Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NexPoint Real Estate Finance, Inc. | nref-ex991_9.htm |

| 8-K - 8-K - NexPoint Real Estate Finance, Inc. | nref-8k_20210218.htm |

EXHIBIT 99.2

CAUTIONARY STATEMENTS FORWARD LOOKING STATEMENTS This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management's current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as "anticipate", "estimate", "expect," "intend," "may", "should" and similar expressions, and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding the Company’s business and industry in general, investment activity, estimated IRRs, guidance for financial results for the first quarter of 2021, including the Company's estimated net income, core earnings, dividend per common share, cash available for distribution (“CAD”) and dividend coverage ratios for the first quarter of 2021. They are not guarantees of future results and forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement, including the ultimate geographic spread, duration and severity of the COVID-19 pandemic, and the effectiveness of actions taken, or actions that may be taken, by governmental authorities to contain the outbreak or treat its impact, as well as those described in greater detail in our filings with the Securities and Exchange Commission, particularly those specifically described in our Registration Statement on Form S-11 and Quarterly Reports on Form 10-Q. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company's Registration Statement on Form S-11 and the Company's other filings with the SEC for a more complete discussion of risks and other factors that could affect any forward-looking statement. The statements made herein speak only as of the date of this presentation and except as required by law, the Company does not undertake any obligation to publicly update or revise any forward-looking statements NON-GAAP FINANCIAL MEASURES This presentation contains non-GAAP financial measures. A “non-GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flows of the Company. The non-GAAP financial measures used within this presentation are core earnings and CAD. Core earnings is defined as the net income (loss) attributable to our common stockholders computed in accordance with GAAP, including realized gains and losses not otherwise included in net income (loss), excluding any unrealized gains or losses or other similar non-cash items that are included in net income (loss) for the applicable reporting period, regardless of whether such items are included in other comprehensive income (loss), or in net income (loss) and adding back amortization of stock-based compensation. We use core earnings to evaluate our performance which excludes the effects of certain GAAP adjustments and transactions that we believe are not indicative of our current operations and loan performance. We believe providing core earnings as a supplement to GAAP net income (loss) to our investors is helpful to their assessment of our performance. We also use core earnings as a component of the management fee paid to our Manager. Core earnings should not be considered as an alternative or substitute to net income (loss). Our computation of core earnings may not be comparable to core earnings reported by other REITs. We calculate CAD by adjusting GAAP net income (loss), including realized gains and losses not otherwise included in GAAP net income (loss), and excluding non-cash equity compensation, amortization and accretion of purchase premiums and discounts, unrealized gains and losses and certain non-cash items including adjustments to our allowance for loan losses. We believe CAD provides meaningful information to consider in addition to our net income and cash flow from operating activities determined in accordance with GAAP. We believe CAD provides meaningful information that is used by investors, analysts and our management to evaluate and determine trends in cash flow as it is not affected by non-cash items. We also use CAD when determining our dividend and the long-term viability of our dividend. CAD does not represent net income or cash flows from operating activities and should not be considered as an alternative to GAAP net income, an indication of our GAAP cash flows from operating activities, a measure of our liquidity or an indication of funds available for our cash needs. Our computation of CAD may not be comparable to CAD reported by other REITs. ADDITIONAL INFORMATION For additional information, see our filings with the SEC. Our filings with the SEC are available on our website, nref.nexpoint.com, under the "Investor Relations" tab.

