Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FEDERAL AGRICULTURAL MORTGAGE CORP | a2020q4pressrelease.htm |

| 8-K - 8-K - FEDERAL AGRICULTURAL MORTGAGE CORP | agm-20210225.htm |

Equity Investor Presentation Fourth Quarter 2020

FARM ER M AC Forward-Looking Statements In addition to historical information, this presentation includes forward- looking statements that reflect management’s current expectations for Farmer Mac’s future financial results, business prospects, and business developments. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements. Management’s expectations for Farmer Mac’s future necessarily involve assumptions, estimates, and the evaluation of risks and uncertainties. Various factors or events, both known and unknown, could cause Farmer Mac’s actual results to differ materially from the expectations as expressed or implied by the forward- looking statements. Some of these factors are identified and discussed in Farmer Mac’s Annual Report on Form 10-K for the year ended December 31, 2020, filed with the U.S. Securities and Exchange Commission (“SEC”) on February 25, 2021. These reports are also available on Farmer Mac’s website (www.farmermac.com). Considering these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this presentation. Any forward-looking statements made in this presentation are current only as of December 31, 2020, except as otherwise indicated. Farmer Mac undertakes no obligation to release publicly the results of revisions to any such forward-looking statements that may be made to reflect new information or any future events or circumstances, except as otherwise mandated by the SEC. The information in this presentation is not necessarily indicative of future results. NO OFFER OR SOLICITATION OF SECURITIES This presentation does not constitute an offer to sell or a solicitation of an offer to buy any Farmer Mac security. Farmer Mac securities are offered only in jurisdictions where permissible by offering documents available through qualified securities dealers. Any investor who is considering purchasing a Farmer Mac security should consult the applicable offering documents for the security and their own financial and legal advisors for information about and analysis of the security, the risks associated with the security, and the suitability of the investment for the investor’s particular circumstances. Copyright © 2021 by Farmer Mac. No part of this document may be duplicated, reproduced, distributed, or displayed in public in any manner or by any means without the written permission of Farmer Mac. 02

