Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HCI Group, Inc. | d246204dex991.htm |

| 8-K - FORM 8-K - HCI Group, Inc. | d246204d8k.htm |

Leading Homeowners InsurTech February 2021 Exhibit 99.2

Disclaimer This presentation may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. For example, the company may not engage in a qualified public offering. Factors that could cause operating, financial and other results to differ are described in HCI Group Inc.’s most recent Quarterly Report on Form 10-Q or Annual Report on Form 10-K filed with the Securities and Exchange Commission and available on the investor relations page of HCI’s website at www.hcigroup.com and on the Securities and Exchange Commission's website at www.sec.gov. TypTap Insurance Group, Inc., together with its parent company HCI Group, Inc. (the “Company,” “TypTap,” “we” or “us” or when possessive “our”) disclaims all obligations to update any forward-looking statements.

is the future of insurance TypTap is an AI-enabled technology company designed to identify homeowners policies that deliver profitable results while mitigating risk

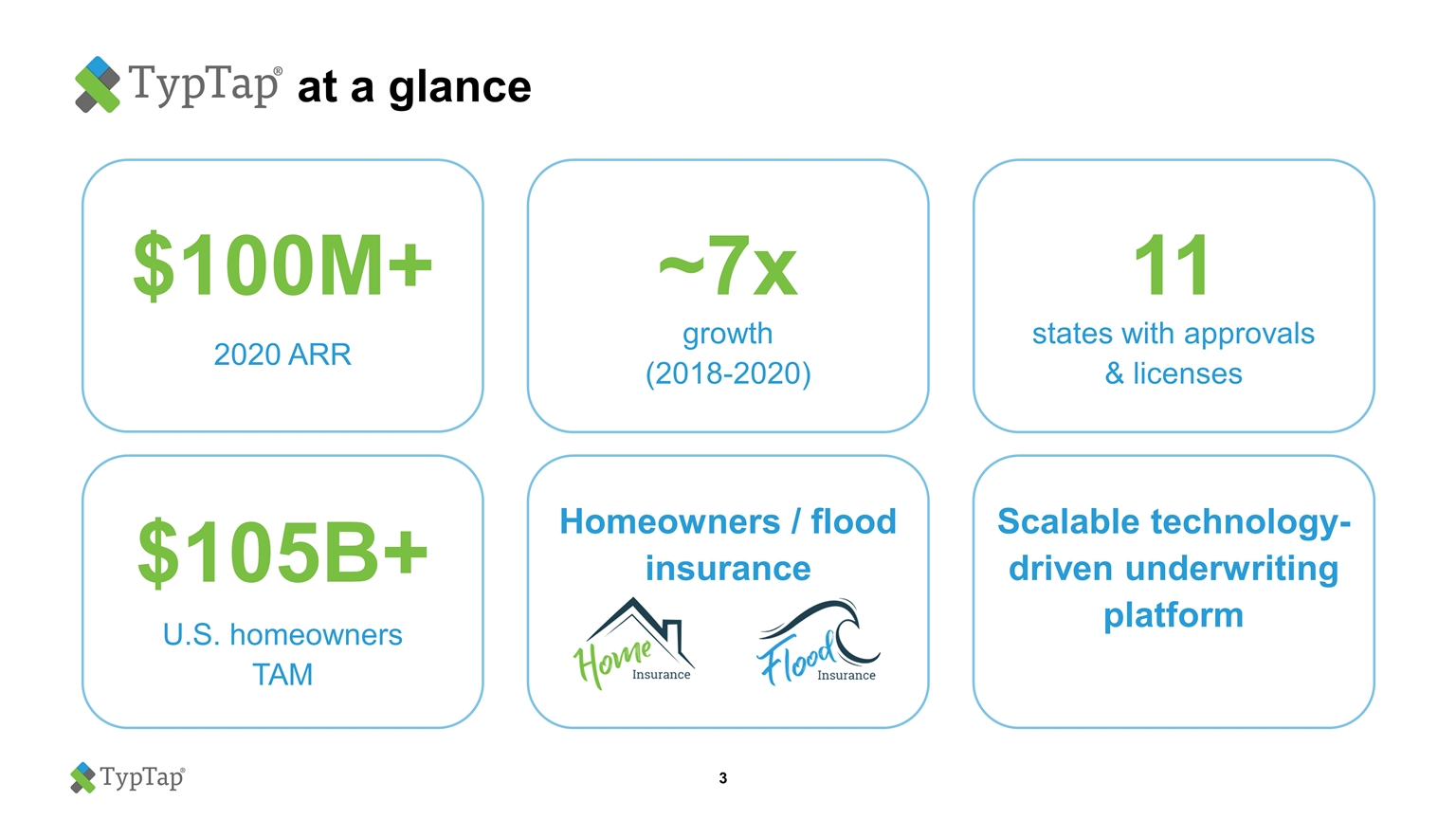

Homeowners / flood insurance Scalable technology-driven underwriting platform at a glance $100M+ 2020 ARR ~7x growth (2018-2020) $105B+ U.S. homeowners TAM 11 states with approvals & licenses

