Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Natera, Inc. | tm217945d1_ex99-1.htm |

| 8-K - FORM 8-K - Natera, Inc. | tm217945d1_8k.htm |

Exhibit 99.2

Natera, Inc. Investor presentation February 2021 Q4 2020 earnings call

2 Not for reproduction or further distribution. This presentation contains forward - looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding the market opportunity, products and launch schedules, reimbursement covera ge and product costs, commercial partners, user experience, clinical trials, financial performance, strategies, anticipated revenue and financial outlook and goals and general business condition s o f Natera, Inc. (“Natera”, the “Company”, “we” or “us”), are forward - looking statements. These forward - looking statements are subject to known and unknown risks and uncertainties that may cause act ual results to differ materially, including: we face numerous uncertainties and challenges in achieving our financial projections and goals; we may be unable to maintain our business and ope rations as planned due to disruptions and economic uncertainty caused by the COVID - 19 pandemic; we may be unable to further increase the use and adoption of Panorama and Horizon, through our direct sales efforts or through our laboratory partners, or to develop and successfully commercialize new products, including Signatera and Prospera; we have incurred losses since our ince pti on and we anticipate that we will continue to incur losses for the foreseeable future; our quarterly results may fluctuate from period to period; our estimates of market opportunity and foreca sts of market growth may prove to be inaccurate; we may be unable to compete successfully with existing or future products or services offered by our competitors; we may not be successful in com mer cializing our cloud - based distribution model; our products may not perform as expected; the results of our clinical studies, including our SNP - based Microdeletion and Aneuploidy RegisTry , or SMART, Study, may not be compelling to professional societies or payors as supporting the use of our tests, particularly in the average - risk pregnancy population or for microdeletions screening , or may not be able to be replicated in later studies required for regulatory approvals or clearances; if either of our primary CLIA - certified laboratory facilities becomes inoperable, we will be unable to perform our tests and our business will be harmed; we rely on a limited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and materials and m ay not be able to find replacements or immediately transition to alternative suppliers; if we are unable to successfully scale our operations, our business could suffer; the marketing, sale, an d use of Panorama and our other products could result in substantial damages arising from product liability or professional liability claims that exceed our resources; we may be unable to expand , o btain or maintain third - party payer coverage and reimbursement for Panorama, Horizon and our other tests, and we may be required to refund reimbursements already received; third - party payers may withdraw coverage or provide lower levels of reimbursement due to changing policies, billing complexities or other factors, such as the increased focus by third - party payers on requiring that prior authorization be obtained prior to conducting a test; if the FDA were to begin actively regulating our tests, we could incur substantial costs and delays associated with trying to obtain pre mar ket clearance or approval and incur costs associated with complying with post - market controls; litigation or other proceedings, resulting from either third party claims of intellectual property in fringement or third party infringement of our technology, is costly, time - consuming and could limit our ability to commercialize our products or services; any inability to effectively protect our pro pri etary technology could harm our competitive position or our brand; and with respect to our ability to service and comply with our outstanding debt obligations and our expectations regarding the co nve rsion of our outstanding convertible notes.” We discuss these and other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and "Management's Discussion and Anal ysi s of Financial Condition and Results of Operations" in our periodic reports on Forms 10 - K and 10 - Q and in other filings we make with the SEC from time to time. Given these uncertainties, you shoul d not place undue reliance on the forward - looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not po ssi ble for our management to predict all risks, nor can we assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statement. In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied. Except as required by law, we undertake no obligation to update publicly any forwar d - looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. We file reports, proxy statemen ts, and other information with the SEC. Such reports, proxy statements, and other information concerning us is available at http:// www.sec.gov . Requests for copies of such documents should be directed to our Investor Relations department at Natera, Inc., 13011 McCallen Pass, Building A Suite 100, Austin, TX 78753. Our telephone number is (650) 249 - 9090. Safe harbor statement

