terms: Effective Date. Capitalized terms used in this Amendment which are not otherwise defined herein shall have the meanings assigned thereto in the Credit Agreement, as amended by this Amendment (the Credit Agreement, as amended by this Amendment, being hereinafter referred to as the “Credit Agreement”). Except as expressly provided to the contrary herein, all amendments to the Credit Agreement set forth herein shall be effective as of the date of this Amendment.

2. Definitions. The following defined terms in Section 1 of the Credit Agreement are hereby amended and restated in their entirety as follows:

1.7 “Chicago Settlement Obligation” means the aggregate of (i) Borrower’s obligation to David Leibowitz, as Chapter 7 Trustee of McDonough Associates pursuant to an agreement dated April 3, 2017, which obligation will not exceed One Hundred Twenty-Five Thousand Dollars {$125,000) at any time, and (ii) Borrower’s obligation to SL PRU LLC pursuant to an agreement dated June 5, 2019, which obligation will not exceed One Million Forty-One Thousand Six Hundred Sixty-Seven Dollars ($1,041,667) at any time.

1.10 “Credit Limit” means the amount of Fifteen Million Dollars ($15,000,000).

1.12 “EBITDA” means net income, less income or plus loss from discontinued operations and extraordinary items, plus income taxes, plus interest expense, plus depreciation, depletion, and amortization, plus other non-cash charges, including non-cash reduction of put liabilities. For purposes of computing EBITDA, the Chicago Settlement Obligation shall be deemed to be an extraordinary item.

1.1 “Guarantor” means Gary Bowman solely with respect to Credit Facility No. 2, together with Bowman Consulting Group DC PC, a District of Columbia professional corporation, and any other person, if any, providing a guaranty with respect to any of the obligations hereunder.

1.31 “Obligor” means the Borrower, any Guarantor and/or Pledger.

1.35 “Permitted Loan or Advance” means (a) the loans or advances by Borrower to its shareholders or employees, or to Gary Bowen which are in existence as of August 1, 2019 and are described on Schedule B attached hereto and (b) any loans or advances made to employees in the ordinary course of Borrower’s business in an aggregate amount not to exceed Two Hundred Thousand Dollars ($200,000).

1.36 “Permitted Redemption” means any redemption, repurchase, or acquisition of the stock of Borrower provided that at the time of such redemption, no event of default has occurred or is then continuing, or after giving effect to such redemption, repurchase, or acquisition, an event of default would occur, and (a) is made pursuant to the terms of the then current Shareholders’ Buy-Sell Agreement following the death, disability or termination of employment of a shareholder, and (b) does not result in principal payments in any twelve (12) month period that would result in a violation of the financial covenant set forth in Section 7.5. For purposes of clarification, Permitted Redemptions shall be included in the calculation of Basic Fixed Charge Coverage Ratio.

1.42 “Put Option Redemption” means any redemption, repurchase, or acquisition of stock of Borrower provided that at the time of such redemption, repurchase, or acquisition, no event of default has occurred or is continuing, or after giving effect to such redemption, repurchase, or acquisition, an event of default would occur, and ls made pursuant to the exercise of a Put Option by a shareholder of Borrower. Notwithstanding anything set forth in this Agreement to the contrary, no Permitted Redemptions shall be permitted if at the time of any such Permitted Redemption or after giving effect thereto, an event of default would occur.

The following defined terms are hereby added to Section 1 of the Credit Agreement immediately after Section 1.52:

1.53 “Facility No. 4 Commitment” is defined in Section 3.6(a).

1.54 “Facility No. 4 ExpirationDate” is defined in Section 3.7.