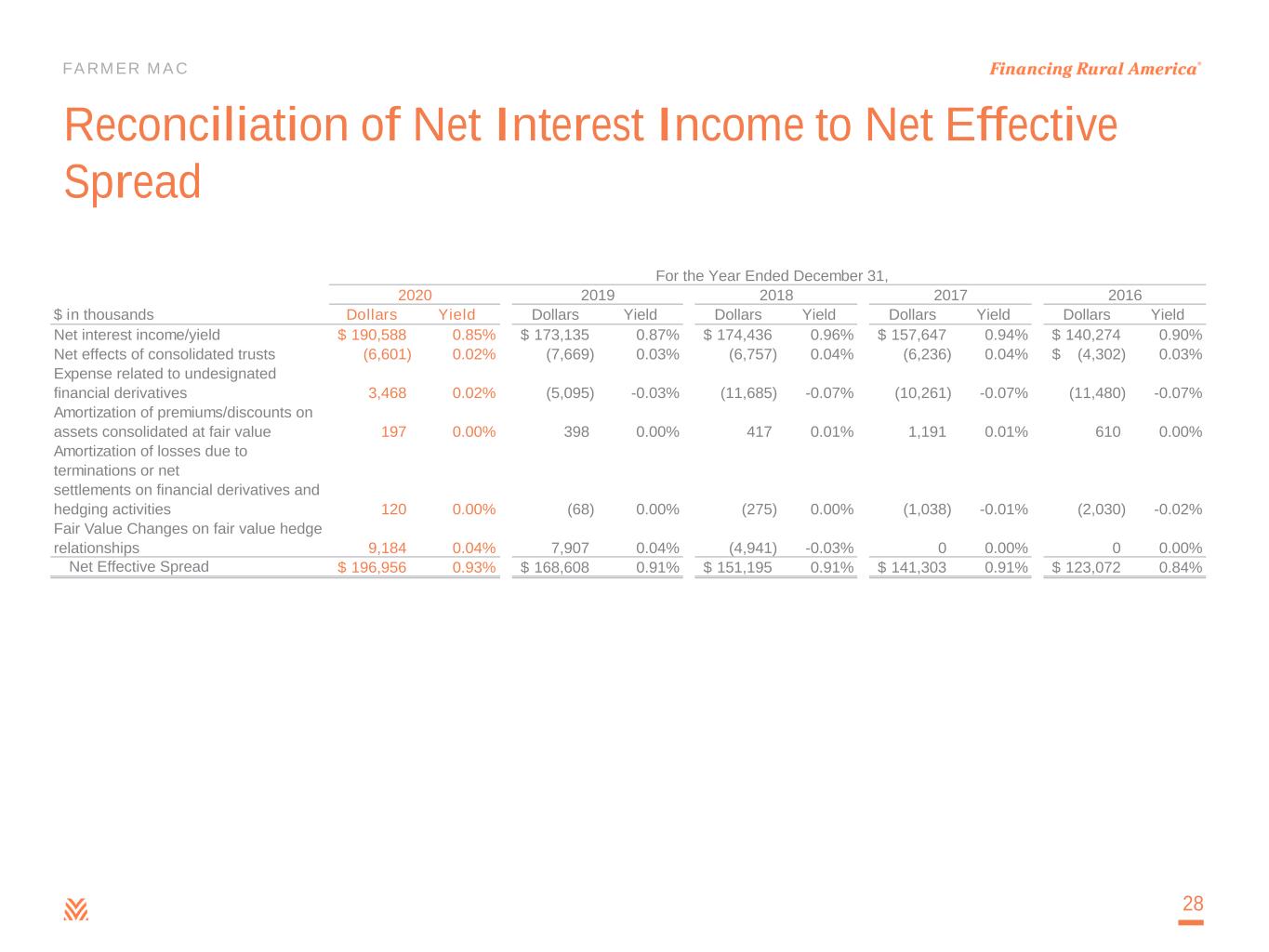

FARM ER M AC Use of Non-GAAP Financial Measures This presentation is for general informational purposes only, is current only as of December 31, 2020, and should be read in conjunction with Farmer Mac’s Annual Report on Form 10-K filed with the SEC on February 25, 2021. In the accompanying analysis of its financial information, Farmer Mac uses the following non-GAAP financial measures: core earnings, core earnings per share, and net effective spread. Farmer Mac uses these non-GAAP measures to measure corporate economic performance and develop financial plans because, in management's view, they are useful alternative measures in understanding Farmer Mac's economic performance, transaction economics, and business trends. The non-GAAP financial measures that Farmer Mac uses may not be comparable to similarly labeled non- GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of these non-GAAP financial measures is intended to be supplemental in nature and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP. Core earnings and core earnings per share principally differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding the effects of fair value fluctuations. These fluctuations are not expected to have a cumulative net impact on Farmer Mac's financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is expected. Core earnings and core earnings per share also differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business. Farmer Mac uses net effective spread to measure the net spread Farmer Mac earns between its interest-earning assets and the related net funding costs of these assets. Net effective spread differs from net interest income and net interest yield because it excludes: (1) the amortization of premiums and discounts on assets consolidated at fair value that are amortized as adjustments to yield in interest income over the contractual or estimated remaining lives of the underlying assets; (2) interest income and interest expense related to consolidated trusts with beneficial interests owned by third parties, which are presented on Farmer Mac's consolidated balance sheets as “Loans held for investment in consolidated trusts, at amortized cost;” and (3) beginning January 1, 2018, the fair value changes of financial derivatives and the corresponding assets and liabilities designated in a fair value hedge relationship. Net effective spread also principally differs from net interest income and net interest yield because it includes: (1) the accrual of income and expense related to the contractual amounts due on financial derivatives that are not designated in hedge relationships; and (2) effective in fourth quarter 2017, the net effects of terminations or net settlements on financial derivatives. 03

FARM ER M AC Investment Highlights •90-Day delinquencies of only 0.21% across all lines of business •Cumulative Farm & Ranch lifetime losses of only 0.13%Quality Assets •Issue at narrow, GSE spreads to U.S. Treasuries •E.g., 10-year U.S. Treasury +0.30% as of December 31, 2020Funding Advantage •Ag productivity must double to meet expected global demand •6.2% share of an ~$267 billion and growing U.S. ag mortgage marketGrowth Prospects •Overhead / outstanding business volume ~30 bps •~$800,000 earnings per employee in 2020Operational Efficiency •99% of total revenues is recurring net effective spread and fees •Outstanding business volume CAGR of 10.3% (2000 to 2020) Quality, Recurring Earnings •Core earnings ROE ~16% in 2020 and consistent net effective spread •Record core earnings results the last 4 Years (17.1% CAGR) Strong Returns, Responsible Growth 04

FARM ER M AC Farmer Mac initially chartered by Congress as an instrumentality of the United States Initial public offering First listed on NASDAQ (FAMCU & FAMCL) First major charter revision and expansion of authority (direct loan purchases) First listed on NYSE (AGM & AGM.A) Second major charter revision and expansion of authority (Rural Utilities) A Mission-Driven, For-Profit Company Our Mission Farmer Mac is committed to help build a strong and vital rural America by increasing the availability and affordability of credit for the benefit of American agricultural and rural communities Our Stakeholders • Farmers, ranchers and rural communities • Stockholders • Financial Institutions & Cooperatives • Employees • Congress • Regulator Our Corporate Social Responsibility • To help create sustainable, vibrant rural American communities • We achieve this by conducting our business – With absolute integrity – By holding ourselves to high ethical standards – By promoting a diverse, respectful, and inclusive culture – Board approved Environmental, Social, Governance (ESG) policy 05 1987 1988 1996 1999 2008

FARM ER M AC Aparna Ramesh Executive Vice President – Chief Financial Officer & Treasurer • 20+ years of experience in mission-oriented finance roles • Joined Farmer Mac in 2020 from Federal Reserve Bank of Boston, where she previously served as Senior Vice President and Chief Financial Officer • Prior experience includes roles spanning product management, asset-liability management and profitability within Cambridge Savings Bank and M&T Bank Bradford T. Nordholm President & Chief Executive Officer • 40+ years of agricultural and energy finance experience • Joined Farmer Mac in October 2018 from Starwood Energy Group, a leading private investment firm where he served as CEO and later as Vice Chairman • Prior experience includes CEO of US Central and management positions at National Cooperative and within the Farm Credit System Executive Leadership 06 Zachary N. Carpenter Executive Vice President – Chief Business Officer • 14+ years of experience in agribusiness banking, capital markets, finance, and corporate strategy • Joined Farmer Mac in 2019 from CoBank, where he previously served as Managing Director and Sector Vice President of its Corporate Agribusiness Banking Group • Prior experience includes Executive Director in CoBank’s Capital Markets division and Vice President in Finance and Corporate Strategy at Goldman Sachs

FARM ER M AC U.S. Agricultural Balance Sheet 07 Investments, $87,479,909 Inventories, $162,685,210 Real Estate $2,545,995,513 Machinery & Vehicles, $278,991,092 $3,075,151,724 Real Estate, $266,840,441 Nonreal Estate, $151,754,403 $418,594,844 $16,542,374 $0 $500,000,000 $1,000,000,000 $1,500,000,000 $2,000,000,000 $2,500,000,000 $3,000,000,000 Farm Sector Assets Farm Sector Debt Farmer Mac $ i n t h o u s a n d s Ag Real Estate Debt-to-Asset Ratio: 10.5% $ IN THOUSANDS (1) (2) Farmer Mac Market Share: 6.2%

