Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Ouster, Inc. | d123656dex993.htm |

| EX-99.2 - EX-99.2 - Ouster, Inc. | d123656dex992.htm |

| 8-K - 8-K - Ouster, Inc. | d123656d8k.htm |

investors.ouster.com Shareholder vote: March 9th Exhibit 99.1

Disclaimers About this Presentation This investor presentation (this “Presentation”) does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination between Ouster, Inc. (“Ouster”) and Colonnade Acquisition Corp. (“Colonnade”) or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Colonnade, Ouster, or any of their respective affiliates. No such offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. Forward Looking Statements This Presentation contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed business combination between Ouster and Colonnade, including statements regarding the benefits of the business combination, preliminary financial information and the anticipated timing of the business combination and projected future results of Ouster’s business. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “forecast,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the risk that the business combination may not be completed in a timely manner or at all, which may adversely affect the price of Colonnade’s securities, (ii) the risk that the business combination may not be completed by Colonnade’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Colonnade, (iii) the failure to satisfy the conditions to the consummation of the business combination, including the adoption of the merger agreement relating to the business combination (the “Merger Agreement”) by the shareholders of Colonnade and Ouster, the satisfaction of the minimum cash condition under the Merger Agreement and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third-party valuation in determining whether or not to pursue the proposed business combination, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the effect of the announcement or pendency of the business combination on Ouster’s business relationships, performance and business generally, (vii) risks that the proposed business combination disrupts current plans of Ouster and potential difficulties in Ouster employee retention as a result of the proposed business combination, (viii) the outcome of any legal proceedings that may be instituted against Ouster or against Colonnade related to the Merger Agreement or the proposed business combination, (ix) the ability to maintain the listing of Colonnade’s securities on the New York Stock Exchange, (x) the price of Colonnade’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Ouster plans to operate, variations in performance across competitors, changes in laws and regulations affecting Ouster’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities, and (xii) the risk of downturns in the highly competitive lidar technology and related industries. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Colonnade’s definitive proxy statement/prospectus discussed below and other documents filed by Colonnade from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Ouster and Colonnade assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Ouster nor Colonnade gives any assurance that either Ouster or Colonnade will achieve its expectations. Use of Projections This Presentation contains financial forecasts for Ouster with respect to certain financial results for Ouster’s fiscal years 2020 through 2025. Neither Colonnade’s nor Ouster’s independent auditors have audited, studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Ouster or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Preliminary Financial Information This Presentation contains financial forecasts for Ouster with respect to certain financial results for Ouster’s fiscal years 2020 through 2025. Neither Colonnade’s nor Ouster’s independent auditors have audited, studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Ouster or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

Disclaimers Non-GAAP Financial Measures This Presentation also includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) including, but not limited to, Adjusted EBITDA and certain ratios and other metrics derived therefrom. Ouster defines EBITDA as net income (loss) before interest and other income and expenses, taxes, depreciation and amortization, and stock-based compensation expense. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing Ouster’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Ouster’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. Colonnade and Ouster believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Ouster’s financial condition and results of operations. Colonnade and Ouster believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing Ouster’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. This Presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Colonnade and Ouster are unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included. Industry and Market Data In this Presentation, Colonnade and Ouster rely on and refer to certain information and statistics obtained from third-party sources which they believe to be reliable. Neither Colonnade nor Ouster has independently verified the accuracy or completeness of any such third-party information. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but Colonnade and Ouster will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Additional Information and Where to Find It Colonnade has filed a registration statement on Form S-4 with the SEC, which includes a definitive proxy statement/prospectus, that is both the proxy statement that has been distributed to holders of Colonnade’s ordinary shares in connection with its solicitation of proxies for the vote by Colonnade’s shareholders with respect to the proposed business combination and other matters as may be described in the registration statement, as well as the prospectus relating to the offer and sale of the securities to be issued in the business combination. Colonnade has mailed a definitive proxy statement/prospectus and other relevant documents to its shareholders. This document does not contain all the information that should be considered concerning the proposed business combination and is not intended to form the basis of any investment decision or any other decision in respect of the business combination. Colonnade’s shareholders, Ouster’s stockholders and other interested persons are advised to read the definitive proxy statement/prospectus and other documents filed in connection with the proposed business combination, as these materials will contain important information about Ouster, Colonnade and the business combination. The definitive proxy statement/prospectus and other relevant materials for the proposed business combination have been mailed to shareholders of Colonnade as of a record date established for voting on the proposed business combination. Colonnade shareholders and Ouster stockholders can also obtain copies of the definitive proxy statement and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to Colonnade’s secretary at 1400 Centrepark Blvd, Suite 810, West Palm Beach, FL 33401, (561) 712-7860. Participants in the Solicitation Colonnade and its directors and executive officers may be deemed participants in the solicitation of proxies from Colonnade’s shareholders with respect to the proposed business combination. A list of the names of those directors and executive officers and a description of their interests in Colonnade is contained in the definitive proxy statement/prospectus, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov. Ouster and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Colonnade in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination is included in the definitive proxy statement/prospectus for the proposed business combination.

Strategic customer agreement with Plus Plus is a supplier of autonomous trucking technology Binding agreement Minimum purchase commitment of 2,000 sensors Currently projected non-binding forecast of 160,000 sensors over next 5 years