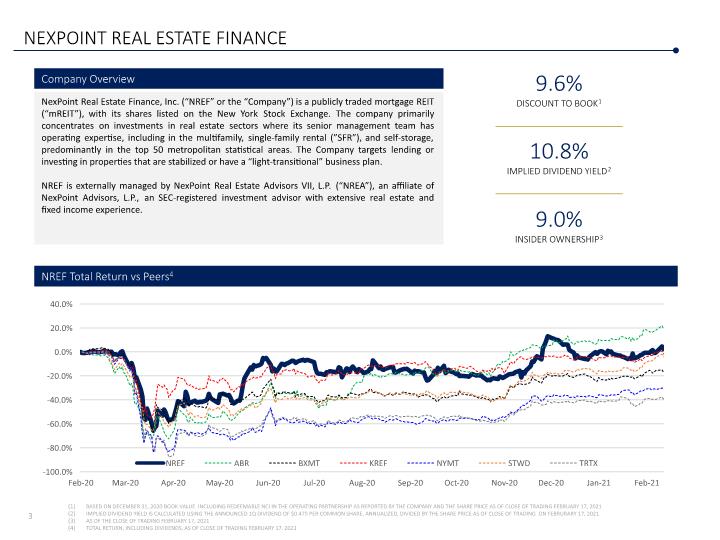

NEXPOINT REAL ESTATE FINANCE NexPoint Real Estate Finance, Inc. (“NREF” or the “Company”) is a publicly traded mortgage REIT (“mREIT”), with its shares listed on the New York Stock Exchange. The company primarily concentrates on investments in real estate sectors where its senior management team has operating expertise, including in the multifamily, single-family rental (”SFR”), and self-storage, predominantly in the top 50 metropolitan statistical areas. The Company targets lending or investing in properties that are stabilized or have a “light-transitional” business plan. NREF is externally managed by NexPoint Real Estate Advisors VII, L.P. (“NREA”), an affiliate of NexPoint Advisors, L.P., an SEC-registered investment advisor with extensive real estate and fixed income experience. Company Overview BASED ON DECEMBER 31, 2020 BOOK VALUE INCLUDING REDEEMABLE NCI IN THE OPERATING PARTNERSHIP AS REPORTED BY THE COMPANY AND THE SHARE PRICE AS OF CLOSE OF TRADING FEBRUARY 17, 2021 IMPLIED DIVIDEND YIELD IS CALCULATED USING THE ANNOUNCED 1Q DIVIDEND OF $0.475 PER COMMON SHARE, ANNUALIZED, DIVIDED BY THE SHARE PRICE AS OF CLOSE OF TRADING ON FEBRURARY 17, 2021 AS OF THE CLOSE OF TRADING FEBRUARY 17, 2021 TOTAL RETURN, INCLUDING DIVIDENDS, AS OF CLOSE OF TRADING FEBRUARY 17. 2021 9.0% INSIDER OWNERSHIP3 10.8% IMPLIED DIVIDEND YIELD2 9.6% DISCOUNT TO BOOK1 NREF Total Return vs Peers4

