Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - UNITED BANCORP INC /OH/ | tm211103d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - UNITED BANCORP INC /OH/ | tm211103d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - UNITED BANCORP INC /OH/ | tm211103d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - UNITED BANCORP INC /OH/ | tm211103d1_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - UNITED BANCORP INC /OH/ | tm211103d1_ex23-1.htm |

| EX-21 - EXHIBIT 21 - UNITED BANCORP INC /OH/ | tm211103d1_ex21.htm |

| 10-K - FORM 10-K - UNITED BANCORP INC /OH/ | tm211103d1_10k.htm |

Exhibit 13

A Letter from the President and CEO

To the shareholders of United Bancorp, Inc….

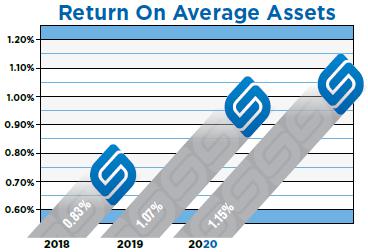

It is with extreme gratitude that I report to you, our valued shareholders, on the strong earnings and solid operational performance that United Bancorp, Inc. (UBCP) achieved in 2020--- (Yes, I am truly thankful for the results that we were able to produce this past year, since at the beginning of 2020... none of us could have imagined what extreme twist was in the proverbial road ahead, that could have easily thrown our Company’s financial performance off course)! This past year, UBCP reported diluted earnings per share of $1.39 and net income of $7,953,000. These levels were $0.20 per share and $1,143,000 greater than the respective levels for each of these earnings metrics reported the previous year (an increase of 17% for both). And, yes… at these levels, our Company has produced record earnings, once again, for the fourth consecutive year!

I humbly report these record levels of earnings to you, since this past year proved to be epically more challenging for our industry and all businesses (on both a national and global basis) due to the unprecedented COVID-19 pandemic, which erupted within our country in the first quarter of this past year and wreaked extreme havoc upon the economies in which we all operate. The scale of this pandemic was truly unfathomable and had not been experienced since the last great pandemic-outbreak that occurred over one century ago. Quite frankly, a pandemic of this magnitude is something of which we were aware and for which we had prepared through years of training; but, a situation that seemed highly improbable during these “modern” times. Yes, the COVID-19 pandemic did cause our Company to veer off course relating to our goal of growing our assets at an annual pace that would lead us to becoming a billion-dollar community banking organization within the near term. But, through proper preparation for and a fluid response to this unimaginable event, our Company was able to shine in terms of its overall performance… even during these darkest of times. As of this report, we are still dealing with COVID-19 and its negative effects on our country and world; but, things are slowly improving. We are hopeful that the worst of this metaphorical storm is behind us and, at this time, are grateful that we were left relatively unscathed by such a treacherous event. For this, we are truly appreciative and our Company is highly fortunate and, ultimately, blessed!

A Sudden, and Unexpected, Change and An Event That Shifted the Paradigm of Our Industry (and, Company): As we all well know, this past year proved to be one of the most challenging in history for all businesses and economies, both nationally and globally, due to the outbreak and spread of the COVID-19 virus and the related pandemic. As the year began, we heard about a virus that was on foreign territory and not yet in the United States. Many of our government officials and citizens wondered what, if any, impact this virus would have on us? Economically-speaking, our country was in a very sound position and our economy was performing at a very high level. Monetary policy was easing somewhat; but, we only anticipated potentially one cut in the target for the Federal Funds Rate by the Federal Open Market Committee (FOMC), which the timing thereof was projected to be at mid-year. As a company that had experienced record growth and earnings for the previous three years, we had very high expectations of continued high performance... with a laser-like focus on becoming a $1.0 billion community banking organization. Also, with a keen focus on digital transformation, internal process and product improvement and the aforementioned desire for accelerated growth to gain certain economies of scale and the potential efficiencies related thereto, our strategic vision looked out over multiple years. When the COVID-19 pandemic abruptly hit, almost overnight, the FOMC reverted to the Zero Interest Rate Policy (ZIRP) that it had first undertaken during the course of the Great Recession, which put pressure on the margins and earnings of all banks. In addition, our long-term vision (which focused on growing our balance sheet, generating increasing earnings and maintaining our relevance) became very short term: focusing on the day to day, week to week and month to month operations and activities of our Company. It suddenly seemed that each quarter was now a year within a year! This reality forced our Company to hyper-focus on being extremely nimble in order to effectively address the unknown. Quite simply, we were in uncharted waters and everyone within our industry (and, others) was doing their best to address an extremely volatile situation. Accordingly, we had to quickly analyze and comprehend the evolving guidance communicated by government, regulatory and public health officials in order to effectively maintain as much normalcy in our operations as reasonably possible under such extreme circumstances. Immediately, our Company went from an offensive focus to a defensive posture in order to effectively and timely deal with this great uncertainty thrown upon us!

| 1 |

A Letter from the President and CEO - Continued

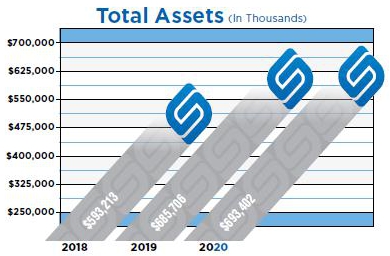

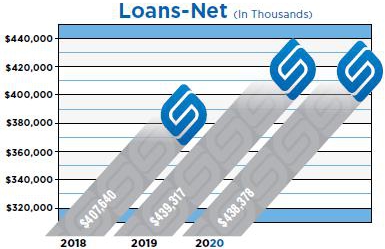

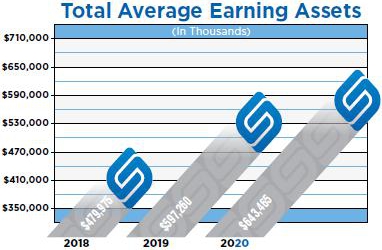

Continuing a Trend of Positive Performance this Past Year (Although, Subdued by the Pandemic): Even with these pandemically-induced, economic headwinds and the sudden change in monetary policy that United Bancorp, Inc. (UBCP) faced during the course of 2020, our Company continued its recent trend of producing record growth and earnings. For the year ending December 31, 2020, United Bancorp, Inc. (UBCP) had net income of $7,953,000 and diluted earnings per share of $1.39. These earnings metrics were $1,143,000 and $0.20 higher than the previous record levels achieved the prior year, an increase of seventeen percent (17%) for each. UBCP achieved this record level of earnings even though an additional $2,429,000 was booked in the loan loss provision in 2020. This additional provisioning (which, we thought was prudent given the nature of the circumstances with which we were confronted) raised the level of our total allowance for loan losses to total loans from fifty-one basis points (0.51%) to one hundred and fifteen basis points (1.15%) at year end. Strongly contributing to UBCP’s achievement of a sound level of earnings this past year was the solid growth that our Company experienced in its earning assets during this time of uncertainty. This level of growth in earning assets was achieved even though we elected not to participate in the Paycheck Protection Program… a program that fueled the growth of many of our peer within the financial services industry this past year. In 2020, average loans increased by $25.8 million, or 6.1%, and average securities and other required stock increased by $9.8 million or 6.2%. The latter increased even though the Company sold roughly $32 million in investment securities that produced gains which lessened the bottom-line impact of the increased provisioning to the loan loss reserve as previously mentioned. Even with the Federal Open Market Committee (FOMC) implementing its Zero Interest Rate Policy (ZIRP) beginning in the first quarter of 2020 due to the COVID-19 pandemic, our solid growth in earning assets, along with our robust loan fee generation (which increased by $575,000, or 61%, year-over-year), led to an increase of $594,000 in the level of total interest income realized by our Company--- an improvement of 2.2% over the previous year.

From an interest expense perspective, UBCP was in a prime position to benefit from the sudden acceleration in the loosening of our country’s monetary policy this past year. As we have formerly disclosed, our Company prudently started to position its balance sheet to being more liability sensitive early in the second quarter of 2019 when the FOMC began to first loosen its monetary policy with its first cut in the target for the Federal Funds Rate after a few years of tightening said policy. Our Company’s quick reaction to this newly adopted loosening posture at that time put us in a more strategic position to fully benefit from the ZIRP that was introduced, almost overnight by the FOMC, in the first quarter of 2020. Such a monumental change in our monetary policy was needed when the potential negative impact of the COVID-19 pandemic on our country and economy were more fully understood. Being in a very good position from a sensitivity perspective when this sudden and drastic change in monetary policy occurred, UBCP saw its total interest expense decrease in 2020 from the previous year by $1,389,000 or 22.7%, a reduction that had not been seen by our Company on a year-over-year basis for several years. As we enter a new year, our Company anticipates further benefitting from our proper and responsive posture in addressing a loosening monetary policy or ZIRP. But, if interest rates remain lower for longer as the FOMC has telegraphed, our Company could experience pressure on its net interest margin. Ultimately, though, our focus last year on both growing earning assets and aggressively managing sensitivity led to our Company seeing a year-over-year increase in its net interest income of $1,983,000 or 9.5%. As of December 31, 2020, UBCP’s net interest margin was 3.76%, which is an increase of nine basis points (0.09%) over the previous year and compares very favorably to our peer (many of which experienced declining net interest margins over the course of this past year).