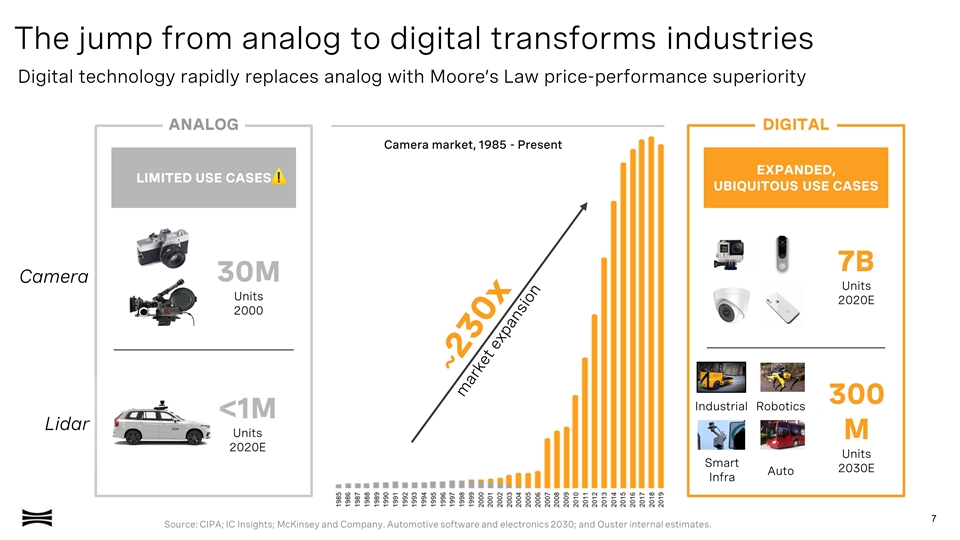

Digital technology rapidly replaces analog with Moore’s Law price-performance superiority ANALOG DIGITAL The jump from analog to digital transforms industries LIMITED USE CASES EXPANDED, UBIQUITOUS USE CASES Camera Lidar Industrial Robotics Smart Infra Auto 7B Units 2020E 300M Units 2030E 30M Units 2000 <1M Units 2020E Camera market, 1985 - Present ~230x market expansion Source: CIPA; IC Insights; McKinsey and Company. Automotive software and electronics 2030; and Ouster internal estimates.

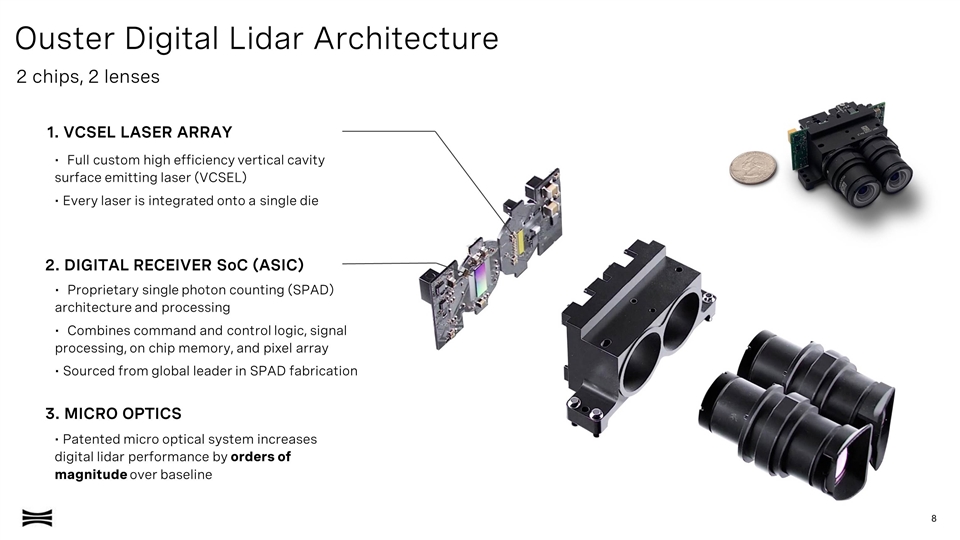

Ouster Digital Lidar Architecture 1. VCSEL LASER ARRAY 2. DIGITAL RECEIVER SoC (ASIC) • Proprietary single photon counting (SPAD) architecture and processing • Combines command and control logic, signal processing, on chip memory, and pixel array • Sourced from global leader in SPAD fabrication • Full custom high efficiency vertical cavity surface emitting laser (VCSEL) • Every laser is integrated onto a single die • Patented micro optical system increases digital lidar performance by orders of magnitude over baseline 3. MICRO OPTICS 2 chips, 2 lenses

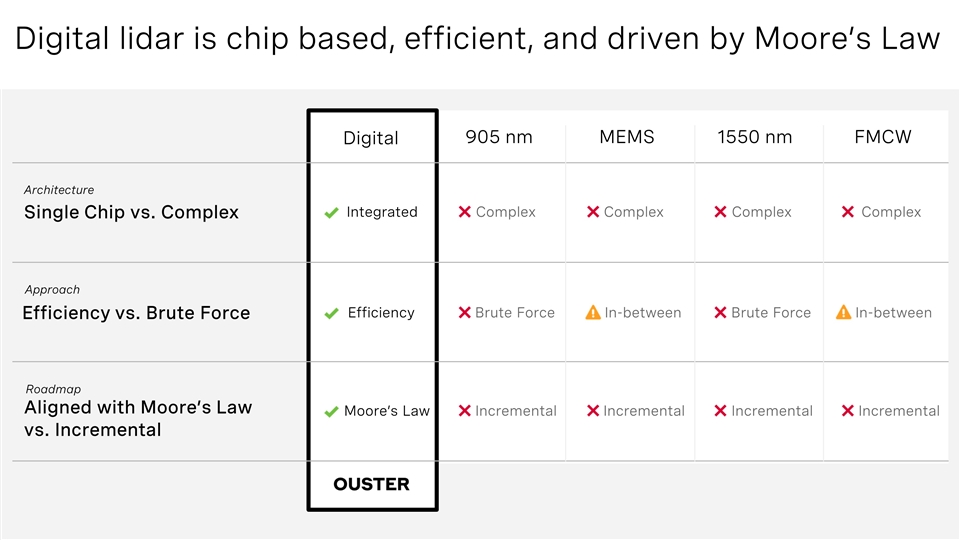

FMCW Digital 905 nm MEMS Single Chip vs. Complex 1550 nm Digital lidar is chip based, efficient, and driven by Moore’s Law Efficiency vs. Brute Force Aligned with Moore’s Law vs. Incremental Integrated Complex Complex Complex Complex Efficiency Brute Force In-between Brute Force In-between Moore’s Law Incremental Incremental Incremental Incremental Architecture Approach Roadmap

