Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - Thryv Holdings, Inc. | exhibit211-202010xk.htm |

| EX-31.2 - EX-31.2 - Thryv Holdings, Inc. | exhibit312-202010xk.htm |

| 10-K - 10-K - Thryv Holdings, Inc. | dxm-20201231.htm |

| EX-23.1 - EX-23.1 - Thryv Holdings, Inc. | exhibit231-202010xk.htm |

| EX-32.1 - EX-32.1 - Thryv Holdings, Inc. | exhibit321-202010xk.htm |

| EX-31.1 - EX-31.1 - Thryv Holdings, Inc. | exhibit311-202010xk.htm |

| EX-4.1 - EX-4.1 - Thryv Holdings, Inc. | exhibit41-202010xk.htm |

| EX-32.2 - EX-32.2 - Thryv Holdings, Inc. | exhibit322-202010xk.htm |

| Exhibit 10.16 | ||||

2020 SHORT TERM INCENTIVE PLAN (“STIP”)

Effective January 1, – December 31, 2020

PURPOSE

The Short Term Incentive Plan (the “Plan” or “STIP”) is designed to reward eligible non-sales, non-bargained for employees for achievement of pre-established corporate performance measures and individual performance objectives that are assigned a specific weight according to their importance in the Company’s business plan. This Plan, for eligible employees, covers the period from January 1, 2020 through December 31, 2020.

This Plan supersedes any prior incentive plan version and cancels any document that provides information contrary to the information contained in this Plan version. The Company may terminate the Plan, amend or modify the Plan in any respect, at any time, and without notice. In addition, incentive awards are not “earned” until the events described in the Administration section occur.

ELIGIBILITY

All regular full-time and part-time non-sales, non-bargained for employees who are employed during the calendar year, and who commence employment with the Company before October 1, 2020, and who do not participate in another incentive plan currently in operation, are potentially eligible to participate in the Plan. To be eligible to earn and receive payment of any incentive award, the participant must be:

1.Classified as a permanent employee;

2.Employed with the Company during some portion of the period for which the award is being measured, and initially hired by the Company before October 1, 2020; and

3.Actively working through the payment date, or on Company-approved or job-protected leave for any periods not worked where the Company has a reasonable expectation that the employee will return to their position in the near future and is active on the date the award is “earned,” as defined in the Administration section. An individual is “actively working” if he or she is actually working and carrying out his or her duties at the Company, or he or she is on PTO or a paid Company holiday.

4.Must be in an STI eligible position for a minimum of 90 consecutive days in order to be eligible for a prorated award.

Incentive awards are not “earned” until the events described in the Administration section occur.

The following individuals are not eligible for a payment under STIP:

1.Employees who voluntarily terminate their employment or are involuntarily terminated for any reason are not eligible for the 2020 STIP payment. In addition, payment to employees who are under investigation for misconduct on the normal payout date may be delayed. If it is determined that misconduct occurred and termination occurs, the award is forfeited in accordance with applicable state law.

2.Contractors and interns are not eligible.

3.Employees who are participating in any other incentive plan within the Company (i.e. Sales Incentive programs, quarterly incentive programs, etc.).

4.Employees who are in an STI eligible position for less than 90 consecutive days.

2020 STIP DESIGN

Performance metrics, weighting, and the pre-established performance goals are set by the Compensation Committee. Performance against pre-established corporate goals, as determined by the Committee and the Chief Executive Officer, determine the funding level that will be available for awarding incentives. If it is determined that the 2020 STIP awards will be granted, senior management and the Board retain the sole discretion to set award levels and to adjust award levels and subsequent employee distribution.

| HR Compensation | 2020 Short Term Incentive Plan Page 1 of 6 | 2020 Short Term Incentive Plan April 2020 | ||||||

| Exhibit 10.16 | ||||

Individual Target Bonus Opportunity

Each individual is assigned a target award opportunity that is a percentage of the individual’s base salary. The target percentage opportunity is determined based on the individual’s job(s) during the Plan Coverage Period, which may result in a target that has been prorated to capture the relevant base salary earnings in each job, the target percentage of each job and the amount of time spent in each job. The eligible employee’s annual eligible base salary on December 31 of the Plan year will be used when proration(s) are not required.