FARM ER M AC (FCS Secondary Market GSE) $16.5 Billion (6.2% Market Share) Loan Purchase Wholesale Funding Credit Protection Farm Credit System (FCS) (Cooperative GSE) • Four FCS Banks • 68 Retail Agricultural Credit Associations Central to a Large Addressable Ag Mortgage Market 08 Addressable Agriculture Mortgage Market {Farmers & Ranchers} Mortgage Financing Mortgage Financing $267 Billion A G B A N K S $ 6 1 B N O N - B A N K L E N D E R S $ 1 3 B (3) (4) (4) Non-FCS Ag Lenders • Insurance Companies • Ag Banks • Non-Bank Lenders

FARM ER M AC Farmer Mac’s Operating Model 09 Farmer Mac’s Regulatory/Congressional Oversight • Regulated by the Farm Credit Administration (FCA) through its Office of Secondary Market Oversight (OSMO) • Congressional oversight through Senate and House Agricultural Committees

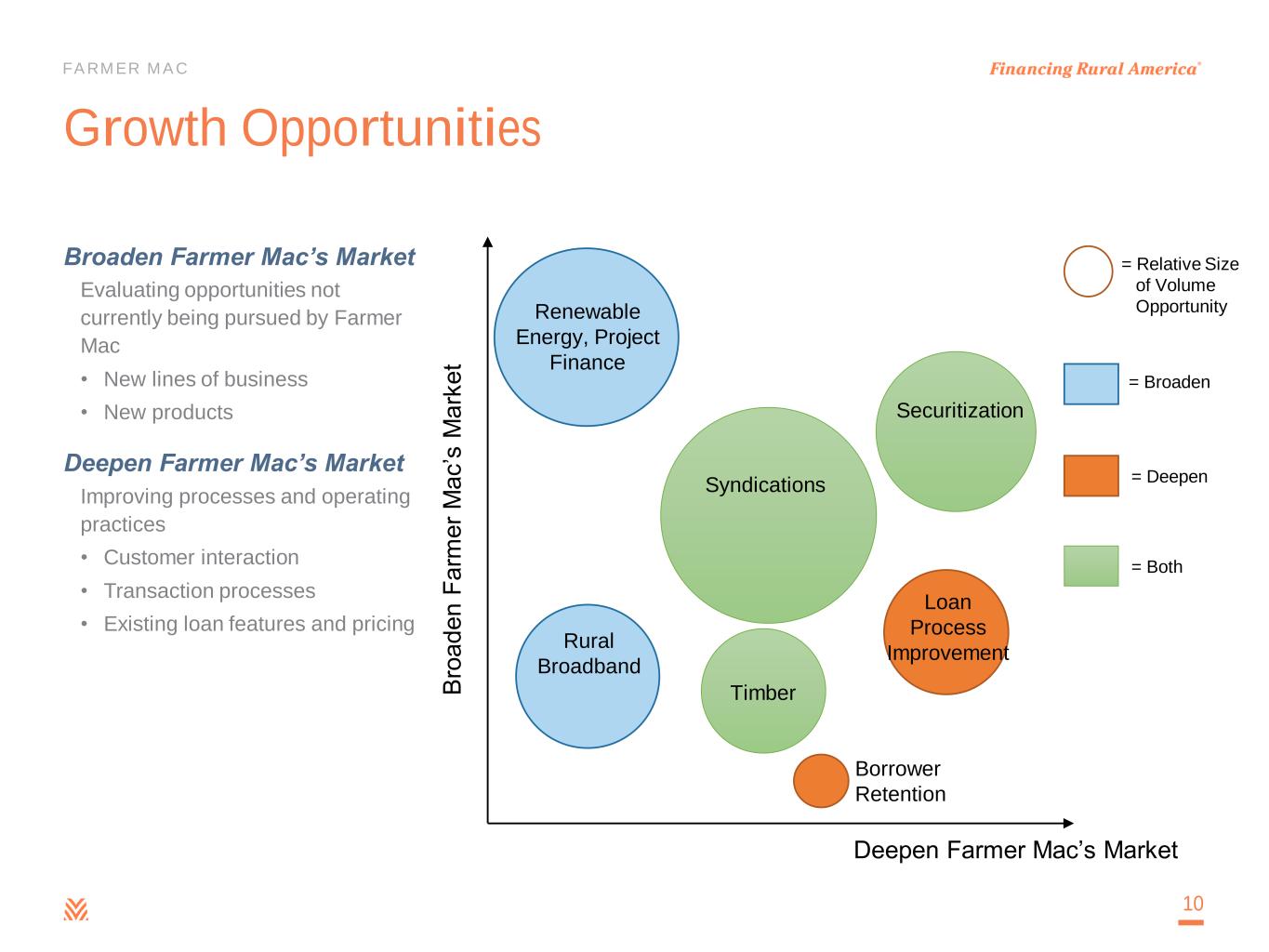

FARM ER M AC Growth Opportunities 10 Deepen Farmer Mac’s Market B ro a d e n F a rm e r M a c ’s M a rk e t Loan Process Improvement Rural Broadband Borrower Retention Renewable Energy, Project Finance Timber Securitization = Relative Size of Volume Opportunity = Broaden = Deepen = Both Syndications Broaden Farmer Mac’s Market Evaluating opportunities not currently being pursued by Farmer Mac • New lines of business • New products Deepen Farmer Mac’s Market Improving processes and operating practices • Customer interaction • Transaction processes • Existing loan features and pricing

