Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - LITTELFUSE INC /DE | pressreleasedated02232021.htm |

| 8-K - 8-K - LITTELFUSE INC /DE | lfus-20210223.htm |

1 LITTELFUSE 2021 INVESTOR & ANALYST EVENT February 23, 2021

2Confidential and Proprietary | Littelfuse, Inc. © 2021 DISCLAIMERS Important Information About Littelfuse, Inc. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Littelfuse, Inc. and no investment decision should be made based upon the information provided herein. Littelfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com/sec.cfm. This website also provides additional information about Littelfuse. “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995. The statements in this presentation that are not historical facts are intended to constitute "forward-looking statements" entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act. These statements may involve risks and uncertainties, including, but not limited to, risks and uncertainties relating to general economic conditions; the severity and duration of the COVID-19 pandemic and the measures taken in response thereto and the effects of those items on the company’s business; product demand and market acceptance; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; failure of an indemnification for environmental liability; exchange rate fluctuations; commodity price fluctuations; the effect of Littelfuse, Inc.'s ("Littelfuse" or the "Company") accounting policies; labor disputes; restructuring costs in excess of expectations; pension plan asset returns less than assumed; integration of acquisitions; uncertainties related to political or regulatory changes; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This presentation should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended December 26, 2020. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended December 26, 2020, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information. Non-GAAP Financial Measure. The information included in this presentation includes the non-GAAP financial measure of free cash flow. A reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure is set forth in the appendix. The company believes that free cash flow is a useful measure of its ability to generate cash. The company believes that this non-GAAP financial measure is commonly used by financial analysts and others in the industries in which we operate, and thus further provides useful information to investors. Management uses this measure when assessing the performance of the business and for business planning purposes. Note that our definition of this non-GAAP financial measure may differ from those terms as defined or used by other companies.

3Confidential and Proprietary | Littelfuse, Inc. © 2021 AGENDA W el co m e • Trisha Tuntland, Head of Investor Relations C om pa ny S tra te gy • Dave Heinzmann, President & CEO M & A S tra te gy • Matt Cole, SVP, eMobility & Corporate Strategy Fi na nc ia l O bj ec tiv es • Meenal Sethna, EVP & CFO Q&A to follow prepared remarks

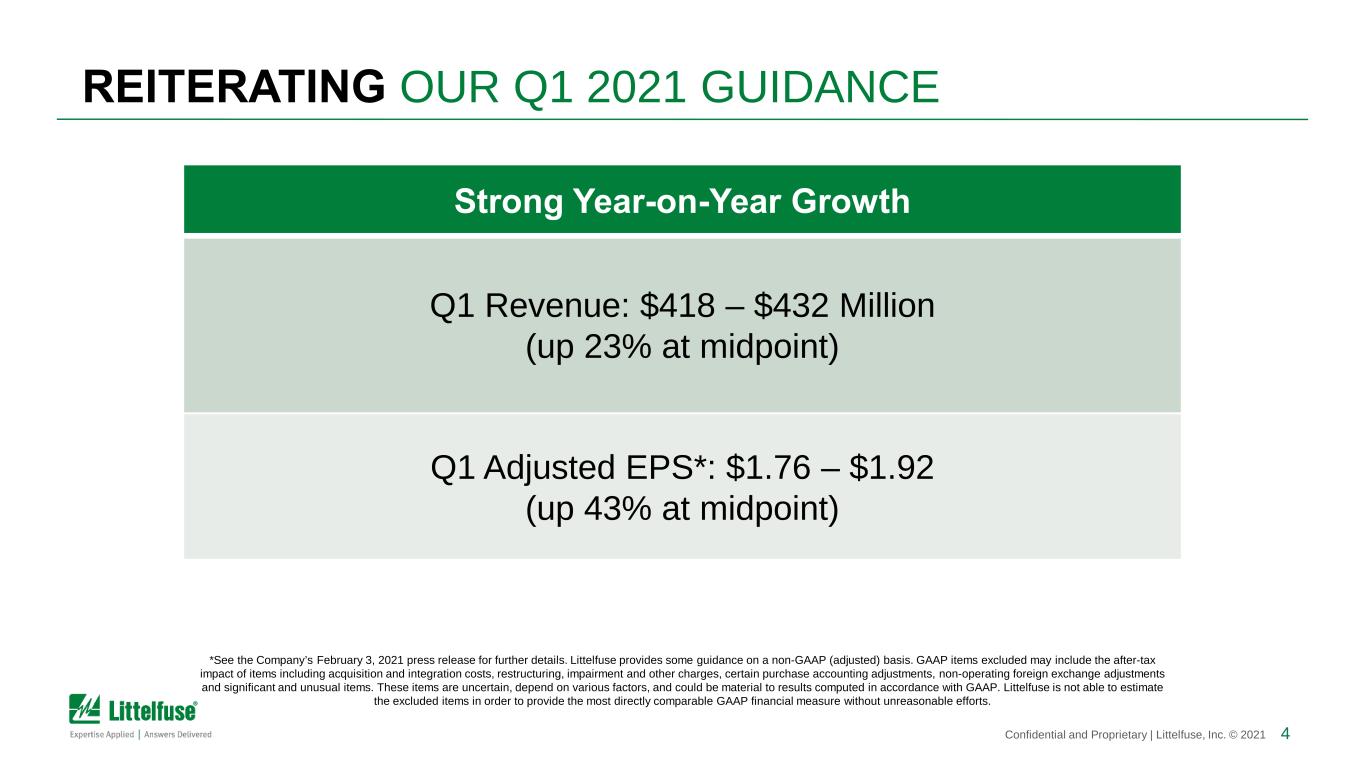

4Confidential and Proprietary | Littelfuse, Inc. © 2021 REITERATING OUR Q1 2021 GUIDANCE *See the Company’s February 3, 2021 press release for further details. Littelfuse provides some guidance on a non-GAAP (adjusted) basis. GAAP items excluded may include the after-tax impact of items including acquisition and integration costs, restructuring, impairment and other charges, certain purchase accounting adjustments, non-operating foreign exchange adjustments and significant and unusual items. These items are uncertain, depend on various factors, and could be material to results computed in accordance with GAAP. Littelfuse is not able to estimate the excluded items in order to provide the most directly comparable GAAP financial measure without unreasonable efforts. Strong Year-on-Year Growth Q1 Revenue: $418 – $432 Million (up 23% at midpoint) Q1 Adjusted EPS*: $1.76 – $1.92 (up 43% at midpoint)

COMPANY STRATEGY Dave Heinzmann President & CEO

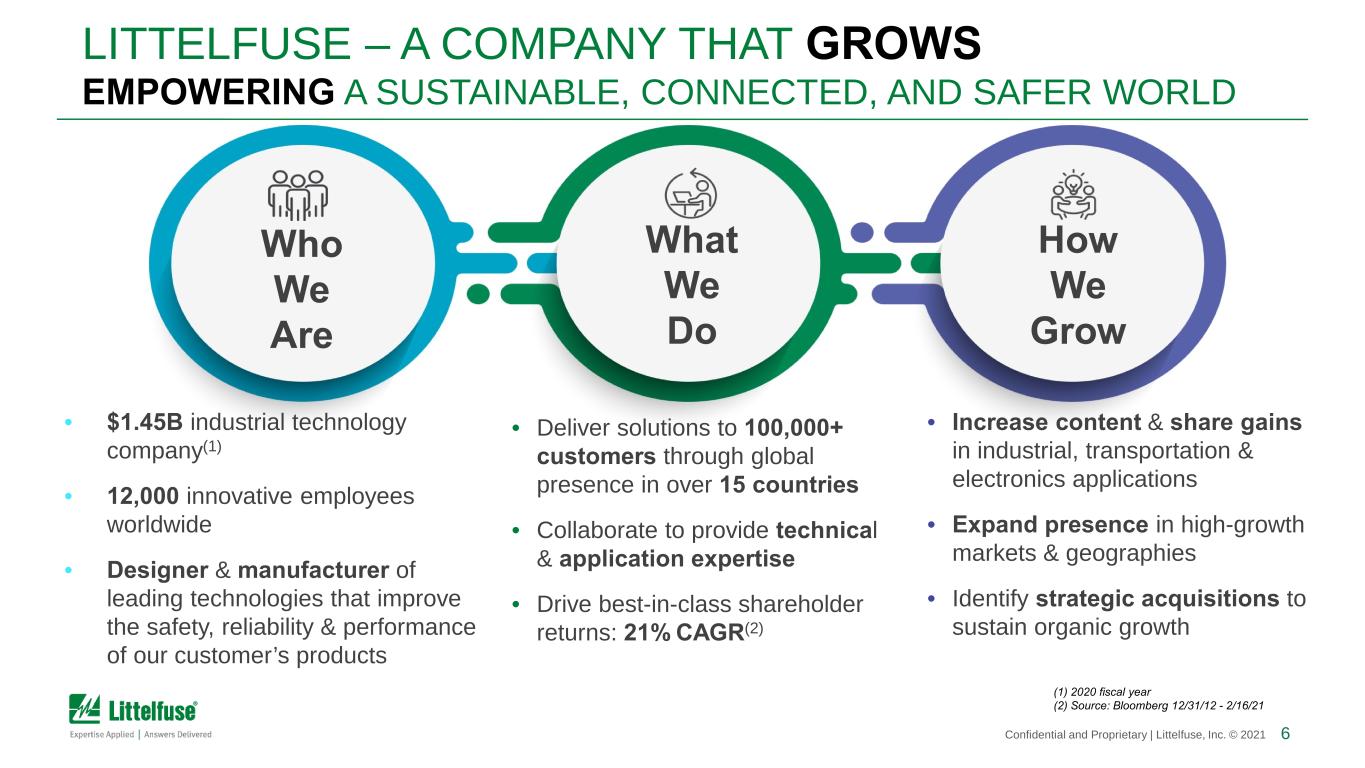

6Confidential and Proprietary | Littelfuse, Inc. © 2021 Who We Are What We Do How We Grow (1) 2020 fiscal year (2) Source: Bloomberg 12/31/12 - 2/16/21 • $1.45B industrial technology company(1) • 12,000 innovative employees worldwide • Designer & manufacturer of leading technologies that improve the safety, reliability & performance of our customer’s products • Deliver solutions to 100,000+ customers through global presence in over 15 countries • Collaborate to provide technical & application expertise • Drive best-in-class shareholder returns: 21% CAGR(2) • Increase content & share gains in industrial, transportation & electronics applications • Expand presence in high-growth markets & geographies • Identify strategic acquisitions to sustain organic growth LITTELFUSE – A COMPANY THAT GROWS EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD

7Confidential and Proprietary | Littelfuse, Inc. © 2021 Broader foundation established to drive profitable growth WHAT WE ACCOMPLISHED BUILDING ON OUR STRENGTHS

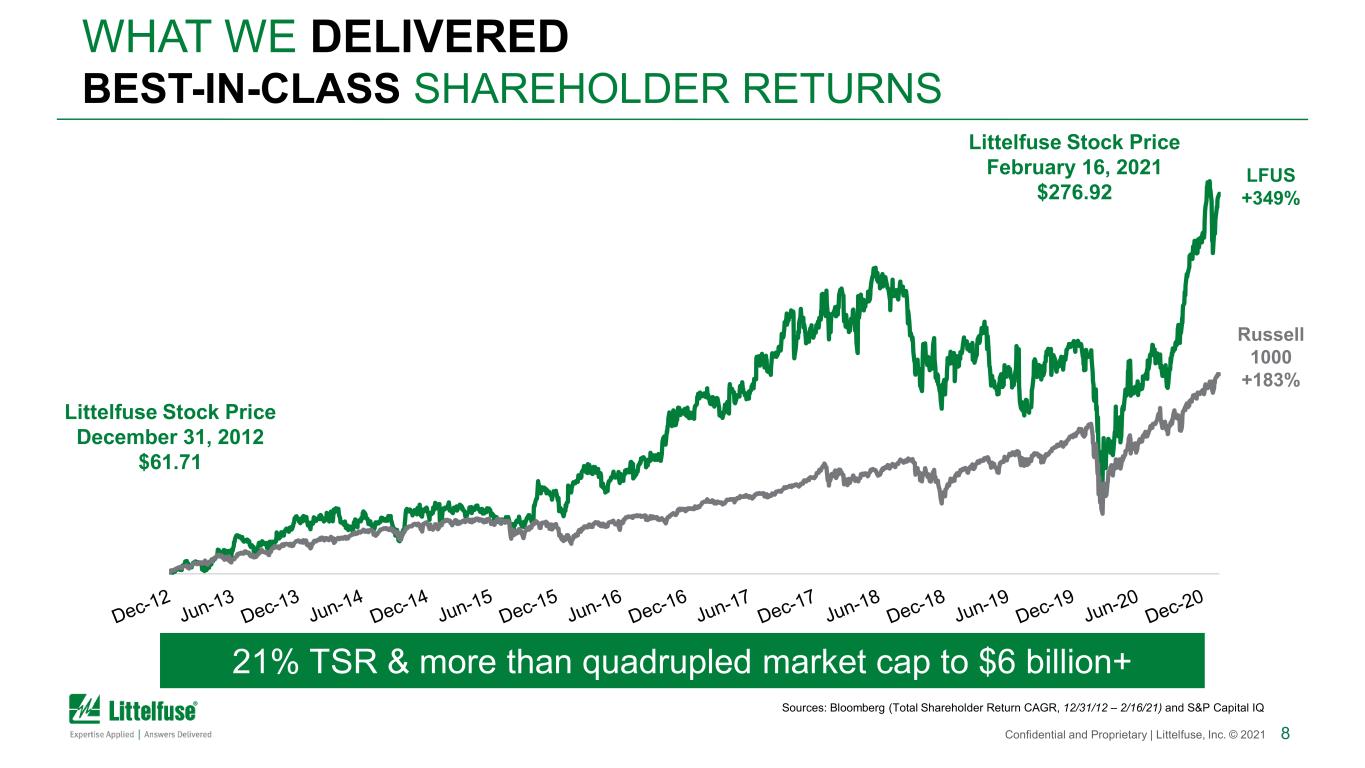

8Confidential and Proprietary | Littelfuse, Inc. © 2021 21% TSR & more than quadrupled market cap to $6 billion+ WHAT WE DELIVERED BEST-IN-CLASS SHAREHOLDER RETURNS Sources: Bloomberg (Total Shareholder Return CAGR, 12/31/12 – 2/16/21) and S&P Capital IQ Littelfuse Stock Price February 16, 2021 $276.92 Littelfuse Stock Price December 31, 2012 $61.71 LFUS +349% Russell 1000 +183%

