Attached files

Exhibit 99.1

MGP BREIT VENTURE 1 LLC | |||||

Consolidated Financial Statements as of December 31, 2020 and for | |||||

the period from February 14, 2020 (Date of Inception) through | |||||

December 31, 2020 and Independent Auditors’ Report | |||||

MGP BREIT VENTURE 1 LLC AND SUBSIDIARIES

I N D E X

| Page | ||||||||

Independent Auditors’ Report | i | |||||||

Consolidated Balance Sheet as of December 31, 2020 | 1 | |||||||

Consolidated Statement of Operations for the period from February 14, 2020 (Date of Inception) through December 31, 2020 | 2 | |||||||

Consolidated Statement of Cash Flows for the period from February 14, 2020 (Date of Inception) through December 31, 2020 | 3 | |||||||

Consolidated Statement of Members’ Capital for the period from February 14, 2020 (Date of Inception) through December 31, 2020 | 4 | |||||||

Notes to Consolidated Financial Statements | 5 | |||||||

Schedule III | 9 | |||||||

INDEPENDENT AUDITORS’ REPORT

To the Members of MGP BREIT Venture 1 LLC

We have audited the accompanying consolidated financial statements of MGP BREIT Venture 1 LLC and its subsidiaries (the “Company”), which comprise the consolidated balance sheet as of December 31, 2020, and the related consolidated statements of operations, members’ capital and cash flows for the period from February 14, 2020 (Date of Inception) through December 31, 2020, and the related notes to the consolidated financial statements and financial statement schedule III (collectively referred to as the “consolidated financial statements”).

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of MGP BREIT Venture 1 LLC and its subsidiaries as of December 31, 2020, and the results of their operations and their cash flows for the period from February 14, 2020 (Date of Inception) through December 31, 2020, in accordance with accounting principles generally accepted in the United States of America.

/s/ Deloitte & Touche LLP

Las Vegas, Nevada

February 15, 2021

i

MGP BREIT VENTURE 1 LLC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(In thousands)

| December 31, | ||||||||

| 2020 | ||||||||

| ASSETS | ||||||||

| Real estate investments, net | $ | 4,523,638 | ||||||

| Cash and cash equivalents | 15 | |||||||

| Indefinite-lived intangible assets | 5,603 | |||||||

| Deferred rent receivable | 89,723 | |||||||

| Total assets | $ | 4,618,979 | ||||||

| LIABILITIES AND MEMBERS’ CAPITAL | ||||||||

| Liabilities | ||||||||

Debt, net | $ | 2,994,269 | ||||||

Accrued interest and other | 7,811 | |||||||

| Total liabilities | 3,002,080 | |||||||

| Members' capital | 1,616,899 | |||||||

| Total liabilities and members' capital | $ | 4,618,979 | ||||||

| The accompanying notes are an integral part of these consolidated financial statements. | ||||||||

1

MGP BREIT VENTURE 1 LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands)

| For the period from February 14, 2020 | ||||||||

| (Date of Inception) through | ||||||||

| December 31, 2020 | ||||||||

| Revenue | ||||||||

Rental revenue | $ | 346,482 | ||||||

| Total revenue | 346,482 | |||||||

| Expenses | ||||||||

Depreciation | 73,518 | |||||||

General and administrative | 589 | |||||||

| Total expenses | 74,107 | |||||||

| Other income (expense) | ||||||||

Interest expense | (94,618) | |||||||

| Total other income (expense) | (94,618) | |||||||

| Net income | $ | 177,757 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

MGP BREIT VENTURE 1 LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(In thousands)

| For the period from February 14, 2020 (Date of Inception) | ||||||||

| through December 31, 2020 | ||||||||

| Cash flows from operating activities | ||||||||

Net income | $ | 177,757 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

Depreciation | 73,518 | |||||||

Amortization of debt issuance costs | 452 | |||||||

Changes in operating assets and liabilities | ||||||||

Deferred rent receivable | (89,723) | |||||||

Accrued interest and other | 7,811 | |||||||

Net cash provided by operating activities | 169,815 | |||||||

| Cash flows from investing activities | ||||||||

Acquisition of Properties | (3,800,759) | |||||||

Net cash used in investing activities | (3,800,759) | |||||||

| Cash flows from financing activities | ||||||||

Contributions from Sponsor Member | 798,798 | |||||||

Distributions to Members | (161,656) | |||||||

Proceeds from debt issuance | 3,000,000 | |||||||

Payments of debt issuance costs | (6,183) | |||||||

Net cash provided by financing activities | 3,630,959 | |||||||

| Cash and cash equivalents and restricted cash | ||||||||

Net increase for the period | 15 | |||||||

Balance, beginning of period | — | |||||||

Balance, end of period | $ | 15 | ||||||

| Supplemental disclosure | ||||||||

Cash interest paid | $ | 86,457 | ||||||

| Non-cash investing/financing activity | ||||||||

| Issuance of equity to Managing Member as consideration for Properties | $ | 802,000 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

