Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Stone Point Credit Corp | d59524dex322.htm |

| EX-32.1 - EX-32.1 - Stone Point Credit Corp | d59524dex321.htm |

| EX-31.2 - EX-31.2 - Stone Point Credit Corp | d59524dex312.htm |

| EX-31.1 - EX-31.1 - Stone Point Credit Corp | d59524dex311.htm |

| EX-14.1 - EX-14.1 - Stone Point Credit Corp | d59524dex141.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2020

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-56209

Stone Point Credit Corporation

(Exact name of registrant as specified in its charter)

Delaware

(State of Incorporation)

20 Horseneck Lane

Greenwich, Connecticut 06830

(Address of principal executive offices)

85-3149929

(I.R.S. Employer Identification No.)

(203) 862-2900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| None | None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The issuer had 4,255,319 shares of common stock, $0.001 par value per share, outstanding as of March 19, 2021.

Table of Contents

Stone Point Credit Corporation

FORM 10-K FOR THE PERIOD ENDED DECEMBER 31, 2020

Table of Contents

Summary of Risk Factors

Investing in the Company’s common stock (the “Common Stock”) involves a high degree of risk. Some, but not all, of the risks and uncertainties that the Company faces are summarized below. Please refer to Item 1A for a more fulsome description of each risk.

Risks Relating to the Company’s Business and Structure

| • | The Company has little operating history. |

| • | The success of the Company depends in substantial part on the experience and expertise of the Adviser and its Investment Team. |

| • | Legal, tax and regulatory changes could occur that may adversely affect the Company at any time during its term. |

| • | The business of identifying and structuring investments of the types contemplated by the Company is highly competitive and involves a high degree of uncertainty. |

| • | The Company’s investments are subject to the risks of investing in the financial services industry. |

| • | Certain sectors targeted by the Company are highly cyclical and subject to significant fluctuation. |

| • | Economic recessions or downturns could impair the portfolio companies, and defaults by the portfolio companies will harm the Company’s operating results. |

| • | Brexit is likely to lead to ongoing political and economic uncertainty and periods of exacerbated volatility in both the United Kingdom and in wider European markets for some time. |

| • | The information and technology systems of the Company, the Adviser and their respective service providers may be vulnerable to cyber-attacks. |

| • | The Common Stock is an illiquid investment for which there is not a secondary market nor is it expected that any such secondary market will develop in the future. |

| • | Shareholders may be subject to significant adverse consequences in the event such a Shareholder defaults on its capital commitment to the Company. |

| • | Employees of the Adviser may serve as directors of some portfolio companies and, as such, may have duties to persons other than the Company, including other shareholders of such portfolio companies. |

| • | The Adviser will not assume any responsibility to the Company other than to render the services described in its Investment Advisory Agreement with the Company, and it will not be responsible for any action of the Board in declining to follow the Adviser’s advice or recommendations. |

| • | As a BDC, the 1940 Act prohibits the Company from acquiring any assets other than certain qualifying assets unless, at the time of and after giving effect to such acquisition, at least 70% of the Company’s total assets are qualifying assets. |

| • | If the Company does not maintain its status as a BDC, the Company might be regulated as a closed-end investment company under the 1940 Act, which would subject it to substantially more regulatory restrictions and correspondingly decrease the Company’s operating flexibility. |

| • | The Company is and will remain an “emerging growth company” as defined in the JOBS Act. |

| • | As a public entity, the Company is subject to the reporting requirements of the Exchange Act and requirements of the Sarbanes-Oxley Act. |

| • | The Company intends to qualify as a RIC under Subchapter M of the Code. To qualify for and maintain RIC tax treatment under the Code, the Company must meet, amongst other requirements, requirements related to annual distributions, source of income and asset diversification. |

| • | Certain of the Company’s debt investments may contain provisions providing for the payment of PIK interest. |

| • | The Company is subject to certain restrictions imposed by ERISA. |

| • | Shareholders may experience dilution. |

| • | The net asset value and liquidity, if any, of the market for shares of the Common Stock may be significantly affected by numerous factors, some of which are beyond the Company’s control and may not be directly related to the Company’s operating performance. |

| • | The Board may be authorized to issue shares of preferred stock in one or more series without Shareholder approval, which could potentially adversely affect the interests of existing Shareholders. |

| • | The amount of any distributions the Company may make on the Common Stock is uncertain. |

| • | The Company’s business faces increasing public scrutiny related to environmental, social and governance (“ESG”) activities. |

| • | The Company intends to operate as a non-diversified investment company within the meaning of the 1940 Act, which means that the Company will not be limited by the 1940 Act with respect to the proportion of its assets that it may invest in a single issuer. |

4

Table of Contents

| • | There can be no assurance that there will be a sufficient number of suitable investment opportunities satisfying the investment objectives of the Company to enable the Company to invest all of its committed capital, or that such investment opportunities will lead to completed investments by the Company. |

| • | Company may co-invest in portfolio companies with third parties (including, in certain circumstances, investment funds, accounts and investment vehicles managed by the Adviser and its affiliates) through partnerships, joint ventures or other arrangements. |

| • | The Company may make minority investments, or may make investments in “club” deals alongside entities sponsored by other private credit or private equity firms, in portfolio companies where the Company may not have the right to appoint a director or otherwise be able to control or effectively influence the business or affairs of such entities. |

| • | The Company may make follow-on investments in certain portfolio companies or have the opportunity to increase an investment in certain portfolio companies. |

| • | The Company may, subject to the limitations described herein, incur leverage in connection with its operations, collateralized by its assets and/or capital commitments. |

| • | General interest rate fluctuations may have a substantial negative impact on the Company’s investments, the value of the Company’s common stock and the Company’s rate of return on invested capital. |

| • | Changes in the method pursuant to which LIBOR is determined, or a discontinuation of LIBOR, may adversely affect the value of the financial obligations to be held or issued by us that are linked to LIBOR. |

| • | In connection with certain portfolio investments, the Company may employ hedging techniques designed to reduce the risk of adverse movements in interest rates, securities prices and currency exchange rates. |

Risks Relating to the Company’s Investments

| • | The Company expects to invest primarily by making loans. |

| • | The Company will acquire a significant percentage of its portfolio company investments from privately held companies in directly negotiated transactions. |

| • | Investments in private and middle-market companies involves a number of significant risks. |

| • | The Company’s investment portfolio may contain securities or instruments issued by publicly held companies. |

| • | The Company will accept subscriptions and will maintain books and records in dollars although the Company may invest a portion of capital outside of the United States (and in various foreign currencies). |

| • | The Company’s investments will be subject to various risks, particularly the risk that the Company will be unable to realize their investment objectives by sale or other disposition at attractive prices or be unable to complete any exit strategy. |

| • | Investing in the Company presents certain risks, including, but not limited to, risks associated with: credit, investments in loans, “higher-yielding” debt securities, stressed and distressed investments, investments in public companies, credit ratings, prepayment, and interest rates. |

