Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IEC ELECTRONICS CORP | iec-20210310x8k.htm |

Exhibit 99.1

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Trusted Ingenuity. Proven Reliability. ® Annual Meeting March 10, 2021 Jeff Schlarbaum, President & CEO |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics References in this presentation to “IEC,” the “Company,” “we,” “our,” or “us” mean IEC Electronics Corp. and its subsidiaries except where the context otherwise requires. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts” or “potential” or the negative of these terms or other similar expressions. These forward-looking statements include, but are not limited to, statements regarding future sales and operating results, future prospects, the capabilities and capacities of business operations, any financial or other guidance and all statements that are not based on historical fact, but rather reflect our current expectations concerning future results and events. The ultimate correctness of these forward-looking statements is dependent upon a number of known and unknown risks and events and is subject to various uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. The following important factors, among others, could affect future results and events, causing those results and events to differ materially from those views expressed or implied in our forward-looking statements: the impact of the COVID-19 pandemic on our business; business conditions and growth or contraction in our customers’ industries, the electronic manufacturing services industry and the general economy; our ability to control our material, labor and other costs; our dependence on a limited number of major customers; uncertainties as to availability and timing of governmental funding for our customers; the impact of government regulations, including FDA regulations; unforeseen product failures and the potential product liability claims that may be associated with such failures; technological, engineering and other start-up issues related to new programs and products; variability and timing of customer requirements; availability of component supplies; dependence on certain industries; the ability to realize the full value of our backlog; the types and mix of sales to our customers; litigation and governmental investigations; intellectual property litigation; variability of our operating results; our ability to maintain effective internal controls over financial reporting; the availability of capital and other economic, business and competitive factors affecting our customers, our industry and business generally; failure or breach of our information technology systems; business impacts related to the relocation of our headquarters; and unanticipated liabilities related to acquired properties. Any one or more of such risks and uncertainties could have a material adverse effect on us or the value of our common stock. For a further list and description of various risks, relevant factors and uncertainties that could cause future results or events to differ materially from those expressed or implied in our forward-looking statements, see our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our other filings with the Securities and Exchange Commission. All forward-looking statements included in this presentation are made only as of the date indicated or as of the date of this presentation. We do not undertake any obligation to, and may not, publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently occur or which we hereafter become aware of, except as required by law. New risks and uncertainties arise from time to time and we cannot predict these events or how they may affect us and cause actual results to differ materially from those expressed or implied by our forward-looking statements. Therefore, you should not rely on our forward-looking statements as predictions of future events. This presentation includes some non-GAAP financial measures, which the Company believes are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. The Company has provided a discussion of these non-GAAP financial measures and reconciliations of comparable GAAP to non-GAAP measures in tables found at the end of this presentation. Cautionary Note Regarding Forward Looking Statements 2 |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 3 Agenda Our Journey Strategic Initiatives Financial Highlights Q & A Marketplace Differentiation |

