Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BRINKS CO | ex991q4202010-k.htm |

| 8-K - 8-K - BRINKS CO | bco-20210223.htm |

1 Fourth-Quarter Results February 23, 2021 Exhibit 99.2

2 These materials contain forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," “model”, "predict," "intend," "plan," "believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials includes, but is not limited to information regarding: 2021 outlook, including revenue, operating profit, adjusted EBITDA earnings per share, capital expenditures, net debt and leverage, free cash flow and the drivers thereof; the impact of cost reductions, the G4S acquisition and Strategy 2.0 results; future in person retail sales and e-commerce; and expected future payments to fund pension and UMWA obligations. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated. These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to: our ability to improve profitability and execute further cost and operational improvement and efficiencies in our core businesses; our ability to improve service levels and quality in our core businesses; market volatility and commodity price fluctuations; seasonality, pricing and other competitive industry factors; investment in information technology (“IT”) and its impact on revenue and profit growth; our ability to maintain an effective IT infrastructure and safeguard confidential information; our ability to effectively develop and implement solutions for our customers; risks associated with operating in foreign countries, including changing political, labor and economic conditions, regulatory issues (including the imposition of international sanctions, including by the U.S. government), currency restrictions and devaluations, restrictions on and cost of repatriating earnings and capital, impact on the Company’s financial results as a result of jurisdictions determined to be highly inflationary, and restrictive government actions, including nationalization; labor issues, including negotiations with organized labor and work stoppages; pandemics (including the ongoing Covid-19 pandemic and related impact to and restrictions on the actions of businesses and consumers, including suppliers and customers), acts of terrorism, strikes or other extraordinary events that negatively affect global or regional cash commerce; anticipated cash needs in light of our current liquidity position and the impact of Covid-19 on our liquidity; the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates; our ability to identify, evaluate and complete acquisitions and other strategic transactions and to successfully integrate acquired companies; costs related to dispositions and product or market exits; our ability to obtain appropriate insurance coverage, positions taken by insurers relative to claims and the financial condition of insurers; safety and security performance and loss experience; employee and environmental liabilities in connection with former coal operations, including black lung claims; the impact of the Patient Protection and Affordable Care Act on legacy liabilities and ongoing operations; funding requirements, accounting treatment, and investment performance of our pension plans, the VEBA and other employee benefits; changes to estimated liabilities and assets in actuarial assumptions; the nature of hedging relationships and counterparty risk; access to the capital and credit markets; our ability to realize deferred tax assets; the outcome of pending and future claims, litigation, and administrative proceedings; public perception of our business, reputation and brand; changes in estimates and assumptions underlying critical accounting policies; the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations. This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2019 and our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2020, June 30, 2020, and September 30, 2020 and in our other public filings with the Securities and Exchange Commission. Unless otherwise noted, the forward-looking information discussed today and included in these materials is representative as of today only and The Brink's Company undertakes no obligation to update any information contained in this document. These materials are copyrighted and may not be used without written permission from Brink's. Today’s presentation is focused primarily on non-GAAP results. Detailed reconciliations of non-GAAP to GAAP results are included in the appendix and in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website: www.brinks.com. Safe Harbor Statements and Non-GAAP Results

3 4Q: Continued revenue recovery, operating leverage and acquisitions drive record results • Revenue up 9%...organic improvement and acquisitions more than offset pandemic headwinds • Operating profit up 26%...margin up 180 bps to 14.2% • U.S. achieves margin rate of 15% • Adjusted EBITDA up 25%...margin up 230 bps to 19% • EPS up 39%...$1.64 vs $1.18 • Strong sequential improvement Cash usage remains strong...continues to be used in two-thirds of global consumer transactions1 • Cash as % of total U.S. retail payments not materially changed since onset of pandemic • U.S cash in circulation up materially in 2020 • U.S. cash processing volumes up over pre-pandemic levels 2021 guidance…continued strong growth expected • Revenue: $4.1B to $4.5B (+17% at midpoint) • Operating profit: $450M to $540M (+30% at midpoint) • Adjusted EBITDA: $640M to $730M (+21% at midpoint) • EPS…$4.15 to $5.35 (+26% at midpoint) Positioned for additional growth in 2021 and beyond • Double digit revenue growth driven by accelerating organic growth and full year of G4S acquisition • Restructuring and permanent cost reductions expected to drive margins higher as revenue grows • Full-year benefit of G4S acquisition and synergies expected to drive additional growth • Minimal Strategy 2.0 results expected in guidance, accelerating in future years Key Messages Outstanding results, focused on strategic execution, continued momentum expected in 2021 (Non-GAAP, $ Millions, except EPS) 1. 2020 McKinsey Global Payments Report Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com.

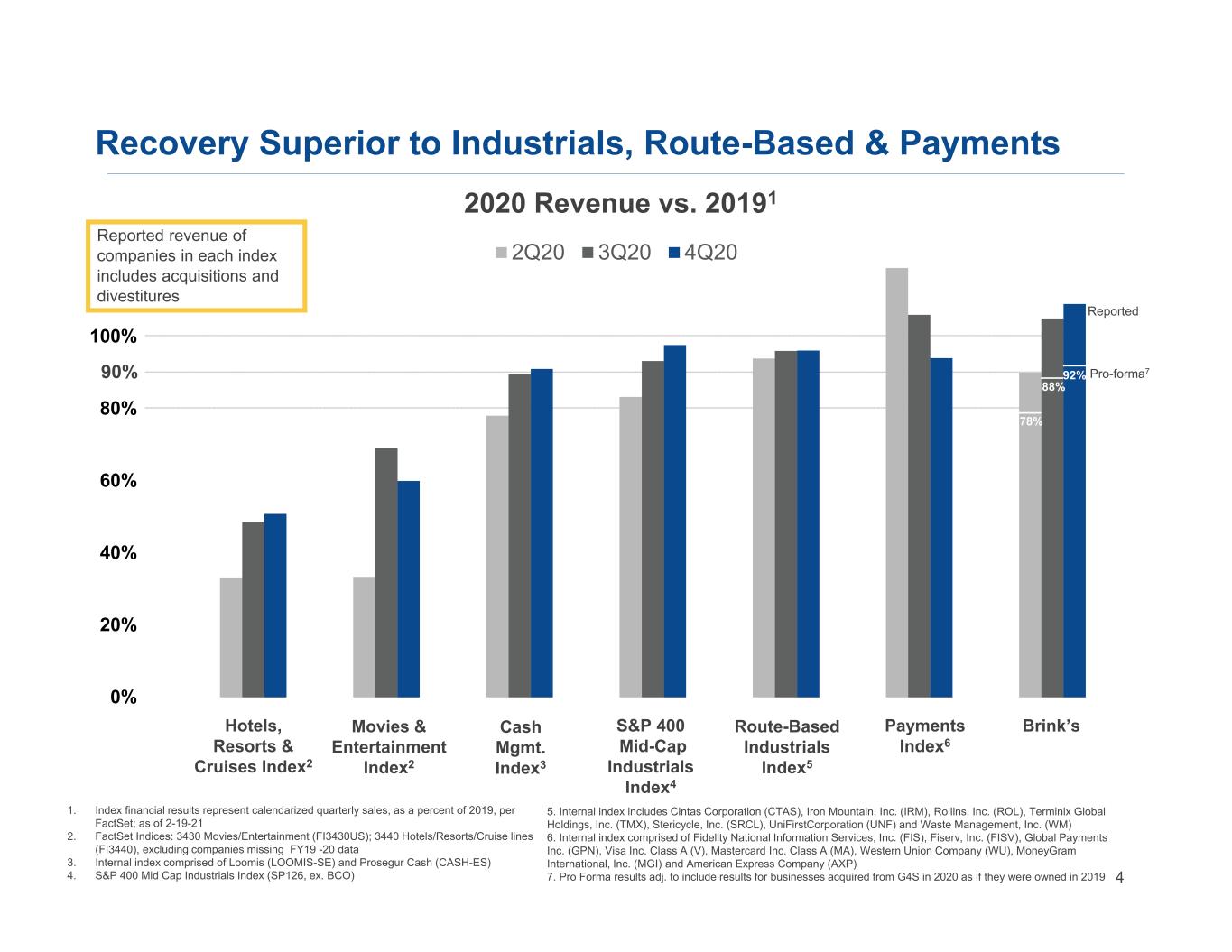

4 Recovery Superior to Industrials, Route-Based & Payments 2020 Revenue vs. 20191 1. Index financial results represent calendarized quarterly sales, as a percent of 2019, per FactSet; as of 2-19-21 2. FactSet Indices: 3430 Movies/Entertainment (FI3430US); 3440 Hotels/Resorts/Cruise lines (FI3440), excluding companies missing FY19 -20 data 3. Internal index comprised of Loomis (LOOMIS-SE) and Prosegur Cash (CASH-ES) 4. S&P 400 Mid Cap Industrials Index (SP126, ex. BCO) 5. Internal index includes Cintas Corporation (CTAS), Iron Mountain, Inc. (IRM), Rollins, Inc. (ROL), Terminix Global Holdings, Inc. (TMX), Stericycle, Inc. (SRCL), UniFirstCorporation (UNF) and Waste Management, Inc. (WM) 6. Internal index comprised of Fidelity National Information Services, Inc. (FIS), Fiserv, Inc. (FISV), Global Payments Inc. (GPN), Visa Inc. Class A (V), Mastercard Inc. Class A (MA), Western Union Company (WU), MoneyGram International, Inc. (MGI) and American Express Company (AXP) 7. Pro Forma results adj. to include results for businesses acquired from G4S in 2020 as if they were owned in 2019 0% 20% 40% 60% 80% 100% 120% 2Q20 3Q20 4Q20 78% 88% 92% Pro-forma7 Reported Brink’sHotels, Resorts & Cruises Index2 Movies & Entertainment Index2 Cash Mgmt. Index3 S&P 400 Mid-Cap Industrials Index4 Route-Based Industrials Index5 Payments Index6 90% Reported revenue of companies in each index includes acquisitions and divestitures

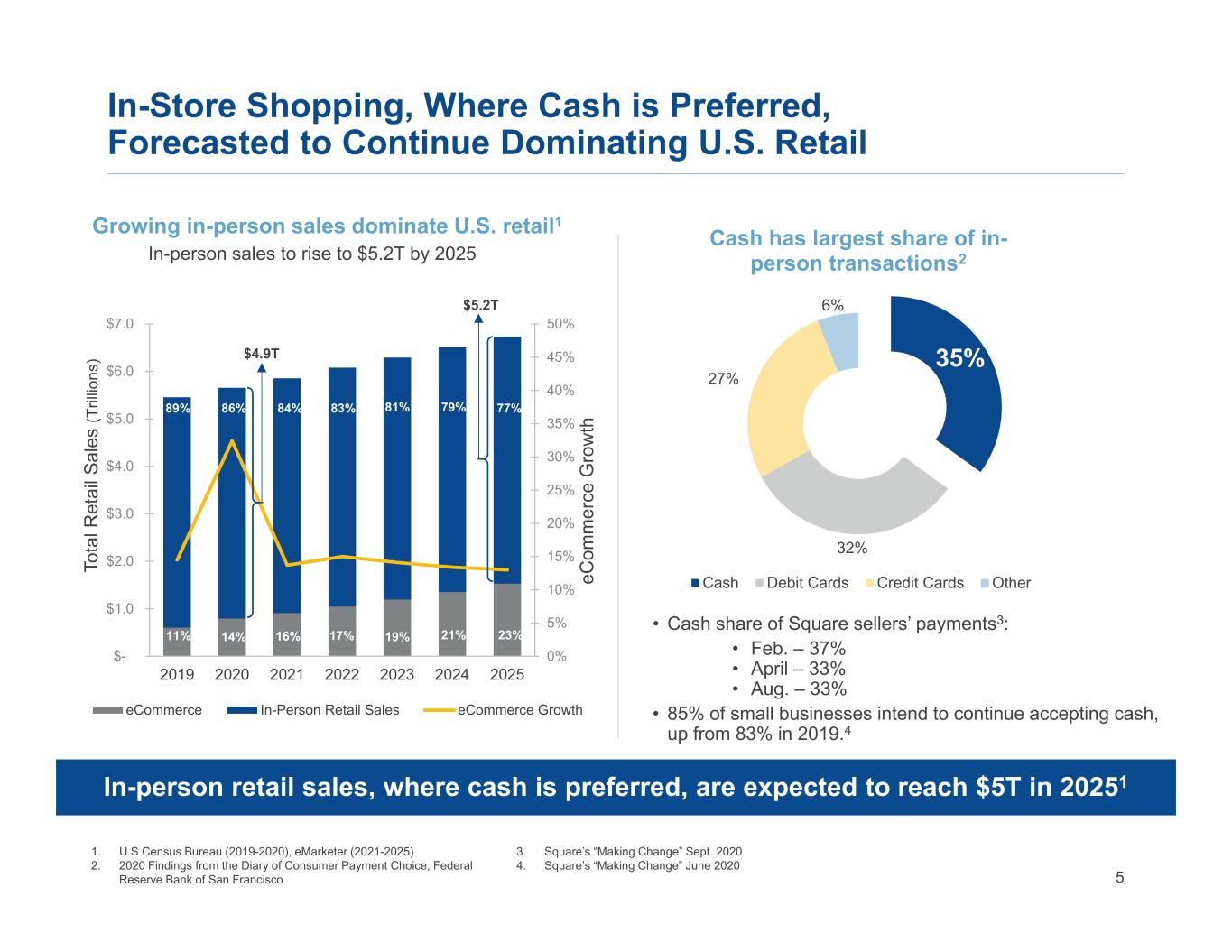

5 In-Store Shopping, Where Cash is Preferred, Forecasted to Continue Dominating U.S. Retail In-person retail sales, where cash is preferred, are expected to reach $5T in 20251 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 2019 2020 2021 2022 2023 2024 2025 eC om m er ce G ro w th To ta l R et ai l S al es (T ril lio ns ) eCommerce In-Person Retail Sales eCommerce Growth 89% 86% 83% 81% 79% 77%84% 11% 14% 16% 17% 19% 21% 23% $4.9T $5.2T Growing in-person sales dominate U.S. retail1 In-person sales to rise to $5.2T by 2025 35% 32% 27% 6% Cash has largest share of in- person transactions2 Cash Debit Cards Credit Cards Other 1. U.S Census Bureau (2019-2020), eMarketer (2021-2025) 2. 2020 Findings from the Diary of Consumer Payment Choice, Federal Reserve Bank of San Francisco 3. Square’s “Making Change” Sept. 2020 4. Square’s “Making Change” June 2020 • Cash share of Square sellers’ payments3: • Feb. – 37% • April – 33% • Aug. – 33% • 85% of small businesses intend to continue accepting cash, up from 83% in 2019.4

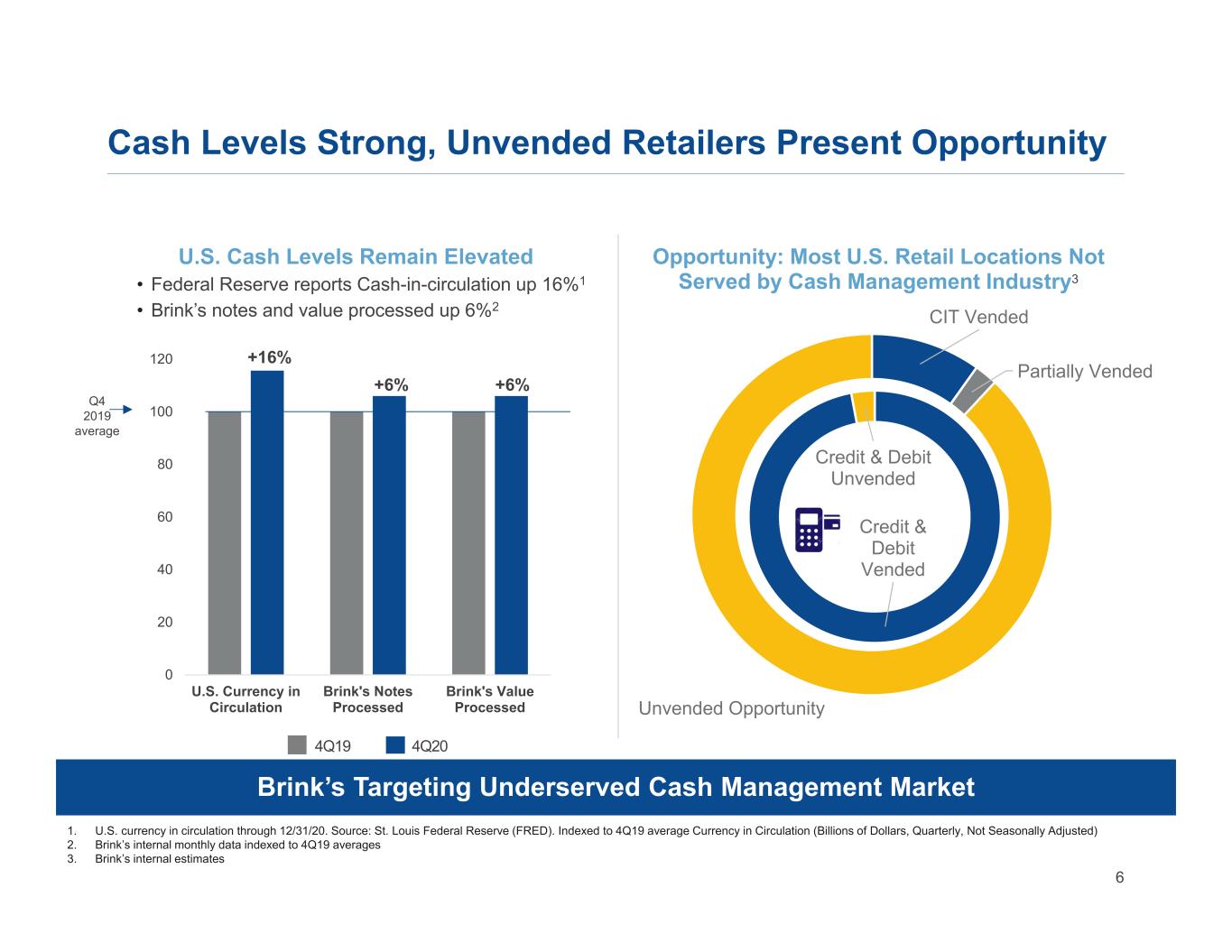

6 Credit & Debit Vended Credit & Debit Unvended Cash Levels Strong, Unvended Retailers Present Opportunity Brink’s Targeting Underserved Cash Management Market 1. U.S. currency in circulation through 12/31/20. Source: St. Louis Federal Reserve (FRED). Indexed to 4Q19 average Currency in Circulation (Billions of Dollars, Quarterly, Not Seasonally Adjusted) 2. Brink’s internal monthly data indexed to 4Q19 averages 3. Brink’s internal estimates 0 20 40 60 80 100 120 U.S. Currency in Circulation Brink's Notes Processed Brink's Value Processed +16% +6% U.S. Cash Levels Remain Elevated • Federal Reserve reports Cash-in-circulation up 16%1 • Brink’s notes and value processed up 6%2 Q4 2019 average 4Q19 4Q20 Opportunity: Most U.S. Retail Locations Not Served by Cash Management Industry3 CIT Vended Partially Vended Unvended Opportunity +6%