From a credit quality perspective, UBCP was able to successfully maintain overall strength and stability within its loan portfolio in 2020. Even though our loan portfolio had the potential to be severely stressed as a result of the negative impacts on our economy created by the COVID-19 pandemic, UBCP continued to have very solid credit quality-related metrics. As of December 31, 2020, our Company had a relatively low level of nonaccrual loans and loans past due thirty (30) plus days, which were $832,000, or nineteen basis points (0.19%) of total loans. This was a decrease of $1,828,000, or forty-one basis points (0.41%), over the previous year when our economy was much more stable and higher performing. Further, net loans charged off, excluding overdrafts, was a very respectable $378,000, or eight basis points (0.08%), which compares very favorably to our peer. With our Company’s increased provision for loan losses in 2020, the total allowance for loan losses more than doubled year-over-year and total loan losses to nonaccrual loans was eight hundred and sixteen percent (816%) at year end… a coverage level that is, on average, much greater than our peer and which gives our Company tremendous cushion to protect against future potential losses. If losses within our presently high performing loan portfolio do not materialize, this robust reserve number could help contribute to future earnings in a positive fashion.

| 2 |  |

Regarding the COVID-19 pandemic and the impact that it had on our borrowers’ ability to repay in a timely manner--- UBCP was committed throughout the course of this past year to working closely with our valued loan customers and helping them keep their loans current. We achieved this by strictly adhering to and following the payment relief practices that were strongly encouraged and fully supported by both our regulatory and accounting partners through their astute guidance. We are happy to report that by working closely with our loan customers and giving them multiple options to remain in good standing, an overwhelming majority of them were able to overcome the challenges that the pandemic posed to their operations, cash flows, and incomes. As of December 31, 2020, we were encouraged to see most of our loan customer base that had previously received some level of payment relief in 2020 make either contractual or interest-only payments on their loans. We are hopeful that this trend will continue in the current year; but, our Company recognizes that its credit quality metrics could potentially deteriorate if our economy does not improve in the near term and normalize throughout the course of this new year.

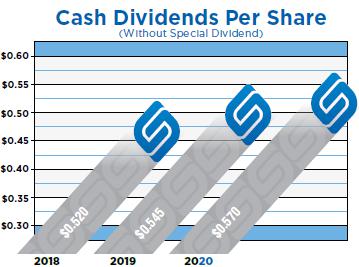

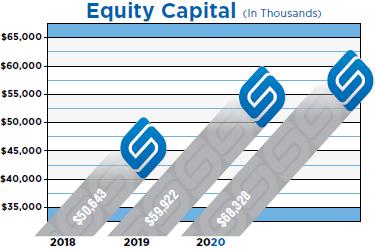

Relating to our overall levels of capitalization as of year-end 2020, UBCP continues to have very sound levels of capital. With the Company producing record earnings… and, having a Return on Assets (ROA) of 1.15% and a Return on Equity (ROE) of 11.45%... capital levels and measurements were enhanced over the course of this past year. As our Company has previously disclosed, in the second quarter of 2019 at the bank subsidiary level, overall capital levels were greatly enhanced with the issuance of $20.0 million in subordinated debt at very favorable terms. Even though this capital is not measured at the corporate, holding company level, it has provided some welcome cushion during these very challenging times in the COVID-19 pandemic era. Overall, UBCP saw its shareholders’ equity grow by $8.4 million, or 14.0%, and its book value increase by $1.21, or 11.8%, year-over-year. And, yes… at these levels, our Company is considered to be well-capitalized by industry and regulatory standards. Even though we closely focused on our capital levels during these clearly uncertain times, our Company is extremely proud of the reality that it was able to maintain (and, not reduce or even suspend) payment of its cash dividend to its valued shareholders. During the course of 2020, UBCP paid cash dividends of $0.57… an increase of $0.025, or five percent (5%). Based on the market value of our Company’s stock at year-end, this payment level produces a yield of 4.32%, which is well above current market rates in this present ZIRP environment.

Overcoming Extreme Challenges and Achieving Solid Operational Performance in 2020--- Continuing to Build for Our Future: From an operational perspective, the COVID-19 pandemic presented UBCP with an extreme challenge… one like we had never seen. But, ultimately, our Company was up to hitting the curve ball that it was thrown and meeting this great challenge, which was no small feat under such trying circumstances! Fortunately, we had well-developed policies relating to business continuity and resumption that were the “torch lights” that guided us through this period of darkness. When government officials issued the stay at home orders, we were able to effectively adjust and keep our operations functioning at a very high level; especially, since we were considered to be an essential business. During that time, many of our valued team members did work remotely and away from our physical locations. Our lobbies did close and we only met with customers at our drive-ups or on an appointment-only basis. Yes, this did have a negative impact on achieving our growth objectives; but, quite frankly, our focus during this time was to primarily meet the more basic needs of our customers. After a couple of months operating in this restricted fashion, we were finally able to safely reopen our lobbies to our valued customers and, once again, begin somewhat normalized operations. Yes, we did take extreme precautions by following all of the health and safety-related guidance provided by both our government and health authorities, which served us well. Once fully reopening in June, 2020, we were able to get back on track without any more severely impactful disruptions to our operations, while protecting the health and well-being of both our valued customers and team members. For this, we are extremely grateful.

Remarkably and despite the shock and negative impact felt by the COVID-19 pandemic, UBCP was able to continue focusing on building its brand, achieving operational improvements, and improving the overall customer experience, through the efforts of:

| · | Our Marketing Team, which stepped up and ensured that we were able to effectively communicate with our customers and the general public by developing effective social media-driven marketing campaigns and communications. In addition, with the utilization of analytics, we were able to identify opportunities to better serve our customers and build better, more well-rounded relationships. Also, brand building and community development remained a central focus of our marketing function and reinforced our steadfast commitment to building better relationships and gaining recognition within our communities! |

| · | Our Technology Team, that successfully implemented and introduced a new internet banking platform that helps us to remain relevant in this ever-more competitive industry in which we compete. With COVID-19 shifting our service or delivery paradigm, we were able to more effectively provide service to our customers--- even though it was on a remote basis--- by giving them the enhanced electronic functionality and connectivity that they desire. Digital services such as: P2P (person-to-person) same-day payments, contactless and instant issue debit cards, mobile banking, virtual wallets, electronic bill presentment and payment, online account origination, a nationwide service charge free ATM network and a complete treasury management solution for our business clients (among other services)... tremendously helped us serve our customers at a high level during this time of crisis! Focusing on our internal operations, our technology team was able to introduce Robotic Process Automation (RPA), which helped us to improve our delivery, achieve additional efficiency and gain intelligence which, collectively, helped us to enhance our operation and become more relevant. |

| 3 |

A Letter from the President and CEO - Continued

| · | Our Retail Delivery Team, which... even during this pandemically-challenged year... was able to construct, staff, and open our newest banking center. In August, we opened a banking center in Moundsville, West Virginia, which is in the heart of the proposed ethane cracker plant area. This is our Company's first full-service banking center in the State of West Virginia and twentieth overall. We are extremely encouraged by the potential for growth that this new location provides and are exceptionally happy to have the opportunity to introduce the “Unified Way” to a new, vibrant community. |

| · | Our Unified Care Center Team, which is our bank-level call center that was in operation for its first full year and proved to be invaluable in servicing our cherished customer base and meeting their individual needs during the COVID-19 pandemic. This operation has helped us to extend our customer service hours to as-late-as 10:00pm and tremendously improve the overall customer experience. |

| · | And... every Unified Team Member within our organization that helped us to continue and improve our operations and differentiate our brand during this most atypical and uncommon year! |

As you all well know, this past year was one of the most trying in the great history of our nation. Our thoughts and prayers go out to everyone as we all continue to work through and address the challenges presented to us by this horrible COVID-19 pandemic. Our number one priority continues to be protecting the health and welfare of our team members and customer base, while delivering the highest quality service possible under the circumstances. During this time of great uncertainty, we are truly blessed to have both personnel and systems capable of delivering uninterrupted and quality service and support to our valued customers. Our Team is extremely caring and resilient... and, they truly are our Number One Asset (or, the “secret sauce” which differentiates our brand)! Quite simply and sincerely, through the effort of our Team in 2020, our Company was able to perform at a record level during arguably the most demanding environment in which any of us has ever worked or experienced. For this, our Team is to be commended and--- as always--- I am exceptionally proud of their willingness to overcome extreme obstacles; their ability to produce stellar results under trying circumstances; and, in general, their overall fortitude. Our Company is uncommonly blessed to have such a motivated, dedicated and “United and Unified” Team! In addition, as a successful financial services company, we greatly benefit from the uncompromising support of our management, board of directors, and shareholders. Together, we will accomplish more!