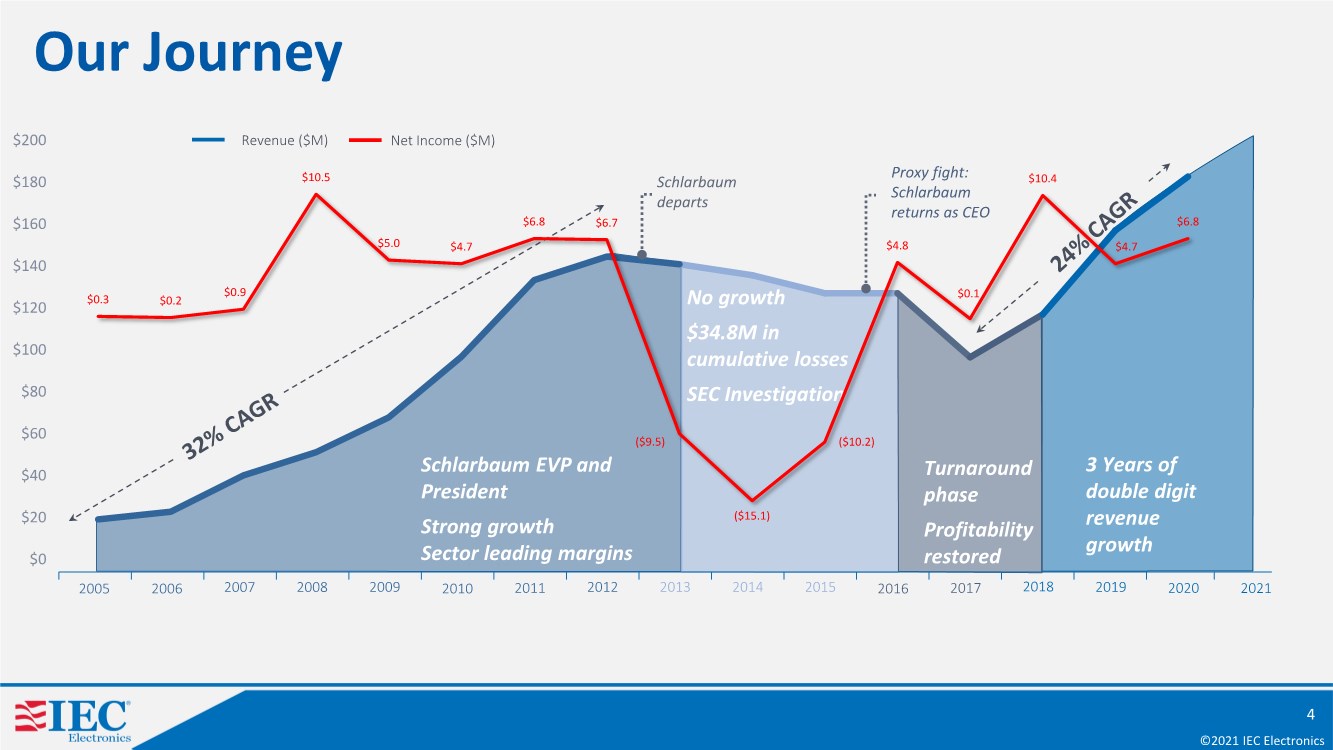

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Revenue ($M) Net Income ($M) 4 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Schlarbaum EVP and President Strong growth Sector leading margins No growth $34.8M in cumulative losses SEC Investigation Turnaround phase Profitability restored 3 Years of double digit revenue growth Our Journey $0.3 $0.2 $0.9 $10.5 $5.0 $4.7 $6.8 $6.7 ($9.5) ($15.1) ($10.2) $4.8 $0.1 $10.4 $4.7 $6.8 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 Schlarbaum departs Proxy fight: Schlarbaum returns as CEO |

