Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Goodness Growth Holdings, Inc. | tm218327d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Goodness Growth Holdings, Inc. | tm218327d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Goodness Growth Holdings, Inc. | tm218327d1_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Goodness Growth Holdings, Inc. | tm218327d1_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Goodness Growth Holdings, Inc. | tm218327d1_ex21-1.htm |

| EX-4.3 - EXHIBIT 4.3 - Goodness Growth Holdings, Inc. | tm218327d1_ex4-3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission file number 000-56225

VIREO HEALTH INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 82-3835655 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

207 South 9th Street Minneapolis, Minnesota |

55402 | |

| (Address of principal executive offices) | (Zip Code) |

(612) 999-1606

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

Subordinate Voting Shares

Multiple Voting Shares

Super Voting Shares

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | x |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the shares of Subordinate Voting Shares, Multiple Voting Shares and Super Voting Shares (based on as converted basis, based on the closing price of these shares on the OTCQX) on June 30, 2020, held by non-affiliates of the registrant was approximately $69,114,651.

As of March 22, 2021, the registrant had the following number of shares of each of its classes of registered securities outstanding: Subordinate Voting Shares – 64,173,402; Multiple Voting Shares – 464,822; and Super Voting Shares – 65,411.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the definitive proxy statement to be filed by the registrant in connection with the 2021 Annual Meeting of Shareholders (the “2021 Management Information Circular and Proxy Statement”). The 2021 Management Information Circular and Proxy Statement will be filed by the registrant with the Securities and Exchange Commission (“SEC”) pursuant to Regulation 14A not later than 120 days after the end of the year ended December 31, 2020.

VIREO HEALTH INTERNATIONAL, INC.

TABLE OF CONTENTS

EXPLANATORY NOTE

Unless the context provides otherwise, references herein to “we,” “us,” “our,” “Company” or “Vireo” refer to Vireo Health International, Inc. together with our wholly owned subsidiaries. References to “Darien Business Development Corp.” or “Darien” refer to the Company prior to completion of the RTO (as hereinafter defined).

Unless otherwise indicated, all references to “$” or “US$” in this report refer to United States dollars, and all references to “C$” refer to Canadian dollars.

Emerging Growth Company Status

As a company with less than $1.07 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”) as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of specified reduced disclosure and other exemptions from requirements that are otherwise applicable to public companies that are not emerging growth companies. These provisions include:

| · | Reduced disclosure about our executive compensation arrangements; | |

| · | Exemptions from non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; | |

| · | Our election under Section 107(b) of the JOBS Act to delay adoption of new or revised accounting standards with different effective dates for public and private companies until those standards would otherwise apply to private companies; and | |

| · | Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission (the “SEC”) or if we issue more than $1.0 billion of non-convertible debt over a three-year period.

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This Form 10-K contains statements that we believe are, or may be considered to be, “forward-looking statements” under U.S. or Canadian securities laws. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on current beliefs, expectations, or assumptions regarding the future of the business, future plans and strategies, operational results, and other future conditions of the Company. All statements other than statements of historical fact included in this report regarding the prospects of our industry or our prospects, plans, financial position, or business strategy may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking words such as “expect,” “plan,” “expected,” “scheduled,” “estimates,” “estimated,” “forecasts,” “continue,” “continued,” “anticipate,” “will,” “expectations,” “cannot,” “could,” “believe,” “focused,” “intention,” “strategic,” “future,” “approach,” “strategy,” “efforts,” “potential,” “potentially,” “possible,” “may,” “intend,” “intended,” “intent,” “should,” “might,” “would,” “achieve,” “allowed to,” “over time,” “likely,” “remain,” “opportunities,” “seeking,” or the negative or plural of these words or similar expressions or variations. Furthermore, forward-looking statements may be included in various filings that we make with the SEC or press releases or oral statements made by or with the approval of one of our authorized executive officers. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections, and other forward-looking statements will not be achieved. We caution readers not to place undue reliance on these statements as many important factors could cause the actual results to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, and intentions expressed in such forward-looking statements. Risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information and statements include, but are not limited to, the risks described in “Risk Factors” in this report.

Readers are cautioned not to place undue reliance on any forward-looking statements contained in this report, which reflect management’s opinions only as of the date hereof. Except as required by law, we undertake no obligation to revise or publicly release the results of any revision to any forward-looking statements. You are advised, however, to consult any additional disclosures we make in our reports to the SEC. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this report.

4

| Item 1. | Business |

Background

Vireo Health International, Inc. is a reporting issuer in Canada, with its securities listed for trading on the Canadian Securities Exchange (the “CSE”) under the symbol “VREO” and on the OTCQX under the symbol “VREOF”. Vireo is a physician-led, science-focused cannabis company focused on building long-term, sustainable value by bringing the best of medicine, science, and engineering to the cannabis industry. With our core operations strategically located in five limited-license medical and adult-use markets, Vireo cultivates and manufactures cannabis products in environmentally friendly greenhouses and other facilities and distributes these products through our growing network of Green Goods™ and other Vireo branded retail dispensaries, as well as third-party dispensaries in the markets in which our subsidiaries hold operating licenses.

As of March 31, 2021, Vireo is licensed in eight states and territories, consisting of Arizona, Maryland, Massachusetts, Minnesota, Nevada, New Mexico, New York, and Puerto Rico. As of March 22, 2021, Vireo retails cannabis products in 16 dispensaries located in Arizona (1), Maryland (1), Minnesota (8), New Mexico (2), and New York (4) and wholesales cannabis products, through third-party companies, in Arizona, Maryland, and New York. We expect to open two additional dispensaries in New Mexico during the second quarter of 2021.

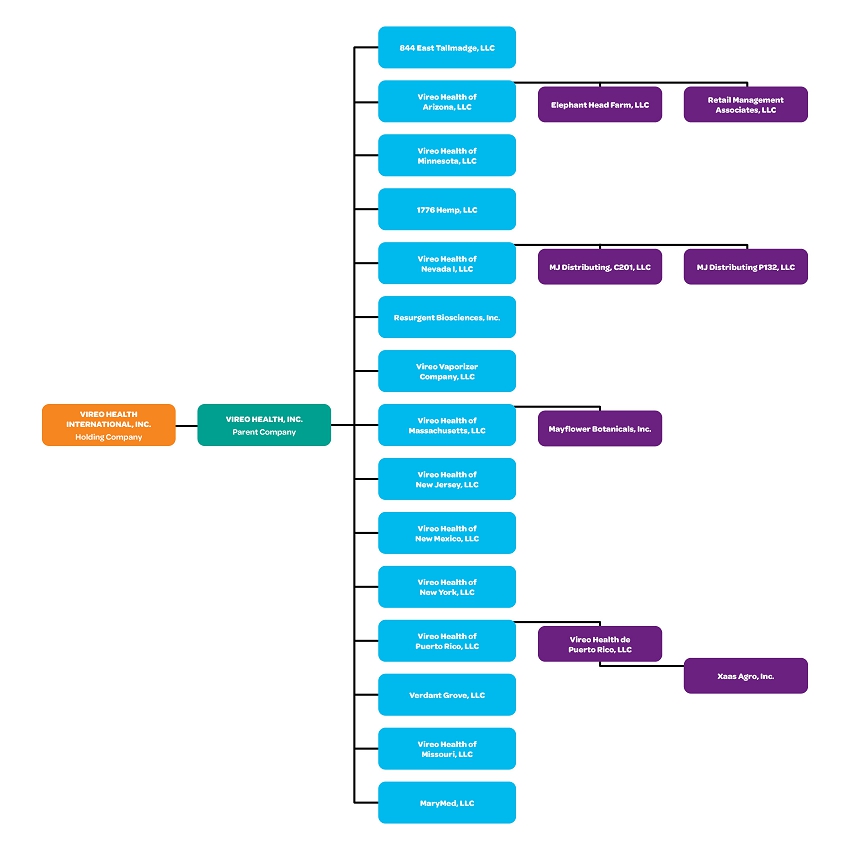

The following chart depicts the organizational structure of the Company as of March 31, 2021.