1.55 “Permitted Debt Service Dividend” means any dividend of distribution paid to Guarantor where the funds generated by such Permitted Debt Service Dividend are immediately used to repay the debt owed by Gary Bowman to Borrower and described as (the “Guarantor Debt”) (i) CastleRock/Bowman loan or (ii) the assumption by Guarantor of Debt owed by Lansdowne Development Group, LLC to Borrower. Notwithstanding anything set forth in this Agreement to the contrary, no Permitted Debt Service Dividend shall be permitted if at the time of any such Permitted Debt Service Dividend or after giving effect thereto, an event of default would occur

1.56 “Permitted Debt Service Redemption” means any redemption, repurchase, or acquisition of the stock of Borrower then owned by Guarantor where the funds generated by such Permitted Debt Service Redemption are immediately used to repay the Guarantor Debt. Notwithstanding anything set forth in this Agreement to the contrary, no Permitted Debt Service Redemption shall be permitted if at the time of any such Permitted Debt Service Redemption or after giving effect thereto, an event of default would occur.

3. Amendments to Credit Agreement. The Borrower and the Bank agree that the following provisions of the Credit Agreement are amended as follows:

2.1. Availability Period. The first paragraph of Section 2.2 of the Credit Agreement is amended and restated in its entirety to read as follows:

The Revolving Line of Credit is available between the date of this Agreement and July 31, 2021 or such earlier date as the availability may terminate as provided in this Agreement (the “Facility No. 1 Expiration Date”).

2.2. FACILITY NO. 4: NON-REVOLVING LINE OF CREDIT AMOUNT AND TERMS. The following provisions are added to Section 3 of the Credit Agreement immediately after Section 3.5:

3.6 Non-Revolving Line of Credit Amount.

(a) During the availability period described below, the Bank will provide a non-revolving line of credit to the Borrower (the “Second Non-Revolving Line of Credit”). The amount of the Non-Revolving Line of Credit (the “Facility No. 4 Commitment”) is One Million Dollars ($1,000,000).

-2-

(b) This is a non-revolving line of credit. Any amount borrowed, even if repaid before the Facility No. 4 Expiration Date, permanently reduces the remaining available Non-Revolving Line of Credit.

(c) The Borrower agrees not to permit the principal balance outstanding to exceed the Facility No. 4 Commitment. If the Borrower exceeds this limit, the Borrower will immediately pay the excess to the Bank upon the Bank’s demand.

3.7 Availability Period.

The Second Non-Revolving Line of Credit is available between the date of this Agreement and August 31, 2020, or such earlier date as the availability may terminate as provided in this Agreement (the “Facility No. 4 Expiration Date”).

3.8 Repayment Terms.

(a) The Borrower will pay interest on September 1, 2019, and then on the same day of each month thereafter until payment in full of any principal outstanding under this facility.

(b) The Borrower will repay the principal amount outstanding on the Facility No. 4 Expiration Date in sixty (60) equal installments beginning on the first (1st) day of the month following the earlier of (i) the date on which no remaining amount is available under the Second Non-Revolving Line of Credit or (ii) the Facility No. 4 Expiration Date, and on the same day of each month thereafter, and ending on the same day of the sixtieth (60th) month thereafter (the “Second Repayment Period”). Each principal installment shall be in an amount sufficient to fully amortize the principal amount over the Second Repayment Period. In any event, on the last day of the Second Repayment Period, the Borrower will repay the remaining principal balance, plus any interest then due.

3.9 Interest Rate.

(a) The interest rate is a rate per year equal to the LIBOR Daily Floating Rate plus the Applicable Rate as defined below.

(b) The Borrower may prepay the principal in full or in part at any time without the payment of a prepayment fee or premium. The prepayment will be applied to the most remote payment of principal due under this Agreement.