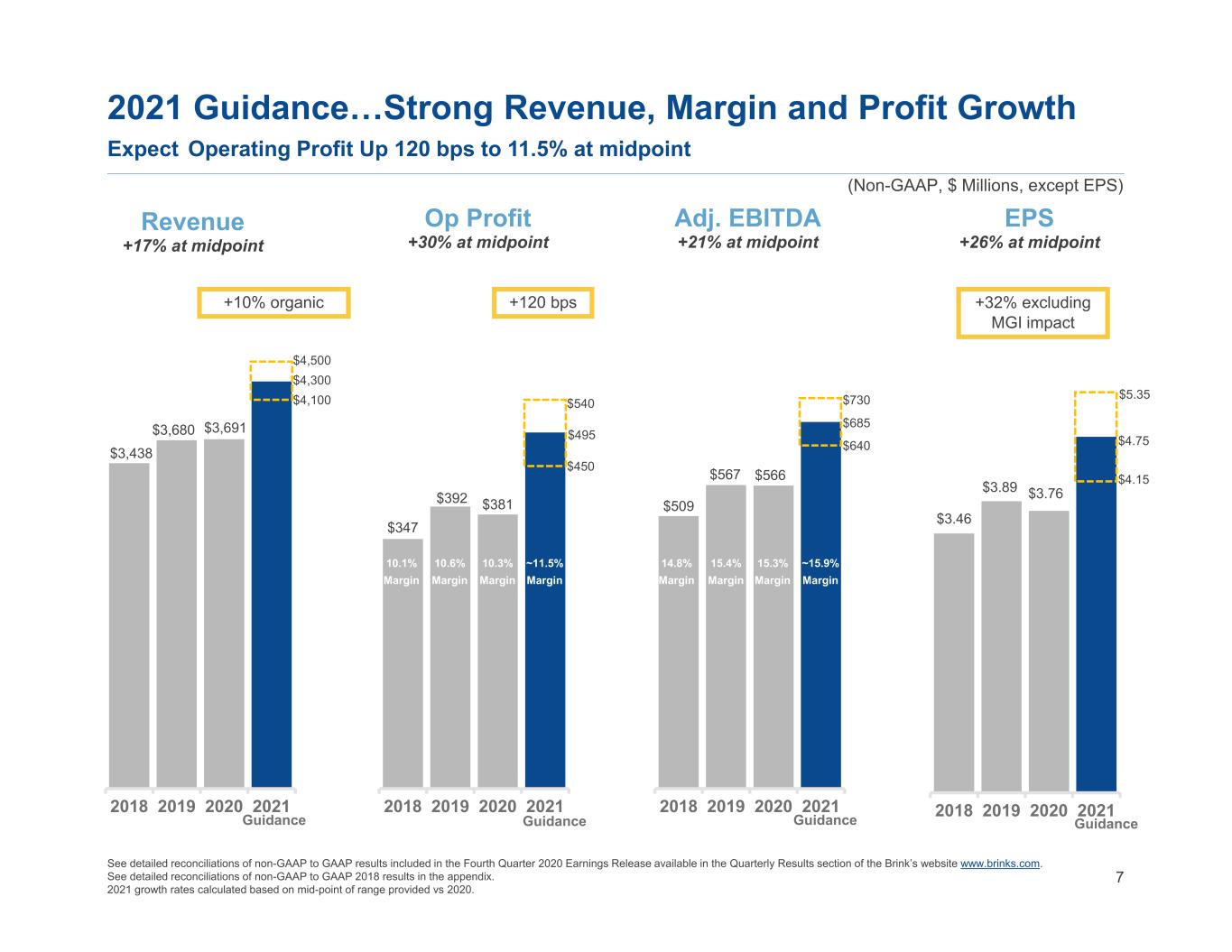

7 $3.46 $3.89 $3.76 2018 2019 2020 2021 $347 $392 $381 2018 2019 2020 2021 See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2018 results in the appendix. 2021 growth rates calculated based on mid-point of range provided vs 2020. 2021 Guidance…Strong Revenue, Margin and Profit Growth Expect Operating Profit Up 120 bps to 11.5% at midpoint 13.5% Margin 15.9% Margin 12.7% Margin 15.8% - 16.3% Margin 13.3% Margin ~14.5% Margin 11.8% Margin Guidance Guidance GuidanceGuidance Revenue +17% at midpoint $3,438 $3,680 $3,691 2018 2019 2020 2021 ~15.7% Margin Adj. EBITDA +21% at midpoint $509 $567 $566 2018 2019 2020 2021 EPS +26% at midpoint Op Profit +30% at midpoint 10.3% Margin 10.6% Margin 10.1% Margin ~15.9% Margin 15.3% Margin 15.4% Margin 14.8% Margin (Non-GAAP, $ Millions, except EPS) ~11.5% Margin $4,500 $4,100 $4,300 $540 $450 $495 $730 $640 $685 $5.35 $4.15 $4.75 +120 bps+10% organic +32% excluding MGI impact

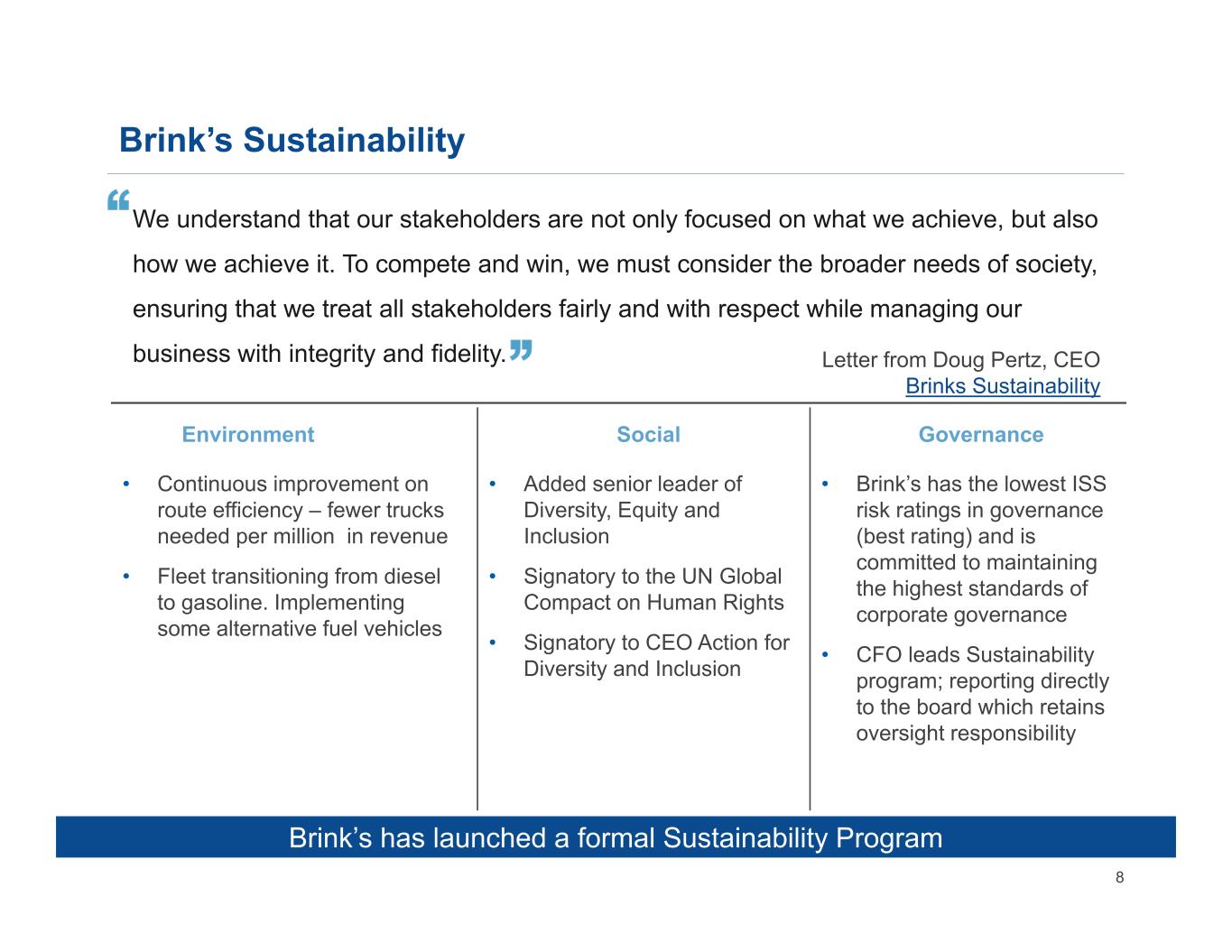

8 Brink’s Sustainability We understand that our stakeholders are not only focused on what we achieve, but also how we achieve it. To compete and win, we must consider the broader needs of society, ensuring that we treat all stakeholders fairly and with respect while managing our business with integrity and fidelity. Brink’s has launched a formal Sustainability Program Environment • Continuous improvement on route efficiency – fewer trucks needed per million in revenue • Fleet transitioning from diesel to gasoline. Implementing some alternative fuel vehicles Social • Added senior leader of Diversity, Equity and Inclusion • Signatory to the UN Global Compact on Human Rights • Signatory to CEO Action for Diversity and Inclusion Letter from Doug Pertz, CEO Brinks Sustainability Governance • Brink’s has the lowest ISS risk ratings in governance (best rating) and is committed to maintaining the highest standards of corporate governance • CFO leads Sustainability program; reporting directly to the board which retains oversight responsibility

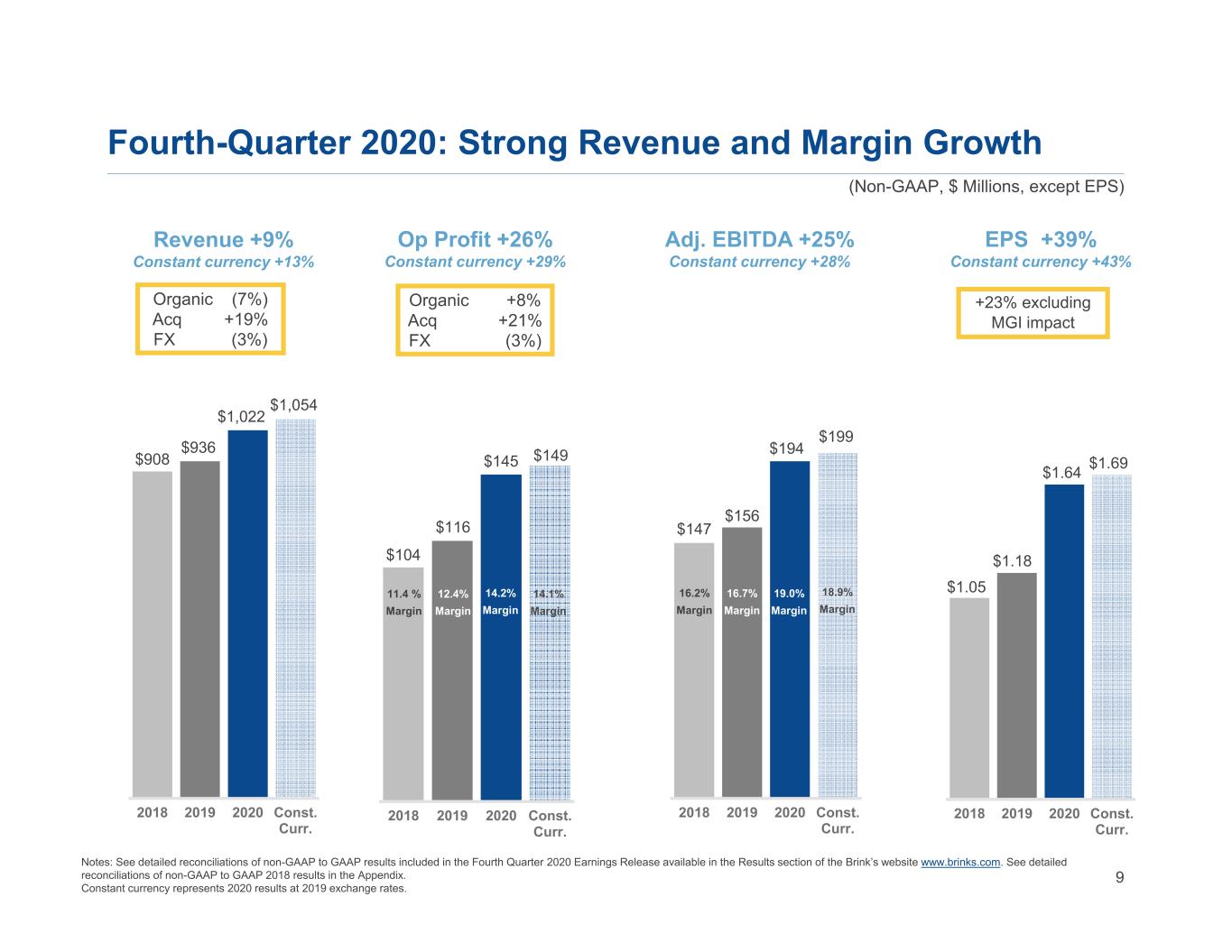

9 $908 $936 $1,022 $1,054 2018 2019 2020 Const. Curr. Revenue +9% Constant currency +13% Organic (7%) Acq +19% FX (3%) Fourth-Quarter 2020: Strong Revenue and Margin Growth (Non-GAAP, $ Millions, except EPS) EPS +39% Constant currency +43% $1.05 $1.18 $1.64 $1.69 2018 2019 2020 Const. Curr. Adj. EBITDA +25% Constant currency +28% $147 $156 $194 $199 2018 2019 2020 Const. Curr. 16.2% Margin Op Profit +26% Constant currency +29% Organic +8% Acq +21% FX (3%) $104 $116 $145 $149 2018 2019 2020 Const. Curr. 11.4 % Margin 16.7% Margin Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2018 results in the Appendix. Constant currency represents 2020 results at 2019 exchange rates. 12.4% Margin 14.2% Margin 19.0% Margin 14.1% Margin 18.9% Margin +23% excluding MGI impact

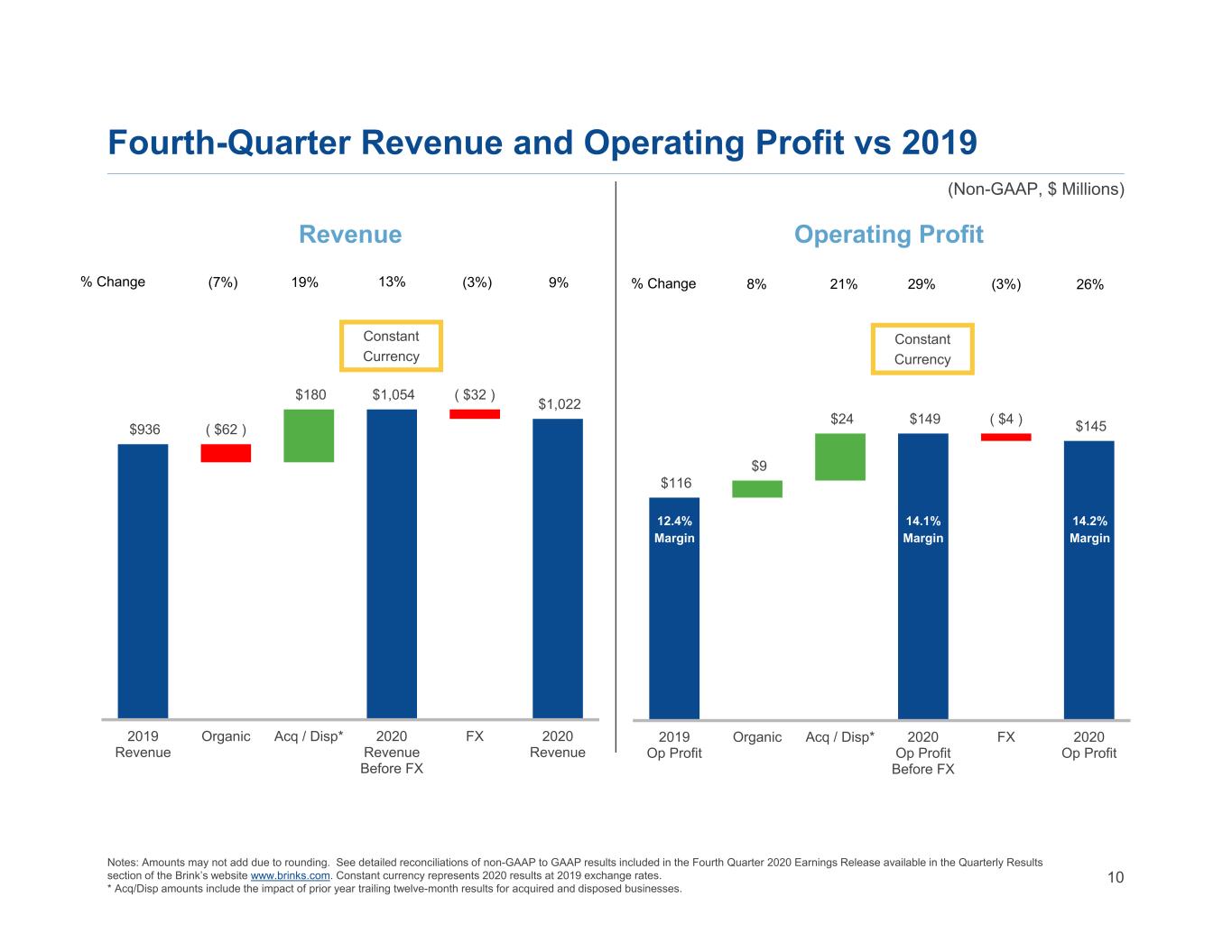

10 Fourth-Quarter Revenue and Operating Profit vs 2019 % Change (3%)(7%) 19% 9%13% Constant Currency Constant Currency 8.8% Margin 10.1% Margin % Change (3%)8% 21% 26%29% (Non-GAAP, $ Millions) Revenue Operating Profit Notes: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. Constant currency represents 2020 results at 2019 exchange rates. * Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses. $936 ( $62 ) $180 $1,054 ( $32 ) $1,022 2019 Revenue Organic Acq / Disp* 2020 Revenue Before FX FX 2020 Revenue $116 $9 $24 $149 ( $4 ) $145 2019 Op Profit Organic Acq / Disp* 2020 Op Profit Before FX FX 2020 Op Profit 12.4% Margin 14.1% Margin 14.2% Margin

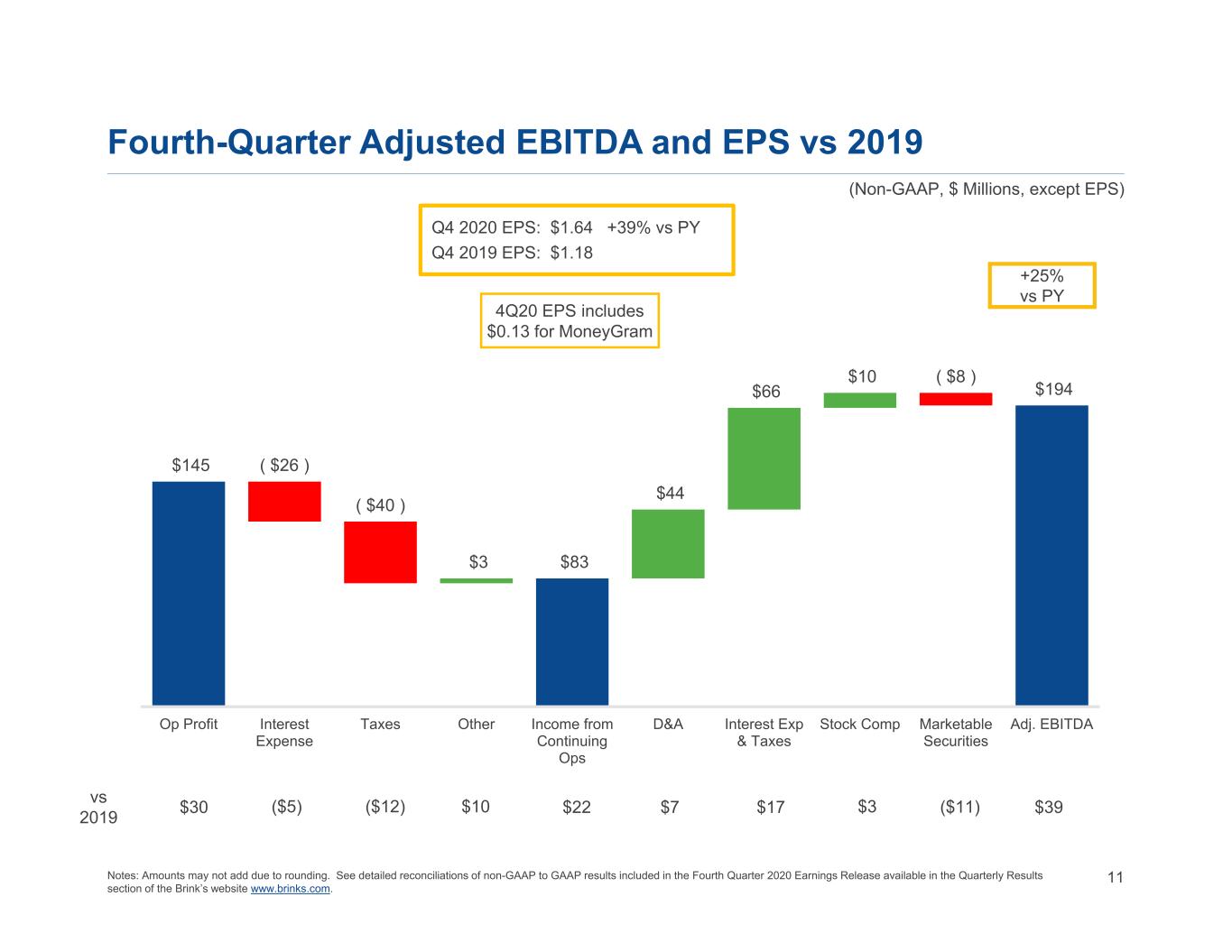

11 $145 ( $26 ) ( $40 ) $3 $83 $44 $66 $10 ( $8 ) $194 Op Profit Interest Expense Taxes Other Income from Continuing Ops D&A Interest Exp & Taxes Stock Comp Marketable Securities Adj. EBITDA Fourth-Quarter Adjusted EBITDA and EPS vs 2019 Q4 2020 EPS: $1.64 +39% vs PY Q4 2019 EPS: $1.18 (Non-GAAP, $ Millions, except EPS) +25% vs PY Notes: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. $30vs2019 ($5) ($12) $22 $7 $17 $3 $39$10 ($11) 4Q20 EPS includes $0.13 for MoneyGram