Vireo’s registered office is located at 1500 Royal Centre, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia V6E 4N7. The head office is located at 207 South Ninth Street, Minneapolis, Minnesota 55402.

History of the Company

Vireo’s business was established in 2014 as Minnesota Medical Solutions, LLC, and we received our first license in December 2014. Darien was incorporated under the Business Corporations Act (Alberta) on November 23, 2004 under the name “Initial Capital Inc.” On May 8, 2007, Darien changed its name to “Digifonica International Inc.” following the completion of a qualifying transaction. On December 9, 2013, Darien continued into British Columbia under the name of “Dominion Energy Inc.” Darien had several name changes before ultimately changing its name to “Darien Business Development Corp.” on March 13, 2017. Vireo Health, Inc. (“Vireo U.S.”) was organized as a limited liability company under Minnesota law on February 4, 2015 and converted to a Delaware corporation on January 1, 2018. Vireo U.S. acquired all the equity of Minnesota Medical Solutions, LLC, and Empire State Health Solutions, LLC, in an equity interest swap transaction on January 1, 2018. On March 18, 2019, Vireo U.S. completed the reverse takeover transaction of Vireo Health International Inc. (formerly Darien Business Development Corp. or “Darien”) (the “RTO”) whereby Darien acquired all the issued and outstanding shares of Vireo U.S. Following the completion of the reverse takeover, the former shareholders of Vireo U.S. acquired control of the Company as they owned a majority of the outstanding shares of the Company upon completion of the RTO. Concurrently with the completion of the RTO, the Company changed our name to “Vireo Health International, Inc.”

General Development of the Business

Other than the developments described below, there have been no material developments in the business since the full description contained in our Registration Statement on Form 10, Amendment No. 2 filed with the SEC on January 20, 2021, which is incorporated by reference herein.

5

Credit Facility

On March 25, 2021, we entered into a Credit Agreement by and among the Company and certain of our subsidiaries (the “Borrowers”), the persons from time-to-time party thereto as guarantors, the lenders party thereto, and Chicago Atlantic Admin, LLC (the “Agent”) as administrative and collateral agent, for a senior secured delayed draw term loan with an aggregate principal amount of up to $46 million (the “Credit Facility”). Green Ivy Capital, LLC served as the lead arranger for the Credit Agreement. The initial term loan was funded at an original issue discount of 3% with Vireo receiving 97% of the $26 million principal amount. Net of fees and closing costs, we received $23.5 million of the first tranche on March 25, 2021. The delayed draw term loans will be funded at a discount rate of up to 3%, to be negotiated by the parties. The proceeds of the initial term loan may be used to pay the transaction fees, costs and expenses incurred directly in connection with the Credit Facility and for any lawful purpose, including general working capital purposes. Obligations under the Credit Agreement are secured by substantially all the assets of the Borrowers. The Credit Agreement and related documents also provide for the payment of certain fees to the Agent, including a closing fee equal to 3% of each loan advanced. The unpaid principal amounts outstanding under the Credit Facility bear interest at a rate of (a) 13.625% per annum payable monthly in cash, and (b) 2.75% per annum, which will be added to the outstanding principal amount on the last day of each month will thereafter be deemed to be part of the principal amount under the Credit Facility. The Credit Facility matures on March 31, 2024.

In connection with the Credit Facility, for each portion of the Credit Facility funded, we issued to the participating lenders warrants representing 20% of the amount drawn and to the Agent warrants representing 10% of the amount drawn, each with a strike price equal to the volume weighted average price of our subordinate voting shares (the “Shares”) for the ten trading days immediately prior to the funding date. On March 25, 2021, in connection with closing the Credit Facility, Vireo issued (a) five year warrants to Agent and each lender to purchase an aggregate of 2,803,984 Shares at an exercise price of CDN$3.50 per Share, and (b) a five year warrant to the broker to purchase 233,665 Shares at an exercise price of CDN$3.50 per Share. Each warrant contains customary anti-dilution provisions.

Sale of Ohio Business

On October 1, 2020, Vireo caused three of our executives to enter into an agreement with a third party to sell Vireo’s affiliated entity Ohio Medical Solutions, Inc. (“OMS”) to the third party for $1.15 million. OMS was directly owned by such executives who directly held a license to operate a processing facility in Ohio. In compliance with Ohio regulatory requirements, in December of 2017, each of the four Vireo executives who then owned OMS jointly executed a $100,000 promissory note to Vireo in exchange for Vireo’s funding of OMS’ capital and operating costs. Since December 2017, additional amounts have been loaned to OMS by Vireo through informal, verbal arrangements. In further compliance with Ohio regulatory requirements, in December of 2017, Vireo entered into an option agreement with the four executives then holding the Ohio license to purchase OMS at a fixed price once the Ohio processing facility had been operational for one year. This option is currently exercisable. Given the various indicia of control over OMS, Vireo has consolidated the operations of OMS for financial statement reporting purposes and treated OMS as a controlled entity of Vireo through which we have conducted our Ohio operations.

On March 31, 2021, the sale of OMS was completed. We received $1.15 million in cash proceeds and were relieved of $3.6 million in right of use liabilities affiliated with lease obligations. We used the cash proceeds to cancel a total of $1.15 million in loans and cash advances made by Vireo to OMS, as well as all amounts incurred as shared services costs by OMS since 2018. The proceeds did not exceed these amounts owed to Vireo. Following the sale of OMS, we have no remaining operations in Ohio.

Description of the Business

Overview of the Company

Vireo is a United States-based multi-state cannabis company with significant operations in our five core markets of Arizona, Maryland, Minnesota, New Mexico, and New York. We are science-focused and dedicated to providing patients and adult-use customers with high quality cannabis-based products. We cultivate cannabis in environmentally friendly greenhouses, manufacture pharmaceutical-grade cannabis extracts, and sell our products at both Company-owned and third-party dispensaries to qualifying patients and adult-use customers. We currently serve thousands of customers each month.

In the November 2020 election, Arizona voters approved adult-use marijuana in Arizona. Our remaining core medical markets of Maryland, Minnesota, New Mexico, and New York all also have the potential to enact adult-use legalization in the next 24 months. The licenses in Massachusetts, Nevada, and Puerto Rico also have potential for commercialization, and we are actively seeking opportunities in Massachusetts and Nevada. Combined with our team’s focus on driving scientific innovation within the industry, improving operational efficiency, and continuing the process of securing meaningful intellectual property complementary to our core business, we believe we are well positioned to become a global market leader in the cannabis industry. As of March 31, 2021, five of our eight markets are operational, with 16 of our total retail dispensary licenses open for business.