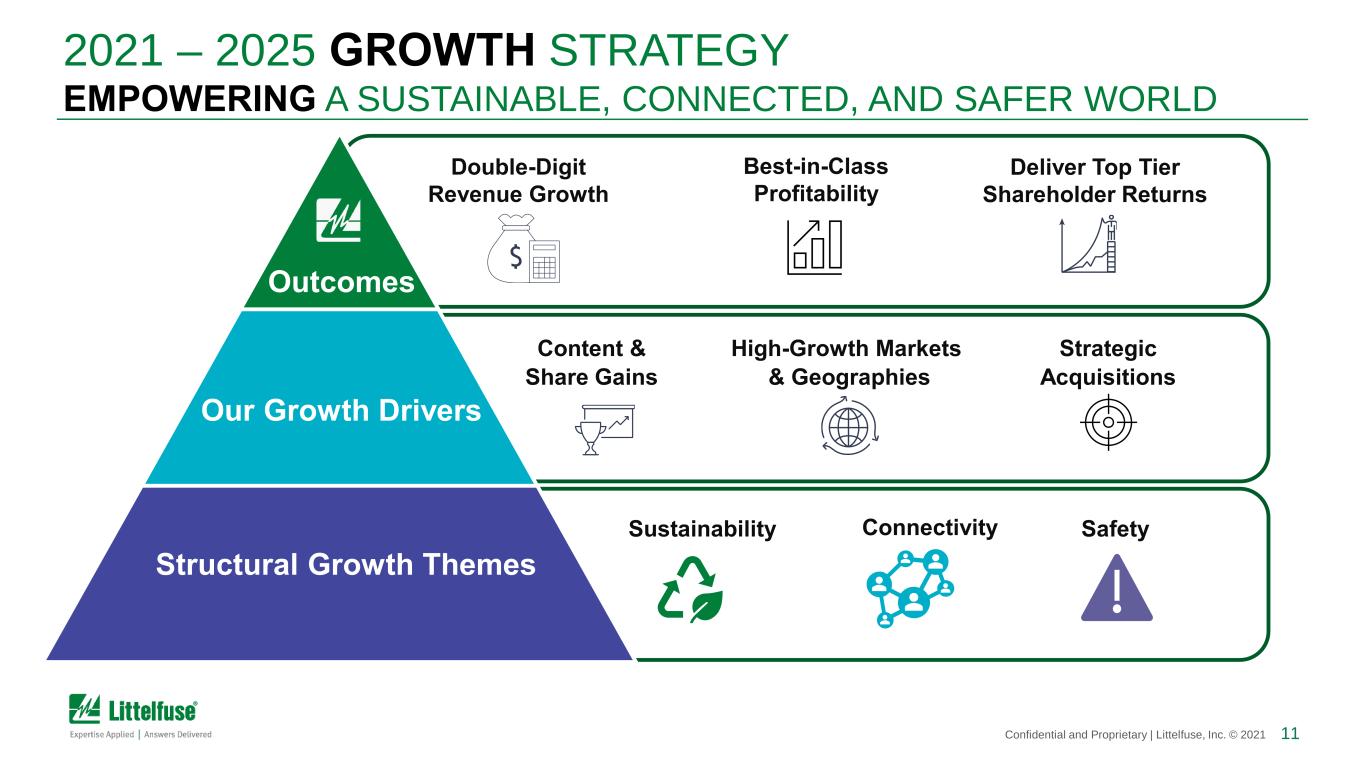

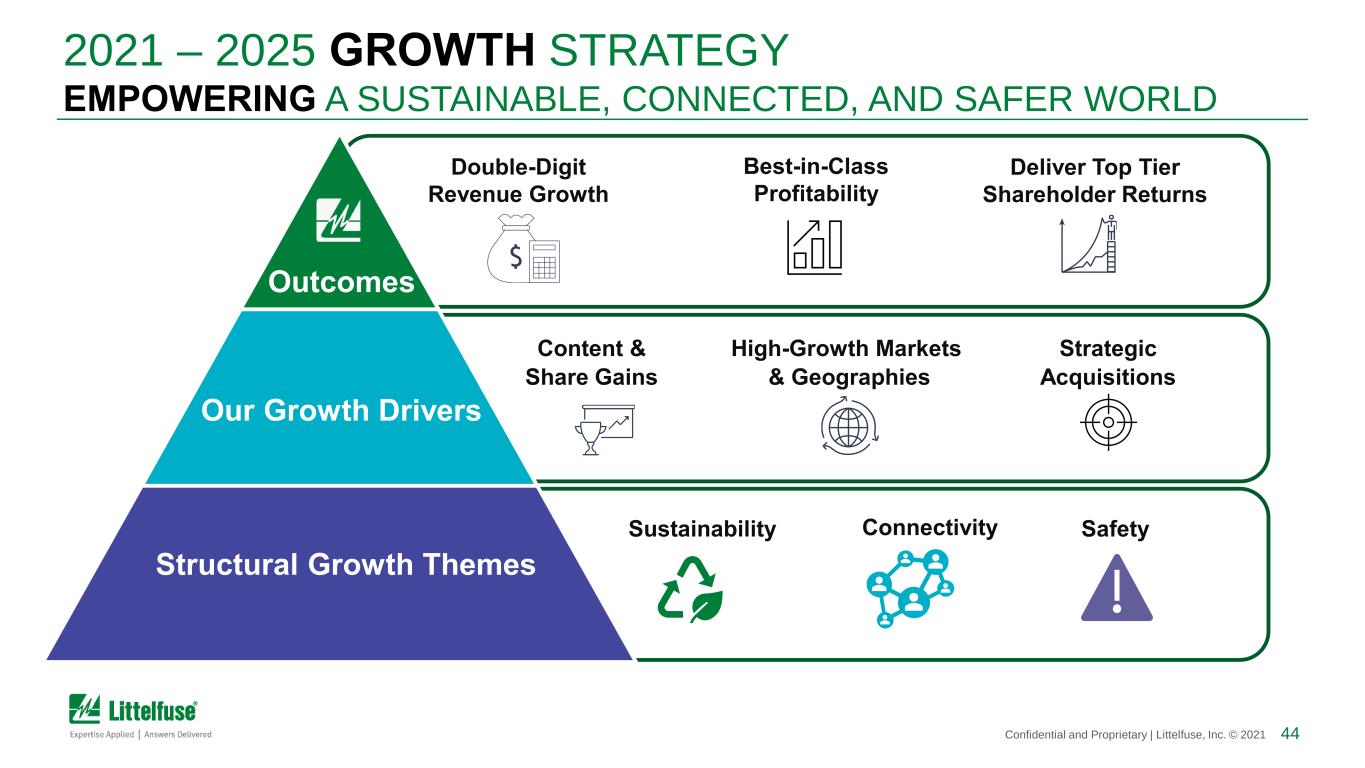

9Confidential and Proprietary | Littelfuse, Inc. © 2021 Structural Growth Themes Sustainability Connectivity Safety 2021 – 2025 GROWTH STRATEGY EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD

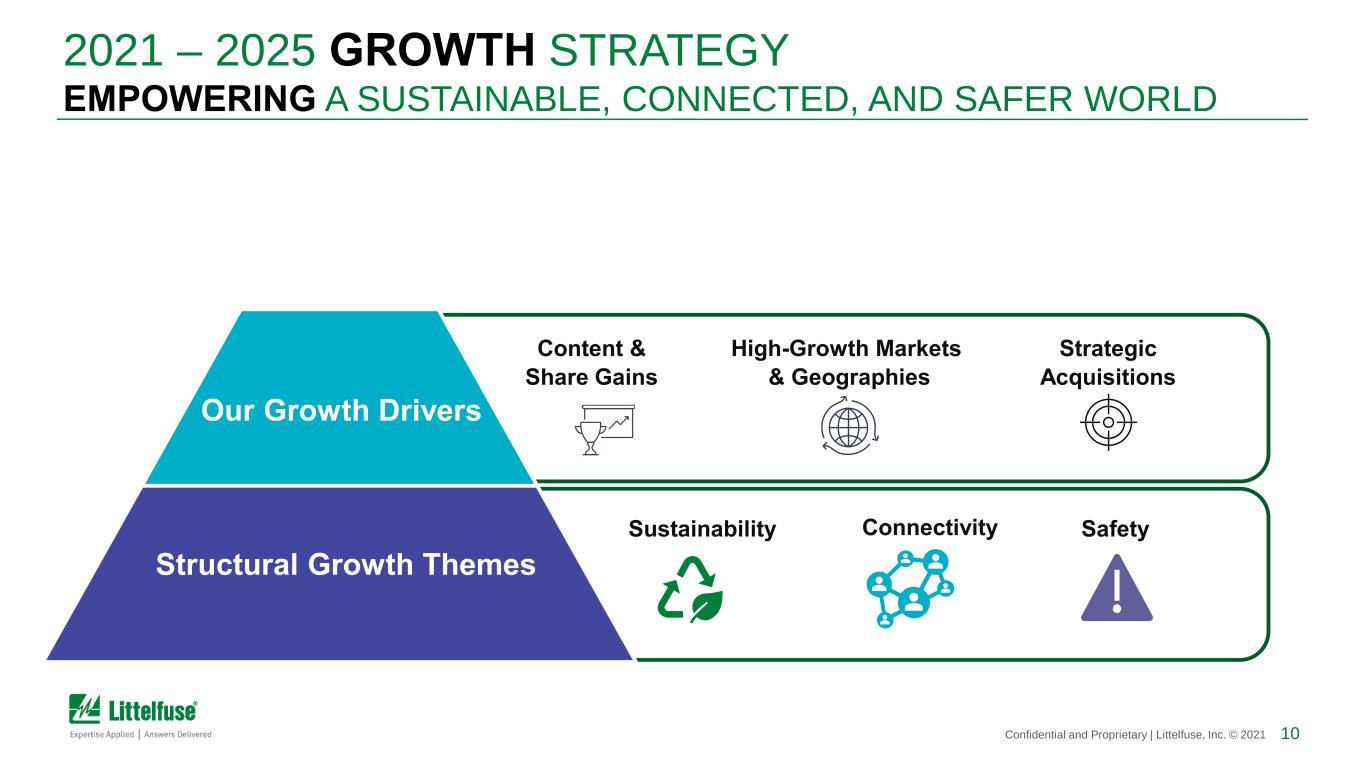

10Confidential and Proprietary | Littelfuse, Inc. © 2021 Structural Growth Themes Sustainability Connectivity Safety 2021 – 2025 GROWTH STRATEGY EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD Our Growth Drivers Content & Share Gains Strategic Acquisitions High-Growth Markets & Geographies

11Confidential and Proprietary | Littelfuse, Inc. © 2021 Structural Growth Themes Sustainability Connectivity Safety 2021 – 2025 GROWTH STRATEGY EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD Our Growth Drivers Content & Share Gains Strategic Acquisitions High-Growth Markets & Geographies Outcomes Double-Digit Revenue Growth Best-in-Class Profitability Deliver Top Tier Shareholder Returns

