Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - ACI WORLDWIDE, INC. | aciw-20210225ex994.htm |

| EX-99.3 - EX-99.3 - ACI WORLDWIDE, INC. | aciw-20210225ex993.htm |

| EX-99.1 - EX-99.1 - ACI WORLDWIDE, INC. | aciw-20210225ex991.htm |

| 8-K - 8-K - ACI WORLDWIDE, INC. | aciw-20210225.htm |

Q4 and FY 2020 EARNINGS PRESENTATION ACI WORLDWIDE February 25, 2021 Exhibit 99.2

2 Private Securities Litigation Reform Act of 1995 Safe Harbor for Forward-Looking Statements This presentation contains forward- looking statements based on current expectations that involve a number of risks and uncertainties. The forward- looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. A discussion of these forward-looking statements and risk factors that may affect them is set forth at the end of this presentation. The Company assumes no obligation to update any forward-looking statement in this presentation, except as required by law.

Year in Review Odilon Almeida President and Chief Executive Officer 3

Three Pillar Strategy for the New ACI 4 • New strategy implemented and generating results • Cost discipline creating strong margin improvement • Focus on real-time payments, large sophisticated global merchants and fast-growing emerging markets • Plan a thorough strategic review of our business portfolio to enhance growth profile Drive organic growth through operational discipline and a strong sales culture FIT FOR GROWTH Focus R&D on growth-rich solutions supported by innovation FOCUSED ON GROWTH Accretive M&A to drive additional growth and value creation STEP CHANGE VALUE CREATION