FARM ER M AC Lines of Business and Products Product Type Target Customers Lines of Business $ IN BILLIONS AND PERCENTAGE OF TOTAL VOLUME LOAN PURCHASES • Ag Banks • FCS Institutions • Insurance Companies • Rural Utilities Cooperatives F & R USDA RU IC Total $6.2 28% $2.8 13% $2.3 10% -- $11.3 51% WHOLESALE FINANCING • AgVantage • Farm Equity AgVantage • Ag Banks • Ag Investment Funds • Insurance Companies • Rural Utilities Cooperatives -- -- -- $7.7 35% $7.7 35% CREDIT PROTECTION • Long-term Standby Purchase Commitments (LTSPCs) • FCS Institutions • Ag Banks • Insurance Companies • Ag Investment Funds • Rural Utilities Cooperatives $2.4 11% -- $0.5 3% -- $2.9 14% Total $8.6 $2.8 $2.8 $7.7 $21.9 11 AS OF DECEMBER 31, 2020 Note: Table may not sum to total due to rounding

FARM ER M AC Northwest 12% Southwest 35% Mid-North 29% Mid-South 12% Northeast 4% Southeast 8% By Geographic Region Crops 50% Permanent Plantings 24% Livestock 18% Part-time Farm 6% Ag. Storage and Processing 2% By Commodity Type Farm & Ranch Loan Portfolio Diversification 12 AS OF DECEMBER 31, 2020 Agricultural Update • USDA projections for 2020 net farm income are at the highest levels since 2013 at $121.1 billion • Early USDA estimates for 2021 show stable income outlook of $111.4 billion in net farm income • 2021 estimate reflects decrease in government support payments and increase in grain cash receipts (5)

FARM ER M AC $123.1 $141.3 $151.2 $168.6 $197.0$53.5 $65.6 $84.0 $93.7 $100.6 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2016 2017 2018 2019 2020 C O R E E A R N IN G S $ IN M IL L IO N S N E T E F F E C T IV E S P R E A D $ I N M IL L IO N S Net Effective Spread & Core Earnings Net Effective Spread Core Earnings Growing, Recurring, High-Quality Earnings $17.4 $19.0 $19.7 $21.1 $21.9 $0.0 $5.0 $10.0 $15.0 $20.0 2016 2017 2018 2019 2020 $ I N B IL L IO N S Outstanding Business Volume Outstanding Business Volume 13 6.0% CAGR (2016-2020) 12.5% CAGR (2016-2020) 17.1% CAGR (2016-2020) Core earnings and net effective spread are non-GAAP measures. For more information on the use of these non-GAAP measures, please see page 3. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 27-28 of the Appendix.