Scott A. Everson

President and Chief Executive Officer

ceo@unitedbancorp.com

March 10, 2021

| Certain statements contained herein are not based on historical facts and are “forward-looking statements” within the meaning of Section 21A of the Securities Exchange Act of 1934. Forward-looking statements, which are based on various assumptions (some of which are beyond the Company's control), may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of these terms. Actual results could differ materially from those set forth in forward-looking statements, due to a variety of factors, including, but not limited to, those related to the economic environment, particularly in the market areas in which the company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset/liability management, changes in the financial and securities markets, including changes with respect to the market value of our financial assets, and the availability of and costs associated with sources of liquidity. The Company undertakes no obligation to update or clarify forward-looking statements, whether as a result of new information, future events or otherwise. |  |

| 4 |  |

DIVIDEND AND STOCK HISTORY

| Distribution Date of | ||||||||

| Cash Dividends | Special Cash Dividends | Dividends and | ||||||

| Declared (1) | and Stock Dividends | Exchanges | ||||||

| 1983 | $ | 0.05 | - | - | ||||

| 1984 | $ | 0.06 | 4 for 1 Exchange(2) | January 2, 1984 | ||||

| 1985 | $ | 0.07 | - | - | ||||

| 1986 | $ | 0.09 | - | - | ||||

| 1987 | $ | 0.09 | 50% Stock Dividend | October 2, 1987 | ||||

| 1988 | $ | 0.10 | - | - | ||||

| 1989 | $ | 0.10 | - | - | ||||

| 1990 | $ | 0.11 | - | - | ||||

| 1991 | $ | 0.12 | - | - | ||||

| 1992 | $ | 0.12 | 100% Stock Dividend | September 10, 1992 | ||||

| 1993 | $ | 0.12 | 100% Stock Dividend | November 30, 1993 | ||||

| 1994 | $ | 0.13 | 10% Stock Dividend | September 9, 1994 | ||||

| 1995 | $ | 0.19 | - | - | ||||

| 1996 | $ | 0.20 | 10% Stock Dividend | June 20, 1996 | ||||

| 1997 | $ | 0.23 | 10% Stock Dividend | September 19, 1997 | ||||

| 1998 | $ | 0.26 | 5% Stock Dividend | December 18, 1998 | ||||

| 1999 | $ | 0.30 | 5% Stock Dividend | December 20, 1999 | ||||

| 2000 | $ | 0.31 | 5% Stock Dividend | December 20, 2000 | ||||

| 2001 | $ | 0.32 | 5% Stock Dividend | December 20, 2001 | ||||

| 2002 | $ | 0.33 | 5% Stock Dividend | December 20, 2002 | ||||

| 2003 | $ | 0.35 | 10% Stock Dividend | December 19, 2003 | ||||

| 2004 | $ | 0.39 | 10% Stock Dividend | December 20, 2004 | ||||

| 2005 | $ | 0.43 | 10% Stock Dividend | December 20, 2005 | ||||

| 2006 | $ | 0.48 | 10% Stock Dividend | December 20, 2006 | ||||

| 2007 | $ | 0.52 | - | - | ||||

| 2008 | $ | 0.54 | - | - | ||||

| 2009 | $ | 0.56 | - | - | ||||

| 2010 | $ | 0.56 | - | - | ||||

| 2011 | $ | 0.56 | - | - | ||||

| 2012 | $ | 0.42 | - | - | ||||

| 2013 | $ | 0.29 | - | - | ||||

| 2014 | $ | 0.33 | - | - | ||||

| 2015 | $ | 0.37 | 5¢ Per Share Special Dividend | December 29, 2015 | ||||

| 2016 | $ | 0.42 | 5¢ Per Share Special Dividend | December 29, 2016 | ||||

| 2017 | $ | 0.46 | 5¢ Per Share Special Dividend | December 29, 2017 | ||||

| 2018 | $ | 0.52 | 5¢ Per Share Special Dividend | December 28, 2018 | ||||

| 2019 | $ | 0.545 | - | - | ||||

| 2020 | $ | 0.57 | - | - | ||||

2021 ANTICIPATED DIVIDEND PAYABLE DATES

| t | First Quarter |

| March 19, 2021 | |

| t | Second Quarter* |

| June 18, 2021 | |

| t | Third Quarter* |

| September 20, 2021 | |

| t | Fourth Quarter* |

| December 20, 2021 |

*Subject to action by Board of Directors

| (1) | Adjusted for stock dividends and exchanges. |

| (2) | Formation of United Bancorp, Inc. (UBCP). Unified Bank (formerly The Citizen's Saving Bank) shareholders received 4 shares of UBCP stock in exchange for 1 share of bank stock. |

TOTAL RETURN PERFORMANCE

| Index | 12/31/15 | 12/31/16 | 12/31/17 | 12/31/18 | 12/31/19 | 12/31/20 | ||||||||||||||||||

| United Bancorp, Inc. | 100.00 | 147.00 | 150.44 | 135.70 | 177.85 | 171.35 | ||||||||||||||||||

| NASDAQ Composite | 100.00 | 108.87 | 141.13 | 137.12 | 187.44 | 271.64 | ||||||||||||||||||

| SNL Bank Index | 100.00 | 126.35 | 149.21 | 124.00 | 167.93 | 145.49 | ||||||||||||||||||

| SNL Bank $500M-$1B Index | 100.00 | 135.02 | 164.73 | 159.00 | 204.78 | 176.93 | ||||||||||||||||||

| SNL Midwest Bank | 100.00 | 133.61 | 143.58 | 122.61 | 159.51 | 136.96 | ||||||||||||||||||

| Dow Jones | 100.00 | 116.50 | 149.24 | 144.05 | 180.56 | 198.11 | ||||||||||||||||||

| 5 |

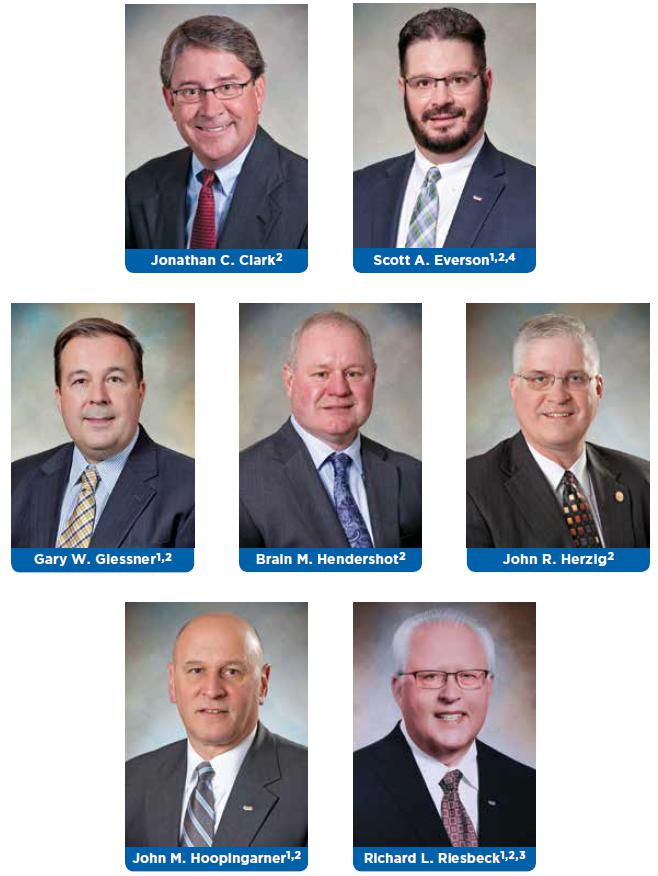

Directors

| 1 = United Bancorp, Inc. | 2 = Unified Bank | |

| 3 = Chairman - United Bancorp Inc. | 4 = Chairman - Unified Bank |

| 6 |  |

Directors and Officers

DIRECTORS OF UNITED BANCORP, INC

| Scott A.Everson1 | President & Chief Executive Officer, United Bancorp, Inc. |

| Chairman, President & Chief Executive Officer, Unified Bank, Martins Ferry, Ohio | |

| Gary W.Glessner2 | CPA & CGMA, Managing Member, Glessner & Associates, PLLC; |

| Glessner Wharton Andrews Insurance, LLC; Tiffany’s, LLC; GWA Realty, LLC, | |

| GW Rentals, LLC; Trustee, Windmill Truckers Center, Inc. | |

| John M. Hoopingarner, Esq.1,2,3,4 | Of Counsel, McMahon, DeGulis LLP, Columbus, Cleveland & Cincinnati, Ohio |

| Richard L. Riesbeck1,2,3,4 | Chairman, United Bancorp, Inc.; President, Riesbeck Food Markets, Inc., St. Clairsville, Ohio |

| James W. Everson | Chairman Emeritus 1969 - 2015 |

OFFICERS OF UNITED BANCORP, INC.