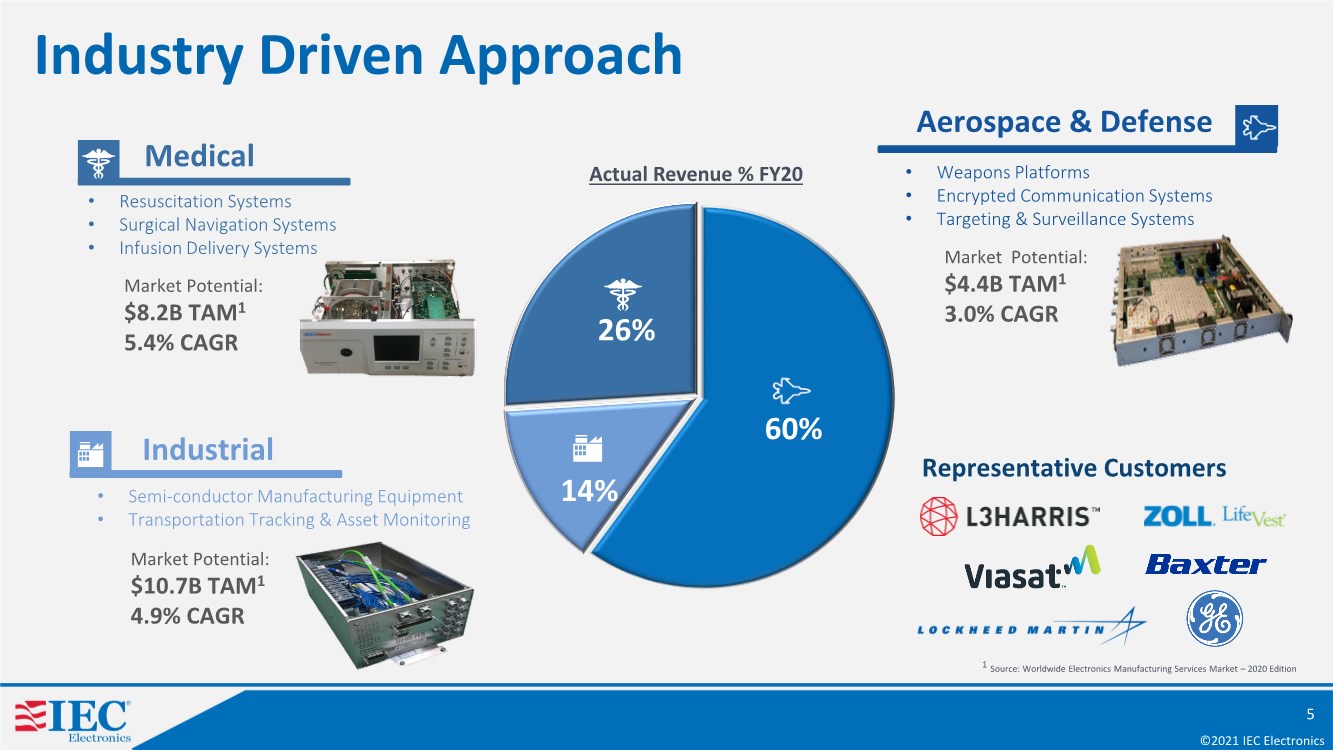

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics • Weapons Platforms • Encrypted Communication Systems • Targeting & Surveillance Systems Medical • Resuscitation Systems • Surgical Navigation Systems • Infusion Delivery Systems Aerospace & Defense • Semi-conductor Manufacturing Equipment • Transportation Tracking & Asset Monitoring Industrial Representative Customers 5 Industry Driven Approach 60% 14% 26% Market Potential: $4.4B TAM1 3.0% CAGR Market Potential: $8.2B TAM1 5.4% CAGR Market Potential: $10.7B TAM1 4.9% CAGR 1 Source: Worldwide Electronics Manufacturing Services Market – 2020 Edition Actual Revenue % FY20 |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Medical Aerospace & Defense Industrial 6 Strategic Partner Announcements Delta Selects Viasat's In-Flight Connectivity to Revolutionize the Customer Experience Rochester, NY company, AeroSafe Global, playing pivotal role in 'last mile' of COVID vaccine delivery Army Selects L3Harris, Elbit Systems for $442M Night-Vision Tech Production OTA Chipmaker SMIC reveals $1.2B deal with ASML for DUV technology |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Marketplace Differentiation Electronic Assembly Interconnect Solutions Precision Metalworking Vertical Manufacturing Services Control Cost, Quality, and Lead Time for Key Commodities 7 Analysis & Testing Laboratory |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 8 Electronic Assembly, Interconnect Solutions, Precision Metalworking, Analysis & Testing Vertical Manufacturing Box-Build, Environmental Test: Temperature & Vibration Full System Assembly Custom configured to specific customer order System Configuration Shipping directly to the end customer Fulfillment Upgrade & Depot Repair Services Aftermarket Support Full Spectrum Manufacturing |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Financial Highlights Enhanced profitability & industry leading performance 3 sequential fiscal years of significant revenue growth Significantly increased 12-month backlog in 2020 9 |

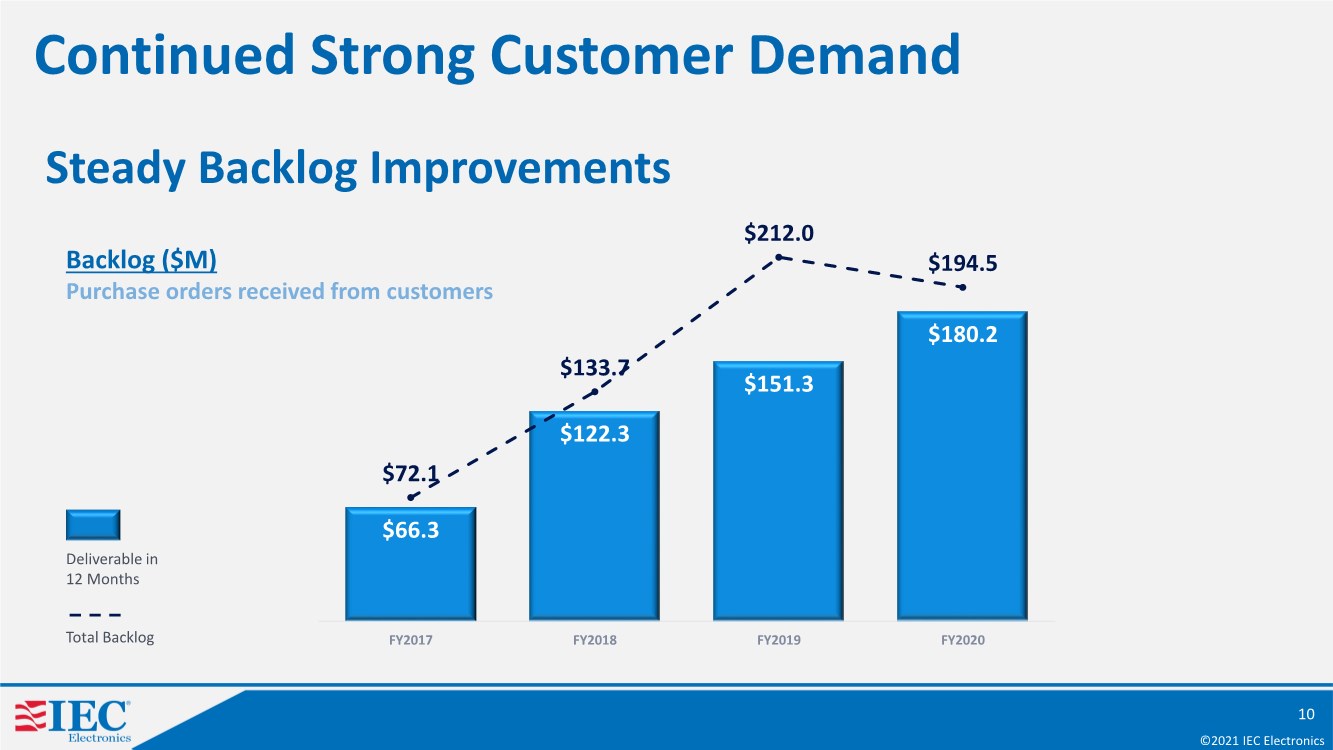

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 10 Continued Strong Customer Demand Steady Backlog Improvements $66.3 $122.3 $151.3 $180.2 $72.1 $133.7 $212.0 $194.5 FY2017 FY2018 FY2019 FY2020 Backlog ($M) Purchase orders received from customers Deliverable in 12 Months Total Backlog |

