Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - MASIMO CORP | masi-q42020nongaapsupp.htm |

| EX-99.1 - EX-99.1 - MASIMO CORP | masi-20210223xex991.htm |

| 8-K - 8-K - MASIMO CORP | masi-20210223.htm |

Improving Patient Outcomes Reducing the Cost of Care® Fourth Quarter 2020 Earnings Presentation | February 23, 2021

FORWARD-LOOKING STATEMENTS These presentations contain forward-looking statements within the meaning of federal securities laws, including, among others, statements about our expectations, plans, strategies or prospects. We generally use the words “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “project,” “assume,” “guide,” “target,” “forecast,” “see,” “seek,” “can,” “should,” “could,” “would,” “intend” “predict,” “potential,” “strategy,” “is confident that,” “future,” “opportunity,” “work toward,” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are, or may be deemed to be, forward-looking statements. Such statements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. Forward-looking statements speak only as of the date they are made, and we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers of these presentations are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in these presentations. The risks and uncertainties that may cause actual results to differ materially from Masimo’s current expectations are more fully described in Masimo’s reports filed with the U.S. Securities and Exchange Commission (SEC), including our most recent Form 10-K and Form 10-Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo.com or upon request.

NON-GAAP FINANCIAL MEASURES The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The non-GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on-going core operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies. The Company has presented the following non-GAAP measures to assist investors in understanding the Company’s core net operating results on an on-going basis: (i) constant currency product revenue growth %, (ii) non-GAAP gross profit/margin %, (iii) non-GAAP SG&A expense, (iv) non-GAAP R&D expense, (v) non- GAAP litigation settlement, award and/or defense costs, (vi) non-GAAP operating expense %, (vii) non-GAAP operating income/margin %, (viii) non-GAAP earnings per diluted share and (ix) adjusted free cash flow. These non-GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes constant currency product revenue growth, non-GAAP gross profit/margin, non-GAAP SG&A expense %, non-GAAP R&D expense %, non-GAAP litigation settlement, award and/or defense costs, non-GAAP operating expense %, non-GAAP operating income/margin, non-GAAP net income, non-GAAP net income per diluted share, and adjusted free cash flow are important measures in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, including GAAP to non-GAAP reconciliations, please visit the Investor Relations section of the Company’s website at www.masimo.com to access Supplementary Financial Information.

Fourth Quarter 2020 Highlights Total revenue, including royalty and other revenue, increased 19.2% to $295.1 million Product revenue increased 19.2% to $295.1 million, or 18.1% on a constant currency basis(1) Shipments of noninvasive technology boards and instruments were 83,000 GAAP operating margin was 22.0% Non-GAAP operating margin(1) was 23.1% GAAP EPS was $1.21 per diluted share Non-GAAP EPS(1) was $0.98 per diluted share Operating cash flow was $64.4 million Adjusted free cash flow(1) was $51.9 million Cash and investments balance was $641.4 million Shipments Revenue Profitability EPS Cash (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

Fourth Quarter 2020 Results – GAAP(1) (in millions; except % and EPS) Q4 2020 Q4 2019 vs. Prior Year Comments Revenue $295.1 $247.5 19.2% Increased demand driven by higher volumes of technology boards and instruments Gross Margin 63.4% 67.4% (400) bps Gross margin decrease due to a higher than usual proportion of revenue coming from our technology boards and instruments, which have a lower margin profile than sensors, and increased manufacturing and supply chain complexity associated with COVID-19 SG&A Expense 30.6% 33.1% (250) bps R&D Expense 10.7% 9.5% 120 bps Operating Expenses 41.4% 42.6% (120) bps Lower operating expenses as a % of revenue driven by strong sales growth, which enabled operating leverage across the global organization while at the same time increasing our investments in R&D, legal, marketing and advertising Operating Margin 22.0% 24.9% (290) bps Tax Rate (5.9)% 17.8% (2,370) bps GAAP tax rate includes excess tax benefits from stock based compensation, which were $10.0M in Q4 2020 compared to $2.6M in Q4 2019 GAAP EPS $1.21 $0.92 31.5% (1) May not foot due to rounding.