3.10 Applicable Rate.

The Applicable Rate shall be the following amounts per annum, based upon the Financial Test, as set forth in the most recent compliance certificate (or, if no compliance certificate is required, the Borrower’s most recent financial statements) received by the Bank as required in the Covenants section; provided, however, from the date hereof until the date on which Bank has received the first compliance certificate or financial statement from the Borrower, the Applicable Rate shall be equal to the LIBOR Daily Floating Rate plus two percent (2.0%).

| Applicable Rate (in percentage points per annum) |

||||||

| Pricing Level |

Funded Debt to EBITDA | LIBOR Daily Floating Rate + |

||||

| 1 |

Greater than 3.0 to 1.0 | 2.6 | % | |||

| 2 |

Greater than or equal to 2.5 to 1.0 but less than or equal to 3.0 to 1.0 |

2.3 | % | |||

| 3 |

Less than 2.5 to 1.0 | 2.0 | % | |||

-3-

The Applicable Rate shall be in effect from the date the most recent compliance certificate or financial statement is received by the Bank until the date the next compliance certificate or financial statement is received; provided, however, that if the Borrower fails to timely deliver the next compliance certificate or financial statement, the Applicable Rate from the date such compliance certificate or financial statement was due until the date such compliance certificate or financial statement is received by the Bank shall be the highest pricing level set forth above.

If, as a result of any restatement of or other adjustment to the financial statements of the Borrower or for any other reason, the Borrower or the Bank determines that (i) the Financial Test as calculated by the Borrower as of any applicable date was inaccurate and (ii) a proper calculation of the Financial Test would have resulted in higher pricing for such period, the Borrower shall immediately and retroactively be obligated to pay to the Bank an amount equal to the excess of the amount of interest and fees that should have been paid for such period over the amount of interest and fees actually paid for such period. The Bank’s acceptance of payment of such amounts will not constitute a waiver of any default under this Agreement. The Borrower’s obligations under this paragraph shall survive the termination of this Agreement and the repayment of all other obligations.

2.3. Dividends and Distributions. Section 7.6 of the Credit Agreement is hereby amended and restated in its entirety as follows:

7.6 Dividends and Distributions.

Not to declare or pay any dividends (except dividends paid in capital stock and Permitted Debt Service Dividends), redemptions of stock or membership interests, distributions and withdrawals (as applicable) to its owners (other than Permitted Tax Distributions, Permitted Put Option Redemptions, Permitted Debt Service Redemptions or Permitted Redemptions) if at the time of any such dividend or redemption or after giving effect thereto a default has occurred or would occur under this Agreement.

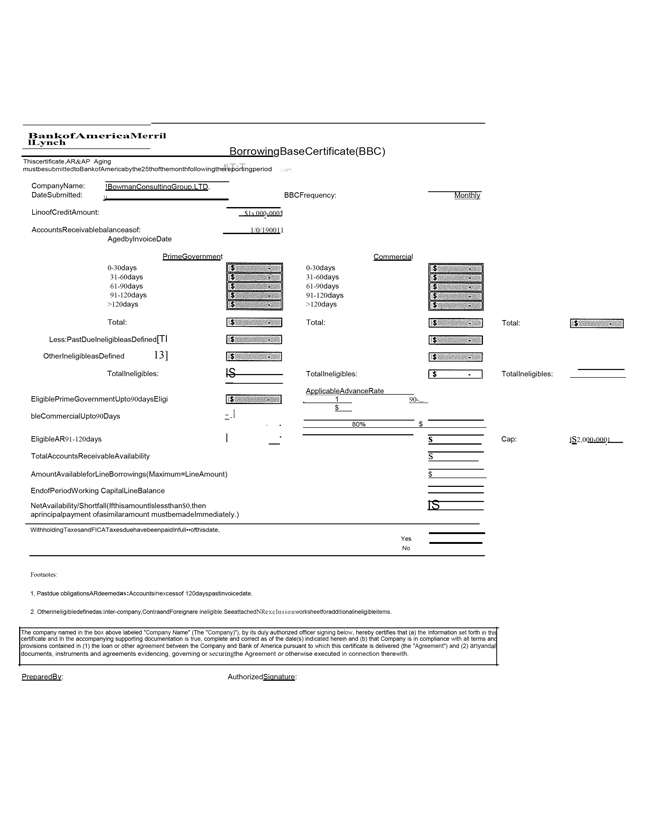

2.4 Borrowing Base Certificate. Exhibit A-1 to the Credit Agreement is replaced in its entirety with Exhibit A-1 attached hereto.

