Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WEYERHAEUSER CO | wy-8k_20210301.htm |

Weyerhaeuser Investor Meetings March 2021 Exhibit 99.1

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES 2 This presentation contains statements and depictions that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, with respect to: future goals and prospects; business strategies; factors affecting market supply of lumber; key initiatives; levels of demand and market drivers for our products, including expected growth in U.S. housing demand and repair and remodel activity, as well as expected Western housing starts; market dynamics; HBU acres and our 2021 Adjusted EBITDA outlook and buyer demand for our Real Estate and Energy and Natural Resources business; our new cash dividend framework, base dividend sustainability, payment of supplemental cash dividends and return of cash as a percentage of Adjusted Funds Available for Distribution (Adjusted FAD); capital structure, credit ratings, future debt maturities and use of revolving line of credit; our outlook for 2021 capital expenditures across the company; plans to upgrade and maximize the value of our timberland portfolio; our ambitions set forth in “3 by 30” sustainability goals; and 2021 operational excellence targets. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and may be identified by our use of certain words in such statements, including without limitation words such as “anticipate,” “believe,” “committed,” “continue,” “continued,” “could,” “forecast,” “growing,” “estimate,” “outlook,” “goal,” “will,” “plan,” “expect,” “sustainable,” “maintain,” “target,” “would” and similar words and terms and phrases using such terms and words. Depictions or illustrations that constitute forward-looking statements may be identified by graphs, charts or other illustrations indicating expected or predicted occurrences of events, trends, conditions, performance or achievements at a future date or during future time periods. We may refer to assumptions, goals or targets, or we may reference expected performance through, or events to occur by or at, a future date, and such references may also constitute forward-looking statements. Forward-looking statements are based on our current expectations and assumptions. The realization of our expectations and the accuracy of our assumptions are subject to a number of risks and uncertainties that are difficult to predict and often are beyond the company’s control. These and other factors could cause one or more of our expectations to be unmet, one or more of our assumptions to be materially inaccurate or actual results to differ materially from those expressed or implied in our forward-looking statements, or all of the foregoing. Such uncertainties and other factors include, without limitation: the effect of general economic conditions, including employment rates, interest rate levels, housing starts, general availability of financing for home mortgages and the relative strength of the U.S. dollar; the effects of COVID-19 and other viral or disease outbreaks and their potential impacts on our business, results of operations, cash flows, financial condition and future prospects; market demand for the company's products, including market demand for our timberland properties with higher and better uses, which is related to, among other factors, the strength of the various U.S. business segments and U.S. and international economic conditions; changes in currency exchange rates, particularly the relative value of the U.S. dollar to the Japanese yen, the Chinese yuan, and the Canadian dollar, and the relative value of the euro to the yen; restrictions on international trade and tariffs imposed on imports or exports; the availability and cost of shipping and transportation; economic activity in Asia, especially Japan and China; performance of our manufacturing operations, including maintenance and capital requirements; potential disruptions in our manufacturing operations; the level of competition from domestic and foreign producers; our operational excellence initiatives; the successful and timely execution and integration of our strategic acquisitions, including our ability to realize expected benefits and synergies, and the successful and timely execution of our strategic divestitures, each of which is subject to a number of risks and conditions beyond our control including, but not limited to, timing and required regulatory approvals or the occurrence of any event, change or other circumstances that could give rise to a termination of any acquisition or divestiture transaction under the terms of the governing transaction agreements; raw material availability and prices; the effect of weather; changes in global or regional climate conditions and governmental response to such changes; the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters, including the 2020 fire outbreaks in the Pacific Northwest; energy prices; transportation and labor availability and costs; federal tax policies; the effect of forestry, land use, environmental and other governmental regulations; legal proceedings; performance of pension fund investments and related derivatives; the effect of timing of employee retirements and changes in the market price of our common stock on charges for share-based compensation; the accuracy of our estimates of costs and expenses related to contingent liabilities and charges related to casualty losses; changes in accounting principles; and other risks and uncertainties identified in our 2020 Annual Report on Form 10-K, as well as those set forth from time to time in our other public statements, reports, registration statements, prospectuses, information statements and other filings with the SEC. It is not possible to predict or identify all risks and uncertainties that might affect the accuracy of our forward-looking statements and, consequently, our descriptions of such risks and uncertainties should not be considered exhaustive. There is no guarantee that any of the events anticipated by these forward-looking statements will occur, and if any of the events do occur, there is no guarantee what effect they will have on the company's business, results of operations, cash flows, financial condition and future prospects. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to publicly update or revise any forward-looking statements. Nothing on our website is intended to be included or incorporated by reference into, or made a part of, this presentation. Also included in this presentation are certain non-GAAP financial measures, which management believes complement the financial information presented in accordance with U.S. GAAP. Management believes such non-GAAP measures may be useful to investors. Our non-GAAP financial measures may not be comparable to similarly named or captioned non-GAAP financial measures of other companies. A reconciliation of each presented non-GAAP measure to its most directly comparable GAAP measure is provided in the appendices to this presentation.

WEYERHAEUSER INVESTMENT THESIS UNMATCHED PORTFOLIO INDUSTRY-LEADING PERFORMANCE DISCIPLINED CAPITAL ALLOCATION SUPERIOR SHAREHOLDER VALUE + + 3 Strong ESG Foundation | Our Forests and Wood Products are Natural Climate Solutions

4 IMPLEMENTED NEW DIVIDEND FRAMEWORK STRENGTHENED BALANCE SHEET DELIVERING RECORD OPERATING PERFORMANCE EXPANDED LEADERSHIP TALENT ENHANCING ESG LEADERSHIP CAPITALIZING ON MARKET OPPORTUNITIES Reduced debt by $900 million Achieved target leverage ratio Returning significant and appropriate levels of cash to shareholders Highest Adjusted EBITDA in 15 years Delivered $100 million of OpX Added Chief Development Officer role Newly appointed CFO Launched new “3 By 30” initiatives Enhancing safety, diversity and inclusion Growing demand for wood-based construction and natural climate solutions POSITIONED FOR SUPERIOR LONG-TERM VALUE CREATION

STRONG HOUSING sector fundamentals Best U.S. Housing Backdrop in a Decade 5 Weyerhaeuser is uniquely positioned to capitalize on U.S. housing strength and create value for shareholders Renewed preference for larger, single-family homes Ongoing work-from-home flexibility enables migration to affordable locations Demographic trends support growing Millennial homeownership Mortgage rates near record lows Very limited existing re-sale inventory Aging housing stock Rising home equity

UNMATCHED PORTFOLIO Our Quality, Diversity and Scale Cannot Be Replicated 6

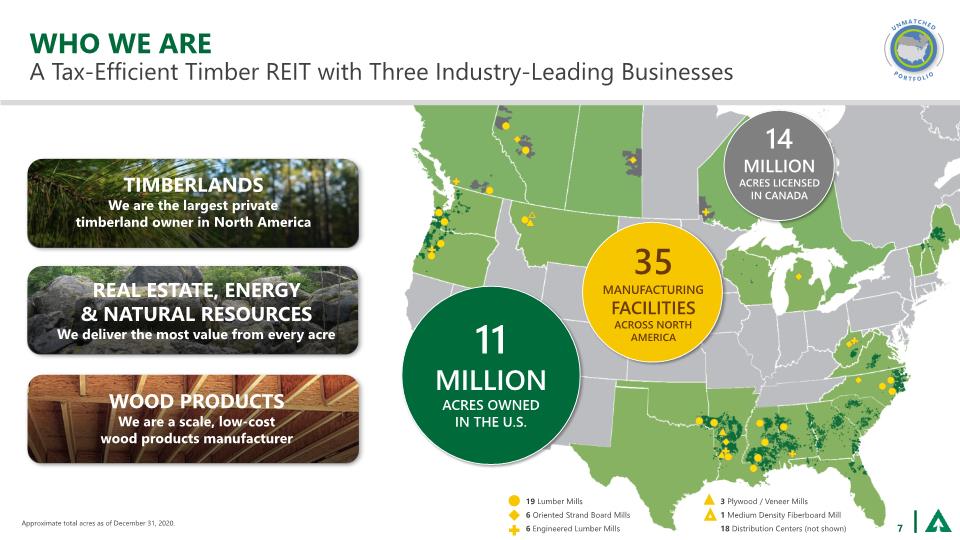

WHO WE ARE A Tax-Efficient Timber REIT with Three Industry-Leading Businesses 7 11 MILLION ACRES OWNED IN THE U.S. 35 MANUFACTURING FACILITIES ACROSS NORTH AMERICA 14 MILLION ACRES LICENSED IN CANADA 19 Lumber Mills 6 Oriented Strand Board Mills 6 Engineered Lumber Mills 3 Plywood / Veneer Mills 1 Medium Density Fiberboard Mill 18 Distribution Centers (not shown) WOOD PRODUCTS We are a scale, low-cost wood products manufacturer TIMBERLANDS We are the largest private timberland owner in North America REAL ESTATE, ENERGY & NATURAL RESOURCES We deliver the most value from every acre Approximate total acres as of December 31, 2020.

WHAT WE DO Create and Capture Superior Value at Every Step 8 Diverse customer mix that fully values our quality, scale, reliability and sustainable practices Proprietary seedlings yield superior growth, wood quality and survival characteristics Customized planting deploys the best genetic material for each acre on our land base Targeted silviculture generates superior volume and value in each geography Low-cost producer to ensure top margin for lumber, panels and engineered wood Premium land sales capture every acre’s highest value Steady royalty and lease income maximizes the value of surface and subsurface assets Delivered log model captures maximum value from each tree using data-driven optimization Superior efficiency and logistics capabilities for low-cost and reliable operations Healthy forests are diverse, productive, and grown sustainably to financial maturity Optimal raw materials are cost effectively sourced internally and externally to maximize mill margins

For more information, see our full ESG Presentation, view our alignment with key ESG frameworks, and visit www.wy.com/sustainability. 9 HOW WE DO IT Our Sustainability Strategy Sustainability Is a Core Value Sustainability Is a Core Value CLIMATE HOMES COMMUNITIES WEYERHAEUSER SUSTAINABILITY AMBITIONS Working to Solve 3 BIG CHALLENGES BY 2030

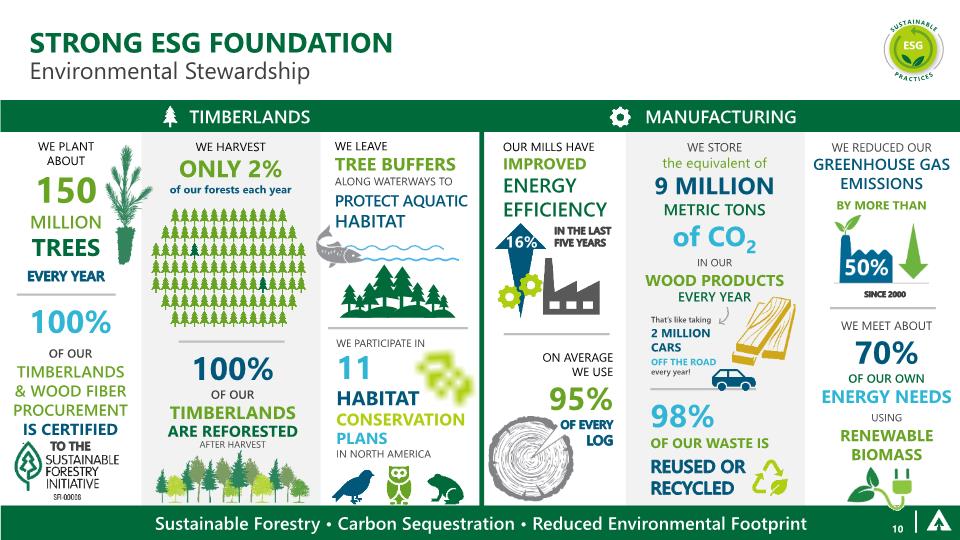

100% OF OUR TIMBERLANDS ARE REFORESTED AFTER HARVEST WE PLANT ABOUT 150 MILLION TREES EVERY YEAR Sustainable Forestry • Carbon Sequestration • Reduced Environmental Footprint Strong ESG Foundation Environmental Stewardship WE PARTICIPATE IN 11 HABITAT CONSERVATION PLANS IN NORTH AMERICA WE HARVEST ONLY 2% of our forests each year WE STORE the equivalent of 9 MILLION METRIC TONS of CO2 IN OUR WOOD PRODUCTS EVERY YEAR That’s like taking 2 MILLION CARS OFF THE ROAD every year! WE MEET ABOUT 70% OF OUR OWN ENERGY NEEDS USING RENEWABLE BIOMASS WE REDUCED OUR GREENHOUSE GAS EMISSIONS BY MORE THAN SINCE 2000 OUR MILLS HAVE IMPROVED ENERGY EFFICIENCY IN THE LAST FIVE YEARS MANUFACTURING TIMBERLANDS 10 ON AVERAGE WE USE 95% OF EVERY LOG 100% OF OUR TIMBERLANDS & WOOD FIBER PROCUREMENT IS CERTIFIED TO THE WE LEAVE TREE BUFFERS ALONG WATERWAYS TO PROTECT AQUATIC HABITAT

