Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DTE ENERGY CO | dte-20210219.htm |

| EX-99.1 - EX-99.1 - DTE ENERGY CO | exhibit991-12312020.htm |

FEBRUARY 19, 2021 DTE YEAR END 2020 EARNINGS CONFERENCE CALL EXHIBIT 99.2

The information contained herein is as of the date of this document. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this document as a result of new information or future events or developments. Words such as “anticipate,” “believe,” “expect,” “may,” “could,” “would,” “projected,” “aspiration,” “plans” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties. This document contains forward-looking statements about DTE Energy’s and DTE Midstream’s financial results and estimates of future prospects, and actual results may differ materially. This document contains forward-looking statements about DTE Energy’s intent to spin-off DTE Midstream and DTE Energy’s preliminary strategic, operational and financial considerations related thereto. The statements with respect to the separation transaction are preliminary in nature and subject to change as additional information becomes available. The separation transaction will be subject to the satisfaction of a number of conditions, including the final approval of DTE Energy’s Board of Directors, and there is no assurance that such separation transaction will in fact occur. Many factors impact forward-looking statements including, but not limited to, the following: risks related to the spin-off of DTE Midstream, including that the process of exploring the transaction and potentially completing the transaction could disrupt or adversely affect the consolidated or separate businesses, results of operations and financial condition, that the transaction may not achieve some or all of any anticipated benefits with respect to either business, and that the transaction may not be completed in accordance with DTE Energy’s expected plans or anticipated timelines, or at all; the duration and impact of the COVID-19 pandemic on DTE Energy and customers, impact of regulation by the EPA, the EGLE, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility of prices in the oil and gas markets on DTE Energy’s gas storage and pipelines operations and the volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; impact of volatility in prices in the international steel markets on DTE Energy’s power and industrial projects operations; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy’s energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power or reduce power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in DTE Energy’s public filings with the Securities and Exchange Commission. Safe harbor statement 2

Participants 3 Jerry Norcia – President and CEO David Slater – President and CEO-Elect, Midstream Dave Ruud – Senior Vice President and CFO Barbara Tuckfield – Director Investor Relations

DTE delivered for employees, customers and communities against a challenging backdrop 4 Achieved extraordinary safety and engagement performance in 2020 ✓ Safest year on record ✓ Ranked by Gallup among the top companies globally for employee engagement ✓ Implemented work from home for over half of our employees Assisted customers and communities during COVID-19 pandemic ✓ Streamlined payment plans significantly for customers who were impacted by COVID-19 ✓ Led $23 million initiative that provided 51,000 tablets and internet access to Detroit public school students ✓ Donated two million masks to emergency managers, first responders and hospitals ✓ Contributed to COVID-19 relief efforts from DTE Foundation Executed on economic response plan ✓ Reduced costs with 10,000+ employees embracing a continuous improvement culture ✓ Delivered distinctive financial results in 2020; well-positioned for future success

Achieved significant success in 2020 across all business units 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Refers to DTE Midstream business post spin transaction which includes DTE’s natural gas pipeline, storage and gathering business and certain DTE Energy holding company activity included in the Corporate & Other segment Delivered strong financial results ✓ Operating EPS1 growth of 14% from 2019; 8.8% above 2020 original guidance, continuing a trend of among best growth in industry ✓ Exceeded original guidance midpoint for 12th consecutive year ✓ Increased 2021 dividend 7% ✓ Nearly 8% average annual operating EPS growth since 2008 Achieved success across all business units ✓ Provided regulatory certainty by maintaining steady base rates for customers through 2021 at utilities ✓ Utilities progressed on clean energy initiatives and infrastructure and reliability improvements ✓ Midstream2 placed LEAP Pipeline in service, ahead of schedule and under budget ✓ P&I operationalized RNG and cogeneration projects 5 Original guidanceActual $7.19 $2.90 Operating EPS 7.9% CAGR

Positioned for success in 2021 and beyond 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Bloomberg as of 12/31/2020 $6.61 $7.07 2020 original guidance midpoint 2021 guidance midpoint Operating EPS 7% Focusing on continued growth in 2021 ✓ Continuing strong growth with 2021 operating EPS1 guidance providing 7% growth over 2020 original guidance ✓ Utility growth from distribution, modernization and cleaner generation investments at DTE Electric and continued main renewal and infrastructure improvements at DTE Gas ✓ Continuing strategic and sustainable growth in non-utility businesses Positioned for future success ✓ Executing spin establishes Midstream as an independent, well-financed and growing gas midstream company; positions DTE as a predominantly pure-play utility ✓ Reaffirming 5% - 7% long-term operating EPS growth from 2020 original guidance midpoint ✓ Continuing long track record of delivering premium shareholder returns 6 79% 285% 422% Total shareholder return2 5-year 10-year 15-year S&P 500 Utilities DTE

DTE Electric progressed on key initiatives in 2020; accelerating distribution and generation investments 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix Advanced our clean energy investments and plan to accelerate the modernization of our electric grid • Progressed toward net zero carbon emissions target by 2050 • Accelerated voluntary renewables program to be one of the largest in the industry − 850 MW of commitments to date; 25,000 customers enrolled • Announced commitment to build extensive electric vehicle charging network Created regulatory certainty • Delayed rate case filing with innovative plan to keep customer base rates unchanged through 2021 • Received approval to provide a one-time voluntary refund to further delay customer rate increases Targeting 7% - 8% long-term operating earnings1 growth from 2020 original guidance midpoint • Investing in generation and distribution for clean and reliable energy • Upgrading substations for load growth and to address aging infrastructure $5 $7 $4 $5 $2 $2 ~$1 Electric investment 2020 - 2024 previous plan $12 $14 Distribution infrastructure Renewables Base infrastructure Natural gas plant 2021 - 2025 current plan 7 (billions)