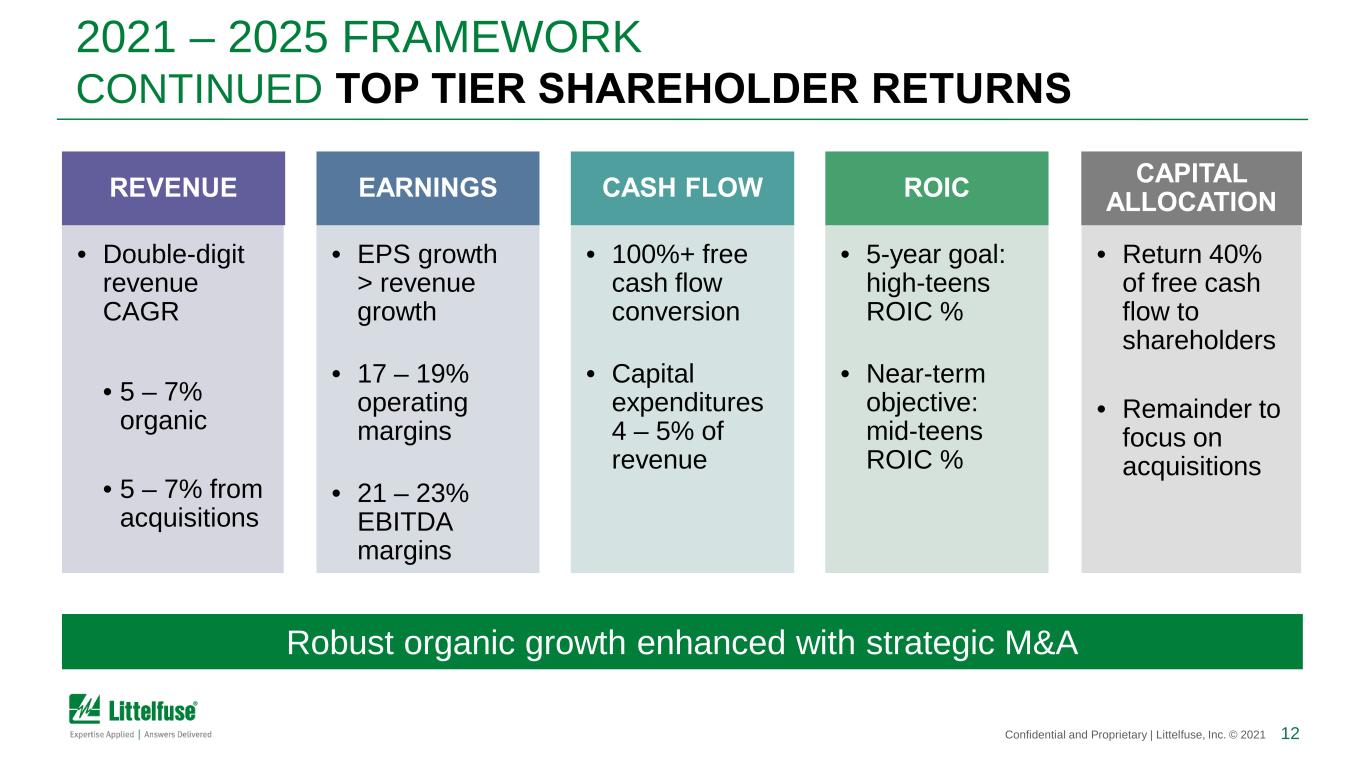

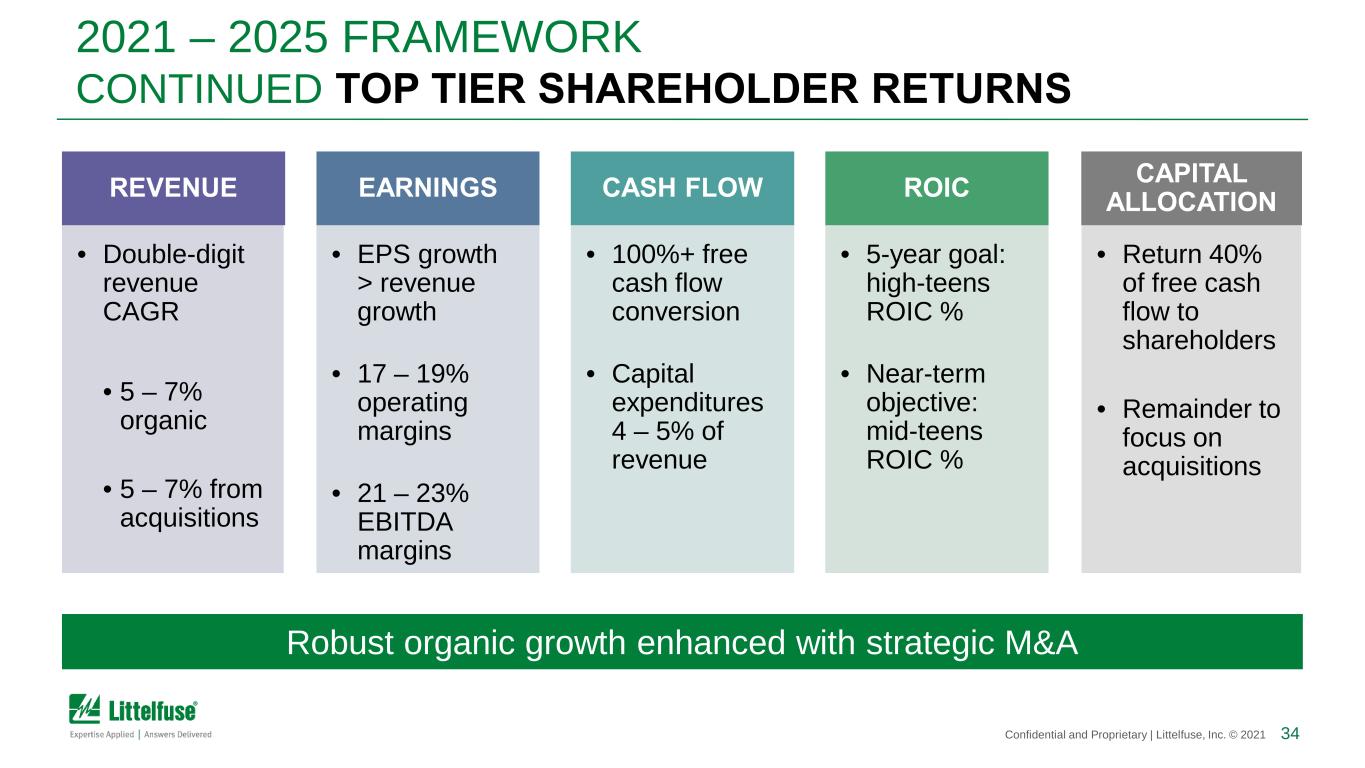

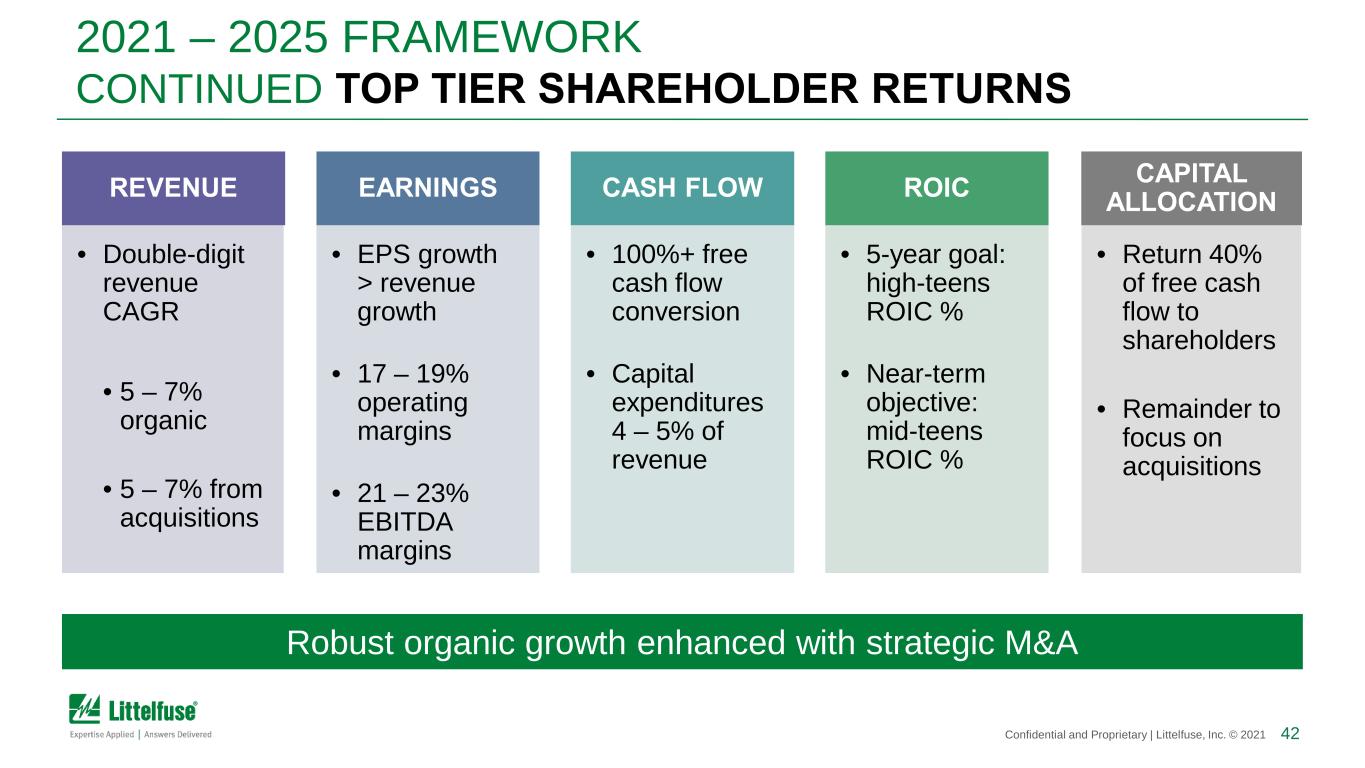

12Confidential and Proprietary | Littelfuse, Inc. © 2021 2021 – 2025 FRAMEWORK CONTINUED TOP TIER SHAREHOLDER RETURNS Robust organic growth enhanced with strategic M&A REVENUE • Double-digit revenue CAGR • 5 – 7% organic • 5 – 7% from acquisitions EARNINGS • EPS growth > revenue growth • 17 – 19% operating margins • 21 – 23% EBITDA margins CASH FLOW • 100%+ free cash flow conversion • Capital expenditures 4 – 5% of revenue ROIC • 5-year goal: high-teens ROIC % • Near-term objective: mid-teens ROIC % CAPITAL ALLOCATION • Return 40% of free cash flow to shareholders • Remainder to focus on acquisitions

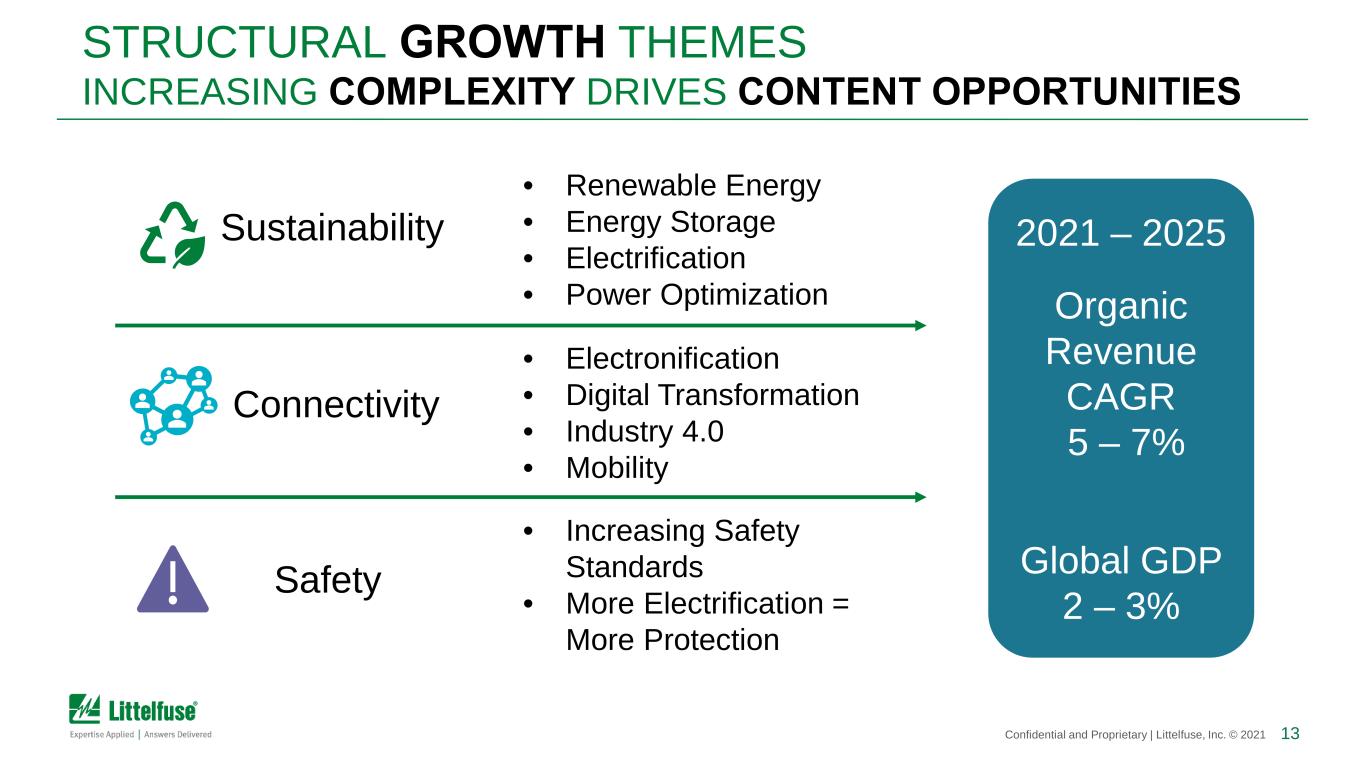

13Confidential and Proprietary | Littelfuse, Inc. © 2021 STRUCTURAL GROWTH THEMES INCREASING COMPLEXITY DRIVES CONTENT OPPORTUNITIES Sustainability Connectivity Safety • Renewable Energy • Energy Storage • Electrification • Power Optimization • Electronification • Digital Transformation • Industry 4.0 • Mobility • Increasing Safety Standards • More Electrification = More Protection 2021 – 2025 Organic Revenue CAGR 5 – 7% Global GDP 2 – 3%

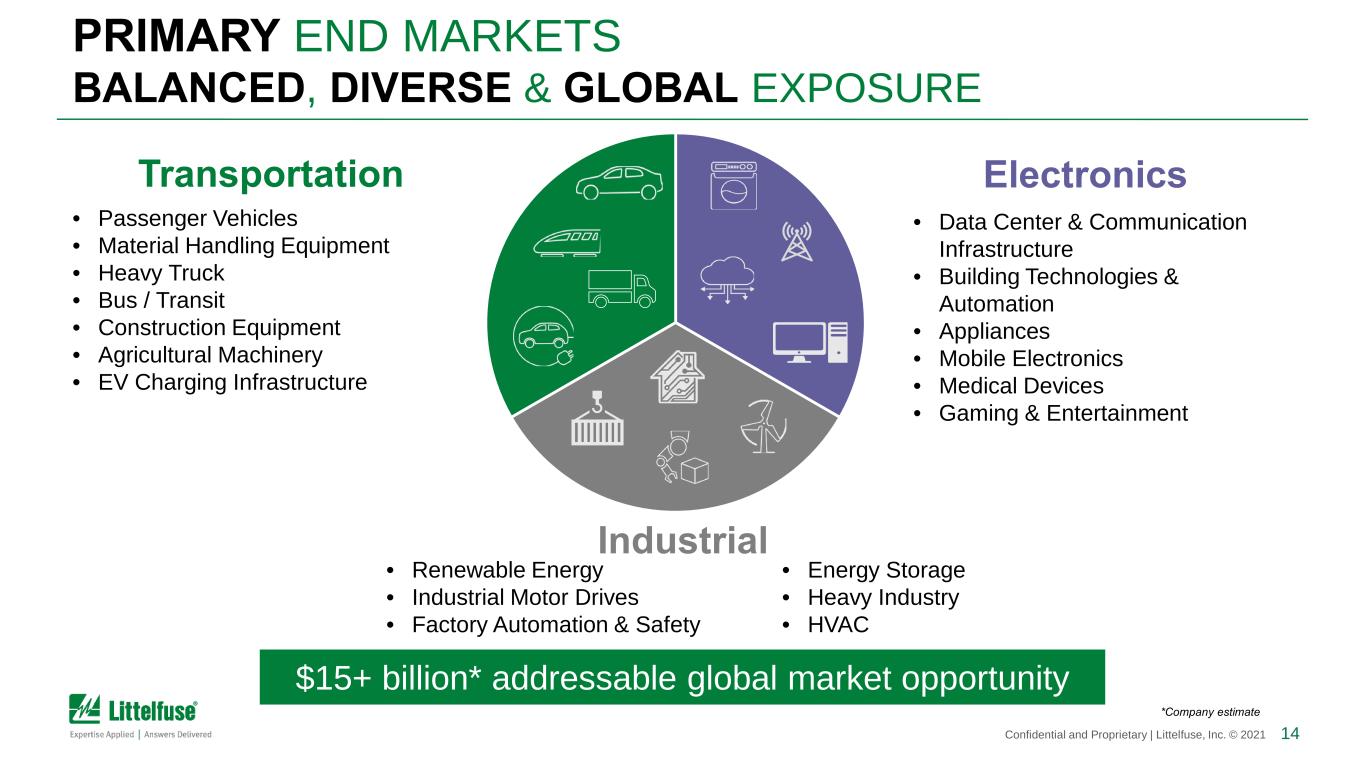

14Confidential and Proprietary | Littelfuse, Inc. © 2021 Transportation • Passenger Vehicles • Material Handling Equipment • Heavy Truck • Bus / Transit • Construction Equipment • Agricultural Machinery • EV Charging Infrastructure Electronics • Data Center & Communication Infrastructure • Building Technologies & Automation • Appliances • Mobile Electronics • Medical Devices • Gaming & Entertainment *Company estimate PRIMARY END MARKETS BALANCED, DIVERSE & GLOBAL EXPOSURE $15+ billion* addressable global market opportunity • Renewable Energy • Industrial Motor Drives • Factory Automation & Safety • Energy Storage • Heavy Industry • HVAC Industrial