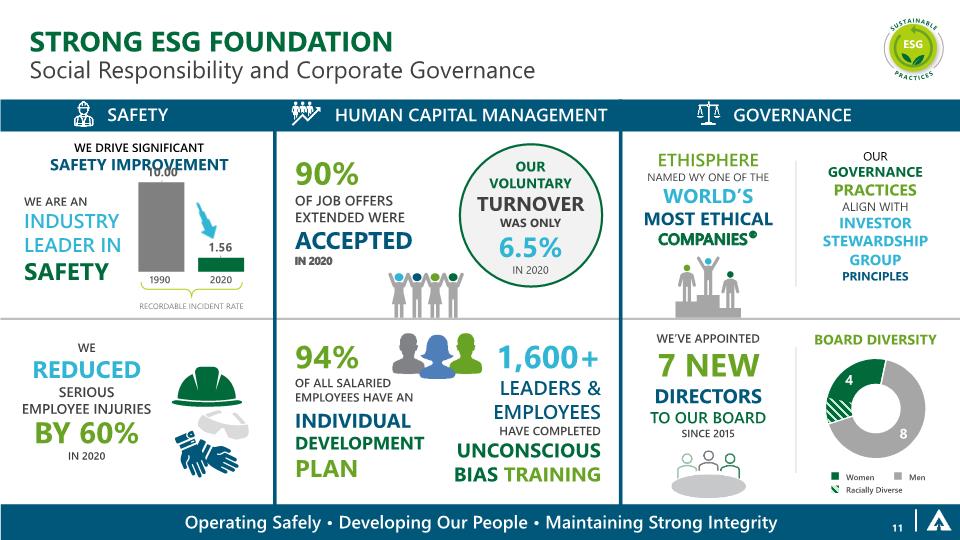

Strong esg foundation Social Responsibility and Corporate Governance GOVERNANCE HUMAN CAPITAL MANAGEMENT 94% OF ALL SALARIED EMPLOYEES HAVE AN INDIVIDUAL DEVELOPMENT PLAN WE DRIVE SIGNIFICANT SAFETY IMPROVEMENT 1,600+ LEADERS & EMPLOYEES HAVE COMPLETED UNCONSCIOUS BIAS TRAINING ETHISPHERE NAMED WY ONE OF THE WORLD’S MOST ETHICAL COMPANIES® OUR GOVERNANCE PRACTICES ALIGN WITH INVESTOR STEWARDSHIP GROUP PRINCIPLES Operating Safely • Developing Our People • Maintaining Strong Integrity 11 90% OF JOB OFFERS EXTENDED WERE ACCEPTED IN 2020 SAFETY RECORDABLE INCIDENT RATE BOARD DIVERSITY Women Men Racially Diverse WE’VE APPOINTED 7 NEW DIRECTORS TO OUR BOARD SINCE 2015 WE REDUCED SERIOUS EMPLOYEE INJURIES BY 60% IN 2020 WE ARE AN INDUSTRY LEADER IN SAFETY 1990 2020

TIMBERLANDS SUPERIOR HOLDINGS CREATE VALUE TODAY AND TOMORROW Unrivaled portfolio that cannot be replicated Diversified holdings at scale Superior supply chain Enduring value across market cycles Enhancing portfolio over time Unmatched timber-growing expertise 12

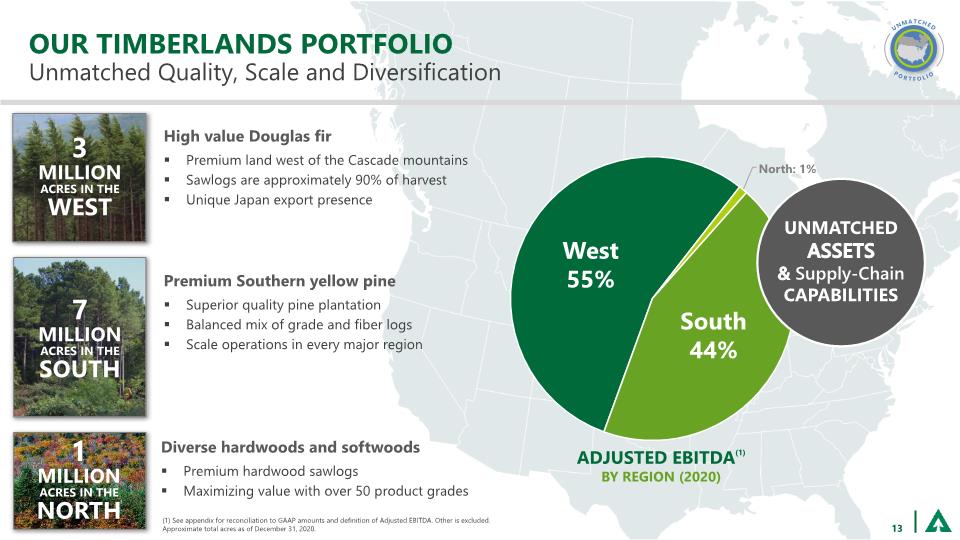

(1) See appendix for reconciliation to GAAP amounts and definition of Adjusted EBITDA. Other is excluded. Approximate total acres as of December 31, 2020. High value Douglas fir Premium land west of the Cascade mountains Sawlogs are approximately 90% of harvest Unique Japan export presence Premium Southern yellow pine Superior quality pine plantation Balanced mix of grade and fiber logs Scale operations in every major region Diverse hardwoods and softwoods Premium hardwood sawlogs Maximizing value with over 50 product grades OUR TIMBERLANDS PORTFOLIO Unmatched Quality, Scale and Diversification UNMATCHED ASSETS & Supply-Chain CAPABILITIES 13 3 MILLION ACRES IN THE WEST 7 MILLION ACRES IN THE SOUTH 1 MILLION ACRES IN THE NORTH

THIRD-PARTY DOMESTIC CUSTOMERS WEYERHAEUSER MILLS EXPORT CUSTOMERS TIMBERLANDS REVENUE BY END MARKET (2020) We flex supply to meet dynamic customer demands and capture market opportunities TIMBERLANDS CUSTOMERS Capture Full Value Through a Diverse Customer Mix 14

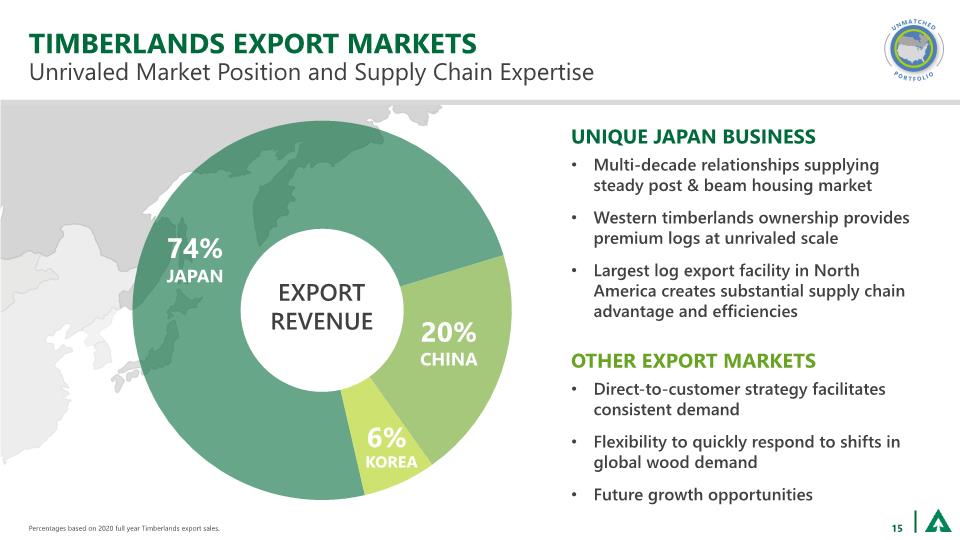

Percentages based on 2020 full year Timberlands export sales. TIMBERLANDS EXPORT MARKETS Unrivaled Market Position and Supply Chain Expertise UNIQUE JAPAN BUSINESS Multi-decade relationships supplying steady post & beam housing market Western timberlands ownership provides premium logs at unrivaled scale Largest log export facility in North America creates substantial supply chain advantage and efficiencies OTHER EXPORT MARKETS Direct-to-customer strategy facilitates consistent demand Flexibility to quickly respond to shifts in global wood demand Future growth opportunities 15 EXPORT REVENUE JAPAN CHINA KOREA

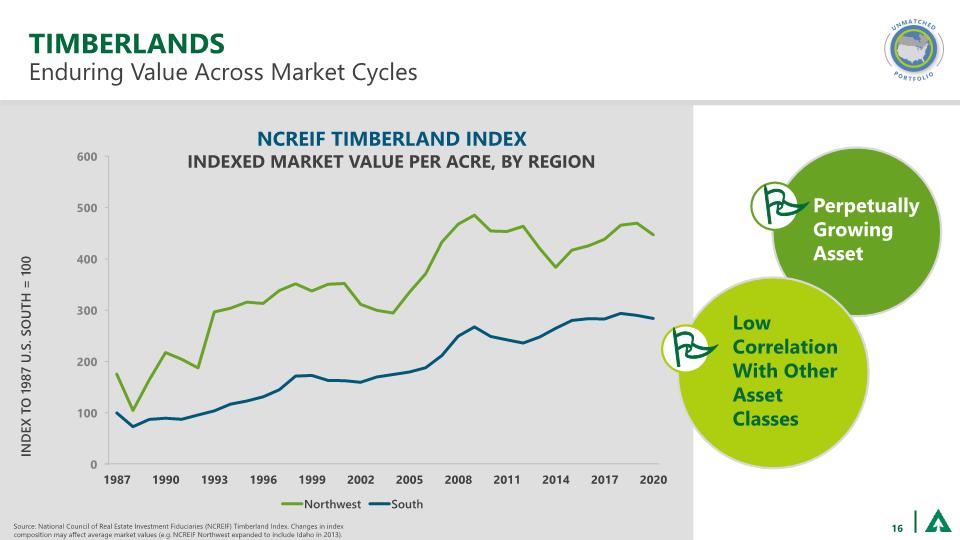

NCREIF Timberland INDEX INDEXED MARKET VALUE Per Acre, by Region Source: National Council of Real Estate Investment Fiduciaries (NCREIF) Timberland Index. Changes in index composition may affect average market values (e.g. NCREIF Northwest expanded to include Idaho in 2013). TIMBERLANDS Enduring Value Across Market Cycles Perpetually Growing Asset Low Correlation With Other Asset Classes 16

ENHANCING AND OPTIMIZING TIMBERLAND HOLDINGS TIMBERLANDS PORTFOLIO MANAGEMENT Disciplined and Opportunistic 17 $1.6 BILLION OF PROCEEDS(1) FROM STRATEGIC DIVESTITURES SINCE 2017 U.S. South U.S. West (1) Divestitures include Montana (2020), Michigan (2019), Uruguay (2017) and Twin Creeks (2017). Twin Creeks proceeds include sale of acres to and redemption of interest in the joint venture. Continue to strategically optimize and upgrade portfolio Strong deal sourcing, diligence and execution expertise Maximize portfolio value and returns

REAL ESTATE, ENERGY & NATURAL RESOURCES MAXIMIZE THE VALUE OF EVERY ACRE WE OWN Continually evaluate every acre Deliver a significant premium to timber value Focus on emerging natural climate solutions Capture the full value of surface and subsurface assets 18 Generate consistent and reliable cash flow