DTE Gas progressed on key initiatives in 2020; replacing aging infrastructure to reduce greenhouse gas emissions 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix Advanced our clean energy investments and upgrading and replacing aging infrastructure • Announced innovative program to achieve net zero greenhouse gas emissions by 2050 • Progressed on major transmission renewal project • Continued main renewal upgrades and operational improvements; completed 206 main renewal miles Created regulatory certainty • Rate case settlement in August supports investment plans Targeting 9% long-term operating earnings1 growth from 2020 original guidance midpoint • Investing in main renewal, pipeline and transmission integrity and technology innovation 8 Gas investment $3.0 Additional opportunity $3.5 Infrastructure renewal Base infrastructure $1.6 $1.6 $1.4 $1.4 $0.5 2020 - 2024 previous plan 2021 - 2025 current plan (billions)

Midstream continuing track record of success; well-positioned for the future Achieved success in 2020 • Placed LEAP in service ahead of schedule and under budget; Blue Union and LEAP executing on plan • Delivered solid operational results across existing platforms • Generated $713 million of adjusted EBITDA1 • Executed contract at NEXUS with Ohio utility • Progressed toward completion of spin transaction Announced net zero emissions target by 2050 • Among first in sector to establish this goal Building on historical success; well-positioned for the future • Diversified counterparties with solid and improving credit profiles • Strong, stable and predictable cash flows • Focused on disciplined capital deployment supported by a flexible, well-capitalized balance sheet 1. Definition of adjusted EBITDA (non-GAAP) included in the appendix 9 Key markets Mid-Atlantic & LNG Ontario Northeast Texas Florida Midwest Southeast Louisiana & LNG

Midstream will be a uniquely positioned C-corp with a strong leadership team Executing Midstream separation • Establishes Midstream as an independent, natural gas midstream C-corp with assets in premium basins connected to major demand markets • Spin transaction is on track with expected completion mid-year − Initiated Form 10 process − Initiating discussions with rating agencies; targeting debt raise in 2Q − Ongoing analyst and investor outreach; planned roadshow in June Positioned for future success • Targeting strong financial metrics in 2021 − Adjusted EBITDA1 target of $710 - $750 million − ~4x debt / adjusted EBITDA − ~2x dividend coverage ratio2 • Strong balance sheet and cash flow generation provides flexibility for future growth Seasoned leadership team with proven track record David Slater President & CEO Jeff Jewell CFO Robert Skaggs, Jr. Executive Chairman 10 1. Definition of adjusted EBITDA (non-GAAP) included in the appendix 2. Subject to Midstream Board approval. The dividend coverage ratio represents the total distributable cash flow (“DCF”) divided by total dividends paid to investors. Definition of DCF (non-GAAP) included in the appendix

2019 2020 Variance Primary drivers DTE Electric $716 $813 $97 Higher residential sales and rate implementation offset by rate base growth costs DTE Gas 181 196 15 One-time O&M cost savings, rate implementation and infrastructure recovery mechanism revenue offset by weather and rate base growth costs Gas Storage & Pipelines 213 303 90 Full year of Blue Union and LEAP in-service Power & Industrial Projects 133 150 17 New RNG and cogeneration projects offset by lower steel-related sales Energy Trading 30 39 9 Gas portfolio performance Corporate & Other (107) (111) (4) Interest expense DTE Energy $1,166 $1,390 $224 Operating EPS $6.30 $7.19 $0.89 Avg. Shares Outstanding 185 193 2020 operating earnings1 variance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 11 (millions, except EPS) Economic response plan generated significant cost reductions which offset COVID-19 and other O&M costs invested ahead of schedule

2020 original guidance midpoint 2021 guidance Primary drivers DTE Electric $766 $826 - $840 Distribution, modernization and cleaner generation investments DTE Gas 189 202 - 212 Continued main renewal and other infrastructure improvements Gas Storage & Pipelines2 285 296 - 312 Full year of LEAP in-service and organic growth Power & Industrial Projects 141 147 - 163 Full year of new RNG and cogeneration projects Energy Trading 20 15 - 25 In-line with economic earnings Corporate & Other2 (127) (148) - (138) Higher interest expense DTE Energy2 $1,274 $1,338 - $1,414 Operating EPS2 $6.61 $6.88 - $7.26 2021 guidance provides 7% operating EPS1 growth over 2020 original guidance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Guidance is with respect to the current consolidated pre-spin version of DTE; the spin is currently expected to occur mid-year 2021 and any post-spin guidance will be provided later in the process (millions, except EPS) 12 2021 guidance growth from 2020 original guidance midpoint does not reflect one-time items included in 2020 actual results