| Scott A. Everson | President & Chief Executive Officer |

| Matthew F. Branstetter | Senior Vice President, Chief Operating Officer |

| Randall M. Greenwood | Senior Vice President, Chief Financial Officer & Treasurer |

| Lisa A. Basinger | Corporate Secretary |

DIRECTORS OF UNIFIED BANK

| Jonathan C. Clark, Esq. | Attorney at Law, Lancaster, Ohio |

| Scott A. Everson1 | President & Chief Executive Officer, United Bancorp, Inc. |

| Chairman, President & Chief Executive Officer, Unified Bank, Martins Ferry, Ohio | |

| Gary W. Glessner2 | CPA & CGMA, Managing Member, Glessner & Associates, PLLC; |

| Glessner Wharton Andrews Insurance, LLC; Tiffany’s, LLC; GWA Realty, LLC, | |

| GW Rentals, LLC; Trustee, Windmill Truckers Center, Inc. | |

| Brian M. Hendershot | President, Ohio-West Virginia Excavating, Shadyside, Ohio |

| John R. Herzig | President, Toland-Herzig Funeral Homes & Crematory, Strasburg, Ohio |

| John M. Hoopingarner, Esq.1,2 | Of Counsel, McMahon, DeGulis LLP, Columbus, Cleveland & Cincinnati, Ohio |

| Richard L. Riesbeck1,2,ª | Chairman, United Bancorp, Inc.; President, Riesbeck Food Markets, Inc., St. Clairsville, Ohio |

| James W. Everson | Chairman Emeritus 1969 - 2015 |

1 = Executive Committee 2 = Audit Committee 3 = Compensation Committee

4 = Nominating and Governance Committee ª = Lead Director

| 7 |

Bank Past Presidents & Directors

The journey to becoming the institution we are today began in Martins Ferry, Ohio in 1902. Originally founded as The German Savings Bank and renamed to The Citizens Savings Bank in 1918, the last 118 years have seen growth and change that would have been unimaginable at its’ founding. The bank has grown through sound management, the addition of new offices and the acquisition of others. With the name change from The Citizens Savings Bank to Unified Bank in 2018, it has and will continue to move forward.

The growth and success of the bank has been attributed to the association of many dedicated individuals.

PAST PRESIDENTS

Edward E. McCombs, 1902-1936

John E. Reynolds, 1936 – 1940

Harold H. Riethmiller, 1940 – 1973

James W. Everson, 1973 – 2002

| Past Board of Directors | |

| Edward E. McCombs, 1902-1936* | Dr. Charles D. Messerly, 1957-1987 |

| John E. Reynolds, 1902-1940 | James M. Blackford, 1962-1968 |

| Dr. Joseph W. Darrah, 1902-1937 | John H. Morgan, 1967-1976 |

| J.A. Crossley, 1902-1903 | Emil F. Snyder, 1968-1975 |

| William M. Lupton, 1902-1902 | James H. Cook, 1976-1986 |

| F.K. Dixon, 1902-1909 | Paul Ochsenbein, 1978-1991 |

| Dr. R.H. Wilson, 1902-1905 | David W. Totterdale, 1981-1995 |

| Chris A. Heil, 1903-1909 | Albert W. Lash, 1975-1996 |

| David Coss, 1904-1938 | Premo R. Funari, 1976-1997 |

| L.L. Scheele, 1905-1917 | Donald A. Davison, 1963-1997* |

| A.T. Selby, 1906-1954 | Harold W. Price, 1999-1999 |

| H.H. Rothermund, 1907-1912 | John H. Clark, Jr., 1976-2001 |

| Dr. J.G. Parr, 1912-1930 | Dwain R. Hicks, 1999-2002 |

| T.E. Pugh, 1920-1953 | Michael A. Ley, 1999-2002 |

| J.J. Weiskircher, 1925-1942 | Michael J. Arciello 1992 - 2009 |

| David H. James, 1925-1963 | Leon F. Favede, O.D., 1981-2012 |

| Dr. C.B. Messerly, 1931-1957 | Herman E. Borkoski, 1987-2012 |

| H.H. Riethmiller, 1936-1980* | James W. Everson, 1969-2014* |

| E.M. Nickles, 1938-1968 | Robin L. Rhodes, 2007-2015 |

| L.A. Darrah, 1939-1962 | Andrew C. Phillips, 2007-2015 |

| R.L. Heslop, 1941-1983 | Errol C. Sambuco, 1996-2015 |

| Joseph E. Weiskircher, 1943-1975 | Samuel J. Jones, 2007-2015 |

| Edward M. Selby, 1953-1976 | Matthew C. Thomas, 1988-2016 |

| David W. Thompson, 1954-1966 | Terry A. McGhee, 2001-2017 |

| Carl A Novak, D.D.S., 2018-2020 |

* Past Chairman

| 8 |  |

Shareholder Information

United Bancorp, Inc.’s (the Company) common stock trades on The Nasdaq Capital Market tier of The Nasdaq Stock Market under the symbol UBCP, CUSIP #909911109. At year-end 2020, there were 6,046,351 shares issued, held among approximately 3,300 shareholders of record and in street name. The following table sets forth the quarterly high and low closing prices of the Company’s common stock from January 1, 2020 to December 31, 2020 compared to the same periods in 2019 as reported by the NASDAQ.

| 2020 | 2019 | |||||||||||||||||||||||||||||||

| 31-Mar | 30-Jun | 30-Sep | 31-Dec | 31-Mar | 30-Jun | 30-Sep | 31-Dec | |||||||||||||||||||||||||

| Market Price Range | ||||||||||||||||||||||||||||||||

| High ($) | $ | 14.75 | 10.70 | 12.67 | 13.35 | $ | 11.75 | 11.84 | 11.85 | 15.30 | ||||||||||||||||||||||

| Low ($) | $ | 9.31 | 9.10 | 10.50 | 11.80 | $ | 10.25 | 10.57 | 11.01 | 10.87 | ||||||||||||||||||||||

| Cash Dividends | ||||||||||||||||||||||||||||||||

| Quarter ($) | $ | 0.1425 | 0.1425 | 0.1425 | 0.1425 | $ | 0.1325 | 0.1350 | 0.1375 | 0.1400 | ||||||||||||||||||||||

| Cumulative ($) | $ | 0.1425 | 0.2850 | 0.4275 | 0.5700 | $ | 0.1325 | 0.2675 | 0.4050 | 0.5450 | ||||||||||||||||||||||

Investor Relations:

A copy of the Company’s Annual Report on form 10-K as filed with the SEC, will be furnished free of charge upon written or E-mail request to:

Randall M. Greenwood, CFO

United Bancorp, Inc.

201 South 4th Street

PO Box 10

Martins Ferry, OH 43935

or

cfo@unitedbancorp.com

Dividend Reinvestment and Stock Purchase Plan:

Shareholders may elect to reinvest their dividends in additional shares of United Bancorp, Inc.’s common stock through the Company’s Dividend Reinvestment Plan. Shareholders may also invest optional cash payments of up to $5,000 per month in our common stock at market price. To arrange automatic purchase of shares with quarterly dividend proceeds, please contact:

American Stock Transfer

and Trust Company

Attn: Dividend Reinvestment

6201 15th Avenue, 3rd Floor

Brooklyn, NY 11219

1-800-278-4353

Annual Meeting:

The Annual Meeting of Shareholders will be held at 2:00 p.m., April 21, 2021 at the Corporate Offices in Martins Ferry, Ohio.

Internet:

Please look us up at http//:www.unitedbancorp.com

Independent Auditors:

BKD LLP

312 Walnut Street, Suite 3000

Cincinnati, Ohio 45202

(513) 621-8300

Corporate Offices:

Unified Bank Building

201 South 4th Street, Martins Ferry, Ohio 43935

Lisa A. Basinger

Corporate Secretary

(888) 275-5566 (EXT 6113)

(740) 633-0445 (EXT 6113)

(740) 633-1448 (FAX)

Transfer Agent and Registrar:

For transfers and general correspondence, please contact:

American Stock Transfer and Trust Company

6201 15th Avenue, 3rd Floor

Brooklyn, NY 11219

1-800-937-5449

Stock Trading:

Raymond James

222 South Riverside Plaza

7th Floor

Chicago, Illinois 60606

Anthony LanFranco

312-655-2961

Stifel, Nicolaus & Company Inc.

655 Metro Place South

Dublin, Ohio 43017

Steven Jefferis

877-875-9352

Tom Thurston

Piper Sandler Companies

1251 Avenue of the Americas

New York, NY 10020

212-466-8027

| 9 |

Management’s Discussion and Analysis

In the following pages, management presents an analysis of United Bancorp, Inc.’s financial condition and results of operations as of and for the year ended December 31, 2020 as compared to prior years. This discussion is designed to provide shareholders with a more comprehensive review of the operating results and financial position than could be obtained from an examination of the financial statements alone. This analysis should be read in conjunction with the Consolidated Financial Statements and related footnotes and the selected financial data included elsewhere in this report.

When used in this discussion or future filings by the Company with the Securities and Exchange Commission, or other public or shareholder communications, or in oral statements made with approval of an authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “believe,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made, and to advise readers that various factors, including regional and national economic conditions, changes in levels of market interest rates, credit risks of lending activities and competitive and regulatory factors, could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from those anticipated or projected.

