Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Shake Shack Inc. | shak-20210225_exhibit991.htm |

| 8-K - 8-K - Shake Shack Inc. | shak-20210225.htm |

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan F O U R T H Q U A R T E R E A R N I N G S S U P P L E M E N T A L F E B R U A R Y 2 5 , 2 0 2 1 1

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, expected financial results and operating performance for fiscal 2020 and fiscal 2021, including expected 2021 key financial drivers, expected development targets for fiscal 2021 and fiscal 2022, including expected Shack construction and openings, expected same-Shack sales growth and trends in the Company’s operations, the expansion of the Company’s delivery services, the Company’s digital investments and strategies, and statements relating to the effects of COVID-19 and the Company’s mitigation efforts. Forward-looking statements discuss the Company’s current expectations and projections relating to its financial operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "future," "intend," "outlook," "potential," "project," "projection," "plan," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. Some of the factors which could cause results to differ materially from the Company’s expectations include the impact of the COVID-19 pandemic, our ability to develop and open new Shacks on a timely basis, the management of our digital capabilities and expansion into delivery, and risks relating to the restaurant industry generally. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 25, 2019 and Quarterly Report on Form 10-Q for the quarterly period ended June 24, 2020 as filed with the Securities and Exchange Commission ("SEC"). All of the Company's SEC filings are available online at www.sec.gov, www.shakeshack.com or upon request from Shake Shack Inc. The forward-looking statements included in this presentation are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS 2

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan FULL YEAR 2020 RESULTS 1. “Shack system-wide sales” is an operating measure and consists of sales from the Company's domestic Company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic Company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks. 2. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative 2019 period was also adjusted. For Q4 2020, same-Shack sales excludes the impact of the fourteenth week and compares the thirteen weeks from September 24, 2020 through December 23, 2020 to the thirteen weeks from September 26, 2019 through December 25, 2019. For fiscal 2020, same-Shack sales excludes the impact of the 53rd week and compares the 52 weeks from December 26, 2019 through December 23, 2020 to the 52 weeks from December 27, 2018 through December 25, 2019. In order to compare like-for-like periods for fiscal 2021, same-Shack sales will compare the 52 weeks from December 31, 2020 through December 29, 2021 to the 52 weeks from January 2, 2020 through December 30, 2020. 3. "Shack-level operating profit," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. See appendix for definition and reconciliation to most comparable GAAP measure. 4. “Adjusted EBITDA,” a non-GAAP measure, a non-GAAP measure, is defined as EBITDA excluding equity-based compensation expense, deferred lease costs, impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non- recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. See appendix for definition and reconciliation to most comparable GAAP measure. $523M FY 2020 Total Revenue $779M Shack system-wide sales1 (27.8%) Decrease in FY same-Shack sales2 $22.7M Adjusted EBITDA4 4.3% of Total Revenue $71.4M Shack-level operating profit3 14.1% of Shack sales 3

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Q4 2020 RESULTS 1. “Shack system-wide sales” is an operating measure and consists of sales from the Company's domestic Company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic Company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks. 2. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative 2019 period was also adjusted. For Q4 2020, same-Shack sales excludes the impact of the fourteenth week and compares the thirteen weeks from September 24, 2020 through December 23, 2020 to the thirteen weeks from September 26, 2019 through December 25, 2019. For fiscal 2020, same-Shack sales excludes the impact of the 53rd week and compares the 52 weeks from December 26, 2019 through December 23, 2020 to the 52 weeks from December 27, 2018 through December 25, 2019. In order to compare like-for-like periods for fiscal 2021, same-Shack sales will compare the 52 weeks from December 31, 2020 through December 29, 2021 to the 52 weeks from January 2, 2020 through December 30, 2020. 3. “Adjusted EBITDA,” a non-GAAP measure, a non-GAAP measure, is defined as EBITDA excluding equity-based compensation expense, deferred lease costs, impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non- recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. See appendix for definition and reconciliation to most comparable GAAP measure. 4. "Shack-level operating profit," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. See appendix for definition and reconciliation to most comparable GAAP measure. $158M Q4 Total Revenue $238M Shack system-wide sales1 $9.2M Adjusted EBITDA3 5.8% of Total Revenue $24.4M Shack-level operating profit4 16.0% of Shack sales (17.4%) Decrease in Q4 same-Shack sales3, compared to (31.7%) in Q3 4