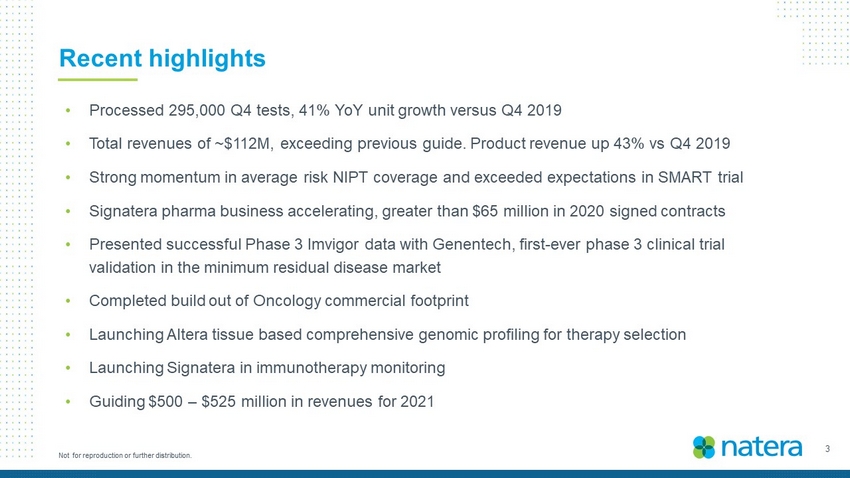

3 Not for reproduction or further distribution. • Processed 295,000 Q4 tests, 41% YoY unit growth versus Q4 2019 • Total revenues of ~$112M, product revenue up 43% vs Q4 2019 • Strong momentum in average risk NIPT coverage and exceeded expectations in SMART trial • Signatera pharma business accelerating, greater than $65 million in 2020 signed contracts • Presented successful Phase 3 Imvigor data with Genentech, first - ever phase 3 clinical trial validation in the minimum residual disease market • Completed build out of Oncology commercial footprint • Launching Altera tissue based comprehensive genomic profiling for therapy selection • Launching Signatera in immunotherapy monitoring • Guiding $500 – $525 million in revenues for 2021 Recent highlights

4 Not for reproduction or further distribution. Q4 volume: Fastest net unit growth in Natera history Total processed units (in thousands) 164K 163K 167K 174K 200K 194K 200K 209K 236K 234K 262K 295K Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 • Strong market share gains in Women’s Health • Continued progress in Transplant and Oncology

5 Not for reproduction or further distribution. Accelerating revenue growth • Volume - out performance combined with improving ASPs • New products gaining momentum Total revenues ($ in millions) Product revenues 1 ($ in millions) $74 $106 Q4 2019 Q4 2020 $54 $67 $83 $112 Q4 2017 Q4 2018 Q4 2019 Q4 2020 24 % 24 % 35 % 43 % 1. Excludes licensing and other revenues

6 Not for reproduction or further distribution. SMART trial results exceed expectations NIPT: • Largest prospective trial ever conducted • 99% sensitivity / 99.97% specificity in Trisomy 21 • Panorama AI algorithm reduces no calls to 1.46% Microdeletions: • 22q11.2 microdeletion incidence higher than expected: 1/1,524 • Best in class 100% sensitivity for >2.5 Mb deletions • SNP method uniquely detects small 22q deletions vs MPSS – 41% of disease load • Overall sensitivity 83% with 53% PPV Drive market share: • Best in class performance • Most extensively validated • Highly differentiated • Low detection rate by ultrasound Revenue upside: • Supports screening for aneuploidies and microdeletions in all women • CMS rate for microdeletions: $759 • >400K microdeletions tests run in 2020 by Natera, 37% YoY growth Future impact Study results

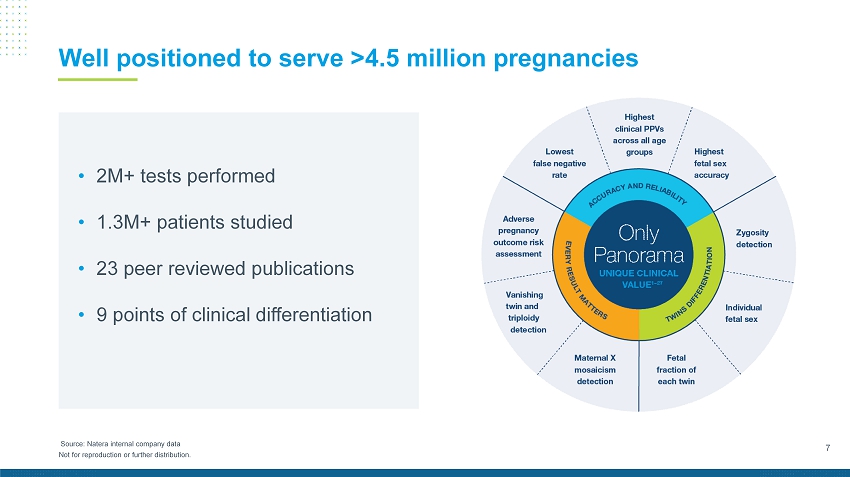

7 Not for reproduction or further distribution. • 2M+ tests performed • 1.3M+ patients studied • 23 peer reviewed publications • 9 points of clinical differentiation Well positioned to serve >4.5 million pregnancies Source: Natera internal company data

