Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

AMENDMENT NO. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

YCQH Agricultural Technology Co. Ltd

(Exact name of registrant as specified in its charter)

Date: April 1, 2021

| Nevada | 2870 | 61-1948707 |

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) | (IRS Employer Identification No.)

|

No. 1408, North District, Libao Building, Kehua North Road No. 62,

Wuhou District, Chengdu, Sichuan Province, China 610042.

Issuer's telephone number: (+86) 13981161812

Company email: ycqhagri@gmail.com

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal mailing address)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |_| | Accelerated filer |_| |

| Non-accelerated filer |X| | Smaller reporting company |X| |

| Emerging growth company |X| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. |_|

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share(1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee (2) |

Common Stock, $0.0001 par value |

29,000,000 | $0.01 | 290,000 | 31.64 |

| (1) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

SUBJECT TO COMPLETION, DATED April 1, 2021

PRELIMINARY PROSPECTUS

YCQH Agricultural Technology Co. Ltd

29,000,000 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

Prior to this Offering, no public market has existed for the common stock of YCQH Agricultural Technology Co. Ltd. Upon completion of this Offering, we will attempt to have the shares quoted on the OTCQB operated by OTC Markets Group, Inc. There is no assurance that the Shares will ever be quoted on the OTCQB. Although we believe that in the future we will meet the eligibility requirements in order to be quoted on the OTCQB, we cannot quantify the likelihood that this will be the case. To be quoted on the OTCQB, a market maker must apply to make a market in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares. Additionally, there is the possibility a market maker may not apply to make a market in our common stock.

In this public offering we, “YCQH Agricultural Technology Co. Ltd” are offering 20,000,000 shares of our common stock and our selling shareholders are offering 9,000,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. The offering is being made on a self-underwritten, “best efforts” basis. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our Chief Executive Officer, Ms. Wang Min, who is deemed to be an underwriter of this offering. The selling shareholders are also deemed to be underwriters of this offering. There is uncertainty that we will be able to sell any of the 20,000,000 shares being offered herein by the Company. Ms. Wang will not receive any commissions or proceeds for selling the shares on our behalf. All of the shares being registered for sale by the Company will be sold at a fixed price of $0.01 per share for the duration of the Offering. Additionally, all of the shares offered by the selling shareholders will be sold at a fixed price of $0.01 for the duration of the Offering. Assuming all of the 20,000,000 shares being offered by the Company are sold, the Company will receive $200,000 in net proceeds. Assuming 15,000,000 shares (75%) being offered by the Company are sold, the Company will receive $150,000 in net proceeds. Assuming 10,000,000 shares (50%) being offered by the Company are sold, the Company will receive $100,000 in net proceeds. Assuming 5,000,000 shares (25%) being offered by the Company are sold, the Company will receive $50,000 in net proceeds. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our Company's business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

YCQH Agricultural Technology Co. Ltd primarily operates, via its subsidiaries, in the bio-carbon-based fertilizer business (herein referred as “BCBF”). This includes the wholesale and retail of fertilizers for consumer use. The Company sources its product from a sole producer in the Peoples Republic of China (herein referred as “China”) and resells its products to customers who also predominantly reside in China.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus, unless extended by our director for an additional 90 days. We may however, at any time and for any reason terminate the offering.

Our Chief Executive Officer, Wang Min, will be selling shares of common stock on behalf of the Company simultaneously to selling shares of common stock in the Company from her own personal account. A conflict of interest may arise between Ms. Wang’s interest in selling shares for her own personal account, and in selling shares on the Company’s behalf.

Regarding the sale of Ms. Wang Min’s shares, such shares will be sold at a fixed price of $0.01 for the duration of the offering.

The Company estimates the costs of this offering at about $40,000. All expenses incurred in this offering are being paid for by the Company. The Company will utilize offering proceeds from this offering to pay for any offering expenses however, the Company may also elect to use available existing cash on hand to pay for any offering expenses.

For the duration of the offering any and all sellers of the shares being registered herein agree to provide this prospectus to potential investors in its entirety.

The proceeds from the sale of the securities sold on behalf of the Company will be placed directly into the Company’s account and or the account of one of its subsidiaries; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the prospectus. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Through April 30, 2022 all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this prospectus is ___________________.

In this Prospectus, ''YCQH Agricultural Technology,'' “YCQH” the "Company,'' ''we,'' ''us,'' and ''our,'' refer to YCQH Agricultural Technology Co. Ltd, unless the context otherwise requires. Unless otherwise indicated, the term ''fiscal year'' refers to our fiscal year ending December 31st. Unless otherwise indicated, the term ''common stock'' refers to shares of the Company's common stock.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 4, and the financial statements, before making an investment decision.

The Company

YCQH Agricultural Technology Co. Ltd, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on October 15, 2019.

On October 15, 2019, Ms. Wang Min was appointed as President, Secretary, Treasurer, Chief Executive Officer, and Director.

On October 15, 2019, the Company issued 100,000 shares of restricted common stock, with a par value of $0.0001 per share, to Ms. Wang Min in consideration of $10. The $10 in proceeds went to the Company to be used as working capital. Ms. Wang Min serves as our Chief Executive Officer, President, Secretary, Treasurer and Director.

