Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - MYOMO, INC. | myo-ex322_9.htm |

| EX-32.1 - EX-32.1 - MYOMO, INC. | myo-ex321_11.htm |

| EX-31.2 - EX-31.2 - MYOMO, INC. | myo-ex312_8.htm |

| EX-31.1 - EX-31.1 - MYOMO, INC. | myo-ex311_7.htm |

| EX-23.1 - EX-23.1 - MYOMO, INC. | myo-ex231_6.htm |

| EX-21 - EX-21.1 - MYOMO, INC. | myo-ex21_348.htm |

| 10-K - 10-K - MYOMO, INC. | myo-10k_20201231.htm |

Exhibit 10.26

SUBLEASE

UPSTATEMENT, LLC, a Massachusetts limited liability company ("Sublessor"), with a place of business at 137 Portland Street, Boston, Massachusetts 02114, and MYOMO, INC., a Delaware corporation ("Sublessee"), with a place of business at One Broadway, Cambridge, Massachusetts 02142, make this Sublease as of December 17, 2020 (the “Effective Date”).

Preliminary Statement

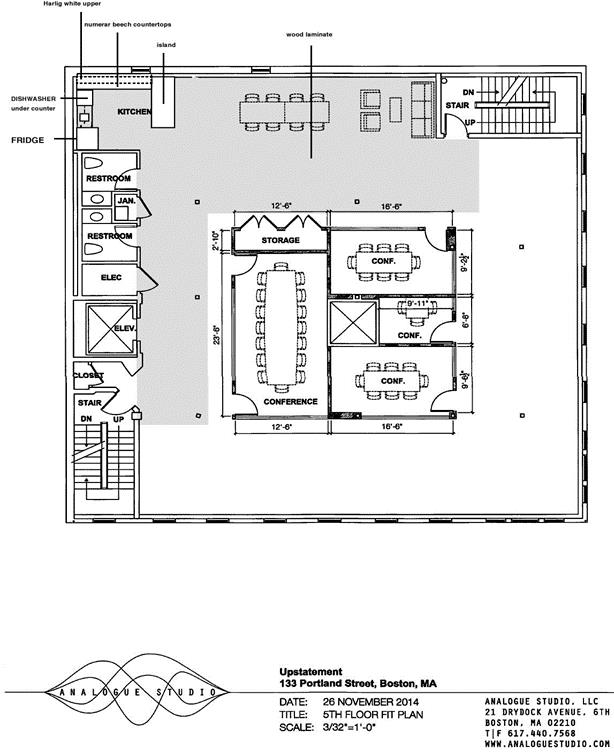

Sublessor is the tenant under a certain Lease dated January 26, 2015 (the “Original Lease”) by and between Sublessor, as tenant, and Portland North LLC, a Massachusetts limited liability company (the “Lessor” or “Major Landlord”), as landlord, as amended by that certain First Amendment to Lease dated August 13, 2015 (the “First Amendment”) and that certain Second Amendment to Lease dated May 10, 2016 (the “Second Amendment”; the Original Lease, the First Amendment, and the Second Amendment, the “Lease”, said Lease is attached hereto as Exhibit A) for certain premises (the “Premises”) consisting of 9,094 rentable square feet located on the fourth (4th) and fifth (5th) floors of the building located at 133 Portland Street, Massachusetts (the “Building”), as more particularly described in the Lease.

Sublessor desires to sublet to Sublessee, and Sublessee desires to accept from Sublessor, the entire Premises (the "Subleased Premises"), on the terms and conditions set forth in this Sublease.

Agreement

In consideration of the mutual covenants of this Sublease and other valuable consideration, the receipt and sufficiency of which Sublessee and Sublessor hereby acknowledge, Sublessor and Sublessee agree as follows:

1.Subleased Premises. Sublessor hereby subleases to Sublessee, and Sublessee hereby subleases from Sublessor, the Subleased Premises subject to the terms and conditions of this Sublease. Sublessor shall deliver the Subleased Premises to Sublessee on the Commencement Date (as hereinafter defined) in such “AS IS, WHERE IS” condition as exists on the date delivered to Sublessee, with the furniture listed on Exhibit B attached hereto (the “Furniture”) remaining therein and free of all occupants other than Sublessee. Upon delivery of possession of the Subleased Premises to Sublessee in accordance with the terms hereof, Sublessee shall conclusively be deemed to have accepted the Subleased Premises in the condition delivered and to have acknowledged that the same are in good condition and satisfactory to Sublessee in all respects and Sublessor has no obligation to make any improvements to such portion of the Sublease Premises. Sublessee acknowledges that Sublessor has made no representations or warranties concerning the Subleased Premises or the Building or their fitness for Sublessee’s purposes, except as expressly set forth in this Sublease.

2.Term. The term of this Sublease (the "Sublease Term") shall commence on the later of (i) the Effective Date, or (ii) the date the written consent of Lessor to this Sublease, as described in Section 18 below, has been obtained (the "Commencement Date") and shall terminate on August 30, 2023 (the “Sublease Term Expiration Date”), or such sooner date upon which the Sublease Term may expire or terminate under this Sublease, the Lease or pursuant to law. Notwithstanding any term or condition of this Sublease to the contrary, Sublessee hereby agrees to vacate and surrender the Subleased Premises in the condition required no later than the Sublease Term Expiration Date, however, commencing on August 15, 2023, Sublessee shall allow Sublessor access to the Subleased Premises for the purpose of performing any

|

{W12548295.7} |

1 |

surrender/restoration obligations required to be peformed by Sublessor under the Lease. However, Sublessor and Sublessee shall cooperate in good faith to schedule and coordinate such required work to minimize interference with Sublessee’s business operations therein.

3.Use. Sublessee shall use and occupy the Subleased Premises for the use permitted under the Lease (the “Permitted Uses”). Sublessee shall also comply with all laws governing or affecting Sublessee’s use of the Subleased Premises, and Sublessee acknowledges that Sublessor has made no representations or warranties concerning whether the Permitted Uses comply with such laws.

4.Fixed Rent. Commencing on June 1, 2021 (the “Rent Commencement Date”) and continuing through the Sublease Term, Sublessee shall pay to Sublessor Annual Fixed Rent (“Annual Fixed Rent” or “Fixed Rent”) for the Subleased Premises at the annual rates applicable to the periods and in the monthly installments as set forth below, in advance, on the first (1st) day of each calendar month during the Sublease Term.

|

Period |

Annual Fixed Renta[ Rate (per rsf) |

Annual Fixed Rent |

Monthly Installment of Fixed Rent |

|

Rent Commencement Date through December 31, 2021 |

$43.00 |

$391,042.00 |

$32,586.83 |

|

January 1, 2022 through December 31, 2022 |

$44.00 |

$400,136.00 |

$33,344.67 |

|

January 1, 2023 through August 30, 2023 |

$45.00 |

$409,230.00 |

$34,102.50 |

The first monthly installment of Fixed Rent shall be delivered to Sublessor by Sublessee simultaneously with Sublessee’s execution of this Sublease and shall be appropriately credited to Sublessee’s rent obligation when the same comes due. If the Sublease Term includes a partial calendar month, the monthly installment of Fixed Rent for such partial month shall be prorated at the rate of 1/30 of the monthly installment for each day in such partial month within the Sublease Term and shall be payable in advance on the first day of such partial month occurring within the Sublease Term. The Fixed Rent shall be paid to Sublessor by ACH wire (pursuant to wiring instructions provided by Sublessor to Sublessee) or by such other method or to such other place as Sublessor may designate in writing, in lawful money of the United States of America, without demand, deduction, offset or abatement. Any installment of Fixed Rent not paid within the timethat said payment must be made under the Sublease shall be governed by the late payment and grace period provisions of Section 7 of the Original Lease.