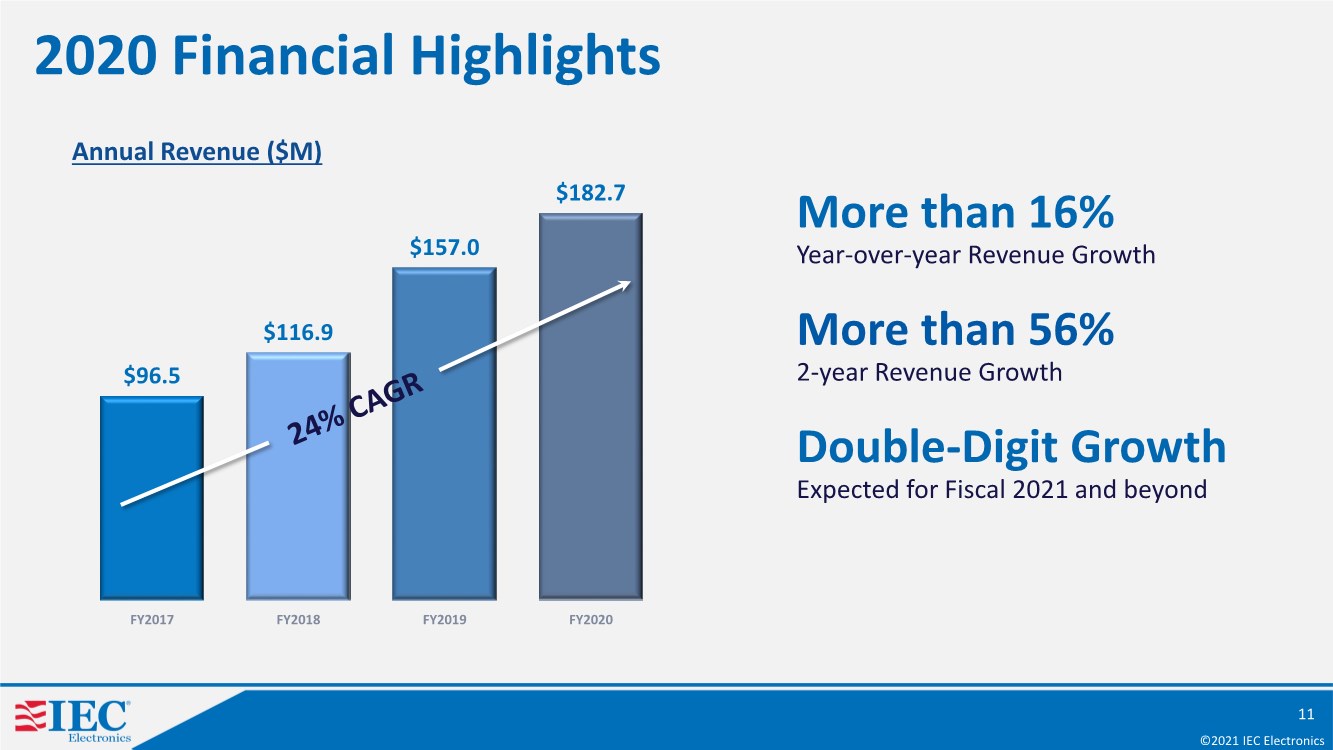

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 11 $96.5 $116.9 $157.0 $182.7 FY2017 FY2018 FY2019 FY2020 Annual Revenue ($M) More than 16% Year-over-year Revenue Growth More than 56% 2-year Revenue Growth Double-Digit Growth Expected for Fiscal 2021 and beyond 2020 Financial Highlights |

