Attached files

| file | filename |

|---|---|

| EX-10.7 - EX-10.7 - Olo Inc. | d867519dex107.htm |

| EX-23.1 - EX-23.1 - Olo Inc. | d867519dex231.htm |

| EX-10.19 - EX-10.19 - Olo Inc. | d867519dex1019.htm |

| EX-10.18 - EX-10.18 - Olo Inc. | d867519dex1018.htm |

| EX-10.17 - EX-10.17 - Olo Inc. | d867519dex1017.htm |

| EX-10.15 - EX-10.15 - Olo Inc. | d867519dex1015.htm |

| EX-10.14 - EX-10.14 - Olo Inc. | d867519dex1014.htm |

| EX-10.13 - EX-10.13 - Olo Inc. | d867519dex1013.htm |

| EX-10.9 - EX-10.9 - Olo Inc. | d867519dex109.htm |

| EX-10.8 - EX-10.8 - Olo Inc. | d867519dex108.htm |

| EX-10.6 - EX-10.6 - Olo Inc. | d867519dex106.htm |

| EX-10.5 - EX-10.5 - Olo Inc. | d867519dex105.htm |

| EX-10.4 - EX-10.4 - Olo Inc. | d867519dex104.htm |

| EX-10.3 - EX-10.3 - Olo Inc. | d867519dex103.htm |

| EX-10.2 - EX-10.2 - Olo Inc. | d867519dex102.htm |

| EX-10.1 - EX-10.1 - Olo Inc. | d867519dex101.htm |

| EX-3.3 - EX-3.3 - Olo Inc. | d867519dex33.htm |

| EX-3.1 - EX-3.1 - Olo Inc. | d867519dex31.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 19, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Olo Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 7372 | 20-2971562 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

285 Fulton Street

One World Trade Center, 82nd Floor

New York, New York 10007

(212) 260-0895

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Noah Glass

Founder and Chief Executive Officer

Olo Inc.

285 Fulton Street

One World Trade Center, 82nd Floor

New York, New York 10007

(212) 260-0895

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to:

| Nicole Brookshire Stephane Levy Brandon Fenn Cooley LLP 55 Hudson Yards New York, NY 10001 (212) 479-6000 |

Nithya B. Das Chief Legal Officer and Corporate Secretary Olo Inc. 285 Fulton Street One World Trade Center, 82nd Floor New York, NY 10007 (212) 260-0895 |

John J. Egan, III Edwin M. O’Connor Andrew R. Pusar Goodwin Procter LLP 620 Eighth Avenue New York, NY 10018 (212) 813-8800 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Class A common stock, par value $0.001 per share |

$100,000,000 | $10,910 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase, if any. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant will file a further amendment which specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated , 2021

Shares

CLASS A COMMON STOCK

This is an initial public offering of shares of Class A common stock of Olo Inc. We are offering shares of Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price for our Class A common stock will be between $ and $ per share. We intend to apply to list our Class A common stock on the New York Stock Exchange, or NYSE, under the symbol “OLO.”

Following this offering, we will have two classes of common stock: Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting, conversion and transfer rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to ten votes and is convertible at any time into one share of Class A common stock. All shares of our capital stock outstanding immediately prior to this offering, including all shares held by our executive officers, directors and their respective affiliates, and all shares issuable on the conversion of our outstanding convertible preferred stock, will be reclassified into shares of our Class B common stock immediately prior to the completion of this offering. The holders of our outstanding Class B common stock will hold approximately % of the voting power of our outstanding capital stock immediately following this offering.

We are an “emerging growth company” and a smaller reporting company as defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 23 to read about factors you should consider before buying our Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Olo Inc. |

$ | $ | ||||||

| (1) | See the section titled “Underwriting” for additional information regarding compensation payable to the underwriters. |

At our request, the underwriters have reserved up to shares of Class A common stock, or up to % of the shares to be issued by us and offered by this prospectus for sale, at the initial public offering price, to our directors, certain of our customers and partners, and the friends and family members of certain of our employees, directors, customers, and partners. See “Underwriting—Directed Share Program” for additional information.

We have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of Class A common stock at the initial public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2021.

| Goldman Sachs & Co. LLC | J.P. Morgan | RBC Capital Markets |

| Piper Sandler | Stifel | Truist Securities | William Blair |

Prospectus dated , 2021.

Table of Contents

Leading SaaS Platform for On-Demand Restaurant Commerce

Table of Contents

OLO AT-A-GLANCE 2005 NYC FOUNDED HEADQUARTERS 64K 400 RESTAURANTS BRANDS 1.8M $14.6B ORDERS PER DAY 2020 GMV AS OF Q4 2020 (1) Gross Merchandise Value

Table of Contents

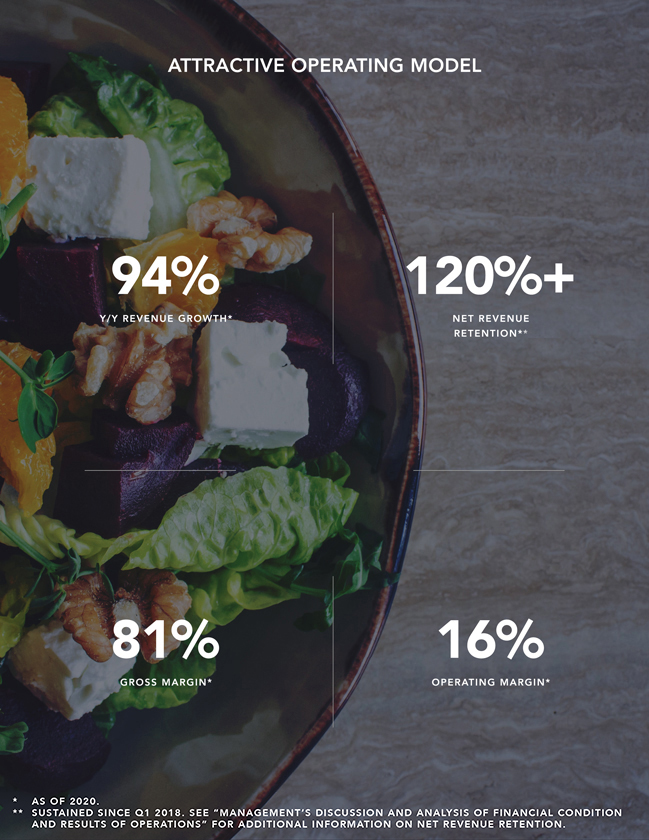

ATTRACTIVE OPERATING MODEL 94% 120%+ Y/Y REVENUE GROWTH* NET REVENUE RETENTION** 81% 16% GROSS MARGIN* OPERATING MARGIN* AS OF 2020 SUSTAINED SINCE Q1 2018 ; See Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information on Net Revenue Retention