2.5 Certain Limitations. The following section is added as Section 7.25 immediately after Section 7.24 of the Credit Agreement:

7.25 Certain Limitations. Notwithstanding anything contained herein to the contrary, until such time as Credit Facility No. 2 has been repaid in full only the following covenants and provisions of this Article shall apply to Gary Bowman: Sections 7.20), 7.2(k),7.8, 7.16, 7.18, 7.19, 7.22, and 7.23, provided, however with respect to Section 7.8, Gary Bowman may incur additional secured debt without restriction and additional unsecured debt after September 1, 2019 in an aggregate amount not to exceed $1,500,000.

-4-

3. Representations and Warranties. The Borrower hereby represents and warrants to the Bank that:

3.1. The Borrower is in compliance with all of the terms, covenants and conditions of the Credit Agreement, and all of the terms, covenants and conditions of each of the other Loan Documents to which it is a party.

3.2. There exists no Event of Default and no event has occurred or condition exists which, with the giving of notice or lapse of time, or both, would constitute an Event of Default.

3.3. After giving effect to this Amendment, the representations and warranties contained in the Credit Agreement are, except to the extent that they relate solely to an earlier date, true with the same effect as though such representations and warranties had been made on the date hereof.

3.4. The Borrower has full corporate power and authority to execute and deliver this Amendment, to perform its obligations under the Credit Agreement and to incur the obligations provided for herein and therein, all of which have been duly authorized by all proper and necessary corporate action. No consent or approval of the stockholders of the Borrower which has not been obtained and no consent or approval of, notice to or filing with, any public authority which has not been obtained or made is required as a condition to the validity of this Amendment.

3.5. This Amendment and the Credit Agreement constitutes the valid and legally binding obligations of the Borrower, enforceable in accordance with their respective terms, except as the enforceability hereof or thereof may be limited by bankruptcy, insolvency, or similar laws affecting creditors’ rights generally or by general principles of equity (regardless of whether such enforceability is considered in a proceeding at law or in equity).

3.6. There is no existing mortgage, lease, indenture, contract or other agreement binding on the Borrower or affecting its property, that would conflict with or in any way prevent the execution or delivery of this Amendment or the carrying out of the terms of the Credit Agreement.

3.7. The Borrower is not (1) an employee benefit plan subject to Title I of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), (2) a plan or account subject to Section 4975 of the Internal Revenue Code of 1986 (the “Code”); (3) an entity deemed to hold “plan assets” of any such plans or accounts for purposes of ERISA or the Code: or (4) a “governmental plan” within the meaning of ERISA.

4. Conditions. The effectiveness of this Amendment is subject to the following conditions precedent:

4.1. Amendment. The Borrower and the Bank shall have executed and delivered one or more counterparts of this Amendment.

4.2. Consent and Reaffirmation of Guarantors and Pledgors. The Borrower shall have caused Gary Bowman and Bowman Consulting Group DC PC to have executed and delivered to the Bank the Consent and Reaffirmation of Guarantors and Pledgors attached hereto.

4.3. Payment of Fees. The Borrower shall pay to the Bank the fees and expenses set forth in paragraph 8 of this Amendment.

4.4 Other Conditions. The Bank shall have received any and all other certificates, statements, opinions and other documents required by the terms of this Amendment or otherwise requested by the Bank.