MGP BREIT VENTURE 1 LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF MEMBERS’ CAPITAL

(In thousands)

| Balance as of February 14, 2020 (Date of Inception) | $ | — | ||||||

| Initial capital contribution | 1,600,798 | |||||||

| Distributions to Members | (161,656) | |||||||

| Net income | 177,757 | |||||||

| Balance as of December 31, 2020 | $ | 1,616,899 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

MGP BREIT VENTURE 1 LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND NATURE OF BUSINESS

Organization. MGP BREIT Venture 1 LLC (together with its wholly owned subsidiaries, the “Company”) is a Delaware limited liability company that was formed in February 2020. The Company is 50.1% owned by a subsidiary of MGM Growth Properties LLC (MGP) and 49.9% owned by a subsidiary of Blackstone Real Estate Investment Trust Inc. (BREIT). MGP is the “Managing Member” and BREIT is the “Sponsor Member” and, together, the “Members.”

Nature of business. The Company was formed for the purposes of acquiring, owning, financing, leasing and maintaining, operating and otherwise dealing with the real estate assets of MGM Grand Las Vegas and Mandalay Bay (including Mandalay Place) (collectively the “Properties”). The Properties were acquired by the Company as part of its formation on February 14, 2020 (“Date of Inception”). Additionally, the Company entered into a lease with a subsidiary of MGM Resorts International (“MGM”) for use of the Properties. Refer to Note 6 for additional details on this lease.

COVID-19. On March 17, 2020, the Properties temporarily closed to the public pursuant to state and local government requirements as a result of the unprecedented public health crisis from the novel coronavirus (“COVID-19”) pandemic. MGM Grand Las Vegas re-opened on June 4, 2020 and Mandalay Bay re-opened on July 1, 2020, both without certain amenities and subject to certain occupancy limitations. In addition, the tenant has temporarily closed the hotel tower operations at Mandalay Bay midweek, with the casino, restaurants, and certain other amenities remaining open throughout the week. The tenant will continue to evaluate business levels to determine how long the closure will remain in effect.

In addition, the Properties (or portions thereof) may be subject to temporary, complete or partial shutdowns in the future due to COVID-19 related concerns and the Company cannot predict whether local, state, or the federal government will adopt restrictive measures in the future, including stay-at-home orders, curfews or additional limitations on operations. Accordingly, although the Properties are open, they are generating revenue for the tenant that are significantly lower than historical results which the Company expects to continue into 2021 and potentially thereafter.

Despite the aforementioned uncertainties and as it relates to the impact of the COVID-19 pandemic, the tenant continues to make rental payments in full and on time and the Company believes the tenant’s (together with MGM’s) liquidity position is sufficient to cover their expected rental obligations for the foreseeable future. Accordingly, while the Company does not anticipate an impact on its operations, the Company cannot estimate the duration of the pandemic and potential impact on the business if the reopened Properties will be required to close again, or if the tenant (or MGM) is otherwise unable or unwilling to make rental payments.

NOTE 2 – BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

Principles of consolidation. The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and include the accounts of the Company and its subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Management’s use of estimates. The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates and assumptions are used by management in determining the useful lives of real estate investments, the initial valuations and underlying allocations, and the determination of fair value for impairment assessments. Actual results could differ from those estimates.

Real estate investments. Real estate investments consist of land, buildings, improvements and integral equipment. Costs of maintenance and repairs to real estate investments are the responsibility of the tenant under the lease. See Note 3 for accounting for acquisition of real estate.

Management assesses impairment of long-lived assets to be held and used whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Management uses an estimate of future undiscounted cash flows of the related asset based on its intended use to determine whether the carrying value is recoverable. If the Company determines that the carrying value of an asset is not recoverable, the fair value of the asset is estimated and an impairment loss is recorded to the extent the carrying value exceeds estimated fair value. Management estimates fair value

5

using discounted cash flow models, market appraisals if available, and other market participant data. During the period from February 14, 2020 (Date of Inception) through December 31, 2020, no impairment charges were recorded.