On November 28, 2019, the Company issued 49,900,000 shares of restricted common stock, with a par value of $0.0001 per share, to Ms. Wang Min in consideration of $4,990. The $4,990 in proceeds went to the Company to be used as working capital.

On January 1, 2020 the Company issued 40,000,000 shares of restricted common stock to a total of ten foreign shareholders, with each having purchased 4,000,000 shares of common stock at a purchase price of $0.001 per share. The $40,000 in proceeds went to the Company to be used as working capital. In regards to all of the above transactions we claim an exemption from registration afforded by Section 4a(2) and/or Regulation S of the Securities Act of 1933, as amended ("Regulation S") due to the fact that all sales of stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On December 16, 2019, the Company, acquired 100% of YCQH Holding Limited, herein referred as “YCQH Seychelles,” a company incorporated in the Republic of Seychelles, from Ms. Wang Min in consideration of $1. That same day YCQH Seychelles acquired YCQH Agricultural Technology Co. Limited, a company incorporated in Hong Kong, herein referred as the “YCQH HK,” from Ms. Wang Min in consideration of HKD100 (equivalent to approximately $13 as of the date of this Registration Statement).

On December 10, 2019, YCQH HK incorporated YCWB Agricultural Technology Co. Limited, a wholly owned foreign enterprise, in Sichuan Province, China, herein referred as “YCWB,” with Ms. Wang Min as the legal representative.

On June 15, 2020 , YCWB acquired SCQC Agricultural Co. Limited., herein referred as “SCQC,” a company incorporated in Sichuan Province, China. YCWB acquired SCQC Agricultural Co. Limited from Mr. Luo Xu in consideration of CNY1,169,996 (equivalent to about $165,605 as of the date of acquisition ).

-

The following diagram details the Company’s corporate structure:

The Company and all its subsidiaries share the same address and maintain physical office space at No. 1408, North District, Libao Building, Kehua North Road No. 62, Wuhou District, Chengdu, Sichuan Province, China 610042. SCQC entered into tenancy agreement with a third party landlord to rent the aforementioned physical office space on November 11, 2020 with an effective period of two years commencing on November 23, 2020 and extending to November 22, 2022 at CNY 9,200 per month, payable on quarterly basis.

Prior to the aforementioned tenancy agreement, the Company and all its subsidiaries shared the same address and maintained physical office space at Building B, Floor 20, Chengdu International Technology Energy Saving Mansion, No. 89 Cuihua Rd, Chengdu Hi-Tech Zone, Chengdu, Sichuan Province, China. Our office space at this location was provided to us rent free by our Chief Executive Officer, Ms. Wang Min.

YCQH Agricultural Technology Co. Ltd primarily operates, via its subsidiaries, in the bio-carbon-based fertilizer business (herein referred as “BCBF”). This includes the wholesale and retail of fertilizers for consumer use. The Company sources its product from a sole producer in the Peoples Republic of China (herein referred as “China”) and resells its products to customers who also predominantly reside in China.

- 1 -

Our Offering

We have authorized capital stock consisting of 800,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 200,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). We have 90,000,000 shares of Common Stock and no shares of Preferred Stock issued and outstanding. Through this offering we will register a total of 29,000,000 shares. These shares represent 20,000,000 additional shares of common stock to be issued by us and 9,000,000 shares of common stock by our selling stockholders. We may endeavor to sell all 20,000,000 shares of common stock after this registration becomes effective. Upon effectiveness of this Registration Statement, the selling stockholders may also sell their own shares. The price at which we, the company, offer these shares is at a fixed price of $0.01 per share for the duration of the offering. The selling stockholders will also sell shares at a fixed price of $0.01 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of our common stock but we will not receive any proceeds from the selling stockholders.

Our Chief Executive Officer, Wang Min, will be selling shares of common stock on behalf of the Company simultaneously to selling shares of common stock in the Company from her own personal accounts. A conflict of interest may arise between Ms. Wang’s interest in selling shares for her own personal accounts, and in selling shares on the Company’s behalf. Please note that at this time Ms. Wang Min intends to sell the Company’s shares prior to selling her own shares, although she is under no obligation to do so. Ms. Wang Min will decide whether shares are being sold by the Company or by Ms. Wang Min herself.

Regarding the sale of Wang Min’s shares, such shares will be sold at a fixed price of $0.01 for the duration of the offering.

*The primary offering on behalf of the Company is separate from the secondary offering of the selling stockholders in that the proceeds from the shares of stock sold by the selling stockholders will go directly to them, not the Company. The same idea applies if the Company approaches or is approached by investors who then subsequently decide to invest with the Company. Those proceeds would then go to the Company. Whomever the investors decide to purchase the shares from will be the beneficiary of the proceeds. None of the proceeds from the selling stockholder’s will be utilized or given to the Company. Ms. Wang will clarify for investors at the time of purchase whether the proceeds are going to the Company or directly to herself.