Table of Contents

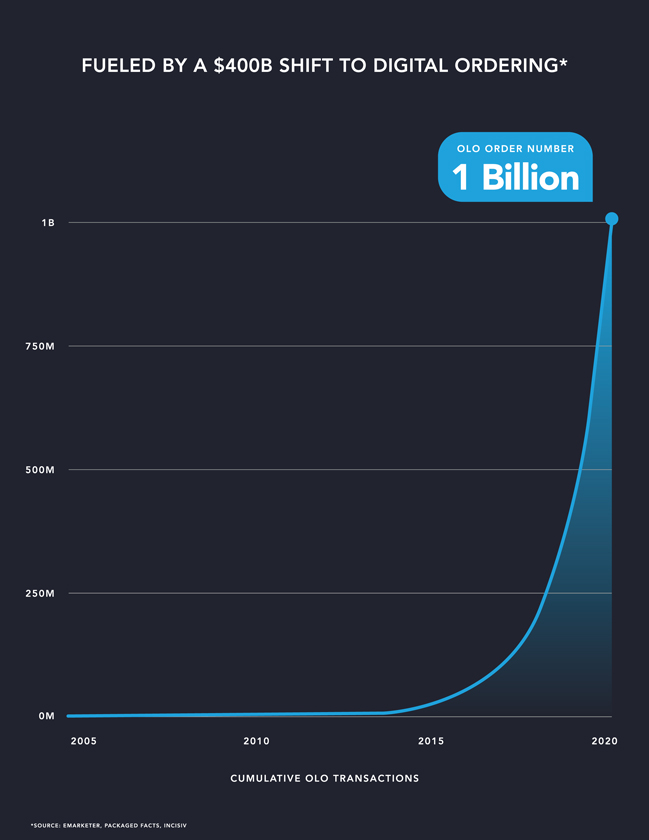

FUELED BY A $400B SHIFT TO DIGITAL ORDERING* 1 Billion 1B 750M 500M 250M 0M 2005 2010 2015 2020 OLO ORDER NUMBER CUMULATIVE OLO TRANSACTIONS * SOU R C E : EMA R K E T E R , PA C K A G E D FA C T S , I N C I S I V

Table of Contents

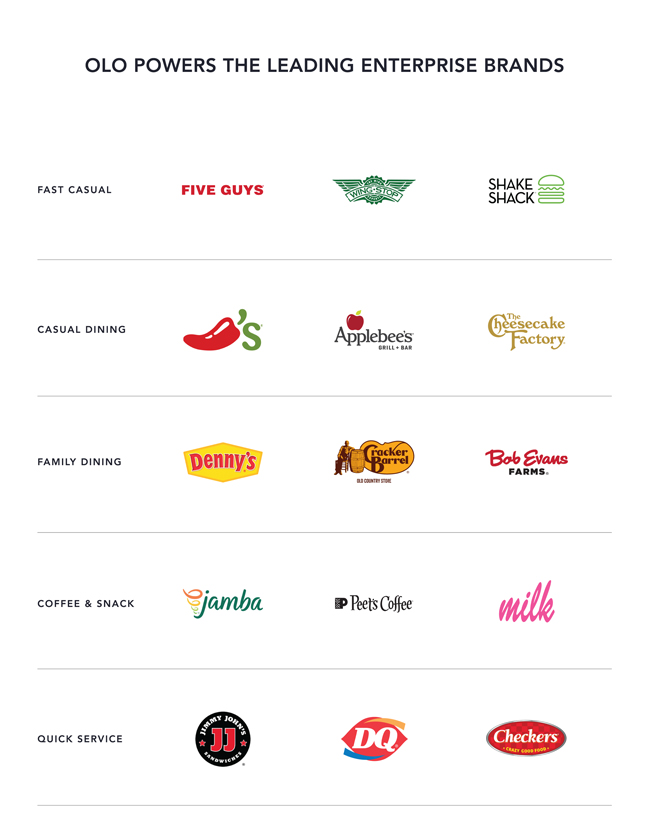

OLO POWERS THE LEADING ENTERPRISE BRANDS FAST CASUAL CASUAL DINING FAMILY DINING COFFEE & SNACK QUICK SERVICE

Table of Contents

THE OLO ON-DEMAND COMMERCE PLATFORM OPEN ECOSYSTEM WITH 100+ TECHNOLOGY PARTNERS

Table of Contents

Prospectus

| Page | ||||

| 1 | ||||

| 23 | ||||

| 61 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 69 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

72 | |||

| 100 | ||||

| 103 | ||||

| 128 | ||||

| 137 | ||||

| 155 | ||||

| 159 | ||||

| 163 | ||||

| 169 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR CLASS A COMMON STOCK |

172 | |||

| 177 | ||||

| 183 | ||||

| 183 | ||||

| 183 | ||||

| F-1 | ||||

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor any of the underwriters take responsibility for, or can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell, and seeking offers to buy, shares of our Class A common stock only under circumstances and in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Class A common stock. Our business, financial condition, results of operations, and prospects may have changed since such date.

i

Table of Contents

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our Class A common stock and the distribution of this prospectus outside of the United States.

We use in this prospectus our Olo logo, for which a U.S. trademark application has been filed. The Olo logo, “Olo” and our other registered and common law trade names, trademarks, and service marks are the property of Olo. This prospectus also includes trademarks, tradenames, and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear (after the first usage) without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

ii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” and our financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, all references in this prospectus to “Olo,” the “company,” “we,” “our,” “us” or similar terms refer to Olo Inc.

Overview

Olo provides a leading cloud-based, on-demand commerce platform for multi-location restaurant brands.

Our platform powers restaurant brands’ on-demand commerce operations, enabling digital ordering and delivery, while further strengthening and enhancing the restaurants’ direct consumer relationships. Consumers today expect more on-demand convenience and personalization from restaurants, particularly through digital channels, but many restaurants lack the in-house infrastructure and expertise to satisfy this increasing demand in a cost-effective manner. Olo provides restaurants with a business-to-business-to-consumer, enterprise-grade, open SaaS platform to manage their complex digital businesses and enable fast and more personalized experiences for their customers. Our platform and application programming interfaces, or APIs, seamlessly integrate with a wide range of solutions, unifying disparate technologies across the restaurant ecosystem. Restaurant brands rely on Olo to increase their digital and in-store sales, maximize profitability, establish and maintain direct consumer relationships, and collect, protect, and leverage valuable consumer data. As a result, we nearly doubled the gross merchandise value, or GMV, which we define as the gross value of orders processed through our platform, in each of the last five years and reached nearly $14.6 billion in GMV during the year ended December 31, 2020. Our well-established platform has led many of the major publicly traded and top 50 fastest growing private restaurant brands, measured by overall sales, in the United States to work with us and has been a factor in our high gross brand retention rate. Further, industry-recognized outlets, including Restaurant Business Online, QSR Magazine, and AP News, have also deemed Olo the leading food ordering platform for the restaurant industry.

The $1.6 trillion food industry is one of the largest consumer markets in the United States. According to the National Restaurant Association, restaurants accounted for $863 billion of that spend in 2019, surpassing grocery in aggregate consumer spending, before dropping to $659 billion in 2020 as a result of COVID-19. However, consumer spending on restaurants is expected to rebound to $1.1 trillion by 2024 according to analysis by The Freedonia Group. Growing consumer demand for convenience has made off-premise consumption, which includes take-out, drive-thru, and delivery orders, the single largest contributor to restaurant industry growth. Even before the onset of the COVID-19 pandemic, off-premise consumption accounted for 60% of restaurant orders in 2020, and was expected to contribute 70% to 80% of total restaurant industry growth in the next five years, according to the National Restaurant Association. Meanwhile, delivery continues to grow as a percentage of sales. The average portion of total sales from third-party delivery in the 12 months ending August 2019 was 6.5%. Even prior to the COVID-19 pandemic, that was expected to increase to 10% in 2020. As consumers have become accustomed to the immediate convenience of on-demand commerce, they are demanding the same digital experience from restaurants, placing significant pressure on restaurants to deploy solutions. This demand has only accelerated since the onset of COVID-19, as on-demand commerce has become a necessity for the majority of restaurants.