5.Taxes, and Operating Costs and Utilities. Sublessee shall pay its prorated share of property taxes and operating costs using the same basis of calculation defined under Sections 9, 10 and 11 of the Original Lease, as amended by Section 3(c) of the Second Amendment, for such applicable calendar year (or fiscal year as the case may be), such amounts payable shall equal the excess of such costs paid by Sublessor for the Sublease Tax Base Year (with respect to Taxes, as defined in the Lease) and the Sublease Operating Cost Base Year (with respect to Operating Costs, as defined in the Lease). In addition, Sublessee shall pay all other additional rent and other charges payable under the Lease by Sublessor, as tenant under

|

{W12548295.7} |

2 |

the Lease with respect to the period falling within the Sublease Term, including, without limitation, all electric and utility charges due under Lease. For purposes of this Section 5, (i) the term “Sublease Tax Base Year” shall mean the period commencing on July 1, 2020 and ending on June 30, 2021, (ii) and the term “Sublease Operating Cost Base Year” shall mean the period commencing on January 1, 2021 and ending on December 31, 2021. Sublessee shall make estimated payments of the amounts due under this Section 5 to Sublessor at the same times as Sublessor shall be obligated to make estimated payments to the Major Landlord under the Lease. All other amounts shall be due to Sublessor from Sublessee within ten (10) days of billing for the same. In the event electrical use by the Subleased Premises is measured by separate meter or check meter, Sublessee shall pay Sublessor for the cost of electricity used by the Subleased Premises, or Sublessor may require Sublessee to contract with the company supplying electrical current, at Sublessee’s sole expense, and pay for such electrical current directly. Sublessee’s obligations hereunder shall survive the expiration or earlier termination of this Sublease

6.Subordination to Lease. (a) This Sublease is subject and subordinate to the terms and conditions of the Lease and Sublessor does not purport to convey, and Sublessee does not hereby take, any greater rights in the Sublease Premises than those accorded to or taken by Sublessor as tenant under the Lease. Sublessee shall not cause a default under the Lease or permit its employees, agents, contractors or invitees to cause a default under the Lease. If the Lease terminates before the end of the Sublease Term, Sublessor shall not be liable to Sublessee for any damages arising out of such termination.

(b)Except as otherwise specified in this Sublease, all of the terms and conditions of the Lease are incorporated as a part of this Sublease, but all references in the Lease to “Landlord”, "Tenant", "Premises", “Revised Premises”, “Term”, “Annual Fixed Rent”, “Fixed Rent”, “Term Commencement Date”, “Rent Commencement Date”, and “Term Expiration Date” shall be deemed to refer, respectively, to Sublessor, Sublessee, Subleased Premises, Subleased Premises, Sublease Term, Annual Fixed Rent or Fixed Rent, Annual Fixed Rent or Fixed Rent, Commencement Date, Rent Commencement Date and “Sublease Term Expiration Date”, as defined in this Sublease. Capitalized terms used but not defined in this Sublease shall have the meaning ascribed to such terms in the Lease. In the event of a conflict or ambiguity between the provisions of the Lease and the provisions of this Sublease, the provisions of this Sublease shall govern and control. To the extent incorporated into this Sublease, Sublessee shall perform the obligations of the Sublessor, as tenant under the Lease. Notwithstanding any other provision of this Sublease, Sublessor, as sublandlord under this Sublease, shall have the benefit of all rights, remedies and limitations of liability enjoyed by Lessor, as the landlord under the Lease, but (i) Sublessor shall have no obligations under this Sublease to perform the obligations of Lessor, as landlord under the Lease, including, without limitation, any obligation to provide services, perform maintenance or repairs, or maintain insurance, and Sublessee shall seek such performance and obtain such services solely from the Lessor; (ii) neither Sublessor nor Lessor shall have any obligation to perform any construction or alteration to the Subleased Premises and neither Sublessor nor Lessor shall be required to pay any allowance or other amount in connection with any work performed by Sublessee in the Subleased Premises; (iii) Sublessor shall not be bound by any representations or warranties of the Lessor under the Lease; (iv) in any instance where the consent of Lessor is required under the terms of the Lease, the consent of Sublessor and Lessor shall be required; and (v) Sublessor shall not be liable to Sublessee for any failure or delay in Lessor's performance of its obligations, as landlord under the Lease, nor shall Sublessee be entitled to terminate this Sublease or abate the Annual Fixed Rent or additional rent due hereunder. Upon request of Sublessee, Sublessor shall, at Sublessee’s expense, use reasonable efforts to cooperate with Sublessee in its efforts to cause Lessor to perform its obligations under the Lease.

|

{W12548295.7} |

3 |

(c)Notwithstanding any contrary provision of this Sublease or the Lease (as incorporated herein) to the contrary, in no event shall Sublessee have the right to (x) extend or renew the Sublease Term beyond the Sublease Term Expiration Date, or (y) expand the Subleased Premises or be offered the opportunity to expand the Subleased Premises.

(d)Further notwithstanding any contrary provision of this Sublease, the following terms and conditions of the Original Lease, the First Amendment (and references thereto) and the Second Amendment (and references thereto) are not incorporated as provisions of this Sublease: (i) Sections 3, 4, 7, 9, 10, 33, and 35 of Section 1 (Reference Data) of the Original Lease; (ii) Section 3 (Term) of the Original Lease; (iii) Section 4 (Landlord Construction) of the Original Lease; (iv) Section 8 (Placement for Payment of Rent) of the Original Lease; (v) Section 25 (Recording) of the Original Lease; (vi) Section 33 (Brokerage) of the Original Lease; (vii) Section 35 (Security Deposit) of the Original Lease; (viii) Section 40 (Extension of Term); Section 41 (Roof Rights) of the Original Lease; (ix) Exhibit B (The Work) of the Original Lease; (x) Exhibit C (Notice of Lease) of the Original Lease; (xi) Exhibit D (Release of Notice of Lease) of the Original Lease; (xii) Section 2(b) (Roof Deck) of the First Amendment (however, for purposes of clarity, Section 2(a) of the First Amendment is incorporated into this Sublease); (xiii) Section 3 (Broker) of the First Amendment; (xiv) Section 1 (Leased Premises) of the Second Amendment, except the first two (2) sentences thereof; (xv) Section 2 (Term) of the Second Amendment; (xvi) Section 3(a)(Basic Rent) of the Second Amendment; (xvii) Section 4 (Security Deposit) of the Second Amendment; (xviii) Section 5 (Space Planning Allowance) of the Second Amendment; (xix) Section 6 (Extension Term) of the Second Amendment; (xx) Section 7 (Right of First Offer) of the Second Amendment; (xxi) Section 12 (Broker) of the Second Amendment; (xxii) Section 14 (Notice of Lease) of the Second Amendment; (xxiii) Exhibit B-2 (Work Letter for Additional Space) of the Second Amendment; (xxiv) Exhibit C-2 (Notice of Lease) of the Second Amendment; (xxv) Exhibit D-2 (Release of Notice of Lease) of the Second Amendment.

7.Insurance. During the Sublease Term, Sublessee shall maintain insurance of such types, in such policies, with such endorsements and coverages, and in such amounts as are set forth in Section 16 of the Original Lease. Sublessee shall name each of Lessor and Sublessor as an additional insured in connection with the liability policy of insurance delivered in connection with this Sublease. Sublessee shall promptly pay all insurance premiums and shall provide Sublessor with policies or certificates evidencing such insurance upon Sublessee’s execution of this Sublease and prior to entering the Subleased Premises.

8.Security Deposit. Simultaneously with the execution of this Sublease, Sublessee shall deliver to Sublessor a security deposit in the amount of $90,000.00 (the “Security Deposit”). The Security Deposit shall be held by Sublessor, without liability for interest, as security for the performance by Sublessee of Sublessee’s covenants and obligations under this Sublease, it being expressly understood that the Security Deposit need not be held in a separate account and shall not be considered an advance payment of rent or a measure of Sublessee’s liability for damages in case of default by Sublessee. Sublessor may, from time to time, without prejudice to any other remedy, use the Security Deposit to the extent necessary to make good any arrearages of rent or to satisfy any other covenant or obligation of Sublessee hereunder. Following any such application of the Security Deposit, Sublessee shall pay to Sublessor on demand the amount so applied in order to restore the Security Deposit to its original amount. Notwithstanding the foregoing, so long as no Default of Sublessee is then in existence and has not occurred in the twelve (12) months prior to the applicable reduction date, the Security Deposit shall be reduced by $30,000.00 to $60,000.00 upon Sublessor’s receipt of Sublessee’s written request therefor at any time following June 1, 2022, and shall be further reduced by $30,000.00 to $30,000.00 upon Sublessor’s receipt of Sublessee’s written request therefor at any time following June 1, 2023. The remaining amount of the Security Deposit

|

{W12548295.7} |

4 |

shall be released to Sublessee within sixty (60) days of the surrender of the Subleased Premises to Sublessor subject to any deductions made by Sublessor pursuant to the terms of this Sublease.