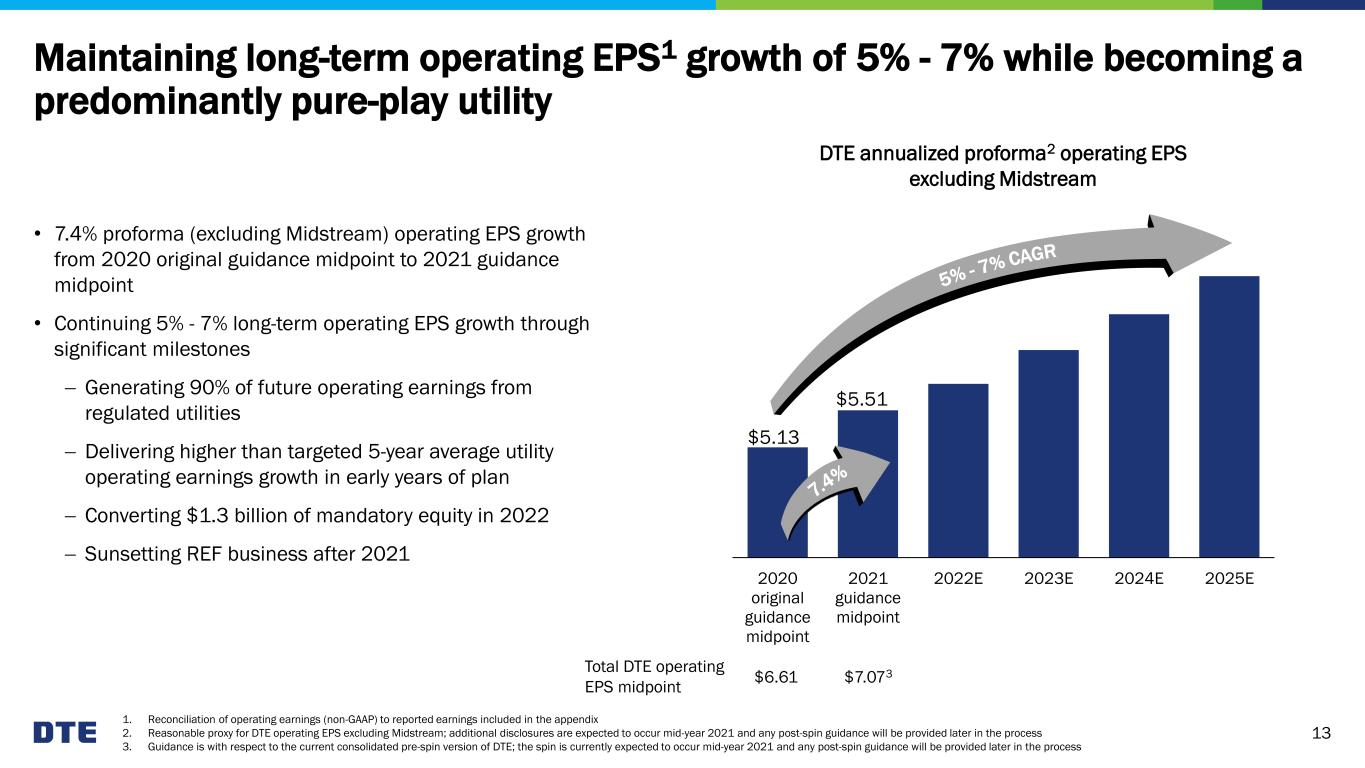

Maintaining long-term operating EPS1 growth of 5% - 7% while becoming a predominantly pure-play utility 13 2020 original guidance midpoint 2021 guidance midpoint 2022E 2023E 2024E 2025E DTE annualized proforma2 operating EPS excluding Midstream • 7.4% proforma (excluding Midstream) operating EPS growth from 2020 original guidance midpoint to 2021 guidance midpoint • Continuing 5% - 7% long-term operating EPS growth through significant milestones − Generating 90% of future operating earnings from regulated utilities − Delivering higher than targeted 5-year average utility operating earnings growth in early years of plan − Converting $1.3 billion of mandatory equity in 2022 − Sunsetting REF business after 2021 $5.13 $5.51 Total DTE operating EPS midpoint $6.61 $7.073 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Reasonable proxy for DTE operating EPS excluding Midstream; additional disclosures are expected to occur mid-year 2021 and any post-spin guidance will be provided later in the process 3. Guidance is with respect to the current consolidated pre-spin version of DTE; the spin is currently expected to occur mid-year 2021 and any post-spin guidance will be provided later in the process

Maintaining strong cash flow, balance sheet and credit profile 1. Funds from Operations (FFO) is calculated using operating earnings 2. Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 14 • Issued $173 million of equity in 2020 through internal mechanisms • Strong investment-grade credit rating − Spin transaction is credit enhancing allowing FFO1 / Debt2 target to be lowered from 18% to ~16% • $3.1 billion of available liquidity at end of 2020 $0.0 - $0.2 $0.0 - $0.2 $1.3 Convertible equity units Planned equity issuances 2021 - 2023 Credit ratings S&P Moody’s Fitch DTE Energy (unsecured) BBB Baa2 BBB DTE Electric (secured) A Aa3 A+ DTE Gas (secured) A A1 A (billions) 2021 2022 2023 $1.3 - $1.7 Strong cash flows have reduced equity needs in plan; targeting low end of planned equity issuances in 2021