1

Table of Contents

Restaurants are an incredibly complex segment of the retail industry, making their shift to on-demand commerce especially challenging. The four walls of the restaurant uniquely serve as both the factory and showroom floor: restaurant operators must manage the intricacies of food production and customer service simultaneously while providing the high-quality, consistency, and hospitality that engenders consumer loyalty and trust. Furthermore, restaurants serve food that is perishable, has near infinite configurations, and must be made to order for just-in-time consumption under strict regulatory standards for health and safety. Most restaurant brands, which we define as a specific restaurant brand or restaurant chain, do not have the expertise or the resources to develop their own solutions to manage on-demand commerce and are more acutely challenged because their in-store technology is comprised of a fragmented set of legacy solutions, many of which were developed before the internet. At the same time, delivery service providers, or DSPs, and ordering aggregators have catalyzed digital demand, but pose new challenges for restaurant brands through lower long-term profitability, increased complexity, disintermediation of the restaurant’s direct relationship with the consumer and, increasingly, directly competitive food offerings. Additionally, restaurants face increasing economic pressure with an intensely competitive landscape, which has only been exacerbated by the COVID-19 pandemic. Due to its unique complexities and challenges, the restaurant industry has historically been one of the lowest penetrated on-demand commerce segments of the retail industry, with digital sales accounting for less than 10% of sales, according to a report published by Cowen Equity Research in 2019.

Our open SaaS platform is purpose-built to meet these complex needs and align with the interests of the restaurant industry. For over 10 years, we have developed our platform in collaboration with many of the leading restaurant brands in the United States. We believe our platform is the only independent open SaaS platform for restaurants to provide seamless digital ordering and efficient delivery enablement, offering centralized management of a restaurant’s entire digital business. Our platform includes the following core modules:

| ● | Ordering. A fully-integrated, white-label, on-demand commerce solution, enabling consumers to order directly from and pay restaurants via mobile, web, kiosk, voice, and other digital channels. |

| ● | Dispatch. A fulfillment solution, enabling restaurants to offer, manage and expand direct delivery while optimizing price, timing, and service quality. |

| ● | Rails. An aggregator and channel management solution, allowing restaurants to control and syndicate menu, pricing, location data, and availability, while directly integrating and optimizing orders from third-parties into the restaurants’ point-of-sale, or POS, systems. |

Leading restaurant brands trust Olo’s enterprise-grade platform for its capabilities, reliability, security, scalability, and interoperability. Our platform currently handles, on average, nearly 2 million orders per day. We continually invest in architectural improvements so our system can scale in tandem with our continued growth. Additionally, both internal and external security experts frequently test our system for vulnerabilities. We have never experienced a material breach of customer or consumer data. Our open SaaS platform integrates with over 100 restaurant technology solutions including POS systems, aggregators, DSPs, payment processors, user experience, or UX, and user interface, or UI, providers, and loyalty programs, giving our customers significant control over the configuration and features of their distinct digital offering.

We are the exclusive direct digital ordering provider for our leading brands across all service models of the restaurant industry, including quick service, fast casual, casual, family, and snack food. Our customers include major publicly traded and the fastest growing private restaurant brands such as Chili’s, Wingstop, Shake Shack, Five Guys, and sweetgreen. As of December 31, 2020, we had

2

Table of Contents

approximately 400 brand customers representing over 64,000 active locations using our platform. We consider each specific restaurant brand to be a customer, even if owned by a parent organization that owns multiple restaurant brands, and define an active location as a specific restaurant location that has deployed one or more of our modules. Our average initial contract length is generally three years with continuous one-year automatic renewal periods, providing visibility into our future financial performance. Our enterprise brands, meaning those brands having 50 or more locations, are also highly loyal. Over the last five years, on average nearly 99% of our enterprise brand customers, which accounted for 91% of our total active locations as of December 31, 2020, have continued using our Ordering module each year. Our customers’ digital same-store sales has increased, on average, by 44% for the month ended December 31, 2019 when compared to the month ended December 31, 2018. This trend has further accelerated over the past year, with digital same-store sales up 156% for the month ended December 31, 2020 when compared to the month ended December 31, 2019.

We have a highly efficient go-to-market model as a result of our industry thought leadership, partnership approach with our restaurant customers, and experienced enterprise sales, customer success, and deployment teams. Unlike other enterprise software businesses, where the sales team works to add a single location or division and expand to others, we enter into relationships at the brand’s corporate level and secure exclusivity across all company-owned and franchise locations. This enables us to deploy our modules across all new and existing brand locations without any additional sales and marketing costs, and upsell new offerings to the brand itself, rather than each individual location. As of December 31, 2019 and 2020, 44% and 71% of our customers used all three of our modules, respectively.

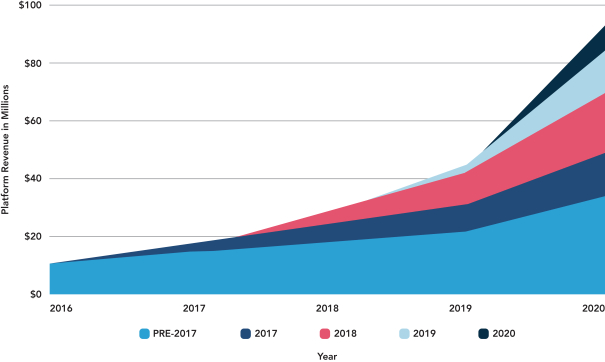

We refer to our business model as a transactional SaaS model as it includes both subscription and transaction-based revenue streams, and we designed it to align with our customers’ success. Our model allows our customers to forego the cost of building, maintaining, and securing their own digital ordering and delivery platforms and to retain direct relationships with their consumers while maximizing profitability. Our hybrid-pricing model provides us with a predictable revenue stream and enables us to further grow our revenue as our customers increase their digital order volume. We generate subscription revenue from our Ordering module and transaction revenue from our Rails and Dispatch modules. We charge our customers a fixed monthly subscription fee per restaurant location for access to our Ordering module. In addition, a growing portion of our customers purchase an allotment of monthly orders for a fixed monthly fee and pay us an additional fee for each excess order, which we also consider to be subscription revenue. Our transaction revenue includes revenue generated from our Rails and Dispatch modules. Customers who subscribe to our Rails and Dispatch modules pay a fee on a per transaction basis. In most cases, we also charge aggregators, channel partners, and other service providers in our ecosystem on a per transaction basis for access to our Rails and Dispatch modules. We also derive transactional revenue from other products, including Network, which allows brands to take orders from non-marketplace digital channels (e.g., Google Food Ordering, which enables restaurants to fulfill orders directly through Google search results and Maps pages). These products generate fees predominantly through revenue sharing agreements with partners. For the years ended December 31, 2018, 2019, and 2020, 93.2%, 80.8%, and 56.7% of our platform revenue was subscription revenue, respectively, and 6.8%, 19.2%, and 43.3% was transaction revenue, respectively.

Our business has experienced rapid growth in a highly capital efficient manner. Since inception 15 years ago, we have raised less than $100.0 million of primary investment capital, net of share repurchases, and as of December 31, 2020, we had cash and cash equivalents of $75.8 million with no outstanding debt. During the years ended December 31, 2018, 2019, and 2020, we generated revenue of $31.8 million, $50.7 million, and $98.4 million, respectively, representing year-over-year growth of 59.4% and 94.2%.