6

Our principal locations and type of operation are listed below:

| Location | Nature and Status of Operations | Opened or Acquired |

| Amado, Arizona | Fully operational cultivation facility | Acquired in 2019 |

| Phoenix, Arizona | Fully operational dispensary facility | Acquired in 2019 |

| Hurlock, Maryland | Fully operational processing facility | Opened in 2018 |

| Massey, Maryland | Fully operational cultivation facility | Opened in 2021 |

| Frederick, Maryland | Fully operational dispensary facility | Opened in 2021 |

| Holland, Massachusetts | Cultivation land purchased; pre-development | Acquired in 2019 |

| Otsego, Minnesota | Fully operational cultivation and processing facility | Opened in 2015 |

| Minneapolis, Minnesota | Fully operational dispensary facility | Opened in 2015 |

| Bloomington, Minnesota | Fully operational dispensary facility | Opened in 2016 |

| Moorhead, Minnesota | Fully operational dispensary facility | Opened in 2015 |

| Rochester, Minnesota | Fully operational dispensary facility | Opened in 2015 |

| Hermantown, Minnesota | Fully operational dispensary facility | Opened in 2020 |

| Blaine, Minnesota | Fully operational dispensary facility | Opened in 2020 |

| Burnsville, Minnesota | Fully operational dispensary facility | Opened in 2020 |

| Woodbury, Minnesota | Fully operational dispensary facility | Opened in 2020 |

| Caliente, Nevada | Initial cultivation and processing facility complete; awaiting interior build out | Acquired in 2021 |

| Gallup, New Mexico | Fully operational dispensary facility | Acquired in 2019 |

| Gallup, New Mexico | Fully operational cultivation facility | Acquired in 2019 |

| Gallup, New Mexico | Cultivation land leased; construction completed; awaiting final operational approval | Pending final approval |

| Santa Fe, New Mexico | Fully operational dispensary facility | Acquired in 2019 |

| Las Cruces, New Mexico | Dispensary leased; construction complete; awaiting final operational approval | Pending final approval |

| Albuquerque, New Mexico | Dispensary leased; construction commenced | Under construction |

| Johnstown, New York | Fully operational cultivation and processing facility | Opened in 2016 |

| Colonie, New York | Fully operational dispensary facility | Opened in 2016 |

| Elmhurst, New York | Fully operational dispensary facility | Opened in 2016 |

| Johnson City, New York | Fully operational dispensary facility | Opened in 2016 |

| White Plains, New York | Fully operational dispensary facility | Opened in 2016 |

| Barceloneta, Puerto Rico | Cultivation and processing facility lease executed; pre-development | Pre-development |

| Vega Baja, Puerto Rico | Cultivation land lease executed; pre-development | Pre-development |

Our mission is to provide patients and consumers with best-in-class cannabis products and expert advice, informed by medicine and science. We also are seeking to develop intellectual property that is complementary to our mission, including novel product formulations, novel delivery systems and harm-mitigation processes. For example, in July 2020, we entered into a licensing agreement with eBottles420 related to our patent-pending, terpene-preserving packaging system.

We have developed proprietary cannabis strains, cultivation methods, carbon dioxide extraction, ethanol extraction, and other processes related to the extraction, refinement, and packaging of cannabis products. We have documented the relevant processes in the form of standard operating procedures and work instructions, which are only shared with third parties when absolutely required and then only upon receipt of written non-disclosure agreements.

We have sought and continue to seek to protect our trademark and service mark rights. Because the cultivation, processing, possession, transport and sale of cannabis and cannabis-related products remain illegal under the Controlled Substances Act (as defined below) we are not able to fully protect our intellectual property at the federal level. As a result, we have sought and continue to seek federal registrations in limited classes of goods and services and have obtained several state registrations in our markets.

7

The Cannabis Industry and Business Lines of the Company

According to market research projections by BDSA Analytics, Inc., global legal cannabis sales are expected to reach over $47 billion by 2025, including U.S. sales of $34.5 billion in 2025.

As described further below, United States federal law now bifurcates the legality of “hemp” from “marihuana” (also commonly known as marijuana). For purposes of this filing, the term “cannabis” means “marihuana” as set forth in the Controlled Substances Act (21 U.S.C. § 811) (the “Controlled Substances Act”) and is used interchangeably with the term “marijuana.”

To date, in the United States, medical cannabis has been legalized in 36 states and the District of Columbia, while 14 states and the District of Columbia have approved cannabis for recreational use by adults (adult-use).

A Gallup national poll in the fall of 2020 indicates that nearly 7 in 10 people support legalization of cannabis. We operate within states where medical and/or recreational use has been approved by state and local governing bodies.

Vireo strives to meet best-in-class health, safety and quality standards relating to the growth, production and sale of cannabis medicines, and products for consumers. Our offerings include cannabis flower, cannabis oil, cannabis topicals, orally ingestible tablets, capsules featuring cannabinoids, and vaporizer pens and cartridges.

Vireo is a vertically integrated cannabis company that operates from “seed-to-sale.” We have three business lines:

i. Cultivation: Vireo grows cannabis in outdoor, indoor and greenhouse facilities. Our expertise in growing enables the Company to produce award-winning and proprietary strains in a cost-effective manner. We sell our products in Vireo-owned or -managed dispensaries and to third parties where lawful.

ii. Production: Vireo converts cannabis biomass into formulated oil, using a variety of extraction techniques. We use some of this oil to produce consumer products such as vaporizer cartridges and edibles, and we sell some oil to third parties in jurisdictions where this practice is lawful.

iii. Retail Dispensaries: Vireo operates retail dispensaries that sell proprietary and, where lawful, third-party cannabis products to retail customers and patients.

Cultivation

We have rights to operate cultivation facilities in seven states and Puerto Rico. Although pricing pressure for dried flower in several mature cannabis markets has led some operators to eschew cultivation, in certain markets the transition from medical-only to adult-use cannabis has increased wholesale market prices significantly. We believe that our cultivation operations provide certain other benefits, including:

| i. | Low Cost: We continually seeks ways to optimize our growing processes and minimize expenses. By having control over our own cultivation, we can reduce input costs and maximize margins. We believe that production at scale, including outdoor cultivation for bulk oil production, is critical to drive down unit cost. |

| ii. | Product Availability: Control over our cultivation facilities allows us to monitor and update the product mix in our dispensaries to meet evolving demand, especially in the form of strain selection and diversity. |

| iii. | Quality Assurance: Quality and safety of cannabis products are critically important to our retail customers. Control over growing processes greatly reduces the risk of plant contamination or infestation. We believe that products with consistent quality can demand higher retail prices. |

Our focuses on quality, potency, strain diversity and production at scale are important because it believes that the wholesale market for cannabis plant material will become increasingly price competitive over time. More companies are entering, and will likely continue to enter, this segment of the industry. However, we believe that manufacturers and retailers that can source high-quality, low-cost plant material will have a significant advantage in the medium and long term.

Cultivation and Production Facilities

Except for our bifurcated cultivation-only and production-only facilities in Maryland, we operate combined cultivation and production facilities. Each cultivation and production facility focuses primarily on the development of cannabis products and, where allowed, dried cannabis plant material for medical and other consumer use, as well as the research and development of new strains of cannabis. At all our facilities, we focus on consumer safety and maintaining strict quality control. The methods used in our facilities result in several key benefits, including consistent production of high-quality product and the minimization of product recalls and patient complaints.

8

We operate the following principal cultivation and production facilities as of the close of business on March 31, 2021:

| Arizona: | · | Operate and control one retail dispensary and an outdoor cultivation facility with production operations. |

| · | Current cultivation capacity is insufficient to supply our dispensary adequately and, therefore, we must purchase a portion of our flower inventory, as well as all manufactured cannabis products, from licensed, third-party suppliers. However, we have recently increased cultivation capacity ninefold and are continuing to seek opportunities to add more cultivation capacity. We expect to complete the construction on further expanded cultivation capacity during the third quarter of 2021. | |

| · | We have a large number of customers; our results of operations and financial results in Arizona are not dependent upon sales to one or a few major customers. | |

| Maryland: | · | We operate one dispensary, one cultivation facility of approximately 110,000 square feet, and one production facility of approximately 30,000 square feet. |

| · | In March 2021, we transferred the cultivation license from our formerly co-located cultivation and processing facility to another facility consisting of approximately 110,000 square feet of greenhouse space and associated land and buildings. We expect to complete the construction on further expanded cultivation capacity during the third quarter of 2021. The production operation remains at the original cultivation and processing facility. | |