Financial Review Scott Behrens Chief Financial Officer 5

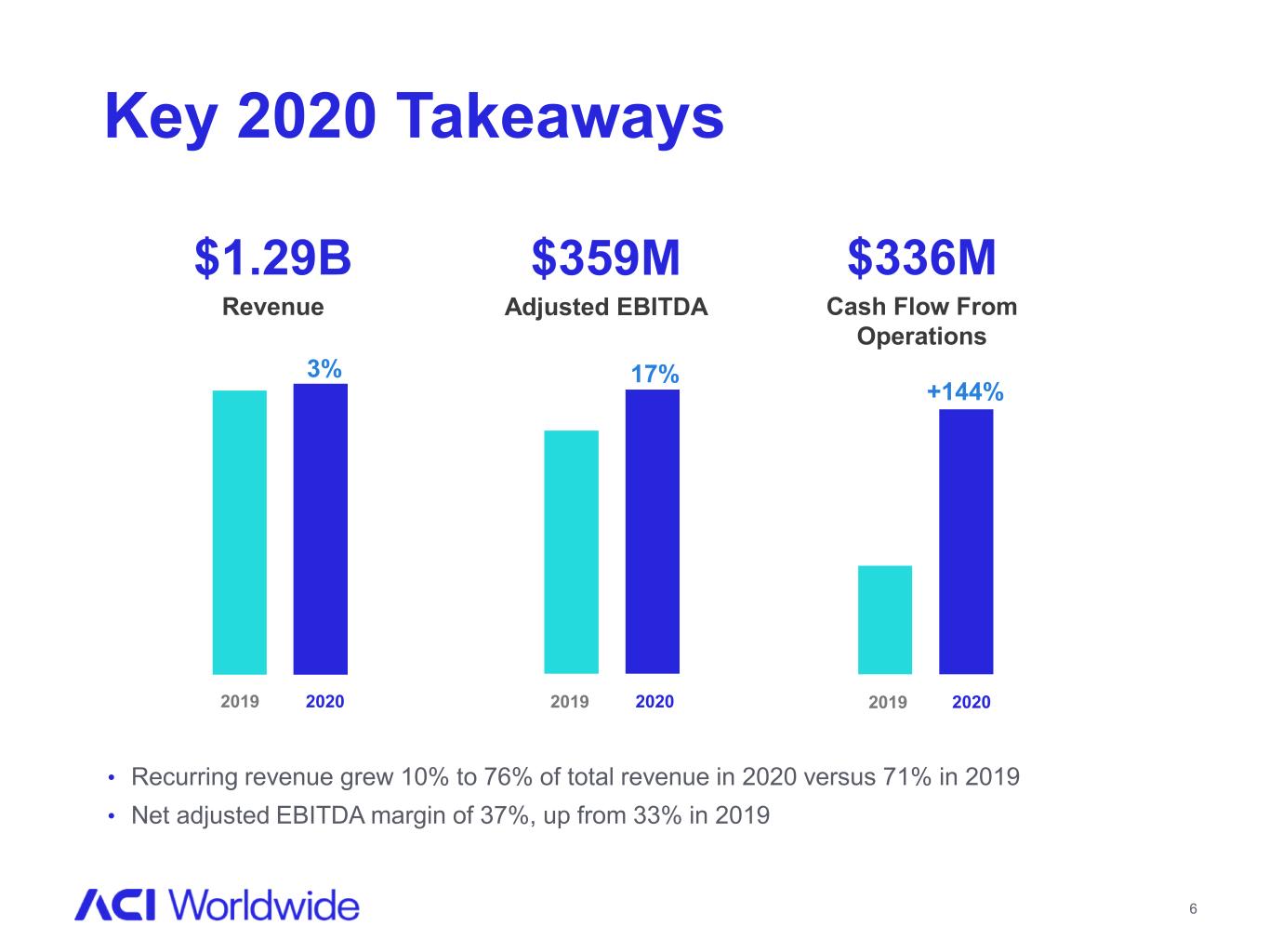

• Recurring revenue grew 10% to 76% of total revenue in 2020 versus 71% in 2019 • Net adjusted EBITDA margin of 37%, up from 33% in 2019 6 Key 2020 Takeaways $336M Cash Flow From Operations $359M Adjusted EBITDA +144% 2019 2020 17% 2019 2020 3% $1.29B Revenue 2019 2020

Margin and Cash Flow Up Materially • Net adjusted EBITDA margin of 37%, up from 33% in 2019 − ACI On Demand revenue increased 13%, while net adjusted EBITDA margin improved to 34% versus 19% in 2019 − ACI On Premise revenue decreased 9% and adjusted EBITDA margin was 55% flat with 2019 • Cash flow from operating activities of $336 million, up 144% compared to 2019 • Repurchased 1 million shares for $29 million − $112 million remaining on share repurchase authorization • Ended year with $165 million in cash; approximately $444 million of available credit facility • Debt balance of $1.2 billion - Paid down $223 million in debt during the year and $115 million in Q4 - Represents net debt leverage of 2.8x - Maximum net debt leverage 4.75x 2021 Guidance • Expect COVID-19-related headwinds to persist through the first half of 2021 and for growth to accelerate to the mid-single digits in the second half of the year • Expect 2021 adjusted EBITDA to be in a range of $375 million to $385 million, with net adjusted EBITDA margin expansion • Expect Q1 2021 revenue to be between $270 million and $280 million and adjusted EBITDA of $25 million to $35 million. 7 Key 2020 Takeaways

8 Appendix

9 Supplemental Financial Data Adjusted EBITDA (millions) Three Months Ended December 31, Years Ended December 31, 2020 2019 2020 2019 Net income $ 67.1 $ 55.5 $ 72.7 $ 67.1 Plus: Income tax expense 24.3 35.2 26.0 5.1 Net interest expense 9.5 15.2 45.0 52.1 Net other (income) expense (5.2) (3.4) 1.1 (0.5) Depreciation expense 6.7 6.2 24.7 24.1 Amortization expense 28.6 27.9 115.6 98.5 Non-cash stock-based compensation expense 6.7 6.4 29.6 36.8 Adjusted EBITDA before significant transaction-related expenses $ 137.7 $ 143.0 $ 314.7 $ 283.2 Significant transaction-related expenses: Employee related actions 11.0 0.8 24.3 0.8 Facility closures 6.5 1.3 10.2 1.3 Other 1.4 0.6 10.1 22.8 Adjusted EBITDA $ 156.6 $ 145.7 $ 359.3 $ 308.1 Net Revenue Revenue $ 387.0 $ 399.9 $ 1,294.3 $ 1,258.3 Interchange 82.5 99.4 334.3 321.5 Total $ 304.5 $ 300.5 $ 960.0 $ 936.8 Net Adjusted EBITDA Margin 51 % 48 % 37 % 33 %