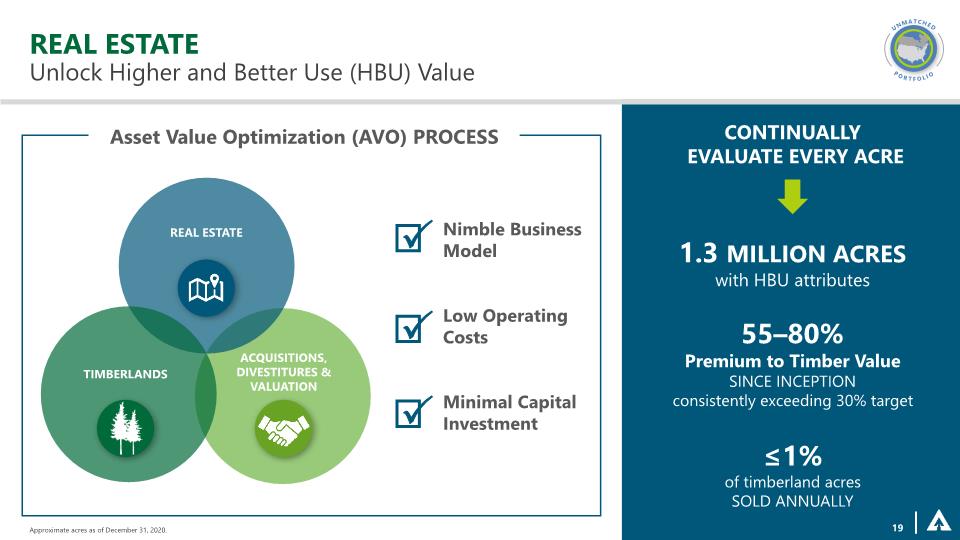

REAL ESTATE Unlock Higher and Better Use (HBU) Value 1.3 MILLION ACRES with HBU attributes CONTINUALLY EVALUATE every acre ≤1% of timberland acres SOLD ANNUALLY 55–80% Premium to Timber Value SINCE INCEPTION consistently exceeding 30% target Asset Value Optimization (AVO) PROCESS 19 Approximate acres as of December 31, 2020.

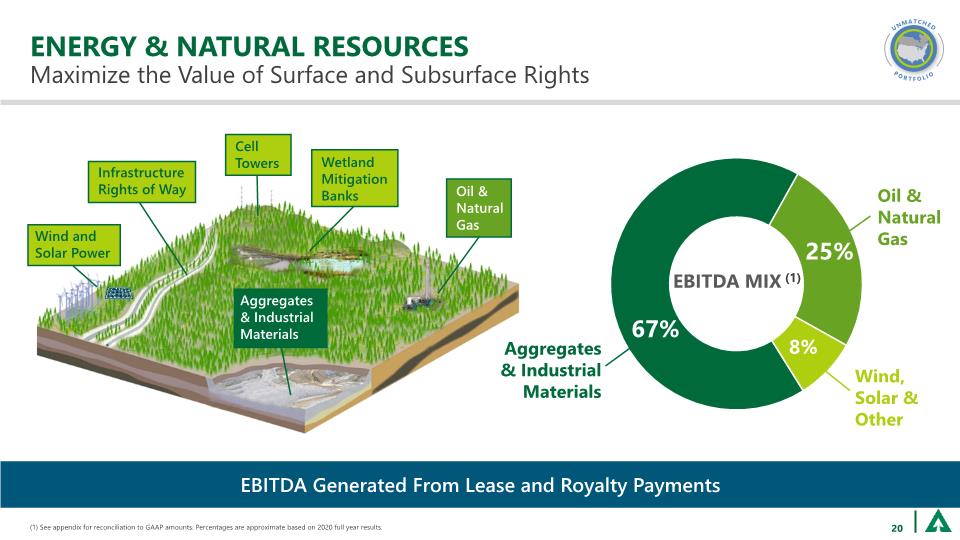

ENERGY & NATURAL RESOURCES Maximize the Value of Surface and Subsurface Rights EBITDA MIX (1) Infrastructure Rights of Way Wind and Solar Power Wetland Mitigation Banks Aggregates & Industrial Materials Oil & Natural Gas Oil & Natural Gas Wind, Solar & Other Aggregates & Industrial Materials Cell Towers 20 (1) See appendix for reconciliation to GAAP amounts. Percentages are approximate based on 2020 full year results. EBITDA Generated From Lease and Royalty Payments

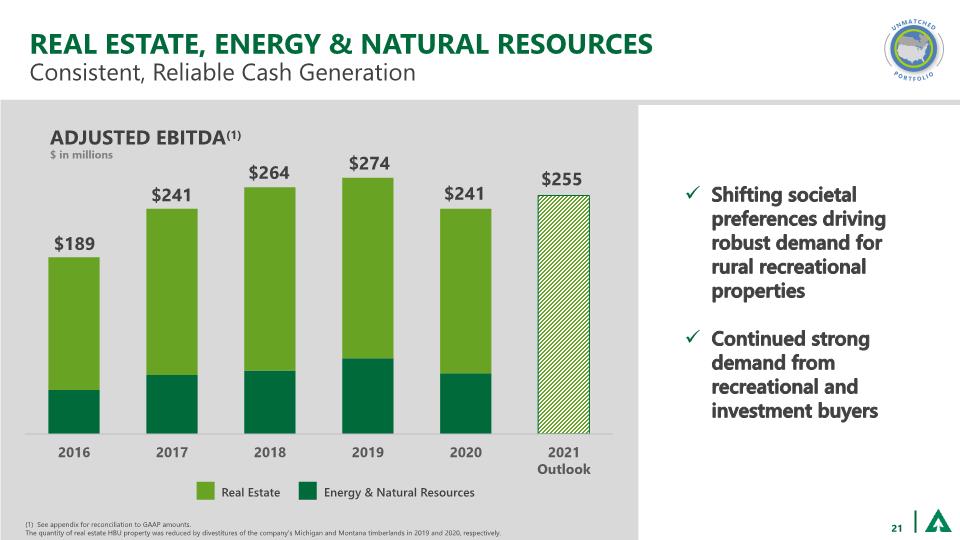

REAL ESTATE, ENERGY & NATURAL RESOURCES Consistent, Reliable Cash Generation (1) See appendix for reconciliation to GAAP amounts. The quantity of real estate HBU property was reduced by divestitures of the company’s Michigan and Montana timberlands in 2019 and 2020, respectively. Adjusted EBITDA(1) $ in millions $189 $241 $264 Real Estate Energy & Natural Resources $274 Shifting societal preferences driving robust demand for rural recreational properties Continued strong demand from recreational and investment buyers 21 $241

WOOD PRODUCTS MAXIMIZING MARGIN THROUGH THE BUSINESS CYCLE Unmatched scale, brand and reputation Diversified mix of high-quality products Relentless focus on industry-leading cost structure Diverse customer mix and demand drivers Superior returns through the cycle: “Black at the bottom” 22

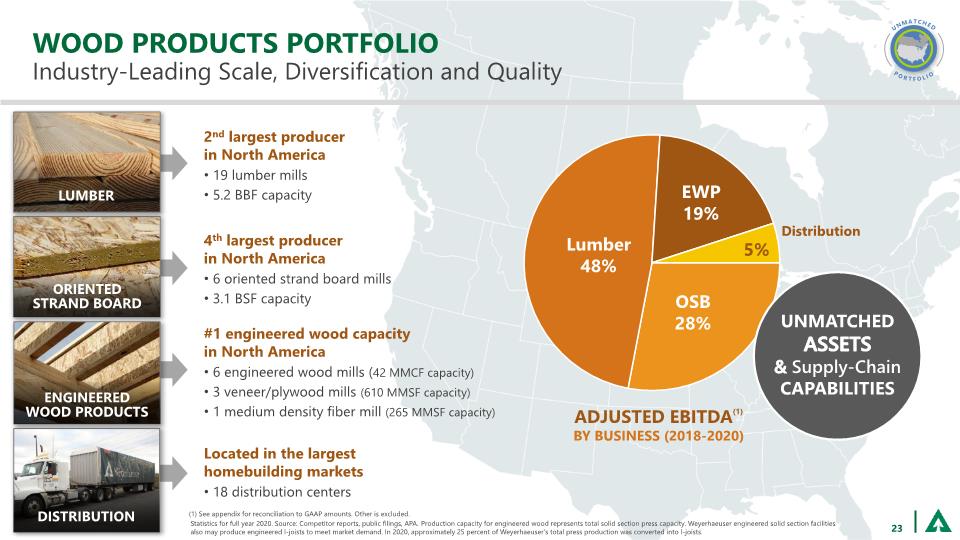

LUMBER ORIENTED STRAND BOARD ENGINEERED WOOD PRODUCTS DISTRIBUTION WOOD PRODUCTS PORTFOLIO Industry-Leading Scale, Diversification and Quality 2nd largest producer in North America 19 lumber mills 5.2 BBF capacity 4th largest producer in North America 6 oriented strand board mills 3.1 BSF capacity Located in the largest homebuilding markets 18 distribution centers Adjusted EBITDA(1) BY BUSINESS (2018-2020) 5% UNMATCHED ASSETS & Supply-Chain CAPABILITIES #1 engineered wood capacity in North America 6 engineered wood mills (42 MMCF capacity) 3 veneer/plywood mills (610 MMSF capacity) 1 medium density fiber mill (265 MMSF capacity) Statistics for full year 2020. Source: Competitor reports, public filings, APA. Production capacity for engineered wood represents total solid section press capacity. Weyerhaeuser engineered solid section facilities also may produce engineered I-joists to meet market demand. In 2020, approximately 25 percent of Weyerhaeuser’s total press production was converted into I-joists. 23 (1) See appendix for reconciliation to GAAP amounts. Other is excluded.

WOOD PRODUCTS Diverse Demand Drivers and Customer Mix NEW RESIDENTIAL: SINGLE & MULTI-FAMILY REPAIR & REMODEL: PROFESSIONAL AND DIY PERCENT OF SALES BY END MARKET (2020) NON-RESIDENTIAL CONSTRUCTION, INDUSTRIAL AND OTHER USES 24 Percentages are approximate based on 2020 full year Wood Products net sales. Customers value our quality, scale, reliability and sustainable practices

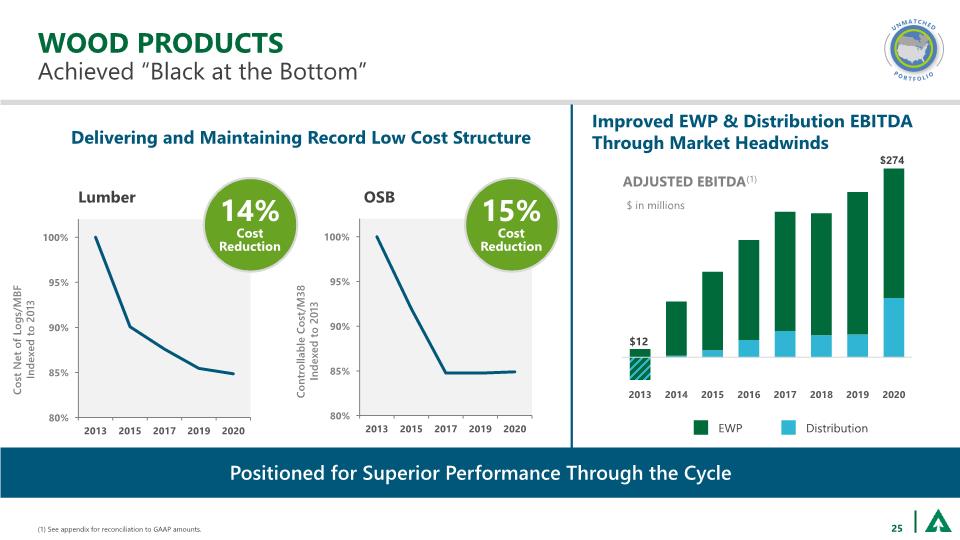

WOOD PRODUCTS Achieved “Black at the Bottom” $ in millions Delivering and Maintaining Record Low Cost Structure Improved EWP & Distribution EBITDA Through Market Headwinds ADJUSTED EBITDA(1) Positioned for Superior Performance Through the Cycle Cost Net of Logs/MBF Indexed to 2013 Controllable Cost/M38 Indexed to 2013 Lumber OSB 25 (1) See appendix for reconciliation to GAAP amounts.