3

Table of Contents

During the years ended December 31, 2018, 2019, and 2020, we generated gross profit of $21.0 million, $35.1 million, and $79.8 million, respectively, or 66.0%, 69.3%, and 81.0% as a percentage of revenue, respectively. During the years ended December 31, 2018 and 2019, we incurred net losses of $11.6 million and $8.3 million, respectively, and during the year ended December 31, 2020, we generated net income of $3.1 million. During the years ended December 31, 2018 and 2019, we incurred operating losses of $8.8 million and $5.1 million, respectively and during the year ended December 31, 2020, we generated operating income of $16.1 million. During the years ended December 31, 2018 and 2019, we incurred non-GAAP operating losses of $4.6 million and $0.2 million, respectively, and during the year ended December 31, 2020, we generated non-GAAP operating income of $21.8 million. See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information on our non-GAAP metrics.

COVID-19 Update

On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic, impacting communities in the United States and across the world. Responses to the outbreak continue to develop, as consequences have affected communities and economies across the world. State mandated lockdowns have adversely impacted many restaurants, as public health regulations transformed or even halted daily operations. In order to stay in business, restaurants were forced to more aggressively adopt digital solutions to provide on-demand services, off-premise dining and delivery solutions for consumers, if they were not already. In just the first few weeks of the COVID-19 shutdowns in the United States, 59% of restaurant operators added new curbside pickup offerings and 20% added new online ordering or pre-pay functionalities as a direct response to the coronavirus pandemic, according to a survey by eMarketer. Consumers were receptive to these changes, with 30% of them affirming that they had begun using restaurant delivery and 50% affirming they had begun take out services, mostly due to COVID-19, according to a report by Packaged Facts.

Although we are optimistic that the emphasis on on-demand commerce in the food services industry will be an enduring trend, we do not have certainty on the long-term impact these developments will have on the industry. The degree of the pandemic’s effect on our restaurant partners across the food services industry will depend on many factors, particularly on government regulations and their impact on the financial viability of restaurant operations as well as the duration of the pandemic. We will continue to monitor these developments and their implications on our business. The COVID-19 pandemic could materially adversely impact our business, financial condition, and results of operations. In the absence of updated industry sources giving effect to the market shifts precipitated by COVID-19, we have included in this prospectus select market research that was published prior to the COVID-19 outbreak and without considerations for its potential effects. Refer to “Risk Factors” in this prospectus for additional information regarding the impact of COVID-19 on our business.

| ● | Impact on Our Operations: |

During the month of March 2020, in accordance with local, state, and national regulations, we closed our offices in New York, and transitioned our employees to work-from-home and efficiently adapted our operations to a remote working environment. In addition, we were able to operate without terminating or furloughing our employees. As the pandemic continued, we grew our employee base to scale the business in order to meet the increased customer demands we were facing.

We continue to monitor updates and consider regulatory guidance for reopening office locations. We believe that we are well equipped to support full or partial remote work without disruption to our business.

4

Table of Contents

| ● | Impact on Our Customers: |

As many restaurants faced on-premise dining restrictions, our customers needed to transition and adapt their businesses quickly. In a recent survey of Olo customers, approximately 70% of respondents offered more off-premise delivery and pick-up options in response to COVID-19. We focused on optimizing the deployment process for our new customers and offered adaptive solutions to help them navigate through this challenging business environment. We reprioritized our strategic roadmap to address the most important solutions for our customers, including enhancements to our curbside pick-up functionality. As curbside pick-up became an even more integral component of restaurant transactions, we further enabled our platform capabilities so restaurants could more efficiently manage these orders, adding quick response, or QR, code functionality, kiosk ordering solutions, and additional ecosystem partners. We engaged with our customers to collaborate on implementing the most relevant short- and long-term solutions. In addition to helping our customer brands react to COVID-19, we recognized the importance of supporting the restaurant industry and front-line workers directly and made donations to the Restaurant Employee Relief Fund.

| ● | Impact on Our Financials: |

Our revenue for the quarters ended March 31, 2020, June 30, 2020, September 30, 2020, and December 31, 2020 increased by 55.2%, 100.2%, 94.2%, and 117.6%, respectively, compared to 2019. While many restaurants have been struggling during this period, we have been uniquely positioned to expand our footprint and help support the restaurant industry when it was most in need. While we expect on-premise dining to return over time, we believe that off-premise offerings will continue to be an essential part of a restaurant’s operations.

Industry Background

There are a number of important industry trends driving our market opportunity.

| ● | Restaurants are facing complex challenges and are under significant economic pressure. The restaurant landscape has become increasingly dynamic, with competition coming from existing restaurant brands, new restaurant brands, aggregators and ghost kitchens, that frequently have sophisticated digital, marketing, ordering, and distribution strategies. As a result, it is difficult for some restaurants to attract and retain loyal consumers. Moreover, restaurant brands are increasingly having to share their revenue with aggregators. These challenges have only been exacerbated by COVID-19 as many governments imposed restrictions to on-premise dining, resulting in significant financial losses and many closures. All restaurant operators have had to adapt to these new, complex challenges or risk losing their business. There is now a real urgency for restaurants to adopt cost-effective digital solutions in order to support their businesses and drive margin expansion and incremental sales over the longer term. |

| ● | The restaurant industry is massive and enterprises are rapidly expanding market share. The nearly $700 billion restaurant industry is undergoing a dynamic transformation, being forced to adapt to the new market environment created by COVID-19. According to the National Restaurant Association, the restaurant industry’s share of the dollars spent on food increased from 25% in 1955 to 51% in 2019, representing the first time in history that restaurants have surpassed grocery in aggregate sales. While restaurants have lost some traction against grocery due to COVID-19, we expect the increase in restaurant spend when compared to grocery to continue over the long-term, and according to analysis by The Freedonia Group, consumer spending on restaurants is expected to increase to $1.1 trillion by 2024. Enterprise restaurant brands in particular are rapidly increasing their share |

5

Table of Contents

| of the market as they are able to leverage their scale to more effectively deploy on-demand commerce solutions than many small and medium business, or SMB, restaurants. We expect consumers will continue to demand digital solutions from restaurants that offer more convenience and personalization, helping to drive sales and expand the industry. |

| ● | Consumer behavior is shifting towards on-demand commerce convenience. In today’s on-demand economy, and even more so during the COVID-19 pandemic, consumers expect goods and services to be easily ordered through digital means. According to a 2019 Salesforce.com, Inc. publication, 66% of all consumers cite instant and on-demand fulfillment of purchases as important and approximately 50% say that they will switch brands if a company does not proactively anticipate their needs. The COVID-19 pandemic has only accelerated this long-term shift in consumer demand for adaptive on-demand commerce platforms. We believe these trends will continue to accelerate in the restaurant industry in particular as advances in technology allow restaurants to further reduce friction in digital ordering and fulfillment to further satisfy consumers’ new engagement preferences. |