Fourth Quarter 2020 Results – Non-GAAP(1) vs. Prior Year (in millions; except % and EPS) Q4 2020 Q4 2019 Reported Constant Currency Comments Revenue $295.1 $247.4 19.2% 18.1% Increased demand driven by higher volumes of technology boards and instruments Gross Margin 63.5% 67.5% (400) bps Gross margin decrease due to a higher than usual proportion of revenue coming from our technology boards and instruments, which have a lower margin profile than sensors, and increased manufacturing and supply chain complexity associated with COVID-19 SG&A Expense 29.7% 32.3% (260) Bps R&D Expense 10.7% 9.5% 120 Bps Operating Expenses 40.4% 41.8% (140) Bps Lower operating expenses as a % of revenue driven by strong sales growth, which enabled operating leverage across the global organization while at the same time increasing our investments in R&D, legal, marketing and advertising Operating Margin 23.1% 25.7% (260) Bps Tax Rate 16.4% 21.9% (550) bps Driven by an increase in R&D tax credits and a decrease in compensation related non-deductible items Non-GAAP EPS $0.98 $0.91 7.7% (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. May not foot due to rounding.

Fourth Quarter 2020 Results – Non-GAAP(1) Q4 2019 Q4 2020 (260) bps Q4 2019 Q4 2020 Q4 2019 Q4 2020 $295M +18.1% +7.7% Non-GAAP(1) Operating MarginProduct Revenue Non-GAAP(1) EPS $247M Constant Currency Growth(1) 23.1% 25.7% $0.80 $0.76 (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. $0.98 $0.91 %

Full Year 2020 Highlights Total revenue, including royalty and other revenue, increased 22.0% to $1,143.7 million Product revenue increased 22.1% to $1,143.7 million, on a reported and constant currency basis(1) Shipments of noninvasive technology boards and instruments were 472,300 GAAP operating margin was 22.4% Non-GAAP operating margin(1) was 23.1% GAAP EPS was $4.14 per diluted share Non-GAAP EPS(1) was $3.60 per diluted share Operating cash flow was $211.0 million Adjusted free cash flow(1) was $137.9 million Cash and investments balance was $641.4 million Shipments Revenue Profitability EPS Cash (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

Full Year 2020 Results – GAAP(1) (in millions; except % and EPS) FY 2020 FY 2019 vs. Prior Year Comments Revenue $1,143.7 $937.8 22.0% Increased demand driven by higher volumes of technology boards and instruments Gross Margin 65.0% 67.1% (210) bps Gross margin decrease due to a higher than usual proportion of revenue coming from our technology boards and instruments, which have a lower margin profile than sensors, and increased manufacturing and supply chain complexity associated with COVID-19 SG&A Expense 32.3% 33.6% (130) bps R&D Expense 10.4% 9.9% 50 bps Operating Expenses 42.6% 43.5% (90) bps Lower operating expenses as a % of revenue driven by strong sales growth, which enabled operating leverage across the global organization while at the same time increasing our investments in R&D, legal, marketing and advertising Operating Margin 22.4% 23.6% (120) bps Tax Rate 8.9% 16.2% (730) bps GAAP tax rate includes excess tax benefits from stock based compensation, which were $30.2M in 2020 compared to $15.7M in 2019 GAAP EPS $4.14 $3.44 20.3% (1) May not foot due to rounding.