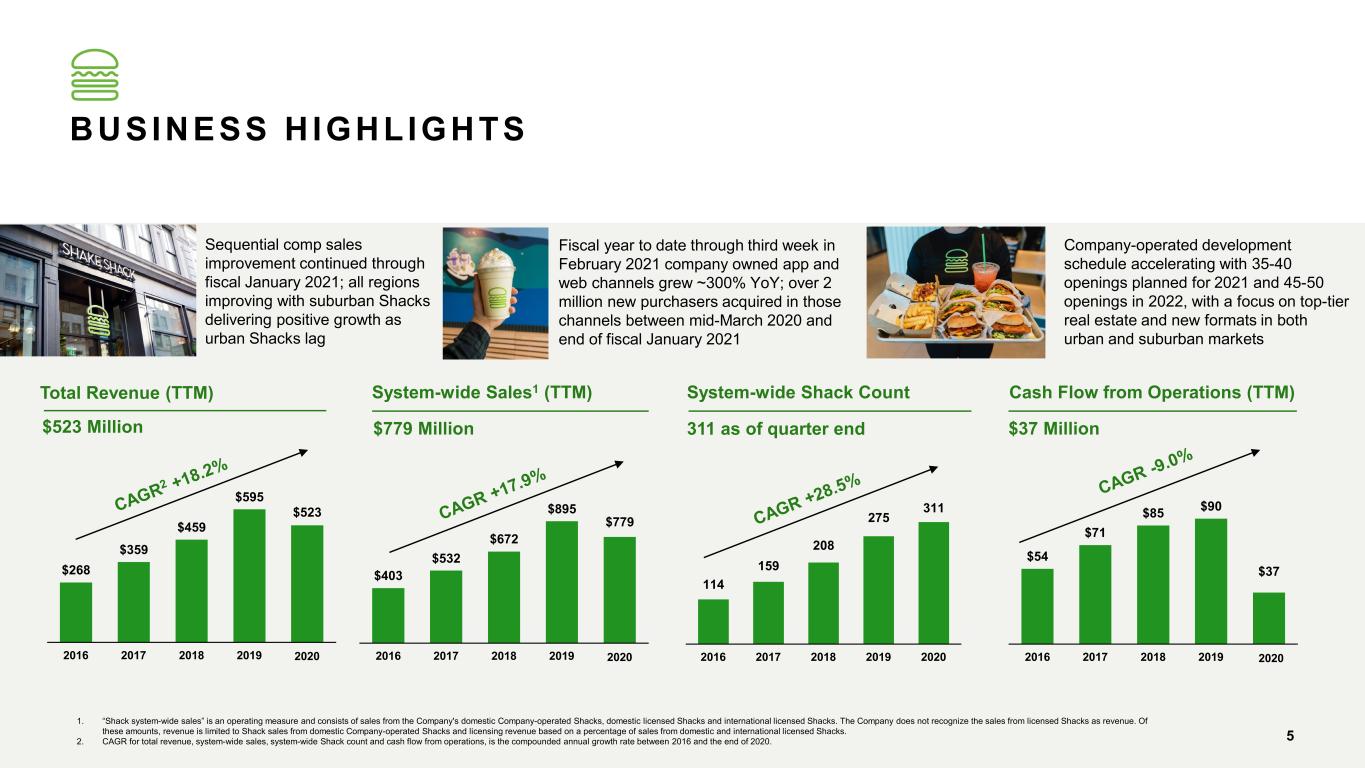

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Total Revenue (TTM) $523 Million System-wide Sales1 (TTM) $779 Million System-wide Shack Count 311 as of quarter end Cash Flow from Operations (TTM) $37 Million 1. “Shack system-wide sales” is an operating measure and consists of sales from the Company's domestic Company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic Company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks. 2. CAGR for total revenue, system-wide sales, system-wide Shack count and cash flow from operations, is the compounded annual growth rate between 2016 and the end of 2020. BUSINESS H IGHLIGHTS $268 $359 $459 $595 $523 2016 20182017 2019 2020 $403 $532 $672 $895 $779 20172016 2018 2019 2020 114 159 208 275 311 202020182016 20192017 $54 $71 $85 $90 $37 202020182016 20192017 5 Company-operated development schedule accelerating with 35-40 openings planned for 2021 and 45-50 openings in 2022, with a focus on top-tier real estate and new formats in both urban and suburban markets Fiscal year to date through third week in February 2021 company owned app and web channels grew ~300% YoY; over 2 million new purchasers acquired in those channels between mid-March 2020 and end of fiscal January 2021 Sequential comp sales improvement continued through fiscal January 2021; all regions improving with suburban Shacks delivering positive growth as urban Shacks lag

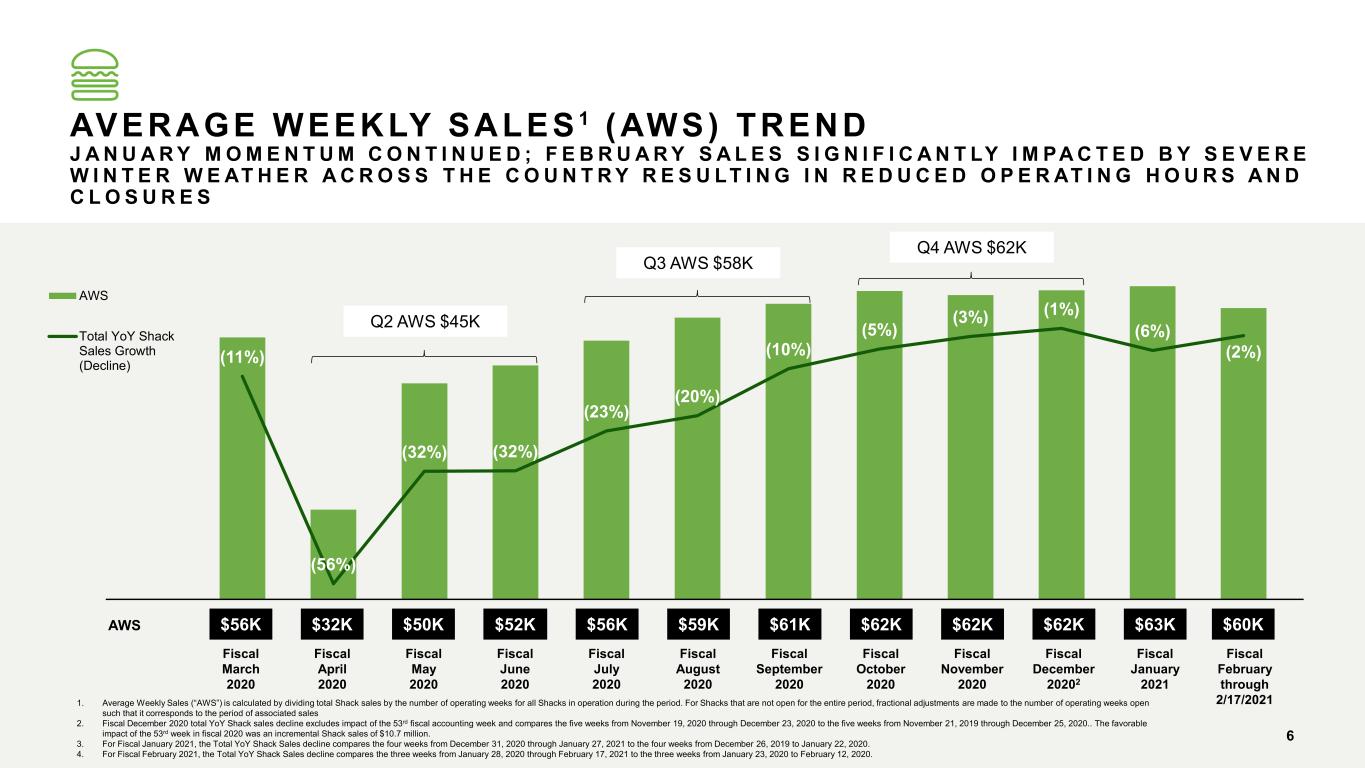

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan (11%) (56%) (32%) (32%) (23%) (20%) (10%) (5%) (3%) (1%) (6%) (2%) AWS Total YoY Shack Sales Growth (Decline) Fiscal August 2020 Fiscal September 2020 1. Average Weekly Sales (“AWS”) is calculated by dividing total Shack sales by the number of operating weeks for all Shacks in operation during the period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of operating weeks open such that it corresponds to the period of associated sales 2. Fiscal December 2020 total YoY Shack sales decline excludes impact of the 53rd fiscal accounting week and compares the five weeks from November 19, 2020 through December 23, 2020 to the five weeks from November 21, 2019 through December 25, 2020.. The favorable impact of the 53rd week in fiscal 2020 was an incremental Shack sales of $10.7 million. 3. For Fiscal January 2021, the Total YoY Shack Sales decline compares the four weeks from December 31, 2020 through January 27, 2021 to the four weeks from December 26, 2019 to January 22, 2020. 4. For Fiscal February 2021, the Total YoY Shack Sales decline compares the three weeks from January 28, 2020 through February 17, 2021 to the three weeks from January 23, 2020 to February 12, 2020. Fiscal July 2020 $56K $59K $61K $62KAWS Fiscal October 2020 Fiscal June 2020 $52K$50K Fiscal May 2020 $56K Fiscal March 2020 $32K Fiscal April 2020 AVERAGE WEEKLY SALES 1 (AWS) TREND J A N U A R Y M O M E N T U M C O N T I N U E D ; F E B R U A R Y S A L E S S I G N I F I C A N T LY I M PA C T E D B Y S E V E R E W I N T E R W E AT H E R A C R O S S T H E C O U N T R Y R E S U LT I N G I N R E D U C E D O P E R AT I N G H O U R S A N D C L O S U R E S $62K Fiscal November 2020 $62K Fiscal December 20202 Q3 AWS $58K Q4 AWS $62K Q2 AWS $45K $63K Fiscal January 2021 $60K Fiscal February through 2/17/2021 6