*We will notify investors by filling a post-effective amendment to our registration statement that will be available for public viewing on the SEC Edgar Database of any such extension of the offering.

| Securities being offered by the Company | 20,000,000 shares of common stock, at a fixed price of $0.01 offered by us in a direct offering. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

| |

| Securities being offered by the Selling Stockholders | 9,000,000 shares of common stock, at a fixed price of $0.01 offered by selling stockholders in a resale offering. As previously mentioned this fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. | |

| Offering price per share | We and the selling shareholders will sell the shares at a fixed price per share of $0.01 for the duration of this Offering. | |

| Number of shares of common stock outstanding before the offering of common stock | 90,000,000 common shares are currently issued and outstanding. | |

| Number of shares of common stock outstanding after the offering of common stock | 110,000,000 common shares will be issued and outstanding if we sell all of the shares we are offering. | |

| The

minimum number of shares to be sold in this offering |

None. | |

| Market for the common shares | There is no public market for the common shares. The price per share is $0.01. | |

| We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop. | ||

| The offering price for the shares will remain at $0.01 per share for the duration of the offering. | ||

- 2 -

| Use of Proceeds | We intend to use the gross proceeds from this offering to us to fund operating expenses, cover any compliance and reporting expenses that may be incurred, payment for offering expenses, advertising costs, and other related expenditures. Funds may be allocated in differing quantities should the Company decide at a later date it would be in the Company’s best interests. |

| Termination of the Offering | This offering will terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 29,000,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. |

| Terms of the Offering | Our Chief Executive Officer will sell the 20,000,000 shares of common stock on behalf of the company, upon effectiveness of this registration statement, on a BEST EFFORTS basis. |

| Subscriptions: | All subscriptions once accepted by us are irrevocable.

|

| Registration Costs | We estimate our total offering registration costs to be approximately $40,000.

|

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

- 3 -

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Company and Our Industry

Our business operations may be materially and adversely affected by the outbreak of the Coronavirus (“COVID-19”).

An outbreak of respiratory illness caused by the novel coronavirus, commonly referred as “COVID-19” emerged in late 2019 and has spread globally. The COVID-19 is considered to be highly contagious and poses a serious public health threat. The World Health Organization labeled the COVID-19 outbreak as a pandemic on March 11, 2020, given its threat beyond a public health emergency of international concern the organization had declared on January 30, 2020.

The epidemic has resulted in social-distancing restrictions, travel restrictions, and the temporary closure of stores and facilities during the past few months. The negative impacts of the COVID-19 outbreak on our business may include, but not strictly be limited to:

| - | The uncertain economic conditions may refrain clients from engaging our services. |

| - | The operations of businesses in most industries have been, and could continue to be, negatively impacted by the epidemic, which may in turn adversely impact their business performance. |

We are unable to accurately predict the impact that the COVID-19 will have due to various uncertainties, including the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak globally, and effectiveness of the actions that may be taken by governmental authorities. Additionally, it is possible that we may face similar difficulties from future events, such as this, should there be at any point another global pandemic. As of the current date, we do not believe that we have been directly impacted by Covid-19. However, economies throughout the world have been impacted significantly in a vast number of ways, and we cannot state with any level of certainty to what extent we may have been indirectly impacted by market conditions as a result of the pandemic and/or if the pandemic has forestalled, in any capacity, our growth to date.

The industry in which we operate is highly fragmented and competitive and we face competition from numerous fertilizer manufacturers, retailers and wholesalers in China and elsewhere.

We compete with numerous local Chinese fertilizer manufacturers and distributors. It is certain that some of these competitors have better access in certain local markets, an enhanced ability to customize products to certain regions and complete established local distribution channels. Although we are confident about the advantages of the products that we offer, there are a number of manufacturers already manufacturing similar products in large scale and we cannot provide any assurances that there will not be new market entrants with similar products in the future. Furthermore, China’s access to the World Trade Organization has led to increased foreign competition; international producers and traders import products into China that generally are of higher quality than those produced by the local Chinese manufacturers. If they are localized and become familiar with the fertilizers we acquire from our supplier, we may face additional competition. If we are not successful in our marketing and advertising, diversifying our distribution channel, improving awareness of our brand, our revenue growth may be limited.

Our competitors, due to their greater size and resources, are more capable of withstanding downturns in our industry. In addition, due to the low barrier of entry of our industry, it is likely that in the future more competitors will emerge and competition will likely be intensified.

Our concentration of customers could have a material adverse effect on our operations.

The Company began generating revenue in June 2020. For the year ended December 31, 2020 , the Company generated revenue of $68,264 from four different customers. As such, the Company has a significant dependency on these four customers. However, as the Company continues to operate, the Company expects to generate more revenue from other customers thereby diluting dependency on these four different customers.

Disruptions in the supply of products could result in failure to meet customer demand in a timely manner, which could result in the loss of customers.

The Company relies on a single supplier to source a single type of product on an independent contractual basis. If the Supplier decided not to extend the supply contract for any reason, or if there are any business interruptions at the supplier’s end, which impact the quality of BCBF, or timely delivery, and we are unable to locate an alternative supplier in a timely manner, or under similar terms, we may not be able to meet customer demand. This may result in the loss of customers and adversely impact our revenue and profit.

