Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - VALMONT INDUSTRIES INC | pressrelease20201226.htm |

| 8-K - 8-K - VALMONT INDUSTRIES INC | vmi-20210217.htm |

© 2021 Valmont® Industries, Inc. Valmont Industries, Inc. Fourth Quarter and Full Year 2020 Earnings Presentation February 18, 2021

Disclosure Regarding Forward-Looking Statements These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries including the continuing and developing effects of COVID-19 including the effects of the outbreak on the general economy and the specific economic effects on the Company’s business and that of its customers and suppliers, competitor responses to the Company’s products and services, the overall market acceptance of such products and services, the integration of acquisitions and other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission. Consequently, such forward-looking statements should be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation2

| Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 20213 STEVE KANIEWSKI PRESIDENT & CHIEF EXECUTIVE OFFICER

4Q 2020 Segment Sales and Segment Summaries February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation4 Solid Fourth Quarter Pricing and Operational Performance • Significantly higher sales of global generation products • Utilities’ continued investment in a more resilient grid • Favorable pricing & FX impacts offset by lower volumes, mostly due to lower int’l sales as COVID-19 affected end-market demand • Continued investments in road & construction projects led to higher North American transportation product sales • Continued strong demand & favorable pricing in all regions led to similar YoY wireless communication sales • Sequential improvement as demand recovers from earlier COVID-19 disruptions • Demand continues to closely follow industrial production trends • North American sales led by improved farmer sentiment; recent increases in ag commodity prices leading to multi-year highs • Int’l sales led by higher sales in Middle East, European & South American markets • Positive momentum on multi-year Egypt project • Completed acquisition of Torrent® Engineering and Equipment (remaining 40% stake) SEGMENT SUMMARIES TOTAL 4Q 2020 SALES: $798.4M $271.0M $256.1M $89.3M $199.3M Utility Support Structures Engineered Support Structures Coatings Irrigation N.A.: $97.1M | International: $102.2M 33.9% of Sales 32.1% of Sales 11.2% of Sales 25.0% of Sales

Full Year 2020 Segment Sales and Segment Summaries February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation5 Delivered Strong Financial and Operational Results in 2020 SEGMENT SUMMARIES TOTAL FY 2020 SALES: $2,895.4M $1,002.2M $995.8M $345.3M $645.8M Utility Support Structures Engineered Support Structures Coatings Irrigation N.A.: $378.4M | International: $267.4M 34.6% of Sales 34.4% of Sales 11.9% of Sales 22.3% of Sales • Continued robust demand driven by renewables and grid resiliency • Higher sales of global generation products • Benefitted from pricing actions & improved operational performance throughout year • In North America, strong demand in transportation markets & increasing number of site buildouts ahead of 5G rollouts, offset lower international end-market demand from COVID-19 • Access Systems sales down 23% YoY due to strategic decision to exit certain product lines • Sales down 6.1% for the year but improved sequentially in 2H20; tracking in line with industrial production levels • Began as sixth consecutive year of off-cycle in North America – low grain prices & food supply disruptions from COVID-19 affected demand earlier in the year • Demand strengthened during 2H20 leading to a strong finish • Very strong demand in Brazil led to record sales, growing 32% YoY in local currency • Global advanced technology solutions grew ~20% YoY to $67.0M

Significant Progress Made in Key Areas During 2020 6 Delivering Strong Operating Performance and Generating Significant Shareholder Value | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 • Elevated commitment to ESG throughout organization – more to come in 2021 • Accelerated innovation through new products and services ‒ Spun concrete distribution poles ‒ Small cell solutions ‒ Valley 365 platform technology advancements • All segments benefited from disciplined pricing strategies throughout the year • Secured largest irrigation order in company’s history to supply $240M of products, services and technology solutions to the Egypt market • Generated $200M+ in FCF through a continued intense focus on working capital management • Quickly responded to inflationary pressures in late 2020 by implementing price increases in all four segments and implemented additional increases in early 2021

Recently Announced Collaboration with the Republic of Kazakhstan to Develop First In-Country Center-Pivot Manufacturing Facility • Kazakhstan is rapidly embracing agriculture as a key contributor to its economy with a national plan to more than double the number of irrigated acres over the next decade • Growing regional demand coupled with excellent infrastructure will allow us to quickly and efficiently serve the greater market • Multi-year agreement with our JV partner, Kusto Group to − Take advantage of the region’s growing agricultural potential − Help enhance mechanized precision agriculture − Create a network of farms that will accelerate efforts to address food security, resource conservation and increasing export demand • Committed to build a local facility with an annual production capacity of up to 1,000 pivots – break ground in 2H21 with production ramping by 2024 7 Remain Committed to ‘Conserving Resources. Improving Life®’ February 18, 2021 “Given the major increases in the importance of the issue of food security in the context of the ongoing and potential future pandemics, it is instrumental that we speed up our efforts in realizing this potential. This is why we so deeply value the role Valmont Industries is willing to play in this process by bringing their production capacity, human capital, and best practices here.” Askar Mamin, Prime Minister of Kazakhstan | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation

