Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NACCO INDUSTRIES INC | d127841d8k.htm |

Exhibit 99

1

®

Leading into the Future

2 0 2 0 Annual Report

Together We Lead

2

NACCO Industries®

Our Operations

NACCO Industries, Inc.®, through a portfolio of mining and natural resources businesses, operates under three business segments: Coal Mining, North American Mining and Minerals

Management.The Coal Mining segment operates surface coal mines under long-term contracts with power generation companies and an activated carbon producer pursuant to a service-based business model.The North American Mining segment provides

value-added contract mining and other services for producers of aggregates, lithium and other minerals.The Minerals Management segment acquires and promotes the development of oil, gas and coal mineral interests, generating income primarily from

royalty-based lease payments from third parties.In addition, the Company’s Mitigation Resources of North America® business provides stream and wetland mitigation solutions. Contents About the Company.1 Selected Financial and Operating

Data.2 Letter to Stockholders.4 Corporate Responsibility.9 Form 10-K.11 Directors and Officers.127 Corporate Information.Inside Back Cover About the Cover We believe our people are the cornerstone of our

success.Employees from across the Company exhibit resiliency and perseverance in everything they do, from safety programs and environmental stewardship to community support and outreach.Along with pictures of our operations, we are highlighting a

few of our employees on the cover and throughout this Annual Report to show our appreciation for all they do to serve our customers. t Opposite Page Our expertise with draglines is unsurpassed.Shown here is a dragline operated by North American

Mining, digging aggressively.Small pictures (inset) include a dragline at the Freedom Mine in North Dakota and employees from Mitigation Resources of North America, North American Coal and North American Mining. 1

