Attached files

|

OVBC

|

|

ANNUAL REPORT

|

|

2020

|

[Picture of Rio Grande Office]

Honoring 50 years in Rio Grande

|

A note about the cover:

Throughout much of this report you will see how your company faced the challenges of the COVID-19 global pandemic that changed

everything. There is no doubt that when we mark this year in history, the pandemic will always be front and center. However, it should also be noted that there were other things that happened in 2020. Fantastic things. Positive milestones

and achievements that deserved not to be swept aside and forgotten. And for this reason, we chose to adorn this year’s cover not with masks, but with a celebration. Help us in congratulating the community bankers at OVB Rio Grande on the

50th anniversary of Ohio Valley Bank’s first branch.

|

[Picture]

Remote workstation technology was set up for 71 employees in just two weeks,

securing the continuancy of financial services for our communities. Pictured in mask is Chairman Wiseman; on screen is President Miller.

Message from Management

Dear Neighbors and Friends,

Before the 2020 pandemic, the CDC notes the Flu Pandemic of 1918 as the most severe in recent history. OVB survived that one too.

We have always attributed the bank’s longevity to the loyal support of our community. We returned that support with interest during this pandemic.

When we had to close Ohio Valley Bank lobbies, we extended drive-thru hours and invested over $170,000 in advancing contactless banking services. When the IRS sent over 3,000

stimulus checks to Loan Central instead of to the people, we didn’t just send them back to the IRS as our competitors did. We got each one to its rightful owner. When gatherings of more than ten were banned, we secured the means to hold the first

virtual Annual Meeting in the company’s history. When the big banks used their might to try to scoop up all the Paycheck Protection Program (PPP) funding, we worked through the nights and weekends to secure over $35 million for our local

businesses.

Ohio Valley Bank and Loan Central did not lay off any workers or permanently close any

offices. As a matter of fact, it was all hands on deck as we accelerated technology projects, put in overtime, sought opportunities for expansion, and worked to be there for our communities in new ways.

And though we were able to keep business as usual for the most part, special honors had

to be delayed. Milestones like the completion of OVB on the Square and the retirement celebration for the distinguished career of former Chairman Jeff Smith were put on hold. We do still plan to celebrate both when Governor DeWine lifts gathering

restrictions.

Another event you can count on, though it will be a virtual event, is our 2021 Annual Shareholders

Meeting. Plan to join us online May 19th at 3:00 p.m. Have your control number, found with your voting information, ready when you log in. We plan to return to the Ariel Theatre in 2022. Until then, know that your teams here at Ohio Valley Banc

Corp. deeply appreciate your ongoing support and will continue working to pay it forward to the communities we share.

Sincerely,

Thomas E. Wiseman

Chairman of the Board & CEO

Ohio Valley Banc Corp.

Larry E. Miller, II

President & Chief Operating Officer

Ohio Valley Banc Corp.

1

[Picture]

Hometown commercial loan officers like Shelly Boothe and Pat Tackett

worked into the wee hours of the morning for several days to secure PPP funding for local businesses.

With lobbies closed for much of 2020, contactless banking channels such as mobile banking, ATMs, and drive-thru windows took center stage. With a

robust technology infrastructure already in place, Ohio Valley Bank was well prepared for the challenges of the year.

OVB’s ATM network includes 35 locally installed machines and customer surcharge-free access to more than 37,000 through the MoneyPass network. The added convenience

of drive-thru ATMs at 12 locations, made banking even easier.

Ohio Valley Bank introduced a major upgrade to its OVB Line telephone banking in May. The project was in progress before the pandemic, but couldn’t come at a better

time. The improved OVB Line fielded over 10,000 calls in its first month, answering customer needs on the first ring.

Users flocked to NetTeller internet banking and the OVB Mobile App each month. More than

2,000 customers discovered the ease of mobile banking for the first time in 2020. Text Message Banking received a record 35,358 requests for balances and history.

These electronic channels provided access 24/7 during the unprecedented crisis, but they could never replace the special touch of our hometown community bankers. These remarkable folks found ways

to work with safety protocols to continue to provide unmatched service, as proven by the more than 450,000 estimated transactions conducted at OVB drive-thru windows during the year

and outreach in the form of six-months of deferred loan payments, waived early closeout fees for Christmas Savings accounts, and financial support for charities committed to helping our communities.

2020 by

the numbers

$35,000,000

In 100% forgiveable loans secured by OVB for businesses through the SBA.

$10,649,306.02

Deposited using a cell phone or tablet on the go.

Over a million in the month of December alone!

225,566

Statements and notices contactlessly delivered by OVB eDelivery.

116,640

Online bill payments sent by customers.

678,320

Safe and secure transactions at the ATM.

214,553

People shopped for their next vehicle at the online OVB Auto Loan Center.

77,903

Calls answered by OVB Line telephone banking, assisting customers with

transfers, loan payments, debit card activation and more.

$172,000,000

Increase in total deposits at December 31 over the prior year.

[Picture]

Our employees found many ways to work with pandemic restrictions and still be there for our communities who needed us.

Above: Community bankers Maranda Prevatt, Rachel Stevens, and Leigh Anne Roten have a little fun during a clean sweep of the high touch

areas at the Barboursville Office lobby.

Right Page Top Row Left: In March, several improvements were made to the Waverly Office including new concrete and

lights for the exterior. Middle: 2020 OVB 4-H Scholar Olivia Harrison with OVB’s Larry Miller and Tom Wiseman. Special thanks to the Gallia Co. 4-H Advisors for allowing us to present this honor during their

awards when COVID restrictions cancelled the event where we usually bestow the honor. Right: Larry Miller presents a donation to God’s Hands at Work to help them provide winter heating bill assistance for

those financially burdened by the pandemic.

Right Page Middle Row Left: “Penny Bandit”, OVB Jackson’s entry in this year’s Farm Bureau Hog Wild fundraiser made the Top 15 in donations

raised. Outfitted in a custom made mask, she was hard to resist. Middle: Community Banker Alex White shines up the drive- thru window at OVB Rio Grande as they prepare for another day of contactless

banking. Right: President and Chief Operating Officer Larry Miller delivered a Merry Christmas message to all from the rooftop patio at OVB on the Square overlooking the OVB Tree at Gallipolis in Lights. OVB

on the Square participated in the event for the first time with lighted window displays, rooftop lights, and red and green spotlights at the base of each of the building’s massive windows.

Right Page Bottom Row Left: In July, community banker Crystal Ramey was excited to welcome customers back into the OVB Milton bank lobby. Like all OVB

branches, Milton is equipped with safety barriers and social distancing markers for the continued health of our customers. Middle: OVBC Chairman Tom Wiseman personally delivers the bank’s donation of

10,000 masks to Holzer Health for frontline healthcare workers in need of PPE. Right: Though the bank’s Veteran’s Action Committee (VAC) was unable to hold their annual Ruck Walk fundraiser, they still

raised $2,400 for local veterans organizations, largely through the Community First Debit Card program’s veterans designs. Pictured are Tom Wiseman and VAC Chair Johnnie Wamsley presenting the donations to representatives from the American Legion

Post 23 in Point Pleasant, Gallia/Meigs/Mason Marine Corps League Detachment 1180, and the Gallipolis VFW.