The Company is not aware of any trends, events or uncertainties that will have or are reasonably likely to have a material effect on its liquidity, capital resources or operations except as discussed herein. The Company is not aware of any current recommendations by regulatory authorities that would have such effect if implemented.

The Company does not undertake, and specifically disclaims, any obligation to publicly release any revisions that may be made to any forward-looking statements to reflect occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

Financial Condition

Overview

United Bancorp, Inc. reported diluted earnings per share of $1.39 and net income of $7,953,000 for the twelve months ended December 31, 2020, as compared to its previous record levels of $1.19 and $6,810,000, respectively, for the corresponding twelve-month period in 2019. The Company’s diluted earnings per share for the three months ended December 31, 2020 was $0.46, as compared to $0.31 for the same period in the previous year, an increase of 48.4%. Even though the Company achieved record earnings in 2020, overall earnings were negatively affected by a higher provision for loan losses and other expenses or revenue losses that it realized due to the impact of the COVID-19 pandemic that ravaged our national economy and country this past year.

For the fourth quarter of 2020, United Bancorp, Inc. achieved net income of $2,640,000 and diluted earnings per share of $0.46, which was a respective increase for each of $872,000 and $0.15, or 48.4%, over the previous year. For the twelve months ending December 31, 2020, the Company had net income of $7,953,000 and diluted earnings per share of $1.39 versus $6,810,000 and $1.19 respectively for the preceding year, an increase for both of 16.8% --- even though we booked an additional $2,429,000 in loan loss provision during the current year, raising the level of our total allowance for loan losses to total loans from 0.51% to

1.15% as of year-end. Contributing to the achievement of a sound level of earnings this past year was the solid growth the Company experienced in its earning assets. Year-over-year, average loans increased by $25.8 million, or 6.1%, and average securities and other required stock increased by $9.8 million or 6.2%. Even with the FOMC implementing its Zero Interest Rate Policy (ZIRP) early in 2020 due to the COVID-19 pandemic, our solid growth in our earning assets, along with our robust loan fee generation (which increased by $575,000, or 61%, year-over-year), led to an increase of $594,000 in our level of total interest income realized --- an improvement of 2.2% over the previous year. As we have formerly disclosed, our Company prudently started to position its balance sheet to be more liability sensitive early

| 10 |  |

in the second quarter of 2019 in response to the FOMC’s change in the direction of monetary policy at that time. This action put us in a more strategic position to fully benefit from the ZIRP implemented almost overnight by the FOMC in the first quarter of 2020 when the potential effects of the COVID-19 pandemic on our country and economy were more fully understood. Being in a very good position from a sensitivity perspective when this sudden and drastic change in monetary policy occurred, our Company saw its total interest expense decrease in 2020 from the previous year by $1,389,000 or 22.7% --- a level which helped us lower our overall total interest expense on a year-over-year basis for the first time in several years as we had properly and responsively prepared for the downward trending rate environment in which we presently operate and foresee operating within for an extended period. With our focus on both growing earning assets and aggressively managing our sensitivity, our Company saw a year-over-year increase in its net interest income of $1,983,000 or 9.5%. As of December 31, 2020, our Company’s net interest margin was 3.76%, which is an increase of nine basis points year-over-year and compares very favorably to our peer. Obviously, if rates stay lower for longer as the FOMC has communicated, this could challenge us to maintain our net interest margin at its present level.

Even though we fully realize that the continuing pandemic situation has the potential to change our qualitative metrics relating to credit, we have successfully maintained overall strength and stability within our loan portfolio throughout the course of this past year and at year-end. As of December 31, 2020, United Bancorp, Inc. continues to have very solid credit quality-related metrics supported by a relatively low level of nonaccrual loans and loans past due 30 plus days, which were $832,000, or 0.19% of total loans, versus $2,660,000 and 0.63%, respectively, the previous year. Further, net loans charged off, excluding overdrafts, was $378,000, or 0.08% . With our increased provision for loan losses this past year, our total allowance for loan losses more than doubled year-over-year and our total allowance for loan losses to nonaccrual loans was 816.4% at year-end. We remain committed to closely working with our valued loan customers to keep their loans current by following payment relief practices fully supported by both regulatory and accounting guidance. We are hopeful that these positive actions will allow our customers who are still being negatively impacted by the pandemic to weather the storm and our Company to maintain its present state of sound credit quality. Over the course of this most recently ended quarter, we were encouraged to see most of our loan customer base that had previously received some level of payment relief in 2020 make either contractual or interest only payments on their loans. We are hopeful that this

current trend will continue; but, being realistic, we firmly recognize that our credit quality metrics could deteriorate if our economy does not normalize in the near term. United Bancorp, Inc. continues to have very sound levels of capital. As previously announced in the second quarter of 2019, we enhanced our capital levels by issuing $20.0 million in subordinated debt at very favorable terms. Even though this capital is only measured at the bank-level, it has provided some very welcome cushion during these very challenging times. Overall, our Company saw shareholders’ equity grow by $8.4 million, or 14.0%, and its book value increase by $1.21, or 11.8%, year-over-year.

As United Bancorp, Inc. navigated through an unprecedented and highly uncertain operating environment in 2020, I am extremely proud to report that we responded well to the challenges with which we were confronted and produced record earnings. We are exceptionally grateful for the level of increased earnings that we achieved in the pandemic-challenged economy in which we operated this past year and continue to be both mindful and respectful of the continuing challenges that it will pose for our Company in the current year. Accordingly, we continue to posture our Company for a longer duration downturn due to the negative macroeconomic forces with which we continue to be confronted related to the impacts of the pandemic on both our domestic and world economies. But, with the recent development of a COVID-19 vaccine and our solid credit related metrics and loss coverage related thereto, our Company did not contribute an additional provision to our relatively robust loan loss reserve this past quarter. Giving consideration to our exceptionally strong coverage ratio at year-end, we may be able to continue this course in the coming year if our credit metrics remain solid and the economy continues to improve and get closer to pre-pandemic performance levels. Our Company continues to be well capitalized under regulatory and industry guidelines, which should help us weather any storm that may confront us. In addition, our Company has always had a long-term view, predicated on sound underwriting practices, superior

| 11 |

customer service and prudent liquidity and capital management, which has served us well through various operating environments. We are confident that this philosophy will again prove to be sound as we support our customers and work through this present crisis; therefore, protecting our shareholder value.

This past year was extremely trying for our nation and our thoughts and prayers continue to go out to everyone as we all work through the challenges presented to us by this horrible COVID-19 pandemic. Our number one priority continues to be protecting the health and welfare of our team members and customer base, while delivering the highest quality service possible under the circumstances. During this time of great uncertainty, we are blessed to have both systems and personnel capable of delivering quality service and support to our valued customers. From an operating perspective, our Company was back to full operations and availability for the entire second half of 2020. The Company’s newest banking center opened in Moundsville, West Virginia, during this timeframe. This new location, our Company’s twentieth full-service banking center, is our first one located in the State of West Virginia. Although we are open to the public, we are taking extreme precautions in our operations by following the strict and further evolving guidance provided by both governmental and health authorities. We are truly blessed to have an extremely caring and resilient team of employees that helped our Company perform at a record level during arguably the most demanding environment in which any of us have ever worked. It is only through the diligence of our team members that we have been able to execute at a high level and achieve the record level of earnings that we did in 2020.

Earning Assets -Loans

The Company’s gross loans totaled $443.4 million at December 31, 2020, representing a 0.04% increase over the $441.5 million at December 31, 2019. Average loans totaled $446.3 million for 2020, representing a 6.1% increase compared to average loans of $420.5 million for 2019.

The increase in gross loans from December 31, 2019 to December 31, 2020 was primarily an increase in residential real estate by $8.6 million.

The Company’s commercial and commercial real estate loan portfolio represents 78.8% of the total portfolio at December 31, 2020 compared to 80.3% at December 31, 2019. The Company’s commercial and commercial real estate loans decreased approximately $5.2 million from December 31, 2019 to December 31, 2020. We utilize all the SBA, Ohio Department of Development and State of Ohio loan programs as well as local revolving loan funds to best fit the needs of our customers.

The Company’s installment lending portfolio represented 1.9% of the total portfolio at December 31, 2020, compared to 2.2% at December 31, 2019. Competition for installment loans principally comes from the captive finance companies offering low to zero percent financing for extended terms.

The Company’s residential real estate portfolio represents 19.3% of the total portfolio at December 31, 2020, compared to 17.5% at December 31, 2019. Residential real estate loans are comprised of 1-, 3-, and 5-year adjustable-rate mortgages and 15-year fixed rate loans used to finance 1-4 family units. The Company also offers fixed-rate real estate loans through our Secondary Market Real Estate Mortgage Program. Once these fixed-rate loans are originated and immediately sold without recourse in what is referred to as the secondary market, the Company does not assume credit risk or interest rate risk in this portfolio. This arrangement is quite common in banks and saves our customers from looking elsewhere for their home financing needs.

The Company did recognize a gain on the sale of secondary market loans of $180,000 in 2020 and a gain of $54,000 in 2019.