AVNER APPLBAUM EVP & CHIEF FINANCIAL OFFICER | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 20218

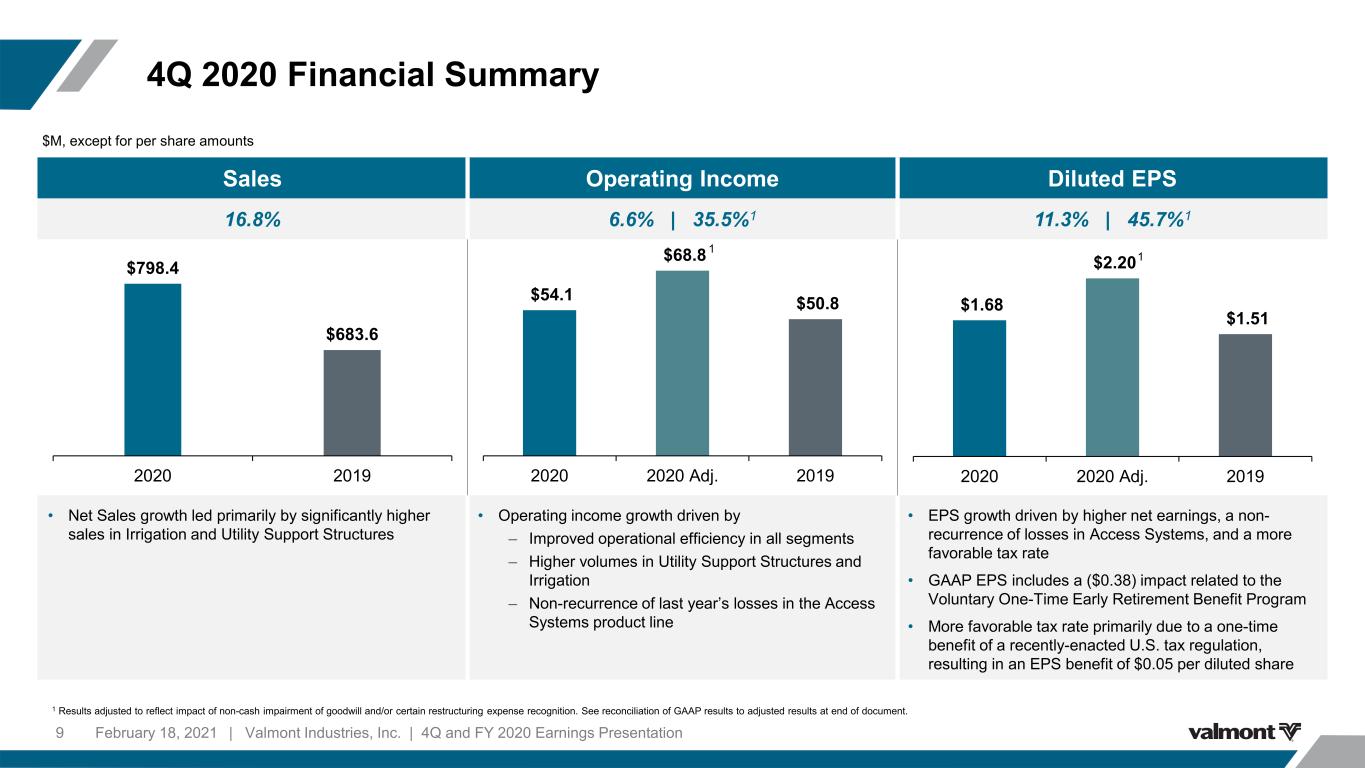

4Q 2020 Financial Summary February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation9 Sales Operating Income Diluted EPS 16.8% 6.6% | 35.5%1 11.3% | 45.7%1 • Net Sales growth led primarily by significantly higher sales in Irrigation and Utility Support Structures • Operating income growth driven by ‒ Improved operational efficiency in all segments ‒ Higher volumes in Utility Support Structures and Irrigation ‒ Non-recurrence of last year’s losses in the Access Systems product line • EPS growth driven by higher net earnings, a non- recurrence of losses in Access Systems, and a more favorable tax rate • GAAP EPS includes a ($0.38) impact related to the Voluntary One-Time Early Retirement Benefit Program • More favorable tax rate primarily due to a one-time benefit of a recently-enacted U.S. tax regulation, resulting in an EPS benefit of $0.05 per diluted share $M, except for per share amounts $798.4 $683.6 2020 2019 $54.1 $68.8 $50.8 2020 2020 Adj. 2019 $1.68 $2.20 $1.51 2020 2020 Adj. 2019 1 1 1 Results adjusted to reflect impact of non-cash impairment of goodwill and/or certain restructuring expense recognition. See reconciliation of GAAP results to adjusted results at end of document.

Sales Operating Income 16.9% (2.8%) | 6.2%2 4Q 2020 Results | Utility Support Structures 10 ($M) Key Statistics 2019 Sales1 $ 229.1 Volume 69.0 Pricing/Mix (24.5) Acquisitions/Divestiture 2.7 Currency Translation 1.9 2020 Sales1 $ 278.2 $278.2 $229.1 2020 2019 $25.6 $28.0 $26.3 2020 2020 Adj. 2019 2 COMMENTARY • Sales growth led by higher volumes from strategic capacity additions in existing North American operations and higher sales of global generation products • Volume increases were partially offset by negative sales impact of lower steel costs compared to prior year • While higher volumes and improved operational performance led to higher profits, quality of earnings was negatively impacted by higher mix of offshore and other complex steel structures 1 Net sales after intersegment eliminations. 2 Results adjusted to reflect impact of non-cash impairment of goodwill and/or certain restructuring expense recognition. See reconciliation of GAAP results to adjusted results at end of document. February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation

Sales Operating Income 0.9% 82.9% | 132.7%2 4Q 2020 Results | Engineered Support Structures February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation11 ($M) Key Statistics 2019 Sales1 $ 250.0 Volume (8.7) Pricing/Mix 4.4 Acquisitions/Divestiture - Currency Translation 6.6 2020 Sales1 $ 252.3 $252.3 $250.0 2020 2019 $19.2 $24.4 $10.5 2020 2020 Adj. 2019 2 COMMENTARY • Sales were similar to last year, as lower volumes, primarily in international markets, were offset by $6.6M of favorable currency impacts and favorable pricing • Lighting and traffic sales of $182.6M increased 2.1% YoY primarily due to favorable pricing across all markets • Wireless communication structures and components sales of $50.4M were similar to last year’s record Q4 sales; higher volumes in Europe and favorable pricing in all regions were offset by slightly lower volumes in North American markets • Access Systems sales of $23.0M decreased 12.2% YoY as expected due to lower volumes from strategically exiting product lines • Profitability improvement was driven by favorable pricing and the non-recurrence of one-time losses in the Access Systems business in 4Q19 1 Net sales after intersegment eliminations. 2 Results adjusted to reflect impact of non-cash impairment of goodwill and/or certain restructuring expense recognition. See reconciliation of GAAP results to adjusted results at end of document.

Sales Operating Income (3.8%) (21.8%) | (1.4%)2 4Q 2020 Results | Coatings February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation12 ($M) Key Statistics 2019 Sales1 $ 72.4 Volume (4.5) Pricing/Mix 0.4 Acquisitions/Divestiture - Currency Translation 1.3 2020 Sales1 $ 69.6 $69.6 $72.4 2020 2019 $9.4 $11.8 $12.0 2020 2020 Adj. 2019 2 COMMENTARY • Sales were similar to last year as higher internal and international market volumes were offset by lower external volumes in North America due to the pandemic’s disruptions on end customers • Favorable pricing and operational efficiency improvements were offset by lower external volumes in North America 1 Net sales after intersegment eliminations. 2 Results adjusted to reflect impact of non-cash impairment of goodwill and/or certain restructuring expense recognition. See reconciliation of GAAP results to adjusted results at end of document.

Sales Operating Income 15.0% 110.7% 89.1% | 114.2%2 4Q 2020 Results | Irrigation February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation13 ($M) Key Statistics 2019 Sales1 $ 132.0 Volume 70.7 Pricing/Mix (1.6) Acquisitions/Divestiture 3.4 Currency Translation (6.3) 2020 Sales1 $ 198.2 $22.3 $25.3 $11.8 2020 2020 Adj. 20192020 2019 $96.0 $102.2 $83.5 $48.5 North America International COMMENTARY • Global sales increased 49.8% YoY due to higher volumes across all markets, particularly in the Middle East, partially offset by $6.3M of unfavorable currency impacts primarily from the depreciation of the Brazilian Real ‒ North American sales grew due to higher volumes across all irrigation product lines and higher industrial tubing sales ‒ International sales more than doubled YoY, which was led by first deliveries of the large multi-year Egypt product, higher volume in South American and European markets, including continued strong demand in Brazil, and sales from recent acquisitions • Profitability growth driven by higher volumes and improved operational efficiency, partially offset by higher SG&A expense, including $1.4M of incremental R&D expense for technology growth investments 1 Net sales after intersegment eliminations. 2 Results adjusted to reflect impact of non-cash impairment of goodwill and/or certain restructuring expense recognition. See reconciliation of GAAP results to adjusted results at end of document. 2

Full Year 2020 Cash Flow Highlights February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation14 Strong Operating CF Driven by Higher Operating Income and Strategic Working Capital Management ($M) FY 12/26/2020 Net Cash Flows from Operating Activities $ 316.3 Net Cash Flows from Investing Activities (104.0) Net Cash Flows from Financing Activities (173.8) Net Cash Flows from Operating Activities $ 316.3 Purchase of Property, Plant & Equipment (106.7) Free Cash Flows $ 209.6 Full Year Cash Flow | FCF Reconciliation Cash and Debt Highlights $400.7M ($208.6M ex-U.S.) Cash at 12/26/2020 $728.4M Total Long-Term Debt at 12/26/2020

Balanced Approach to Capital Allocation February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation15 $107 $16 $59 $56 $37 Capital Expenditures Acquisitions Purchase of NCI Share Repurchases Dividends FY20 Capital Deployment: $275M ($M) Capital Expenditures • Working capital investment to support investments in people, technology and systems • 2020 CapEx of $107M, including ~$42M for strategic growth initiatives Acquisitions • Strategic fit + market expansion • Returns exceeding cost of capital within 3 years Purchase of NCI • Amount includes $59M purchase of non-controlling interest of AgSense, Convert Italia, and Torrent Share Repurchases • Opportunistic approach, supported by FCF • Resumed share repurchases on September 10, 2020 • $148M remains on current authorization as of 12/26/20 Dividends • 20% dividend increase announced February 2020 • Payout ratio target: 15% of earnings • Current payout: ~24% G ro w in g O ur B us in es s R et ur ni ng C as h to S ha re ho ld er s