[ Pictures Only]

OVBC DIRECTORS

Thomas E. Wiseman

Chairman and Chief Executive Officer, Ohio Valley Banc Corp.

and Ohio Valley Bank

Larry E. Miller, II

President & Chief Operating Officer, Ohio Valley Banc Corp. and

Ohio Valley Bank

David W. Thomas, Lead Director

Former Chief Examiner, Ohio Division of Financial Institutions

bank supervision and regulation

Anna P. Barnitz

Treasurer & CFO, Bob’s Market & Greenhouses, Inc.

wholesale horticultural products and retail landscaping stores

Brent A. Saunders

Chairman of the Board, Holzer Health System

Attorney, Halliday, Sheets & Saunders

healthcare

Harold A. Howe

Self-employed, Real Estate Investment and Rental Property

Brent R. Eastman

President and Co-owner, Ohio Valley Supermarkets

Partner, Eastman Enterprises

Kimberly A. Canady

Owner, Canady Farms, LLC

agricultural products and agronomy services

Edward J. Robbins

President & CEO, Ohio Valley Veneer, Inc.

wood harvesting, processing and manufacturing of dry

lumber & flooring in Ohio, Kentucky, and Tennessee

OHIO VALLEY BANK DIRECTORS

Thomas E. Wiseman Brent R. Eastmam

DavidW. Thomas K imberly A. Canady Harold A. Howe Edward J. Robbins

Anna P. Barnitz Larry E. Miller, II

Brent A. Saunders

|

OVBC OFFICERS

Thomas E. Wiseman, Chairman and Chief Executive Officer

Larry E. Miller, II, President & Chief Operating Officer

Scott W. Shockey, Senior Vice President & Chief Financial Officer

Tommy R. Shepherd, Senior Vice President & Secretary

Bryan F. Stepp, Senior Vice President - Lending/Credit

Mario P. Liberatore, Vice President

Cherie A. Elliott, Vice President

Frank W. Davison, Vice President

Ryan J. Jones, Vice President

Allen W. Elliott, Vice President

Shawn R. Siders, Vice President

Bryna S. Butler, Vice President

Marilyn G. Kearns, Vice President

Paula W. Clay, Assistant Secretary

Cindy H. Johnston, Assistant Secretary

LOAN CENTRAL DIRECTORS

Larry E. Miller, II

Cherie A. Elliott

Ryan J. Jones

LOAN CENTRAL OFFICERS

Larry E. Miller, II Chairman of the Board

Cherie A. Elliott President

Timothy R. Brumfield Vice President & Secretary

Manager, Gallipolis Office

John J. Holtzapfel Compliance Officer &

Manager, Wheelersburg Office

T. Joe Wilson Manager, Waverly Office

Joseph I. Jones

Manager, South Point Office

Gregory G. Kauffman Manager,

Chillicothe Office

Steven B. Leach Manager, Jackson Office

WEST VIRGINIA ADVISORY BOARD

Mario P. Liberatore E. Allen Bell

Richard L. Handley John A. Myers

Stephen L. Johnson

DIRECTORS EMERITUS

W. Lowell Call Barney A. Molnar

Steven B. Chapman Jeffrey E. Smith

Robert E. Daniel Wendell B. Thomas

John G. Jones Lannes C.

Williamson

|

|

OHIO VALLEY BANK OFFICERS

EXECUTIVE OFFICERS

Thomas E. Wiseman

Larry E. Miller, II

Scott W. Shockey

Tommy R. Shepherd

Bryan F. Stepp

Mario P. Liberatore

SENIOR VICE PRESIDENTS

FrankW.Davison

Ryan J.Jones

Allen W.Elliott

Shawn R. Siders

Bryna S. Butler

Marilyn G. Kearns

VICE PRESIDENTS

Patrick H. Tackett

Rick A. Swain

Tamela D. LeMaster

Christopher L. Preston

Gregory A. Phillips

Diana L. Parks

John A. Anderson

Kyla R. Carpenter

E. Kate Cox

Brian E. Hall

Daniel T. Roush

Adam D. Massie

Jay D. Miller

Jody M. DeWees

Christopher S. Petro

Benjamin F. Pewitt

Lori A. Edwards

Brandon O. Huff

ASSISTANT VICE PRESIDENTS

Melissa P. Wooten

Kimberly R. Williams

Paula W. Clay

Cindy H. Johnston

Joe J. Wyant

Brenda G. Henson

Barbara A. Patrick

Richard P. Speirs

Raymond G. Polcyn

Anita M. Good

Angela S. Kinnaird

Terri M. Camden

Shelly N. Boothe

Stephenie L. Peck

|

Chairman and Chief Executive Officer

President and Chief Operating Officer

Executive Vice President, Chief Financial Officer

Executive Vice President and Secretary

Executive Vice President,Lending/Credit

President, OVB West Virginia

Financial Bank Group

Chief Risk Officer

Branch Administration

Chief Credit Officer

Corporate Communications

Human Resources

Western Division Branch Manager

Branch Administration/CRM

Business Development West Virginia

Consumer Lending

Internal Audit Liaison

Director of Loan Operations

Director of Marketing

Director of Cultural Enhancement

Corporate Banking

Senior Compliance Officer

Northern Region Manager

Business Development Officer

Trust

Comptroller

Business Development

Residential Loan Operations Manager

Director of IT

Systems Officer

Assistant Secretary

Assistant Secretary

Region Manager Jackson County

Manager Deposit Services

BSA Officer/Loss Prevention

Facilities Manager /Security Officer

Manager of Buying Department

Branch Retail Banking Officer

Customer Support Manager

Human Resources Officer

Business Development Officer

Regional Branch Administrator

|

OUR

VISION is

to

remain an

independent

community bank

ASSISTANT CASHIERS

Lois J. Scherer EFT Officer

Glen P. Arrowood, II Manager of Indirect Lending

Anthony W. Staley Product Development

Business Sales & Support

Jon C. Jones Western Cabell Region Manager

Daniel F. Short Bend Area

Region Manager

Pamela K. Smith Eastern Cabell Region Manager

William F. Richards Advertising Manager

|

[Picture]