Depreciation. Depreciation expense is recognized over the useful lives of real estate investments by applying the straight-line method over the following estimated useful lives, which are periodically reviewed:

| Buildings and improvements | 10 to 43 years | ||||||||||

| Land improvements | 5 to 15 years | ||||||||||

| Integral equipment | 3 to 10 years | ||||||||||

Cash and cash equivalents. Cash and cash equivalents represent cash held in banks and on hand.

Indefinite-lived intangible assets. Indefinite-lived intangible assets consist of water rights at the Properties. Indefinite-lived intangible assets must be reviewed for impairment at least annually and between annual test dates in certain circumstances. The Company performs its annual impairment tests in the fourth quarter of each fiscal year. No impairments were indicated or recorded as a result of the annual impairment review for indefinite-lived intangible assets in 2020.

Accounting guidance provides entities the option to perform a qualitative assessment of indefinite-lived intangible assets (commonly referred to as “step zero”) in order to determine whether further impairment testing is necessary. In performing the step zero analysis, the Company considers macroeconomic conditions, industry and market considerations, current and forecasted financial performance, and entity-specific events. In addition, the Company takes into consideration the amount of excess of fair value over carrying value determined in the last quantitative analysis that was performed, if applicable, as well as the period of time that has passed since the last quantitative analysis. If the step zero analysis indicates that it is more likely than not that the fair value is less than its carrying amount, the entity would proceed to a quantitative analysis.

Under the quantitative analysis, water rights are tested for impairment using a discounted cash flow approach. If the fair value of an indefinite-lived intangible asset is less than its carrying amount, an impairment loss is recognized equal to the difference.

Debt issuance costs. The Company records debt issuance costs, which include legal and other direct costs related to the issuance of debt, as a direct deduction from the carrying value of the associated debt liability. The capitalized costs are amortized to interest expense over the contractual term of the debt.

Revenue recognition and deferred revenue. Rental revenues for the Company’s lease, which is accounted for as an operating lease, are recognized on a straight-line basis over the non-cancelable term, which includes the initial lease term of thirty years and does not include the renewal options, for all contractual revenues that are determined to be fixed and measurable, payment has been received, or collectability is probable. The difference between such rental revenue earned and the cash rent due under the provisions of the lease is recorded as deferred rent receivable or as deferred revenue if the cash rent due exceeds rental revenue earned.

Distributions. Cash available for distribution shall be apportioned between the Members in proportion to their respective percentage interests.

Concentrations of credit risk. As of December 31, 2020, all of the Company’s Properties have been leased to a subsidiary of MGM, and all of the Company’s revenues are derived from such lease.

Fair value measurements. Fair value measurements are utilized in the accounting of the Company’s assets acquired and liabilities assumed. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and is measured according to a hierarchy that includes: Level 1 inputs, such as quoted prices in an active market; Level 2 inputs, which are observable inputs for similar assets; or Level 3 inputs, which are unobservable inputs. The Company used Level 2 inputs for its debt fair value disclosures (see Note 5) and Level 3 inputs when assessing the fair value of the assets acquired and liabilities assumed within the Properties’ purchase price allocation (see Note 3).

Income taxes. The Company is treated as a partnership for federal income tax purposes. Therefore, federal income taxes are the responsibility of the Members. As a result, no provision for income taxes are reflected in the consolidated financial statements.

6

Subsequent events. Management has evaluated subsequent events through February 15, 2021, the date these consolidated financial statements were available to be issued and has not identified any such events.

NOTE 3 – ACQUISITION OF PROPERTIES

On February 14, 2020, the Company acquired the real estate assets of the Properties, which was accounted for as an asset acquisition under ASC 805 for total consideration of $4.6 billion. The fair value of consideration consisted of cash paid of $2.5 billion, which is inclusive of acquisition costs of $2.8 million, the issuance of equity of $802 million, and the repayment of bridge facility indebtedness assumed of $1.3 billion.

The Company recognized 100% of the assets and liabilities at fair value on the date of acquisition. Under the acquisition method, the fair value was allocated to the assets acquired in the transaction based on their relative fair values on the date of acquisition. The Company estimated fair value using level 3 inputs, which are unobservable inputs.

The following table sets forth the purchase price allocation (in thousands):

| Real estate investments | $ | 4,597,156 | ||||||

| Indefinite-lived intangible asset | 5,603 | |||||||

| $ | 4,602,759 | |||||||

The Company recognized the identifiable intangible asset at fair value. The estimated fair value of the intangible asset, which is for water rights, was determined using methodologies under the income approach based on significant inputs that were not observable.