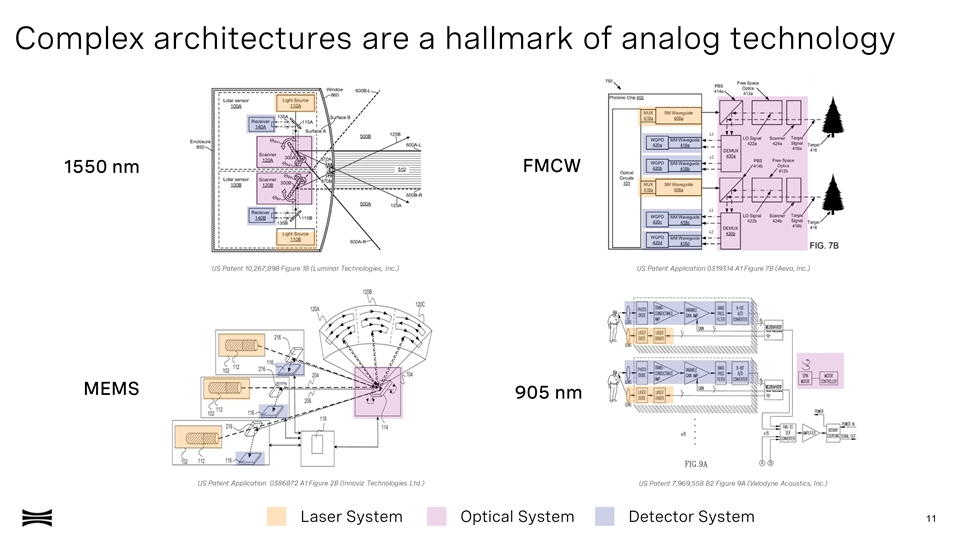

Complex architectures are a hallmark of analog technology 1550 nm FMCW MEMS 905 nm US Patent 10,267,898 Figure 18 (Luminar Technologies, Inc.) Laser System Detector System Optical System US Patent Application 0386872 A1 Figure 2B (Innoviz Technologies Ltd.) US Patent Application 0319314 A1 Figure 7B (Aeva, Inc.) US Patent 7,969,558 B2 Figure 9A (Velodyne Acoustics, Inc.)

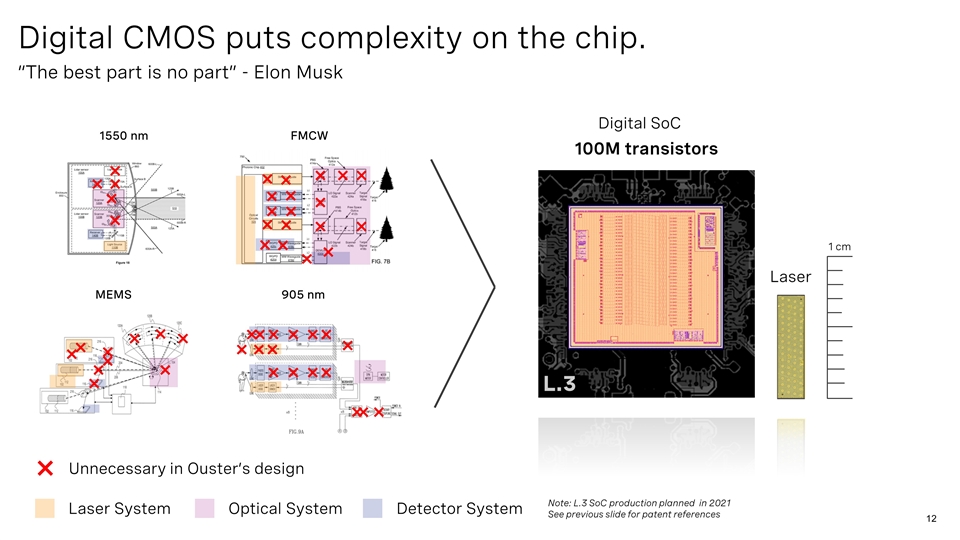

1550 nm FMCW MEMS 905 nm Laser System Detector System Optical System Digital CMOS puts complexity on the chip. 100M transistors L.3 Unnecessary in Ouster’s design Digital SoC Laser 1 cm “The best part is no part” - Elon Musk Note: L.3 SoC production planned in 2021 See previous slide for patent references

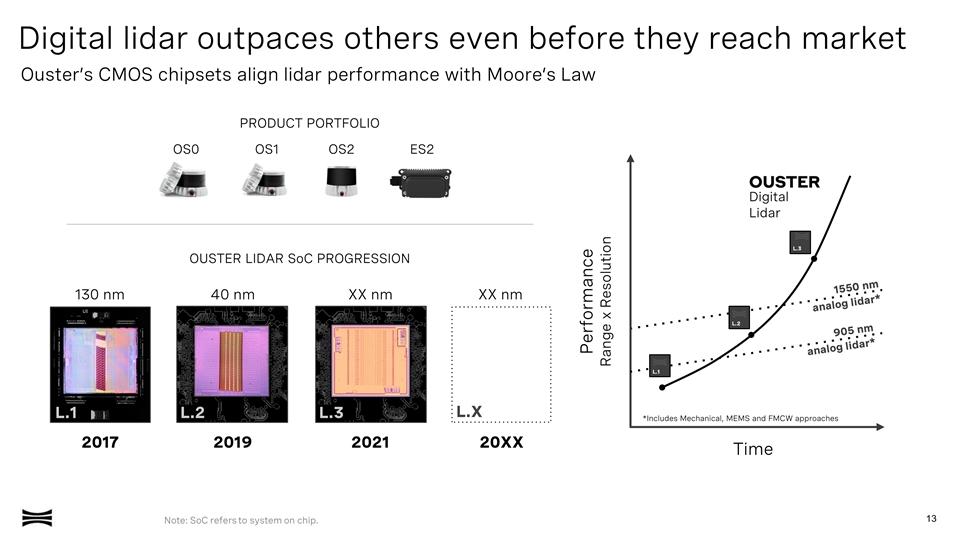

Digital lidar outpaces others even before they reach market OS0 OS1 OS2 ES2 PRODUCT PORTFOLIO Performance Range x Resolution Time 905 nm analog lidar* Digital Lidar *Includes Mechanical, MEMS and FMCW approaches 130 nm L.1 L.2 L.3 40 nm XX nm OUSTER LIDAR SoC PROGRESSION L.1 L.2 L.3 1550 nm analog lidar* 2017 2019 2021 20XX L.X XX nm Note: SoC refers to system on chip. Ouster’s CMOS chipsets align lidar performance with Moore’s Law