If we are unable to adapt to changes in market demand, our business will be adversely affected.

We must source new products to adapt to market demand and to maintain or increase our sales. The success of new products may depend on a number of factors including anticipating and effectively addressing user preferences and demand, the success of our sales and marketing efforts, timely and successful product sourcing, effective forecasting and management of product demand. The risk of not meeting our customers’ preferences and or demands may result in lower sales revenue, adversely affecting our business.

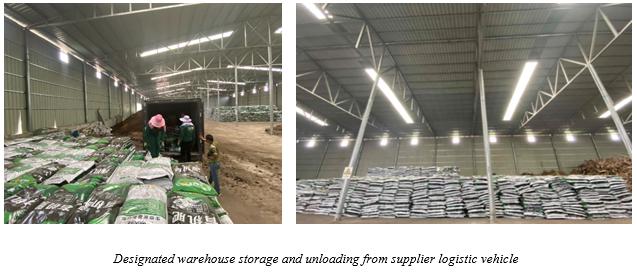

Any significant fluctuation in our operating costs may have a material adverse effect on our operating results.

The Company relies on an external warehousing provider to store our products, and a logistic company to ship our products to customers. These operating costs may fluctuate from time to time depending on general economic conditions. If these costs increase significantly and we are unable to pass these costs on to our customers, we could incur significant losses.

The occurrence of any acts of God, war, terrorist attacks and other emergencies which are beyond our control may have a material adverse effect on our business operations and financial condition.

Acts of God, war, terrorist attacks and other emergencies which are beyond our control may have a material adverse effect on the economy and infrastructure in the PRC and on the livelihood of the Chinese population. Our business operations and financial condition may be materially and adversely affected should such events occur. We cannot give assurance that any acts of God such as floods, earthquakes, drought or any war, terrorist attack or other hostilities in any part of the PRC or even the world, potential or threatened, will not, directly or indirectly, have a material adverse effect on our business, financial condition and operating results.

The economy of PRC in general might not grow as quickly as expected, which could adversely affect our revenues and business prospects.

Our business and prospects depend on the continuing development of the economy in PRC. We cannot assure you that the PRC economy will continue to grow at the same pace as in the past. Economic growth is determined by countless factors, and it is extremely difficult to predict with any level of absolute certainty. In the event that the PRC economy suffers, demand for our products may diminish, which would in turn result in our profitability. This could in turn result in a substantial need for restructuring of our business objectives and could result in a partial or entire loss of an investment in our Company.

Our failure to comply with anti-corruption laws and regulations, or effectively manage our employees, customers and business partners, could severely damage our reputation, and materially and adversely affect our business, financial condition, results of operations and prospects.

We are subject to risks in relation to actions taken by us, our employees, third-party customers or business partners that constitute violations of the anti-corruption laws and regulations. If we, our employees, third-party customers or business partners violate these laws, rules or regulations, we could be subject to fines and/or other penalties. Actions by PRC regulatory authorities or the courts to provide an alternative interpretation of the laws and regulations or to adopt additional anti-bribery or anti-corruption related regulations could also require us to make changes to our operations. Our reputation, corporate image, and business operations may be materially and adversely affected if we fail to comply with these measures or become the target of any negative publicity as a result of actions taken by us, our employees, third-party customers or business partners.

We, and our supplier, are subject to laws and regulations that could require us to modify our current business practices and incur increased costs, which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to numerous laws and regulations, including labor, employment and taxation laws to which the industry participants are typically subject to. If we fail to comply with those regulations, we would be subject to significant penalties or claims, which would harm our business operations. In addition, the adoption of new regulations or changes in the interpretations of existing regulations may result in significant compliance costs or discontinuation of product sales and may impair the marketability of products we may offer, resulting in significant loss of net sales. Our failure to comply with regulations may result in enforcement actions and imposition of penalties or otherwise harm the distribution and sale of products we may offer for sale. The occurrence of any of the foregoing will have a material adverse effect on our business, financial condition, and results of operations.

Compliance with public disclosure will result in additional expenses.

In compliance with Securities Exchange Act 1934, reporting obligations will increase the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to these compliance activities.

We have limited insurance coverage, which could expose us to significant costs and business disruption.

We cannot provide assurances that our current insurance policies are sufficient to cover all of the risks associated with our operations. Any business disruption, litigation or natural disaster may place a strain on management resources, affect our reputation or require us to spend a significant sum of money on legal costs. There is no assurance that the insurance policies we maintain are sufficient or that we will be able to successfully claim our losses under our current insurance policies on a timely basis, or at all. If we incur any loss that is not covered by our insurance policies, or the insured amount is significantly less than our actual loss, our business, financial condition and results of operations could be materially and adversely affected.

- 4 -

The Company’s ability to expand its operations will depend upon the company’s ability to raise significant additional financing as well as to generate continuous income stream.

Developing our business may require significant capital in the future. To meet our capital needs, we expect to rely on our cash flow from operations and, potentially, third-party financing. Third-party financing may not, however, be available on terms favorable to us, or at all. Our ability to obtain additional funding will be subject to various factors, including market conditions, our operating performance, lender sentiment and our ability to incur additional debt. These factors may make the timing, amount, terms and conditions of additional financings unattractive. Our inability to raise capital could lead to a slowdown in our anticipated growth.