5. No Other Amendments: Reaffirmation: No Novation: No Waiver: Reservation of Rights and Release. Except as expressly amended hereby, the terms of the Credit Agreement shall remain in full force and effect in all respects, and the Borrower hereby reaffirms its obligations under the Credit Agreement and under each of the other Loan Documents to which it is a party. The Borrower acknowledges and agrees that (a) the execution and delivery of this Agreement and consummation of the transactions contemplated

-5-

hereby do not reduce, discharge, release, impair or otherwise limit any of the Borrower’s obligations under the Credit Agreement or any of the other Loan Documents to which it is a party, (b) the Borrower does not have any offset, counterclaim or defense of any kind to its obligations, covenants or agreements under the Credit Agreement or any of the other Loan Documents to which it is a party, (c) nothing contained in this Agreement shall be deemed to constitute a waiver or release by the Bank of any default or Event of Default that may now or hereafter exist under the Credit Agreement or any of the other Loan Documents, or of the Bank’s right to exercise any and all of its rights and remedies thereunder, all of which rights and remedies are hereby reserved by the Bank, and (d) nothing contained in this Agreement shall be construed to constitute a novation with respect to the indebtedness described in the Credit Agreement and the other Loan Documents. The Borrower, for itself and for its successors and assigns, hereby releases and forever discharges the Bank and the Bank’s, respective predecessors, successors, assigns, officers, managers, directors, employees, agents, attorneys, representatives and affiliates (collectively, the “Bank Group”), from any and all presently existing claims, demands, damages, liabilities, actions and/or causes of action of any nature whatsoever, including, without limitation, all claims, demands and causes of action for contribution and indemnity, whether arising at law or in equity, whether known or unknown, whether liability be direct or indirect, liquidated or unliquidated, whether absolute or contingent, foreseen or unforeseen, and whether or not heretofore asserted, which the Borrower may have or claim to have against any of the Bank Group arising out of facts or events in any way related to the Credit Agreement, any of the other Loan Documents, or the transactions contemplated thereby or hereby that exist on the date hereof or arise from facts or actions occurring prior hereto or on the date hereof.

6. Security for Obligations. The Borrower hereby acknowledges and agrees that all indebtedness and other obligations of the Borrower under the Credit Agreement are secured by the collateral described in the Loan Documents.

7. References. All references in the Credit Agreement to “this Agreement,” “herein,” “hereunder” or other words of similar import, and all references to the “Credit Agreement” or similar words in the other Loan Documents, or any other document or instrument that refers to the Credit Agreement, shall be deemed to be references to the Credit Agreement as amended by this Amendment.

8. Fees and Expenses. In consideration of Bank’s agreement to amend the terms of the Credit Agreement, the Borrower agrees to pay the Bank a nonrefundable fee in the amount of (i) $37,500 with respect to Facility No. 1, and (ii) $2,500 with respect to Facility No. 4. In addition, the Borrower hereby agrees that it will pay all reasonable out-of-pocket expenses incurred by the Bank in connection with the preparation of this Amendment and the consummation of the transactions described herein, including, without limitation, the reasonable attorneys’ fees and expenses of the Bank.

9. Applicable Law. This Amendment shall be construed in accordance with and governed by the laws of the Commonwealth of Virginia, without reference to conflicts of law principles.

10. Counterparts: Electronic Delivery. This Amendment may be executed in any number of counterparts, each of which shall be an original, but all of which taken together shall constitute one and the same instrument. Delivery by any party to this Amendment of its signatures hereon through facsimile or other electronic image file (including .pdf) (i) may be relied upon as if this Amendment were physically delivered with an original hand-written signature of such party, and (ii) shall be binding on such party for all purposes.