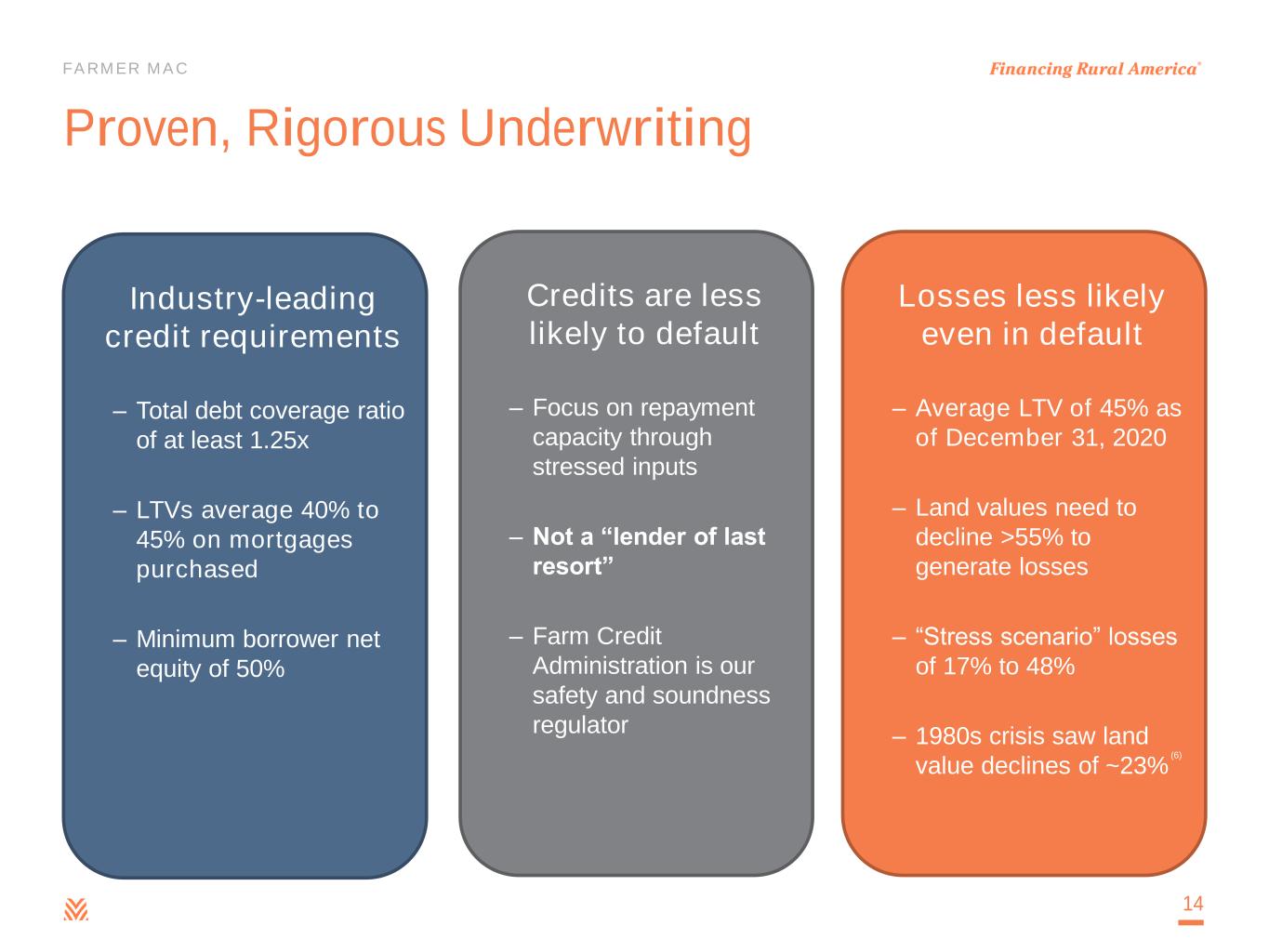

FARM ER M AC Losses less likely even in default – Average LTV of 45% as of December 31, 2020 – Land values need to decline >55% to generate losses – “Stress scenario” losses of 17% to 48% – 1980s crisis saw land value declines of ~23% Proven, Rigorous Underwriting Industry-leading credit requirements – Total debt coverage ratio of at least 1.25x – LTVs average 40% to 45% on mortgages purchased – Minimum borrower net equity of 50% 14 Credits are less likely to default – Focus on repayment capacity through stressed inputs – Not a “lender of last resort” – Farm Credit Administration is our safety and soundness regulator (6)

FARM ER M AC Credit Consistently Outperforms 15 1.22% 0.54% 0.21% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 90-Day Delinquencies Industry 90-Day Delinquencies Farmer Mac 90-Day Delinquencies (Farm & Ranch Portfolio Only) Farmer Mac 90-Day Delinquences (Total Portfolio) -0.10% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 C H A R G E -O F F S A S % O F A S S E T S Agricultural Lender Charge-off Rates Banks Farm Credit System Farmer Mac Farmer Mac Average 0.02% Farm Credit System Average 0.11% Banks Average 0.19% All Commercial Banks Loans and Leases Average 0.96% (8) (7) (8) (9) (10) (11) (12)

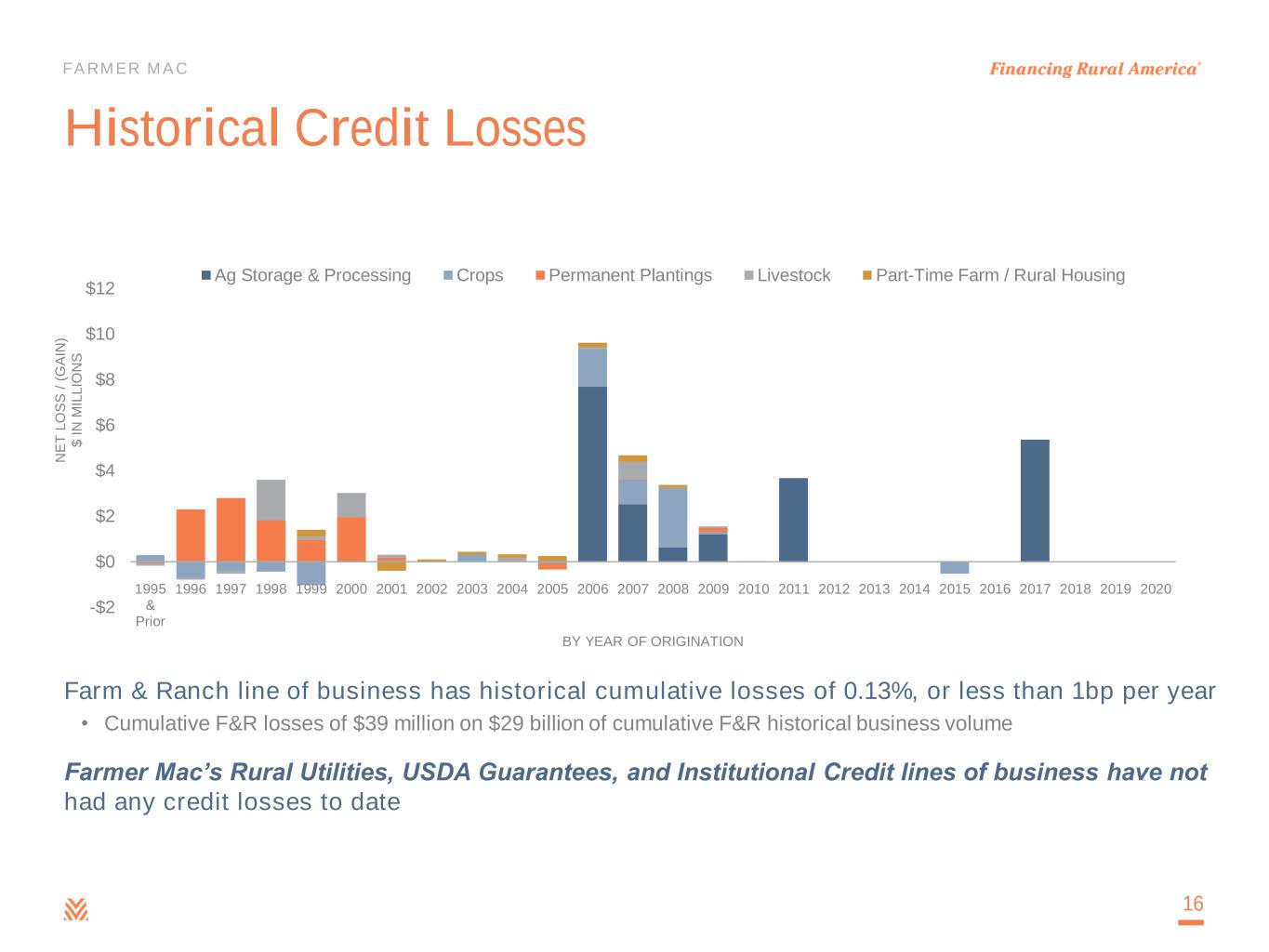

FARM ER M AC Historical Credit Losses Farm & Ranch line of business has historical cumulative losses of 0.13%, or less than 1bp per year • Cumulative F&R losses of $39 million on $29 billion of cumulative F&R historical business volume Farmer Mac’s Rural Utilities, USDA Guarantees, and Institutional Credit lines of business have not had any credit losses to date 16 -$2 $0 $2 $4 $6 $8 $10 $12 1995 & Prior 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 N E T L O S S / ( G A IN ) $ I N M IL L IO N S BY YEAR OF ORIGINATION Ag Storage & Processing Crops Permanent Plantings Livestock Part-Time Farm / Rural Housing