| · | Our wholesale business is continuing to experience growth in this medical market. Investments in operational expansion within this market during calendar year 2020 are expected to contribute to continued increased available product in fiscal year 2021, with the potential for improved financial results from increased scale and the significant expansion of flower production capacity. | |

| · | We have a number of customers; our results of operations and financial results in Maryland are not dependent upon sales to one or a few major customers. | |

| Minnesota | · | Currently operate eight retail dispensaries and one cultivation and production facility of approximately 90,000 square feet. |

| · | We have a large number of customers; our results of operations and financial results in Minnesota are not dependent upon sales to one or a few major customers. | |

| New Mexico | · | Currently operate and control approximately 3,000 square feet of cultivation and production and have two operational retail dispensaries. |

| · | We are awaiting final approval of our expanded cultivation capacity, which will add an additional 12,600 square feet. We also are seeking to open two additional retail dispensary locations during the second quarter of 2021. | |

| · | We have a large number of customers; our results of operations and financial results in New Mexico are not dependent upon sales to one or a few major customers. | |

| · | Current cultivation capacity in New Mexico is insufficient to supply our dispensaries adequately and, therefore, we must purchase a portion of our flower inventory, as well as most manufactured cannabis products, from licensed, third-party suppliers. Our principal suppliers of flower in New Mexico are Seven Points Farms and Urban Wellness. The availability of flower from these suppliers is inconsistent. Our principal suppliers of manufactured cannabis products in New Mexico are Hi Extracts/Bloom, Budder Pros, Slang Worldwide/O. Pen Vape, and Vitality Extracts/Elevated. The availability of manufactured cannabis products from these suppliers is consistent. | |

| New York | · | Currently operate four retail dispensaries and one cultivation and production facility of approximately 60,000 square feet. |

| · | We purchase a modest portion of our manufactured products inventory from several of the nine other registered organizations. | |

| · | Also operate a legal home-delivery business in New York City and certain surrounding areas. | |

| · | While we believe the long-term opportunity in New York is substantial, recent performance has been impacted by neighboring states transitioning to recreational-use jurisdictions, as well as by substantial investments in retail dispensaries and cultivation by certain of New York’s nine competitive registered organizations (vertically-integrated medical cannabis companies). We believe that new product introductions, the expansion of wholesale revenue streams and the potential relocation of some of our retail dispensaries to superior sites will contribute to improving profit margins in the future. We also anticipate additional growth of our home delivery service. | |

| · | We have a large number of customers; our results of operations and financial results in New York are not dependent upon sales to one or a few major customers. |

9

Manufacturing

We manufacture, assemble, and package cannabis finished goods across a variety of product segments:

| i. | Inhalable: flower and trim, dabbable concentrates (e.g., Hash, Rosin, Temple Balls), distillate pre-filled vaporizer pens and cartridges, pre-rolls, distillate syringes. |

| ii. | Ingestible: tablets, softgels, oral solutions, oral spray, tinctures, lozenges. |

| iii. | Topicals: balms and topical bars. |

We have wholesale operations in Arizona, Maryland, and New York. Manufactured products are sold to third parties, where allowed, and are also distributed to Vireo-owned and operated retail dispensaries.

Principal Products or Services

Vireo’s brands include:

| · | Vireo Health® brand pre-filled distillate vaporizer pens and cartridges, syringes, distilled oil, softgels, tablets, oral solutions, oral spray, tinctures, topical bars, and topical balms; |

| · | Vireo Spectrum™ brand pre-filled distillate vaporizer pens and cartridges, syringes, bulk oil, softgels, tablets, oral solutions, oral spray, topical bars, and topical balms; | |

| · | 1937™ brand distillate vaporizer pens and cartridges, flower and trim, and dabbable concentrates (e.g., Hash, Rosin, Temple Balls); |

| · | LiteBud™ pre-roll and flower products; and |

| · | Various other flower and trim brands. |

The following table shows which principal manufactured products we currently sell at our dispensaries in our various markets:

| Market | Principal Products |

| Arizona | Bulk Flower; 1937 Pre-Pack Flower; Bulk Trim; Bulk Whole Plant Strip; Bulk Manicured Whole Plant Strip; 1937 Temple Balls; 1937 Hash |

| Maryland | 1937 Vape Cartridges; Vireo Spectrum Vape Cartridges; Vireo Spectrum Syringes/Bulk Oil; Vireo Spectrum Oral Solution; Vireo Spectrum Oral Spray; Vireo Spectrum Balm; Vireo Spectrum Tablet; 1937 Concentrates; 1937 Pre-Rolls; Litebud Pre-Rolls; 1937 Pre-Pack Flower; 1937 Bulk Flower; 1937 Bulk Trim |

| Minnesota | Vireo Spectrum Vape Cartridges; Vireo Spectrum Capsules; Vireo Spectrum Tincture; Vireo Spectrum Oral Solution; Vireo Spectrum Oral Spray; Sinergi Oral Spray; Vireo Spectrum Syringe/Bulk Oil; Vireo Spectrum Tablet; Vireo Spectrum Topical Balm; Vireo Spectrum Topical Bar |

| New Mexico | Bulk flower; Trim |

| New York | Vireo Spectrum Vape Cartridges; Vireo Spectrum Syringes/Bulk Oil; Vireo Spectrum Softgel; Moonlight Softgel; Vireo Spectrum Oral Solution; Vireo Spectrum Oral Spray; Vireo Spectrum Balm; Vireo Spectrum Ground Metered Flower |

Retail Strategy

We have invested substantial resources in developing customer-friendly store designs and floorplans. In 2020, we began constructing new dispensaries using a new layout and color scheme tied to the Green Goods™ trademark and began converting existing dispensaries to this new theme.

Members of our management team have experience in real estate development, which has enabled us to secure premium locations for some of our dispensaries. Typically, we seek locations with high foot traffic and good visibility, close to densely populated residential areas. We also consider location, vehicular traffic, demographics, and competitor locations when selecting retail locations.

10

Principal Business Objectives

Our principal business objectives over the next 12-month period include achieving positive operating cash flow, commencing cultivation and processing operations in Nevada, expanding cultivation and processing capacity in certain other markets, opening or acquiring additional dispensaries in one or more states, improving operational efficiencies, continued asset development, converting the New York dispensaries to our Green GoodsTM retail concept, and subject to regulatory approval.

Employees

As of March 15, 2021, we had 477 employees, 376 of whom were full time employees. Certain of our employees in Maryland, Minnesota and New York are represented by local offices of the United Food and Commercial Workers International Union (“UFCW”). The collective bargaining agreements with the employees in these states expire as follows:

| State | Agreement Expiration | |

| Maryland | March 31, 2022 | |

| Minnesota | May 1, 2021 | |

| New York | July 31, 2022 |

In addition, our home delivery drivers in New York are represented by the Warehouse Production Sales & Allied Service Employees Union, AFL-CIO Local 811 (“Local 811”). Our collective bargaining agreement with Local 811 expires July 31, 2023. We consider our relations with our employees, with UFCW and with Local 811 to be good overall.

Research and Development

Our research and development activities have primarily focused on developing new, innovative, and patent-protectable products for the cannabis market. These efforts focus on novel cannabinoid formulations as well as accessory products designed to improve the cannabis experience. We also experiment with plant spacing and nutrient blends, cannabis variety trialing and improved pest management techniques. We also engage in research and development activities focused on developing new extracted or infused products.

Patents and Trademarks

We hold two patents for “Tobacco Products with Cannabinoid Additives and Methods for Reducing the Harm Associated with Tobacco Use” (US Patents 10,369,178 and 10,702,565) and have a number of other patents pending with the United States Patent and Trademark Office (“USPTO”).