Full Year 2020 Results – Non-GAAP(1) vs. Prior Year (in millions; except % and EPS) FY 2020 FY 2019 Reported Constant Currency Comments Revenue $1,143.7 $936.4 22.1% 22.1% Increased demand driven by higher volumes of technology boards and instruments Gross Margin 65.1% 67.1% (200) bps Gross margin decrease due to a higher than usual proportion of revenue coming from our technology boards and instruments, which have a lower margin profile than sensors, and increased manufacturing and supply chain complexity associated with COVID-19 SG&A Expense 31.7% 33.2% (150) Bps R&D Expense 10.4% 10.0% 40 Bps Operating Expenses 42.1% 43.1% (100) Bps Lower operating expenses as a % of revenue driven by strong sales growth, which enabled operating leverage across the global organization while at the same time increasing our investments in R&D, legal, marketing and advertising Operating Margin 23.1% 24.0% (90) Bps Tax Rate 22.2% 22.8% (60) bps Driven by an increase in R&D tax credits partially offset by unfavorable OUS income mix Non-GAAP EPS $3.60 $3.22 11.8% (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. May not foot due to rounding.

Full Year 2020 Results – Non-GAAP(1) FY 2019 FY 2020 (90) bps FY 2019 FY 2020 FY 2019 FY 2020 $1,144M +22.1% +11.8% Non-GAAP(1) Operating MarginProduct Revenue Non-GAAP(1) EPS $936M Constant Currency Growth(1) 23.1% 24.0% $0.80 $0.76 (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. $3.60 $3.22 %

Full Year 2021 Financial Guidance Total revenue, including royalty and other revenue, of $1,200 million Product revenue increasing 4.9% to $1,200 million or 3.6% constant on a currency basis(1) GAAP operating margin of 23.5% Non-GAAP operating margin(1) of 24.5% GAAP EPS of $3.81 per diluted share Non-GAAP EPS(1) of $3.80 per diluted share Revenue Profitability EPS (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

Full Year 2021 Financial Guidance – GAAP(1) (in millions; except % and EPS) FY 2021 FY 2020 vs. Prior Year Comments Revenue $1,200.0 $1,143.7 4.9% Tough comparisons to 2020 growth rate of ~22% 2-Year compound annual growth rate (CAGR) of ~13% vs. 2019 Gross Margin 66.8% 65.0% 180 bps Gross margin increase due to expectations for product revenue mix to gradually recover toward traditional levels Operating Expenses 43.3% 42.6% 70 bps Higher operating expenses as a % of revenue driven by continued investments in R&D, increased legal costs, and incremental expenses related to the LiDCO business, partially offset by increased operational efficiencies Operating Margin 23.5% 22.4% 110 bps Tax Rate 20.7% 8.9% 1,180 bps GAAP tax rate includes excess tax benefits from stock based compensation, assumed to be $10.0M in FY 2021 compared to $30.2M in FY 2020 GAAP EPS $3.81 $4.14 (8.0)% (1) May not foot due to rounding.