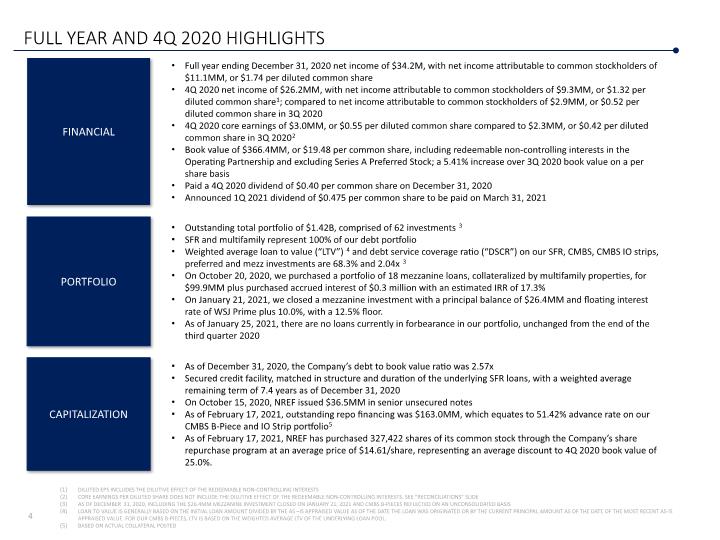

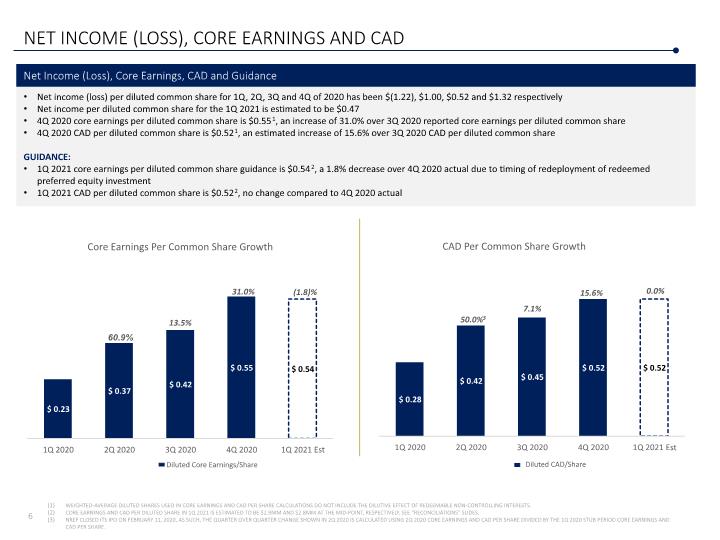

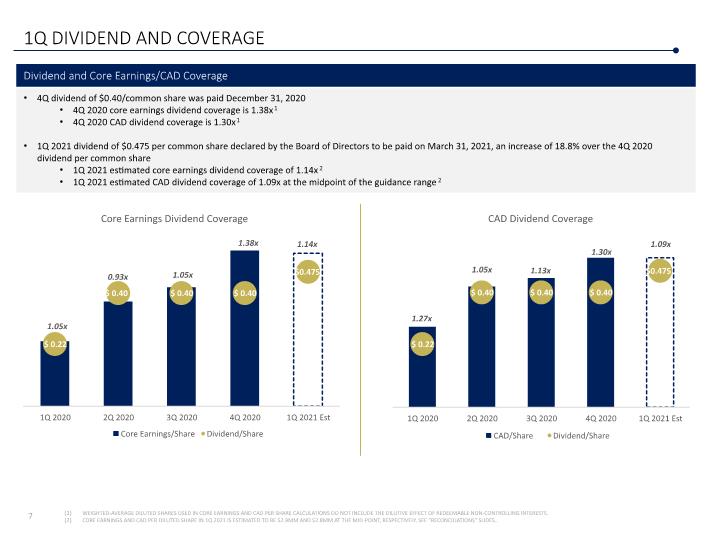

FULL YEAR AND 4Q 2020 HIGHLIGHTS DILUTED EPS INCLUDES THE DILUTIVE EFFECT OF THE REDEEMABLE NON-CONTROLLING INTERESTS CORE EARNINGS PER DILUTED SHARE DOES NOT INCLUDE THE DILUTIVE EFFECT OF THE REDEEMABLE NON-CONTROLLING INTERESTS. SEE “RECONCILIATIONS” SLIDE AS OF DECEMBER 31, 2020, INCLUDING THE $26.4MM MEZZANINE INVESTMENT CLOSED ON JANUARY 21, 2021 AND CMBS B-PIECES REFLECTED ON AN UNCONSOLIDATED BASIS LOAN TO VALUE IS GENERALLY BASED ON THE INITIAL LOAN AMOUNT DIVIDED BY THE AS –IS APPRAISED VALUE AS OF THE DATE THE LOAN WAS ORIGINATED OR BY THE CURRENT PRINCIPAL AMOUNT AS OF THE DATE OF THE MOST RECENT AS-IS APPRAISED VALUE. FOR OUR CMBS B-PIECES, LTV IS BASED ON THE WEIGHTED AVERAGE LTV OF THE UNDERLYING LOAN POOL. BASED ON ACTUAL COLLATERAL POSTED Full year ending December 31, 2020 net income of $34.2M, with net income attributable to common stockholders of $11.1MM, or $1.74 per diluted common share 4Q 2020 net income of $26.2MM, with net income attributable to common stockholders of $9.3MM, or $1.32 per diluted common share1; compared to net income attributable to common stockholders of $2.9MM, or $0.52 per diluted common share in 3Q 2020 4Q 2020 core earnings of $3.0MM, or $0.55 per diluted common share compared to $2.3MM, or $0.42 per diluted common share in 3Q 20202 Book value of $366.4MM, or $19.48 per common share, including redeemable non-controlling interests in the Operating Partnership and excluding Series A Preferred Stock; a 5.41% increase over 3Q 2020 book value on a per share basis Paid a 4Q 2020 dividend of $0.40 per common share on December 31, 2020 Announced 1Q 2021 dividend of $0.475 per common share to be paid on March 31, 2021 Outstanding total portfolio of $1.42B, comprised of 62 investments 3 SFR and multifamily represent 100% of our debt portfolio Weighted average loan to value (“LTV”) 4 and debt service coverage ratio (“DSCR”) on our SFR, CMBS, CMBS IO strips, preferred and mezz investments are 68.3% and 2.04x 3 On October 20, 2020, we purchased a portfolio of 18 mezzanine loans, collateralized by multifamily properties, for $99.9MM plus purchased accrued interest of $0.3 million with an estimated IRR of 17.3% On January 21, 2021, we closed a mezzanine investment with a principal balance of $26.4MM and floating interest rate of WSJ Prime plus 10.0%, with a 12.5% floor. As of January 25, 2021, there are no loans currently in forbearance in our portfolio, unchanged from the end of the third quarter 2020 PORTFOLIO As of December 31, 2020, the Company’s debt to book value ratio was 2.57x Secured credit facility, matched in structure and duration of the underlying SFR loans, with a weighted average remaining term of 7.4 years as of December 31, 2020 On October 15, 2020, NREF issued $36.5MM in senior unsecured notes As of February 17, 2021, outstanding repo financing was $163.0MM, which equates to 51.42% advance rate on our CMBS B-Piece and IO Strip portfolio5 As of February 17, 2021, NREF has purchased 327,422 shares of its common stock through the Company’s share repurchase program at an average price of $14.61/share, representing an average discount to 4Q 2020 book value of 25.0%. CAPITALIZATION FINANCIAL

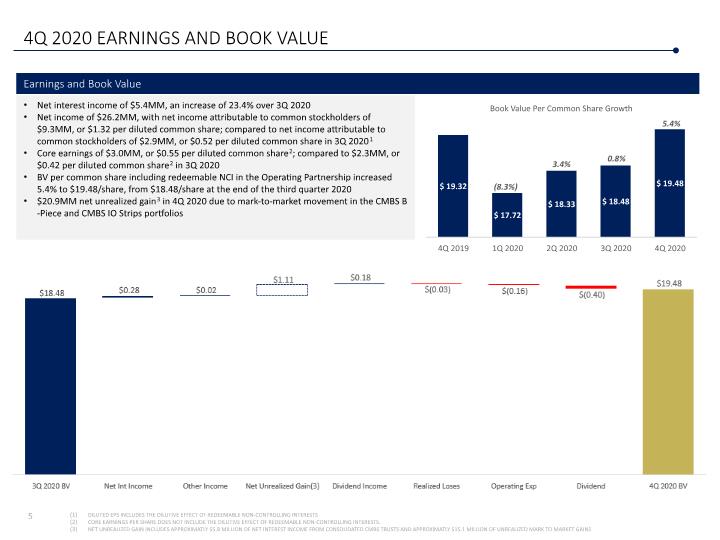

4Q 2020 EARNINGS AND BOOK VALUE DILUTED EPS INCLUDES THE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS CORE EARNINGS PER SHARE DOES NOT INCLUDE THE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS. NET UNREALIZED GAIN INCLUDES APPROXIMATLY $5.8 MILLION OF NET INTEREST INCOME FROM CONSOLIDATED CMBS TRUSTS AND APPROXIMATLY $15.1 MILLION OF UNREALIZED MARK TO MARKET GAINS (8.3%) 3.4% 0.8% 5.4%

NET INCOME (LOSS), CORE EARNINGS AND CAD WEIGHTED-AVERAGE DILUTED SHARES USED IN CORE EARNINGS AND CAD PER SHARE CALCULATIONS DO NOT INCLUDE THE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS. CORE EARNINGS AND CAD PER DILUTED SHARE IN 1Q 2021 IS ESTIMATED TO BE $2.9MM AND $2.8MM AT THE MID-POINT, RESPECTIVELY. SEE “RECONCILIATIONS” SLIDES. NREF CLOSED ITS IPO ON FEBRUARY 11, 2020, AS SUCH, THE QUARTER OVER QUARTER CHANGE SHOWN IN 2Q 2020 IS CALCULATED USING 2Q 2020 CORE EARNINGS AND CAD PER SHARE DIVIDED BY THE 1Q 2020 STUB PERIOD CORE EARNINGS AND CAD PER SHARE.

