Attached files

| file | filename |

|---|---|

| EX-10.20 - EX-10.20 - Zai Lab Ltd | d85279dex1020.htm |

| 10-K - FORM 10-K - Zai Lab Ltd | d85279d10k.htm |

| EX-32.2 - EX-32.2 - Zai Lab Ltd | d85279dex322.htm |

| EX-32.1 - EX-32.1 - Zai Lab Ltd | d85279dex321.htm |

| EX-31.2 - EX-31.2 - Zai Lab Ltd | d85279dex312.htm |

| EX-31.1 - EX-31.1 - Zai Lab Ltd | d85279dex311.htm |

| EX-23.1 - EX-23.1 - Zai Lab Ltd | d85279dex231.htm |

| EX-21.1 - EX-21.1 - Zai Lab Ltd | d85279dex211.htm |

| EX-10.32 - EX-10.32 - Zai Lab Ltd | d85279dex1032.htm |

| EX-10.30 - EX-10.30 - Zai Lab Ltd | d85279dex1030.htm |

| EX-10.29 - EX-10.29 - Zai Lab Ltd | d85279dex1029.htm |

| EX-10.22 - EX-10.22 - Zai Lab Ltd | d85279dex1022.htm |

| EX-10.21 - EX-10.21 - Zai Lab Ltd | d85279dex1021.htm |

| EX-10.6 - EX-10.6 - Zai Lab Ltd | d85279dex106.htm |

| EX-4.5 - EX-4.5 - Zai Lab Ltd | d85279dex45.htm |

| EX-3.1 - EX-3.1 - Zai Lab Ltd | d85279dex31.htm |

Exhibit 10.33

314 MAIN STREET

CAMBRIDGE, MASSACHUSETTS

LEASE SUMMARY SHEET

| Execution Date: | December 22, 2020 | |

| Tenant: | Zai Lab (US) LLC, a Delaware limited liability company | |

| Tenant’s Mailing Address Prior to Occupancy: | c/o Ropes & Gray LLP 1211 Avenue of the Americas New York, NY 10036 Attention: Laurie C. Nelson | |

| Landlord: | MIT 314 Main Street Leasehold LLC, a Massachusetts limited liability company | |

| Building: | A 17-story building commonly known as 314 Main Street, Cambridge, Massachusetts. The Building consists of approximately 440,506 rentable square feet1 of retail, institutional and office space. The land on which the Building is located (the “Land”) is more particularly described in Exhibit 1 attached hereto and made a part hereof (the Land, together with the Building, are hereinafter collectively referred to as the “Property”). | |

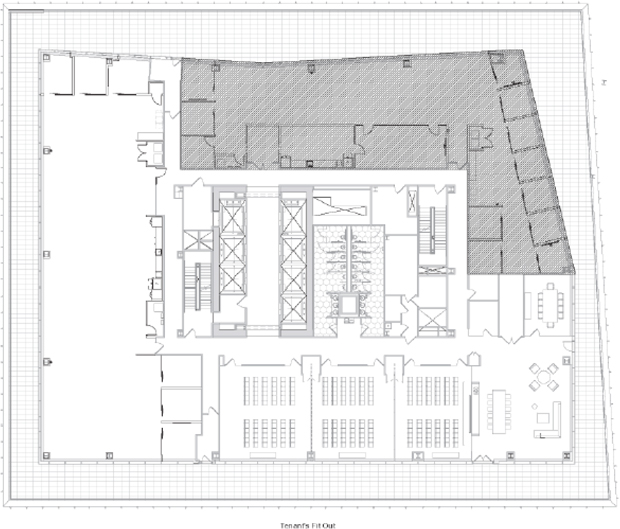

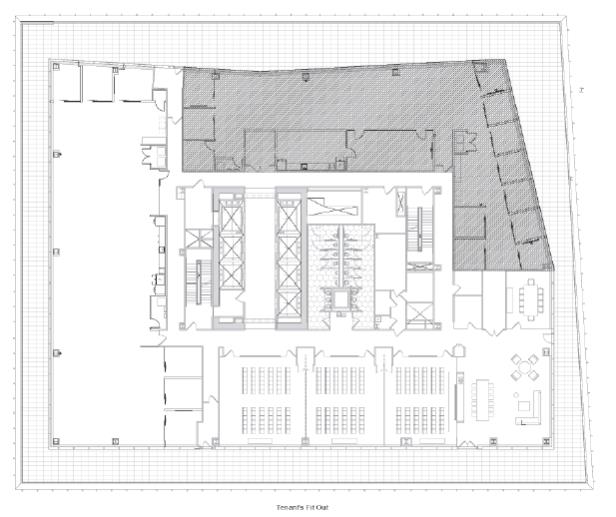

| Premises: | Approximately 6,766 rentable square feet1 of space on the fourth (4th) floor of the Building, as more particularly shown as hatched, highlighted or outlined on the plan attached hereto as Exhibit 2A and made a part hereof (the “Lease Plan”). | |

| Commencement Date: | The date on which the Premises are delivered to Tenant in the condition required by Section 3.1 of this Lease. | |

| Rent Commencement Date: | Subject to Section 2(e) of the Work Letter, the Rent Commencement Date shall occur on the Commencement Date. | |

| Expiration Date: | The last day of the seventh (7th) Rent Year.2 | |

| Extension Term: | Subject to Section 1.2 below, one (1) extension term of five (5) years. | |

| Parking Passes: | Subject to Section 1.4(c) below, 0.80 parking pass for each 1,000 rentable square feet of the Premises. | |

| 1 | Measured in accordance with the BOMA 2010 (ANSI Z65.l-2010)] standard for measuring office space |

| 2 | For the purposes of this Lease, the first “Rent Year” shall be defined as the period commencing as of the Rent Commencement Date and ending on the last day of the month in which the first (1st) anniversary of the Rent Commencement Date occurs; provided, however, if the Rent Commencement Date occurs on the first day of a calendar month, then the first Rent Year shall end on the day immediately preceding the first (1st) anniversary of the Rent Commencement Date. Thereafter, “Rent Year” shall be defined as any subsequent twelve (12) month period during the term of this Lease. |

PAGE 1

| Permitted Uses: | Subject to Legal Requirements (hereinafter defined) as of right, general office use and uses ancillary thereto in proportions consistent with the design of the Building. | |||||||

| Base Rent: | RENT YEAR |

ANNUAL BASE RENT |

MONTHLY PAYMENT |

RATE PER RSF | ||||

| 1 | $696,898.00 | $58,074.83 | $103.00 | |||||

| 2 | $717,804.94 | $59,817.08 | $106.09 | |||||

| 3 | $739,339.09 | $61,611.59 | $109.27 | |||||

| 4 | $761,519.26 | $63,459.94 | $112.55 | |||||

| 5 | $784,364.84 | $65,363.74 | $115.93 | |||||

| 6 | $807,895.78 | $67,324.65 | $119.41 | |||||

| 7 | $832,132.66 | $69,344.39 | $122.99 | |||||

| Operating Costs and Taxes: | See Sections 5.2 and 5.3. | |||||||

| Tenant’s Share: | A fraction, the numerator of which is the number of rentable square feet in the Premises and the denominator of which is the number of rentable square feet in the premises demised under the Master Lease. As of the Execution Date, Tenant’s Share is 1.85%. | |||||||

| Tenant’s Tax Share: | A fraction, the numerator of which is the number of rentable square feet in the Premises and the denominator of which is the number of rentable square feet in the buildings on the Tax Lot (hereinafter defined) recognized by the City of Cambridge as being used for purposes which are not exempt from real estate taxation as of the date on which the assessment is made for the tax year in question. As of the Execution Date, Tenant’s Tax Share is estimated to be 1.85%. | |||||||

| Letter of Credit: | Two Hundred Thirty-Two Thousand Three Hundred Dollars ($232,300) | |||||||