9.Alterations. Notwithstanding any provisions of the Lease incorporated herein to the contrary, Sublessee shall not make any alterations, improvements or installations in the Subleased Premises without in each instance obtaining the prior written consent of both Lessor and Sublessor, which consent shall not be unreasonable withheld, conditioned or delayed by Sublessor but may be granted, withheld or conditioned by Lessor in its sole discretion. Notwithstanding the foregoing, Sublessor acknowledges and agrees that the plans and specifications for Sublessee’s initial improvements to the Subleased Premises attached hereto as Exhibit C (the “Plans and Specifications”) are deemed approved by Sublessor and Sublessor agrees to present the Plans and Specifications for Lessor’s approval promptly following the Effective Date. If Sublessor and Lessor consent to any such alterations, improvements or installations, Sublessee shall perform and complete such alterations, improvements and installations at its expense, in compliance with applicable laws and in compliance with Section 14 and other applicable provisions of the Lease and, to the extent that Lessor requires such removal, Sublessor may require Sublessee to remove any and all such alterations, improvements or installations, restore the Subleased Premises and repair any damage arising from such a removal or restoration at the expiration or early termination of the Sublease Term. If Sublessee performs any alterations, improvements or installations without obtaining the prior written consent of both Lessor and Sublessor, Sublessor may remove such alterations, improvements or installations, restore the Subleased Premises and repair any damage arising from such a removal or restoration, and Sublessee shall be liable to Sublessor for all costs and expenses incurred by Sublessor in the performance of such removal, repairs or restoration.

10.Default.

(a).Of Sublessee. In the event of a default by Sublessee in the full and timely performance of its obligations under the Sublease, including, without limitation, its obligation to pay Annual Fixed Rent or any additional rent, Sublessor shall have all of the rights and remedies available to “Landlord” under the Lease as though Sublessor were “Landlord” and Sublessee were “Tenant”, including without limitation the rights and remedies set forth in Article 24 of the Original Lease. The foregoing shall survive the expiration or early termination of this Sublease.

(b).Of Sublessor Under the Lease/Notice/Cure Rights. Each party agrees to perform and comply with the terms, provisions, covenants and conditions of the Lease and not to do or suffer or permit anything to be done which would result in a default under the Lease, or cause the Lease to be terminated or forfeited. The Sublessor agrees that it will take all action necessary to keep the Lease in full force and effect and will perform all of its affirmative obligations under the Lease throughout the term of this Sublease and will duly perform and observe all other obligations imposed on it as tenant under the Lease, to the extent that such obligations are not provided in this Sublease to be observed or performed by the Sublessee, except with respect to any failure in such observance or performance which results from any default by the Sublessee hereunder. In the event that the Major Landlord fails or refuses to perform its obligations under the Lease with respect to the Subleased Premises, Sublessor shall use commercially reasonable efforts to cause Major Landlord to satisfy those obligations.

Sublessor agrees that any notices received by it as tenant under the Lease shall, upon receipt, be delivered to Sublessee in accordance with the provisions of this Sublease.

|

{W12548295.7} |

5 |

To the extent that Sublessor fails to perform an obligation as tenant under the Lease beyond any applicable notice and cure periods, Sublessee shall have the right, at any time and from time to time, but shall not be obligated, to make any payment or take any action necessary to prevent default under the terms of the Lease, and the amount of any such payment or the cost of any such action shall be treated as a sum of money advanced by the Sublessee to the Sublessor and shall be repayable by the Sublessor to the Sublessee on demand.

Sublessor shall not modify, surrender, transfer or assign the Lease without the prior written consent of the Sublessee, and any modification, surrender, transfer or assignment made without such consent shall be null and void and shall have no effect on the rights of the Sublessee under this Sublease.

Subject to the Section 22 of the Lease, as amended by Section 8 of the Second Amendment, as incorporated herein, and the terms and conditions of this Sublease, Sublessee shall have the right to sub-sublease the Subleased Premises (or any part therof) or assign its interest and obligations under this Sublease, with Sublessor's approval, which shall not be unreasonably withheld, delayed or conditioned, and with the approval of the Major Landlord, which Major Landlord may grant or withhold in its sole and absolute discretion, provided however, in the event Sublessor is willing to approve such sublease or assignment, Sublessor shall use commercially reasonable efforts to request and obtain such consent from the Major Landlord.

11.Furniture. Sublessee shall use and maintain the Furniture in substantially the same condition as it was in on the Commencement Date, reasonable wear and tear excepted, and shall deliver same to Sublessor in such condition at the expiration or early termination of the Sublease Term. Sublessor shall maintain ownership of the Furniture. Any furniture located in the Subleased Premises on the Commencement Date which is not listed on the list of Furniture attached to this Sublease as Exhibit C shall be removed by Sublessor at its expense. Sublessee shall reimburse Sublessor, as additional rent, for any personal property taxes Sublessor may be required to pay to the City of Boston with respect to the Furniture, such reimbursement to be made within thirty (30) days following Sublessee’s receipt of a request for such payment, along with reasonable documentation to evidence that Sublessor has paid such amount with respect to the Furniture.

12.Signage. Pursuant to Section 39 of the Original Lease and Section 11 of the Second Amendment, Sublessor is entitled to certain rights to building standard signage for the Premises. Sublessor shall request that Lessor agree to provide such signage to Sublessee with respect to the Subleased Premises.

13.Mail Deliveries. Sublessee acknowledges and agrees that Sublessor may, in its sole discretion, continue to use the Subleased Premises as its physical mailing address for mail and/or other deliveries for a period of 180 days after the Effective Date, and to the extent mail and other deliveries arrive at the Subleased Premises addressed to Sublessor, Sublessee shall hold such mail and other deliveries in a reasonably safe and secure area within the Subleased Premises and use commercially reasonable efforts to promptly contact Sublessor informing Sublessor that such mail or other deliveries have been received and may be retrieved.

14.Internet Service. Sublessee intends to contract for its own internet service. Should Sublessee require it, Sublessor agrees that Sublessee may continue to utilize its internet service until such time Sublessee’s service is operational. Sublessee shall reimburse the cost of such service to Sublessor and provide Sublessor ten (10) days’ notice by email to terminate the service.

|

{W12548295.7} |

6 |

15.Notices. All notices and demands under this Sublease shall be in writing and shall be effective (except for notices to Lessor which shall be given in accordance with Section 32 of the Original Lease) upon the earlier of (i) receipt at the address set forth below by the party being served, or (ii) two days after being sent to address set forth below by United States certified mail, return receipt requested, postage prepaid, or (iii) one day after being sent to address set forth below by a nationally recognized overnight delivery service that provides tracking and proof of receipt. A notice given on behalf of a party hereto by its attorney shall be deemed a notice from such party.

|

If to Lessor: |

As required under the Lease. |

|

|

|

|

If to Sublessor: |

Upstatement, LLC |

|

|

c/o Pierce Atwood LLP |

|

|

100 Summer Street |

|

|

Boston, Massachusetts 02110 |

|

|

Attention: Christopher J. Dole, Esq. |

|

|

Email: cdole@pierceatwood.com |

|

|

|

|

With a copy by email to: |

Jared@upstatement.com |

|

|

|

|

|

|

|

If to Sublessee: |

Prior to the Rent Commencement Date: |

|

|

|

|

|

at the address set forth in the opening paragraph of this Sublease, |

|

|

Attention: David Henry |

|

|

|

|

|

After the Rent Commencement Date: |

|

|

|

|

|

137 Portland Street |

|

|

Boston, Massachusetts 02114 |

|

|

Attention: David Henry |

|

|

|

|

With a copy by email to: |

Karin@fgd-law.com |

Either party may change its address for notices and demands under this Sublease by notice to the other party.

16.Brokers. Sublessor and Sublessee each represent and warrant to the other that it has not dealt with any broker other than Avison Young, as broker for Sublessor, and Newmark Knight Frank, as broker for Sublessee (the “Brokers”) in connection with the consummation of this Sublease. Sublessor and Sublessee each shall indemnify and hold harmless the other against any loss, damage, claims or liabilities arising out of the failure of its representation or the breach of its warranty set forth in the previous sentence. Sublessor shall be responsible for paying the Brokers for any fees or commissions due with respect to this Sublease pursuant to a separate agreement with the Brokers.