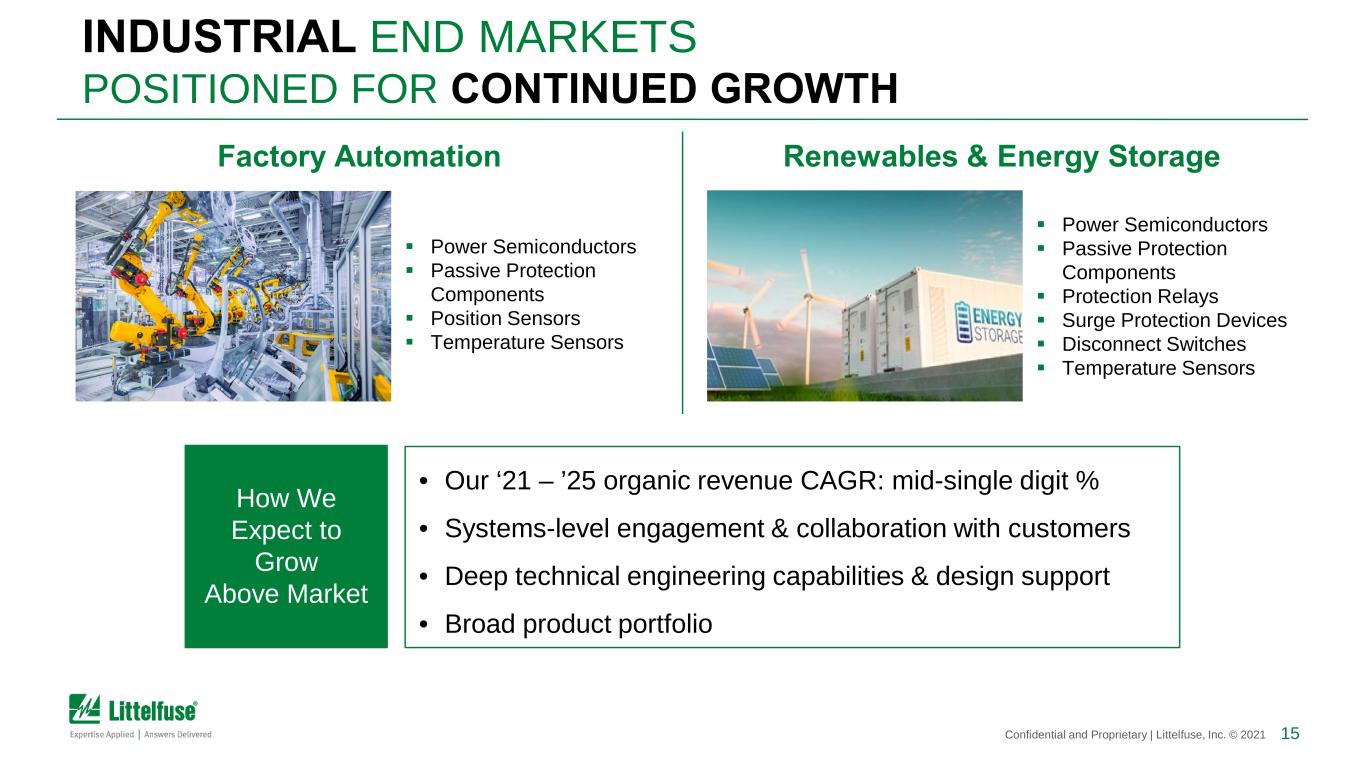

15Confidential and Proprietary | Littelfuse, Inc. © 2021 INDUSTRIAL END MARKETS POSITIONED FOR CONTINUED GROWTH Power Semiconductors Passive Protection Components Position Sensors Temperature Sensors Factory Automation Power Semiconductors Passive Protection Components Protection Relays Surge Protection Devices Disconnect Switches Temperature Sensors Renewables & Energy Storage • Our ‘21 – ’25 organic revenue CAGR: mid-single digit % • Systems-level engagement & collaboration with customers • Deep technical engineering capabilities & design support • Broad product portfolio How We Expect to Grow Above Market

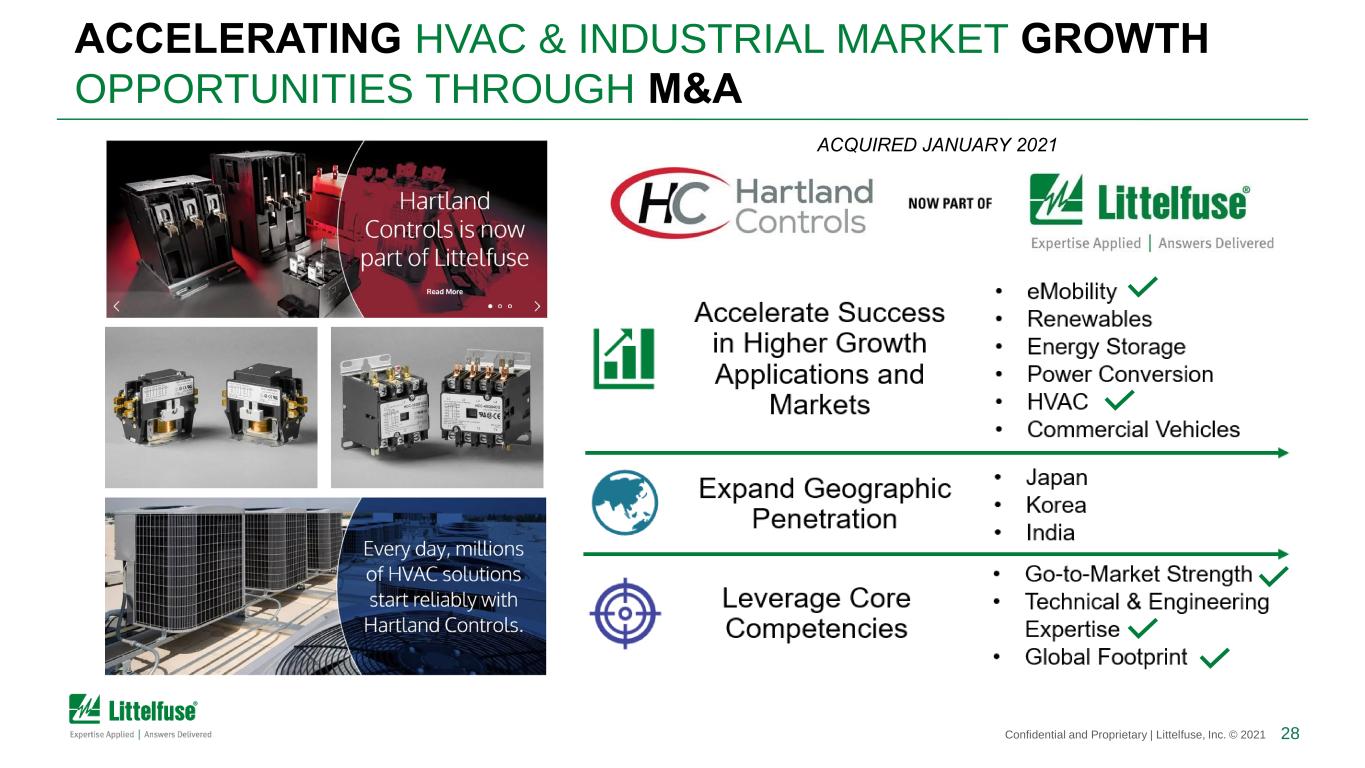

16Confidential and Proprietary | Littelfuse, Inc. © 2021 ACQUIRED JANUARY 2021 ACCELERATING INDUSTRIAL GROWTH HVAC Passive Protection Components Power Semiconductors Protection Relays Temperature Sensors Contactors Transformers

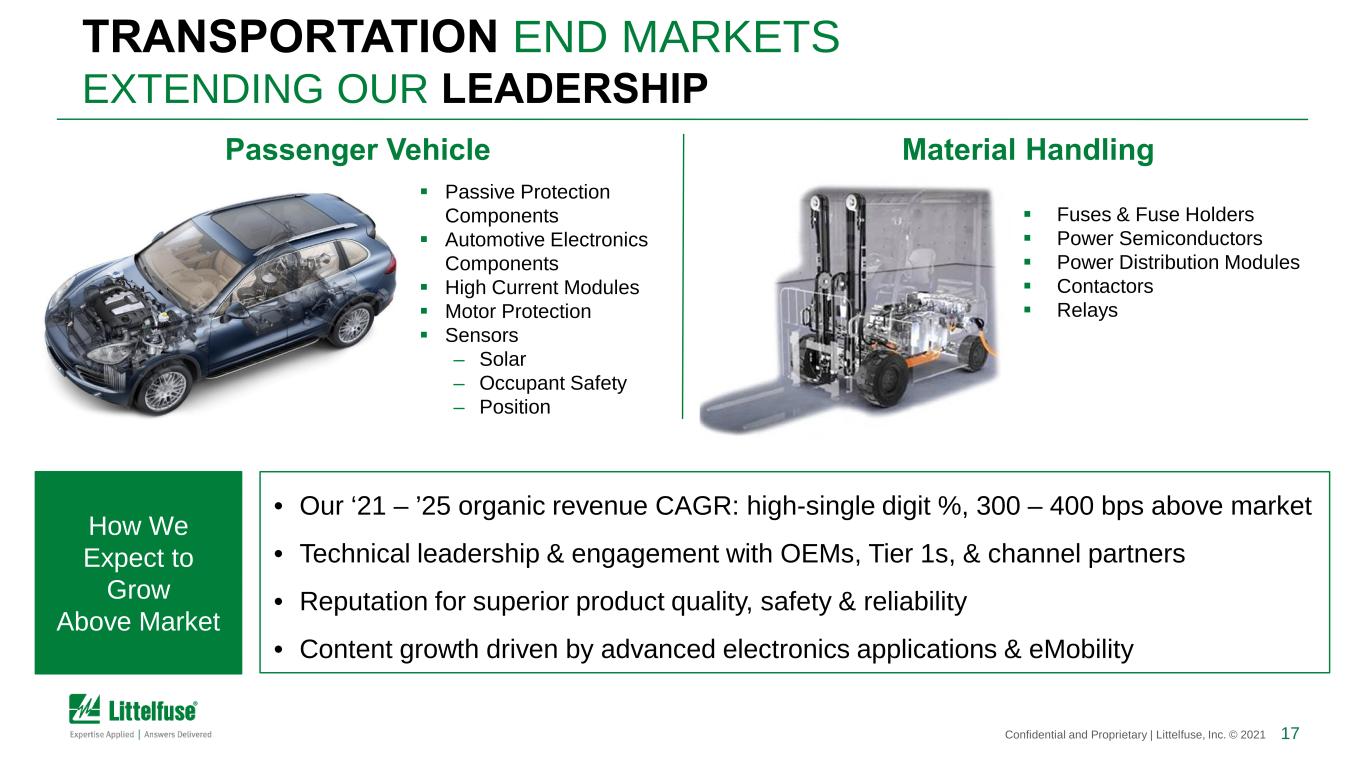

17Confidential and Proprietary | Littelfuse, Inc. © 2021 TRANSPORTATION END MARKETS EXTENDING OUR LEADERSHIP Passive Protection Components Automotive Electronics Components High Current Modules Motor Protection Sensors – Solar – Occupant Safety – Position Passenger Vehicle Material Handling Fuses & Fuse Holders Power Semiconductors Power Distribution Modules Contactors Relays • Our ‘21 – ’25 organic revenue CAGR: high-single digit %, 300 – 400 bps above market • Technical leadership & engagement with OEMs, Tier 1s, & channel partners • Reputation for superior product quality, safety & reliability • Content growth driven by advanced electronics applications & eMobility How We Expect to Grow Above Market

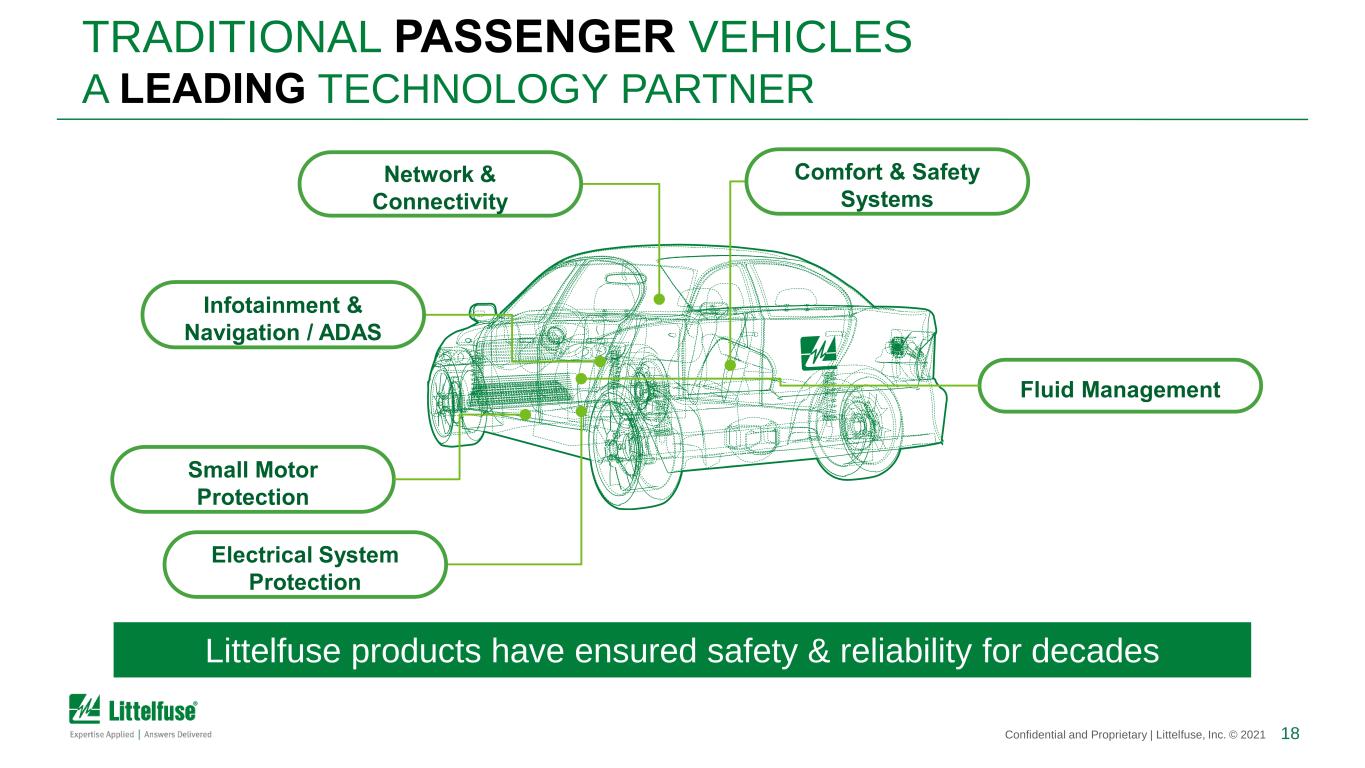

18Confidential and Proprietary | Littelfuse, Inc. © 2021 TRADITIONAL PASSENGER VEHICLES A LEADING TECHNOLOGY PARTNER Littelfuse products have ensured safety & reliability for decades Infotainment & Navigation / ADAS Comfort & Safety Systems Electrical System Protection Fluid Management Network & Connectivity Small Motor Protection