VISIT US: DTE INVESTOR RELATIONS 2020 ESG REPORT 2019 - 2020 CORPORATE CITIZENSHIP HIGHLIGHTS

16 Appendix

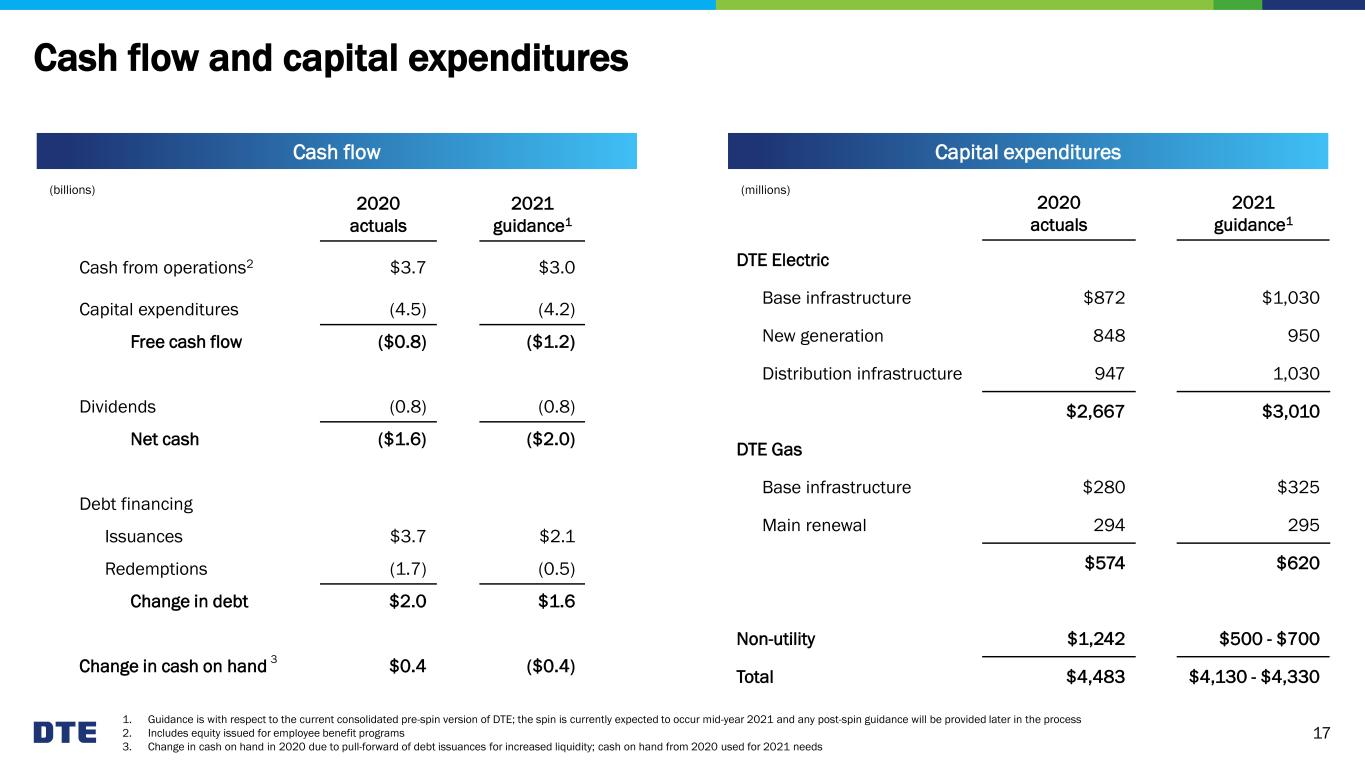

Cash flow and capital expenditures 1. Guidance is with respect to the current consolidated pre-spin version of DTE; the spin is currently expected to occur mid-year 2021 and any post-spin guidance will be provided later in the process 2. Includes equity issued for employee benefit programs 3. Change in cash on hand in 2020 due to pull-forward of debt issuances for increased liquidity; cash on hand from 2020 used for 2021 needs 17 2020 actuals 2021 guidance1 Cash from operations2 $3.7 $3.0 Capital expenditures (4.5) (4.2) Free cash flow ($0.8) ($1.2) Dividends (0.8) (0.8) Net cash ($1.6) ($2.0) Debt financing Issuances $3.7 $2.1 Redemptions (1.7) (0.5) Change in debt $2.0 $1.6 Change in cash on hand $0.4 ($0.4) 2020 actuals 2021 guidance1 DTE Electric Base infrastructure $872 $1,030 New generation 848 950 Distribution infrastructure 947 1,030 $2,667 $3,010 DTE Gas Base infrastructure $280 $325 Main renewal 294 295 $574 $620 Non-utility $1,242 $500 - $700 Total $4,483 $4,130 - $4,330 (millions) Cash flow Capital expenditures (billions) 3

2019 2020 % Change Actuals 863 961 11% Normal 803 803 0% Deviation from normal 7% 20% (millions) (per share) 4Q YTD 4Q YTD 2019 $1 $28 $0.01 $0.15 2020 ($8) $36 ($0.04) $0.19 Cooling degree days Operating earnings1 impact of weather Weather normal sales (GWh) 2019 2020 % Change Residential 14,820 15,947 8% Commercial 19,624 18,116 (8%) Industrial 11,552 9,719 (16%) Other 226 220 (3%) 46,222 44,002 (5%) DTE Electric 4Q 2019 4Q 2020 % Change 2019 2020 % Change Actuals 2,289 2,100 (8%) 6,625 6,082 (8%) Normal 2,197 2,205 0% 6,340 6,389 1% Deviation from normal 4% (5%) 4% (5%) (millions) (per share) 4Q YTD 4Q YTD 2019 $6 $16 $0.03 $0.09 2020 ($7) ($19) ($0.04) ($0.10) Heating degree days Operating earnings impact of weather DTE Gas Weather impact on sales 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 18