General Risk Factors

| • | General economic conditions may affect the Company’s activities. |

| • | The Company is currently operating in a period of capital markets disruption, significant volatility and economic uncertainty. |

| • | The outbreak of COVID-19 has caused, and for an unknown period of time, will continue to cause, disruptions in global debt and equity markets and economies in regions in which the Company operates. |

| • | Portfolio investments may be affected by force majeure events. |

The Company – Stone Point Credit Corporation

Stone Point Credit Corporation (the “Company”) is structured as an externally managed, non-diversified closed-end management investment company focused on lending to middle market companies. The Company was formed as a Delaware limited liability company on September 8, 2020. On December 1, 2020, in connection with its election to be regulated as a BDC, the Company changed its name and converted to Stone Point Credit Corporation, a Delaware corporation, and the member of Stone Point Capital Credit LLC became the sole Shareholder of Stone Point Credit

5

Table of Contents

Corporation (the “BDC Conversion”). The Company elected to be treated as a BDC under the 1940 Act. In addition, for tax purposes the Company intends to elect to be treated as a RIC under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) for the year ended December 31, 2020.

The Company seeks to generate current income and, to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns. Though no assurance can be given that the Company’s investment objective will be achieved, and investment results may vary substantially on a monthly, quarterly and annual basis. Stone Point Credit Adviser LLC (the “Adviser”) believes that the Company’s investment objective can be achieved by primarily investing in senior secured debt, including first lien, second lien and unitranche debt, or unsecured loans and, to a lesser extent, subordinated loans, mezzanine loans and equity-related securities including warrants, preferred stock and similar forms of senior equity, which may or may not be convertible into a portfolio company’s common equity. The Company may invest without limit in originated or syndicated debt.

The instruments in which the Company will invest typically are not rated by any rating agency, but the Adviser believes that if such instruments were rated, they would be below investment grade, which is an indication of having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. Investments that are rated below investment grade are sometimes referred to as “high yield bonds,” “junk bonds” or “leveraged loans.” Therefore, the Company’s investments may result in an above average amount of risk and volatility or loss of principal.

The Adviser believes that the current market environment presents an attractive investment opportunity for a newly capitalized entrant, such as the Company, which is unencumbered by legacy investments. The Adviser believes the middle market direct lending sector will experience a period of stress over the coming years due to the impact of COVID-19 and that credit impairments for legacy direct lenders, combined with strong demand for new loans from the private equity industry, will present an attractive opportunity for newly capitalized middle market direct lenders unencumbered by legacy portfolio issues. In addition to favorable market dynamics, the Adviser believes the Investment Team’s extensive network of contacts and targeted outbound search model, combined with Stone Point’s reputation and record as a leader in investing in the financial services industry, will provide the Company with a significant competitive advantage in sourcing attractive investment opportunities.

The Adviser – Stone Point Credit Adviser LLC

Subject to the supervision of the Board of Directors (the “Board”), pursuant to an investment advisory agreement between the Company and the Adviser (the “Investment Advisory Agreement”), the Adviser manages the day-to-day operations of the Company and provides the Company with investment advisory and management services. The Adviser is an affiliate of Stone Point Capital LLC (“Stone Point” or the “firm”), which is a privately-held firm specializing in investments within the global financial services industry with an investment track record of over 20 years and more than $27 billion in assets under management. The Adviser, an affiliate of Stone Point, manages more than $2.6 billion in assets under management across the credit platform. Stone Point has significant experience investing in both the private equity and credit sectors.

Pursuant to a resource sharing agreement between Stone Point and the Adviser (the “Resource Sharing Agreement”), Stone Point makes the investment professionals on the Stone Point credit investment team (the “Stone Point Credit Investment Team”) available to the Adviser for purposes of originating and identifying investment opportunities, conducting research and due diligence on prospective investments, analyzing and underwriting investment opportunities, structuring investments and monitoring and servicing the Company’s investments in accordance with the services provided by the Adviser under the Investment Advisory Agreement (“Credit Activities”). On an as needed basis, certain other investment professionals on the Stone Point private equity investment team (together with the Stone Point Credit Investment Team, the “Investment Team”) will contribute a portion of their time, effort and expertise to support Credit Activities. The Stone Point Credit Investment Team employs a blend of top-down and bottom-up analysis. The senior members of the Stone Point Credit Investment Team have been actively involved in the alternative credit investing market for many years and have built strong relationships with private equity sponsors, banks and financial intermediaries. As of December 31, 2020, the Investment Team was comprised of approximately 64 investment professionals. A substantial majority of the Investment Team is focused in the private equity markets; however, Stone Point intends to continue to expand the dedicated Stone Point Credit Investment Team to support the ongoing growth of the BDC and expansion of Credit Activities. In addition, the Investment Team is supported by finance, operational, administrative, compliance, investor relations and business development professionals. These individuals may have additional responsibilities other than those relating to the Company, including other credit products sponsored by Stone Point Credit and private equity products sponsored by Stone Point, but will allocate a portion of their time in support of the Company’s business and investment objective. In addition, the Adviser believes that it has access to the assistance of Stone Point’s experienced personnel, including expertise in risk management, legal, accounting, tax, information technology and compliance, among others. The Company expects to benefit from the support provided by these personnel in its operations.

6

Table of Contents

The Adviser’s investment committee servicing the Company is comprised of James D. Carey, Charles A. Davis, Stephen Friedman, David J. Wermuth and Nicolas D. Zerbib (the “Investment Committee”), who bring substantial private equity, investment banking, insurance, government and executive management experience and also serve as the Investment Committee for the private equity funds raised and managed by Stone Point (the “Stone Point Funds”). This group has had primary responsibility for managing the Stone Point Funds since 1998. The Investment Committee is responsible for making all investment and disposition decisions subject to the supervision of the Board, a majority of which is made up of Independent Directors.

The Adviser believes that the Investment Team’s and Investment Committee’s extensive network of contacts, which includes financial sponsors, debt investors, banks and specialty lenders, as well as the Adviser’s targeted outbound search model and its reputation and record as a leader in investing in the financial services industry, will provide the Company with a significant competitive advantage in sourcing, diligencing and underwriting attractive investment opportunities. Stone Point has created a network in sourcing, monitoring and workouts/restructuring that may be utilized by the Company as needed in managing the Company’s investments.

The Board of Directors

The Company’s business and affairs are managed under the direction of its Board. The Board consists of five members, three of whom are not “interested persons” of the Company, the Adviser or their respective affiliates as defined in Section 2(a)(19) of the 1940 Act. These individuals are referred to as the “Independent Directors.” The Independent Directors compose a majority of the Board. Directors who are “interested persons,” as defined in Section 2(a)(19) of the 1940 Act, of the Company or the Adviser are referred to herein as “Interested Directors.” The Board elects the Company’s officers, who serve at the discretion of the Board. The responsibilities of the Board include quarterly determinations of fair value of the Company’s assets, corporate governance activities, oversight of the Company’s financing arrangements and oversight of the Company’s investment activities.