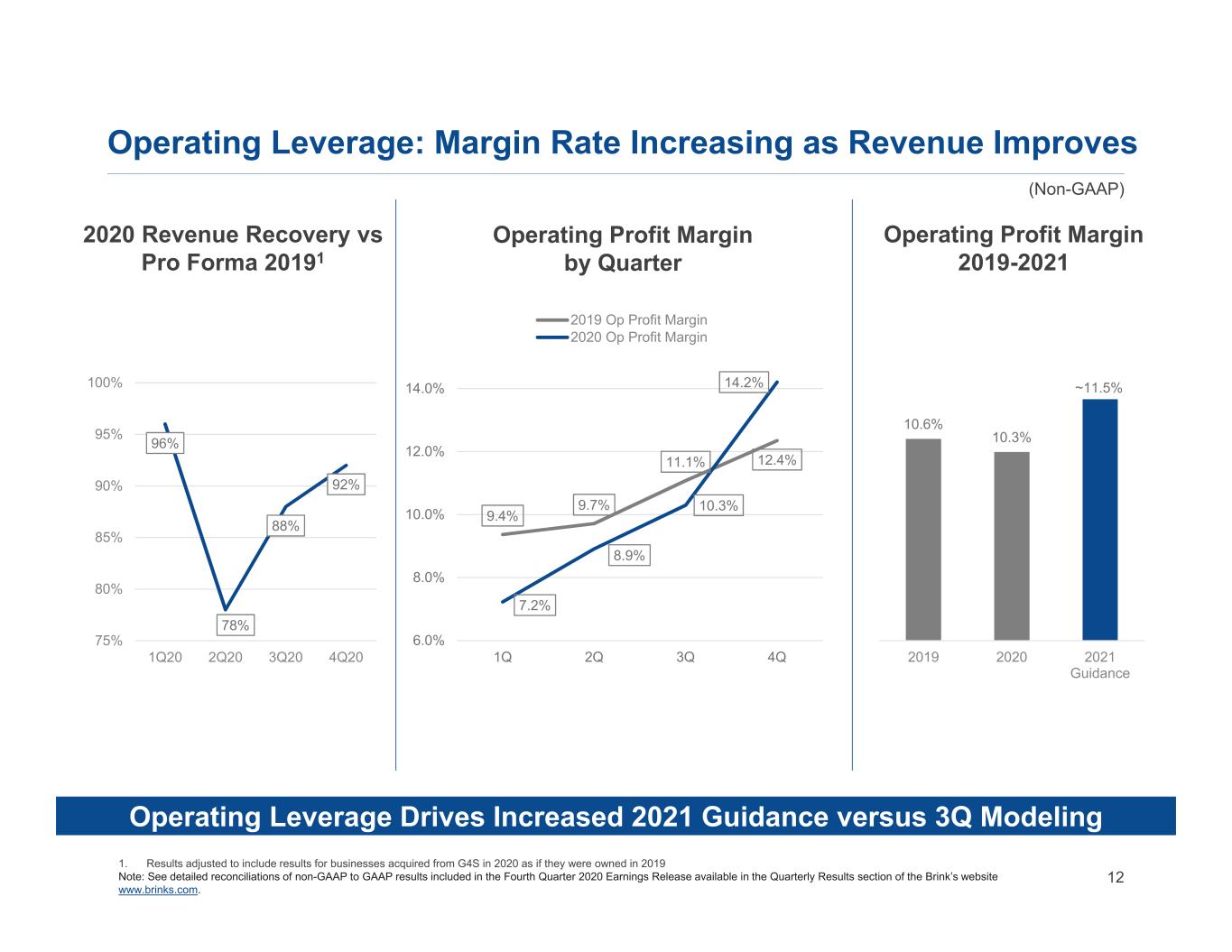

12 Operating Leverage: Margin Rate Increasing as Revenue Improves 1. Results adjusted to include results for businesses acquired from G4S in 2020 as if they were owned in 2019 Note: See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. Operating Profit Margin by Quarter 2020 Revenue Recovery vs Pro Forma 20191 Operating Leverage Drives Increased 2021 Guidance versus 3Q Modeling Operating Profit Margin 2019-2021 10.6% 10.3% ~11.5% 2019 2020 2021 Guidance 9.4% 9.7% 11.1% 12.4% 7.2% 8.9% 10.3% 14.2% 6.0% 8.0% 10.0% 12.0% 14.0% 1Q 2Q 3Q 4Q 2019 Op Profit Margin 2020 Op Profit Margin 96% 78% 88% 92% 75% 80% 85% 90% 95% 100% 1Q20 2Q20 3Q20 4Q20 (Non-GAAP)

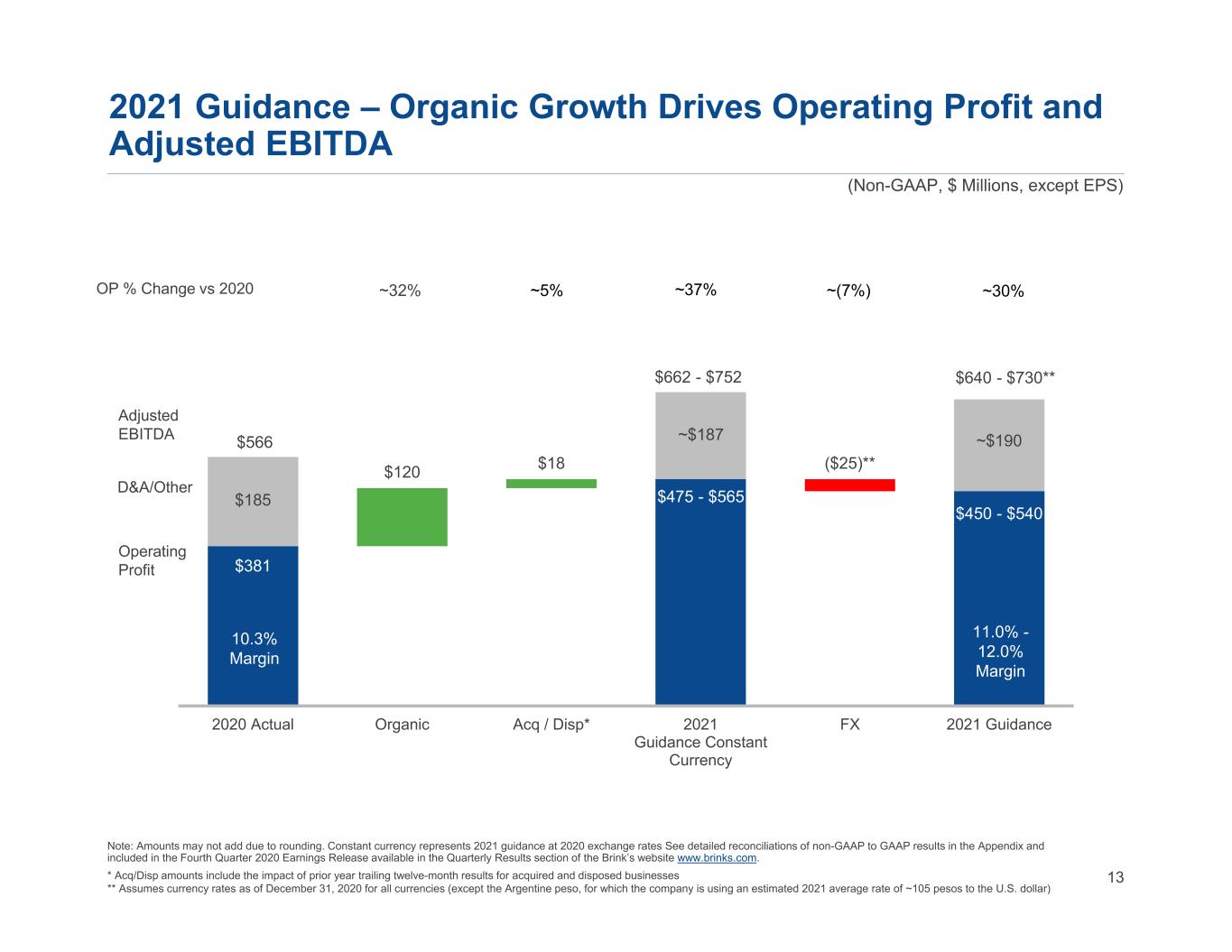

13 $381 $475 - $565 $450 - $540 $185 $120 $18 ~$187 ($25)** ~$190 2020 Actual Organic Acq / Disp* 2021 Guidance Constant Currency FX 2021 Guidance Note: Amounts may not add due to rounding. Constant currency represents 2021 guidance at 2020 exchange rates See detailed reconciliations of non-GAAP to GAAP results in the Appendix and included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. * Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses ** Assumes currency rates as of December 31, 2020 for all currencies (except the Argentine peso, for which the company is using an estimated 2021 average rate of ~105 pesos to the U.S. dollar) (Non-GAAP, $ Millions, except EPS) OP % Change vs 2020 ~(7%)~32% ~5% ~30%~37% 2021 Guidance – Organic Growth Drives Operating Profit and Adjusted EBITDA 11.0% - 12.0% Margin 10.3% Margin $566 $662 - $752 $640 - $730** Operating Profit Adjusted EBITDA D&A/Other

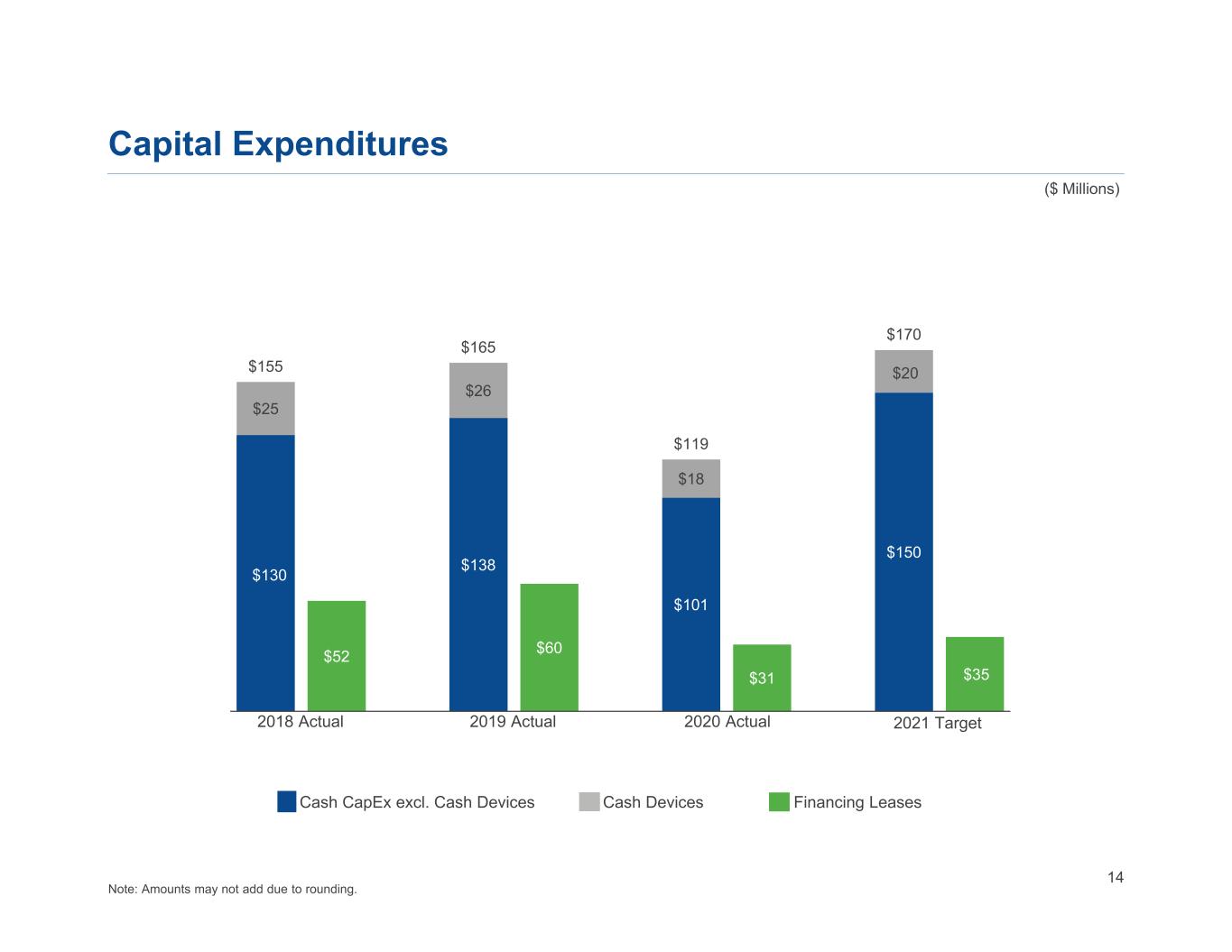

14 $130 $52 $138 $60 $101 $31 $150 $35 $25 $26 $18 $20$155 $165 $119 $170 Capital Expenditures ($ Millions) 2018 Actual 2019 Actual 2020 Actual 2021 Target Cash CapEx excl. Cash Devices Cash Devices Financing Leases Note: Amounts may not add due to rounding.

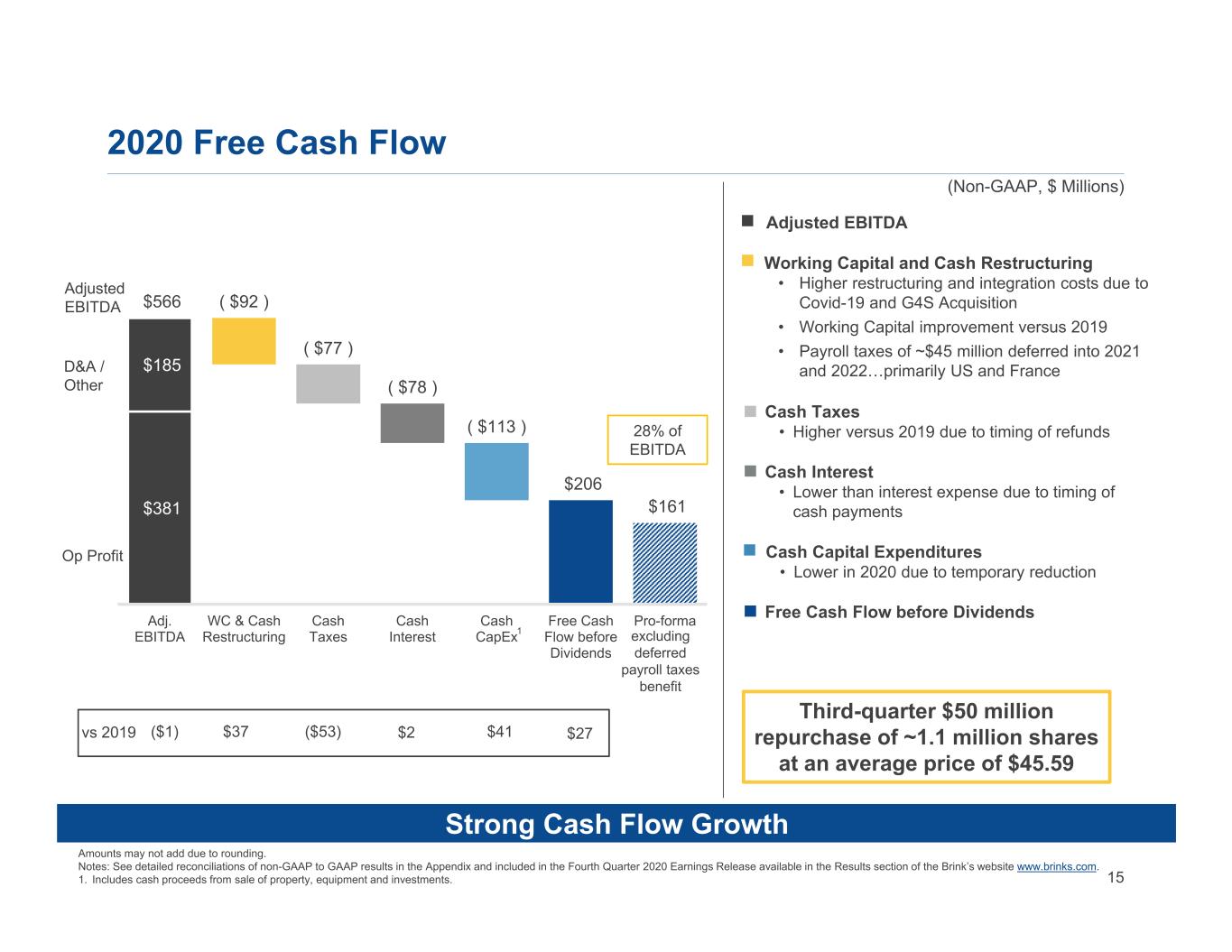

15 2020 Free Cash Flow (Non-GAAP, $ Millions) $381 $185 $566 ( $92 ) ( $77 ) ( $78 ) ( $113 ) $206 $161 Adj. EBITDA WC & Cash Restructuring Cash Taxes Cash Interest Cash CapEx Free Cash Flow before Dividends Pro-forma Strong Cash Flow Growth Working Capital and Cash Restructuring • Higher restructuring and integration costs due to Covid-19 and G4S Acquisition • Working Capital improvement versus 2019 • Payroll taxes of ~$45 million deferred into 2021 and 2022…primarily US and France Cash Taxes • Higher versus 2019 due to timing of refunds Cash Interest • Lower than interest expense due to timing of cash payments Cash Capital Expenditures • Lower in 2020 due to temporary reduction Free Cash Flow before Dividends Adjusted EBITDA Third-quarter $50 million repurchase of ~1.1 million shares at an average price of $45.59 ($1)vs 2019 $37 ($53) $2 $41 $27 D&A / Other Op Profit Adjusted EBITDA 1 Amounts may not add due to rounding. Notes: See detailed reconciliations of non-GAAP to GAAP results in the Appendix and included in the Fourth Quarter 2020 Earnings Release available in the Results section of the Brink’s website www.brinks.com. 1. Includes cash proceeds from sale of property, equipment and investments. excluding deferred payroll taxes benefit 28% of EBITDA