INDUSTRY-LEADING PERFORMANCE Significant, Sustainable Margin Improvement Through the Cycle 26

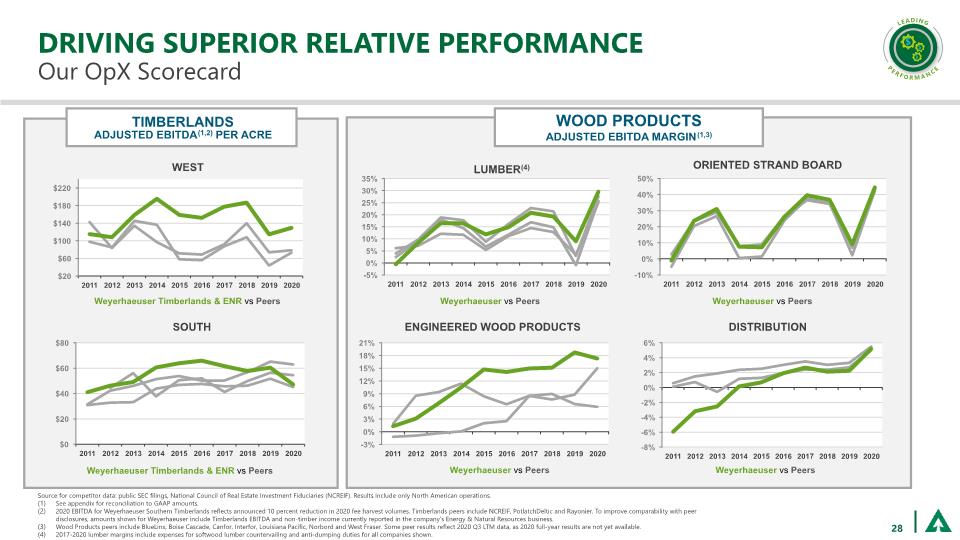

27 27 OPERATIONAL EXCELLENCE Delivering Superior Execution and Ongoing Improvement OUR FOCUS AREAS TIMBERLANDS Harvest & Haul • Silviculture • Marketing • Merchandising WOOD PRODUCTS Controllable Cost • Recovery • Reliability • Product Mix Cross- Business OpX MARGIN IMPROVEMENT FUTURE VALUE COST AVOIDANCE EFFICIENCY OUR PERFORMANCE VS. PEERS OPX HIGHLIGHTS BY BUSINESS Western Timberlands Best EBITDA per acre Lumber, OSB and EWP Highest Margin Distribution Largest Margin Improvement

DRIVING SUPERIOR RELATIVE PERFORMANCE Our OpX Scorecard We are “Black at the Bottom” TIMBERLANDS ADJUSTED EBITDA(1,2) PER ACRE WEST LUMBER(4) ORIENTED STRAND BOARD SOUTH ENGINEERED WOOD PRODUCTS DISTRIBUTION Source for competitor data: public SEC filings, National Council of Real Estate Investment Fiduciaries (NCREIF). Results include only North American operations. See appendix for reconciliation to GAAP amounts. 2020 EBITDA for Weyerhaeuser Southern Timberlands reflects announced 10 percent reduction in 2020 fee harvest volumes. Timberlands peers include NCREIF, PotlatchDeltic and Rayonier. To improve comparability with peer disclosures, amounts shown for Weyerhaeuser include Timberlands EBITDA and non-timber income currently reported in the company’s Energy & Natural Resources business. Wood Products peers include BlueLinx, Boise Cascade, Canfor, Interfor, Louisiana Pacific, Norbord and West Fraser. Some peer results reflect 2020 Q3 LTM data, as 2020 full-year results are not yet available. 2017-2020 lumber margins include expenses for softwood lumber countervailing and anti-dumping duties for all companies shown. WOOD PRODUCTS ADJUSTED EBITDA MARGIN(1,3) Weyerhaeuser Timberlands & ENR vs Peers Weyerhaeuser Timberlands & ENR vs Peers Weyerhaeuser vs Peers Weyerhaeuser vs Peers Weyerhaeuser vs Peers Weyerhaeuser vs Peers 28

DISCIPLINED CAPITAL ALLOCATION Long-Term Commitment to Balancing Three Key Priorities 29

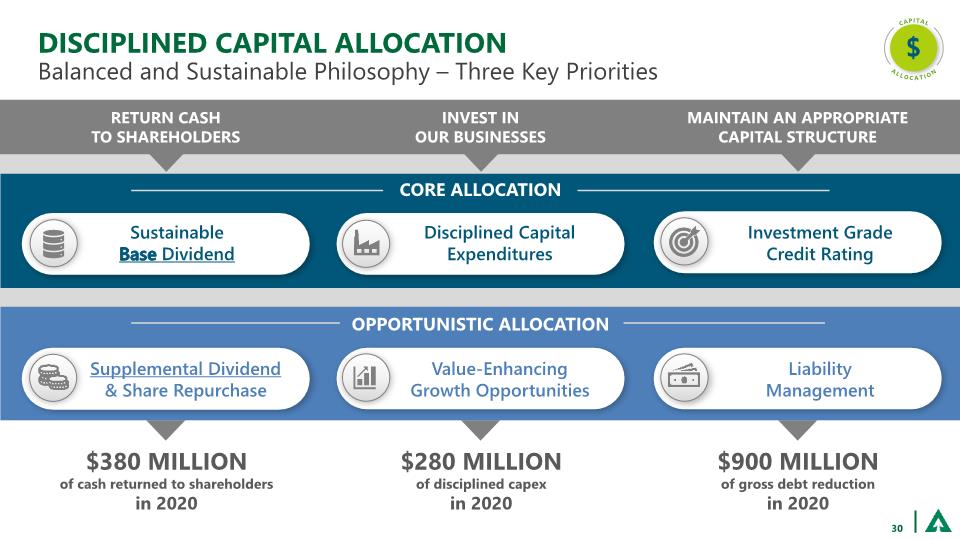

Disciplined capital allocation Balanced and Sustainable Philosophy – Three Key Priorities 30 INVEST IN OUR BUSINESSES RETURN CASH TO SHAREHOLDERS MAINTAIN AN APPROPRIATE CAPITAL STRUCTURE CORE ALLOCATION Investment Grade Credit Rating Disciplined Capital Expenditures Sustainable Base Dividend OPPORTUNISTIC ALLOCATION Value-Enhancing Growth Opportunities Liability Management Supplemental Dividend & Share Repurchase $380 MILLION of cash returned to shareholders in 2020 $280 MILLION of disciplined capex in 2020 $900 MILLION of gross debt reduction in 2020

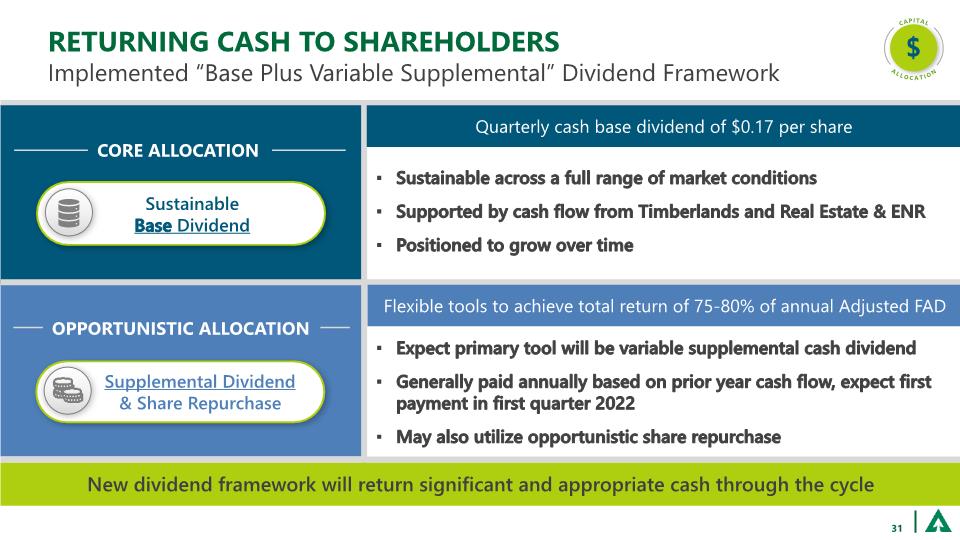

CORE ALLOCATION RETURNING CASH TO SHAREHOLDERS Implemented “Base Plus Variable Supplemental” Dividend Framework Sustainable Base Dividend Sustainable across a full range of market conditions Supported by cash flow from Timberlands and Real Estate & ENR Positioned to grow over time Supplemental Dividend & Share Repurchase OPPORTUNISTIC ALLOCATION Expect primary tool will be variable supplemental cash dividend Generally paid annually based on prior year cash flow, expect first payment in first quarter 2022 May also utilize opportunistic share repurchase New dividend framework will return significant and appropriate cash through the cycle Sustainable Base Dividend Supplemental Dividend & Share Repurchase 31 Quarterly cash base dividend of $0.17 per share Flexible tools to achieve total return of 75-80% of annual Adjusted FAD

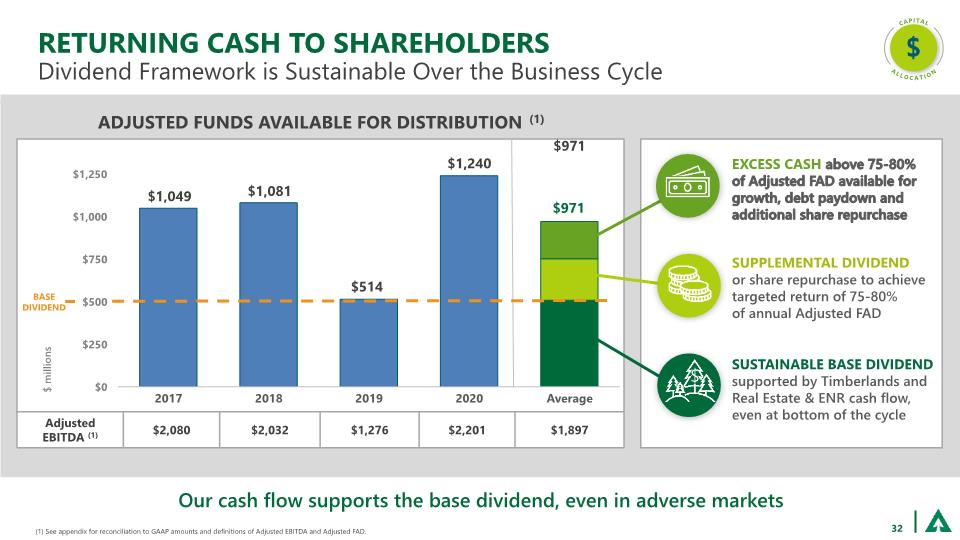

Returning cash to shareholders Dividend Framework is Sustainable Over the Business Cycle 32 SUSTAINABLE BASE DIVIDEND supported by Timberlands and Real Estate & ENR cash flow, even at bottom of the cycle SUPPLEMENTAL DIVIDEND or share repurchase to achieve targeted return of 75-80% of annual Adjusted FAD EXCESS CASH above 75-80% of Adjusted FAD available for growth, debt paydown and additional share repurchase ADJUSTED FUNDS AVAILABLE FOR DISTRIBUTION (1) Our cash flow supports the base dividend, even in adverse markets $ millions BASE DIVIDEND $971 (1) See appendix for reconciliation to GAAP amounts and definitions of Adjusted EBITDA and Adjusted FAD.

