Attached files

| file | filename |

|---|---|

| EX-2.2 - UNIT EXCHANGE AGREEMENT - RC-1, Inc. | rc1_ex0202.htm |

| EX-2.1 - FORM OF SHARE EXCHANGE AGREEMENT - RC-1, Inc. | rc1_ex0201.htm |

| 8-K - CURRENT REPORT - RC-1, Inc. | rc1_8k.htm |

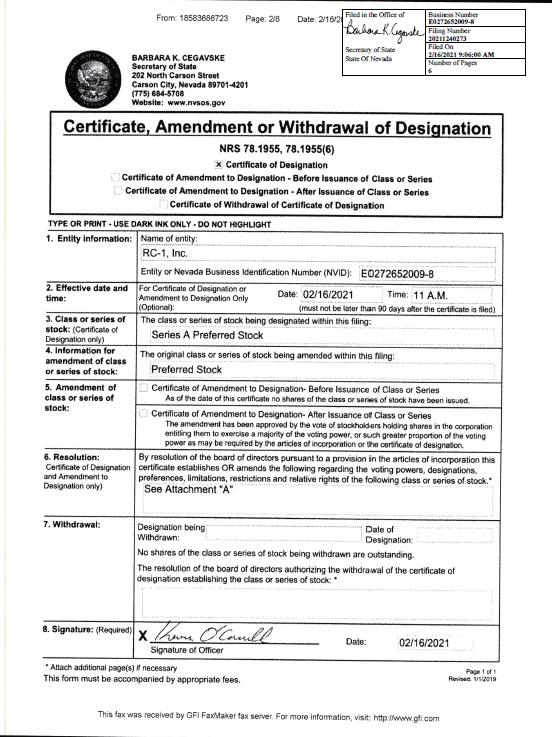

Exhibit 3(iii)

| 1 |

| A. | Description and Designation of Series A Preferred Stock |

1. Designation. A total of 100,000 shares of the Corporation’s Preferred Stock shall be designated the “Series A Preferred Stock” (the “Series A Preferred”). Except as otherwise defined herein, all terms used herein shall have the meanings ascribed to such terms in the Corporation’s Amended and Restated Articles of Incorporation (the “Articles of Incorporation”). Any terms used and not defined herein shall have the meanings ascribed to them in the Articles of Incorporation. The Series A Preferred Stock shall automatically be canceled and redeemed on such date that the Corporation reports total gross revenues of more than two million five hundred thousand United States dollars ($2,500,000) on a Quarterly Report on Form 10-Q filed with the United States Securities and Exchange Commission.

2. Stated Capital. The amount to be represented in stated capital at all times for each share of Series A Preferred Stock shall be $.001.

3. All shares of Series A Preferred Stock shall rank subordinate and junior to all of the Common Stock now or hereafter issued, as to distributions of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

4. No dividend shall be declared or paid on the Series A Preferred Stock.

5. No Liquidation Participation. In the event of any voluntary or involuntary liquidation, dissolution, or winding-up of the Corporation, the holders of shares of Series A Preferred Stock shall not be entitled to participate in the distribution of the assets of the Corporation. A liquidation, dissolution, or winding-up of the Corporation, as such terms are used in this of Article (V) shall not be deemed to be occasioned by or to include any merger of the Corporation with or into one or more corporations or other entities, any acquisition or exchange of the outstanding shares of one or more classes or series of the Corporation, or any sale, lease, exchange, or other disposition of all or a part of the assets of the Corporation.

6. Right to Action by Vote or Consent. The Series A Preferred Stock shall have no right to vote at any meeting of the shareholders of Common Stock, except, if for any reason that the Corporation shall become a non-reporting company under the Securities Act of 1933, as amended, (the “Milestone Event”), then the shares of outstanding Series A Preferred Stock shall have the right to take action at any meeting of shareholders of Common Stock, by written consent or vote based on the number of votes equal to twice the number of votes of all outstanding shares of Common Stock, such that the holders of outstanding shares of Series A Preferred Stock shall then always constitute sixty-six and two thirds (66 2/3rds) of the voting rights of the Corporation. The 66 2/3rds voting rights may be exercised by vote or written consent based on the will of a majority of the holders of Series A Preferred Stock. If there is a Milestone Event the holders of shares of Common Stock and Series A Preferred Stock shall vote together and not as separate classes.