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 1. Urban refers to a Shack that is located in a very densely populated city area. These locations tend to be very walkable, close to lots of traffic, shopping, tourism and/or office buildings. Suburban is any Shack that is not classified as urban. As of the end of FY 2020, there were 61 suburban Shacks and 53 urban Shacks in the comp base. 2. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative previous year period was also adjusted. 3. For Q4 2020, same-Shack sales excludes the impact of the fourteenth week and compares the thirteen weeks from September 24, 2020 through December 23, 2020 to the thirteen weeks from September 26, 2019 through December 25, 2019. 4. For Fiscal January, same-Shack sales compares the four weeks from December 31, 2020 through January 27, 2021 to the four weeks from January 2, 2020 to January 29, 2020. 5. For Fiscal February, same-Shack sales compares the three weeks from January 28, 2021 to February 17, 2021 to the three weeks from January 30, 2020 to February 19, 2020. SUBURBAN RECOVERY CONTINUES TO OUTPACE URBAN S U B U R B A N S H A C K S D E L I V E R E D G R O W T H I N F I S C A L J A N U A R Y ; F I S C A L F E B R U A R Y W A S N E G AT I V E LY I M PA C T E D B Y S E V E R E W I N T E R W E AT H E R (57%) (43%) (31%) (17%) (27%)(38%) (16%) (0%) 8% (4%) (49%) (32%) (17%) (5%) (16%) Second Quarter 2020 Third Quarter 2020 Fourth Quarter 2020 Fiscal January 2021 Fiscal February through 2/17/2021 Urban SSS%Suburban SSS% URBAN/SUBURBAN1 SAME-SHACK SALES2 VS PRIOR YEAR Total SSS% 43 5 7

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan REGIONAL IMPROVEMENTS CONTINUED THROUGH JANUARY C A L I F O R N I A I M PA C T E D B Y S TAY - AT - H O M E O R D E R S I N F I S C A L J A N U A R Y ; A L L R E G I O N S I M PA C T E D B Y C L O S U R E S D U E T O C H A L L E N G I N G W E AT H E R C O N D I T I O N S I N F I S C A L F E B R U A R Y 1. The regions of domestic Company-operated Shacks are defined as: NYC, which represents 5 boroughs; Northeast, which represents non-NYC NY, CT, DC, DE, MA, MD, NJ, PA, RI, VA; Southeast, which represents AL, FL, GA, LA, NC, TN, TX; Midwest, which represents IL, KS, KY, MI, MN, MO, OH, WI; and West, which represents AZ, CA, CO, NV, UT, WA. 2. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative previous year period was also adjusted. 3. For Q4 2020, same-Shack sales excludes the impact of the fourteenth week and compares the thirteen weeks from September 24, 2020 through December 23, 2020 to the thirteen weeks from September 26, 2019 through December 25, 2019. 4. For Fiscal January, same-Shack sales compares the four weeks from December 31, 2020 through January 27, 2021 to the four weeks from January 2, 2020 to January 29, 2020. 5. For Fiscal February, same-Shack sales compares the three weeks from January 28, 2021 to February 17, 2021 to the three weeks from January 30, 2020 to February 19, 2020. REGIONAL1 SAME-SHACK SALES 2 VS PRIOR YEAR (64%) (24%) (35%) (69%) (38%) (46%) (41%) 11% (7%) (41%) 1% (5%) (47%) 1% (17%) (45%) (15%) (16%) Second Quarter 2020 Third Quarter 2020 Fourth Quarter 2020 Fiscal January 2021 Fiscal February through 2/17/2021 Northeast Southeast West Midwest NYC (incl. Manhattan) Manhattan 43 5 8

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan1. Licensed weekly sales is an operating measure and consists of sales from domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees. 2. “Number of Shacks Open“ excludes temporarily closed Shacks, and Shacks in stadiums that are closed due to COVID. 3. Fiscal December 2020 total YoY licensed sales decline excludes impact of the 53rd fiscal accounting week. The favorable impact of the 53rd week in fiscal 2020 was an incremental licensed sales of $7.0 million. 9 13% (65%) (58%) (47%) (32%) (23%) (9%) (10%) (10%) (15%) (27%) (7%) Licensed Weekly Sales Total year-over-year licensed sales growth (decline) Fiscal August 2020 Fiscal September 2020 Fiscal July 2020 $4.6M $5.4M $5.7M $5.9M Fiscal October 2020 98 104 105 107Number of Shacks Open2 Licensed Weekly Sales1 Fiscal May 2020 $2.4M 59 Fiscal June 2020 $3.5M 91 Fiscal April 2020 $2.0M 56 Fiscal March 2020 96 $4.6M $5.9M Fiscal November 2020 106 $6.4M Fiscal December 20203 106 $5.6M Fiscal January 2021 107 L ICENSED RECOVERY SLOWED IN JANUARY DUE TO INCREASED COVID RESTRICTIONS IN THE UK, ASIA & THE MIDDLE EAST B E G I N N I N G T O R E B O U N D I N F E B R U A R Y A S A S I A L A P S I N I T I A L C O V I D I M PA C T S 1 $6.0M Fiscal February through 2/17/2021 108

