Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - VICI PROPERTIES INC. | viciprojectpioneerpressrel.htm |

| EX-10.3 - EX-10.3 - VICI PROPERTIES INC. | exhibit103pioneer-commitme.htm |

| EX-10.2 - EX-10.2 - VICI PROPERTIES INC. | exhibit102.htm |

| EX-10.1 - EX-10.1 - VICI PROPERTIES INC. | exhibit101.htm |

| EX-3.1 - EX-3.1 - VICI PROPERTIES INC. | vici-articlesofamendment20.htm |

| 8-K - 8-K - VICI PROPERTIES INC. | vici-20210302.htm |

T HE VEN ET I A N RES O RT T R A N S A C T I O N O V E R V I E W M A R C H 3 , 2 0 2 1 E x h i b i t 9 9 . 2

2 DISCLAIMERS Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws. You can identify these statements by our use of the words “assumes,” “believes,” “estimates,” “expects,” “guidance,” “intends,” “plans,” “projects,” and similar expressions that do not relate to historical matters. All statements other than statements of historical fact are forward-looking statements. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors which are, in some cases, beyond the control of VICI Properties Inc. and its subsidiaries (collectively, the “Company” or “VICI”) and could materially affect actual results, performance, or achievements. Among those risks, uncertainties and other factors are the impact of changes in general economic conditions, including low consumer confidence, unemployment levels and depressed real estate prices resulting from the severity and duration of any downturn in the U.S. or global economy (including stemming from the COVID-19 pandemic and changes in economic conditions as a result of the COVID-19 pandemic); risks that the pending purchase of The Venetian Resort and Sands Expo & Convention Center (the “Venetian Resort”) pursuant to the agreement entered into by the Company and Las Vegas Sands Corp. (“LVS” or “Las Vegas Sands”) or other pending transactions may not be consummated on the terms or timeframe described herein, or at all; the ability of the parties to satisfy the conditions set forth in the definitive transaction documents for the pending transactions, including the ability to receive, or delays in receiving, the regulatory and other approvals and/or consents required to consummate the transactions; the terms on which the Company finances the pending transactions, including the source of funds used to finance such transactions; disruptions to the real property and operations of the Venetian Resort during the pendency of the closing; risks that the Company may not achieve the benefits contemplated by its pending and recently completed acquisitions of real estate assets, including the transactions described herein, and other pending transactions (including any expected accretion or the amount of any future rent payments); risks that not all potential risks and liabilities have been identified in the Company’s due diligence for our pending and recently completed transactions, including the transactions described herein; the historical financial and operating results of the Venetian Resort may not be a reliable indicator of their future results; and the effects of our recently completed and pending transactions and the pending transactions, including the transactions described herein, on us, including the future impact on our financial condition, financial and operating results, cash flows, strategy and plans. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the impact of the COVID-19 pandemic on the financial condition, results of operations, cash flows and performance of the Company, its tenants and its pending transactions. The extent to which the COVID-19 pandemic impacts the Company and its tenants will largely depend on future developments that are highly uncertain and cannot be predicted with confidence, including the impact of the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures on our tenants, including various state governments and/or regulatory authorities issuing directives, mandates, orders or similar actions restricting freedom of movement and business operations, such as travel restrictions, border closures, business closures, limitations on public gatherings, quarantines and “shelter-at-home” orders resulting in the closure of our tenants' operations at our properties. Each of the foregoing could have a material adverse effect on our tenants' ability to satisfy their obligations under their leases with us, including their continued ability to pay rent in a timely manner, or at all, and/or to fund capital expenditures or make other payments required under their leases. In addition, changes and instability in global, national and regional economic activity and financial markets as a result of the COVID-19 pandemic could negatively impact consumer discretionary spending and travel, which could have a material adverse effect on our tenants' businesses. Investors are cautioned to interpret many of the risks identified here and under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020 as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Las Vegas Sands Information The Company makes no representation as to the accuracy or completeness of the information regarding LVS included in this presentation. Certain financial and other information for LVS included in this presentation has been derived from publicly available presentations and press releases. Certain financial and other information for LVS included in this presentation has been derived from its filings, if and as applicable, and other publicly available presentations and press releases. While we believe this information to be reliable, we have not independently investigated or verified such data. Non‐GAAP Financial Measure This presentation includes a non-GAAP financial measure. With respect to the adjusted property EBITDA of The Venetian, while VICI believes that this non-GAAP measure included in this presentation is reliable, this information was prepared by LVS and therefore does not guarantee the accuracy or completeness of this information. See page 14 for a reconciliation to the most directly comparable financial measures calculated in accordance with GAAP. © VICI. All rights reserved. No part of this publication may be reproduced, distributed or transmitted in any form or by any means, including without limitation photocopying, recording or any other electronic or mechanical methods, without the expression written permission of VICI.