DTE Electric • General rate case final order (U-20561) − Effective: May 15, 2020 − Rate recovery: $188 million − ROE: 9.9% − Capital structure: 50% equity, 50% debt − Rate base: $17.9 billion • Renewable energy plan (U-18232) − Received order: July 9, 2020 − 350 MW of additional renewable energy by 2022 (225 MW of wind and 125 MW of solar) • Alternative rate case strategy (U-20835) − Received order: July 9, 2020 − Delays rate case filing • Voluntary renewable plan (U-20713) − Filed: August 31, 2020 − Additional 420 MW of solar by 2022 • Innovative, one-time customer refund regulatory liability (U-20921) − Received order: December 9, 2020 − $30 million voluntary refund DTE Gas • General rate case filed February 2021 (U-20940) − Effective: January 1, 2022 − Rate recovery: $195 million − ROE: 10.25% − Capital structure: 52% equity, 48% debt − Rate base: $5.6 billion • Voluntary emissions offset plan (U-20839) − Received order: October 29, 2020 − Comprised of a combination of both carbon offsets and Renewable Natural Gas (RNG) − 95% of planned emissions reduction is carbon emissions − 5% of planned emissions reduction is RNG DTE Electric and DTE Gas regulatory update 19 Dan Scripps Chair Katherine Peretick Commissioner Tremaine Phillips Commissioner Michigan Public Service Commission

Environmental, social and governance efforts are key priorities; aspiring to be the best in the industry 20 Environmental Transitioning towards net zero greenhouse gas emissions Delivering clean and reliable energy to customers Protecting our natural resources Social Focusing on the diversity, safety, well-being and success of our employees Committing to a strong culture provides a solid framework for success Revitalizing neighborhoods and investing in communities World-class volunteerism Governance Focusing on the oversight of environmental sustainability, social and governance Ensuring board diversity Providing incentive plans tied to safety and customer satisfaction targets

Award-winning commitment to being a top ESG employer in the country 21 Gallup Great Workplace Award 8 consecutive years Inclusion of women-owned businesses in their supply chains Overall excellence in diversity Superior corporate citizenship and community involvement Ambassadors Championing Excellence Award for commitment to supporting minority businesses America’s Most Responsible Companies 2021 Veteran friendly employer

Environmental sustainability is critical to the creation of long-term shareholder value 22 Driving collaboration in the fight against climate change • Leading by example with aggressive goal to achieve net zero carbon emissions by 2050 • Active participant in coalitions that advocate for strong environmental public policies • Key participant in Governor Whitmer’s initiative to develop and implement pathways to meet the state of Michigan’s economy-wide climate goals • Leading EEI’s strategic plan for effective federal climate policy Protecting our natural resources and promoting environmental sustainability through stewardship and conservation • Targeting a 25% reduction of energy, water and waste at our facilities by 2022 compared to 2016 levels • Providing habitats for hundreds of species of birds, mammals, fish and insects in our service territory • Over 35 sites certified under the Wildlife Habitat Council • Received Corporate Conservation Leadership award from the Wildlife Habitat Council for leadership in wildlife management • Corporate-wide certification to the ISO14001 Standard for Environmental Management Systems

77% 45% 30% 20% 20% 20% 2% 18% 20 - 25% 1% 17% 25 – 30% 2005 2023E 2030E More than doubling renewable energy by 2024 23 Cleaner generation mix River Rouge Trenton Channel Belle River Monroe 2022 2030 2040 St. Clair Renewables Natural gas Nuclear & other Coal 2021

Committed to diversity, equity and inclusion, creating an environment where all are welcome 24 Office of Diversity, Equity and Inclusion • Led by our CEO and key executive leaders • Focused on sustaining a diverse workforce which is representative of the communities we serve Commitment to create a diverse, equitable and inclusive workforce and supplier base influences our hiring strategies and business practices • Annual review of compensation practices to ensure equitable pay • Formal training programs including unconscious bias training for employees and leaders • Hiring people with disabilities and returning citizens • Over $700 million invested with diverse suppliers in 2020 as part of our award-winning supplier diversity program • Public advocacy and financial support − Michigan civil rights reform − Removing the digital divide − Equity funding for schools Differently-abled group Latinx professionals group Young professionals group LGBTQ groupBlack professionals group Family oriented group Asian and Middle Eastern group Veteran empowerment group Women’s group 9 active employee resource groups that promote a safe and welcoming environment, and offer professional development, networking, mentoring and support

Governance framework provides shareholder rights and enables sustainable value creation 25 average tenure~9yr 3 Directors added since 2018 33% gender or ethnically diverse 83% independent 2 10 4 8 Board diversity Best-in-class governance practices ✓ Lead Independent Director ✓ Stock ownership guidelines for non-employee Directors ✓ Majority voting standard ✓ Annual Director elections ✓ Established corporate governance guidelines ✓ Publication of Environmental, Social, Governance and Sustainability report ✓ Shareholder ability to call a special meeting ✓ No supermajority voting provisions to approve mergers or amend charter ✓ Overboard policy