PAGE 2

TABLE OF CONTENTS

| 1. LEASE GRANT; TERM; APPURTENANT RIGHTS; EXCLUSIONS |

1 | |||||

| 1.1 |

Lease Grant | 1 | ||||

| 1.2 |

Extension Term | 1 | ||||

| 1.3 |

Notice of Lease | 3 | ||||

| 1.4 |

Appurtenant Rights | 3 | ||||

| 1.5 |

Tenant’s Access | 5 | ||||

| 1.6 |

Exclusions | 6 | ||||

| 2. RIGHTS RESERVED TO LANDLORD |

6 | |||||

| 2.1 |

Additions and Alterations | 6 | ||||

| 2.2 |

Additions to the Property | 6 | ||||

| 2.3 |

Landlord’s Access | 7 | ||||

| 2.4 |

Pipes, Ducts and Conduits | 7 | ||||

| 2.5 |

Minimize Interference | 7 | ||||

| 2.6 |

Name and Address of Building | 7 | ||||

| 2.7 |

Master Declaration; SOMA REA; REA; Condominium | 8 | ||||

| 2.8 |

Construction in Vicinity | 8 | ||||

| 3. CONDITION OF PREMISES; CONSTRUCTION |

9 | |||||

| 3.1 |

Condition of Premises | 9 | ||||

| 3.2 |

Tenant’s Fitout | 9 | ||||

| 4. USE OF PREMISES |

9 | |||||

| 4.1 |

Permitted Uses | 9 | ||||

| 4.2 |

Prohibited Uses | 9 | ||||

| 5. RENT; ADDITIONAL RENT |

10 | |||||

| 5.1 |

Base Rent | 10 | ||||

| 5.2 |

Operating Costs | 11 | ||||

| 5.3 |

Taxes | 14 | ||||

| 5.4 |

Late Payments | 16 | ||||

| 5.5 |

No Offset; Independent Covenants; Waiver | 16 | ||||

| 5.6 |

Survival | 17 | ||||

| 6. INTENTIONALLY OMITTED |

17 | |||||

| 7. LETTER OF CREDIT |

17 | |||||

| 7.1 |

Amount | 17 | ||||

| 7.2 |

Application of Proceeds of Letter of Credit | 17 | ||||

| 7.3 |

Transfer of Letter of Credit | 18 | ||||

| 7.4 |

Credit of Issuer of Letter of Credit | 18 | ||||

| 7.5 |

Security Deposit | 18 | ||||

| 7.6 |

Return of Security Deposit or Letter of Credit | 18 | ||||

| 8. SECURITY INTEREST IN TENANT’S PROPERTY |

19 | |||||

| 9. UTILITIES, HVAC; WASTE REMOVAL |

19 | |||||

| 9.1 |

Electricity | 19 | ||||

| 9.2 |

Water | 19 | ||||

| 9.3 |

Condenser Water | 20 | ||||

-i-

| 9.4 |

Heat, Ventilating and Air Conditioning | 20 | ||||

| 9.5 |

Other Utilities; Utility Information | 20 | ||||

| 9.6 |

Interruption or Curtailment of Utilities | 20 | ||||

| 9.7 |

Telecommunications Providers | 21 | ||||

| 9.8 |

Trash Removal; Recycling Removal; Composting Removal | 21 | ||||

| 9.9 |

Landlord’s Services | 21 | ||||

| 10. MAINTENANCE AND REPAIRS |

22 | |||||

| 10.1 |

Maintenance and Repairs by Tenant | 22 | ||||

| 10.2 |

Maintenance and Repairs by Landlord | 22 | ||||

| 10.3 |

Accidents to Sanitary and Other Systems | 22 | ||||

| 10.4 |

Floor Load—Heavy Equipment | 23 | ||||

| 11. ALTERATIONS AND IMPROVEMENTS BY TENANT |

23 | |||||

| 11.1 |

Landlord’s Consent Required | 23 | ||||

| 11.2 |

Supervised Work | 24 | ||||

| 11.3 |

Harmonious Relations | 25 | ||||

| 11.4 |

Liens | 25 | ||||

| 11.5 |

General Requirements | 25 | ||||

| 12. SIGNAGE |

26 | |||||

| 12.1 |

Restrictions | 26 | ||||

| 12.2 |

Building Directory | 26 | ||||

| 13. ASSIGNMENT, MORTGAGING AND SUBLETTING |

26 | |||||

| 13.1 |

General; Transfer Defined | 26 | ||||

| 13.2 |

Landlord’s Recapture Right | 27 | ||||

| 13.3 |

Request for Consent | 27 | ||||

| 13.4 |

Permitted Transfers | 28 | ||||

| 13.5 |

Listing Confers no Rights | 29 | ||||

| 13.6 |

Profits in Connection with Transfers | 29 | ||||

| 13.7 |

Prohibited Transfers | 29 | ||||

| 13.8 |

Restrictions on Subleases | 29 | ||||

| 13.9 |

No Release | 29 | ||||

| 13.10 |

Investment Policies | 30 | ||||

| 14. INSURANCE; INDEMNIFICATION; EXCULPATION |

30 | |||||

| 14.1 |

Tenant’s Insurance | 30 | ||||

| 14.2 |

Indemnification | 30 | ||||

| 14.3 |

Property of Tenant | 30 | ||||

| 14.4 |

Limitation of Landlord’s Liability for Damage or Injury | 31 | ||||

| 14.5 |

Waiver of Subrogation; Mutual Release | 31 | ||||

| 14.6 |

Tenant’s Acts - Effect on Insurance | 32 | ||||

| 15. CASUALTY; TAKING |

32 | |||||

| 15.1 |

Damage | 32 | ||||

| 15.2 |

Termination Rights | 33 | ||||

| 15.3 |

Taking for Temporary Use | 34 | ||||

| 15.4 |

Disposition of Awards | 34 | ||||

| 16. ESTOPPEL CERTIFICATE |

34 | |||||

| 17. HAZARDOUS MATERIALS |

34 | |||||

-ii-

| 17.1 |

Prohibition | 34 | ||||

| 17.2 |

Environmental Laws | 35 | ||||

| 17.3 |

Hazardous Material Defined | 35 | ||||

| 17.4 |

Hazardous Materials Indemnity | 35 | ||||

| 17.5 |

Non-Tenant Contamination | 35 | ||||

| 18. RULES AND REGULATIONS |

36 | |||||

| 18.1 |

Rules and Regulations | 36 | ||||

| 18.2 |

Energy Conservation | 36 | ||||

| 18.3 |

Recycling | 36 | ||||

| 19. LAWS AND PERMITS |

37 | |||||

| 19.1 |

Legal Requirements | 37 | ||||

| 19.2 |

Required Permits | 37 | ||||

| 20. DEFAULT |

37 | |||||

| 20.1 |

Events of Default | 37 | ||||

| 20.2 |

Remedies | 39 | ||||

| 20.3 |

Damages - Termination | 40 | ||||

| 20.4 |

Landlord’s Self-Help; Fees and Expenses | 41 | ||||

| 20.5 |

Waiver of Redemption, Statutory Notice and Grace Periods | 41 | ||||

| 20.6 |

Landlord’s Remedies Not Exclusive | 41 | ||||

| 20.7 |

No Waiver | 42 | ||||

| 20.8 |

Restrictions on Tenant’s Rights | 42 | ||||

| 20.9 |

Landlord Default | 42 | ||||

| 21. SURRENDER; ABANDONED PROPERTY; HOLD-OVER |

42 | |||||

| 21.1 |

Surrender | 42 | ||||

| 21.2 |

Abandoned Property | 43 | ||||

| 21.3 |

Holdover | 43 | ||||

| 22. SUBORDINATION; MORTGAGES AND MASTER LEASE |

44 | |||||

| 22.1 |

Subordination | 44 | ||||

| 22.2 |

Mortgagee Notices | 44 | ||||

| 22.3 |

Mortgagee Liability | 44 | ||||

| 22.4 |

Mortgagee Consent | 44 | ||||

| 22.5 |

Master Lease | 45 | ||||

| 23. QUIET ENJOYMENT |

45 | |||||

| 24. NOTICES |

45 | |||||

| 25. MISCELLANEOUS |

46 | |||||

| 25.1 |

Separability | 46 | ||||

| 25.2 |

Captions; Interpretation | 46 | ||||

| 25.3 |

Broker | 46 | ||||

| 25.4 |

Entire Agreement | 46 | ||||

| 25.5 |

Governing Law; Personal Jurisdiction | 47 | ||||

| 25.6 |

Tenant Representations | 47 | ||||

| 25.7 |

Expenses Incurred by Landlord Upon Tenant Requests | 47 | ||||

| 25.8 |

Survival | 47 | ||||

| 25.9 |

Limitation of Liability | 47 | ||||

| 25.10 |

Binding Effect | 48 | ||||

-iii-

| 25.11 |

Landlord Obligations upon Transfer | 48 | ||||

| 25.12 |

Grants of Interest | 48 | ||||

| 25.13 |

No Air Rights | 48 | ||||

| 25.14 |

Office of Workforce Development | 48 | ||||

| 25.15 |

Intentionally Omitted | 48 | ||||

| 25.16 |

Financial Information | 48 | ||||

| 25.17 |

Measurements | 49 | ||||