The allowance for loan losses represents the amount which management and the Board of Directors estimates is adequate to provide for probable incurred losses in the loan portfolio. Accounting for the allowance and the related provision for loan losses is viewed by management as a critical accounting policy. The allowance balance and the annual provision charged to expense are reviewed by management and the Board of Directors on a monthly basis. The allowance calculation is determined by utilizing a risk grading model that considers borrowers’ past due experience, coverage ratio to industry averages, economic

| 12 |  |

conditions and various other circumstances that are subject to change over time. In general, the loan loss policy for installment loans requires a charge-off if the loan reaches 120-day delinquent status or if notice of bankruptcy liquidation is received. The Company follows lending policies, with established criteria for determining the repayment capacity of borrowers, requirements for down payments and current market appraisals or other valuations of collateral when loans are originated. Installment lending also utilizes credit scoring to help in the determination of credit quality and pricing.

The Company generally recognizes interest income on the accrual basis, except for certain loans which are placed on non-accrual status, when in the opinion of management doubt exists as to collection on the loan. The Company’s policy is to generally place loans greater than 90 days past due on non-accrual status unless the loan is both well secured and in the process of collection. When a loan is placed on non-accrual status, interest income may be recognized on a cash basis as payment is received if the loan is well secured. If the loan is not deemed well secured, payments are credited to principal.

Management and the Board of Directors believe the current balance of the allowance for loan losses is sufficient to cover probable incurred losses. Refer to the Provision for Loan Losses section for further discussion on the Company’s credit quality.

Earning Assets – Securities and Federal Funds Sold

The securities portfolio is comprised of U.S. Government agency-backed securities, tax-exempt obligations of state and political subdivisions and certain other investments. Securities available for sale at December 31, 2020 decreased approximately $30.7 million from December 31, 2019 totals. To take advantage of a favorable yield curve on state and municipal obligation, the Company sold certain available-

for-sale securities for a total gain of approximately $2.6 million during 2020.

Sources of Funds – Deposits

The Company’s primary source of funds is retail core deposits from individuals and business customers. These core deposits include all categories of time deposits, excluding certificates of deposit greater than $250,000. Total deposits increased $31.5 million, or 5.7%, from $548.0 million at December 31, 2019 to $579.5 million at December 31, 2020. Overall total deposit growth was mainly focused on interest bearing money market and savings accounts.

The Company has a strong deposit base from public agencies, including local school districts, city and township municipalities, public works facilities and others, which may tend to be more seasonal in nature resulting from the receipt and disbursement of state and federal grants. These entities have maintained relatively stable balances with the Company due to various funding and disbursement timeframes.

Certificates of deposit greater than $250,000 are not considered part of core deposits and, as such, are used to balance rate sensitivity as a tool of funds management. At December 31, 2020, certificates of deposit greater than $250,000 decreased $6.2 million, from December 31, 2019 totals.

Sources of Funds – Securities Sold Under Agreements to Repurchase and Other Borrowed Funds

Other interest-bearing liabilities include securities sold under agreements to repurchase, and Federal Home Loan Bank (“FHLB”) advances. Securities sold under agreements to repurchase increased approximately $5.8 million from December 31, 2019 to December 31, 2020.

Advances from the Federal Home Loan Bank (FHLB) decreased $39.8 million from December 31, 2019 to December 31, 2020.

On May 14, 2019 the Company issued $20,000,000 of junior subordinated debentures in denominations of not less than $250,000. The debentures bear interest at a fixed rate of 6.0% until May 2024, which then becomes a floating interest rate equal to the three-month LIBOR (or an equivalent index) plus 3.625%, resetting quarterly. Interest on the subordinated notes will be payable semiannually through May 2024 and quarterly thereafter through the maturity date of May 2029. Principal is due upon maturity. The debentures are unsecured and payable to various investors. For purposes of computing regulatory capital, the

| 13 |

debentures are included in Tier 2 Capital. The subordinated notes may not be repaid in whole or in part prior to the fifth anniversary of the issue date (May 2019).

Performance Overview 2020 to 2019

Net Income

The Company reported basic and diluted earnings per share of $1.39 and net income of $7,953,000 for the year ended December 31, 2020, an increase of $1.1 million, or 16.8%, over net income of $6,810,000 for the year ended December 31, 2019.

Net Interest Income

Net interest income, by definition, is the difference between interest income generated on interest-earning assets and the interest expense incurred on interest-bearing liabilities. Various factors contribute to changes in net interest income, including volumes, interest rates and the composition or mix of interest-earning assets in relation to interest-bearing liabilities. Comparing the year ended December 31, 2020 to 2019, the Company’s net interest margin was 3.76% compared to 3.67%, an increase of 9 basis points.

Average interest-earning assets increased $46.2 million in 2020 as compared to 2019 while the associated weighted-average yield on these interest-earning assets decreased from 4.69% in 2019 to 4.49% for 2020. Average interest-bearing liabilities increased $45.2 million in 2020 as compared to 2019, while the associated weighted-average costs on these interest-bearing liabilities decreased from 1.31% in 2019 to 0.92% in 2020.

Refer to the sections on Asset and Liability Management and Sensitivity to Market Risks and Average Balances, Net Interest Income and Yields Earned and Rates Paid elsewhere herein for further information.

Provision For Loan Losses

The provision for loan losses is a charge to expense recorded to maintain the related balance sheet allowance for loan losses at an amount considered adequate by Management and the Board of Directors to cover probable incurred losses in the portfolio.

Gross loans were up $1.9 million year-over-year to a level of $443.4 million as of December 31, 2020. During this same period, the Company’s non-accrual loans decreased $826,000, or 56.9%, to a level of $626,000 and net loans charged off were down by $223,000, or 37.1%, to a level of $378,000 (exclusive of overdraft charge off). With the concerns around COVID-19 and the surge in unemployment, the Company increased the provision for loan losses which was $3.3 million for the year ended December 31, 2020 compared to $908,000 for the year ended December 31, 2019, an increase of $2.4 million year-over-year. Total allowance for loan losses to total loans was 1.15% and the total allowance for loan losses to nonperforming loans was 816.7% at year end 2020, compared to 0.51% and 153.6% at year end 2019.

Noninterest Income

Total noninterest income is made up of bank-related fees and service charges, as well as other income-producing services, sales of loans in the secondary market, ATM income, early-redemption penalties for certificates of deposit, safe deposit rental income, internet bank service fees, earnings on bank-owned life insurance, realized gains on available-for-sale securities and other miscellaneous items.

Noninterest income for the year ended December 31, 2020 was $6.9 million, an increase of $3.0 million, compared to $3.9 million for the year ended December 31, 2019. The main driver of this increase was the $2.6 million gain recognized on the sale of available-for- sale securities.

Noninterest Expense

In 2020, our Company saw its overall noninterest expense levels increase as we continued to build for the future and support our overall mission for growth. Most of the increase in our noninterest expense levels occurred in the following areas: hiring additional personnel to support service delivery, opening a full service banking center in Moundsville West Virginia and enhancing our digital channel to improve the overall customer experience Overall noninterest expense for 2020 increased $1.4 million, as compared to 2019.

Salaries and employee benefits increased $535,000, or 6.1%, from 2019 to 2020. As described above, we had an increased

| 14 |  |

level of personnel from the opening of our Moundsville, West Virginia office in the third quarter of 2020

Other expenses increased $637,000, or 25.1%. Items contributing to this increase were ATM expense of $208,000, as we issue and grow our debit card usage. We also saw an increase of $117,000 related to our Unified Care Center customer support group, which, once again, was implemented to improve the overall customer experience levels This service was rolled out in the fourth quarter of 2019 and provides a “live” personal service to our valued customer base six days a week, Monday through Saturday, at hours as late as 10:00 p.m.

Income tax expense for 2020 was $629,000 compared to $599,000 in 2019, an increase of $30,000. The Company’s effective income tax rate was 7.3% in 2020 and 8.1% in 2019. Refer to Note 9 Income Taxes for a reconciliation of the effective tax rate for the Company.

Asset/Liability Management and Sensitivity to Market Risks

In the environment of changing business cycles, interest rate fluctuations and growing competition, it has become increasingly difficult for banks to produce adequate earnings on a consistent basis. Although management can anticipate changes in interest rates, it is not possible to reliably predict the magnitude of interest rate changes. As a result, the Company must establish a sound asset/liability management policy, which will minimize exposure to interest rate risk while maintaining an acceptable interest rate spread and insuring adequate liquidity.

The principal goal of asset/liability management – earnings management – can be accomplished by establishing decision processes and control procedures for all bank assets and liabilities. Thus, the full scope of asset/liability management encompasses the entire balance sheet of the Company. The broader principal components of asset/ liability management include, but are not limited to liquidity planning, capital planning, gap management and spread management.

By definition, liquidity is measured by the Company’s ability to raise cash at a reasonable cost or with a minimum amount of loss. Liquidity planning is necessary so the Company will be capable of funding all obligations to its customers at all times, from meeting their immediate cash withdrawal requirements to fulfilling their short-term credit needs.