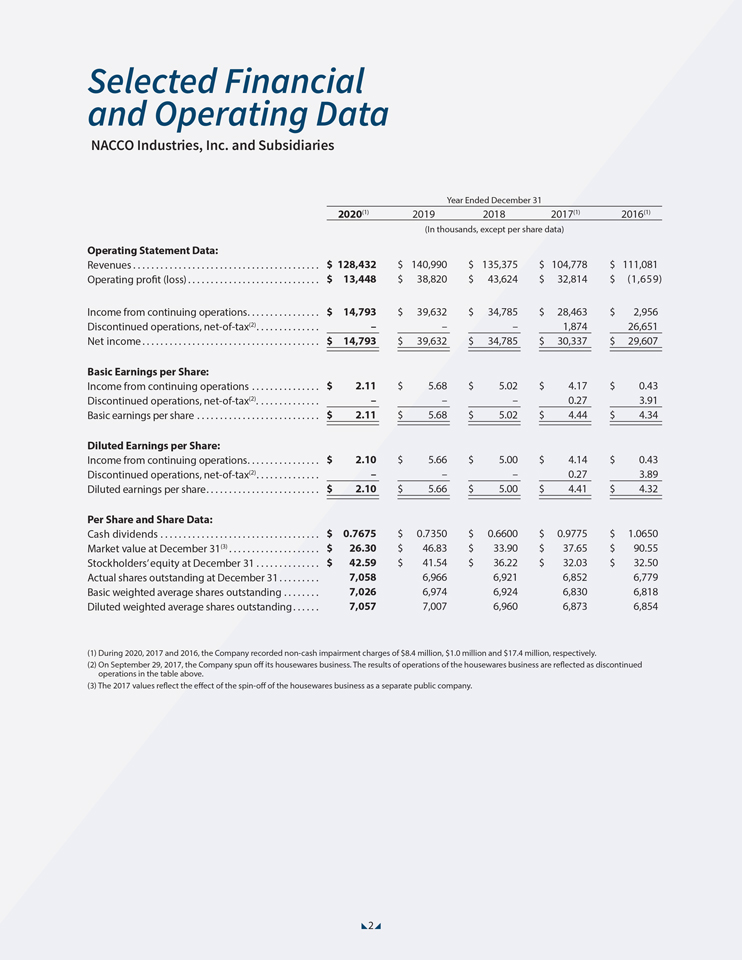

Selected Financial and Operating Data NACCO Industries, Inc. and Subsidiaries Year Ended December 31 2020(1) 2019 2018 2017(1) 2016(1) (In thousands, except per share data) Operating Statement Data: Revenues. Operating profit (loss). Income from continuing operations. Discontinued operations, net-of-tax(2). Net income. Basic Earnings per Share: Income from continuing operations. Discontinued operations, net-of-tax(2).. Basic earnings per share. Diluted Earnings per Share: Income from continuing operations. Discontinued operations, net-of-tax(2). Diluted earnings per share. Per Share and Share Data: Cash dividends. Market value at December 31(3). Stockholders’ equity at December 31. Actual shares outstanding at December 31. Basic weighted average shares outstanding. Diluted weighted average shares outstanding. $ 128,432 $ 13,448 $ 14,793 – $ 14,793 $ 2.11 – $ 2.11 $ 2.10 – $ 2.10 $ 0.7675 $ 26.30 $ 42.59 7,058 7,026 7,057 $ 140,990 $ 38,820 $ 39,632 – $ 39,632 $ 5.68 – $ 5.68 $ 5.66 – $ 5.66 $ 0.7350 $ 46.83 $ 41.54 6,966 6,974 7,007 $ 104,778 $ 32,814 $ 28,463 1,874 $ 30,337 $ 4.17 0.27 $ 4.44 $ 4.14 0.27 $ 4.41 $ 0.9775 $ 37.65 $ 32.03 6,852 6,830 6,873 $ 135,375 $ 43,624 $ 34,785 – $ 34,785 $ 5.02 – $ 5.02 $ 5.00 – $ 5.00 $ 0.6600 $ 33.90 $ 36.22 6,921 6,924 6,960 $ 111,081 $ (1,659) $ 2,956 26,651 $ 29,607 $ 0.43 3.91 $ 4.34 $ 0.43 3.89 $ 4.32 $ 1.0650 $ 90.55 $ 32.50 6,779 6,818 6,854 (1) During 2020, 2017 and 2016, the Company recorded non-cash impairment charges of $8.4 million, $1.0 million and $17.4 million, respectively. (2) On September 29, 2017, the Company spun off its housewares business. The results of operations of the housewares business are reflected as discontinued operations in the table above. (3) The 2017 values reflect the effect of the spin-off of the housewares business as a separate public company. 2