8 Not for reproduction or further distribution. Source: internal company estimates Expanding Oncology TAM opportunity ctDNA / liquid biopsy Monitoring/MRD $15B Therapy selection $6B Early detection

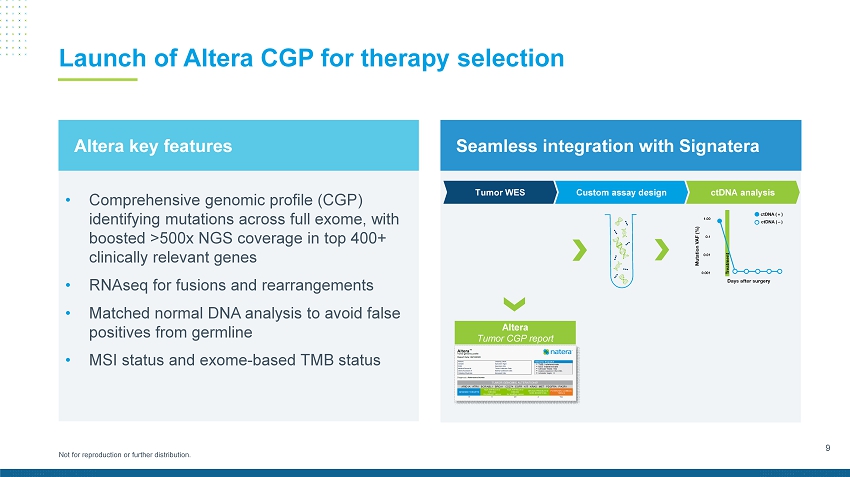

9 Not for reproduction or further distribution. Launch of Altera CGP for therapy selection • Comprehensive genomic p rofile (CGP) identifying mutations across full exome, with boosted >500x NGS coverage in top 400+ clinically relevant genes • RNAseq for fusions and rearrangements • Matched normal DNA analysis to avoid false positives from germline • MSI status and exome - based TMB status Altera key features Seamless integration with Signatera Altera Tumor CGP report Custom assay design ctDNA analysis Tumor WES

10 Not for reproduction or further distribution. Signatera IO monitoring with Altera ● > 200,000 patients treated with immunotherapy (IO) annually, mostly with advanced disease ● IO eligibility often depends on CGP analysis, to identify therapeutically actionable mutations, TMB, MSI ● Clinically indicated for Signatera personalized monitoring, to identify tumor response earlier and more accurately than imaging alone 1. IQVIA Œ Institute for Human Data Science Releases Global Oncology Trends 2019 Study: Record Number of Cancer Drugs Launched in 2018 a cr oss 17 Indications. IQVIA 2. Bratman SV, Yang SYC, Iafolla MAJ, et al. Personalized circulating tumor DNA analysis as a predictive biomarker in solid tumor patients treated with pembro li zumab. Nat. Cancer. 2020. doi : 10.1038/s43018 - 020 - 0096 - 5 CT #1 CT #2 CT #3 Signatera TM Regimen B Regimen A DECISION POINT 2 Modify treatment strategy? TIME DECISION POINT 3 Discontinue IO in exceptional responders? True progression? DECISION POINT 1 BASELINE Signatera with Altera CGP

11 Not for reproduction or further distribution. Acceleration in Pharma business, ~$120M signed to date Average deal size getting larger, including multiple phase 3 trials with patient volume and development fees Two key benefits for pharma: 1. Study enrichment: treating only MRD - positive patients, for higher drug efficacy 2. Surrogate endpoint: observing rates of MRD clearance, for faster study results Value of new signed contracts 2018 2019 2020 $9M $46M >$65M

12 Not for reproduction or further distribution. Phase 3 IMvigor study proved that Signatera is predictive of treatment benefit in the adjuvant setting 1. Powles T, Assaf ZJ, Davarpanah N, et al. Clinical outcomes in post - operative ctDNA (+) muscle - invasive urothelial carcinoma patients after atezolizumab adjuva nt therapy. ESMO IO, Dec 9 - 12, 2020, Virtual Meeting, Oral Presentation #10 . Background: • GNE - sponsored, PhIII randomized controlled trial of atezo vs. obs in adjuvant bladder cancer. Pre - specified analysis with Signatera. Results: • 41% survival benefit in MRD - positive patients treated with atezo. Zero treatment benefit in MRD - negative population. Significance: 1. Pharma: MRD stratification becomes a must - have for adjuvant trials 2. Clinical: predictive evidence strengthens utility of Signatera in CRC Overall survival 0.75 1.00 0.50 0.25 0.00 MRD - negative (63%) HR, 1.31 P =0.32 Months 0 10 20 30 40 50 Atezolizumab Observation MRD - positive: (37%) HR, 0.59 P =0.0059 Overall survival in MIBC patients treated with adjuvant atezolizumab vs. observation 1