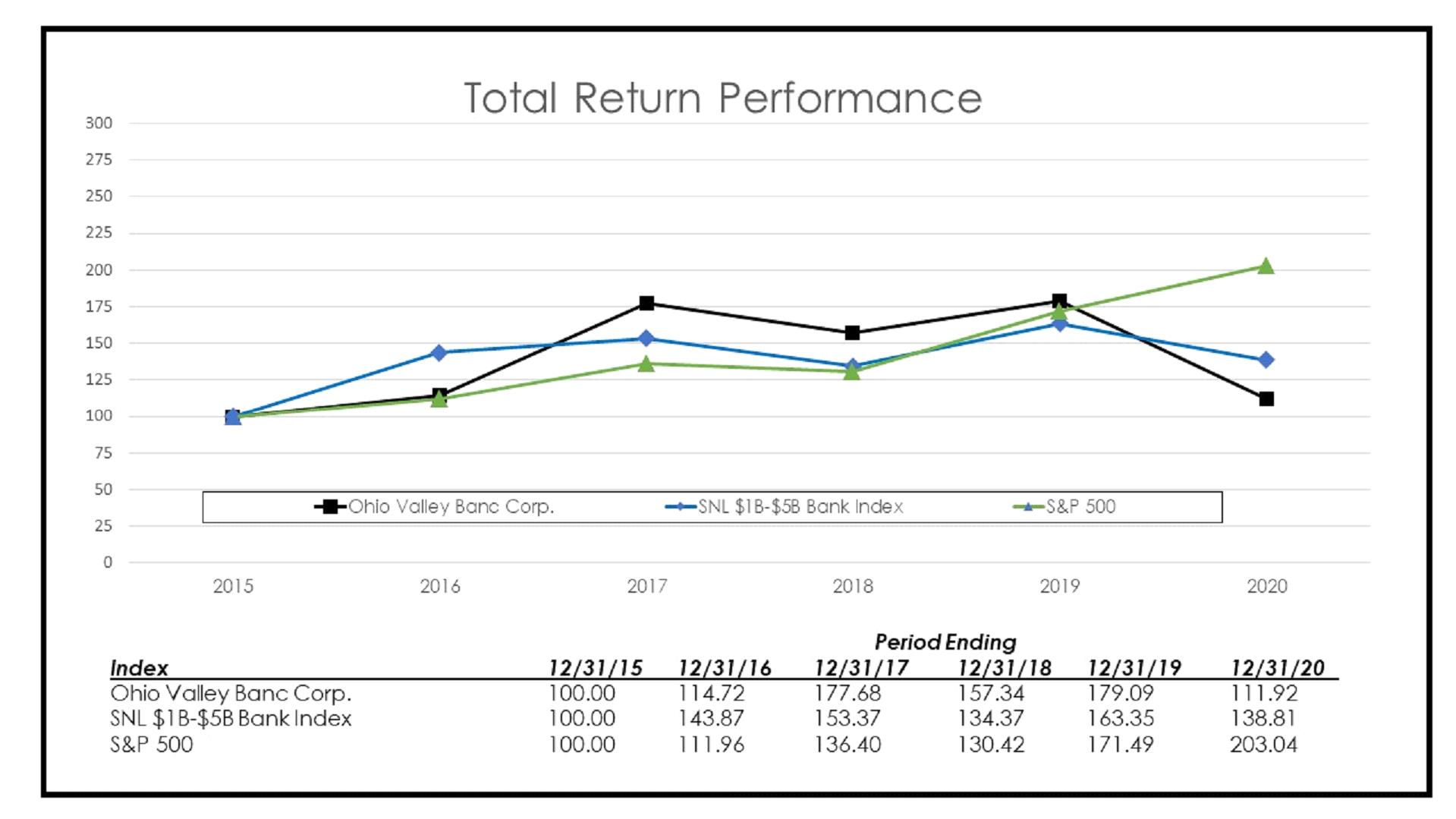

Secure the Legacy

Ohio Valley Bank celebrates 150 years in business in 2022. This American institution has

survived two World Wars, the Great Depression, the Great Recession, and now two global pandemics.

The company’s continued success lies in large part with our loyal OVBC shareholders who join Ohio Valley Bank and

Loan Central in our work to put Community First. Our shareholders reinvested over $1 million of their dividends in Ohio Valley Banc Corp. stock in 2020 through the Dividend Reinvestment Program and Employee

Stock Ownership Plan. They didn’t stop there. OVBC shareholders then went on to invest close to $600,000 in supplemental investments in the company. When we pay a dividend and shareholders overwhelmingly choose to invest that money back into the

company, we know we are doing something right.

As we look to the future of Ohio Valley Banc Corp., it is important to think about securing the legacy of what our shareholders, customers, and employees have worked so hard

to build. As a shareholder, you can help by making plans to pass on shares to heirs who will not just sell them on the open market, but to those who will be dedicated to following your

example. Let your family and friends know that you support OVBC and its importance in your life and community. Ensure

that your shares will go to those who believe, as you do, in the importance of giving back to our community.

We urge you to make plans now to not only secure the legacy of Ohio Valley Banc Corp., but to secure your role in the continuation of this local success story.

Want to get your family involved now? Did you know that you can transfer ownership of shares at any time without brokerage fees? Gifting shares to a

child, grandchild, or anyone you wish is simple. If you are a registered shareholder, contact our Shareholder Relations Department at 800-468-6682 or email investorrelations@ ovbc.com for information.

Thank you for playing a vital role in OVBC’s past, present, and future. We look forward to serving you and your loved ones for many generations to come.

OHIO VALLEY BANC CORP.

ANNUAL REPORT 2020

FINANCIALS

SELECTED FINANCIAL DATA

|

|

Years Ended December 31

|

|||||||||||||||||||

|

|

2020

|

2019

|

2018

|

2017

|

2016

|

|||||||||||||||

|

(dollars in thousands, except share and per share data)

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

SUMMARY OF OPERATIONS:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total interest income

|

$

|

46,173

|

$

|

50,317

|

$

|

49,197

|

$

|

45,708

|

$

|

39,348

|

||||||||||

|

Total interest expense

|

6,191

|

7,265

|

5,471

|

3,975

|

3,022

|

|||||||||||||||

|

Net interest income

|

39,982

|

43,052

|

43,726

|

41,733

|

36,326

|

|||||||||||||||

|

Provision for loan losses

|

2,980

|

1,000

|

1,039

|

2,564

|

2,826

|

|||||||||||||||

|

Total other income

|

11,438

|

9,166

|

8,938

|

9,435

|

8,239

|

|||||||||||||||

|

Total other expenses

|

36,133

|

39,498

|

37,426

|

36,609

|

32,899

|

|||||||||||||||

|

Income before income taxes

|

12,307

|

11,720

|

14,199

|

11,995

|

8,840

|

|||||||||||||||

|

Income taxes

|

2,048

|

1,813

|

2,255

|

4,486

|

1,920

|

|||||||||||||||

|

Net income

|

10,259

|

9,907

|

11,944

|

7,509

|

6,920

|

|||||||||||||||

|

|

||||||||||||||||||||

|

PER SHARE DATA:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Earnings per share

|

$

|

2.14

|

$

|

2.08

|

$

|

2.53

|

$

|

1.60

|

$

|

1.59

|

||||||||||

|

Cash dividends declared per share

|

$

|

0.84

|

$

|

0.84

|

$

|

0.84

|

$

|

0.84

|

$

|

0.82

|

||||||||||

|

Book value per share

|

$

|

28.48

|

$

|

26.77

|

$

|

24.87

|

$

|

23.26

|

$

|

22.40

|

||||||||||

|

Weighted average number of common shares outstanding

|

4,787,446

|

4,767,279

|

4,725,971

|

4,685,067

|

4,351,748

|

|||||||||||||||

|

|

||||||||||||||||||||

|

AVERAGE BALANCE SUMMARY:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total loans

|

$

|

811,434

|

$

|

775,860

|

$

|

773,995

|

$

|

753,204

|

$

|

644,690

|

||||||||||

|

Securities(1)

|

205,532

|

189,187

|

223,390

|

193,199

|

196,389

|

|||||||||||||||

|

Deposits

|

906,315

|

850,400

|

886,639

|

845,227

|

749,054

|

|||||||||||||||

|

Other borrowed funds(2)

|

40,416

|

45,850

|

48,967

|

47,663

|

39,553

|

|||||||||||||||

|

Shareholders’ equity

|

131,038

|

122,314

|

112,393

|

108,110

|

98,133

|

|||||||||||||||

|

Total assets

|

1,096,191

|

1,035,230

|

1,063,256

|

1,014,115

|

899,209

|

|||||||||||||||

|

|

||||||||||||||||||||

|

PERIOD END BALANCES:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total loans

|

$

|

848,664

|

$

|

772,774

|

$

|

777,052

|

$

|

769,319

|

$

|

734,901

|

||||||||||

|

Securities(1)

|

255,662

|

166,761

|

184,925

|

189,941

|

151,985

|

|||||||||||||||

|

Deposits

|

993,739

|

821,471

|

846,704

|

856,724

|

790,452

|

|||||||||||||||

|

Shareholders’ equity

|

136,324

|

128,179

|

117,874

|

109,361

|

104,528

|

|||||||||||||||

|

Total assets

|

1,186,932

|

1,013,272

|

1,030,493

|

1,026,290

|

954,640

|

|||||||||||||||

|

|

||||||||||||||||||||

|

KEY RATIOS:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Return on average assets

|

.94

|

%

|

.96

|

%

|

1.12

|

%

|

0.74

|

%

|

0.77

|

%

|

||||||||||

|

Return on average equity

|

7.83

|

%

|

8.10

|

%

|

10.63

|

%

|

6.95

|

%

|

7.05

|

%

|

||||||||||

|

Dividend payout ratio

|

39.20

|

%

|

40.37

|

%

|

33.20

|

%

|

52.36

|

%

|

51.79

|

%

|

||||||||||

|

Average equity to average assets

|

11.95

|

%

|

11.82

|

%

|

10.57

|

%

|

10.66

|

%

|

10.91

|

%

|

||||||||||

(1) Securities include interest-bearing deposits with banks and restricted investments in bank stocks.