FARM ER M AC Allowance for Losses – Quarterly 17 Total allowance decreased $2.4 million sequentially • $3.6 million provision in Farm & Ranch portfolio related to specialized poultry loan – Recorded a direct charge-off of $5.4 million related to the same poultry loan that Farmer Mac deemed a portion to be uncollectible at this time. • Improvements in credit quality contributed to the decline in Rural Utilities provision • Release in AgVantage portfolio driven by scheduled maturities

FARM ER M AC Allowance for Losses – Annual 18 2020 forecasts included the effects of COVID-19 on economic factors such as land values, GDP, credit spreads, and unemployment expectations • Unemployment expectations had the most significant impact on 2020 provision, particularly on the Rural Utilities portfolio • Farm & Ranch portfolio less impacted due to: – Stable farmland values – Improved credit quality in the F&R portfolio during the year • $5.8 million in charge-offs also contributed to the decline in the Farm & Ranch allowance

FARM ER M AC $467 $520 $545 $619 $681 $143 $137 $183 $197 $325 $610 $657 $728 $815 $1,006 12.7% 12.6% 13.4% 12.9% 14.1% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% $0 $200 $400 $600 $800 $1,000 2016 2017 2018 2019 2020 T IE R 1 C A P IT A L R A T IO ( % ) C O R E C A P IT A L $ I N M IL L IO N S Statutory Minimum Core Capital Core Capital Amount Above Statutory Minimum Capital Tier 1 Capital Ratio Strong and Growing Equity Capital Base 19Statutory Minimum Core Capital defined as total stockholders’ equity less accumulated other comprehensive income.

FARM ER M AC Quality Earnings Drives Strong Dividends $0.05 $0.10 $0.12 $0.14 $0.16 $0.26 $0.36 $0.58 $0.70 $0.80 $0.88 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 $1.00 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 $ P E R S H A R E Quarterly Dividend per Common Share 20 Initiated New Dividend Policy: Target ~30% Payout Ratio of Core Earnings Increased Target Payout Ratio of Core Earnings to ~35% Note: The dividend declared on February 23, 2021 is scheduled to be paid on March 31, 2021.

FARM ER M AC Investment Highlights •90-Day delinquencies of only 0.21% across all lines of business •Cumulative Farm & Ranch lifetime losses of only 0.13%Quality Assets •Issue at narrow, GSE spreads to U.S. Treasuries •E.g., 10-year U.S. Treasury +0.30% as of December 31, 2020Funding Advantage •Ag productivity must double to meet expected global demand •6.2% share of an ~$267 billion and growing U.S. ag mortgage marketGrowth Prospects •Overhead / outstanding business volume ~30 bps •~$800,000 earnings per employee in 2020Operational Efficiency •99% of total revenues is recurring net effective spread and fees •Outstanding business volume CAGR of 10.3% (2000 to 2020) Quality, Recurring Earnings •Core earnings ROE ~16% in 2020 and consistent net effective spread •Record core earnings results the last 4 Years (17.1% CAGR) Strong Returns, Responsible Growth 21

Appendix

FARM ER M AC • Core earnings, core earnings per share, and net effective spread are non-GAAP measures. For more information on the use of these non- GAAP measures, please see page 3. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and core earnings per share to earnings per common share, and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 27-28 of the Appendix. • Periods prior to fourth quarter 2017 have been recast to reflect the revised methodology for calculating net effective spread that became effective in fourth quarter 2017, as further described on page 3. • Book Value per Share excludes accumulated other comprehensive income. Key Company Metrics 23 ($ in thousands, except per share amounts) 2020 2019 2018 2017 2016 Core Earnings $100,612 $93,742 $84,047 $65,631 $53,481 Core Earnings per Diluted Share $9.33 $8.70 $7.82 $6.08 $4.98 Net Effective Spread ($) $196,956 $168,608 $151,195 $141,303 $123,072 Net Effective Spread (%) 0.93% 0.91% 0.91% 0.91% 0.84% Guarantee & Commitment Fees $19,150 $21,335 $20,733 $20,350 $19,170 Core Capital Above Statutory Minimum $325,400 $196,700 $182,600 $136,800 $143,200 Common Stock Dividends per Share $3.20 $2.80 $2.32 $1.44 $1.04 Outstanding Business Volume $21,929,095 $21,117,942 $19,724,525 $19,007,311 $17,399,475 90-Day Delinquencies 0.21% 0.29% 0.14% 0.25% 0.12% Charge-Offs $5.759 $67 $17 $327 $130 Book Value per Share $59.91 $54.80 $49.01 $42.59 $38.42 Core Earnings Return on Equity 16% 17% 17% 15% 13%