13 Not for reproduction or further distribution. Extending our industry leadership in MRD 1. CRC – Reinert et al (JAMA Oncology) 2. IO pan - cancer – Bratman et al (Nature Cancer) 3. Lung – Abbosh et al (Nature) 4. Bladder – Christensen et al (JCO) 5. Breast – Coombes et al (CCR) 6. Breast – Magbanua et al (Annals) 7. Esophageal – Einstein et al (JCOPO) 8. Breast – accepted manuscript NEW 2K patients studied with leading pan - tumor sensitivity and specificity >$65M • Breast • Melanoma • Renal • Pancreatic • Liver • Lymphoma • Multiple myeloma • Colorectal • Lung • Prostate • Glioblastoma • Ovarian • Head & neck • Gastro - esophageal 8 clinical studies published 50+ studies in pipeline

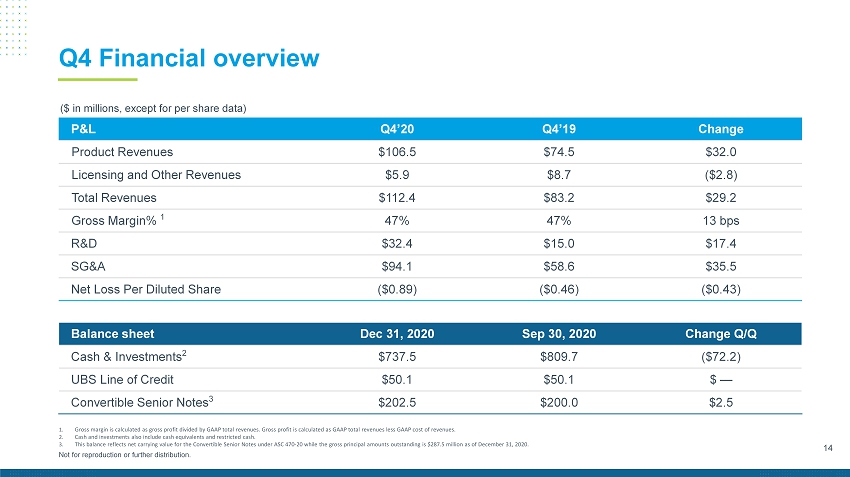

14 Not for reproduction or further distribution. Q4 Financial overview ($ in millions, except for per share data) Balance sheet Dec 31, 2020 Sep 30, 2020 Change Q/Q Cash & Investments 2 $737.5 $809.7 ($72.2) UBS Line of Credit $50.1 $50.1 $ — Convertible Senior Notes 3 $202.5 $200.0 $2.5 P&L Q4’20 Q4’19 Change Product Revenues $106.5 $74.5 $32.0 Licensing and Other Revenues $5.9 $8.7 ($2.8) Total Revenues $112.4 $83.2 $29.2 Gross Margin% 1 47% 47% 13 bps R&D $32.4 $15.0 $17.4 SG&A $94.1 $58.6 $35.5 Net Loss Per Diluted Share ($0.89) ($0.46) ($0.43) 1. Gross margin is calculated as gross profit divided by GAAP total revenues. Gross profit is calculated as GAAP total revenues les s GAAP cost of revenues. 2. Cash and investments also include cash equivalents and restricted cash. 3. This balance reflects net carrying value for the Convertible Senior Notes under ASC 470 - 20 while the gross principal amounts out standing is $287.5 million as of December 31, 2020.

15 Not for reproduction or further distribution. 2021 Annual guidance Guide $ (millions) Key drivers Revenue $500 – $525 Continued volume growth, conservative ASPs, growing contribution from new products Gross margin % revenue 47% – 52% Conservative ASP assumptions, COGS improvement, product revenues higher proportion of revenue mix vs. 2020 SG&A $430 – $450 Full commercial teams for Oncology, Transplant in place R&D $160 – $180 Expansion into new Oncology indications and products Cash burn $230 - $250 Focused on new business expansion Natera expects the Women’s H ealth business to reach cash flow breakeven in 2021

16 Not for reproduction or further distribution. ©2020 Natera, Inc. All Rights Reserved. Not for reproduction or further distribution. ©2021 Natera, Inc. All Rights Reserved. Not for reproduction or further distribution.