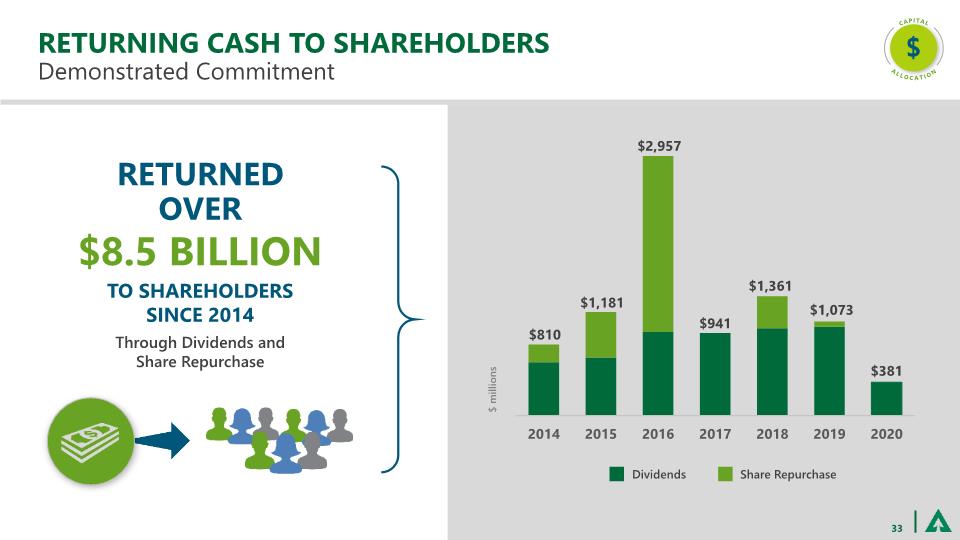

Returning cash to shareholders Demonstrated Commitment 33 RETURNED OVER $8.5 BILLION TO SHAREHOLDERS SINCE 2014 Through Dividends and Share Repurchase $ millions

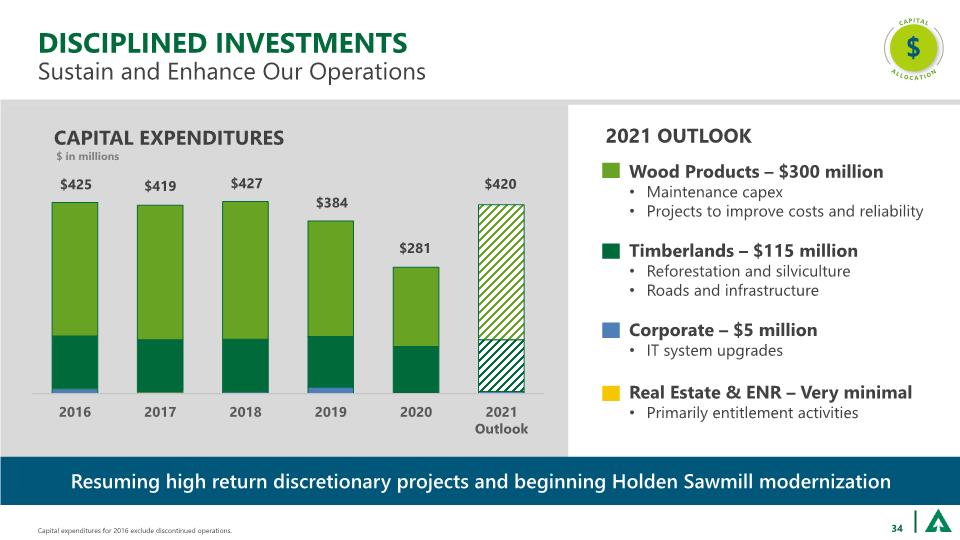

CAPITAL EXPENDITURES Wood Products – $300 million Maintenance capex Projects to improve costs and reliability Timberlands – $115 million Reforestation and silviculture Roads and infrastructure Corporate – $5 million IT system upgrades Real Estate & ENR – Very minimal Primarily entitlement activities DISCIPLINED INVESTMENTS Sustain and Enhance Our Operations Resuming high return discretionary projects and beginning Holden Sawmill modernization 34 2021 outlook $ in millions Capital expenditures for 2016 exclude discontinued operations.

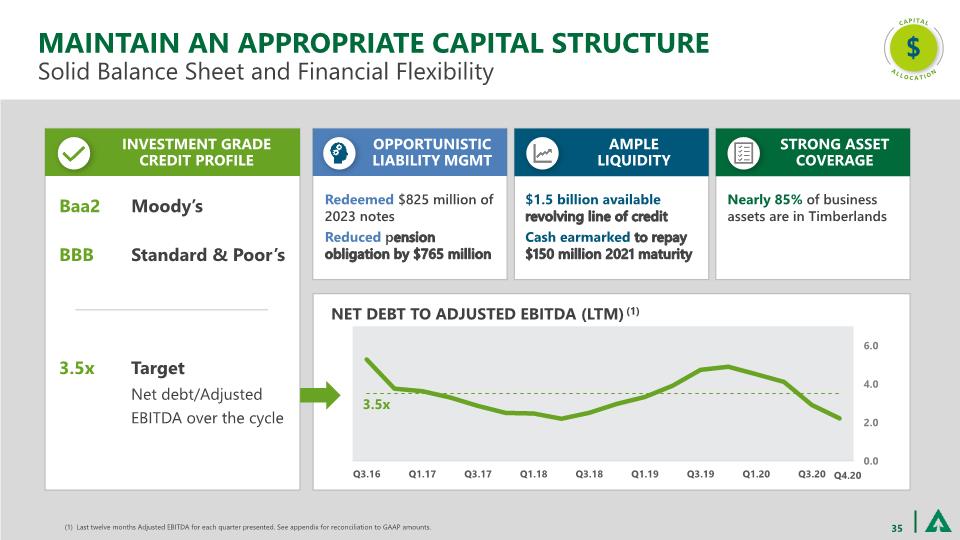

Maintain AN appropriate capital structure Solid Balance Sheet and Financial Flexibility (1) Last twelve months Adjusted EBITDA for each quarter presented. See appendix for reconciliation to GAAP amounts. 35 NET DEBT TO ADJUSTED EBITDA (LTM)(1) 3.5x INVESTMENT GRADE CREDIT PROFILE Baa2 Moody’s BBB Standard & Poor’s AMPLE LIQUIDITY $1.5 billion available revolving line of credit Cash earmarked to repay $150 million 2021 maturity OPPORTUNISTIC LIABILITY MGMT Redeemed $825 million of 2023 notes Reduced pension obligation by $765 million STRONG ASSET COVERAGE Nearly 85% of business assets are in Timberlands Q4.20 3.5x Target Net debt/Adjusted EBITDA over the cycle

SUPERIOR SHAREHOLDER VALUE Capitalizing on Strong Portfolio and Operational Performance 36

FAVORABLE FUNDAMENTALS ACROSS OUR MARKETS Driven By Continued Demand for U.S. Housing LUMBER ORIENTED STRAND BOARD WESTERN LOGS SOUTHERN LOGS 37 Improving sawlog demand Fiber log demand generally stable Log pricing flat, expect sawlog prices will rise slowly over time Emerging log export opportunity Increasing demand from residential construction activity Favorable industry operating rates B.C. mill closures reduced industry capacity Pricing in record territory Mass timber and CLT gaining momentum Increasing demand from residential construction activity High industry operating rates Pricing in record territory Rising domestic wood products production WY Oregon fire salvage proceeding well, with little downgrade in log quality and pricing Favorable Japanese demand Improved Chinese log demand, with European and Australian supply challenges

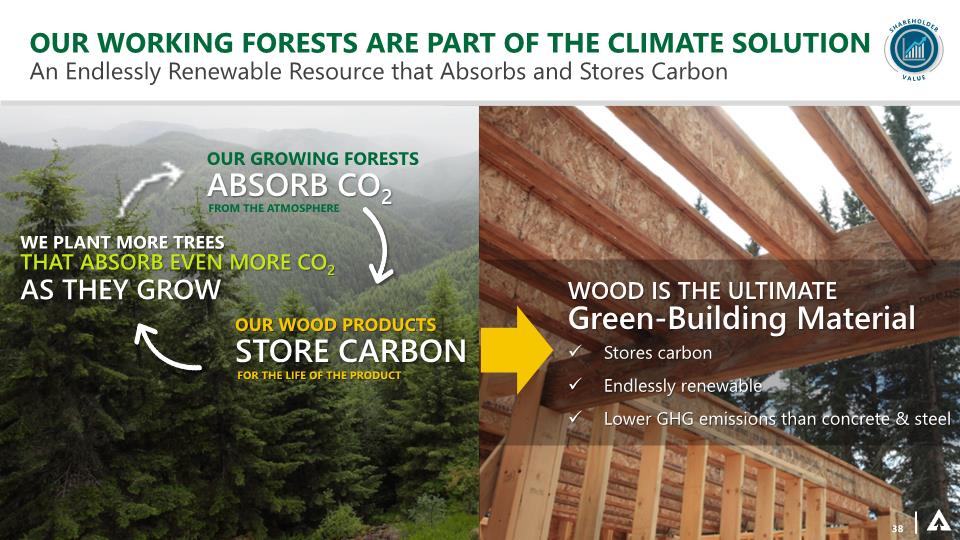

OUR WORKING FORESTS ARE PART OF THE CLIMATE SOLUTION An Endlessly Renewable Resource that Absorbs and Stores Carbon OUR GROWING FORESTS ABSORB CO2 OUR WOOD PRODUCTS STORE CARBON FROM THE ATMOSPHERE FOR THE LIFE OF THE PRODUCT WE PLANT MORE TREES THAT ABSORB EVEN MORE CO2 AS THEY GROW 38 WOOD IS THE ULTIMATE Green-Building Material Stores carbon Endlessly renewable Lower GHG emissions than concrete & steel

WEYERHAEUSER INVESTMENT THESIS UNMATCHED PORTFOLIO INDUSTRY-LEADING PERFORMANCE DISCIPLINED CAPITAL ALLOCATION SUPERIOR SHAREHOLDER VALUE + + 39 Strong ESG Foundation | Our Forests and Wood Products are Natural Climate Solutions

APPENDIX Market Overview and Supplemental Information 40

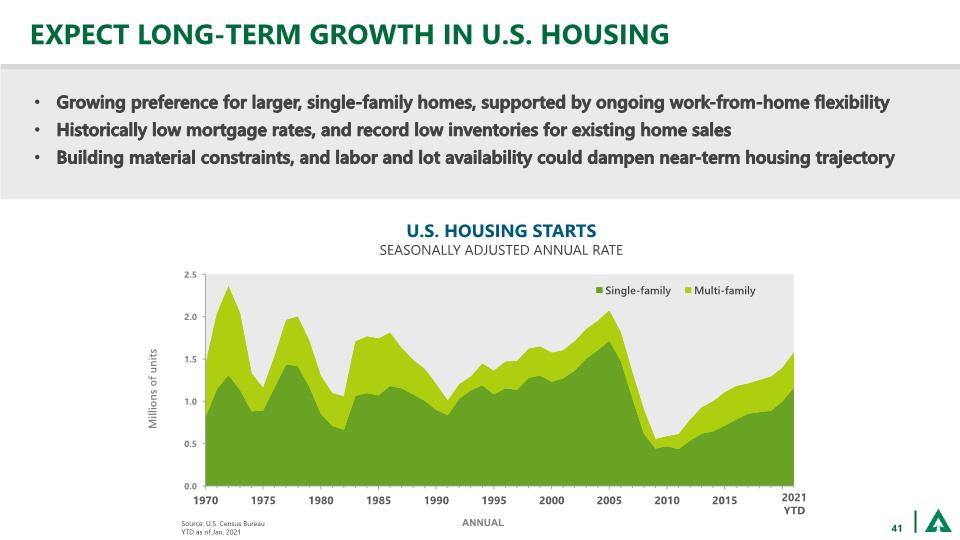

EXPECT LONG-TERM GROWTH IN U.S. HOUSING Source: U.S. Census Bureau YTD as of Jan. 2021 41 Growing preference for larger, single-family homes, supported by ongoing work-from-home flexibility Historically low mortgage rates, and record low inventories for existing home sales Building material constraints, and labor and lot availability could dampen near-term housing trajectory U.S. HOUSING STARTS SEASONALLY ADJUSTED ANNUAL RATE 2021 YTD