17.Entire Agreement. This Sublease contains all of the agreements, conditions, warranties and representations relating to the sublease of the Subleased Premises and may be amended or modified only by written instruments executed by both Sublessor and Sublessee.

|

{W12548295.7} |

7 |

18.Authority. Sublessor and Sublessee each represent and warrant to the other that the individual(s) executing and delivering this Sublease on its behalf is/are duly authorized to do so and that this Sublease is binding on Sublessee and Sublessor in accordance with its terms. Simultaneously with the execution of this Sublease, Sublessee shall deliver evidence of such authority to Sublessor in a form reasonably satisfactory to Sublessor.

19.Condition Precedent. This Sublease, and the rights and obligations of Sublessor and Sublessee under this Sublease, are subject to the condition that Lessor consent to the subleasing of the Subleased Premises to the extent required under the Lease, and this Sublease shall be effective only upon the receipt by Sublessor of such consent. Sublessee agrees to join such consent if so requested by Lessor in the form requested by Lessor. In the event such consent is not received by January 31, 2021, Sublessor shall have the right to rescind its execution of this Sublease, and upon exercise of such right, this Sublease shall be void and the installment of Annual Fixed Rent and Security Deposit which have been paid on or about Sublessee’s execution of this Sublease shall be returned to Sublessee.

20.Not an Offer. The submission of an unsigned copy of this Sublease to Sublessee for Sublessee’s consideration does not constitute an offer to sublease the Subleased Premises. This Sublease shall become binding only upon the execution and delivery of this Sublease by Sublessor and Sublessee, subject to Section 19 above.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK. SIGNATURES APPEAR ON THE FOLLOWING PAGE]

|

{W12548295.7} |

8 |

IN WITNESS WHEREOF, Sublessor and Sublessee execute this Sublease as of the date first written above.

|

SUBLESSOR: UPSTATEMENT, LLC, |

||

|

a Massachusetts limited liability company |

||

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Jared Novack |

|

Name: |

|

Jared Novack |

|

Title: |

|

Manager |

|

|

|

|

|

|

|

|

|

SUBLESSEE: |

||

|

|

|

|

|

MYOMO, INC., |

||

|

a Delaware corporation |

||

|

|

|

|

|

|

|

|

|

By: |

|

/s/ David Henry |

|

Name: |

|

David Henry |

|

Title: |

|

Chief Financial Officer |

Lease

(Attached)

LEASE TO UPSTATEMENT, LLC

133 Portland Street Boston, Massachusetts

Dated As of January 26th, 2015

LEASE TO

UPSTATEMENT, LLC

TABLE OF CONTENTS

|

1. |

REFERENCE DATA |

1 |

|

2. |

DEMISED PREMISES |

3 |

|

3. |

TERM |

3 |

|

4. |

LANDLORD CONSTRUCTION |

4 |

|

5. |

GENERAL PROVISIONS APPLICABLE TO CONSTRUCTION |

5 |

|

6. |

REPRESENTATIVES |

6 |

|

7. |

RENT |

6 |

|

8. |

PLACE OF PAYMENT OF RENT |

6 |

|

9. |

TAXES |

6 |

|

10. |

OPERATING COSTS |

7 |

|

11. |

PAYMENT OF OPERATING COSTS AND TAXES |

10 |

|

12. |

QUIET ENJOYMENT |

12 |

|

13. |

RESTRICTIONS ON USE |

12 |

|

14. |

ALTERATIONS |

13 |

|

15. |

MAINTENANCE AND REPAIRS |

14 |

|

16. |

INSURANCE |

15 |

|

17. |

DAMAGE TO PREMISES |

16 |

|

18. |

EMINENT DOMAIN |

17 |

|

19. |

UTILITIES |

17 |

|

20. |

LANDLORD’S SERVICES |

18 |

|

21. |

ACCESS AND SECURITY |

19 |

|

22. |

SUBLEASE AND ASSIGNMENT |

20 |

|

23. |

SUBORDINATION |

22 |

|

24. |

RIGHTS OF LANDLORD ON TENANT’S DEFAULTS |

22 |

|

25. |

RECORDING |

26 |

|

26. |

TENANT’S COVENANTS |

26 |

|

27. |

LANDLORD’S LIABILITY |

27 |

|

28. |

FORCE MAJEURE |

27 |

|

29. |

MECHANICS’ LIENS |

28 |

|

30. |

DEFINITIONS |

28 |

|

31. |

SEPARABILITY CLAUSE |

28 |

|

32. |

NOTICES |

28 |

|

33. |

BROKERAGE |

28 |

|

34. |

ESTOPPEL CERTIFICATES |

29 |

|

35. |

SECURITY DEPOSIT |

29 |

|

36. |

LANDLORD’S DEFAULT |

29 |

|

37. |

SUBSTITUTE SPACE |

29 |

|

38. |

HOLDING OVER |

30 |

|

39. |

TENANT’S SIGNAGE |

30 |

|

40. |

EXTENSION TERM |

30 |

|

41. |

ROOF RIGHTS |

31 |

|

42. |

HAZARDOUS MATERIALS |

32 |

|

FIRST AMENDMENT TO LEASE |

2 |

|

|

R E C I T A L S |

2 |

|

|

2. |

Roof Deck. |

2 |

|

“Landlord”: |

“Tenant”: |

1 |

|

EXHIBIT C-2 - |

NOTICE OF LEASE |

4 |

|

EXHIBIT D-2 - |

RELEASE OF NOTICE OF LEASE |

14 |

|

|

|

19 |

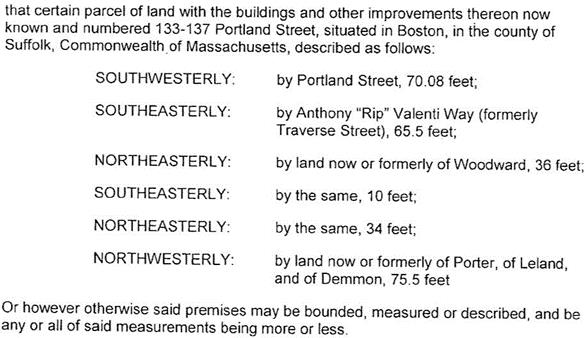

Portland North, LLC, hereinafter called “Landlord”, hereby leases to tenant described in the Reference Data, hereinafter called “Tenant,” the following Premises, to wit:

Each reference in this Lease to any of the terms and titles contained in the Reference Data set forth below shall be deemed and construed to incorporate the data stated under that term or title in such Reference Data.

REFERENCE DATA

|

Execution Date: |

|

|

|

January 26th, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Landlord: |

|

|

|

Portland North LLC, a Massachusetts limited liability company |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenant: |

|

|

|

Upstatement, LLC, a Massachusetts limitedliability company |

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 2 |

|

Premises: |

|

Space on the fifth floor of the Building, which space contains a Total Rental Area of approximately Four Thousand Four Hundred Forty-Three (4,443) rentable square feet as shown on Exhibit A. |

|

|

|

|

|

|

|

|

|

Building: |

|

133 Portland Street, Boston, Massachusetts |

|

|

|

|

|

|

|

|

|

Total Rentable Area of the Building: |

|

30,048 square feet |

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 3 |

|

Term: |

|

Seven (7) Years from the Rent Commencement Date |

|

|

|

|

|

|

|

|

|

Term Commencement Date: |

|

Shall be determined pursuant to the terms of Article 3 hereof. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Possession Date: |

|

Subject to the terms of Article 3 hereof, the later of June 1, 2015 or ninety (90) days following the issuance of a “Long Form” Building Permit from the City of Boston Inspectional Services Department. |

|

{W12548295.7} |

1 |

|

|

|

|

|

|

||

|

|

|

Rent Commencement Date: |

|

Three (3) months after the Term Commencement Date |

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

Term Expiration Date: |

|

August 31, 2022, unless the Term Commencement Date is delayed, in which event the Term Expiration Date shall be that date which is the last calendar day of the month in which the seventh (7th) anniversary of the Rent Commencement Date occurs. |