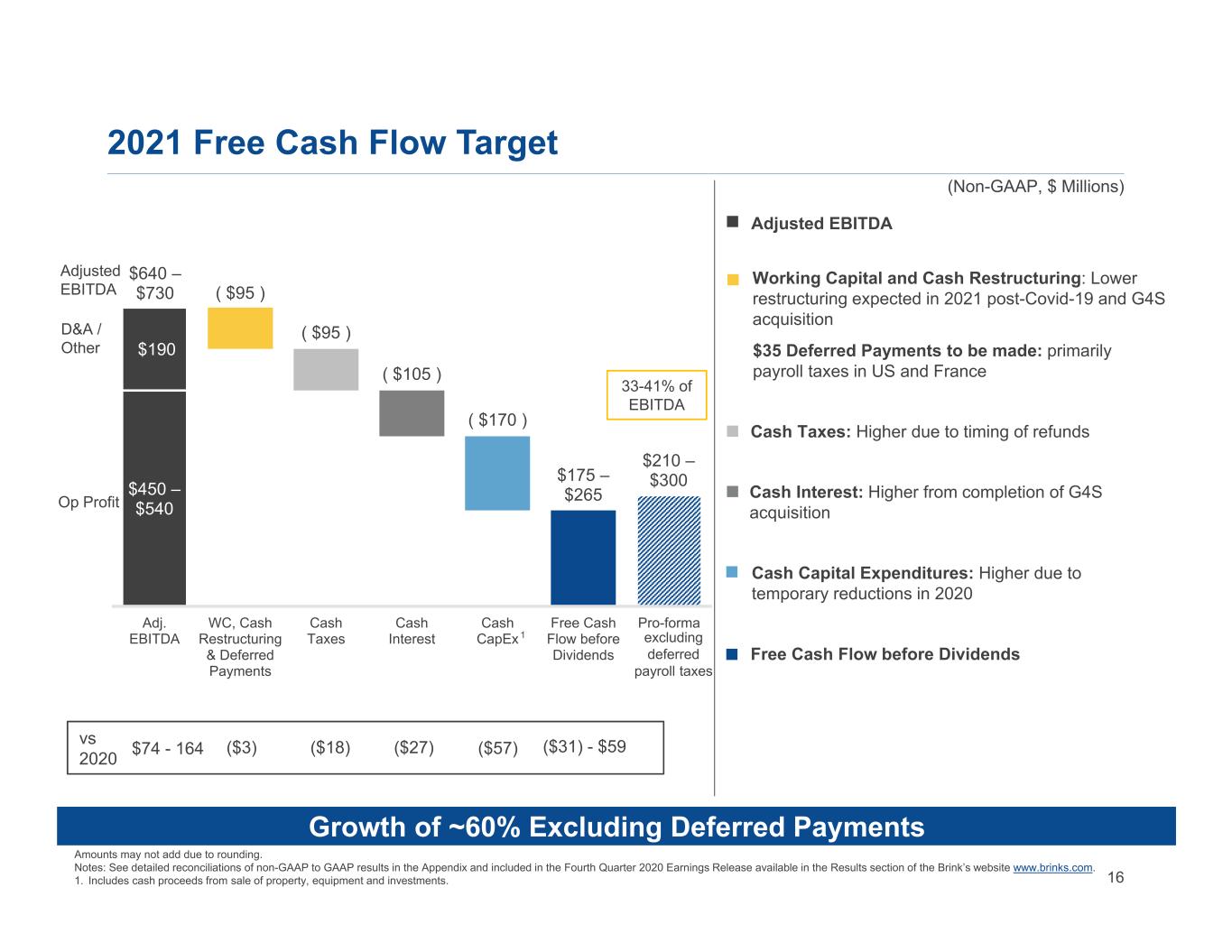

16 2021 Free Cash Flow Target (Non-GAAP, $ Millions) $450 – $540 $190 $640 – $730 ( $95 ) ( $95 ) ( $105 ) ( $170 ) $175 – $265 $210 – $300 Adj. EBITDA WC, Cash Restructuring & Deferred Payments Cash Taxes Cash Interest Cash CapEx Free Cash Flow before Dividends Pro-forma Growth of ~60% Excluding Deferred Payments $74 - 164vs 2020 ($3) ($18) ($27) ($57) ($31) - $59 Cash Interest: Higher from completion of G4S acquisition Cash Capital Expenditures: Higher due to temporary reductions in 2020 Cash Taxes: Higher due to timing of refunds Free Cash Flow before Dividends Working Capital and Cash Restructuring: Lower restructuring expected in 2021 post-Covid-19 and G4S acquisition $35 Deferred Payments to be made: primarily payroll taxes in US and France Adjusted EBITDA D&A / Other Op Profit Adjusted EBITDA 1 Amounts may not add due to rounding. Notes: See detailed reconciliations of non-GAAP to GAAP results in the Appendix and included in the Fourth Quarter 2020 Earnings Release available in the Results section of the Brink’s website www.brinks.com. 1. Includes cash proceeds from sale of property, equipment and investments. excluding deferred payroll taxes 33-41% of EBITDA

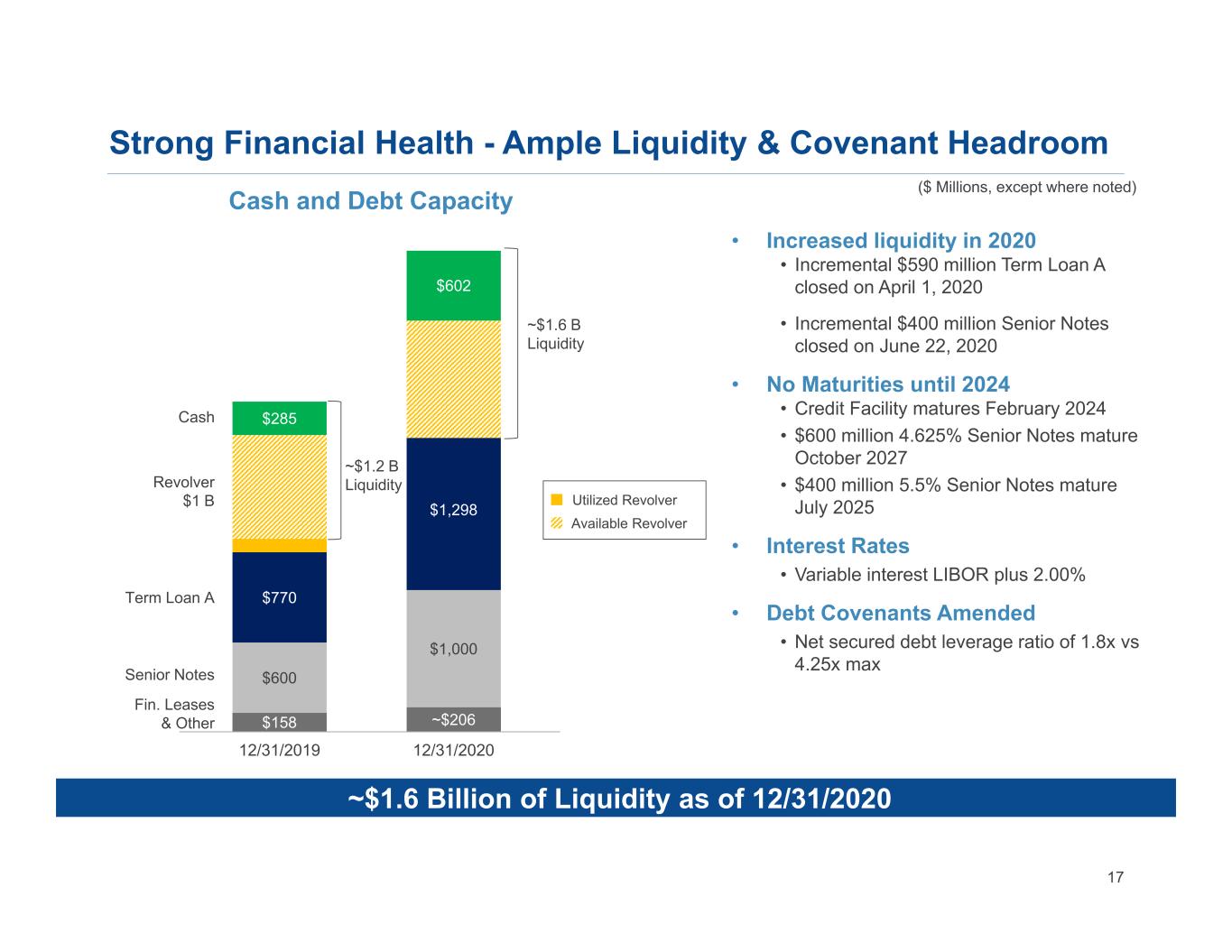

17 $158 ~$206 $600 $1,000 $770 $1,298 $285 $602 12/31/2019 12/31/2020 Senior Notes Term Loan A Revolver $1 B Fin. Leases & Other Cash and Debt Capacity ~$1.6 Billion of Liquidity as of 12/31/2020 Strong Financial Health - Ample Liquidity & Covenant Headroom ($ Millions, except where noted) Cash ~$1.2 B Liquidity Available Revolver Utilized Revolver ~$1.6 B Liquidity • Increased liquidity in 2020 • Incremental $590 million Term Loan A closed on April 1, 2020 • Incremental $400 million Senior Notes closed on June 22, 2020 • No Maturities until 2024 • Credit Facility matures February 2024 • $600 million 4.625% Senior Notes mature October 2027 • $400 million 5.5% Senior Notes mature July 2025 • Interest Rates • Variable interest LIBOR plus 2.00% • Debt Covenants Amended • Net secured debt leverage ratio of 1.8x vs 4.25x max

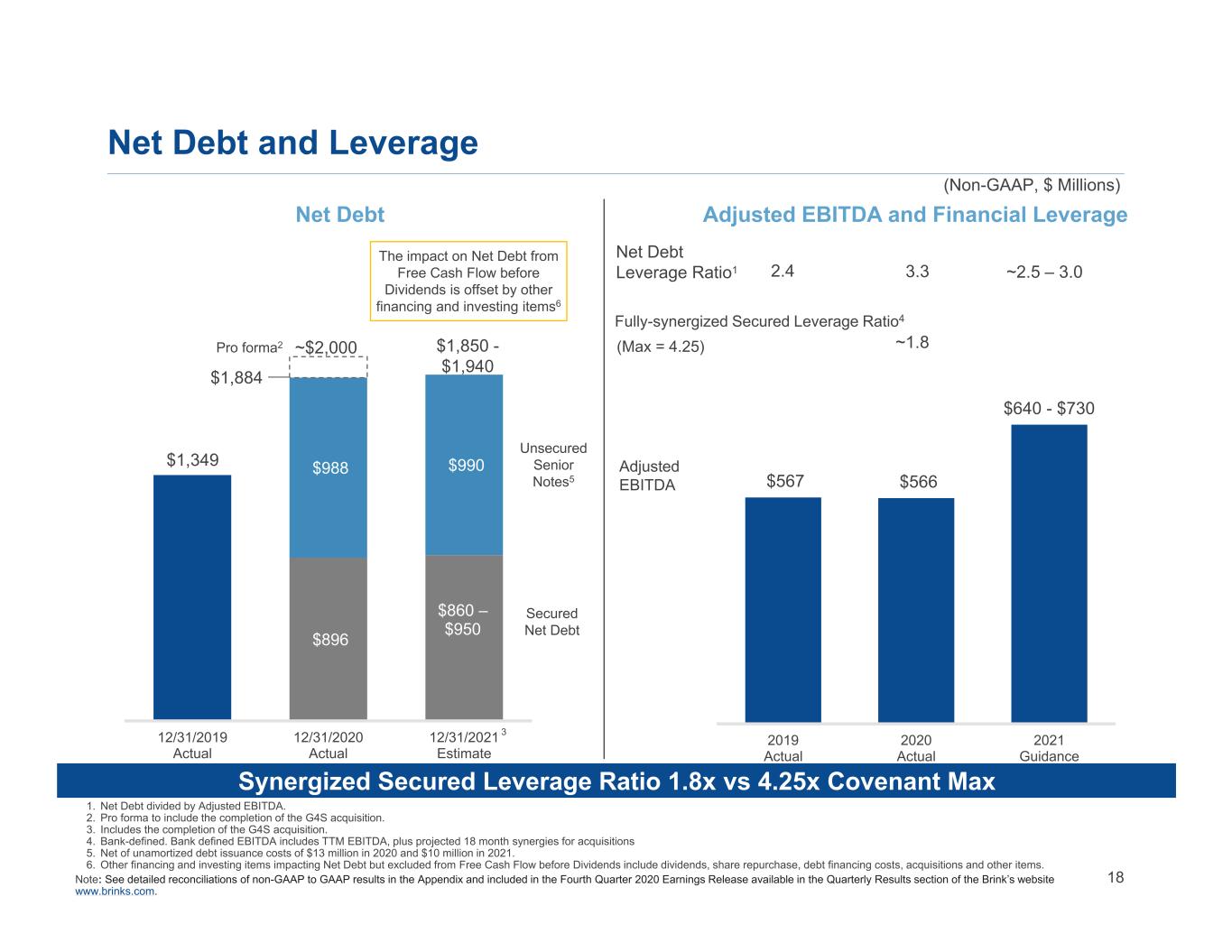

18 $1,349 $896 $860 – $950 $988 $990 12/31/2019 Actual 12/31/2020 Actual 12/31/2021 Estimate Note: See detailed reconciliations of non-GAAP to GAAP results in the Appendix and included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. Net Debt and Leverage $567 $566 $640 - $730 2019 Actual 2020 Actual 2021 Guidance Net Debt Adjusted EBITDA and Financial Leverage Net Debt Leverage Ratio1 2.4 (Non-GAAP, $ Millions) 3.3 1. Net Debt divided by Adjusted EBITDA. 2. Pro forma to include the completion of the G4S acquisition. 3. Includes the completion of the G4S acquisition. 4. Bank-defined. Bank defined EBITDA includes TTM EBITDA, plus projected 18 month synergies for acquisitions 5. Net of unamortized debt issuance costs of $13 million in 2020 and $10 million in 2021. 6. Other financing and investing items impacting Net Debt but excluded from Free Cash Flow before Dividends include dividends, share repurchase, debt financing costs, acquisitions and other items. Adjusted EBITDA Synergized Secured Leverage Ratio 1.8x vs 4.25x Covenant Max (Max = 4.25) Fully-synergized Secured Leverage Ratio4 Unsecured Senior Notes5 Secured Net Debt ~1.8 ~2.5 – 3.0 $1,850 - $1,940 Pro forma2 $1,884 ~$2,000 The impact on Net Debt from Free Cash Flow before Dividends is offset by other financing and investing items6 3

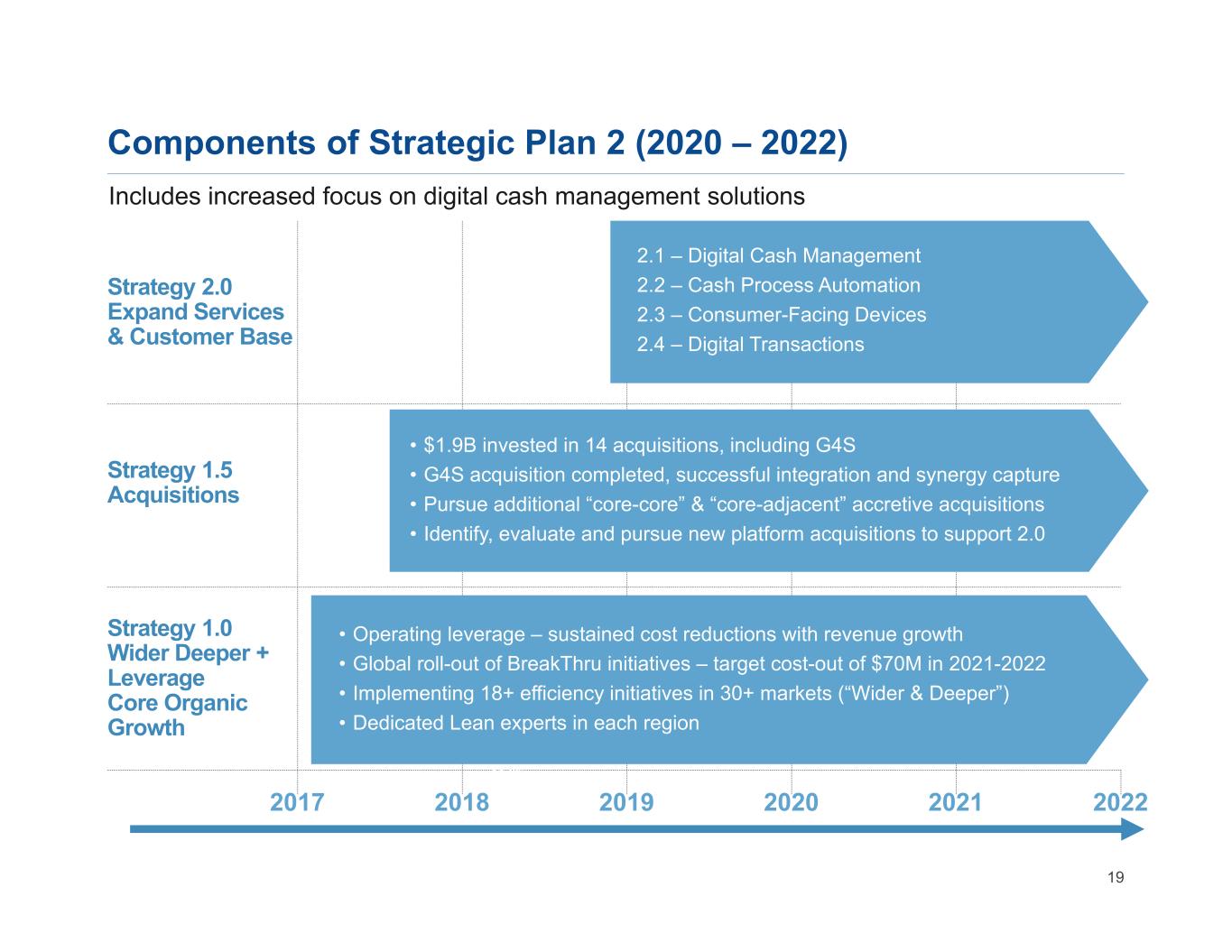

19 Strategy 2.0 Expand Services & Customer Base Strategy 1.5 Acquisitions Strategy 1.0 Wider Deeper + Leverage Core Organic Growth 11.4% Margin 11.0% Margin Components of Strategic Plan 2 (2020 – 2022) 20182017 2019 2020 2021 • Operating leverage – sustained cost reductions with revenue growth • Global roll-out of BreakThru initiatives – target cost-out of $70M in 2021-2022 • Implementing 18+ efficiency initiatives in 30+ markets (“Wider & Deeper”) • Dedicated Lean experts in each region • $1.9B invested in 14 acquisitions, including G4S • G4S acquisition completed, successful integration and synergy capture • Pursue additional “core-core” & “core-adjacent” accretive acquisitions • Identify, evaluate and pursue new platform acquisitions to support 2.0 2.1 – Digital Cash Management 2.2 – Cash Process Automation 2.3 – Consumer-Facing Devices 2.4 – Digital Transactions 2022 Includes increased focus on digital cash management solutions

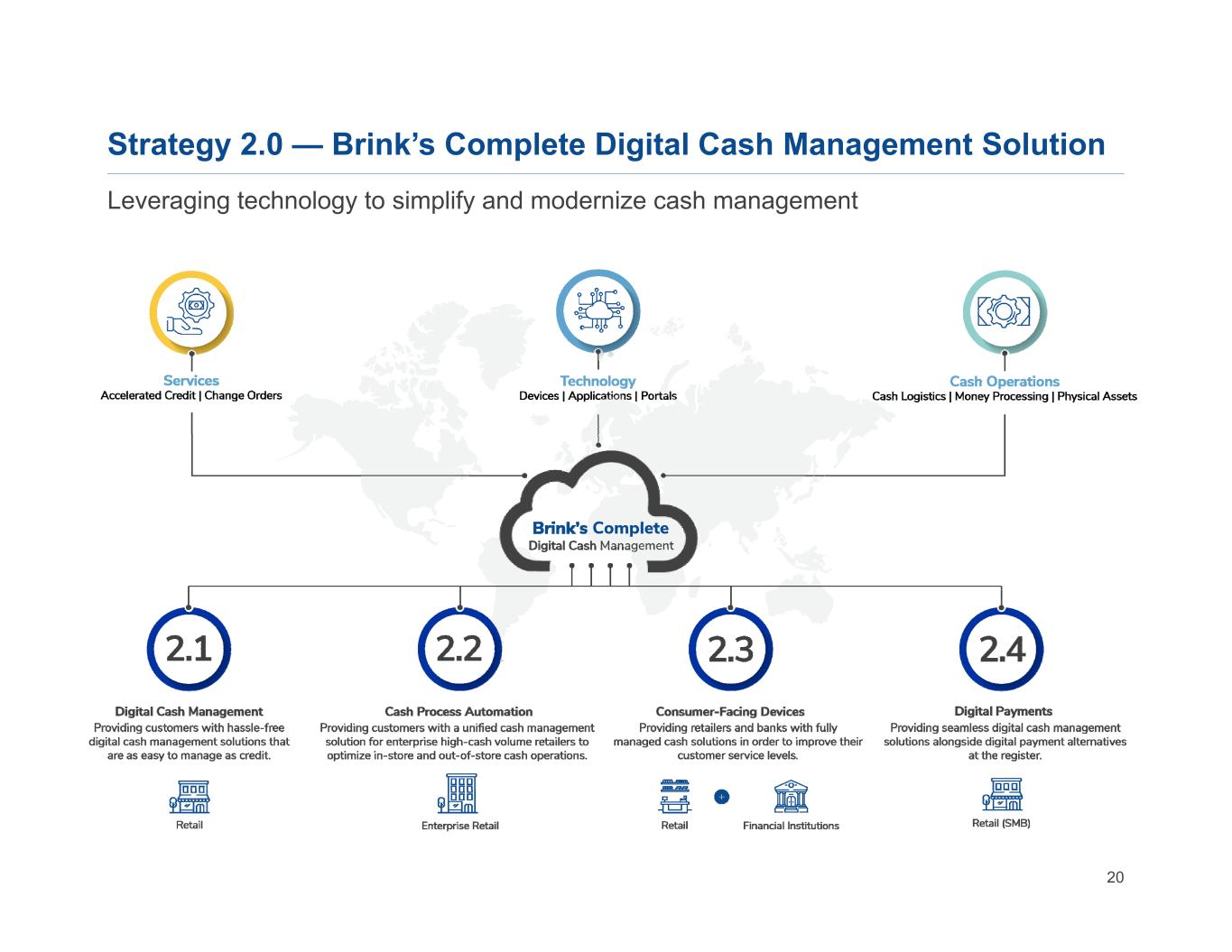

20 Leveraging technology to simplify and modernize cash management Strategy 2.0 — Brink’s Complete Digital Cash Management Solution