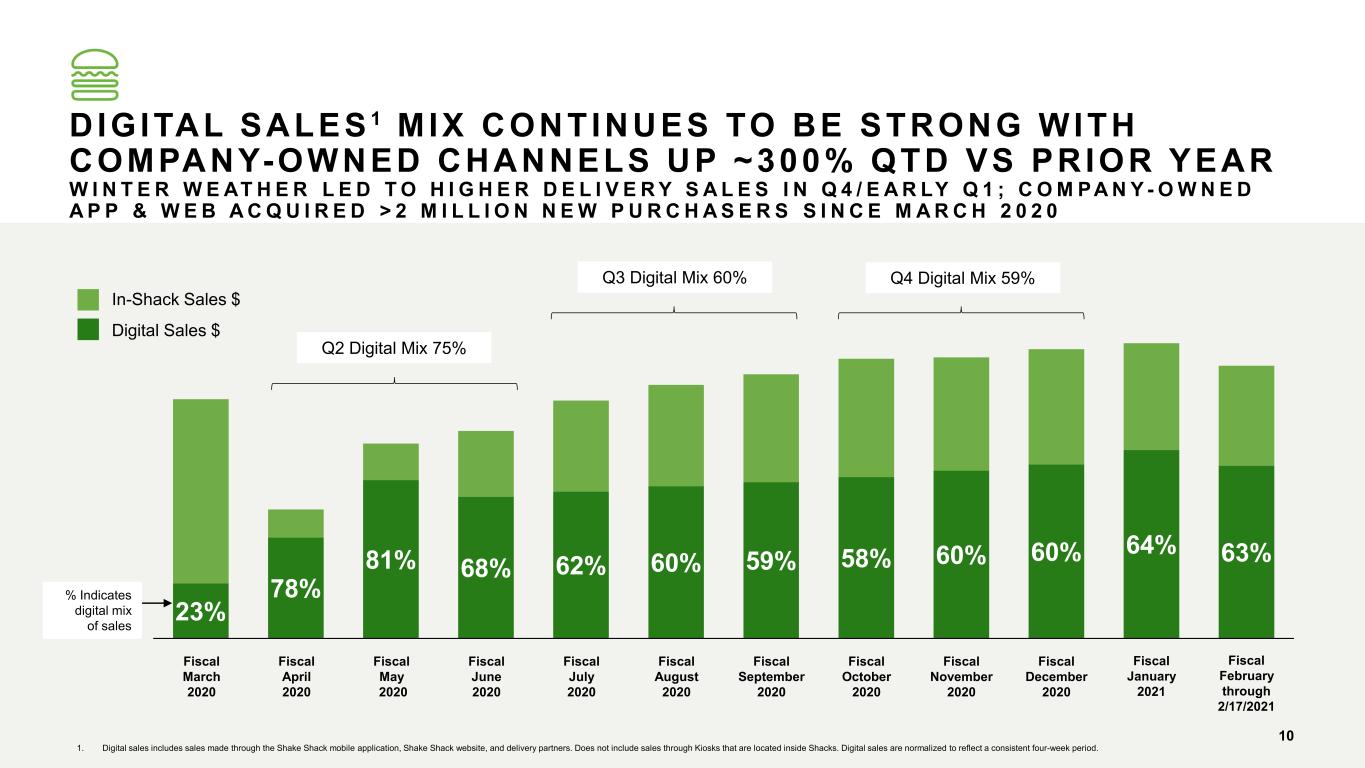

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 1. Digital sales includes sales made through the Shake Shack mobile application, Shake Shack website, and delivery partners. Does not include sales through Kiosks that are located inside Shacks. Digital sales are normalized to reflect a consistent four-week period. DIGITAL SALES 1 MIX CONTINUES TO BE STRONG WITH COMPANY-OWNED CHANNELS UP ~300% QTD VS PRIOR YEAR W I N T E R W E AT H E R L E D T O H I G H E R D E L I V E R Y S A L E S I N Q 4 / E A R LY Q 1 ; C O M PA N Y - O W N E D A P P & W E B A C Q U I R E D > 2 M I L L I O N N E W P U R C H A S E R S S I N C E M A R C H 2 0 2 0 23% 78% 81% 68% 62% 60% 59% 58% 60% 60% 64% 63% % Indicates digital mix of sales In-Shack Sales $ Digital Sales $ Q3 Digital Mix 60% Q4 Digital Mix 59% Fiscal August 2020 Fiscal September 2020 Fiscal July 2020 Fiscal October 2020 Fiscal March 2020 Fiscal April 2020 Fiscal May 2020 Fiscal June 2020 Fiscal November 2020 Fiscal December 2020 Q2 Digital Mix 75% Fiscal January 2021 Fiscal February through 2/17/2021 10

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 44 64 90 124 163 183 2015 2016 2017 2018 2019 2020 2021E 2022E ACCELERATED DEVELOPMENT PLANS UNDERWAY; ~45% DOMESTIC COMPANY-OPERATED UNIT GROWTH PLANNED OVER THE NEXT TWO YEARS Targeting 35-40 openings in fiscal 2021 and 45-50 openings in fiscal 2022 4 new Shacks opened to date in 2021; majority of 2021 openings expected to be heavily back-half weighted, impacted by ongoing COVID challenges Aggressive pursuit of top-tier real estate in both urban and suburban markets with a focus on breadth of diverse formats First drive-thru targeted for Q4 2021 in Orlando, Florida; five to eight additional planned through fiscal 2022 Company-operated Shacks2 217-222 262-272 1. CAGR measures 2015 through mid point of 2022 range. 2. 2021 Shack count range is net of one Shack closure. Subsequent to the end of the fiscal year 2020, the Company was notified by its Landlord of their early termination of the Company's lease at Penn Station, NY due to its plans to redevelop the Long Island Rail Road Concourse following the successful completion of the East End Gateway and opening of the Moynihan Train Hall. This closure is expected to be effective by February 2021. 2022 Shack range assumes no Shack closures. 11

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 40 50 69 84 112 128 2015 2016 2017 2018 2019 2020 2021E 2022E TARGETING >170 TOTAL L ICENSED SHACKS BY END OF 2022 F O C U S O N A S I A ; E V O LV I N G D E S I G N I N C O R P O R AT E S S H A C K T R A C K C O N V E N I E N C E 143-148 163-173 1. CAGR measures 2015 through mid point of 2022 range. 2. 2015-2020 is net of closures. 2021-2022 Shack count assumes no Shack closures. Targeting 15-20 openings in 2021 and 20-25 in 2022 across mainland China, Mexico and other markets 2 new licensed Shacks opened to date in 2021; Kuwait and Dubai Strength of brand continues to reinforce opportunity for global expansion Licensed partners are strong, proven operators with previous success expanding global brands Licensed Shacks2 12

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan LICENSED DEVELOPMENT TARGETING 15-20 OPENINGS IN 2021 N E W S H A C K S W I L L I N C R E A S I N G LY I N C O R P O R AT E S H A C K T R A C K F E AT U R E S 1313 Motor City, Dubai opened Feb 2021 with both curbside and a walk-up window

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 2021 OUTLOOK G I V E N T H E S U B S TA N T I A L U N C E R TA I N T Y A N D R E S U LT I N G M AT E R I A L E C O N O M I C I M PA C T C A U S E D B Y T H E C O V I D - 1 9 PA N D E M I C , F U L L G U I D A N C E F O R T H E F I S C A L Y E A R E N D I N G D E C E M B E R 2 9 , 2 0 2 1 W I L L N O T B E P R O V I D E D 1. Includes approximately $9M of the approximately $10M total Equity-based compensation. These forward-looking projections are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different. Factors that might cause such differences include, but are not limited to, those discussed in the Company's Form 10-K for the fiscal year ended December 25, 2019 and the Form 10-Q for the quarterly period ended June 24, 2020. These forward-looking projections should be reviewed in conjunction with the consolidated financial statements and the section titled “Trends in Our Business” which forms the basis of our assumptions used to prepare these forward-looking projections. You should not attribute undue certainty to these projections, and we undertake no obligation to revise or update any forward-looking information, except as required by law. Domestic Company-operated openings Licensed openings General and administrative expenses Equity-based compensation Depreciation expense Pre-opening costs 35 to 40 15 to 20 $83M to $86M1 Approximately $10M $60M to $63M $14M to $15M 14 • Operating environment continues to be volatile and timing of full recovery uncertain with dining room restrictions in place and varying states of open markets • No major inflationary changes across food costs expected at the current time and packaging levels staying high due to digital mix, although continue to monitor closely given uncertain and changing operating environment • Labor inflation expected to be in the mid-single digit range compared to last year. Potential inefficiencies in the short term while increasing hiring and training new team members to support sales return • Operating expenses expected to be elevated in the near term due to a higher delivery mix, COVID-specific safety supplies for the teams, and the gradual return of certain other costs in preparation for an expected sales recovery • Commitment to G&A investments to meet ramped up development schedule. Continued focus on scalable growth, Shack format evolution, including drive- thru, Shack Track, and the digital guest experience • Given the uncertainty caused by the COVID-19 pandemic in terms of the timing of a full sales recovery – and the resulting impact on taxable income – specific 2021 tax rate guidance will not be issued at this time. In a normal operating environment, the adjusted pro forma tax rate, excluding the impact of stock- based compensation is expected to be between 26% and 28%, in line with 2020