||

|

|

|

|

|

|

||

|

Section 4 |

|

Landlord Work |

|

As described on Exhibit B attached hereto |

||

|

|

|

|

|

|

||

|

Section 6: |

|

Authorized Representatives: For Landlord: |

|

Richard Epstein |

||

|

|

|

For Tenant: |

|

Kenneth Epstein Michael Swartz/Jared Novack |

||

|

|

|

|

|

|

||

|

Section 7 |

|

Annual Fixed Rent: |

|

|

||

|

|

|

|

|

|

||

|

|

|

|

Lease Year |

|

Annual Rent |

Monthly Rent |

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

REDACTED |

REDACTED |

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

||

|

|

|

As used herein, Lease Year shall mean each consecutive twelve (12) calendar month period commencing on the Rent Commencement Date and each anniversary thereof. Notwithstanding the preceding sentence, if the Rent Commencement Date shall not be the first day of a calendar month, the second and subsequent lease years shall commence on the first day of the calendar month following the first anniversary of the Rent Commencement Date and each anniversary thereof. |

||||

|

|

|

|

|

|

||

|

Section 9-11 |

|

Tenant’s Proportionate Share: |

|

14.79% |

||

|

|

|

|

|

|

||

|

Section 9 |

|

Tax Base Year: |

|

July 1, 2015 through June 30, 2016 |

||

|

|

|

|

|

|

||

|

Section 10 |

|

Operating Cost Base Year: |

|

Calendar Year 2015 |

||

|

|

|

|

|

|

||

|

Section 13 |

|

Permitted Use: |

|

General office use |

||

|

|

|

|

|

|

||

2

|

|

Broker(s): |

|

Newmark Grubb Knight Frank and Avison Young |

|||

|

|

|

|

|

|

||

|

Section 35 |

|

Security Deposit Amount: |

|

REDACTED |

||

The Premises are as set forth in the Reference Data, in the Building which is situated at 133 Portland Street, Boston, Massachusetts, which space contains a Total Rentable Area (“TRA”) as set forth in the Reference Data.

EXCEPTING AND RESERVING to Landlord, however, from the Premises the space necessary to install, maintain and operate, by means of pipes, ducts, wires or otherwise those utilities and services required for the Building and common facilities thereof (including the Premises), and the right of access to and entry on the Premises (after notice, or without notice in the event of an emergency) by Landlord and its agents therefor and for the purpose of making repairs, alterations and additions to the Premises and to the Building if Landlord so elects.

Subject to the conditions herein stated, Tenant shall hold the Premises for the Term, commencing on the Term Commencement Date and ending on the Term Expiration Date, provided that if the Rent Commencement Date shall be a day other than the first day of a calendar month, then the Term of this Lease shall be deemed extended by the number of days between the Rent Commencement Date and the first day of the first calendar month thereafter, so that the term of this Lease shall expire seven (7) years after such first day of the first calendar month following the Rent Commencement Date and, in such a case, Tenant shall pay pro rata rent in advance for the period from the Rent Commencement Date to the first day of such following calendar month at the annual Fixed Rent rate set forth in the Reference Data for the first year of the Term of this Lease. The term “Term Commencement Date” shall mean the third business day following the date on which the Total Work, as hereinafter defined, has been substantially completed. “Substantially complete” means that the Total Work has been completed except for items of work (and, if applicable, adjustment of equipment and fixtures), which can be completed after occupancy has been taken without causing material interference with Tenant’s intended use of the Premises (“Punch List” Items). Tenant may occupy the Premises at any time after, but not before, the Term Commencement Date. The Premises shall be conclusively deemed “substantially complete” on the earlier of (a) that date so certified in writing by an architect (at Landlord’s expense) or (b) Tenant’s taking possession of and occupying the Premises for the conduct of its business. Notwithstanding anything to the contrary herein, Landlord’s failure to deliver the Premises to Tenant on the Estimated Possession Date due to: (i) the failure of any prior occupant to vacate the Premises; or (ii) Landlord’s failure to complete Total Work; or (iii) Landlord’s failure to obtain any necessary Certificate of Occupancy for the Premises, then Landlord shall not be subject to any liability to Tenant nor shall the validity of this Lease be impaired. The Term Commencement Date, the Rent Commencement Date and the Term, shall be extended until Landlord is able to deliver possession of the Premises to Tenant. In the event that Total Work is not completed within thirty (30) days after the Estimated Possession Date, regardless of the reason for the delay, other than delays caused by Tenant, then for each day of delayed delivery between day thirty (30) and day sixty (60) after the Estimated Possession Date, Tenant shall receive one-half of one additional day of Rent abatement and for each day of delayed delivery beyond the sixty-first (61) day after the Estimated Possession Date that the Total Work is not completed Tenant shall receive one additional day of Rent abatement. In the event that any such additional rent abatement is applicable to Tenant due to a delay in delivery of the Premises, then the Rent Commencement Date shall be adjusted accordingly. In the event that the Premises have not been delivered to Tenant with the Total Work substantially complete within ninety (90) days after the Estimated

3

Possession Date, unless such delay is caused by Tenant, then, until the Total Work is substantially complete Tenant may terminate the Lease upon written notice to Landlord, provided, however, that in the event that the Total Work is substantially completed within thirty (30) days after Landlord’s receipt of any such termination notice and Landlord provides Tenant with written notice of such fact within such thirty (30) day period, then such termination notice by Tenant shall be void and of no further force and effect. In the event that this Lease is terminated pursuant to the provisions of this Section 3, the security deposit shall be refunded by Landlord to Tenant within forty-five (45) days after such termination.

Subject to the limitations set forth in this Section 4 and with information and cooperation provided by Tenant, Landlord shall cause to be performed within the Premises the work described in Exhibit B, attached hereto (the “Landlord’s Work”) and any Additional Work, as hereinafter defined. Landlord’s Work and the Additional Work are hereinafter referred to as the “Total Work”. The following terms and conditions shall be applicable to the performance of the Total Work:

a.The Landlord’s Work shall be performed by Landlord in accordance with the plan attached hereto as Exhibit A (hereinafter the “Plan”) and any and all other plans deemed necessary by Landlord to prepare the Premises for occupancy by Tenant in accordance with the Plan. All plans prepared by Landlord for performance of the Work shall be completed at Landlord’s sole cost and expense.

b.Landlord and Tenant agree that Landlord shall be responsible for paying Landlord’s employees, agents, contractors and suppliers who provide services or materials in connection with completion of the Landlord’s Work, other than those alterations outlined in the Total Work that shall be at the sole expense and responsibility of the Tenant.

c.In the event Tenant desires to have Landlord undertake improvements to the Premises other than the Landlord’s Work prior to the Term Commencement Date (hereinafter the “Additional Work”), Landlord and Tenant shall execute a written agreement concerning the scope of the Additional Work and unless Landlord otherwise elects, Landlord shall not be required to undertake any Additional Work unless Landlord and Tenant have executed such an agreement. Any Additional Work and any plans prepared for the Additional Work shall be undertaken at the sole cost and expense of Tenant. Landlord shall bill Tenant for all of Landlord’s costs for the Additional Work (including the cost of labor and materials and the cost of said plans) within ten (10) days after the architect employed by Landlord at Landlord’s expense issues a certificate of final completion in good faith to the effect that the Additional Work is complete, provided that said certificate shall be conclusive and binding upon the parties hereto. Within forty-five (45) days after receipt of said bill, Tenant shall pay the full amount of said bill to Landlord.

d.Subject to Force Majeure or delay caused by the action or inaction of Tenant, Landlord shall use reasonable efforts in the performance of the Total Work so as to have the Premises ready for occupancy by Tenant on the Estimated Possession Date as set forth in the Reference Data. Provided that Landlord complies with the provisions of this Section 4, if the Premises are not ready for occupancy by Tenant on the Estimated Possession Date, the validity and term of this Lease and the obligations of Tenant hereunder shall in no way be affected and Tenant shall have no claim against Landlord and Landlord shall have no liability to Tenant by reason thereof.

e.The Total Work shall be performed by Landlord or contractors selected by Landlord.