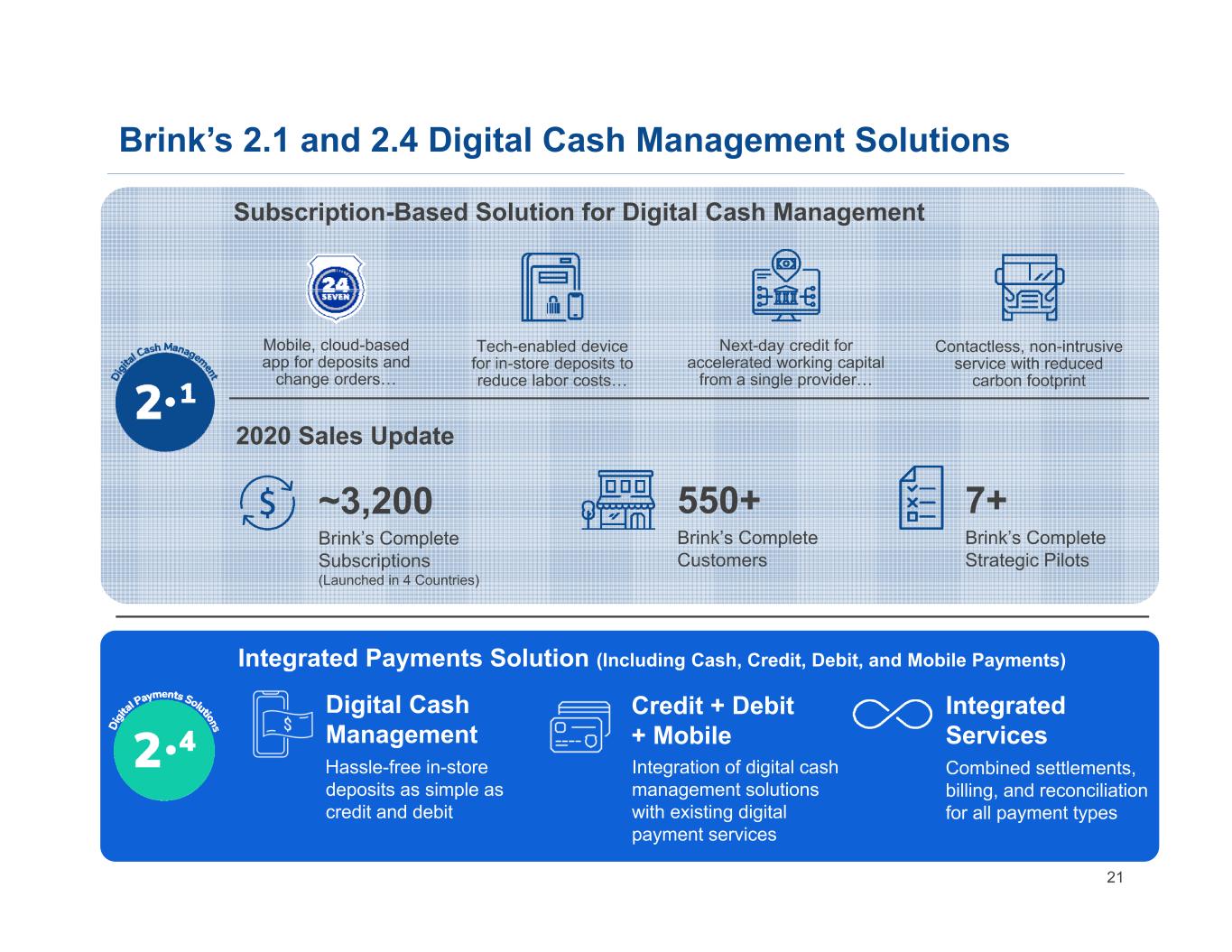

21 Brink’s 2.1 and 2.4 Digital Cash Management Solutions Subscription-Based Solution for Digital Cash Management Tech-enabled device for in-store deposits to reduce labor costs… Next-day credit for accelerated working capital from a single provider… Contactless, non-intrusive service with reduced carbon footprint 2020 Sales Update Integrated Payments Solution (Including Cash, Credit, Debit, and Mobile Payments) Brink’s Complete Subscriptions (Launched in 4 Countries) ~3,200 Brink’s Complete Customers 550+ Brink’s Complete Strategic Pilots 7+ Mobile, cloud-based app for deposits and change orders… Hassle-free in-store deposits as simple as credit and debit Digital Cash Management Integration of digital cash management solutions with existing digital payment services Credit + Debit + Mobile Combined settlements, billing, and reconciliation for all payment types Integrated Services

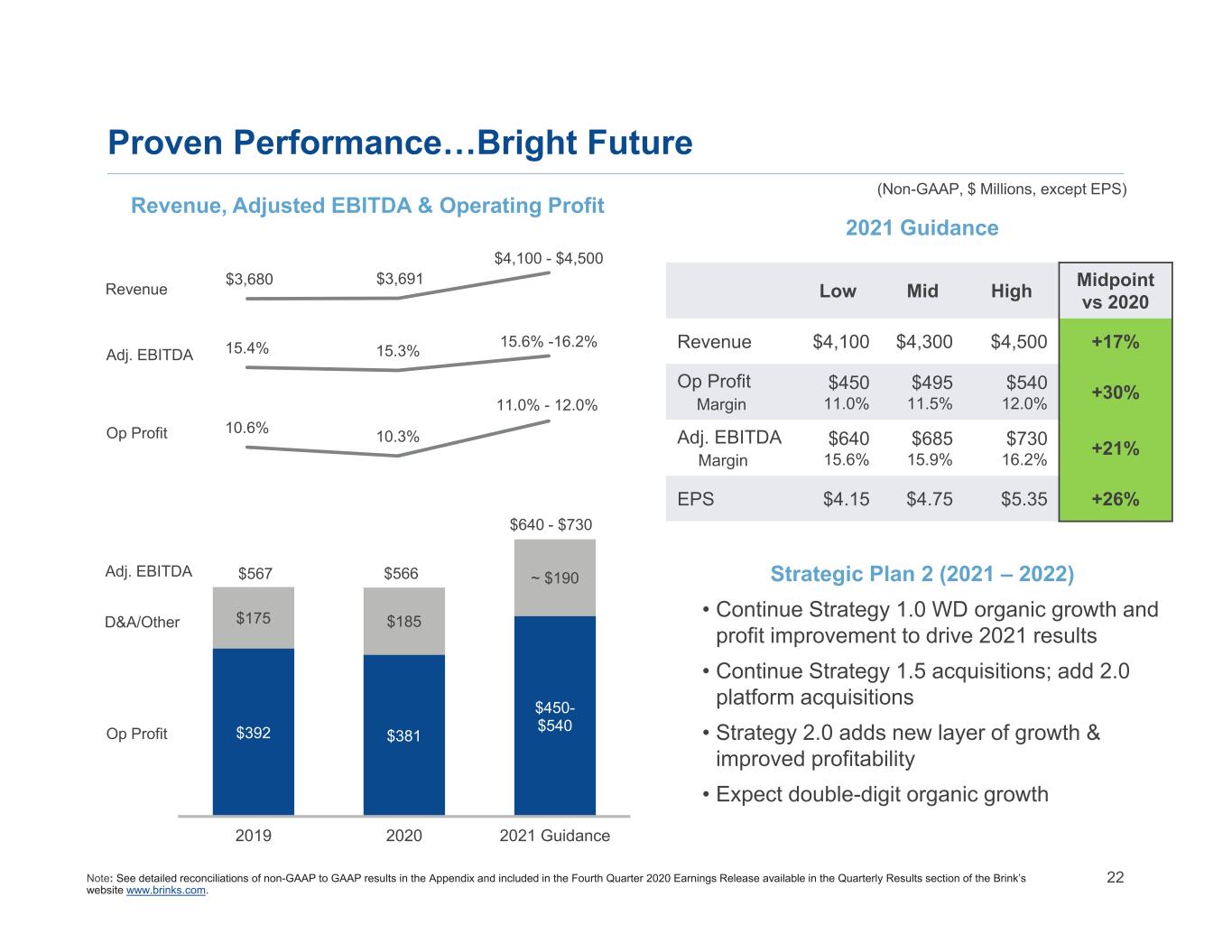

22 $3,680 $3,691 $4,100 - $4,500 $392 $381 $450- $540 $175 $185 ~ $190 2019 2020 2021 Guidance 10.6% 10.3% 11.0% - 12.0% Proven Performance…Bright Future Adj. EBITDA Op Profit D&A/Other Op Profit Adj. EBITDA Revenue, Adjusted EBITDA & Operating Profit (Non-GAAP, $ Millions, except EPS) 2021 Guidance $640 - $730 Low Mid High Midpoint vs 2020 Revenue $4,100 $4,300 $4,500 +17% Op Profit Margin $450 11.0% $495 11.5% $540 12.0% +30% Adj. EBITDA Margin $640 15.6% $685 15.9% $730 16.2% +21% EPS $4.15 $4.75 $5.35 +26% Strategic Plan 2 (2021 – 2022) • Continue Strategy 1.0 WD organic growth and profit improvement to drive 2021 results • Continue Strategy 1.5 acquisitions; add 2.0 platform acquisitions • Strategy 2.0 adds new layer of growth & improved profitability • Expect double-digit organic growth $567 $566 Note: See detailed reconciliations of non-GAAP to GAAP results in the Appendix and included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. 15.4% 15.3% 15.6% -16.2% Revenue

23 Appendix

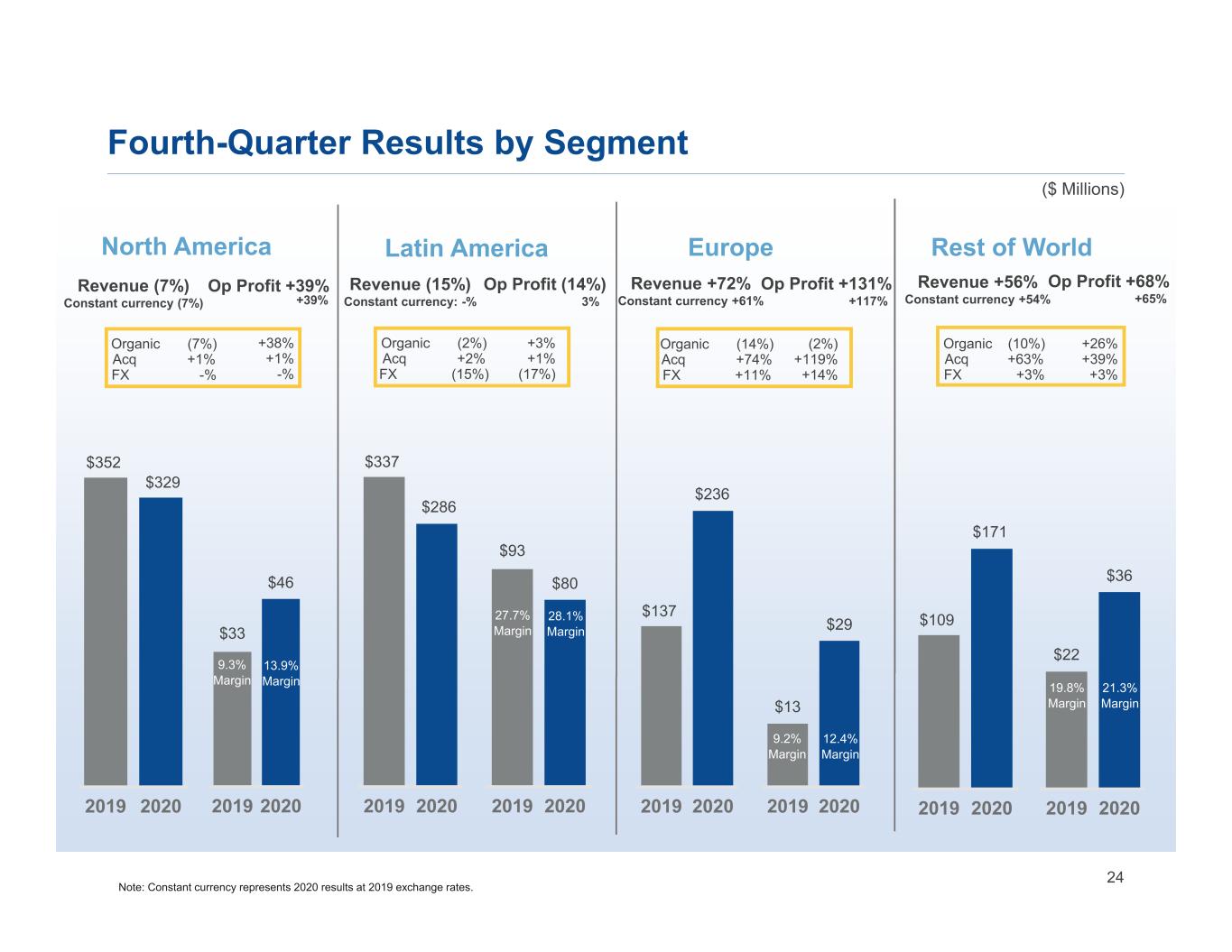

24 Fourth-Quarter Results by Segment ($ Millions) Op Profit +39% +39% Revenue (7%) Constant currency (7%) $352 $329 2019 2020 $33 $46 2019 2020 North America +38% +1% -% Organic (7%) Acq +1% FX -% Op Profit (14%) 3% Revenue (15%) Constant currency: -% $93 $80 2019 2020 Latin America $337 $286 2019 2020 $109 $171 2019 2020 Op Profit +68% +65% Revenue +56% Constant currency +54% $22 $36 2019 2020 Rest of World +26% +39% +3% Organic (10%) Acq +63% FX +3% Note: Constant currency represents 2020 results at 2019 exchange rates. $137 $236 2019 2020 Op Profit +131% +117% Revenue +72% Constant currency +61% $13 $29 2019 2020 Europe +3% +1% (17%) Organic (2%) Acq +2% FX (15%) (2%) +119% +14% Organic (14%) Acq +74% FX +11% 27.7% Margin 28.1% Margin 9.3% Margin 13.9% Margin 9.2% Margin 12.4% Margin 19.8% Margin 21.3% Margin

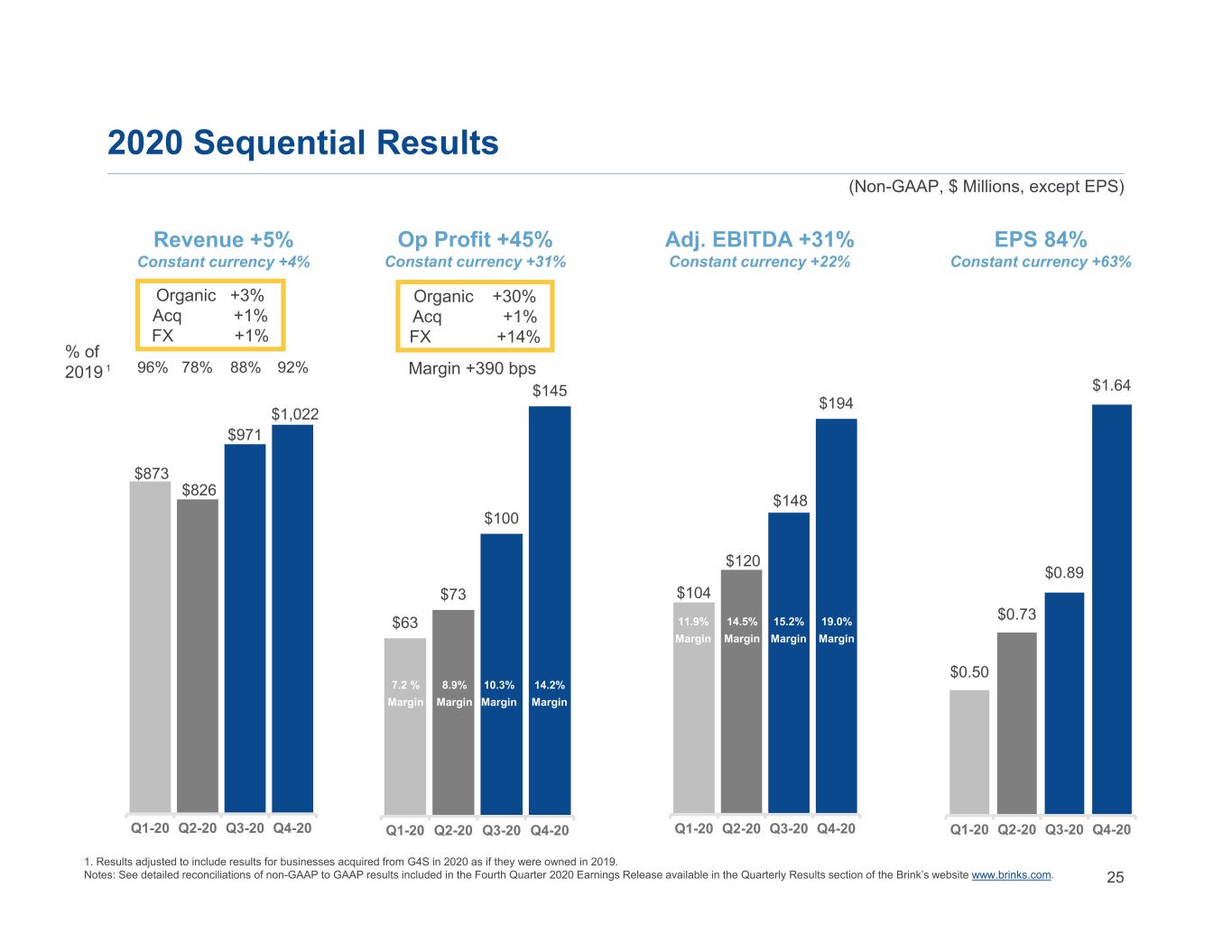

25 Organic +3% Acq +1% FX +1% $873 $826 $971 $1,022 Q1-20 Q2-20 Q3-20 Q4-20 2020 Sequential Results (Non-GAAP, $ Millions, except EPS) $0.50 $0.73 $0.89 $1.64 Q1-20 Q2-20 Q3-20 Q4-20 $104 $120 $148 $194 Q1-20 Q2-20 Q3-20 Q4-20 11.9% Margin $63 $73 $100 $145 Q1-20 Q2-20 Q3-20 Q4-20 7.2 % Margin 14.5% Margin 8.9% Margin 10.3% Margin 15.2% Margin Margin +390 bps Revenue +5% Constant currency +4% EPS 84% Constant currency +63% Adj. EBITDA +31% Constant currency +22% Op Profit +45% Constant currency +31% Organic +30% Acq +1% FX +14% 1. Results adjusted to include results for businesses acquired from G4S in 2020 as if they were owned in 2019. Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. % of 2019 1 78% 88%96% 92% 14.2% Margin 19.0% Margin