(2) Other borrowed funds include subordinated debentures.

consolidated statements of condition

|

|

As of December 31

|

|||||||

|

|

2020

|

2019

|

||||||

|

(dollars in thousands, except share and per share data)

|

||||||||

|

|

||||||||

|

Assets

|

||||||||

|

|

||||||||

|

Cash and noninterest-bearing deposits with banks

|

$

|

14,989

|

$

|

12,812

|

||||

|

Interest-bearing deposits with banks

|

123,314

|

39,544

|

||||||

|

Total cash and cash equivalents

|

138,303

|

52,356

|

||||||

|

|

||||||||

|

Certificates of deposit in financial institutions

|

2,500

|

2,360

|

||||||

|

Securities available for sale

|

112,322

|

105,318

|

||||||

|

Securities held to maturity (estimated fair value: 2020 - $10,344; 2019 - $12,404)

|

10,020

|

12,033

|

||||||

|

Restricted investments in bank stocks

|

7,506

|

7,506

|

||||||

|

|

||||||||

|

Total loans

|

848,664

|

772,774

|

||||||

|

Less: Allowance for loan losses

|

(7,160

|

)

|

(6,272

|

)

|

||||

|

Net loans

|

841,504

|

766,502

|

||||||

|

|

||||||||

|

Premises and equipment, net

|

21,312

|

19,217

|

||||||

|

Premises and equipment held for sale, net

|

637

|

653

|

||||||

|

Other real estate owned, net

|

49

|

540

|

||||||

|

Accrued interest receivable

|

3,319

|

2,564

|

||||||

|

Goodwill

|

7,319

|

7,319

|

||||||

|

Other intangible assets, net

|

112

|

174

|

||||||

|

Bank owned life insurance and annuity assets

|

35,999

|

30,596

|

||||||

|

Operating lease right-of-use asset, net

|

880

|

1,053

|

||||||

|

Other assets

|

5,150

|

5,081

|

||||||

|

Total assets

|

$

|

1,186,932

|

$

|

1,013,272

|

||||

|

|

||||||||

|

Liabilities

|

||||||||

|

|

||||||||

|

Noninterest-bearing deposits

|

$

|

314,777

|

$

|

222,607

|

||||

|

Interest-bearing deposits

|

678,962

|

598,864

|

||||||

|

Total deposits

|

993,739

|

821,471

|

||||||

|

|

||||||||

|

Other borrowed funds

|

27,863

|

33,991

|

||||||

|

Subordinated debentures

|

8,500

|

8,500

|

||||||

|

Operating lease liability

|

880

|

1,053

|

||||||

|

Accrued liabilities

|

19,626

|

20,078

|

||||||

|

Total liabilities

|

1,050,608

|

885,093

|

||||||

|

|

||||||||

|

Commitments and Contingent Liabilities (See Note L)

|

----

|

----

|

||||||

|

|

||||||||

|

Shareholders’ Equity

|

||||||||

|

|

||||||||

|

Common stock ($1.00 stated value per share, 10,000,000 shares authorized; 2020 – 5,447,185 shares issued; 2019 - 5,447,185 shares issued)

|

5,447

|

5,447

|

||||||

|

Additional paid-in capital

|

51,165

|

51,165

|

||||||

|

Retained earnings

|

92,988

|

86,751

|

||||||

|

Accumulated other comprehensive income

|

2,436

|

528

|

||||||

|

Treasury stock, at cost (659,739 shares)

|

(15,712

|

)

|

(15,712

|

)

|

||||

|

Total shareholders’ equity

|

136,324

|

128,179

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

1,186,932

|

$

|

1,013,272

|

||||

See accompanying notes to consolidated financial statements

Consolidated Statements of Income

|

For the years ended December 31

|

2020

|

2019

|

2018

|

|||||||||

|

(dollars in thousands, except per share data)

|

||||||||||||

|

|

||||||||||||

|

Interest and dividend income:

|

||||||||||||

|

Loans, including fees

|

$

|

43,204

|

$

|

45,766

|

$

|

44,365

|

||||||

|

Securities:

|

||||||||||||

|

Taxable

|

2,164

|

2,542

|

2,377

|

|||||||||

|

Tax exempt

|

286

|

344

|

369

|

|||||||||

|

Dividends

|

245

|

393

|

440

|

|||||||||

|

Interest-bearing deposits with banks

|

226

|

1,221

|

1,608

|

|||||||||

|

Other interest

|

48

|

51

|

38

|

|||||||||

|

|

46,173

|

50,317

|

49,197

|

|||||||||

|

Interest expense:

|

||||||||||||

|

Deposits

|

5,254

|

6,026

|

4,155

|

|||||||||

|

Other borrowed funds

|

729

|

883

|

986

|

|||||||||

|

Subordinated debentures

|

208

|

356

|

330

|

|||||||||

|

|

6,191

|

7,265

|

5,471

|

|||||||||

|

Net interest income

|

39,982

|

43,052

|

43,726

|

|||||||||

|

Provision for loan losses

|

2,980

|

1,000

|

1,039

|

|||||||||

|

Net interest income after provision for loan losses

|

37,002

|

42,052

|

42,687

|

|||||||||

|

|

||||||||||||

|

Noninterest income:

|

||||||||||||

|

Service charges on deposit accounts

|

1,685

|

2,118

|

2,084

|

|||||||||

|

Trust fees

|

257

|

264

|

263

|

|||||||||

|

Income from bank owned life insurance and annuity assets

|

820

|

704

|

717

|

|||||||||

|

Mortgage banking income

|

1,254

|

310

|

342

|

|||||||||

|

Electronic refund check / deposit fees

|

----

|

5

|

1,579

|

|||||||||

|

Debit / credit card interchange income

|

4,031

|

3,905

|

3,662

|

|||||||||

|

Loss on other real estate owned

|

(35

|

)

|

(65

|

)

|

(559

|

)

|

||||||

|

Net gain on branch divestitures

|

----

|

1,256

|

----

|

|||||||||

|

Tax preparation fees

|

644

|

----

|

----

|

|||||||||

|

Litigation settlement

|

2,000

|

----

|

----

|

|||||||||

|

Other

|

782

|

669

|

850

|

|||||||||

|

|

11,438

|

9,166

|

8,938

|

|||||||||

|

Noninterest expense:

|

||||||||||||

|

Salaries and employee benefits

|

21,636

|

23,524

|

22,191

|

|||||||||

|

Occupancy

|

1,817

|

1,771

|

1,754

|

|||||||||

|

Furniture and equipment

|

1,096

|

1,060

|

1,023

|

|||||||||

|

Professional fees

|

1,519

|

2,508

|

2,016

|

|||||||||

|

Marketing expense

|

613

|

841

|

777

|

|||||||||

|

FDIC insurance

|

165

|

113

|

447

|

|||||||||

|

Data processing

|

2,170

|

1,996

|

2,115

|

|||||||||

|

Software

|

1,454

|

1,705

|

1,533

|

|||||||||

|

Foreclosed assets

|

128

|

266

|

238

|

|||||||||

|

Amortization of intangibles

|

62

|

206

|

135

|

|||||||||

|

Other

|

5,473

|

5,508

|

5,197

|

|||||||||

|

|

36,133

|

39,498

|

37,426

|

|||||||||

|

Income before income taxes

|

12,307

|

11,720

|

14,199

|

|||||||||

|

Provision for income taxes

|

2,048

|

1,813

|

2,255

|

|||||||||

|

NET INCOME

|

$

|

10,259

|

$

|

9,907

|

$

|

11,944

|

||||||

|

Earnings per share

|

$

|

2.14

|

$

|

2.08

|

$

|

2.53

|

||||||

See accompanying notes to consolidated financial statements

Consolidated Statements of

Comprehensive Income

|

For the years ended December 31

|

2020

|

2019

|

2018

|

|||||||||

|

(dollars in thousands)