4

f.The Total Work shall be performed using Building standard materials and construction methods as determined by Landlord from time to time. In the event Landlord or Tenant desires to substitute different materials or construction methods for the materials and methods set forth in said Building standard, said substitutions shall not occur unless Landlord and Tenant have executed a written change order setting forth their agreement for the substitutions and the additional cost, if any, which Tenant shall be required to pay to Landlord as a result of such substitutions.

g.Any Punch List Items not fully completed on the Term Commencement Date, shall thereafter be so completed with reasonable diligence by Landlord, provided that Tenant shall be conclusively deemed to have agreed that Landlord has performed all of its obligations under this Section 4 unless not later than sixty (60) days after the Term Commencement Date, Tenant shall give Landlord written notice specifying in detail the respects in which Landlord has not performed any such obligation. In the event of a dispute between Landlord and Tenant as to whether any element of the Total Work has been completed, a certificate of final completion issued in good faith by Landlord’s architect shall be prima facie correct. Except for Landlord’s Work, the Premises are being leased in their “as is” condition, without warranty or representation by Landlord. Tenant acknowledges that it has inspected the Premises and common areas of the Building and, except for Landlord’s Work, it has found the same to be satisfactory. Landlord shall be responsible for latent defects in the Premises for a period of one year from the date of delivery of the Premises to Tenant.

h.Landlord shall permit Tenant access to the Premises for installing equipment and furnishings in the Premises fifteen (15) days prior to the Term Commencement Date when such installation can be done without material interference with the Total Work; provided, however, that if Tenant’s personnel shall occupy all or any part of the Premises for the conduct of its business prior to the Term Commencement Date, such date shall for all purposes of this Lease be the Term Commencement Date. Prior to any such early access, Tenant shall provide Landlord with proof of insurance in effect as required by Article 16.

i.Tenant’s interior furnishings, i.e., specification, supply and installation of furniture, furnishings, telephone/data and moveable equipment, shall be the responsibility of Tenant. All of Tenant’s installation of interior furnishings and equipment and any later changes or additions of the same shall be coordinated with any work being performed by Landlord in the Premises or elsewhere in the Building in such manner as to maintain harmonious labor relations and not damage the Building or the Premises or interfere with Building operations.

j.All construction materials, fixtures and goods installed in the Premises by Landlord or Landlord’s contractors as part of the Total Work shall become the property of Landlord upon the expiration or other sooner termination of this Lease.

All construction work required or permitted by this Lease, whether by Landlord or by Tenant, shall be done in a good and workmanlike manner and in compliance with all applicable laws and all ordinances, regulations and orders of governmental authority and insurers of the Building. Either party may inspect the work of the other at reasonable times and shall promptly give notices of observed defects.

5

Each party authorizes the other to rely in connection with their respective rights and obligations upon approval and other actions on the party’s behalf by Landlord or Tenant authorized representatives specified in the Reference Data, or by any person designated in substitution or addition by notice in writing to the other party.

The annual fixed cash rent (“Fixed Rent”) payable by Tenant during the Term shall be as set forth in the Reference Data. The Fixed Rent shall be payable without offset, abatement (except as provided in Section 17), deduction or demand, in equal monthly installments of one-twelfth of the Fixed Rent payable for the year in which said monthly installment payments are to be paid and said monthly installments shall be paid in advance commencing on the Rent Commencement Date and thereafter on the first day of each and every month during the Term of this Lease. Any and all payments payable by Tenant under this Lease other than Fixed Rent shall be deemed “Additional Rent” or “additional rent” and Landlord reserves the same rights and remedies against Tenant for default in making any such payments as Landlord shall have for default in the payment of Fixed Rent; including, but not limited to, the right to seek and recover such payments as rent under any applicable provisions of the United States Bankruptcy Code. Fixed Rent and Additional Rent may be referred to herein as “Rent”. Rent for any partial months shall be pro-rated. Tenant further agrees that all covenants and agreements to pay Rent as set forth herein are independent of all other lease covenants and agreements set forth in this Lease. In the event that any installment of Rent or other sums payable hereunder are not paid within five (5) business days of the due date, Tenant shall pay, in addition to any other additional charges due under this Lease, an administrative fee equal to five percent (5%) of the overdue payment, provided that Tenant shall only be given such five (5) business day grace period once in any twelve (12) month period.

All payments of rent shall be made by Tenant to Landlord without notice or demand at such place as Landlord may from time to time designate in writing. The initial place for payment of rent shall be c/o The Winhall Companies, 129 South Street, Boston, Massachusetts 02111. Any extension of time for the payment of any installment of rent, or the acceptance of rent after the time at which it is payable shall not be a waiver of the rights of Landlord to insist on having all other payments made in the manner and at the times herein specified.

In addition to the Fixed Rent to be paid by Tenant as above set forth, if in any of Landlord’s fiscal years of the term of this Lease, real estate taxes exceed those incurred during the Tax Base Year as set forth in the Reference Data (the “Tax Base”), Tenant shall also pay as Additional Rent to Landlord, Tenant’s Proportionate Share of such excess, such amount being referred to as “Tax Excess”. “Tenant’s Proportionate Share”, as used herein, shall be as set forth in the Reference Data, being the fraction, the numerator of which is the Total Rentable Area of the Premises and the denominator of which is the sum total (aggregate) of the Total Rentable Area of the Building. If any payment for increase in taxes, as hereinabove provided, shall be due for any time in which this Lease shall be in force and effect for less than a full tax period, such payment shall be pro-rated so that the amount payable by Tenant (if any) for increase in taxes shall be based on the actual number of days that said Lease shall be in force and effect during such tax period. Payment by Tenant for its portion of such increased real estate taxes shall be paid before

6

twenty (20) days after written demand by Landlord. There shall be deducted from the amounts required hereunder any amounts paid on account of estimated Tax Excess as set forth in Section 11 herein. Landlord represents that it has not filed for any tax abatements applicable to the Building as of the date hereof.

For the purpose of this Article the term “real estate taxes” means all taxes, rates, and assessments, general and special, levied or imposed with respect to Landlord’s land and improvements constructed thereon, including all taxes, rates, and assessments, general and special, levied or imposed for school, public betterment, general, or local improvements (excluding any penalties for late payment). If the system of real estate taxation shall be altered or varied and any new tax shall be levied or imposed on said land and improvements, and/or Landlord, in substitution for real estate taxes presently levied or imposed on immovables in the jurisdiction therein the Building is located, then any such new tax or levy shall be included within the term “real estate taxes” and the terms of this provision shall apply mutatis mutandis. The amount of the real estate taxes which shall be deemed to have been levied or imposed with respect to said land and improvements shall be such amount as the legal authority imposing real estate taxes shall have attributed thereto or, in the absence of such attribution, or, if such legal authority shall include immovables other than said land and improvements in imposing such real estate taxes, such amount as Landlord in the exercise of reasonable judgment shall establish. Notwithstanding anything in this Lease to the contrary, real estate taxes shall not include any income, excess profits, transfer, gift, estate, franchise, inheritance or similar tax. In the event that any real estate tax is payable in installments, only the installments due and payable during a given year shall be included in the real estate taxes for that year.

If Landlord shall receive any refund of real estate taxes previously taken into account for computing Tenant’s obligations pursuant to this Section 9, an appropriate recomputation shall be made and any surplus payments made by Tenant shall be accounted for and refunded to Tenant.

In the event the total Operating Costs incurred by Landlord for the Building in any calendar year of Landlord during the term of this Lease increase for any reason above those incurred in the Operating Cost Base Year as set forth in the Reference Data (“Base Operating Costs”), Tenant shall pay to Landlord as Additional Rent hereunder Tenant’s Proportionate Share of such increase.

The term “Operating Costs” shall mean all costs incurred and expenditures of whatever nature made by Landlord in the operation and management, for repair and replacements, cleaning and maintenance of the Building and grounds, including related equipment, facilities and appurtenances, elevators, cooling and heating equipment (not including, however, mortgage principal or interest charges, the cost of work done by or special services performed by Landlord for a particular tenant, income taxes payable by Landlord, depreciation on the Building and such portion of expenditures as are not properly chargeable against income), provided, however, that (i) if, during the Term of this Lease, Landlord shall replace any capital items or make any capital expenditures (collectively called “capital expenditures”), the total amount of which shall not be included in Operating Costs for the Operating Year in which they were made, but there shall nevertheless be included in such Operating Costs, and in Operating Costs for each succeeding fiscal year of Landlord, the amount, if any, by which the annual charge-off (determined as hereinafter provided) of such capital expenditure (less insurance proceeds if any, collected by Landlord by reason of damage to, or destruction of the capital item being replaced) exceeds the annual charge-off of the original amount of such capital expenditure; and (ii) if a new capital item is acquired, then there shall be included in Operating Costs for each fiscal year of Landlord in which and after such capital expenditure is made the annual charge-off of such capital expenditure. (Annual charge-off, including the depreciation of such capital item, shall be determined by (A) dividing the original cost of the capital expenditure by the number

7

of years of useful life thereof, the useful life shall be reasonably determined by Landlord in accordance with generally accepted accounting principles and practices in effect at the time of acquisition of the capital item; and (B)adding to such quotient an interest factor computed on the unamortized balance of such capital expenditure at an annual rate of one percentage point over the Prime Rate as reported in the financial press at the time the capital expenditure is made.)