FARM ER M AC Equity Capital Structure 24 NYSE Ticker Dividend Yield Shares Outstanding C O M M O N S T O C K CLASS A VOTING COMMON STOCK • Ownership restricted to non-Farm Credit System financial institutions AGM.A 4.90% 1.0 million CLASS B VOTING COMMON STOCK • Ownership restricted to Farm Credit System institutions -- -- 0.5 million CLASS C NON-VOTING COMMON STOCK • No ownership restrictions AGM 4.31% 9.2 million P R E F E R R E D S T O C K SERIES C FIXED-TO-FLOATING RATE NON-CUMULATIVE PREFERRED STOCK • Option to redeem at any time on or after July 18, 2024 • Redemption Value: $25 per share AGM.PR.C 6.000% 3.0 million SERIES D NON-CUMULATIVE PREFERRED STOCK • Option to redeem at any time on or after July 17, 2024 • Redemption Value: $25 per share AGM.PR.D 5.700% 4.0 million SERIES E NON-CUMULATIVE PREFERRED STOCK • Option to redeem at any time on or after July 17, 2025 • Redemption Value: $25 per share AGM.PR.E 5.750% 3.2 million SERIES F NON-CUMULATIVE PREFERRED STOCK • Option to redeem at any time on or after October 17, 2025 • Redemption Value: $25 per share AGM.PR.F 5.250% 4.8 million • Common stock dividend annualized divided by quarter-end closing price • Par value of annual dividend for preferred stock

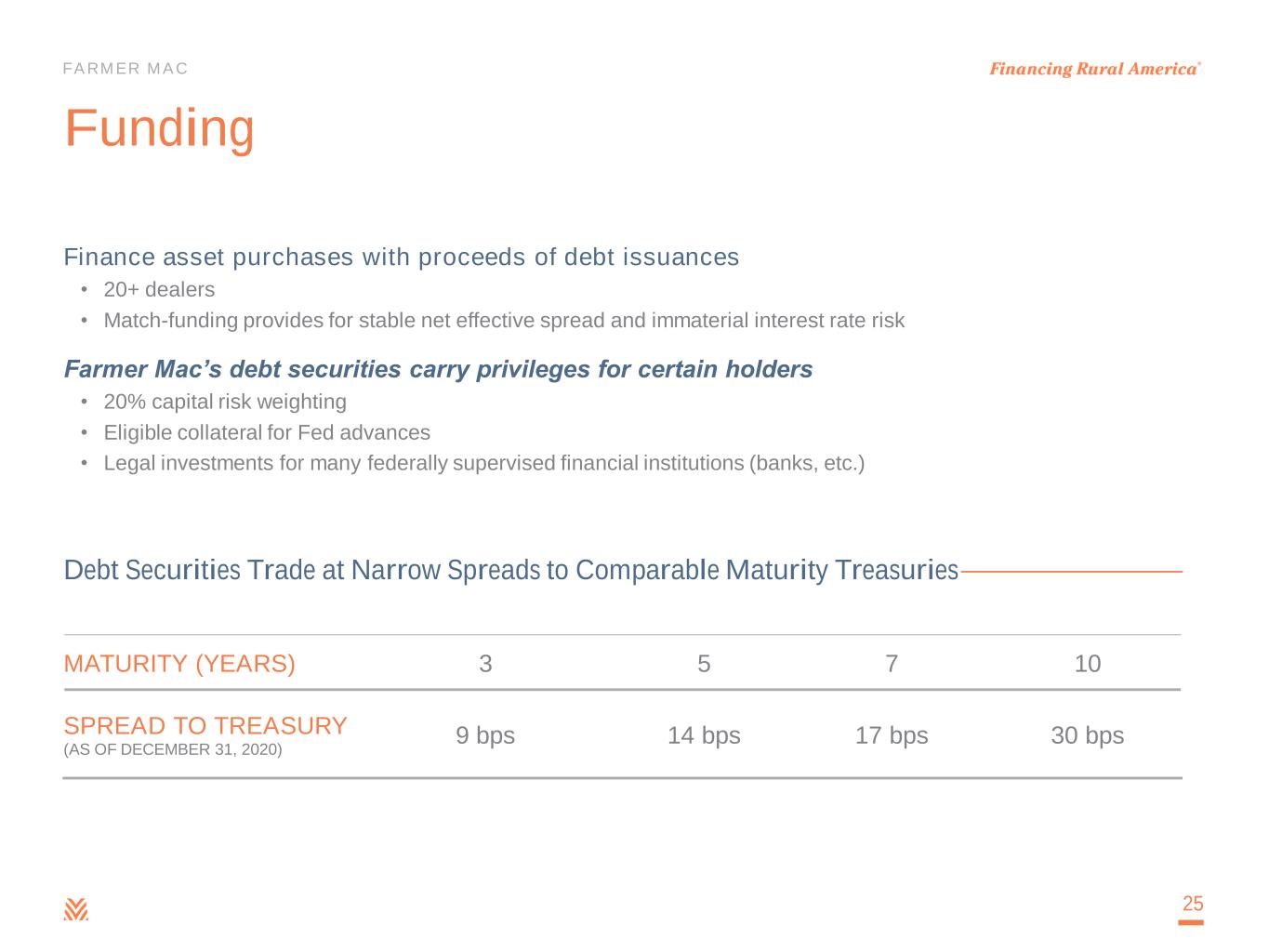

FARM ER M AC Funding Finance asset purchases with proceeds of debt issuances • 20+ dealers • Match-funding provides for stable net effective spread and immaterial interest rate risk Farmer Mac’s debt securities carry privileges for certain holders • 20% capital risk weighting • Eligible collateral for Fed advances • Legal investments for many federally supervised financial institutions (banks, etc.) 25 Debt Securities Trade at Narrow Spreads to Comparable Maturity Treasuries MATURITY (YEARS) 3 5 7 10 SPREAD TO TREASURY (AS OF DECEMBER 31, 2020) 9 bps 14 bps 17 bps 30 bps