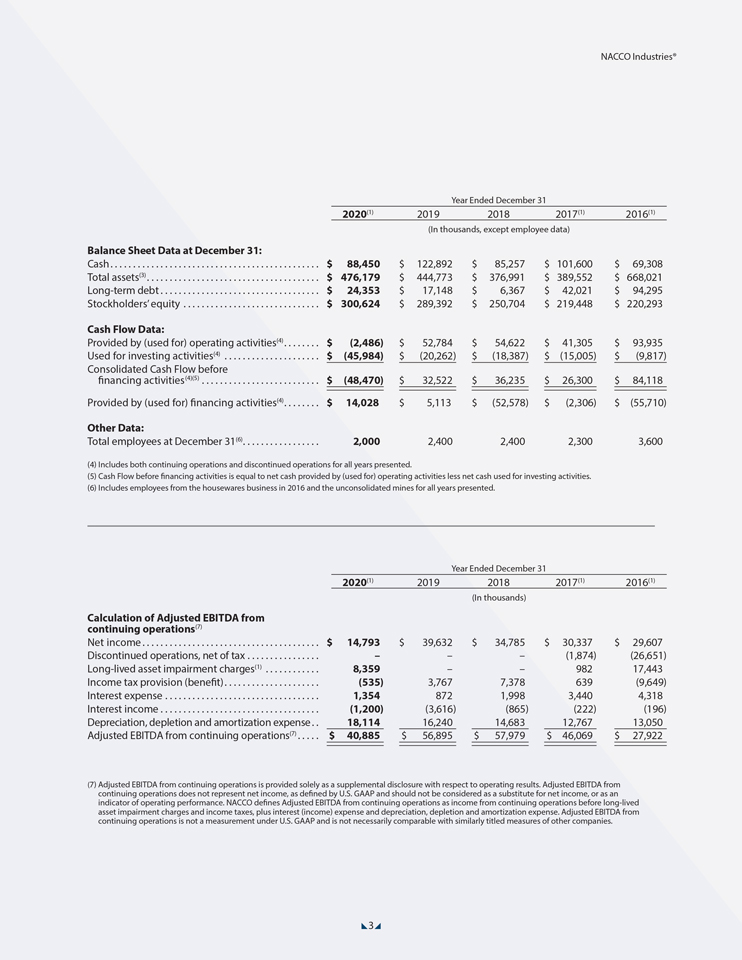

NACCO Industries®Year Ended December 31 2020(1) 2019 2018 2017(1) 2016(1) (In thousands, except employee data) Balance Sheet Data at December 31: Cash. Total assets(3). Long-term debt. Stockholders’ equity. Cash Flow Data: Provided by (used for) operating activities(4). Used for investing activities(4). Consolidated Cash Flow before financing activities(4)(5). Provided by (used for) financing activities(4). Other Data: Total employees at December 31(6). $ 88,450 $ 476,179 $ 24,353 $ 300,624 $ (2,486) $ (45,984) $ (48,470) $ 14,028 2,000 $ 122,892 $ 444,773 $ 17,148 $ 289,392 $ 52,784 $ (20,262) $ 32,522 $ 5,113 2,400 $ 101,600 $ 389,552 $ 42,021 $ 219,448 $ 41,305 $ (15,005) $ 26,300 $ (2,306) 2,300 $ 85,257 $ 376,991 $ 6,367 $ 250,704 $ 54,622 $ (18,387) $ 36,235 $ (52,578) 2,400 $ 69,308 $ 668,021 $ 94,295 $ 220,293 $ 93,935 $ (9,817) $ 84,118 $ (55,710) 3,600 (4) Includes both continuing operations and discontinued operations for all years presented. (5) Cash Flow before financing activities is equal to net cash provided by (used for) operating activities less net cash used for investing activities. (6) Includes employees from the housewares business in 2016 and the unconsolidated mines for all years presented. Year Ended December 31 2020(1) 2019 2018 2017(1) 2016(1) (In thousands) Calculation of Adjusted EBITDA from continuing operations(7) Net income. Discontinued operations, net of tax. Long-lived asset impairment charges(1). Income tax provision (benefit). Interest expense. Interest income. Depreciation, depletion and amortization expense. Adjusted EBITDA from continuing operations(7). $ 14,793 – 8,359 (535) 1,354 (1,200) 18,114 $ 40,885 $ 39,632 – – 3,767 872 (3,616) 16,240 $ 56,895 $ 30,337 (1,874) 982 639 3,440 (222) 12,767 $ 46,069 $ 34,785 – – 7,378 1,998 (865) 14,683 $ 57,979 $ 29,607 (26,651) 17,443 (9,649) 4,318 (196) 13,050 $ 27,922 (7) Adjusted EBITDA from continuing operations is provided solely as a supplemental disclosure with respect to operating results.Adjusted EBITDA from continuing operations does not represent net income, as defined by U.S.GAAP and should not be considered as a substitute for net income, or as an indicator of operating performance.NACCO defines Adjusted EBITDA from continuing operations as income from continuing operations before long-lived asset impairment charges and income taxes, plus interest (income) expense and depreciation, depletion and amortization expense.Adjusted EBITDA from continuing operations is not a measurement under U.S.GAAP and is not necessarily comparable with similarly titled measures of other companies. 3

4 To Our Stockholders Managing change seemed to be the constant in 2020.We modified how we work and live in response to the global COVID-19 pandemic and dealt with disappointing news from certain of our customers, while continuing to execute our plans for growth and diversification.In a year of change, transition and challenges, our team adapted and charged ahead, leading us into the future. Our employees showed dedication and resiliency as they supported our customers in the wake of the global pandemic.I’m incredibly proud of our team.Our culture, the common fiber of our company, is built on safety, integrity and quality – we believe in doing the right thing every time, and we do.Our safety mindset allowed us to move quickly at the onset of the COVID-19 pandemic.We took deliberate and immediate actions, including implementing the Centers for Disease Control and Prevention’s recommended safety protocols across our operations, to keep employees safe so we could continue operating as an essential business during the pandemic.We also mobilized a cross-functional task force focused on understanding and communicating critical safety and operating issues related to the pandemic.While some employees were able to transition to a remote working environment, the vast majority of our employees remained on-site to deliver the highest levels of customer service and operational excellence.This is a real testament to the talent, dedication and strength of our team. Our Coal Mining business also faced challenges in 2020 beyond COVID-19.Customers for our Falkirk and Sabine Mines announced plans to retire the power plants supplied by those mines in 2022 and 2023, respectively, and to close the mines.Falkirk’s customer has indicated a willingness to transfer ownership of the power plant and mine, which could allow operations to continue past 2022.While we are working to support those efforts, there is no guarantee that a solution will be found.Also, in 2020, our contract to operate the Camino Real Fuels Mine was terminated when our customer’s contract to sell coal in Mexico was prematurely terminated, and the Caddo Creek Mine entered reclamation after its customer was acquired by a competitor. We are highly engaged in activities to support our coal customers through a key strategic initiative we call Protect the Core.We work diligently to drive down coal production costs and maximize efficiencies and operating capacity, while operating safely, to help customers with management fee contracts improve their competitiveness.These activities benefit our customers and our company, as coal cost is a significant driver for power plant dispatch.Increased power plant dispatch results in increased demand for coal by our customers. While the development of new mines to supply newly built coal-fired power plants remains unlikely, growth could come by assuming operations of existing mines, similar to the way we became the operator of the Navajo Mine in New Mexico in 2017.We will approach any such opportunity cautiously, and we anticipate that we would leverage our low capital/low risk management fee contract structure for any new coal mining projects we consider. Our culture, the common fiber of our company, is built on safety, integrity and quality—we believe in doing the right thing every time. â–¼ Safety is always the top priority at every location.Ongoing safety training and communication ensures everyone is committed to keeping themselves and their co-workers safe.Everyone at our mine sites and quarries must wear personal protection equipment.