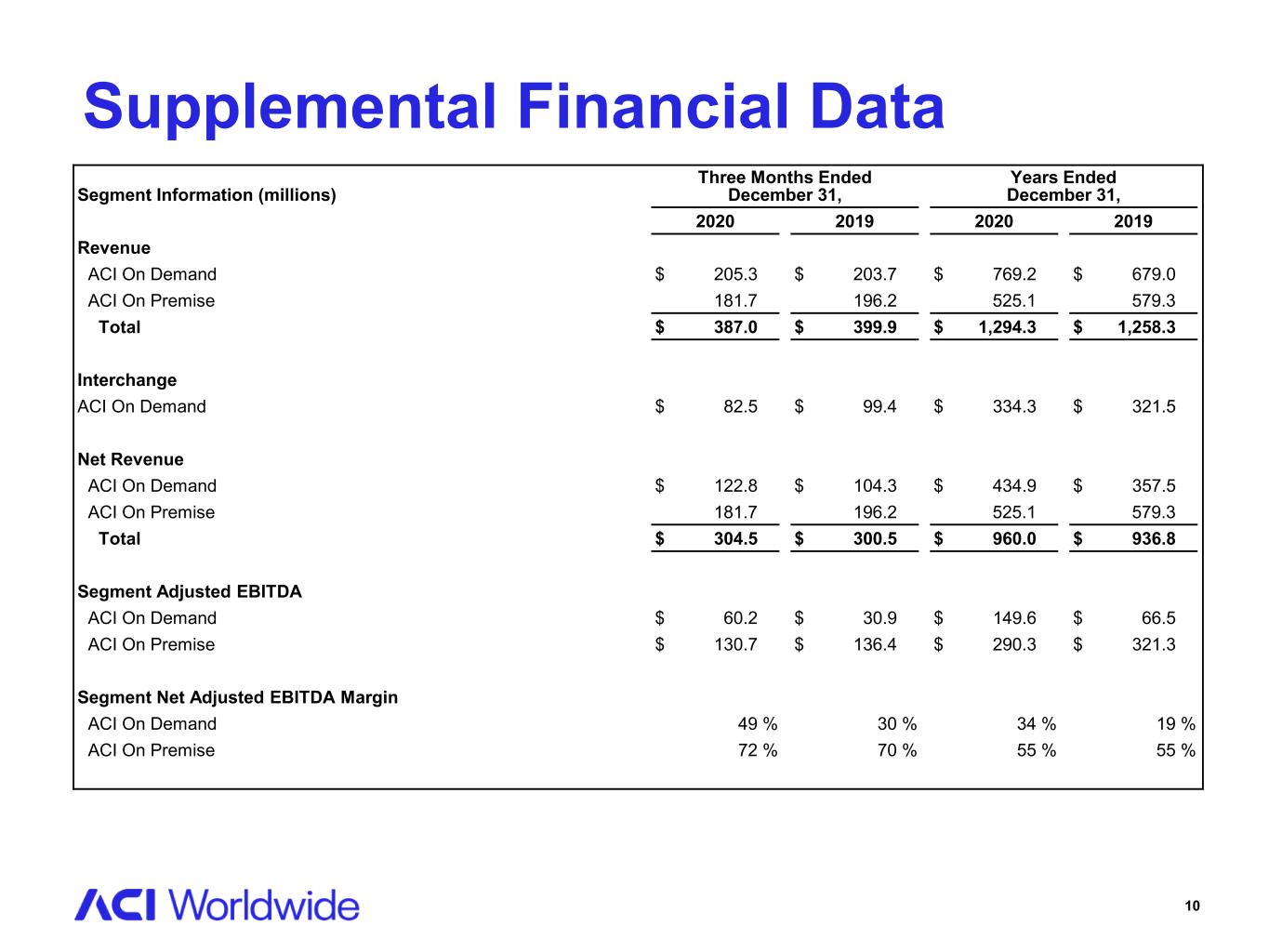

10 Segment Information (millions) Three Months Ended December 31, Years Ended December 31, 2020 2019 2020 2019 Revenue ACI On Demand $ 205.3 $ 203.7 $ 769.2 $ 679.0 ACI On Premise 181.7 196.2 525.1 579.3 Total $ 387.0 $ 399.9 $ 1,294.3 $ 1,258.3 Interchange ACI On Demand $ 82.5 $ 99.4 $ 334.3 $ 321.5 Net Revenue ACI On Demand $ 122.8 $ 104.3 $ 434.9 $ 357.5 ACI On Premise 181.7 196.2 525.1 579.3 Total $ 304.5 $ 300.5 $ 960.0 $ 936.8 Segment Adjusted EBITDA ACI On Demand $ 60.2 $ 30.9 $ 149.6 $ 66.5 ACI On Premise $ 130.7 $ 136.4 $ 290.3 $ 321.3 Segment Net Adjusted EBITDA Margin ACI On Demand 49 % 30 % 34 % 19 % ACI On Premise 72 % 70 % 55 % 55 % Supplemental Financial Data