We have successfully registered the trademark Vireo Health® with the USPTO and have applied to register a number of other trademarks with the USPTO, including:

| · | Green Goods™ | |

| · | 1937™ | |

| · | Lite Bud™ | |

| · | Chandra™ | |

| · | Terp Safe™ | |

| · | Relief Ratio™ | |

| · | Amplifi™ |

We have also received registrations of certain of these marks in some of the states in which we sell cannabis products.

11

Competitive Conditions and Position of Vireo

We employ a multi-tiered approach to entering markets and building out our operational footprint. Historically, Vireo U.S. won licenses in competitive, merit-based selection processes. Since the RTO, we have primarily pursued a dual strategy of limited acquisitions in additional markets and adding cultivation, processing, and dispensary capacity in states where we are already licensed. We evaluate each market and associated opportunities to determine an appropriate strategy for market entry and development, which in some markets has included acquiring an existing licensee. In most instances, we have developed a fully vertically integrated supply chain from seed to sale, building out cultivation, production, and retail operations. Historically, we have pursued opportunities in limited license markets with higher barriers to entry presenting an opportunity for higher returns or the development of strategic opportunities. We also plan for overcapacity in our production facilities to enable rapid increases in production capacity when adult-use cannabis sales are permitted.

The industry is highly competitive with many operators, including large multi-state operators and smaller regional and local enterprises. We face competition from other companies that may have greater resources, enhanced access to public equity and debt markets, more experienced management, or that may be more mature as businesses. There are several multi-state operators that we compete directly with in some of our operating markets. Aside from current direct competition, other multi-state operators that are sufficiently capitalized to enter the Company’s markets through acquisitive growth are also considered potential competitors. Similarly, if and to the extent we continue to enter new markets, we will encounter new direct competitors. We also face an increased competitive environment across several markets as those markets mature arising from better capitalized competitors, some with superior locations and lower costs than Vireo.

See “Risk Factors – We face intense competition in a new and rapidly growing industry from licensed companies with more experience and financial resources than we have and from unlicensed and unregulated participants.”

Regulation of Cannabis in the United States

Below is a discussion of the federal and state-level U.S. regulatory regimes in those jurisdictions where we operate through our subsidiaries. We currently operate facilities in Arizona, Maryland, Minnesota, New Mexico, and New York,. We will evaluate, monitor and reassess this disclosure, and any related risks, and will provide updated information to investors in public filings, including in the event of government policy changes or the introduction of new or amended guidance, laws or regulations regarding cannabis regulation, to the extent required by applicable securities laws. Any non-compliance, citations or notices of violation that may impact the Company’s licenses, business activities or operations will be promptly disclosed.

Regulation of Cannabis in the United States Federally

The U.S. Supreme Court has ruled that Congress has the constitutional authority to enact the existing federal prohibition on cannabis. As described further below, U.S. federal law now bifurcates the legality of “hemp” from “marihuana” (also commonly known as marijuana). For purposes of this filing, the term “cannabis” means “marihuana” as set forth in the Controlled Substances Act (21 U.S.C. § 811) (the “Controlled Substances Act”) and is used interchangeably with the term “marijuana.”

The U.S. federal government regulates drugs through the Controlled Substances Act, which places controlled substances, including marijuana, on a schedule. Marijuana is classified as a Schedule I drug. The Department of Justice defines Schedule I drugs, substances or chemicals as “drugs with no currently accepted medical use and a high potential for abuse.” With the limited exceptions of Epidiolex, a pharmaceutical derived from the cannabis extract cannabidiol (“CBD”), and certain drugs that incorporate synthetically derived cannabinoids (i.e., Marinol, Syndros, and Cesamet), the U.S. Food and Drug Administration has not approved marijuana as a safe and effective drug for any indication. Moreover, under the Agriculture Improvement Act of 2018 (commonly referred to as the 2018 Farm Bill), marijuana remains a Schedule I controlled substance under the Controlled Substances Act, with the exception of hemp and extracts derived from hemp (such as CBD) with a tetrahydrocannabinol (“THC”) concentration of less than 0.3%.

Unlike in Canada, which has federal legislation uniformly governing the cultivation, distribution, sale, and possession of medical marijuana under the Access to Cannabis for Medical Purposes Regulations, marijuana is largely regulated at the state level in the U.S.

State laws regulating cannabis are in direct conflict with the Controlled Substances Act. Although certain states and territories of the U.S. authorize medical or recreational cannabis production and distribution by licensed or registered entities, under U.S. federal law, the possession, use, cultivation, and transfer of cannabis and any related drug paraphernalia is illegal; any such acts are criminal acts under federal law under the Controlled Substances Act. Although our activities are compliant with applicable state and local laws, strict compliance with state and local laws with respect to cannabis may neither absolve the Company of liability under U.S. federal law, nor may it provide a defense to any federal proceeding which may be brought against the Company.

12

In August 2013, then-Deputy Attorney General, James Cole, authored a memorandum (the “Cole Memorandum”) addressed to all United States district attorneys acknowledging that, notwithstanding the designation of cannabis as a controlled substance at the federal level in the United States, several states had enacted laws relating to cannabis for medical purposes.

The Cole Memorandum outlined the priorities for the Department of Justice (the “DOJ”) relating to the prosecution of cannabis offenses. In particular, the Cole Memorandum noted that in jurisdictions that have enacted laws legalizing cannabis in some form and that have also implemented strong and effective regulatory and enforcement systems to control the cultivation, distribution, sale, and possession of cannabis, conduct in compliance with those laws and regulations is less likely to be a priority at the federal level. Notably, however, the DOJ never provided specific guidelines for what regulatory and enforcement systems it deemed sufficient under the Cole Memorandum standard. In light of limited investigative and prosecutorial resources, the Cole Memorandum concluded that the DOG should be focused on addressing only the most significant threats related to cannabis. States where medical cannabis had been legalized were not characterized as a high priority.

In March 2017, the newly appointed Attorney General Jeff Sessions again noted limited federal resources and acknowledged that much of the Cole Memorandum had merit. However, on January 4, 2018, Mr. Sessions issued a new memorandum that rescinded and superseded the Cole Memorandum effective immediately (the “Sessions Memorandum”). The Sessions Memorandum stated, in part, that current law reflects Congress’ determination that cannabis is a dangerous drug and cannabis activity is a serious crime”, and Mr. Sessions directed all U.S. Attorneys to enforce the laws enacted by Congress and to follow well-established principles when pursuing prosecutions related to marijuana activities. The inconsistency between federal and state laws and regulations is a major risk factor.

As a result of the Sessions Memorandum, federal prosecutors were free to utilize their prosecutorial discretion to decide whether to prosecute cannabis activities despite the existence of state-level laws that may be inconsistent with federal prohibitions. No direction was given to federal prosecutors in the Sessions Memorandum as to the priority they should ascribe to such cannabis activities, and resultantly it is uncertain how active federal prosecutors will be in relation to such activities. Furthermore, the Sessions Memorandum did not discuss the treatment of medical cannabis by federal prosecutors. As an industry best practice, despite the rescission of the Cole Memorandum, Vireo continues to do the following to ensure compliance with the guidance provided by the Cole Memorandum:

| · | Ensure the operations of our subsidiaries and business partners are compliant with all licensing requirements that are set forth with regards to cannabis operation by the applicable state, county, municipality, town, township, borough, and other political/administrative divisions. To this end, we retain appropriately experienced legal counsel to conduct the necessary due diligence to ensure compliance of our operations with all applicable regulations. |

| · | The activities relating to cannabis business adhere to the scope of the licensing obtained for example, in the states where only medical cannabis is permitted, the products are only sold to patients who hold the necessary documentation to permit the possession of the cannabis. |

| · | We only work through licensed operators, which must pass a range of requirements, adhere to strict business practice standards, and be subjected to strict regulatory oversight whereby sufficient checks and balances ensure that no revenue is distributed to criminal enterprises, gangs, and cartels. |

| · | We conduct reviews of products and product packaging to ensure that the products comply with applicable regulations and contain necessary disclaimers about the contents of the products to prevent adverse public health consequences from cannabis use and prevent impaired driving. |

| · | Our subsidiaries have implemented inventory-tracking systems and necessary procedures to ensure that inventory is effectively tracked, and the diversion of cannabis and cannabis products is prevented. |