3 INVESTING IN EXPERIENTIAL: ONE OF THE LARGEST SINGLE ASSETS ON THE LAS VEGAS STRIP…

4 …AND THE LARGEST SINGLE HOTEL COMPLEX IN AMERICA… Note: By hotel rooms.

5 …AS WELL AS ONE OF THE LARGEST GAMING ASSETS IN AMERICA…

6 …AND THE LARGEST PRIVATELY-OWNED MEETING, CONVENTION & EVENT SPACE IN AMERICA Note: By square footage.

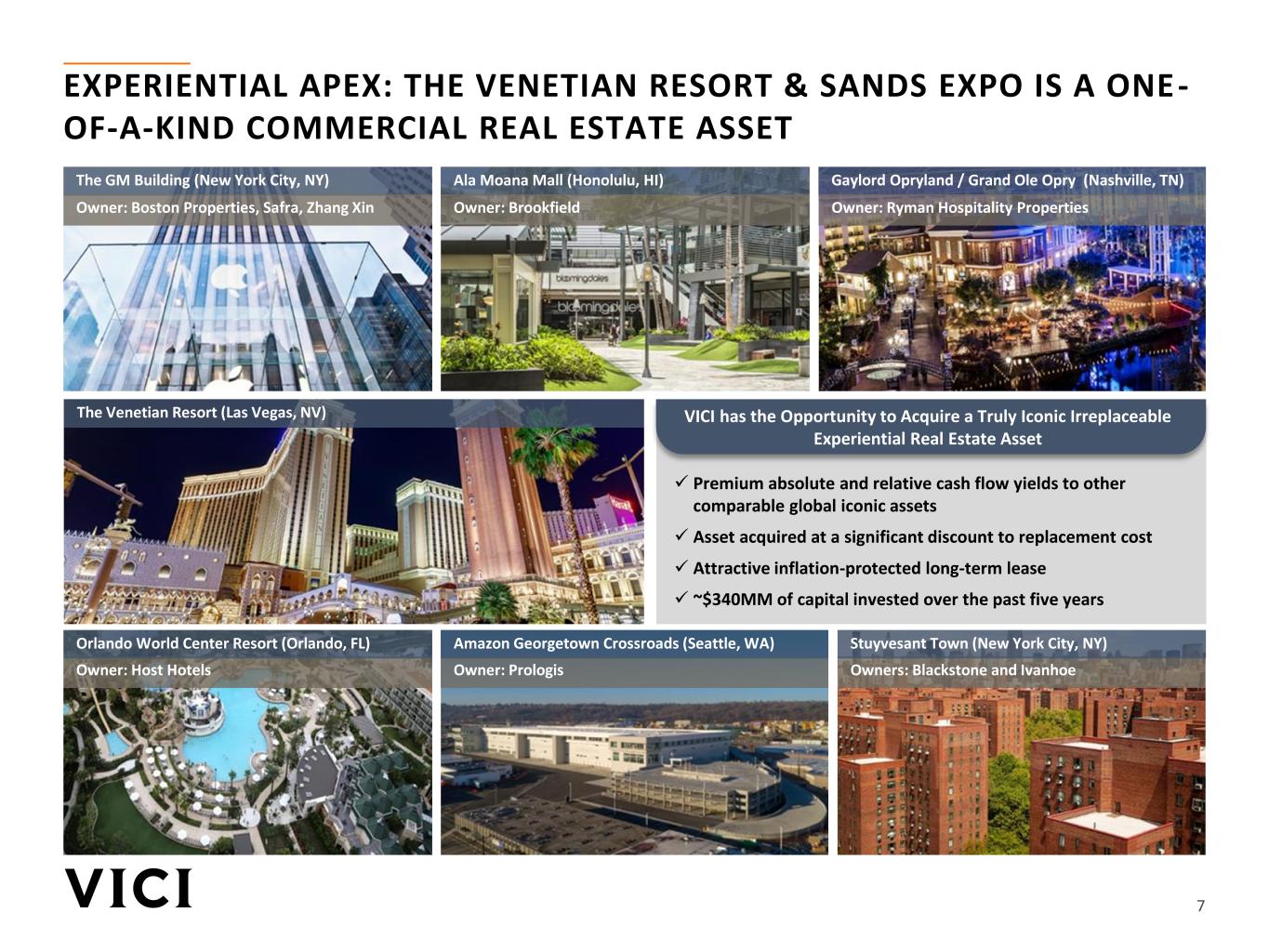

7 EXPERIENTIAL APEX: THE VENETIAN RESORT & SANDS EXPO IS A ONE- OF-A-KIND COMMERCIAL REAL ESTATE ASSET The Venetian Resort (Las Vegas, NV) The GM Building (New York City, NY) Owner: Boston Properties, Safra, Zhang Xin Ala Moana Mall (Honolulu, HI) Owner: Brookfield Owners: Blackstone and Ivanhoe Stuyvesant Town (New York City, NY) VICI has the Opportunity to Acquire a Truly Iconic Irreplaceable Experiential Real Estate Asset ✓ Premium absolute and relative cash flow yields to other comparable global iconic assets ✓ Asset acquired at a significant discount to replacement cost ✓ Attractive inflation-protected long-term lease ✓ ~$340MM of capital invested over the past five years Gaylord Opryland / Grand Ole Opry (Nashville, TN) Owner: Ryman Hospitality Properties Owner: Host Hotels Orlando World Center Resort (Orlando, FL) Owner: Prologis Amazon Georgetown Crossroads (Seattle, WA)