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan SHACK TRACK CONVENIENCE BEING INTEGRATED INTO BOTH NEW AND EXISTING SHACKS SHACKS WILL CONTINUE TO ENHANCE PICKUP EXPERIENCE 13 SHACK TRACK WALK-UP WINDOWS TODAY; 10-15 MORE NEW AND RETROFITS IN 2021 1 SHACK TRACK DRIVE-UP WINDOW TODAY; 5-6 MORE NEW IN 2021 Pre-order digitally and pickup your shack… …inside, contact-free …outside, at a window …in your car, through a drive- up lane 15

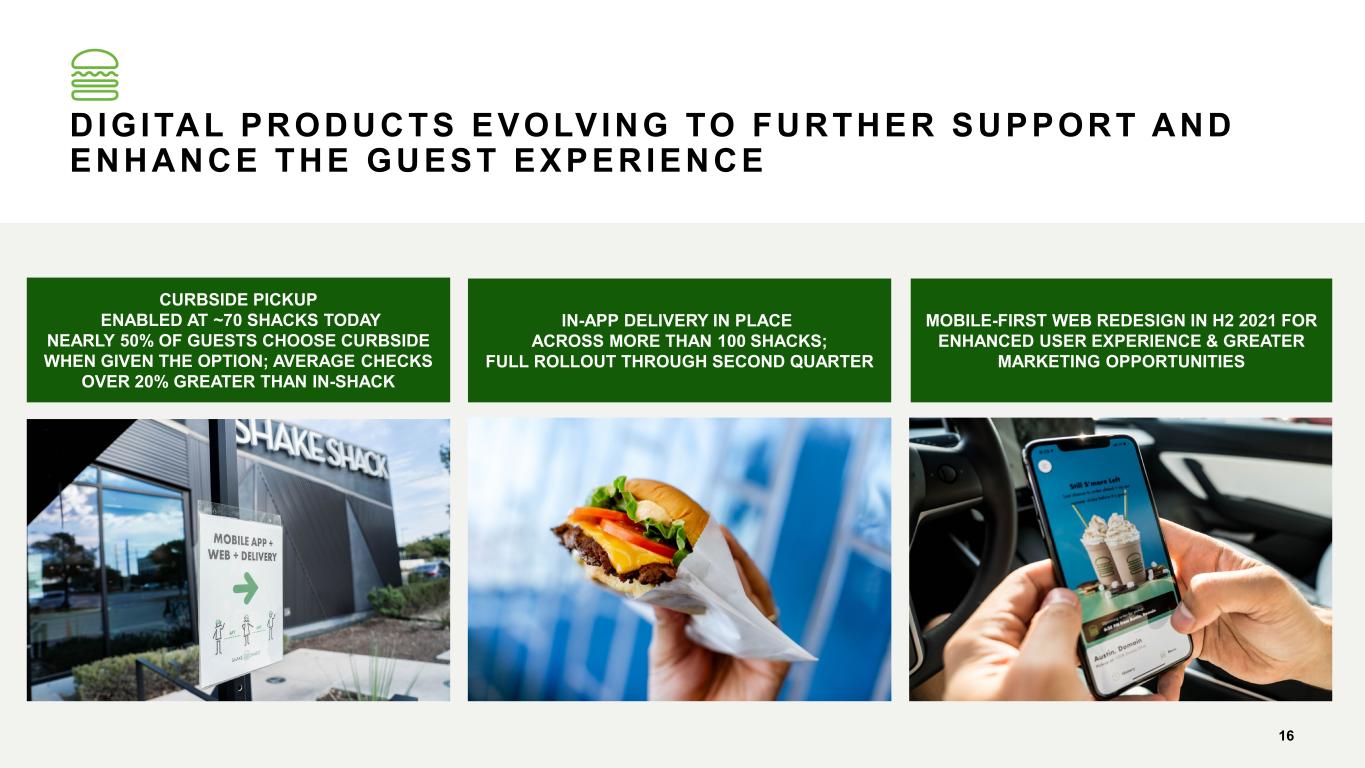

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan CURBSIDE PICKUP ENABLED AT ~70 SHACKS TODAY NEARLY 50% OF GUESTS CHOOSE CURBSIDE WHEN GIVEN THE OPTION; AVERAGE CHECKS OVER 20% GREATER THAN IN-SHACK D IGITAL PRODUCTS EVOLVING TO FURTHER SUPPORT AND ENHANCE THE GUEST EXPERIENCE IN-APP DELIVERY IN PLACE ACROSS MORE THAN 100 SHACKS; FULL ROLLOUT THROUGH SECOND QUARTER MOBILE-FIRST WEB REDESIGN IN H2 2021 FOR ENHANCED USER EXPERIENCE & GREATER MARKETING OPPORTUNITIES 16

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan LTO'S TO DRIVE ENGAGEMENT IN 2021 C O N T I N U E D F O C U S O N E L E VAT E D , M O D E R N , F U N V E R S I O N S O F T H E C L A S S I C S 1717

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan INVESTING IN OUR TEAMS TO DRIVE GROWTH Launched the Shift Up Education Program to progress the careers of the future leaders of Shake Shack, covering training in professional, financial, and leadership skills, with the goal of promotion within the Company More than 56% of internal promotions in 2020 were women, and 76% were underrepresented minorities Created over 1,000 new jobs in 2020 across our business, including nearly 20% increase to home office employee count Paid out close to $6M in additional pay to our Shack team members in 2020, including bonuses, and continue to award equity grants to GMs Rolled out a new formalized comp and incentive structure that ensures transparency and equity Increased entry-level wages at a majority of Shacks, at beginning of 2021 Launching a dependent care FSA for all benefit-eligible employees, expanding parental leave to Shift Managers and extending the bonding leave benefit Awarded 100% score for third year in a row on Human Rights Campaign’s Corporate Equality Index, for support of the LGBTQ+ community in the workplace Building extensive diversity, equity and inclusion initiatives including mentoring programs, unconscious bias training, and employee resource groups Created paid time off Vaccination and Voting Policy to encourage participation Career Development Culture Salary & Benefits 18