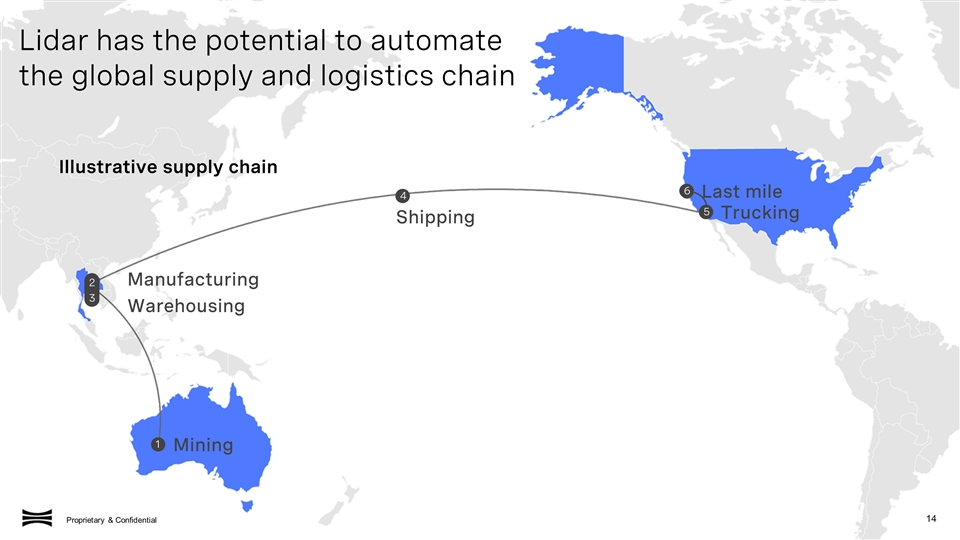

Mining 1 Manufacturing Trucking 5 Last mile 6 Shipping 4 2 Warehousing Lidar has the potential to automate the global supply and logistics chain Illustrative supply chain 3

Lidar type Short-range Mid-range Quantity on-vehicle 3 - 4 1 - 2 Range Field of View (H x V) 0 - 50 meters 0 - 100 meters 180° x 90° 180° x 45° Mining Automation Note: Vehicles are meant as representations of common configurations, not indicative of current customers

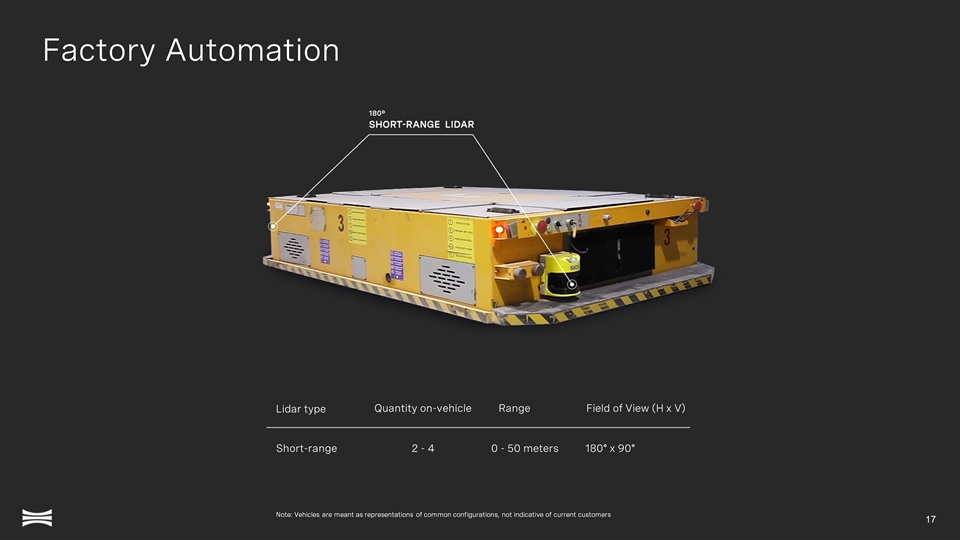

Lidar type Quantity on-vehicle Range Field of View (H x V) Short-range 2 - 4 0 - 50 meters 180° x 90° Factory Automation Note: Vehicles are meant as representations of common configurations, not indicative of current customers

Warehouse Automation Lidar type Short-range Mid-range Quantity on-vehicle 3 - 4 1 - 2 Range Field of View (H x V) 0 - 50 meters 0 - 100 meters 180° x 90° 180° x 45° Note: Vehicles are meant as representations of common configurations, not indicative of current customers

Port Automation Lidar type Quantity on-vehicle Range Field of View (H x V) Mid-range 1 - 2 0 - 100 meters 360° x 45° Note: Vehicles are meant as representations of common configurations, not indicative of current customers

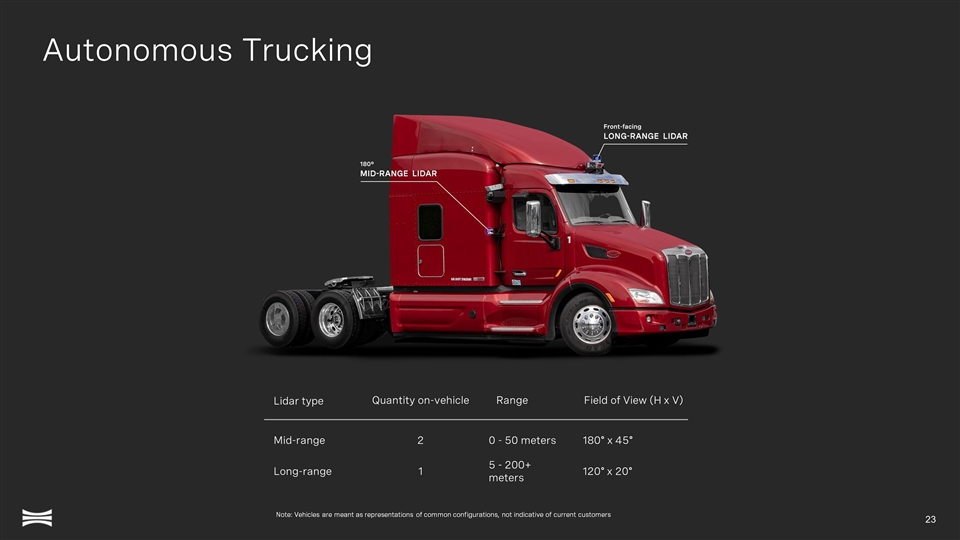

Lidar type Mid-range Long-range Quantity on-vehicle 2 1 Range Field of View (H x V) 0 - 50 meters 5 - 200+ meters 180° x 45° 120° x 20° Autonomous Trucking Note: Vehicles are meant as representations of common configurations, not indicative of current customers