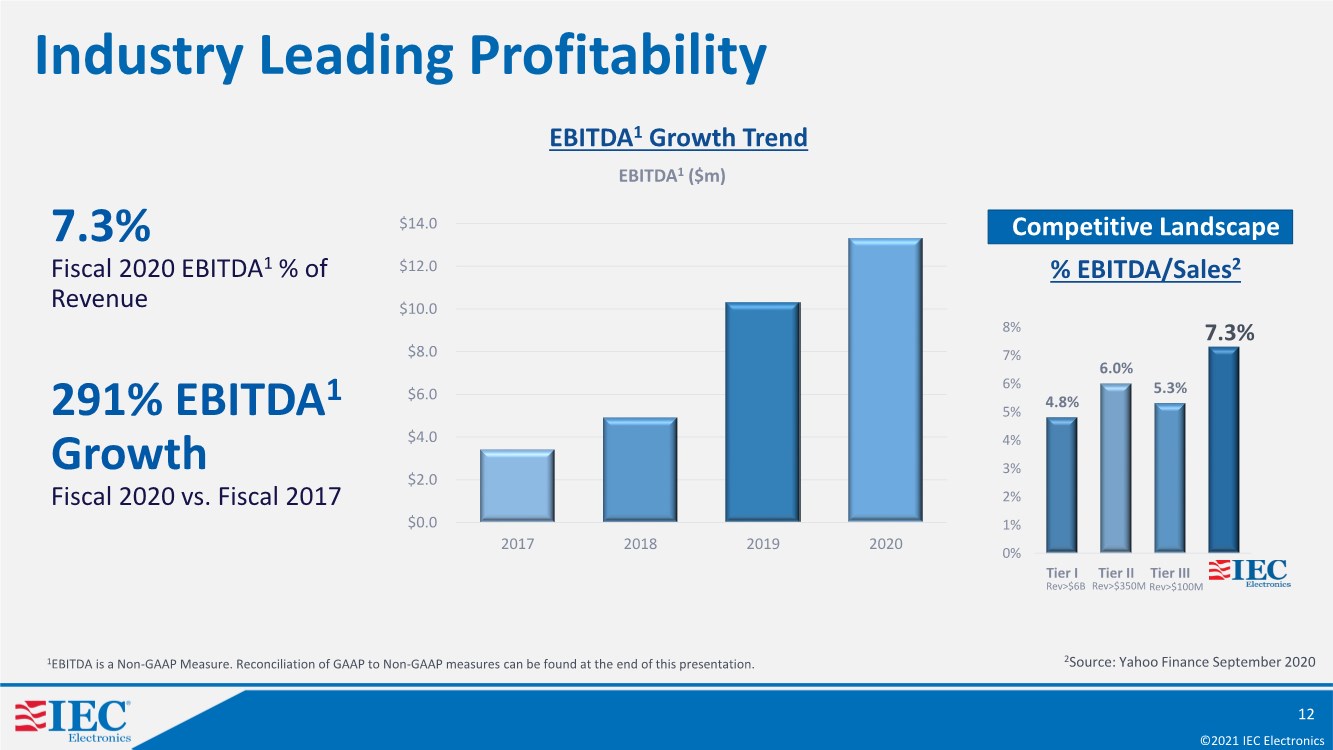

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics EBITDA1 Growth Trend 4.8% 6.0% 5.3% 0% 1% 2% 3% 4% 5% 6% 7% 8% Tier I Tier II Tier III IEC Rev>$6B Rev>$350M Rev>$100M % EBITDA/Sales2 7.3% 2Source: Yahoo Finance September 2020 12 Industry Leading Profitability 291% EBITDA1 Growth Fiscal 2020 vs. Fiscal 2017 7.3% Fiscal 2020 EBITDA1 % of Revenue Competitive Landscape 1EBITDA is a Non-GAAP Measure. Reconciliation of GAAP to Non-GAAP measures can be found at the end of this presentation. $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2017 2018 2019 2020 EBITDA1 ($m) |

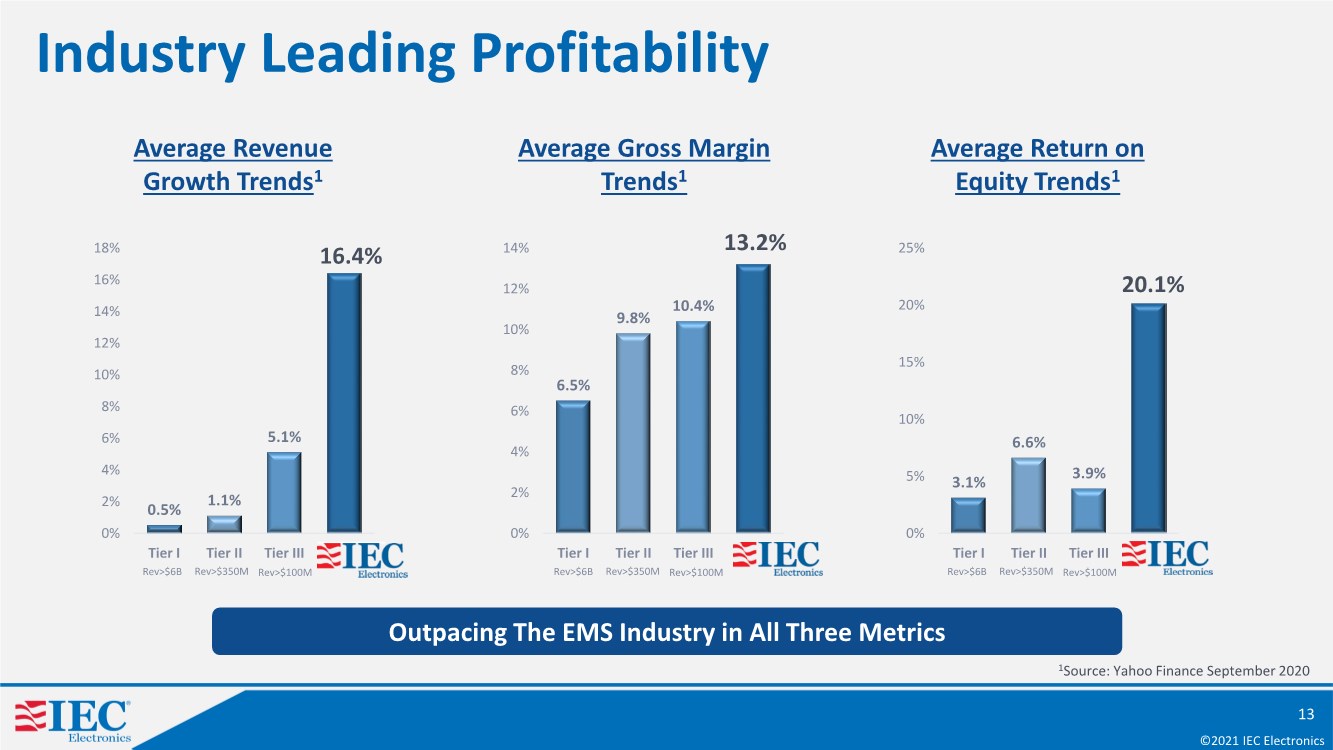

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 0.5% 1.1% 5.1% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% Tier I Tier II Tier III IEC Rev>$6B Rev>$350M Rev>$100M 6.5% 9.8% 10.4% 0% 2% 4% 6% 8% 10% 12% 14% Tier I Tier II Tier III IEC Rev>$6B Rev>$350M Rev>$100M 3.1% 6.6% 3.9% 0% 5% 10% 15% 20% 25% Tier I Tier II Tier III IEC Rev>$6B Rev>$350M Rev>$100M Average Revenue Growth Trends1 Average Gross Margin Trends1 Average Return on Equity Trends1 16.4% 13.2% 20.1% Outpacing The EMS Industry in All Three Metrics 1Source: Yahoo Finance September 2020 13 Industry Leading Profitability |