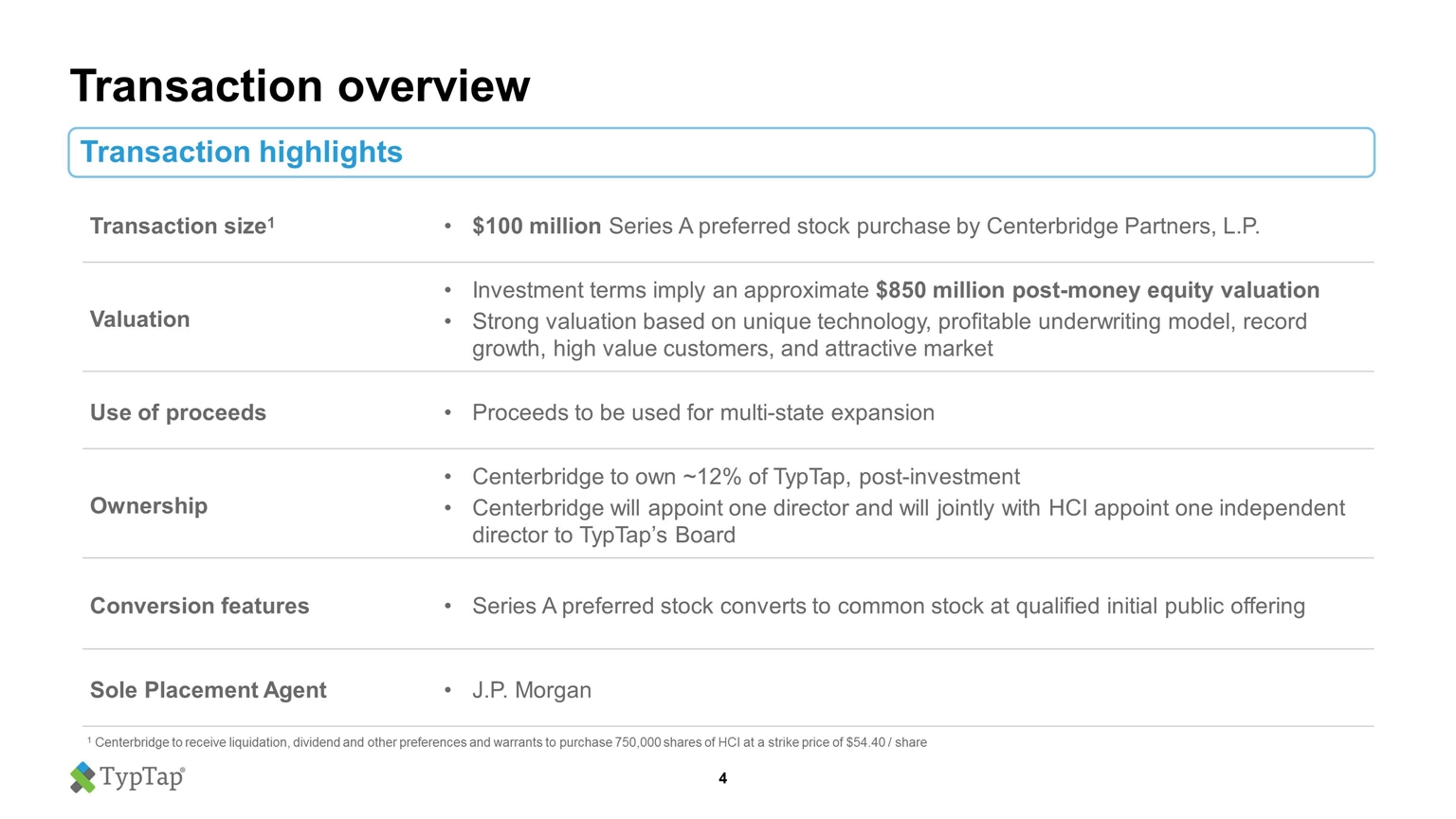

Transaction overview Transaction highlights Transaction size1 $100 million Series A preferred stock purchase by Centerbridge Partners, L.P. Valuation Investment terms imply an approximate $850 million post-money equity valuation Strong valuation based on unique technology, profitable underwriting model, record growth, high value customers, and attractive market Use of proceeds Proceeds to be used for multi-state expansion Ownership Centerbridge to own ~12% of TypTap, post-investment Centerbridge will appoint one director and will jointly with HCI appoint one independent director to TypTap’s Board Conversion features Series A preferred stock converts to common stock at qualified initial public offering Sole Placement Agent J.P. Morgan 1 Centerbridge to receive liquidation, dividend and other preferences and warrants to purchase 750,000 shares of HCI at a strike price of $54.40 / share