5 We are fully aware of the political and economic pressures related to COâ,, emissions that our customers face, and the challenges that our legacy Coal Mining business faces.In addition, company- and customer-controlled coal reserves are being depleted with each year of mining, while the expiration dates on our coal contracts draw closer.In this context, we recognize that we must continue to adapt with a sense of urgency befitting the ongoing disruption in the coal industry.That is why we continue to execute on key initiatives developed over the last several years as part of a core strategy to Grow and Diversify.We are purposefully and deliberately diversifying into other businesses that leverage our core skills, capabilities and reputation.For more than 100 years, our company has repeatedly demonstrated its ability to adapt to change, and today is no different.We are building a strong portfolio of affiliated businesses for growth and diversification, with long-term income growth targets that exceed our projected levels of future coal-related income. We are well-positioned for growth in our North American Mining business.This business started with our operation of one dragline at a single limestone quarry for one customer in south Florida in 1995.We celebrated 25 years of continued deliveries to that customer in 2020.Our efforts to grow this business have been successful and give us confidence for the future.In 2015, just five years ago, we worked with two customers at seven quarries operating 10 draglines, all in the southern part of Florida.Through a deliberate focus on growth and diversification, we ended 2020 serving 10 customers at 20 quarries operating 32 draglines and a rope-shovel, and we are developing a greenfield lithium project in Nevada.The pandemic slowed North American Mining’s business development initiatives in 2020, but our outlook for growth in 2021, including growth outside Florida, is strong. North American Mining President Phil Berry has overseen this period of rapid growth at North American Mining and leads our ongoing activities to grow and diversify this business.Phil holds B.S.and M.S.degrees in mining-related fields and has a long career in the mining industry, including at our Sabine Mine in Texas.This business is supported by a strong team of operational experts who work each day to serve our customers. We continue to pursue growth opportunities in dragline operations, as well as more comprehensive mining services where we would operate a broader range of specialized mining equipment for customers across the country.Our capabilities build on decades of experience operating draglines and a diverse fleet of surface mining equipment.Today, North American Mining’s pipeline of potential projects is larger than ever, with opportunities spanning a diverse group of customers in a broad range of geographies, and with more large-scale projects than in prior periods.Importantly, we are seeing increased opportunities to provide mining services for a broad range of minerals that extend beyond limerock. North American Mining is working with Lithium Americas (TSX and NYSE: LAC) to develop the largest-known lithium resource in the United States, the Thacker Pass Project in northern Nevada.North American Mining will provide comprehensive mining services with responsibility for all operational aspects of the lithium mine, similar to our typical scope of work at a coal mine.We will perform these services for Lithium Americas under a long-term, hybrid management-fee mining contract.In January 2021, the Thacker Pass Project received a Record of Decision from the U.S.Bureau of Land Management.Additional permitting decisions are expected later in 2021, and production is expected to begin in the second half of 2022. Our diversification from coal into mining limestone, aggregates and lithium demonstrates our ability to develop a diversified mining-services business and provide value-added mining services for a wide range of customers.Investments in people, systems and infrastructure in recent years have served us well throughout the pandemic and are expected to allow us to grow this part of our business without substantial additions to overhead.Our goal is to build North American Mining into a leading provider of contract mining services for customers who produce a wide variety of minerals and materials.We believe North American Mining can grow to be a substantial contributor to operating profit, delivering unlevered after-tax returns on invested capital in the mid-teens as this business model matures and achieves significant scale. Mitigation Resources of North America offers opportunity for growth and diversification in an area where we have substantial expertise and a very strong reputation. Mitigation Resources acquires properties with impaired streams, wetlands or species habitats, and restores, enhances and preserves them, creating mitigation credits that can be sold to offset nearby disturbances by others. In addition, Mitigation Resources provides services for permittee-responsible mitigation projects, such as the Tobaksákola Mitigation Site, shown here.

6 Whether mining coal in North Dakota or Mississippi or limestone in Florida, our commitment to customer satisfaction, operational excellence, safety and environmental stewardship shows clearly in everything we do. Clockwise from top left, a dragline in North Dakota moves overburden to uncover a seam of coal; a dragline operator with Mississippi Lignite Mining Company is focused on safe operations; and an employee safely overseeing activity at a North American Mining site.