NOTE 4 – REAL ESTATE INVESTMENTS, NET

Real estate investments, net consisted of the following:

| December 31, | ||||||||

| 2020 | ||||||||

| (In thousands) | ||||||||

| Land and improvements | $ | 1,575,394 | ||||||

| Building and building improvements | 2,954,194 | |||||||

| Furniture, fixtures and equipment | 65,380 | |||||||

| Construction in progress | 2,188 | |||||||

| 4,597,156 | ||||||||

| Less: Accumulated depreciation | (73,518) | |||||||

| Real estate investments, net | $ | 4,523,638 | ||||||

NOTE 5 – DEBT

Debt, net consisted of the following:

| December 31, | ||||||||

| 2020 | ||||||||

| (In thousands) | ||||||||

| Principal amount of indebtedness | $ | 3,000,000 | ||||||

| Less: Unamortized debt issuance costs | (5,731) | |||||||

| Debt, net | $ | 2,994,269 | ||||||

Debt. At December 31, 2020, the Company’s debt consisted of $3.0 billion of principal amount of indebtedness. The terms of the loan agreement include a maturity date of March 2032 with an anticipated repayment date of March 2030 (as defined within the loan agreement). During 2020, the Company and its lenders amended its debt agreement, which resulted in increases in the interest rate from 3.308% to 3.438% as of March 30, 2020 and to 3.558% as of May 1, 2020. Interest expense was $94.6 million for the period ended December 31, 2020.

7

The indebtedness contains customary representations and warranties, events of default, and positive, negative and financial covenants. The Company was in compliance with its debt covenants as of December 31, 2020.

The indebtedness is secured by substantially all the assets of the Properties. Mandatory prepayments of the principal will be required upon the occurrence of the receipt of cash in certain instances not in the ordinary course of business, subject to certain exceptions.

MGM provides a shortfall guarantee of the principal amount of the indebtedness and any interest accrued and unpaid thereon. The terms of the shortfall guarantee provide that after the lenders have exhausted certain remedies to collect on the obligations under the indebtedness, MGM would then be responsible for any shortfall between the value of the collateral and the debt obligation.

The Members provide a guarantee for the losses incurred by the lenders of the indebtedness arising out of certain bad acts by either Member or the Company, such as fraud or willful misconduct, based on the Member’s percentage ownership of the Company. This guarantee is capped at 10% of the principal amount outstanding at the time of the loss. The Members have separately indemnified each other for the other Member’s share of the overall liability exposure, if at fault.

Fair value of debt. The estimated fair value of the indebtedness was $3.0 billion at December 31, 2020.

NOTE 6 – LEASES

Lease. Pursuant to a lease agreement between a subsidiary of MGM and the Company, a subsidiary of MGM leases the Properties from the Company. The lease has an initial term of thirty years with two subsequent ten-year renewal periods, exercisable at the tenant’s option. The lease provides for an initial annual rent of $292 million with a fixed 2% escalator for the first fifteen years and, thereafter, an escalator equal to the greater of 2% and the consumer price index increase during the prior year, subject to a cap of 3%. MGM guarantees the tenant’s performance and payments under the lease.

The Company does not consider the renewal options reasonably certain of being exercised and, accordingly, has determined the lease term to be 30 years. In consideration of such, the Company determined the expected lease term of 30 years to be less than 75% of the economic useful life of the Properties. Further, using the implicit rate, the Company determined that the present value of the future lease payments is less than 90% of the fair market value of the Properties. Accordingly, in consideration of these lease classification tests, as well as the fact that the lease does not transfer ownership of the assets back to the tenant at the end of the lease term or grant the tenant a purchase option, and the real estate assets have alternative uses at the end of the lease term, the Company classified the lease as an operating lease.

Straight-line rental revenues from the lease were $346.5 million for the period from February 14, 2020 (Date of Inception) through December 31, 2020.

Future non-cancelable minimum rental cash payments, which are payments under the initial 30-year term through February 28, 2050 and do not include the two ten-year renewal options are as follows as of December 31, 2020:

| For the year ending December 31, | (In thousands) | |||||||

| 2021 | $ | 296,867 | ||||||

| 2022 | 302,804 | |||||||

| 2023 | 308,860 | |||||||

| 2024 | 315,037 | |||||||

| 2025 | 321,338 | |||||||

| Thereafter | 10,057,640 | |||||||

| Total future minimum lease payments | $ | 11,602,546 | ||||||

NOTE 7 – COMMITMENTS AND CONTINGENCIES

Litigation. In the ordinary course of business, from time to time, the Company expects to be subject to legal claims and administrative proceedings, none of which are currently outstanding, which the Company believes could have, individually or in the aggregate, a material adverse effect on the Company’s business, financial conditions or results of operations, liquidity, or cash flows.