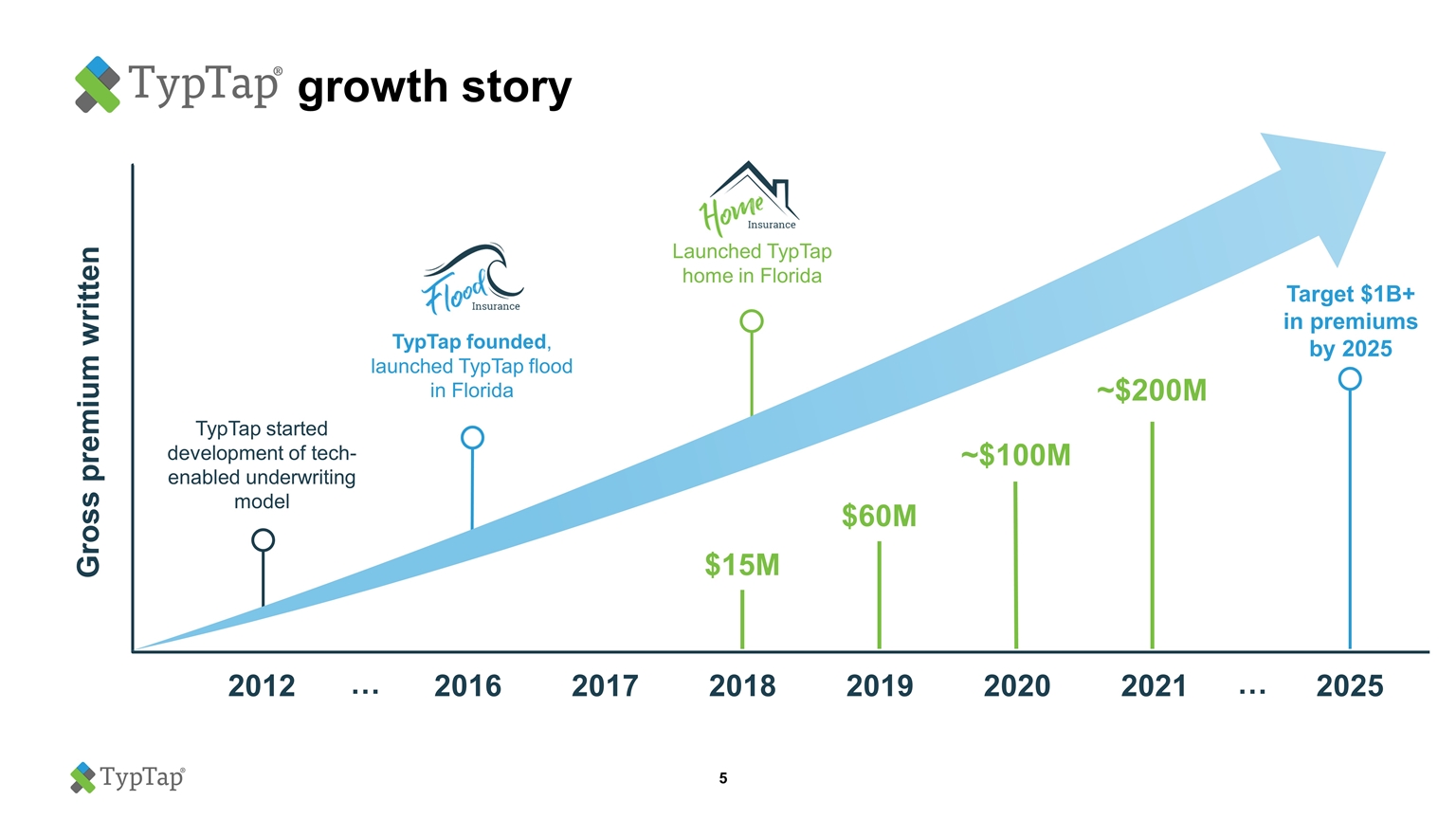

growth story 2012 2016 2018 TypTap started development of tech-enabled underwriting model Launched TypTap home in Florida TypTap founded, launched TypTap flood in Florida Target $1B+ in premiums by 2025 2019 2017 $15M $60M ~$100M Gross premium written 2020 2025 … 2021 ~$200M …