1Q DIVIDEND AND COVERAGE WEIGHTED-AVERAGE DILUTED SHARES USED IN CORE EARNINGS AND CAD PER SHARE CALCULATIONS DO NOT INCLUDE THE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS. CORE EARNINGS AND CAD PER DILUTED SHARE IN 1Q 2021 IS ESTIMATED TO BE $2.9MM AND $2.8MM AT THE MID-POINT, RESPECTIVELY. SEE “RECONCILIATIONS” SLIDES.. 1.05x 0.93x 1.05x 1.38x 1.14x

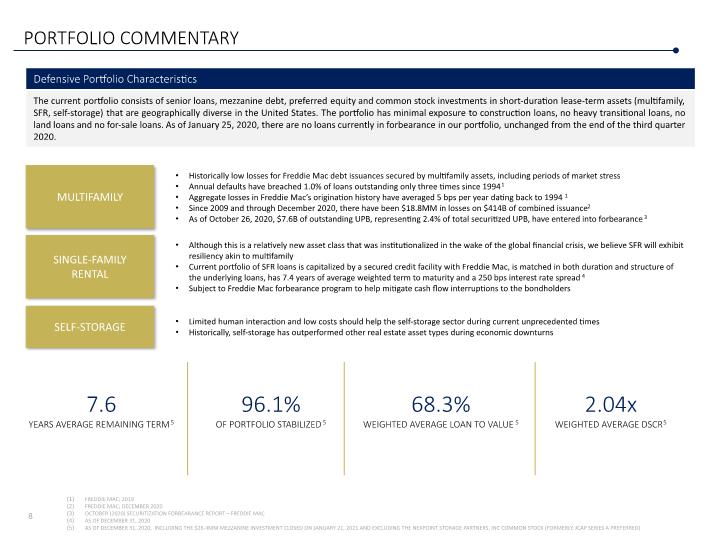

PORTFOLIO COMMENTARY The current portfolio consists of senior loans, mezzanine debt, preferred equity and common stock investments in short-duration lease-term assets (multifamily, SFR, self-storage) that are geographically diverse in the United States. The portfolio has minimal exposure to construction loans, no heavy transitional loans, no land loans and no for-sale loans. As of January 25, 2020, there are no loans currently in forbearance in our portfolio, unchanged from the end of the third quarter 2020. Defensive Portfolio Characteristics FREDDIE MAC; 2019 FREDDIE MAC; DECEMBER 2020 OCTOBER (2020) SECURITIZATION FORBEARANCE REPORT – FREDDIE MAC AS OF DECEMBER 31, 2020 AS OF DECEMBER 31, 2020, INCLUDING THE $26.4MM MEZZANINE INVESTMENT CLOSED ON JANUARY 21, 2021 AND EXCLUDING THE NEXPOINT STORAGE PARTNERS, INC COMMON STOCK (FORMERLY, JCAP SERIES A PREFERRED) 7.6 YEARS AVERAGE REMAINING TERM5 68.3% WEIGHTED AVERAGE LOAN TO VALUE5 2.04x WEIGHTED AVERAGE DSCR5 96.1% OF PORTFOLIO STABILIZED5 Historically low losses for Freddie Mac debt issuances secured by multifamily assets, including periods of market stress Annual defaults have breached 1.0% of loans outstanding only three times since 19941 Aggregate losses in Freddie Mac’s origination history have averaged 5 bps per year dating back to 19941 Since 2009 and through December 2020, there have been $18.8MM in losses on $414B of combined issuance2 As of October 26, 2020, $7.6B of outstanding UPB, representing 2.4% of total securitized UPB, have entered into forbearance3 MULTIFAMILY Although this is a relatively new asset class that was institutionalized in the wake of the global financial crisis, we believe SFR will exhibit resiliency akin to multifamily Current portfolio of SFR loans is capitalized by a secured credit facility with Freddie Mac, is matched in both duration and structure of the underlying loans, has 7.4 years of average weighted term to maturity and a 250 bps interest rate spread4 Subject to Freddie Mac forbearance program to help mitigate cash flow interruptions to the bondholders SINGLE-FAMILY RENTAL Limited human interaction and low costs should help the self-storage sector during current unprecedented times Historically, self-storage has outperformed other real estate asset types during economic downturns SELF-STORAGE