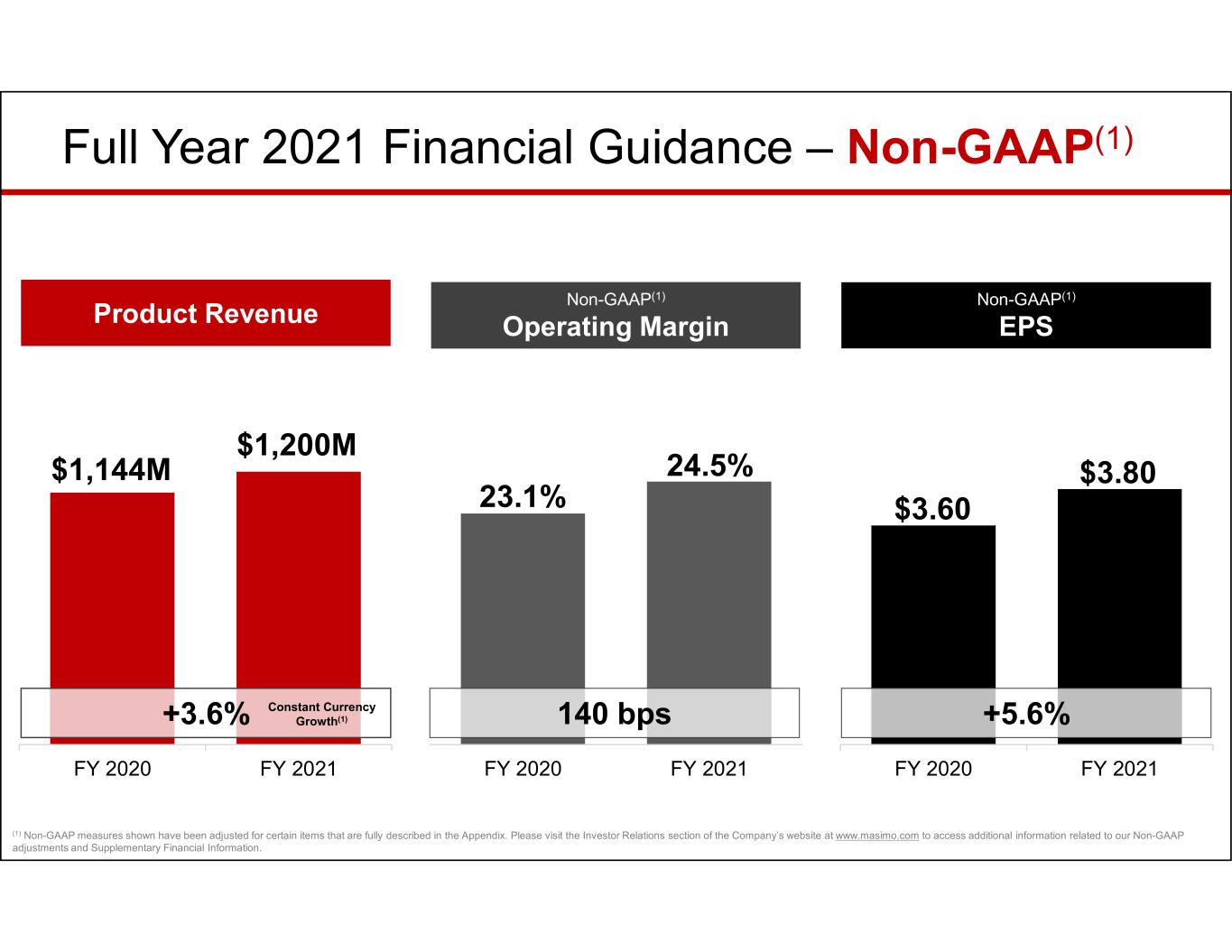

Full Year 2021 Financial Guidance – Non-GAAP(1) vs. Prior Year (in millions; except % and EPS) FY 2021 FY 2020 Reported Constant Currency Comments Revenue $1,200.0 $1,143.7 4.9% 3.6% Tough comparisons to 2020 growth rate of ~22% 2-Year compound annual growth rate (CAGR) of ~13% vs. 2019 . Gross Margin 67.0% 65.1% 190 bps Gross margin increase due to expectations for product revenue mix to gradually recover toward traditional levels Operating Expenses 42.5% 42.1% 40 bps Higher operating expenses as a % of revenue driven by continued investments in R&D, increased legal costs, and incremental expenses related to the LiDCO business, partially offset by increased operational efficiencies Operating Margin 24.5% 23.1% 140 bps Tax Rate 24.1% 22.2% 190 bps Driven by a decrease in R&D tax credits and an increase in non- deductible compensation-related expenses Non-GAAP EPS $3.80 $3.60 5.6% (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. May not foot due to rounding.