The annual STIP targets by job level are as follows:

Table 1:

| JOB LEVEL | 2020 STIP TARGET % | ||||

| Chief Executive Officer | 100% | ||||

| Executive Vice President (EVP) | 60% - 70% | ||||

| Vice President (VP) | 40% | ||||

| Assistant Vice President (AVP) | 30% | ||||

| Director (DIR) | 25% | ||||

Sr Manager (SRMGR), Manager (MGR), Sr Exempt Individual Contributor (SRIC) | 15% | ||||

| Supervisor (SUPV) | 10% | ||||

| Exempt Individual Contributor (IC) | 8% | ||||

| Non-Exempt Individual Contributor (NEIC) | 5% | ||||

Performance Goals

There are three components of the 2020 STIP performance goals for January 1 through December 31, 2020:

Table 2:

| Plan Component | Weighting | Target for January 1, 2020 through December 31, 2020 | ||||||

| EBITDA | 50% | $400 MM | ||||||

| Adjusted Free Cash Flow | 25% | $197 MM | ||||||

| Individual Performance | 25% | Funds once EBITDA reaches $375 MM | ||||||

The individual performance awards are determined based on individual performance ratings as recorded on the year-end performance appraisal. As a result, eligible employees may receive an award that is higher or lower than the 2020 STIP target awards as defined by their job level.

| HR Compensation | 2020 Short Term Incentive Plan Page 2 of 6 | 2020 Short Term Incentive Plan April 2020 | ||||||

| Exhibit 10.16 | ||||

FUNDING

2020 STIP Financial Targets and Payout “Curve”

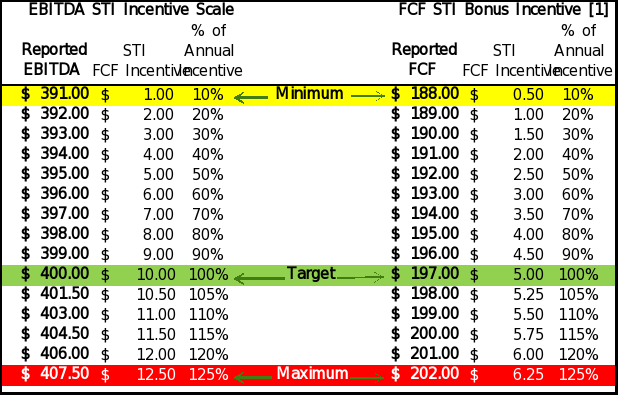

–EBITDA incentive component begins to fund after exceeding minimum EBITDA of $391 MM after cost of individual performance incentive and any adjusted FCF incentive earned, payout curve shown in Table 3 below.

–The Free Cash Flow (FCF) incentive component begins to fund after exceeding a minimum FCF of $188 MM, payout curve shown in Table 3 below.

–Individual performance component of the incentive funds after obtaining minimum EBITDA of $375 MM.

Table 3:

[1] FCF approved 605 (Accounting Standard) Budget dated 12-10-2019 has been adjusted for the settlement of the $50 MM Tax Liabilities assumed in the YP acquisition.