7 Our Minerals Management business is built from our historical ownership of mineral rights in the natural gas-rich Marcellus and Utica basins in southeastern Ohio.These mineral rights were acquired decades ago, when we were actively mining coal in that part of the country.Technological advancements for domestic production of oil and gas, and new and upgraded transportation pipelines serving this area, allowed rapid development and monetization of these mineral reserves over the last few years. We began executing on our strategy to Grow and Diversify the Minerals Management business in 2020 with the acquisition of $14.2 million of mineral and royalty interests in the Permian Basin in Texas.These acquisitions represent the first step in a disciplined acquisition plan to expand our geographic footprint of mineral and royalty interests and diversify into a more balanced mix of oil and gas assets across a range of development stages that include undeveloped interests.Our initial focus is generally in oil-rich basins offering diversification from our legacy mineral interests. We established Catapult Mineral Partners to manage this part of our business, and have built a small but highly effective staff with low overhead and advanced technology, to advance our strategies.Catapult President Brian Larson, a West Point graduate and petroleum engineer with an MBA, oversees our Minerals Management business, managing our legacy assets and leading our acquisition program. Our minerals acquisition strategy focuses on developing external relationships and leveraging in-house expertise to identify and acquire interests in high-quality oil and gas resources at advantageous prices.While we will fund the initial investment to acquire these interests, we will not incur any development capital expenditures thereafter, as all further development costs are entirely borne by third-party producers who lease the minerals.Our return on investment in this business comes from receiving a royalty interest derived from production revenue generated by the third-party producers.This business model for the Minerals Management business can deliver higher average operating margins over the life of a reserve, compared with traditional oil and gas companies that bear the cost of exploration, production and/or development.Our goal is to construct a diversified portfolio of high-quality oil and, to a lesser extent, gas, mineral and royalty interests in the United States that deliver near-term cash flow yields and long-term projected growth.We believe this business will provide unlevered after-tax returns on invested capital in the low-to-mid-teens as our portfolio of reserves and mineral interests grows and this business model matures. Mitigation Resources of North America made excellent progress in 2020 as it expanded operations into multiple states across the southeastern part of the country.Mitigation Resources provides stream and wetland mitigation solutions by developing mitigation banks on its own or in conjunction with land owners and others.This business offers opportunity for growth and diversification in an industry where we have substantial expertise and a very strong reputation, built on decades of high-quality environmental work at our mining operations.Mitigation Resources acquires properties with impaired streams, wetlands, or species habitats and restores, enhances and preserves them, creating mitigation credits that can be sold to offset nearby disturbances by others.Mitigation Resources also provides mitigation advisory services using our service-based business model to design and implement mitigation projects on behalf of others. Mitigation Resources is led by Eric Anderson, who has more than 20 years of management and technical experience in “Waters of the United States” identification, functional assessment, permitting and restoration services.Eric holds a Ph.D.in soil science from North Carolina State University and spent time as a research scientist focused on carbon sequestration in wetland ecosystems, along with previously serving as Environmental Manager at our Sabine Mine in Texas. Our goal is to grow Mitigation Resources into one of the ten largest U.S.providers of mitigation solutions, largely focused on streams and wetlands, initially in the southeast United States.While this business is in the early stages of development, we believe that Mitigation Resources can provide solid rates of return as this business matures. It is clear that we are a company in transition.While we continue to believe that coal represents a reliable source of power, our coal-related Protect the Core efforts are balanced by our work to Grow and Diversify into new lines of business, each with promising prospects.As the nature of our business evolves, we are midway through an initiative that will better describe what each of our businesses does and how each business delivers value. Support for our portfolio of businesses is provided by a lean corporate group.Our efforts to effectively and strategically manage costs led us to initiate a voluntary separation program in the fourth quarter of 2020.This program, and natural attrition, reduced headcount at our headquarters locations by approximately 25%.As a company with a historically strong employee-retention rate and deep roots in our communities, it was difficult to see employees leave.However, we believe we Our goal is to build North American Mining into a leading provider of contract mining services for customers who produce a wide variety of minerals and materials.