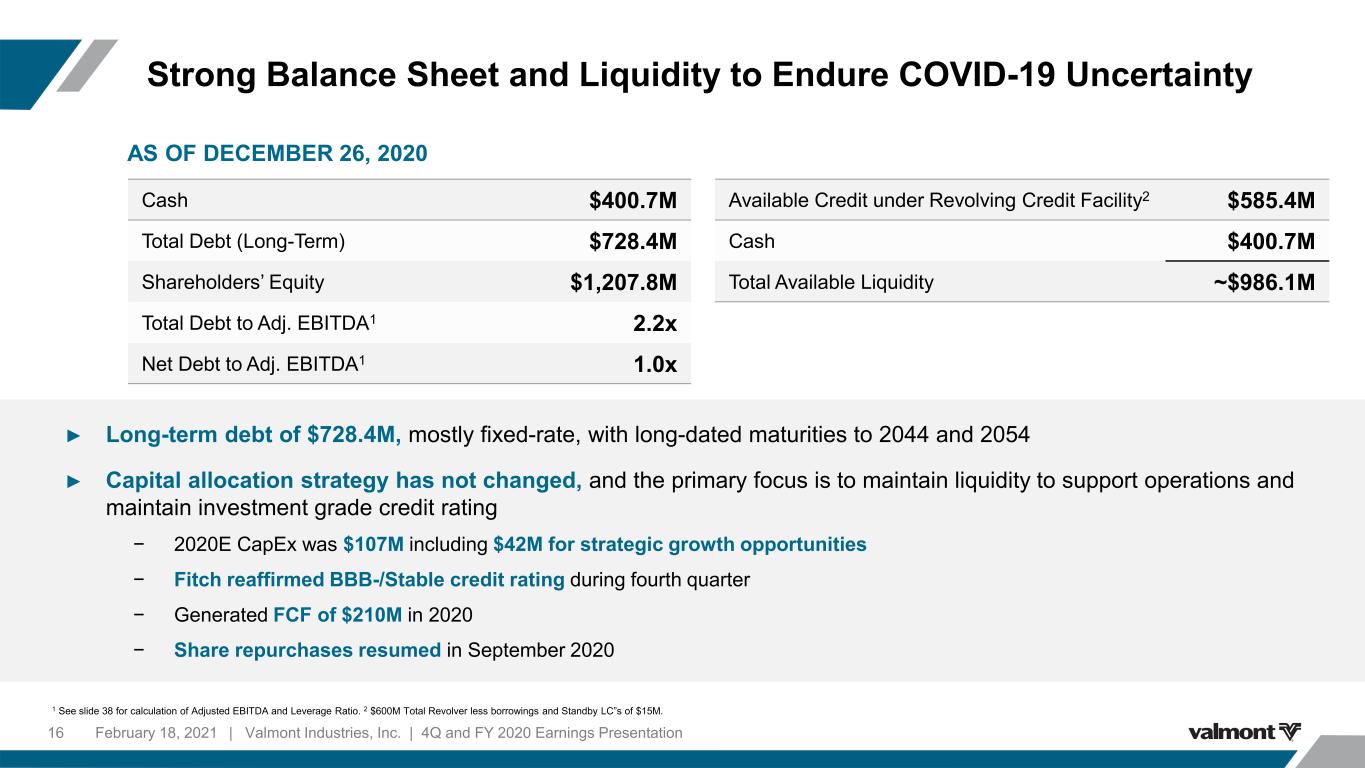

Strong Balance Sheet and Liquidity to Endure COVID-19 Uncertainty February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation16 Cash $400.7M Total Debt (Long-Term) $728.4M Shareholders’ Equity $1,207.8M Total Debt to Adj. EBITDA1 2.2x Net Debt to Adj. EBITDA1 1.0x Available Credit under Revolving Credit Facility2 $585.4M Cash $400.7M Total Available Liquidity ~$986.1M AS OF DECEMBER 26, 2020 ► Long-term debt of $728.4M, mostly fixed-rate, with long-dated maturities to 2044 and 2054 ► Capital allocation strategy has not changed, and the primary focus is to maintain liquidity to support operations and maintain investment grade credit rating − 2020E CapEx was $107M including $42M for strategic growth opportunities − Fitch reaffirmed BBB-/Stable credit rating during fourth quarter − Generated FCF of $210M in 2020 − Share repurchases resumed in September 2020 1 See slide 38 for calculation of Adjusted EBITDA and Leverage Ratio. 2 $600M Total Revolver less borrowings and Standby LC”s of $15M.

1Q 2021 / Full Year 2021 Outlook and Key Assumptions 17 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 1Q21 OUTLOOK1 KEY ASSUMPTIONS • Favorable foreign currency translation impact of ~2% of Net Sales • In Utility Support Structures, significant raw material cost inflation will negatively impact gross profit margins in 1H21 • Expect tax rate between 24% - 25% • Capital expenditures to be in the range of $110M - $120M to support strategic growth initiatives and Industry 4.0 advanced manufacturing initiatives • No closures of large manufacturing facilities, workforce disruptions, or significant supply chain interruptions due to COVID-19 $740M – $765M Net Sales, an increase of 10% - 13% YoY 1 Excludes potential future restructuring activities. See reconciliation of GAAP outlook to adjusted outlook at end of document. 9% – 10% Operating Profit Margin $235M – $245M Irrigation Segment Sales, an increase of 50% - 56% YoY 9% – 14% Increase in Net Sales YoY $9.00 – $9.70 Diluted EPS 27% – 30% Increase in Irrigation Segment Sales YoY FY21 OUTLOOK1

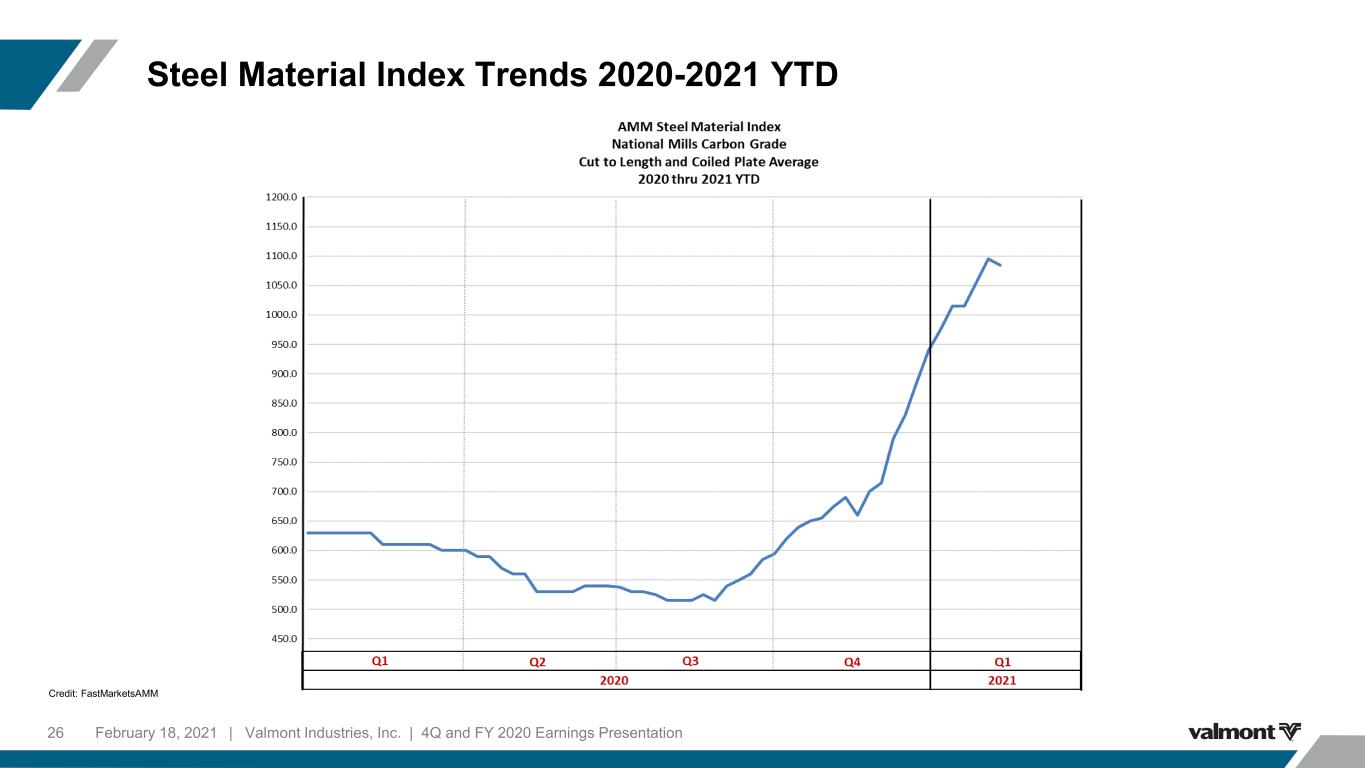

2021 Segment Market Trends and Potential Risks February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation18 Consistent Solid Cash Flow Generation Expected USS • Strong backlog provides good visibility • Aggressively raising prices due to rapidly escalating raw material costs; pricing actions in response to rapid inflation take 1 to 2 quarters to recover • Expect unfavorable gross profit margin comparisons in 1H21, but expect full-year gross profit contribution to be favorable YoY when higher steel cost indices are reflected in selling prices ESS • Entered year with solid backlog • Anticipate short-term softness in transportation markets due to COVID-19 impacts on state/local tax revenues & delays in FAST Act extension • Expect wireless communication products & components demand to remain strong; anticipate carriers’ 5G investments to accelerate throughout 2021; sales expected to grow ~15% • Decision made to divest Access Systems product line as part of ongoing strategic portfolio review COATINGS • End-market demand correlates closely to industrial production levels; expect modest sequential growth as economy continues to improve IRRIGATION • Providing additional details on expected sales growth based on estimated timing of deliveries of the large Egypt project, strong net farm income driving positive farmer sentiment, & robust Brazilian market • Expect full year sales to increase of 27% - 30% YoY