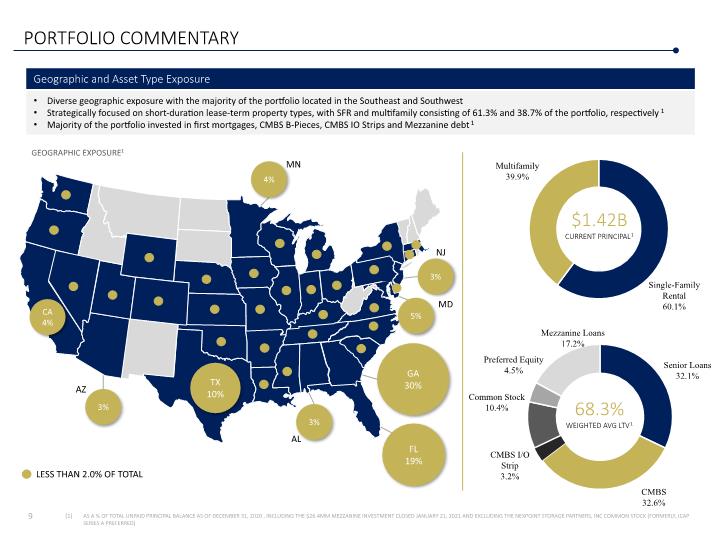

PORTFOLIO COMMENTARY AS A % OF TOTAL UNPAID PRINCIPAL BALANCE AS OF DECEMBER 31, 2020 , INCLUDING THE $26.4MM MEZZANINE INVESTMENT CLOSED JANUARY 21, 2021 AND EXCLUDING THE NEXPOINT STORAGE PARTNERS, INC COMMON STOCK (FORMERLY, JCAP SERIES A PREFERRED) Diverse geographic exposure with the majority of the portfolio located in the Southeast and Southwest Strategically focused on short-duration lease-term property types, with SFR and multifamily consisting of 61.3% and 38.7% of the portfolio, respectively1 Majority of the portfolio invested in first mortgages, CMBS B-Pieces, CMBS IO Strips and Mezzanine debt1 Geographic and Asset Type Exposure $1.42B CURRENT PRINCIPAL1 GA 30% FL 19% TX 10% 4% MN 3% AL 3% AZ 3% NJ GEOGRAPHIC EXPOSURE1 68.3% WEIGHTED AVG LTV1 5% MD CA 4%

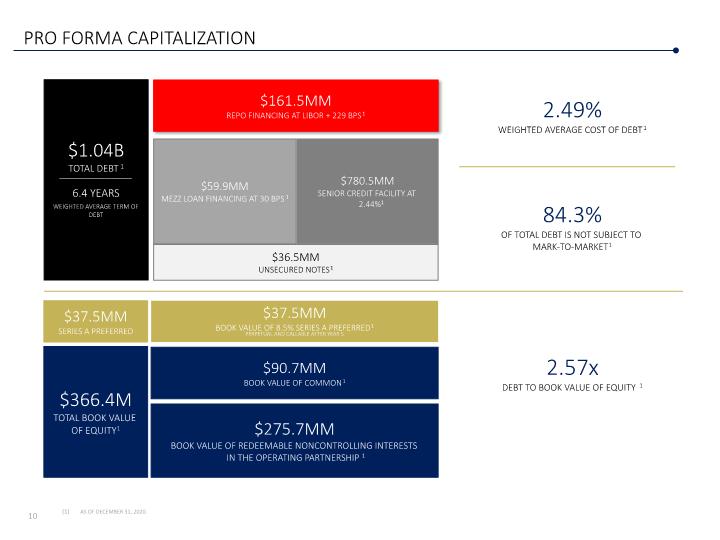

PRO FORMA CAPITALIZATION AS OF DECEMBER 31, 2020. $161.5MM REPO FINANCING AT LIBOR + 229 BPS1 $780.5MM SENIOR CREDIT FACILITY AT 2.44%1 $1.04B TOTAL DEBT1 _____________________ 6.4 YEARS WEIGHTED AVERAGE TERM OF DEBT 2.57x DEBT TO BOOK VALUE OF EQUITY 1 $90.7MM BOOK VALUE OF COMMON1 $275.7MM BOOK VALUE OF REDEEMABLE NONCONTROLLING INTERESTS IN THE OPERATING PARTNERSHIP1 $366.4M TOTAL BOOK VALUE OF EQUITY1 $37.5MM BOOK VALUE OF 8.5% SERIES A PREFERRED1 PERPETUAL AND CALLABLE AFTER YEAR 5 2.49% WEIGHTED AVERAGE COST OF DEBT1 $36.5MM UNSECURED NOTES1 $59.9MM MEZZ LOAN FINANCING AT 30 BPS1 $37.5MM SERIES A PREFERRED 84.3% OF TOTAL DEBT IS NOT SUBJECT TO MARK-TO-MARKET1