Former Attorney General William Barr, who succeeded Attorney General Sessions, did not provide a clear policy directive for the United States related to state-legal cannabis-related activities. However, in a written response to questions from U.S. Senator Cory Booker made as a nominee, Attorney General Barr stated, “I do not intend to go after parties who have complied with state law in reliance on the Cole Memorandum.” Attorney General Barr’s statements were not an official declaration of the DOJ policy and were not binding on the DOJ, on any U.S. Attorney or on the Federal courts. On March 11, 2021, Merrick Garland was confirmed as the new Attorney General. Attorney General Garland has not yet made a formal statement or written response on the matter; however, during his confirmation hearings he stated that federal prosecution of state-licensed cannabis operators is not a “useful use” of limited prosecutorial resources. Moreover, there is no guarantee that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned, or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. Unless and until the U.S. Congress amends the Controlled Substances Act with respect to cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a risk that Federal authorities may enforce current U.S. federal law. We will continue to monitor compliance on an ongoing basis in accordance with our compliance program and standard operating agreement procedures. While our operations are in full compliance with all applicable state laws, regulations and licensing requirements, such activities remain illegal under United States federal law. For the reasons described above and the risks further described in the Risk Factors section below, there are significant risks associated with our business.

13

Although the Cole Memorandum has been rescinded, Congress has passed a so-called “rider” provision in the FY 2015, 2016, 2017, 2018, and 2019 Consolidated Appropriations Acts to prevent the DOJ from using congressionally appropriated funds to prevent any state or jurisdiction from implementing a law that authorizes the use, distribution, possession, or cultivation of medical marijuana. The rider is known as the “Rohrabacher-Farr” Amendment after its original lead sponsors (it is also sometimes referred to as the “Rohrabacher-Blumenauer” or, in its Senate Form, the “Leahy” Amendment, but it is referred to in this report as “Rohrabacher-Farr”).

Rohrabacher-Farr is typically included in short-term funding bills or continuing resolutions by the House of Representatives, whereas the Leahy Amendment was included in the fiscal year 2020 budget by the Senate, which was signed on December 20, 2019. The Leahy Amendment prevents the DOJ from using congressionally appropriated funds to enforce federal cannabis laws against regulated medical cannabis actors operating in compliance with state and local law. The Leahy Amendment was in effect until September 30, 2020 when the fiscal year ended. Rohrabacher-Farr was renewed through the signing of a series of stopgap spending bills until December 27, 2020, when Rohrabacher-Farr was renewed through the signing of the Consolidated Appropriations Act, 2021, effective through September 30, 2021.

The risk of federal enforcement and other risks associated with the Company’s business are described in Item 1A.—"Risk Factors.”

Regulation of the Cannabis Market at State and Local Levels

Below is a summary overview of the licensing and regulatory framework in the states where Vireo or our subsidiaries are currently operating or expect to operate within the next 12 months, under licenses or rights to operate.

Arizona

Arizona Regulatory Landscape

On November 2, 2010, Arizona voters enacted a medical cannabis initiative - Proposition 203 - with 50.13% of the vote. The Arizona legislature thereafter enacted the Arizona Medical Marijuana Act (“AMMA”), decriminalizing the medical use of cannabis. Arizona Department of Health Services (“AZDHS”) finalized dispensary and registry identification card regulations on March 28, 2011. On April 14, 2011, it began accepting applications for registry cards that provide patients and their caregivers with protection from arrest. AZDHS was preparing to accept dispensary applications starting in June and to register one dispensary for every 10 pharmacies in the state, totaling 125. However, on May 27, 2011, Gov. Jan Brewer led a federal lawsuit seeking a declaratory judgment on whether Arizona’s new medical cannabis program conflicted with federal law. Her lawsuit was rejected in 2012.

The Arizona legislature subsequently rolled back some of Proposition 203’s protections, such as possibly allowing an employer to fire a medical cannabis patient based on a report alleging workplace impairment from a colleague who is “believed to be reliable.” The legislature also passed H.B. 2585, which contradicts Proposition 203 by adding medical cannabis patient data to the prescription drug-monitoring program. In 2015, the legislature again undermined patient protections again with the passage of H.B. 2346, which specifies that nothing requires a government medical assistance program, a private health insurer or a workers’ compensation carrier or self-insured employer providing workers’ compensation benefits to reimburse a person for costs associated with the medical use of marijuana.

To qualify under Arizona’s program, patients must have one of the listed debilitating medical conditions: cancer, HIV-positive; AIDS; Hepatitis C; glaucoma; amyotrophic lateral sclerosis (ALS); Crohn’s disease; agitation of Alzheimer’s disease; or a medical condition that produces wasting syndrome, severe and chronic pain, severe nausea, seizures, or severe and persistent muscle spasms, including those characteristics of multiple sclerosis.

On November 3, 2020, 60% of Arizona voters supported and enacted the Smart and Arizona Safe Act (“Proposition 207”), which took effect on November 30, 2020, following certification of the 2020 election results by the Arizona Secretary of State. Proposition 207 legalizes the possession and use of marijuana for adults age 21 years and older in Arizona. Individuals are permitted to grow up to six marijuana plants within their own residence, in a lockable, enclosed area out of public view. The AZDHS is responsible for adopting rules to regulate adult-use marijuana, including the licensing of marijuana retail stores, cultivation facilities, and production facilities. Among other provisions, Proposition 207 imposes an additional 16 percent tax on marijuana sales and creates a Social Equity Ownership Program, which issues licenses to entities whose owners are “from communities disproportionately impacted by the enforcement of previous marijuana laws.” It also restricts local governments from enacting adult-use regulations, zoning, or license controls more restrictive than those that apply to medical marijuana facilities.

14

Vireo’s Licenses in Arizona

All medical cannabis certificates are vertically integrated and authorize the holders to cultivate and dispense medical cannabis to patients. Our subsidiaries Elephant Head Farm, LLC and Retail Management Associates, LLC perform fee-based management services consisting of the operation of one dispensary, dually licensed for adult-use and medical sales, and one medical cultivation facility for a non-profit licensee and affiliate of Vireo, Arizona Natural Remedies, Inc. (“ANR”) (executives of the Company constitute all of the members of the board of directors of ANR). The non-profit licensee holds a Medical Marijuana Dispensary Registration Certificate, Marijuana Establishment License for adult-use sales, and Approval to Operate, issued by the DHS, as well as a Special Use permit issued by the city of Phoenix, which collectively permit ANR to own a single, dual licensed dispensary in Phoenix and a cultivation facility in southern Arizona designated for use with ANR’s medical license. ANR’s medical cultivation facility license permits it to wholesale cannabis to other medical and/or adult use licensed dispensaries within Arizona. The adult-use component of ANR’s dual license allows for one additional off-site adult-use cultivation facility that has yet to be developed.

Arizona Licenses and Regulations

Arizona state licenses are renewed biennially. Every other year, licensees are required to submit a renewal application per guidelines published by the AZDHS. While renewals are biennial, there is no ultimate expiry after which no renewals are permitted. Additionally, in respect of the renewal process, provided that the requisite renewal fees are paid, the renewal application is submitted in a timely manner, and there are no material violations noted against the applicable licenses, the Company would expect to receive the applicable renewed license in the ordinary course of business. While the Company’s compliance controls have been developed to mitigate the risk of any material violations of a license arising, there is no assurance that the Company’s licenses will be renewed in the future in a timely manner.