will be able to gain efficiencies as we continue to rethink how we operate in a more streamlined manner, including through the use of technology and innovation. Our 2020 financial results were disappointing.As we entered 2020, we expected a decrease in operating profit in the Minerals Management segment compared with 2019 due to low natural gas prices and the natural decline in production expected at newer natural gas wells in Ohio.The pandemic made natural gas market conditions worse than expected, which negatively affected our results, and we also experienced a reduction in earnings in the Coal Mining segment as we dealt with transition in the coal industry.For the year ended December 31, 2020, we reported net income of $14.8 million compared with net income of $39.6 million in 2019.Despite the challenges experienced in 2020, we continue to have a positive view of our long-term business prospects, given our strategy to Grow and Diversify, a strong pipeline of business development opportunities and the quality of our team. NACCO is fortunate to have long-term stockholders, talented and dedicated people and a strong capital structure.Our disciplined approach to capital allocation allowed us to end 2020 with a cash balance of $88.5 million, debt of $46.5 million, and equity of over $300 million, giving NACCO ample financial flexibility to continue to execute our strategy to Grow and Diversify.While we may consider growth through acquisition, we would be very selective in any M&A activity, and we will not take on excessive debt.Our priorities for capital remain unchanged: fund needed capital expenditures for existing businesses while investing in initiatives that will drive future growth.While we maintain a disciplined approach to investing capital, we also continue to return cash to stockholders through dividends and, as appropriate, share repurchases. I would like to recognize General (Ret.) Lori Robinson, who joined our Board of Directors in September 2019.General Robinson served in the United States Air Force and at retirement was serving as Commander, North American Aerospace Defense Command (NORAD) and United States Northern Command (USNORTHCOM), where she became the United States’ first female combatant commander.We are privileged to have General Robinson as a director. During 2020, Tim Light retired from our Board of Directors.Mr.Light added tremendous value as a thoughtful and committed Board member during his tenure and I would like to thank him for his service.I would also like to welcome Bob Shapard, who joined our Board of Directors in September 2020.Mr.Shapard is the chairman of the Board of Oncor Electric Delivery Co.LLC, where he served as CEO from April 2007 until March 2018.He is also a director at Oncor Electric Delivery Holdings Co.LLC and Leidos Holdings, Inc.Mr.Shapard is adding great value to our Board and we are excited to be working with him. Our employees, management team and Board are strongly aligned in our commitment to create long-term stockholder value, with an eye on taxable investors.We are committed to maintaining a strong balance sheet, and ultimately, we believe our two key strategies – Protect the Core and Grow and Diversify – provide the right balance as we chart our future. While 2020 was not an easy year, I am awed by the tremendous accomplishments of our incredible team of employees, and I am proud of the progress we made to advance our goals.Together, as a team, we look forward to building on our 108-year history.â–² We believe our two key strategies – Protect the Core and Grow and Diversify– provide the right balance as we chart our future. J.C. Butler, Jr. President and Chief Executive Officer, NACCO Industries, Inc. and The North American Coal Corporation 8

9 Corporate Responsibility Corporate responsibility has been a cornerstone of our company for decades, long before environmental, social and governance (ESG) nomenclature was developed.We hold ourselves to high standards.Quite simply, we believe we have a responsibility to do the right thing, every time, in every situation.This core value of responsible behavior shapes our approach to all relationships, our focus on safety, our involvement in the communities where we live and work, and our care for the environment.Our reputation is important to us.We recognize that our legacy will determine our future, so we operate with a long-term perspective.We operate this way because it is in the long-term best interest of our employees, our company and our stockholders. Long-term thinking is part of our culture, our corporate DNA.Our company was founded in 1913, and we continue to operate in the communities where our business began.Descendants of Frank Taplin, our founder, continue to own a substantial portion of our stock today and are deeply committed to the company and its future.Five generations of stock ownership provide a long-term perspective that few companies enjoy.A number of our institutional investors have owned our stock for many years as well. We firmly believe that good corporate governance and long-term success are inextricably linked.A clear, well-thought-out approach to corporate governance allows our management team to focus on running the company, and doing what is right, with a long-term perspective.We believe that short-term perspectives fall short when thinking about transformational business strategies that can take years to develop and implement. Our Board of Directors has long maintained strong governance practices, designed to ensure accountability, fiscal responsibility and the highest levels of ethical conduct.Our Board of Directors, management team and employees are aligned in expectations that everyone has responsibility for operating ethically, responsibly and safely at every level of our business.It is always the right thing to do. While NACCO may be viewed as having certain characteristics of a closely held corporation, our Board has annually decided to comply with the independence rules of the New York Stock Exchange.Independent directors make up a majority of our Board (nine of 12), and independent directors chair each of the key Board committees.In fact, no members of the extended founding family serve on any of the Audit Review, Compensation or Nominating and Corporate Governance Committees.Our Board includes a balance of longer-tenured members with in-depth knowledge of our business and newer members who bring valuable additional attributes, skills and experience.The strength of our corporate governance structure is sustained by a careful balancing and delineation of the roles of our Board, management and stockholders.We believe that our governance structure offers us a distinct competitive advantage by allowing long-term thinking and decision-making to guide our way, including our approach to social and environmental matters. In 2020, we established an employee-led ESG Advisory Group which is responsible for providing thoughtful input on our corporate social and environmental responsibility initiatives.Areas of focus include people, safety, community and environmental responsibility.We have a strong record in each of these focus areas, and we see opportunities to better highlight our work and progress. Our people are our greatest asset.To attract and retain the best people, we provide competitive compensation and benefits, as well as extensive training and educational assistance programs to all employees.We believe in open communication at all levels of the company, insist that everyone be treated with dignity and respect and operate as a team.We provide opportunities for employees to expand their skill sets, and in doing so provide employees with opportunities to grow and develop within our organization.As a result, we enjoy a high level of employee engagement and an extraordinarily high employee-retention rate.We are fiercely proud of what we do, and our employees share a strong bond.Looking out for one another is a key part of the pact between each of us. For over 25 years, we have utilized a restricted stock employee compensation plan which We believe coal represents a reliable source of power, our efforts to support our coal customers are balanced with our work to grow and diversify into new lines of business, each with promising prospects for the future. As a result of our focus on diversification and growth, new businesses such as Catapult Mineral Partners and Mitigation Resources of North American allow us to provide additional value. We are committed to a strong legacy of environmental stewardship. In every instance, we aim to leave the land better than we found it. Our natural resource reclamation process includes planting and maintaining thousands of trees, acres of native grasses and other flora. Many of us live in the very same communities where we work, and we value and act as good stewards of these local natural resources.