History of Stone Point Capital

Stone Point has a history of successfully investing in the global financial services industry over a period of more than 30 years. The platform began in 1985 and operated as MMC Capital under the ownership of Marsh & McLennan Companies, Inc. until 2005. Current managing directors of Stone Point led the management of MMC Capital from 1998 until 2005, when they formed Stone Point to acquire the business from Marsh & McLennan. Between 1985 and 1993, Stone Point continued to execute a strategy of investing in property & casualty underwriting businesses on an opportunistic basis as market opportunities were identified. In 1994, Stone Point formed its first private equity fund, Trident I, with committed capital to invest in underwriting companies operating principally within the insurance industry. During the last 20 years, the scope of investment activities has broadened to include other financial services companies, including companies in the following sectors: insurance distribution, insurance services, life insurance underwriting, property & casualty insurance underwriting, insurance run-off, depository institutions, outsourcing service providers, specialty finance and non-bank lenders, real estate finance and services, managed care and healthcare services, asset management and distribution, and broker dealers and merchant trading. Stone Point’s expertise, reputation and contacts have enabled it to identify, evaluate and respond quickly to market opportunities, and to work actively in partnership with managers to enhance the value of portfolio companies in numerous segments within the financial services industry.

Investment Objective and Strategy

The Company’s investment objective is to generate current income and, to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns. The Company seeks to invest primarily in senior secured or unsecured loans and, to a lesser extent, subordinated loans, mezzanine loans and equity-related securities including warrants, preferred stock and similar forms of senior equity, which may or may not be convertible into a portfolio company’s common equity.

The Company generally expects to invest in middle market companies with earnings before interest expense, income tax expense, depreciation and amortization, or “EBITDA,” between $30 million and $125 million annually, and/or annual revenue of $75 million to $1.5 billion. Typical middle market senior loans may be issued by middle market companies in the context of leveraged buyouts, acquisitions, debt refinancings, recapitalizations, and other similar transactions. Notwithstanding the foregoing, the Adviser may determine whether companies qualify as “middle market” in

7

Table of Contents

its sole discretion, and the Company may from time to time invest in larger or smaller companies if an attractive opportunity presents itself, especially when there are dislocations in the capital markets, including the high yield and syndicated loan markets. The Company’s target credit investments will typically have maturities between 3 and 6 years and generally range in size between $20 million and $100 million. The investment size will vary with the size of the Company’s capital base. The Company has adopted a non-fundamental policy to invest, under normal market conditions, at least 75% of the value of its total assets (measured at the time of each such investment taking into account certain initial assumptions regarding the expected amount of total assets of the Company once fully invested) in portfolio companies that are in the financial services, business services, software and technology or healthcare services sectors. The remaining 25% of the value of the Company’s total assets (measured at the time of each such investment taking into account certain initial assumptions regarding the expected amount of total assets of the Company once fully invested) may be invested across a wide range of sectors (although the Company expects to avoid businesses which at the time of the Company’s investment participate in certain sectors such as payday lending, pawn shops, automobile title and tax refund anticipation loans, credit repair services, strip mining, drug paraphernalia, marijuana related businesses, tax evasion gaming and pornography).

The Company expects to generate revenues primarily through receipt of interest income from its investments. In addition, the Company may generate income from capital gains on the sales of loans and debt and equity related securities and various loan origination and other fees and dividends on direct equity investments.

As a BDC, the Company must invest at least 70% of its assets in “qualifying assets,” which may include investments in “eligible portfolio companies.” Under the relevant SEC rules, the term “eligible portfolio company” includes all U.S. private operating companies and small U.S. public operating companies with a market capitalization of less than $250 million. See “Item 1. Business – Qualifying Assets.”

Market Opportunity and Competitive Advantages

The Adviser believes the Company presents an attractive investment opportunity for several reasons:

Increasing Demand for Debt Capital. Private equity sponsors have unprecedented levels of capital available for investment, which the Adviser believes will continue to drive demand for direct lending over the coming years as private equity firms seek to deploy capital through leveraged buyouts. The Company believes this dynamic, coupled with the Adviser’s strong relationships in the middle market, will provide significant investment opportunities for the Company.

Near-Term Reduction in Competition from Legacy Non-Bank Lenders. Due to the impacts resulting from the COVID-19 pandemic, as well as relaxed underwriting standards in recent years, the Adviser believes that existing middle market direct lenders are likely to experience significant near-term stress due to disruptions to their portfolio companies’ businesses. Since the Global Financial Crisis, leverage multiples across middle market borrowers have increased significantly and EBITDA adjustments have become more prevalent, resulting in potentially understated “true” leverage levels. The Adviser believes the economic and financial impacts of COVID-19 may result in lower achievement of EBITDA adjustments and less cash flow, which is likely to exacerbate liquidity issues and credit losses over the coming years for existing middle market direct lenders.

The Adviser expects these credit issues to cause middle market lenders to focus on conserving capital to protect their existing portfolio and to limit capital deployment to new middle market direct lending opportunities. The Adviser expects that these capital constraints among legacy direct lenders will provide an opportunity for new market entrants, such as the Company, to pursue investments with attractive risk-adjusted returns.

Proactive Sourcing and Relationship-Driven Deal Flow. The Adviser believes that focusing its activities on proactive, outbound, multi-year searches produces higher quality investment opportunities. The Adviser seeks investment opportunities in sectors that it believes are attractive using a focused three-prong origination strategy. In sourcing investments for the Fund, the Adviser leverages (i) its dedicated team of origination professionals and Stone Point’s broker-dealer professionals focusing on sponsor communities and financial intermediaries within targeted sectors, (ii) its extensive network of private equity investment professionals, focused on more than 70 financial services-related end markets, and (iii) its longstanding relationships with commercial banks who may provide investment opportunities to the Company.

Disciplined Underwriting Process. The Adviser seeks investment opportunities that it believes are attractive using a rigorous “top down” and “bottom up” process. The Adviser regularly evaluates and selects sectors on which to focus based on an investment thesis (top down approach) and designates a team of investment professionals to identify leading companies and managers in these sectors (bottom up approach). For more than 70 identified sectors of the financial services industry, this process includes:

| • | Firm-wide discussions to prioritize the identified sectors |

8

Table of Contents

| • | Dedicating small teams of investment professionals to study these sectors |

| • | Interaction with industry experts and attendance at key industry conferences |

| • | Proactive outbound calling efforts and meetings with private equity sponsors and management teams |

The Adviser employs a “triangulation” approach in evaluating the quality of a credit, focused on borrower characteristics, loan structure and quality of sponsorship. The Adviser generally seeks to invest in companies that are led by experienced management teams, have market-leading positions and high barriers to entry, and generate predictable free cash flow across market cycles. In structuring a loan, the Adviser is generally focused on determining appropriate leverage levels (with a significant focus on adjustments and free cash flow), ensuring sufficient minimum sponsor equity and seeking to mitigate downside risk through structural protections. Finally, the Adviser seeks to invest in companies with strong financial sponsor ownership, focused on underwriting a sponsor’s ability to support the borrower.