Arizona is a vertically integrated system, so that each license permits the holder to acquire, cultivate, process, distribute and/or dispense, deliver, manufacture, transfer, and supply medical marijuana in compliance with the AMMA and AZDHS rules and regulations. For every ten (10) pharmacies that have registered under A.R.S. § 32-1929, have obtained a pharmacy permit from the Arizona Board of Pharmacy, and operate in the State, the AZDHS may issue one non-profit medical cannabis dispensary registration certificate and one marijuana establishment license. Non-profit medical cannabis dispensaries may acquire, possess, cultivate, manufacture, deliver, transfer, transport, supply, sell or dispense marijuana or related supplies and educational materials to qualifying patients, a designated caregiver, a nonprofit medical cannabis dispensary agent or an independent third-party laboratory agent who has been issued and possesses a valid registry identification card. Marijuana establishment licensees may operate all of the following: (1) a single retail location at which the licensee may sell marijuana and marijuana products to consumers, cultivate marijuana and manufacture marijuana products; (2) a single off-site cultivation location at which the licensee may cultivate marijuana, process marijuana and manufacture marijuana products, but from which marijuana and marijuana products may not be transferred or sold to consumers; and (3) a single off-site location at which the licensee may manufacture marijuana products and package and store marijuana and marijuana products, but from which marijuana and marijuana products may not be transferred or sold to consumer. Cultivation and processing sites can be located anywhere in the State and are not limited to their district (Community Health Analysis Area). Dispensaries are limited to their district for their first three years of operation and may apply to relocate thereafter. Arizona dispensary registration certificates are valid for two years after the date of issuance. The holder of a dispensary registration certificate must also submit an application for approval to operate a dispensary to the AZDHS. A dispensary that has approval to operate as a dispensary issued by the AZDHS is subject to biennial renewals of its Medical Marijuana Dispensary Registration Certificate and Marijuana Establishment License.

Arizona Reporting Requirements

The ADHS requires that dispensaries implement policies and procedures regarding inventory control, including tracking, packaging, acquisition, and disposal of cannabis. ANR uses BioTrackTHC as its in-house computerized seed to sale software, which integrates with the state’s program and captures the required data points for cultivation, manufacturing and retail as required in Arizona’s medical cannabis laws and regulations. ANR is required to submit audited financial statements annually to AZDHS.

The State of Arizona uses the AZDHS Facility Licensing Portal (“AZDHS FLP”) to validate card holders, verify allotment amounts, and track all retail transactions for Arizona. The AZDHS FLP system is also used by license holders to renew the dispensary registration certificates.

We use BioTrack software as our computerized, seed-to-sale tracking and inventory system. Individual licensees whether directly or through third-party integration systems are required to capture and retain all information pertaining to the acquisition, possession, cultivation, manufacturing, delivery, transfer, transportation, supplying, selling, distributing, or dispensing of medical marijuana, to meet all reporting requirements for the State of Arizona.

15

Maryland

Maryland Regulatory Landscape

In 2012, a state law was enacted in Maryland to establish a state-regulated medical cannabis program. Legislation was signed in May 2013 and the program became operational on December 1, 2017. The Natalie M. LaPrade Maryland Medical Cannabis Commission (the “MMCC”) regulates the state program and awarded operational licenses in a highly competitive application process. The market is divided into three primary classes of licenses: dispensary, cultivation, and processing. Medical cannabis dispensary license pre-approvals were issued to 102 dispensaries out of a pool of over 800 applicants, 15 processing licenses were awarded out of a pool of 124 applicants and 15 cultivation licenses were awarded out of a pool of 145 applicants.

The medical cannabis program was written to allow access to medical cannabis for patients with qualifying medical conditions, including chronic pain, nausea, seizures, glaucoma, and post-traumatic stress disorder or “PTSD.”

In April 2018, Maryland lawmakers agreed to expand the state’s medical cannabis industry by adding another 20 licenses: 7 for cultivation and 13 for processing. Permitted products for sale and consumption include oil-based formulations, dry flower and edibles and other concentrates.

Vireo’s Licenses in Maryland

In Maryland, we operate one dispensary in Frederick, Maryland, which opened in March 2021. We also operate in Maryland a production facility of 30,000 square feet to serve the wholesale market and a new, 110,000 square-foot cultivation facility. We hold phase 2 licenses for cultivation, processing, and dispensing. Wholesale revenues have grown, driven in part by new product offerings and increased market penetration. Heading into fiscal year 2021, we anticipate continued revenue growth. Our licenses in Maryland were awarded to our affiliate MaryMed, LLC through merit-based license application processes. Merit-based license awards require limited investment and thus present high-return opportunities. We believe that our medical and scientific background has helped Vireo develop a competitive advantage in the marketplace with respect to applying and winning some merit-based license awards.

Maryland Licenses and Regulations

Maryland licenses are valid for a period of six years and are subject to four-year renewals after required fees are paid and provided that the business remains in good standing. Renewal requests are typically communicated through email from the MMCC and include a renewal form.

Maryland Reporting Requirements

The State of Maryland uses Marijuana Enforcement Tracking Regulation and Compliance system (METRC) as the state’s computerized T&T system for seed-to-sale. Individual licensees whether directly or through third-party integration systems are required to use this system for all reporting.

The State of Maryland uses METRC as the state’s computerized T&T system for seed-to-sale. Individual licensees whether directly or through third-party integration systems are required to push data to the state to meet all reporting requirements. We use a third-party application for our computerized seed to sale software, which integrates with the state’s Metric program and captures the required data points for cultivation, manufacturing and retail as required in the Maryland Medical Cannabis law.

16

Minnesota

Minnesota Regulatory Landscape

Legislation passed during the 2014 Minnesota legislative session created a new process allowing seriously ill individuals from Minnesota to use medical cannabis to treat a set of nine qualifying medical conditions. The qualifying medical conditions have been expanded to now include 15 qualifying conditions. Effective August 2021, two additional qualifying conditions will be added: sickle cell disease and chronic motor or vocal tic disorder. The Medical Cannabis Program is regulated and administered by the Minnesota Department of Health which oversees all cultivation, production, and distribution facilities. In the initial program the Minnesota Department of Health had registered two manufacturers, with each manufacturer having licenses for four distribution facilities across the state. Minnesota now allows a manufacturer to operate eight distribution facilities, which may include the manufacturer’s single location for cultivation, harvesting, manufacturing, packaging, and processing but is not required to include that location.

Medical cannabis is provided to patients as a liquid, pill, topical (lotions, balms, and patches), vaporized delivery method that does not require the use of dried leaves or plant form, water-soluble cannabinoid multi-particulates (for example, granules, powders, and sprinkles) and orally dissolvable products such as lozenges, gums, mints, buccal tablets, and sublingual tablets.

In terms of safety and security, there are several precautions built into the program. For example, registered manufacturers must contract with a laboratory for testing the quality and consistency of the medical cannabis products. Manufacturers’ facilities are also subject to state inspections.

Minnesota has also implemented a process for monitoring and evaluating the health impacts of medical cannabis on patients which will be used to help patients and health professionals grow their understanding of the benefits, risks, and side effects of medical cannabis.

In 2021, there is potential for the addition of raw flower to the medical program in Minnesota.

Vireo’s Licenses and Permits in Minnesota

Our license in Minnesota was awarded to Vireo through merit-based license application processes. Merit-based license awards require limited investment and thus present high-return opportunities. We believe that our medical and scientific background has helped us develop a competitive advantage in the marketplace with respect to applying and winning some merit-based license awards.

Vireo Health of Minnesota, LLC (“Vireo Minnesota”), which is a subsidiary of Vireo, holds one vertically-integrated medical cannabis license to operate one cultivation and production facility in Otsego, MN and eight retail medical cannabis dispensaries in the state of Minnesota, located in Blaine, Bloomington, Burnsville, Hermantown, Rochester, Minneapolis, Moorhead, and Woodbury.