Capital planning is an essential portion of asset/liability management, as capital is a limited Bank resource, which, due to minimum capital requirements, can place possible restraints on Bank growth. Capital planning refers to maintaining capital standards through effective growth management, dividend policies and asset/liability strategies.

Gap is defined as the dollar difference between rate sensitive assets and rate sensitive liabilities with respect to a specified time frame. A gap has three components – the asset component, the liability component, and the time component. Gap management involves the management of all three components.

| (In thousands) | 2020 | 2019 | ||||||

| Noninterest income | ||||||||

| Customer service fees | $ | 2,580 | $ | 2,843 | ||||

| Gains on sales of loans | 180 | 54 | ||||||

| Earnings on bank-owned life insurance | 706 | 533 | ||||||

| Realized gains on available-for-sale securities | 2,593 | - | ||||||

| Other income | 856 | 458 | ||||||

| Total noninterest income | $ | 6,915 | $ | 3,888 | ||||

| Noninterest expense | ||||||||

| Salaries and employee benefits | $ | 9,311 | $ | 8,776 | ||||

| Occupancy and equipment | 2,406 | 2,263 | ||||||

| Professional services | 1,232 | 1,292 | ||||||

| Insurance | 486 | 468 | ||||||

| Deposit insurance premiums | 184 | 75 | ||||||

| Franchise and other taxes | 492 | 408 | ||||||

| Marketing expense | 339 | 383 | ||||||

| Printing and office supplies | 122 | 136 | ||||||

| Amortization of intangibles | 150 | 150 | ||||||

| Other expenses | 3,168 | 2,531 | ||||||

| Total noninterest expense | $ | 17,890 | $ | 16,482 | ||||

| 15 |

Gap management is defined as those actions taken to measure and match rate-sensitive assets to rate-sensitive liabilities. A rate-sensitive asset is any interest-earning asset, which can be repriced to a market rate in a given time frame. Similarly, a rate-sensitive liability is any interest-bearing liability, which can have its interest rate changed to a market rate during the specified time period. Caps, collars and prepayment penalties may prevent certain loans and securities from adjusting to the market rate.

A negative gap is created when rate-sensitive liabilities exceed rate-sensitive assets and, conversely, a positive gap occurs when rate-sensitive assets exceed rate-sensitive liabilities. Generally, a negative gap position will cause profits to decline in a rising interest rate environment and cause profits to increase in a falling interest rate environment. Conversely, a positive gap will cause profits to decline in a falling interest rate environment and increase is a rising interest rate environment. The Company’s goal is to have acceptable profits under any interest rate environment. To avoid volatile profits as a result of interest rate fluctuations, the Company attempts to match interest rate sensitivities. The Company achieves this by pricing both the asset and liability components to yield a sufficient interest rate spread, so that profits will remain relatively consistent across interest rate cycles.

Management of the income statement is called spread management and is defined as managing investments, loans, and liabilities to achieve an acceptable spread between the Company’s return on its earning assets and its cost of funds. Gap management without consideration of interest spread can cause unacceptably low profit margins. Spread management without consideration of gap positions can cause acceptable profits in some interest rate environments and unacceptable profits in others. A sound asset/liability management program combines gap and spread management into a single cohesive system.

Management measures the Company’s interest rate risk by computing estimated changes in net interest income and the Net Portfolio Value (“NPV”) of its cash flows from assets, liabilities and off-balance-sheet items in the event of a range of assumed changes in market interest rates. The Bank’s senior management and the Executive Committee of the Board of Directors, comprising the Asset/Liability Committee (“ALCO”), review the exposure to interest rates monthly. Exposure to interest rate risk is measured with the use of an interest rate sensitivity analysis to determine the change in NPV in the event of hypothetical changes in interest rates, while interest rate sensitivity gap analysis is used to determine the repricing characteristics of the assets and liabilities.

NPV represents the market value of portfolio equity and is equal to the market value of assets minus the market value of liabilities, with adjustments made for off-balance-sheet items.

Computations of prospective effects of hypothetical interest rate changes are based on numerous assumptions, including relative levels of market interest rates, loan prepayments and deposit decay rates, and should not be relied upon as indicative of actual results. Further, the computations do not contemplate any actions the Company may undertake in response to changes in interest rates. The NPV calculation is based on the net present value of discounted cash flows utilizing market prepayment assumptions and market rates of interest provided by surveys performed during each quarterly period, with adjustments made to reflect the shift in the Treasury yield curve between the survey date and quarter-end date.

| 16 |  |

Certain shortcomings are inherent in this method of analysis presented in the computation of estimated NPV. Certain assets such as adjustable-rate loans have features that restrict changes in interest rates on a short-term basis and over the life of the asset. In addition, the portion of adjustable-rate loans in the Company’s portfolio could decrease in future periods if market interest rates remain at or decrease below current levels due to refinancing activity. Further, in the event of a change in interest rates, prepayment and early withdrawal levels would likely deviate from those assumed in the table. Finally, the ability of many borrowers to repay their adjustable-rate debt may decrease in the case of an increase in interest rates.

The following tables present an analysis of the potential sensitivity of the Company’s net present value of its financial instruments to sudden and sustained changes in the prevailing interest rates.

The projected volatility of the net present value at both December 31, 2020 and 2019 fall within the general guidelines established by the Board of Directors. The 2020 NPV table shows that in a falling interest rate environment, in the event of a 100 basis point change, the NPV would decrease 13%. The other consideration is that once rates decrease 100 basis points from current levels, we tend to

| (Dollars in Thousands) | ||||||||||||

| Net Portfolio Value - December 31, 2020 | ||||||||||||

| Change in Rates | $ Amount | $ Change | % Change | |||||||||

| +200 | 133,203 | 13,597 | 10 | % | ||||||||

| +100 | 127,611 | 8,005 | 6 | % | ||||||||

| Base | 119,606 | - | - | |||||||||

| -100 | 105,524 | (14,082 | ) | -13 | % | |||||||

| (Dollars in Thousands) | ||||||||||||

| Net Portfolio Value - December 31, 2019 | ||||||||||||

| Change in Rates | $ Amount | $ Change | % Change | |||||||||

| +200 | 128,125 | (1,627 | ) | -1 | % | |||||||

| +100 | 129,388 | (364 | ) | 0 | % | |||||||

| Base | 129,752 | - | - | |||||||||

| -100 | 120,886 | (8,866 | ) | -7 | % | |||||||

| -200 | 105,871 | (23,881 | ) | -23 | % | |||||||

reach a floor on how low depository rates can adjust downward.

In an upward change in interest rates, the Company’s NPV would increase 6% with a 100 basis point interest rate increase. In a 200 basis point rate increase, the Company’s NPV would increase 10%.

| 17 |

The following table is a summary of selected quarterly results of operations for the years ended December 31, 2020 and 2019.

| Three Months Ended | ||||||||||||||||

| March 31 | June 30 | September 30 | December 31 | |||||||||||||

| (In thousands, except per share data) | ||||||||||||||||

| 2020 | ||||||||||||||||

| Total interest income | $ | 7,319 | $ | 6,949 | $ | 6,692 | $ | 6,668 | ||||||||

| Total interest expense | 1,685 | 1,427 | 948 | 674 | ||||||||||||

| Net interest income | 5,634 | 5,522 | 5,744 | 5,994 | ||||||||||||

| Provision for losses on loans | 563 | 1,408 | 1,333 | 33 | ||||||||||||

| Other income | 1,044 | 2,156 | 2,340 | 1,375 | ||||||||||||

| General, administrative and other expense | 4,410 | 4,579 | 4,492 | 4,409 | ||||||||||||

| Income before income taxes | 1,705 | 1,691 | 2,259 | 2,927 | ||||||||||||

| Federal income taxes | 126 | 16 | 200 | 287 | ||||||||||||

| Net income | 1,579 | 1,675 | 2,059 | 2,640 | ||||||||||||

| Earnings per share | ||||||||||||||||

| Basic | 0.28 | 0.29 | 0.36 | 0.46 | ||||||||||||

| Diluted | 0.28 | 0.29 | 0.36 | 0.46 | ||||||||||||

| Three Months Ended | ||||||||||||||||

| March 31 | June 30 | September 30 | December 31 | |||||||||||||

| (In thousands, except per share data) | ||||||||||||||||

| 2019 | ||||||||||||||||

| Total interest income | $ | 6,315 | $ | 6,648 | $ | 6,921 | $ | 7,150 | ||||||||

| Total interest expense | 1,207 | 1,469 | 1,726 | 1,721 | ||||||||||||

| Net interest income | 5,108 | 5,179 | 5,195 | 5,429 | ||||||||||||

| Provision for losses on loans | 90 | 120 | 120 | 578 | ||||||||||||

| Other income | 945 | 947 | 1,003 | 993 | ||||||||||||

| General, administrative and other expense | 4,162 | 4,172 | 4,162 | 3,986 | ||||||||||||

| Income before income taxes | 1,801 | 1,834 | 1,916 | 1,858 | ||||||||||||

| Federal income taxes | 187 | 188 | 135 | 89 | ||||||||||||

| Net income | 1,614 | 1,646 | 1,781 | 1,769 | ||||||||||||

| Earnings per share | ||||||||||||||||

| Basic | 0.28 | 0.29 | 0.31 | 0.31 | ||||||||||||

| Diluted | 0.28 | 0.29 | 0.31 | 0.31 | ||||||||||||

| 18 |  |

Average Balances, Net Interest Income and Yields Earned and Rates Paid

The following table provides average balance sheet information and reflects the taxable equivalent average yield on interest-earning assets and the average cost of interest-bearing liabilities for the years ended December 31, 2020 and 2019. The yields and costs are calculated by dividing income or expense by the average balance of interest-earning assets or interest-bearing liabilities.