| 25.18 |

OFAC | 49 | ||||

| 25.19 |

Confidentiality | 49 | ||||

| 25.20 |

Security | 49 | ||||

| 25.21 |

Time | 50 | ||||

| 25.22 |

WAIVER OF JURY TRIAL | 50 | ||||

| 25.23 |

Bankruptcy | 50 | ||||

| 25.24 |

Not Binding Until Executed | 50 | ||||

| 25.25 |

MBTA Red Line | 50 | ||||

| 25.26 |

Force Majeure | 51 |

EXHIBIT 1 LEGAL DESCRIPTION

EXHIBIT 2A LEASE PLAN

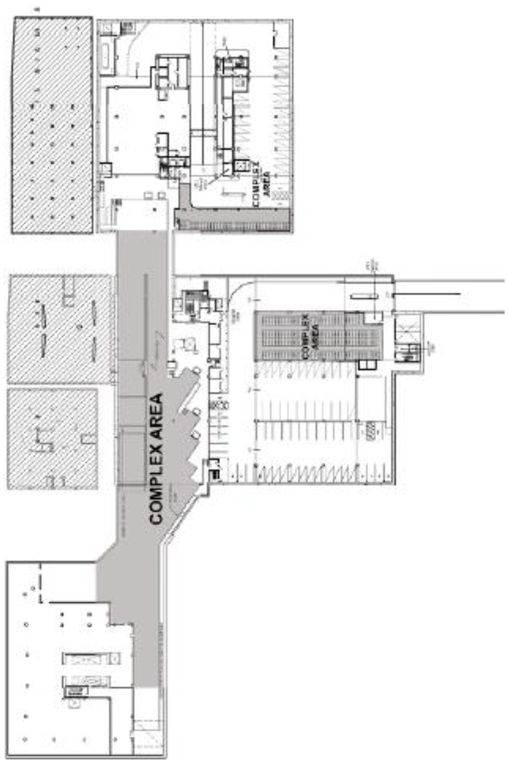

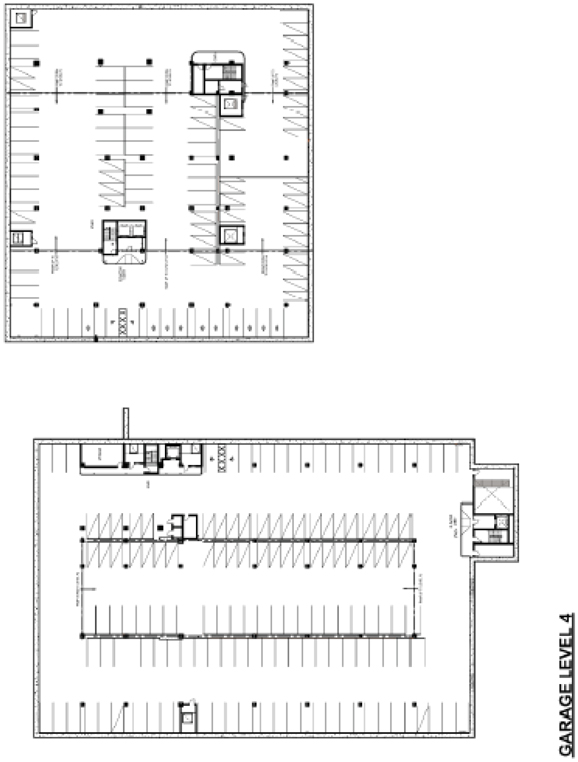

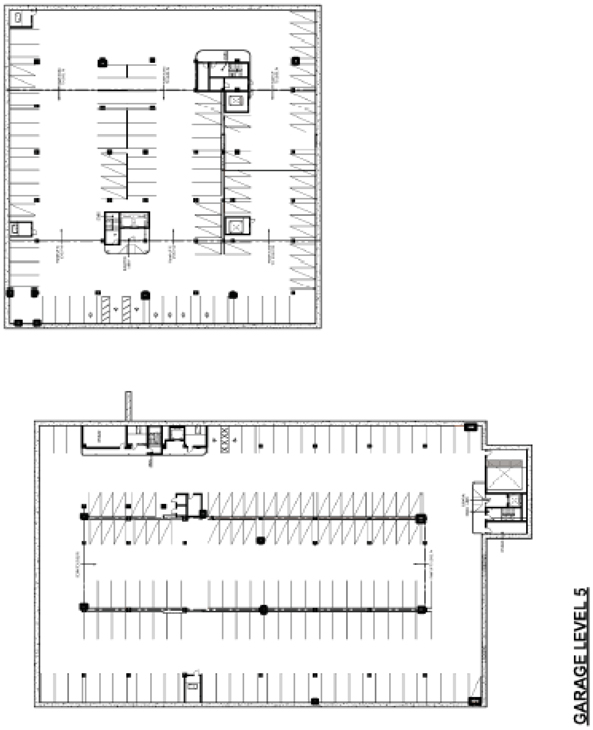

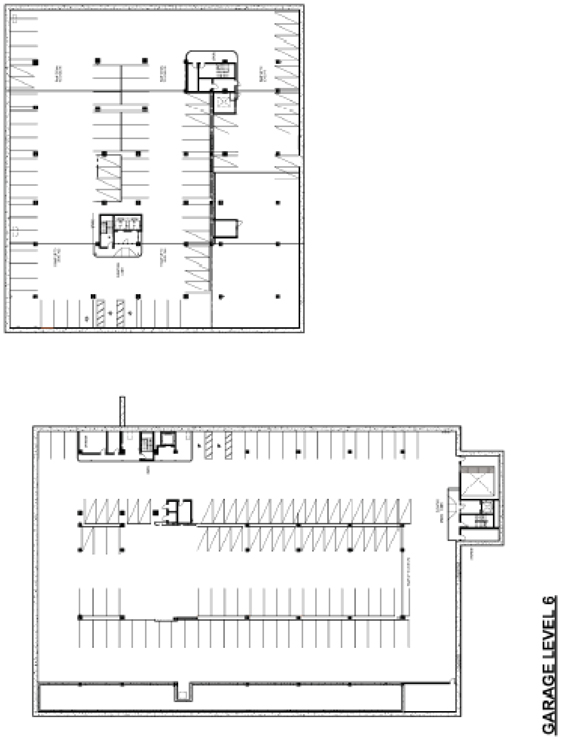

EXHIBIT 2B PLAN OF CERTAIN COMPLEX AREAS

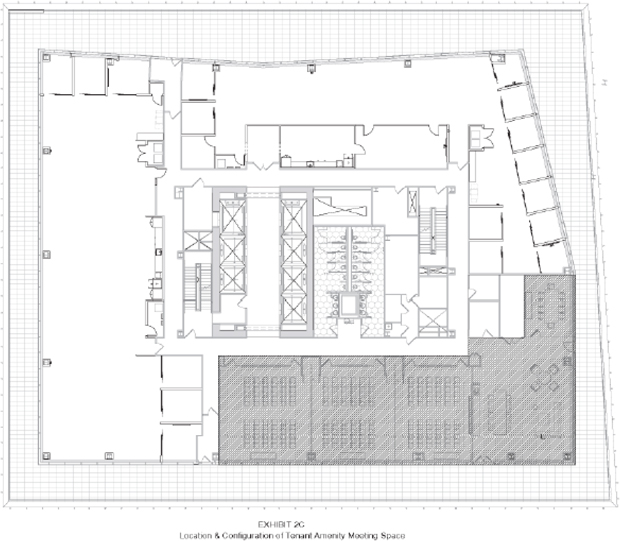

EXHIBIT 2C PLAN OF MEETING SPACE

EXHIBIT 3 MEMORIALIZATION OF DATES AGREEMENT

EXHIBIT 4 FORM OF NOTICE OF LEASE

EXHIBIT 5 WORK LETTER

EXHIBIT 6 PROHIBITED USES

EXHIBIT 7 FORM OF LETTER OF CREDIT

EXHIBIT 8 LANDLORD’S SERVICES

EXHIBIT 9 ALTERATIONS CHECKLIST

EXHIBIT 9A ALTERATIONS INSURANCE SCHEDULE

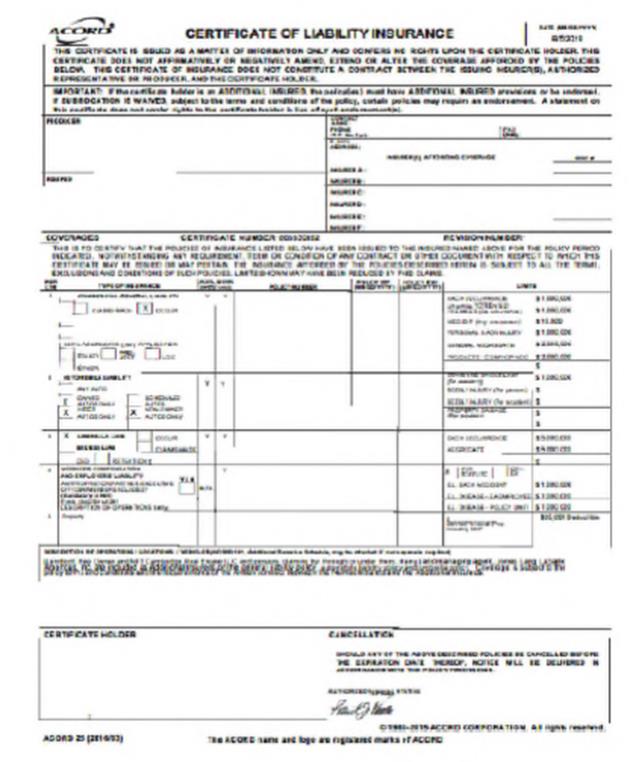

EXHIBIT 10 TENANT’S INSURANCE REQUIREMENTS

EXHIBIT 10A SAMPLE INSURANCE CERTIFICATE

EXHIBIT 11 RULES AND REGULATIONS

EXHIBIT 12 FORM OF MASTER LEASE RNDA

EXHIBIT 13 MIT COVENANT IN FAVOR OF MBTA

-iv-

THIS INDENTURE OF LEASE (this “Lease”) is hereby made and entered into on the Execution Date by and between Landlord and Tenant.

1. LEASE GRANT; TERM; APPURTENANT RIGHTS; EXCLUSIONS.

1.1 Lease Grant. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises upon and subject to matters of record as of the Execution Date and subject further to the terms and conditions of this Lease, for a term of years commencing on the Commencement Date and, unless earlier terminated or extended pursuant to the terms hereof, ending on the Expiration Date (the “Initial Term”; the Initial Term and the Extension Term, if duly exercised, are hereinafter collectively referred to as the “Term”). Once the Commencement Date and the Rent Commencement Date are determined, Landlord and Tenant shall execute an agreement confirming the Commencement Date, the Rent Commencement Date and the Expiration Date in substantially the form attached hereto as Exhibit 3. Tenant’s failure to execute and return any such agreement proposed by Landlord, or to provide written objection to the statements contained therein, within ten (10) business days after the date of Tenant’s receipt thereof, shall be deemed an approval by Tenant of Landlord’s determination of such dates as set forth therein.

1.2 Extension Term.

(a) Provided that the following conditions (the “Extension Conditions”), any or all of which may be waived by Landlord in its sole discretion, are satisfied: (i) Tenant, an Affiliate (hereinafter defined) and/or a Successor (hereinafter defined) is/are then occupying one hundred percent (100%) of the Premises; and (ii) there is no Monetary Default (hereinafter defined) nor any Event of Default (1) as of the date of the Extension Notice (hereinafter defined), nor (2) at the commencement of the Extension Term (hereinafter defined), Tenant shall have the option to extend the Initial Term for one (1) additional term of five (5) years (the “Extension Term”), commencing as of the expiration of the Initial Term. Tenant must exercise such option to extend, if at all, by giving Landlord written notice (the “Extension Notice”) no earlier than eighteen (18) months and no later than twelve (12) months prior to the expiration of the Initial Term, time being of the essence. Notwithstanding the foregoing, Landlord may nullify Tenant’s exercise of its option to extend the Term by written notice to Tenant (the “Nullification Notice”) if (A) on the date Landlord receives the Extension Notice, there is an event which, with the passage of time and/or the giving of notice, would constitute an Event of Default hereunder and (B) Tenant fails to cure such default within the applicable cure period set forth in Section 20.1 after receipt of the Nullification Notice. Upon the satisfaction of the Extension Conditions and the timely giving of the Extension Notice without a subsequent valid nullification by Landlord, the Term shall be deemed extended for the Extension Term upon all of the terms and conditions of this Lease, except that Base Rent during such Extension Term shall be calculated in accordance with this Section 1.2. Landlord shall have no obligation to construct or renovate the Premises and Tenant shall have no further right to extend the Initial Term. If Tenant fails to give a timely Extension Notice, as aforesaid, Tenant shall have no further right to extend the Initial Term. Notwithstanding the fact that Tenant’s proper and timely exercise of such option to extend the Initial Term shall be self-executing, the parties shall promptly execute a lease amendment reflecting such Extension Term after Tenant validly exercises its option. The execution of such lease amendment shall not be deemed to waive any of the conditions to Tenant’s exercise of its rights under this Section 1.2.

1

(b) The Base Rent during the Extension Term (the “Extension Term Base Rent”) shall be determined in accordance with the process described hereafter. Extension Term Base Rent shall be the greater of (i) the Base Rent for the last Rent Year of the Initial Term, increased by three percent (3%) on the first day of such Extension Term and annually thereafter, or (ii) the fair market rental value of the Premises then demised to Tenant as of the commencement of the Extension Term as determined in accordance with the process described below, for renewals of office space in the Kendall Square area of equivalent quality, size, utility and location, with the length of the Extension Term, the credit standing of Tenant and all other relevant factors to be taken into account, with fair market escalations. On or before the date which is eleven (11) months prior to the expiration of the Initial Term, Landlord shall deliver to Tenant written notice of its determination of the Extension Term Base Rent. Tenant shall, within thirty (30) days after receipt of such notice, notify Landlord in writing whether Tenant accepts or rejects Landlord’s determination of the Extension Term Base Rent (“Tenant’s Response Notice”). If Tenant fails timely to deliver Tenant’s Response Notice, Landlord’s determination of the Extension Term Base Rent shall be binding on Tenant.