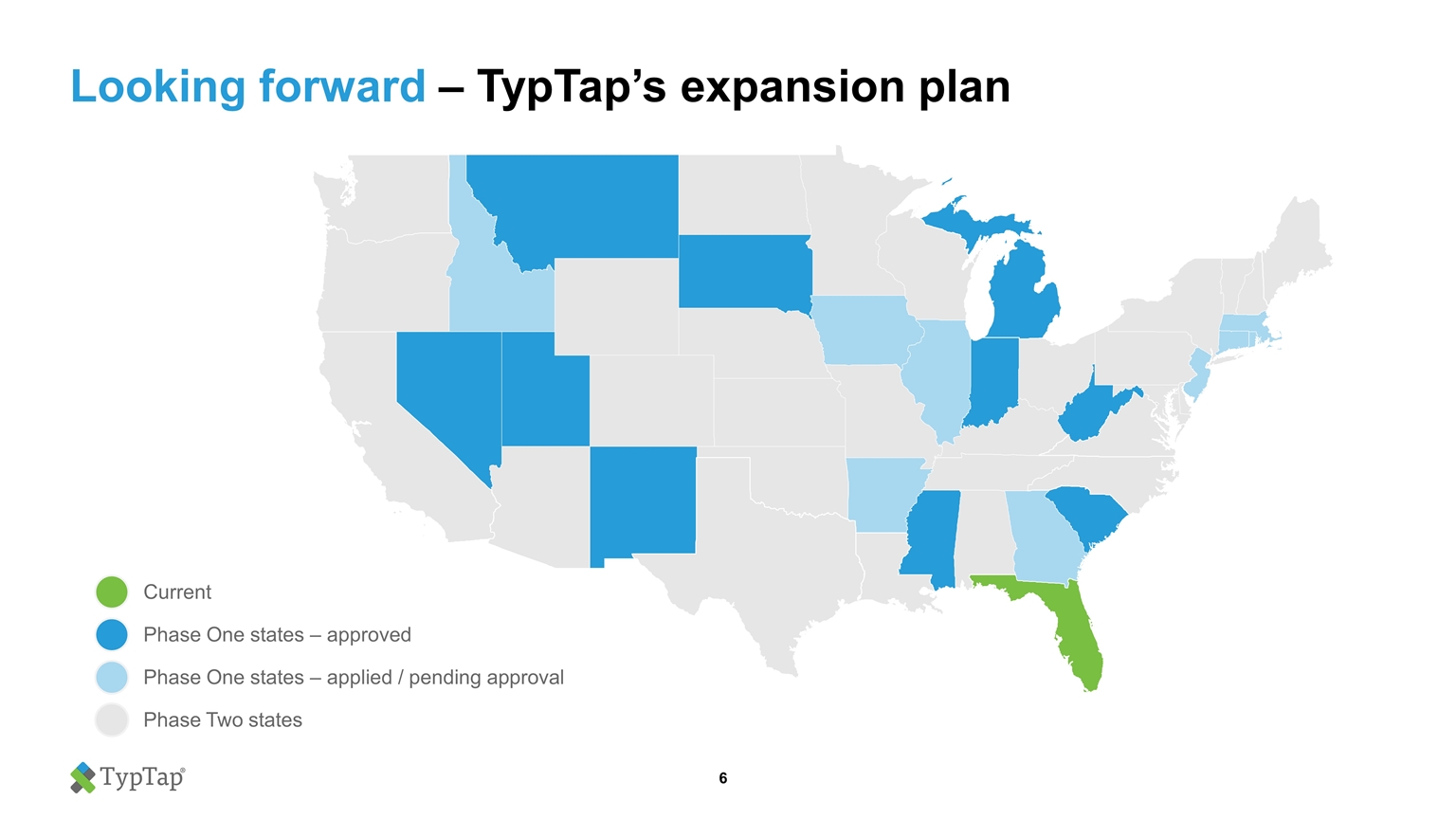

Looking forward – TypTap’s expansion plan Phase One states – approved Phase One states – applied / pending approval Phase Two states Current