The average balance of available-for-sale securities is computed using the carrying value of securities while the yield for available for sale securities has been computed using the average amortized cost. Average balances are derived from average month-end balances, which include nonaccruing loans in the loan portfolio, net of the allowance for loan losses. Interest income has been adjusted to tax-equivalent basis.

| 2020 | 2019 | ||||||||||||||||||||||||

| (Dollars In thousands) | Interest | Interest | |||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | ||||||||||||||||||||

| Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||||||

| Assets | |||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||

| Loans (1) | $ | 446,256 | 22,106 | 4.95 | % | $ | 420,487 | 21,803 | 5.19 | % | |||||||||||||||

| Taxable securities - AFS | 29,472 | 596 | 2.02 | 48,911 | 996 | 2.04 | |||||||||||||||||||

| Tax-exempt securities - AFS (1) | 137,948 | 6,057 | 4.39 | 106,528 | 4,687 | 4.40 | |||||||||||||||||||

| Federal funds sold | 25,522 | 49 | 0.19 | 17,285 | 333 | 1.93 | |||||||||||||||||||

| FHLB stock and other | 4,267 | 98 | 2.29 | 4,049 | 211 | 5.21 | |||||||||||||||||||

| Total interest-earning assets | 643,465 | 28,906 | 4.49 | 597,260 | 28,030 | 4.69 | |||||||||||||||||||

| Noninterest-earning assets | |||||||||||||||||||||||||

| Cash and due from banks | 7,864 | 5,405 | |||||||||||||||||||||||

| Premises and equipment (net) | 13,164 | 12,232 | |||||||||||||||||||||||

| Other nonearning assets | 42,228 | 22,787 | |||||||||||||||||||||||

| Less: allowance for loan losses | (3,794 | ) | (2,127 | ) | |||||||||||||||||||||

| Total noninterest-earning assets | 59,462 | 38,297 | |||||||||||||||||||||||

| Total assets | 702,927 | 635,557 | |||||||||||||||||||||||

| Liabilities & stockholders’ equity | |||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||

| Demand deposits | $ | 248,167 | 1,395 | 0.56 | % | $ | 209,810 | 2,381 | 1.13 | % | |||||||||||||||

| Savings deposits | 114,709 | 37 | 0.03 | 109,806 | 188 | 0.17 | |||||||||||||||||||

| Time deposits | 94,168 | 1,709 | 1.81 | 112,211 | 2,258 | 2.01 | |||||||||||||||||||

| FHLB advances | 9,341 | 174 | 1.86 | 27 | 1 | 3.70 | |||||||||||||||||||

| Federal funds purchased | 9,472 | 60 | 0.63 | 8,933 | 185 | 2.07 | |||||||||||||||||||

| Subordinated debentures | 23,604 | 1,329 | 5.63 | 16,276 | 975 | 5.99 | |||||||||||||||||||

| Repurchase agreements | 12,524 | 30 | 0.24 | 9,699 | 136 | 1.40 | |||||||||||||||||||

| Total interest-bearing liabilities | 511,985 | 4,734 | 0.92 | 466,762 | 6,124 | 1.31 | |||||||||||||||||||

| Noninterest-bearing liabilities | |||||||||||||||||||||||||

| Demand deposits | 115,340 | 109,349 | |||||||||||||||||||||||

| Other liabilities | 6,145 | 5,054 | |||||||||||||||||||||||

| Total noninterest-bearing liabilities | 121,485 | 114,403 | |||||||||||||||||||||||

| Total liabilities | |||||||||||||||||||||||||

| Total stockholders’ equity | 69,457 | 54,392 | |||||||||||||||||||||||

| Total liabilities & stockholders’ equity | $ | 702,927 | $ | 635,557 | |||||||||||||||||||||

| Net interest income | $ | 24,172 | $ | 21,906 | |||||||||||||||||||||

| Net interest spread | 3.57 | % | 3.38 | % | |||||||||||||||||||||

| Net yield on interest-earning assets | 3.76 | % | 3.67 | % | |||||||||||||||||||||

• For purposes of this schedule, nonaccrual loans are included in loans.

• Fees collected on loans are included in interest on loans.

(1) Shown on a tax equivalent basis.

| 19 |

Rate/Volume Analysis

The table below describes the extent to which changes in interest rates and changes in volume of interest-earning assets and interest-bearing liabilities have affected interest income and expense during 2020. For purposes of this table, changes in interest due to volume and rate were determined using the following methods:

| · | Volume variance results when the change in volume is multiplied by the previous year’s rate. |

| · | Rate variance results when the change in rate is multiplied by the previous year’s volume. |

| · | Rate/volume variance results when the change in volume is multiplied by the change in rate. |

NOTE: The rate/volume variance was allocated to volume variance and rate variance in proportion to the relationship of the absolute dollar amount of the change in each. Nonaccrual loans are ignored for purposes of the calculations due to the nominal amount of the loans.

Capital Resources

Internal capital growth, through the retention of earnings, is the primary means of maintaining capital adequacy for the Bank. The Company’s stockholders’ equity was $68.3 million and $59.9 million at December 31, 2020 and 2019, respectively. Total stockholders’ equity in relation to total assets was 9.85% at December 31, 2020 and

| 2020 Compared to 2019 | ||||||||||||

| Increase/(Decrease) | ||||||||||||

| (In thousands) | ||||||||||||

| Change | Change | |||||||||||

| Total | Due To | Due To | ||||||||||

| Change | Volume | Rate | ||||||||||

| Interest and dividend income | ||||||||||||

| Loans | $ | 303 | 1,302 | (999 | ) | |||||||

| Taxable securities available for sale | (400 | ) | (550 | ) | 150 | |||||||

| Tax-exempt securities available for sale | 1,370 | 1,380 | (10 | ) | ||||||||

| Federal funds sold | (284 | ) | 109 | (393 | ) | |||||||

| FHLB stock and other | (113 | ) | 11 | (124 | ) | |||||||

| Total interest and dividend income | 876 | 2,252 | (1,376 | ) | ||||||||

| Interest expense | ||||||||||||

| Demand deposits | (986 | ) | 377 | (1,363 | ) | |||||||

| Savings deposits | (151 | ) | 8 | (159 | ) | |||||||

| Time deposits | (549 | ) | (341 | ) | (208 | ) | ||||||

| FHLB advances | 173 | 174 | (1 | ) | ||||||||

| Federal funds purchased | (125 | ) | 11 | (136 | ) | |||||||

| Subordinated debentures | 354 | - | 354 | |||||||||

| Repurchase agreements | (106 | ) | 31 | (137 | ) | |||||||

| Total interest expense | (1,390 | ) | 260 | (1,650 | ) | |||||||

| Net interest income | $ | 2,266 | 1,992 | 274 | ||||||||

| 20 |  |

8.74% at December 31, 2019. Please refer to the Consolidated Statements of Stockholders’ Equity for a detailed roll forward of stockholders’ equity from 2019 to 2020.

The Company has established a Dividend Reinvestment Plan (“The Plan”) for stockholders under which the Company’s common stock will be purchased by The Plan for participants with automatically reinvested dividends. The Plan does not represent a change in the dividend policy or a guarantee of future dividends. Stockholders who do not wish to participate in The Plan continue to receive cash dividends, as declared in the usual and customary manner.

The Company’s Articles of Incorporation permits the creation of a class of preferred shares with 2,000,000 authorized shares. If utilized, this will enable the Company, at the option of the Board of Directors, to issue series of preferred shares in a manner calculated to take advantage of financing techniques which may provide a lower effective cost of capital to the Company. The class of preferred shares provides greater flexibility to the Board of Directors in structuring the terms of equity securities that may be issued by the Company. As of December 31, 2020, the Company has not issued any preferred shares.

On May 14, 2019 the Company issued $20,000,000 of junior subordinated debentures in denominations of not less than $250,000. The debentures bear interest at a fixed rate of 6.0% until May 2024, which then becomes a floating interest rate equal to the three-month LIBOR (or an equivalent index) plus 3.625%, resetting quarterly. Interest on the subordinated notes will be payable semiannually through May 2024 and quarterly thereafter through the maturity date of May 2029. Principal is due upon maturity. The debentures are unsecured and payable to various investors. For purposes of computing regulatory capital, the debentures are included in Tier 2 Capital. The subordinated notes may not be repaid in whole or in part prior to the fifth anniversary of the issue date (May 2019).