(c) If and only if Tenant’s Response Notice is timely delivered to Landlord and indicates both that Tenant rejects Landlord’s determination of the Extension Term Base Rent and desires to submit the matter to the determination process described in this Section 1.2(c) (the “Determination Process”), then the Extension Term Base Rent shall be determined in accordance with the procedure set forth in this Section 1.2(c). In such event, within ten (10) days after receipt by Landlord of Tenant’s Response Notice indicating Tenant’s desire to submit the determination of the Extension Term Base Rent to the Determination Process, Tenant and Landlord shall each notify the other, in writing, of their respective selections of an appraiser (respectively, “Landlord’s Appraiser” and “Tenant’s Appraiser”). If Landlord’s Appraiser and Tenant’s Appraiser are unable to agree within thirty (30) days on the Extension Term Base Rent, Landlord’s Appraiser and Tenant’s Appraiser shall then jointly select a third appraiser (the “Third Appraiser”) within ten (10) days after the end of such 30-day period. All of the appraisers selected shall be individuals with at least ten (10) consecutive years’ commercial appraisal experience in the area in which the Premises are located, shall be members of the Appraisal Institute (M.A.I.), and, in the case of the Third Appraiser, shall not have acted in any capacity for either Landlord or Tenant within five (5) years of his or her selection. The three appraisers shall determine the Extension Term Base Rent in accordance with the requirements and criteria set forth in Section 1.2(b) above, employing the method commonly known as Baseball Arbitration, whereby Landlord’s Appraiser and Tenant’s Appraiser each sets forth its determination of the Extension Term Base Rent as defined above, and the Third Appraiser must select one or the other (it being understood that the Third Appraiser shall be expressly prohibited from selecting a compromise figure). Landlord’s Appraiser and Tenant’s Appraiser shall deliver their determinations of the Extension Term Base Rent to the Third Appraiser within five (5) days of the appointment of the Third Appraiser and the Third Appraiser shall render his or her decision within ten (10) days after receipt of both of the other two determinations of the Extension Term Base Rent. The Third Appraiser’s decision shall be binding on both Landlord and Tenant. Each party shall bear the cost of its own appraiser, and the cost of the Third Appraiser shall be paid by the party whose determination is not selected.

2

1.3 Notice of Lease. Neither party shall record this Lease, but, after the Rent Commencement Date, each of the parties hereto agrees to join in the execution of a statutory notice of lease in substantially the form attached hereto as Exhibit 4, which notice of lease may be recorded by Tenant with the Middlesex South Registry of Deeds and/or filed with the Registry District of the Land Court, as appropriate (collectively, the “Registry”) at Tenant’s sole cost and expense. If a notice of lease was previously recorded with the Registry, upon the expiration or earlier termination of this Lease, Landlord shall deliver to Tenant a notice of termination of lease and Tenant shall promptly execute, acknowledge and deliver the same (together with any other instrument(s) that may be necessary in order to record and/or file the same with the Registry) to Landlord for Landlord’s execution and recordation with the Registry, which obligation shall survive the expiration or earlier termination of the Lease. If Tenant fails to deliver the executed notice of termination of lease within ten (10) days of receipt thereof, time being of the essence, Tenant hereby appoints Landlord as Tenant’s attorney-in-fact to execute the same, such appointment being coupled with an interest.

1.4 Appurtenant Rights.

(a) Common Areas. Subject to the terms of this Lease and the Rules and Regulations (hereinafter defined)., Tenant shall have, as appurtenant to the Premises, rights to use in common with others entitled thereto, the areas designated from time to time for the common use of Tenant and other tenants of the Property (such areas are hereinafter referred to as the “Common Areas”). The Common Areas include: (i) the common lobby(ies), hallways, elevators and stairways of the Building serving the Premises, (ii) the loading dock serving the Building (it being understood and agreed that Tenant shall not have exclusive use of any portion thereof); (iii) common walkways necessary for access to the Building, (iv) if the Premises include less than the entire rentable area of any floor, the common restrooms and other common facilities of such floor; (v) bicycle storage areas, and (vi) other areas designated by Landlord from time to time for the common use of Tenant and other tenants of the Building; and no other appurtenant rights or easements.

(b) Complex Areas. Subject to the terms of this Lease and reasonable rules and regulations promulgated with respect thereto (including rules regarding scheduling of access to the loading facilities serving the Building), Tenant shall have, as appurtenant to the Premises, rights to use in common with others entitled thereto, the areas designated from time to time pursuant to the SOMA REA and/or any REA (as such terms are hereinafter defined) for the common use of tenants of the Property, including the Parking Areas, roadways, driveways and other areas serving and/or providing access to/from the Building’s loading dock(s), open space and indoor and outdoor bicycle storage with access to bicycle repair equipment (such areas are hereinafter referred to as the “Complex Areas”). As of the Execution Date, it is contemplated that the areas shown on the plan attached hereto as Exhibit 2B and made a part hereof, inter alia, shall be designated as Complex Areas.

3

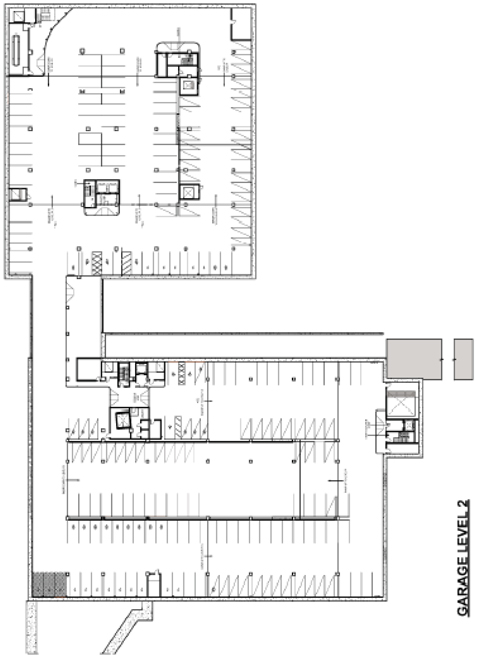

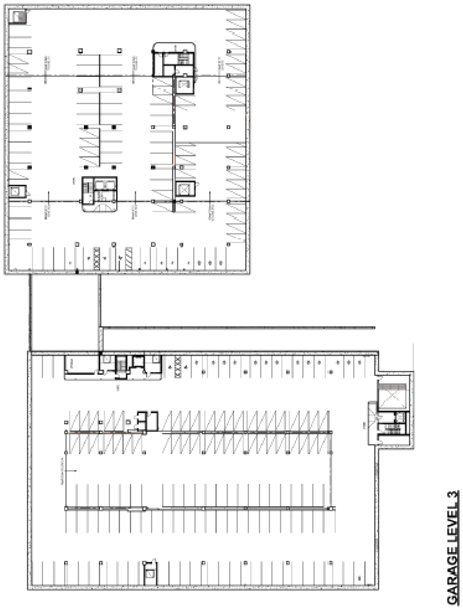

(c) Parking. During the Term, commencing on the Commencement Date, Landlord shall, subject to the terms hereof, make available to Tenant monthly parking passes for the shared subsurface parking garage serving the Building (the “Parking Areas”), based upon a ratio of 0.80 parking pass for each 1,000 rentable square feet of the Premises, for the parking of passenger vehicles in unreserved stalls in the Parking Areas by Tenant’s employees and the employees of any transferee pursuant to a Transfer permitted by Article 13 of this Lease (“Permitted Pass Holders”). Tenant shall receive one (1) parking pass, or other suitable device providing access to the Parking Areas, for each parking privilege paid for by Tenant. The number of parking passes provided to Tenant, as modified pursuant to this Lease or as otherwise permitted by Landlord, are hereinafter referred to as the “Parking Passes.” Tenant shall have no right to hypothecate or encumber the Parking Passes, and shall not sublet, assign, or otherwise transfer the Parking Passes except in connection with a Transfer permitted by Article 13 of this Lease. During the Term, commencing on the Commencement Date, Tenant shall pay Landlord (or at Landlord’s election, directly to the parking operator3) for all of the Parking Passes at the then-current prevailing rate, as such rate may vary from time to time. As of the Execution date, the monthly charge for parking is $400 per Parking Pass per month. Landlord shall deliver (or cause to be delivered) written notice to Tenant of any change in the monthly parking charge. If, for any reason, Tenant shall fail timely to pay the charge for any of said Parking Passes two (2) or more times, upon the second (2nd) (or any subsequent) occurrence of such default continuing for ten (10) days after written notice thereof, Landlord shall have the right to revoke Tenant’s right to the Parking Passes for which Tenant failed to pay the charge under this Section 1.4(b) and Landlord may allocate such Parking Passes for use by others free and clear of Tenant’s rights under this Section 1.4(b). Use of the Parking Areas and the Parking Passes will be subject to such reasonable rules and regulations as may be in effect from time to time (including Landlord’s right, without additional charge to Tenant above the prevailing rate for Parking Passes, to institute a valet or attendant-managed parking system). Tenant shall provide Landlord and/or the operator of the Parking Areas with such information as may be reasonably requested, including a monthly identification roster listing, for each Parking Pass, the name of the employee and the make, color and registration number of the vehicle to which it has been assigned. Except to the extent prohibited by Legal Requirements, neither Landlord nor the operator of the Parking Areas assumes any responsibility whatsoever for loss or damage due to casualty or theft or otherwise to any automobile or to any personal property therein, howsoever caused, and Tenant agrees to notify each Permitted Pass Holder of such limitation of liability. No bailment is intended or shall be created by the provision of, or use of, the parking privileges described herein. Reserved and handicap parking spaces must be honored. Notwithstanding anything to the contrary contained herein, Landlord shall have the right to relocate the parking privileges from time to time to other property owned, leased or controlled by Landlord or its affiliates, so long as such other property is within 1,000 feet of the Land. If Landlord exercises such relocation right, Landlord shall not relocate more than Tenant’s Share of the total number of parking spaces relocated.

| 3 | E.g., in the event that Landlord has leased or subleased the parking garage/areas to a third party. |