| ● | Off-premise dining is the main engine of restaurant growth, with pickup continuing to lead. Off-premise dining has continued to grow rapidly, accounting for 63% of U.S. restaurant transactions in 2019. Prior to the COVID-19 pandemic, off-premise dining had been expected to contribute 70% to 80% of total restaurant industry growth in the next five years according to the National Restaurant Association. Since then, off-premise offerings have become an even more critical part of a restaurant’s business and long-term growth. While off-premise consumption is growing rapidly, only approximately 3% of total restaurant orders were fulfilled through delivery in 2018, and 39% and 21% were attributed to take-out and drive-thru, respectively. Restaurants operators have known the importance of off-premise offerings, with 78% of operators identifying off-premise solutions as a strategic priority, according to the State of the Industry Report published by the National Restaurant Association in 2019. COVID-19 has accelerated this shift with at least 27% of restaurant operators reporting having added new off-premise delivery options since the pandemic began, according to a survey by the National Restaurant Association. While consumers currently appear less apprehensive to visit restaurants and dine-in than they did at the beginning of the pandemic, usage of delivery and carry-out options remains higher than pre-COVID-19 levels. According to a recent survey by the National Restaurant Association, approximately 70% of restaurant operators across service categories plan to keep the changes they made to their restaurant after COVID-19 has subsided. |

| ● | Digital restaurant ordering is experiencing rapid growth in a shifting landscape. Both direct and indirect digital ordering channels are powering this expansion. Aggregators created consumer applications to meet the growing demand for convenient restaurant food, helping expand off-premise dining. In addition, major consumer facing platforms are embedding food ordering into products such as maps and search results, making it even more convenient for consumers to place orders from their favorite restaurant brands. Furthermore, COVID-19 tailwinds have accelerated this expansion, forcing restaurants to develop direct digital ordering operations or leverage indirect channels to meet customers’ digital demands through this unpredictable period. These channels are expected to drive the expansion of the U.S. online food delivery market, a subset of the restaurant digital ordering market, from $356 billion in 2019 to $470 billion by 2025, according to industry research. |

| ● | Restaurant brands must evolve to own digital relationships with their consumers. Like any other retailer, understanding and owning the consumer relationship is vital to restaurants |

6

Table of Contents

| as it allows them to better analyze interactions, customize offerings, and maximize the long-term value of their consumers. However, restaurants risk losing direct consumer relationships if they are heavily reliant on aggregators, which generally do not provide visibility into who is ordering or enable a restaurant to articulate its unique brand value. According to a recent survey by the National Restaurant Association, 64% of adults prefer to order directly through the restaurant for delivery, compared to only 18% who prefer to order through a third-party service for delivery. In fact, over 70% of Olo customers in a recent survey indicated that their primary reason to own their own branded digital storefront was to own a direct relationship with their guests. The majority of respondents have 50% or less of their online orders coming through an aggregator compared to their own channel, and they expect their mix of aggregator order volumes to decrease in the future relative to their own channel. Additionally, aggregators typically limit a restaurant’s ability to collect and use data about consumers and orders transacted through the aggregator. Consumers also value this direct and personal connectivity with restaurant brands, and we believe consumers would rather interact directly with a brand than through an intermediary. |

| ● | On-demand commerce has substantial opportunity to expand penetration in the restaurant industry. The nearly $700 billion restaurant market in the United States continues to be one of the most underpenetrated in terms of on-demand commerce at less than 10% of industry sales, according to research published by Cowen Equity Research, as well as U.S. government data. In comparison, sectors such as books and electronics have digital penetration well over 50%. Restaurants are uniquely positioned to benefit from consumers’ demand for digital convenience, but are limited by significant complexities in the restaurant ecosystem, which have slowed penetration to-date. |

Complexities of the Current Ecosystem

The key complexities that hinder restaurants’ digital transformation progress include:

POS and Technology Integration

| ● | Inconsistent technologies within and across brand locations. Restaurant brands historically have not standardized the type of technology platforms that must be deployed across their locations. For example, in our survey, 70% of respondents indicated they use two to four different technology providers to collect orders across various channels. This has led to significant differences in the types of technology that restaurants use across a brand and even within a given restaurant location. |

| ● | Multiple platforms within a restaurant. Many brands have multiple POS systems, payment processors, and now tablets to manage incoming orders across various aggregators. In addition, many of these technologies have become deeply entrenched into their operations, making them difficult to replace with more modern solutions. These platforms cannot act quickly and harmoniously to meet the changing needs of restaurants, particularly during the COVID-19 pandemic. |

| ● | Disparate integrations across the ecosystem. Many restaurants have adopted narrow point solutions that do not integrate seamlessly with other systems, such as POS systems, aggregators, DSPs, payment processors, UI and UX providers, and loyalty programs. Restaurant location operators often lack the technical expertise and resources necessary to integrate both legacy and modern technologies. |

7

Table of Contents

| ● | Static, legacy software infrastructure. Legacy restaurant systems were not built for modern, cloud-based environments. As a result, many lack the reliability, scalability, and security capabilities that today’s SaaS solutions offer, leaving restaurants and their consumer data vulnerable. Furthermore, brands are unable to access their consumer data, as it resides in different systems and databases that cannot communicate with each other. |

Food and Menu Management

| ● | Numerous, highly modifiable menu items. Restaurant menus are inherently complex, highly configurable, and frequently updated for changing consumer preferences, out-of-stock ingredients, or product recalls. In addition, restaurants must ensure menus and pricing are always accurately reflected across their various channels to ensure consumers have the latest information and receive the exact food they order, particularly as food allergies, dietary preferences, and other health issues become more prevalent. This has made it challenging for restaurant brands, who are increasingly expected to offer intuitive digital menus where consumers can add, subtract, or modify a wide variety of ingredients or menu items, creating a nearly infinite number of order permutations. |

Order Channels

| ● | Multiple ordering channels. Today’s restaurants need to seamlessly manage on-premise and off-premise operations to ensure they provide the optimal experience to all of their consumers. In-store orders are only one part of the overall operation, as restaurants receive off-premise orders from several different direct and indirect channels, which often require multiple POS systems and tablets at a single location. Food orders can be placed directly through restaurants’ mobile applications or over the phone and indirectly from aggregators at the same time. Many restaurants are not equipped to balance this on-premise and off-premise dynamic, let alone the direct and indirect channels of ordering. |

| ● | Shifting from serial to parallel processing. Restaurants are accustomed to serial order processing, which means that they receive an order from an on-premise consumer and fulfill it accordingly. With the rise of off-premise dining and multiple direct and indirect channels for ordering, restaurants increasingly receive multiple orders simultaneously. Legacy restaurant technology is not properly equipped to centralize and track these orders or help restaurants prioritize orders to ensure high quality fulfillment or to provide accurate estimates of when the food will be ready. Restaurants require modernization to better accommodate parallel processing and streamline their operations. |

Operations and Logistics

| ● | Complex, on-demand logistics management. A report published by Cowen Equity Research in 2019 projects that the majority of restaurant growth will come from expanded off-premises dining, which we expect will continue to place significant operational burdens on restaurants. Restaurant staff must prepare food at exactly the right time to ensure optimal quality. Restaurants must adapt locations to better accommodate take-out orders and manage multiple DSPs to ensure consumers get their food reliably at a cost-effective price. The COVID-19 pandemic has only exacerbated these complexities, as restaurants have had to adapt their operations to accommodate the massive increase in delivery and take-out orders, in particular. |