Sector Focus. The Company will make its investments primarily in sectors in which Stone Point has developed a longstanding network and can leverage real-time insights from private portfolio companies to provide a discernible origination and underwriting edge. The Adviser currently expects to focus the Company’s investments in the financial services, business services, software and technology, and healthcare services sectors. As a result of this specialization by the Investment Team at the Adviser, the Adviser believes that it is well positioned to source proprietary deals and evaluate a broad range of investments with a deep understanding of the market dynamics and cycles for these sectors.

Further, the Adviser believes the Company’s focus on the financial services, business services, software and technology, and healthcare services sectors will provide strong downside protection, given the low default rates in these industries, as well as Stone Point’s investment experience. The Company’s targeted sectors have performed well across market cycles, consistently generating lower cumulative default rates compared with non-financial sectors, which should contribute to enhanced risk adjusted returns.

Ability to Leverage Stone Point’s Highly Experienced Investment Team. The Adviser intends to utilize Stone Point’s significant resources and expertise throughout the life cycle of each investment to support the Stone Point Credit Investment Team’s Credit Activities. On an as-needed basis, certain other investment professionals will contribute a portion of their time, effort and expertise to support Credit Activities. Stone Point has a long, successful record of making investments and managing businesses in the financial services industry. Stone Point has raised eight private equity funds with an investment track record of over 25 years and a focus on investments in companies in the global financial services industry and related sectors. Stone Point Capital and its affiliates have invested in 26 asset management platforms over 15 years and Stone Point believes that its experience investing in and building businesses across a variety of credit strategies, positions the Company for success in the direct lending middle market. The Stone Point Credit Investment Team is responsible for making all investment and disposition recommendations to the Investment Committee. The Investment Committee will make all investment and disposition decisions, subject to Board oversight. As of December 31, 2020, the Investment Team is comprised of approximately 64 investment professionals (a substantial majority of whom are primarily focused in the private equity markets), operating partners and senior advisors who bring to Stone Point considerable experience with Stone Point and/or from other leading private equity, private debt, investment banking, financial services, corporate law, and accounting firms.

Highly Experienced Investment Committee. The Investment Committee for the Adviser is comprised of James D. Carey, Charles A. Davis, Stephen Friedman, David J. Wermuth and Nicolas D. Zerbib. The Investment Committee currently leads the investment activities of the Stone Point Funds, has worked together at Stone Point for approximately 20 years investing across multiple credit cycles and different investing environments and, previously, Mr. Davis and Mr. Friedman worked together for more than 20 years at Goldman Sachs.

| • | Mr. Carey is a Managing Director at Stone Point. Prior to joining Stone Point, he was in the Financial Institutions Investment Banking Group at Merrill Lynch & Co. and prior to that time was an attorney with Kelley Drye & Warren LLP. |

| • | Mr. Davis is the Chief Executive Officer at Stone Point and the Chairman of the Investment Committees of the Trident Funds. He is a former Vice Chairman of Marsh & McLennan and the former head of the Financial Services Industry Group and head of Investment Banking Services worldwide at Goldman Sachs. |

9

Table of Contents

| • | Mr. Friedman is the Chairman at Stone Point and is the former Chairman of Goldman Sachs, where he was instrumental in creating the firm’s principal investment business. He also previously served as Assistant to President George W. Bush for Economic Policy and Director of the National Economic Council. |

| • | Mr. Wermuth is a Managing Director and the General Counsel at Stone Point. Prior to joining Stone Point, he was an attorney specializing in mergers and acquisitions at Cleary, Gottlieb, Steen & Hamilton LLP and prior to that time an auditor for KPMG Peat Marwick. |

| • | Mr. Zerbib is a Managing Director at Stone Point. Prior to joining Stone Point, he was in the Financial Institutions Group at Goldman Sachs. |

All investment decisions are reviewed and approved by the Investment Committee, which has principal responsibility for approving new investments and overseeing the management of existing investments. This senior management team is supported by a team of investment professionals, operating partners and senior advisors who bring to Stone Point considerable experience with Stone Point.

The following table sets forth the experience of Stone Point’s investment committee.

| Stone Point Senior Investment Team | Years in Financial Services |

Years at Stone Point |

||||||

| James D. Carey, Managing Director |

27 | 24 | ||||||

| Member of the Investment Committee |

||||||||

| Charles A. Davis, Chief Executive Officer |

30+ | 23 | ||||||

| Chairman of the Investment Committee |

||||||||

| Stephen Friedman, Chairman |

30+ | 21 | ||||||

| Member of the Investment Committee |

||||||||

| David J. Wermuth, Managing Director, General Counsel |

24 | 21 | ||||||

| Member of the Investment Committee |

||||||||

| Nicolas D. Zerbib, Managing Director |

26 | 23 | ||||||

| Member of the Investment Committee |

||||||||

Investment Advisory Agreement

The Company entered into the Investment Advisory Agreement dated December 1, 2020 with the Adviser. Pursuant to the Investment Advisory Agreement, the Adviser manages the Company’s day-to-day operations and provides the Company with investment advisory services. Among other things, the Adviser (i) determines the composition and allocation of the Company’s investment portfolio, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identifies, evaluates and negotiates the structure of the investments made by the Company; (iii) performs due diligence on prospective portfolio companies; (iv) executes, closes, services and monitors the Company’s investments; (v) determines the securities and other assets that the Company will purchase, retain or sell; (vi) arranges financings and borrowing facilities for the Company and (vii) provides the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its fund and (viii) to the extent permitted under the 1940 Act and the Investment Advisers Act of 1940 (the “Advisers Act”), on the Company’s behalf, and in coordination with any sub-adviser and any administrator, provides significant managerial assistance to those portfolio companies to which the Company is required to provide such assistance under the 1940 Act, including utilizing appropriate personnel of the Adviser to, among other things, monitor the operations of the Company’s portfolio companies, participate in board and management meetings, consult with and advise officers of portfolio companies and provide other organizational and financial consultation. The Adviser’s services under the Investment Advisory Agreement are not exclusive, and the Adviser is generally free to furnish similar services to other entities so long as its performance under the Investment Advisory Agreement is not adversely affected.

Under the Investment Advisory Agreement, the Company pays the Adviser (i) a base management fee and (ii) an incentive fee as compensation for the investment advisory and management services it provides the Company thereunder.

10

Table of Contents

Base Management Fee

The Company pays to the Adviser an asset-based fee (the “Management Fee”) for management services in an amount equal to an annual rate of 1.30% of the average value of the Company’s gross assets (excluding cash and cash equivalents) as of the last day of the most recently completed calendar quarter and the last day of the immediately preceding calendar quarter payable quarterly in arrears. The Management Fee for any partial quarter will be appropriately prorated and adjusted for any share issuances or repurchases during the relevant calendar months or quarters.