Full Year 2021 Financial Guidance – Non-GAAP(1) FY 2020 FY 2021 140 bps FY 2020 FY 2021 FY 2020 FY 2021 $1,200M +3.6% +5.6% Non-GAAP(1) Operating MarginProduct Revenue Non-GAAP(1) EPS $1,144M Constant Currency Growth(1) 24.5% 23.1% $3.80 $3.60 (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

Improving Patient Outcomes Reducing the Cost of Care® APPENDICES GAAP to Non-GAAP Adjustments and Reconciliations

The non-GAAP financial measures reflect adjustments for the following items, as well as the related income tax effects thereof: Constant currency adjustments Some of our sales agreements with foreign customers provide for payment in currencies other than the U.S. Dollar. These foreign currency revenues, when converted into U.S. Dollars, can vary significantly from period to period depending on the average and quarter-end exchange rates during a respective period. We believe that comparing these foreign currency denominated revenues by holding the exchange rates constant with the prior year period is useful to management and investors in evaluating our product revenue growth rates on a period-to-period basis. We anticipate that fluctuations in foreign exchange rates and the related constant currency adjustments for calculation of our product revenue growth rate will continue to occur in future periods. Royalty and other revenue, net of related costs We derive royalty and other revenue, net of related costs, associated with certain non-recurring contractual arrangements that we do not expect to continue in the future. We believe the exclusion of royalty and other revenue, net of related costs, associated with these certain non-recurring revenue streams is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. Acquisition/strategic investment-related costs, including depreciation and amortization Depreciation and amortization related to the revaluation of assets and liabilities (primarily intangible assets, property, plant and equipment adjustments, inventory revaluation, lease liabilities, etc.) to fair value through purchase accounting related to value created by the seller prior to the acquisition/strategic investment rather than ongoing costs of operating our core business. As a result, we believe that exclusion of these costs in presenting non-GAAP financial measures provides management and investors a more effective means of evaluating historical performance and projected costs and the potential for realizing cost efficiencies within our core business. Depreciation and amortization related to the revaluation of acquisition related assets and liabilities will generally recur in future periods. In the event the Company acquires, invests in or divests certain business operations, there may be non-recurring gains, losses or expenses that will be recognized related to the assets and/or liabilities sold or acquired that are not representative of normal on-going cash flows. These gains, losses or expenses are excluded from non-GAAP earnings. Litigation damages, awards and settlements In connection with litigation proceedings arising in the course of our business, we have recorded expenses as a defendant in such proceedings in the form of damages, as well as gains as a plaintiff in such proceedings in the form of litigation awards and settlement proceeds. Litigation matters can vary in their characteristics, frequency and significance to our operating results. We believe that exclusion of these gains (net of any related costs incurred in the period the award or settlement is recognized) and losses is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these expenses and gains are generally unrelated to our core business and/or infrequent in nature. Description of Non-GAAP Adjustments

Realized and unrealized gains or losses from foreign currency transactions: We are exposed to foreign currency gains or losses on outstanding foreign currency denominated receivables and payables related to certain customer sales agreements, product costs and other operating expenses. As the Company does not actively hedge these currency exposures, changes in the underlying currency rates relative to the U.S. Dollar may result in realized and unrealized foreign currency gains and losses between the time these receivables and payables arise and the time that they are settled in cash. Since such realized and unrealized foreign currency gains and losses are the result of macro-economic factors and can vary significantly from one period to the next, we believe that exclusion of such realized and unrealized gains and losses are useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. Realized and unrealized foreign currency gains and losses are likely to recur in future periods. Excess tax benefits from stock-based compensation Current authoritative accounting guidance requires that excess tax benefits or costs recognized on stock-based compensation expense be reflected in our provision for income taxes rather than paid-in capital. Since we cannot control or predict when stock option awards will be exercised or the price at which such awards will be exercised, the impact of such guidance can create significant volatility in our effective tax rate from one period to the next. We believe that exclusion of these excess tax benefits or costs is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. These excess tax benefits or costs will generally recur in future periods as long as we continue to issue equity awards to our employees. Tax impacts that may not be representative of the ongoing results of our core operations The Tax Cuts and Jobs Act of 2017 (2017 Tax Act) was signed into law in December 2017, and became effective January 1, 2018. The 2017 Tax Act included a number of changes to existing U.S. federal tax law impacting businesses including, among other things, a permanent reduction in the corporate income tax rate from 35% to 21%, a one-time transition tax on the “deemed repatriation” of cumulative undistributed foreign earnings as of December 31, 2017 and changes in the prospective taxation of the foreign operations of U.S. multinational companies. From time to time, we may also record tax benefits relating to the de-recognition of uncertain tax positions due to the expiration of the statutes of limitations. We believe that exclusion of the tax charges related to the 2017 Tax Act and the tax benefit resulting from the expiration of certain statutes of limitations related to non-recurring transactions is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these tax items are unrelated to our core business and non-recurring in nature. Adjusted Free Cash Flow Represents free cash flow (cash flow from operations less cash used for the purchase of property, plant and equipment) adjusted for the impact of cash receipts or payments relating to certain previously described non-GAAP adjustments, which may impact period over period comparability. Description of Non-GAAP Adjustments