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan STAND FOR SOMETHING GOOD & OUR COMMITMENT TO ESG I N A L L A R E A S O F T H E B U S I N E S S I N C L U D I N G M E N U A N D S O U R C I N G , S U P P O R T I N G O U R T E A M , C O M M U N I T Y E N G A G E M E N T, O P E R AT I O N S A N D C O R P O R AT E G O V E R N A N C E Board of Directors consists of majority independent seats, with a diverse board in terms of gender, race, and ethnicity, and separate CEO & Chairman positions Robust oversight by committee in areas including executive compensation, Company-wide benefit programs, food safety, enterprise risk management and data security Active outreach and engagement with major shareholders in relation to corporate governanc and ESG priorities Extensive diversity, equity & inclusion initiatives including mentoring programs, unconscious bias training, employee resource groups and targeted educational and development programs Distributed 6,500 BLM uniform shirts to team members, and made donations to Equal Justice Initiative, Fresh Air Fund, ROAR, and other local non-profits Provided over 11,000 meals to healthcare & frontline workers and non-profits Hormone- and antibiotic-free protein sourcing supported by robust animal welfare policies Focus on evolution of food packaging where possible and lessening our impact within Shacks through design Expanding menu with growing chicken category and additional vegetarian and vegan options Developing partnerships with grass-fed and regenerative ranchers for premium local burgers Governance Environmental Social 19

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Board of Direct rs M eting 1 20 FINANCIAL DETAILS

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan “Adjusted EBITDA,” a non-GAAP measure”, is defined as EBITDA (as defined below), excluding equity-based compensation expense, deferred lease costs, impairment and loss on disposal of assets, amortization of cloud-based software implementation assets, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. “Adjusted EBITDA margin,” a non-GAAP measure, is defined as net income (loss) before net interest, taxes, depreciation and amortization, which also excludes equity-based compensation expense, deferred lease costs, impairment and loss on disposal of assets, amortization of cloud-based software implementation assets, as well as certain non- recurring and other items that the Company does not believe directly reflect its core operations, as a percentage of revenue. "Same-Shack Sales" represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative 2019 period was also adjusted. “Licensed weekly sales” is calculated by dividing the total sales for the period for all licensed Shacks by the number of weeks in the period. “EBITDA,” a non-GAAP measure, is defined as net income (loss) before interest expense (net of interest income), income tax expense, and depreciation and amortization expense. DEFIN IT IONS "Shack-level operating profit," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. "Shack-level operating profit margin," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses as a percentage of Shack sales. "Shack sales" is defined as the aggregate sales of food, beverages and Shake Shack- branded merchandise at domestic Company-operated Shacks and excludes sales from licensed Shacks. “Shack system-wide sales” is an operating measure and consists of sales from domestic Company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic Company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees such as territory fees and opening fees. “Adjusted pro forma effective tax rate,” a non-GAAP measure, represents the effective tax rate assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of its recurring business operations. 21

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan INCOME STATEMENT 22 Shack sales $ 152,484 96.8% $ 145,814 96.3% $ 506,339 96.8% $ 574,625 96.7% Licensing revenue 5,026 3.2% 5,621 3.7% 16,528 3.2% 19,894 3.3% TOTAL REVENUE 157,510 100.0% 151,435 100.0% 522,867 100.0% 594,519 100.0% Shack-level operating expenses(2): Food and paper costs 45,841 30.1% 43,127 29.6% 153,335 30.3% 168,176 29.3% Labor and related expenses 46,217 30.3% 41,920 28.7% 156,814 31.0% 160,811 28.0% Other operating expenses 22,394 14.7% 17,899 12.3% 73,220 14.5% 69,169 12.0% Occupancy and related expenses 13,618 8.9% 13,142 9.0% 51,592 10.2% 48,451 8.4% General and administrative expenses 19,080 12.1% 19,229 12.7% 64,250 12.3% 65,649 11.0% Depreciation expense 12,568 8.0% 11,153 7.4% 48,801 9.3% 40,392 6.8% Pre-opening costs 2,781 1.8% 4,156 2.7% 8,580 1.6% 14,834 2.5% Impairment and loss on disposal of assets 7,227 4.6% 321 0.2% 10,151 1.9% 1,352 0.2% TOTAL EXPENSES 169,726 107.8% 150,947 99.7% 566,743 108.4% 568,834 95.7% OPERATING INCOME (LOSS) (12,216) -7.8% 488 0.3% (43,876) -8.4% 25,685 4.3% Other income (loss), net (1,121) -0.7% 1,004 0.7% (786) -0.2% 2,263 0.4% Interest expense (118) -0.1% (132) -0.1% (815) -0.2% (434) -0.1% INCOME (LOSS) BEFORE INCOME TAXES (13,455) -8.5% 1,360 0.9% (45,477) -8.7% 27,514 4.6% Income tax expense 6,859 4.4% 3,433 2.3% 57 0.0% 3,386 0.6% NET INCOME (LOSS) (20,314) -12.9% (2,073) -1.4% (45,534) -8.7% 24,128 4.1% Less: net income (loss) attributable to non-controlling interests (886) -0.6% 20 —% (3,376) -0.6% 4,301 0.7% NET INCOME (LOSS) ATTRIBUTABLE TO SHAKE SHACK INC. $ (19,428) -12.3% $ (2,093) -1.4% $ (42,158) -8.1% $ 19,827 3.3% Earnings (loss) per share of Class A common stock: Basic ($0.50) ($0.06) ($1.14) $0.63 Diluted ($0.50) ($0.06) ($1.14) $0.61 Weighted-average shares of Class A common stock outstanding: Basic 38,513 33,877 37,129 31,381 Diluted 38,513 33,877 37,129 32,251 Fiscal Quarter Ended December 30, 2020 (1) December 25, 2019 Fiscal Year Ended December 30, 2020 (1) December 25, 2019 (1) The Company operates on a 52/53 week fiscal year that ends on the last Wednesday of the calendar year. Fiscal year 2020 was a 53-week year. The fourth quarter and fiscal year 2020 each contained an extra operating week. (2) As a percentage of Shack sales.