8

Table of Contents

Building a Digital Brand and Owning the Consumer Relationship

| ● | Navigating the shift to digital branding. Many restaurants have spent decades building brand equity with their consumers and securing their loyalty. Meanwhile, consumers themselves are seeking direct engagement with brands through digital channels. However, restaurants lack the tools they need to interact and engage with their consumers across digital channels and to foster those direct relationships. |

| ● | Competition for the direct consumer relationship. As aggregators have scaled, they have often disintermediated restaurants’ direct consumer relationships. Each consumer is more valuable to an aggregator than any individual restaurant brand and, therefore, aggregators can afford to spend more than a particular restaurant brand to acquire a consumer. These aggregators are digitally savvy, have more capabilities in search engine marketing and optimization, and are specialists at leveraging data to acquire consumers and extract much higher customer lifetime value relative to the cost of acquiring a consumer. Many restaurants do not have the digital aptitude to stay competitive, and are at risk of losing direct contact with their consumers. |

| ● | Inability to access and leverage consumer data. Establishing direct digital relationships enables restaurants to collect data and learn from consumer interactions, evolve their offerings, and drive increased consumer loyalty. However, restaurants’ legacy technologies generally do not have the capabilities to collect, organize, and analyze these consumer data sets. There are also no major customer relationship management solutions built exclusively for the restaurant industry at scale. As a result, restaurants are forced to collect and integrate data from disparate systems, making it almost impossible to draw impactful, data-driven insights. |

Our Platform

We provide the leading on-demand commerce platform designed for multi-location restaurant brands. Our customers use our software to create unique direct-to-consumer digital ordering experiences, manage orders across channels, and enable delivery across their restaurant locations. We have an open SaaS platform that seamlessly integrates with technology solutions throughout the restaurant ecosystem, including most POS systems, aggregators, DSPs, payment processors, UI and UX providers, and loyalty programs. We provide restaurants with a centralized system to manage their digital business and ensure consumers receive better, faster, and more personalized service while increasing restaurant order volume and improving yield at lower cost.

We engineered our platform to handle the most complex issues for the leading restaurant brands, but with the simplicity and ease-of-use required within an individual restaurant. We developed our infrastructure with application programming interfaces, or APIs, which facilitate interactions across and integrate with multiple software programs and components of the restaurant ecosystem. We enable more streamlined data collection and facilitate analytical decision-making, so restaurants can better understand and adapt to unique consumer preferences. We are constantly innovating and enhancing our platform, with our continuously deployed, multi-tenant architecture ensuring all restaurant locations are always using the latest technology.

9

Table of Contents

Our platform includes the following core modules:

Ordering

| ● | Secure, white-label, direct-to-consumer, front-end solution enables consumers to directly order from and pay restaurants via mobile, web, kiosk, car, voice, and other digital channels. |

| ● | Integrates with our customers’ back-end systems and provides a scalable digital ordering infrastructure behind custom front-end applications. |

Dispatch

| ● | Enables restaurants to offer and expand delivery for orders generated via their own websites and applications. |

| ● | Manages each restaurant’s delivery options and selects DSPs, including in-house couriers, based on optimal price, timing, availability, and other attributes. |

Rails

| ● | Centralizes and manages location specific menu, pricing, and availability, enabling automatic updates across multiple ordering channels. |

| ● | Integrates orders from aggregators into a restaurant’s POS systems. |

Our Position in the Restaurant Industry

Restaurants rely on our enterprise-grade open SaaS platform to power their critically important digital ordering and fulfillment offerings. Our focus on developing solutions has aligned with restaurant brands’ interests, and our history of deploying our platform to approximately 400 restaurant brands through exclusive direct digital ordering relationships has allowed us to build what we believe is one of the largest technology ecosystems in the restaurant industry. We integrate with over 100 technology partners and believe that this positions us to be the only party able to unify and enhance the utility of disparate technologies across the industry, including POS systems, aggregators, DSPs, payment processors, UI and UX providers, and loyalty programs.

We believe that our approach to building this two-sided network, comprised of restaurants and technology partners, has given us a valuable position that is deeply embedded within the restaurant industry. We intend to expand our influence and position as we onboard new customer brands, integrate with additional modern or legacy software systems and technology providers, improve our platform’s functionality, develop new modules, continue to provide industry-leading security, and as our restaurant customers increasingly process orders through digital channels.

Key Benefits of Our Platform

Restaurants use our intuitive ordering, delivery, and aggregator enablement platform to streamline restaurant operations and provide a superior consumer experience. Our platform enables restaurants to overcome the complexities of building and growing a digital business, own the overall consumer relationship, and scale, secure, and centralize their on-demand commerce operations with our enterprise-grade technology. The key benefits of our platform include:

10

Table of Contents

Overcome the Complexities of Restaurant On-Demand Commerce Operations

| ● | Utilize Olo as a centralized source of data. Our restaurant brand customers, many of whom leverage multiple technology providers across locations, can manage menus, including menu-item availability, and day-to-day operations with permission-based administration tools and reporting, utilizing Olo as a centralized source of data. |

| ● | Extensible, modular platform. We have an open SaaS platform that integrates with over 100 restaurant technology solutions across the restaurant ecosystem. These integrations allow us to streamline order processing and fulfillment, and keep information in sync with a variety of POS systems, aggregators, DSPs, payment processors, UX and UI providers, and loyalty programs. Our platform’s extensibility ensures restaurants are able to quickly adapt and address problems they face as the landscape rapidly evolves. |

| ● | Manage demand across platforms to optimize yield. Our Rails module consolidates demand across aggregators, allowing our customers to generate more orders through an intuitive, coordinated system. Our customers are able to monitor and parallel process orders across the various channels and more easily and accurately prioritize and fulfill orders. We also help our restaurant brand customers optimize yield during peak periods by prioritizing different ordering channels as needed to ensure the highest priority items are fulfilled while maximizing profitability. |

| ● | Enable and manage a restaurant’s delivery functions across providers. Our Dispatch module enables restaurants to automatically select the optimal delivery provider for an individual order based on dozens of attributes, such as delivery time, order size or value, cost of delivery, or service level, for each individual order at each individual location. Restaurant brands are able to fulfill orders just-in-time to allow for a better consumer experience at a competitive cost. |

Enhance and Own the Consumer Experience

| ● | Own the consumer relationship. Our platform enables restaurants to provide individually branded and direct-to-consumer experiences across devices through our web and mobile front-end or via customized consumer experiences using our APIs and third-party UI and UX providers. This unique consumer experience extends beyond aesthetic and operative functionality to expanded order offerings like upsell, group ordering, and loyalty programs. With Olo, restaurants know their consumers better and can more effectively meet their needs while maximizing on-demand commerce results. |

| ● | Leverage powerful data and analytics to guarantee the highest quality consumer experience. We enable our customers to collect a significant amount of data that they can use to generate valuable insights into their consumers’ ordering behaviors. Restaurant brands and their individual locations can leverage this data to better manage operations, provide consumers with a more personalized experience, and drive incremental sales. |

Scalable and Secure Operations with Enterprise Grade Technology

| ● | Built for ensuring scalability and reliability. Our software infrastructure is cloud-hosted and highly flexible with the ability to handle large spikes in traffic and withstand many failure scenarios. Our high-availability, frequently deployed, multi-tenant architecture ensures that all of our customers are able to operate with the latest features and the |