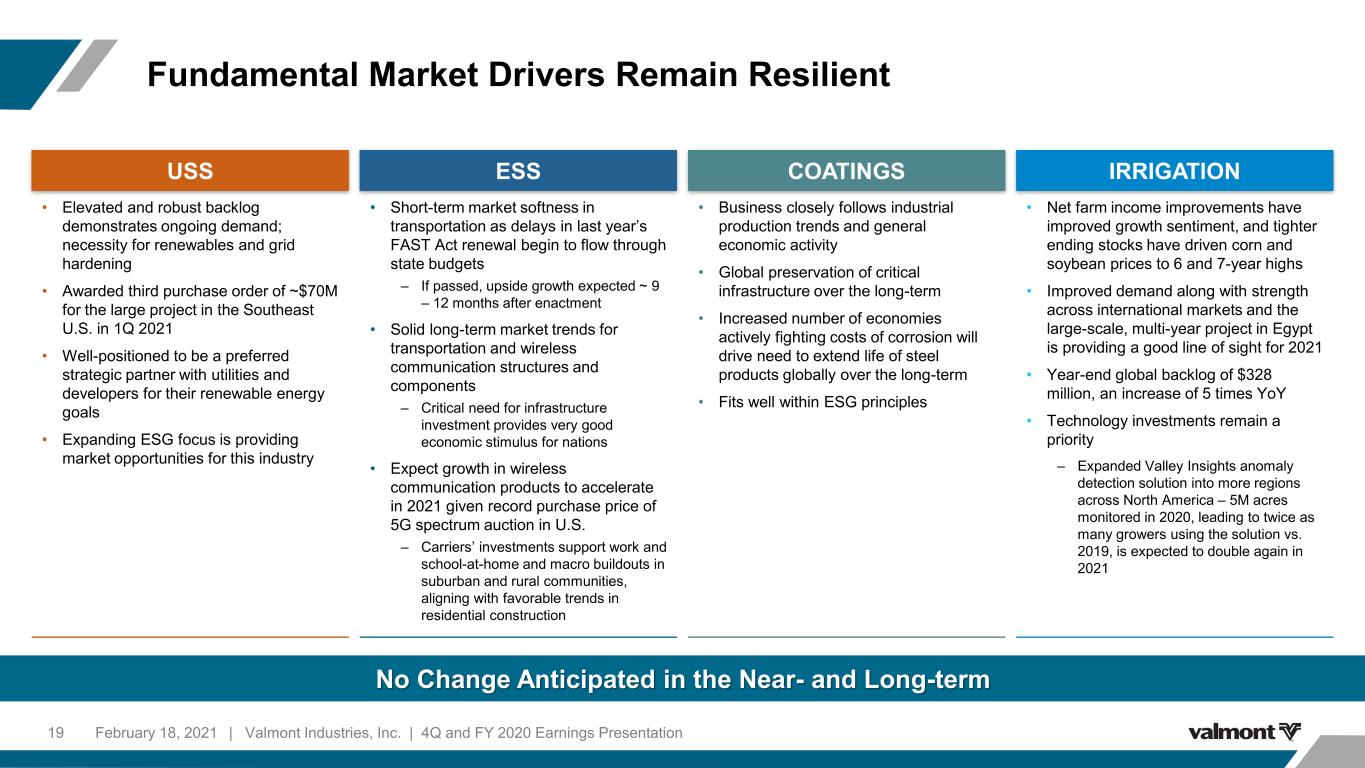

Fundamental Market Drivers Remain Resilient 19 No Change Anticipated in the Near- and Long-term | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 COATINGS IRRIGATION • Business closely follows industrial production trends and general economic activity • Global preservation of critical infrastructure over the long-term • Increased number of economies actively fighting costs of corrosion will drive need to extend life of steel products globally over the long-term • Fits well within ESG principles • Net farm income improvements have improved growth sentiment, and tighter ending stocks have driven corn and soybean prices to 6 and 7-year highs • Improved demand along with strength across international markets and the large-scale, multi-year project in Egypt is providing a good line of sight for 2021 • Year-end global backlog of $328 million, an increase of 5 times YoY • Technology investments remain a priority ‒ Expanded Valley Insights anomaly detection solution into more regions across North America – 5M acres monitored in 2020, leading to twice as many growers using the solution vs. 2019, is expected to double again in 2021 • Short-term market softness in transportation as delays in last year’s FAST Act renewal begin to flow through state budgets ‒ If passed, upside growth expected ~ 9 – 12 months after enactment • Solid long-term market trends for transportation and wireless communication structures and components ‒ Critical need for infrastructure investment provides very good economic stimulus for nations • Expect growth in wireless communication products to accelerate in 2021 given record purchase price of 5G spectrum auction in U.S. ‒ Carriers’ investments support work and school-at-home and macro buildouts in suburban and rural communities, aligning with favorable trends in residential construction • Elevated and robust backlog demonstrates ongoing demand; necessity for renewables and grid hardening • Awarded third purchase order of ~$70M for the large project in the Southeast U.S. in 1Q 2021 • Well-positioned to be a preferred strategic partner with utilities and developers for their renewable energy goals • Expanding ESG focus is providing market opportunities for this industry ESSUSS