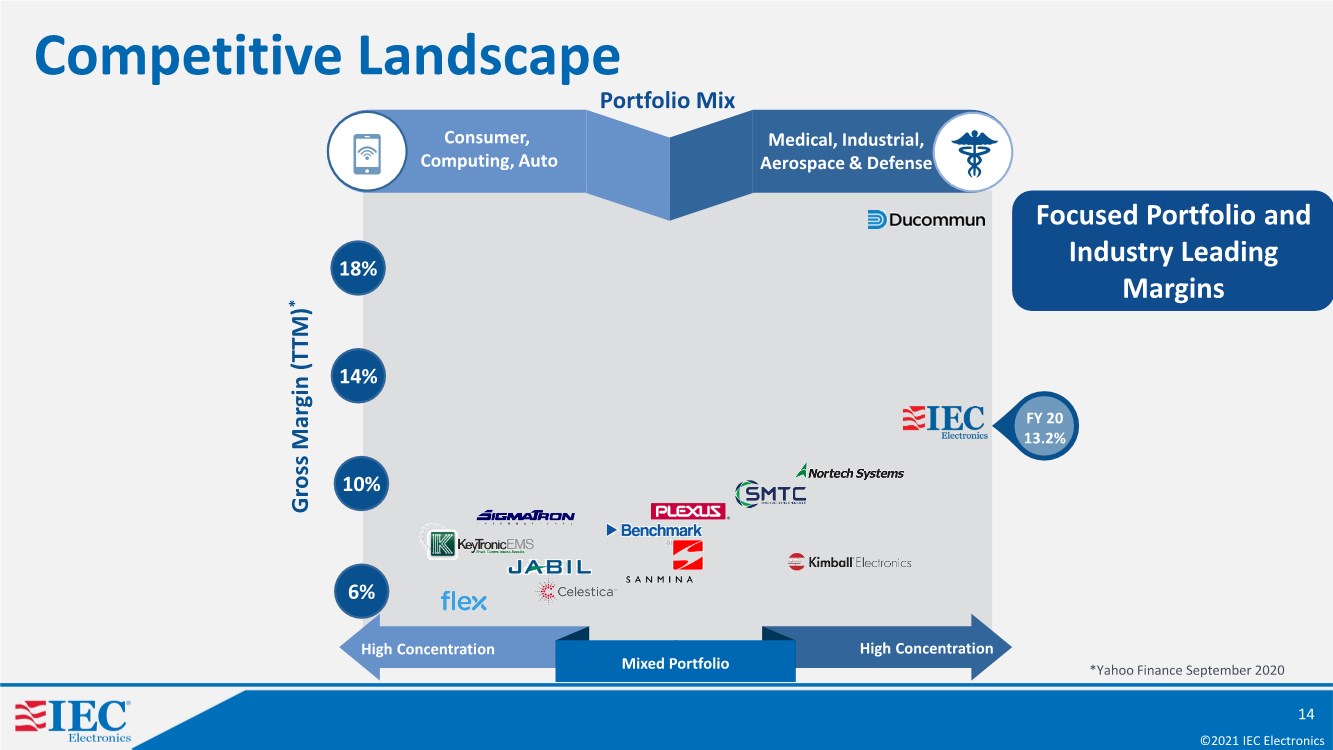

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics FY 20 13.2% Consumer, Computing, Auto Portfolio Mix Medical, Industrial, Aerospace & Defense 18% 14% 10% 6% Mixed Portfolio High Concentration High Concentration Gross Margin (TTM) * *Yahoo Finance September 2020 Focused Portfolio and Industry Leading Margins 14 Competitive Landscape |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 15 Stock Close Price 183% Growth 3-Year Return* 62% Growth 1-Year Return* $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 3/5/2018 3/5/2019 3/5/2020 3/5/2021 * Growth calculation based on March 5 each year Stock Price Trends (NASDAQ: IEC) |