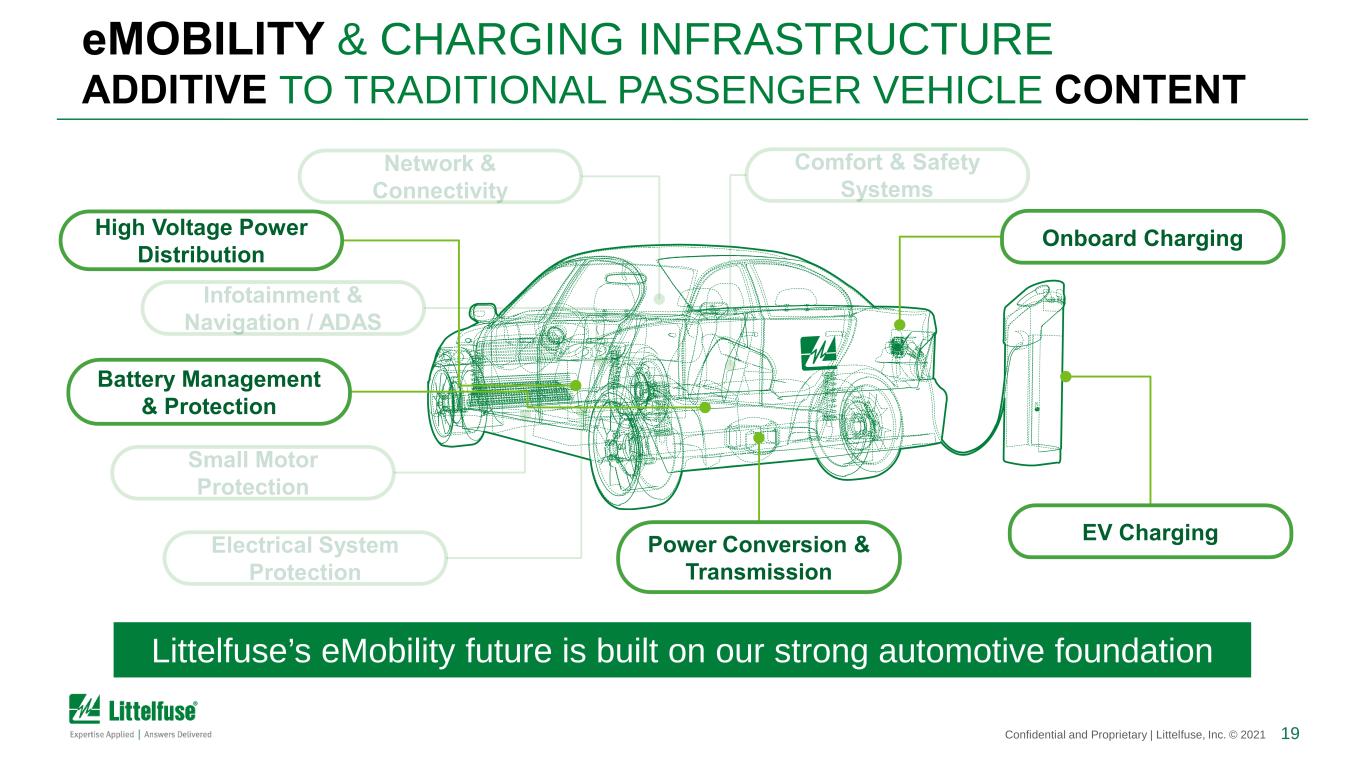

19Confidential and Proprietary | Littelfuse, Inc. © 2021 eMOBILITY & CHARGING INFRASTRUCTURE ADDITIVE TO TRADITIONAL PASSENGER VEHICLE CONTENT Battery Management & Protection Onboard ChargingHigh Voltage Power Distribution EV ChargingPower Conversion & Transmission Littelfuse’s eMobility future is built on our strong automotive foundation

20Confidential and Proprietary | Littelfuse, Inc. © 2021 ELECTRONICS END MARKETS LEVERAGING OUR LEADERSHIP Passive Protection Components Magnetic Sensors Power Semiconductors Solid State Relays Building Technologies Passive Protection Components Power Semiconductors Data Center & Communication Infrastructure • Our ‘21 – ’25 organic revenue CAGR: mid-single digit % • Deep strategic distribution channel & OEM partnerships • Broad diversity of applications & customer base • Comprehensive product offering How We Expect to Grow Above Market

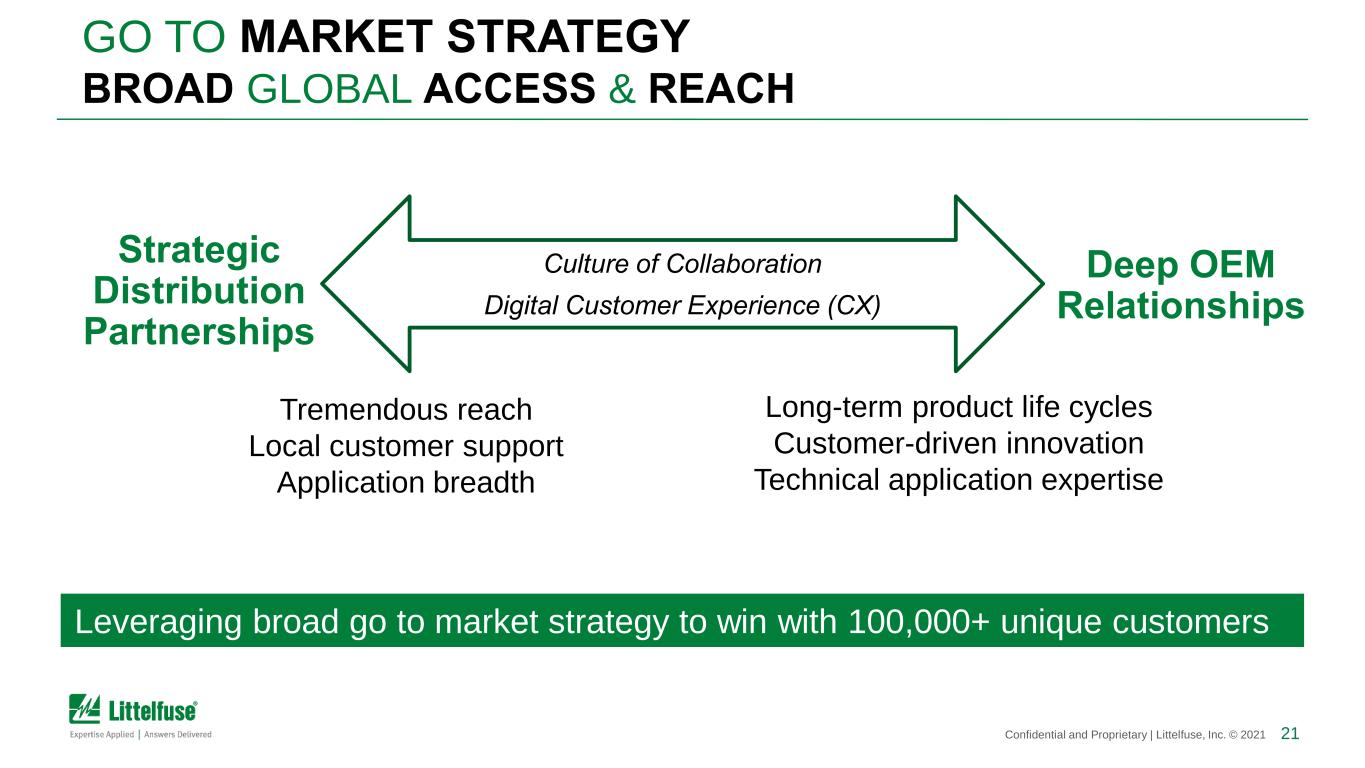

21Confidential and Proprietary | Littelfuse, Inc. © 2021 GO TO MARKET STRATEGY BROAD GLOBAL ACCESS & REACH Tremendous reach Local customer support Application breadth Long-term product life cycles Customer-driven innovation Technical application expertise Strategic Distribution Partnerships Digital Customer Experience (CX) Deep OEM Relationships Leveraging broad go to market strategy to win with 100,000+ unique customers Culture of Collaboration

22Confidential and Proprietary | Littelfuse, Inc. © 2021 Winning With Customers Manufacturing Excellence Lean Six Sigma Culture Digital Transformation Global Presence Application Expertise Supplier Quality Excellence Award Top Performance Award Supplier Excellence Award Strong execution led by local management teams Association of Manufacturing Excellence Awards (5 sites) OPERATIONAL & COMMERCIAL EXCELLENCE RECOGNIZED BY OUR CUSTOMERS Supplier Excellence Award Product Innovation Award

23Confidential and Proprietary | Littelfuse, Inc. © 2021 Digital Customer Experience EARNINGS INVESTMENTS FOR BEST-IN-CLASS ORGANIC GROWTH BUILDING FORWARD MOMENTUM • Expand new business opportunities in higher growth markets & applications • Leverage & broaden product portfolio • Enhance internal capabilities • Improve customer accessibility eMobility Customer- Driven Innovation Ongoing Cost Leadership

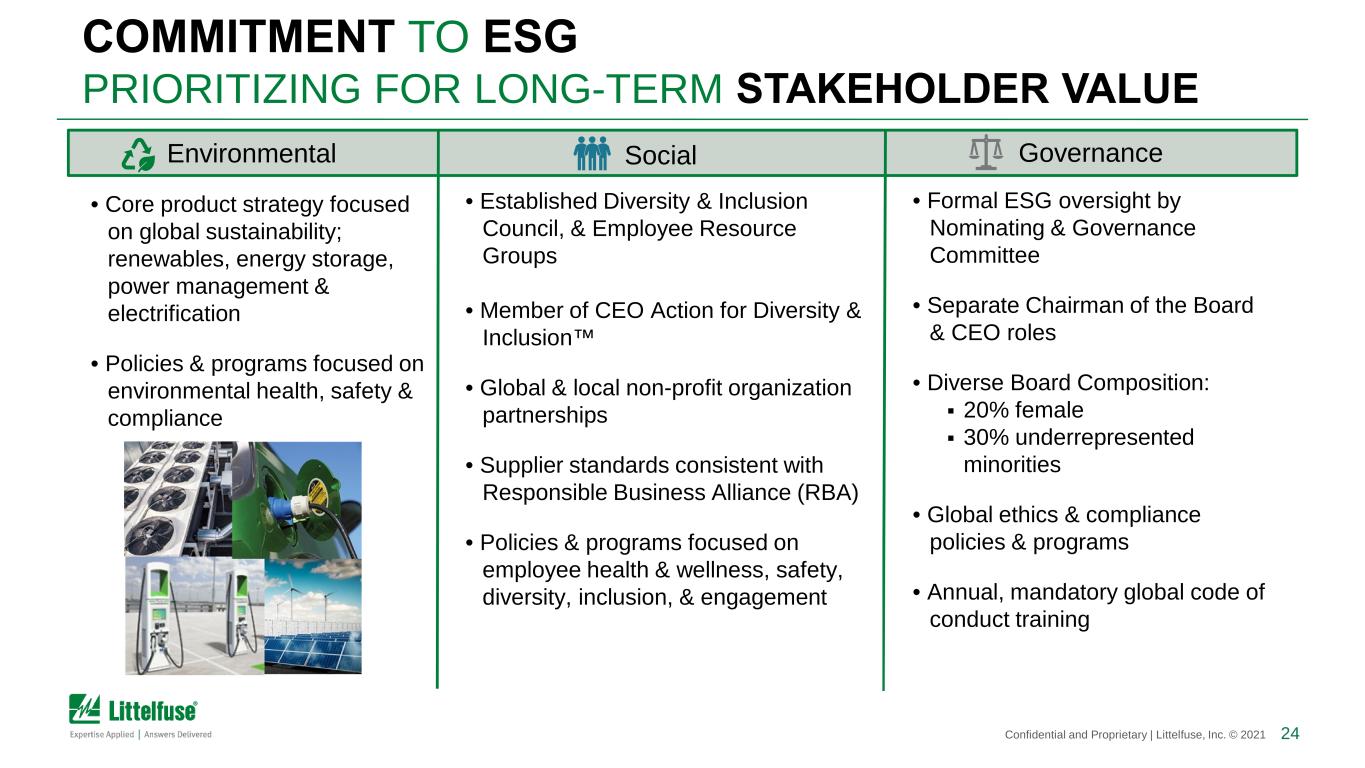

24Confidential and Proprietary | Littelfuse, Inc. © 2021 COMMITMENT TO ESG PRIORITIZING FOR LONG-TERM STAKEHOLDER VALUE Social Governance • Core product strategy focused on global sustainability; renewables, energy storage, power management & electrification • Policies & programs focused on environmental health, safety & compliance • Formal ESG oversight by Nominating & Governance Committee • Separate Chairman of the Board & CEO roles • Diverse Board Composition: 20% female 30% underrepresented minorities • Global ethics & compliance policies & programs • Annual, mandatory global code of conduct training • Established Diversity & Inclusion Council, & Employee Resource Groups • Member of CEO Action for Diversity & Inclusion™ • Global & local non-profit organization partnerships • Supplier standards consistent with Responsible Business Alliance (RBA) • Policies & programs focused on employee health & wellness, safety, diversity, inclusion, & engagement Environmental