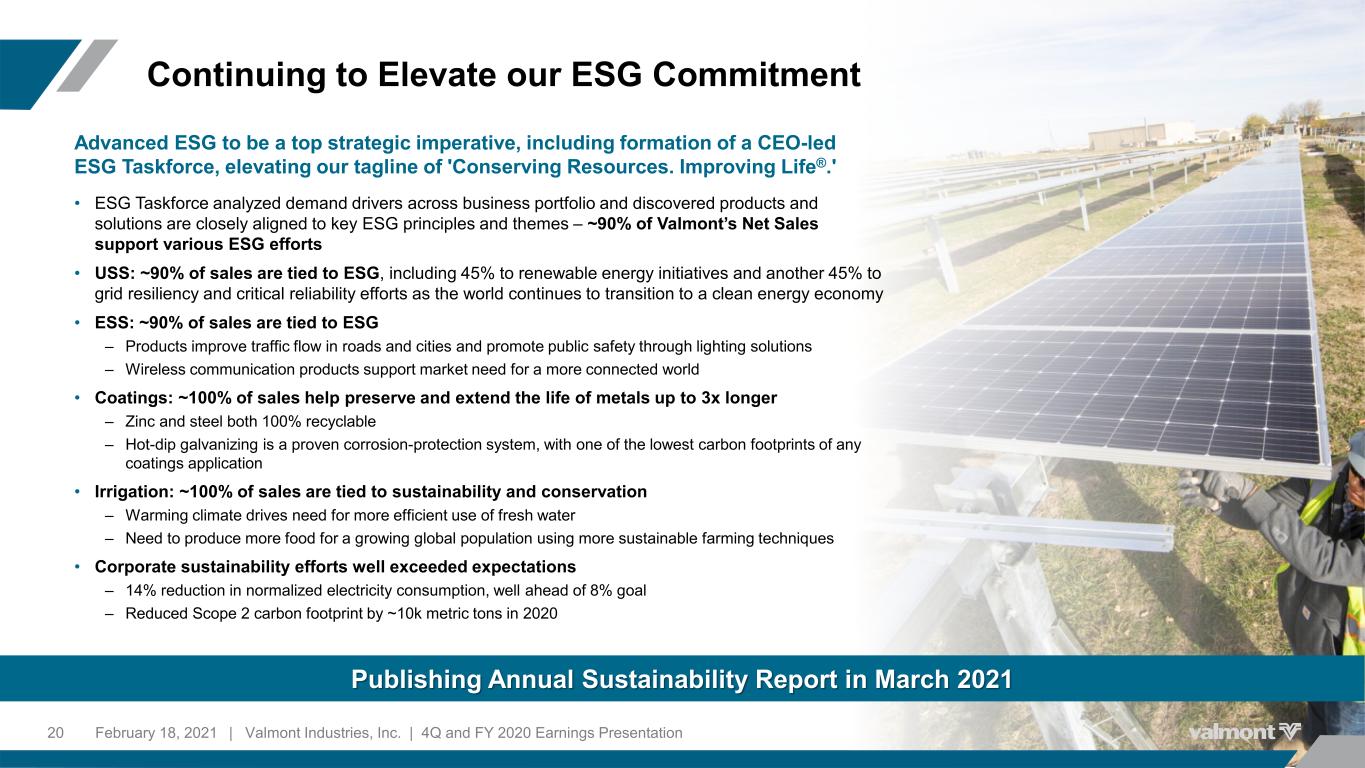

Continuing to Elevate our ESG Commitment 20 Publishing Annual Sustainability Report in March 2021 Advanced ESG to be a top strategic imperative, including formation of a CEO-led ESG Taskforce, elevating our tagline of 'Conserving Resources. Improving Life®.' • ESG Taskforce analyzed demand drivers across business portfolio and discovered products and solutions are closely aligned to key ESG principles and themes – ~90% of Valmont’s Net Sales support various ESG efforts • USS: ~90% of sales are tied to ESG, including 45% to renewable energy initiatives and another 45% to grid resiliency and critical reliability efforts as the world continues to transition to a clean energy economy • ESS: ~90% of sales are tied to ESG ‒ Products improve traffic flow in roads and cities and promote public safety through lighting solutions ‒ Wireless communication products support market need for a more connected world • Coatings: ~100% of sales help preserve and extend the life of metals up to 3x longer ‒ Zinc and steel both 100% recyclable ‒ Hot-dip galvanizing is a proven corrosion-protection system, with one of the lowest carbon footprints of any coatings application • Irrigation: ~100% of sales are tied to sustainability and conservation ‒ Warming climate drives need for more efficient use of fresh water ‒ Need to produce more food for a growing global population using more sustainable farming techniques • Corporate sustainability efforts well exceeded expectations ‒ 14% reduction in normalized electricity consumption, well ahead of 8% goal ‒ Reduced Scope 2 carbon footprint by ~10k metric tons in 2020 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021

Expect solid operating performance and strong EPS accretion in 2021 as well as sales growth exceeding our stated long-term financial goal Focused on profitable growth and ROIC improvement, while keeping employees and communities safe and investing in the business for growth; strategic framework remains intact Strong performance in 2020 is a testament to our team’s ability to remain flexible and committed to delivering solid results and long-term shareholder value Summary 21 More to Come at Upcoming Virtual Investor Day in May 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 01 02 03

Q&A 22 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021

APPENDIX 23 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021

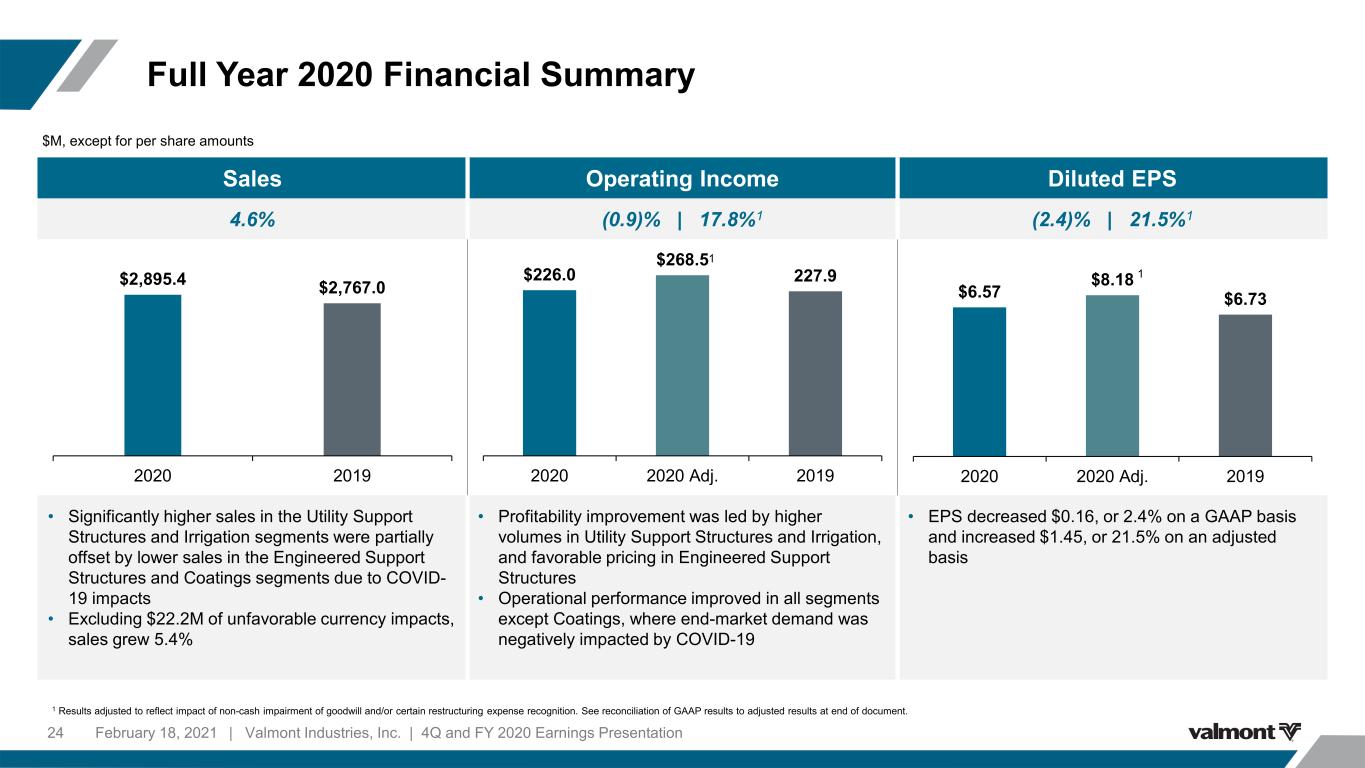

Full Year 2020 Financial Summary February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation24 Sales Operating Income Diluted EPS 4.6% (0.9)% | 17.8%1 (2.4)% | 21.5%1 • Significantly higher sales in the Utility Support Structures and Irrigation segments were partially offset by lower sales in the Engineered Support Structures and Coatings segments due to COVID- 19 impacts • Excluding $22.2M of unfavorable currency impacts, sales grew 5.4% • Profitability improvement was led by higher volumes in Utility Support Structures and Irrigation, and favorable pricing in Engineered Support Structures • Operational performance improved in all segments except Coatings, where end-market demand was negatively impacted by COVID-19 • EPS decreased $0.16, or 2.4% on a GAAP basis and increased $1.45, or 21.5% on an adjusted basis $M, except for per share amounts $2,895.4 $2,767.0 2020 2019 $6.57 $8.18 $6.73 2020 2020 Adj. 2019 1 1$226.0 $268.5 227.9 2020 2020 Adj. 2019 1 Results adjusted to reflect impact of non-cash impairment of goodwill and/or certain restructuring expense recognition. See reconciliation of GAAP results to adjusted results at end of document.