(1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Consistent with guidance provided on January 13, 2021. Constant Currency Product Revenue(1),(2) (in thousands, except percentages) Q4 2019 FY 2019 FY 2020 247,434$ 936,408$ 295,054$ 1,143,744$ 1,200,000$ Constant currency F/X adjustments N/A N/A (2,917) (491) (15,000) Constant currency (non-GAAP) product revenue $ 247,434 $936,408 $ 292,137 $ 1,143,253 $ 1,185,000 GAAP product revenue growth 19.2% 22.1% 4.9% Constant currency (non-GAAP) product revenue growth 18.1% 22.1% 3.6% 2021 Full Year Guidance (3) GAAP product revenue RECONCILIATION OF GAAP PRODUCT REVENUE GROWTH TO CONSTANT CURRENCY PRODUCT REVENUE GROWTH Q4 2020

(1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Consistent with guidance provided on January 13, 2021. (4) Calculated as a percentage of product revenue. Non-GAAP Gross Margin %(1),(2) (in thousands, except percentages) Q4 2019 FY 2019 Q4 2020 GAAP gross profit/margin 166,923$ 629,172$ 186,926$ 743,065$ 801,300$ Non-GAAP adjustments: Royalty and other revenue, net of related costs (45) (1,262) - - - Acquisition & investment related costs 167 511 447 1,807 2,500 Total non-GAAP gross profit/margin adjustments 122 (751) 447 1,807 2,500 Non-GAAP gross profit/margin 167,046$ 628,421$ 187,373$ 744,872$ 803,800$ Non-GAAP gross margin % (4) 67.5% 67.1% 63.5% 65.1% 67.0% RECONCILIATION OF GAAP GROSS PROFIT/MARGIN TO NON-GAAP GROSS PROFIT/MARGIN: 2021 Full Year Guidance (3)FY 2020

(1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Consistent with guidance provided on January 13, 2021. (4) Calculated as a percentage of product revenue. Non-GAAP Operating Expense %(1),(2) (in thousands, except percentages) Q4 2019 FY 2019 Q4 2020 GAAP selling, general and administrative operating expenses 81,943$ 314,661$ 90,343$ 369,057$ Non-GAAP adjustments: Acquisition & investment related costs (1,968) (4,218) (2,749) (6,347) Non-GAAP selling, general and administrative operating expenses 79,975$ 310,443$ 87,593$ 362,709$ Non-GAAP selling, general and administrative operating expenses % (4) 32.3% 33.2% 29.7% 31.7% GAAP research and development operating expenses 23,423$ 93,295$ 31,688$ 118,659$ Non-GAAP adjustments: Acquisition & investment related costs - - (53) (132) Non-GAAP research and development operating expenses 23,423$ 93,295$ 31,635$ 118,526$ Non-GAAP research and development operating expenses % (4) 9.5% 10.0% 10.7% 10.4% GAAP litigation settlement, award and/or defense costs -$ -$ -$ (474)$ Non-GAAP adjustments: Litigation damages, awards and settlements - - - 474 Non-GAAP litigation settlement, award and/or defense costs -$ -$ -$ -$ 4 GAAP operating expenses 105,366$ 407,956$ 122,031$ 487,242$ 519,400$ Non-GAAP adjustments: Acquisition & investment related costs (1,968) (4,218) (2,802) (6,479) (9,500) Litigation damages, awards and settlements - - - 474 - Total non-GAAP operating expense adjustments (1,968) (4,218) (2,802) (6,005) (9,500) Non-GAAP operating expenses 103,398$ 403,738$ 119,228$ 481,236$ 509,900$ Non-GAAP operating expenses % (4) 41.8% 43.1% 40.4% 42.1% 42.5% RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES: 2021 Full Year Guidance (3)FY 2020