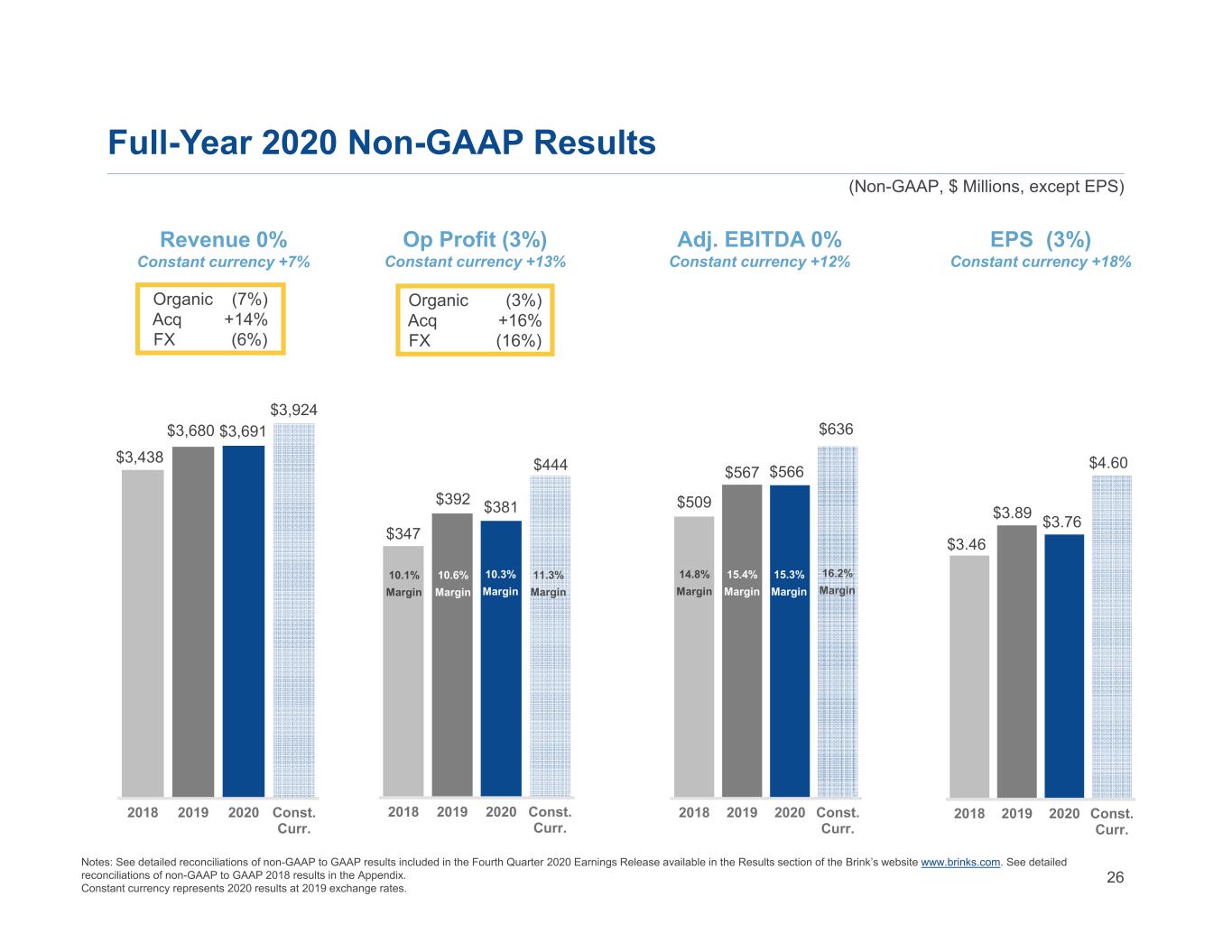

26 $3,438 $3,680 $3,691 $3,924 2018 2019 2020 Const. Curr. Revenue 0% Constant currency +7% Organic (7%) Acq +14% FX (6%) Full-Year 2020 Non-GAAP Results (Non-GAAP, $ Millions, except EPS) EPS (3%) Constant currency +18% $3.46 $3.89 $3.76 $4.60 2018 2019 2020 Const. Curr. Adj. EBITDA 0% Constant currency +12% $509 $567 $566 $636 2018 2019 2020 Const. Curr. 14.8% Margin Op Profit (3%) Constant currency +13% Organic (3%) Acq +16% FX (16%) $347 $392 $381 $444 2018 2019 2020 Const. Curr. 10.1% Margin 15.4% Margin Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2018 results in the Appendix. Constant currency represents 2020 results at 2019 exchange rates. 10.6% Margin 10.3% Margin 15.3% Margin 11.3% Margin 16.2% Margin

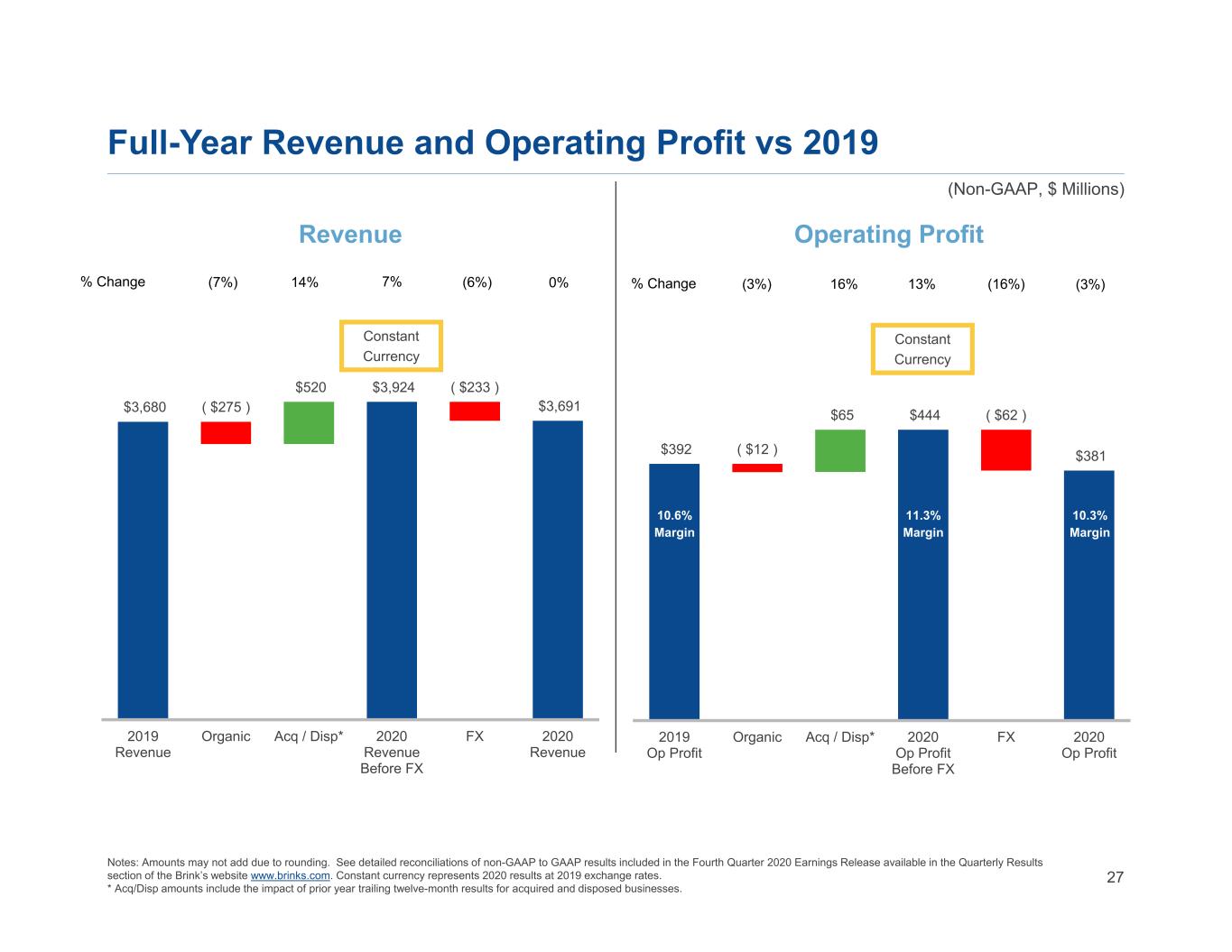

27 Full-Year Revenue and Operating Profit vs 2019 % Change (6%)(7%) 14% 0%7% Constant Currency Constant Currency 8.8% Margin 10.1% Margin % Change (16%)(3%) 16% (3%)13% (Non-GAAP, $ Millions) Revenue Operating Profit Notes: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. Constant currency represents 2020 results at 2019 exchange rates. * Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses. $3,680 ( $275 ) $520 $3,924 ( $233 ) $3,691 2019 Revenue Organic Acq / Disp* 2020 Revenue Before FX FX 2020 Revenue $392 ( $12 ) $65 $444 ( $62 ) $381 2019 Op Profit Organic Acq / Disp* 2020 Op Profit Before FX FX 2020 Op Profit 10.6% Margin 11.3% Margin 10.3% Margin

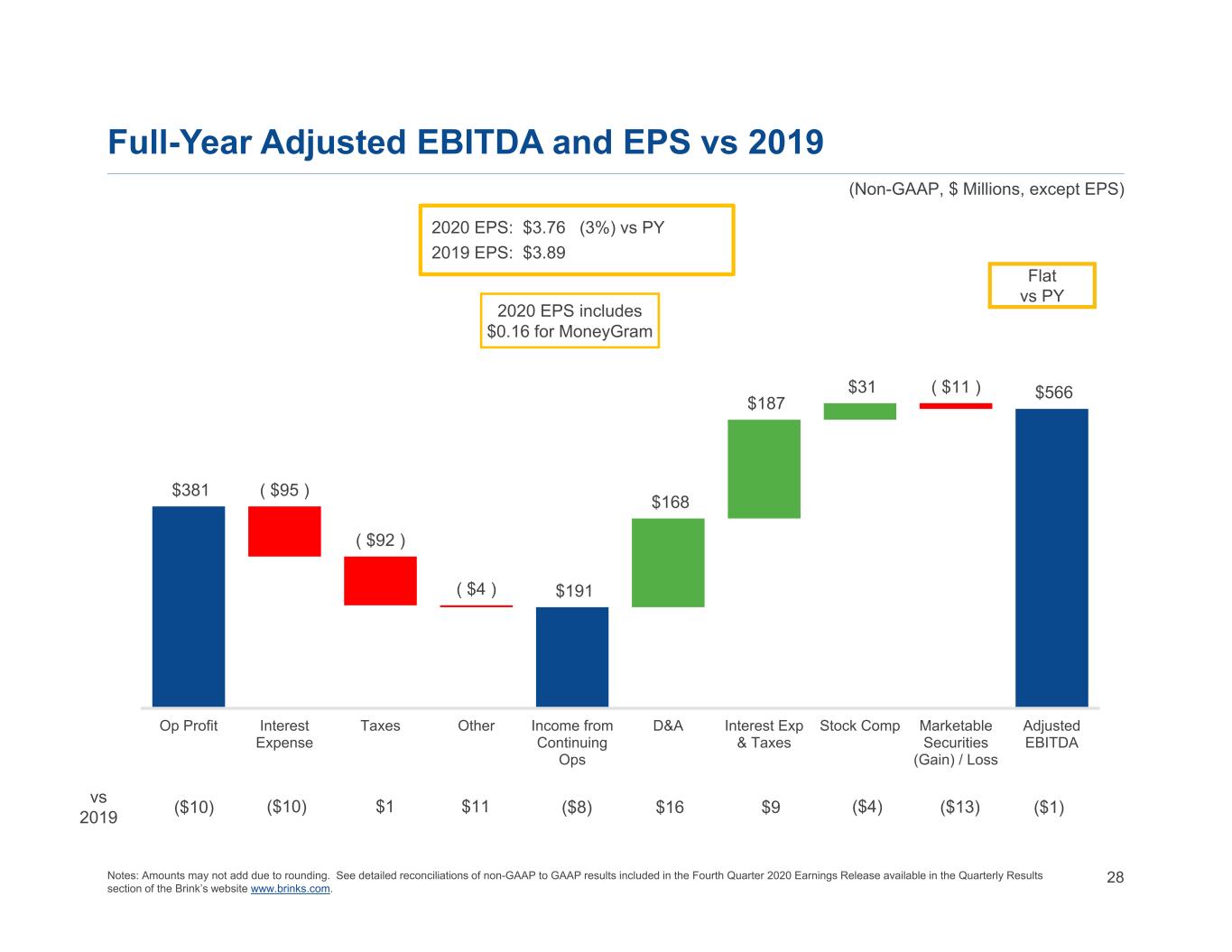

28 $381 ( $95 ) ( $92 ) ( $4 ) $191 $168 $187 $31 ( $11 ) $566 Op Profit Interest Expense Taxes Other Income from Continuing Ops D&A Interest Exp & Taxes Stock Comp Marketable Securities (Gain) / Loss Adjusted EBITDA Full-Year Adjusted EBITDA and EPS vs 2019 2020 EPS: $3.76 (3%) vs PY 2019 EPS: $3.89 (Non-GAAP, $ Millions, except EPS) Flat vs PY Notes: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. ($10)vs2019 ($10) $1 ($8) $16 $9 ($4) ($1)$11 ($13) 2020 EPS includes $0.16 for MoneyGram

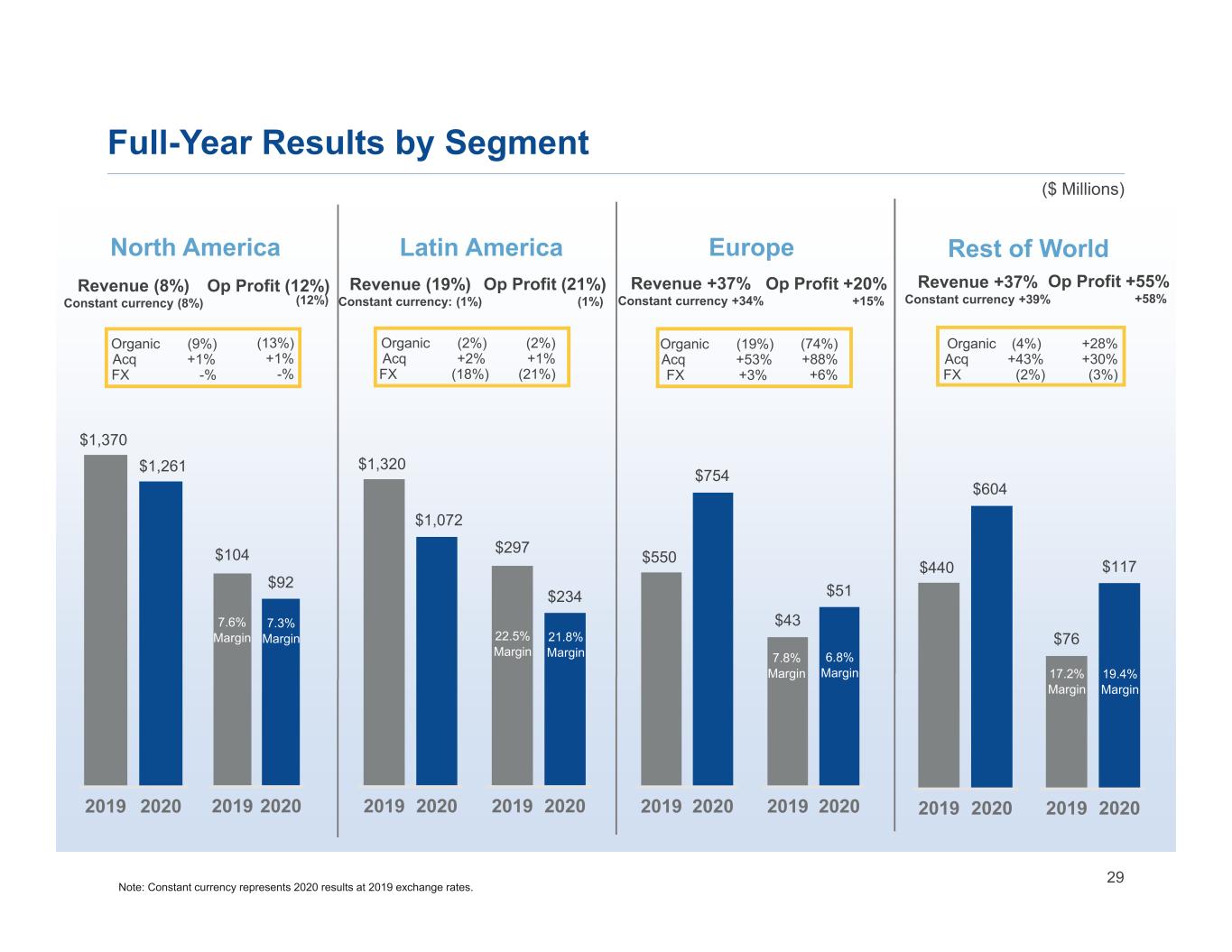

29 Full-Year Results by Segment ($ Millions) Op Profit (12%) (12%) Revenue (8%) Constant currency (8%) $1,370 $1,261 2019 2020 $104 $92 2019 2020 North America (13%) +1% -% Organic (9%) Acq +1% FX -% Op Profit (21%) (1%) Revenue (19%) Constant currency: (1%) $297 $234 2019 2020 Latin America $1,320 $1,072 2019 2020 $440 $604 2019 2020 Op Profit +55% +58% Revenue +37% Constant currency +39% $76 $117 2019 2020 Rest of World +28% +30% (3%) Organic (4%) Acq +43% FX (2%) Note: Constant currency represents 2020 results at 2019 exchange rates. $550 $754 2019 2020 Op Profit +20% +15% Revenue +37% Constant currency +34% $43 $51 2019 2020 Europe (2%) +1% (21%) Organic (2%) Acq +2% FX (18%) (74%) +88% +6% Organic (19%) Acq +53% FX +3% 22.5% Margin 21.8% Margin 7.6% Margin 7.3% Margin 7.8% Margin 6.8% Margin 17.2% Margin 19.4% Margin

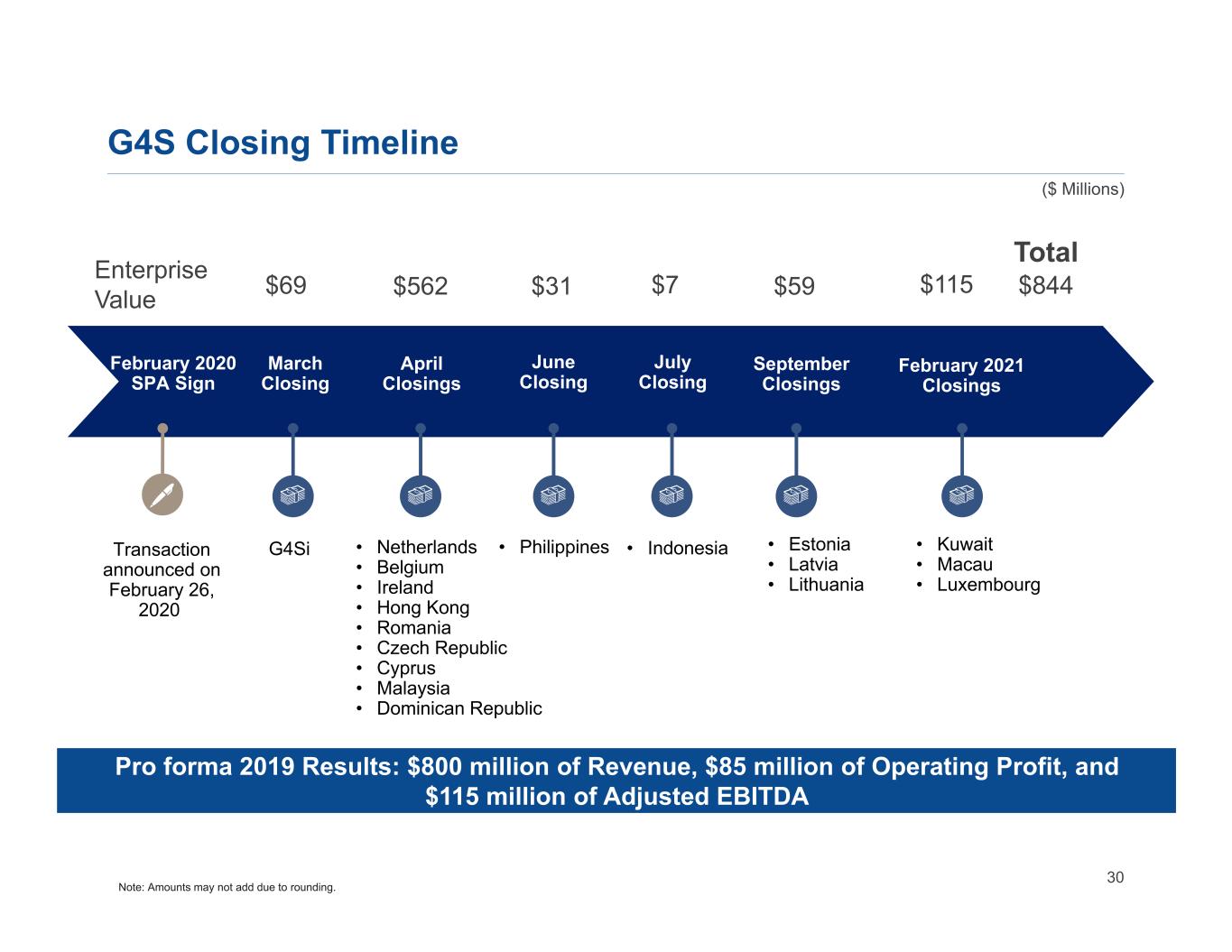

30 G4S Closing Timeline April Closings June Closing • Netherlands • Belgium • Ireland • Hong Kong • Romania • Czech Republic • Cyprus • Malaysia • Dominican Republic February 2020 SPA Sign G4Si March Closing Transaction announced on February 26, 2020 July Closing Enterprise Value $69 $562 $31 $7 $59 $844 Total September Closings • Kuwait • Macau • Luxembourg February 2021 Closings $115 • Philippines • Indonesia • Estonia • Latvia • Lithuania ($ Millions) Note: Amounts may not add due to rounding. Pro forma 2019 Results: $800 million of Revenue, $85 million of Operating Profit, and $115 million of Adjusted EBITDA