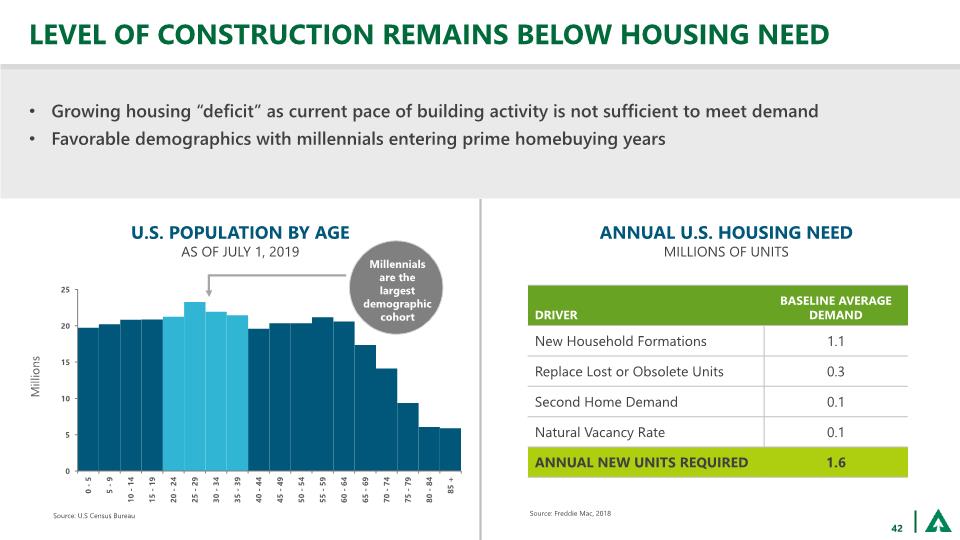

LEVEL OF CONSTRUCTION REMAINS BELOW HOUSING NEED ANNUAL U.S. HOUSING NEED MILLIONS OF UNITS Source: Freddie Mac, 2018 U.S. POPULATION BY AGE AS OF JULY 1, 2019 Source: U.S Census Bureau 42 Growing housing “deficit” as current pace of building activity is not sufficient to meet demand Favorable demographics with millennials entering prime homebuying years Millennials are the largest demographic cohort

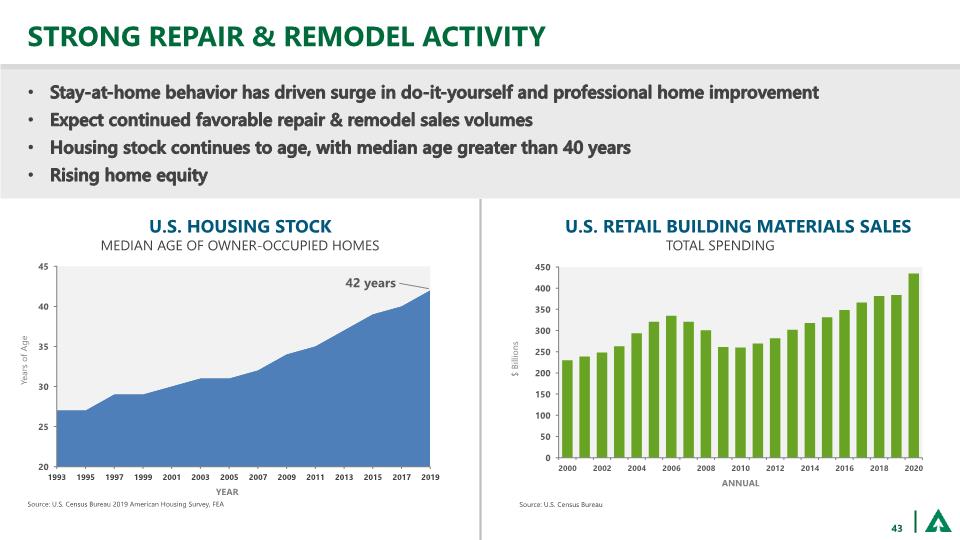

STRONG REPAIR & REMODEL ACTIVITY Stay-at-home behavior has driven surge in do-it-yourself and professional home improvement Expect continued favorable repair & remodel sales volumes Housing stock continues to age, with median age greater than 40 years Rising home equity U.S. HOUSING STOCK MEDIAN AGE OF OWNER-OCCUPIED HOMES U.S. RETAIL BUILDING MATERIALS SALES TOTAL SPENDING 43 42 years

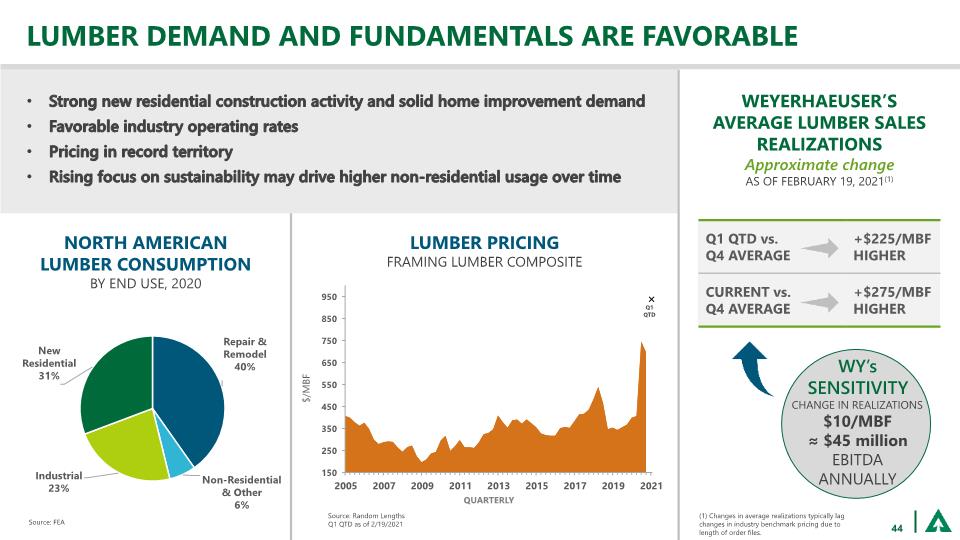

LUMBER DEMAND AND FUNDAMENTALS ARE FAVORABLE LUMBER PRICING FRAMING LUMBER COMPOSITE NORTH AMERICAN LUMBER CONSUMPTION BY END USE, 2020 Source: FEA Source: Random Lengths Q1 QTD as of 2/19/2021 44 Strong new residential construction activity and solid home improvement demand Favorable industry operating rates Pricing in record territory Rising focus on sustainability may drive higher non-residential usage over time WEYERHAEUSER’S AVERAGE LUMBER SALES REALIZATIONS Approximate change AS OF FEBRUARY 19, 2021(1) WY’s SENSITIVITY CHANGE IN REALIZATIONS $10/MBF ≈ $45 million EBITDA ANNUALLY (1) Changes in average realizations typically lag changes in industry benchmark pricing due to length of order files.

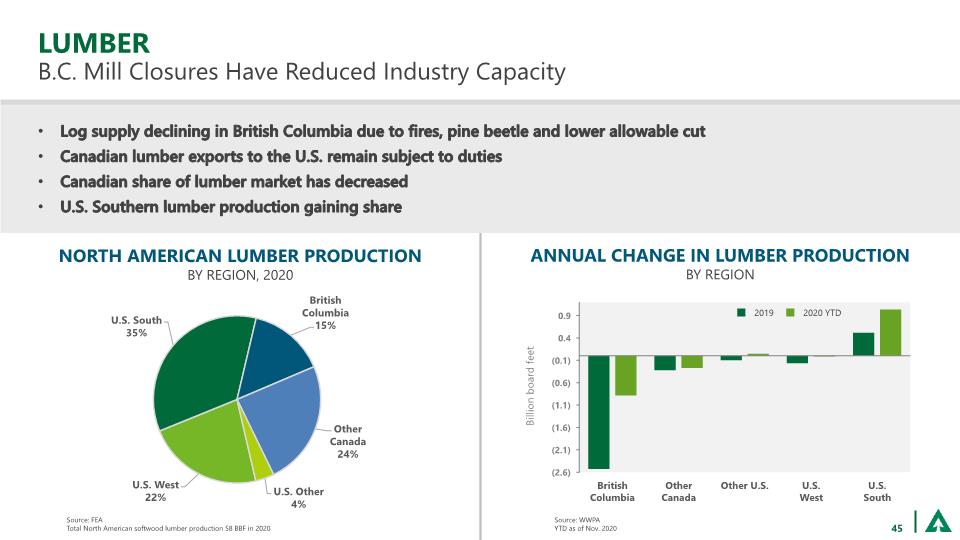

LUMBER B.C. Mill Closures Have Reduced Industry Capacity Log supply declining in British Columbia due to fires, pine beetle and lower allowable cut Canadian lumber exports to the U.S. remain subject to duties Canadian share of lumber market has decreased U.S. Southern lumber production gaining share Source: WWPA YTD as of Nov. 2020 Billion board feet 45 ANNUAL CHANGE IN LUMBER PRODUCTION BY REGION NORTH AMERICAN LUMBER PRODUCTION BY REGION, 2020 Source: FEA Total North American softwood lumber production 58 BBF in 2020

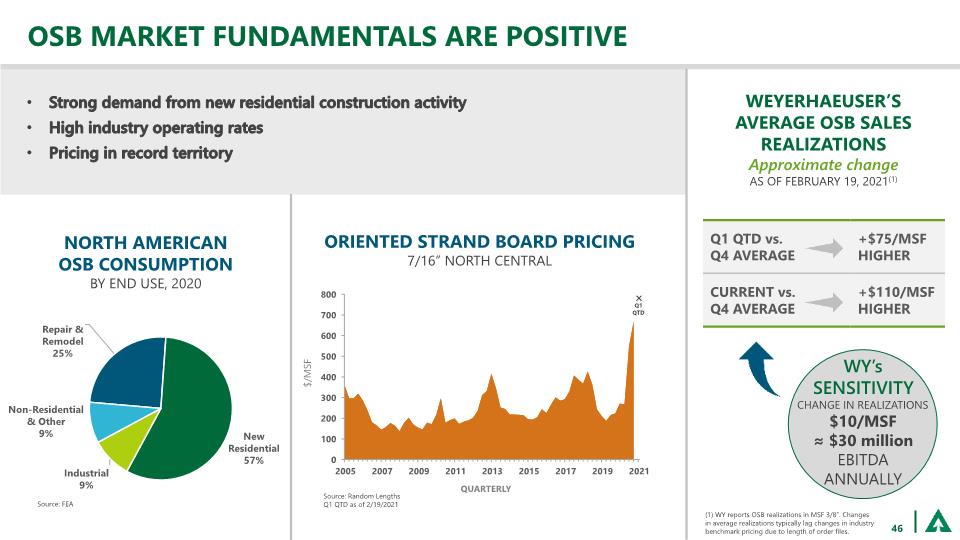

OSB MARKET FUNDAMENTALS ARE POSITIVE 46 Strong demand from new residential construction activity High industry operating rates Pricing in record territory ORIENTED STRAND BOARD PRICING 7/16” NORTH CENTRAL WY’s SENSITIVITY CHANGE IN REALIZATIONS $10/MSF ≈ $30 million EBITDA ANNUALLY WEYERHAEUSER’S AVERAGE OSB SALES REALIZATIONS Approximate change AS OF FEBRUARY 19, 2021(1) (1) WY reports OSB realizations in MSF 3/8”. Changes in average realizations typically lag changes in industry benchmark pricing due to length of order files. NORTH AMERICAN OSB CONSUMPTION BY END USE, 2020 Source: FEA

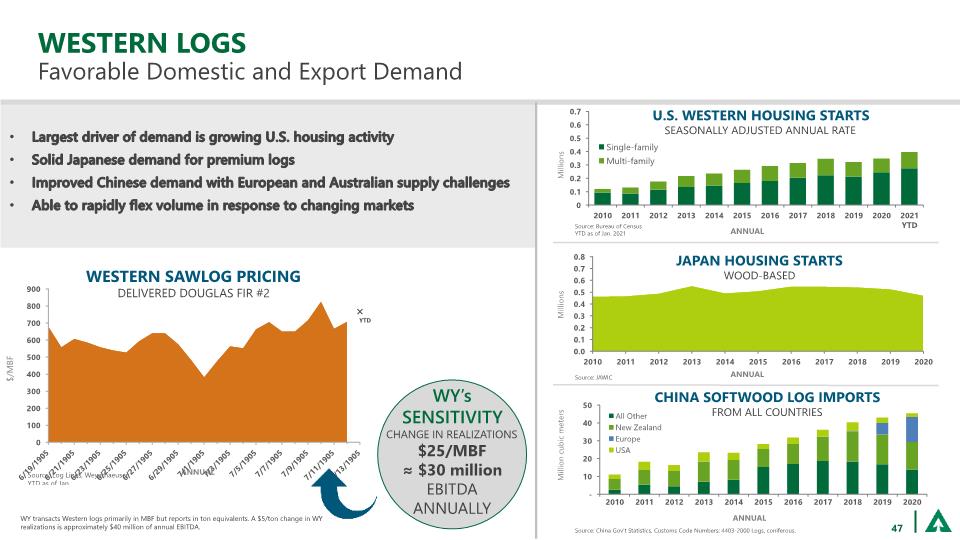

Largest driver of demand is growing U.S. housing activity Solid Japanese demand for premium logs Improved Chinese demand with European and Australian supply challenges Able to rapidly flex volume in response to changing markets JAPAN HOUSING STARTS WOOD-BASED WESTERN SAWLOG PRICING DELIVERED DOUGLAS FIR #2 Million cubic meters U.S. WESTERN HOUSING STARTS SEASONALLY ADJUSTED ANNUAL RATE Source: China Gov't Statistics. Customs Code Numbers: 4403-2000 Logs, coniferous. 47 WESTERN LOGS Favorable Domestic and Export Demand CHINA SOFTWOOD LOG IMPORTS FROM ALL COUNTRIES WY’s SENSITIVITY CHANGE IN REALIZATIONS $25/MBF ≈ $30 million EBITDA ANNUALLY YTD Millions Millions ANNUAL Source: JAWIC WY transacts Western logs primarily in MBF but reports in ton equivalents. A $5/ton change in WY realizations is approximately $40 million of annual EBITDA. ANNUAL Source: Bureau of Census YTD as of Jan. 2021