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Shack-Level Operating Profit Shack-level operating profit is defined as Shack sales less Shack-level operating expenses, including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. How This Measure Is Useful When used in conjunction with GAAP financial measures, Shack-level operating profit and Shack-level operating profit margin are supplemental measures of operating performance that the Company believes are useful measures to evaluate the performance and profitability of its Shacks. Additionally, Shack-level operating profit and Shack-level operating profit margin are key metrics used internally by management to develop internal budgets and forecasts, as well as assess the performance of its Shacks relative to budget and against prior periods. It is also used to evaluate employee compensation as it serves as a metric in certain performance- based employee bonus arrangements. The Company believes presentation of Shack- level operating profit and Shack-level operating profit margin provides investors with a supplemental view of its operating performance that can provide meaningful insights to the underlying operating performance of the Shacks, as these measures depict the operating results that are directly impacted by the Shacks and exclude items that may not be indicative of, or are unrelated to, the ongoing operations of the Shacks. It may also assist investors to evaluate the Company's performance relative to peers of various sizes and maturities and provides greater transparency with respect to how management evaluates the business, as well as the financial and operational decision-making. Limitations of the Usefulness of this Measure Shack-level operating profit and Shack-level operating profit margin may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of Shack-level operating profit and Shack-level operating profit margin is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Shack-level operating profit excludes certain costs, such as general and administrative expenses and pre-opening costs, which are considered normal, recurring cash operating expenses and are essential to support the operation and development of the Company's Shacks. Therefore, this measure may not provide a complete understanding of the Company's operating results as a whole and Shack-level operating profit and Shack-level operating profit margin should be reviewed in conjunction with the Company’s GAAP financial results. A reconciliation of Shack-level operating profit to operating income, the most directly comparable GAAP financial measure, is set forth on next slide. SHACK-LEVEL OPERATING PROFIT DEFIN IT IONS 23

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan SHACK-LEVEL OPERATING PROFIT 24 (dollar amount in thousands) December 25, 2019 December 25, 2019 Operating income (loss)(2) (12,216)$ 488$ (43,876)$ 25,685$ Less: Licensing revenue 5,026 5,621 16,528 19,894 Add: General and administrative expenses 19,080 19,229 64,250 65,649 Depreciation expense 12,568 11,153 48,801 40,392 Pre-opening costs 2,781 4,156 8,580 14,834 Impairment and loss on disposal of assets(3) 7,227 321 10,151 1,352 Shack-level operating profit 24,414$ 29,726$ 71,378$ 128,018$ Total revenue 157,510$ 151,435$ 522,867$ 594,519$ Less: licensing revenue 5,026 5,621 16,528 19,894 Shack sales 152,484$ 145,814$ 506,339$ 574,625$ Shack-level operating profit margin(4) 16.0% 20.4% 14.1% 22.3% Fiscal Quarter Ended Fiscal Year Ended December 30, 2020 (1) December 30, 2020 (1) (1) (2) (3) (4) As a percentage of Shack sales. The Company operates on a 52/53 week fiscal year that ends on the last Wednesday of the calendar year. Fiscal year 2020 was a 53-week year and fiscal year 2019 was a 52-week year. The fourth quarter and fiscal year 2020 each contained an extra operating week. In fiscal 2020, Operating income (loss) included a $0.9 million reduction in Occupancy and related expenses due to the closure of the Company's Shack in Penn Station. For the fourth quarter of 2020, this amount includes a non-cash impairment charge of $6.5 million related to one Shack and the Company's home office. For the full year ended fiscal 2020, this amount includes a non-cash impairment charge of $7.6 million related to two Shacks and the Company's home office.

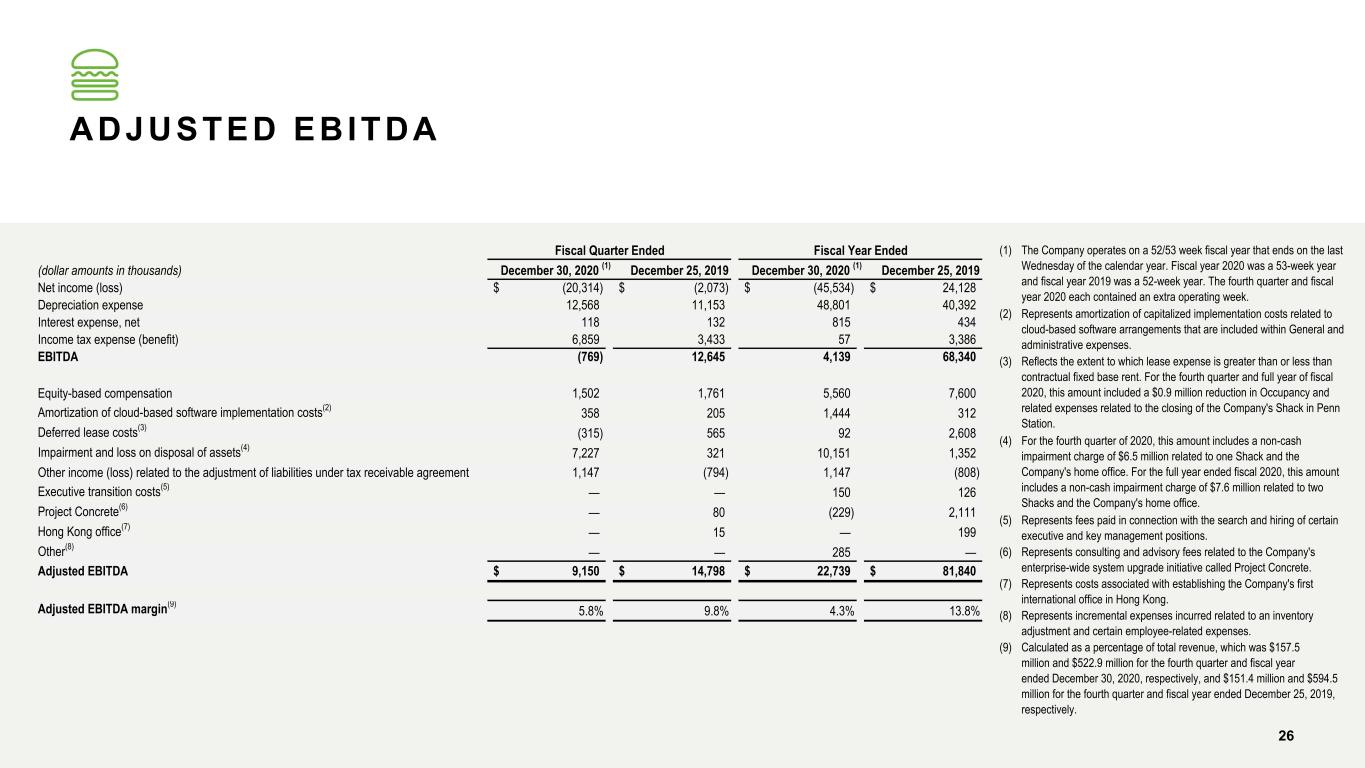

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan EBITDA and Adjusted EBITDA EBITDA is defined as net income (loss) before interest expense (net of interest income), income tax expense and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA (as defined above) excluding equity- based compensation expense, deferred lease cost, impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. How These Measures Are Useful When used in conjunction with GAAP financial measures, EBITDA and adjusted EBITDA are supplemental measures of operating performance that the Company believes are useful measures to facilitate comparisons to historical performance and competitors' operating results. Adjusted EBITDA is a key metric used internally by management to develop internal budgets and forecasts and also serves as a metric in its performance-based equity incentive programs and certain bonus arrangements. The Company believes presentation of EBITDA and adjusted EBITDA provides investors with a supplemental view of the Company's operating performance that facilitates analysis and comparisons of its ongoing business operations because they exclude items that may not be indicative of the Company's ongoing operating performance. ADJUSTED EBITDA DEFIN IT IONS Limitations of the Usefulness of These Measures EBITDA and adjusted EBITDA may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of EBITDA and adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA and adjusted EBITDA exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. A reconciliation of EBITDA and adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth on next slide. 25