M&A STRATEGY Matt Cole SVP, eMobility & Corporate Strategy

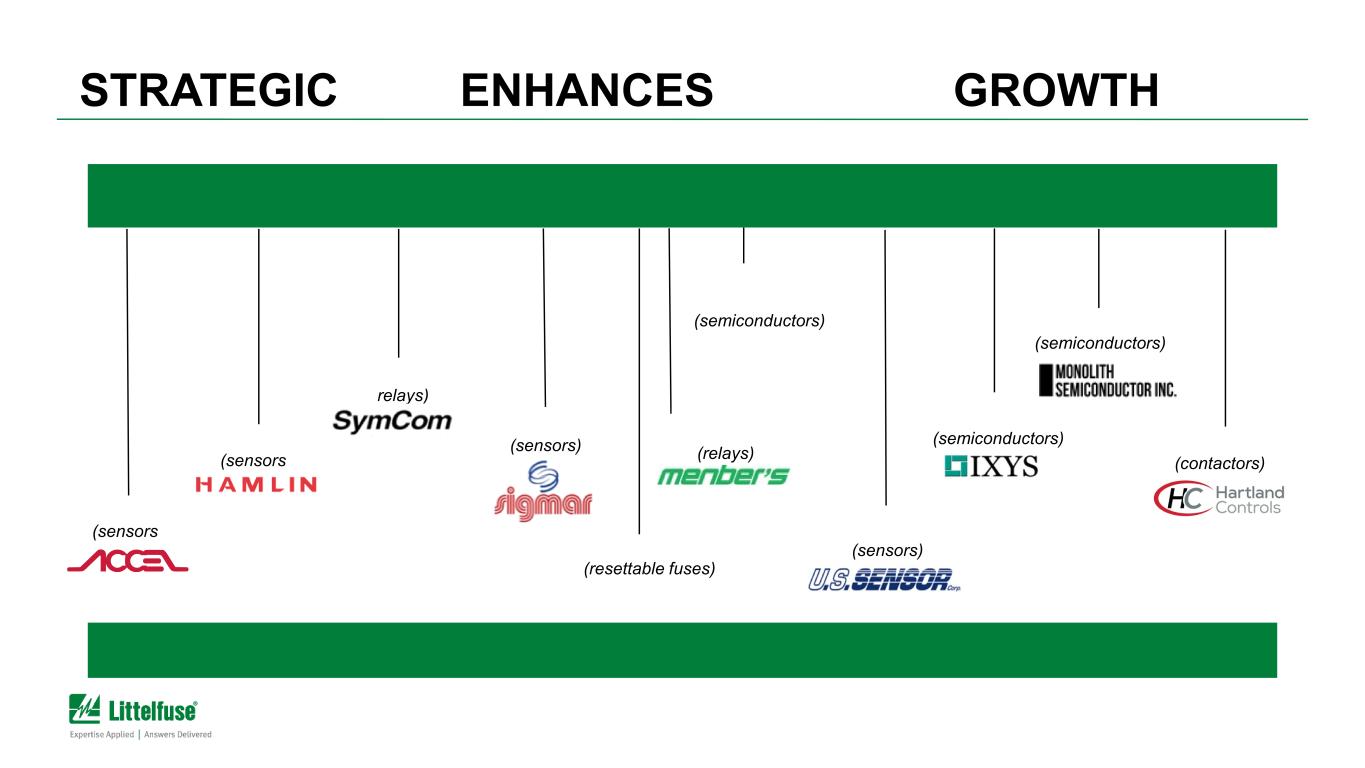

26Confidential and Proprietary | Littelfuse, Inc. © 2021 STRATEGIC M&A ENHANCES ORGANIC GROWTH Sigmar (sensors) Accel AB (sensors) Hamlin (sensors) SymCom (relays) Monolith (semiconductors) PolySwitch (resettable fuses) Menber’s S.p.A. (relays) ON Semiconductor Portfolio (semiconductors) US Sensor (sensors) IXYS (semiconductors) 2012 2013 2014 2015 2016 2017 2018 Successful track record of acquisitions creates stakeholder value 2021 Hartland Controls (contactors)

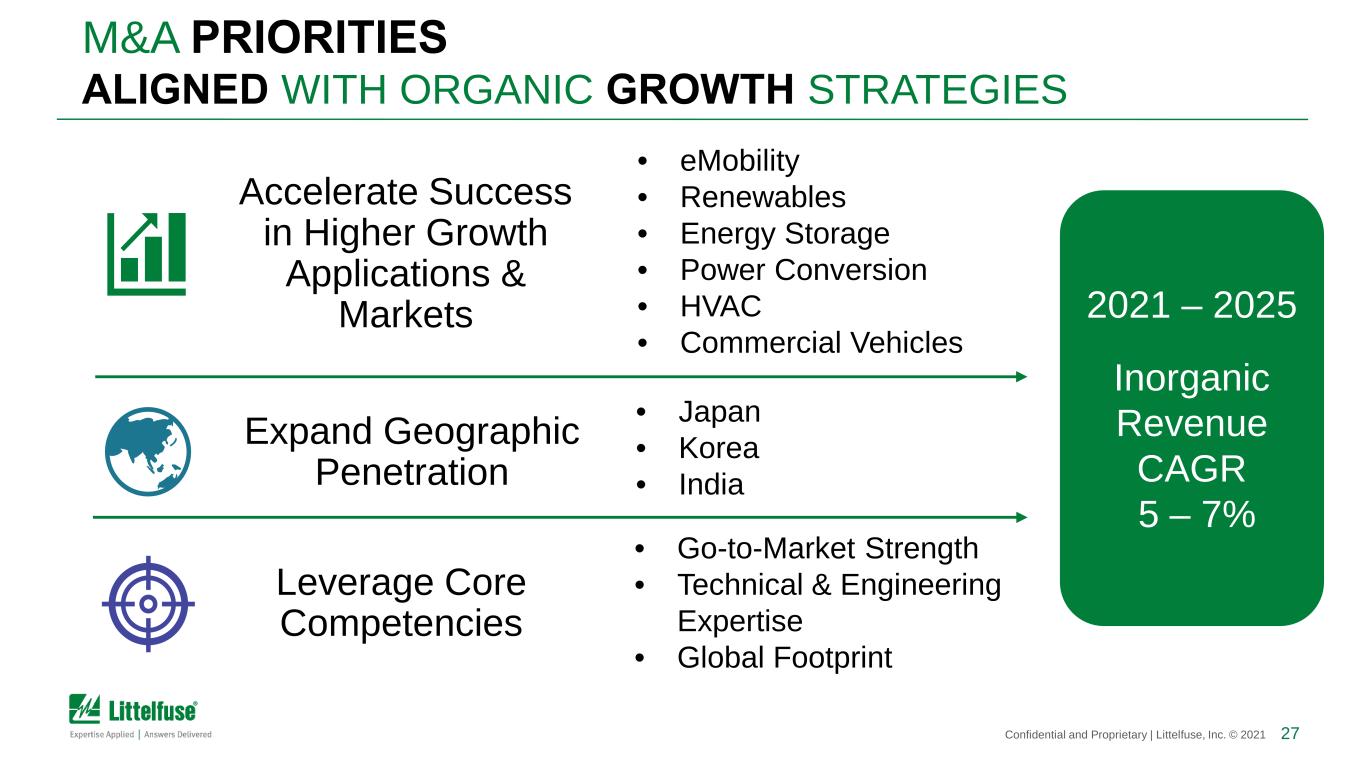

27Confidential and Proprietary | Littelfuse, Inc. © 2021 M&A PRIORITIES ALIGNED WITH ORGANIC GROWTH STRATEGIES 2021 – 2025 Inorganic Revenue CAGR 5 – 7% Expand Geographic Penetration • Japan • Korea • India Leverage Core Competencies • Go-to-Market Strength • Technical & Engineering Expertise • Global Footprint Accelerate Success in Higher Growth Applications & Markets • eMobility • Renewables • Energy Storage • Power Conversion • HVAC • Commercial Vehicles

28Confidential and Proprietary | Littelfuse, Inc. © 2021 ACQUIRED JANUARY 2021 ACCELERATING HVAC & INDUSTRIAL MARKET GROWTH OPPORTUNITIES THROUGH M&A

29Confidential and Proprietary | Littelfuse, Inc. © 2021 Sustained M&A strategy prioritizing strategic fit & synergies ACQUISITION PRINCIPLES A FOUNDATION FOR ENHANCED ORGANIC GROWTH Align with business growth strategies Cultivate a systemic pipeline of bolt-ons Enhance above-market organic revenue growth Margin improvement potential Year 5 target: double-digit operating margin & ROIC Accelerating Profitable Growth

30Confidential and Proprietary | Littelfuse, Inc. © 2021 Investing in resources to enhance our funnel of opportunities Robust diligence and integration processes informed by key value creation drivers Solid balance sheet and cash flow provides sufficient capital to enable success Strong alignment of M&A objectives across businesses and company strategy HOW WE SUCCEED IN M&A Well-positioned to capitalize on value driving opportunities

BREAK 10 MINUTE BREAK

Meenal Sethna, EVP & CFO FINANCIAL OBJECTIVES

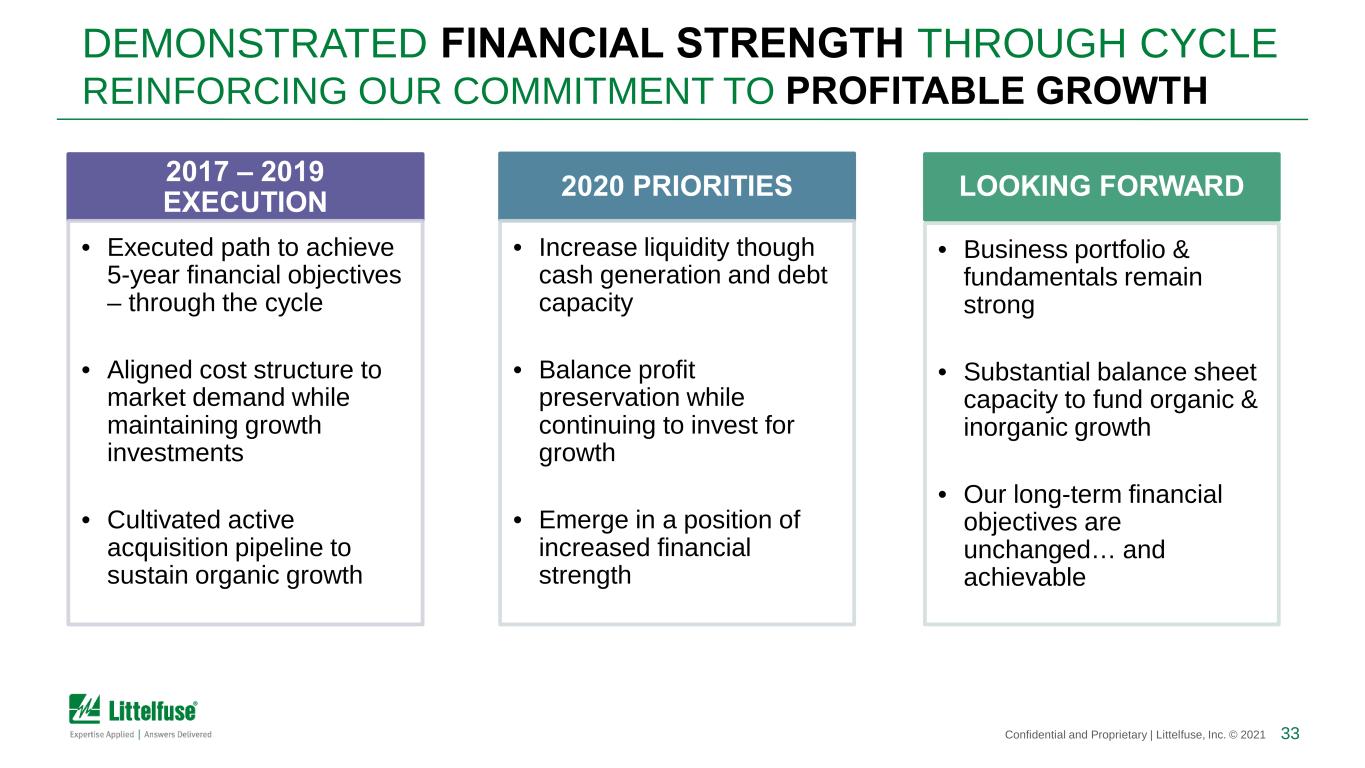

33Confidential and Proprietary | Littelfuse, Inc. © 2021 DEMONSTRATED FINANCIAL STRENGTH THROUGH CYCLE REINFORCING OUR COMMITMENT TO PROFITABLE GROWTH 2017 – 2019 EXECUTION • Executed path to achieve 5-year financial objectives – through the cycle • Aligned cost structure to market demand while maintaining growth investments • Cultivated active acquisition pipeline to sustain organic growth 2020 PRIORITIES LOOKING FORWARD • Business portfolio & fundamentals remain strong • Substantial balance sheet capacity to fund organic & inorganic growth • Our long-term financial objectives are unchanged… and achievable • Increase liquidity though cash generation and debt capacity • Balance profit preservation while continuing to invest for growth • Emerge in a position of increased financial strength

34Confidential and Proprietary | Littelfuse, Inc. © 2021 2021 – 2025 FRAMEWORK CONTINUED TOP TIER SHAREHOLDER RETURNS Robust organic growth enhanced with strategic M&A REVENUE • Double-digit revenue CAGR • 5 – 7% organic • 5 – 7% from acquisitions EARNINGS • EPS growth > revenue growth • 17 – 19% operating margins • 21 – 23% EBITDA margins CASH FLOW • 100%+ free cash flow conversion • Capital expenditures 4 – 5% of revenue ROIC • 5-year goal: high-teens ROIC % • Near-term objective: mid-teens ROIC % CAPITAL ALLOCATION • Return 40% of free cash flow to shareholders • Remainder to focus on acquisitions