8

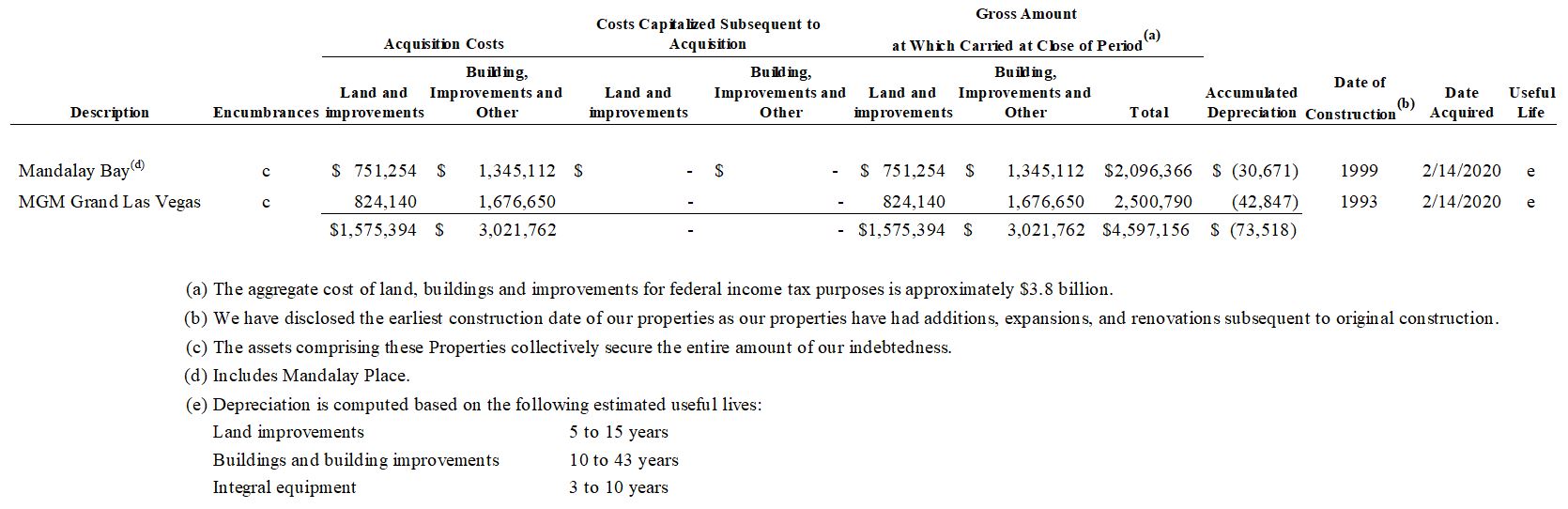

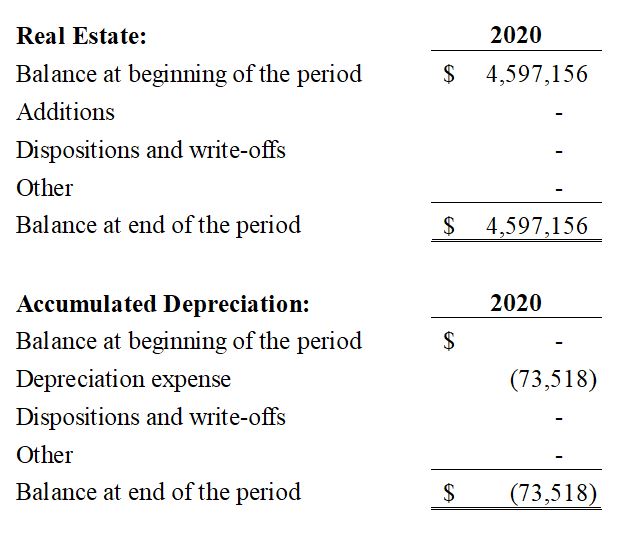

SCHEDULE III

REAL ESTATE ASSETS AND ACCUMULATED DEPRECIATION

December 31, 2020

(in thousands)

A summary of activity for real estate and accumulated depreciation is as follows, with the real estate assets acquired on Date of Inception reflected as the balance at the beginning of the period for 2020:

9