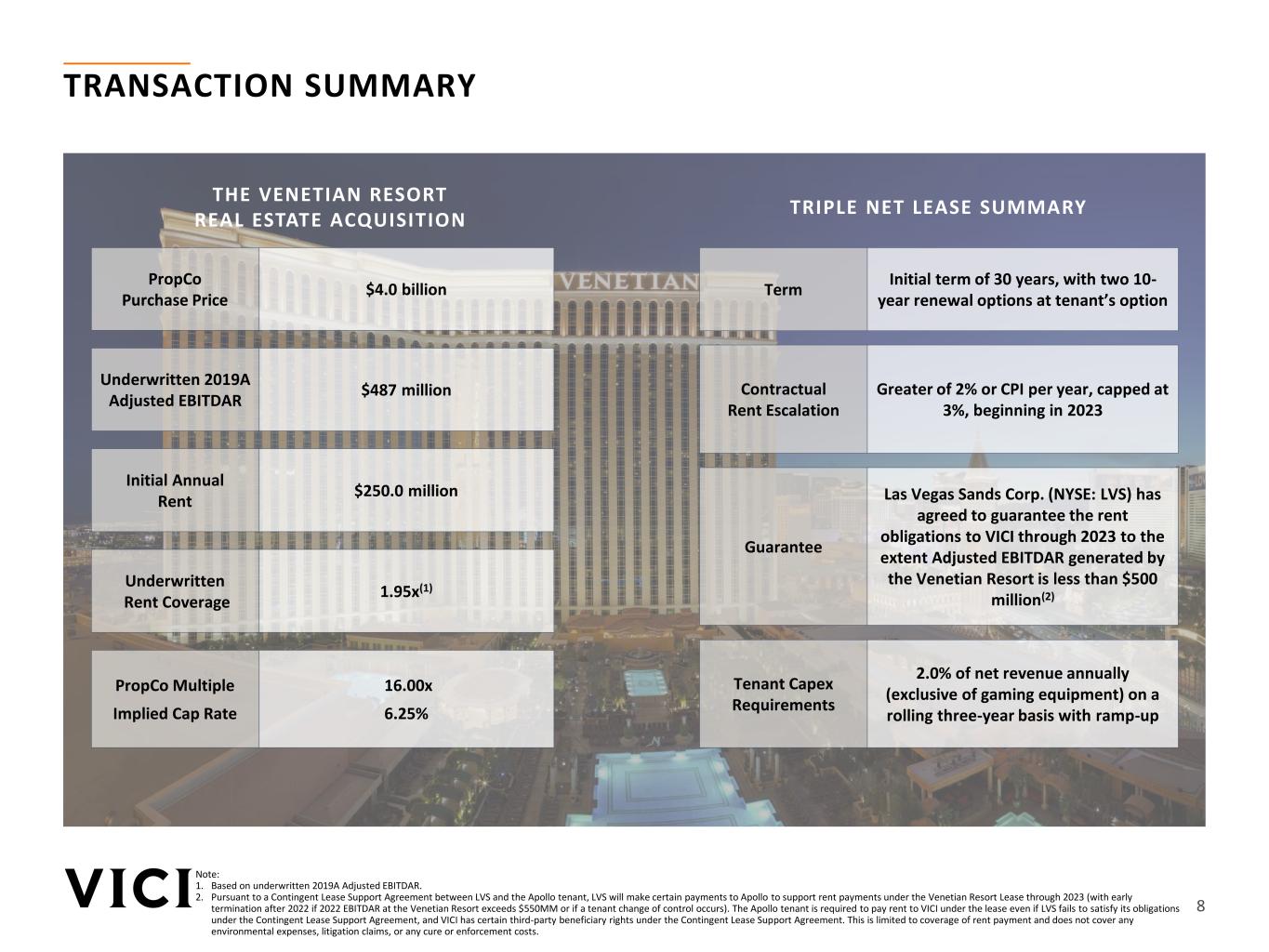

8 TRANSACTION SUMMARY THE VENETIAN RESORT REAL ESTATE ACQUISITION TRIPLE NET LEASE SUMMARY 1.95x(1) 16.00x 6.25% $487 million $4.0 billion PropCo Multiple Implied Cap Rate Underwritten 2019A Adjusted EBITDAR Underwritten Rent Coverage PropCo Purchase Price Initial term of 30 years, with two 10- year renewal options at tenant’s option Greater of 2% or CPI per year, capped at 3%, beginning in 2023 Las Vegas Sands Corp. (NYSE: LVS) has agreed to guarantee the rent obligations to VICI through 2023 to the extent Adjusted EBITDAR generated by the Venetian Resort is less than $500 million(2) Contractual Rent Escalation Guarantee Term 2.0% of net revenue annually (exclusive of gaming equipment) on a rolling three-year basis with ramp-up Tenant Capex Requirements $250.0 million Initial Annual Rent Note: 1. Based on underwritten 2019A Adjusted EBITDAR. 2. Pursuant to a Contingent Lease Support Agreement between LVS and the Apollo tenant, LVS will make certain payments to Apollo to support rent payments under the Venetian Resort Lease through 2023 (with early termination after 2022 if 2022 EBITDAR at the Venetian Resort exceeds $550MM or if a tenant change of control occurs). The Apollo tenant is required to pay rent to VICI under the lease even if LVS fails to satisfy its obligations under the Contingent Lease Support Agreement, and VICI has certain third-party beneficiary rights under the Contingent Lease Support Agreement. This is limited to coverage of rent payment and does not cover any environmental expenses, litigation claims, or any cure or enforcement costs.

9 THE VENETIAN RESORT HIGHLIGHTS A MARQUEE, IRREPLACEABLE ASSET ON THE LAS VEGAS STRIP ASSET OVERVIEW Hotel Rooms Gaming Platform MICE Platform Food & Beverage Entertainment Retail 3 Towers ~7,100 keys ~225K SF ~200 tables ~2,000 slots ~2.3MM SF 14 ballrooms 5 exposition halls 333 meeting rooms 35 restaurants 9 bars 4 venues (~5,000 seats) The MSG Sphere (~18,000 seats) – Owned by MSG Expected Opening: 2H2023 The Grand Canal Shoppes (~160+ stores) – Owned by Brookfield THE VENETIAN RESORT – A TRULY IRREPLACEABLE EXPERIENTIAL ASSET Largest Single Hotel Complex in America(1) One of the Largest Single Assets on the Las Vegas Strip Largest Private Sector Convention and Trade Center in America(2) One of the Largest Gaming Assets in America(2) One of the Highest On-Site Revenue Producing Single Asset in American Commercial Real Estate Highest Combined Rating of Any Asset on the Las Vegas Strip by TripAdvisor THE VENEZIA Note: 1. By number of hotel rooms. 2. By square footage.