APPENDICES INTENTIONALLY LEFT BLANK

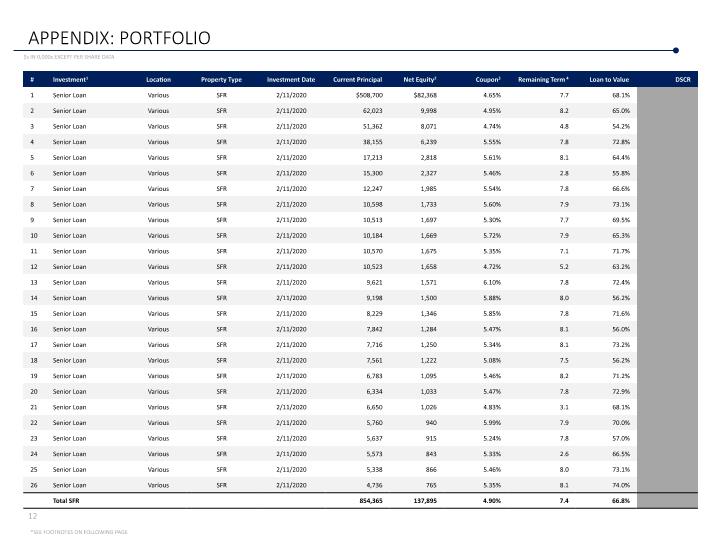

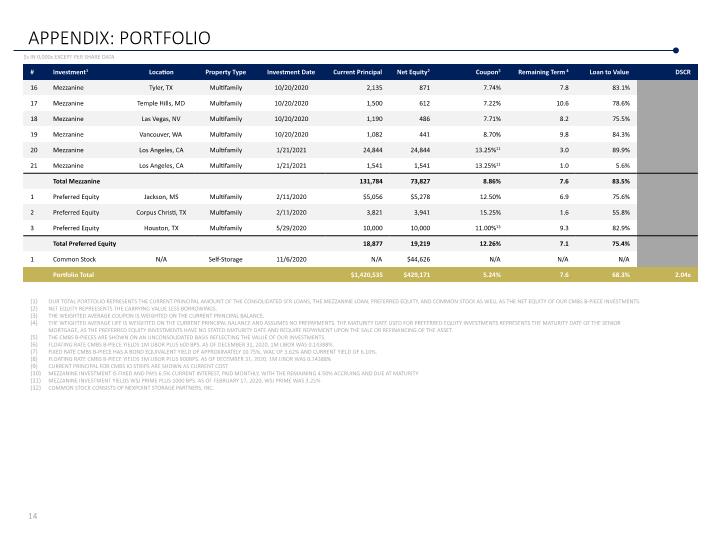

APPENDIX: PORTFOLIO $s IN 0,000s EXCEPT PER SHARE DATA *SEE FOOTNOTES ON FOLLOWING PAGE

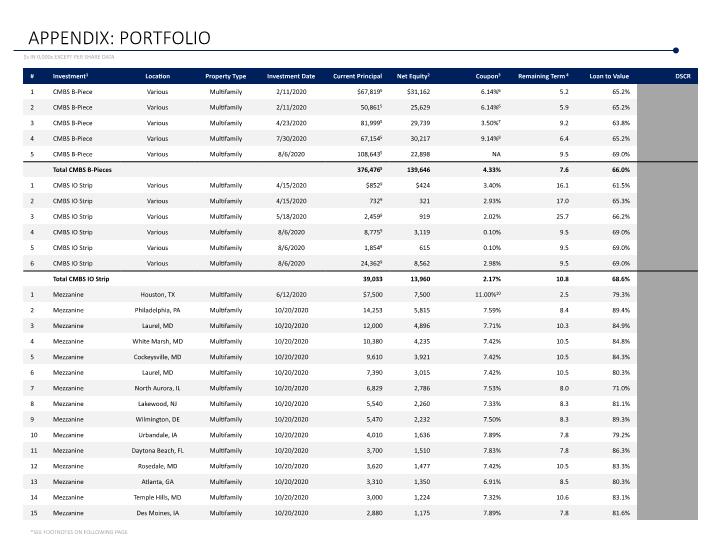

APPENDIX: PORTFOLIO $s IN 0,000s EXCEPT PER SHARE DATA *SEE FOOTNOTES ON FOLLOWING PAGE

APPENDIX: PORTFOLIO $s IN 0,000s EXCEPT PER SHARE DATA OUR TOTAL PORTFOLIO REPRESENTS THE CURRENT PRINCIPAL AMOUNT OF THE CONSOLIDATED SFR LOANS, THE MEZZANINE LOAN, PREFERRED EQUITY, AND COMMON STOCK AS WELL AS THE NET EQUITY OF OUR CMBS B-PIECE INVESTMENTS. NET EQUITY REPREESENTS THE CARRYING VALUE LESS BORROWINGS. THE WEIGHTED AVERAGE COUPON IS WEIGHTED ON THE CURRENT PRINCIPAL BALANCE. THE WEIGHTED AVERAGE LIFE IS WEIGHTED ON THE CURRENT PRINCIPAL BALANCE AND ASSUMES NO PREPAYMENTS. THE MATURITY DATE USED FOR PREFERRED EQUITY INVESTMENTS REPRESENTS THE MATURITY DATE OF THE SENIOR MORTGAGE, AS THE PREFERRED EQUITY INVESTMENTS HAVE NO STATED MATURITY DATE AND REQUIRE REPAYMENT UPON THE SALE OR REFINANCING OF THE ASSET. THE CMBS B-PIECES ARE SHOWN ON AN UNCONSOLIDATED BASIS REFLECTING THE VALUE OF OUR INVESTMENTS. FLOATING RATE CMBS B-PIECE YIELDS 1M LIBOR PLUS 600 BPS. AS OF DECEMBER 31, 2020, 1M LIBOR WAS 0.14388%. FIXED RATE CMBS B-PIECE HAS A BOND EQUIVALENT YIELD OF APPROXIMATELY 10.75%, WAC OF 3.62% AND CURRENT YIELD OF 6.10%. FLOATING RATE CMBS B-PIECE YIELDS 1M LIBOR PLUS 900BPS. AS OF DECEMBER 31, 2020, 1M LIBOR WAS 0.14388% CURRENT PRINCIPAL FOR CMBS IO STRIPS ARE SHOWN AS CURRENT COST MEZZANINE INVESTMENT IS FIXED AND PAYS 6.5% CURRENT INTEREST, PAID MONTHLY, WITH THE REMAINING 4.50% ACCRUING AND DUE AT MATURITY MEZZANINE INVESTMENT YIELDS WSJ PRIME PLUS 1000 BPS. AS OF FEBRUARY 17, 2020, WSJ PRIME WAS 3.25% COMMON STOCK CONSISTS OF NEXPOINT STORAGE PARTNERS, INC.