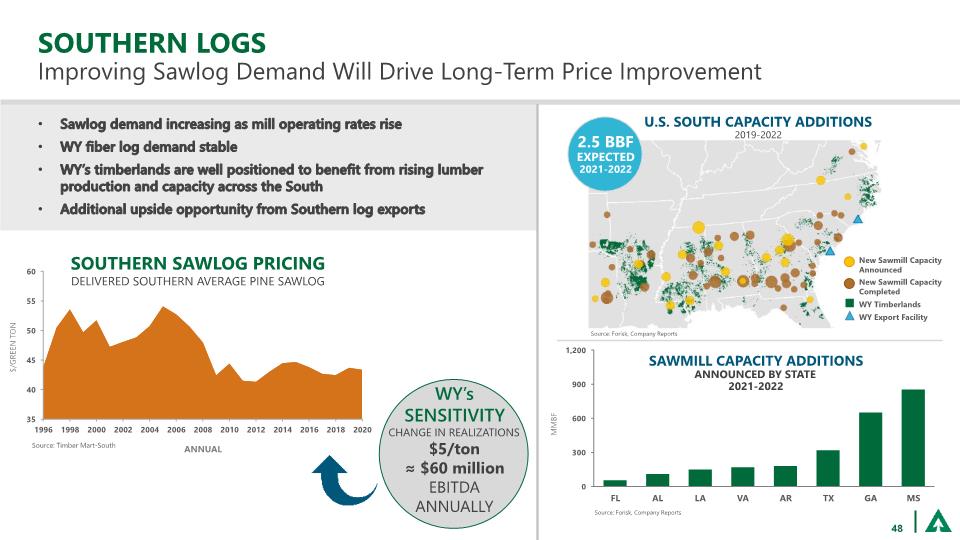

Sawlog demand increasing as mill operating rates rise WY fiber log demand stable WY’s timberlands are well positioned to benefit from rising lumber production and capacity across the South Additional upside opportunity from Southern log exports 48 SOUTHERN LOGS Improving Sawlog Demand Will Drive Long-Term Price Improvement SAWMILL CAPACITY ADDITIONS ANNOUNCED BY STATE 2021-2022 Source: Forisk, Company Reports MMBF WY’s SENSITIVITY CHANGE IN REALIZATIONS $5/ton ≈ $60 million EBITDA ANNUALLY SOUTHERN SAWLOG PRICING DELIVERED SOUTHERN AVERAGE PINE SAWLOG Source: Forisk, Company Reports U.S. SOUTH CAPACITY ADDITIONS 2019-2022 2.5 BBF EXPECTED 2021-2022

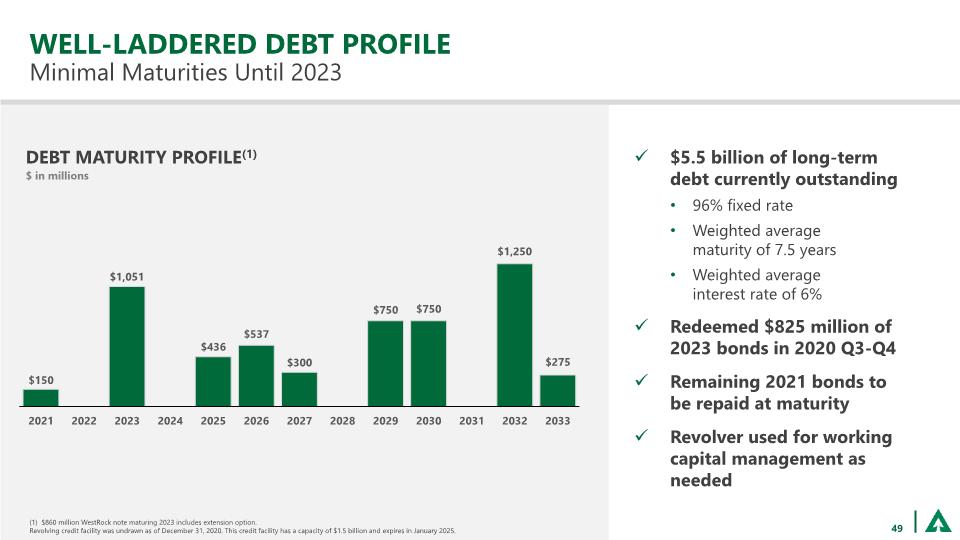

WELL-LADDERED DEBT PROFILE Minimal Maturities Until 2023 (1) $860 million WestRock note maturing 2023 includes extension option. Revolving credit facility was undrawn as of December 31, 2020. This credit facility has a capacity of $1.5 billion and expires in January 2025. $5.5 billion of long-term debt currently outstanding 96% fixed rate Weighted average maturity of 7.5 years Weighted average interest rate of 6% Redeemed $825 million of 2023 bonds in 2020 Q3-Q4 Remaining 2021 bonds to be repaid at maturity Revolver used for working capital management as needed Debt maturity profile(1) $ in millions 49

LISTINGS ON ESG INDICES ESG RATINGS AND RANKINGS We have a “WINNING” RATING from 2020 WOMEN ON BOARDS 3BL MEDIA named WY one of the 100 BEST CORPORATE CITIZENS 50 Environmental, social & governance External Recognition JUST CAPITAL named WY one of AMERICA’S MOST JUST Companies ETHISPHERE named WY one of the WORLD’S MOST ETHICAL COMPANIES®

TARGETED SILVICULTURE CUSTOMIZED PLANTING We are TIMBER-GROWING Experts Deeply Committed to Environmental Stewardship PROPRIETARY SEEDLINGS We cultivate seedlings with superior survival, growth, and wood-quality characteristics We deploy the best genetic material for each acre on our land base Our practices generate superior volume and value in each geography HEALTHY FORESTS Our forests are diverse and more resistant to disease and drought 100% OF OUR FORESTS ARE CERTIFIED WE PROTECT WATERWAYS AND CRITICAL HABITAT OF OUR TIMBERLANDS ARE REFORESTED AFTER HARVEST 100% 51

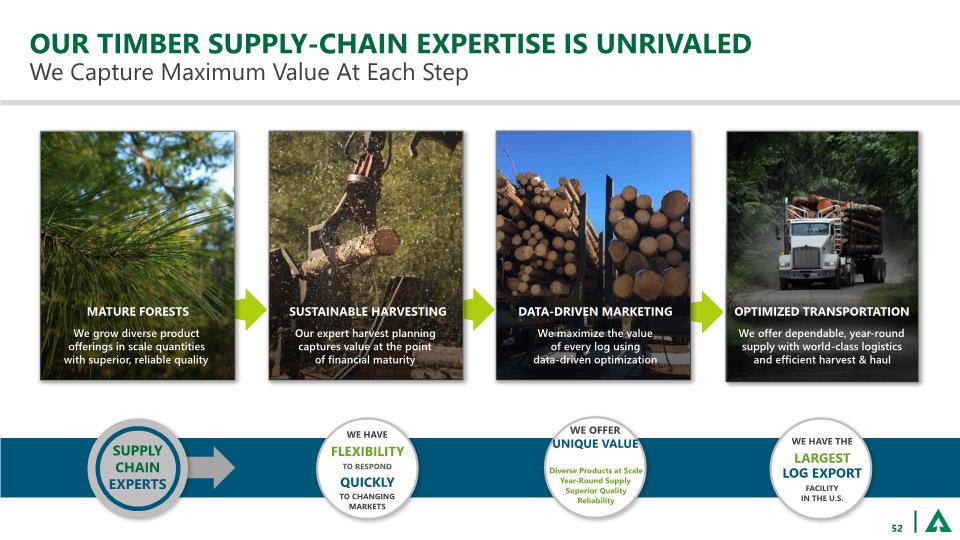

Our TIMBER Supply-chain EXPERTISE is unrivaled We Capture Maximum Value At Each Step Unmatched supply chain capabilities MATURE FORESTS We grow diverse product offerings in scale quantities with superior, reliable quality DATA-DRIVEN MARKETING SUSTAINABLE HARVESTING Our expert harvest planning captures value at the point of financial maturity We maximize the value of every log using data-driven optimization OPTIMIZED TRANSPORTATION We offer dependable, year-round supply with world-class logistics and efficient harvest & haul SUPPLY CHAIN EXPERTS WE OFFER UNIQUE VALUE WE HAVE FLEXIBILITY TO RESPOND QUICKLY TO CHANGING MARKETS Diverse Products at Scale Year-Round Supply Superior Quality Reliability WE HAVE THE LARGEST LOG EXPORT FACILITY IN THE U.S. 52

9 MILLION PRODUCT DISTRIBUTION LOW-COST MANUFACTURING OUR WOOD PRODUCTS SUPPLY CHAIN IS EFFICIENT We Drive Out Cost and Maximize Value From Raw Materials to End Use FIBER PROCUREMENT We source the optimal mix of raw materials internally and externally to maximize margins Our operational excellence and reliability focus drives top margins for lumber, OSB and EWP We maximize value by using the right mix of our own and other distribution channels DIVERSE CUSTOMERS Our customers value our quality, scale, reliability and sustainable practices 53 WE MAXIMIZE THE RESOURCE BY USING 95% OF EACH LOG METRIC TONS OF CO2 OUR PRODUCTS STORE THE EQUIVALENT OF EACH YEAR ON AVERAGE

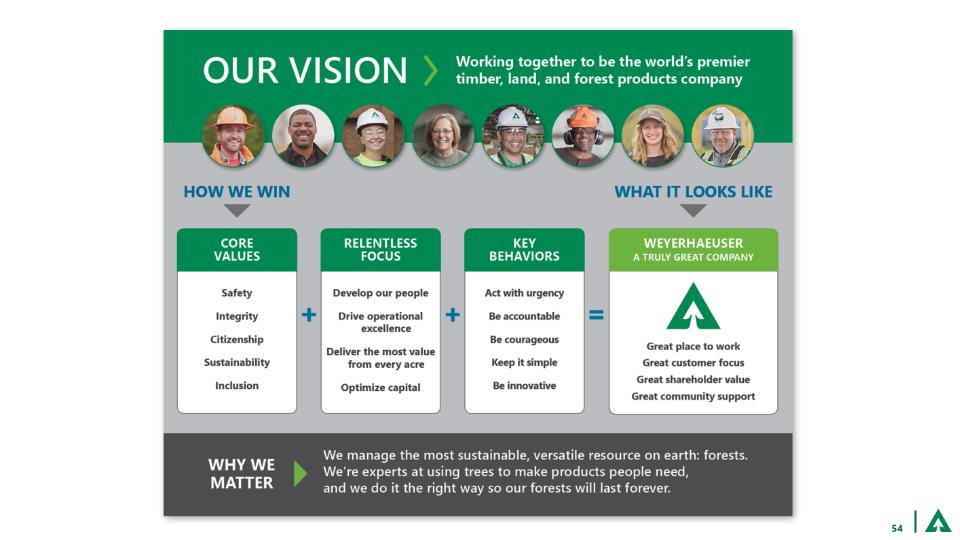

54

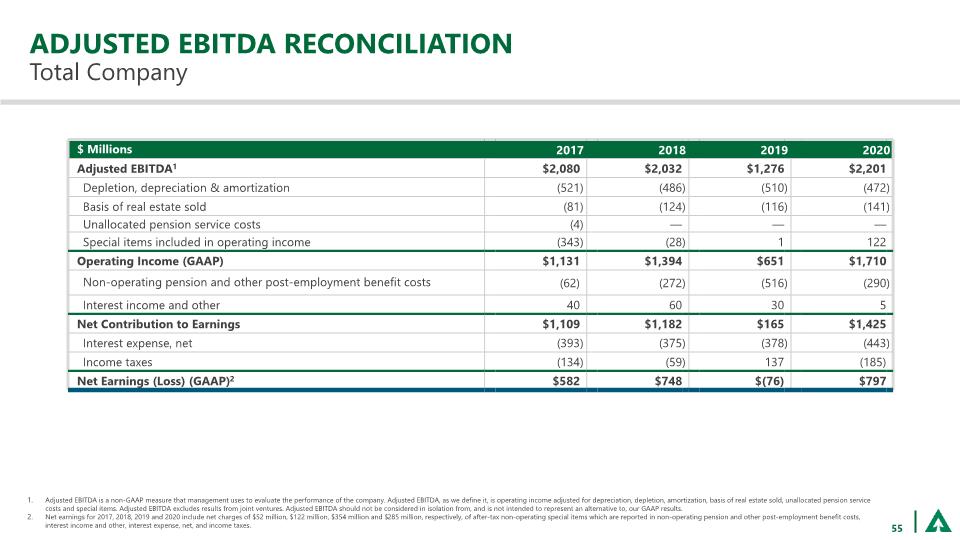

ADJUSTED EBITDA RECONCILIATION Total Company Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. Net earnings for 2017, 2018, 2019 and 2020 include net charges of $52 million, $122 million, $354 million and $285 million, respectively, of after-tax non-operating special items which are reported in non-operating pension and other post-employment benefit costs, interest income and other, interest expense, net, and income taxes. 55