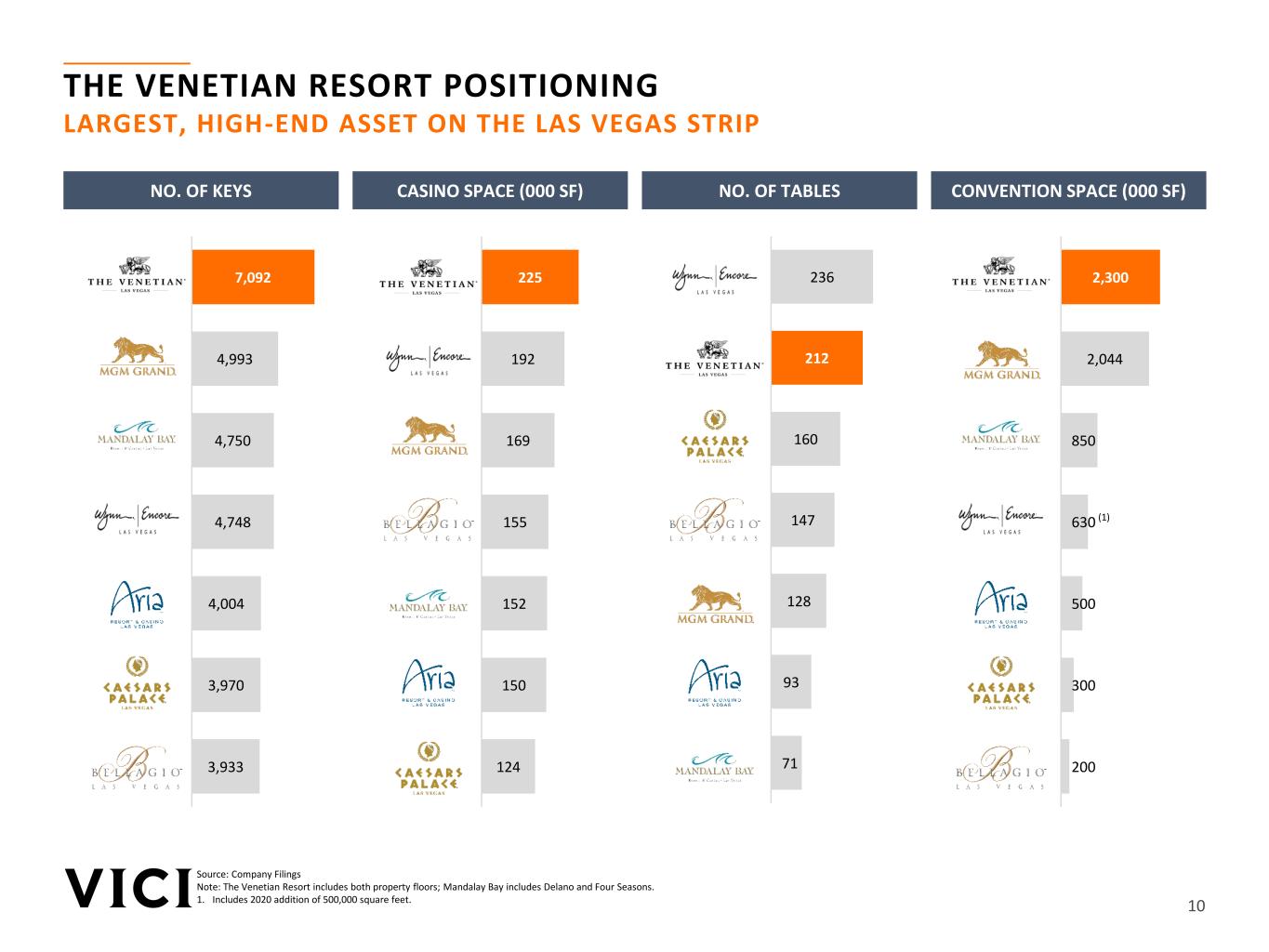

10 THE VENETIAN RESORT POSITIONING LARGEST, HIGH-END ASSET ON THE LAS VEGAS STRIP 225 192 169 155 152 150 124 Venetian Wynn MGM Bellagio Mandalay Bay Aria Caesars Palace 2,300 2,044 850 630 500 300 200 Venetian Mandalay Bay MGM Wynn Aria Caesars Palace Bellagio 236 212 160 147 128 93 71 Wynn Venetian Caesars Palace Bellagio MGM Aria Mandalay Bay 7,092 4,993 4,750 4,748 4,004 3,970 3,933 Venetian MGM Mandalay Bay Wynn Aria Caesars Palace Bellagio NO. OF KEYS CASINO SPACE (000 SF) NO. OF TABLES CONVENTION SPACE (000 SF) Source: Company Filings Note: The Venetian Resort includes both property floors; Mandalay Bay includes Delano and Four Seasons. 1. Includes 2020 addition of 500,000 square feet. (1)

11 THE VENETIAN RESORT ACQUISITION ATTRACTIVE OPPORTUNITY TO ACQUIRE A WORLD-RENOWNED REAL ESTATE ASSET AT A SIGNIFICANT DISCOUNT TO ESTIMATED REPLACEMENT COST Note: 1. Based on annualized adjusted EBITDA for the quarter ended December 31, 2020 and, in the case of VICI, as further adjusted for the $250MM of incremental rent attributable to the pending Venetian Resort acquisition. 2. AUM measured as of December 31, 2020. 3. Pursuant to a Contingent Lease Support Agreement between LVS and the Apollo tenant, LVS will make certain payments to Apollo to support rent payments under the Venetian Resort Lease through 2023 (with early termination after 2022 if 2022 EBITDAR at the Venetian Resort exceeds $550MM or if a tenant change of control occurs). The Apollo tenant is required to pay rent to VICI under the lease even if LVS fails to satisfy its obligations under the Contingent Lease Support Agreement, and VICI has certain third-party beneficiary rights under the Contingent Lease Support Agreement. This is limited to coverage of rent payment and does not cover any environmental expenses, litigation claims, or any cure or enforcement costs. ✓ Adds $250 million of inflation-protected rent to VICI, growing annual rent by ~20% and creates the largest triple net lease REIT by Adjusted EBITDA(1) ✓ Continues VICI’s tenant diversification progress – top tenant concentration is meaningfully reduced from 83% to 70% of cash rent ✓ Maintains VICI’s balanced geographic exposure with 42% of rent coming from Las Vegas assets and 58% of rent coming from regional market assets pro forma for the acquisition of the Venetian Resort ✓ Creates partnership with an affiliate of Apollo Global Management, one of the largest alternative asset managers globally with ~$455 billion of AUM(2) and a long track record of success ✓ Reduces COVID-19 recovery period risk through a lease support agreement provided by LVS over the next three years (through 2023) and increases the tenant’s liquidity via seller financing in the amount of $1.2 billion provided by LVS(3) ✓ Expected to be accretive to AFFO per share immediately upon closing STRATEGIC RATIONALE