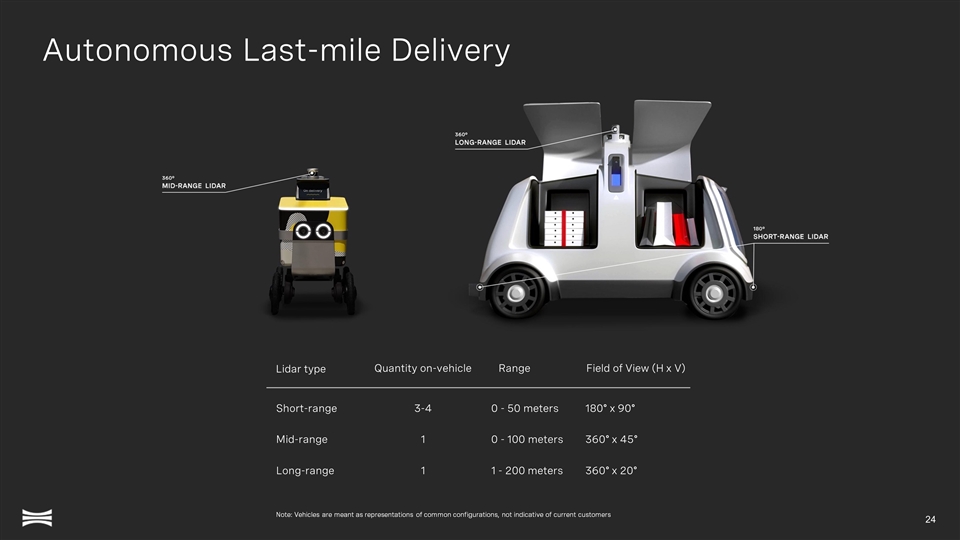

Autonomous Last-mile Delivery Lidar type Quantity on-vehicle Range Field of View (H x V) Short-range Mid-range 3-4 1 0 - 50 meters 0 - 100 meters 180° x 90° 360° x 45° Long-range 1 1 - 200 meters 360° x 20° Note: Vehicles are meant as representations of common configurations, not indicative of current customers

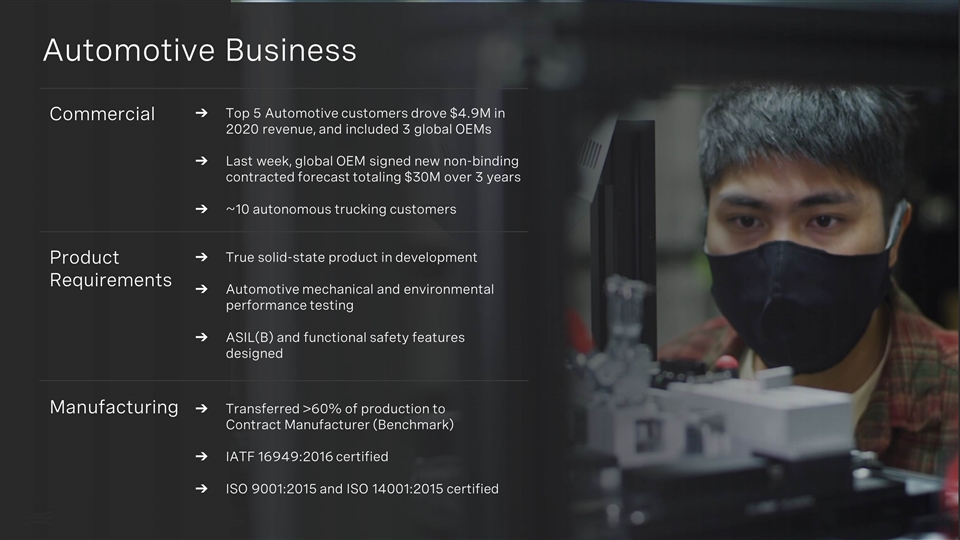

Automotive Business Product Requirements Manufacturing Transferred >60% of production to Contract Manufacturer (Benchmark) IATF 16949:2016 certified ISO 9001:2015 and ISO 14001:2015 certified True solid-state product in development Automotive mechanical and environmental performance testing ASIL(B) and functional safety features designed Commercial Top 5 Automotive customers drove $4.9M in 2020 revenue, and included 3 global OEMs Last week, global OEM signed new non-binding contracted forecast totaling $30M over 3 years ~10 autonomous trucking customers

Ouster’s perspective on automotive lidar Automakers want a package of lidar sensors, not just one. Price will be a key differentiator between winners and losers in auto We expect gross margins to match the auto industry, not tech 1. 2. 3.