Operating Costs shall include, but not be limited to, the following:

(a)Taxes (other than real estate taxes)

Sales, Federal Social Security, Unemployment and Old Age Taxes and contributions and State Unemployment taxes and contributions accruing to and paid by Landlord on account of all non-principal employees of Landlord who are employed in, about or on account of the Building, except that taxes levied upon the net income of Landlord and taxes withheld from employees, and real estate taxes as defined in Section 9 shall not be included herein. In the event said employees do not work full time in, about or on account of the Building, the taxes and contributions attributable to such employees shall be apportioned fairly and equitably by Landlord between the Building and other places at which said employees provide services to Landlord. The amount of taxes related to non- principal employees of Landlord included as an Operating Cost pursuant to this sub-section shall be the same for the Operating Cost Base Year and all years during the Lease Term.

|

|

(b) |

Water |

All charges and rates connected with water supplied to the Building and related sewer use charges.

|

|

(c) |

Heat and Air Conditioning |

All charges connected with heat and air conditioning supplied to the Building and not billed directly to a tenant.

|

|

(d) |

Wages |

Wages and cost of all employee benefits of all non-principal employees of Landlord who are employed in, about or on account of the Building, provided that in the event such employees do not work full time in, about or on account of the Building, the wages and benefits attributable to such employees shall be apportioned fairly and equitably by Landlord between the Building and other places at which said employees provide services to Landlord. The amount of wages and employee benefits included as an Operating Cost pursuant to this sub-section shall be the same for the Operating Cost Base Year and all years during the Lease Term.

|

|

(e) |

Cleaning |

The cost of labor and material for cleaning the Building, surrounding areaways and windows in the Building.

|

|

(f) |

Elevator Maintenance |

All expenses for or on account of the upkeep and maintenance of all elevators in the Building.

8

|

|

(g) |

Electricity |

The cost of all electric current for the operation of any machine, appliance or device used for the operation of the Premises and the Building, including the cost of electric current for the elevators, lights, air conditioning and heating, but not including electric current which is paid for directly to the utility by the user/tenant in the Building, provided that if and so long as Tenant is billed directly by the electric utility for its own consumption as determined by its separate meter, then Operating Costs shall include only the areas of the Building not occupied by tenants and public area electric current consumption and not any premises electric current consumption. Wherever separate metering is unlawful, prohibited by utility company regulation or tariff or is otherwise impracticable, relevant consumption figures for the purposes of this Section 10 shall be determined by fair and reasonable allocations and engineering estimates made by Landlord.

|

|

(h) |

Insurance, etc. |

Fire, casualty, rental interruption, liability and such other insurance as may from time to time be required by lending institutions on similar office buildings in the Downtown Central Business District of the City of Boston.

|

|

(i) |

Management Fees |

The cost of all management fees paid by Landlord to any person or entity in exchange for management of the Building. The calculation of Management Fees shall be made in a consistent manner and at the same percentage rate for 2015 and all years during the Lease Term.

|

|

(j) |

Repairs and Snow Removal |

The cost of repairs, maintenance and snow removal for the Building.

|

|

(k) |

Security |

The cost of all fire alarm and other protective or security services furnished by Landlord for the benefit of the Building.

|

|

(l) |

Supplies |

The cost of all supplies, including paper goods, lubricants and chemicals, used by Landlord in the operation of the Building and its various elements.

|

|

(m) |

Municipal Charges |

The cost of all licenses, permits and fees paid by Landlord and arising out of its operation of the Building.

|

|

(n) |

Administrative Expenses |

Administrative charge equal to fifteen (15%) percent of all Operating Costs as otherwise determined under this Section 10 to help defray Landlord’s indirect costs thereof. The calculation of

9

Administrative Expenses shall be made in a consistent manner for 2015 and all years during the Lease Term.

|

|

(o) |

Other Expenses |

All other expenses customarily incurred in connection with the operation and maintenance of similar office buildings in the Downtown Central Business District of City of Boston.

The calculation of Tenant’s Proportionate Share of Increased Operating Costs shall include an adjustment to actual Operating Costs to the 2015 Base Year and each year thereafter to reflect expenses that would be incurred assuming occupancy in the Building equal to the greater of (i) 95% occupancy, or (ii) actual occupancy, so that Tenant shall not be unfairly charged for any increased Operating Costs incurred by Landlord in maintaining a Building at less than 95% occupancy.

Notwithstanding anything in this Lease to the contrary, the Operating Costs shall not include: (a) the costs (or depreciation of the costs) of acquiring the Building; (b) the cost of improvements to any tenant premises; (c) leasing and marketing expenses of any kind, (d) reserves of any kind; (e) any interest or payments on any financing for the Building, interest and penalties incurred as a result of Landlord’s late payment of any bill and any bad debt loss, rent loss or reserves for bad debts, (f) legal expenses incurred in connection with the preparation or negotiation of leases, subleases, assignments or other lease-related documents with current, prior or prospective tenants; (g) any ground, underlying or master lease rental or other payments; (h) transfer taxes; or (i) cost of repairing or restoring any portion of the Building damaged or destroyed by any casualty or peril that is covered by insurance.

Pursuant to Section 11 below, Landlord will provide Tenant with an annual statement of Operating Costs within ninety (90) days after the close of each of Landlord’s fiscal years.

Landlord shall deliver to Tenant within ninety (90) days after the close of each of Landlord’s fiscal years during the Term of this Lease (including the fiscal year in which this Lease terminates) a statement (a “Statement”) signed by an agent of Landlord setting forth (A) the Operating Costs for such fiscal year, (B) the total amount of Tenant’s Proportionate Share of Operating Costs for the preceding fiscal year and (C) the balance, if any, due from or overpaid by Tenant for the preceding fiscal year. Tenant shall pay to Landlord the amount due from Tenant as described in this Section 11 within thirty (30) days of the receipt of a Statement. In the event Landlord’s annual Statement shows an overpayment by Tenant, Landlord shall accompany the Statement with payment of the amount of the overpayment provided Tenant is not then in default in the performance of any of its obligations under this Lease.

In addition, during the term of this Lease, commencing with the first day of the first month following the delivery to Tenant of a Statement with respect to the first Landlord fiscal year (or portion thereof) occurring during the Term (which fiscal year is presently the calendar year) and on the first day of each month thereafter throughout the Term, Tenant shall pay to Landlord, on account towards Tenant’s Proportionate Share of anticipated increases in Operating Costs and real estate taxes, one- twelfth of the total amount of the estimated Tax Excess and increases over the Base Operating Costs for which Tenant is responsible, as such anticipated payments are as set forth on a certificate signed by Landlord or its managing agent.

10

Any payments due under the terms of this Section 11 for any portion of a Lease Year shall be appropriately pro-rated.

In the event that the combination of Operating Cost and Taxes increase by three percent (3%) or more over the combination of Tax Base and Base Operating Costs for any year during the Term, then upon Tenant’s request, Landlord shall provide Tenant with a line item statement of Operating Costs and a calculation of the gross up provision.