7. Conversion The shares of Series A Preferred Stock shall be convertible into shares of Common Stock on the terms and conditions set forth in this Section 7

| 2 |

(a) Optional Conversion Right. At any time or times after the Milestone Event, all of the holder(s) of shares of Series A Preferred Stock, acting as a group, shall be entitled, without any further consideration, to convert then-outstanding shares of Series A Preferred Stock into fully paid and non-assessable shares of Common Stock in accordance with Section 7(b), at the Conversion Rate. The Corporation shall not issue any fraction of a share of Common Stock upon any conversion. If the issuance would result in the issuance of a fraction of a share of Common Stock, the Corporation shall round such fraction of a share of Common Stock up to the nearest whole share. The Corporation shall pay any and all transfer, stamp, and similar taxes that may be payable with respect to the issuance and delivery of Common Stock upon conversion of any shares of Series A Preferred Stock. Except as specifically set forth herein, the optional conversion of any shares of Series A Preferred Stock shall immediately terminate any rights, including rights to payment of accrued dividends, attached to such shares of Series A Preferred Stock upon conversion.

(b) Conversion Rate. The number of shares of Common Stock issuable upon conversion of any shares of Series A Preferred Stock pursuant to Section 7(a) shall be determined by multiplying the number of outstanding shares of Common Stock issued and outstanding on the date of the Conversion, such that the holders of outstanding shares of Series A Preferred Stock shall then receive a pro-rata amount of Common Stock that would then constitute sixty-six and two thirds (66 2/3rds) of the total issued and outstanding Common Stock of the Corporation (the “Conversion Shares”).

(c) Insufficient Authorized Shares. If at any time after the Milestone Event, the Corporation does not have a sufficient number of authorized and unreserved shares of Common Stock to satisfy its obligation to issue at least a number of Conversion Shares (appropriately adjusted for any stock split, stock dividend, reverse stock split, stock combination or other similar transaction) (an “Authorized Share Failure”), to the Series A Preferred Stock shareholders, then the Corporation shall immediately take all action necessary to increase the Corporation’s authorized shares of Common Stock to an amount sufficient to allow the Corporation to issue the Conversion Shares (appropriately adjusted for any stock split, stock dividend, reverse stock split, stock combination or other similar transaction) for the Series A Preferred Stock.

(d) Mechanics of Conversion. To convert the shares of Series A Preferred Stock into the Conversion Shares, the Holders of the Series A Preferred Stock or their duly appointed Designee (the “Designee“) (i) shall transmit by facsimile (or otherwise deliver), for receipt at least five days prior to a date on which such shares of Series A Preferred Stock, a copy of an executed notice of conversion in the form attached hereto as Exhibit A (the “Conversion Notice”) to the Corporation and (ii) surrender the certificate(s) representing and/or including such shares of Series A Preferred Stock on the same day on which the Conversion Notice is delivered to a nationally recognized overnight delivery service for delivery to the Corporation (or an indemnification undertaking with respect to such shares of Series A Preferred Stock in the case of its loss, theft, or destruction) (the date on which the conditions set forth in (i) and (ii) are satisfied being the “Conversion Date”). On or before the third Business Day following the Conversion Date, the Corporation shall transmit by facsimile (or otherwise deliver) an acknowledgment of confirmation of receipt of such Conversion Notice to the Holder(s) of such shares and the Corporation’s transfer agent. Subject to the timely receipt of the certificates or indemnification undertaking referred to in clause (ii) above, on or before the fifth Business Day following the Conversion Date, the Corporation shall issue and deliver a certificate, registered in the name of the Holder(s) or such Holders’ designee, for the number of shares of Common Stock to which the Holder(s) shall be entitled.

| 3 |

(e) Adjustments for Mergers or Reorganizations, etc. If at any time there shall occur any reclassification, reorganization, recapitalization, consolidation, sale of all or substantially all of the Corporation’s assets, property, or business, or any merger involving the Corporation, in each case in which the Common Stock is converted into or exchanged for securities (including warrants or other subscription or purchase rights), cash or other property, or pursuant to which any such securities, cash, or other property is to be received by or distributed to the holders of common stock of the Corporation (each, a “Reorganization Event”), then, following any such Reorganization Event, the Conversion Rate shall be adjusted such that Holders of shares of Series A Preferred Stock shall be entitled to receive upon the conversion hereof the kind and amount of securities, cash, or other property which the Holders would have been entitled to receive if, immediately prior to such Reorganization Event, the Holder had held the number of shares of Common Stock as provided hereunder, giving application to all adjustments called for during such period hereunder. The Corporation shall not effect any Reorganization Event unless, prior to the consummation thereof, the successor or surviving entity (if other than the Corporation) and, if an entity different from the successor or surviving entity, the entity whose stock, securities, assets, or other property the holders of common stock are entitled to receive as a result of such Reorganization Event, assumes by written instrument (i) the obligations to deliver such shares of stock, securities, assets, or other property as, in accordance with the foregoing provisions, the Holders of shares of the Series A Preferred Stock may be entitled to receive and (ii) the due and punctual observance and performance of the powers, designations, preferences, and relative, participating, optional, or other special rights, and the qualifications, limitations, or restrictions applicable to the Series A Preferred Stock as set forth herein. The foregoing provisions shall similarly apply to successive Reorganization Events and to the stock or securities of any other corporation.