now covers more than 30 of our senior leaders.Performance is measured against prescribed factors that include specific financial metrics and progress toward meeting strategic goals.Employees take full ownership of their shares on the date granted, and are required to maintain ownership for a number of years after issuance – three, five or 10 years, depending on role.We believe this equity-based incentive plan motivates our leaders to maintain a long-term perspective on decision making – aligning them with our Board’s vision and our stockholders’ long-term best interest. Safety is our number-one priority.Each day, we commit to every employee that we will provide a safe working environment, and in return we ask every employee to commit to working safely, so that every employee goes home safe at the end of the work day.The National Mining Association ranks us as an industry leader in safety, and we are proud that we have earned more than 100 safety awards at the state and national levels.Our lost-time accident rate is consistently below the national average for comparable mines, and we continue to emphasize the importance of safety at all of our operations.During 2020, five of our mine sites completed the year with no lost-time accidents.Several of our mines have operated for many years without such accidents.For example, Demery Resources celebrated eight years without a lost-time accident and Bisti Fuels celebrated three years without a lost-time accident in 2020.We continue to strive for zero lost-time accidents and zero reportable incidents each and every day. We are actively engaged in the local communities where our employees live and work by supporting employees in their volunteer activities, providing financial support to local non-profits, and providing stable, well-paying jobs.We invest in these local communities to keep them strong.We are long-standing supporters of literacy programs, provide support to local educational and arts organizations, and dependably donate to a wide range of local groups, from volunteer fire departments and ambulance squads to 4-H Clubs and local school groups.Our employees value these organizations and events, and we believe providing this support is important. As an example, we proudly support many community initiatives in the western part of North Dakota, where close to half of our employees live and work.We are long-term contributors to the Sakakawea Medical Center in Hazen, North Dakota, which provides important medical care in the area, including care for many of our employees and their families.If the Sakakawea Medical Center were to close, the nearest emergency room would be more than 80 miles away.We are proud to provide local support for this important asset to the community.We also provide a company-wide matching gift program through which we match charitable donations, dollar for dollar, up to $5,000 per employee, helping our employees raise funds for organizations they believe in. We are committed to a strong legacy of environmental stewardship.In every instance, we aim to leave the land better than we found it.Our natural resource reclamation process includes planting and maintaining thousands of trees, acres of native grasses and other flora.Many of us live in the very same communities where we work, and we value and act as good stewards of these local natural resources.Our commitment to productive reclamation is demonstrated by the fact that we have received more than 90 federal and state awards for successful and innovative reclamation projects over the last 30 years.We are very proud that our Bisti Fuels mine received the Excellence in Surface Coal Mining Reclamation Award from the U.S.Department of the Interior’s Office of Surface Mining Reclamation and Enforcement and the National Mineral Education Award from the Interstate Mining Compact Commission in 2020.These awards are presented to coal mining companies that achieve the most exemplary mining and reclamation work in the country.The North Dakota Public Service Commission awarded the Excellence in Surface Coal Mining and Reclamation Award to The Coteau Properties Company for protecting and preserving a cultural site important to local Native American history.The National Association of State Land Reclamationists awarded its 2020 Mined Land Reclamation Award to Demery Resources in recognition of the exemplary concurrent reclamation work at the Five Forks Mine. In fact, our strong legacy of environmental work led us to create our new business, Mitigation Resources of North America®, dedicated to developing and protecting streams and wetlands.This business builds on our skills, the experience of our people, and our reputation as thoughtful stewards of the environment, while allowing us to deliver tangible environmental benefits in locations outside our normal mining operations. We believe that our focus on developing and maintaining strong relationships with people and communities, keeping everyone safe and operating in an environmentally sensitive manner are critical parts of our commitment to being a good corporate citizen.We believe that the approach to governance prescribed by our Board of Directors promotes our long-term success.â–² Safety is our #1 priority. Each day, we commit to every employee that we will provide a safe working environment, and in return we ask every employee to commit to working safely. 10