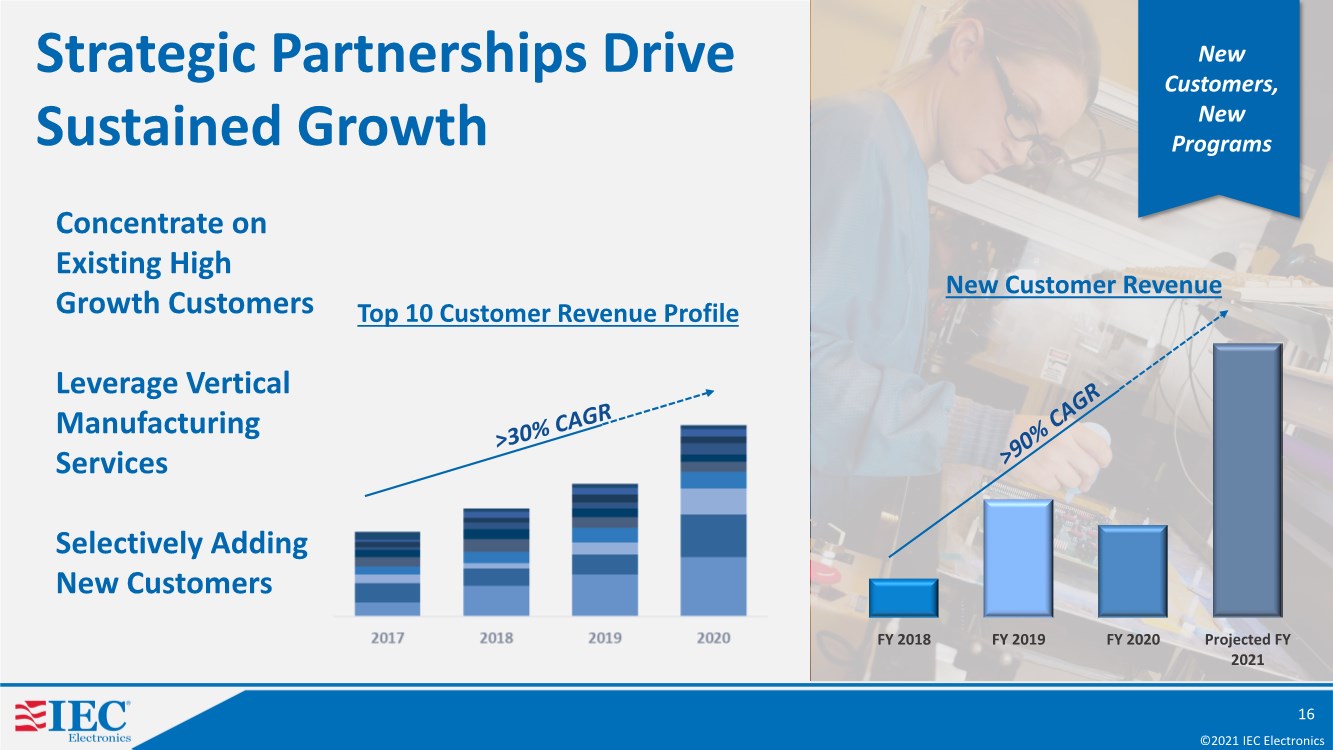

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 16 New Customer Revenue Strategic Partnerships Drive Sustained Growth New Customers, New Programs Top 10 Customer Revenue Profile Concentrate on Existing High Growth Customers Leverage Vertical Manufacturing Services Selectively Adding New Customers FY 2018 FY 2019 FY 2020 Projected FY 2021 |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Support growing customer demand and access to larger pool of qualified human capital Creating manufacturing redundancy in Rochester region Expanded capacity and expected efficiency gains Investing for Growth 17 Rochester Area Eastside Campus: Silver Hill Technology Park, Newark, NY Rochester Area Westside Campus: Jetview Drive, Rochester, NY |