11. Successors. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

12. FINAL AGREEMENT. BY SIGNING THIS AMENDMENT, EACH PARTY REPRESENTS AND AGREES THAT: (A) THIS AMENDMENT REPRESENTS THE FINAL AGREEMENT BETWEEN OR AMONG THE PARTIES WITH RESPECT TO THE SUBJECT MATTER HEREOF, (B) THIS AMENDMENT SUPERSEDES ANY COMMITMENT LETTER, TERM SHEET OR OTHER WRITTEN OUTLINE OF TERMS AND CONDITIONS RELATING TO THE SUBJECT MATTER HEREOF, UNLESS SUCH COMMITMENT LETTER, TERM SHEET OR OTHER WRITTEN OUTLINE OF TERMS AND CONDITIONS

-6-

EXPRESSLY PROVIDES TO THE CONTRARY, (C) THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN OR AMONG THE PARTIES, AND (D) THIS AMENDMENT MAY NOT BE CONTRADICTED BY EVIDENCE OF ANY PRIOR, CONTEMPORANEOUS , OR SUBSEQUENT ORAL AGREEMENTS OR UNDERSTANDINGS OF THE PARTIES.

[Signatures begin on following page]

-7-

IN WITNESS WHEREOF, the Borrower and the Bank have caused this Amendment to be duly executed under seal, all as of the day and year first above written.

| BOWMAN CONSULTING GROUP, LTD., | ||

| A Virginia Corporation | ||

| /S/ | (Seal) | |

| Gary Bowman President | ||

| /S/ | ||

| Michael Bruen (Seal) | ||

| Vice-President and Assistant Secretary | ||

[Signatures continue on following page]

| BANK OF AMERICA, N.A., a national banking association | ||

| By: | /S/ (Seal) | |

| Name: |

| |

| Title: |

| |

2

CONSENT AND REAFFIRMATION OF GUARANTORS AND PLEDGORS

Capitalized terms used herein shall have the meanings specified in the foregoing Amendment. Each of the undersigned (each, a “Credit Support Provider”) is a guarantor of, and/or is a grantor or pledgor of collateral for, the Borrower’s obligations to the Bank under Facility No. 1 or Facility No. 2 of the Credit Agreement, as the case may be. Each Credit Support Provider hereby consents and agrees to the terms of the Amendment, and, without limiting the generality of the terms of its guaranty and/or any agreement under which it has granted to the Bank a lien or security interest in any of its real or personal property (collectively, the “Credit Support Provider Documents”), acknowledges and agrees that (i) the Credit Support Provider Documents cover and apply to the Borrower’s obligations with respect to Facility No. 1 or Facility No. 2, as the case may be, under the Credit Agreement as amended and increased by the Amendment, (ii) each reference in the Credit Support Provider Documents to the Credit Agreement shall be deemed to be a reference to the Credit Agreement as amended by the Amendment, (iii) the Amendment does not release, impair or otherwise limit any of such Credit Support Provider’s obligations under the Credit Support Provider Documents, (iv) such Credit Support Provider does not have any offset, counterclaim or defense of any kind to its obligations, covenants or agreements under the Credit Support Provider Documents, all of which obligations, covenants and agreements are hereby expressly reaffirmed, and (v) the Credit Support Provider Documents remain in full force and effect in all respects.

Each Credit Support Provider, for itself and for its heirs, personal representatives, successors and assigns, hereby releases and forever discharges the Bank and the Bank’s, respective predecessors, successors, assigns, officers, managers, directors, employees, agents, attorneys, representatives and affiliates (collectively, the “Bank Group”), from any and all presently existing claims, demands, damages, liabilities, actions and/or causes of action of any nature whatsoever, including, without limitation, all claims, demands and causes of action for contribution and indemnity, whether arising at law or in equity, whether known or unknown, whether liability be direct or indirect, liquidated or unliquidated, whether absolute or contingent, foreseen or unforeseen, and whether or not heretofore asserted, which such Credit Support Provider may have or claim to have against any of the Bank Group arising out of facts or events in any way related to the Credit Support Provider Documents, the Credit Agreement or the transactions contemplated thereby that exist on the date hereof or arise from facts or actions occurring prior hereto or on the date hereof.

Although each Credit Support Provider has been informed of the terms of the Amendment, it understands and agrees that the Bank has no duty to so notify it or any other guarantor now or in the future, or to seek this or any future acknowledgment , consent or reaffirmation, and nothing contained herein shall create or imply any such duty as to any transactions, past or future.