11

Table of Contents

| newest innovations of the latest version of our platform. While our platform currently handles, on average, nearly 2 million orders per day, we continually invest in architectural improvements so our system can scale in tandem with our continued growth. |

| ● | Enterprise-grade security and privacy. Our customers trust our platform with their most sensitive consumer and business data and many have run security assessments of our platform to verify that it has robust security capable of protecting their consumer data. We also employ in-house Blue and Red Security Teams that constantly monitor the platform, testing for and addressing vulnerabilities. Our technology also incorporates privacy-safe practices and tools as an integral and foundational part of our platform’s approach. Privacy best practices are proactively embedded into our systems and infrastructure. |

| ● | Secure by design. Our software engineering practices consider, evaluate, and manage risk throughout the design, development, and deployment phases to provide best-in-class security across our platform. This includes risk and threat evaluation at the inception of all of our products and services, leveraging zero trust, least privilege, and role based access concepts, secure development training, avoiding common security anti-patterns, and extensive automated and manual security testing. Our security program also includes regular third-party examinations for security, including annual PCI-DSS Attestation of Compliance, or AoC, and SOC 1 and SOC 2 audits. The SOC 2 report demonstrates our compliance with the American Institute of Certified Public Accountants’ trust service principles criteria for security, availability, confidentiality, and processing integrity. |

Our Market Opportunity

We believe our total addressable market opportunity is $7 billion based on our current product offerings and focus on enterprise restaurants primarily in the United States. To arrive at this figure, we determined the number of enterprise restaurant locations and number of orders that we could generate revenue from on a per location basis. According to a 2019 publication by the NPD Group, there are approximately 300,000 enterprise restaurant locations across the United States. We determined the number of orders per enterprise location, based on industry research, by dividing their total sales by the average order value in the United States. To determine our opportunity per location, we then multiplied the implied number of orders by the percentage of digital orders, and by our actual average fee per order, and then added our actual annual average subscription fee per location as of December 31, 2020 to get the estimated total annual average revenue per restaurant location. This figure was then multiplied by the number of enterprise locations to arrive at the U.S. estimate.

Driven by the COVID-19 pandemic, digital platforms are enabling many more restaurant transactions, including on-premise solutions such as table-top dining through the use of QR codes and kiosk ordering. While this is one of many potential opportunities, we believe that we can fulfill these transactions as we introduce new solutions to enable these services. By providing more products and services to our customers, we believe we can increase our fees per transaction, which could expand our total addressable market further to $15 billion.

As we provide more products and services and increase our efforts to pursue SMB restaurants, we believe our total addressable market will expand further. This is based on an increase the total number of SMB restaurants we serve, which would expand our market potential by an approximately 400,000 additional estimated restaurant locations. If successful, we believe this expansion would allow Olo to reach a total addressable market of $20 billion. We believe our opportunity outside of the United States is at least as large as our domestic opportunity implying a total global addressable market of $40 billion.

12

Table of Contents

Our Growth Strategies

We aim to be the leading on-demand commerce platform for the restaurant industry. The principal components of our growth strategy are:

| ● | Add new large multi-location and high-growth restaurant brands and scale with them. We believe there is a substantial opportunity to continue to grow our customer base within the U.S. restaurant industry, adding to our approximately 400 existing brands across more than 64,000 active locations. We intend to continue to drive new customer growth by leveraging our brand and experience within the industry, and expanding our sales and marketing efforts. We have also historically pursued and will continue to target the most well-capitalized, fastest growing restaurant brands in the industry. As our restaurant brand customers open new locations, we are well-positioned to organically grow our revenue with little to no incremental sales and marketing costs to target additional locations. |

| ● | Upsell existing customers additional modules. As of December 31, 2019 and 2020, 44% and 71% of our customers used all three of our modules, respectively. We believe that we are well-positioned to upsell our remaining customers, as our modules provide significant value, are simple to add, operate seamlessly together, and improve restaurant brands’ on-demand commerce capabilities and consumer experience. |

| ● | Enable higher transaction volume. We will continue to work with our existing restaurant customers to enable higher transaction volumes at their locations particularly through direct channels. As on-demand commerce grows to represent a larger share of total off-premise food consumption, we expect to significantly benefit from this secular trend through increased revenue. As we continue to expand our product offerings across both on and off-premise dining and improve our current software, we also believe there is an opportunity to increase our share of the transaction volume that flows through our platform both through direct channels and revenues from aggregators. |

| ● | Develop and launch new product offerings. We intend to continue to invest in expanding the functionality of our current platform and broadening capabilities that address new opportunities, particularly around payments, on-premise dining, and data analytics. We plan to continue broadening our new product offerings for on-premise transactions, such as table top ordering, as the COVID-19 impacted restaurant landscape offers increased opportunity for technology integration even for on-premise dining. We believe this strategy will provide new avenues for growth and allow us to continue to deliver differentiated high-value outcomes to both our customers and stockholders. |

| ● | Expand our ecosystem. We plan to expand our current ecosystem of developers, user experience designers, and other partners to better support our customers, attract new customers, and strengthen our competitive position. We believe that we can leverage our partnerships with POS systems, aggregators, DSPs, payment processors, UX and UI providers, and loyalty programs to deliver additional value to our customers. |

| ● | Grow our longer-term market opportunity. While we have not made any significant investments in this area to date, we believe there is an opportunity to partner with SMB brands to enable their on-demand commerce presence. Additionally, as many of our customers operate internationally, we believe there is a robust opportunity to expand their usage of our platform outside of the United States. We also believe that our platform can be applied to other verticals beyond the restaurant industry that are undergoing similar digital transformations. For example, we currently work with a number of grocery chains and convenience stores who use our software to help their consumers order ready-to-eat meals, and we may expand our efforts in these or other verticals in the future. |

13

Table of Contents

Risk Factors Summary

Investing in our Class A common stock involves substantial risks. The risks described in the section titled “Risk Factors” immediately following this summary may cause us to not realize the full potential of our key benefits or to be unable to successfully execute all or part of our strategy. Some of the more significant risks include the following:

| ● | Our rapid growth may not be sustainable and depends on our ability to attract new customers, retain revenue from existing customers, and increase sales to both new and existing customers. |

| ● | The COVID-19 pandemic could materially adversely affect our business, financial condition, and results of operations. |

| ● | Our limited operating history with our new modules in a new and developing market makes it difficult to evaluate our current business and future prospects, and may increase the risk that we will not be successful. |

| ● | Our business could be harmed if we fail to manage our growth effectively. |

| ● | We have a history of losses and we may be unable to sustain profitability. |

| ● | Our sales cycles can be long and unpredictable, and our sales efforts require considerable investment of time and expense. If our sales cycle lengthens or we invest substantial resources pursuing unsuccessful sales opportunities, our operating results and growth would be harmed. |

| ● | We expect fluctuations in our financial results, making it difficult to project future results, and if we fail to meet the expectations of securities analysts or investors with respect to our results of operations, our stock price and the value of your investment could decline. |

| ● | Our business depends on customers increasing their use of our platform, and any loss of customers or decline in their use of our platform could materially and adversely affect our business, results of operations, and financial condition. |

| ● | If we fail to continue to improve and enhance the functionality, performance, reliability, design, security, or scalability of our platform in a manner that responds to our customers’ evolving needs, our business may be adversely affected. |

| ● | Our growth depends in part on the success of our strategic relationships with third parties and our ability to integrate with third-party applications and software. |

| ● | Our Dispatch module currently relies on a limited number of DSPs. |

| ● | Our Rails module currently relies on a limited number of aggregators. |

| ● | We currently generate significant revenue from our largest restaurant customers, and the loss or decline in revenue from any of these customers could harm our business, results of operations and financial condition. |