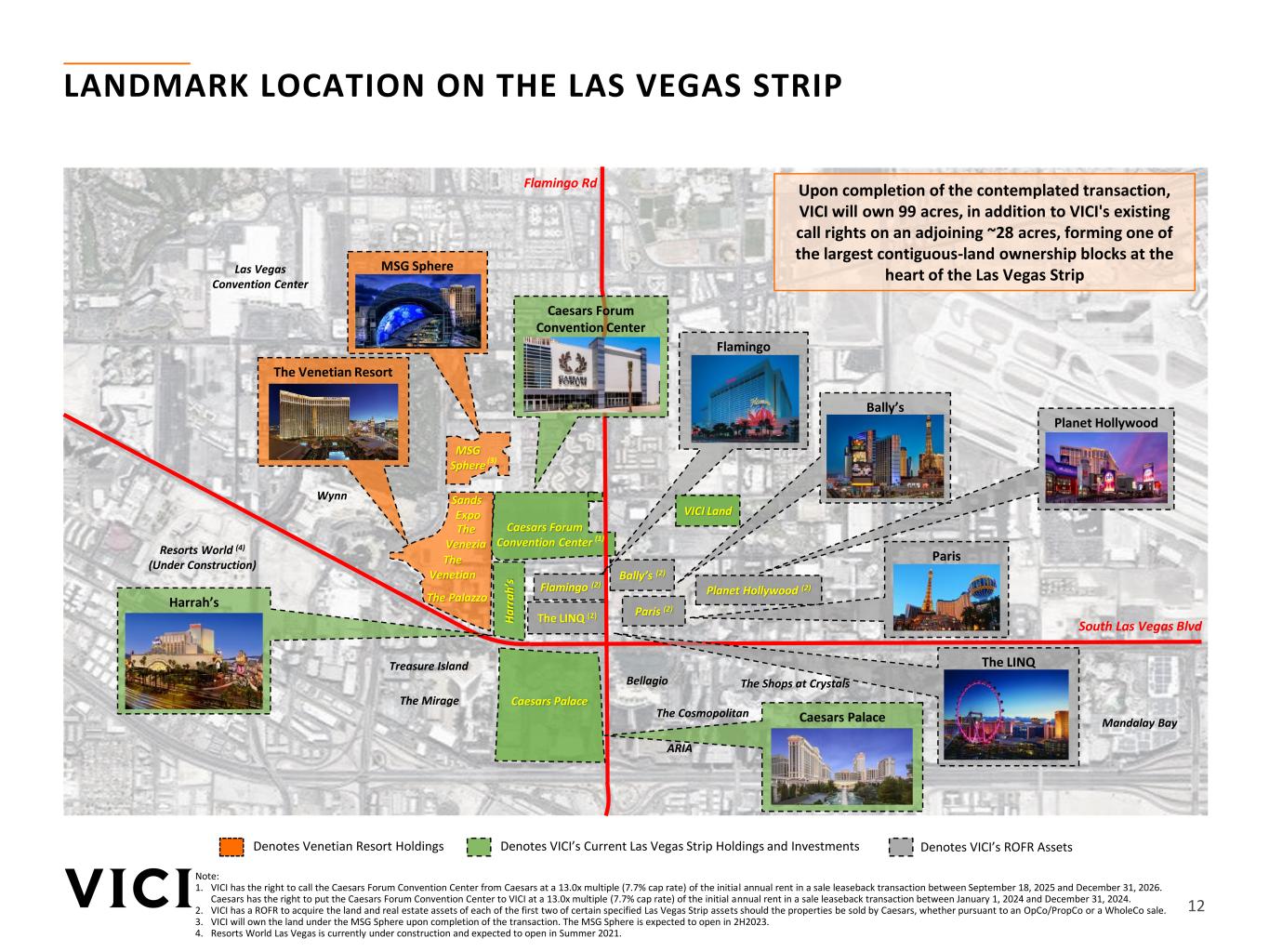

12 LANDMARK LOCATION ON THE LAS VEGAS STRIP Note: 1. VICI has the right to call the Caesars Forum Convention Center from Caesars at a 13.0x multiple (7.7% cap rate) of the initial annual rent in a sale leaseback transaction between September 18, 2025 and December 31, 2026. Caesars has the right to put the Caesars Forum Convention Center to VICI at a 13.0x multiple (7.7% cap rate) of the initial annual rent in a sale leaseback transaction between January 1, 2024 and December 31, 2024. 2. VICI has a ROFR to acquire the land and real estate assets of each of the first two of certain specified Las Vegas Strip assets should the properties be sold by Caesars, whether pursuant to an OpCo/PropCo or a WholeCo sale. 3. VICI will own the land under the MSG Sphere upon completion of the transaction. The MSG Sphere is expected to open in 2H2023. 4. Resorts World Las Vegas is currently under construction and expected to open in Summer 2021. The Venetian The Palazzo Sands Expo MSG Sphere The Venezia H a rr a h ’s Wynn The LINQ (2) Flamingo (2) Bally’s (2) Paris (2) Planet Hollywood (2) Caesars Palace Bellagio The Cosmopolitan The Shops at Crystals ARIA The Mirage Treasure Island (3) Las Vegas Convention Center Resorts World (4) (Under Construction) Mandalay Bay Upon completion of the contemplated transaction, VICI will own 99 acres, in addition to VICI's existing call rights on an adjoining ~28 acres, forming one of the largest contiguous-land ownership blocks at the heart of the Las Vegas Strip South Las Vegas Blvd Denotes Venetian Resort Holdings Denotes VICI’s Current Las Vegas Strip Holdings and Investments (1) Caesars Forum Convention Center The Venetian Resort MSG Sphere Flamingo Rd Harrah’s Caesars Forum Convention Center Flamingo Planet Hollywood Caesars Palace Bally’s The LINQ Paris VICI Land Denotes VICI’s ROFR Assets