4

(d) Meeting Space. Subject to the terms of this Lease and reasonable rules and regulations (including rules and regulations pertaining to security and decorum), Tenant shall have, as appurtenant to the Premises, the right to use in common with others entitled thereto, portions of the fourth (4th) floor of the Building designated by Landlord from time to time (“Meeting Space”) for meetings and events held and hosted by Tenant (“Events”). The current configuration of the Meeting Space is shown on the plan attached hereto as Exhibit 2C and incorporated herein. The Meeting Space shall be available on a first-come, first-served basis. Promptly after the end of each Event, Tenant shall remove from the Meeting Space all decorations and other personal property used in connection with the Event (any personal property not timely removed therefrom shall be deemed abandoned). Subject to Section 14.5 of the Lease, Tenant shall, at Tenant’s sole cost and expense, be responsible for any damage to the Building or personal property within the Building caused as a result of any Event (including any injury, breakage and damage caused by the acts or negligent omissions of Tenant or any of its employees, agents, contractors or invitees) and shall restore the Meeting Space to its condition immediately prior to such damage. Events shall be conducted by Tenant (i) at Tenant’s sole cost and expense, (ii) in compliance with all legal and regulatory requirements applicable thereto, and (iii) lien-free. Tenant covenants and agrees to (A) not use the Meeting Space for any unlawful purpose or in any manner that will constitute waste, nuisance or unreasonable annoyance or unreasonably interfere with access to and from other areas on the fourth floor, (B) maintain order and decorum in and around all portions of the Meeting Space in association with such Events, and (C) not disturb occupants of the Building as a result of any Event. Without limiting the generality of the foregoing, in connection with any Event in which Tenant is serving or permitting the serving of alcoholic beverages, Tenant shall strictly comply with all applicable laws, rules, regulations, ordinances and other requirements of governmental authorities relating to the serving of alcoholic beverages, including refusing to serve alcoholic beverages to people below the legal drinking age. Without limiting any other provision of this Lease, to the maximum extent permitted by Legal Requirements, Tenant shall indemnify the Landlord Parties for any Claims arising from the use of the Meeting Space by any of the Tenant Parties, including Claims related to the provision of food and/or alcohol. Tenant shall cause each vendor and/or contractor engaged in connection with an Event to carry (1) commercial general liability insurance in the amount of One Million and 00/100 Dollars ($1,000,000.00) per occurrence and Two Million and 00/100 Dollars ($2,000,000.00) aggregate (and from time to time in such higher amounts as may be reasonably required by Landlord based on requirements of prudent owners of similar properties in East Cambridge), unless lesser limits are approved by Landlord in advance, on a primary and non-contributory basis, naming the Landlord Parties as additional insureds, (2) worker’s compensation insurance with statutory limits and (3) liquor liability coverage, if alcohol will be provided, in the amount of Five Million and 00/100 Dollars ($5,000,000.00) (and from time to time in such higher amounts as may be reasonably required by Landlord based on requirements of prudent owners of similar properties in East Cambridge), unless lesser limits are approved by Landlord in advance, on a primary and non-contributory basis, naming the Landlord Parties as additional insureds. Prior to each Event, Tenant shall provide Landlord with evidence reasonably acceptable to Landlord of such general liability, worker’s compensation and, if alcoholic beverages are to be served, liquor liability insurance.

1.5 Tenant’s Access.

(a) From and after the Commencement Date and until the end of the Term, Tenant shall have access to the Premises (and Permitted Pass Holders shall have access to the parking areas) twenty-four (24) hours a day, seven (7) days a week, three hundred sixty-five (365) days per year, subject to Legal Requirements, the Rules and Regulations, the terms of this Lease and Force Majeure (hereinafter defined).

(b) Subject to Article 11 below. Tenant shall have the right to access the Premises, at Tenant’s sole risk, at times reasonably approved by Landlord prior to the Commencement Date for purposes reasonably related to the installation of Tenant’s wiring and cabling, provided such access does not materially interfere with the preparation for or performance of Tenant’s Fitout (hereinafter defined). Tenant shall, prior to the first entry to the Premises pursuant to this Section 1.5(b), provide Landlord with certificates of insurance evidencing that the insurance required in Article 14 hereof is in full force and effect and covering any person or entity entering the Building. To the maximum extent permitted by Legal Requirements, Tenant shall defend, indemnify and hold the Landlord Parties (hereinafter defined) harmless from and against any and all Claims (hereinafter defined) for injury to persons or property resulting from or relating to Tenant’s access to and use of the Premises prior to the Commencement Date as provided under this Section 1.5(b). Tenant shall coordinate any access to the Premises prior to the Commencement Date with Landlord’s property manager.

5

1.6 Exclusions. The following are expressly excluded from the Premises and reserved to Landlord: all the perimeter walls of the Premises (except the inner surfaces thereof), the Common Areas, and any space in or adjacent to the Premises used for shafts, stacks, pipes, conduits, wires and appurtenant fixtures, fan rooms, ducts, electric or other utilities, sinks or other Building facilities, and the use of all of the foregoing, except as expressly permitted pursuant to Section 1.4(a) above.

2. RIGHTS RESERVED TO LANDLORD.

2.1 Additions and Alterations. Landlord reserves the right, at any time and from time to time, to make such changes, alterations, additions, improvements, repairs or replacements in or to the Property (including the Premises but, with respect to the Premises, only for purposes of repairs, maintenance, replacements and the exercise of any other rights expressly reserved to Landlord herein) and the fixtures and equipment therein, as well as in or to the street entrances and/or the Common Areas, as it may deem necessary or desirable (“Changes”), provided, however, that there be no material obstruction of permanent access to, or material interference with the use and enjoyment of, the Premises by Tenant. Subject to the foregoing, Landlord expressly reserves the right to temporarily close all, or any portion, of the Common Areas for the purpose of making repairs or changes thereto.

2.2 Additions to the Property. Landlord may at any time and from time to time (i) construct additional improvements and related site improvements (collectively, “Future Development”) in all or any part of the Property, (ii) change the location or arrangement of (A) any improvement outside the Building in or on the Property and/or (B) all or any part of the Common Areas, and/or (iii) add or deduct any land to or from the Property; provided that there shall be no material increase in Tenant’s obligations under this Lease in connection with the exercise of the foregoing reserved rights.

6

2.3 Landlord’s Access. Subject to the terms hereof, Tenant shall (a) upon at least forty-eight (48) hours’ advance notice, which may be oral (except that no notice shall be required in emergency situations), permit Landlord, Fee Owner (hereinafter defined) and any holder of a Mortgage (hereinafter defined) (each such holder, a “Mortgagee”), and their respective agents, representatives, employees and contractors, to have reasonable access to the Premises at all reasonable hours for the purposes of inspection, making repairs, replacements or improvements in or to the Premises or the Building or equipment therein (including sanitary, electrical, heating, air conditioning or other systems), complying with the Development Documents (hereinafter defined) and all applicable laws, ordinances, rules, regulations, statutes, by-laws, court decisions and orders and requirements of all public authorities (collectively, “Legal Requirements”), or exercising any right reserved to Landlord under this Lease (including the right to take upon or through, or to keep and store within the Premises all necessary materials, tools and equipment); (b) permit Landlord and its agents and employees, at reasonable times, upon reasonable advance notice, to show the Premises during normal business hours (i.e. Monday—Friday 8:00 A.M.—6:00 P.M. and Saturday 9:00 A.M.—1:00 P.M., excluding holidays) to any prospective Mortgagee, capital partner or purchaser of the Building and/or the Property or any portion thereof or of the interest of Landlord therein, and, during the last twelve (12) months of the Term, or at any time after the occurrence of an Event of Default, prospective tenants; (c) upon reasonable prior written notice from Landlord, permit Landlord, Fee Owner and their respective agents and contractors, at Landlord’s sole cost and expense, to perform environmental audits, environmental site investigations and environmental site assessments (“Site Assessments”) in, on, under and at the Premises and the Land, it being understood that Landlord shall repair any damage arising as a result of the Site Assessments, and such Site Assessments may include both above and below the ground testing and such other tests as may be necessary or appropriate to conduct the Site Assessments; and (d) in case any excavation shall be made for building or improvements or for any other purpose upon the land adjacent to or near the Premises, afford without charge to Landlord, or the persons or entities causing or making such excavation, license to enter upon the Premises for the purpose of doing such work as Landlord or such persons or entities shall deem to be necessary to preserve the walls or structures of the Building from injury, and to protect the Building by proper securing of foundations. In addition, to the extent that it is necessary to enter the Premises in order to access any area that serves any portion of the Building outside the Premises, then Tenant shall, upon as much advance notice as is practical under the circumstances, and in any event at least twenty-four (24) hours’ prior written notice (except that no notice shall be required in emergency situations), permit contractors engaged by other occupants of the Building to pass through the Premises in order to access such areas but only if accompanied by a representative of Landlord. The parties agree and acknowledge that, despite reasonable and customary precautions (which Landlord agrees it shall exercise), any property or equipment in the Premises of a delicate, fragile or vulnerable nature may nevertheless be damaged in the course of performing Landlord’s obligations. Accordingly, Tenant shall take reasonable protective precautions with unusually fragile, vulnerable or sensitive property and equipment.

2.4 Pipes, Ducts and Conduits. Tenant shall permit Landlord to erect, use, maintain and relocate pipes, ducts and conduits in and through the Premises, provided the same do not materially reduce the floor area or materially adversely affect the appearance thereof.

2.5 Minimize Interference. Except in the event of an emergency, Landlord shall use commercially reasonable efforts, consistent with accepted construction practice when applicable, to minimize any materially adverse interference with Tenant’s use and occupancy of the Premises as a result of the exercise of Landlord’s rights under Sections 2.1-2.4 above. Except in the event of an emergency, the exercise of Landlord’s rights under Sections 2.1-2.14 above shall not prevent access to the Premises. Tenant agrees to cooperate with Landlord as reasonably necessary in connection with the exercise of Landlord’s rights under this Article 2. Subject to Landlord’s obligations under this Section 2.5. Tenant further agrees that dust, noise, vibration, temporary closures of Common Areas, or other inconvenience or annoyance resulting from the exercise of Landlord’s rights under this Article 2 shall not be deemed to be a breach of Landlord’s obligations under the Lease.

2.6 Name and Address of Building. Landlord reserves the right at any time and from time to time to change the name or address of the Building and/or the Property or any portion thereof, provided Landlord gives Tenant at least three (3) months’ prior written notice thereof.