(1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Consistent with guidance provided on January 13, 2021. (4) Calculated as a percentage of product revenue. Non-GAAP Operating Margin %(1),(2) (in thousands, except percentages) Q4 2019 FY 2019 Q4 2020 GAAP operating income/margin 61,557$ 221,216$ 64,895$ 255,823$ 281,900$ Non-GAAP adjustments: Royalty and other revenue, net of related costs (45) (1,262) - - - Acquisition & investment related costs 2,135 4,729 3,249 8,286 12,000 Litigation damages, awards and settlements - - - (474) - Total non-GAAP operating income/margin adjustments 2,090 3,467 3,249 7,812 12,000 Non-GAAP operating income/margin 63,647$ 224,683$ 68,145$ 263,636$ 293,900$ Non-GAAP operating income % (4) 25.7% 24.0% 23.1% 23.1% 24.5% RECONCILIATION OF GAAP OPERATING INCOME/MARGIN TO NON-GAAP OPERATING INCOME/MARGIN: 2021 Full Year Guidance (3)FY 2020

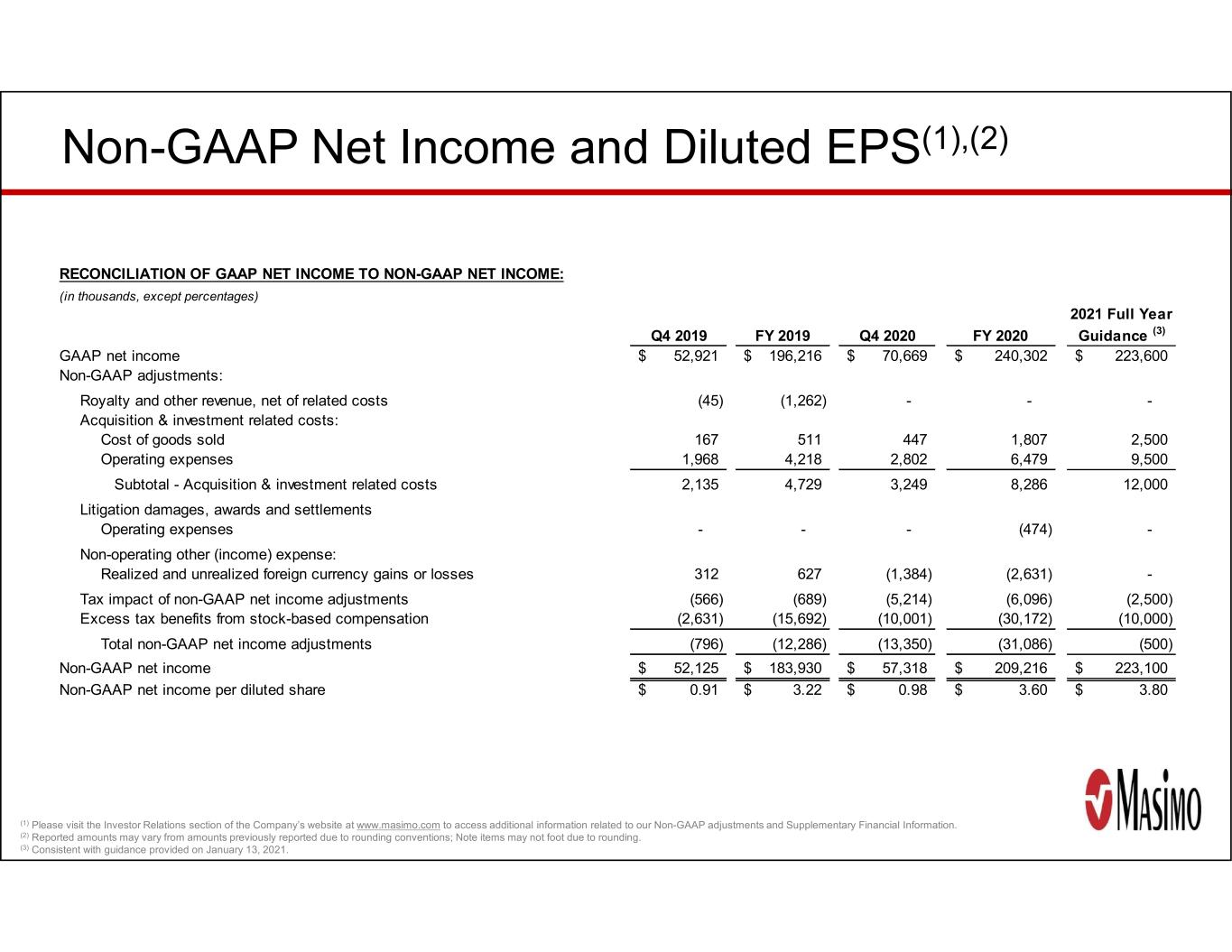

(1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Consistent with guidance provided on January 13, 2021. Non-GAAP Net Income and Diluted EPS(1),(2) (in thousands, except percentages) Q4 2019 FY 2019 Q4 2020 GAAP net income 52,921$ 196,216$ 70,669$ 240,302$ 223,600$ Non-GAAP adjustments: Royalty and other revenue, net of related costs (45) (1,262) - - - Acquisition & investment related costs: Cost of goods sold 167 511 447 1,807 2,500 Operating expenses 1,968 4,218 2,802 