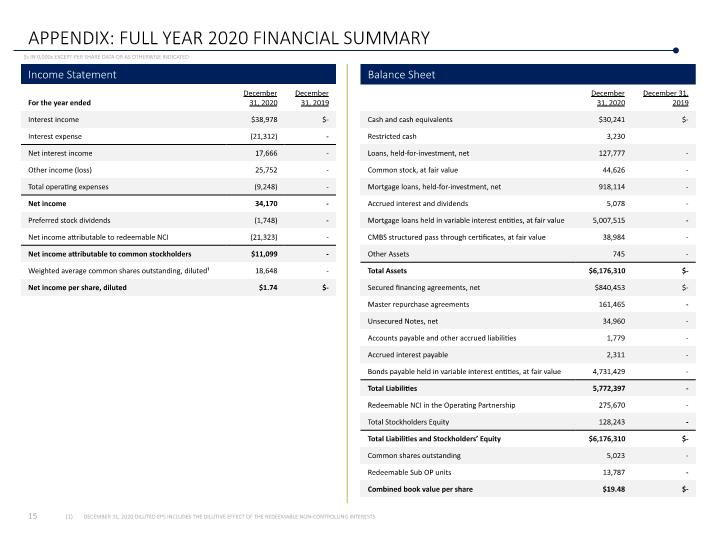

APPENDIX: FULL YEAR 2020 FINANCIAL SUMMARY Balance Sheet Income Statement $s IN 0,000s EXCEPT PER SHARE DATA OR AS OTHERWISE INDICATED DECEMBER 31, 2020 DILUTED EPS INCLUDES THE DILUTIVE EFFECT OF THE REDEEMABLE NON-CONTROLLING INTERESTS

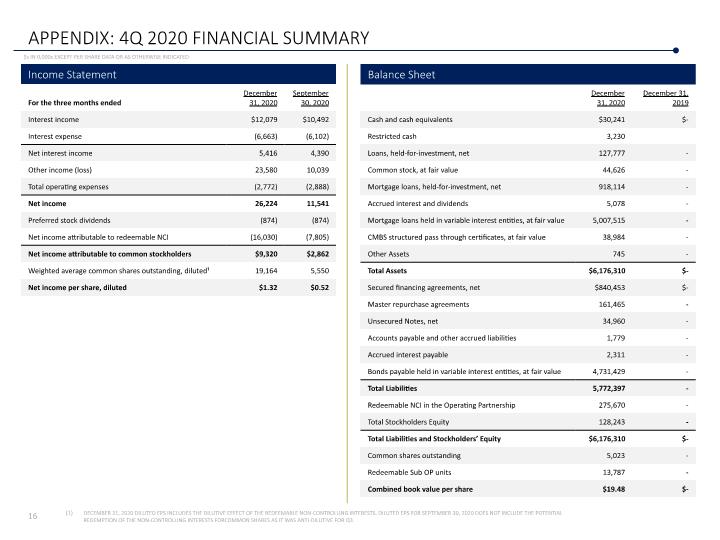

APPENDIX: 4Q 2020 FINANCIAL SUMMARY Balance Sheet Income Statement $s IN 0,000s EXCEPT PER SHARE DATA OR AS OTHERWISE INDICATED DECEMBER 31, 2020 DILUTED EPS INCLUDES THE DILUTIVE EFFECT OF THE REDEEMABLE NON-CONTROLLING INTERESTS. DILUTED EPS FOR SEPTEMBER 30, 2020 DOES NOT INCLUDE THE POTENTIAL REDEMPTION OF THE NON-CONTROLLING INTERESTS FORCOMMON SHARES AS IT WAS ANTI-DILUTIVE FOR Q3.

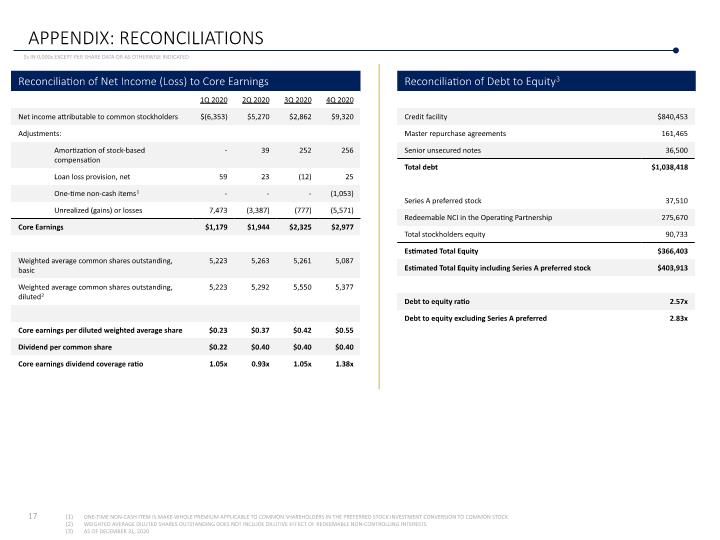

APPENDIX: RECONCILIATIONS $s IN 0,000s EXCEPT PER SHARE DATA OR AS OTHERWISE INDICATED Reconciliation of Net Income (Loss) to Core Earnings Reconciliation of Debt to Equity3 ONE-TIME NON-CASH ITEM IS MAKE-WHOLE PREMIUM APPLICABLE TO COMMON SHAREHOLDERS IN THE PREFERRED STOCK INVESTMENT CONVERSION TO COMMON STOCK. WEIGHTED AVERAGE DILUTED SHARES OUTSTANDING DOES NOT INCLUDE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS AS OF DECEMBER 31, 2020