Incentive Fee

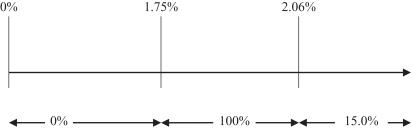

Beginning on the fourth anniversary of the date on which Shareholders are required to fund their initial drawdown (the “Incentive Commencement Date”), the Company will pay the Adviser an incentive fee (“Incentive Fee”) as set forth below. The Incentive Fee will consist of two parts. The first part (the “Investment Income Incentive Fee”) will be calculated and payable following the Incentive Commencement Date on a quarterly basis, in arrears, and will equal 15% of “pre-incentive fee net investment income” for the immediately preceding calendar quarter, subject to a quarterly preferred return of 1.75% (i.e., 7% annualized) measured on a quarterly basis and a “catch-up” feature. For purposes of computing the initial installment of the Investment Income Incentive Fee, if the Incentive Commencement Date does not fall on the first day of a calendar quarter, then the initial payment of the Investment Income Incentive Fee shall be payable for the period that commences on the Incentive Commencement Date through the last day of the first complete calendar quarter immediately following the Incentive Commencement Date and, thereafter, at the end of each subsequent calendar quarter as described above. The second part (the “Capital Gains Incentive Fee”) will be an annual fee that will also commence with the period beginning on the Incentive Commencement Date and will be determined and payable following the Incentive Commencement Date, in arrears, as of the end of each calendar year (or upon termination of the Investment Advisory Agreement) in an amount equal to 15% of realized capital gains, if any, determined on a cumulative basis from the Incentive Commencement Date (based on the fair market value of each investment as of such date) through the end of such calendar year (or upon termination of the Investment Advisory Agreement), computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis from the Incentive Commencement Date (based on the fair market value of each investment as of such date) through the end of such calendar year (or upon termination of the Investment Advisory Agreement), less the aggregate amount of any previously paid Capital Gains Incentive Fees. For the purpose of computing the Capital Gains Incentive Fees, the calculation methodology will look through derivative financial instruments or swaps as if the Company owned the reference assets directly.

Pre-incentive fee net investment income means interest income, dividend income and any other income accrued during the calendar quarter, minus operating expenses for the quarter, including the base Management Fee, expenses payable to the Administrator under the Administration Agreement, any interest expense and distributions paid on any issued and outstanding preferred stock, but excluding (x) the Incentive Fee and (y) any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as debt instruments with payment-in-kind (“PIK”) interest and zero coupon securities), accrued income that the Company has not yet received in cash. The Adviser is not obligated to return to the Company the Incentive Fee it receives on PIK interest that is later determined to be uncollectible in cash.

The following is a graphical representation of the calculation of the income incentive fee:

Incentive Fee on

Pre-Incentive Fee Net Investment Income

Beginning on the Incentive Commencement Date

(expressed as a percentage of average adjusted capital)

Percentage of Pre-Incentive Fee Net Investment Income

11

Table of Contents

Allocated to Quarterly Incentive Fee

The second component of the Incentive Fee is the Capital Gains Incentive Fee. The Capital Gains Incentive Fee is payable at the end of each calendar year in arrears and equals, commencing on the Incentive Commencement Date, 15.0% of cumulative realized capital gains, net of all realized capital losses and unrealized capital depreciation on a cumulative basis from the Incentive Commencement Date to the end of each calendar year. Each year, the Capital Gains Incentive Fee will be paid net of the aggregate amount of any previously paid Capital Gains Incentive Fee for prior periods. The Company will accrue, but will not pay, a Capital Gains Incentive Fee with respect to unrealized appreciation because a Capital Gains Incentive Fee would be owed to the Adviser if the Company were to sell the relevant investment and realize a capital gain. The fees that are payable under the Investment Advisory Agreement for any partial period will be appropriately prorated. For the sole purpose of calculating the Capital Gains Incentive Fee, the cost basis as of the Incentive Commencement Date for all of the Company’s investments made prior to the date of the Exchange Listing will be equal to the fair market value of such investments as of the last day of the calendar quarter in which the date of the Exchange Listing occurs; provided, however, that in no event will the Capital Gains Incentive Fee payable pursuant to the Investment Advisory Agreement exceed the amount permitted by the Advisers Act, including Section 205 thereof.

Indemnification

Pursuant to the Investment Advisory Agreement, the Adviser and its directors, officers, shareholders, members, agents, representatives, employees, controlling persons, and any other person or entity affiliated with, or acting on behalf of the Adviser will not be liable to the Company for their acts under the Investment Advisory Agreement, absent willful misfeasance, bad faith, gross negligence or reckless disregard in the performance of their duties. The Company will also agree to indemnify, defend and protect the Adviser and its directors, officers, shareholders, members, agents, representatives, employees, controlling persons and any other person or entity affiliated with, or acting on behalf of the Adviser with respect to all damages, liabilities, costs and expenses resulting from acts of the Adviser not arising out of willful misfeasance, bad faith, gross negligence or reckless disregard in the performance of their duties.

The Administrator

Stone Point Credit Adviser LLC also serves as the administrator of the Company (in such capacity, the “Administrator”). Subject to the supervision of the Board, the Administrator provides the administrative services necessary for the Company to operate and the Company will utilize the Administrator’s office facilities, equipment and recordkeeping services. The Company will reimburse the Administrator for all reasonable costs and expenses incurred by the Administrator in providing these services, facilities and personnel, as provided by the administration agreement by and between the Company and the Administrator (the “Administration Agreement”). There will be no separate fee paid in connection with the services provided under the Administration Agreement. In addition, the Administrator is permitted to delegate its duties under the Administration Agreement to affiliates or third parties, and the Company will reimburse the expenses of these parties incurred directly and/or paid by the Administrator on the Company’s behalf.

The Administration Agreement provides that, absent willful misfeasance, bad faith or negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, the Administrator and its officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Administrator’s services under the Administration Agreement or otherwise as our administrator.