7

2.7 Master Declaration; SOMA REA; REA; Condominium.

(a) The Building is part of the mixed use development (the “Development”) in the City of Cambridge, which is being developed pursuant to the Special Permit and other applicable documents (collectively, as the same may each be amended from time to time, the “Development Documents”) which collectively govern the development, construction, use and operation of, and certain rights benefitting and restrictions burdening, the Building and the Development. The Development Documents include (i) that certain Planning Board Special Permit issued by the City of Cambridge Planning Board on June 23, 2016 and recorded in the Registry in Book 68192, page 334, as amended by Amendment No. 1 (Minor) to special Permit issued by the City of Cambridge Planning Board on March 21, 2017 (as the same may be further amended, the “Special Permit”), (ii) that certain Agreement of Covenants, Easements and Restrictions (Kendall Square Initiative) dated as of April 30, 2019 and recorded with the Registry in Book 72551, Page 270 (as the same may be amended, the “Master Declaration”), and (iii) that certain Declaration of Cross-Easements, Restrictions and Operating Agreement dated as of February 20, 2020 and recorded with the Registry in Book 74235, Page 1 (as the same may be amended, the “SOMA REA”).

(b) Landlord and Tenant each hereby acknowledges and agrees that (i) Landlord shall have the right to enter into, and subject the Property to the terms and conditions of, one or more additional reciprocal easement agreements, declarations of covenants and/or cross-easement agreements with any one or more of the neighboring or nearby property owners (including any owner of any portion of the Property that may be divided from the whole) (each, a “REA”); (ii) this Lease shall be subject and subordinate to any REA, provided that such REA shall not materially impair Tenant’s use or occupancy of the Premises or access thereto, and provided, further, that if any REA contains lien rights in favor of such neighboring or nearby property owners, Landlord shall obtain for Tenant’s benefit a commercially reasonable subordination, non-disturbance and attornment agreement from all such neighboring property owners (“SNDA”); (iii) Landlord shall have the right to subdivide the Property so long as Tenant’s use or occupancy of the Premises is not materially impaired; (iv) Landlord shall have the right to subject the Land and the improvements located now or in the future located thereon to a commercial condominium regime (“Condominium”) on terms and conditions consistent with first-class office and retail buildings; (v) this Lease shall be subject and subordinate to the Master Deed and other documents evidencing the Condominium (collectively, the “Condo Documents”) provided that Tenant’s access to the Premises and Tenant’s use or occupancy of the Premises are not materially impaired; and provided, further, that such subordination shall be conditioned upon execution of a SNDA; and (vi) Tenant shall execute such reasonable documents (which may be in recordable form) evidencing the foregoing within ten (10) business days after Landlord’s request. Tenant shall provide to Landlord, at no cost to Landlord, any other instrument(s) that may be necessary in order to record and/or file the same with the Registry.

2.8 Construction in Vicinity. Tenant acknowledges that (a) Landlord and/or its affiliates (“Neighboring Owners”) own several properties in the vicinity of the Building, (b) during the Term, the Neighboring Owners may undertake various construction projects, which may include the construction of new and/or additional buildings (each, a “Project,” and collectively, the “Projects”), and (c) customary construction impacts (taking into account the urban nature of the Property, the proximity of the Building to the Project site and other relevant factors) may result therefrom. Landlord shall use commercially reasonable efforts to minimize (and cause its affiliates to minimize) materially adverse construction impacts in accordance with the mitigation plan described below. Prior to commencing any Project, Landlord shall deliver to Tenant a construction mitigation plan that shall detail such commercially reasonable mitigation measures. Subject to Landlord’s compliance with this paragraph, and notwithstanding any other provision of this Lease, in no event shall Landlord be liable to Tenant for any compensation or reduction of rent or any other damages arising from the Projects and Tenant shall not have the right to terminate the Lease due to the construction of the Projects, nor shall the same give rise to a claim in Tenant’s favor that such construction constitutes actual or constructive, total or partial, eviction from the Premises. Notwithstanding any provision in this Lease to the contrary, in no event shall Tenant seek injunctive or any similar relief to stop, delay or modify any Project.

8

3. CONDITION OF PREMISES; CONSTRUCTION.

3.1 Condition of Premises. Subject to Landlord’s obligation to perform Tenant’s Fitout in accordance with the terms of the Work Letter attached hereto as Exhibit 5, Tenant acknowledges and agrees that Tenant is leasing the Premises in their “AS IS,” “WHERE IS” condition and with all faults on the Commencement Date, without representations or warranties, express or implied, in fact or by law, of any kind, and without recourse to Landlord.

3.2 Tenant’s Fitout. Tenant’s Fitout shall be performed by Landlord in accordance with the Work Letter attached hereto as Exhibit 5.

4. USE OF PREMISES

4.1 Permitted Uses. During the Term, Tenant shall use the Premises only for the Permitted Uses and for no other purposes. Service and utility areas (whether or not a part of the Premises) shall be used only for the particular purpose for which they are designed. All corridor doors, when not in use, shall be kept closed. Tenant shall keep the Premises equipped with appropriate safety appliances to the extent required by Legal Requirements or insurance requirements.

4.2 Prohibited Uses.

(a) Notwithstanding any other provision of this Lease, Tenant shall not use the Premises or the Building, or any part thereof, or suffer or permit the use and/or occupancy of the Premises or the Building or any part thereof by Tenant and/or Tenant’s agents, servants, employees, consultants, contractors, subcontractors, licensees and or subtenants (collectively with Tenant, the “Tenant Parties”) (i) in a manner which would violate any of the covenants, agreements, terms, provisions and conditions of this Lease or otherwise applicable to or binding upon the Premises; (ii) for any unlawful purposes or in any unlawful manner; (iii) in a manner which, in the reasonable judgment of Landlord (taking into account the use of the Building as a combination institutional, office and retail building and the Permitted Uses) shall (a) impair the appearance or reputation of the Building; (b) impair, interfere with or otherwise diminish the quality of any of the Building services or the proper and economic heating, cleaning, ventilating, air conditioning or other servicing of the Building or Premises, or the use of any of the Common Areas; (c) occasion discomfort, inconvenience or annoyance in any material respect (and Tenant shall not install or use any electrical or other equipment of any kind which, in the reasonable judgment of Landlord, will cause any such impairment, interference, discomfort, inconvenience, annoyance or injury), or cause any injury or damage to any occupants of the Premises or other tenants or occupants of the Building or their property; or (d) cause harmful air emissions or any unusual or other objectionable odors, noises or emissions to emanate from the Premises; (iv) in a manner which is inconsistent with the operation and/or maintenance of the Building as a first-class combination institutional, office and retail facility; (v) for any fermentation processes whatsoever; (vi) in a manner which shall increase such insurance rates on the Building or on property located therein over that applicable when Tenant first took occupancy of the Premises hereunder; (vii) for any use listed in Exhibit 6 attached hereto and made a part hereof; or (viii) in violation of any exclusive use granted to any tenant.

9

(b) With respect to the use and occupancy of the Premises and the Common Areas, Tenant will not: (i) place or maintain any garbage, trash, rubbish or other refuse (collectively, “Trash”), signage (except as may be permitted by Article 12 below) or other articles in any vestibule or entry of the Premises, on the footwalks or corridors adjacent thereto or elsewhere on the exterior of the Premises, nor obstruct any driveway, corridor, footwalk, parking area, mall or any other Common Areas; (ii) permit undue accumulations of or burn Trash within or without the Premises; (iii) permit the parking of vehicles so as to interfere with the use of any driveway, corridor, footwalk, parking area, or other Common Areas; (iv) receive or ship articles of any kind outside of those areas reasonably designated by Landlord; (v) conduct or permit to be conducted any auction, going out of business sale, bankruptcy sale (unless directed by court order), or other similar type sale in or connected with the Premises; (vi) use the name of Landlord, Fee Owner, or any of Landlord’s affiliates or subsidiaries in any publicity, promotion, trailer, press release, advertising, printed, or display materials without Landlord’s prior written consent (which may be withheld in Landlord’s sole discretion); (vii) permit or keep any animals other than trained certified service animals in the Building; or (viii) except in connection with Tenant’s Fitout and/or Alterations (hereinafter defined) approved by Landlord, cause or permit any hole to be drilled or made in any part of the Building.

5. RENT; ADDITIONAL RENT

5.1 Base Rent. During the Term, commencing on the Rent Commencement Date, Tenant shall pay to Landlord Base Rent in equal monthly installments, in advance and without demand on the first day of each month for and with respect to such month (except that, if the Rent Commencement Date is any day other than the first day of a calendar month, Base Rent due for the period between the Rent Commencement Date and the last day of the calendar month in which the Rent Commencement Date occurs shall be due on the Rent Commencement Date). Unless otherwise expressly provided herein, the payment of Base Rent and additional rent and other charges reserved and covenanted to be paid under this Lease with respect to the Premises (collectively, “Rent”) shall commence on the Rent Commencement Date, and shall be prorated for any partial months. Rent shall be payable to Landlord or, if Landlord shall so direct in writing, to Landlord’s agent or nominee, in lawful money of the United States which shall be legal tender for payment of all debts and dues, public and private, at the time of payment. In no event shall Tenant pay any installment of Base Rent more than one (1) month in advance.

10

5.2 Operating Costs.

(a) “Operating Costs” shall mean all costs incurred and expenditures of whatever nature made by Landlord in the operation, management, repair, replacement, maintenance and insurance (including environmental liability insurance and property insurance on Landlord-supplied leasehold improvements for tenants, but not property insurance on tenants’ equipment) of the Property or allocated to the Property, including: all costs of labor (wages, salaries, fringe benefits, etc.) up to and including the group or portfolio manager, however denominated; any costs for utilities supplied to exterior areas and the Common Areas; any costs for repair and replacements, cleaning and maintenance of exterior areas and the Common Areas, related equipment, facilities and appurtenances and HVAC equipment; costs of consultants and/or experts engaged to evaluate cost-savings measures for the Building (such as, but not limited to, tax and energy conservation consultants); costs relating to open space serving the Kendall Square complex; costs incurred pursuant to the Master Declaration, the SOMA REA, any REA and/or Condo Documents (including costs related to the operation, management, repair, replacement, maintenance, and insurance of the Complex Areas and real estate taxes assessed with respect to the Complex Areas); any operating costs charged pursuant to the Master Lease (hereinafter defined); costs incurred in connection with the PTDM; costs of security services; a management fee paid to Landlord’s property manager; the costs, including a commercially reasonable rental factor, of Landlord’s management office for the Property (which management office may be located outside the Property and which may serve other properties in addition to the Property (in which event the costs thereof shall be equitably allocated among the properties served by such office)); and the cost of operating any amenities in the Property available to all tenants of the Property and any subsidy provided by Landlord for or with respect to any such amenity. For costs and expenditures made by Landlord in connection with the operation, management, repair, replacement, maintenance and insurance of the Property as a whole, Landlord shall make a reasonable allocation thereof between the retail and non-retail portions of the Property. Operating Costs shall not include Excluded Costs (hereinafter defined). Landlord shall have the right but not the obligation, from time to time, to equitably allocate some or all of the Operating Costs among different tenants of the Building (for example, and without limiting the generality of the foregoing, based in whole or in part on shared or similar use of particular systems or equipment).