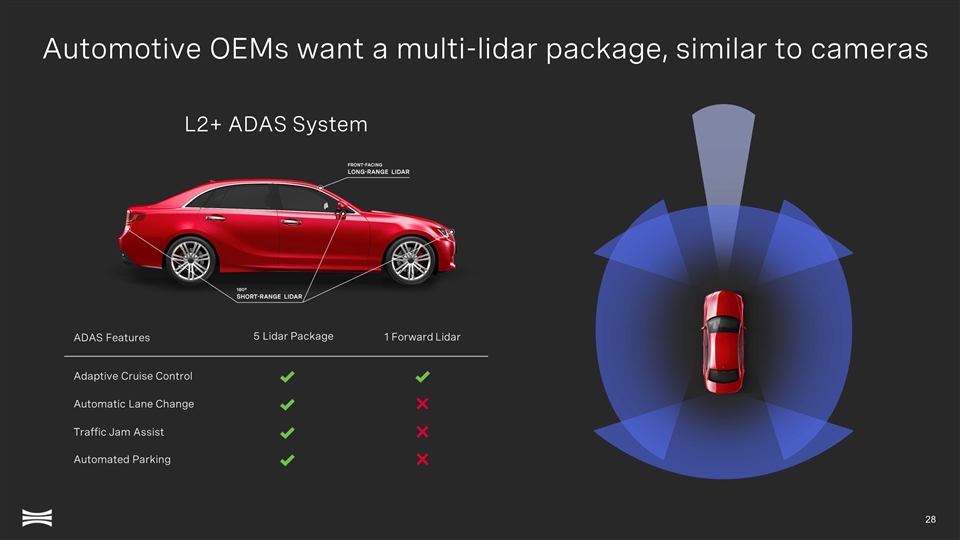

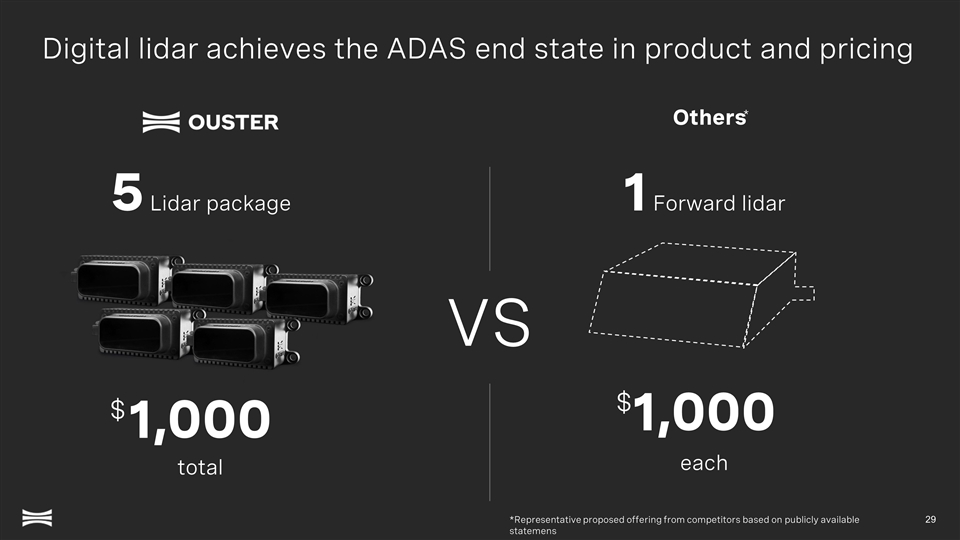

Automotive OEMs want a multi-lidar package, similar to cameras L2+ ADAS System ADAS Features Traffic Jam Assist 5 Lidar Package 1 Forward Lidar Automated Parking Adaptive Cruise Control Automatic Lane Change

Digital lidar achieves the ADAS end state in product and pricing 1 Forward lidar 1,000 5 Lidar package total 1,000 each $ $ VS Others * *Representative proposed offering from competitors based on publicly available statemens

Financial Overview

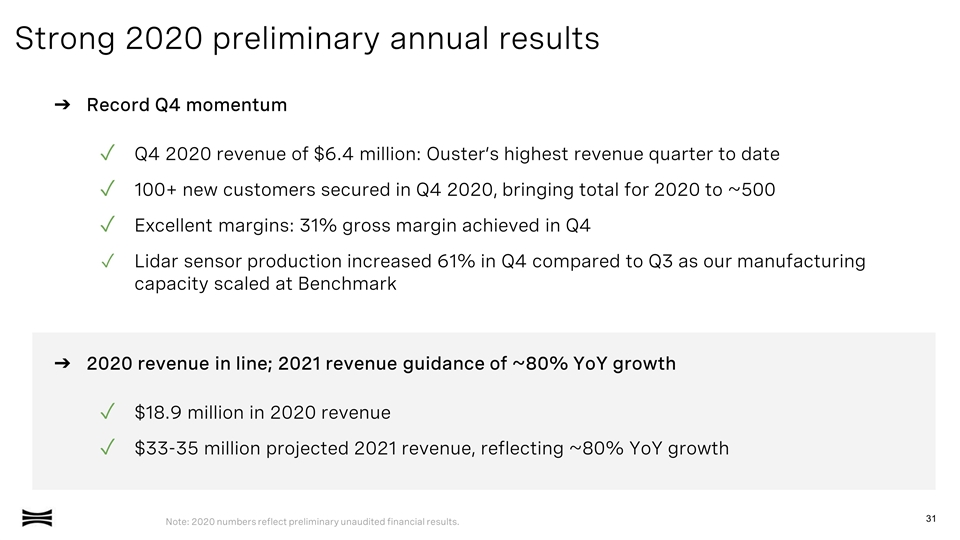

Record Q4 momentum Q4 2020 revenue of $6.4 million: Ouster’s highest revenue quarter to date 100+ new customers secured in Q4 2020, bringing total for 2020 to ~500 Excellent margins: 31% gross margin achieved in Q4 Lidar sensor production increased 61% in Q4 compared to Q3 as our manufacturing capacity scaled at Benchmark 2020 revenue in line; 2021 revenue guidance of ~80% YoY growth $18.9 million in 2020 revenue $33-35 million projected 2021 revenue, reflecting ~80% YoY growth Strong 2020 preliminary annual results Note: 2020 numbers reflect preliminary unaudited financial results.