Directors and Officers NACCO Industries, Inc. The North American Coal Corporation Directors: J.C. Butler, Jr. President and Chief Executive Officer, NACCO Industries, Inc. andThe North American Coal Corporation John S. Dalrymple Former Governor of the State of North Dakota John P. Jumper Retired Chief of Staff, United States Air Force Dennis W. LaBarre Retired Partner, Jones Day Michael S. Miller Retired Managing Director, The Vanguard Group Richard de J. Osborne Retired Chairman and Chief Executive Officer, ASARCO Incorporated Alfred M. Rankin, Jr. Non-Executive Chairman, NACCO Industries, Inc. Chairman and Chief Executive Officer, Hyster-Yale Materials Handling, Inc. Non-Executive Chairman, Hamilton Beach Brands Holding Company Matthew M. Rankin President and Chief Executive Officer, Carlisle Residential Properties Roger F. Rankin Self-employed (personal investments) Lori J. Robinson Retired General, United States Air Force Robert S. Shapard Chairman and Retired Chief Executive Officer of Oncor Electric Delivery Company Britton T. Taplin Self-employed (personal investments) Officers: J.C. Butler, Jr. President and Chief Executive Officer Elizabeth I. Loveman Vice President and Controller Thomas A. Maxwell Vice President – Financial Planning and Analysis and Treasurer John D. Neumann Vice President, General Counsel and Secretary Sarah E. Fry Associate General Counsel and Assistant Secretary Miles B. Haberer Associate General Counsel Matthew J. Dilluvio Associate Counsel and Assistant Secretary Officers: J. C. Butler, Jr. President and Chief Executive Officer Carroll L. Dewing Vice President – Operations John D. Neumann Vice President, General Counsel and Secretary J. Patrick Sullivan, Jr. Vice President and Chief Financial Officer Eric S. Anderson President, Mitigation Resources of North America Philip N. Berry President, North American Mining Brian M. Larson President, Catapult Mineral Partners Eric A. Dale Treasurer and Senior Director, Financial Planning and Analysis Andrew B. Hart Controller Sarah E. Fry Associate General Counsel and Assistant Secretary Miles B. Haberer Associate General Counsel, Assistant Secretary and President, North American Coal Royalty Company Matthew J. Dilluvio Associate Counsel and Assistant Secretary

NACCO Industries® Corporate Information Annual Meeting The Annual Meeting of Stockholders of NACCO Industries, Inc. will be held on May 19, 2021, at 11:00 a.m. located at: 5875 Landerbrook Drive, Cleveland, Ohio 44124 Form 10-K Additional copies of the Company’s Form 10-K filed with the Securities and Exchange Commission are available free of charge through NACCO Industries’ website (nacco.com) or by request to: Investor Relations NACCO Industries 5875 Landerbrook Drive, Suite 220 Cleveland, Ohio 44124 (440) 229-5130 Stock Transfer Agent and Registrar Stockholder Correspondence: Computershare P.O. Box 505000 Louisville, KY 40233-5000 Overnight Correspondence: Computershare 462 South 4th St., Suite 1600 Louisville, KY 40202 (800) 622-6757 (U.S., Canada and Puerto Rico) (781) 575-4735 (International) Legal Counsel McDermott Will & Emery LLP 444 West Lake Street Chicago, Illinois 60606 Independent Registered PublicAccounting Firm Ernst & Young LLP 950 Main Ave., Suite 1800 Cleveland, Ohio 44113 Stock Exchange Listing The New York Stock Exchange Symbol: NC Investor Relations Contact Investor questions may be addressed to: Investor Relations NACCO Industries 5875 Landerbrook Drive, Suite 220 Cleveland, Ohio 44124 (440) 229-5130 NACCO Industries Website Additional information about NACCO Industries may be found at nacco.com. The Company considers this website to be one of the primary sources of information for investors and other interested parties. North American Coal Website Additional information about North American Coal may be found at nacoal.com.

14 ® 5875 Landerbrook Drive, Suite 220 • Cleveland, Ohio 44124 An Equal Opportunity Employer