11

(b) “Excluded Costs” shall be defined as (i) any mortgage charges (including interest, principal, points and fees); (ii) brokerage commissions; (iii) salaries of executives and owners not directly employed in the management/operation of the Property; (iv) the cost of work done by Landlord for a particular tenant; (v) the cost of items which, by generally accepted accounting principles, would be capitalized on the books of Landlord or are otherwise not properly chargeable against income, except to the extent such capital item is (A) required by any Legal Requirements enacted or first enforced after the Execution Date, (B) reasonably projected to reduce Operating Costs, or (C) reasonably expected to improve the management and or operation of the Building; (vi) any contributions made to any tenant of the Property for, or costs incurred by Landlord in connection with, the initial build-out or subsequent improvement of leasable space in the Building, including Tenant’s Fitout; (vii) franchise or income taxes imposed on Landlord; (viii) costs paid directly by individual tenants to suppliers, including tenant electricity, telephone and other utility costs; (ix) increases in premiums for insurance when such increase is caused by the use of the Property by Landlord or any other tenant of the Property; (x) maintenance and repair of capital items not a part of the Property; (xi) depreciation of the Property; (xii) costs relating to maintaining Landlord’s existence as a corporation, partnership or other entity; (xiii) advertising and other fees and costs incurred in procuring tenants; (xiv) the cost of any items for which Landlord is actually reimbursed by insurance, condemnation awards, refund, rebate or otherwise, and any expenses for repairs or maintenance to the extent covered by warranties, guaranties and service contracts; (xv) costs incurred in connection with any disputes between Landlord and its employees, between Landlord and Building management, or between Landlord and other tenants or occupants; (xvi) the costs of the initial development and construction of the Building (including mitigation payments and impact fees associated therewith, if any (including traffic mitigation expenses or payments pursuant to the approvals for the project)), provided, however, that the foregoing shall not exclude from Operating Costs the reasonable costs incurred in connection with the PTDM; (xvii) costs resulting from violations by Landlord of Legal Requirements; and (xviii) the cost of testing, remediation or removal, transportation or storage of Hazardous Materials (hereinafter defined) in the Building or on the Property required by Environmental Laws (hereinafter defined), provided, however, with respect to the testing, remediation, removal, transportation or storage of (A) any material or substance that is part of the Building on the Commencement Date and which, as of the Commencement Date, is not considered, as a matter of law, to be a Hazardous Material, but which is subsequently determined to be a Hazardous Material as a matter of law and must be remediated or removed, and (B) any material or substance located in the Building after the Commencement Date and which, when placed in the Building was not considered as a matter of law to be a Hazardous Material but which is subsequently determined to be a Hazardous Material as a matter of law, then the costs thereof may be included in Operating Costs.

(c) Payment of Operating Costs. Commencing on the Rent Commencement Date, and thereafter throughout the Term, Tenant shall pay to Landlord, as additional rent, Tenant’s Share of Operating Costs. Landlord may make a good faith estimate of Tenant’s Share of Operating Costs for any fiscal year or part thereof during the Term, and Tenant shall pay to Landlord, on the Rent Commencement Date and on the first (1st) day of each calendar month thereafter, an amount equal to Tenant’s Share of Operating Costs for such fiscal year and/or part thereof divided by the number of months therein. Landlord may estimate and re-estimate Tenant’s Share of Operating Costs and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Tenant’s Share of Operating Costs shall be appropriately adjusted in accordance with the estimations so that, by the end of the fiscal year in question, Tenant shall have paid all of Tenant’s Share of Operating Costs as estimated by Landlord. Any amounts paid based on such an estimate shall be subject to adjustment as herein provided when actual Operating Costs are available for each fiscal year.

(d) Annual Reconciliation. Landlord shall, within one hundred twenty (120) days after the end of each fiscal year, deliver to Tenant a reasonably detailed statement of the actual amount of Operating Costs for such fiscal year (“Year End Statement”). Failure of Landlord to provide the Year End Statement within the time prescribed shall not relieve Tenant from its obligations hereunder. If the total of such monthly remittances on account of any fiscal year is greater than Tenant’s Share of Operating Costs actually incurred for such fiscal year, then, provided there is no Event of Default nor any event which, with the passage of time and/or the giving of notice would constitute an Event of Default, Tenant may credit the difference against the next installment of additional rent on account of Operating Costs due hereunder, except that if such difference is determined after the end of the Term, Landlord shall refund such difference to Tenant within thirty (30) days after such determination to the extent that such difference exceeds any amounts then due from Tenant to Landlord (it being understood and agreed that if Tenant cures any default prior to the expiration of the notice and/or cure periods set forth in Section 20.1 below, Tenant shall then be entitled to take such credit). If the total of such remittances is less than Tenant’s Share of Operating Costs actually incurred for such fiscal year, Tenant shall pay the difference to Landlord, as additional rent hereunder, within ten (10) days of Tenant’s receipt of an invoice therefor. Landlord’s estimate of Operating Costs for the next fiscal year shall be based upon the Operating Costs actually incurred for the prior fiscal year as reflected in the Year-End Statement plus a reasonable adjustment based upon estimated increases in Operating Costs.

12

(e) Part Years. If the Rent Commencement Date or the Expiration Date occurs in the middle of a fiscal year, Tenant shall be liable for only that portion of the Operating Costs with respect to such fiscal year within the Term.

(f) Gross-Up. If, during any fiscal year, less than 95% of the Building is occupied by tenants or if Landlord was not supplying at least 95% of tenants with the services being supplied to Tenant hereunder, actual Operating Costs incurred shall be reasonably extrapolated by Landlord on an item-by-item basis to the reasonable Operating Costs that would have been incurred if the Building was 95% occupied and such services were being supplied to 95% of tenants, and such extrapolated Operating Costs shall, for all purposes hereof, be deemed to be the Operating Costs for such fiscal year. This “gross up” treatment shall be applied only with respect to variable Operating Costs arising from services provided to Common Areas or to space in the Building being occupied by tenants (which services are not provided to vacant space or may be provided only to some tenants) in order to allocate equitably such variable Operating Costs to the tenants receiving the benefits thereof.

(g) Audit Right. Provided there is no Event of Default nor any event which, with the passage of time and/or the giving of notice would constitute an Event of Default, Tenant may, upon at least thirty (30) days’ prior written notice, inspect or audit Landlord’s records relating solely to Operating Costs for the fiscal year covered by the Year End Statement in question. However, no audit or inspection shall extend to periods of time before the Rent Commencement Date. If Tenant fails to object to the calculation of Tenant’s Share of Operating Costs on the Year-End Statement within sixty (60) days after such statement has been delivered to Tenant and/or fails to complete any such audit or inspection within ninety (90) days after receipt of the Year End Statement, then Tenant shall be deemed to have waived its right to object to the calculation of Tenant’s Share of Operating Costs for the year in question and the calculation thereof as set forth on such statement shall be final. Landlord’s records shall be made available electronically or, at Landlord’s election, at Landlord’s offices or the offices of Landlord’s property manager during business hours reasonably designated by Landlord. Tenant shall pay the cost of such audit or inspection. Tenant may not conduct an inspection or have an audit performed more than once during any fiscal year. If such inspection or audit reveals that Tenant was overcharged by more than one percent (1%) and Landlord does not reasonably object to such inspection or audit results, then, provided no Event of Default has occurred nor an event which, with the passage of time and/or the giving of notice would constitute an Event of Default, and provided, further, that Tenant has delivered to Landlord a copy of the final inspection or audit report reflecting such error. Tenant may credit the difference against the next installment of additional rent on account of Operating Costs due hereunder, except that if such difference is determined after the end of the Term, Landlord shall refund such difference to Tenant within thirty (30) days after such determination to the extent that such difference exceeds any amounts then due from Tenant to Landlord. If such inspection or audit reveals an underpayment by Tenant, then Tenant shall pay to Landlord, as additional rent hereunder, any underpayment of any such costs, as the case may be, within thirty (30) days after receipt of an invoice therefor. Tenant shall maintain the results of any such audit or inspection confidential and shall not be permitted to use any third party to perform such audit or inspection, other than an independent firm of certified public accountants (A) reasonably acceptable to Landlord, (B) which is not compensated on a contingency fee basis or in any other manner which is dependent upon the results of such audit or inspection, and (C) which executes Landlord’s standard confidentiality agreement whereby it shall agree to maintain the results of such audit or inspection confidential. Tenant hereby acknowledges and agrees that Tenant’s sole right to contest Landlord’s Year End Statement shall be as expressly set forth in this Section 5.2(g). Tenant hereby waives any and all other rights provided pursuant to any Legal Requirements to examine Landlord’s books and records and/or to contest Landlord’s Year End Statement. No subtenant or licensee shall have any right to conduct any such examination.