If Tenant objects in writing to any annual Statement from Landlord given pursuant to Section 11 within sixty (60) days following receipt of such Statement by Tenant, so long as Tenant is not in default, Landlord shall permit Tenant to examine, at the offices of Landlord where such records are customarily kept, upon fourteen (14) days’ advance notice and during regular business hours, such of Landlord’s books and records pertaining directly to the determination of Operating Costs as are relevant to the Statement in question. Such examination shall be completed within sixty (60) days following the delivery of such Statement. Such inspection may be made either by employees of Tenant or by a certified public accounting firm that is not compensated on a contingent fee basis. In making such examination, Tenant agrees, and shall cause its agents and employees as well as any accounting firm conducting the examination to agree in writing, to keep confidential any and all information contained in such books and records, save and except that Tenant may disclose such information to a trier of fact in the event of any dispute between Tenant and Landlord with regard to Operating Costs or as otherwise required by law; provided, however, that Tenant shall stipulate to such protective or other orders in any proceeding as may be reasonably required to preserve the confidentiality of such information. Tenant shall provide a copy of such CPA confidentiality agreements to Landlord promptly upon request. Within five (5) business days after receipt of a report regarding such inspection (the “Report Due Date”), Tenant shall provide Landlord with a complete copy of any report issued to Tenant in connection with such inspection. All costs and expenses of any such examination or audit shall be paid by Tenant. If it is determined (within all applicable time periods) that the amount of Operating Cost, as shown on Statement for the year as to which the inspection is undertaken, was overstated, and, as a result thereof, the Additional Rent payments for Operating Costs made by Tenant was in excess of the amount Tenant should have paid in respect of such year, and Tenant is not then in default beyond any applicable notice and cure period and Landlord does not dispute the results of Tenant’s review, then Landlord shall apply such overpayment to Tenant’s next due installment of Additional Rent, or if the Term has expired and Tenant is not in default hereunder, such overpayment shall be refunded within forty-five (45) days after such final determination. If it is determined by Tenant’s review that the amount of Operating Costs, as shown on Landlord’s Statement for the subject year, was understated, and, as a result thereof, the Additional Rent payments relating to Operating Costs made by Tenant was less than the amount Tenant should have paid in respect of such year, then Tenant shall pay to Landlord the amount of such underpayment within fifteen (15) days of such final determination. In the event Tenant does not give Landlord notice within such sixty (60) day period after receipt of such Statement that it is contesting Landlord’s calculation (and describing in detail any items which Tenant contests) and/or Tenant does not complete its inspection of Landlord’s records within sixty (60) days after receipt of such Statement, any such Statement shall be deemed to be accepted by Tenant without dispute and Tenant’s rights to inspect Landlord’s records with respect to such Landlord’s Statement shall have been waived. The right to inspect pursuant to this Section 11 shall not be available to any subtenant or assignee of the original Tenant hereunder. If, following the Report Due Date, Landlord disputes the findings contained therein, and Landlord and Tenant are not able to resolve their differences within thirty (30) days following the Report Due Date, the dispute shall be resolved by binding arbitration as follows: Landlord and Tenant shall each designate an independent certified public accountant (which shall not be the accountant used by Tenant to perform the initial review), which shall in turn jointly select a third independent certified public accountant (which shall not be the accountant used by Tenant to perform the initial review), other qualified

11

real estate professional or commercial real estate audit firm (the “Third CPA”). The Third CPA, within thirty (30) days of selection, shall, at Tenant’s sole expense, audit the relevant records and certify the proper amount within. That certification by the Third CPA shall be final and conclusive. If the Third CPA determines that the amount of Operating Costs billed to Tenant was incorrect, the appropriate party shall pay to the other party the deficiency or overpayment, as applicable, within ten (10) days following delivery of the Third Party CPA’s decision, without interest.

Within ninety (90) days after the close of Landlord’s fiscal year, Landlord shall provide Tenant with a Statement regarding the Operating Costs for the Base Operating Costs. Tenant shall have the right to audit the Base Operating Costs pursuant to the terms and provisions of the immediately preceding paragraph, however, Tenant’s deadline to object to such Statement shall be four hundred and twenty-five (425) days after receipt of such Statement.

Tenant, upon payment of the rent herein reserved and upon the performance of all the terms of this Lease, shall at all times during the Lease Term and during any extension or renewal term, peaceably and quietly enjoy the Premises without any disturbance from Landlord or from any other person claiming through Landlord.

(a)Tenant shall not at any time use or occupy the Premises in violation of the certificate of occupancy or building permit issued for the Building of which the Premises forms a part or any applicable zoning ordinance. The statement in this Lease of the Permitted Uses does not constitute a representation or guaranty by Landlord that such business may be conducted on the Premises or is lawful under the certificate of occupancy or building permit or is otherwise permitted by law.

(b)Tenant shall conduct its business in such a manner both as regards noise and other nuisances, as will not unreasonably interfere with, annoy or disturb any other tenant in the conduct of its business, or Landlord in the management of the Building.

(c)Tenant shall not keep within the Premises any article of dangerous, inflammable or explosive character which increases the danger of fire upon the Premises or which may be deemed “hazardous” by any reputable insurance company.

(d)The sidewalks, entrances, corridors and stairways shall not be obstructed or encumbered by Tenant or used for any purpose other than ingress and egress to and from the Premises.

(e)Tenant covenants that it will use the Premises continuously and uninterruptedly only for the Permitted Use as defined in the Reference Data, and then only as permitted under federal, state and local laws, regulations and orders applicable from time to time, including, without limitation, city ordinances, land use and zoning laws, environmental laws and regulations (including all laws and regulations regulating the production, use, and disposal of any pollution or toxic or hazardous material), and occupational health and safety laws, and shall procure all approvals, licenses and permits necessary therefor without any, in each case giving Landlord true and complete copies of same in all applications therefor.

(f)Tenant shall promptly comply with all present and future laws applicable to Tenant’s use of the Premises or Tenant’s signs thereon, foreseen or unforeseen, and whether or not the same necessitates

12

extraordinary changes or non-structural improvements to the Premises or interfere with Tenant’s use and enjoyment of the Premises, and shall keep the Premises equipped with adequate safety appliances and comply with all requirements reasonable in light of the use Tenant is making of the Premises of insurance inspection or rating bureaus having jurisdiction. Notwithstanding the above, Tenant shall be responsible for structural changes or changes which affect other portions of the Premises or Building which Landlord is required to maintain but which are required due to Tenant’s alterations or unusual use of the Premises.

(g)If Tenant’s use of the Premises results in any increase in the premium for any insurance carried by Landlord, then upon Landlord’s notice to Tenant of such increase, Tenant shall pay the same to Landlord upon demand as additional rent.

(h)Tenant agrees to comply with reasonable regulations as shall from time to time hereafter be established by Landlord for the safety, care, cleanliness, or orderly conduct of the Premises and the Building and for the benefit, comfort and convenience of all of the occupants of the Building which regulations may, at the option of Landlord, from time to time be posted in the common facilities of the Building.

(a)Except for those items specified elsewhere herein, no alterations, additions (including, for purposes hereof, wall to wall carpeting) or improvements to the Premises shall be made by Tenant without prior written consent of Landlord, which consent shall not be unreasonably withheld. Any such alterations, additions or improvements shall (i) be in accordance with complete plans and specifications prepared by Tenant and approved in advance by Landlord; (ii) be performed in a good and workmanlike manner and in compliance with all applicable laws; (iii) be performed and completed in the manner required in subsection (d) hereof; (iv) be made at Tenant’s sole expense and at such times as Landlord may from time to time designate; and (v) become a part of the Premises and the property of Landlord.

If Landlord shall elect not to keep any alteration, addition or improvement installed by Tenant, Landlord shall so notify Tenant at the time Landlord approves Tenant’s plans and Tenant shall remove such fixtures at its expense and shall repair any damage to the Building caused by such removal upon the expiration or termination of this Lease, leaving the Premises in good order and repair, reasonable wear and tear only excepted. Notwithstanding the foregoing, Tenant shall not be required to remove the roof deck as descripted in Section 41, if such roof deck is constructed.

(b)All articles of personal property and all trade fixtures, machinery and equipment and furniture owned or installed by Tenant in the Premises (“Tenant’s Removable Property”) shall remain the property of Tenant and may be removed by Tenant at any time prior to the expiration of this Lease, provided that Tenant, at its expense, shall repair any damage to the Building caused by such removal.

(c)Notice is hereby given that Landlord shall not be liable for any labor or materials furnished or to be furnished to Tenant upon credit, and that no mechanic’s or other lien for any such labor or materials shall attach to or affect the reversion or other estate or interest of Landlord in and to the Premises. Whenever and as often as any mechanic’s lien shall have been filed against the Premises based upon any act or interest of Tenant or of anyone claiming through Tenant, Tenant shall forthwith take such actions by bonding, deposit or payment as will remove or satisfy the lien.

(d)Landlord and Tenant shall cooperate reasonably to coordinate any alterations, additions, improvements, maintenance, repairs, replacements and other work being performed by Landlord or Tenant

13