Adverse developments in our existing areas of operation could adversely impact our results of operations, cash flows and financial condition.

Our operations are focused on utilizing our sales efforts which are principally located in the PRC. As a result, our results of operations, cash flows and financial condition depend upon the demand for our products in the PRC. Due to the lack of broad diversification in industry type and geographic location, adverse developments in our current segment of the midstream industry, or our existing areas of operation, could have a significantly greater impact on our results of operations, cash flows and financial condition than if our operations were more diversified.

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

| ● | General economic conditions; | |

| ● | The demand for products under our brand name; | |

| ● | Our ability to retain, grow our business and attract new customers; | |

| ● | Administrative costs; | |

| ● | Advertising and other marketing costs; and |

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. Investors relying upon this misinformation may make an uninformed investment decision. If we could not provide reliable financial reports, our business and operating results could be harmed, investors could lose confidence in our reported financial information. This could result in the trading price of our common stock to drop significantly and result in a loss of some or all of your investment.

We may be adversely affected by the performance of external service providers.

The Company relies on an external service provider to carry out storage and logistic service to our customers. If any such external service provider fails to provide satisfactory storage and logistics services at the level of quality or within the timeframe required by us or our customers then our material results could suffer. We generally require our service provider to fully reimburse us for any losses arising from storage failure or delay in delivery or non-delivery, our results of operation and financial condition may be adversely affected if any of the losses are not borne by them. If the performance of any service provider is not satisfactory, we may need to utilize other delivery methods or take other remedial actions, which could adversely affect the cost structure and delivery schedule of our products and services and thus have a negative impact on our reputation, financial position and business operations. In addition, as we expand our business into other geographical locations, we may utilize alternative service providers to carry out logistic services and there may be a shortage of third party services that meet our quality standards and other selection criteria in such locations and, as a result, we may not be able to engage a sufficient number of service providers in a timely manner, which may adversely affect our storage arrangement, delivery schedules and storage and delivery costs and hence our business, results of operations and financial conditions.

Our success depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lose their services.

Our future success heavily depends upon the continued services of our senior executives and other key employees. If one or more of our senior management personnel or key employees are unable or unwilling to continue in their present positions, it could disrupt our business operations, and we may not be able to replace them easily or at all. In addition, competition for senior management personnel and key employees in our industry is intense, and we may be unable to retain our senior management personnel and key personnel or attract and retain new senior management personnel and key employees in the future, in which case our business may be severely disrupted.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An “emerging growth company” can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to follow the extended transition period, and as a result, we will delay adoption of certain new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies.

Our Officer and Director lacks experience in the reporting and disclosure obligations of publicly-traded companies.

The lack of reporting and disclosure experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. This includes the fact that our sole officer and director lacks experience in US GAAP requirements. As a result of this lack of familiarity, we rely on an internal accountant, our PCAOB auditor, and/or additional third parties on a need be basis, in order to comply with reporting requirements and/or US GAAP. Consequently, our operations, future earnings and ultimate financial success could suffer irreparable harm due to our Officer’s and Director’s ultimate lack of experience in our industry and with publicly-traded companies and their reporting requirements in general.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. Investors relying upon this misinformation may make an uninformed investment decision. If we could not provide reliable financial reports, our business and operating results could be harmed, investors could lose confidence in our reported financial information. This could result in the trading price of our common stock to drop significantly and result in a loss of some or all of your investment.

If we fail to maintain a quality service and value, our sales are likely to be negatively affected.

Our success depends on the safety and quality of externally sourced product that we obtain for our clients. Our future customers will identify our brand name with a certain level of quality and value. If we could not meet this perceived value or level of quality, we may be adversely impacted and our operating results may suffer. Additionally, any failure on the part of external supplier to maintain the quality of their products, will in turn substantially harm the results of our business operations, potentially forcing us to identify other external supplier or alter our business strategy significantly.

- 5 -

Risks Related to Doing Business in the PRC

Substantially all our assets and operations are in the PRC, and substantially all our revenue is sourced from the PRC. Accordingly, our results of operations and financial position are subject to a significant degree to economic, political and legal developments in the PRC, including the following risks:

American investors may have difficulty enforcing judgments against our Company and Officer.

We are a Nevada corporation and most of our assets are and will be located outside of the United States. Almost all of our operations will be conducted in the PRC. In addition, our officer and director is a national and resident of a country other than the United States. All of her and the Company’s assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon either party. It may also be difficult to enforce court judgments on the civil liability provisions of the U.S. federal securities laws against our Company and or our officer and director, since she is not a resident in the United States. In addition, there is uncertainty as to whether the courts of Hong Kong or other Asian countries would recognize or enforce judgments of U.S. courts.

Adverse changes in global or the PRC’s economic, political or social conditions or government policies could have a material adverse effect on our business, financial condition and results of operations.