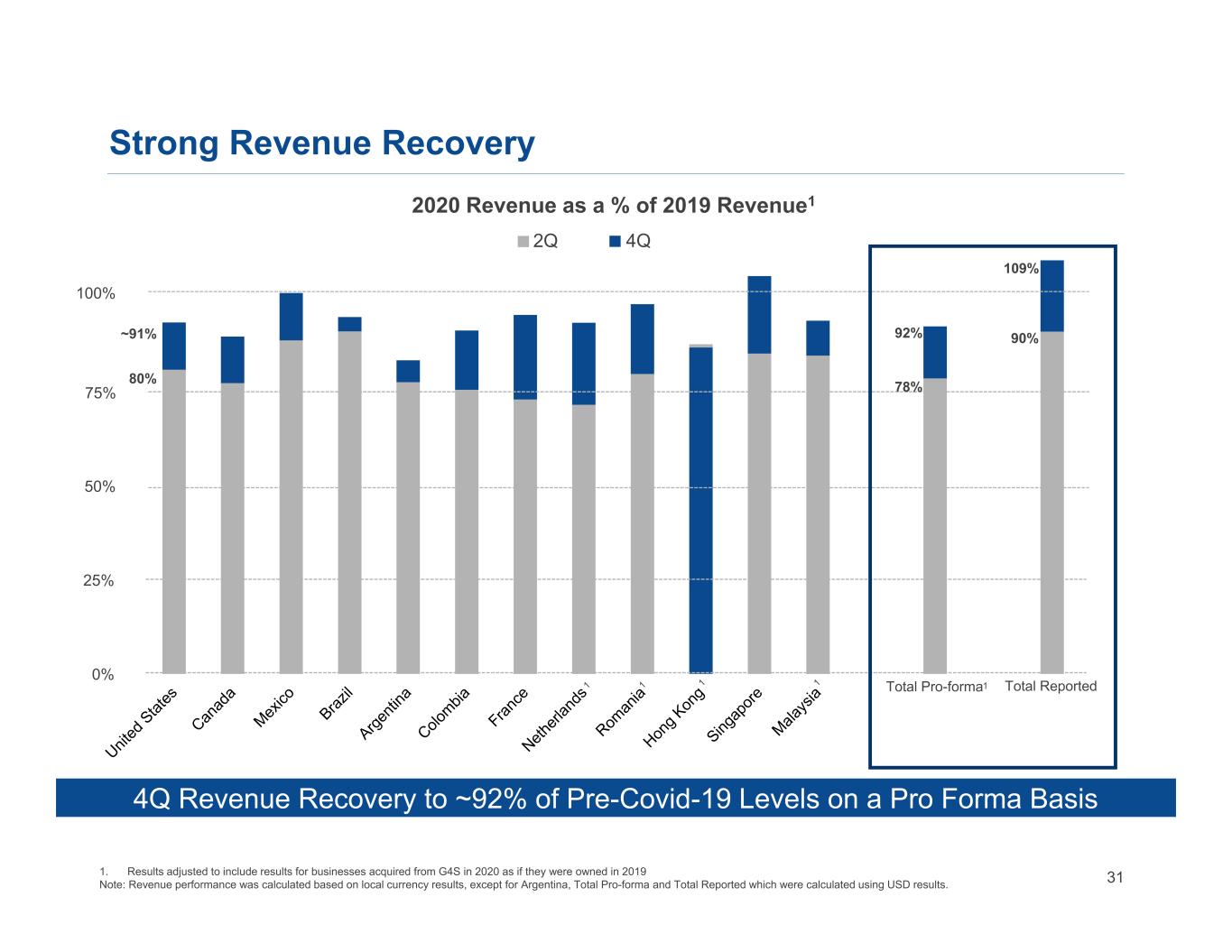

31 4Q Revenue Recovery to ~92% of Pre-Covid-19 Levels on a Pro Forma Basis Strong Revenue Recovery 0% 25% 50% 75% 100% ~91% 80% 109% 90% Total Reported 1. Results adjusted to include results for businesses acquired from G4S in 2020 as if they were owned in 2019 Note: Revenue performance was calculated based on local currency results, except for Argentina, Total Pro-forma and Total Reported which were calculated using USD results. 4Q2Q 2020 Revenue as a % of 2019 Revenue1 92% 78% Total Pro-forma1

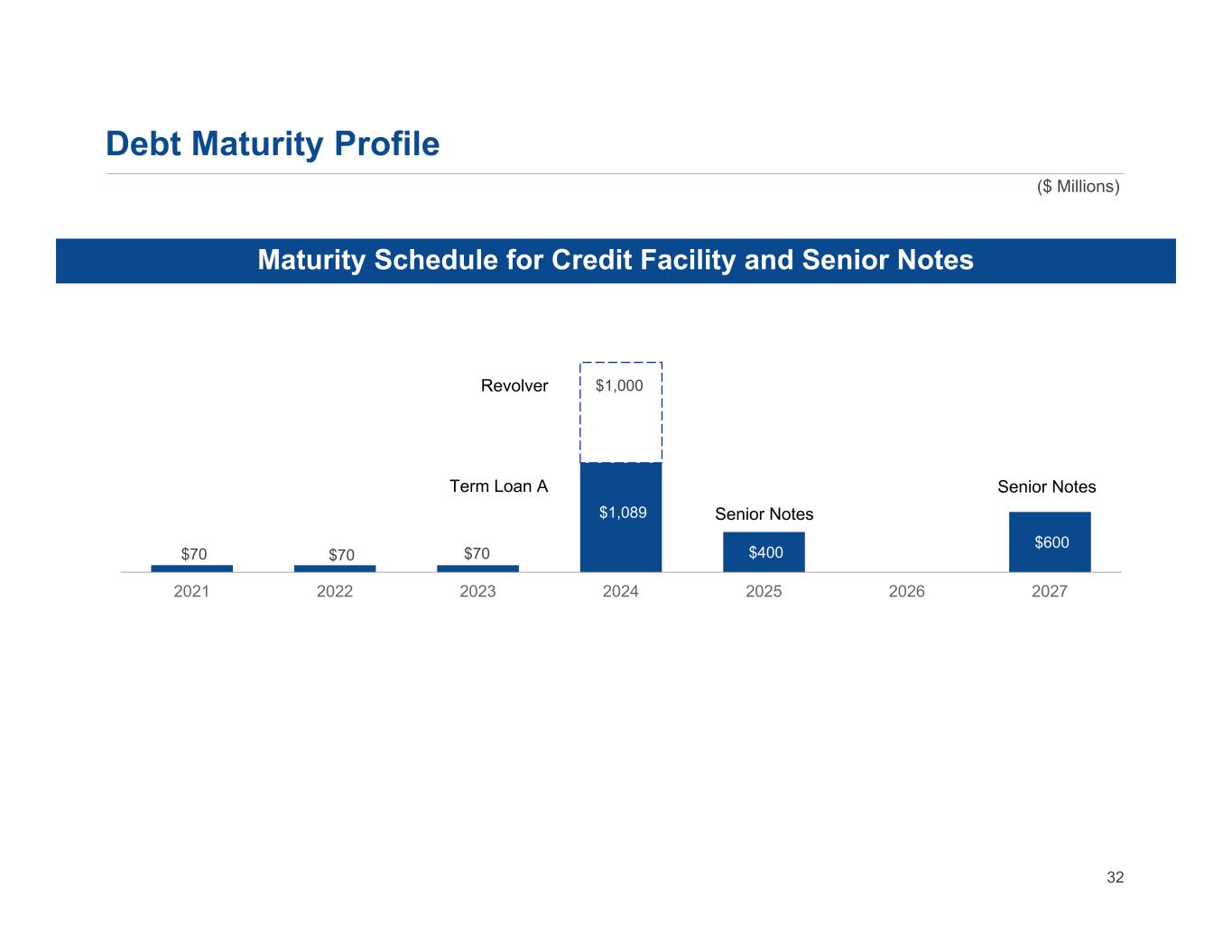

32 Debt Maturity Profile $70 $70 $70 $1,089 $400 $600 $1,000 2021 2022 2023 2024 2025 2026 2027 Term Loan A Senior Notes Revolver Maturity Schedule for Credit Facility and Senior Notes Senior Notes ($ Millions)

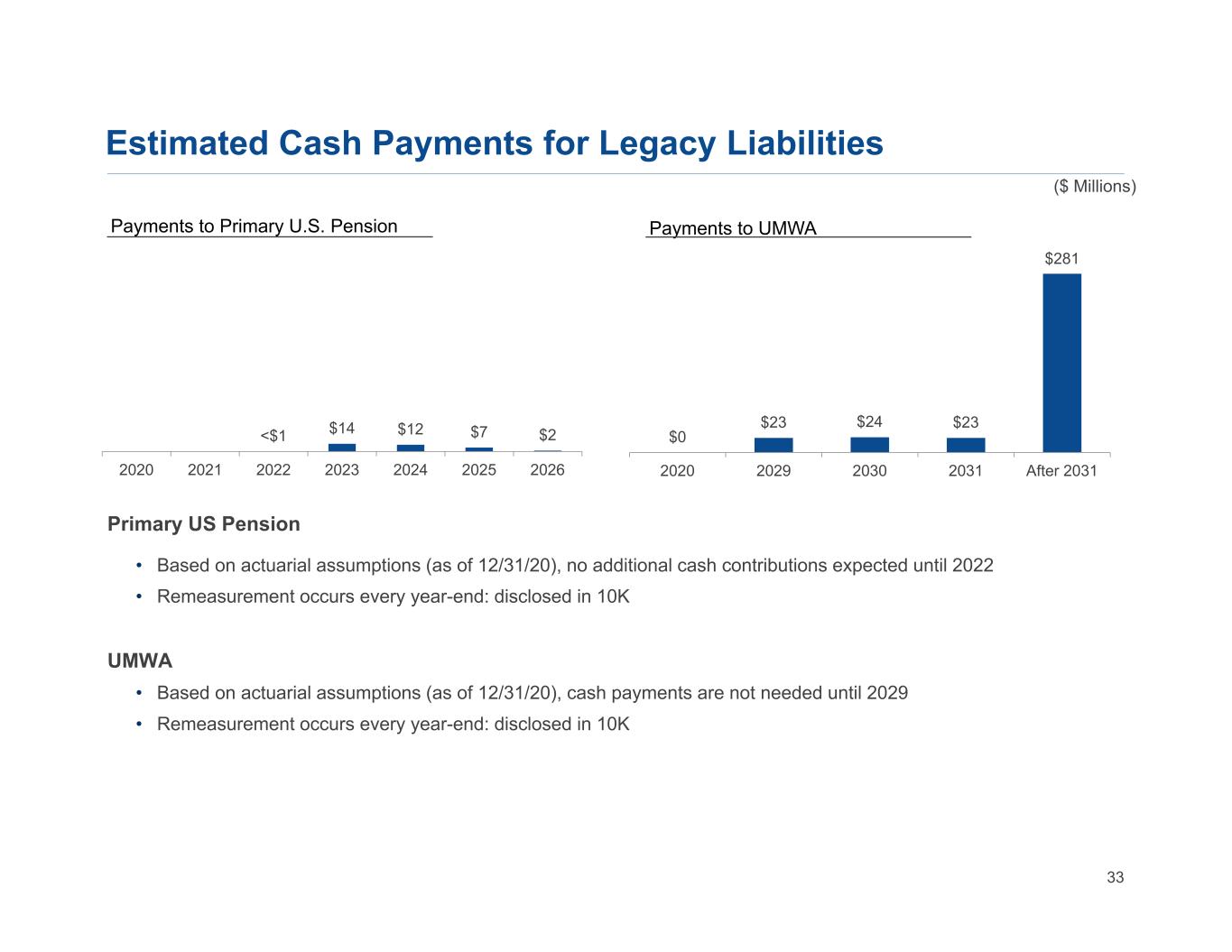

33 Primary US Pension • Based on actuarial assumptions (as of 12/31/20), no additional cash contributions expected until 2022 • Remeasurement occurs every year-end: disclosed in 10K UMWA • Based on actuarial assumptions (as of 12/31/20), cash payments are not needed until 2029 • Remeasurement occurs every year-end: disclosed in 10K Estimated Cash Payments for Legacy Liabilities Payments to Primary U.S. Pension Payments to UMWA ($ Millions) <$1 $14 $12 $7 $2 2020 2021 2022 2023 2024 2025 2026 $0 $23 $24 $23 $281 2020 2029 2030 2031 After 2031

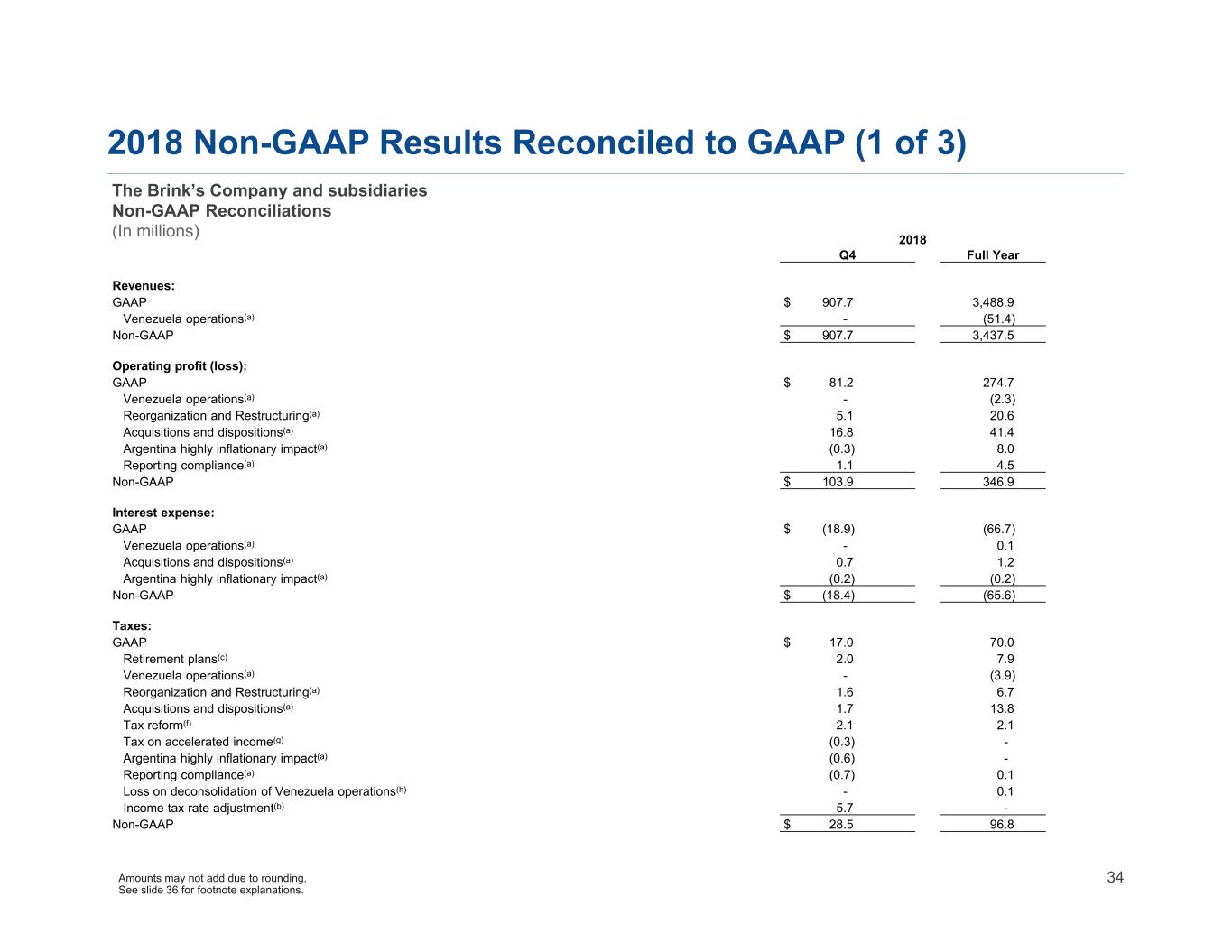

34 2018 Q4 Full Year Revenues: GAAP $ 907.7 3,488.9 Venezuela operations(a) - (51.4) Non-GAAP $ 907.7 3,437.5 Operating profit (loss): GAAP $ 81.2 274.7 Venezuela operations(a) - (2.3) Reorganization and Restructuring(a) 5.1 20.6 Acquisitions and dispositions(a) 16.8 41.4 Argentina highly inflationary impact(a) (0.3) 8.0 Reporting compliance(a) 1.1 4.5 Non-GAAP $ 103.9 346.9 Interest expense: GAAP $ (18.9) (66.7) Venezuela operations(a) - 0.1 Acquisitions and dispositions(a) 0.7 1.2 Argentina highly inflationary impact(a) (0.2) (0.2) Non-GAAP $ (18.4) (65.6) Taxes: GAAP $ 17.0 70.0 Retirement plans(c) 2.0 7.9 Venezuela operations(a) - (3.9) Reorganization and Restructuring(a) 1.6 6.7 Acquisitions and dispositions(a) 1.7 13.8 Tax reform(f) 2.1 2.1 Tax on accelerated income(g) (0.3) - Argentina highly inflationary impact(a) (0.6) - Reporting compliance(a) (0.7) 0.1 Loss on deconsolidation of Venezuela operations(h) - 0.1 Income tax rate adjustment(b) 5.7 - Non-GAAP $ 28.5 96.8 2018 Non-GAAP Results Reconciled to GAAP (1 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) Amounts may not add due to rounding. See slide 36 for footnote explanations.