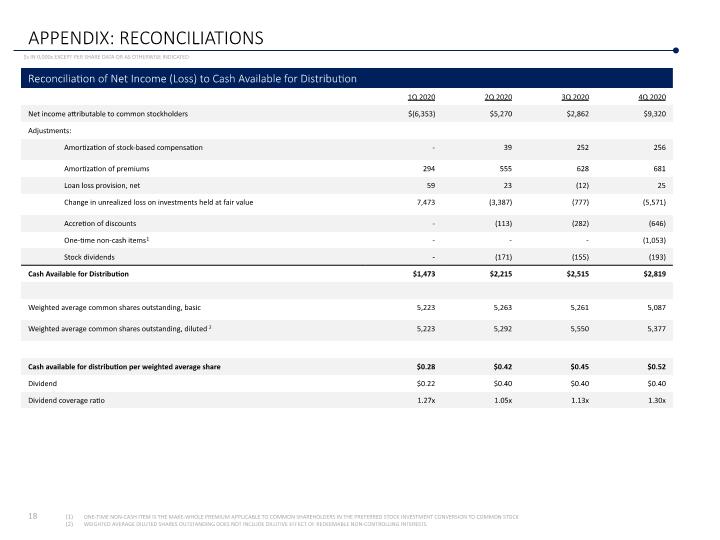

APPENDIX: RECONCILIATIONS $s IN 0,000s EXCEPT PER SHARE DATA OR AS OTHERWISE INDICATED Reconciliation of Net Income (Loss) to Cash Available for Distribution ONE-TIME NON-CASH ITEM IS THE MAKE-WHOLE PREMIUM APPLICABLE TO COMMON SHAREHOLDERS IN THE PREFERRED STOCK INVESTMENT CONVERSION TO COMMON STOCK WEIGHTED AVERAGE DILUTED SHARES OUTSTANDING DOES NOT INCLUDE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS

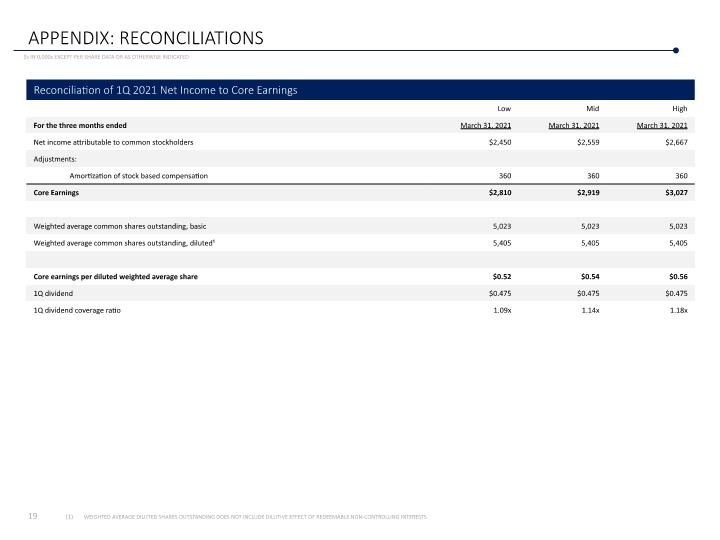

APPENDIX: RECONCILIATIONS $s IN 0,000s EXCEPT PER SHARE DATA OR AS OTHERWISE INDICATED Reconciliation of 1Q 2021 Net Income to Core Earnings WEIGHTED AVERAGE DILUTED SHARES OUTSTANDING DOES NOT INCLUDE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS

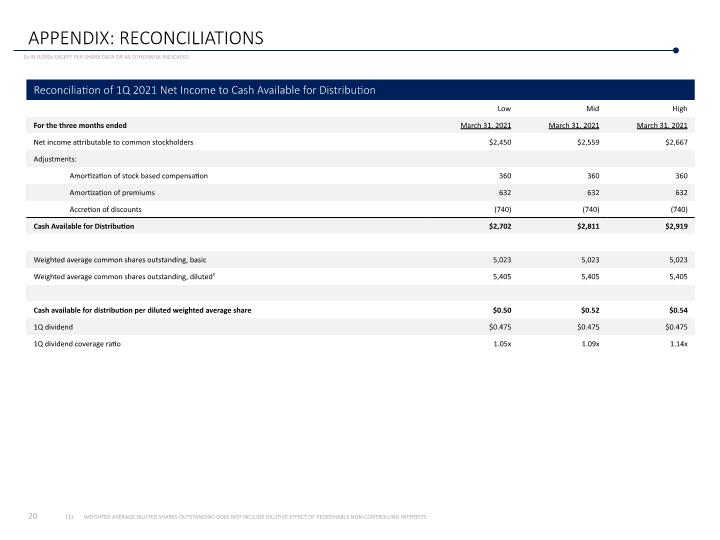

APPENDIX: RECONCILIATIONS $s IN 0,000s EXCEPT PER SHARE DATA OR AS OTHERWISE INDICATED Reconciliation of 1Q 2021 Net Income to Cash Available for Distribution WEIGHTED AVERAGE DILUTED SHARES OUTSTANDING DOES NOT INCLUDE DILUTIVE EFFECT OF REDEEMABLE NON-CONTROLLING INTERESTS

CONTACT NEXPOINT REAL ESTATE FINANCE (NYSE:NREF) 300 Crescent Court, Suite 700 Dallas, Texas 75201 Website: nref.nexpoint.com Phone: 833.463.6697