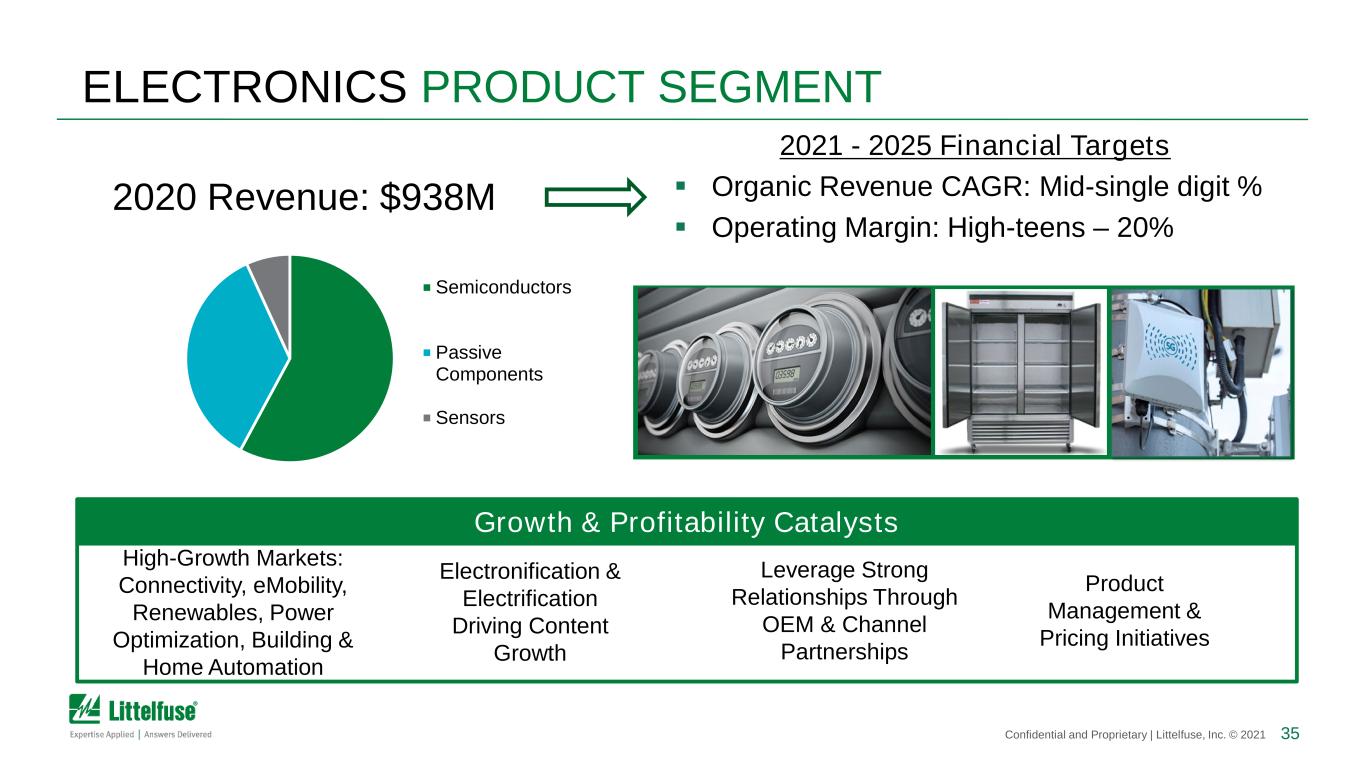

35Confidential and Proprietary | Littelfuse, Inc. © 2021 ELECTRONICS PRODUCT SEGMENT 2021 - 2025 Financial Targets Organic Revenue CAGR: Mid-single digit % Operating Margin: High-teens – 20% 2020 Revenue: $938M Semiconductors Passive Components Sensors Growth & Profitability Catalysts High-Growth Markets: Connectivity, eMobility, Renewables, Power Optimization, Building & Home Automation Electronification & Electrification Driving Content Growth Product Management & Pricing Initiatives Leverage Strong Relationships Through OEM & Channel Partnerships

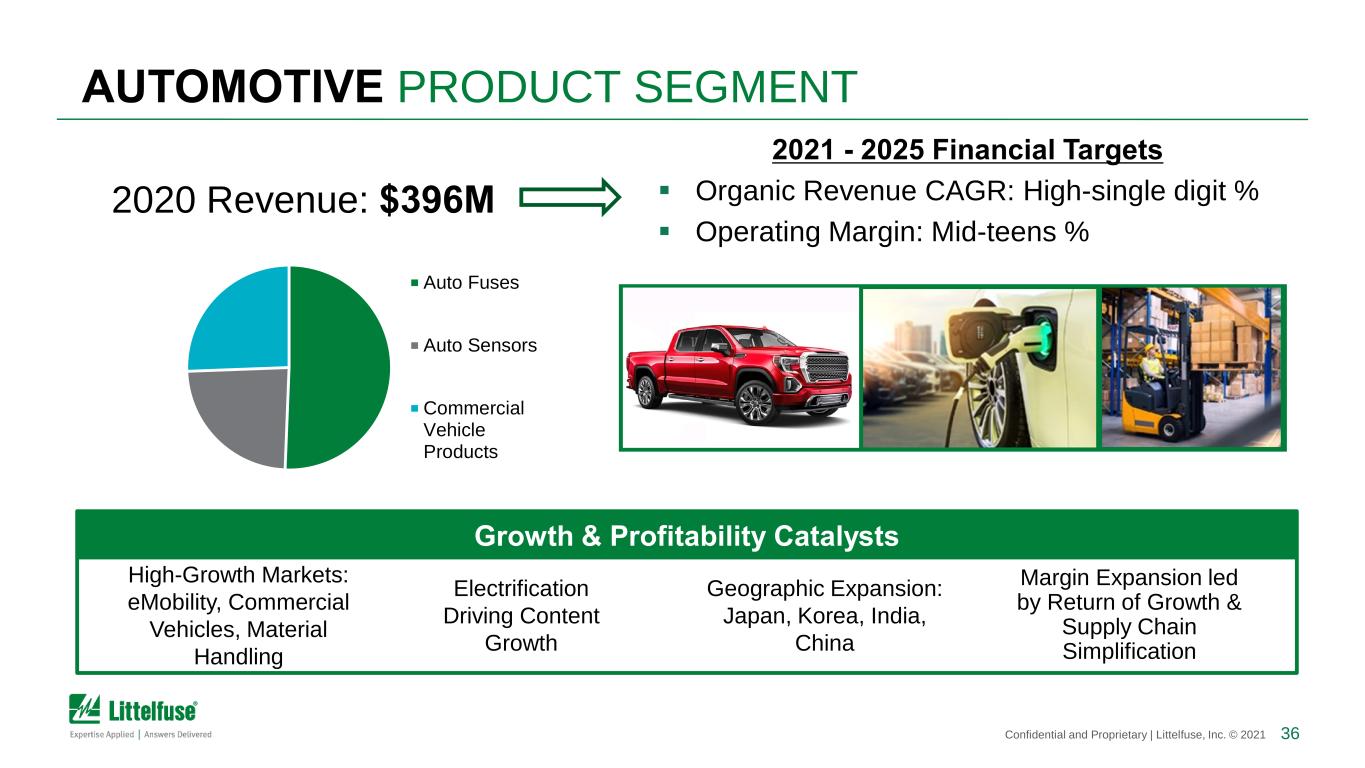

36Confidential and Proprietary | Littelfuse, Inc. © 2021 AUTOMOTIVE PRODUCT SEGMENT Auto Fuses Auto Sensors Commercial Vehicle Products Growth & Profitability Catalysts High-Growth Markets: eMobility, Commercial Vehicles, Material Handling Electrification Driving Content Growth Margin Expansion led by Return of Growth & Supply Chain Simplification Geographic Expansion: Japan, Korea, India, China 2020 Revenue: $396M 2021 - 2025 Financial Targets Organic Revenue CAGR: High-single digit % Operating Margin: Mid-teens %

37Confidential and Proprietary | Littelfuse, Inc. © 2021 INDUSTRIAL PRODUCT SEGMENT Fuses Relays/Sensors Hartland Controls High-Growth Markets: Renewables, Energy Storage, Automation, HVAC Geographic Expansion & Customer Extension Execute Growth Strategy for Hartland Controls Margin Expansion led by Growth & Post- COVID Normalization Growth & Profitability Catalysts 2020 Proforma Revenue*: $180M 2021 - 2025 Financial Targets Organic Revenue CAGR: Mid-single digit % Operating Margin: High-teens % *Includes $68m of revenue for Hartland Controls acquisition

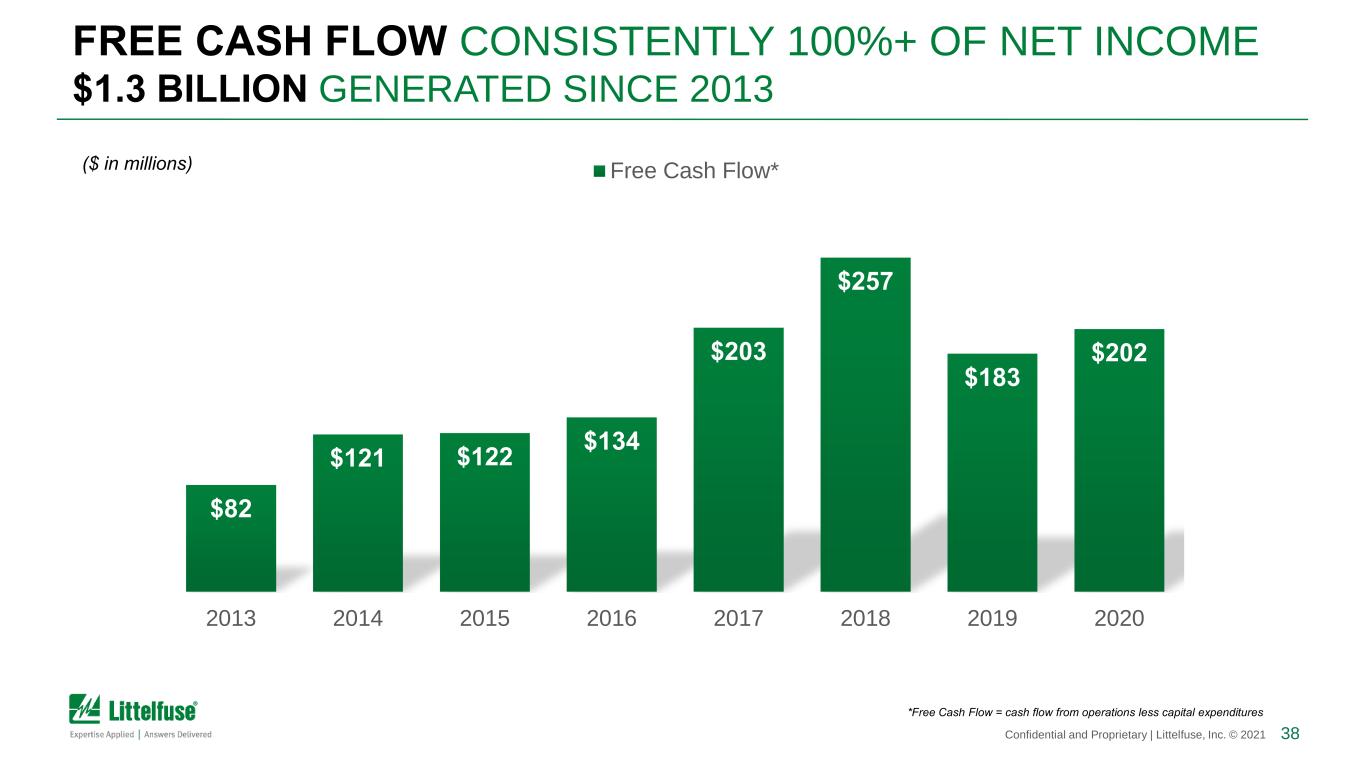

38Confidential and Proprietary | Littelfuse, Inc. © 2021 $82 $121 $122 $134 $203 $257 $183 $202 2013 2014 2015 2016 2017 2018 2019 2020 Free Cash Flow* FREE CASH FLOW CONSISTENTLY 100%+ OF NET INCOME $1.3 BILLION GENERATED SINCE 2013 *Free Cash Flow = cash flow from operations less capital expenditures ($ in millions)

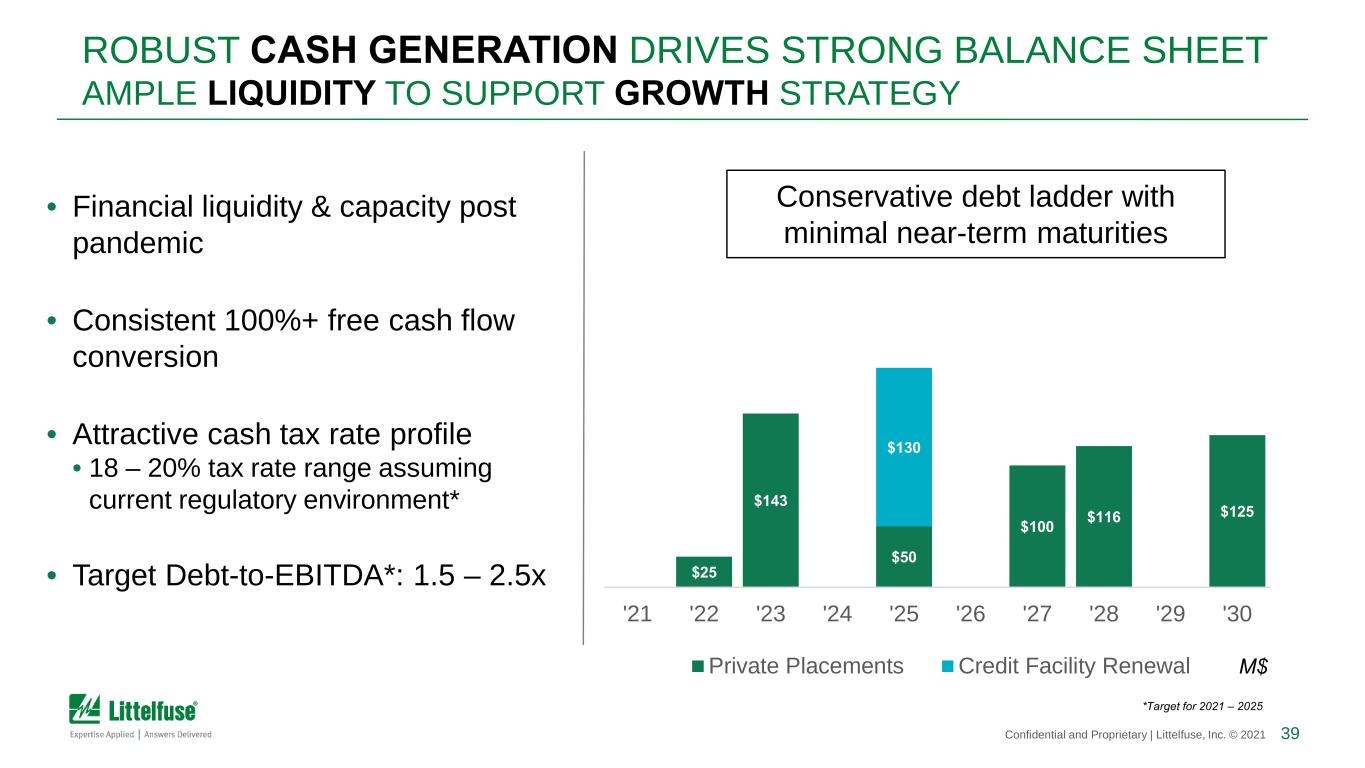

39Confidential and Proprietary | Littelfuse, Inc. © 2021 $25 $143 $50 $100 $116 $125 $130 '21 '22 '23 '24 '25 '26 '27 '28 '29 '30 Private Placements Credit Facility Renewal Conservative debt ladder with minimal near-term maturities • Financial liquidity & capacity post pandemic • Consistent 100%+ free cash flow conversion • Attractive cash tax rate profile • 18 – 20% tax rate range assuming current regulatory environment* • Target Debt-to-EBITDA*: 1.5 – 2.5x ROBUST CASH GENERATION DRIVES STRONG BALANCE SHEET AMPLE LIQUIDITY TO SUPPORT GROWTH STRATEGY M$ *Target for 2021 – 2025