Spin transaction underway with completion expected mid-2021 1. Expected to remain an independent Director of DTE Energy post spin transaction 26 Structure • Spin-off of Midstream designed to be tax-free • Immediately after closing, DTE shareholders will: − Retain current DTE shares − Receive pro-rata dividend of Midstream shares Timing / approvals • Expected close mid-year 2021 • Multiple workstreams well underway • Subject to a Form 10 registration statement being declared effective by the SEC, regulatory approvals and satisfaction of other conditions • Requires final Board of Directors approval Leadership DTE Energy • CEO: Jerry Norcia • Executive Chairman: Gerry Anderson • Lead Independent Director: Ruth Shaw Midstream • CEO: David Slater • Executive Chairman: Robert Skaggs, Jr.1 • CFO: Jeff Jewell Post spin transaction businesses DTE Energy • DTE Electric • DTE Gas • Power & Industrial Projects and Energy Trading Midstream • Pipelines & Other: Millennium, Vector, NEXUS, Birdsboro, Generation, Washington 10 Storage Complex, Bluestone, LEAP and Stonewall • Gathering: Susquehanna, Blue Union, Appalachia, Tioga and Michigan Gathering

90% 10% 92% 8% 70% 30% 80% 20% Enhanced strategic focus ✓ Premier, predominantly pure-play regulated electric and natural gas utility Investments in growth opportunities ✓ Substantially growing rate base with $17 billion of utility growth capital investment, a 13% increase over prior plan ✓ Aligned with aggressive ESG targets, net zero greenhouse gas emissions by 2050 Distinguished growth profiles ✓ 5% - 7% operating EPS1 growth target from 2020 original guidance midpoint − Targeting average annual operating earnings growth of 7% - 8% at DTE Electric and 9% at DTE Gas from 2020 original guidance midpoint Improved investor alignment ✓ Attracts shareholders desiring predictable, low-risk growth associated with regulated utilities Seasoned management team ✓ Track record of providing clean, safe, reliable and affordable energy to our customers and being a force for growth in the communities where we live and serve Competitive dividends ✓ Targeting dividend growth and payout ratio consistent with pure-play utility peers Numerous benefits for DTE Energy as a predominantly pure-play regulated utility 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Excludes Midstream capital 27 Today Diversified energy company Operating earnings transformation Post- transaction Predominantly pure-play regulated utility Previous 5-year plan 2020 - 2024 Capital investment Post- transaction 5-year plan2 2021 - 2025 Utility Non-utility

Midstream will be well-positioned with experienced leadership and unique, high-quality assets 1. Definition of adjusted EBITDA (non-GAAP) included in the appendix 2. Subject to Midstream Board approval. The dividend coverage ratio represents the total distributable cash flow (“DCF”) divided by total dividends paid to investors. Definition of DCF (non-GAAP) included in the appendix 28 Enhanced strategic focus ✓ Positioned to be a premier, publicly traded natural gas midstream company with high-quality assets strategically located in premium basins connected to major demand markets Experienced leadership ✓ Proven, experienced leadership and highly engaged employees ✓ Among the best safety and reliability rankings in the industry Valuable growth opportunities ✓ Highly accretive organic growth on existing platforms ✓ Contracted growth on Haynesville assets Distinguished growth profile ✓ Assets backed by long-term contracts ✓ Diversified counterparties with solid and improving credit profiles ✓ Growing cash flows Better investor alignment ✓ Only independent, mid-cap, gas-focused midstream investment opportunity in Marcellus / Utica and Haynesville ✓ Attracts shareholders desiring higher dividends and upside opportunities associated with high-quality midstream companies Strong capital structure and dividend policy ✓ Improved flexibility to pursue accretive growth projects ✓ Initially targeting ~4x debt / adjusted EBITDA1 and ~2x dividend coverage ratio2 in 2021