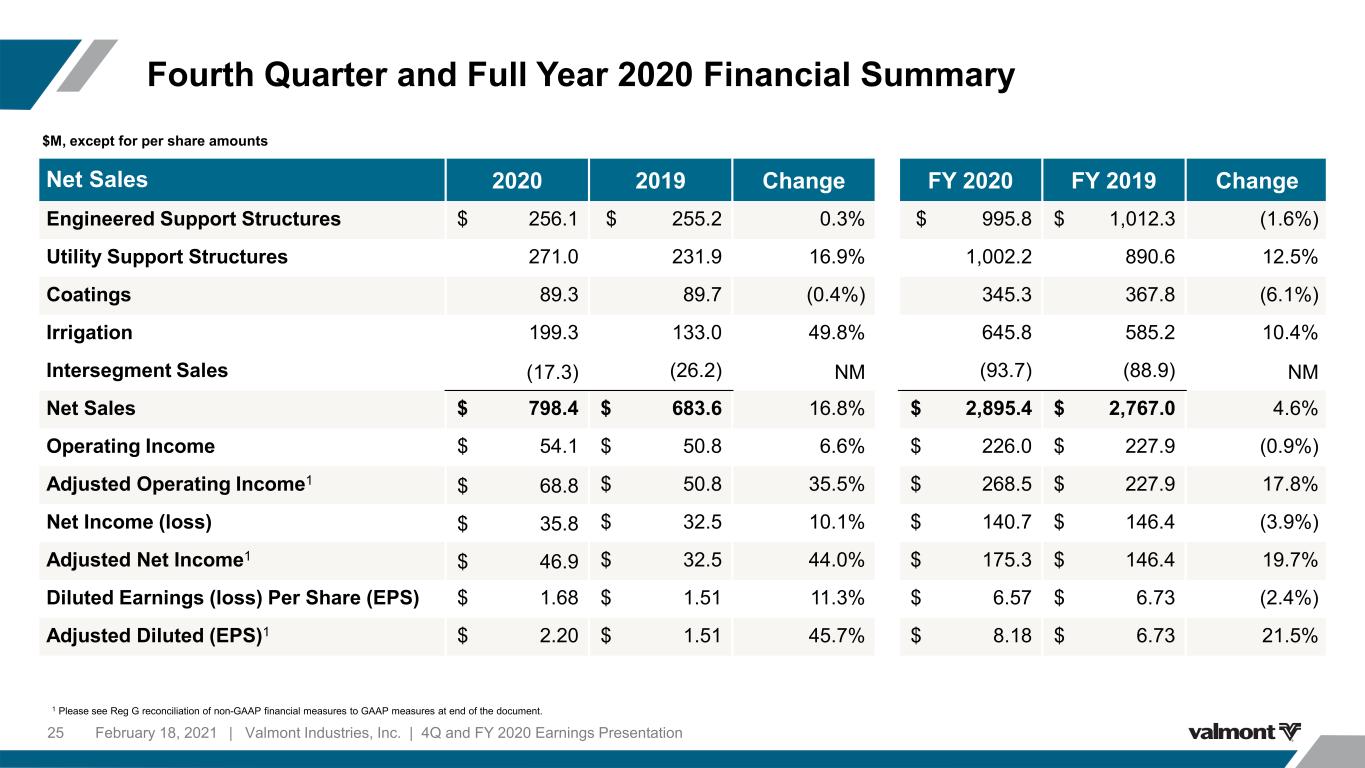

Fourth Quarter and Full Year 2020 Financial Summary 25 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 Net Sales 2020 2019 Change FY 2020 FY 2019 Change Engineered Support Structures $ 256.1 $ 255.2 0.3% $ 995.8 $ 1,012.3 (1.6%) Utility Support Structures 271.0 231.9 16.9% 1,002.2 890.6 12.5% Coatings 89.3 89.7 (0.4%) 345.3 367.8 (6.1%) Irrigation 199.3 133.0 49.8% 645.8 585.2 10.4% Intersegment Sales (17.3) (26.2) NM (93.7) (88.9) NM Net Sales $ 798.4 $ 683.6 16.8% $ 2,895.4 $ 2,767.0 4.6% Operating Income $ 54.1 $ 50.8 6.6% $ 226.0 $ 227.9 (0.9%) Adjusted Operating Income1 $ 68.8 $ 50.8 35.5% $ 268.5 $ 227.9 17.8% Net Income (loss) $ 35.8 $ 32.5 10.1% $ 140.7 $ 146.4 (3.9%) Adjusted Net Income1 $ 46.9 $ 32.5 44.0% $ 175.3 $ 146.4 19.7% Diluted Earnings (loss) Per Share (EPS) $ 1.68 $ 1.51 11.3% $ 6.57 $ 6.73 (2.4%) Adjusted Diluted (EPS)1 $ 2.20 $ 1.51 45.7% $ 8.18 $ 6.73 21.5% $M, except for per share amounts 1 Please see Reg G reconciliation of non-GAAP financial measures to GAAP measures at end of the document.

Steel Material Index Trends 2020-2021 YTD 26 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 Credit: FastMarketsAMM

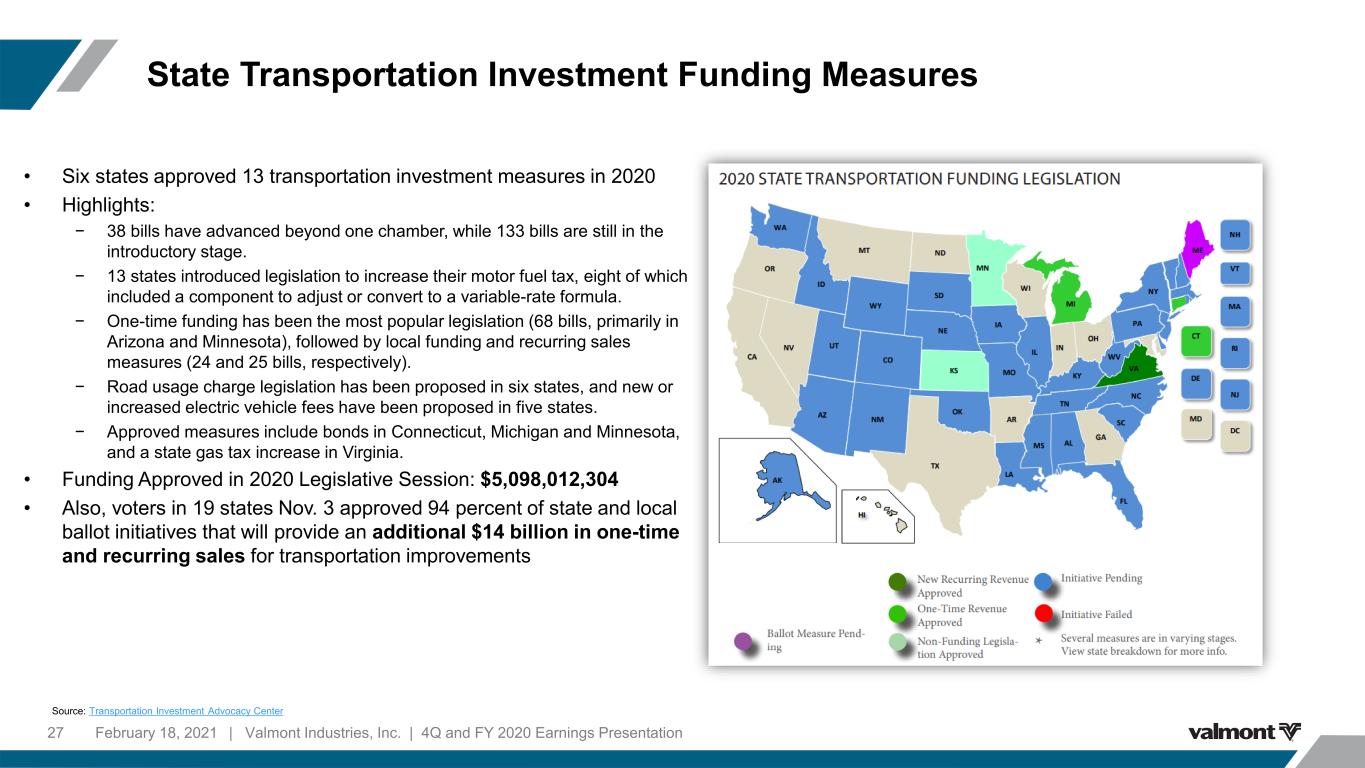

State Transportation Investment Funding Measures 27 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 • Six states approved 13 transportation investment measures in 2020 • Highlights: − 38 bills have advanced beyond one chamber, while 133 bills are still in the introductory stage. − 13 states introduced legislation to increase their motor fuel tax, eight of which included a component to adjust or convert to a variable-rate formula. − One-time funding has been the most popular legislation (68 bills, primarily in Arizona and Minnesota), followed by local funding and recurring sales measures (24 and 25 bills, respectively). − Road usage charge legislation has been proposed in six states, and new or increased electric vehicle fees have been proposed in five states. − Approved measures include bonds in Connecticut, Michigan and Minnesota, and a state gas tax increase in Virginia. • Funding Approved in 2020 Legislative Session: $5,098,012,304 • Also, voters in 19 states Nov. 3 approved 94 percent of state and local ballot initiatives that will provide an additional $14 billion in one-time and recurring sales for transportation improvements Source: Transportation Investment Advocacy Center