13

5.3 Taxes.

(a) “Taxes” shall mean the real estate taxes and other taxes, levies and assessments imposed upon the Building and the tax lot(s) on which the Building is located (the “Tax Lot”) and any other buildings located on the Tax Lot (collectively, the “Tax Property”), and upon any personal property of Landlord used in the operation thereof, or on Landlord’s interest therein or such personal property or reasonably allocated thereto; charges, fees and assessments for transit, housing, police, fire or other services or purported benefits to the Tax Property (including any community preservation assessments and/or business improvement district assessments); service or user payments in lieu of taxes; and any and all other taxes, levies, betterments, assessments and charges arising from the ownership, leasing, operation, use or occupancy of the Tax Property or based upon rentals derived therefrom, which are or shall be imposed by federal, state, county, municipal or other governmental authorities. To the extent Taxes are assessed against the Tax Property as a whole, such amounts shall be allocated among the buildings located on the Tax Lot and shall be based on the assessor’s records or, if the records do not provide a separate allocation, based on square footage of the buildings in question unless Landlord reasonably determines that such allocation should be made on another basis. Furthermore, if different tax rates apply to spaces in the buildings located on the Tax Lot, Taxes will be allocated based on the applicable tax rate (e.g., if retail space is taxed at a different rate than office space, then Taxes subject to such different rate shall be allocated accordingly). If any such Tax is levied or assessed directly against Tenant, then Tenant shall be responsible for and shall pay the same at such times and in such manner as the taxing authority shall require. From and after substantial completion of any occupiable improvements constructed as part of a Future Development, if such improvements are not separately assessed, Landlord shall reasonably allocate Taxes between the Building and such improvements and the land area associated with the same. Taxes shall not include any inheritance, estate, succession, gift, franchise, rental, income or profit tax, capital stock tax, capital levy or excise, or any income taxes arising out of or related to the ownership and operation of the Tax Property, provided, however, that any of the same and any other tax, excise, fee, levy, charge or assessment, however described, that may in the future be levied or assessed as a substitute for or in addition to, in whole or in part, any tax, levy or assessment which would otherwise constitute Taxes, whether or not now customary or in the contemplation of the parties on the Execution Date of this Lease, shall constitute Taxes, but only to the extent calculated as if the Tax Property were the only real estate owned by Landlord. “Taxes” shall also include reasonable expenses (including legal and consultant fees) of tax abatement or other proceedings contesting assessments or levies. Tenant shall pay, prior to delinquency, any and all Taxes levied or assessed against any personal property or trade fixtures placed by Tenant in the Premises, whether levied or assessed against Landlord or Tenant. If any Taxes on Tenant’s personal property or trade fixtures are levied against Landlord or Landlord’s property, or if the assessed valuation of the Tax Property is increased by a value attributable to improvements in or alterations to the Premises made by Tenant, whether owned by Landlord or Tenant and whether or not affixed to the real property so as to become a part thereof, Landlord shall have the right, but not the obligation, to pay such Taxes. The amount of any such payment by Landlord shall constitute additional rent due from Tenant to Landlord within thirty (30) days of invoice therefor.

14

(b) “Tax Period” shall be any fiscal/tax period in respect of which Taxes are due and payable to the appropriate governmental taxing authority (i.e., as mandated by the governmental taxing authority), any portion of which period occurs during the Term of this Lease.

(c) Payment of Taxes. Commencing on the Rent Commencement Date, and thereafter throughout the Term, Tenant shall pay to Landlord, as additional rent, Tenant’s Tax Share of Taxes. Landlord may make a good faith estimate of the Taxes to be due by Tenant for any Tax Period or part thereof during the Term, and Tenant shall pay to Landlord, on the Rent Commencement Date and on the first (1st) day of each calendar month thereafter, an amount equal to Tenant’s Tax Share of Taxes for such Tax Period or part thereof divided by the number of months therein. Landlord may estimate and re-estimate Tenant’s Tax Share of Taxes and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Tenant’s Tax Share of Taxes shall be appropriately adjusted in accordance with the estimations so that, by the end of the Tax Period in question, Tenant shall have paid all of Tenant’s Tax Share of Taxes as estimated by Landlord. Any amounts paid based on such an estimate shall be subject to adjustment as herein provided when actual Taxes are available for each Tax Period. If the total of such monthly remittances is greater than Tenant’s Tax Share of Taxes actually due for such Tax Period, then, provided no Event of Default has occurred nor any event which, with the passage of time and/or the giving of notice would constitute an Event of Default, Tenant may credit the difference against the next installment of additional rent on account of Taxes due hereunder, except that if such difference is determined after the end of the Term, Landlord shall refund such difference to Tenant within thirty (30) days after such determination to the extent that such difference exceeds any amounts then due from Tenant to Landlord (it being understood and agreed that if Tenant cures any default prior to the expiration of the notice and/or cure periods set forth in Section 20.1 below, Tenant shall then be entitled to take such credit). If the total of such remittances is less than Tenant’s Tax Share of Taxes actually due for such Tax Period, Tenant shall pay the difference to Landlord, as additional rent hereunder, within thirty (30) days of Tenant’s receipt of an invoice therefor. Landlord’s estimate for the next Tax Period shall be based upon actual Taxes for the prior Tax Period plus a reasonable adjustment based upon estimated increases in Taxes. In the event that Payments in Lieu of Taxes (“PILOT”), instead of or in addition to Taxes, are separately assessed to certain portions of the Tax Property including the Premises, Tenant agrees, except as otherwise expressly provided herein to the contrary, to pay to Landlord, as additional rent, the portion of such PILOT attributable to the Premises in the same manner as provided above for the payment of Taxes.

15

(d) Effect of Abatements. Appropriate credit against Taxes and/or PILOT shall be given for any refund obtained by reason of a reduction in any Taxes by the assessors or the administrative, judicial or other governmental agency responsible therefor after deduction of Landlord’s expenditures for reasonable legal fees and for other reasonable expenses incurred in obtaining the Tax or PILOT refund.

(e) Part Years. If the Rent Commencement Date or the Expiration Date occurs in the middle of a Tax Period, Tenant shall be liable for only that portion of the Taxes, as the case may be, with respect to such Tax Period within the Term.

5.4 Late Payments.

(a) Any payment of Rent due hereunder not paid when due shall bear interest for each month or fraction thereof from the due date until paid in full at the annual rate of ten percent (10%), or at any applicable lesser maximum legally permissible rate for debts of this nature (the “Default Rate”). Acceptance of interest or any partial payment shall not constitute a waiver of Tenant’s default with respect to the overdue amount or prevent Landlord from exercising any of the other rights and remedies available to Landlord under this Lease or at law or in equity now or hereafter in effect.

(b) For each Tenant payment check to Landlord that is returned by a bank for any reason, Tenant shall pay a returned check charge equal to the amount as shall be customarily charged by Landlord’s bank at the time.

(c) Money paid by Tenant to Landlord shall be applied to Tenant’s account in the following order: first, to any unpaid additional rent, including late charges, returned check charges, legal fees and/or court costs chargeable to Tenant hereunder; and then to unpaid Base Rent.

5.5 No Offset; Independent Covenants; Waiver. Rent shall be paid without notice or demand, and without setoff, counterclaim, defense, abatement, suspension, deferment, reduction or deduction, except as expressly provided herein. TENANT WAIVES ALL RIGHTS (I) TO ANY ABATEMENT, SUSPENSION, DEFERMENT, REDUCTION OR DEDUCTION OF OR FROM RENT, AND (II) EXCEPT AS EXPRESSLY PROVIDED IN SECTION 15.2 BELOW, TO QUIT, TERMINATE OR SURRENDER THIS LEASE OR THE PREMISES OR ANY PART THEREOF. TENANT HEREBY ACKNOWLEDGES AND AGREES THAT THE OBLIGATIONS OF TENANT UNDER THIS LEASE SHALL BE SEPARATE AND INDEPENDENT COVENANTS AND AGREEMENTS, THAT RENT SHALL CONTINUE TO BE PAYABLE IN ALL EVENTS AND THAT THE OBLIGATIONS OF TENANT HEREUNDER SHALL CONTINUE UNAFFECTED, UNLESS THE REQUIREMENT TO PAY OR PERFORM THE SAME SHALL HAVE BEEN TERMINATED PURSUANT TO AN EXPRESS PROVISION OF THIS LEASE. LANDLORD AND TENANT EACH ACKNOWLEDGES AND AGREES THAT THE INDEPENDENT NATURE OF THE OBLIGATIONS OF TENANT HEREUNDER REPRESENTS FAIR, REASONABLE, AND ACCEPTED COMMERCIAL PRACTICE WITH RESPECT TO THE TYPE OF PROPERTY SUBJECT TO THIS LEASE, AND THAT THIS AGREEMENT IS THE PRODUCT OF FREE AND INFORMED NEGOTIATION DURING WHICH BOTH LANDLORD AND TENANT WERE REPRESENTED BY COUNSEL SKILLED IN NEGOTIATING AND DRAFTING COMMERCIAL LEASES IN MASSACHUSETTS, AND THAT THE ACKNOWLEDGEMENTS AND AGREEMENTS CONTAINED HEREIN ARE MADE WITH FULL KNOWLEDGE OF THE HOLDING IN WESSON V. LEONE ENTERPRISES, INC., 437 MASS. 708 (2002). SUCH ACKNOWLEDGEMENTS, AGREEMENTS AND WAIVERS BY TENANT ARE A MATERIAL INDUCEMENT TO LANDLORD ENTERING INTO THIS LEASE.

16

5.6 Survival. Any obligations under this Article 5 which shall not have been paid at the expiration or earlier termination of the Term shall survive such expiration or earlier termination and shall be paid when and as the amount of same shall be determined and be due.

6. INTENTIONALLY OMITTED.

7. LETTER OF CREDIT.

7.1 Amount. Within ten (10) business days after the Execution Date, Tenant shall deliver to Landlord an irrevocable letter of credit which shall (a) be in the amount specified in the Lease Summary Sheet and otherwise in the form attached hereto as Exhibit 7: (b) issued by a FDIC insured financial institution (i) reasonably acceptable to Landlord upon which presentment may be made (A) in Boston, Massachusetts (if Landlord so requires at the time of its approval thereof) or (B) by facsimile expressly pursuant to the terms of the letter of credit), and (ii) which satisfies the Minimum Rating Agency Threshold and the Minimum Capital Threshold (as such terms are hereinafter defined); and (c) be for a term of one (1) year, subject to extension in accordance with the terms hereof (the “Letter of Credit”). The Letter of Credit shall be held by Landlord, without liability for interest, as security for the faithful performance by Tenant of all of the terms, covenants and conditions of this Lease by the Tenant to be kept and performed during the Term. In no event shall the Letter of Credit be deemed to be a prepayment of Rent nor shall it be considered a measure of liquidated damages. Unless the Letter of Credit is automatically renewing, at least thirty (30) days prior to the maturity date of the Letter of Credit (or any replacement Letter of Credit), Tenant shall deliver to Landlord a replacement Letter of Credit which shall have a maturity date no earlier than the next anniversary of the Commencement Date or one (1) year from its date of delivery to Landlord, whichever is later.