|

||||||||||||

|

|

||||||||||||

|

NET INCOME

|

$

|

10,259

|

$

|

9,907

|

$

|

11,944

|

||||||

|

Other comprehensive income (loss):

|

||||||||||||

|

Change in unrealized gain (loss) on available for sale securities

|

2,415

|

3,371

|

(1,373

|

)

|

||||||||

|

Related tax (expense) benefit

|

(507

|

)

|

(708

|

)

|

289

|

|||||||

|

Total other comprehensive income (loss), net of tax

|

1,908

|

2,663

|

(1,084

|

)

|

||||||||

|

Total comprehensive income

|

$

|

12,167

|

$

|

12,570

|

$

|

10,860

|

||||||

See accompanying notes to consolidated financial statements

Consolidated Statements of Changes in

Shareholders’ Equity

|

For the years ended December 31, 2020, 2019, and 2018

|

||||||||||||||||||||||||

|

(dollars in thousands, except share and per share data)

|

||||||||||||||||||||||||

|

|

Common

Stock

|

Additional

Paid-In

Capital

|

Retained

Earnings

|

Accumulated Other Comprehensive Income (Loss)

|

Treasury

Stock

|

Total

Shareholders' Equity

|

||||||||||||||||||

|

Balances at January 1, 2018

|

$

|

5,362

|

$

|

47,895

|

$

|

72,694

|

$

|

(878

|

)

|

$

|

(15,712

|

)

|

$

|

109,361

|

||||||||||

|

Net income

|

----

|

----

|

11,944

|

----

|

----

|

11,944

|

||||||||||||||||||

|

Other comprehensive income (loss), net

|

----

|

----

|

----

|

(1,084

|

)

|

----

|

(1,084

|

)

|

||||||||||||||||

|

Amount reclassified out of accumulated other

comprehensive income (loss) per ASU 2018-02

|

----

|

----

|

173

|

(173

|

)

|

---- |

----

|

|||||||||||||||||

|

Common stock issued to ESOP, 7,294 shares

|

7

|

288

|

----

|

----

|

----

|

295

|

||||||||||||||||||

|

Common stock issued through dividend reinvestment,

30,766 shares

|

31

|

1,294

|

----

|

----

|

----

|

1,325

|

||||||||||||||||||

|

Cash dividends, $.84 per share

|

----

|

----

|

(3,967

|

)

|

----

|

----

|

(3,967

|

)

|

||||||||||||||||

|

Balances at December 31, 2018

|

5,400

|

49,477

|

80,844

|

(2,135

|

)

|

(15,712

|

)

|

117,874

|

||||||||||||||||

|

Net income

|

----

|

----

|

9,907

|

----

|

----

|

9,907

|

||||||||||||||||||

|

Other comprehensive income (loss), net

|

----

|

----

|

----

|

2,663

|

----

|

2,663

|

||||||||||||||||||

|

Common stock issued to ESOP, 8,333 shares

|

8

|

320

|

----

|

----

|

----

|

328

|

||||||||||||||||||

|

Common stock issued through dividend reinvestment,

38,787 shares

|

39

|

1,368

|

----

|

----

|

----

|

1,407

|

||||||||||||||||||

|

Cash dividends, $.84 per share

|

----

|

----

|

(4,000

|

)

|

----

|

----

|

(4,000

|

)

|

||||||||||||||||

|

Balances at December 31, 2019

|

5,447

|

51,165

|

86,751

|

528

|

(15,712

|

)

|

128,179

|

|||||||||||||||||

|

Net income

|

----

|

----

|

10,259

|

----

|

----

|

10,259

|

||||||||||||||||||

|

Other comprehensive income (loss), net

|

----

|

----

|

----

|

1,908

|

----

|

1,908

|

||||||||||||||||||

|

Cash dividends, $.84 per share

|

----

|

----

|

(4,022

|

)

|

----

|

----

|

(4,022

|

)

|

||||||||||||||||

|

Balances at December 31, 2020

|

$

|

5,447

|

$

|

51,165

|

$

|

92,988

|

$

|

2,436

|

$

|

(15,712

|

)

|

$

|

136,324

|

|||||||||||

See accompanying notes to consolidated financial statements

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

For the years ended December 31

|

2020

|

2019

|

2018

|

|||||||||

|

(dollars in thousands)

|

||||||||||||

|

|

||||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net income

|

$

|

10,259

|

$

|

9,907

|

$

|

11,944

|

||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||

|

Depreciation of premises and equipment

|

1,341

|

1,183

|

1,141

|

|||||||||

|

Net (accretion) of purchase accounting adjustments

|

(42

|

)

|

(494

|

)

|

(188

|

)

|

||||||

|

Net amortization of securities

|

459

|

173

|

260

|

|||||||||

|

Proceeds from sale of loans in secondary market

|

40,158

|

9,840

|

11,034

|

|||||||||

|

Loans disbursed for sale in secondary market

|

(38,904

|

)

|

(9,530

|

)

|

(10,692

|

)

|

||||||

|

Amortization of mortgage servicing rights

|

126

|

68

|

55

|

|||||||||

|

Impairment of mortgage servicing rights

|

11

|

----

|

----

|

|||||||||

|

Gain on sale of loans

|

(1,391

|

)

|

(378

|

)

|

(397

|

)

|

||||||

|

Amortization of intangible assets

|

62

|

206

|

135

|

|||||||||

|

Deferred tax (benefit) expense

|

12

|

367

|

(134

|

)

|

||||||||

|

Provision for loan losses

|

2,980

|

1,000

|

1,039

|

|||||||||

|

Common stock issued to ESOP

|

----

|

328

|

295

|

|||||||||

|

Earnings on bank owned life insurance and annuity assets

|

(820

|

)

|

(704

|

)

|

(717

|

)

|

||||||

|

Loss on sale of other real estate owned

|

35

|

57

|

21

|

|||||||||

|

Net write-down of other real estate owned

|

----

|

8

|

538

|

|||||||||

|

Net gain on branch divestitures

|

----

|

(1,256

|

)

|

----

|

||||||||

|

Change in accrued interest receivable

|

(755

|

)

|

74

|

(135

|

)

|

|||||||

|

Change in accrued liabilities

|

(632

|

)

|

2,376

|

1,946

|

||||||||

|

Change in other assets

|

(408

|

)

|

1,528

|

1,996

|

||||||||

|

Net cash provided by operating activities

|

12,491

|

14,753

|

18,141

|

|||||||||

|

|

||||||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Payments related to branch divestitures

|

----

|

(26,326

|

)

|

----

|

||||||||

|

Proceeds from maturities and paydowns of securities available for sale

|

36,154

|

20,199

|

21,139

|

|||||||||

|

Purchases of securities available for sale

|

(41,162

|

)

|

(20,126

|

)

|

(23,757

|

)

|

||||||

|

Proceeds from calls and maturities of securities held to maturity

|

2,694

|

3,754

|

1,711

|

|||||||||

|

Purchases of securities held to maturity

|

(721

|

)

|

----

|

----

|

||||||||

|

Proceeds from maturities of certificates of deposit in financial institutions

|

980

|

----

|

----

|

|||||||||

|

Purchases of certificates of deposit in financial institutions

|

(1,120

|

)

|

(295

|

)

|

(245

|

)

|

||||||

|

Net change in loans

|

(78,038

|

)

|

2,323

|

(9,981

|

)