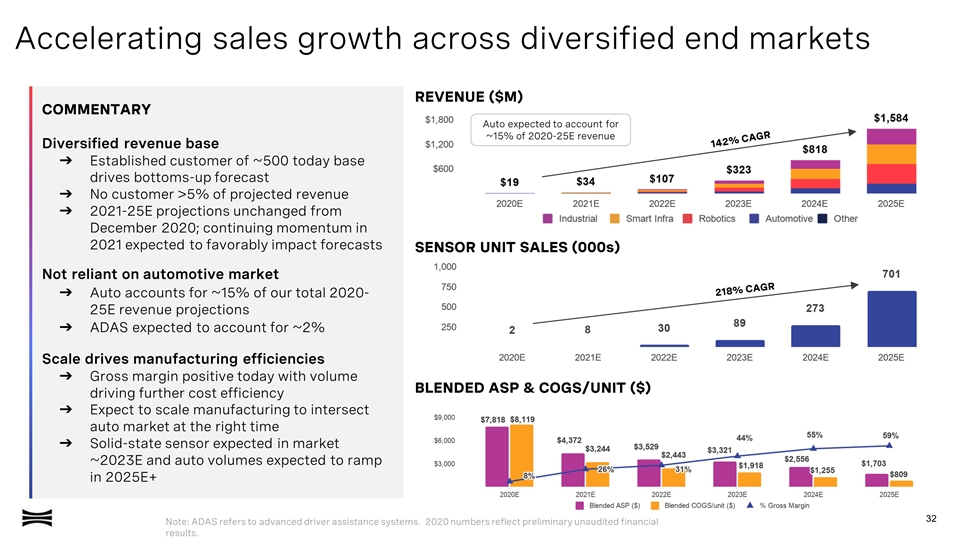

Accelerating sales growth across diversified end markets REVENUE ($M) SENSOR UNIT SALES (000s) 142% CAGR Auto expected to account for ~15% of 2020-25E revenue BLENDED ASP & COGS/UNIT ($) 218% CAGR Note: ADAS refers to advanced driver assistance systems. 2020 numbers reflect preliminary unaudited financial results. COMMENTARY Diversified revenue base Established customer of ~500 today base drives bottoms-up forecast No customer >5% of projected revenue 2021-25E projections unchanged from December 2020; continuing momentum in 2021 expected to favorably impact forecasts Not reliant on automotive market Auto accounts for ~15% of our total 2020-25E revenue projections ADAS expected to account for ~2% Scale drives manufacturing efficiencies Gross margin positive today with volume driving further cost efficiency Expect to scale manufacturing to intersect auto market at the right time Solid-state sensor expected in market ~2023E and auto volumes expected to ramp in 2025E+

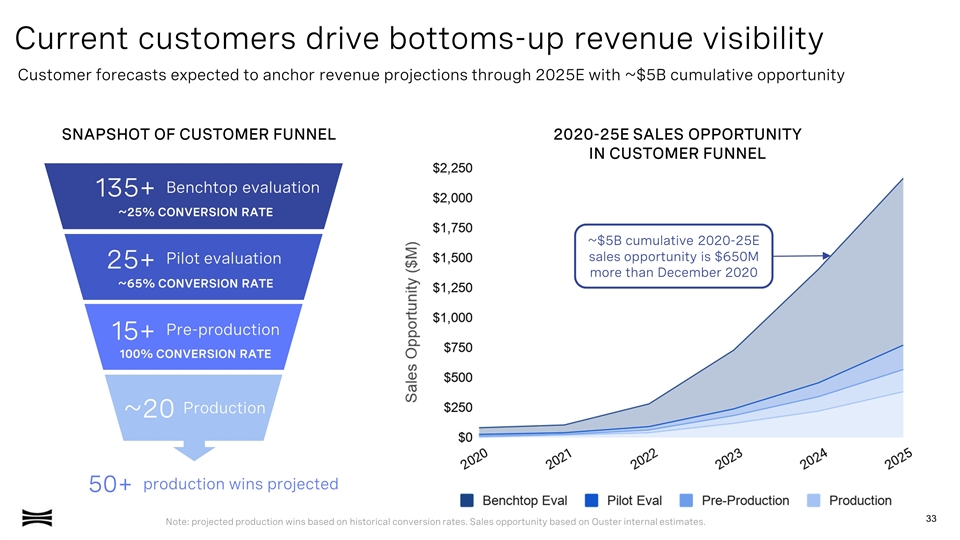

Customer forecasts expected to anchor revenue projections through 2025E with ~$5B cumulative opportunity Current customers drive bottoms-up revenue visibility 210 existing 25+ Pilot evaluation Production 135+ Benchtop evaluation ~20 ~25% CONVERSION RATE ~65% CONVERSION RATE 15+ 100% CONVERSION RATE Pre-production 50+ production wins projected 2020-25E SALES OPPORTUNITY IN CUSTOMER FUNNEL ~$5B cumulative 2020-25E sales opportunity is $650M more than December 2020 SNAPSHOT OF CUSTOMER FUNNEL Note: projected production wins based on historical conversion rates. Sales opportunity based on Ouster internal estimates.

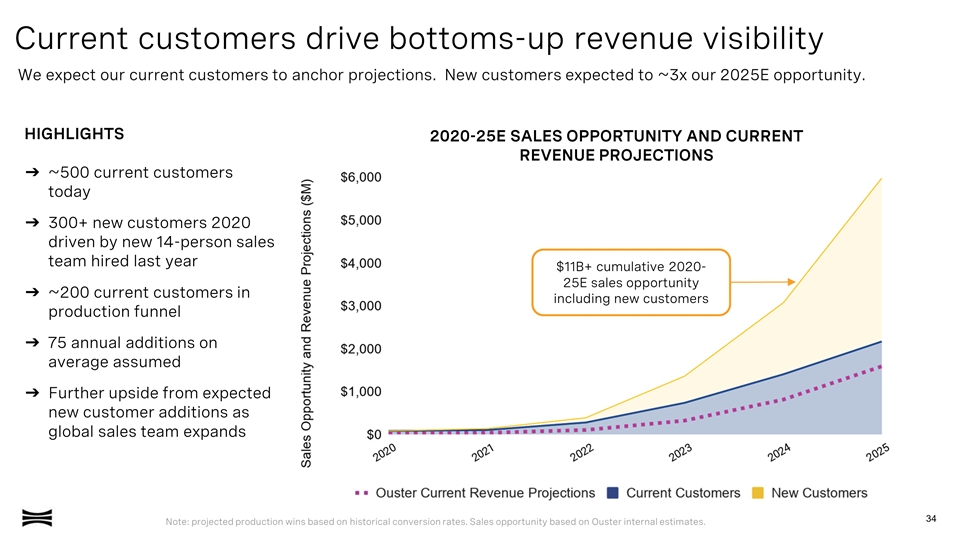

We expect our current customers to anchor projections. New customers expected to ~3x our 2025E opportunity. Current customers drive bottoms-up revenue visibility $11B+ cumulative 2020-25E sales opportunity including new customers 2020-25E SALES OPPORTUNITY AND CURRENT REVENUE PROJECTIONS HIGHLIGHTS ➔~500 current customers today ➔300+ new customers 2020 driven by new 14-person sales team hired last year ➔~200 current customers in production funnel ➔75 annual additions on average assumed ➔ Further upside from expected new customer additions as global sales team expands Note: projected production wins based on historical conversion rates. Sales opportunity based on Ouster internal estimates.