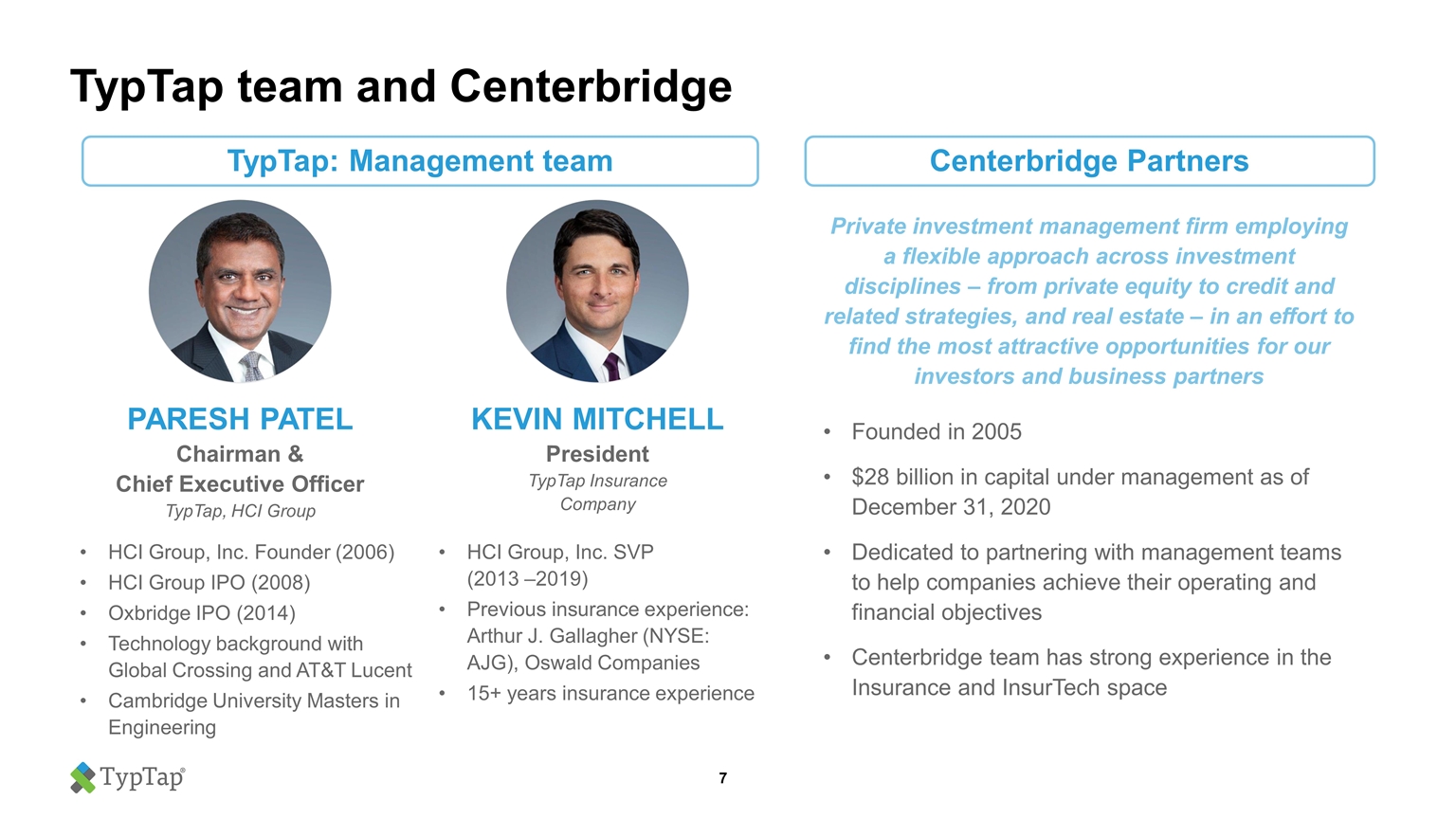

TypTap team and Centerbridge Chairman & Chief Executive Officer TypTap, HCI Group President TypTap Insurance Company PARESH PATEL KEVIN MITCHELL TypTap: Management team Centerbridge Partners Private investment management firm employing a flexible approach across investment disciplines – from private equity to credit and related strategies, and real estate – in an effort to find the most attractive opportunities for our investors and business partners Founded in 2005 $28 billion in capital under management as of December 31, 2020 Dedicated to partnering with management teams to help companies achieve their operating and financial objectives Centerbridge team has strong experience in the Insurance and InsurTech space HCI Group, Inc. Founder (2006) HCI Group IPO (2008) Oxbridge IPO (2014) Technology background with Global Crossing and AT&T Lucent Cambridge University Masters in Engineering HCI Group, Inc. SVP (2013 –2019) Previous insurance experience: Arthur J. Gallagher (NYSE: AJG), Oswald Companies 15+ years insurance experience