|

|||||||

|

Proceeds from sale of other real estate owned

|

548

|

392

|

1,132

|

|||||||||

|

Purchases of premises and equipment

|

(3,450

|

)

|

(6,232

|

)

|

(2,725

|

)

|

||||||

|

Disposals of premises and equipment

|

13

|

402

|

----

|

|||||||||

|

Purchases of bank owned life insurance and annuity assets

|

(4,583

|

)

|

(500

|

)

|

----

|

|||||||

|

Net cash (used in) investing activities

|

(88,685

|

)

|

(26,409

|

)

|

(12,726

|

)

|

||||||

|

|

||||||||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Change in deposits

|

172,290

|

1,147

|

(9,930

|

)

|

||||||||

|

Proceeds from common stock through dividend reinvestment

|

----

|

1,407

|

1,325

|

|||||||||

|

Cash dividends

|

(4,022

|

)

|

(4,000

|

)

|

(3,967

|

)

|

||||||

|

Proceeds from Federal Home Loan Bank borrowings

|

----

|

----

|

8,000

|

|||||||||

|

Repayment of Federal Home Loan Bank borrowings

|

(5,093

|

)

|

(3,676

|

)

|

(3,162

|

)

|

||||||

|

Change in other long-term borrowings

|

(405

|

)

|

(2,046

|

)

|

(989

|

)

|

||||||

|

Change in other short-term borrowings

|

(629

|

)

|

----

|

(85

|

)

|

|||||||

|

Net cash provided by (used in) by financing activities

|

162,141

|

(7,168

|

)

|

(8,808

|

)

|

|||||||

|

|

||||||||||||

|

Cash and cash equivalents:

|

||||||||||||

|

Change in cash and cash equivalents

|

85,947

|

(18,824

|

)

|

(3,393

|

)

|

|||||||

|

Cash and cash equivalents at beginning of year

|

52,356

|

71,180

|

74,573

|

|||||||||

|

Cash and cash equivalents at end of year

|

$

|

138,303

|

$

|

52,356

|

$

|

71,180

|

||||||

|

Supplemental disclosure:

|

||||||||||||

|

Cash paid for interest

|

$

|

6,681

|

$

|

6,931

|

$

|

5,008

|

||||||

|

Cash paid for income taxes

|

2,050

|

890

|

2,050

|

|||||||||

|

Transfers from loans to other real estate owned

|

92

|

570

|

547

|

|||||||||

|

Initial recognition of operating lease right-of-use asset

|

----

|

1,280

|

----

|

|||||||||

|

Operating lease liability arising from obtaining right-of-use asset

|

----

|

1,280

|

----

|

|||||||||

See accompanying notes to consolidated financial statements

Amounts are in thousands, except share and per share data.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note A - Summary of Significant Accounting Policies

Description of Business: Ohio Valley Banc Corp. (“Ohio Valley”) is a financial holding company registered under the Bank Holding Company Act of 1956. Ohio Valley has one banking subsidiary, The Ohio Valley

Bank Company (the “Bank”), an Ohio state-chartered bank that is a member of the Federal Reserve Bank (“FRB”) and is regulated primarily by the Ohio Division of Financial Institutions and the Federal Reserve Board. Ohio Valley also has a subsidiary

that engages in consumer lending generally to individuals with higher credit risk history, Loan Central, Inc.; a subsidiary insurance agency that facilitates the receipts of insurance commissions, Ohio Valley Financial Services Agency, LLC; and a

limited purpose property and casualty insurance company, OVBC Captive, Inc. The Bank has one wholly-owned subsidiary, Ohio Valley REO, LLC ("Ohio Valley REO"), an Ohio limited liability company, to which the Bank transfers certain real estate

acquired by the Bank through foreclosure for sale by Ohio Valley REO. Ohio Valley and its subsidiaries are collectively referred to as the “Company.”

The Company provides a full range of commercial and retail banking services from 21 offices located in southeastern Ohio and western West Virginia. It accepts deposits in checking, savings, time and

money market accounts and makes personal, commercial, floor plan, student, construction and real estate loans. Substantially all loans are secured by specific items of collateral, including business assets, consumer assets, and commercial and

residential real estate. Commercial loans are expected to be repaid from cash flow from business operations. The Company also offers safe deposit boxes, wire transfers and other standard banking products and services. The Bank’s deposits are insured

by the Federal Deposit Insurance Corporation (“FDIC”). In addition to accepting deposits and making loans, the Bank invests in U. S. Government and agency obligations, interest-bearing deposits in other financial institutions and investments

permitted by applicable law.

The Bank’s trust department provides a wide variety of fiduciary services for trusts, estates and benefit plans and also provides investment and security services as an agent for its customers.

Principles of Consolidation: The consolidated financial statements include the accounts of Ohio Valley and its wholly-owned subsidiaries, the Bank, Loan Central, Inc., Ohio Valley Financial Services Agency, LLC,

and OVBC Captive, Inc. All material intercompany accounts and transactions have been eliminated.

Industry Segment Information: Internal financial information is primarily reported and aggregated in two lines of business, banking and consumer finance.

Use of Estimates: To prepare financial statements in conformity with accounting principles generally accepted in the U.S., management makes estimates and assumptions based on available information. These estimates

and assumptions affect the amounts reported in the financial statements and the disclosures provided, and actual results could differ.

Cash and Cash Equivalents: Cash and cash equivalents include cash on hand, noninterest-bearing deposits with banks, federal funds sold and interest-bearing deposits with banks with maturity terms of less than 90

days. Generally, federal funds are purchased and sold for one-day periods. The Company reports net cash flows for customer loan transactions, deposit transactions, short-term borrowings and interest-bearing deposits with other financial institutions.

Certificates of deposit in financial institutions: Certificates of deposit in financial institutions are carried at cost and have maturity terms of 90 days or greater. The longest maturity date is May 31, 2023.

Securities: The Company classifies securities into held to maturity and available for sale categories. Held to maturity securities are those which the Company has the positive intent and ability to hold to

maturity and are reported at amortized cost. Securities classified as available for sale include securities that could be sold for liquidity, investment management or similar reasons even if there is not a present intention of such a sale. Available

for sale securities are reported at fair value, with unrealized gains or losses included in other comprehensive income, net of tax.

Premium amortization is deducted from, and discount accretion is added to, interest income on securities using the level yield method without anticipating prepayments, except for mortgage-backed

securities where prepayments are anticipated. Gains and losses are recognized upon the sale of specific identified securities on the completed trade date.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note A - Summary of Significant Accounting Policies (continued)

Other-Than-Temporary Impairments of Securities: In determining an other-than-temporary impairment (“OTTI”), management considers many factors, including: (1) the length of time and the extent to which the fair

value has been less than cost, (2) the financial condition and near-term prospects of the issuer, (3) whether the market decline was affected by macroeconomic conditions, and (4) whether the Company has the intent to sell the debt security or more

likely than not will be required to sell the debt security before its anticipated recovery. The assessment of whether an OTTI decline exists involves a high degree of subjectivity and judgment and is based on the information available to management at

a point in time.

When an OTTI occurs, the amount of the OTTI recognized in earnings depends on whether an entity intends to sell the security or it is more likely than not it will be required to sell the security

before recovery of its amortized cost basis, less any current-period credit loss. If an entity intends to sell or it is more likely than not it will be required to sell the security before recovery of its amortized cost basis, less any current-period

credit loss, the OTTI shall be recognized in earnings equal to the entire difference between the investment’s amortized cost basis and its fair value at the balance sheet date. If an entity does not intend to sell the security and it is not more likely

than not that the entity will be required to sell the security before recovery of its amortized cost basis less any current-period loss, the OTTI shall be separated into the amount representing the credit loss and the amount related to all other

factors. The amount of the total OTTI related to the credit loss is determined based on the present value of cash flows expected to be collected and is recognized in earnings. The amount of the total OTTI related to other factors is recognized in other

comprehensive income, net of applicable taxes. The previous amortized cost basis less the OTTI recognized in earnings becomes the new amortized cost basis of the investment.