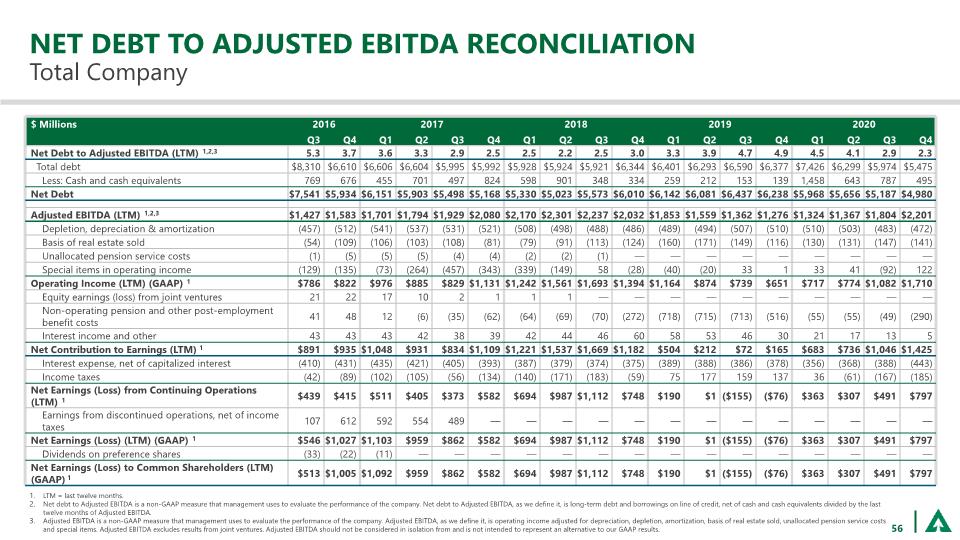

Net debt to ADJUSTED EBITDA RECONCILIATION Total Company 56 LTM = last twelve months. Net debt to Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Net debt to Adjusted EBITDA, as we define it, is long-term debt and borrowings on line of credit, net of cash and cash equivalents divided by the last twelve months of Adjusted EBITDA. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.

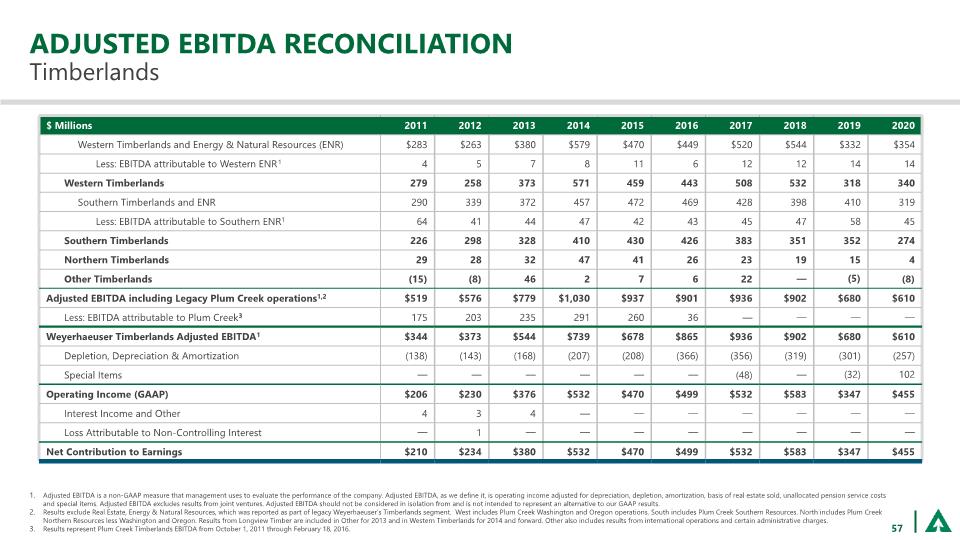

Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. Results exclude Real Estate, Energy & Natural Resources, which was reported as part of legacy Weyerhaeuser’s Timberlands segment. West includes Plum Creek Washington and Oregon operations. South includes Plum Creek Southern Resources. North includes Plum Creek Northern Resources less Washington and Oregon. Results from Longview Timber are included in Other for 2013 and in Western Timberlands for 2014 and forward. Other also includes results from international operations and certain administrative charges. Results represent Plum Creek Timberlands EBITDA from October 1, 2011 through February 18, 2016. ADJUSTED EBITDA RECONCILIATION Timberlands 57

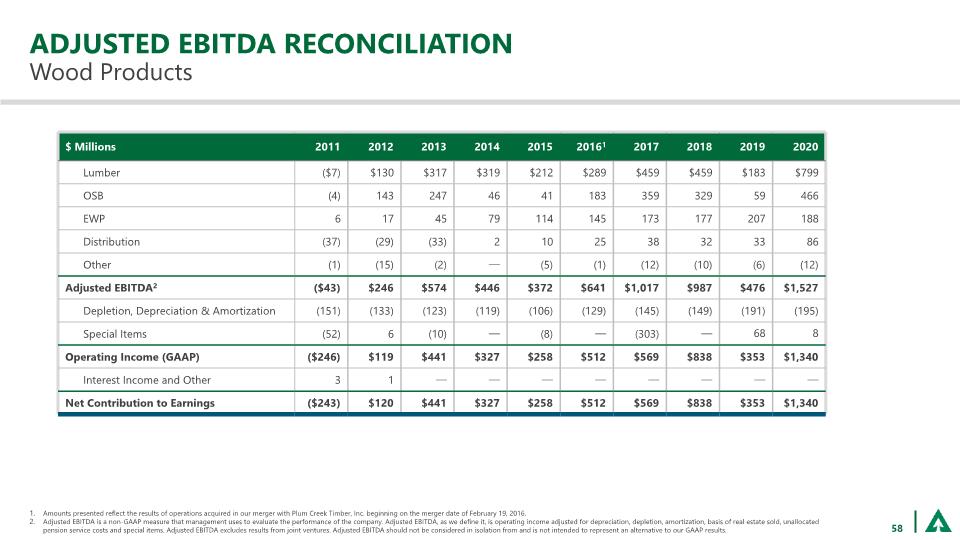

Amounts presented reflect the results of operations acquired in our merger with Plum Creek Timber, Inc. beginning on the merger date of February 19, 2016. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. ADJUSTED EBITDA RECONCILIATION Wood Products 58

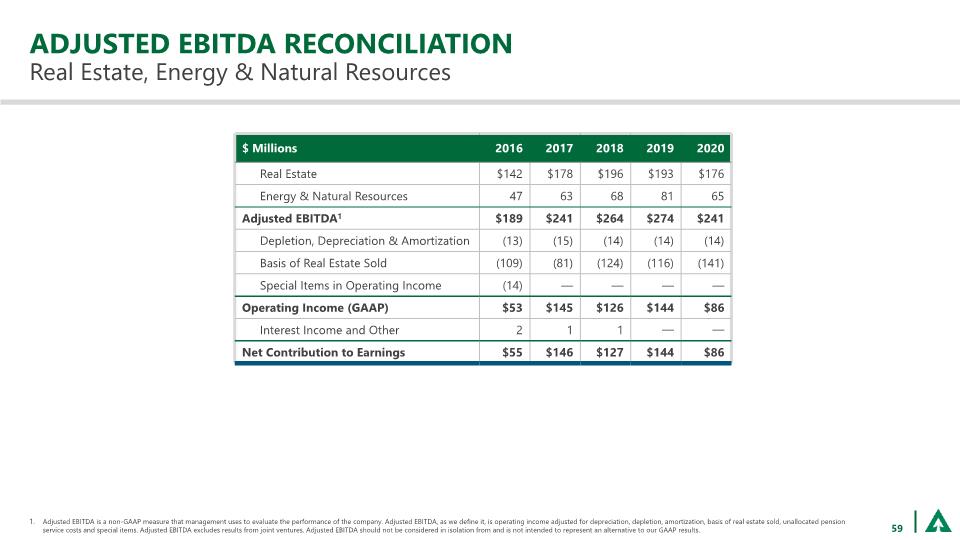

Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. ADJUSTED EBITDA RECONCILIATION Real Estate, Energy & Natural Resources 59

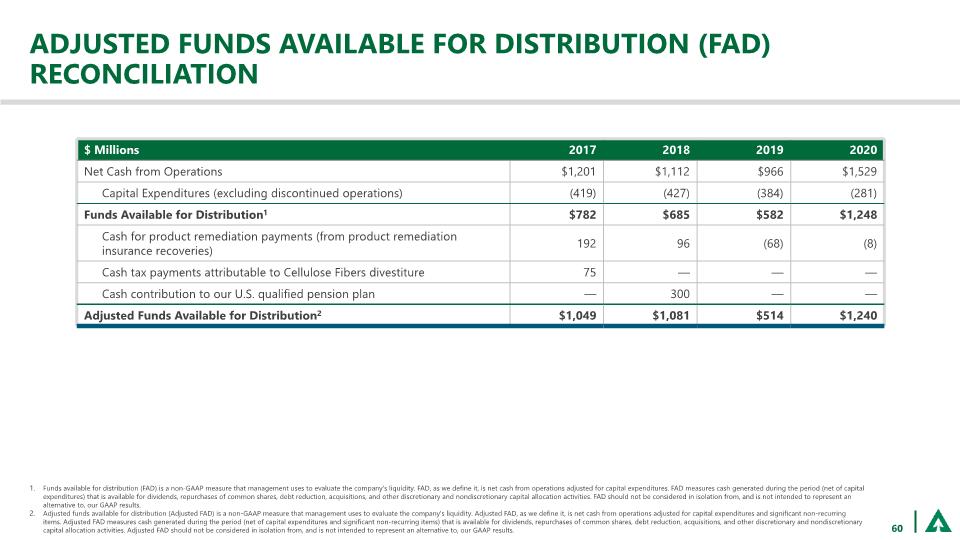

ADJUSTED FUNDS AVAILABLE FOR DISTRIBUTION (FAD) RECONCILIATION 60 Funds available for distribution (FAD) is a non-GAAP measure that management uses to evaluate the company's liquidity. FAD, as we define it, is net cash from operations adjusted for capital expenditures. FAD measures cash generated during the period (net of capital expenditures) that is available for dividends, repurchases of common shares, debt reduction, acquisitions, and other discretionary and nondiscretionary capital allocation activities. FAD should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. Adjusted funds available for distribution (Adjusted FAD) is a non-GAAP measure that management uses to evaluate the company's liquidity. Adjusted FAD, as we define it, is net cash from operations adjusted for capital expenditures and significant non-recurring items. Adjusted FAD measures cash generated during the period (net of capital expenditures and significant non-recurring items) that is available for dividends, repurchases of common shares, debt reduction, acquisitions, and other discretionary and nondiscretionary capital allocation activities. Adjusted FAD should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results.