Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INTERNATIONAL BUSINESS MACHINES CORP | tm217754d1_8k.htm |

Exhibit 99.1

Strategic Update on IBM Global Financing

24 February 2021

IBM Global Financing (IGF) is continuing to take action to support IBM’s hybrid cloud and AI strategy and to optimize IBM’s capital structure with the announced make-whole call of the outstanding IBM Credit LLC (IBM Credit) public debt and intent to de-register IBM Credit with the SEC.

IBM Global Financing Strategy

IGF is the captive financing business of IBM that includes client and commercial financing as well as a hardware remanufacturing and remarketing business.

Over the last few years, IGF has taken several strategic actions to focus on higher-value opportunities supporting IBM’s hybrid cloud and AI strategy. These actions have improved its go-forward financial and risk profiles — continuing IBM’s disciplined portfolio and financial management approach and strengthening IBM’s liquidity and balance sheet position.

For example, in the second quarter of 2019, IGF began to wind down the portion of its operations that provided short-term working capital solutions for OEM IT suppliers, distributors, and resellers. Additionally, IGF implemented a robust process to reduce certain portions of its remaining financing portfolio as well as its originations in specific industries and geographies. Finally, in the fourth quarter of 2020, it entered into an agreement with a third party to sell up to $3 billion of short-term commercial financing receivables, at any one time, on a revolving basis.

Financial Implications

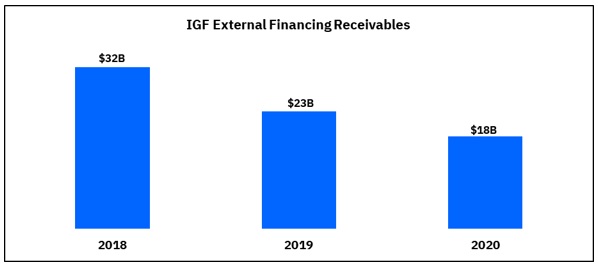

These actions have resulted in a more targeted and streamlined financing portfolio, lower overall debt, and an improved risk profile. From 2018 to 2020, IGF external financing receivables were reduced from $32 billion to $18 billion, with a corresponding $10 billion reduction in debt. IGF expects to further reduce external financing receivables and debt in 2021. As a reminder, changes to global financing receivables do not impact IBM’s Free Cash Flow.1

1IBM’s Free Cash Flow is defined as Net Cash from Operating Activities less the change in Global Financing Receivables and Net Capital Expenditures, including the investment in software.

IBM Credit LLC

In 2017, IGF’s legal entity structure was reorganized to consolidate its operations (except for the remanufacturing and remarketing business) under IBM Credit LLC, a wholly owned subsidiary of IBM. This enabled operational benefits as well as enhanced clarity around the financing business. At the same time, IBM Credit registered with the SEC to facilitate the issuance of its own public debt as an alternative funding source from its parent. Since the reorganization, IBM Credit has issued $7 billion of public term debt, of which $1.75 billion remains outstanding.

Due to the evolution of the IGF strategy, IBM Credit will no longer require direct access to the capital markets as its on-going financing requirements will be met through IBM. As a result, IBM Credit intends to de-register with the SEC and will no longer file its own financial information. To effectuate this change, on February 24, 2021, IBM Credit announced a make-whole call for its outstanding public debt of $1.75 billion, which will result in the retirement of all outstanding public debt issued by IBM Credit. To ensure visibility to the financing business, IBM’s future reporting will provide enhanced IGF segment disclosures including a separate segment balance sheet and additional relevant information previously reported in the IBM Credit SEC filings.

For additional information regarding IBM Global Financing including a detailed description of its business, please see the most recent IBM 10-K accessible through the IBM Investor Relations website at www.ibm.com/investor.