State Transportation Investment Funding Measures 28 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 State Name Change in 2020 Gas Tax (cents/gallon) Effective Date Kentucky 10.0$ Proposal Pending New Jersey 9.3$ 10/1/2020 Alaska 8.0$ Proposal Pending Arizona 6.0$ Proposal Pending Massachusetts 5.0$ Proposal Pending Virginia 5.0$ 7/1/2020 Georgia 4.0$ 1/1/2020 Nebraska 3.9$ 7/1/2020 California 3.2$ 7/1/2020 Wyoming 3.0$ Proposal Pending Alabama 2.0$ 10/1/2020 Oregon 2.0$ 1/1/2020 South Carolina 2.0$ 7/1/2020 Utah 1.1$ 1/1/2020 Florida 1.0$ 1/1/2020 Indiana 1.0$ 7/1/2020 Illinois 0.7$ 7/1/2020 Washington 0.6$ Proposal Pending North Carolina (0.1)$ 1/1/2020 Iowa (0.5)$ 7/1/2020 Maryland (0.7)$ 7/1/2020 Source: IHS Markit

5G Adoption Forecast and Capex Spend Post-COVID 29 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 Source: GSM Association

U.S. Level of Farm Subsidies October 22, 2020 | Valmont Industries, Inc. | 3Q 2020 Earnings Presentation30 113 82 71 49 64 68 61 73 84 11 10 11 13 12 14 22 46 11 0 20 40 60 80 100 120 140 2013 2014 2015 2016 2017 2018 2019 2020 2021e $ B IL LI O N S U.S. GOV'T CONTRIBUTION TO NFI Net Farm Income (NFI) Government Assistance Source: American Farm Bureau Federation

US Commodity Price Trends, July 2020 – Feb 2021 31 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 Source: Investing.com

U.S. Corn for Fuel Ethanol, Feed, and Other Use February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation32 5.43 5.61 5.38 4.85 0 2 4 6 8 10 12 14 D om es tic U se (B ill io n B us he ls ) Year Used for Ethanol Feed and Residual Use Produced for Other Uses Source: afdc.energy.gov/data – data from Tables 4 & 31, OCT2020. Years run from September through August. Exports not included in above values.

U.S. Net Cash Farm Income by Year February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation33 Source: USDA, American Farm Bureau Federation