Restricted Investments in Bank Stocks: As a member of the Federal Home Loan Bank (“FHLB”) system and the FRB system, the Bank is required to own a certain amount of stock based on its level of borrowings and

other factors and may invest in additional amounts. FHLB stock and FRB stock are carried at cost, classified as restricted securities, and periodically evaluated for impairment based on ultimate recovery of par value. Both cash and stock dividends

are reported as income. The Company has additional investments in other restricted bank stocks that are not material to the financial statements.

Loans: Loans that management has the intent and ability to hold for the foreseeable future or until maturity or payoff are reported at the principal balance outstanding, net of unearned interest, deferred loan

fees and costs, and an allowance for loan losses. Interest income is reported on an accrual basis using the interest method and includes amortization of net deferred loan fees and costs over the loan term using the level yield method without

anticipating prepayments. The amount of the Company’s recorded investment is not materially different than the amount of unpaid principal balance for loans.

Interest income is discontinued and the loan moved to non-accrual status when full loan repayment is in doubt, typically when the loan is impaired or payments are past due 90 days or over unless the

loan is well-secured or in process of collection. Past due status is based on the contractual terms of the loan. In all cases, loans are placed on nonaccrual or charged-off at an earlier date if collection of principal or interest is considered

doubtful. Nonaccrual loans and loans past due 90 days or over and still accruing include both smaller balance homogeneous loans that are collectively evaluated for impairment and individually classified impaired loans.

All interest accrued but not received for loans placed on nonaccrual is reversed against interest income. Interest received on such loans is accounted for on the cash-basis method until qualifying for

return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

The Bank also originates long-term, fixed-rate mortgage loans, with full intention of being sold to the secondary market. These loans are considered held for sale during the period of time after the

principal has been advanced to the borrower by the Bank, but before the Bank has been reimbursed by the Federal Home Loan Mortgage Corporation, typically within a few business days. Loans sold to the secondary market are carried at the lower of

aggregate cost or fair value. As of December 31, 2020, there were $70 in loans held for sale by the Bank, as compared to no loans held for sale at December 31, 2019.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note A - Summary of Significant Accounting Policies (continued)

Allowance for Loan Losses: The allowance for loan losses is a valuation allowance for probable incurred credit losses. Loan losses are charged against the allowance when management believes the uncollectibility

of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance. Management estimates the allowance balance required using past loan loss experience, the nature and volume of the portfolio, information about specific

borrower situations and estimated collateral values, economic conditions, and other factors. Allocations of the allowance may be made for specific loans, but the entire allowance is available for any loan that, in management’s judgment, should be

charged-off.

The allowance consists of specific and general components. The specific component relates to loans that are individually classified as impaired. A loan is impaired when, based on current information

and events, it is probable that the Company will be unable to collect all amounts due according to the contractual terms of the loan agreement. Loans for which the terms have been modified and for which the borrower is experiencing financial

difficulties are considered troubled debt restructurings and classified as impaired.

Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal

and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case

basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length and reasons for the delay, the borrower’s prior payment record, and the amount of shortfall in relation to the principal and

interest owed.

Commercial and commercial real estate loans are individually evaluated for impairment. If a loan is impaired, a portion of the allowance is allocated so that the loan is reported, net, at the present

value of estimated future cash flows using the loan’s existing rate or at the fair value of collateral if repayment is expected solely from the collateral. Smaller balance homogeneous loans, such as consumer and most residential real estate, are

collectively evaluated for impairment, and accordingly, they are not separately identified for impairment disclosure. Troubled debt restructurings are measured at the present value of estimated future cash flows using the loan’s effective rate at

inception. If a troubled debt restructuring is considered to be a collateral dependent loan, the loan is reported, net, at the fair value of the collateral. For troubled debt restructurings that subsequently default, the Company determines the amount

of reserve in accordance with the accounting policy for the allowance for loan losses.

The general component covers non-impaired loans and impaired loans that are not individually reviewed for impairment and is based on historical loss experience adjusted for current factors. The

historical loss experience is determined by portfolio segment and is based on the actual loss history experienced by the Company over the most recent 3 years for the consumer and real estate portfolio segment and 5 years for the commercial portfolio

segment. The total loan portfolio’s actual loss experience is supplemented with other economic factors based on the risks present for each portfolio segment. These economic factors include consideration of the following: levels of and trends in

delinquencies and impaired loans; levels of and trends in charge-offs and recoveries; trends in volume and terms of loans; effects of any changes in risk selection and underwriting standards; other changes in lending policies, procedures, and

practices; experience, ability, and depth of lending management and other relevant staff; national and local economic trends and conditions; industry conditions; and effects of changes in credit concentrations. The following portfolio segments have

been identified: Commercial and Industrial, Commercial Real Estate, Residential Real Estate, and Consumer.

Commercial and industrial loans consist of borrowings for commercial purposes to individuals, corporations, partnerships, sole proprietorships, and other business enterprises. Commercial and

industrial loans are generally secured by business assets such as equipment, accounts receivable, inventory, or any other asset excluding real estate and generally made to finance capital expenditures or operations. The Company’s risk exposure is

related to deterioration in the value of collateral securing the loan should foreclosure become necessary. Generally, business assets used or produced in operations do not maintain their value upon foreclosure, which may require the Company to write

down the value significantly to sell.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note A - Summary of Significant Accounting Policies (continued)

Commercial real estate consists of nonfarm, nonresidential loans secured by owner-occupied and nonowner-occupied commercial real estate as well as

commercial construction loans. An owner-occupied loan relates to a borrower purchased building or space for which the repayment of principal is dependent upon cash flows from the ongoing business operations conducted by the party, or an affiliate of

the party, who owns the property. Owner-occupied loans that are dependent on cash flows from operations can be adversely affected by current market conditions for their product or service. A nonowner-occupied loan is a property loan for

which the repayment of principal is dependent upon rental income associated with the property or the subsequent sale of the property. Nonowner-occupied loans that are dependent upon rental income are primarily impacted by local economic conditions

which dictate occupancy rates and the amount of rent charged. Commercial construction loans consist of borrowings to purchase and develop raw land into 1-4 family residential properties. Construction loans are extended to individuals as well as

corporations for the construction of an individual or multiple properties and are secured by raw land and the subsequent improvements. Repayment of the loans to real estate developers is dependent upon the sale of properties to third parties in a

timely fashion upon completion. Should there be delays in construction or a downturn in the market for those properties, there may be significant erosion in value which may be absorbed by the Company.

Residential real estate loans consist of loans to individuals for the purchase of 1-4 family primary residences with repayment primarily through wage or other income sources of the individual

borrower. The Company’s loss exposure to these loans is dependent on local market conditions for residential properties as loan amounts are determined, in part, by the fair value of the property at origination.

Consumer loans are comprised of loans to individuals secured by automobiles, open-end home equity loans and other loans to individuals for household, family, and other personal expenditures, both

secured and unsecured. These loans typically have maturities of 6 years or less with repayment dependent on individual wages and income. The risk of loss on consumer loans is elevated as the collateral securing these loans, if any, rapidly depreciate

in value or may be worthless and/or difficult to locate if repossession is necessary. The Company has allocated the highest percentage of its allowance for loan losses as a percentage of loans to the other identified loan portfolio segments due to the

larger dollar balances associated with such portfolios.

At December 31, 2020, there were no changes to the accounting policies or methodologies within any of the Company’s loan portfolio segments from the prior period.