FARM ER M AC World population is expected to grow to 9.8 billion by 2050 • Arable land per person is expected to decline over 40% from 2005 to 2050 USDA projects a 75% increase in total production and consumption of major field crops in the same period • 43% increase in world population • Higher protein diets as incomes in developing countries increase Productivity would need to nearly double by 2050 to feed the world “Demand Pull” Provides Sustained Growth Opportunity 3.0 9.8 0.43 0.18 0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 0.0 2.0 4.0 6.0 8.0 10.0 12.0 1960 1970 1980 1990 2000 2010 2020 2030 2040 2050 A R A B L E L A N D P E R C A P IT A (h e c ta re in u s e p e r p e rs o n )W O R L D P O P U L A T IO N (i n b il li o n s ) World Population Arable Land per capita 26 (13) (14)

FARM ER M AC Reconciliation of Net Income to Core Earnings 27 (in thousands) 2020 2019 2018 2017 2016 Net income attributable to common stockholders 89,176$ 93,650$ 94,898$ 71,300$ 64,152$ Less reconciling items: (Losses)/gains on undesignated financial derivatives due to fair value changes (3,691) 10,077 7,959 10,218 8,585 (Losses)/gains on hedging activities due to fair value changes (10,019) (9,010) 4,449 (719) 5,043 Unrealized gains/(losses) on trading assets 51 326 81 (24) 1,460 Amortization of premiums/discounts and deferred gains on assets consolidated at fair value 58 (122) (461) (1,327) (849) Net effects of terminations or net settlements on financial derivatives and hedging activities 1,236 1,089 1,708 2,674 2,178 Issuance costs on retirement of preferred stock (1,667) (1,956) - - - Re-measurement of net deferred tax asset due to enactment of new tax legislation - - - (1,365) - Income tax effect related to reconciling items 2,596 (496) (2,885) (3,788) (5,746) Sub-total (11,436) (92) 10,851 5,669 10,671 Core earnings 100,612$ 93,742$ 84,047$ 65,631$ 53,481$ Core Earnings by Period Ended • Periods prior to 2017 have been recast to reflect the revised methodology for calculating net effective spread that became effective in fourth quarter 2017, as further described on page 3. • Issuance costs on retirement of preferred stock relates to the write-off of deferred issuance costs as a result of the retirement of Series A Preferred Stock and Series B Preferred Stock.

FARM ER M AC Reconciliation of Net Interest Income to Net Effective Spread 28 $ in thousands Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield Net interest income/yield 190,588$ 0.85% 173,135$ 0.87% 174,436$ 0.96% 157,647$ 0.94% 140,274$ 0.90% Net effects of consolidated trusts (6,601) 0.02% (7,669) 0.03% (6,757) 0.04% (6,236) 0.04% (4,302)$ 0.03% Expense related to undesignated financial derivatives 3,468 0.02% (5,095) -0.03% (11,685) -0.07% (10,261) -0.07% (11,480) -0.07% Amortization of premiums/discounts on assets consolidated at fair value 197 0.00% 398 0.00% 417 0.01% 1,191 0.01% 610 0.00% Amortization of losses due to terminations or net settlements on financial derivatives and hedging activities 120 0.00% (68) 0.00% (275) 0.00% (1,038) -0.01% (2,030) -0.02% Fair Value Changes on fair value hedge relationships 9,184 0.04% 7,907 0.04% (4,941) -0.03% 0 0.00% 0 0.00% Net Effective Spread 196,956$ 0.93% 168,608$ 0.91% 151,195$ 0.91% 141,303$ 0.91% 123,072$ 0.84% 2020 For the Year Ended December 31, 2019 2018 2017 2016

FARM ER M AC Resources Footnote 1: USDA Economic Research Service year end 2019 balance sheet (https://data.ers.usda.gov/reports.aspx?ID=17835). Footnote 2: Farmer’s Mac’s total excludes loan purchases, LTSPCs, and AgVantage business with rural utilities customers. Market share represents Farmer Mac’s percentage of only Farm Sector Real Estate Debt outstanding. Footnote 3: Eligible ag real estate mortgage market structure shown includes the forecast for outstanding unpaid principal balance of first lien ag mortgage assets as of December 31, 2019. Footnote 4: USDA, Economic Research Service forecast for remaining non-bank lenders for year-end 2019 on a prorated basis. Footnote 5: USDA, Economic Research Service U.S. and State-Level Farm Income and Wealth Statistic (https://www.ers.usda.gov/data- products/farm-income-and-wealth-statistics/data-files-us-and-state-level-farm-income-and-wealth-statistics/) Footnote 6: USDA, National Agricultural Statistics Service (as of August 2015). Historic values are not necessarily predictive of future results or outcomes. Footnote 7: FDIC Call Report Data & Farm Credit Funding Corp Annual Information Statements – Non-accrual real estate loans and accruing loans that are 90 days or more past due made by commercial and Farm Credit System banks (as of June 2020). Footnote 8: Delinquencies include loans held and loans underlying off-balance sheet Farm & Ranch Guaranteed Securities and LTSPCs that are 90 days or more past due, in foreclosure, or in bankruptcy with at least one missed payment, excluding loans performing under either their original loan terms or a court-approved bankruptcy plan. Footnote 9: Board of Governors of the Federal Reserve System charge-off rates (https://www.federalreserve.gov/releases/chargeoff/). Footnote 10: Banks’ charge-off rate is a percentage of agricultural loan assets. Footnote 11: Farm Credit Banks Funding Corporation Annual Information Statements; Farm Credit System’s charge-off rate is the percentage of total loans and guarantees. Footnote 12: Farmer Mac’s charge-off rate is the percentage of total loans and guarantees. Footnote 13: USDA, Economic Research Service Global Drivers of Agricultural Demand and Supply, September 2014. Footnote 14: Food and Agriculture Organization of the United Nations, “World Agriculture Towards 2030/2050,” June 2012. 29