(f) Adjustment for Reclassification, Exchange, and Substitution. If at any time or from time to time, the common stock issuable upon conversion hereof is changed into the same or a different number of shares of any class or classes of stock, the shares of Series A Preferred Stock will thereafter obtain the right to acquire such number and kind of securities as would have been issuable as a result of conversion of such shares and the Conversion Price therefor shall be appropriately adjusted, such adjustment to be determined by the Board in its sole and absolute discretion, all subject to further adjustment in this Section 7.

(g) Certain Limitations. The Corporation will not enter into any agreements inconsistent with the rights of the Holders hereunder.

(h) Reservation of Common Stock. The Corporation shall, so long as any shares of Series A Preferred Stock are outstanding, reserve and keep available out of its authorized and unissued Common Stock, solely for the purpose of effecting the conversion of the Series A Preferred Stock, such number of shares of Common Stock as shall from time to time be sufficient to effect the conversion of all of the Series A Preferred Stock then outstanding.

| 4 |

(i) Leal Fees. In the event that any action is instituted by the Holders of the Class A Preferred Stock under this Section 7 of these Designations to enforce or interpret any of the terms hereof, the Holders of the Class A Preferred Stock shall be entitled to be paid all court costs and expenses, including reasonable attorneys’ fees, incurred by the Class A Preferred Stock Holders with respect to such action, unless as a part of such action, the court of competent jurisdiction determines that each of the material assertions made by Class A Preferred Stock Holders as a basis for such action were not made in good faith or were frivolous. In the event of an action instituted by or in the name of the Corporation under this Section 7 of these Designations or to enforce or interpret any of the terms of this Section 7 of these Designations, shall be entitled to be paid all court costs and expenses, including attorneys’ fees, incurred by Class A Preferred Stock Holders in defense of such action (including with respect to Class A Preferred Stock Holders’ counterclaims and cross-claims made in such action), unless as a part of such action the court determines that each of Class A Preferred Stock Holders material defenses to such action were made in bad faith or were frivolous.

(j) No Redemption. The shares of Series A Preferred Stock are not redeemable.

(k) Preemptive Rights. The Series A Preferred Stock is not entitled to any preemptive or subscription rights in respect of any securities of the Corporation.

(l) Number of Shares of Series A Preferred Stock. The number of shares of Series A Preferred Stock may not be increased or decreased by the Corporation. Shares of Series A Preferred Stock converted by the Corporation shall be cancelled and shall revert to authorized but unissued Preferred Stock, undesignated as to series.

(m) Consent of Holders. So long as any shares of the Series A Preferred Stock remain outstanding, in addition to any other vote or consent of stockholders required by law or the Articles of Incorporation, the Corporation shall not (through the action of the Board, its stockholders, or otherwise), without the affirmative vote at a meeting or the written consent with or without a meeting of the Holders of at least a majority of the number of shares of Series A Preferred Stock then outstanding, authorize or approve the issuance of any shares of, or of any security convertible into, or convertible or exchangeable for, shares of, preferred stock or any other capital stock of the Corporation, which shares rank prior to or on a parity with shares of Series A Preferred Stock which authorize or create, or increase the authorized number of, any class or series of capital stock of the Corporation the shares of which rank greater to or on a parity with rights of the Holder(s) of Series A Preferred Stock or amend, alter or repeal any of the provisions of this Certificate of Designations designating the Series A Preferred Stock as a series of Preferred Stock or of the Articles of Incorporation so as to affect adversely the powers, designations, preferences, and rights of the Series A Preferred Stock or the Holders thereof

| 5 |

RC-1, INC.

CONVERSION NOTICE

Reference is made to the shares of Series A Preferred Stock, par value $.001 (the “Series A Preferred Stock”) issued to the undersigned by RC-1, Inc. (the “Company”). In accordance with and pursuant to the certificate of designation for the Series A Preferred Stock, the undersigned hereby elects to convert all of the shares of Series A Preferred Stock indicated below into shares of Common Stock, par value $0.001 per share (the “Common Stock”), of the Company, as of the date specified below.

Date of Conversion: _____________________________________________________

Number of shares of Series A Preferred Stock to be converted: _____________________

Please confirm the following information:

Conversion Price: _______________________________________________________

Number of shares of Common Stock to be issued: _______________________________

Please issue the Common Stock into which the Series A Preferred Stock is being converted in the following name and to the following address:

Issue to: _____________________________________________________________

____________________________________________________________________

____________________________________________________________________

Facsimile Number: ______________________________________________________

Authorization: _________________________________________________________

By: ___________________________________________________________

Title: _________________________________________________________

Dated: _____________________________

| 6 |