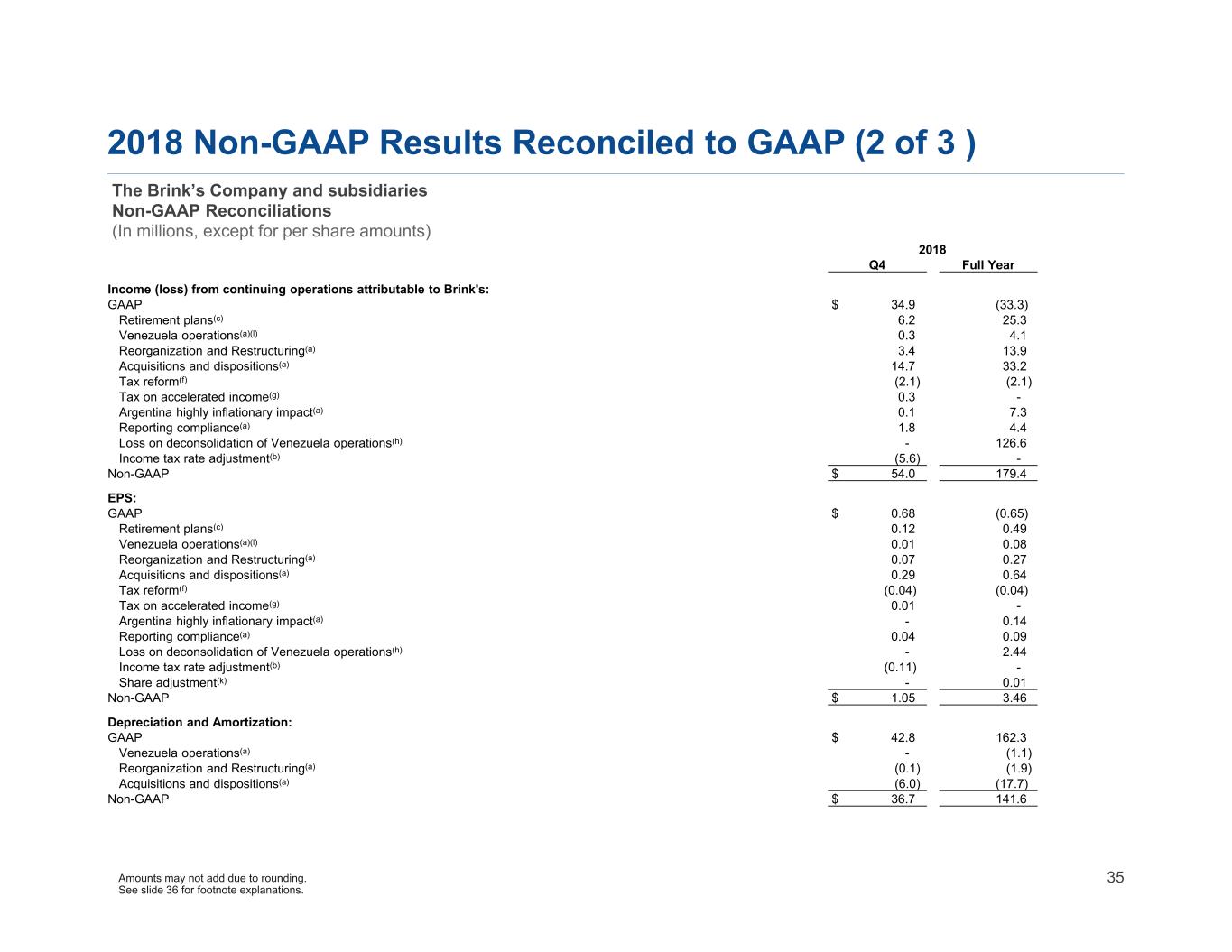

35 2018 Q4 Full Year Income (loss) from continuing operations attributable to Brink's: GAAP $ 34.9 (33.3) Retirement plans(c) 6.2 25.3 Venezuela operations(a)(l) 0.3 4.1 Reorganization and Restructuring(a) 3.4 13.9 Acquisitions and dispositions(a) 14.7 33.2 Tax reform(f) (2.1) (2.1) Tax on accelerated income(g) 0.3 - Argentina highly inflationary impact(a) 0.1 7.3 Reporting compliance(a) 1.8 4.4 Loss on deconsolidation of Venezuela operations(h) - 126.6 Income tax rate adjustment(b) (5.6) - Non-GAAP $ 54.0 179.4 EPS: GAAP $ 0.68 (0.65) Retirement plans(c) 0.12 0.49 Venezuela operations(a)(l) 0.01 0.08 Reorganization and Restructuring(a) 0.07 0.27 Acquisitions and dispositions(a) 0.29 0.64 Tax reform(f) (0.04) (0.04) Tax on accelerated income(g) 0.01 - Argentina highly inflationary impact(a) - 0.14 Reporting compliance(a) 0.04 0.09 Loss on deconsolidation of Venezuela operations(h) - 2.44 Income tax rate adjustment(b) (0.11) - Share adjustment(k) - 0.01 Non-GAAP $ 1.05 3.46 Depreciation and Amortization: GAAP $ 42.8 162.3 Venezuela operations(a) - (1.1) Reorganization and Restructuring(a) (0.1) (1.9) Acquisitions and dispositions(a) (6.0) (17.7) Non-GAAP $ 36.7 141.6 2018 Non-GAAP Results Reconciled to GAAP (2 of 3 ) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions, except for per share amounts) Amounts may not add due to rounding. See slide 36 for footnote explanations.

36 2018 Q4 Full Year Adjusted EBITDA(j): Net income (loss) attributable to Brink's - GAAP $ 34.9 (33.3) Interest expense - GAAP 18.9 66.7 Income tax provision - GAAP 17.0 70.0 Depreciation and amortization - GAAP 42.8 162.3 EBITDA $ 113.6 265.7 Retirement plans(c) 8.2 33.2 Venezuela operations(a)(l) 0.3 (1.0) Reorganization and Restructuring(a) 4.9 18.7 Acquisitions and dispositions(a) 9.7 28.1 Argentina highly inflationary impact(a) (0.3) 7.5 Reporting compliance(a) 1.1 4.5 Loss on deconsolidation of Venezuela operations(h) - 126.7 Income tax rate adjustment(b) 0.1 - Share-based compensation(i) 9.5 28.3 Marketable securities (gain) loss(m) (0.1) (2.7) Adjusted EBITDA $ 147.0 509.0 2018 Non-GAAP Results Reconciled to GAAP (3 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) The 2021 Non-GAAP outlook amounts exclude certain forecasted Non-GAAP adjusting items, such as intangible asset amortization and U.S. retirement plan costs. We have not forecasted the impact of highly inflationary accounting on our Argentina operations in 2021 or other potential Non-GAAP adjusting items for which the timing and amounts are currently under review, such as future restructuring actions. We have also not forecasted changes in cash held for customer obligations or proceeds from the sale of property, equipment and investments in 2021. The 2021 Non-GAAP outlook amounts for operating profit, EPS from continuing operations, free cash flow before dividends and Adjusted EBITDA cannot be reconciled to GAAP without unreasonable effort. We cannot reconcile these amounts to GAAP because we are unable to accurately forecast the impact of highly inflationary accounting on our Argentina operations in 2021 or other potential Non- GAAP adjusting items for which the timing and amounts are currently under review, such as future restructuring actions. We are also unable to forecast changes in cash held for customer obligations or proceeds from the sale of property, equipment and investments in 2021. Amounts may not add due to rounding a) See “Other Items Not Allocated To Segments” on slide 37 for details. We do not consider these items to be reflective of our core operating performance due to the variability of such items from period-to-period in terms of size, nature and significance. b) Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate was 34.2% for 2018 and was 34.2% for 2017. c) Our U.S. retirement plans are frozen and costs related to these plans are excluded from non-GAAP results. Certain non-U.S. operations also have retirement plans. Settlement charges related to these non-U.S. plans are also excluded from non-GAAP results. d) Penalties upon prepayment of Private Placement notes in September 2017 and a term loan in October 2017. e) Related to an unfavorable court ruling in the third quarter of 2017 on a non-income tax claim in Brazil. The court ruled that Brink's must pay interest accruing from the initial claim filing in 1994 to the current date. The principal amount of the claim was approximately $1 million and was recognized in selling, general and administrative expenses in the third quarter of 2017. f) Represents the estimated impact of tax legislation enacted into law in the fourth quarter of 2017. This primarily relates to the U.S. Tax Reform expense from the remeasurement of our net deferred tax assets. The 2018 amount represents a benefit associated with reversing a portion of the 2017 estimated impact as a result of guidance issued by U.S. authorities. g) The non-GAAP tax rate excludes the 2018 and 2017 foreign tax benefits that resulted from the transaction that accelerated U.S. tax in 2015. h) Effective June 30, 2018, we deconsolidated our investment in Venezuelan subsidiaries and recognized a pretax charge of $126.7 million. i) Due to reorganization and restructuring activities, there was a $0.1 million non-GAAP adjustment to share-based compensation in the fourth quarter and full-year of 2018. There is no difference between GAAP and non-GAAP share-based compensation amounts for the other periods presented. j) Adjusted EBITDA is defined as non-GAAP income from continuing operations excluding the impact of non-GAAP interest expense, non-GAAP income tax provision, non-GAAP depreciation and amortization, non-GAAP share-based compensation and non-GAAP marketable securities (gain) loss. In the fourth quarter of 2020, we changed our definition of Adjusted EBITDA to exclude non-GAAP marketable securities (gain) loss and all previously disclosed information for all periods presented has been revised. k) Because we reported a loss from continuing operations on a GAAP basis in the full year 2018, GAAP EPS was calculated using basic shares. However, as we reported income from continuing operations on a non-GAAP basis in the full year 2018, non-GAAP EPS was calculated using diluted shares. l) Post-deconsolidation funding of ongoing costs related to our Venezuelan operations was $0.6 million in the second half of 2018 and was expensed as incurred and reported in interest and other nonoperating income (expense). We do not expect any future funding of the Venezuela business, as long as current U.S. sanctions remain in effect. m) Due to the impact of Argentina highly inflationary accounting, there was a $0.5 million non-GAAP adjustment for a gain in 2018. There is no difference between GAAP and non-GAAP marketable securities gain and losses amounts for the other periods presented.

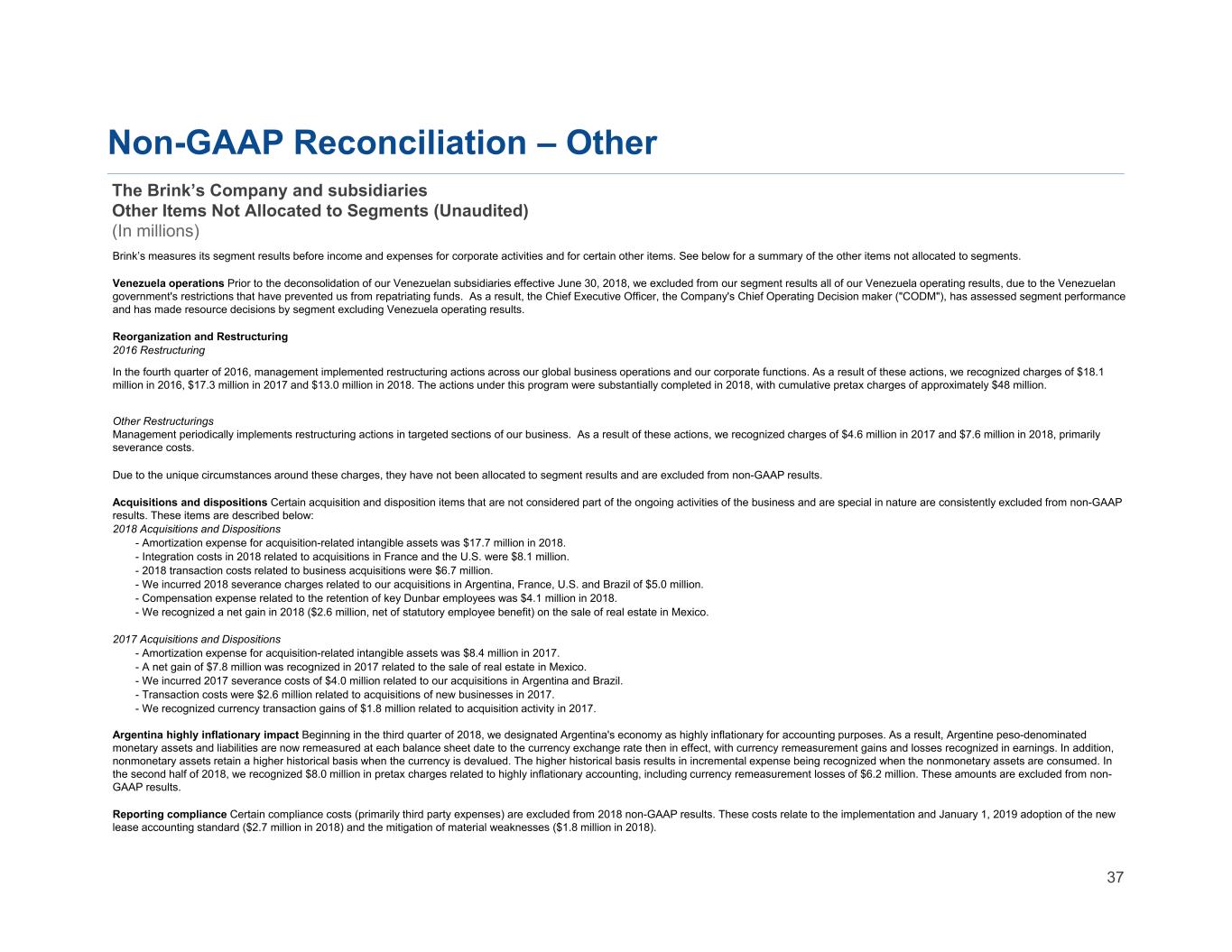

37 Non-GAAP Reconciliation – Other The Brink’s Company and subsidiaries Other Items Not Allocated to Segments (Unaudited) (In millions) Brink’s measures its segment results before income and expenses for corporate activities and for certain other items. See below for a summary of the other items not allocated to segments. Venezuela operations Prior to the deconsolidation of our Venezuelan subsidiaries effective June 30, 2018, we excluded from our segment results all of our Venezuela operating results, due to the Venezuelan government's restrictions that have prevented us from repatriating funds. As a result, the Chief Executive Officer, the Company's Chief Operating Decision maker ("CODM"), has assessed segment performance and has made resource decisions by segment excluding Venezuela operating results. Reorganization and Restructuring 2016 Restructuring In the fourth quarter of 2016, management implemented restructuring actions across our global business operations and our corporate functions. As a result of these actions, we recognized charges of $18.1 million in 2016, $17.3 million in 2017 and $13.0 million in 2018. The actions under this program were substantially completed in 2018, with cumulative pretax charges of approximately $48 million. Other Restructurings Management periodically implements restructuring actions in targeted sections of our business. As a result of these actions, we recognized charges of $4.6 million in 2017 and $7.6 million in 2018, primarily severance costs. Due to the unique circumstances around these charges, they have not been allocated to segment results and are excluded from non-GAAP results. Acquisitions and dispositions Certain acquisition and disposition items that are not considered part of the ongoing activities of the business and are special in nature are consistently excluded from non-GAAP results. These items are described below: 2018 Acquisitions and Dispositions - Amortization expense for acquisition-related intangible assets was $17.7 million in 2018. - Integration costs in 2018 related to acquisitions in France and the U.S. were $8.1 million. - 2018 transaction costs related to business acquisitions were $6.7 million. - We incurred 2018 severance charges related to our acquisitions in Argentina, France, U.S. and Brazil of $5.0 million. - Compensation expense related to the retention of key Dunbar employees was $4.1 million in 2018. - We recognized a net gain in 2018 ($2.6 million, net of statutory employee benefit) on the sale of real estate in Mexico. 2017 Acquisitions and Dispositions - Amortization expense for acquisition-related intangible assets was $8.4 million in 2017. - A net gain of $7.8 million was recognized in 2017 related to the sale of real estate in Mexico. - We incurred 2017 severance costs of $4.0 million related to our acquisitions in Argentina and Brazil. - Transaction costs were $2.6 million related to acquisitions of new businesses in 2017. - We recognized currency transaction gains of $1.8 million related to acquisition activity in 2017. Argentina highly inflationary impact Beginning in the third quarter of 2018, we designated Argentina's economy as highly inflationary for accounting purposes. As a result, Argentine peso-denominated monetary assets and liabilities are now remeasured at each balance sheet date to the currency exchange rate then in effect, with currency remeasurement gains and losses recognized in earnings. In addition, nonmonetary assets retain a higher historical basis when the currency is devalued. The higher historical basis results in incremental expense being recognized when the nonmonetary assets are consumed. In the second half of 2018, we recognized $8.0 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $6.2 million. These amounts are excluded from non- GAAP results. Reporting compliance Certain compliance costs (primarily third party expenses) are excluded from 2018 non-GAAP results. These costs relate to the implementation and January 1, 2019 adoption of the new lease accounting standard ($2.7 million in 2018) and the mitigation of material weaknesses ($1.8 million in 2018).

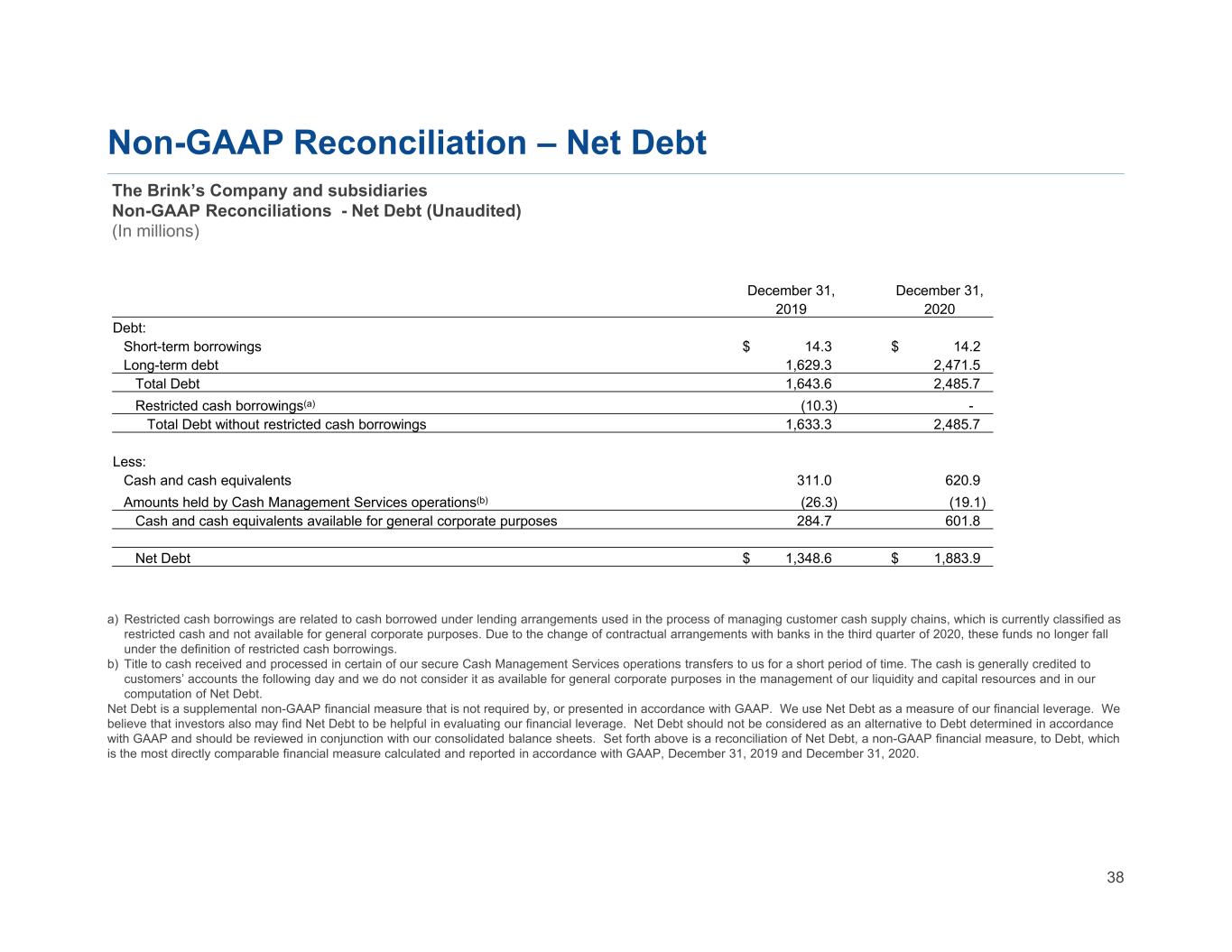

38 Non-GAAP Reconciliation – Net Debt The Brink’s Company and subsidiaries Non-GAAP Reconciliations - Net Debt (Unaudited) (In millions) a) Restricted cash borrowings are related to cash borrowed under lending arrangements used in the process of managing customer cash supply chains, which is currently classified as restricted cash and not available for general corporate purposes. Due to the change of contractual arrangements with banks in the third quarter of 2020, these funds no longer fall under the definition of restricted cash borrowings. b) Title to cash received and processed in certain of our secure Cash Management Services operations transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources and in our computation of Net Debt. Net Debt is a supplemental non-GAAP financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most directly comparable financial measure calculated and reported in accordance with GAAP, December 31, 2019 and December 31, 2020. December 31, December 31, 2019 2020 Debt: Short-term borrowings $ 14.3 $ 14.2 Long-term debt 1,629.3 2,471.5 Total Debt 1,643.6 2,485.7 Restricted cash borrowings(a) (10.3) - Total Debt without restricted cash borrowings 1,633.3 2,485.7 Less: Cash and cash equivalents 311.0 620.9 Amounts held by Cash Management Services operations(b) (26.3) (19.1) Cash and cash equivalents available for general corporate purposes 284.7 601.8 Net Debt $ 1,348.6 $ 1,883.9