6,479 9,500 Subtotal - Acquisition & investment related costs 2,135 4,729 3,249 8,286 12,000 Litigation damages, awards and settlements Operating expenses - - - (474) - Non-operating other (income) expense: Realized and unrealized foreign currency gains or losses 312 627 (1,384) (2,631) - # Tax impact of non-GAAP net income adjustments (566) (689) (5,214) (6,096) (2,500) 9800Excess tax benefits from stock-based compensation (2,631) (15,692) (10,001) (30,172) (10,000) Total non-GAAP net income adjustments (796) (12,286) (13,350) (31,086) (500) Non-GAAP net income 52,125$ 183,930$ 57,318$ 209,216$ 223,100$ Non-GAAP net income per diluted share 0.91$ 3.22$ 0.98$ 3.60$ 3.80$ RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME: 2021 Full Year Guidance (3)FY 2020

(1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. Adjusted Free Cash Flow(1),(2) (in thousands, except percentages) Q4 2019 FY 2019 Q4 2020 Net cash provided by operating activities 70,224$ 221,640$ 64,418$ 210,963$ Purchases of property and equipment, net (12,311) (68,375) (12,532) (72,549) Free cash flow 57,913 153,265 51,886 138,414 - - - (499) Tax payments related to litigation awards and damages - - - - Adjusted free cash flow $ 57,913 $ 153,265 $ 51,886 $ 137,915 RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW Net cash provided by operating activities Litigation damages, awards and settlements FY 2020