13 STRENGTH OF LAS VEGAS SANDS GUARANTEE (1) LAS VEGAS SANDS OVERVIEW (NYSE: LVS) Baa3 / BBB- Moody’s / S&P $48Bn Equity Market Cap(2) $13.7Bn 2019 Net Revenue(3) 1988 Year Founded $2.1Bn+ Cash on Balance Sheet 2019 Pro Forma Property EBITDAR: $3.9Bn(3)(4) • Owner and operator of The Venetian Resort and the Sands Expo and Convention Center – Three hotel towers with 7,000+ suites, 225K SF of gaming space (Venetian opened in 1999, Venezia in 2003, Palazzo in 2007) – 2.3MM SF of exhibition space (opened in 1990) • Top tier operator in Las Vegas for 30+ years Las Vegas (U.S.) • Owns and operates a Cotai strip property portfolio – Total of 12,000 rooms across Macau properties, representing 49% of total Cotai inventory – Leader in entertainment with more seats, shows and venues than any other operator Sands China (Macau) • Owner and operator of the Marina Bay Sands Hotel with ~2,600 rooms • Recently entered into development agreement with Singapore government to expand with a new, 1,000 room all-suite luxury resort Marina Bay Sands (Singapore) 57% Macau 43% Singapore Note: The Venetian Resort includes both property floors; Mandalay Bay includes Delano and Four Seasons. 1. Pursuant to a Contingent Lease Support Agreement between LVS and the Apollo tenant, LVS will make certain payments to Apollo to support rent payments under the Venetian Resort Lease through 2023 (with early termination after 2022 if 2022 EBITDAR at the Venetian Resort exceeds $550MM or if a tenant change of control occurs). The Apollo tenant is required to pay rent to VICI under the lease even if LVS fails to satisfy its obligations under the Contingent Lease Support Agreement, and VICI has certain third-party beneficiary rights under the Contingent Lease Support Agreement. This is limited to coverage of rent payment and does not cover any environmental expenses, litigation claims, or any cure or enforcement costs. 2. Market data as of February 26, 2021. 3. LVS revenue and Pro Forma Property EBITDAR in 2020 were $3.6Bn and $81MM, respectively. 2020 results were significantly impacted by COVID-19. 4. Based on 2019A property EBITDAR. LVS share of reported Macau EBITDAR 70% based on LVS ownership; excludes Sands Bethlehem, PA (sold in May 2019); pro forma for the sale of the Venetian Resort.