11 EPS impact of non-cash and significant transaction-related items Three Months Ended December 31, (millions) 2020 2019 EPS Impact $ in Millions (Net of Tax) EPS Impact $ in Millions (Net of Tax) GAAP net income $ 0.56 $ 67.1 $ 0.47 $ 55.5 Adjusted for: Significant transaction-related expenses 0.12 14.5 0.02 2.0 Amortization of acquisition-related intangibles 0.06 7.0 0.06 7.1 Amortization of acquisition-related software 0.06 7.5 0.07 8.2 Non-cash stock-based compensation 0.04 5.1 0.04 4.9 Total adjustments $ 0.28 $ 34.1 $ 0.19 $ 22.2 Diluted EPS adjusted for non-cash and significant transaction- related items $ 0.84 $ 101.2 $ 0.66 $ 77.7 EPS impact of non-cash and significant transaction-related items Years Ended December 31, (millions) 2020 2019 EPS Impact $ in Millions (Net of Tax) EPS Impact $ in Millions (Net of Tax) GAAP net income $ 0.62 $ 72.7 $ 0.57 $ 67.1 Adjusted for: Tax benefit from release of valuation allowances — — (0.13) (15.5) Significant transaction-related expenses 0.29 34.2 0.16 18.9 Amortization of acquisition-related intangibles 0.24 28.2 0.20 24.2 Amortization of acquisition-related software 0.27 31.8 0.24 29.0 Non-cash stock-based compensation 0.19 22.5 0.24 27.9 Total adjustments $ 0.99 $ 116.7 $ 0.71 $ 84.5 Diluted EPS adjusted for non-cash and significant transaction- related items $ 1.61 $ 189.4 $ 1.28 $ 151.6 Supplemental Financial Data

12 Three Months Ended December 31, Years Ended December 31, Bookings by Type (millions) 2020 2019 2020 2019 New Account & New Application $ 107.7 $ 65.8 $ 275.4 $ 223.8 Add-on 239.6 138.8 461.6 319.0 Term Extensions 270.8 400.0 757.9 696.4 Total Bookings $ 618.1 $ 604.6 $ 1,494.9 $ 1,239.2 Three Months Ended Backlog 60-Month (millions) December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 December 31, 2019 ACI On Demand $ 3,965 $ 3,868 $ 3,863 $ 3,781 $ 3,855 ACI On Premise 2,074 2,041 1,976 1,933 1,977 Backlog 60-Month $ 6,039 $ 5,909 $ 5,839 $ 5,714 $ 5,832 Three Months Ended December 31, Years Ended December 31, Recurring Revenue (millions) 2020 2019 2020 2019 SaaS and PaaS fees $ 205.3 $ 203.7 $ 769.2 $ 677.7 Maintenance fees 52.6 53.7 211.7 213.4 Total Bookings $ 257.9 $ 257.4 $ 980.9 $ 891.1 Supplemental Financial Data

13 To supplement our financial results presented on a GAAP basis, we use the non-GAAP measures indicated in the tables, which exclude significant transaction related expenses, as well as other significant non-cash expenses such as depreciation, amortization, and stock- based compensation, that we believe are helpful in understanding our past financial performance and our future results. The presentation of these non-GAAP financial measures should be considered in addition to our GAAP results and are not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. Management generally compensates for limitations in the use of non-GAAP financial measures by relying on comparable GAAP financial measures and providing investors with a reconciliation of non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. We believe that these non-GAAP financial measures reflect an additional way to view aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. Certain non-GAAP measures include: • Adjusted EBITDA: net income plus income tax expense, net interest income (expense), net other income (expense), depreciation, amortization, and stock-based compensation, as well as significant transaction related expenses. Adjusted EBITDA should be considered in addition to, rather than as a substitute for, net income (loss). • Net Adjusted EBITDA Margin: Adjusted EBITDA divided by revenue net of pass-through interchange revenue. Net Adjusted EBITDA Margin should be considered in addition to, rather than as a substitute for, net income (loss). • Diluted EPS adjusted for non-cash and significant transaction related items: diluted EPS plus tax effected significant transaction related items, amortization of acquired intangibles and software, non-cash stock-based compensation, and discreet income tax times. Diluted EPS adjusted for non-cash and significant transaction related items should be considered in addition to, rather than as a substitute for, diluted EPS. Non-GAAP Financial Measures