Our revenues are currently sourced from operations within the PRC. Accordingly, our results of operations, financial condition and prospects are influenced by economic, political and legal developments in the PRC. Economic reforms begun in the late 1970s have resulted in significant economic growth. However, any economic reform policies or measures in the PRC may from time to time be modified or revised. The PRC’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past 40 years, growth has been uneven across different regions and among different economic sectors and the rate of growth has been slowing.

The PRC’s economic conditions are sensitive to global economic conditions. The global financial markets have experienced significant disruptions since 2008 and the United States, Europe and other economies have experienced periods of recession. The global macroeconomic environment is facing new challenges and there is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies. Recent international trade disputes, including tariff actions announced by the United States, the PRC and certain other countries, and the uncertainties created by such disputes may cause disruptions in the international flow of goods and services and may adversely affect the Chinese economy as well as global markets and economic conditions. There have also been concerns about the economic effect of the military conflicts and political turmoil or social instability in the Middle East, Europe, Africa and other places. Any severe or prolonged slowdown in the global economy may adversely affect the Chinese economy which in turn may adversely affect our business and operating results.

The PRC government exercises significant control over the PRC’s economic growth through strategically allocating resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Although the PRC economy has grown significantly in the past decade, that growth may not continue, as evidenced by the slowing of the growth of the PRC economy since 2012. Any adverse changes in economic conditions in the PRC, in the policies of the PRC government or in the laws and regulations in the PRC could have a material adverse effect on the overall economic growth of the PRC. Such developments could adversely affect our business and operating results, lead to reduction in demand for our products and adversely affect our competitive position.

Inflation could pose a risk to our business.

Inflation is an important factor that must be considered as we move forward. A change in the rate of inflation could influence the profits that we generate from our business. When the rate of inflation rises, the operational costs of running our company would increase, such as labor costs and inventory costs, affecting our ability to provide our products at competitive prices. An increase in the rate of inflation would force our clients to search for other household appliance providers, causing us to lose business and revenue.

We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

The PRC’s economy is in a transition from a planned economy to a market-oriented economy subject to five-year and annual plans adopted by the central government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, we cannot assure you that this will be the case. A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, we cannot assure you that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC’s political, economic and social environment.

There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations.

Most of our operations are conducted in the PRC, and are governed by PRC laws, rules and regulations. Our PRC subsidiaries are subject to laws, rules and regulations applicable to foreign investment in PRC. The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions may be cited for reference but have limited precedential value.

In 1979, the PRC government began to promulgate a comprehensive system of laws, rules and regulations governing economic matters in general. The overall effect of legislation over the past four decades has significantly enhanced the protections afforded to various forms of foreign investment in PRC. However, PRC has not developed a fully integrated legal system, and recently enacted laws, rules and regulations may not sufficiently cover all aspects of economic activities in PRC or may be subject to significant degree of interpretation by PRC regulatory agencies and courts. In particular, because these laws, rules and regulations are relatively new, and because of the limited number of published decisions and the non-precedential nature of these decisions, and because the laws, rules and regulations often give the relevant regulator significant discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. Therefore, it is possible that our existing operations may be found not to be in full compliance with relevant laws and regulations in the future. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of the violation.

Any administrative and court proceedings in PRC may be protracted, resulting in substantial costs and diversion of resources and management attention. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. These uncertainties may impede our ability to enforce the contracts we have entered into and could materially and adversely affect our business, financial condition and results of operations.

PRC regulations regarding acquisitions impose significant regulatory approval and review requirements, which could make it more difficult for us to pursue growth through acquisitions.

Under the PRC Anti-Monopoly Law, companies undertaking acquisitions relating to businesses in PRC must notify the anti-monopoly enforcement agency, in advance of any transaction where the parties’ revenues in the PRC market exceed certain thresholds and the buyer would obtain control of, or decisive influence over, the other party. In addition, on August 8, 2006, six PRC regulatory agencies, including the MOFCOM, the State-Owned Assets Supervision and Administration Commission, the State Administration of Taxation, the SAIC, the PRC Securities Regulatory Commission, or the CSRC, and the State Administration of Foreign Exchange, or SAFE, jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, which came into effect on September 8, 2006 and was amended on June 22, 2009. Under the M&A Rules, the approval of MOFCOM must be obtained in circumstances where overseas companies established or controlled by PRC enterprises or residents acquire domestic companies affiliated with such PRC enterprises or residents. Applicable PRC laws, rules and regulations also require certain merger and acquisition transactions to be subject to security review.

We may be treated as a resident enterprise for PRC tax purposes under the PRC Enterprise Income Tax Law, and we may therefore be subject to PRC income tax on our global income.