14

Table of Contents

| ● | Security breaches, denial of service attacks, or other hacking and phishing attacks on our systems or the systems with which our platform integrates could harm our reputation or subject us to significant liability and adversely affect our business and financial results. |

| ● | Our business is highly competitive. We may not be able to compete successfully against current and future competitors. |

| ● | If we cannot maintain our corporate culture as we grow, our success and our business and competitive position may be harmed. |

| ● | Our future success depends in part on our ability to drive the adoption of our platform by international and SMB customers, and to expand into new, on-demand commerce verticals. |

| ● | We may be subject to claims by third parties of intellectual property infringement. |

| ● | We identified a material weakness in our internal control over our financial reporting process. If we are unable to remediate this material weakness, we may not be able to accurately or timely report our financial condition or results of operations. |

| ● | The dual-class structure of our common stock will have the effect of concentrating voting control with our existing stockholders, executive officers, directors, and their affiliates, which will limit your ability to influence the outcome of important transactions and to influence corporate governance matters, such as electing directors, and to approve material mergers, acquisitions, or other business combination transactions that may not be aligned with your interests. |

Our Corporate Information

We were incorporated in Delaware in June 2005. In January 2020, we changed our name from Mobo Systems, Inc. to Olo Inc. Our principal executive offices are located at 285 Fulton Street, One World Trade Center, 82nd Floor, New York, New York 10007, and our telephone number is (212) 260-0895. Our website address is www.olo.com. Information contained on, or that can be accessed through, our website is not incorporated by reference in this prospectus, and you should not consider information on our website to be part of this prospectus or in deciding to purchase our Class A common stock.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We may take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm under Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions for up to five years or until we are no longer an emerging growth company, whichever is earlier. In addition, the JOBS Act provides that an “emerging growth company” can delay adopting new or revised accounting standards until those standards apply to private companies. We have elected to use the extended transition period under the JOBS Act.

15

Table of Contents

Accordingly, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until the earliest of: (1) the last day of the fiscal year following the fifth anniversary of this offering; (2) the last day of the first fiscal year in which our annual gross revenue is $1.07 billion or more; (3) the date on which we have, during the previous rolling three-year period, issued more than $1.0 billion in non-convertible debt securities; and (4) the last day of the fiscal year in which the market value of our equity securities, which includes Class A common stock and Class B common stock held by non-affiliates exceeds $700 million as of June 30 of such fiscal year.

We are also a smaller reporting company as defined in the Securities Exchange Act of 1934, as amended. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as (i) the market value of our voting and non-voting common stock held by non-affiliates is less than $250 million measured on the last business day of our second fiscal quarter or (ii) our annual revenue is less than $100 million during the most recently completed fiscal year and the market value of our voting and non-voting common stock held by non-affiliates is less than $700 million measured on the last business day of our second fiscal quarter. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and have reduced disclosure obligations regarding executive compensation, and, similar to emerging growth companies, if we are a smaller reporting company with less than $100 million in annual revenue, we would not be required to obtain an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

16

Table of Contents

THE OFFERING

| Class A common stock offered by us |

shares |

| Option to purchase additional shares of Class A common stock offered by us |

shares |

| Class A common stock to be outstanding immediately after this offering |

shares ( shares if the option to purchase additional shares is exercised in full). |

| Class B common stock to be outstanding immediately after this offering |

shares |

| Total Class A common stock and Class B common stock to be outstanding after this offering |

shares |

| Use of proceeds |

We estimate that our net proceeds from the sale of our Class A common stock that we are offering will be approximately $ million (or approximately $ million if the underwriters’ option to purchase additional shares of our Class A common stock from us is exercised in full), assuming an initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| The principal purposes of this offering are to increase our capitalization and financial flexibility, to create a public market for our Class A common stock, and to facilitate our future access to the capital markets. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds we receive from this offering. However, we currently intend to use the net proceeds we receive from this offering for general corporate purposes, including working capital, operating expenses, and capital expenditures. We may also use a portion of the net proceeds we receive from this offering to acquire complementary businesses, products, services, or technologies. However, we do not have agreements or commitments to enter into any acquisitions at this time. |

| See the section titled “Use of Proceeds” for additional information. |

17

Table of Contents

| Directed share program |

At our request, the underwriters have reserved up to shares of Class A common stock, or % of the shares offered by this prospectus, for sale at the initial public offering price, to our directors, certain of our customers and partners, and the friends and family members of certain of our employees, directors, customers, and partners. Shares purchased through the directed share program will not be subject to a lock-up restriction, except in the case of shares purchased by any of our directors or officers and certain of our employees and existing equity holders. The number of shares of Class A common stock available for sale to the general public will be reduced to the extent these individuals purchase such reserved shares. Any reserved shares not so purchased will be offered by the underwriters to the general public as the same basis as the other shares of Class A common stock offered by this prospectus. See the section titled “Underwriting—Directed Share Program” for additional information. |

| Voting rights |

We will have two classes of common stock: Class A common stock and Class B common stock. Class A common stock is entitled to one vote per share and Class B common stock is entitled to ten votes per share. Holders of Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by law or our amended and restated certificate of incorporation that will be in effect in connection with the closing of this offering. Once this offering is completed, based on the number of shares outstanding as of December 31, 2020, the holders of our outstanding Class B common stock will own approximately % of our outstanding shares and control approximately % of the voting power of our outstanding shares, and our executive officers, directors, and stockholders holding more than 5% of our outstanding shares, together with their affiliates, will beneficially own, in the aggregate, approximately % of our outstanding shares and control approximately % of the voting power of our outstanding shares. The holders of our outstanding Class B common stock will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and the approval of any change in control transaction. See the section titled “Principal Stockholders” and “Description of Capital Stock” for additional information. |

| Risk factors |

You should carefully read the section titled “Risk Factors” beginning on page 23 and the other information included in this prospectus for a discussion of facts that you should consider before deciding to invest in shares of our Class A common stock. |

| Proposed NYSE trading symbol |

“OLO” |

18

Table of Contents

The number of shares of Class A common stock and Class B common stock that will be outstanding after this offering is based on no shares of Class A common stock and 7,210,075 shares of Class B common stock outstanding as of December 31, 2020, and excludes:

| ● | 482,079 shares and 1,821,535 shares of Class B common stock issuable upon the exercise of stock options outstanding as of December 31, 2020 under our 2005 Equity Incentive Plan, or 2005 Plan, and our 2015 Equity Incentive Plan, or 2015 Plan, respectively, with a weighted-average exercise price of $2.69 per share and $40.75 per share, respectively; |

| ● | 386,940 shares of Class B common stock issuable upon the exercise of outstanding stock options issued after December 31, 2020 pursuant to our 2015 Plan, with a weighted-average exercise price of $165.32 per share; |

| ● | 8,920 shares of Class B common stock issuable upon the exercise of a warrant to purchase preferred stock, which will become a warrant to purchase shares of Class B common stock upon the closing of this offering, at an exercise price of $2.80 per share; |

| ● | 96,853 shares of Class B common stock issuable upon the exercise of outstanding stock appreciation rights issued pursuant to our 2015 Plan which will become vested upon the completion of this offering; |

| ● | shares of Class A common stock reserved for future issuance under our 2021 Equity Incentive Plan, or 2021 Plan, which will become effective in connection with this offering, as well as any future increases, including annual automatic evergreen increases, in the number of shares of Class A common stock reserved for issuance thereunder, and any shares underlying outstanding stock awards granted under our 2005 Plan or our 2015 Plan that expire or are repurchased, forfeited, cancelled or withheld, as more fully described in the section titled “Executive Compensation—Equity Incentive Plans”; |