Each Credit Support Provider represents and warrants to the Bank that it is not (1) an employee benefit plan subject to Title I of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), (2) a plan or account subject to Section 4975 of the Internal Revenue Code of 1986 (the “Code”); (3) an entity deemed to hold “plan assets’’ of any such plans or accounts for purposes of ERISA or the Code; or (4) a “governmental plan” within the meaning of ERISA.

Each Credit Support Provider has caused this Consent of Credit Support Providers to be duly executed under seal, all as of the day and year first written in the foregoing Amendment.

| Bowman Consulting Group DC PC, a District of Columbia professional corporation | ||

| (SEAL) | ||

| By: | /S/ | |

| Gary Bowman individually | ||

[Consent and Reaffirmation of Guarantors and Pledgors]

SCHEDULE B

| Date | Amount of Loan or Advance | Current Unpaid Balance | Description of Evidence of Loan | |||||

| 8/1/19 |

various | $ | 1,368,651.36 | Promissory Note due from Gary Bowman | ||||

| 4/30/19 |

$ | 4,852,027.00 | Restated Assignment, Assumption and Amendment of Promissory Note (Gary Bowman) | |||||

| 8/1/19 |

various | $ | 419,58 4.34 | Promissory Note due from Bruce Labovitz | ||||

| 9/12/13 |

$ | 70,7 08.89 | Promissory Note due from Clifton Dayton | |||||

[Consent and Reaffirmation of Guarantors and Pledgors]

| Bank of America | BOWMAN CONSULTING GROUP, LTD

BORROWING BASE CERTIFICATE |

Bank Merrill of Lynch America Borrowing Base Certificate (BBC) This certificate, AR & AP Aging must be submitted to Bank of America by the 25th of the month following the reporting period - t \ T:T :, Company Name: !Bowman Consulting Group, LTD. Date Submitted: 11 BBC Frequency: Monthly Lino of Credit Amount: $1 s,000 1000 1 Accounts Receivable balance as of: 1/0/190011 Aged by Invoice Date Prime Government Commercial 0-30 days 0-30 days 31-60 days 31-60 days 61-90 days 61-90 days 91-120 days 91-120 days >120 days >120 days Total: Total: Total: Less: Past Due Ineligible as Defined [TI Other Ineligible as Defined 13] Total Ineligibles: IS Total Ineligibles: Total Ineligibles: Applicable Advance Rate Eligible Prime Government Up to 90 days 1 90-,,. $ Eligible Commercial Up to 90 Days — . 1 80% $ Eligible AR 91-120 days I s Cap: I s 2,0001000 1 Total Accounts Receivable Availability s Amount Available for Line Borrowings (Maximum= Line Amount) $ End of Period Working Capital Line Balance Net Availability/Shortfall (If this amount ls less than $0, then IS a principal payment of a similar amount must be made Immediately.) Withholding Taxes and FICA Taxes due have been paid In full •• of this date, Yes No Footnotes: 1, Past due obligations AR deemed as: Accounts in excess of 120 days past invoice date. 2. Other ineligible defined as: inter-company, Contra and Foreign are ineligible. See attached NR exc lus io n worksheet for additional ineligible items. The company named in the box above labeled “Company Name” (The “Company)”), by its duly authorized officer signing below, hereby certifies that (a) the Information set forth in this certificate and In the accompanying supporting documentation is true, complete and correct as of the dale(s) indicated herein and (b) that Company is in compliance with all terms and provisions contained in (1) the loan or other agreement between the Company and Bank of America pursuant to which this certificate is delivered (the “Agreement”) and (2) any and all documents, instruments and agreements evidencing, governing or securing the Agreement or otherwise executed in connection therewith. Prepared By: Authorized Signature:

Amounts will flow from date entered to “Inellgible AR Worksheet”