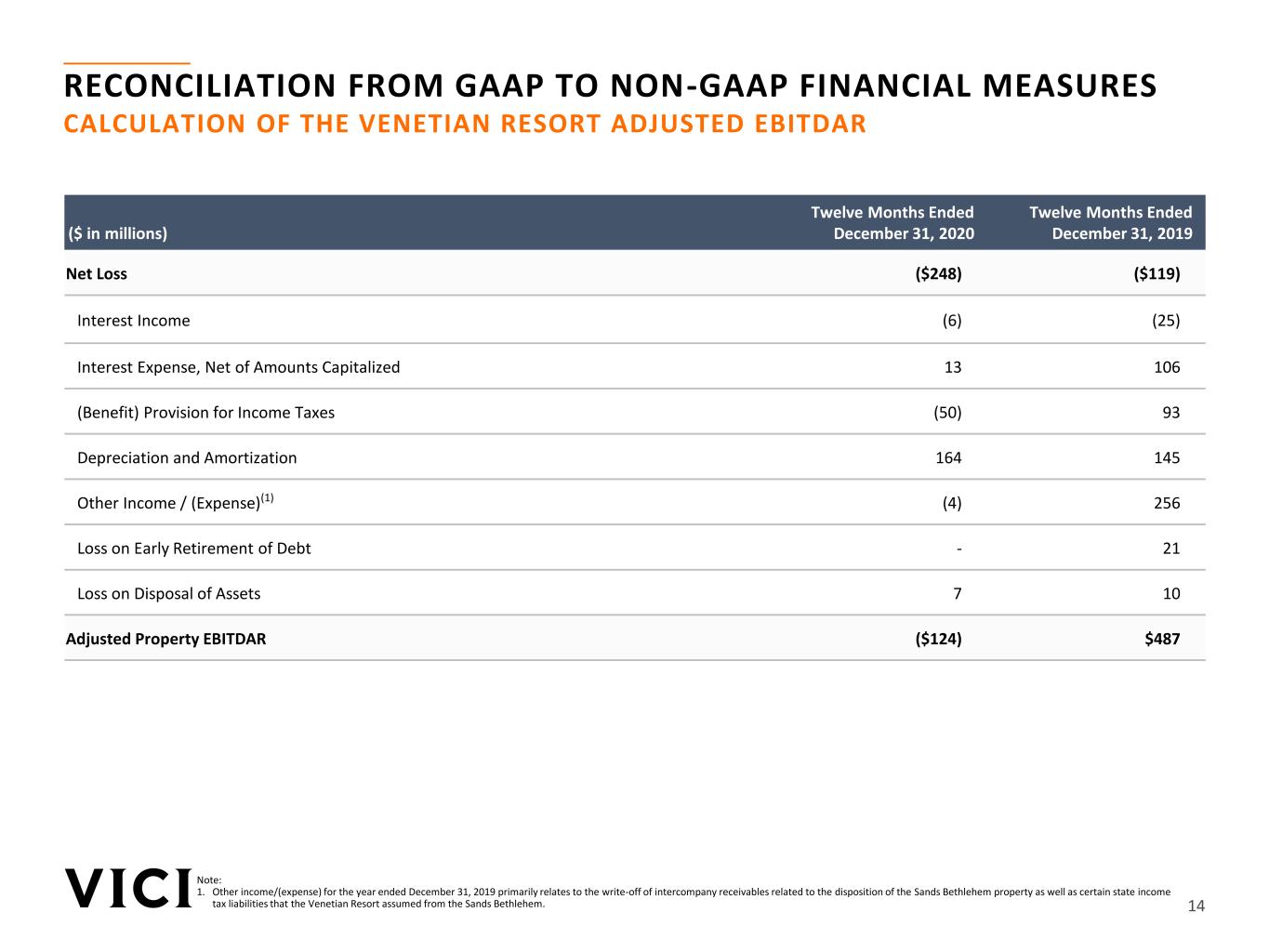

14 RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES CALCULATION OF THE VENETIAN RESORT ADJUSTED EBITDAR ($ in millions) Twelve Months Ended December 31, 2020 Twelve Months Ended December 31, 2019 Net Loss ($248) ($119) Interest Income (6) (25) Interest Expense, Net of Amounts Capitalized 13 106 (Benefit) Provision for Income Taxes (50) 93 Depreciation and Amortization 164 145 Other Income / (Expense)(1) (4) 256 Loss on Early Retirement of Debt - 21 Loss on Disposal of Assets 7 10 Adjusted Property EBITDAR ($124) $487 Note: 1. Other income/(expense) for the year ended December 31, 2019 primarily relates to the write-off of intercompany receivables related to the disposition of the Sands Bethlehem property as well as certain state income tax liabilities that the Venetian Resort assumed from the Sands Bethlehem.