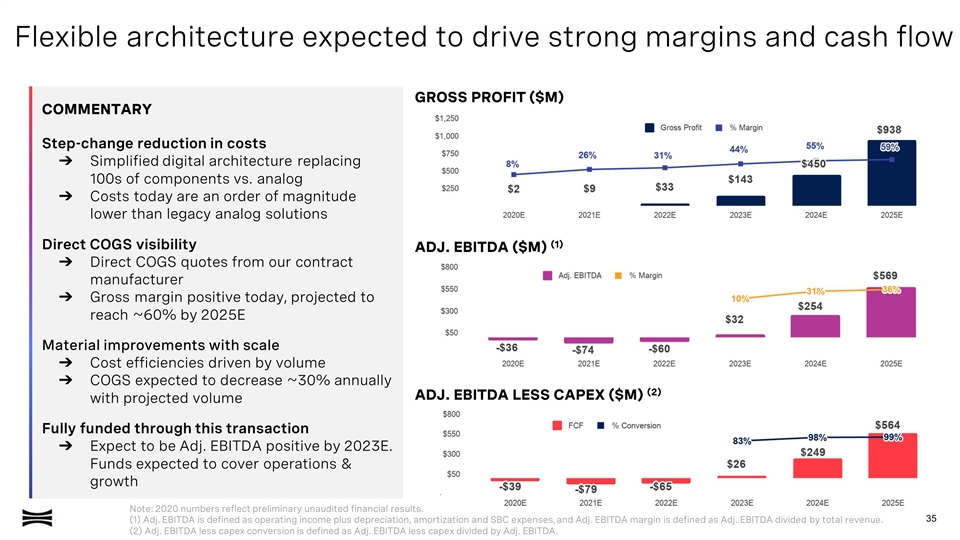

Note: 2020 numbers reflect preliminary unaudited financial results. (1) Adj. EBITDA is defined as operating income plus depreciation, amortization and SBC expenses, and Adj. EBITDA margin is defined as Adj. EBITDA divided by total revenue. (2) Adj. EBITDA less capex conversion is defined as Adj. EBITDA less capex divided by Adj. EBITDA. ADJ. EBITDA ($M) (1) GROSS PROFIT ($M) Flexible architecture expected to drive strong margins and cash flow ADJ. EBITDA LESS CAPEX ($M) (2) COMMENTARY Step-change reduction in costs Simplified digital architecture replacing 100s of components vs. analog Costs today are an order of magnitude lower than legacy analog solutions Direct COGS visibility Direct COGS quotes from our contract manufacturer Gross margin positive today, projected to reach ~60% by 2025E Material improvements with scale Cost efficiencies driven by volume COGS expected to decrease ~30% annually with projected volume Fully funded through this transaction Expect to be Adj. EBITDA positive by 2023E. Funds expected to cover operations & growth

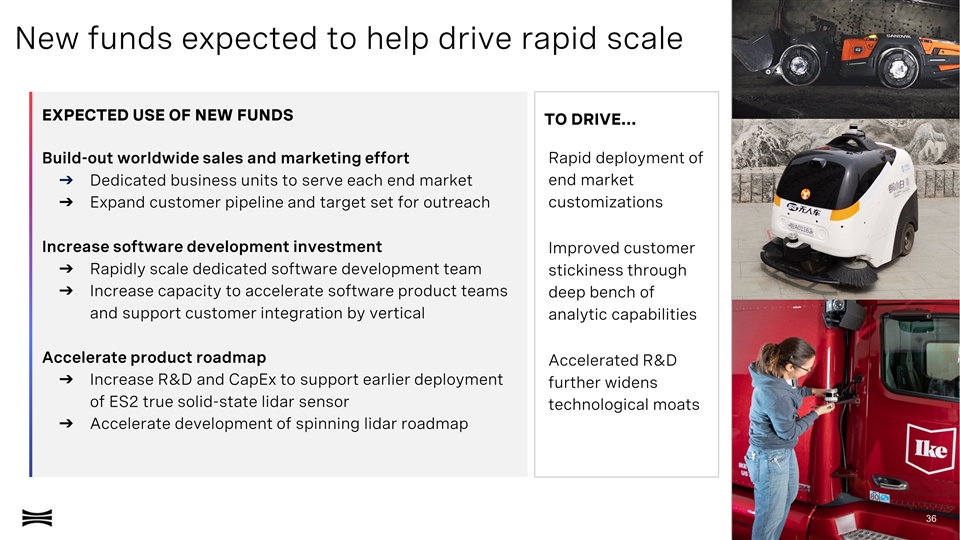

TO DRIVE… New funds expected to help drive rapid scale Rapid deployment of end market customizations Improved customer stickiness through deep bench of analytic capabilities Accelerated R&D further widens technological moats EXPECTED USE OF NEW FUNDS Build-out worldwide sales and marketing effort Dedicated business units to serve each end market Expand customer pipeline and target set for outreach Increase software development investment Rapidly scale dedicated software development team Increase capacity to accelerate software product teams and support customer integration by vertical Accelerate product roadmap Increase R&D and CapEx to support earlier deployment of ES2 true solid-state lidar sensor Accelerate development of spinning lidar roadmap 36

investors.ouster.com Shareholder vote: March 9th