Under the PRC Enterprise Income Tax Law and its implementing rules, both of which came into effect on January 1, 2008, enterprises established under the laws of jurisdictions outside of PRC with “de facto management bodies” located in PRC may be considered PRC tax resident enterprises for tax purposes and may be subject to the PRC enterprise income tax at the rate of 25% on their global income. “De facto management body” refers to a managing body that exercises substantive and overall management and control over the production and business, personnel, accounting books and assets of an enterprise. The State Administration of Taxation issued the Notice Regarding the Determination of Chinese-Controlled Offshore-Incorporated Enterprises as PRC Tax Resident Enterprises on the basis of de facto management bodies, or Circular 82, on April 22, 2009. Circular 82 provides certain specific criteria for determining whether the “de facto management body” of a Chinese-controlled offshore-incorporated enterprise is located in PRC. Although Circular 82 only applies to offshore enterprises controlled by PRC enterprises, not those controlled by foreign enterprises or individuals, the determining criteria set forth in Circular 82 may reflect the State Administration of Taxation’s general position on how the “de facto management body” test should be applied in determining the tax resident status of offshore enterprises, regardless of whether they are controlled by PRC enterprises. If we were to be considered a PRC resident enterprise, we would be subject to PRC enterprise income tax at the rate of 25% on our global income. In such case, our profitability and cash flow may be materially reduced as a result of our global income being taxed under the Enterprise Income Tax Law. We believe that none of our entities outside of PRC is a PRC resident enterprise for PRC tax purposes. However, the tax resident status of an enterprise is subject to determination by the PRC tax authorities and uncertainties remain with respect to the interpretation of the term “de facto management body.”

The disclosures in our reports and other filings with the SEC and our other public pronouncements are not subject to the scrutiny of any regulatory bodies in the PRC.

We are regulated by the SEC and our reports and other filings with the SEC are subject to SEC review in accordance with the rules and regulations promulgated by the SEC under the Securities Act and the Exchange Act. Our SEC reports and other disclosure and public pronouncements are not subject to the review or scrutiny of any PRC regulatory authority. For example, the disclosure in our SEC reports and other filings are not subject to the review by PRC Securities Regulatory Commission, a PRC regulator that is responsible for oversight of the capital markets in PRC. Accordingly, you should review our SEC reports, filings and our other public pronouncements with the understanding that no local regulator has done any review of us, our SEC reports, other filings or any of our other public pronouncements.

Introduction of new laws or changes to existing laws by the PRC government may adversely affect our business.

The PRC legal system is a codified legal system made up of written laws, regulations, circulars, administrative directives and internal guidelines. Unlike common law jurisdictions like the U.S., decided cases (which may be taken as reference) do not form part of the legal structure of the PRC and thus have no binding effect on subsequent cases with similar issues and fact patterns. Furthermore, in line with its transformation from a centrally-planned economy to a more free market-oriented economy, the PRC government is still in the process of developing a comprehensive set of laws and regulations. As the legal system in the PRC is still evolving, laws and regulations or the interpretation of the same may be subject to further changes. For example, the PRC central and municipal governments may impose more stringent environmental regulations which would affect our ability to comply with, or our costs to comply with, such regulations. Such changes, if implemented, may adversely affect our business operations and may reduce our profitability.

Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

The PRC’s economy is in a transition from a planned economy to a market oriented economy, subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on economic conditions in China. Our interests may be adversely affected by changes in policies by the PRC government, including:

| ● | changes in laws, regulations or their interpretation; |

| ● | confiscatory taxation; |

| ● | restrictions on currency conversion, imports or sources of supplies and export tariff; |

| ● | expropriation or nationalization of private enterprises. |

Although the PRC government has been pursuing economic reform policies for more than two decades, we cannot assure you that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting political, economic and social life in China.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on our business.

We and any future subsidiaries are considered foreign persons or foreign funded enterprises under PRC laws, and we are subject to PRC laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance from foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our business.

We derive a substantial portion of our revenues from sales in the PRC and any downturn in the Chinese economy could have an adverse effect on our business and financial condition material.

At this time, substantially all of our operations are conducted in the PRC and all of our revenues at this time are generated from sales in the PRC. We anticipate that revenues from sales of our products in the PRC will continue to represent a substantial proportion of our total revenues. Any significant decline in the condition of the PRC economy could, among other things, adversely affect the consumption of our products, which in turn would have a material adverse effect on our revenues and profitability.

Inflation in the PRC could negatively affect our profitability and growth.

While the PRC economy has experienced rapid growth, it has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products do not rise at a rate that is sufficient to fully absorb inflation-driven increases in our costs of supplies, our profitability can be adversely affected.

According to the International Monetary Fund or IMF, the inflation rate in China fluctuated on an annual basis from a low rate of -1.4% in 1999 to the highest rate of 5.9% in 2008. The inflation rate was 3.0%, 5.2%, and 2.7% in 2016, 2017 and 2018, respectively. These fluctuations and economic factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. To control inflation in the past, the PRC government has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. The implementation of these and other similar policies can impede economic growth and thereby harm the market for our products.

Governmental control of currency conversion may affect the value of our common stock.

The PRC government imposes controls on the convertibility of Renminbi (“RMB”) into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive substantially all our revenues in RMB, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange (“SAFE”) by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where RMB is to be converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

The PRC government also may at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

- 6 -

Ms. Wang Min will be able to sell her shares at any time during the duration of the offering. This may pose a conflict of interest since she is also selling shares on behalf of the company in this offering. It is possible that this conflict of interest could affect the ultimate amount of funds raised by the Company. This could negatively affect your investment.