Expenses

The Company’s primary operating expenses include the payment of fees to the Adviser under the Investment Advisory Agreement, the Company’s allocable portion of overhead expenses under the Administration Agreement, and all other costs and expenses relating to the Company’s operations and transactions, including: operational and organizational costs; the costs of any public offerings of the Company’s Common Stock and other securities, including registration and listing fees; the cost of calculating the Company’s net asset value, including the cost and expenses of third-party valuation services; fees and expenses payable to third parties relating to evaluating, making and disposing of investments, including the Adviser’s or its affiliates’ travel expenses, research costs and out-of-pocket fees and expenses associated with performing due diligence and reviews of prospective investments, monitoring investments and, if necessary, enforcing the Company’s rights; interest payable on debt and other borrowing costs, if any, incurred to finance the Company’s

12

Table of Contents

investments; costs of effecting sales and repurchases of the Company’s Common Stock and other securities; the base Management Fee and any incentive fee; distributions on the Company’s Common Stock; transfer agent and custody fees and expenses; the allocated costs incurred by the Administrator in providing managerial assistance to those portfolio companies that request it; other expenses incurred by the Administrator, the Adviser or the Company in connection with administering the Company’s business, including payments made to third-party providers of goods or services; brokerage fees and commissions; federal and state registration fees; U.S. federal, state and local taxes; independent directors’ fees and expenses; costs associated with the Company’s reporting and compliance obligations under the 1940 Act and applicable U.S. federal and state securities laws; costs of any reports, proxy statements or other notices to Shareholders, including printing costs; costs of holding Shareholder meetings; the Company’s fidelity bond; directors and officers’ errors and omissions liability insurance, and any other insurance premiums; litigation, indemnification and other non-recurring or extraordinary expenses; direct costs and expenses of administration and operation, including printing, mailing, long distance telephone, staff, audit, compliance, tax and legal costs; fees and expenses associated with marketing efforts; dues, fees and charges of any trade association of which the Company is a member; and all other expenses reasonably incurred by the Company or the Administrator in connection with administering the Company’s business.

The Company is expected to make use of certain “mixed-use” services, products and resources that are utilized by the Adviser to provide investment advisory and administrative services to other clients or for proprietary purposes, including but not limited to research and information services, information technology services and software platforms, and third-party service providers. To the extent that the cost of such services may be borne in part by the Company as an operating expense, the Administrator may use various methodologies to determine the Company’s allocable portion of the total cost of such service, product or resource, including but not limited to allocating between the Company and other clients pro rata based on number of clients receiving such services, proportionately in accordance with asset size, or on such other basis that the Administrator determines to be fair and equitable under the circumstances.

The Company will reimburse the Administrator for the allocable portion of overhead and other expenses incurred by the Administrator in performing its obligations under the Administration Agreement, including furnishing the Company with office facilities, equipment and clerical, bookkeeping and recordkeeping services at such facilities, as well as providing the Company with other administrative services. In addition, the Company will reimburse the Administrator for the fees and expenses associated with performing compliance functions, and the Company’s allocable portion of the compensation of certain of the Company’s officers, including the Company’s Chief Financial Officer, Chief Compliance Officer and any support staff.

Dividend Reinvestment Plan

The Company has adopted an “opt out” dividend reinvestment plan (“DRIP”), under which a Shareholder’s distributions would automatically be reinvested under the DRIP in additional whole and fractional Shares, unless the Shareholder “opts out” of the DRIP, thereby electing to receive cash dividends.

Prior to an Exchange Listing, the Company will use newly issued shares of Common Stock to implement the DRIP. Shares of Common Stock will be issued at a price per share equal to the most recent net asset value per share determined by the Board.

After an Exchange Listing, if any, the number of shares of Common Stock to be issued to a Shareholder is expected to be determined by dividing the total dollar amount of the distribution payable to such Shareholder by the market price per share of the Company’s Common Stock at the close of regular trading on the national securities exchange on which the Company’s Common Stock is traded on the date of such distribution. However, in the event the market price per share on the date of such distribution exceeds the most recently computed net asset value per share, the Company would expect to issue shares of Common Stock at the greater of the most recently computed net asset value per share or 95% of the current market price per share (or such lesser discount to the current market price per share that still exceeds the most recently computed net asset value per share). The market price per share on that date would be the closing price for the shares of Common Stock on the national securities exchange on which the Common Stock is traded or, if no sale is reported for such day, at the average of their reported bid and asked prices.

Shareholders who receive distributions in the form of additional shares of Common Stock generally will be subject to the same U.S. federal, state and local tax consequences as Shareholders who elect not to reinvest distributions. Participation in the DRIP will not in any way reduce the amount of a Shareholder’s Capital Commitment.

13

Table of Contents

Regulation as a Business Development Company

The Company has elected to be treated as a BDC under the 1940 Act. As with other companies regulated by the 1940 Act, a BDC must adhere to certain substantive regulatory requirements. The 1940 Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates (including any investment advisers or sub-advisers), principal underwriters and affiliates of those affiliates or underwriters and requires that a majority of the directors be persons other than “interested persons,” as that term is defined in the 1940 Act.

In addition, the 1940 Act provides that the Company may not change the nature of the Company’s business so as to cease to be, or to withdraw the Company’s election as a BDC unless approved by a majority of the Company’s outstanding voting securities. A majority of the outstanding voting securities of a company is defined under the 1940 Act as the lesser of: (i) 67% or more of the voting securities present at such meeting, if the holders of more than 50% of the outstanding voting securities of such company are present or represented by proxy or (ii) more than 50% of the outstanding voting securities of such company.

Any issuance of preferred stock must comply with the requirements of the 1940 Act. The 1940 Act requires, among other things, that (1) immediately after issuance and before any dividend or other distribution is made with respect to the Company’s Common Stock and before any purchase of Common Stock is made, such preferred stock together with all other senior securities must not exceed an amount equal to 50% of the Company’s total assets after deducting the amount of such dividend, distribution or purchase price, as the case may be, and (2) the holder of shares of preferred stock, if any are issued, must be entitled as a class to elect two directors at all times and to elect a majority of the directors if dividends on such preferred stock are in arrears by two full years or more.

Certain other matters under the 1940 Act require a separate class vote of the holders of any issued and outstanding preferred stock. For example, holders of preferred stock would be entitled to vote separately as a class from the holders of Common Stock on a proposal involving a plan of reorganization adversely affecting such securities.

The Company may invest up to 100% of the Company’s assets in securities acquired directly from issuers in privately negotiated transactions. With respect to such securities, the Company may, for the purpose of public resale, be deemed a “principal underwriter” as that term is defined under the Securities Act. The Company may purchase or otherwise receive warrants which offer an opportunity (not a requirement) to purchase equity of a portfolio company in connection with an acquisition financing or other investments. Similarly, the Company may acquire rights that obligate an issuer of acquired securities or their affiliates to repurchase the securities at certain times, under certain circumstances.

The Company does not intend to acquire securities issued by any investment company whereby the Company’s investment would exceed the limits imposed by the 1940 Act. Under those limits, the Company generally cannot acquire more than (i) 3% of the total outstanding voting stock of any investment company, (ii) invest more than 5% of the value of the Company’s total assets in the securities of one investment company, or (iii) invest more than 10% of the value of the Company’s total assets in the securities of investment companies in general. These limitations do not apply where the Company (i) makes investments through a subsidiary or (ii) acquires interests in a money market fund as long as the Company does not pay a sales charge or service fee in connection with the purchase. Subject to certain exemptive rules, including Rule 12d1-4, which was recently adopted by the SEC, the Company may, subject to certain conditions, invest in other investment companies in excess of such thresholds. With respect to the portion of the Company’s portfolio invested in securities issued by investment companies, it should be noted that such investments might subject the Company’s Shareholders to additional expenses.