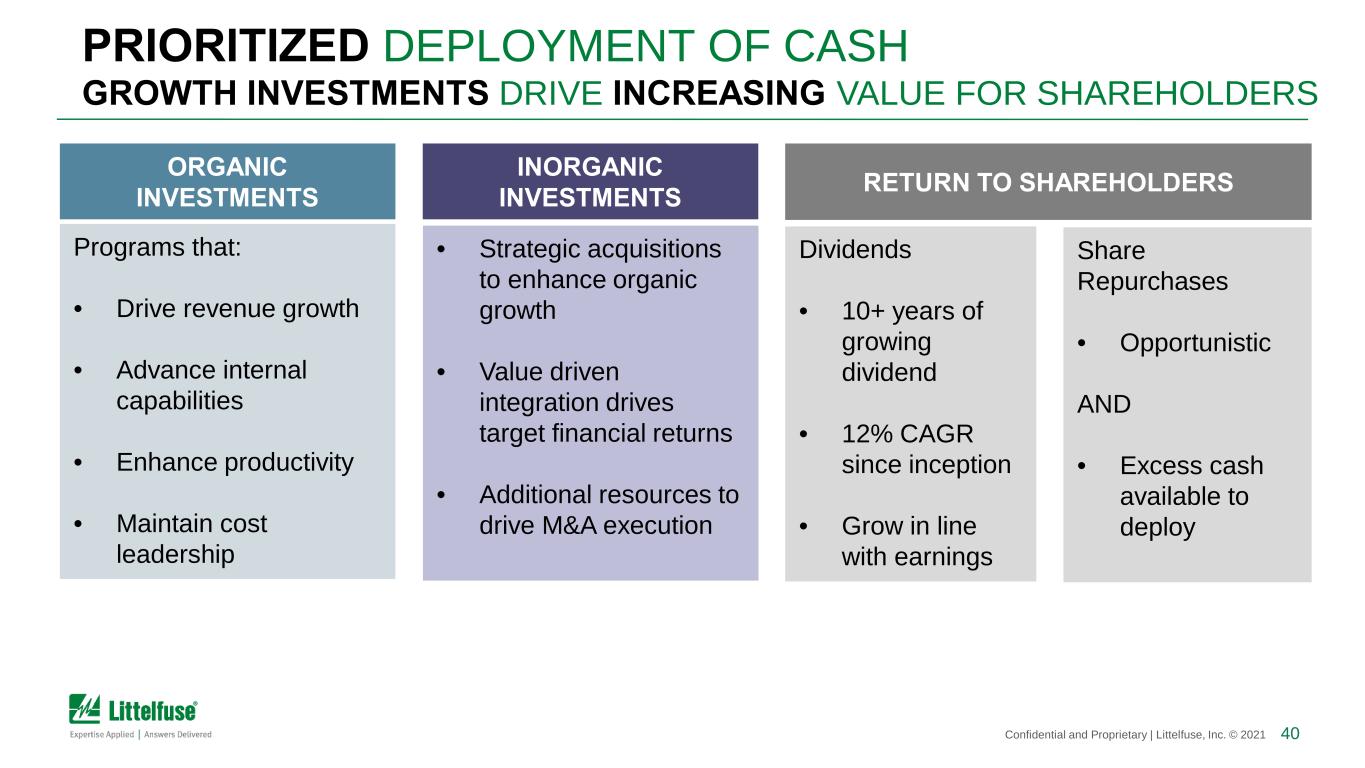

40Confidential and Proprietary | Littelfuse, Inc. © 2021 ORGANIC INVESTMENTS INORGANIC INVESTMENTS RETURN TO SHAREHOLDERS Programs that: • Drive revenue growth • Advance internal capabilities • Enhance productivity • Maintain cost leadership • Strategic acquisitions to enhance organic growth • Value driven integration drives target financial returns • Additional resources to drive M&A execution Share Repurchases • Opportunistic AND • Excess cash available to deploy Dividends • 10+ years of growing dividend • 12% CAGR since inception • Grow in line with earnings PRIORITIZED DEPLOYMENT OF CASH GROWTH INVESTMENTS DRIVE INCREASING VALUE FOR SHAREHOLDERS

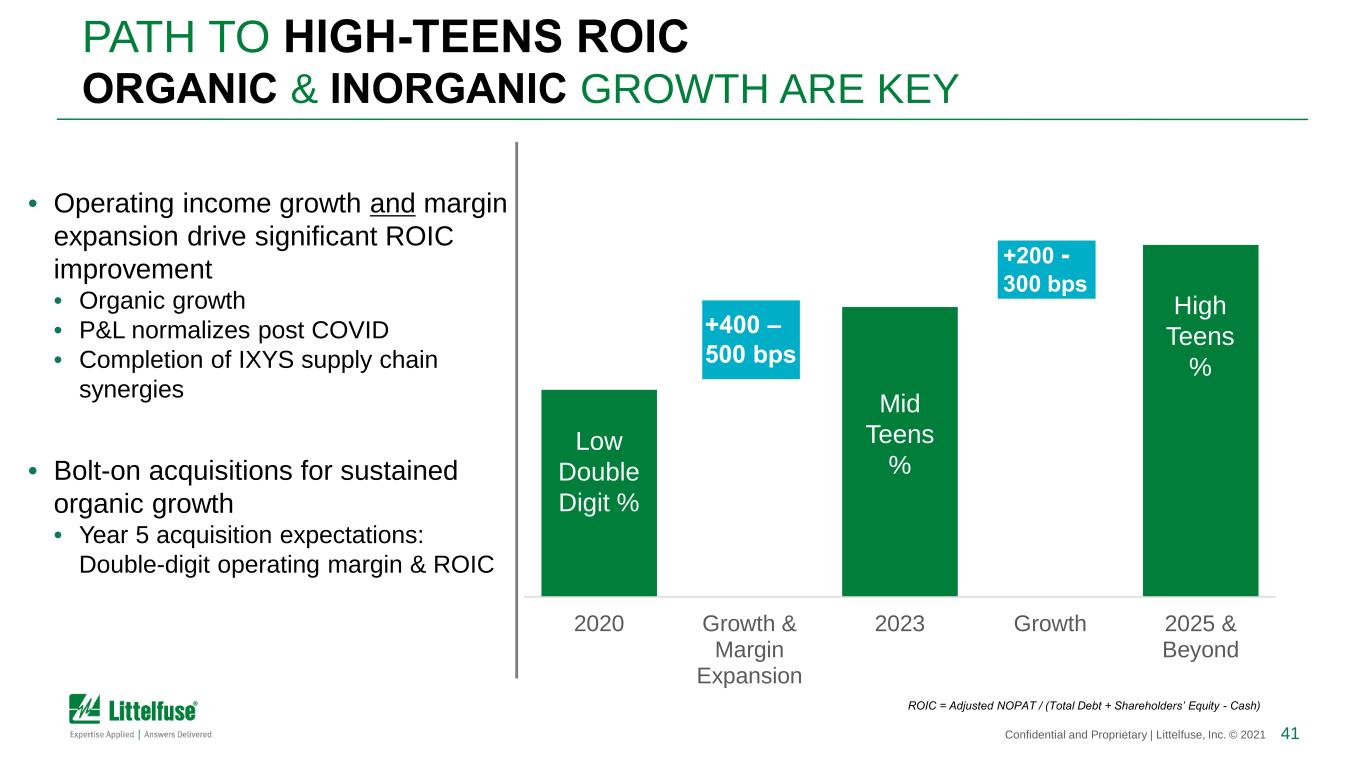

41Confidential and Proprietary | Littelfuse, Inc. © 2021 0% 5% 10% 15% 20% 2020 Growth & Margin Expansion 2023 Growth 2025 & Beyond Upper Teens Low Double Digit % +400 – 500 bps Mid Teens % High Teens % +200 - 300 bps PATH TO HIGH-TEENS ROIC ORGANIC & INORGANIC GROWTH ARE KEY • Operating income growth and margin expansion drive significant ROIC improvement • Organic growth • P&L normalizes post COVID • Completion of IXYS supply chain synergies • Bolt-on acquisitions for sustained organic growth • Year 5 acquisition expectations: Double-digit operating margin & ROIC ROIC = Adjusted NOPAT / (Total Debt + Shareholders’ Equity - Cash)

42Confidential and Proprietary | Littelfuse, Inc. © 2021 2021 – 2025 FRAMEWORK CONTINUED TOP TIER SHAREHOLDER RETURNS Robust organic growth enhanced with strategic M&A REVENUE • Double-digit revenue CAGR • 5 – 7% organic • 5 – 7% from acquisitions EARNINGS • EPS growth > revenue growth • 17 – 19% operating margins • 21 – 23% EBITDA margins CASH FLOW • 100%+ free cash flow conversion • Capital expenditures 4 – 5% of revenue ROIC • 5-year goal: high-teens ROIC % • Near-term objective: mid-teens ROIC % CAPITAL ALLOCATION • Return 40% of free cash flow to shareholders • Remainder to focus on acquisitions

Dave Heinzmann President & CEO CORPORATE STRATEGY SUMMARY

44Confidential and Proprietary | Littelfuse, Inc. © 2021 Structural Growth Themes Sustainability Connectivity Safety 2021 – 2025 GROWTH STRATEGY EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD Our Growth Drivers Content & Share Gains Strategic Acquisitions High-Growth Markets & Geographies Outcomes Double-Digit Revenue Growth Best-in-Class Profitability Deliver Top Tier Shareholder Returns

45Confidential and Proprietary | Littelfuse, Inc. © 2021 Innovative Product Portfolio of Multiple Technologies Trusted Global Brand Reliability, Quality & Safety Industry- Leading Technical & Engineering Knowledge Global Reach, Local Touch LITTELFUSE COMPETITIVE ADVANTAGE Breadth & Depth of Application Expertise Our talent, capabilities & solutions are key differentiators Strong Customer & Channel Partnerships

46Confidential and Proprietary | Littelfuse, Inc. © 2021 Best-in-class shareholder returns Positioned within structural growth themes across diverse end markets Focused on high-growth applications that enable above market organic growth through the cycle High-value, high-opportunity product portfolio Deep customer & distributor relationships Industry-leading profitability & cash generation Strong track record of value-added strategic acquisitions Global technical & application expertise Prioritizing ESG for long-term stakeholder value Strong execution led by diverse leadership team COMPELLING INVESTMENT PROPOSITION A PROVEN SOURCE OF VALUE CREATION

Q&A

APPENDIX

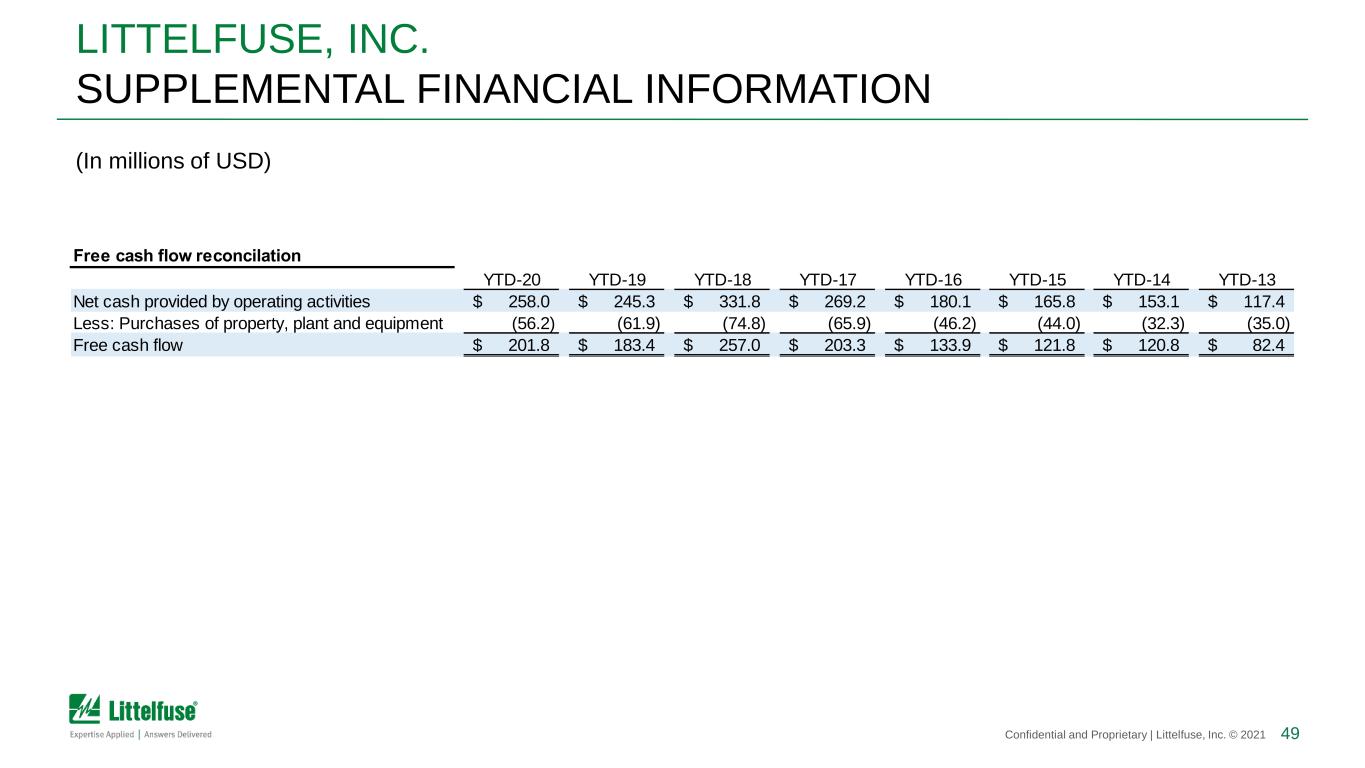

49Confidential and Proprietary | Littelfuse, Inc. © 2021 LITTELFUSE, INC. SUPPLEMENTAL FINANCIAL INFORMATION Free cash flow reconcilation YTD-20 YTD-19 YTD-18 YTD-17 YTD-16 YTD-15 YTD-14 YTD-13 Net cash provided by operating activities 258.0$ 245.3$ 331.8$ 269.2$ 180.1$ 165.8$ 153.1$ 117.4$ Less: Purchases of property, plant and equipment (56.2) (61.9) (74.8) (65.9) (46.2) (44.0) (32.3) (35.0) Free cash flow 201.8$ 183.4$ 257.0$ 203.3$ 133.9$ 121.8$ 120.8$ 82.4$ (In millions of USD)