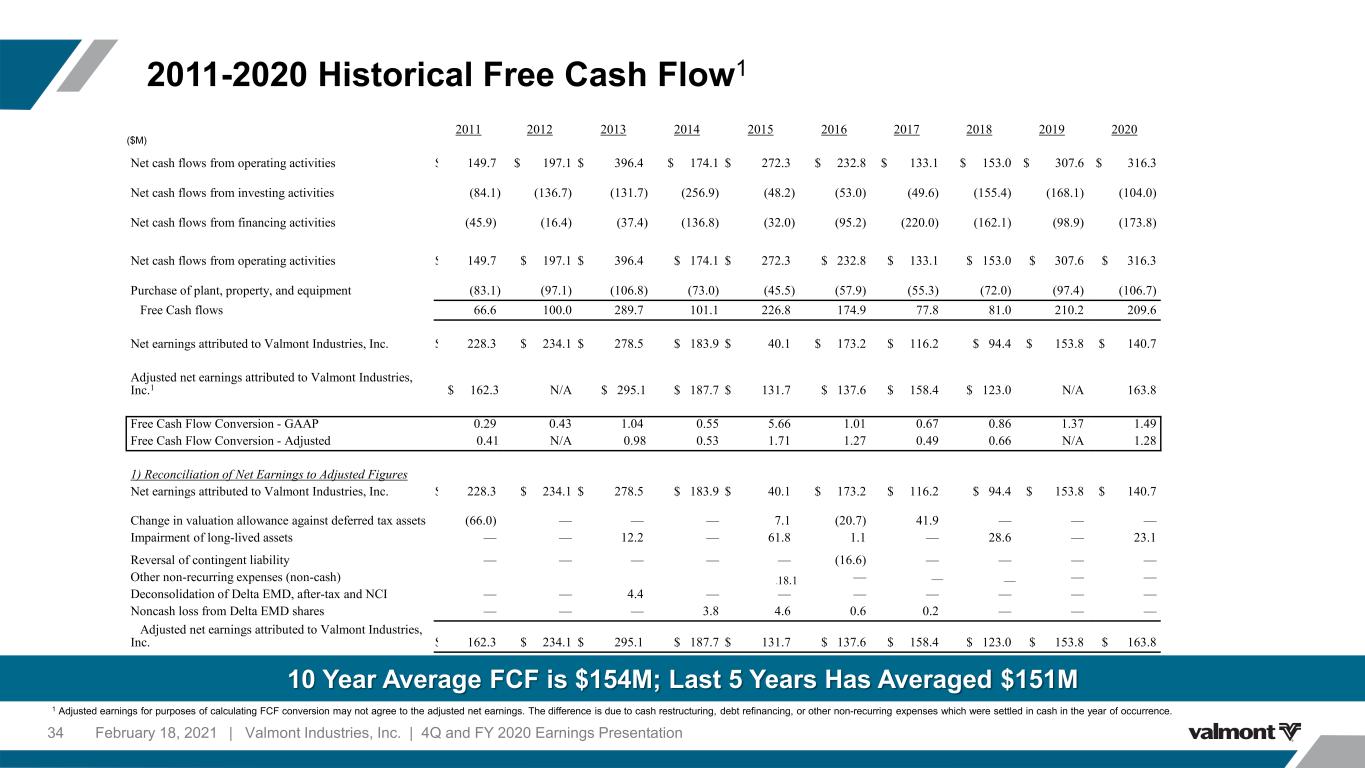

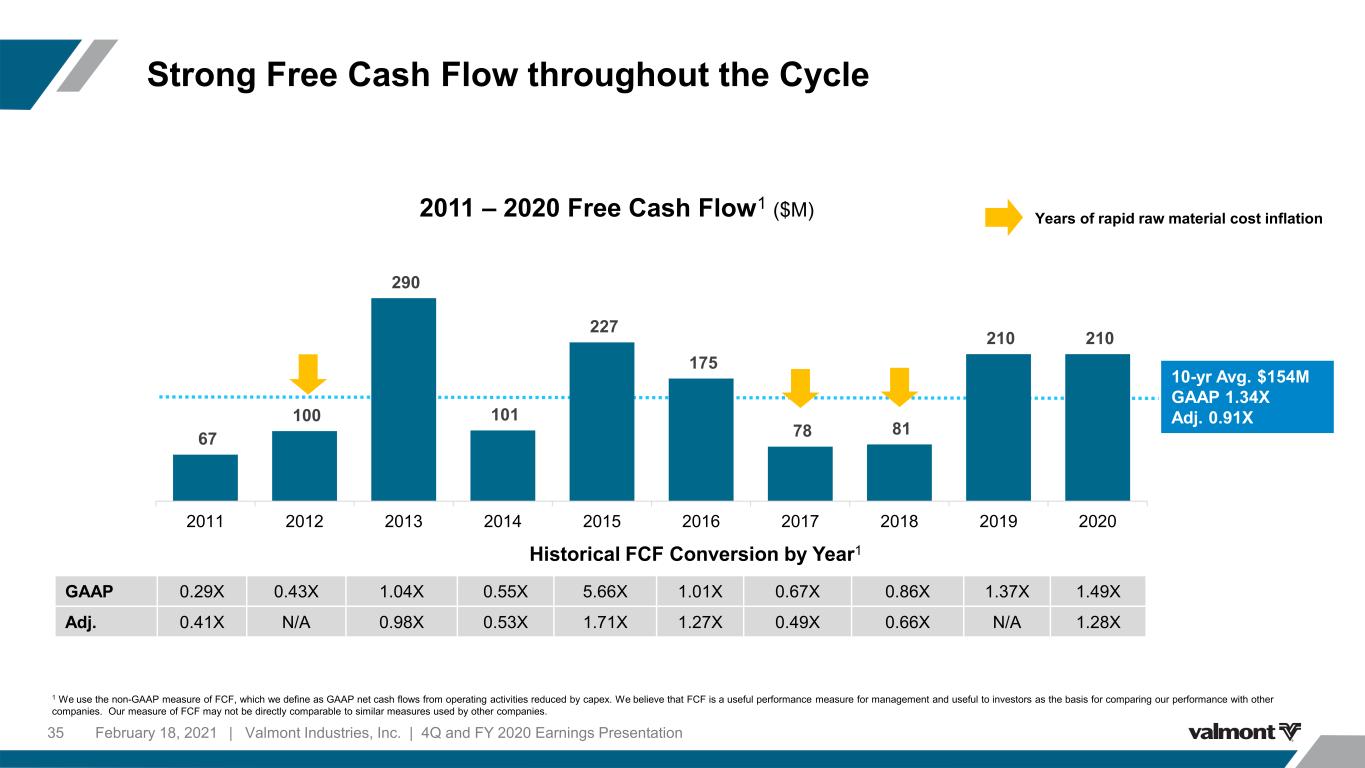

2011-2020 Historical Free Cash Flow1 February 18, 2021 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings Presentation34 10 Year Average FCF is $154M; Last 5 Years Has Averaged $151M 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Net cash flows from operating activities $ 149.7 $ 197.1 $ 396.4 $ 174.1 $ 272.3 $ 232.8 $ 133.1 $ 153.0 $ 307.6 $ 316.3 Net cash flows from investing activities (84.1) (136.7) (131.7) (256.9) (48.2) (53.0) (49.6) (155.4) (168.1) (104.0) Net cash flows from financing activities (45.9) (16.4) (37.4) (136.8) (32.0) (95.2) (220.0) (162.1) (98.9) (173.8) Net cash flows from operating activities $ 149.7 $ 197.1 $ 396.4 $ 174.1 $ 272.3 $ 232.8 $ 133.1 $ 153.0 $ 307.6 $ 316.3 Purchase of plant, property, and equipment (83.1) (97.1) (106.8) (73.0) (45.5) (57.9) (55.3) (72.0) (97.4) (106.7) Free Cash flows 66.6 100.0 289.7 101.1 226.8 174.9 77.8 81.0 210.2 209.6 Net earnings attributed to Valmont Industries, Inc. $ 228.3 $ 234.1 $ 278.5 $ 183.9 $ 40.1 $ 173.2 $ 116.2 $ 94.4 $ 153.8 $ 140.7 Adjusted net earnings attributed to Valmont Industries, Inc.1 $ 162.3 N/A $ 295.1 $ 187.7 $ 131.7 $ 137.6 $ 158.4 $ 123.0 N/A 163.8 Free Cash Flow Conversion - GAAP 0.29 0.43 1.04 0.55 5.66 1.01 0.67 0.86 1.37 1.49 Free Cash Flow Conversion - Adjusted 0.41 N/A 0.98 0.53 1.71 1.27 0.49 0.66 N/A 1.28 1) Reconciliation of Net Earnings to Adjusted Figures Net earnings attributed to Valmont Industries, Inc. $ 228.3 $ 234.1 $ 278.5 $ 183.9 $ 40.1 $ 173.2 $ 116.2 $ 94.4 $ 153.8 $ 140.7 Change in valuation allowance against deferred tax assets (66.0) — — — 7.1 (20.7) 41.9 — — — Impairment of long-lived assets — — 12.2 — 61.8 1.1 — 28.6 — 23.1 Reversal of contingent liability — — — — — (16.6) — — — — Other non-recurring expenses (non-cash) 18. 8.1 — — — — — Deconsolidation of Delta EMD, after-tax and NCI — — 4.4 — — — — — — — Noncash loss from Delta EMD shares — — — 3.8 4.6 0.6 0.2 — — — Adjusted net earnings attributed to Valmont Industries, Inc. $ 162.3 $ 234.1 $ 295.1 $ 187.7 $ 131.7 $ 137.6 $ 158.4 $ 123.0 $ 153.8 $ 163.8 ($M) 1 Adjusted earnings for purposes of calculating FCF conversion may not agree to the adjusted net earnings. The difference is due to cash restructuring, debt refinancing, or other non-recurring expenses which were settled in cash in the year of occurrence.

Years of rapid raw material cost inflation GAAP 0.29X 0.43X 1.04X 0.55X 5.66X 1.01X 0.67X 0.86X 1.37X 1.49X Adj. 0.41X N/A 0.98X 0.53X 1.71X 1.27X 0.49X 0.66X N/A 1.28X 2011 – 2020 Free Cash Flow1 ($M) 67 100 290 101 227 175 78 81 210 210 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 10-yr Avg. $154M GAAP 1.34X Adj. 0.91X Historical FCF Conversion by Year1 Strong Free Cash Flow throughout the Cycle 35 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 1 We use the non-GAAP measure of FCF, which we define as GAAP net cash flows from operating activities reduced by capex. We believe that FCF is a useful performance measure for management and useful to investors as the basis for comparing our performance with other companies. Our measure of FCF may not be directly comparable to similar measures used by other companies.

Calculation of Adjusted EBITDA and Leverage Ratio 36 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 Certain of our debt agreements contain covenants that require us to maintain certain coverage ratios. Our Debt/Adjusted EBITDA may not exceed 3.5X Adjusted EBITDA (or 3.75X Adjusted EBITDA after certain material acquisitions) of the prior four quarters. See “Leverage Ratio “ below. YTD 26-Dec-20 Net earnings attributable to Valmont Industries, Inc. $ 140,693 Interest expense 41,075 Income tax expense 49,615 Depreciation and amortization expense 82,892 EBITDA 314,275 Cash restructuring expenses 18,955 Impairment of goodwill and intangible assets 16,638 Impairment of property, plant, and equipment 3,751 Adjusted EBITDA $ 353,619 Debt $ 766,326 Leverage Ratio 2.17 Debt $ 766,326 Cash 400,726 Net Debt 365,600 Leverage Ratio 1.03 ($000s)

2018-2019 Financials Retrospectively Adjusted from LIFO to FIFO Change 37 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 Valmont Industries, Inc. Retrospectively Adjusted from LIFO to FIFO Change First Quarter 2019 Second Quarter 2019 Third Quarter 2019 Fourth Quarter 2019 Fiscal Year 2019 As Previously Retrospectively As Previously Retrospectively As Previously Retrospectively As Previously Retrospectively As Previously Retrospectively (in 000's, except earnings per share) Reported Adjusted Reported Adjusted Reported Adjusted Reported Adjusted Reported Adjusted Cost of sales 527,010 527,512 520,457 522,695 514,254 517,053 512,759 517,035 2,074,480 2,084,295 Operating income 55,104 54,602 63,712 61,474 63,863 61,064 55,041 50,765 237,720 227,905 Income tax expense 12,427 12,302 13,961 13,402 13,763 13,063 10,056 8,987 50,207 47,753 Net earnings attributed to Valmont Industries, Inc. 36,481 36,104 41,397 39,719 40,144 38,045 35,747 32,540 153,769 146,408 Net earnings per diluted share $ 1.66 $ 1.64 $ 1.90 $ 1.82 $ 1.85 $ 1.75 $ 1.66 $ 1.51 $ 7.06 6.73 First Quarter 2018 Second Quarter 2018 Third Quarter 2018 Fourth Quarter 2018 Fiscal Year 2018 As Previously Retrospectively As Previously Retrospectively As Previously Retrospectively As Previously Retrospectively As Previously Retrospectively Reported Adjusted Reported Adjusted Reported Adjusted Reported Adjusted Reported Adjusted Cost of sales 529,444 528,363 507,406 505,755 514,352 511,572 547,662 543,282 2,098,864 2,088,972 Operating income 63,960 65,041 63,670 65,321 38,360 41,140 36,290 40,670 202,280 212,172 Income tax expense 12,532 12,802 14,405 14,818 9,091 9,786 7,107 8,202 43,135 45,608 Net earnings attributed to Valmont Industries, Inc. 39,281 40,092 32,960 34,198 4,448 6,533 17,662 20,947 94,351 101,770 Net earnings per diluted share $ 1.72 $ 1.76 $ 1.46 $ 1.51 $ 0.20 $ 0.29 $ 0.80 $ 0.95 $ 4.20 $ 4.53

Summary of Effect of Significant Non-Recurring Items on Reported Results 38 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021

Summary of Effect of Significant Non-Recurring Items on Reported Results 39 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 ($000s)

Summary of Effect of Significant Non-Recurring Items on Reported Results 40 | Valmont Industries, Inc. | 4Q and FY 2020 Earnings PresentationFebruary 18, 2021 Whole Corporation (Q4) • Severance of $10.9 million for early retirement program (across all segments) Engineered Support Structures (Q4) • Cash restructuring expenses to reduce administrative headcounts in India. Utility Support Structures (Q4) • Cash restructuring expenses to reduce headcounts in the offshore and other complex steel product line. ($000s)