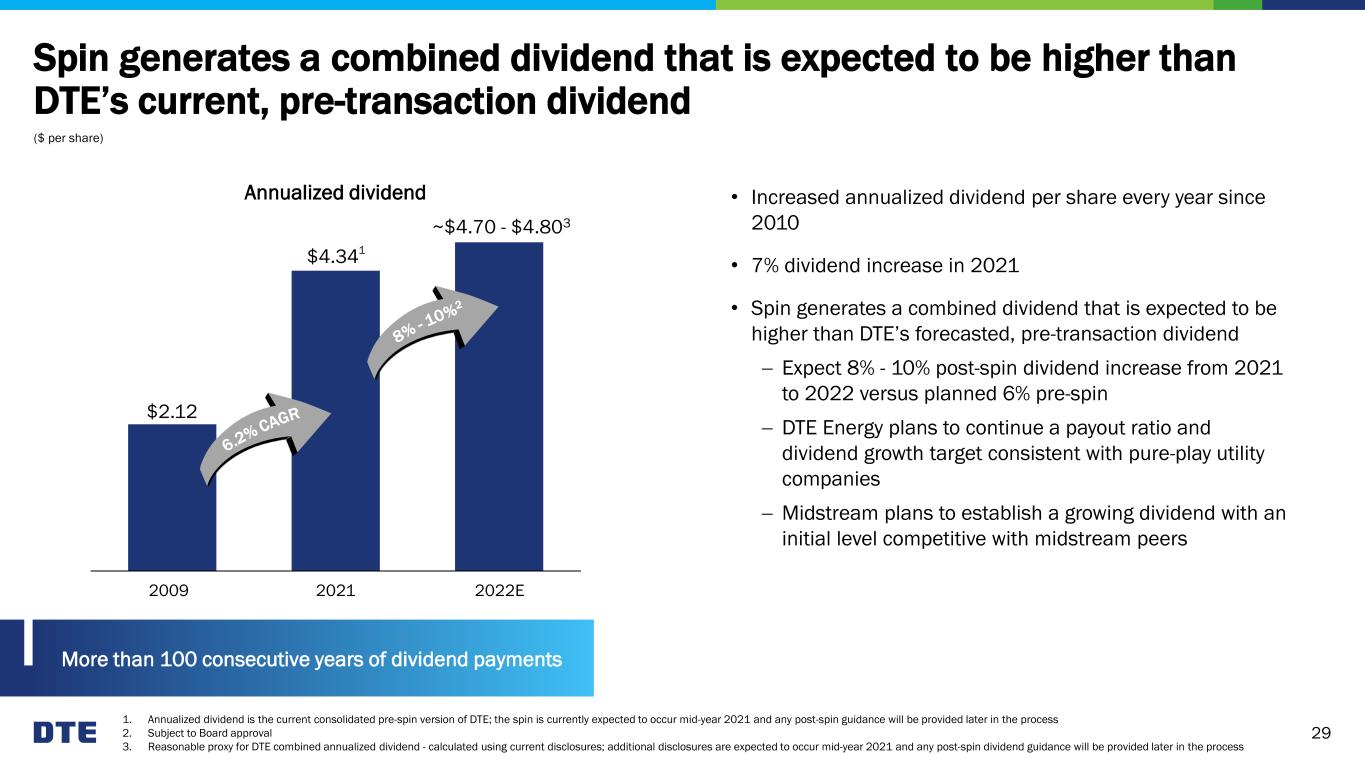

1. Annualized dividend is the current consolidated pre-spin version of DTE; the spin is currently expected to occur mid-year 2021 and any post-spin guidance will be provided later in the process 2. Subject to Board approval 3. Reasonable proxy for DTE combined annualized dividend - calculated using current disclosures; additional disclosures are expected to occur mid-year 2021 and any post-spin dividend guidance will be provided later in the process 29 Spin generates a combined dividend that is expected to be higher than DTE’s current, pre-transaction dividend Annualized dividend $2.12 $4.34 • Increased annualized dividend per share every year since 2010 • 7% dividend increase in 2021 • Spin generates a combined dividend that is expected to be higher than DTE’s forecasted, pre-transaction dividend − Expect 8% - 10% post-spin dividend increase from 2021 to 2022 versus planned 6% pre-spin − DTE Energy plans to continue a payout ratio and dividend growth target consistent with pure-play utility companies − Midstream plans to establish a growing dividend with an initial level competitive with midstream peers More than 100 consecutive years of dividend payments 2009 2021 2022E ($ per share) 1 ~$4.70 - $4.803