As previously mentioned Ms. Wang is going to be selling shares on behalf of the Company in this offering. Ms. Wang is also simultaneously having her shares registered for resale. This conflict of interest could divert Ms. Wang’s time and attention in selling shares on behalf of the Company since she will also be able to sell her own shares. Several factors that could result are less monies raised by the company, and less desire to purchase shares by investors to name a few negative consequences. Because of this, your investment could be adversely affected.

The fluctuation of RMB may materially and adversely affect our common stock.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. As we rely entirely on revenues earned in the PRC, any significant revaluation of RMB may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. dollars we receive from an offering of our securities into RMB for our operations, appreciation of the RMB against the U.S. dollar could lead the RMB equivalent of the U.S. dollars be reduced and could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert our RMB into U.S. dollars for making dividend payments on our common stock or for other business purposes and the U.S. dollar appreciates against the RMB, the U.S. dollar equivalent of the RMB we convert would be reduced. In August 2015, China’s currency dropped by a cumulative 4.4% against the U.S. dollar on hopes of boosting the domestic economy, making Chinese exports cheaper and imports into China more expensive by that amount. The effect on trade can be substantial. In addition, the depreciation of significant U.S. dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

PRC regulations relating to the establishment of offshore special purpose companies by PRC domestic residents may subject our PRC resident beneficial owners to personal liability, limit our ability to inject capital into our PRC subsidiaries, limit our subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us.

SAFE promulgated the Circular on Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Offshore Investment and Financing and Roundtrip Investment through Special Purpose Vehicles, or SAFE Circular 37, on July 4, 2014, which replaced the former circular commonly known as “SAFE Circular 75” promulgated by SAFE on October 21, 2005. SAFE Circular 37 (the “SAFE Notice”) requires PRC residents to register with local branches of SAFE regarding their direct establishment or indirect control of an offshore entity, for overseas investment and financing, with such PRC residents’ legally owned assets or equity interests in domestic enterprises or offshore assets or interests, referred to in SAFE Circular 37 as a “special purpose vehicle” (the “SPV”). SAFE Circular 37 further requires amendment to the registration in the event of any significant changes with respect to the special purpose vehicle, such as increase or decrease of capital contributed by PRC individuals, share transfer or exchange, merger, division or other material event. Under the SAFE Notice, failure to comply with the registration procedures set forth above could result in liability under Chinese law for foreign exchange evasion and may result in penalties and legal sanctions, including fines, the imposition of restrictions on a Chinese subsidiary’s foreign exchange activities and its ability to distribute dividends to the SPV, its ability to pay the SPV proceeds from any reduction in capital, share transfer or liquidation in respect of the Chinese subsidiary and the SPV’s ability to contribute additional capital into or provide loans to the Chinese subsidiary. After consultation with China counsel, we do not believe that any of our PRC domestic resident stockholders are subject to the SAFE registration requirement. However, we cannot provide any assurances that all our stockholders who are PRC residents will not be required to make or obtain any applicable registrations or approvals required by these SAFE regulations in the future. The failure or inability of our PRC resident stockholders to comply with the registration procedures set forth therein may subject us to fines and legal sanctions, restrict our cross-border investment activities, or limit our PRC subsidiaries’ ability to distribute dividends or obtain foreign-exchange-dominated loans to our company.

As it is uncertain how the SAFE regulations will be interpreted or implemented, we cannot predict how these regulations will affect our business operations or future strategy. For example, we may be subject to more stringent review and approval process with respect to our foreign exchange activities, such as remittance of dividends and foreign-currency-denominated borrowings, which may adversely affect our results of operations and financial condition. In addition, if we decide to acquire a PRC domestic company, we cannot assure you that we or the owners of such company will be able to obtain the necessary approvals or complete the necessary filings and registrations required by the SAFE regulations. This may restrict our ability to implement our acquisition strategy and could adversely affect our business and prospects.

We may be subject to fines and legal sanctions by SAFE or other PRC government authorities if we or our employees who are PRC citizens fail to comply with PRC regulations relating to employee stock options granted by offshore listed companies to PRC citizens.

On March 28, 2007, SAFE promulgated the Operating Procedures for Foreign Exchange Administration of Domestic Individuals Participating in Employee Stock Ownership Plans and Stock Option Plans of Offshore Listed Companies, or Circular 78. Under Circular 78, Chinese citizens who are granted share options by an offshore listed company are required, through a Chinese agent or Chinese subsidiary of the offshore listed company, to register with SAFE and complete certain other procedures, including applications for foreign exchange purchase quotas and opening special bank accounts. We and our Chinese employees who have been granted share options are subject to Circular 78. Failure to comply with these regulations may subject us or our Chinese employees to fines and legal sanctions imposed by SAFE or other PRC government authorities and may prevent us from further granting options under our share incentive plans to our employees. Such events could adversely affect our business operations.

PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds we received from any offerings to make loans to our PRC subsidiaries or to make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

We are a holding company in the United States conducting our operations in China through our PRC subsidiaries. In utilizing the proceeds, we received from any offerings, we may make loans to our PRC subsidiaries, whether currently in existence or to be formed in the future, or make additional capital contributions to our PRC subsidiaries.