IMPACT OF INDIVIDUAL PERFORMANCE RATING ON THE 2020 STI AWARD

Individual performance rating has a direct impact on the individual performance component (25% of total) of the incentive STIP award. Employees with an individual performance rating of “Did Not Meet Expectations” are not eligible for the individual performance component of the aware (25% of total). Your manager will determine the award amount for this component based on the scale below:

| HR Compensation | 2020 Short Term Incentive Plan Page 3 of 6 | 2020 Short Term Incentive Plan April 2020 | ||||||

| Exhibit 10.16 | ||||

Table 4:

| 2020 Performance Rating | Recommended Payout Percentage for Individual Performance Component | ||||

| Did Not Meet Expectations | 0% | ||||

| Partially Met Expectations | 50% to 75% | ||||

| Achieved Expectations | 75% to 100% | ||||

| Exceeded Expectations | 100% to 125% | ||||

| Far Exceeded Expectations | 125% to 150% | ||||

Award amounts for the company performance metrics (75% of total) are fixed based on Company’s performance for those receiving a rating of “Partially Met Expectations” or higher. Employees with an individual performance rating of “Did Not Meet Expectations” will receive a reduced payout in the range of 25% to 50% of the Company’s performance component.

PRORATION OF INCENTIVE

If an employee meets Plan eligibility requirements for only a portion of the Plan Coverage Period, the 2020 STIP award will be prorated for any periods the employee was not eligible. For example, the 2020 STIP will be prorated in an amount equivalent to the amount of time the employee was on any of the following:

1.Unpaid leave

2.Leave supplemented with a pay replacement benefit (such as STD, LTD, or workers compensation)

3.Absent without leave

4.Administrative leave as part of any Company investigation, discipline, or inquiry

5.Hire date after January 1, 2020

6.Movement from the 2020 STIP to another incentive plan (e.g., Sales / Operations)

7.Movement to the 2020 STIP eligible position from another incentive plan (e.g., Sales / Operations) or from a position covered by a collective bargaining agreement

8.A job change that results in a change in Target % or a change in base pay during the Plan Coverage Period.

In such situations as described above, the 2020 STIP award, if any, will be paid at the time that other 2020 STIP awards are scheduled to be paid in accordance to Plan, unless otherwise specifically stated in this Plan. For employees on leave, STIP awards will be paid to the employee once they return to work, are active and no longer on leave.

EXAMPLE - INCENTIVE AWARD CALCULATIONS:

Thryv Plan – January 1 to December 31:

Company performance metrics as well as your individual performance count towards your 2020 STIP payout calculation. Below is an example of the target 2020 STIP calculation for an eligible employee who has been employed with the Company since January 1, 2020 with an annual base salary of $60,000 and a 10% STIP target opportunity. For illustration purposes, this assumes a full 365 days of the Plan Coverage Period within the same eligible job (I.e. no prorations):

| HR Compensation | 2020 Short Term Incentive Plan Page 4 of 6 | 2020 Short Term Incentive Plan April 2020 | ||||||

| Exhibit 10.16 | ||||

Compensation Assumptions: January 1 – December 31:

•Base Salary = $60,000

•Bonus Target % = 10%

•Bonus Target $ = $6,000

•Performance Rating = Achieved Expectations

Company Performance Assumptions: January 1 – December 31:

•Company EBITDA achievement of $395 MM, 50% of target.

•Company FCF achievement of $189 MM, 20% of target.

•MBO pool fully funded as EBITDA threshold of $375 MM exceeded.

The employee’s 2020 STIP will therefore be as follows for each of the components:

Payout calculation for the Period January 1 – December 31:

Table 5:

| A | B | C | ||||||||||||

2020 STIP Component | Bonus Target ($) | Measure Weighting | Target Achieved | Award Payout (A*B*C) | ||||||||||

| EBITDA | $6,000 | 50% | 50% | $1,500 | ||||||||||

| FCF | $6,000 | 25% | 20% | $300 | ||||||||||

| Individual Performance (MBO) | $6,000 | 25% | 100% * | $1,500 | ||||||||||

| 2020 STIP Payout | $3,300 | |||||||||||||

* Awarded by manager within allotted range, see table 4.

TIMING OF PAYMENTS

Assuming Plan requirements are satisfied, which include Board review and approval, award payments will be targeted for spring 2021 to eligible employees actively working and on payroll at the time of payment.