14 ACI also includes backlog estimates, which include all SaaS and PaaS, license, maintenance, and services revenue specified in executed contracts that will be recognized in future periods, as well as revenue from assumed contract renewals to the extent that we believe recognition of the related revenue will occur within the corresponding backlog period. We have historically included assumed renewals in backlog estimates based upon automatic renewal provisions in the executed contract and our historic experience with customer renewal rates. Backlog is considered a non-GAAP financial measure as defined by SEC Regulation G. Our 60-month backlog estimates are derived using the following key assumptions: ◦ License arrangements are assumed to renew at the end of their committed term or under the renewal option stated in the contract at a rate consistent with historical experience. If the license arrangement includes extended payment terms, the renewal estimate is adjusted for the effects of a significant financing component. ◦ Maintenance fees are assumed to exist for the duration of the license term for those contracts in which the committed maintenance term is less than the committed license term. ◦ SaaS and PaaS arrangements are assumed to renew at the end of their committed term at a rate consistent with our historical experiences. ◦ Foreign currency exchange rates are assumed to remain constant over the 60-month backlog period for those contracts stated in currencies other than the U.S. dollar. ◦ Our pricing policies and practices are assumed to remain constant over the 60-month backlog period. Estimates of future financial results require substantial judgment and are based on several assumptions as described above. These assumptions may turn out to be inaccurate or wrong for reasons outside of management’s control. For example, our customers may attempt to renegotiate or terminate their contracts for many reasons, including mergers, changes in their financial condition, or general changes in economic conditions (e.g. economic declines resulting from COVID-19) in the customer’s industry or geographic location. We may also experience delays in the development or delivery of products or services specified in customer contracts, which may cause the actual renewal rates and amounts to differ from historical experiences. Changes in foreign currency exchange rates may also impact the amount of revenue recognized in future periods. Accordingly, there can be no assurance that amounts included in backlog estimates will generate the specified revenues or that the actual revenues will be generated within the corresponding 60-month period. Additionally, because certain components of Committed Backlog and all of Renewal Backlog estimates are operating metrics, the estimates are not required to be subject to the same level of internal review or controls as a contracted but not recognized Committed Backlog. Backlog estimates should be considered in addition to, rather than as a substitute for, reported revenue and contracted but not recognized revenue (including deferred revenue). Non-GAAP Financial Measures

15 This presentation contains forward-looking statements based on current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words or phrases such as “believes,” “will,” “expects,” “anticipates,” “intends,” and words and phrases of similar impact. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation include, but are not limited to, (i) statements regarding our Three Pillar strategy being implemented and generating results, focus on real-time payments, large sophisticated global merchants and fast-growing emerging markets, and plans for a thorough strategic review of our business portfolio to enhance our growth profile, and (ii) 2021 financial guidance, including expectations for COVID-19-related headwinds to persist through the first half of 2021 and for growth to accelerate to the mid- single digits in the second half of the year, full year 2021 adjusted EBITDA, net adjusted EBITDA margin expansion, and first quarter 2021 revenue and EBITDA. All of the foregoing forward-looking statements are expressly qualified by the risk factors discussed in our filings with the Securities and Exchange Commission. Such factors include, but are not limited to, increased competition, demand for our products, consolidations and failures in the financial services industry, customer reluctance to switch to a new vendor, failure to obtain renewals of customer contracts or to obtain such renewals on favorable terms, delay or cancellation of customer projects or inaccurate project completion estimates, the complexity of our products and services and the risk that they may contain hidden defects or be subjected to security breaches or viruses, compliance of our products with applicable legislation, governmental regulations and industry standards, our compliance with privacy regulations, our ability to protect customer information from security breaches or attacks, our ability to adequately defend our intellectual property, exposure to credit or operating risks arising from certain payment funding methods, business interruptions or failure of our information technology and communication systems, our offshore software development activities, risks from operating internationally, including fluctuations in currency exchange rates, exposure to unknown tax liabilities, adverse changes in the global economy, worldwide events outside of our control, failure to attract and retain key personnel, litigation, future acquisitions, strategic partnerships, and investments, integration of and achieving benefits from the Speedpay acquisition, impairment of our goodwill or intangible assets, restrictions and other financial covenants in our debt agreements, our existing levels of debt, replacement of LIBOR benchmark interest rate, the accuracy of management's backlog estimates, exposure to unknown tax liabilities, the cyclical nature of our revenue and earnings and the accuracy of forecasts due to concentration of revenue-generating activity during the final weeks of each quarter, volatility in our stock price, and the COVID-19 pandemic. For a detailed discussion of these risk factors, parties that are relying on the forward-looking statements should review our filings with the Securities and Exchange Commission, including our most recently filed Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Forward-Looking Statements