Minnesota Licenses and Regulations

We currently operate eight retail dispensaries and one cultivation and production facility of approximately 90,000 square feet. Recent changes to the state’s qualifying conditions for medical cannabis patients have contributed to increases in patient enrollment, and the legislature also recently granted Vireo four additional dispensary licenses, all of which opened in the fourth quarter of 2020. These additional dispensary licenses, combined with the potential for the state to add dry flower to the list of allowed delivery methods, give our management team optimism that the Minnesota market remains a strong near-term growth opportunity for the Company.

Minnesota state licenses are renewed every two years. Every two years, licensees are required to submit a renewal application with the commissioner at least six months before its registration term expires per Minnesota Administrative Rule 4770.1460. The most recent manufacturer annual fee paid in 2019 was $146,000 and is non-refundable. Additionally, provided that the requisite renewal fees are paid, the renewal application is submitted in a timely manner, and there are no material violations noted against the applicable licenses, Vireo Minnesota expects to receive the applicable renewed license in the ordinary course of business. While Vireo Minnesota’s compliance controls have been developed to mitigate the risk of any material violations of a license arising, there is no assurance that Vireo Minnesota’s license will be renewed in the future in a timely manner. Any unexpected delays or costs associated with the licensing renewal process could impede the ongoing or planned operations of the Company and have a material, adverse effect on the Company’s business and financial results.

Minnesota Reporting Requirements

The State of Minnesota does not require a specific computerized T&T system for seed-to-sale. Individual licensees whether directly or through third-party integration systems are required to push data to the state to meet all reporting requirements.

Vireo Minnesota currently uses Leaf Logix to satisfy our reporting requirements.

17

Nevada

Nevada Regulatory Landscape

In Nevada, medical marijuana use was legalized by a ballot initiative (Nevada Medical Marijuana Act, Question 9) in 2000. State-certified medical marijuana establishments were first operational in 2015. On November 8, 2016, voters in Nevada passed the Nevada Marijuana Legalization Initiative (Ballot Question 2) to allow for the sale, possession, and consumption of recreational marijuana in the state for adults 21 and older. The first dispensaries providing adult-use cannabis began sales in July 2017. The Nevada Cannabis Compliance Board is the regulatory agency overseeing the medical and adult-use cannabis programs. Cities and counties in Nevada can determine the number of local cannabis licenses they will issue.

Vireo’s Licenses in Nevada

Vireo Health of Nevada I, LLC (“Vireo Nevada”), which is a subsidiary of Vireo, holds the equity interest of MJ Distributing C201, LLC (“C201”). C201 holds medical and adult-use cannabis cultivation licenses to operate a cultivation facility in Caliente, NV.

Vireo Nevada also holds the equity interest of MJ Distributing P132, LLC (“P132”). P132 holds medical and recreational cannabis production license to operate a product manufacturing facility in Caliente, NV.

Nevada Licenses and Regulations

In the state of Nevada, only cannabis that is grown/produced in the state by a licensed establishment may be sold in the state. The state also allows Vireo to make wholesale sales of cannabis to other licensed entities within the state. There are three principal license categories in Nevada: (1) cultivation, (2) processing and (3) dispensary.

The medical and recreational cultivation licenses permit C201 to acquire, possess, cultivate, deliver, transfer, have tested, transport, supply or sell marijuana and related supplies to medical marijuana dispensaries, facilities for the production of medical marijuana products and/or medical marijuana-infused products, or other medical marijuana cultivation facilities.

The medical and recreational product manufacturing licenses permit P132 to acquire, possess, manufacture, deliver, transfer, transport, supply, or sell marijuana products or marijuana infused products to other medical marijuana production facilities or medical marijuana dispensaries.

Nevada Reporting Requirements

The state of Nevada uses METRC as the state’s computerized T&T system used to track commercial cannabis activity and seed-to-sale. Individual licensees, whether directly or through third-party integration systems, are required to push data to the state to meet all reporting requirements. For the cultivation and processing licenses P132 and C201 will designate an inhouse computerized seed to sale software that will integrate with METRC via API. The chosen seed-to-sale system must capture the required data points for cultivation and manufacturing as required in Nevada Revised Statutes section 453A.

18

New Mexico

New Mexico Regulatory Landscape

The Lynn and Erin Compassionate Use Act (“Compassionate Use Act”) was signed into law in 2007 and became effective July 1, 2007. The Compassionate Use Act established the regulatory framework for use of medical cannabis by New Mexico residents and created the New Mexico Medical Cannabis Program (“NMMCP”). It allows practitioners to prescribe medical cannabis to patients with a debilitating medical condition (as defined in the Compassionate Use Act). Currently, there are at least 23 qualifying conditions under the Compassionate Use Act. When a practitioner determines that the patient has a debilitating medical condition and provides written certification so stating and that the potential health benefits of the cannabis use would likely outweigh the health risks for the patient, the patient can apply with the New Mexico Department of Health (“NMDOH”) for a registry identification card. A qualified patient is allowed to possess cannabis in an amount that is reasonably necessary to ensure uninterrupted availability of cannabis for a period of three months. In 2019, New Mexico announced it would begin permitting non-residents of the state to obtain cannabis under the Compassionate Use Act and as of July 1, 2020, the state now extends reciprocity to residents of all other medical cannabis states, allowing visiting medical marijuana patients to use their home-state credentials to purchase at licensed New Mexico medical marijuana dispensaries.

The governor of New Mexico said she will call lawmakers into a special session in late March 2021 to work on proposed legislation legalizing adult-use cannabis.

Vireo’s Licenses in New Mexico

Pursuant to a management agreement with our affiliate Red Barn Growers, Inc., a New Mexico non-profit corporation and NMDOH licensee, Vireo Health of New Mexico, LLC (“VHNM”), a wholly-owned subsidiary of Vireo, currently operates two dispensaries located in Santa Fe and Gallup and a cultivation and processing facility located in Gallup.

New Mexico Licenses and Regulations

In New Mexico, we currently operate an approximately 10,000 square feet of cultivation and production and have two operational retail dispensaries. The licensee is in the process of developing two additional dispensaries, located in Albuquerque and Las Cruces, as well as additional cultivation capacity in Gallup, which will also be operated by VHNM. We expect that the expansion of the cultivation capacity, if and when approved by regulators, will enable us to begin wholesaling in this market.

The NMMCP is overseen by the NMDOH. The NMMCP has at least 35 Licensed Non-Profit Producers (LNPPs). LNPPs cultivate and distribute cannabis to qualified patients. The NMDOH is not currently accepting new applications for licensure of LNPPs. Each LNPP can operate an unlimited number of dispensaries. The NMMCP approves third-party manufactures to make cannabis-derived products that are then sold through the LNPPs. With approval by the NMMCP, LNPPs can also manufacture products to sell to patients.

New Mexico Reporting Requirements

The state of New Mexico uses BIOTRACKTHC© as the state’s computerized T&T system used to track commercial cannabis activity and seed-to-sale. Individual licensees are required to push data to the state to meet all reporting requirements.

19

New York

New York Regulatory Landscape

The Compassionate Care Act was signed into law on July 5, 2014. It allows patients to use medical cannabis if they have been diagnosed with a specific severe, debilitating, or life-threatening condition that is accompanied by an associated or complicating condition. The law was expanded to include chronic pain and PTSD. The law has a sunset provision whereby it will expire after seven years (July 5, 2021) unless renewed by the legislature.

Physicians must complete a New York State Department of Health-approved course and register with the New York Department of Health Medical Marijuana Program to certify patients. Practitioners must consult the New York State Prescription Monitoring Program Registry prior to issuing a certification to a patient for medical cannabis.