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 26 ADJUSTED EBITDA (dollar amounts in thousands) December 25, 2019 December 25, 2019 Net income (loss) (20,314)$ (2,073)$ (45,534)$ 24,128$ Depreciation expense 12,568 11,153 48,801 40,392 Interest expense, net 118 132 815 434 Income tax expense (benefit) 6,859 3,433 57 3,386 EBITDA (769) 12,645 4,139 68,340 Equity-based compensation 1,502 1,761 5,560 7,600 Amortization of cloud-based software implementation costs(2) 358 205 1,444 312 Deferred lease costs(3) (315) 565 92 2,608 Impairment and loss on disposal of assets(4) 7,227 321 10,151 1,352 Other income (loss) related to the adjustment of liabilities under tax receivable agreement 1,147 (794) 1,147 (808) Executive transition costs(5) — — 150 126 Project Concrete(6) — 80 (229) 2,111 Hong Kong office(7) — 15 — 199 Other(8) — — 285 — Adjusted EBITDA 9,150$ 14,798$ 22,739$ 81,840$ Adjusted EBITDA margin(9) 5.8% 9.8% 4.3% 13.8% Fiscal Quarter Ended Fiscal Year Ended December 30, 2020 (1) December 30, 2020 (1) (1) The Company operates on a 52/53 week fiscal year that ends on the last Wednesday of the calendar year. Fiscal year 2020 was a 53-week year and fiscal year 2019 was a 52-week year. The fourth quarter and fiscal year 2020 each contained an extra operating week. (2) Represents amortization of capitalized implementation costs related to cloud-based software arrangements that are included within General and administrative expenses. (3) Reflects the extent to which lease expense is greater than or less than contractual fixed base rent. For the fourth quarter and full year of fiscal 2020, this amount included a $0.9 million reduction in Occupancy and related expenses related to the closing of the Company's Shack in Penn Station. (4) For the fourth quarter of 2020, this amount includes a non-cash impairment charge of $6.5 million related to one Shack and the Company's home office. For the full year ended fiscal 2020, this amount includes a non-cash impairment charge of $7.6 million related to two Shacks and the Company's home office. (5) Represents fees paid in connection with the search and hiring of certain executive and key management positions. (6) Represents consulting and advisory fees related to the Company's enterprise-wide system upgrade initiative called Project Concrete. (7) Represents costs associated with establishing the Company's first international office in Hong Kong. (8) Represents incremental expenses incurred related to an inventory adjustment and certain employee-related expenses. (9) Calculated as a percentage of total revenue, which was $157.5 million and $522.9 million for the fourth quarter and fiscal year ended December 30, 2020, respectively, and $151.4 million and $594.5 million for the fourth quarter and fiscal year ended December 25, 2019, respectively.

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Adjusted Pro Forma Effective Tax Rate Adjusted pro forma effective tax rate represents the effective tax rate assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of its recurring business operations. How This Measure Is Useful When used in conjunction with GAAP financial measures, adjusted pro forma effective tax rate is a supplemental measure of operating performance that the Company believes is useful to evaluate its performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes this measure facilitates comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in effective tax rate driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. ADJUSTED PRO FORMA EFFECTIVE TAX RATE DEFIN IT IONS Limitations of the Usefulness of this Measure Adjusted pro forma effective tax rate may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma effective tax rate should not be considered an alternative to effective tax rate, as determined under GAAP. While this measure is useful in evaluating the Company's performance, it does not account for the effective tax rate attributable to the non-controlling interest holders and therefore does not provide a complete understanding of effective tax rate. Adjusted pro forma effective tax rate should be evaluated in conjunction with GAAP financial results. A reconciliation of adjusted pro forma effective tax rate, the most directly comparable GAAP measure, is set forth on next slide. 27

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 2020 ADJUSTED PRO FORMA EFFECTIVE TAX RATE 28 (1) Represents incremental expenses incurred related to an inventory adjustment and certain employee-related expenses. (dollar amounts in thousands) Income Tax Expense Income Before Income Taxes Effective Tax Rate Income Tax Expense Income Before Income Taxes Effective Tax Rate As reported 6,859$ (13,455)$ -51.0% 57$ (45,477)$ -0.1% Non-GAAP adjustments (before tax): Executive transition costs - - - - 150 - Project Concrete - - - - (229) - Asset impairment charge - 6,512 - - 7,644 - Reduction in Occupancy and related expenses due to Shack closure - (897) - - (897) - Other(1) - - - - 285 - Other loss related to the adjustment of liabilities under tax receivable agreement - 1,147 - - 1,147 - Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests (12,262) - - (15,089) - - Adjusted pro forma (5,403)$ (6,693)$ 80.7% (15,032)$ (37,377)$ 40.2% Less: Net tax impact from stock-based compensation 3,746 4,743 Adjusted pro forma (excluding windfall tax benefits) (1,657)$ (6,693)$ 24.8% (10,289)$ (37,377)$ 27.5% December 30, 2020 December 30, 2020 Fiscal Quarter Ended Fiscal Year Ended

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 2019 ADJUSTED PRO FORMA EFFECTIVE TAX RATE 29 (dollar amounts in thousands) Income Tax Expense Income Before Income Taxes Effective Tax Rate Income Tax Expense Income Before Income Taxes Effective Tax Rate As reported 3,433$ 1,360$ 252.4% 3,386$ 27,514.0$ 12.3% Non-GAAP adjustments (before tax): Executive transition costs - - - - 126 - Project Concrete - 80 - - 2,111 - Hong Kong office - 15 - - 199 - Other income related to the adjustment of liabilities under tax receivable agreement - (794) - - (808) - Tax effect of change in basis related to the adoption of ASC 842 - - - (1,161) - - Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests (4,924) - - (446) - - Adjusted pro forma (1,491)$ 661$ -225.6% 1,779$ 29,142.0$ 6.1% Less: Windfall tax benefits from stock-based compensation 1,598 5,842 Adjusted pro forma (excluding windfall tax benefits) 107$ 661$ 16.2% 7,621$ 29,142$ 26.2% December 25, 2019 December 25, 2019 Fiscal Quarter Ended Fiscal Year Ended

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan CONTACT INFORMATION INVESTOR CONTACT Melissa Calandruccio, ICR Michelle Michalski, ICR (844) Shack-04 (844-742-2504) investor@shakeshack.com MEDIA CONTACT Kristyn Clark, Shake Shack kclark@shakeshack.com 30