Concentrations of Credit Risk: The Company grants residential, consumer and commercial loans to customers located primarily in the southeastern Ohio and western West Virginia areas.

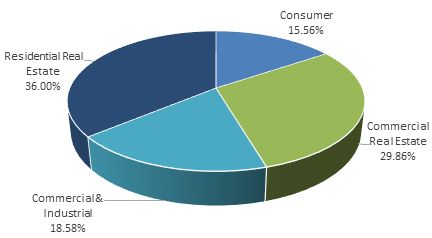

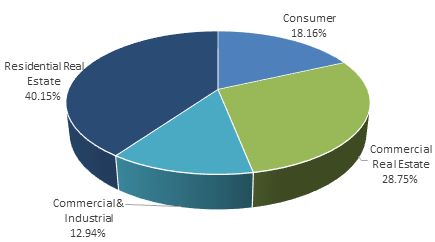

The following represents the composition of the Company’s loan portfolio as of December 31:

|

% of Total Loans

|

||||||||

|

2020

|

2019

|

|||||||

|

Residential real estate loans

|

36.00

|

%

|

40.15

|

%

|

||||

|

Commercial real estate loans

|

29.86

|

%

|

28.75

|

%

|

||||

|

Consumer loans

|

15.56

|

%

|

18.16

|

%

|

||||

|

Commercial and industrial loans

|

18.58

|

%

|

12.94

|

%

|

||||

|

100.00

|

%

|

100.00

|

%

|

|||||

Approximately 4.22% of total loans were unsecured at December 31, 2020, down from 5.00% at December 31, 2019.

The Bank, in the normal course of its operations, conducts business with correspondent financial institutions. Balances in correspondent accounts, investments in federal funds, certificates of

deposit and other short-term securities are closely monitored to ensure that prudent levels of credit and liquidity risks are maintained. At December 31, 2020, the Bank’s primary correspondent balance was $121,148 on deposit at the FRB, Cleveland,

Ohio.

Premises and Equipment: Land is carried at cost. Premises and equipment are stated at cost less accumulated depreciation, which is computed using the straight-line method over the estimated useful life of the

owned asset and, for leasehold improvement, over the remaining term of the leased facility, whichever is shorter. The useful lives range from 3 to 8 years for equipment, furniture and fixtures and 7 to 39 years for buildings and improvements.

Foreclosed assets: Assets acquired through or instead of loan foreclosure are initially recorded at fair value less costs to sell when acquired, establishing a new cost basis. Physical possession of residential

real estate property collateralizing a consumer mortgage loan occurs when legal title is obtained upon completion of foreclosure or when the borrower conveys all interest in the property to satisfy the loan through completion of a deed in lieu of

foreclosure or through a similar legal agreement. These assets are subsequently accounted for at lower of cost or fair value less estimated costs to sell. If fair value declines subsequent to foreclosure, a valuation allowance is recorded through

expense. Operating costs after acquisition are expensed. Foreclosed assets totaled $49 and $540 at December 31, 2020 and 2019.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note A - Summary of Significant Accounting Policies (continued)

Goodwill: Goodwill arises from business combinations and is generally determined as the excess of the fair value of the consideration transferred, plus the fair value of any noncontrolling interests in the

acquiree, over the fair value of the net assets acquired and liabilities assumed as of the acquisition date. Goodwill acquired in a purchase business combination and determined to have an indefinite useful life are not amortized, but tested for

impairment at least annually. Goodwill is the only intangible asset with an indefinite life on our balance sheet. The Company has selected December 31 as the date to perform its annual qualitative impairment test. Given that the Company’s stock price

had traded below book value for an extended period throughout 2020, management could not conclude using a qualitative assessment that its fair value of goodwill exceeded the carrying amount during the year ended December 31, 2020. Therefore, the

Company performed a quantitative impairment test to conclude that there was no goodwill impairment for the year ended December 31, 2020. For the year ended December 31, 2019, the Company used a qualitative assessment based on profitability and positive

equity to determine that it was more likely than not that the fair value of goodwill was more than the carrying amount, resulting in no impairment. See Note F for more specific disclosures related to goodwill impairment testing.

Long-term Assets: Premises and equipment and other long-term assets are reviewed for impairment when events indicate their carrying amount may not be recoverable from future undiscounted cash flows. If impaired,

the assets are recorded at fair value.

Mortgage Servicing Rights: A mortgage servicing right (“MSR”) is a contractual agreement where the right to service a mortgage loan is sold by the original lender to another party. When the Company sells mortgage

loans to the secondary market, it retains the servicing rights to these loans. The Company’s MSR is recognized separately when acquired through sales of loans and is initially recorded at fair value with the income statement effect recorded in mortgage

banking income. Subsequently, the MSR is then amortized in proportion to and over the period of estimated future servicing income of the underlying loan. The MSR is then evaluated for impairment periodically based upon the fair value of the rights as

compared to the carrying amount, with any impairment being recognized through a valuation allowance. Fair value of the MSR is based on market prices for comparable mortgage servicing contracts. Impairment is determined by stratifying rights into

groupings based on predominant risk characteristics, such as interest rate, loan type and investor type. If the Company later determines that all or a portion of the impairment no longer exists for a particular grouping, a reduction of the allowance

may be recorded as an increase to income. At December 31, 2020 and 2019, the Company’s MSR assets were $458 and $357, respectively.

Earnings Per Share: Earnings per share is based on net income divided by the following weighted average number of common shares outstanding during the periods: 4,787,446 for 2020; 4,767,279 for 2019; 4,725,971 for 2018. Ohio Valley had no dilutive effect and no potential common shares issuable under stock options or other agreements for any period presented.

Earnings Per Share: Earnings per share is based on net income divided by the following weighted average number of common shares outstanding during the periods: 4,787,446 for 2020; 4,767,279 for 2019; 4,725,971 for 2018. Ohio Valley had no dilutive effect and no potential common shares issuable under stock options or other agreements for any period presented.

Income Taxes: Income tax expense is the sum of the current year income tax due or refundable and the change in deferred tax assets and liabilities. Deferred tax assets and liabilities are the expected future tax

consequences of temporary differences between the carrying amounts and tax bases of assets and liabilities, computed using enacted tax rates. The effect on deferred tax assets and liabilities of a change in tax rates is recognized at the time of

enactment of such change in tax rates. A valuation allowance, if needed, reduces deferred tax assets to the amount expected to be realized.

A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount

recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The Company recognizes interest and/or

penalties related to income tax matters in income tax expense.

Comprehensive Income: Comprehensive income consists of net income and other comprehensive income (loss). Other comprehensive income (loss) includes unrealized gains and losses on securities available for sale

which are also recognized as separate components of equity, net of tax.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note A - Summary of Significant Accounting Policies (continued)

Loss Contingencies: Loss contingencies, including claims and legal actions arising in the ordinary course of business, are recorded as liabilities when the likelihood of loss is probable and an amount or range of

loss can be reasonably estimated. Management does not believe there now are such matters that will have a material effect on the financial statements.

Bank Owned Life Insurance and Annuity Assets: The Company has purchased life insurance policies on certain key executives. Bank owned life insurance is recorded at the amount that can be realized under the

insurance contract at the balance sheet date, which is the cash surrender value adjusted for other charges or other amounts due that are probable at settlement. The Company also purchased an annuity investment for a certain key executive that earns

interest.

Employee Stock Ownership Plan: Compensation expense is based on the market price of shares as they are committed to be allocated to participant accounts.

Dividend Reinvestment Plan: The Company maintains a Dividend Reinvestment Plan. The plan enables shareholders to elect to have their cash dividends on all or a portion of shares held automatically reinvested in

additional shares of the Company’s common stock. The stock is issued out of the Company’s authorized shares and credited to participant accounts at fair market value. Dividends are reinvested on a quarterly basis.