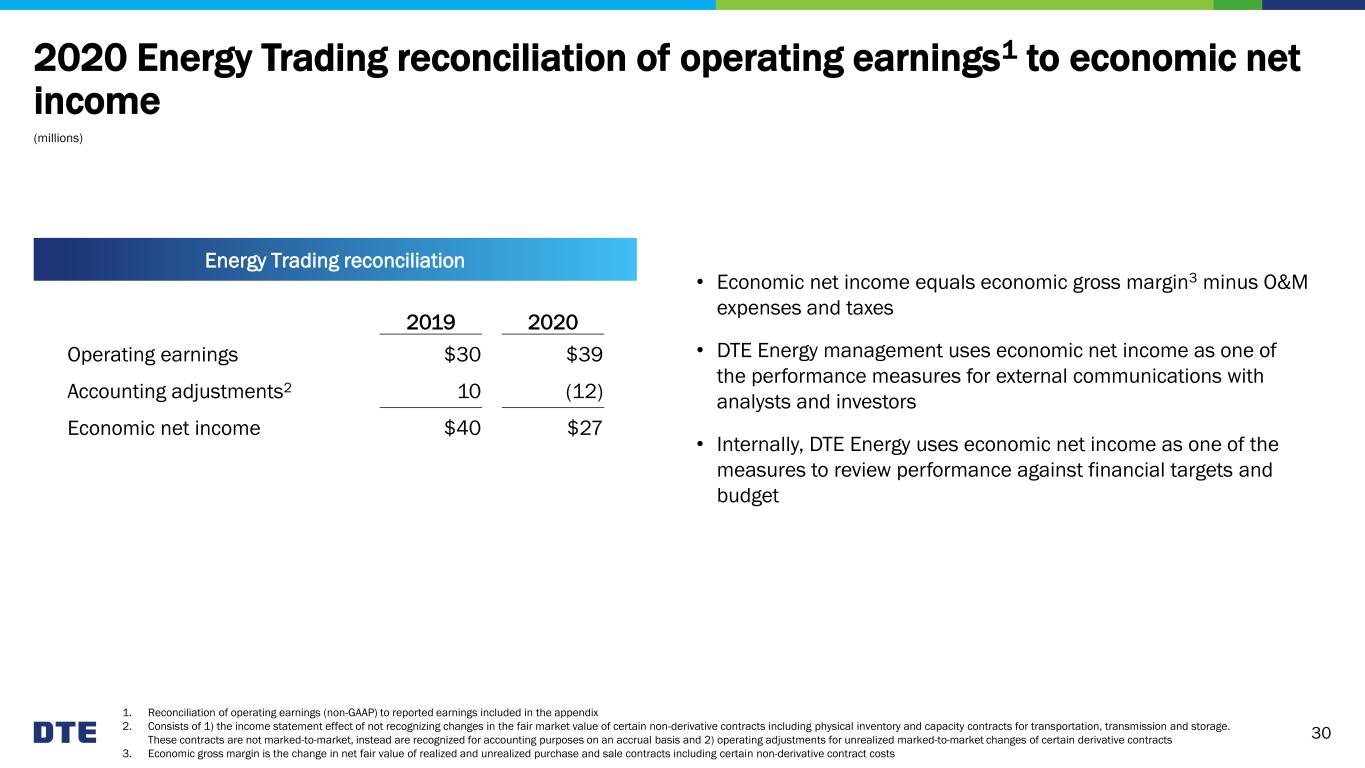

• Economic net income equals economic gross margin3 minus O&M expenses and taxes • DTE Energy management uses economic net income as one of the performance measures for external communications with analysts and investors • Internally, DTE Energy uses economic net income as one of the measures to review performance against financial targets and budget Energy Trading reconciliation 2019 2020 Operating earnings $30 $39 Accounting adjustments2 10 (12) Economic net income $40 $27 2020 Energy Trading reconciliation of operating earnings1 to economic net income 30 (millions) 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Consists of 1) the income statement effect of not recognizing changes in the fair market value of certain non-derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not marked-to-market, instead are recognized for accounting purposes on an accrual basis and 2) operating adjustments for unrealized marked-to-market changes of certain derivative contracts 3. Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs

Adjustments key A) MPSC disallowance of capital expenses previously recorded in 2018 and 2019 related to incentive compensation — recorded in Operating Expenses — Asset (gains) losses and impairments, net B) Shift premiums and other incremental costs associated with the sequestration of employees critical to continued operations due to COVID-19 — recorded in Operating Expenses — Operating and maintenance C) Post-acquisition settlement recorded in Other (Income) and Deductions — Other income D) Transaction costs relating to the planned spin-off of the DTE Midstream business — recorded in Operating Expenses — Operating and maintenance E) Settlement charge relating to a non-regulated qualified pension plan — recorded in Other (Income) and Deductions — Non-operating retirement benefits, net 2019 - 2020 reconciliation of reported to operating earnings (non-GAAP) and operating EPS (non-GAAP) 1. For the year ended December 31, 2020, excluding tax related adjustments, the amount of income taxes was calculated using a combined federal and state income tax rate of 27% for Gas Storage and Pipelines, 26% for Utility operations and Corporate and Other, and 25% for Power and Industrial Projects and Energy Trading. For the year ended December 31, 2019, the rates were 29% for Gas Storage and Pipelines, 26% for Utility operations, and 25% for Energy Trading and Corporate and Other. 2. Per share amounts are divided by Weighted Average Common Shares Outstanding – Diluted, as noted on the Consolidated Statements of Operations (Unaudited). 31 Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. F) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non-derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, and gas — non-utility G) Reduction to Income Tax Expense resulting from carrying back 2018 net operating losses to 2013 pursuant to CARES Act H) MPSC approval of the deferral for the new customer billing system post-implementation expenses — recorded in Operating Expenses — Operation and maintenance I) MPSC disallowance of power plant capital expenses — recorded in Operating Expenses — Asset (gains) losses and impairments, net J) Transaction-related costs resulting from the acquisition of Blue Union and LEAP K) Impairment of equity method investment — recorded in Other income (Earnings per share2)

2008 reconciliation of reported to operating EPS (non-GAAP) 32 Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2008 Segment Diluted Earnings Per Share Pre-tax adjustments Income taxes EPS DTE Energy Reported EPS $3.36 DTE Electric - - - DTE Gas Performance excellence process 0.04 (0.01) 0.03 Gas Storage & Pipelines - - - Power & Industrial Projects Performance excellence process 0.01 - 0.01 Energy Trading Performance excellence process 0.01 - 0.01 Corporate & Other Residual hedge impact from Antrim sale 0.12 (0.04) 0.08 Tax true-up from sale of joint venture - Crete 0.01 - 0.01 Discontinued operations Synfuel (0.20) 0.07 (0.13) Unconventional gas production (0.74) 0.27 (0.47) DTE Energy Operating EPS ($0.75) $0.29 $2.90

Reconciliation of reported to operating earnings (non-GAAP) 33 Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings.

Adjusted EBITDA and distributable cash flow (DCF) are non-GAAP measures 34 Adjusted EBITDA is calculated using net income, the most comparable GAAP measure and adding back expenses for interest, taxes, depreciation and amortization. Adjusted EBITDA also includes an adjustment for DTE’s proportional share of joint venture net income, excluding taxes and depreciation. DCF is calculated as Adjusted EBITDA less pre-tax interest expense, maintenance capital investment and cash taxes. For GSP, DTE Energy management believes that Adjusted EBITDA is a meaningful disclosure to investors as it is more commonly used as the primary performance measurement for external communications with analysts and investors in the Midstream industry. DCF is used in the calculation of dividend coverage ratios, which DTE Energy management believes is another meaningful performance measurement to disclose to Midstream analysts and investors. Reconciliation of net income to Adjusted EBITDA or DCF as projected for full-year 2021 is not provided. We do not forecast net income as we cannot, without unreasonable efforts, estimate or predict with certainty the components of net income. These components, net of tax, may include, but are not limited to, impairments of assets and other charges, divesture costs, acquisition costs, or changes in accounting principles. All of these components could significantly impact such financial measures. At this time, management is not able to estimate the aggregate impact, if any, of these items on future period reported earnings. Accordingly, we are not able to provide a corresponding GAAP equivalent for Adjusted EBITDA or DCF. (millions) 2020 Gas Storage & Pipelines Reported earnings $315 Interest expense, net 104 Income taxes 116 Depreciation & amortization 151 Pre-tax operating adjustments (16) Adjustment for joint venture net income 43 Adjusted EBITDA $713