DEFINITIONS

BASE SALARY EARNINGS

An eligible employee’s base salary earnings paid during the Plan period as of December 31 or prorated for each eligible job(s) within the Plan period. Base salary earnings for this purpose do not include benefits, bonuses, overtime, or other awards.

BOARD

The Company’s Board of Directors.

COMMITTEE

The Compensation and Benefits Committee of the Board of Directors of the Company.

COMPANY

Thryv Holdings, Inc. and its consolidated subsidiaries.

| HR Compensation | 2020 Short Term Incentive Plan Page 5 of 6 | 2020 Short Term Incentive Plan April 2020 | ||||||

| Exhibit 10.16 | ||||

EBITDA

Total Company operating income, before interest, taxes, depreciation and amortization, each calculated in accordance with GAAP, adjusted to exclude the impact of stock compensation expense.

FREE CASH FLOW (FCF)

Free Cash Flow approved 605 (Accounting Standard) Budget of 12/10/2019 has been adjusted for the settlement of the $50 MM Tax Liabilities assumed in the YP Acquisition.

INDIVIDUAL TARGET OPPORTUNITY

An eligible STI target percentage for eligible employee based on one’s job level(s).

NON-BARGAINED FOR

Non-represented employees or those employees not working under a collective bargaining agreement.

PLAN COVERAGE PERIOD

The Plan Coverage Period is January 1, 2020 through December 31, 2020.

ADMINISTRATION

Approval/Objectives Guidelines

2020 STIP Awards are at the sole discretion of senior management and the Board of Directors, and may or may not be granted based upon Company, functional unit, departmental, and/or individual performance in the plan year. If it is determined that 2020 STIP awards will be granted, senior management and the Board of Directors retain the sole discretion to set award levels and to adjust award levels and subsequent employee distributions.

When 2020 STIP Awards are Earned

2020 STIP Awards are not earned, are not due, and shall not vest unless and until the following conditions are met: (1) the Approval/Objective Guidelines are met, (2) the Board approves corporate performance and payment, (3) all 2020 STIP eligibility requirements as described herein are met, (4) the individual is employed and actively working for the Company (or on Company Approved or job protected leave) on the payment date, and (5) the payout date occurs.

2020 STIP awards, if any, will be paid within guidelines noted within, and processed via payroll. All legally required and applicable income and employment taxes and withholdings will be deducted from the gross incentive award paid to participants. Awards are considered eligible compensation for the purposes of calculating 401(k) plan match and contributions, but are not otherwise considered compensation for the purpose of other employee benefits.

Interpretation

The Company shall have the full power and authority to interpret, construe, and administer this Plan, including the determination of the amount of each participant’s award amount.

Short-Term Deferral

All 2020 STIP awards will be paid with the short-term deferral period, and thus, are exempt from Internal Revenue Code Section 409A.

Disclaimer

This Plan is not a contract of employment OR OTHERWISE ALTER YOUR AT-WILL EMPLOYMENT STATUS and does not create any contractual rights. Any payment under the Plan or this incentive award is discretionary and at the will of the Company. This Plan document and the award schedules set forth herein do not constitute an express or implied promise of continued employment for any period or at all, and will not interfere in any way with a participant’s right to terminate or the Company’s right to terminate a participant’s employment at any time, with or without cause and with or without notice.

| HR Compensation | 2020 Short Term Incentive Plan Page 6 of 6 | 2020 Short Term Incentive Plan April 2020 | ||||||

| Exhibit 10.16 | ||||

The Company may terminate the Plan, or amend or modify the Plan in any respect, at any time, and without notice. This Plan may be superseded by

federal, state, and local laws to the extent applicable.

| HR Compensation | 2020 Short Term Incentive Plan Page 7 of 6 | 2020 Short Term Incentive Plan April 2020 | ||||||