None of the Company’s policies described above are fundamental and each such policy may be changed without Shareholder approval, subject to any limitations imposed by the 1940 Act.

Private funds that are excluded from the definition of “investment company” pursuant to either Section 3(c)(1) or 3(c)(7) of the 1940 Act are also subject to certain of the limits under the 1940 Act noted above. Specifically, such private funds generally may not acquire directly or through a controlled entity more than 3% of the Company’s total outstanding voting stock (measured at the time of the acquisition). As a result, such private funds would be required to hold a smaller position in the Company’s stock than if they were not subject to this restriction.

14

Table of Contents

Qualifying Assets

The Company may invest up to 30% of the Company’s portfolio opportunistically in “non-qualifying assets”, which are driven primarily through opportunities sourced through the Adviser. However, under the 1940 Act, a BDC may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as “qualifying assets,” unless, at the time the acquisition is made, qualifying assets represent at least 70% of the BDC’s total assets. The principal categories of qualifying assets relevant to the Company’s proposed business are the following:

| 1. | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act and rules adopted pursuant thereto as any issuer which: |

| a. | is organized under the laws of, and has its principal place of business in, the United States; |

| b. | is not an investment company (other than a small business investment company wholly owned by the BDC) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

| c. | satisfies any of the following: |

| i. | does not have any class of securities that is traded on a national securities exchange; |

| ii. | has a class of securities listed on a national securities exchange, but has an aggregate market value of outstanding voting and non-voting common equity of less than $250 million; |

| iii. | is controlled by a BDC or a group of companies including a BDC and the BDC has an affiliated person who is a director of the eligible portfolio company; or |

| iv. | is a small and solvent company having total assets of not more than $4.0 million and capital and surplus of not less than $2.0 million, |

| 2. | Securities of any eligible portfolio company which the Company controls. |

| 3. | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities, was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

| 4. | Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and the Company already owns 60% of the outstanding equity of the eligible portfolio company. |

| 5. | Securities received in exchange for or distributed on or with respect to securities described in (1) through (4) above, or pursuant to the exercise of warrants or rights relating to such securities. |

| 6. | Cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment. |

In addition, a BDC must have been organized and have its principal place of business in the United States and must be operated for the purpose of making investments in the types of securities described in 1., 2., 3. or 4. above.

If at any time less than 70% of the Company’s gross assets are comprised of qualifying assets, including as a result of an increase in the value of any non-qualifying assets or decrease in the value of any qualifying assets, the Company would generally not be permitted to acquire any additional non-qualifying assets, other than office furniture and equipment, interests in real estate and leasehold improvements and facilities maintained to conduct the business operations of the BDC, deferred organizational and operating expenses, and other non-investment assets necessary and appropriate to its operations as a BDC, until such time as 70% of the Company’s then current gross assets were comprised of qualifying assets. The Company would not be required, however, to dispose of any non-qualifying assets in such circumstances.

15

Table of Contents

Managerial Assistance to Portfolio Companies

A BDC must have been organized under the laws of, and have its principal place of business in, any state or states within the United States and must be operated for the purpose of making investments in the types of securities described in 1., 2. or 3. above. However, in order to count portfolio securities as qualifying assets for the purpose of the 70% test, the BDC must either control the issuer of the securities or must offer to make available to the issuer of the securities (other than small and solvent companies described above) significant managerial assistance; except that, where the BDC purchases such securities in conjunction with one or more other persons acting together, one of the other persons in the group may make available such managerial assistance. Making available managerial assistance means, among other things, any arrangement whereby the BDC, through its directors or officers, offers to provide, and, if accepted, does so provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company.

Temporary Investments

The Company generally expects to call capital for investment purposes only at the time the Company identifies an investment opportunity. Notwithstanding the foregoing, the Company expects to deploy all proceeds from each capital call for investment purposes within two years of calling such capital. Until such time as the Company invests the proceeds of such capital calls in portfolio companies and while new investments are pending, the Company’s investments may consist of cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment, referred to herein, collectively, as “temporary investments,” so that 70% of the Company’s assets are qualifying assets. The Company may invest in U.S. Treasury bills or in repurchase agreements, provided that such agreements are fully collateralized by cash or securities issued by the U.S. government or its agencies. A repurchase agreement involves the purchase by an investor, such as the Company, of a specified security and the simultaneous agreement by the seller to repurchase it at an agreed-upon future date and at a price which is greater than the purchase price by an amount that reflects an agreed-upon interest rate. There is no percentage restriction on the proportion of the Company’s assets that may be invested in such repurchase agreements. However, if more than 25% of the Company’s net assets constitute repurchase agreements from a single counterparty, the Company may not meet the diversification tests in order to qualify as a RIC. Thus, the Company does not intend to enter into repurchase agreements with a single counterparty in excess of this limit. The Adviser will monitor the creditworthiness of the counterparties with which the Company enters into repurchase agreement transactions.

Code of Ethics

The Company and the Adviser have each adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Advisers Act, respectively, that establishes procedures for personal investments and restricts certain transactions by the Company’s personnel. These codes of ethics generally will not permit investments by the Company’s and the Adviser’s personnel in securities that may be purchased or sold by the Company.

Compliance Policies and Procedures

The Company and the Adviser have adopted and implemented written policies and procedures reasonably designed to detect and prevent violation of the federal securities laws and will be required to review these compliance policies and procedures annually for their adequacy and the effectiveness of their implementation and designate a Chief Compliance Officer to be responsible for administering the policies and procedures. Jacqueline Giammarco currently serves as the Company’s Chief Compliance Officer.

Sarbanes-Oxley Act of 2002

The Sarbanes-Oxley Act imposes a wide variety of regulatory requirements on publicly-held companies and their insiders. Many of these requirements will affect the Company. For example:

| • | pursuant to Rule 13a-14 of the Exchange Act, the Company’s Principal Executive Officer and Principal Financial Officer must certify the accuracy of the financial statements contained in the Company’s periodic reports; |

| • | pursuant to Item 307 of Regulation S-K, the Company’s periodic reports must disclose the Company’s conclusions about the effectiveness of its disclosure controls and procedures; |

| • | pursuant to Rule 13a-15 of the Exchange Act, the Company’s management must prepare an annual report regarding its assessment of the Company’s internal control over financial reporting and (once the Company ceases to be an emerging growth company under the JOBS Act or, if later, for the year following the Company’s first annual report required to be filed with the SEC) must obtain an audit of the effectiveness of internal control over financial reporting performed by its independent registered public accounting firm; and |

16

Table of Contents

| • | pursuant to Item 308 of Regulation S-K and Rule 13a-15 of the Exchange Act, the Company’s periodic reports must disclose whether there were significant changes in the Company’s internal control over financial reporting or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. |

The Sarbanes-Oxley Act requires the Company to review its current policies and procedures to determine whether the Company complies with the Sarbanes-Oxley Act and the regulations promulgated thereunder. The Company will continue to monitor its compliance with all regulations that are adopted under the Sarbanes-Oxley Act and will take actions necessary to ensure that the Company is in compliance therewith.