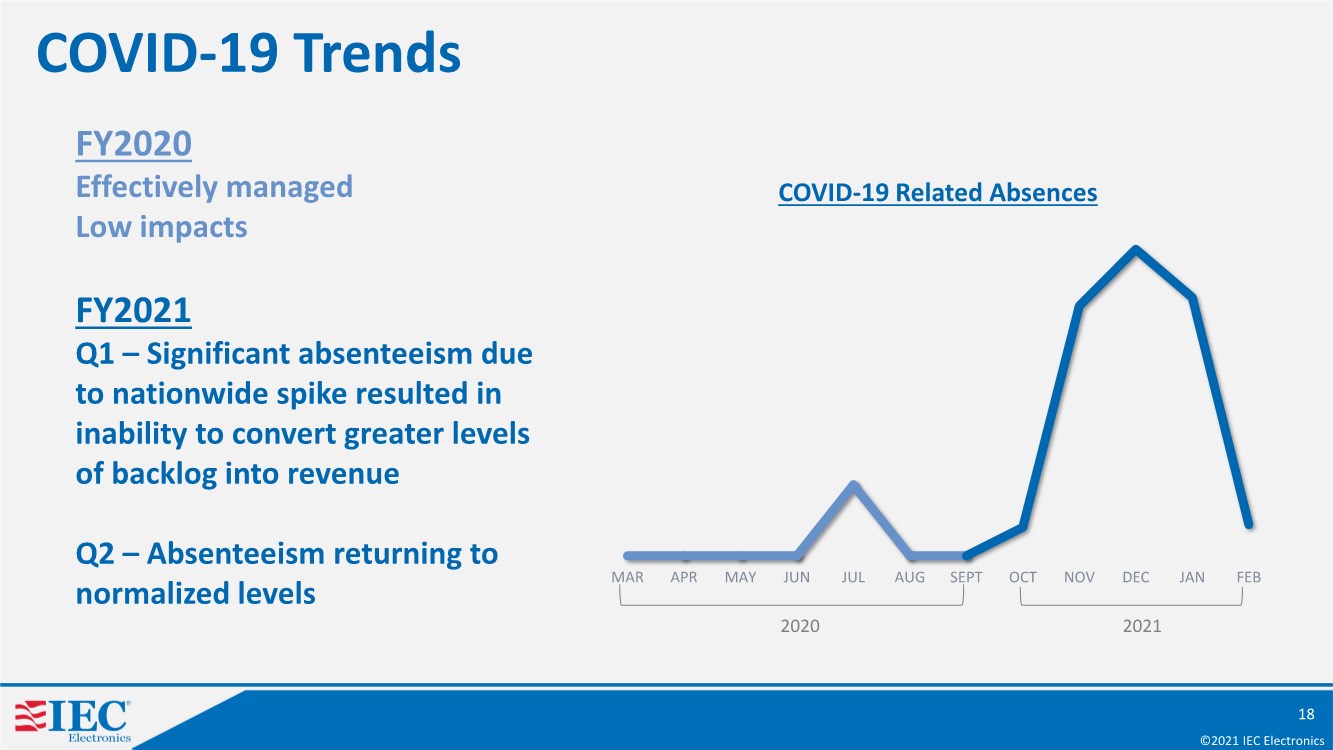

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics COVID-19 Trends 18 MAR APR MAY JUN JUL AUG SEPT OCT NOV DEC JAN FEB COVID-19 Related Absences FY2020 Effectively managed Low impacts FY2021 Q1 – Significant absenteeism due to nationwide spike resulted in inability to convert greater levels of backlog into revenue Q2 – Absenteeism returning to normalized levels 2020 2021 |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Key Takeaways Industry leading financial performance Strong backlog expected to support continued double-digit revenue growth Strategic partnerships with global, industry leading companies 100% US Manufacturing 19 |

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics Thank You 20 |

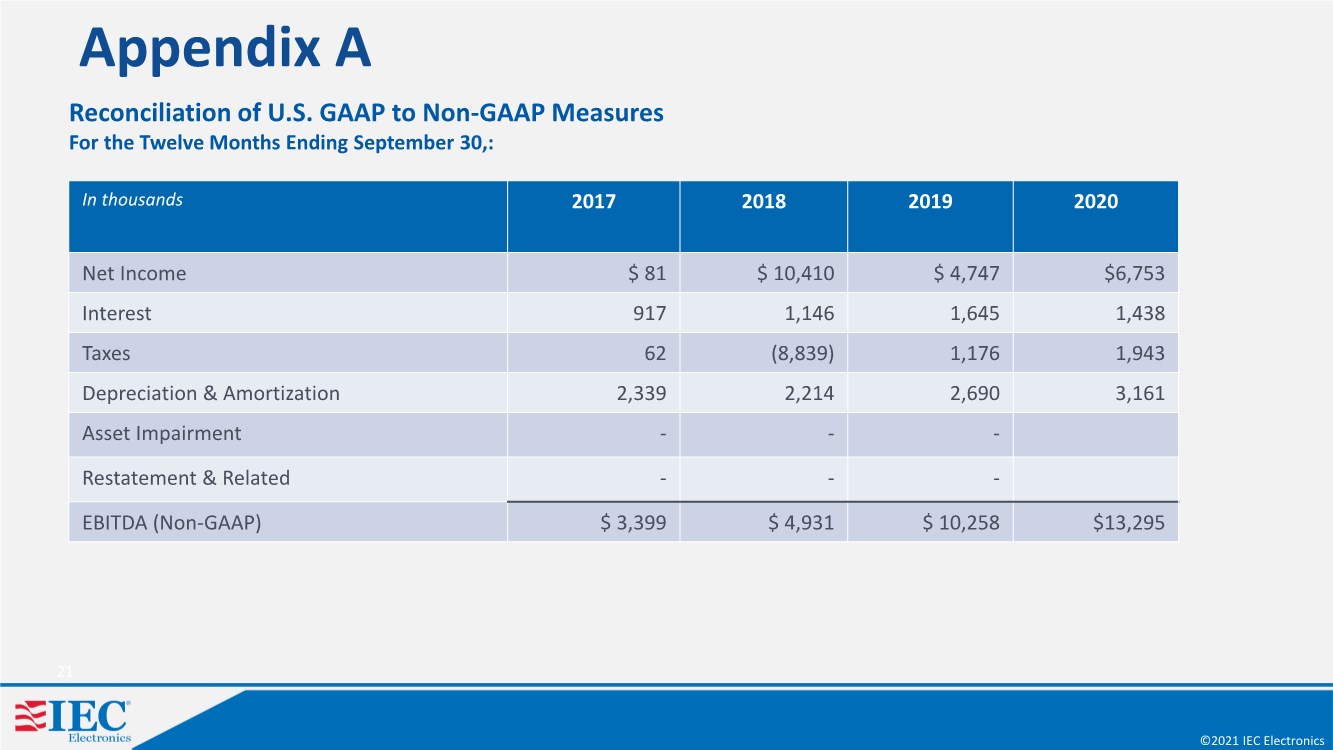

| ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2021 IEC Electronics 21 Reconciliation of U.S. GAAP to Non-GAAP Measures For the Twelve Months Ending September 30,: In thousands 2017 2018 2019 2020 Net Income $ 81 $ 10,410 $ 4,747 $6,753 Interest 917 1,146 1,645 1,438 Taxes 62 (8,839) 1,176 1,943 Depreciation & Amortization 2,339 2,214 2,690 3,161 Asset Impairment --- Restatement & Related --- EBITDA (Non-GAAP) $ 3,399 $ 4,931 $ 10,258 $13,295 Appendix A |