Proxy Voting Policies and Procedures

The Company will delegate its proxy voting responsibility to the Adviser. As a fiduciary, the Adviser has a duty to monitor corporate events and to vote proxies, as well as a duty to cast votes in the best interest of the Company and not to subrogate Company interests to its own interests. To meet its fiduciary obligations, the Adviser seeks to ensure that it votes proxies in the best interest of the Company, and addresses how the Adviser will resolve any conflict of interest that may arise when voting proxies. The Adviser’s proxy voting policy attempts to generalize a complex subject and the Adviser may, from time to time, determine that it is in the best interests of the Company to depart from specific policies described therein.

Shareholders may, without charge, obtain information regarding how the Company voted proxies with respect to the Company’s portfolio securities by making a written request for proxy voting information to: Chief Compliance Officer, 20 Horseneck Lane, Greenwich, Connecticut 06830 or by contacting the Company’s investor relations department at SPCreditIR@stonepoint.com.

Privacy Principles

The Adviser considers privacy to be fundamental to its relationship with its Shareholders. The Company is committed to maintaining the confidentiality, integrity and security of a Shareholder’s non-public personal information. Accordingly, the Company has implemented internal policies and practices to protect the confidentiality of non-public personal information while still meeting investor needs. The Company will not disclose any non-public personal information about Shareholders, except to its affiliates and service providers as allowed by applicable law or regulation, including any anti-money laundering or anti-terrorist laws or regulations. In the normal course of serving Shareholders, information the Company collects may be shared with companies that perform various services to the Company such as its accountants, attorneys, transfer agents, escrow agents, custodians, administrative agents, marketing service firms, broker-dealers and other similar relationships.

In addition, information the Company collects may be shared with certain of the Company’s portfolio investments and/or their advisors, when necessary, to meet withholding tax requirements or other legal and/or regulatory obligations or to facilitate transaction-related matters.

Any third party that receives non-public personal information is required to use Shareholder information only for the purposes for which the Company discloses the information to them and as allowed by applicable law or regulation. Such third party is not permitted to share or use this information for any other purpose. The Company does not sell Shareholder personal information.

Visitors to the Company’s website at www.stonepoint.com should review the Terms of Use & Privacy Policy statements on the website.

Reporting Obligations

The Company will furnish the Shareholders with annual reports containing audited financial statements, quarterly reports, and such other periodic reports as the Company determines to be appropriate or as may be required by law. The Company is required to comply with all periodic reporting, proxy solicitation and other applicable requirements under the Exchange Act. Shareholders and the public may view materials the Company files with the SEC on its website (http://www.sec.gov).

17

Table of Contents

Material U.S. Federal Income Tax Considerations

The following discussion is a general summary of certain material U.S. federal income tax considerations applicable to the Company and an investment in shares of Common Stock. The discussion is based upon the Code, the regulations of the U.S. Department of Treasury promulgated thereunder, referred to herein as the “Treasury regulations,” the legislative history of the Code, current administrative interpretations and practices of the Internal Revenue Service, referred to herein as the “IRS” (including administrative interpretations and practices of the IRS expressed in private letter rulings which are binding on the IRS only with respect to the particular taxpayers that requested and received those rulings) and judicial decisions, each as of the date of this Form 10-K and all of which are subject to change or differing interpretations, possibly retroactively, which could affect the continuing validity of this discussion. The Company has not sought, and will not seek, any ruling from the IRS regarding any matter discussed in this summary, and this summary is not binding on the IRS. Accordingly, there can be no assurance that the IRS will not assert, and a court will not sustain, a position contrary to any of the tax consequences discussed below.

Investors should note that this summary does not purport to be a complete description of all the tax aspects affecting the Company or the Shareholders. For example, this summary does not describe all of the U.S. federal income tax consequences that may be relevant to certain types of Shareholders subject to special treatment under the U.S. federal income tax laws, including Shareholders subject to the alternative minimum tax, tax-exempt organizations, insurance companies, partnerships or other pass-through entities and their owners, Non-U.S. Shareholders (as defined below) engaged in a trade or business in the United States or entitled to claim the benefits of an applicable income tax treaty, persons who have ceased to be U.S. citizens or to be taxed as residents of the United States, U.S. Shareholders (as defined below) whose functional currency is not the U.S. dollar, persons holding the Company’s Common Stock in connection with a hedging, straddle, conversion or other integrated transaction, dealers in securities, traders in securities that elect to use a mark-to-market method of accounting for securities holdings, pension plans and trusts, and financial institutions. This summary assumes that Shareholders hold shares of Common Stock as capital assets for U.S. federal income tax purposes (generally, assets held for investment). This summary does not discuss any aspects of U.S. estate or gift taxation, U.S. state or local taxation or non-U.S. taxation. It does not discuss the special treatment under U.S. federal income tax laws that could result if the Company invests in tax-exempt securities or certain other investment assets.

For purposes of this discussion, a “U.S. Shareholder” is a beneficial owner of shares of Common Stock that is, for U.S. federal income tax purposes:

| • | an individual who is a citizen or resident of the United States; |

| • | a corporation, or other entity treated as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United States or any state thereof, including, for this purpose, the District of Columbia; |

| • | a trust if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more “United States persons” (as defined in the Code) have the authority to control all substantive decisions of the trust, or (ii) the trust has in effect a valid election to be treated as a domestic trust for U.S. federal income tax purposes; or |

| • | an estate, the income of which is subject to U.S. federal income taxation regardless of its source. |

For purposes of this discussion, a “Non-U.S. Shareholder” is a beneficial owner of shares of Common Stock that is not a U.S. Shareholder or a partnership (or an entity or arrangement treated as a partnership) for U.S. federal income tax purposes.

If a partnership, or other entity or arrangement treated as a partnership for U.S. federal income tax purposes, holds shares of Common Stock, the U.S. federal income tax treatment of a partner in the partnership generally will depend on the status of the partner, the activities of the partnership and certain determinations made at the partner level. A Shareholder that is a partnership holding shares of Common Stock, and each partner in such a partnership, should consult his, her or its own tax adviser with respect to the tax consequences of the purchase, ownership and disposition of shares of Common Stock.

18

Table of Contents

Tax matters are very complicated and the tax consequences to each Shareholder of the ownership and disposition of shares of Common Stock will depend on the facts of his, her or its particular situation. Investors should consult their own tax adviser regarding the specific tax consequences of the ownership and disposition of shares of Common Stock to them, including tax reporting requirements, the applicability of U.S. federal, state and local tax laws and non-U.S. tax laws, eligibility for the benefits of any applicable income tax treaty and the effect of any possible changes in the tax laws.

Election to be Taxed as a RIC